Science Group PLC Trading Update (2012U)

22 Noviembre 2023 - 1:00AM

UK Regulatory

TIDMSAG

RNS Number : 2012U

Science Group PLC

22 November 2023

22 November 2023

SCIENCE GROUP PLC

('Science Group', the 'Group' or the 'Company')

TRADING UPDATE

The Board of Science Group anticipates that Adjusted Operating

Profit for the year ending 31 December 2023 will be in line with

expectations. Benefitting from the Group's sector portfolio and

disciplined cost management, Science Group remains on track for

another record year in 2023.

Revenue for the year has been impacted by the global economic

and geopolitical climate with investment by clients in consumer and

industrial sectors particularly affected. The acquisition of TP

Group provided a timely entry into the defence market and

integration of TPG Services and CMS2 (formerly TPG Maritime) is

progressing well with investment made in strengthening operational

management and business development functions.

The Board remains cautious on the outlook for 2024 with

geopolitical instability exacerbating the impact on our clients

from high interest rates, a weak consumer economic environment and

uncertainty associated with political elections (USA and UK). While

the reduction in inflation in the Group's key geographies provides

some optimism, confidence in end-user markets is unlikely to

improve in the near term. However, as consistently demonstrated,

the Board considers that Science Group's sector diversity,

disciplined management culture and strong financial position will

continue to provide resilience.

In this challenging period for small cap investors, the Board

recognises the importance of share trading liquidity. As a result,

when permissible and if in the Board's opinion to be in the best

interests of all shareholders, the Board has continued the buy-back

programme. During 2023, the Company has (to 17 November 2023)

bought back 828,885 shares, equivalent to approximately 1.8% of the

issued share capital, at a total cost of GBP3.3 million.

Science Group maintains a very strong balance sheet with gross

cash at 31 October 2023 of GBP32.4 million and net funds of GBP19.2

million. This robust capital foundation, further enhanced by the

undrawn bank facility of GBP25 million, enables the Board to

continue to evaluate corporate opportunities in line with the

Group's strategy.

Science Group plc

Tel: +44 (0) 1223

Martyn Ratcliffe, Chairman 875 200

Jon Brett, Group Finance Director www.sciencegroup.com

Stifel Nicolaus Europe Limited (Nominated

Adviser and Joint Broker)

Tel: +44 (0) 20 7710

Nick Adams, Alex Price, Richard Short 7600

Liberum Capital Limited (Joint Broker)

Tel: +44 (0) 20 3100

Max Jones, Miquela Bezuidenhoudt 2000

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTUASWROAUAUAA

(END) Dow Jones Newswires

November 22, 2023 02:00 ET (07:00 GMT)

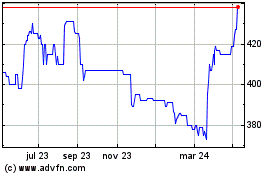

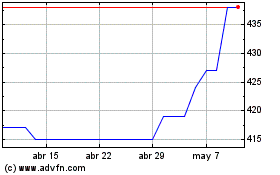

Science (LSE:SAG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Science (LSE:SAG)

Gráfica de Acción Histórica

De May 2023 a May 2024