Starwood European Real Estate Finance Ltd (SWEF) SWEF: Half

Yearly Report 30 June 2022 06-Sep-2022 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement that contains inside

information in accordance with the Market Abuse Regulation (MAR),

transmitted by EQS Group. The issuer is solely responsible for the

content of this announcement.

-----------------------------------------------------------------------------------------------------------------------

Starwood European Real Estate Finance Limited

Half Year Results for the Period Ended 30 June 2022

Income Stability, Strong Cash Generation and Inflation

Protection

Starwood European Real Estate Finance Limited and its

subsidiaries ("SEREF" or "the Group"), a leading investor

originating, executing and managing a diverse portfolio of

high-quality real estate debt investments in the UK and Europe,

announces strong Half Year Results for the period from 1 January

2022 to 30 June 2022.

Highlights

-- Strong cash generation - the portfolio continues to support

annual dividend payments of 5.5 pence, paidquarterly, and generates

an annual dividend yield of 6.0 per cent on the share price as at

30 June 2022

-- Regular and consistent dividend - GBP190m of dividends paid

since inception

-- Inflation protection - 78.8 per cent of the portfolio is

contracted at floating interest rates (withfloors) which will

provide an increase in revenue as expected higher inflation results

in higher interest rates

-- Continued income stability - all loan interest and scheduled

amortisation payments paid in full and ontime

-- Robust and high quality portfolio - which continues to

perform in line with expectations? Defensive qualities reflected in

the Group's ongoing successful track record of delivering

NAVstability ? Weighted average Loan to Value for the portfolio is

60.5 per cent as at 30 June 2022 (31 December2021: 61.9 per

cent)

-- 51.2 per cent - share price total return since inception in

December 2012

-- Strong pipeline of opportunities - the Investment Manager

continues to see a strong investment pipelinewhich represents

attractive risk adjusted returns

Portfolio Statistics

As at 30 June 2022, the portfolio was invested in line with the

Group's investment policy. The key portfolio statistics are

summarised below.

30 June 2022 30 June 2021

Number of investments 19 18

Percentage of currently invested portfolio in floating rate loans 78.8% 78.3%

Invested Loan Portfolio unlevered annualised total return* 7.1% 6.6%

Portfolio levered annualised total return* 7.2% 6.8%

Weighted average portfolio LTV - to Group first GBP* 14.9% 18.0%

Weighted average portfolio LTV - to Group last GBP* 60.5% 63.5%

Average loan term (stated maturity at inception) 5.0 years 4.7 years

Average remaining loan term 1.9 years 2.2 years

Net Asset Value GBP422.9m GBP423.7m

Amount drawn under Revolving Credit Facilities (excluding accrued interest) (GBP18.5m) (GBP11.0m)

Loans advanced GBP433.6m GBP420.8m

Cash GBP3.1m GBP1.4m

Other net assets (including hedges) GBP4.7m GBP12.5m

*Alternative performance measure

NAV Performance - as anticipated and stable demonstrating

resilience of portfolio

The table below shows the NAV per share achieved over the 6

months to 30 June 2022:

Jan-22 Feb-22 Mar-22 Apr-22 May-22 Jun-22

NAV per share (pence) at end of month 102.02 102.78 103.13 102.33 102.94 103.42

John Whittle, Chairman of the Group commented:

"The UK and global economies are in a state of market and

political turmoil as a result of the conflict in Ukraine and rising

inflation and interest rates. Despite this, the Group has

demonstrated its unique portfolio resilience through the strength

and consistency of its results.

"Once again, it is significant, and very gratifying, to note

that all loan interest and scheduled amortisation payments were

received on time and that underlying collateral valuations continue

to provide reassuring headroom.

"While this half year has been a turbulent period in the equity

markets and, as a direct result, for the share price of the Group,

it has not been a turbulent time for the Group's NAV which has once

again remained stable throughout. The Group's NAV stability

demonstrates the positive fundamentals of the Group's portfolio as

an exceptionally attractive risk-adjusted source of alternative

income tested in the harshest of market environments. Against

market volatility, the Group has not only maintained a stable net

asset value but has also met its dividend targets, delivering an

annualised 5.5 pence per share to shareholders. We have also

instituted share buybacks in response to the volatility of the

share price which we believe is primarily due to the volatility of

the equity markets in general.

"Given our stability of income, strong cash generation and

attractive pipeline of potential investments, I and the whole Board

remain confident of continuing to extend the resilient track record

of the strategy in delivering compelling risk adjusted income

returns."

For further information, please contact:

Apex Fund and Corporate Services (Guernsey) Limited as Company

Secretary

+44 (0) 20 3530 5630

Duke Le Prevost

Starwood Capital +44 (0) 20 7016 3655

Duncan MacPherson

Jefferies International Limited +44 (0) 20 7029 8000

Stuart Klein

Neil Winward

Gaudi Le Roux

Buchanan +44 (0) 20 7466 5000

Helen Tarbet +44 (0) 07872 604453

Henry Wilson +44 (0) 07788 528143

Notes:

Starwood European Real Estate Finance Limited is an investment

company listed on the premium segment of the main market of the

London Stock Exchange with an investment objective to provide

Shareholders with regular dividends and an attractive total return

while limiting downside risk, through the origination, execution,

acquisition and servicing of a diversified portfolio of real estate

debt investments in the UK and the wider European Union's internal

market. www.starwoodeuropeanfinance.com. The Company is the largest

London-listed vehicle to provide investors with pure play exposure

to real estate lending. The Group's assets are managed by Starwood

European Finance Partners Limited, an indirect wholly-owned

subsidiary of the Starwood Capital Group.

Interim Financial Report and Unaudited Condensed

Consolidated Financial Statements

for the six-month period from 1 January 2022 to 30 June 2022

Overview Corporate Summary

PRINCIPAL ACTIVITIES AND INVESTMENT OBJECTIVE

The investment objective of Starwood European Real Estate

Finance Limited (the "Company"), together with its wholly owned

subsidiaries Starfin Public Holdco 1 Limited, Starfin Public Holdco

2 Limited, Starfin Lux S.à.r.l, Starfin Lux 3 S.à.r.l and Starfin

Lux 4 S.à.r.l (collectively the "Group"), is to provide its

shareholders with regular dividends and an attractive total return

while limiting downside risk, through the origination, execution,

acquisition and servicing of a diversified portfolio of real estate

debt investments in the UK and the European Union's internal

market.

The Company seeks to limit downside risk by focusing on secured

debt with both quality collateral and contractual protection.

The Company anticipates that the typical loan term will be

between three and seven years. Whilst the Company retains absolute

discretion to make investments for either shorter or longer

periods, at least 75 per cent of total loans by value will be for a

term of seven years or less.

The Group aims to be appropriately diversified by geography,

real estate sector, loan type and counterparty. The Group pursues

investments across the commercial real estate debt asset class

through senior loans, subordinated loans and mezzanine loans,

bridge loans, selected loan-on-loan financings and other debt

instruments.

STRUCTURE

The Company was incorporated with limited liability in Guernsey

under the Companies (Guernsey) Law, 2008, as amended, on 9 November

2012 with registered number 55836, and has been authorised by the

Guernsey Financial Services Commission ("GFSC") as a registered

closed-ended investment company. The Company's ordinary shares were

first admitted to the premium segment of the UK's Financial Conduct

Authority's Official List and to trading on the Main Market of the

London Stock Exchange as part of its initial public offering which

completed on 17 December 2012. Further issues took place in March

2013, April 2013, July 2015, September 2015, August 2016 and May

2019. The issued capital during the period comprises the Company's

Ordinary Shares denominated in Sterling.

The Company received authority at the 2020 Annual General

Meeting ("AGM"), to purchase up to 14.99 percent of the Ordinary

Shares in issue. This authority was renewed at the 2021 and 2022

AGMs.

In August 2020 the Board announced that it had engaged Jefferies

International Limited as buy-back agent to effect share buybacks on

behalf of the Company.

During 2020 the Company bought back 3,648,125 shares at an

average cost per share of 86.9 pence per share. During 2021, the

Company bought back 660,000 Ordinary Shares at an average price of

89.54 pence per share. In the first half of 2022 the Company did

not buy back any shares but between 1 July 2022 and 2 September

2022 (having re-engaged Jefferies International Limited as buy-back

agent to effect share buybacks on behalf of the Company) the

Company has bought back a further 5,230,919 shares at an average

price per share of 93.7 pence.

Ordinary shares bought back are held in treasury. Share buybacks

are subject to sufficient cash being available.

The Company makes its investments through Starfin Lux S.à.r.l

(indirectly wholly-owned via a 100% shareholding in Starfin Public

Holdco 1 Limited), Starfin Lux 3 S.à.r.l and Starfin Lux 4 S.à.r.l

(both indirectly wholly-owned via a 100% shareholding in Starfin

Public Holdco 2 Limited).

The Investment Manager is Starwood European Finance Partners

Limited (the "Investment Manager"), a company incorporated in

Guernsey with registered number 55819 and regulated by the GFSC.

The Investment Manager has appointed Starwood Capital Europe

Advisers, LLP (the "Investment Adviser"), an English limited

liability partnership authorised and regulated by the Financial

Conduct Authority, to provide investment advice, pursuant to an

Investment Advisory Agreement.

Chairman's Statement

Dear Shareholder,

I am delighted to present the Interim Financial Report and

Unaudited Condensed Consolidated Financial Statements of Starwood

European Real Estate Finance Limited (the "Group") for the period

from 1 January 2022 to 30 June 2022.

Six months ago, when I presented the Annual Report and Audited

Consolidated Financial Statements of the Group for the year ended

31 December 2021 to you, none of us foresaw the market and

political turmoil that would be experienced between then and now in

both UK and global economies as a result of the conflict in Ukraine

and rising inflation and interest rates. Despite this, and as in

2020 and 2021, the Group has demonstrated its unique portfolio

resilience through the strength and consistency of its results.

Once again, it is significant, and very gratifying, to note that

all loan interest and scheduled amortisation payments were received

on time and that underlying collateral valuations continue to

provide reassuring headroom.

While this half year has been a turbulent period in the equity

markets and, as a direct result, for the share price of the

Company, it has not been a turbulent time for the Group's NAV which

has once again remained stable throughout. The Group's NAV

stability demonstrates the positive fundamentals of the Group's

portfolio as an exceptionally attractive risk-adjusted source of

alternative income tested in the harshest of market environments.

Against market volatility, the Group has not only maintained a

stable net asset value but has also met its dividend targets,

delivering an annualised 5.5 pence per share to shareholders.

The Board remains keen to engage with shareholders and potential

investors with a view to stabilising and increasing the share price

to at or above par to reflect the Group's stability of net asset

value and consistency of results.

HIGHLIGHTS OVER THE SIX MONTHS TO 30 JUNE 2022

? Strong cash generation - the portfolio continues to support

annual dividend payments of 5.5 pence per Ordinary Share, paid

quarterly, and generates an annual dividend yield of 6.0 per cent

on the share price as at 30 June 2022

? Regular and Consistent Dividend - GBP190 million of dividends

paid since inception

? Inflation protection - 78.8 per cent of the portfolio is

contracted at floating interest rates (with floors) which will

provide an increase in revenue as expected higher inflation results

in higher interest rates

? Robust portfolio - the loan book is performing in line with

expectations with its defensive qualities reflected in the Group's

continued stable NAV; the weighted average Loan to Value for the

portfolio is 60.5 per cent as at 30 June 2022 compared with 61.9

per cent at the end of 2021

? 51.2 per cent - share price total return since inception in

December 2012

? Strong pipeline of opportunities - The Investment Adviser and

Manager continue to see a strong investment pipeline which

represents attractive risk adjusted returns.

INVESTMENT PERFORMANCE

INTEREST & AMORTISATION PAYMENTS

All loan interest and scheduled amortisation payments to date

have been paid in full and on time. This includes loans in sectors

that have been most impacted by the pandemic, namely, hospitality

and retail assets, where borrowers continue to remain adequately

capitalised as previously reported.

STRONG CASH GENERATION

The portfolio performance continues to support the targeted

annual dividend payments of 5.5 pence per Ordinary Share, paid

quarterly.

INFLATION PROTECTION

78.8 per cent of the portfolio is contracted at floating

interest rates (with floors) which will provide an increase in

revenue as expected higher inflation results in higher interest

rates. The majority of underlying floating rate borrowers have

hedging in place such that their exposure to rising base rates are

capped. Where no hedging is in place, there are other mitigating

factors in place which provide comfort of the headroom available to

borrowers to be able to absorb base rate increases.

The Invested Loan Portfolio unlevered annualised total return

has been increasing steadily as interest rate curves have moved

upwards. The year on year increase is 50 basis points (i.e. now 7.1

per cent, up from 6.6 per cent in June 2021). As interest rates

increase there will be additional income to cover the dividend.

RECATEGORISATION OF STAGE 2 ASSET TO STAGE 1

Of the three loans categorised at Stage 2 in the December 2021

financial statements one of those has now been recategorised as

Stage 1 reflecting the Investment Manager's and Investment

Advisor's conclusion that the risk related to the loan had

reduced.

INVESTMENT MOMENTUM

The table below summarises the new commitments made and

repayments received in the first six months of each year from 2018

to 2022.

H1 2018 H1 2019 H1 2020 H1 2021 H1 2022

New Commitments GBP147.5m GBP49.9m GBP72.7m GBP26.6m GBP19.5m

Repayments & Amortisation (GBP74.1m) (GBP45.9m) (GBP65.3m) (GBP45.8m) (GBP14.9m)

Net Increase / (Decrease) in Commitments GBP73.4m GBP4.0m GBP7.4m (GBP19.2m) GBP4.6m

The net change in commitments during the first half of 2022 is

showing a small increase. Importantly, the Group is fully invested,

with a strong pipeline of new loans, all of which supports the

Group's income generation going forward.

As at 30 June 2018 to 2022 the Group had commitments as shown in

the table below.

June 2018 June 2019 June 2020 June 2021 June 2022

Funded loans GBP429.9m GBP447.0m GBP447.5m GBP418.5m GBP429.1m

Unfunded Commitments GBP42.2m GBP31.9m GBP67.2m GBP36.8m GBP36.8m

Total Portfolio GBP472.1m GBP478.9m GBP514.7m GBP455.3m GBP465.9m

Between 1 July 2022 and 2 September 2022 the Group received

GBP13.1 million in partial repayments and funded an additional

GBP3.1 million on loans it had committed to as at 30 June 2022. NAV

PERFORMANCE

Jan - 22 Feb - 22 Mar - 22 Apr - 22 May - 22 Jun - 22

NAV per share at beginning of month 103.09 102.02 102.78 103.13 102.33 102.94

Monthly Movements

Operating Income available to distribute(i) 0.46 0.44 0.46 0.48 0.54 0.44

Realised FX gains/(losses) not distributable 0.00 0.00 0.78 0.00 0.29 0.00

Unrealised FX gains/(losses) (0.15) 0.32 (0.89) 0.10 (0.22) 0.04

Dividends declared (1.38) 0.00 0.00 (1.38) 0.00 0.00

NAV per share as end of month 102.02 102.78 103.13 102.33 102.94 103.42

(i) Operating Income available to distribute comprises loan

income recognised in the period less the cost of debt facilities

utilised by the Group and operating costs incurred. The Operating

Income available to distribute also includes any realised foreign

exchange gains or losses upon settlement of hedges not expected to

reverse. In the months to 31 May and 30 June the balance includes

circa GBP200,000 of realised FX gains and GBP150,000 of realised FX

losses respectively.

As anticipated, as shown above and as in the past, we are

pleased to report that the Group's NAV has once again remained

stable over the first half of the year demonstrating the highly

resilient credentials of the asset class that contributes to its

success as a reliable source of alternative income. We do not

expect to see significant movements in NAV as the Group's loans are

held at amortised cost and Euro exposures are hedged.

The NAV would be materially impacted if an impairment in the

value of a loan was required but despite the disruption to markets

in the last few years (caused by the Covid-19 pandemic, the

Ukraine/Russia conflict, the high inflationary and rising interest

rate environment), no such impairment has been needed and the

Group's collateral valuations remain stable and current (the

current weighted average age of valuations is 1.07 years). Please

refer to the Investment Manager's report for detailed sector

performance reporting, information on the accounting for our loans,

consideration of the changes in loan risk level in the six month

period to 30 June 2022 and the current loan to value position for

the portfolio as a whole and for each sector.

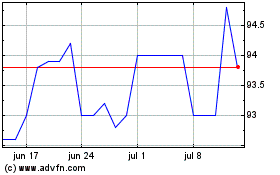

SHARE PRICE PERFORMANCE

During the first half of 2022, the Company's share price had

been volatile, primarily, it is believed, because of the volatility

of the market. In the six month period to 30 June 2022, the share

price has been trading at between 90.2 pence and 97.2 pence and

ended the half year at 91.6 pence. On 19 July 2022 the Board

announced that it had re-engaged Jefferies International Limited as

buy-back agent to effect share buy backs on behalf of the Company.

Since then and to 2 September 2022 5,230,919 shares have been

purchased at an average price of 93.7 pence per share. Any shares

bought back will be held in treasury. Share buy backs are subject

to available cash.

The Company's shares closed on 30 June 2022 at 91.6 pence,

resulting in a share price total return for the first half of 2022

of 0.3 per cent. As at 30 June 2022, the discount to NAV stood at

11.4 per cent, with an average discount to NAV of 6.7 per cent over

the half year. The Board, the Investment Manager and Adviser

continue to believe that the shares represent attractive value at

this level as demonstrated by the personal purchases of shares by

two of the directors of the Company during July 2022.

Notwithstanding this, if the Ordinary Shares trade at an average

discount to Net Asset Value per Share of five percent or more

during the six month period ending 31 December 2022, the Directors,

at their absolute discretion, may put forward a realisation offer

to Shareholders ("Realisation Offer"). The terms of such

realisation offer would provide, broadly, that Shareholders may

request for up to 75% of the Ordinary Shares in issue to be

realised for cash.

DIVIDS

The Directors declared dividends in respect of the first two

quarters of 2022 of 1.375 pence per Ordinary Share, equating to an

annualised 5.5 pence per annum. This was covered by earnings

excluding unrealised FX gains and realised FX gains expected to

reverse. With the current portfolio, and based on current

forecasts, we expect the dividend to continue to be covered by

earnings over the 12 months to 31 December 2022.

On the share price at 30 June 2022, a dividend of 5.5 pence per

annum represents a 6.0 per cent dividend yield.

BOARD COMPOSITION AND DIVERSITY

The Board believes in the value and importance of diversity in

the boardroom and it continues to consider the recommendations of

the Davies, Hampton Alexander and Parker Reports and these

recommendations will be taken into account should the appointment

of a new director be required.

The Board is now well advanced in the programme of board

rotations with only my own planned retirement at the end of 2023 in

sight. I am very pleased with the composition of the Board, of

which 50% is female, and I believe we have a very relevant

diversity of skills and expertise which places us well for the

future.

Based on the recent change in the listing rules regarding the

disclosure of diversity on listed company boards and executive

committees effective for accounting periods starting from April

2022, the Board are considering the impact, if any, on disclosure

requirements.

GOING CONCERN

Under the AIC Code of Corporate Governance and applicable

regulations, the Directors are required to satisfy themselves that

it is reasonable to assume that the Group is a going concern.

As set out in more detail in the 2021 Annual Report, and subject

to the discount triggered Realisation Offer not being activated,

the Directors shall exercise the discretion afforded to them under

the Articles to put forward a realisation vote (as an ordinary

resolution) ("Realisation Vote") to Shareholders by no later than

28 February 2023. The Board is actively investigating and

considering the options available to them in the best interests of

Shareholders. This process is ongoing and the outcome uncertain at

the current time.

The Directors have undertaken a comprehensive review of the

Group's ability to continue as a going concern including a review

of the ongoing cash flows and the level of cash balances as of the

reporting date as well as forecasts of future cash flows. After

making enquiries of the Investment Manager, Investment Adviser and

the Administrator and having reassessed the principal risks, the

Directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for at least one

year from the date the unaudited condensed consolidated financial

statements are signed. A range of scenarios has been evaluated as

part of this analysis. In the worst case scenario evaluated, the

Group was still able to meet its liabilities as they fall due,

although the dividend would need to be reduced to reflect the

reduced cash received. Accordingly, the Directors continue to adopt

a going concern basis in preparing these Unaudited Condensed

Consolidated Financial Statements.

OUTLOOK

The Board is pleased that the diligent underwriting, loan

structuring and active asset management of the Investment Manager

and Adviser during this last turbulent two and a half years has led

to very robust performance of the loans during the period, meaning

that all interest has been paid in full and on time and no

impairments have been required. Importantly, future interest

payments continue to be expected to be paid on time and in full and

no loan defaults are anticipated.

The Investment Adviser is seeing a strong pipeline of

opportunities and will continue to apply its rigorous approach to

the selection of appropriate opportunities as it re-invests capital

into new opportunities. At 30 June 2022, the Group was very

modestly levered with net debt of GBP15.4 million (3.6 per cent of

NAV) and undrawn revolving credit facilities of GBP107.5 million to

fund existing commitments of circa GBP37 million. If the Group does

not receive any further repayments this year, it means the Group

has approximately GBP70 million of capacity for new loans.

The focus of the Group for the rest of 2022 remains:

(i) the continued robust asset management of the existing loan

portfolio; and

(ii) the continued efforts, alongside the Investment Manager and

the Investment Adviser, to enhance both origination capacity and

portfolio construction of the Group in order to continue to deliver

attractive risk adjusted returns to its investors.

I would like to close by thanking you for your commitment and

support.

John Whittle

Chairman

5 September 2022

Investment Manager's Report

MARKET SUMMARY AND INVESTMENT OUTLOOK

? Inflation data is delivering month on month records and

central banks continue to fight this inflation by raising interest

rates

? Unemployment remains very low in major European economies

? Public markets remain volatile with credit markets reflecting

a new interest rate environment, with the biggest effect seen in

medium to long-term fixed rate credit markets

? Fundamentals for real estate remain healthy

? Hotel market data reports higher average daily rates in May

2022 than May 2019 with 2022 likely to be a strong year in many

major European markets

In our recent factsheets we had highlighted the well-reported

global inflationary pressures and the expected impact on interest

rates. This theme has continued with higher inflation rates and

interest rates across all markets during the quarter reflecting

expectations of more persistent inflation and resulting interest

rate policy actions from central banks. We have also commented on

the inverted interest rate curve in the UK signalling the market's

anticipation that interest rate policy might go too far resulting

in recessionary pressures. The market is now expecting higher

probabilities of technical recessions in many countries and we have

seen interest rate expectations coming off recent peaks. However,

across major European countries unemployment rates remain very low

(UK: 3.8 per cent and Euro Area: 6.6 per cent). This will remain a

key focus for central banks as they balance the fight against

inflation with other key macro-economic signals.

Inflation data continues to deliver month on month records with

July headline inflation for the Eurozone coming in at the highest

recorded figure since the inception of the Euro currency at 9.8 per

cent expected). The UK CPI rate was 10.1 per cent and the US CPI

level was 8.5 per cent. Inflation numbers continue to be driven by

increased energy costs. Energy prices in July were estimated to be

up 39.7 per cent compared to a year earlier for the Eurozone, up

57.8 per cent for the UK and up 32.9 per cent for the US. After

stripping out energy and food, core inflation was 4.0 per cent for

the Eurozone, 6.2 per cent for the UK and 5.9 per cent for the US.

Commodity prices are expected to remain volatile while the war in

Ukraine causes disruption to energy, agricultural and other exports

from Ukraine due to blockades of the ports and from Russia due to

sanctions.

Previously we commented on seeing a step change in interest rate

expectations in reaction to the persistence of inflationary

pressures. These rate expectations were feeding into the SONIA,

Euribor and swap rates, to which most of the Group's investments

are linked. As at 19 August 2022 the 3 month SONIA

(forward-looking) and Euribor stood at 2.12 per cent and 0.43 per

cent respectively versus 0.05 percent and negative 0.55 per cent

respectively the same time last year. As at 18 August, the 5 year

sterling swap and 5 year Euro swap were at 2.84 per cent and 1.65

per cent respectively versus 0.42 per cent and negative 0.41 per

cent respectively the same time last year. Much of this change has

occurred since the beginning of 2022. In the case of the 2.42 per

cent increase in the 5 year sterling swap, the majority of the move

(1.79 per cent) was since the beginning of 2022. These movements

have provided a significant yield benefit to lenders with exposure

to floating rate loans.

In the public credit capital markets, primary issuance has

slowed across asset classes and secondary pricing has increased as

investors digest the implications of the rising rate environment

and the knock on effects. The most significant impact can be seen

in fixed rate credit markets where lenders do not have the benefit

of rising rates in the credit instrument they own. The iTraxx

Crossover index had more than doubled from 238 basis points at the

same time last year to 525 basis points at week ending 19 August.

This is a combination of changing rates being reflected in the

credit markets and an increase in the risk premium which investors

are seeking. We are seeing similar patterns for real estate in

Europe with primary markets for corporate unsecured bonds and CMBS

currently taking a pause and a reduced capacity of investment banks

to underwrite and distribute. We expect this to persist over the

typically quiet European summer period. These markets will create

good opportunities for lenders to originate loans with strong risk

adjusted returns.

In the underlying real estate markets, we are also seeing

dislocation in public equity capital markets. Most public real

estate companies are trading at a discount to private market values

as investors assess the impact of rising rates on valuations for

the asset class. While rising rates will have an impact on the cost

of financing real estate, there are many factors that will

influence value on an asset specific basis and so stock selection

and quality of business plan remain key. Countering a higher cost

of debt, inflation helps revenues for many types of real estate

where leases are linked to inflation metrics or where operational

real estate can benefit from inflation in top line revenues. We

continue to see occupiers willing to pay well for product with high

environmental accreditation and the right amenities. We are also

seeing strong top line inflation across operational asset

classes.

Another key effect of inflation in real estate is that

speculative development of new real estate is constrained when

development costs are higher, helping keep supply and demand in

check and benefitting existing stock.

Examples of this inflation in operational real estate can be

seen in hotel market data. Despite the fact that corporate travel

is still down on pre-pandemic levels, a large majority of the

gateway markets in Europe reported higher average daily rates in

June 2022 than June 2019. Examples include rates 46 per cent higher

in Paris, 24 per cent higher in Rome and 17 per cent higher in

London. On the leisure side according to the BBC the average price

of all-inclusive package holidays for British holiday makers is up

17 per cent versus 2019. Of the leading European markets, only

Prague had a lower average daily rate in June 2022 than 2019. These

rises have come without a full return of corporate business,

however leading indicators are now showing that corporate business

is likely to increase in the coming months. Corporate travel

expectations surveys for the resumption of both domestic and

business travel over the coming months are hitting new post Covid

highs which is likely to put further upward pressure on rates for

urban hotels.

The slow summer period for volumes in both credit and equity

markets for real estate is unlikely to be broken quickly as market

participants take stock on returning from vacations and we expect a

cautious resumption in the later part of the year with all eyes

remaining on how economies navigate through to a stabilisation in

inflation and interest rates expectations. These markets provide a

great canvas for company to operate in, allowing it to focus on

deal selection and generating strong returns with good downside

protections.

PORTFOLIO STATISTICS

As at 30 June 2022, the portfolio was invested in line with the

Group's investment policy. The key portfolio statistics are as

summarized below.

30 June 30 June

2022 2021

Number of investments 19 18

Percentage of currently invested portfolio in floating rate loans 78.8% 78.3%

Invested Loan Portfolio unlevered annualised total return (1) 7.1% 6.6%

Portfolio levered annualised total return (1) 7.2% 6.8%

Weighted average portfolio LTV - to Group first GBP (1) 14.9% 18.0%

Weighted average portfolio LTV - to Group last GBP (1) 60.5% 63.5%

Average loan term (stated maturity at inception) 5.0 years 4.7 years

Average remaining loan term 1.9 years 2.2 years

Net Asset Value GBP422.9m GBP423.7m

Amount drawn under Revolving Credit Facilities (excluding accrued interest) (GBP18.5m) (GBP11.0m)

Loans advanced GBP433.6m GBP420.8m

Cash GBP3.1m GBP1.4m

Other net assets (including hedges) GBP4.7m GBP12.5m

(1) Alternative performance measure - for definitions and

calculation methodology.

The maturity profile of investments as at 30 June 2022 is shown

below.

% of invested

Remaining years to contractual maturity (1) Principal value of loans GBPm

portfolio

0 to 1 years GBP145.7 34.0%

1 to 2 years GBP68.7 16.0%

2 to 3 years GBP132.0 30.8%

3 to 5 years GBP82.7 19.2%

The Board considers that the Group is engaged in a single

segment of business, being the provision of a diversified portfolio

of real estate backed loans. The analysis presented in this report

is presented to demonstrate the level of diversification achieved

within that single segment. The Board does not believe that the

Group's investments constitute separate operating segments.

SHARE PRICE PERFORMANCE

As at 30 June 2022, the NAV was 103.42 pence per Ordinary Share

(31 December 2021: 103.09 pence; 30 June 2021: 103.62 pence) and

the share prices was 91.6 pence (31 December 2021: 94 pence; 30

June 2021: 94 pence).

The Company's share price has been volatile since March 2020.

This volatility has been driven by market conditions and trading

volumes rather than a change in the Company's NAV.

INVESTMENT DEPLOYMENT

As at 30 June 2022, the Group had 19 investments and commitments

of GBP465.9 million as follows:

Sterling equivalent Sterling equivalent unfunded Sterling Total (Drawn and

balance (1) commitment (1) Unfunded)

Hospitals, UK GBP25.0 m GBP25.0 m

Hotel & Residential, UK GBP49.9 m GBP49.9 m

Office, London GBP17.0 m GBP3.5 m GBP20.5 m

Hotel, Oxford GBP22.8 m GBP0.1 m GBP22.9 m

Hotel, Scotland GBP42.6 m GBP42.6 m

Hotel, North Berwick GBP15.0 m GBP15.0 m

Life Science, UK GBP19.5 m GBP7.1 m GBP26.6 m

Hotel and Office, Northern Ireland GBP12.5 m GBP12.5 m

Two Hotels, Manchester & Edinburgh GBP30.4 m GBP20.3 m GBP50.7 m

Office and Industrial Portfolio, UK GBP5.5 m GBP5.5 m

(2)

Total Sterling Loans GBP240.2 m GBP31.0 m GBP271.2 m

Three Shopping Centres, Spain GBP29.9 m GBP29.9 m

Shopping Centre, Spain GBP14.6 m GBP14.6 m

Hotel, Dublin GBP51.7 m GBP51.7 m

Office, Madrid, Spain GBP15.9 m GBP0.9 m GBP16.8 m

Mixed Portfolio, Europe GBP16.0 m GBP16.0 m

Mixed Use, Dublin GBP7.8 m GBP4.8 m GBP12.6 m

Office Portfolio, Spain GBP8.3 m GBP0.1 m GBP8.4 m

Office Portfolio, Dublin, Ireland GBP27.3 m GBP27.3 m

Logistics Portfolio, Germany GBP3.3 m GBP3.3 m

Office and Industrial Portfolio, The GBP14.1 m GBP14.1 m

Netherlands(2)

Total Euro Loans GBP188.9 m GBP5.8 m GBP194.7 m

Total Portfolio GBP429.1 m GBP36.8 m GBP465.9 m

(1) Euro balances translated to sterling at period-end exchange

rate.

(2) Office and Industrial Portfolio, UK and Office and

Industrial Portfolio, The Netherlands is one single loan agreement

with sterling and Euro tranches.

Between 1 January 2022 and 30 June 2022, the following

significant investment activity occurred (included in the table

above):

NEW LOAN: OFFICE AND INDUSTRIAL PORTFOLIO, THE NETHERLANDS AND

UK:

On 26 May 2022, the Group announced its EUR16.4 million and

GBP5.5 million investment in a three-year multi-currency loan

secured on a portfolio of five offices and one industrial property

located in the Netherlands and the UK. The Dutch portfolio consists

of four office properties in the highly sought-after Randstad

region that contains two of the largest Dutch cities - The Hague

and Utrecht. The portfolio also includes an industrial property of

7,586 square metres located near the Port of Rotterdam, Europe's

largest and busiest industrial zone. The UK office asset is located

in Southwark, London, adjacent to Borough tube station and very

close to London Bridge station, one of the city's major terminals

for commuter and regional services. It provides 16,000 square feet

of space which was let to four tenants across six floors.

REPAYMENTS:

OFFICE, SCOTLAND:

The GBP5 million loan repaid in full upon the sale of the

underlying property in line with the sponsors business plan.

PARTIAL REPAYMENTS:

Despite lower transaction volumes across the markets as a result

of the cautionary approach being adopted by investors, borrowers in

the portfolio successfully executed a number of disposals ahead of

business plan, for example:

? EUR6.6 million, equivalent to approximately 36 per cent of the

remaining loan balance was repaid on the Mixed Portfolio, Europe

during May 2022. This was due to the sale of the Finnish

sub-portfolio which has resulted in the Group's exposure to Finland

reducing to zero.

? EUR2.1 million, equivalent to approximately 35 per cent of the

remaining loan balance was repaid on the Logistics, Germany and UK

loan upon the sale of a major UK logistics property which had been

leased up and sold at a price exceeding underwritten

expectations.

Subsequent to 30 June 2022, the following significant

investments activity occurred: PARTIAL REPAYMENTS

HOTEL, DUBLIN:

EUR4.3 million, equivalent to 7 per cent of the remaining loan

balance was repaid on Hotel, Dublin in July. This cash was

generated from surplus trading cash at the election of the sponsor

and in line with the parameters of the underlying facility

agreement.

MIXED PORTFOLIO, EUROPE:

EUR4.8 million, equivalent to 26 per cent of the remaining loan

balance was repaid on Mixed Portfolio, Europe in July 2022, upon

the sponsor selling a portfolio of seven industrial assets in well

located areas across Germany. The portfolio was sold at a

significant premium to underwritten values.

OFFICE AND INDUSTRIAL PORTFOLIO, THE NETHERLANDS

EUR5.8 million, equivalent to 35 per cent of the remaining loan

balance was repaid on Office and Industrial Portfolio, The

Netherlands in August 2022 following the sale of one of the assets

in the portfolio.

Amounts received were used primarily to fund amounts drawndown

on existing loan commitments, share buybacks and to repay debt.

PORTFOLIO OVERVIEW

The existing portfolio continues to perform robustly. As

indicated above, we are also seeing loan repayments in line with

sponsors executing underwritten business plans, with a total of

GBP14.9 million repaid in the six months to 30 June 2022 from a

combination of underlying property sub- portfolio sales, one loan

repaying in full upon sale of the underlying property and scheduled

amortisation. The portfolio remains fully invested.

We continue to closely monitor any actual or potential impact of

market headwinds such as energy, food, labour and construction cost

inflation through review of underlying asset performance and

discussions with sponsors and asset managers. As previously noted,

the majority of loan structures have interest rate hedging

requirements which assist in limiting the cash flow impact for

borrowers of increased loan interest payments as interest rates

continue to rise. Other structural features which provide

additional headroom on many of the investments include interest

reserves and the trapping of surplus trading cash until

underwritten business plans are achieved. All interest and

scheduled amortisation have been paid in line with contractual

obligations and no shortfall in interest due to the Group is

projected as a result of forecast interest rate rises.

The Group's key sector exposures of hospitality (40 per cent of

total invested portfolio), office (25 per cent) and retail (11 per

cent) all continue to perform in line with expectations. Hotels

that are open and trading are performing very well, with average

daily rates exceeding the Group's underwritten expectations,

underpinning the demand for these hotels, driven by robust demand

for business and leisure travel. Occupancy across the office

portfolio continues to be robust, with valuations holding up well.

Typically, valuations of collateral for income producing loans are

updated annually and such valuations that contain office collateral

and which are not under construction or heavy refurbishment have an

average age of under 1 year. The Group's retail exposure has

decreased by just under 1 per cent to 11 per cent of the total

invested portfolio as a result of scheduled amortisation and a sub

portfolio sale within the Mixed Portfolio, Europe loan. Occupancy

of the Spanish Shopping Centres, which comprise over 90 per cent of

the Group's retail exposure, continues to be robust and remains

ahead of the pre- pandemic level occupancy. Additionally, the

Group's independent valuations of the Spanish Shopping Centres have

been very recently updated and confirm that valuations are holding

up with a marginal increase in overall value.

Loan to Value

All assets securing the loans undergo third party valuations

before each investment closes and periodically thereafter at a time

considered appropriate by the lenders. The current weighted average

age of the dates of these third party valuations for the whole

portfolio is 1.07 years while the current weighted average age of

the valuations for the income-producing portfolio (i.e. excluding

loans for development or heavy refurbishment) is 0.71 years.

On the basis of the methodology and valuation processes

previously disclosed and including new valuations received, at 30

June 2022, the Group has an average last GBP LTV of 60.5 per cent

(31 December 2021: 61.9 per cent; 30 June 2021: 63.5 per cent).

The table below shows the sensitivity of the loan to value

calculation for movements in the underlying property valuation and

demonstrates that the Group has considerable headroom within the

currently reported last LTVs.

Change in Valuation Hospitality Retail Residential Other Total

-25% 80.4% 94.3% 79.0% 77.4% 80.7%

-20% 75.4% 88.4% 74.1% 72.5% 75.6%

-15% 70.9% 83.2% 69.7% 68.3% 71.2%

-10% 67.0% 78.6% 65.8% 64.5% 67.2%

-5% 63.5% 74.5% 62.4% 61.1% 63.7%

0% 60.3% 70.7% 59.3% 58.0% 60.5%

5% 57.4% 67.4% 56.4% 55.3% 57.6%

10% 54.8% 64.3% 53.9% 52.7% 55.0%

15% 52.4% 61.5% 51.5% 50.5% 52.6% LIQUIDITY AND HEDGING

The Group is very modestly levered with net debt of GBP15.4

million (3.6 per cent of NAV) at 30 June 2022 and has significant

liquidity available with undrawn revolving credit facilities (see

note 3g of the 2021 Annual Report for further information) of

GBP107.5 million to fund existing commitments as summarised

below.

As at 30 June 2022 GBP million

Drawn on Group debt facilities (18.5)

Cash at hand 3.1

Net Debt (15.4)

Undrawn Debt Facilities available to Group 107.5

Undrawn Commitments to Borrowers (36.8)

Available Capacity 70.7

The way in which the Group's borrowing facilities are structured

means that it does not need to fund mark to market margin calls.

The Group does have the obligation to post cash collateral under

its hedging facilities. However, cash would not need to be posted

until the hedges were more than GBP20 million out of the money. The

mark to market of the hedges at 30 June 2022 was GBP4.6 million (in

the money) and with the robust hedging structure employed by the

Group, cash collateral has never been required to be posted since

inception.

The Group has a large proportion (44%) of its investments

denominated in Euros (although this can change over time) and is a

sterling denominated group. The Group is therefore subject to the

risk that exchange rates move unfavourably and that a) foreign

exchange losses on the loan principal are incurred and b) that

interest payments received are lower than anticipated when

converted back to Sterling and therefore returns are lower than the

underwritten returns.

The Group manages this risk by entering into forward contracts

to hedge the currency risk. All non-Sterling loan principal is

hedged back to Sterling to the maturity date of the loan (unless it

was funded using the revolving credit facilities in which case it

will have a natural hedge). Interest payments are generally hedged

for the period for which prepayment protection is in place.

However, the risk remains that loans are repaid earlier than

anticipated and forward contracts need to be broken early. In these

circumstances the forward curve may have moved since the forward

contracts were placed which can impact the rate received. In

addition, if the loan repays after the prepayment protection,

interest after the prepayment protected period may be received at a

lower rate than anticipated leading to lower returns for that

period. Conversely the rate could have improved and returns may

increase.

EXPECTED CREDIT LOSSES (IMPAIRMENT)

All loans within the portfolio are classified and measured at

amortised cost less impairment.

Under IFRS 9 a three stage approach for recognition of

impairment is used, based on whether there has been a significant

deterioration in the credit risk of a financial asset since initial

recognition. These three stages then determine the amount of

impairment provision recognised.

At initial

recognition Recognise a loss allowance equal to 12 months expected credit losses resulting from default

(if asset is not events that are possible within 12 months

credit impaired)

After initial recognition:

Credit risk has not increased significantly since initial recognition. Recognise 12 months

expected credit losses.

Stage 1

Interest income is recognised by applying the effective interest rate to the gross carrying

amount of financial assets.

Credit risk has increased significantly since initial recognition. Recognise lifetime expected

losses.

Stage 2

Interest income is recognised by applying the effective interest rate to the gross carrying

amount of financial assets.

Credit impaired financial asset. Recognise lifetime expected losses.

Stage 3

Interest income is recognised by applying the effective interest rate to the amortised cost (that

is net of the expected loss provision) of financial assets.

The Group has not recognised any impairment at initial

recognition on any of its loans due to the detailed and

conservative underwriting undertaken, robust loan structures in

place and a strong equity cushion with an average LTV of 60.5 per

cent (based on the latest available valuation for each asset).

A detailed description of how the Group determines on what basis

loans are classified as stage 1, stage 2 and stage 3 post initial

recognition is provided in the full year accounts.

As at 30 June 2022 two loans held in the balance sheet at

GBP45,650,969 (31 December 2021: three loans of GBP59,031,888) have

been classified as Stage 2. One investment was upgraded to Stage 1

from Stage 2 during the period as the underlying hotel asset has

completed its refurbishment project, demonstrated strong trading in

Q2 2022 since re-opening and has significant headroom to the loan's

basis, with no heightened credit risk vs recognition

continuing.

FAIR VALUE OF THE PORTFOLIO COMPARED TO AMORTISED COST

The table below represents the fair value of the loans based on

a discounted cash flow basis using a range of potential discount

rates.

% of book

Discount Rate Value Calculated

value

5.30% GBP 451.6m = fair value 104.10%

5.5% GBP 450.0m 103.8%

6.0% GBP 445.8m 102.8%

6.5% GBP441.7m 101.9%

7.0% GBP 437.6m 100.9%

7.5% GBP 433.6m = book value 100.0%

8.0% GBP 429.7m 99.1%

8.5% GBP 425.9m 98.2%

9.0% GBP 422.1m 97.3%

9.5% GBP 418.3m 96.5%

The effective interest rate ("EIR") - i.e. the discount rate at

which future cash flows equal the amortised cost, is 7.5 per cent.

We have sensitised the cash flows at EIR intervals of 0.5 per cent

up to +/- 2.0 per cent. The table reflects how a change in market

interest rates or credit risk premiums may impact the fair value of

the portfolio versus the amortised cost. Further, the Group

considers the EIR of 7.5 per cent to be conservative as many of

these loans were part of a business plan which involved

transformation and many of these business plans are advanced in the

execution and therefore significantly de-risked from the original

underwriting and pricing. The volatility of the fair value to

movements in discount rates is low due to the low remaining

duration of most loans.

RELATED PARTY TRANSACTIONS

Related party disclosures are given in note 15 to the Unaudited

Condensed Consolidated Financial Statements.

FORWARD LOOKING STATEMENTS

Certain statements in this interim report are forward-looking.

Although the Group believes that the expectations reflected in

these forward-looking statements are reasonable, it can give no

assurance that these expectations will prove to have been correct.

Because these statements involve risks and uncertainties, actual

results may differ materially from those expressed or implied by

these forward-looking statements.

The Group undertakes no obligation to update any forward-looking

statements whether as a result of new information, future events or

otherwise.

Starwood European Finance Partners Limited

Investment Manager

5 September 2022

Principal Risks

PRINCIPAL RISKS FOR THE REMAINING SIX MONTHS OF THE YEAR TO 31

DECEMBER 2022

The principal risks assessed by the Board relating to the Group

were disclosed in the Annual Report and Audited consolidated

Financial Statements for the year to 31 December 2021. The Board

and Investment Manager have reassessed the principal risks and do

not consider these risks to have changed. Therefore, the following

are the principal risks assessed by the Board and the Investment

Manager as relating to the Group for the remaining six months of

the year to 31 December 2022:

FINANCIAL MARKET VOLATILITY (RISK THAT DIVIDS AND/OR SHARE PRICE

IS LOWER THAN ANTICIPATED)

The Group's targeted returns are based on estimates and

assumptions that are inherently subject to significant business and

economic uncertainties and contingencies and, consequently, the

actual rate of return may be materially lower than the targeted

returns. In addition, the pace of investment has, in the past and

may in the future, be slower than expected or the principal on

loans may be repaid earlier than anticipated, causing the return on

affected investments to be less than expected.

Furthermore, if repayments are not promptly re-invested this may

result in cash drag, which may lower portfolio returns. As a

result, the level of dividends to be paid by the Company may

fluctuate and there is no guarantee that any such dividends will be

paid. Since March 2020 and as a direct impact of the uncertainty

caused by the COVID-19 pandemic, the shares have traded at a

discount to NAV per share and shareholders may be unable to realise

their investments through the secondary market at NAV per

share.

The Board, along with the Investment Manager and the Investment

Adviser, monitor, review and consider the estimates and assumptions

that underpin the targeted return of the business and, where

necessary, communicate any changes in those estimates and

assumptions to the market. The Group has met its targeted returns

since inception.

The Board monitors the level of premium or discount of share

price to NAV per share and announced a resumption of a share

buyback programme in July 2022 in order to support the share price.

While the Directors may seek to mitigate any discount to NAV per

share through this share buyback and/or other discount management

mechanisms set out in this Annual Report, there can be no guarantee

that they will do so or that such mechanisms will be

successful.

LONG-TERM STRATEGIC RISK (RISK THAT THE BUSINESS MODEL IS NO

LONGER ATTRACTIVE)

The Group's targeted returns are based on estimates and

assumptions that are inherently subject to significant business and

economic uncertainties and contingencies and, consequently, the

actual rate of return may be materially lower than the targeted

returns. In addition, the pace of investment has, in the past and

may in the future, be slower than expected or the principal on

loans may be repaid earlier than anticipated, causing the return on

affected investments to be less than expected.

The Board, along with the Investment Manager and the Investment

Adviser, monitor, review and consider the estimates and assumptions

that underpin the targeted return of the business and, where

necessary, refocus the Group's strategy to respond to changes in

the market.

The Investment Adviser provides the Investment Manager and the

Board with a regular report on pipeline opportunities, which

includes an analysis of the strength of the pipeline and the

returns available. The Directors also regularly receive information

on the performance of the existing loans, including the performance

of underlying assets versus underwritten business plan and the

likelihood of any early repayments, the need for any loan

amendments to allow the loans continue to perform in different

economic circumstances which may impact returns.

The Board monitors investment strategy and performance on an

ongoing basis and regularly reviews the Investment Objective and

Investment Policy in light of prevailing investor sentiment to

ensure the Company remains attractive to its shareholders.

MARKET DETERIORATION RISK (RISK OF THE ECONOMIES IN WHICH THE

GROUP OPERATES EITHER STAGNATE OR GO INTO RECESSION)

The Group's investments are comprised principally of debt

investments in the UK and the European Union's internal market and

it is therefore exposed to economic movements and changes in these

markets. Any deterioration in the global, UK or European economy

could have a significant adverse effect on the activities of the

Group and may result in significant loan defaults or

impairments.

The COVID-19 pandemic had a material impact on global economies

and on the operations of the Group's borrowers during 2022 (as it

had in 2021/2020). There is continued uncertainty as large parts of

the world open up and learn to live with the long terms impacts of

the pandemic and the full impact of the consequences for the world

economy is unclear.

The situation in Ukraine, which has become more unstable since

February 2022 with the incursion into Ukraine by Russia, also

presents a significant risk to European and Global economies and,

potentially, world peace. While the Group has no direct or known

indirect involvement with Ukraine, Russia or Belarus it may be

impacted by the consequences of the usability caused by the

Ukrainian/ Russian conflict.

The impact of the United Kingdom's departure from the European

Union in 2020 still represents a potential threat to the UK economy

as well as wider Europe. On a cyclical view, the national economies

across Europe appear to be heading towards lower growth, and

alongside the economic impact of COVID-19 and the destabilising

impact of the conflict in Ukraine, towards recession.

The Board have considered the impact of market deterioration on

the current and future operations of the Group and its portfolio of

loans advanced. Because of the cash and loan facilities available

to the Group and the underlying quality of the portfolio of loans

advanced, both the Investment Manager and the Board still believe

the fundamentals of the portfolio remain optimistic and that the

Group can adequately support the portfolio of loans advanced

despite current market conditions.

In the event of a loan default in the portfolio, the Group is

generally entitled to accelerate the loan and enforce security, but

the process may be expensive and lengthy, and the outcome is

dependent on sufficient recoveries being made to repay the

borrower's obligations and associated costs. Some of the

investments held would rank behind senior debt tranches for

repayment in the event that a borrower defaults, with the

consequence of greater risk of partial or total loss. In addition,

repayment of loans by the borrower at maturity could be subject to

the availability of refinancing options, including the availability

of senior and subordinated debt and is also subject to the

underlying value of the real estate collateral at the date of

maturity. The Group is mitigated against this with an average

weighted loan to value of the portfolio of 60.5 per cent.

Therefore, the portfolio should be able to withstand a significant

level of deterioration before credit losses are incurred.

The Investment Adviser also mitigates the risk of credit losses

by undertaking detailed due diligence on each loan. Whilst the

precise scope of due diligence will depend on the proposed

investment, such diligence will typically include independent

valuations, building, measurement and environmental surveys, legal

reviews of property title, assessment of the strength of the

borrower's management team and key leases and, where necessary,

mechanical and engineering surveys, accounting and tax reviews and

know your customer checks.

The Investment Adviser, Investment Manager and Board also manage

these risks by ensuring a diversification of investments in terms

of geography, market and type of loan. The Investment Manager and

Investment Adviser operate in accordance with the guidelines,

investment limits and restrictions policy determined by the Board.

The Directors review the portfolio against these guidelines, limits

and restrictions on a regular basis.

The Investment Adviser meets with all borrowers on a regular

basis to monitor developments in respect of each loan and reports

to the Investment Manager and the Board periodically and on an ad

hoc basis where considered necessary.

The Group's loans are held at amortised cost. The performance of

each loan is reviewed quarterly by the Investment Adviser for any

indicators of significant increase in credit risk, impaired or

defaulted loans. The Investment Adviser also provides their

assessment of any expected credit loss for each loan advanced. The

results of the performance review and allowance for expected credit

losses are discussed with the Investment Manager and the Board.

Three loans, in the retail and hospitality sectors, were in

Stage 2 (increased risk of default) at the beginning of the year as

disclosed in the Annual Report and Audited consolidated Financial

Statements for the year to 31 December 2021 largely as a result of

the uncertainty and operational disruption caused by the impact of

the COVID-19 pandemic. One of these loans has now stabilised to the

extent that it has now been moved back to Stage 1 (which indicates

that it is judged to be at the same risk of default as it was when

it was originally underwritten). The two loans currently classified

as Stage 2 account for 11 per cent of the loans advanced by the

Group as at 31 December 2021. No expected credit losses have been

recognised against any of the loans, because of the strong LTVs

across the loan portfolio and strong contractual agreements with

Borrowers, including against these Stage 2 loans.

PREPAYMENT RISK (RISK OF MORE FAVORABLE LOAN TERMS BEING

AVAILABLE TO BORROWERS WHICH WOULD LEAD TO THE EARLY PREPAYMENT OF

LOANS ADVANCED)

All loans are provided to borrowers on a contractual basis which

will ensure a minimum return to the Group in the event of early

repayment.

The Directors receive regular information on the performance of

the existing loans, including the performance of underlying assets

versus underwritten business plan and the likelihood of any early

repayments, the need for any loan amendments to allow the loans

continue to perform in different economic circumstances which may

impact returns.

INTEREST RATE RISK

The Group is subject to the risk that the loan income and income

from the cash and cash equivalents will fluctuate due to movements

in interbank rates.

The loans in place at 30 June 2022 have been structured so that

21 per cent by value of the loans are fixed rate, which provides

protection from downward interest rate movements to the overall

portfolio (but also prevents the Group from benefiting from any

interbank rate rises on these positions). In addition, whilst the

remaining 79 per cent is classified as floating, 100 per cent of

these loans are subject to interbank rate floors such that the

interest cannot drop below a certain level, which offers some

protection against downward interest rate risk. When reviewing

future investments, the Investment Manager will continue to review

such opportunities to protect against downward interest rate

risk.

FOREIGN EXCHANGE RISK

The majority of the Group's investments are Sterling denominated

(circa 56 per cent as at 30 June 2022) with the remainder being

Euro denominated. The Group is subject to the risk that the

exchange rates move unfavourably and that a) foreign exchange

losses on the Euro loan principals are incurred and b) that Euro

interest payments received are lower than anticipated when

converted back to Sterling and therefore returns are lower than the

underwritten returns.

The Group manages this risk by entering into forward contracts

to hedge the currency risk. All non-Sterling loan principal is

hedged back to Sterling to the maturity date of the loan.

Interest payments are normally hedged for the period for which

prepayment protection is in place. However, the risk remains that

loans are repaid earlier than anticipated and forward contracts

need to be broken early.

In these circumstances, the forward curve may have moved since

the forward contracts were placed which can impact the rate

received. In addition, if the loan repays after the prepayment

protection, interest after the prepayment-protected period may be

received at a lower rate than anticipated leading to lower returns

for that period. Conversely, the rate could have improved, and

returns may increase.

As a consequence of the hedging strategy employed as outlined

above, the Group is subject to the risk that it will need to post

cash collateral against the mark to market on foreign exchange

hedges which could lead to liquidity issues or leave the Group

unable to hedge new non-Sterling investments.

The Company had approximately GBP286.1 million of hedged gross

notional exposure with Lloyds Bank plc at 30 June 2022 (converted

at 30 June 2022 FX rates).

As at 30 June 2022, the hedges were in the money. If the hedges

move out of the money and at any time this mark to market exceeds

GBP15 million, the Company is required to post collateral, subject

to a minimum transfer amount of GBP1 million. This situation is

monitored closely, however, and as at 30 June 2022, the Company had

sufficient liquidity and credit available on the revolving credit

facility to meet any cash collateral requirements.

RISK OF DEFAULT UNDER THE REVOLVING CREDIT FACILITIES

The Group is subject to the risk that a borrower could be unable

or unwilling to meet a commitment that it has entered into with the

Group as outlined above under market deterioration risk. As a

consequence of this, the Group could breach the covenants of its

revolving credit facilities and fall into default itself.

A number of the measures the Group takes to mitigate market

deterioration risk as outlined above, such as portfolio

diversification and rigorous due diligence on investments and

monitoring of borrowers, will also help to protect the Group from

the risk of default under the revolving credit facility as this is

only likely to occur as a consequence of borrower defaults or loan

impairments.

The Board regularly reviews the balances drawn under the credit

facility against commitments and pipeline and reviews the

performance under the agreed covenants. The loan covenants are also

stress tested to test how robust they are to withstand default of

the Group's investments.

CYBERCRIME

The Group is subject to the risk of unauthorised access into

systems, identification of passwords or deleting data, which could

result in loss of sensitive data, breach of data physical and

electronic, amongst other potential consequences. This risk is

managed and mitigated by regular reviews of the Group's operational

and financial control environment. The matter is also contained

within service providers' surveys which is completed by Group's

service providers and is regularly reviewed by the Board. No

adverse findings in connection with the service provider surveys

have been found. The Company and its service providers have

policies and procedures in place to mitigate this risk, the

cybercrime risk continues to be closely monitored.

REGULATORY RISK

The Group is also subject to regulatory risk as a result of any

changes in regulations or legislation. Constant monitoring by the

Investment Adviser, Investment Manager and the Board is in place to

ensure the Group keeps up to date with any regulatory changes and

compliance with them.

OPERATIONAL RISK

The Group has no employees and is reliant on the performance of

third-party service providers. Failure by the Investment Manager,

Investment Adviser, Administrator or any other third-party service

provider to perform in accordance with the terms of its appointment

could have a material detrimental impact on the operation of the

Company.

The Board maintains close contact with all service providers to

ensure that the operational risks are minimised.

EMERGING RISKS

Emerging risks to the Group are considered by the Board to be

trends, innovations and potential rule changes relevant to the real

estate mortgage and financial sector. The challenge to the Group is

that emerging risks are known to some extent but are not likely to

materialise or have an impact in the near term. The Board regularly

reviews and discusses the risk matrix and has identified climate

change as an emerging risk.

CLIMATE CHANGE

The consequences that climate change could have are potentially

severe but highly uncertain. The potential impact of possible

losses has done a lot to raise the awareness of this risk in

investment circles. The Board, in conjunction with the Investment

Adviser, considers the possible physical and transitional impact of

climate change on properties secured on loans provided by the Group

and includes the consideration of such factors in valuation

instructions of the collateral properties and in considering any

potential expected credit losses on loans. The Investment Adviser

considers the possible physical and transitional impact of climate

change as part of the origination process. In addition, the Board,

in conjunction with the Investment Adviser, is monitoring closely

the regulation and any developments in this area.

Governance

Board of Directors

JOHN WHITTLE | Non-executive Director - Chairman of the

Board

John is a Fellow of the Institute of Chartered Accountants in

England and Wales and holds the Institute of Directors Diploma in

Company Direction. He is a Non-Executive Director of The Renewable

Infrastructure Group Ltd (FTSE 250), Sancus Lending Group Ltd

(listed on AIM), and Chenavari Toro Limited Income Fund Limited

(listed on the SFS segment of the Main Market of the London Stock

Exchange). He was previously Finance Director of Close Fund

Services, a large independent fund administrator, where he

successfully initiated a restructuring of client financial

reporting services and was a key member of the business transition

team. Prior to moving to Guernsey, he was at Pricewaterhouse in

London before embarking on a career in business services,

predominantly telecoms. He co-led the business turnaround of

Talkland International (which became Vodafone Retail) and was

directly responsible for the strategic shift into retail

distribution and its subsequent implementation; he subsequently

worked on the private equity acquisition of Ora Telecom. John is a

resident of Guernsey.

GARY YARDLEY | Non-executive Director

Gary is a Fellow of the Royal Institution of Chartered Surveyors

and holds a degree in estate management from Southbank University

and an MBA. He has been a senior deal maker in the UK and European

real estate market for over 25 years. Gary was formally Managing

Director & Chief Investment Officer of Capital & Counties

Property PLC ("Capco") and led Capco's real estate investment and

development activities. Leading Capco's team on the redevelopment

of Earls Court, Gary was responsible for acquiring and subsequently

securing planning consent for over 11m sq. ft. at this strategic

opportunity area capable of providing over 7,500 new homes for

London. Gary was also heavily involved in the curation and growth

of the Covent Garden estate for Capco, now an established premier

London landmark. Gary is a Chartered Surveyor with over 30 years'

experience in UK & European real estate. He is a former CIO of

Liberty International and former equity partner of King Sturge and

led PwC's real estate team in Prague and Central Europe in the

early 1990s. Gary is a resident of the United Kingdom.

SHELAGH MASON | Non-executive Director - Management Engagement

Committee Chairman and Senior Independent Director

Shelagh Mason is a solicitor specialising in English commercial

property who retired as a consultant with Collas Crill LLP in 2020.

She is the Non-Executive Chairman of the Channel Islands Property

Fund Limited listed on the International Stock Exchange and is also

Non-Executive Chairman of Riverside Capital PCC, sits on the board

of Skipton International Limited, a Guernsey Licensed bank, and

until 28 February 2022, she was a Non-Executive Director of the

Renewables Infrastructure Fund a FTSE 250 company, standing down

after nine years on the board. In addition to the Company, she has

a non- executive position with Ruffer Investment Company Limited,

recently admitted to the FTSE 250. Previously Shelagh was a member

of the board of directors of Standard Life Investments Property

Income Trust, a property fund listed on the London Stock Exchange

for 10 years until December 2014. She retired from the board of

Medicx Fund Limited, a main market listed investment company

investing in primary healthcare facilities in 2017 after 10 years

on the board. She is a past Chairman of the Guernsey Branch of the

Institute of Directors and she also holds the IOD Company Direction

Certificate and Diploma with distinction. Shelagh is a resident of

Guernsey.

CHARLOTTE DENTON | Non-executive Director - Audit Committee

Chairman

Charlotte is a Fellow of the Institute of Chartered Accountants

in England and Wales and holds a degree in politics from Durham

University. She is also a member of the Society of Trust and Estate

Practitioners, a Chartered Director and a fellow of the Institute

of Directors. During Charlotte's executive career she worked in

various locations through roles in diverse organisations, including

KPMG, Rothschild, Northern Trust, a property development startup

and a privately held financial services group. She has served on

boards for over fifteen years and is currently a Non-Executive

Director of various entities including Butterfield Bank (Guernsey)

Limited, the GP boards of Private Equity groups Cinven and Hitec

and the Investment Manager for NextEnergy. Charlotte is a resident

of Guernsey.

Statement of Directors' Responsibilities

To the best of their knowledge, the Directors of Starwood

European Real Estate Finance Limited confirm that:

1. The Unaudited Condensed Consolidated Financial Statements

have been prepared in accordance with IAS 34, "Interim Financial

Reporting" as adopted by the European Union as required by DTR

4.2.4 R; and

2. The Interim Financial Report, comprising of the Chairman's

Statement, the Investment Manager's Report and the Principal Risks,

meets the requirements of an interim management report and includes

a fair review of information required by:

(i) DTR 4.2.7R of the UK Disclosure and Transparency Rules,

being an indication of important events that have occurred during