TIDMTAM

RNS Number : 4690C

Tatton Asset Management PLC

13 June 2023

13 June 2023

Tatton Asset Management PLC

("TAM plc", the "Group" or the "Company")

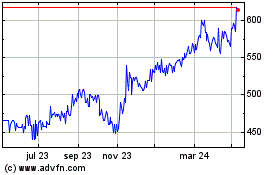

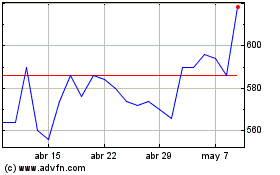

AIM: TAM

AUDITED FINAL RESULTS

For the year ended 31 March 2023

TAM plc, the investment management and IFA support services

group, today announces its audited final results for the year ended

31 March 2023 ("FY23"), which show strong, double-digit growth

across all metrics in line with market expectations.

FINANCIAL HIGHLIGHTS

-- Group revenue increased 10.1% to GBP32.327m (2022: GBP29.356m)

-- Adjusted operating profit(1) up 12.9% to GBP16.402m (2022:

GBP14.526m)

-- Adjusted operating profit(1) margin 50.7% (2022: 49.5%)

-- Adjusted fully diluted EPS(2) increased 10.7% to 20.61p (2022:

18.62p)

-- Final dividend up 17.6% to 10.0p (2022: 8.5p), full year dividend

of 14.5p (2022: 12.5p)

-- Strong financial liquidity position, with net cash of GBP26.494m

(2022: GBP21.710m)

-- Strong balance sheet - Net assets increased 34.6% to GBP41.781m

(2022: GBP31.044m)

1 Operating profit before exceptional items, share-based payment

charges and amortisation of acquired intangibles and changes

in fair value of contingent consideration.

2 Adjusted fully diluted earnings per share is calculated by

dividing the adjusted operating profit less cash interest

and less tax on operating activities by the weighted average

number of ordinary shares in issue during the year plus potentially

dilutive ordinary shares.

OPERATIONAL HIGHLIGHTS

-- Assets Under Management ("AUM") increased 12.3% to GBP12.735bn

(2022: GBP11.341bn). Current AUM at June 2023 c.GBP13.204bn

(AUM/AUI: c.GBP14.325bn)

-- Organic net inflows were GBP1.794bn (2022: GBP1.277bn), an

increase of 15.8% of opening AUM with an average run rate

of GBP150m per month

-- Acquisition of 50% of the share capital of 8AM Global Limited

("8AM" or "8AM Global") adding assets under influence ("AUI")

of GBP1.136bn, resulting in AUM/AUI totalling GBP13.871bn

-- Tatton's non-Managed Portfolio Services ("MPS") propositions

now account for c.GBP1.2bn of AUM

-- Tatton's IFA firms increased by 16.5% to 869 (2022: 746) and

the number of accounts increased 19.2% to 107,010 (2022: 89,780)

-- Paradigm Mortgages completions up by 10.3% to GBP14.50bn (2022:

GBP13.15bn). Paradigm Mortgages member firms increased to

1,751 members (2022: 1,674 members)

-- Paradigm Consulting increased its members increased to 431

(2022: 421)

Paul Hogarth, Chief Executive Officer, commented:

"This is the 10(th) anniversary year for Tatton and I am

delighted with the progress we have continued to make throughout

that decade. It is fitting that in this 10(th) anniversary year, we

have raised the bar further, delivering our best performance to

date with record net inflows of GBP1.8bn, AUM/AUI of GBP13.9bn and

involvement in lending through Paradigm of GBP14.5bn.

"While it has been a difficult and volatile year for many asset

managers and businesses, we have continued to execute our strategy

and build on our strengths, leveraging our wide distribution

capability, deep industry expertise, robust long-term investment

performance and talented team across the whole business.

"As we look forward, we are mindful that we remain in uncertain

times, both from an economic and geo-political standpoint. While

not unaffected by these conditions, despite this uncertainty we are

optimistic about the Group's prospects. Assets on platform continue

to grow and our MPS proposition is becoming increasingly attractive

to IFAs and their clients. With our long-term consistent investment

track record rewarding and enhancing client outcomes, wide

distribution footprint and competitive market position we are well

placed to capitalise on these conditions and achieve our goal of

delivering long-term, sustainable growth for all our

stakeholders."

For further information please contact:

Tatton Asset Management plc

Paul Hogarth (Chief Executive Officer)

Paul Edwards (Chief Financial Officer)

Lothar Mentel (Chief Investment Officer) +44 (0) 161 486 3441

Zeus - Nomad and Broker

Martin Green/Dan Bate (Investment

Banking) +44 (0) 20 3829 5000

Singer Capital Markets - Joint Broker

Peter Steel / Charles Leigh-Pemberton

(Investment Banking) +44 (0) 20 7496 3000

Belvedere Communications - Financial

PR +44 (0) 7407 023147

John West / Llew Angus (media) + 44 (0) 7715 769078

Cat Valentine / Keeley Clarke (investors) tattonpr@belvederepr.com

Trade Media Enquiries

Roddi Vaughan Thomas +44 (0) 20 7139 1452

For more information, please visit:

www.tattonassetmanagement.com

CHAIRMAN'S STATEMENT

Teamwork and talent delivers results

DEAR SHAREHOLDER

The 12 month period ended 31 March 2023, in common with the

previous trading period, has been a challenging time for asset

management, with economic stimuli, both positive and negative,

constantly changing, while the political landscape, globally as

well as in the UK, has done little to brighten prospects. An

uncertain trading environment has encouraged the Group to sustain a

focus on our core strategies, so it is satisfying to be able to

report further progress with increases in assets under management,

revenues, profits and, as a result, the dividend.

Our strategic ambition continues to be growth centred on organic

development, augmented by appropriate M&A activity when

opportunities arise, and we aspire to be the provider of choice for

the independent financial adviser ("IFA") community as a result of

providing products and services that enable them to better advise

their clients.

In common with businesses globally, and throughout the UK, the

Group has been buffeted by economic and political shocks, the

pandemic, the war in Ukraine, and the economic consequences of

these events, which have led to widely reported volatility and

difficult trading conditions. Riding these storms measures the

resilience of any organisation, so it is gratifying to be able to

report that TAM finds itself, at the end of this financial year, a

larger and stronger organisation with record asset net inflows,

higher levels of assets managed and influenced, and with an

increasing number of IFAs and their clients supporting the

business.

A material factor behind the results that we are reporting now

is the significant growth in demand for Model Portfolio Services

("MPS") generally. As provision for income in later life becomes an

ever more important consideration in the minds of investors, the

combination of clarity, positive investment returns, and low

charges is fuelling an appetite for MPS products, leading to new

entrants and increasing inflows as the MPS concept becomes a

leading strategic pillar for investors and their advisers.

Increasing demand is growing the overall market and validating the

proposition.

In my statement last year, I highlighted our "Roadmap to Growth"

aspiration based on a three-year target, set in 2021, of assets

under management increasing from GBP9.0bn to GBP15.0bn by March

2024. Despite the difficult trading conditions alluded to above,

assets under management at 31 March 2023 stood at GBP12.735bn,

excluding the assets derived from the acquisition of 8AM Global Ltd

of GBP1.136bn.

Paradigm Consulting, our consultancy business, has performed in

line with expectations, delivering expert regulatory consulting to

the IFA community and is well positioned to continue to do so. The

Mortgage business enjoyed a very positive performance this year,

with involvement in record mortgage completions of GBP14.50bn

(2022: GBP13.15bn). While the results of Government policy on

interest rates over the trading period are still being felt, the

situation has stabilised, and rates and products have reverted to

near normal, although the mortgage market remains uncertain.

Nevertheless, we are confident that the business remains well

placed in its markets and strongly positioned to take advantage of

opportunities that will undoubtedly lie ahead.

FINANCIAL HIGHLIGHTS

Group revenue increased by 10.1% to GBP32.3m (2022: GBP29.4m),

while adjusted operating profit(1) rose by 12.9% to GBP16.4m (2022:

GBP14.5m) and profit before tax, after incurring exceptional costs

and share-based payment charges, improved further to GBP16.0m

(2022: GBP11.3m). The impact of the above on fully diluted adjusted

earnings per share(1) was an increase of 10.7% to 20.61p (2022:

18.62p), while basic earnings per share was 22.43p (2022:

15.92p).

OUR PEOPLE

As ever, we believe our people are the most important factor in

the successful delivery of the Group's strategy and the maintenance

of long-term growth and value creation. On behalf of the Board, I

would like to thank every member of staff for their outstanding

performance over the past year, which is behind the delivery of a

gratifying set of results.

It has been a difficult year for many businesses, more so for

many employees across the country with the increased cost of living

and the impact of acute energy issues. With this in mind, the Group

made a one-off "winter support" payment to all employees of

GBP1,000 in recognition of the pressures people have faced and to

reflect the hard work and dedication that our employees have shown

in difficult times.

1. Alternative performance measures are detailed in note 23.

ROLE OF THE BOARD AND ITS EFFECTIVENESS

My primary role as Chairman is to provide leadership to the

Board and to provide the right environment to enable each of the

Directors, and the Board as a whole, to perform effectively to

optimise the success of the Company for the benefit of its

shareholders and other stakeholders.

It is my view that the Board has an appropriate balance of

skills and is highly effective, with a thorough understanding of

the opportunities and threats facing the Group.

UK CORPORATE GOVERNANCE

TAM plc remains committed to the highest standards of corporate

governance. The Board understands that this commitment is necessary

for managing our business effectively and for maintaining investor

confidence. Good governance adds value and reduces risk, and in a

business which continues to grow and evolve, we look to sustain,

develop, and improve our governance arrangements continually.

Details of how we have approached and applied corporate governance

are provided throughout our Annual Report and detailed on pages 54

to 57 and to be published on 13 June 2023.

SECTION 172 STATEMENT

Section 172 ("s.172") of the Companies Act 2006 requires the

Directors to act in the way that they consider, in good faith,

would be most likely to promote the success of the Company for the

benefit of its members as a whole. In doing this, s.172 requires a

Director to have regard, amongst other matters, to the likely

consequences of any decisions in the long term; the interests of

the Company's employees; the need to foster the Company's business

relationships with suppliers, customers and others; the impact of

the Company's operations on the community and environment; the

desirability of the Company to maintain a reputation for high

standards of business conduct; and the need to act fairly between

members of the Company. Further information can be found on pages

48 to 51 of our Annual Report.

DIVIDS

We remain on track to deliver against our set strategic goals

and create long-term sustainable shareholder value. Given the

continued progress, the Board is proposing to increase the final

full year dividend by 17.6% to 10.0p per share (see note 9),

bringing the total ordinary dividend for the year to 14.5p per

share, an increase of 16.0%, which is 1.4 times covered by adjusted

earnings per share. Subject to shareholder approval at the

forthcoming Annual General Meeting, the dividend will be paid on 15

August 2023 to shareholders on the register on 7 July 2023. The ex

dividend date will be 6 July 2023.

OUTLOOK

While the general economic outlook for the year ahead looks no

better than the period under review, both nationally and

internationally, there are factors that promote some optimism.

Momentum is a very useful ally, and we have confidence in being

able to increase our market share in what is widely recognised as a

growing sector of the asset management world. By remaining focused

on our stated strategy over the past year, we have been able to

grow the business significantly, and sustaining this focus, while

remaining alert to other opportunities, should enable us to report

further progress at the end of the 12 month trading period in front

of us.

Roger Cornick

Chairman

CHIEF EXECUTIVE'S REVIEW

10 years of continued growth: Model portfolios have come of

age

This year has seen the Group continue its progress and deliver

another year of strong financial performance. We have also made

good progress against our Strategic Goals and Priorities which I

set out in detail last year.

We move closer to delivering our stated goal of GBP15.0bn of

assets under management ("AUM") by March 2024 and we have

complemented our strong organic growth of AUM with a successful

acquisition strategy. Acquisitions in prior years have not only

delivered improved AUM but also expanded our distribution

footprint, giving us greater access to more IFAs and potential new

flows. This year, we have continued this strategy through the

acquisition of a 50% share in 8AM Global Limited, which now

contributes GBP1.136bn of assets under influence ("AUI") and a

solid management team. We are enjoying working together and look

forward to developing the business further together in the coming

years.

FINANCIAL PERFORMANCE

This year has been a difficult year for many businesses against

the backdrop of war in Ukraine, global economic instability, high

inflation, labour shortages and major geo--political events that

have unsettled markets. While not wholly unaffected by these

issues, we have been able to make excellent progress this year

through a combination of our resilient markets, strong business

model, the strength of our distribution and quality of our

propositions that continue to resonate with our firms and their

clients.

Group revenue increased 10.1% to GBP32.3m (2022: GBP29.4m) and

Group adjusted operating profit(1) increased 12.9% to GBP16.4m,

with margins improving to 50.7% (2022: 49.5%). Cash generation

remains very strong and we ended the year with cash on the balance

sheet of GBP26.5m (2022: GBP21.7m).

Tatton revenue increased by 11.1% to GBP25.9m, further

underpinned by record organic new net inflows in the year of

GBP1.794bn or 15.8% of opening AUM, an average of GBP149.5m per

month. In addition to organic flows, we also added GBP1.136bn of

AUI in the year following the acquisition of 50% of 8AM Global.

While markets improved in the second half of the year, annually

they contracted, reducing AUM by GBP400m or 3.5%, which ultimately

delivered a total AUM/AUI of GBP13.871bn or a 22.3% increase on the

prior year.

AUM Movement GBPbn

---------------------------------- -------

Opening AUM 1 April 2022 11.341

Organic net flows 1.794

Market and investment performance (0.400)

---------------------------------- -------

Total AUM 31 March 2023 12.735

Acquisition 50% 8AM Global (AUI) 1.136

---------------------------------- -------

Total AUM/AUI 31 March 2023 13.871

---------------------------------- -------

Tatton adjusted operating profit(1) increased by 13.9% to

GBP15.8m and margins were maintained at 61.1%, as investment to

drive the future growth of the business continued. Tatton continues

to account for a greater proportion of the income and now stands at

80.2% of Group revenue and also 96.5% of the Group's trading

profits.

Paradigm revenue increased by 6.8% to GBP6.4m. The Paradigm

Mortgage business delivered a very good year, with involvement in

mortgage completions exceeding GBP14.5bn for the first time, a

10.3% increase in the year. Operating profit(1) remains in line

with the prior year at GBP2.4m following investment in our cost

base. Including new personnel and cost inflation, the corresponding

margin reduced to 37.6%.

1.Alternative performance measures are detailed in note 23.

STRATEGY, PROGRESS AND MARKET TRS

Tatton

We are delighted to celebrate the 10th Anniversary of the

incorporation of Tatton this year. The last 10 years have flown by

since we created the business and in all honesty I never envisaged

we would be so successful with a product that had yet to fully find

its place in the investment management market. There have been many

milestones on the way but our first billion of AUM to break even

and our AIM listing back in 2017, which has been very beneficial

for the business, remain the standout points. I am humbled by our

success and I would like to thank all our IFAs and firms that have

supported us over the years, and also every one of our employees

who have helped in this journey, as our success would not have been

possible without their contribution.

Over these last 10 years, Tatton has been at the forefront of a

changing financial services and investment landscape and, from a

standing start in January 2013, we have created a market leading

investment business which now manages over GBP12.7bn. This growth

has principally been through the creation and promotion of a range

of risk-rated model portfolios, which makes discretionary fund

management ("DFM") available to the mass affluent while delivering

value and consistent investment returns at a market leading cost,

exclusively on their chosen Retail Investment Platform

("Platform").

Strategic Goals and Priorities

As part of our stated Strategic Goals and Priorities, I want to

update you on our continued progress in delivering our "Roadmap to

Growth" strategy, a three-year target of increasing AUM by

GBP6.0bn, from GBP9.0bn in FY21 to GBP15.0bn by FY24, with 50%

growth delivered from organic net inflows and 50% of the growth

through acquisition. With one year to go or being two thirds of the

way through that journey, we have AUM/AUI of GBP13.9bn. We have

delivered 82% of the target, with approximately three quarters of

the target achieved through new organic flows. In fact, this year

alone we delivered record net inflows of GBP1.794bn (2022:

GBP1.277bn), a 40.5% increase on the prior year.

Market development

The assets held on platforms and in Model Portfolio Services

("MPS") are now the fastest growing area for wealth managers, with

a consistent growth rate of c.25% per annum. MPS now accounts for

over GBP81bn of advised assets on Platforms and accounts for 12% of

the GBP680bn total adviser platform assets. The level of advised

assets on platform is forecast to grow to over a trillion in the

next few years, with the proportion of MPS also anticipated to take

an increasing share of this total.

As previously highlighted, new entrants and competition,

including long-standing traditional investment managers, continue

to enter the MPS market. While these traditional discretionary fund

managers have seen redemptions and net outflows from funds and

bespoke products, they have conversely seen good inflows into their

MPS offering which has underpinned their asset flows. I believe

this validates my long-held view that MPS has now come of age. We

anticipate the trend for further MPS growth and adoption this year

will maintain the strong net inflows we have seen across the

competitive landscape in the last 12 months. While it is clear

competition is increasing, Tatton is very well placed to take

advantage of the above market opportunity.

Distribution footprint

As the largest DFM MPS provider, we keep the IFA at the heart of

our business. We believe it is important to support the IFA and we

maintain a position that we do not compete with our IFAs. Amongst

many other factors, we believe that this has enabled us to continue

to increase our distribution footprint; we have increased the

number of firms to 869 firms (2022: 746). Each year, we have

increased our distribution footprint organically through adding

more direct IFA relationships beyond the Paradigm members, which

was the initial base for Tatton. Importantly, the three

acquisitions we have made since September 2019 have also

contributed to this growth and enabled us to further expand our

reach, as have the range of strategic partnerships we hold and

maintain. As we look forward, there remains significant opportunity

to grow and deepen these relationships and get a greater share of

the IFAs' available assets. At the same time, we will also look to

continue to add further firms from existing partnerships but also

new firms beyond these, to obtain a greater share of the overall

market available, which continues to grow.

Regulation

As the new consumer duty regulation is now imminent,

preparations should be complete and the implications are now clear.

There is a clear difference between IFAs as distributors when using

a third party MPS solution compared with advisers running their own

portfolios, which potentially makes them "manufacturers",

increasing their regulatory burden. We have already seen, prior to

the regulation coming into effect, IFAs migrating away from

in-house managed portfolios to third party MPS providers. We

believe this trend is set to continue as the implications of

consumer duty become more widely understood. Third party MPS

remains perfectly positioned to respond to consumer duty regulation

by delivering low cost and competitive investment solutions for

clients, whilst supporting the IFA in meeting consumer duty

obligations. I continue to believe that, as an MPS focused

investment manager, consumer duty plays to our strengths in placing

the adviser at the heart of the value chain and facilitating the

delivery of improved client outcomes.

PARADIGM

2022/23 was a good year for Paradigm's membership division.

Revenue increased 6.8% to GBP6.4m (2022: GBP6.0m) with contribution

maintained at GBP2.4m (2022: GBP2.4m), delivering a contribution

margin of 37.6%. We have continued to grow and add new firms, with

Paradigm Consulting firms increasing to 431 (2022: 421) and

Paradigm Mortgage firms increasing to 1,751 (2022: 1,674). The

integration of Paradigm's compliance and mortgage and protection

aggregation entities into a single membership division has proved

successful as the FCA's regime and oversight moves further towards

a more consumer focused regulatory environment and we have seen the

continued growth in share of compliance contract sales within our

Mortgage firm broker base.

Paradigm Consulting business continued to make steady progress,

increasing new membership fees as well as other consultancy

services while also investing in new personnel to ensure our

service level remains the best in the market. 2022/23 was an

exceptional year for Paradigm's Mortgage business, certainly given

the context of the mortgage market which demonstrated relentless

uncertainty. This year has seen borrowers faced with a challenging

period of rising inflation and interest rates, which combined with

significant lender service issues arising from the continued

challenges of working from home, resulting in record process and

pipeline delays.

The resilience and value of brokers was never more evident

during this last year. This is clearly demonstrated as intermediary

share of all mortgages rose to c.85% as consumers turned to brokers

to help with affordability issues arising from rising interest

rates, an issue most modern-day borrowers had never experienced.

The second half of the year was affected by the fall out from

September's mini-budget, which resulted in mass lender product

withdrawals, with those remaining charging unaffordable rates.

Borrowing volumes, especially in the purchase market, fell to a

near stop; however, brokers moved swiftly to address record levels

of product transfer maturities and protection cross-sales to

maintain activities, and with calmer markets, lenders began again

to compete, introducing greater product choice and, critically,

lower, more affordable rates. Given this context, we are delighted

with the fact the Paradigm Mortgages participated in a record

GBP14.50bn (2022: GBP13.15bn) of mortgage completions, a 10.3%

increase on the previous year.

As we look to the new year, despite the cost of living

challenges ahead, a sense of calmness has returned to the mortgage

market. We anticipate another year of two halves, with initially a

quieter purchase market, fuelled by essential movers. As inflation

and rising interest rates surpass their peaks, the drive and

affordability for home ownership will return, underpinned by the

perennial issue whereby supply doesn't match demand. In the

meantime, record levels of loan maturities and remortgages continue

to be an area of focus where brokers' experience will shine.

STRATEGIC GOALS AND PRIORITIES

As we look forward to the new year, our strategic direction

remains unchanged.

We will continue to consolidate and build on the gains we have

made to date and further develop the business to drive growth and

long-term value creation. Specifically, we look to achieve the

following:

-- Continue with the strong organic growth of new net inflows,

utilising our increasing range of firm distribution platforms.

-- Deliver the final phase of our three-year "Roadmap to Growth"

strategy, taking us from GBP9.0bn in FY21 to GBP15.0bn

by FY24. Building on the strong performance in 2022/23,

where we delivered an additional GBP1.8bn of AUM through

organic growth and GBP1.1bn of AUI through acquisition.

We anticipate we will reach our goal this year with over

GBP1.0bn of organic net new inflows.

-- Identify and execute on further acquisitions that contribute

to the "Roadmap to Growth" strategy but also, importantly,

fulfil our basic criteria of being value enhancing, strategically

complementary and earnings enhancing.

-- Build on our recent success by delivering further strategic

partnerships, joint ventures and collaborations with larger

IFA firms, delivering enhanced client outcomes.

-- Continue to grow the number of firms utilising Paradigm,

specifically taking a greater share of the available mortgage

broker and intermediary market, and growing the level of

mortgage completions.

OUTLOOK AND SUMMARY

In summary, the Group has delivered another strong year of

growth in net inflows and AUM while demonstrating resilience,

adaptability, and unwavering commitment to our clients. We remain

ever more optimistic about the future prospects and continue to

build on our strengths, leveraging our wide distribution

capability, our deep industry expertise, robust long-term

investment performance and talented team to deliver our strategic

goals. Our continued focus will be to expand the number of IFAs we

work with while driving increased new flows to further strengthen

our position as the leading MPS asset management company and ensure

the long-term sustainability of our business.

Lastly, I would like to express my gratitude to our dedicated

employees, who have demonstrated resilience, creativity, and

adaptability during these challenging times. Their unwavering

commitment to our clients and their exceptional talent are the

driving force behind our success.

Paul Hogarth

Chief Executive Officer

Q&A WITH PAUL HOGARTH

CHIEF EXECUTIVE OFFICER

1. How will the new consumer duty rules and regulation impact

Tatton?

Unlike most industry commentators, I look forward to embracing

the new legislation. I categorise it as being as important as other

previous market defining regulation such as RDR (Retail

Distribution Review) and TCF (Treating Customers Fairly). For me,

the main focus of consumer duty is price, value and ultimately

client outcomes. These three attributes have always been at the

forefront of our philosophy here at Tatton. I know we have all

worked hard to be ready and compliant, but I believe this will all

be worthwhile in due course and we are better placed than most, and

it may even be a competitive advantage to us.

2. Why does Tatton adopt the approach of Reliance on Others as

opposed to Agent as Client in its business model?

We actually have been Reliance on Others from day one. We

believe that the IFA and their client need to have total control of

the suitability of the advice while we at Tatton remain responsible

for the safeguarding of the investment management of the portfolio

selected. Each end client should be contracted with us through the

DFM mandate making sure that all clients are invested exactly as

they should be. Our next big campaign is intended to raise

awareness with the IFA community of the differences between to the

two contractual relationships. Our position has since been

supported by the professional indemnity industry, which has

questioned the disclosure of Agent as Client and a number of our

competitors have since followed our lead.

3. Tatton is 10 years old - how do you see the next 10 years

developing for the business?

Now that's an interesting question. Undoubtedly, we are

incredibly well positioned for further growth in the DFM MPS

market. As a bare minimum, we anticipate maintaining our market

share as the MPS market continues to mature and grow. We constantly

review the other opportunities in the wealth management arena and

always come back to the same point, which is: there is nothing

better than the DFM MPS space right now here in the UK.

Undoubtedly, other territories will adopt the UK market leading

position on compliance and regulation, replicating our regulators'

concentration on the overall costs of investing. This opens up the

opportunity to further expand our footprint outside of the UK.

4. Do you think you benefit from being single channel i.e.

receiving business purely from the IFA community?

Here at Tatton, we have always championed the IFA sector and

that is evident throughout all our business. We believe the IFA

market is in rude health and we have been well rewarded for

supporting and remaining loyal to the IFA community. Most of our

competitors, as we know, are multi-channel and a quick visit to

their websites shows that the IFA is just one of their routes to

market. We have seen some interesting moves from market

protagonists over the last 12 months as they try to get closer to

the end client, effectively directly competing with the IFA as they

attempt to vertically integrate. We watch this space with

interest.

5. How will the current market volatility and general global

economic uncertainty affect Tatton?

Firstly, I would say the Group has managed to navigate its way

through the last three years and been able to make substantial

progress against its strategic goals in what has been a challenging

environment. In the current environment and as we look forward, we

are comfortable that we have a very clear strategy and direction, a

strong business model and, certainly with Tatton, we participate in

a market that is growing strongly. In terms of the latter, with our

competitive attributes of a strong track record, high value

competitive pricing and best-in-class service with continued focus,

we intend to take full advantage of that.

CHIEF INVESTMENT OFFICER'S REPORT

First 10 years builds foundation for the next

PROPOSITION DEVELOPMENT

The experience and understanding that we have developed as a

team means that we recognise the importance of listening to our

clients. By better understanding their needs, we have evolved our

service to further embed Tatton into their operating models. To

achieve this at ever greater scale, we have continued to invest in

our proprietary adviser facing and platform connecting IT platform,

the Tatton Portal, which is the operational engine room of our

success, and a key differentiator in the market we serve.

With online client portfolio and valuation information for

advisers (and Tatton), the portal embeds us operationally into

IFAs' day to day business, offering a wide range of IFA tools.

These include personalised investment proposals; E-signing; adviser

dashboards; as well as a document resource library; factsheets; and

white label and co-branded portal access.

Our Ethical (ESG) portfolios (launched in 2014) have continued

to grow, but compared with previous years had a more challenging

year, caused principally by the relative return headwinds of the

energy and resource price shock. We believe, however, that consumer

interest remains strong and our experience in the sector has been

built up over many years, with a long-standing commitment to giving

the clients of financial advisers genuine transparency in how their

discretionary assets are allocated.

Tatton's investment process has been tested during both benign

and volatile market environments, and we are proud of our portfolio

performance consistency over the last 10 years. Ensuring investors

understand how global events impact or benefit their investments is

vital to keep them on track and committed towards their long-term

investment goals. To achieve this aim, we have continued to deliver

benchmark-setting, investment and market communications of highest

relevance through video, webinar and the investment team's Tatton

Weekly market update. Post COVID, we have also adopted a hybrid

model of virtual and physical interaction with our clients, to best

suit their needs and preferences.

2022/23 CAPITAL MARKETS AND RETURNS

Tatton's strength is based around the ability of its team to

understand and anticipate market developments. In capital market

terms (and by nearly any measure), the early 2020s have been a

period of extraordinary challenge, making it even more remarkable

that our performance has remained consistent throughout. This is

testament to the fact that our investment team follows a clearly

defined, robust and repeatable investment process that draws on its

experience and expertise.

Inflation has dominated in terms of policy. Central banks, led

by the US Federal Reserve, have aggressively tightened policy,

seeking to ease inflation through monetary policy moves. These

measures included dramatic increases in the short-term target

interest rates and a substantial reduction in bond holdings.

In the UK, Truss' ill-advised fiscal policy boosted an uptrend

in bond yields that had been well underway since the beginning of

the year.

The return of inflation and increasing interest rates mark the

end of the 40 year bond bull market, as bond prices and interest

rates move in opposite directions in conventional bond securities.

This is undoubtedly leading to valuation pressures as a result of

higher yields, leading to a poor year for investors, despite the

economy remaining in growth mode and showing resilience to the

sharpest succession of interest rate hikes in a generation.

Higher rates also substantially alter the equity investment

landscape. Much investor confidence will now depend not only on the

outcome of the war in Ukraine and the strength of its ripples

through the global economy, but also on the shape of the

inflationary pressures it is experiencing and if transitory does

indeed become systematic inflation. The war in Ukraine certainly

exacerbates inflation, as well as accelerating the transition to a

non-carbon fuel economy, if nothing else, now out of sheer

necessity.

The impact of energy commodity price increases and the winter of

cold homes and discontent did not lead to a recession in the UK and

Europe, as predicted, pointing perhaps to a brighter environment

ahead, but equity markets are in a challenging period, reflecting a

transformation in the underlying economic environment. A

combination of rising interest rates and a persistent surge in the

inflation rate has created substantial headwinds for a wide swath

of the investment markets, equities included, with significant

"repricing" occurring in stock markets during 2022.

While the bond market suffered in 2022, so did the tech

stock-heavy Nasdaq 100, an index with greater potential for high

long-term returns. Present value calculations of future earnings

for equities are tied to assumptions about interest rates and

inflation. If investors anticipate higher rates in the future, it

reduces the present value of future earnings for equities. When

this occurs, prices tend to face more pressure. The hardest hit

stocks have primarily been those with premium price-to-earnings

("P/E") multiples. These included secular growth and technology

companies that enjoyed extremely strong performance since the

pandemic began. Our decision to remain (in the main) underweight in

these stocks and US equities more generally proved the right

decision. Moving forward, we see more decoupling of the global

economy and opportunities within Asian markets.

An additional factor that creates challenges for equity markets

is higher debt costs (resulting from elevated interest rates),

which can reduce corporate profits. Companies that have to roll

over debt in today's market must pay more for that debt. That opens

the door to the potential for reduced corporate earnings going

forward. Lower earnings are typically reflected in lower equity

prices.

It should be noted that a changing interest rate environment,

while creating more headwinds for equities, does not mean there is

not continued upside opportunity. The key is how well companies

perform. One of the variables we are watching is whether inflation

declines sufficiently so that equities valuations are still

considered reasonable given the underlying environment. A return to

lower inflation would generally benefit equities.

OUTLOOK

2023 is certainly tricky to forecast and valuation arguments are

never the best guide to short-term stock market performance.

However, valuations often guide how professional investors position

over the shorter term between asset classes. Being underweight,

equities seems to be a "crowded" trade, but the increasing

likelihood of a steep downturn in the US economy, combined with

valuations being at low levels, signals that now could be an

attractive time to (tentatively) invest in bonds. Increasing yields

and spreads have left many parts of the bond market far more

favourably priced.

For 2023, we do see a transition from pain to gain. While we

still see a bumpy road ahead, investors can lock in yields that

have not been this high in years. More stability in interest rates

and clarity on monetary policy should bring flows back into fixed

income.

Our investment philosophy and process are deeply founded on a

principle of portfolio stewardship. Stewardship, to us, means

keeping portfolios aligned to the desired long-term investment

objectives in the face of a constantly changing world. As such, we

offer clients a broad range of investment risk exposure and

investment strategies, always guarding against the unintended risks

that can arise when making such investments.

Invariably, if you chase performance, you end up shooting

yourself in the foot, and Tatton's approach has always been to

remain calm in the face of volatility, adopting a level headed

management of portfolios. Our performance highlighted in the table

above bears testament to that.

The scalability of our model is maintained through our

operational efficiency, our flexibility and the strength of our

team in implementing our strategy. We have emerged from the global

upheavals of recent years as a much bigger, better and more

resilient business.

We are extremely proud of our achievements during the last 10

years, but our focus is resolutely fixed on the next 10 years, as

we build on our strong foundations to continue to deliver for the

clients of financial advisers whatever economic environment

develops. We are perfectly placed to benefit from increased

investor interest and involvement, and a desire to have the more

"grown-up" investment approach that personal portfolios on platform

can undoubtedly provide.

Lothar Mentel

Chief Investment Officer

Q&A WITH LOTHAR MENTEL

CHIEF INVESTMENTOFFICER

1. As we reach Tatton's 10 year anniversary, which achievement

are you most proud of?

When we started, there were already several DFMs offering MPS

and everyone thought there was no opportunity for growth. RDR

forced independent financial advisers to change their approach. The

commission-based business model was replaced with a need to offer

true independent and effective discretionary wealth management

advice at an affordable cost.

The offerings from traditional wealth managers were unwieldy and

too expensive. But we created something different. We created a

business designed to generate consistent risk rated returns for

private investors while also benefiting the advice sector, this

remains at the heart of our product and service development. We

designed this around a low cost DFM fee of only 0.15%. Despite

industry wide scepticism, we now have AUM of GBP12.7 billion and

0.15% is fast becoming the industry standard.

2. Is there a particular ethos that has shaped your business

development since inception?

That of client service and communication. We have reformulated

the whole process of giving UK retail investors access to returns

and services which previously were only made available to HNWIs

(High Net Worth Individuals) with private banking and wealth

management access.

Where others have needed hundreds of employees and heavy

operational costs, we have a team of just over 50 individuals and

are providing more ongoing communications and information to

advisers than many of our competitors. Our operational

effectiveness is extraordinary, as is our client relationship

management.

3. What would you like to see in terms of progression in the

industry and in the business?

What excites me is to create investment solutions and services

that continue to democratise retail access to discretionary

portfolio management via platforms. We have already succeeded in

taking what was only available to HNWIs, and making that available

to a wider group of people. I would like that group to become even

larger.

With the market forecast to grow at a rate of 25% per annum and

reach up to GBP200 billion by the end of 2026, it would be great to

help IFAs continue to succeed and take a larger slice of a growing

market.

CHIEF FINANCIAL OFFICER'S REPORT

A resilient financial performance in challenging conditions

OVERVIEW

Recent years have presented a number of challenges for

businesses and unfortunately this year has been no different. The

war in Ukraine, disrupted supply chains, increased costs and the

highest inflation we have seen in a generation have all contributed

to significant economic uncertainty and volatile markets. Our

ability to adapt to these conditions is supported by a resilient

business model which has been crucial for us to navigate these

challenges and emerge stronger than ever. This year has seen the

Group deliver its strongest financial performance to date,

including double digit growth in revenue and adjusted operating

profits(1), improving margins and record net inflows, all while

maintaining a robust balance sheet and strong liquidity.

This year is the 10 year anniversary of the inception of Tatton

Investment Management Limited and six years since Tatton Asset

Management plc was publicly listed on AIM. Over this period, the

Group has seen significant development, strong organic growth and

three strategically aligned acquisitions which have resulted in

investment-related income now accounting for 80.2% of our total

Group revenue and 96.5% of adjusted operating profit(1), a trend

that is anticipated to continue thanks to our focused strategy and

current market trends.

Our revenue since listing on AIM, has achieved a compound annual

growth rate of 18.2%, with adjusted operating profit(1) growing

even more strongly, achieving a compound growth rate of 24.0%.

Margins over the same period have increased by 12.7% in absolute

terms, resulting in a Group margin this year of 50.7%.

REVENUE AND PROFITS

Revenue - Group reported revenue increased by 10.1% to GBP32.3m

(2022: GBP29.4m). Tatton revenue increased by 11.1% to GBP25.9m

(2022: GBP23.3m). While many asset managers have seen redemptions

and outflows this year, AUM increased by 12.3% to reach GBP12.7bn

(2022: GBP11.3bn) and while negative market performance impacted

growth by GBP400m, record net new inflows in the year of GBP1,794m,

or 15.8% of the opening AUM, more than compensated.

Our industry leading growth reflects the strength of the MPS

market and the underlying trends that are driving MPS adoption by

IFAs. As the leading MPS provider, our focused approach on this

market and increased distribution footprint, as we add to the

number of IFAs we work with, have enabled us to continue to take

advantage of these trends. Complementing this organic growth, this

year saw us make a strategic investment in another MPS provider,

further expanding our reach into the MPS market. In August 2022, we

acquired 50% of the share capital of 8AM Global Limited which

contributes AUI of GBP1.136bn, and when combined with the Group AUM

of GBP12.735bn results in a total AUM/AUI of GBP13.871bn.

Paradigm's revenue increased by 6.8% to GBP6.4m (2022: GBP6.0m).

The number of mortgage member firms increased to 1,751 (2022:

1,674) and Paradigm Consulting member firms increased to 431 (2022:

421). Paradigm Consulting maintained its steady performance while

Paradigm Mortgages delivered an impressive performance as

completions reached a record level of GBP14.50bn (2022:

GBP13.15bn), an increase of 10.3% on the prior year. There has been

a significant degree of uncertainty in the mortgage market for most

of this year, due to rising interest rates, consumer affordability

concerns and the removal of a large number of products towards the

end of the calendar year following the emergency budget in

September 2022. Given this context, the strong performance

demonstrates both the agility of the business and its firms, but

also the robustness of the business model to continue to grow both

the number of firms it works with and increase its market share.

The business's other income streams, such as protection premia,

continued to grow, further strengthening the division's overall

performance.

Profit - The Group delivered adjusted operating profit(1) of

GBP16.4m (2022: GBP14.5m), an increase of 12.9%. Adjusted operating

profit margin(1) increased to 50.7% (2022: 49.5%). This increase in

margin can be attributed to a combination of the Group's business

model and operational gearing but also the fact that we have

successfully navigated an inflationary cost environment while

continuing to make cost investments to help drive and support

future growth. In line with last year, and as a response to the

inflationary environment, the Group has implemented an average 5%

annual salary increase, materially ahead of historical levels

(excludes Executive Directors(2) ). While personnel costs remain at

c.60% of the Group's total cost base, we do not anticipate that

these increases will be margin dilutive.

1. Alternative performance measures are detailed in note 23.

2. Executive Directors' salaries remain unchanged

Tatton's adjusted operating profit(1) increased by 13.9% to

GBP15.8m (2022: GBP13.9m) and its adjusted operating profit

margin(1) increased to 61.1% (2022: 59.6%). Paradigm's adjusted

operating profit(1) remained in line with the prior year at

GBP2.4m, following re-investment in personnel costs to strengthen

the team, bringing the margin more in line with historical

performance but reducing the margin year on year to 37.6% (2022:

40.6%).

Group operating profit was GBP16.6m (2022: GBP11.6m), which

includes the cost impact of separately disclosed items of -GBP0.2m

(2022: GBP2.9m).

ACQUISITIONS

During the year, the Group acquired 50% of the share capital of

8AM Global Limited. The consideration payable is up to GBP7.3m,

with GBP3.8m paid on completion through the issuing of shares in

TAM plc. The remaining GBP3.5m is to be paid in two equal

instalments, after year one and two following completion, dependent

on the business hitting predetermined profitability targets.

On acquisition, the Group recognised goodwill of GBP5.1m and

intangible assets of GBP2.1m, as well as an associated deferred tax

liability of GBP0.5m and discounted contingent consideration of

GBP2.9m. At the year end, the deferred contingent consideration

liability recognised on completion was remeasured to fair value

based on the anticipated profitability against the deferred payment

profitability target.

It has been determined that the business is unlikely to meet the

stretching deferred payment profitability targets, and so the

deferred payment liability has been "fair valued" in line with the

anticipated payment value. The difference being GBP1.9m, between

the original deferred payment fair value on completion and the fair

value at the year end, which has been taken through the profit and

loss account and included as a separately disclosed item. The fair

value of the deferred contingent consideration relating to the

acquisition of the Verbatim funds in September 2021 has also been

reduced by GBP0.7m.

SEPARATELY DISCLOSED ITEMS

Separately disclosed items totaling GBP0.208m include the cost

of share-based payments of GBP1.511m, amortisation of

acquisition-related intangible assets of GBP0.534m and GBP0.398m of

acquisition-related fees, see note 6. These costs have been offset

by a credit of GBP2.651m relating to the fair value adjustment of

contingent consideration payments.

Although some of these items may recur from one period to the

next, operating profit has been adjusted for these items to give

better clarity of the underlying performance of the Group. The

alternative performance measures ("APMs") are consistent with how

the business performance is planned and reported within the

internal management reporting to the Board. Some of these measures

are also used for the purpose of setting remuneration targets.

Earnings per share

Basic earnings per share increased to 22.43p (2022: 15.92p).

Adjusted earnings per share(1) increased by 9.3% to 21.72p (2022:

19.87p) and adjusted fully diluted earnings per share(1) increased

by 10.7% to 20.61p (2022: 18.62p), full details are shown in note

9.

1. Alternative performance measures are detailed in note 23.

Statement of financial position and cash

The Group's balance sheet remains strong as net assets increased

34.6% to GBP41.8m (2022: GBP31.0m), with cash on the balance sheet

contributing GBP26.5m (2022: GBP21.7m). Return on capital employed

was 36.7% (2022: 43.0%). The Group has issued shares valued at

GBP2.8m in relation to acquisitions and paid GBP7.7m in dividends

during the year. Our financial resources are kept under continual

review, incorporating comprehensive stress and scenario testing

which is formally reviewed and agreed at least annually.

Year ended Year ended

31 March 31 March

2023 2022

------------------------------- ---------- ----------

Total Shareholder funds 41,781 31,044

Less: Foreseeable dividend (6,000) (5,100)

Less: Non-Qualifying assets (20,972) (14,225)

Total qualifying capital

resources 14,809 11,719

Less capital requirement (4,400) (4,100)

Surplus Capital 10,409 7,619

------------------------------- ---------- ----------

% Capital resource requirement

held 337% 286%

------------------------------- ---------- ----------

In January 2022, the Investment Firms Prudential Regime ("IFPR")

came into effect focusing prudential requirements on the potential

harm the firm can pose to consumers and markets, whilst introducing

a basic liquidity requirement for all investment firms. Over the

year, the Group has maintained a healthy surplus over our

regulatory capital resource requirement and maintained very strong

liquidity.

Dividends

The Board is recommending a final dividend of 10.0p. When added

to the interim dividend of 4.5p, this gives a full year dividend of

14.5p (2022: 12.5p), an increase of 16.0% on the prior year. This

proposed dividend reflects both our cash performance in the period

and our underlying confidence in our business and maintains our

policy of paying a dividend approximately 70% of the adjusted

earnings and split on a one third two third basis between the

interim period and year end. If approved at the Annual General

Meeting, the final dividend will be paid on 15 August 2023 to

shareholders on the register on 7 July 2023.

Risk management

Risk is managed closely and is spread across our businesses and

managed to individual materiality. In our Annual Report and

Accounts published on 13 June 2023, our key risks have been

referenced primarily on pages 32 and 33 of the Annual Report. We

choose key performance indicators that reflect our strategic

priorities of investment, growth and profit, and these are detailed

on pages 28 and 29. In addition, the Strategic Report found on

pages 1 to 51 has been approved and authorised for issue by the

Board of Directors and signed on their behalf on 12 June 2023

by:

Paul Edwards

CHIEF FINANCIAL OFFICER

Consolidated Statement of Total Comprehensive Income

FOR THE YEARED 31 MARCH 2023

31-Mar 31-Mar

Note 2023 (GBP'000) 2022 (GBP'000)

--------------------------------------------------------- ---- --------------- ---------------

Revenue 32,327 29,356

Share of profit from joint venture 160 -

Administrative expenses (15,877) (17,726)

--------------------------------------------------------- ---- --------------- ---------------

Operating profit 16,610 11,630

--------------------------------------------------------- ---- --------------- ---------------

Share-based payment costs 6 1,511 2,399

Amortisation of acquisition-related intangibles 6 534 266

Gains arising on changes in fair value of contingent

consideration (2,651) -

Exceptional items 6 398 231

--------------------------------------------------------- ---- --------------- ---------------

Adjusted operating profit (before separately

disclosed items)(1) 16,402 14,526

--------------------------------------------------------- ---- --------------- ---------------

Unwinding of the discount rate on deferred consideration (228) -

--------------------------------------------------------- ---- --------------- ---------------

Other finance costs (386) (355)

--------------------------------------------------------- ---- --------------- ---------------

Finance costs 7 (614) (355)

--------------------------------------------------------- ---- --------------- ---------------

Profit before tax 15,996 11,275

Taxation charge 8 (2,623) (2,033)

--------------------------------------------------------- ---- --------------- ---------------

Profit attributable to shareholders 13,373 9,242

--------------------------------------------------------- ---- --------------- ---------------

Earnings per share - Basic 9 22.43p 15.92p

Earnings per share - Diluted 9 21.70p 15.17p

Adjusted earnings per share - Basic(1) 9 21.72p 19.87p

Adjusted earnings per share - Fully Diluted(2) 9 20.61p 18.62p

--------------------------------------------------------- ---- --------------- ---------------

1. Adjusted for exceptional items, amortisation on

acquisition-related intangibles, changes in the fair value of

contingent consideration and share -- based payments and the tax

thereon. See note 23.

2. Adjusted for exceptional items, amortisation on

acquisition-related intangibles, unwinding of discount on deferred

consideration, changes in the fair value of contingent

consideration and share-based payments and the tax thereon. See

note 23.

All revenue, profit and earnings are in respect of continuing

operations.

There were no other recognised gains or losses other than those

recorded above in the current or prior year and therefore a

Statement of Other Comprehensive Income has not been presented.

Consolidated Statement of Financial Position

AS AT 31 MARCH 2023

31-Mar 31-Mar

Note 2023 (GBP'000) 2022 (GBP'000)

---------------------------------------------- ---- --------------- ---------------

Non-current assets

Investments in joint ventures 11 6,762 -

Goodwill 12 9,337 9,337

Intangible assets 13 3,615 4,047

Property, plant and equipment 14 454 749

Deferred tax assets 17 1,258 841

---------------------------------------------- ---- --------------- ---------------

Total non-current assets 21,426 14,974

---------------------------------------------- ---- --------------- ---------------

Current assets

Trade and other receivables 15 3,782 3,805

Financial assets at fair value through profit

or loss 18 123 152

Corporation tax 121 706

Cash and cash equivalents 26,494 21,710

---------------------------------------------- ---- --------------- ---------------

Total current assets 30,520 26,373

---------------------------------------------- ---- --------------- ---------------

Total assets 51,946 41,347

---------------------------------------------- ---- --------------- ---------------

Current liabilities

Trade and other payables 16 (7,911) (7,556)

---------------------------------------------- ---- --------------- ---------------

Total current liabilities (7,911) (7,556)

---------------------------------------------- ---- --------------- ---------------

Non-current liabilities

Other payables 16 (2,254) (2,747)

---------------------------------------------- ---- --------------- ---------------

Total non-current liabilities (2,254) (2,747)

---------------------------------------------- ---- --------------- ---------------

Total liabilities (10,165) (10,303)

---------------------------------------------- ---- --------------- ---------------

Net assets 41,781 31,044

---------------------------------------------- ---- --------------- ---------------

Equity attributable to equity holders of the

Company

Share capital 19 12,011 11,783

Share premium account 15,259 11,632

Own shares 20 - -

Other reserve 2,041 2,041

Merger reserve (28,968) (28,968)

Joint venture reserve (21) -

Retained earnings 41,459 34,556

---------------------------------------------- ---- --------------- ---------------

Total equity 41,781 31,044

---------------------------------------------- ---- --------------- ---------------

The financial statements were approved by the Board of Directors

on 12 June 2023 and were signed on its behalf by:

Paul Edwards

Director

Company registration number: 10634323

Consolidated Statement of Changes in Equity

FOR THE YEARED 31 MARCH 2023

Joint

Share Share Other Merger venture Retained Total

capital premium Own shares reserve reserve reserve earnings equity

Note (GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000)

---------------- ---- ---------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

At 1 April 2021 11,578 11,534 (1,969) 2,041 (28,968) - 30,230 24,446

---------------- ---- ---------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Profit and total

comprehensive

income - - - - - - 9,242 9,242

Dividends 9 - - - - - - (6,641) (6,641)

Share-based

payments - - - - - - 2,679 2,679

Deferred tax on

share-based

payments - - - - - - 157 157

Current tax on

share-based

payments - - - - - - 1,051 1,051

Issue of share

capital

on exercise of

employee

share options 205 98 - - - - - 303

Own shares

acquired

in the year 20 - - (193) - - - - (193)

Own shares

utilised

on exercise of

options 20 - - 2,162 - - - (2,162) -

---------------- ---- ---------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

At 31 March 2022 11,783 11,632 - 2,041 (28,968) - 34,556 31,044

---------------- ---- ---------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

Profit and total

comprehensive

income - - - - - 39 13,334 13,373

Dividends 9 - - - - - - (7,714) (7,714)

Share-based

payments - - - - - - 1,307 1,307

Deferred tax on

share-based

payments - - - - - - 18 18

Current tax on

share-based

payments - - - - - - (102) (102)

Issue of share

capital

on exercise of

employee

share options 52 117 - - - - - 169

Own shares

acquired

in the year 20 - - (28) - - - - (28)

Own shares

utilised

on exercise of

options 20 - - 28 - - - - 28

Issue of share

capital

on acquisition

of

a joint venture 176 3,510 - - - - - 3,686

Dividends

received

from joint

venture - - - - - (60) 60 -

---------------- ---- ---------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

At 31 March 2023 12,011 15,259 - 2,041 (28,968) (21) 41,459 41,781

---------------- ---- ---------- ---------- ---------- ---------- ---------- ---------- ---------- ----------

The other reserve and merger reserve were created on 19 June

2017 when the Group was formed, where the difference between the

Company's capital and the acquired Group's capital was recognised

as a component of equity being the merger reserve. Both the other

reserve and the merger reserve are non-distributable. The joint

venture reserve represents the Group's share of post-tax profits

yet to be received (for example, in the form of dividends or

distributions), less amortisation of related intangible assets.

Consolidated Statement of Cash Flows

FOR THE YEARED 31 MARCH 2023

31-Mar 31-Mar

Note 2023 (GBP'000) 2022 (GBP'000)

------------------------------------------------------ ---- --------------- ---------------

Operating activities

Profit for the year 13,373 9,242

Adjustments:

Income tax expense 2,623 2,033

Finance costs 7 614 355

Depreciation of property, plant and equipment 14 384 377

Amortisation of intangible assets 13 661 536

Share-based payment expense 21 1,420 1,492

Post tax share of profits of joint venture less

amortisation of related intangible assets 11 (39) -

Changes in fair value of contingent consideration 6 (2,651) -

Changes in:

Trade and other receivables (146) 309

Trade and other payables (449) 907

------------------------------------------------------ ---- --------------- ---------------

Exceptional items 6 398 231

------------------------------------------------------ ---- --------------- ---------------

Cash generated from operations before exceptional

items 16,188 15,482

------------------------------------------------------ ---- --------------- ---------------

Cash generated from operations 15,790 15,251

------------------------------------------------------ ---- --------------- ---------------

Income tax paid (2,559) (1,612)

------------------------------------------------------ ---- --------------- ---------------

Net cash from operating activities 13,231 13,639

------------------------------------------------------ ---- --------------- ---------------

Investing activities

Payment for the acquisition of a business combination

and joint venture,

net of cash acquired (152) (2,825)

Purchase of intangible assets (229) (211)

Purchase of property, plant and equipment (89) (74)

------------------------------------------------------ ---- --------------- ---------------

Net cash used in investing activities (470) (3,110)

------------------------------------------------------ ---- --------------- ---------------

Financing activities

Interest paid (186) (144)

Dividends paid 9 (7,714) (6,641)

Dividends received from joint venture 60 -

Proceeds from the issue of shares 132 111

Purchase of own shares 20 - -

Proceeds from the exercise of options - 1,230

Repayment of lease liabilities (269) (309)

------------------------------------------------------ ---- --------------- ---------------

Net cash used in financing activities (7,977) (5,753)

------------------------------------------------------ ---- --------------- ---------------

Net increase in cash and cash equivalents 4,784 4,776

Cash and cash equivalents at beginning of period 21,710 16,934

------------------------------------------------------ ---- --------------- ---------------

Net cash and cash equivalents at end of period 26,494 21,710

------------------------------------------------------ ---- --------------- ---------------

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1 General Information

Tatton Asset Management plc (the "Company") is a public company

limited by shares. The address of the registered office is Paradigm

House, Brooke Court, Lower Meadow Road, Wilmslow, SK9 3ND. The

registered number is 10634323.

The Group comprises the Company and its subsidiaries. The

Group's principal activities are discretionary fund management, the

provision of compliance and support services to independent

financial advisers ("IFAs"), the provision of mortgage adviser

support services, and the marketing and promotion of multi-manager

funds.

News updates, regulatory news and financial statements can be

viewed and downloaded from the Group's website,

www.tattonassetmanagement.com . Copies can also be requested from:

The Company Secretary, Tatton Asset Management plc, Paradigm House,

Brooke Court, Lower Meadow Road, Wilmslow, SK9 3ND.

The Company has taken advantage of the exemption in section 408

of the Companies Act 2006 not to present its own income

statement.

2 Accounting Policies

The principal accounting policies applied in the presentation of

the annual financial statements are set out below.

2.1 Basis of preparation

The consolidated financial statements of the Group have been

prepared in accordance with International Financial Reporting

Standards ("IFRSs") as adopted by the United Kingdom and

International Financial Reporting Interpretations Committee

("IFRIC") interpretations issued by the International Accounting

Standards Board ("IASB") and the Companies Act 2006. The financial

statements of the Company have been prepared in accordance with UK

Generally Accepted Accounting Practice, including Financial

Reporting Standard 101 "Reduced Disclosure Framework" ("FRS

101").

The consolidated financial statements have been prepared on a

going concern basis and prepared on the historical cost basis.

The consolidated financial statements are presented in sterling

and have been rounded to the nearest thousand (GBP'000). The

functional currency of the Company is sterling as this is the

currency of the jurisdiction where all of the Group's sales are

made.

The preparation of financial information in conformity with

IFRSs requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities at the date

of the financial statements and the reported amounts of revenues

and expenses during the reporting period. Although these estimates

are based on management's best knowledge of the amount, event or

actions, actual events may ultimately differ from those

estimates.

The accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in the

consolidated financial statements.

2.2 Going concern

These financial statements have been prepared on a going concern

basis. The Directors have prepared cash flow projections and are

satisfied that the Group has adequate resources to continue in

operational existence for the foreseeable future. The Group's

forecasts and projections, which take into account reasonably

possible changes in trading performance, show that the Group will

be able to operate within the level of its current resources.

Accordingly, the Directors continue to adopt the going concern

basis in preparing these financial statements.

2.3 Basis of consolidation

The Group's financial statements consolidate those of the Parent

Company and all of its subsidiaries and joint ventures as at 31

March 2023. The Parent controls a subsidiary if it is exposed, or

has rights, to variable returns from its involvement with the

subsidiary and has the ability to affect those returns through its

power over the subsidiary. All subsidiaries have a reporting date

of 31 March. In the case of joint ventures, those entities are

presented as a single line item in the Consolidated Statement of

Total Comprehensive Income and Consolidated Statement of Financial

Position.

All transactions between Group companies are eliminated on

consolidation, including unrealised gains and losses on

transactions between Group companies. Where unrealised losses on

intra-group asset sales are reversed on consolidation, the

underlying asset is also tested for impairment from a Group

perspective. Amounts reported in the financial statements of

subsidiaries have been adjusted where necessary to ensure

consistency with the accounting policies adopted by the Group.

Profit or loss and other comprehensive income of subsidiaries

acquired or disposed of during the year are recognised from the

effective date of acquisition, up to the effective date of

disposal, as applicable.

2.4 Adoption of new and revised standards

New and amended IFRS Standards that are effective for the

current year

IFRS 10 "Consolidated Financial Statements" IAS 28 "Investments

in Associates and Joint Ventures", IAS 1 "Presentation of Financial

Statements", IFRS 3 "Business Combinations", IAS 8 "Accounting

Policies, Changes in Accounting Estimates and Errors", IAS 16

"Property, Plant and Equipment", IAS 37 "Provisions, Contingent

Liabilities and Contingent Assets".

The Directors adopted the new or revised Standards listed above

but they have had no material impact on the financial statements of

the Group.

Standards in issue not yet effective

The following IFRS and IFRIC interpretations have been issued

but have not been applied by the Group in preparing the historical

financial information, as they are not yet effective. The Group

intends to adopt these Standards and Interpretations when they

become effective, rather than adopt them early.

Effective date 1 January 2023

IFRS 17 "Insurance Contracts", IAS 1 "Presentation of Financial

Standards", IAS 12 "Income Taxes", IAS 8 "Accounting Policies,

Changes in Accounting Estimates and Errors".

Effective date 1 January 2024

IFRS 16 "Leases", IAS 1 "Presentation of the Financial

Statements".

2.5 Revenue

Revenue is measured at the fair value of the consideration

received or receivable and represents amounts receivable for

services provided in the normal course of business, net of

discounts, VAT and other sales-related taxes. Revenue is reduced

for estimated rebates and other similar allowances. Revenue is

recognised when control is transferred and the performance

obligations are considered to be met.

The Group's revenue is made up of the following principal

revenue streams:

- Fees for discretionary fund management services in relation

to on-platform investment assets under management ("AUM").

Revenue is recognised daily based on the AUM.

- Fees charged to IFAs for compliance consultancy services,

which are recognised when performance obligations are met.

- Fees for providing investment platform services. Revenue

is recognised on a daily basis, in line with the satisfaction

of performance obligations, on the assets under administration

held on the relevant investment platform.

- Fees for mortgage-related services including commissions

from mortgage and other product providers and referral

fees from strategic partners. Commission is recognised

when performance obligations are met.

- Fees for marketing services provided to providers of mortgage

and investment products, which is recognised when performance

obligations are met.

2.6 Exceptional items

Exceptional items are disclosed and described separately in the

financial statements where it is necessary to do so to provide

further understanding of the underlying financial performance of

the Group. These include material items of income or expense that

are shown separately due to the significance of their nature and

amount.

2.7 Interest income and interest expense

Finance income is recognised as interest accrued (using the

effective interest method) on funds invested outside the Group.

Finance expense includes the unwinding of discounts on deferred

consideration liabilities, the cost of borrowing from third parties

and is recognised on an effective interest rate basis, resulting

from the financial liability being recognised on an amortised cost

basis.

2.8 Impairment

Assets which have an indefinite useful life are not subject to