TIDMTAM

RNS Number : 6021T

Tatton Asset Management PLC

16 November 2023

16 November 2023

Tatton Asset Management PLC

("TAM plc", the "Group" or the "Company")

AIM: TAM

UNAUDITED INTERIM RESULTS

For the six-month period ended 30 September 2023

"Strong net inflows underpin the Group's track record of

consistent growth"

TAM plc, the investment management and IFA support services

group, today announces its interim results for the six-month period

ended 30 September 2023 (the "Period").

FINANCIAL HIGHLIGHTS

-- Group revenue increased 9.9% to GBP17.506m (Sep 2022: GBP15.934m)

-- Adjusted operating profit (1) up 11.2% to GBP8.872m (Sep 2022:

GBP7.982m)

-- Adjusted operating profit (1) margin 50.7% (Sep 2022: 50.1%)

-- Adjusted fully diluted EPS (2) increased 6.4% to 10.52p (Sep

2022: 9.89p)

-- Strong financial liquidity position, with net cash of GBP24.222m

(Mar 2023: GBP26.494m)

-- Interim dividend (3) up 77.8% to 8.0p (Sep 2022: 4.5p)

-- Strong balance sheet with net assets GBP40.336m

Operating profit before exceptional items, share-based payment

(1) charges and amortisation of acquired intangibles.

Adjusted fully diluted earnings per share is adjusted for

(2) exceptional items, share-based payment charges, amortisation

of acquired intangibles, the unwinding of discount on deferred

consideration and the tax thereon. The dilutive shares for

this measure assumes that all contingently issuable shares

will fully vest.

A larger element of this year's total dividend has been brought

(3) forward, our progressive dividend policy of paying c.70% of

annual adjusted diluted earnings per share remains unchanged.

OPERATIONAL HIGHLIGHTS

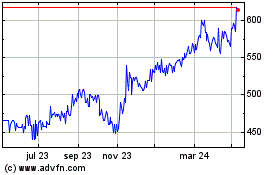

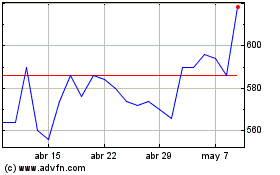

-- Assets Under Management/Influence ("AUM/I") increased 19.8%

to GBP14.784bn (Sep 2022: GBP12.343bn). AUM/I at 31 March

2023 GBP13.871bn, an annualised increase of 13.2%

-- Organic net inflows were GBP0.910bn (Sep 2022: GBP0.907bn),

an annualised increase of 13.1% of opening AUM/I with an average

run rate of GBP152m per month

-- Tatton's IFA firms increased by 5.2% to 914 (Mar 2023: 869)

and the number of accounts increased 7.1% to 114,650 (Mar

2023: 107,010)

-- Paradigm Mortgages completions reduced by 5.5% to GBP6.9bn

(Sep 2022: GBP7.3bn). Paradigm Mortgages member firms increased

to 1,798 members (Mar 2023: 1,751 members)

-- Paradigm Consulting members increased to 437 (Mar 2023: 431)

-- Expansion of MPS range with the successful launch of Money

Market risk profile

-- Implementation of Consumer Duty regulation - strong alignment

with Tatton's MPS proposition and core values

Paul Hogarth, Chief Executive Officer, commented:

"The Group has delivered a solid first half result, successfully

meeting our strategic objectives and maintaining strong organic

growth of revenue and profits. While volatile markets continued to

be a challenge, our Assets Under Management/Influence (AUM/I) still

reached GBP14.8 billion and we expect to exceed our GBP15 billion

"Roadmap to Growth" strategy by March 2024.

"I am delighted with the performance of Tatton, which has

continued to perform strongly by consistently delivering an average

of GBP150 million net inflows per month over the last eighteen

months. This level of net inflow has continued into the second

half, reinforcing the attractiveness of the MPS proposition and

highlighting our ability to maintain consistent performance even in

difficult macroeconomic conditions.

"Paradigm has also delivered a resilient performance in the

period, despite a subdued housing market which has led to a

changing mix of mortgage lending. We anticipate that this trend

will continue throughout the second half of the year, with

expectations for Paradigm to maintain its resilient

performance.

"We look forward to making further progress over the rest of the

year, while remaining acutely aware of the continuing macroeconomic

turbulence and market volatility. The Board remains confident in

the future prospects of the Group."

For further information please contact:

Tatton Asset Management plc

Paul Hogarth (Chief Executive Officer)

Paul Edwards (Chief Financial Officer)

Lothar Mentel (Chief Investment Officer) +44 (0) 161 486 3441

Zeus - Nomad and Broker

Martin Green (Investment Banking)

Dan Bate (Investment Banking and QE) +44 (0) 20 3829 5000

Singer Capital Markets - Joint Broker

Peter Steel / Charles Leigh-Pemberton (Investment

Banking) +44 (0) 20 7496 3000

Belvedere Communications - Financial PR

John West / Llew Angus (media) 44 (0) 20 7653 8705

Cat Valentine / Keeley Clarke (investors) + 44 (0) 7715 769078

tattonpr@belvederepr.com

Trade Media Enquiries +44 (0) 7469 854

Roddi Vaughan Thomas 011

For more information, please visit:

www.tattonassetmanagement.com

STRATEGIC REVIEW

The Group maintains a track record of steady growth

The Group has performed well in the Period and delivered

continued growth in revenue and profits, with strong net inflows

reflecting high demand for our services. We have continued to make

substantial progress in line with our strategic objectives, in what

has been a difficult and volatile market, demonstrating the

effectiveness of our business model.

Group revenue for the Period increased by 9.9% to GBP17.506

million (Sep 2022: GBP15.934 million). Adjusted operating profit(1)

for the Period increased by 11.2% to GBP8.872 million (Sep 2022:

GBP7.982 million), with adjusted operating profit margin(1) at

50.7% (Sep 2022: 50.1%).

Pre-tax profit after the impact of amortisation of intangibles

relating to acquisitions and joint ventures, finance costs and

share-based payment charges increased to GBP7.693 million (Sep

2022: GBP6.624 million) and taxation charges for the Period were

GBP2.302 million (Sep 2022: GBP1.291 million). This gives an

effective tax rate of 29.9% when measured against profit before

tax. Adjusting for amortisation and share-based payments, the

effective tax rate is 25.8%.

The basic earnings per share was 8.97p (Sep 2022: 9.01p). When

adjusted for amortisation of intangibles relating to acquisitions

and joint ventures, finance costs relating to the unwinding of

discounts on deferred consideration, and share-based payment

charges, basic adjusted earnings per share was 11.08p (Sep 2022:

10.43p). Adjusted earnings per share fully diluted for the impact

of share options was 10.52p (Sep 2022: 9.89p), an increase of

6.4%.

Tatton

Tatton continues to perform strongly and has sustained strong

organic net inflows in an environment where, in general, asset

managers have been suffering redemptions. In the last six months,

organic net inflows have averaged GBP152 million per month and were

in total GBP910 million (Sep 2022: GBP907 million). In fact, over

the last eighteen months we have now consistently delivered an

average of GBP150 million per month, which reinforces both the

attractiveness of the model portfolio services ("MPS") proposition

and our ability to maintain consistency of performance even in

difficult macroeconomic conditions.

The total AUM/AUI(1) at the end of the Period increased to

GBP14.784 billion (Mar 2023: GBP13.871 billion). As we enter the

final leg of the journey in our "Roadmap to Growth" strategy of

delivering GBP15 billion AUM/AUI(1) by March 2024, we remain very

confident that we will exceed this amount by the target date.

Platforum, the Financial Services research consultants, have

maintained their forecast that the MPS market is expected to grow

at a rate of 25% per annum and reach up to GBP200 billion by the

end of 2026 (Platforum MPS Report: July 2023). The current level of

MPS on platform is GBP103.5 billion (Dec 2021: GBP81.4 billion).

The Group has GBP14.784 billion, or 14.3% share of this market (Mar

2023: 13.4%).

Through this market growth and our increased activity, Tatton's

revenue has increased by 13.4% to GBP14.451 million (Sep 2022:

GBP12.738 million) and now accounts for 82.5% of total Group

revenue. Meanwhile, Tatton's adjusted operating profit(1) grew by

17.3% to GBP8.986 million (Sep 2022: GBP7.663 million), delivering

an adjusted operating profit margin(1) of 62.2% (Sep 2022:

60.2%).

This Period has also seen an expansion in our range of

propositions. With the changing shape of the economic landscape and

the potential for investor fatigue from market volatility coupled

with rising interest rates, we launched a new risk rating within

our MPS range, the Money Market risk profile. Our new risk profile

offers the potential for clients to receive a return on cash that

tracks the Bank of England base rate more closely than most instant

access UK bank deposit accounts. While still early days, the

initial uptake has been encouraging as we continue to support IFAs

and their clients by providing products that meet their evolving

needs.

Our strategy to promote and support the growth of the MPS market

on platform through a wide-ranging IFA education programme will

continue. We also continue to increase our market penetration

through a broadened distribution base. As a minimum, we aim to

maintain our market share and continue to grow our distribution

footprint through meaningful strategic partnerships. In support of

this, we have been pleased to see our IFA firms continue to grow by

over 5.2% to 914 (Mar 2023: 869) over this Period. We look forward

to seeing these close relationships continue to develop in the

coming months as intensive activity continues to further promote

the Tatton service.

As we look ahead, we will keep the needs of the IFA at the heart

of our business as this remains central to all we do. This year we

welcomed the launch of Consumer Duty regulation and we continue to

help and assist IFAs in meeting the rising regulatory bar by

continuing to build and strengthen long-term partnerships. We aim

to deliver a consistent high level of service, investment

performance and IFA support. Consequently, we were delighted to be

recognised as leaders in our field for a sixth year running by

Moneyfacts, this year winning both the "Best Investment Service"

award for the second consecutive year and also this year the "Best

Ethical Fund Manager" - voted for by IFAs across the UK.

As we head towards the end of our GBP15 billion three-year

strategic growth target by the end of March 2024, we have broadly

delivered the target with six months remaining. The business has

made strong progress over this Period and we look forward to making

further progress in the coming years. Setting targets keeps the

Group focused and has served the Group well as we have consistently

met our goals. It has taken Tatton ten years to grow to GBP15

billion and we intend to set a new ambitious AUM/AUI(1) target

following the end of this financial year, March 2024. To do this,

we will give careful thought to the stability of the market

environment at that time, but more importantly, taking into

consideration our leading position in the growing and maturing MPS

market, the strength of our brand and the quality of the Tatton

proposition.

Paradigm

Paradigm has delivered a resilient performance in the Period,

delivering revenue of GBP3.059 million (Sep 2022: GBP3.198 million)

and adjusted operating profit(1) of GBP0.959 million (Sep 2022:

GBP1.352 million). Paradigm Mortgages increased the number of

mortgage firms utilising the services to 1,798 (Mar 2023: 1,751)

and Paradigm Consulting increased its members to 437 (Mar 2023:

431).

Paradigm Consulting continues to perform in line with our

expectations and Paradigm Mortgages has continued to deliver a

strong volume of completions in a challenging economic climate,

where lenders are predicting a gross market of c.GBP220 billion in

2023, c.30% below 2022 volumes of GBP320 billion. Intermediary

channel share, as opposed to mortgages sold direct by banks,

continued to grow, reaching c.85% of all new sales and record

product transfer maturities despite significantly reduced

residential purchases. New mortgage and remortgage activity helped

Paradigm Mortgages participate in completions totalling GBP6.9

billion (Sep 2022: GBP7.3 billion), a 5.5% reduction, which

compares well with the total market and demonstrates the resilience

of the Paradigm business.

The ongoing cost of living issues, driven by the economic

climate and stubborn inflationary pressures, have negatively

impacted mortgage affordability and confidence of both sellers and

buyers. As a consequence, mortgage intermediaries have focused on

maturities (Product Transfers) which, for the first time on record,

are likely to exceed the value of gross mortgages. The impact of

rising interest rates has also had a significant impact on both the

supply and confidence in both the residential and buy to let

mortgage market throughout 2023, and the nature and distribution of

our completions this Period has reflected the wider market and

shifted towards this lower margin product mix.

Looking forward, CACI, the retail finance benchmarking

specialist, confirms that there are c.GBP176 billion of maturities

in the second half of the calendar year 2023, with record peaks

expected in both November and December. These product transfer

opportunities, combined with a more stable but subdued house

purchase market, improving consumer confidence and greater

affordability, suggests a similar volume and mix of completions for

the second half of our financial year.

There continues to be underlying demand for home ownership in

the UK, albeit lower levels of new build activity means stock

remains stubbornly low. However, on a point of optimism, subdued

house prices and wage increases/inflation have led to a fall of up

to 10% in the house price to income ratio, which has led to greater

affordability in both consumer and lender outlook.

Lenders are now delivering record levels of choice of available

products and rates continue to fall. In addition, with house price

falls stabilising, we believe that, once inflation is seen to be

under control and rates begin to fall further, pent up purchase

activity will once again provide a strong mortgage market.

Separately disclosed items

Share-based payment charges, amortisation of intangible assets

relating to acquisitions and joint ventures, and exceptional items

are reported separately to give better clarity of the underlying

performance of the Group. The alternative performance measures

("APMs") are consistent with how the business performance is

planned and presented within the internal reporting to the Board.

Some of these measures are also used for the purpose of setting

remuneration targets.

Balance sheet

The Group's balance sheet remains healthy, with net assets at 30

September 2023 totalling GBP40.3 million (Sep 2022: GBP35.7

million) reflecting the continued growth and profitability of the

Group.

Cash resources

Cash generated from operations before exceptional costs was

GBP8.3 million (Sep 2022: GBP7.3 million) and was 93% of adjusted

operating profit(1) . The Group remains debt free, with closing net

cash at the end of the Period of GBP24.2 million (Mar 2023: GBP26.5

million). The cash resources are after the purchase of own shares

of GBP2.6m, the payment of corporation tax of GBP2.2 million and

dividend payments of GBP6.0 million relating to the final dividend

for the year ended 31 March 2023.

Issue of new shares

In the Period, the Group issued 455,677 new shares, which were

issued to satisfy the exercise of options related to the Enterprise

Management Incentive ("EMI") and Company's Save As You Earn

("SAYE") employee share option schemes.

Dividend proposal and capital adequacy

In this interim period, the Board recommends an increase in the

interim dividend to 8.0p (Sep 2022: 4.5p), an increase of 77.8%. A

larger element of this year's total dividend has been brought

forward to the interim dividend and reflects the confidence of the

Board in the Group's financial performance, high levels of cash and

liquidity, and headroom over our regulatory capital requirement.

Our long-held progressive dividend policy of paying c.70% of annual

adjusted diluted earnings per share remains unchanged.

The interim dividend of 8.0p per share, totalling GBP4.8

million, will be paid on 8 December 2023 to shareholders on the

register at close of business on 24 November 2023 and will have an

ex-dividend date of 23 November 2023. In accordance with

International Financial Reporting Standards ("IFRSs"), the interim

dividend has not been included as a liability in this interim

statement.

Business risk

The Board identified principal risks and uncertainties which may

have a material impact on the Group's performance in the Group's

2023 Annual Report and Accounts (pages 32 and 33), and believes

that the nature of these risks remains largely unchanged at the

half year. The Board will continue to monitor and manage identified

principal risks throughout the second half of the year.

Post balance sheet events

There have been no post balance sheet events.

Going concern

As stated in note 2.2 of these condensed financial statements,

the Directors are satisfied that the Group has sufficient resources

to continue in operation for the foreseeable future, a period not

less than twelve months from the date of this report. Accordingly,

they continue to adopt the going concern basis in preparing these

condensed financial statements.

Summary and outlook

The Group has delivered a solid first half result, delivering

against our strategic objectives and maintaining strong organic

growth of revenue and profits. While volatile markets continued to

remain a drag on asset growth at the end of this Period, our

AUM/AUI(1) still reached GBP14.8 billion and we are pleased with

the overall performance of the Group.

Net inflows remained very strong in the first six months and we

remain focused on continuing to deliver similar levels of flows but

remain mindful of the economic environment. However, we expect to

exceed our GBP15 billion "Roadmap to Growth" strategy by March 2024

and Paradigm should continue to perform in line with the first half

of the year.

In summary, we look forward to making further progress over the

rest of the year, while remaining acutely aware of the continuing

macroeconomic turbulence and market volatility. The Board remains

confident in the future prospects of the Group.

(1) Alternative performance measures are detailed in note 17

CONSOLIDATED STATEMENT OF TOTAL COMPREHENSIVE INCOME

For the six months ended 30 September 2023

Unaudited Unaudited

six months six months Audited

ended ended year ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

Note (GBP'000) (GBP'000) (GBP'000)

Revenue 17,506 15,934 32,327

Share of profit from joint

venture 257 - 160

Administrative expenses (10,030) (9,006) (15,877)

----------------------------------------- ----- ------------ ------------ -------------

Operating profit 7,733 6,928 16,610

----------------------------------------- ----- ------------ ------------ -------------

Share-based payment costs 4 829 495 1,511

Amortisation of acquisition-related

intangibles 4 310 207 534

Gains arising on changes in

fair value of contingent consideration 4 - - (2,651)

Exceptional items 4 - 352 398

----------------------------------------- ----- ------------ ------------ -------------

Adjusted operating profit (before

separately disclosed items)(1) 8,872 7,982 16,402

----------------------------------------- ----- ------------ ------------ -------------

Finance costs (40) (304) (614)

----------------------------------------- ----- ------------ ------------ -------------

Profit before tax 7,693 6,624 15,996

----------------------------------------- ----- ------------ ------------ -------------

Taxation charge 5 (2,302) (1,291) (2,623)

----------------------------------------- ----- ------------ ------------ -------------

Profit attributable to shareholders 5,391 5,333 13,373

----------------------------------------- ----- ------------ ------------ -------------

Earnings per share - Basic 6 8.97p 9.01p 22.43p

Earnings per share - Diluted 6 8.66p 8.72p 21.70p

Adjusted earnings per share

- Basic(2) 6 11.08p 10.43p 21.72p

Adjusted earnings per share

- Diluted(2) 6 10.52p 9.89p 20.61p

----------------------------------------- ----- ------------ ------------ -------------

(1) Adjusted for exceptional items, share-based payment charges

and amortisation of acquired intangibles. See note 17.

(2) Adjusted for exceptional items, share-based payment charges,

amortisation of acquired intangibles, the unwinding of discount

on deferred consideration and the tax thereon. The dilutive

shares for this measure assumes that all contingently issuable

shares will fully vest. See note 17.

There were no other recognised gains or losses other than those

recorded above in the current or prior period and therefore a

statement of other comprehensive income has not been presented.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

As at 30 September 2023

Unaudited Unaudited

six months six months Audited

ended ended year ended

31-Mar

30-Sep 2023 30-Sep 2022 2023

Note (GBP'000) (GBP'000) (GBP'000)

Non-current assets

Investment in joint ventures 8 6,820 6,996 6,762

Goodwill 7 9,337 9,337 9,337

Intangible assets 9 3,405 3,831 3,615

Property, plant and equipment 10 328 593 454

Deferred tax assets 1,541 806 1,258

Other receivables 11 188 - -

------------------------------- ----- ------------- ------------- ------------

Total non-current assets 21,619 21,563 21,426

------------------------------- ----- ------------- ------------- ------------

Current assets

Trade and other receivables 11 4,078 3,902 3,782

Financial assets at fair

value through profit or loss 13 175 122 123

Corporation tax 570 941 121

Cash and cash equivalents 24,222 21,622 26,494

------------------------------- ----- ------------- ------------- ------------

Total current assets 29,045 26,587 30,520

------------------------------- ----- ------------- ------------- ------------

Total assets 50,664 48,150 51,946

------------------------------- ----- ------------- ------------- ------------

Current liabilities

Trade and other payables 12 (8,013) (6,633) (7,911)

------------------------------- ----- ------------- ------------- ------------

Total current liabilities (8,013) (6,633) (7,911)

------------------------------- ----- ------------- ------------- ------------

Non-current liabilities

Other payables 12 (2,315) (5,851) (2,254)

------------------------------- ----- ------------- ------------- ------------

Total non-current liabilities (2,315) (5,851) (2,254)

------------------------------- ----- ------------- ------------- ------------

Total liabilities (10,328) (12,484) (10,165)

------------------------------- ----- ------------- ------------- ------------

Net assets 40,336 35,666 41,781

------------------------------- ----- ------------- ------------- ------------

Equity attributable to equity

holders of the entity

Share capital 12,102 12,006 12,011

Share premium account 15,487 15,219 15,259

Own shares (2,567) - -

Other reserve 2,041 2,041 2,041

Merger reserve (28,968) (28,968) (28,968)

Joint venture reserve 37 - (21)

Retained earnings 42,204 35,368 41,459

------------------------------- ----- ------------- ------------- ------------

Total equity 40,336 35,666 41,781

------------------------------- ----- ------------- ------------- ------------

The financial statements were approved by the Board of Directors

on 15 November 2023 and were signed on its behalf by:

Paul Edwards

Director

Company registration number: 10634323

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the six months ended 30 September 2023

Joint

Share Share Other Merger venture Retained Total

capital premium Own shares reserve reserve reserve earnings equity

(GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000) (GBP'000)

At 1 April

2022 11,783 11,632 - 2,041 (28,968) - 34,556 31,044

--------------- ---------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Profit and

total

comprehensive

income - - - - - - 5,333 5,333

Dividends - - - - - - (5,012) (5,012)

Share-based

payments - - - - - - 658 658

Tax on

share-based

payments - - - - - - (167) (167)

Issue of share

capital on

exercise

of employee

share

options 47 77 (28) - - - - 96

Own shares

utilised

on exercise

of

options - - 28 - - - - 28

Issue of share

capital on

acquisition

of a joint

venture 176 3,510 - - - - - 3,686

--------------- ---------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

At 30

September

2022 12,006 15,219 - 2,041 (28,968) - 35,368 35,666

--------------- ---------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Profit and

total

comprehensive

income - - - - - 39 8,001 8,040

Dividends - - - - - - (2,702) (2,702)

Share-based

payments - - - - - - 649 649

Tax on

share-based

payments - - - - - - 83 83

Issue of share

capital on

exercise

of employee

share

options 5 40 - - - - - 45

Dividends

received

from joint

venture - - - - - (60) 60 -

--------------- ---------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

At 31 March

2023 12,011 15,259 - 2,041 (28,968) (21) 41,459 41,781

--------------- ---------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

Profit and

total

comprehensive

income - - - - - 178 5,213 5,391

Dividends - - - - - - (6,006) (6,006)

Share-based

payments - - - - - - 521 521

Tax on

share-based

payments - - - - - - 897 897

Issue of share

capital on

exercise

of employee

share

options 91 228 - - - - - 319

Own shares

acquired

in the Period - - (2,567) - - - - (2,567)

Dividends

received

from joint

venture - - - - - (120) 120 -

--------------- ---------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

At 30

September

2023 12,102 15,487 (2,567) 2,041 (28,968) 37 42,204 40,336

--------------- ---------- ----------- ----------- ----------- ----------- ----------- ----------- -----------

CONSOLIDATED STATEMENT OF CASH FLOWS

For the six months ended 30 September 2023

Unaudited Unaudited

six months six months Audited

ended ended year ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

Note (GBP'000) (GBP'000) (GBP'000)

Operating activities

Profit for the Period 5,391 5,333 13,373

Adjustments:

Income tax expense 5 2,302 1,291 2,623

Finance costs 40 304 614

Depreciation of property, plant

and equipment 10 192 190 384

Amortisation of intangible

assets 9 330 330 661

Share-based payment expense 4 829 495 1,420

Post-tax share of profits of

joint venture less amortisation

of related intangible assets (153) (40) (39)

Changes in fair value of contingent

consideration - - (2,651)

Changes in:

Trade and other receivables (619) (169) (146)

Trade and other payables (46) (751) (449)

------------------------------------- ----- ------------ ------------ ------------

Exceptional costs - 352 398

------------------------------------- ----- ------------ ------------ ------------

Cash generated from operations

before exceptional costs 8,266 7,335 16,188

------------------------------------- ----- ------------ ------------ ------------

Cash generated from operations 8,266 6,983 15,790

Income tax paid (2,160) (1,620) (2,559)

------------------------------------- ----- ------------ ------------ ------------

Net cash from operating activities 6,106 5,363 13,231

------------------------------------- ----- ------------ ------------ ------------

Investing activities

Payment for the acquisition

of subsidiary, net of cash

acquired - - (152)

Purchase of intangible assets (120) (114) (229)

Purchase of property, plant

and equipment (66) (34) (89)

Cost of underwriting shares - (152) -

------------------------------------- ----- ------------ ------------ ------------

Net cash used in investing

activities (186) (300) (470)

------------------------------------- ----- ------------ ------------ ------------

Financing activities

Interest received/(paid) 146 (92) (186)

Dividends paid (6,006) (5,012) (7,714)

Dividends received from joint

venture 120 - 60

Proceeds from the issue of

shares 249 87 132

Purchase of own shares (2,567) - -

Repayment of the lease liabilities (134) (134) (269)

------------------------------------- ----- ------------ ------------ ------------

Net cash used in financing

activities (8,192) (5,151) (7,977)

------------------------------------- ----- ------------ ------------ ------------

Net (decrease)/increase in

cash and cash equivalents (2,272) (88) 4,784

------------------------------------- ----- ------------ ------------ ------------

Cash and cash equivalents at

beginning of Period 26,494 21,710 21,710

------------------------------------- ----- ------------ ------------ ------------

Net cash and cash equivalents

at end of Period 24,222 21,622 26,494

------------------------------------- ----- ------------ ------------ ------------

The accompanying notes are an integral part of the interim

financial statements.

NOTES TO THE CONSOLIDATED FINANCIAL STATEMENTS

1. General Information

Tatton Asset Management plc (the "Company") is a public company

limited by shares. The address of the registered office is Paradigm

House, Brooke Court, Lower Meadow Road, Wilmslow, SK9 3ND, United

Kingdom. The registered number is 10634323.

The Group comprises the Company and its subsidiaries. The

Group's principal activities are discretionary fund management, the

provision of compliance and support services to IFAs, the provision

of mortgage adviser support services and the marketing and

promotion of multi-manager funds run by the companies under Tatton

Capital Limited.

The condensed consolidated interim financial statements for the

six months ended 30 September 2023 do not constitute statutory

accounts as defined under section 434 of the Companies Act 2006.

The Annual Report and Accounts (the "financial statements") for the

year ended 31 March 2023 were approved by the Board on 12 June 2023

and have been delivered to the Registrar of Companies. The auditor,

Deloitte LLP, reported on these financial statements; its report

was unqualified, did not contain an emphasis of matter paragraph

and did not contain statements under section 498 (2) or (3) of the

Companies Act 2006.

News updates, regulatory news and financial statements can be

viewed and downloaded from the Group's website,

www.tattonassetmanagement.com. Copies can also be requested from:

The Company Secretary, Tatton Asset Management plc, Paradigm House,

Brooke Court, Lower Meadow Road, Wilmslow, SK9 3ND.

2. Accounting Policies

The principal accounting policies applied in the presentation of

the interim financial statements are set out below.

2.1 Basis of preparation

The unaudited condensed consolidated interim financial

statements for the six months ended 30 September 2023 have been

prepared in accordance with IAS 34 'Interim Financial Reporting' as

adopted by the United Kingdom. The condensed consolidated interim

financial statements should be read in conjunction with the

financial statements for the year ended 31 March 2023, which have

been prepared in accordance with International Financial Reporting

Standards ("IFRSs") as adopted by the United Kingdom. The condensed

consolidated interim financial statements were approved for release

on 15 November 2023.

The condensed consolidated interim financial statements have

been prepared on a going concern basis and prepared on the

historical cost basis.

The condensed consolidated interim financial statements are

presented in sterling and have been rounded to the nearest thousand

(GBP'000). The functional currency of the Company is sterling as

this is the currency of the jurisdiction where all the Group's

sales are made.

The preparation of financial information in conformity with

IFRSs requires management to make estimates and assumptions that

affect the reported amounts of assets and liabilities at the date

of the financial statements and the reported amounts of revenues

and expenses during the reporting period. Although these estimates

are based on management's best knowledge of the amount, event or

actions, actual events may ultimately differ from those

estimates.

The key accounting policies set out below have, unless otherwise

stated, been applied consistently to all periods presented in the

consolidated financial statements.

The accounting policies adopted by the Group in these interim

financial statements are consistent with those applied by the Group

in its consolidated financial statements for the year ended 31

March 2023.

2.2 Going concern

These financial statements have been prepared on a going concern

basis. The Directors have prepared cash flow projections and are

satisfied that the Group has adequate resources to continue in

operational existence for the foreseeable future. To form the view

that the consolidated financial statements should continue to be

prepared on an ongoing basis in light of the current economic

uncertainty, the Directors have assessed the outlook of the Group

by considering various market scenarios and management actions.

This review has allowed management to assess the potential impact

on income, costs, cash flow and capital, and the ability to

implement effective management actions that may be taken to

mitigate the impact. Accordingly, the Directors continue to adopt

the going concern basis in preparing these financial

statements.

2.3 New accounting standards

There have been a number of amendments to standards which have

been adopted in the period, but these have not had a significant

impact on the Group's financial results or position.

A number of new standards are effective for annual periods

beginning after 1 April 2024 and earlier application is permitted;

however, the Group has not early adopted the new or amended

standards in preparing these condensed consolidated financial

statements.

None of the standards not yet effective are expected to have a

material impact on the Group's financial statements.

2.4 Operating segments

The Group comprises the following two operating segments, which

are defined by trading activity:

-- Tatton - investment management services.

-- Par adigm - the provision of compliance and support services

to IFAs and mortgage advisers.

The Board is considered to be the chief operating decision

maker.

2.5 Significant judgements, key assumptions and estimates

In the process of applying the Group's accounting policies,

which are described in the consolidated financial statements for

the year ended 31 March 2023, management have made judgements and

estimations about the future that have an effect on the amounts

recognised in the financial statements. The estimates and

underlying assumptions are reviewed on an ongoing basis. Revisions

to accounting estimates are recognised in the period in which the

estimate is revised if the revision affects only that period. If

the revision affects both current and future periods, it is revised

in the period of the revision and in future periods. Changes for

accounting estimates would be accounted for prospectively under IAS

8.

The judgements, estimates and assumptions applied in the interim

financial statements, including the key sources of estimation

uncertainty, were the same as those applied in the Group's last

annual financial statements for the year ended 31 March 2023.

Management have reviewed the estimates for the satisfaction of

the performance obligations attached to certain awards in the

share-based payment schemes. It is currently estimated that 100% of

the options in the existing schemes will vest.

2.6 Alternative performance measures

In reporting financial information, the Group presents

alternative performance measures ("APMs") which are not defined or

specified under the requirements of IFRSs. The Group believes that

these APMs provide users with additional helpful information on the

performance of the business.

The APMs are consistent with how the business performance is

planned and reported within the internal management reporting to

the Board. Some of these measures are also used for the purpose of

setting remuneration targets. All the APMs used by the Group are

set out in note 17, including explanations of how they are

calculated and how they can be reconciled to a statutory measure

where relevant.

3. Segment Reporting

Information reported to the Board of Directors as the chief

operating decision maker ("CODM") for the purposes of resource

allocation and assessment of segmental performance is focused on

the type of revenue. The principal types of revenue are

discretionary fund management and the marketing and promotion of

the funds run by the companies under Tatton Capital Limited

("Tatton") and the provision of compliance and support services to

IFAs and mortgage advisers ("Paradigm").

The Group's reportable segments under IFRS 8 are therefore

Tatton, Paradigm, and "Central", which contains the operating

Group's central overhead costs. Centrally incurred overhead costs

are allocated to the Tatton and Paradigm divisions on a pro rata

basis as this is how information is presented to the Group's

CODM.

The principal activity of Tatton is that of discretionary fund

management of investments on platform and the provision of

investment wrap services. The principal activity of Paradigm is

that of provision of support services to IFAs and mortgage

advisers. For management purposes, the Group uses the same

measurement policies used in its financial statements.

The following is an analysis of the Group's revenue and results

by reportable segment:

Period ended 30 September Tatton Paradigm Central Group

2023 (GBP'000) (GBP'000) (GBP'000) (GBP'000)

Revenue 14,451 3,059 (4) 17,506

Share of post-tax

profit from joint

ventures 257 - - 257

Administrative expenses (6,032) (2,100) (1,898) (10,030)

------------------------------------- ----------- ----------- ----------- -----------

Operating profit/(loss) 8,676 959 (1,902) 7,733

------------------------------------- ----------- ----------- ----------- -----------

Share-based payment

costs - - 829 829

Amortisation of acquisition-related

intangibles 310 - - 310

Exceptional costs - - - -

------------------------------------- ----------- ----------- ----------- -----------

Adjusted operating

profit/(loss) (before

separately disclosed

items) (1) 8,986 959 (1,073) 8,872

------------------------------------- ----------- ----------- ----------- -----------

Finance costs 43 (1) (82) (40)

------------------------------------- ----------- ----------- ----------- -----------

Profit/(loss) before

tax 8,719 958 (1,984) 7,693

------------------------------------- ----------- ----------- ----------- -----------

Period ended 30 September Tatton Paradigm Central Group

2022 (GBP'000) (GBP'000) (GBP'000) (GBP'000)

Revenue 12,738 3,198 (2) 15,934

Administrative expenses (5,634) (1,846) (1,526) (9,006)

------------------------------------- ----------- ----------- ----------- -----------

Operating profit/(loss) 7,104 1,352 (1,528) 6,928

------------------------------------- ----------- ----------- ----------- -----------

Share-based payment

costs - - 495 495

Amortisation of acquisition-related

intangibles 207 - - 207

Exceptional costs 352 - - 352

------------------------------------- ----------- ----------- ----------- -----------

Adjusted operating

profit/(loss) (before

separately disclosed

items) (1) 7,663 1,352 (1,033) 7,982

------------------------------------- ----------- ----------- ----------- -----------

Finance costs (124) (1) (179) (304)

------------------------------------- ----------- ----------- ----------- -----------

Profit/(loss) before

tax 6,980 1,351 (1,707) 6,624

------------------------------------- ----------- ----------- ----------- -----------

Year ended 31 March Tatton Paradigm Central Group

2023 (GBP'000) (GBP'000) (GBP'000) (GBP'000)

Revenue 25,929 6,404 (6) 32,327

Share of post-tax

profit from joint

ventures 160 - - 160

Administrative expenses (8,540) (3,999) (3,338) (15,877)

------------------------------------- ----------- ----------- ----------- -----------

Operating profit/(loss) 17,549 2,405 (3,344) 16,610

------------------------------------- ----------- ----------- ----------- -----------

Share-based payment

costs - - 1,511 1,511

Amortisation of acquisition-related

intangibles 534 - - 534

Gain arising on changes

in fair value of

contingent consideration (2,651) - - (2,651)

Exceptional costs 398 - - 398

------------------------------------- ----------- ----------- ----------- -----------

Adjusted operating

profit/(loss) (before

separately disclosed

items) (1) 15,830 2,405 (1,833) 16,402

------------------------------------- ----------- ----------- ----------- -----------

Finance costs (182) - (432) (614)

------------------------------------- ----------- ----------- ----------- -----------

Profit/(loss) before

tax 17,367 2,405 (3,776) 15,996

------------------------------------- ----------- ----------- ----------- -----------

All turnover arose in the United Kingdom.

(1) Alternative performance measures are detailed in note 17

4. Separately Disclosed Items

Unaudited Unaudited Audited

six months six months year

ended ended ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

(GBP'000) (GBP'000) (GBP'000)

Acquisition-related expenses - 352 398

------------------------------------- ------------ ------------ -----------

Total exceptional costs - 352 398

------------------------------------- ------------ ------------ -----------

Gain arising on changes

in the fair value of contingent

consideration - - (2,651)

Amortisation of acquisition-related

intangible assets 310 207 534

Share-based payment costs 829 495 1,511

------------------------------------- ------------ ------------ -----------

Total separately disclosed

costs 1,139 1,054 (208)

------------------------------------- ------------ ------------ -----------

Separately disclosed items shown separately on the face of the

Consolidated Statement of Total Comprehensive Income or included

within Administrative expenses reflect costs and income that do not

relate to the Group's normal business operations and that are

considered material individually, or in aggregate if of a similar

type, due to their size or frequency.

Amortisation of acquisition-related intangible assets

Amortisation of intangible assets relating to joint ventures is

GBP104,000 (2022: GBPnil). This includes the acquisition of

customer relationships and brands. Amortisation of other customer

relationships and brand intangible assets is GBP206,000 (2022:

GBP207,000).

Payments made for the introduction of customer relationships and

brands that are deemed to be intangible assets are capitalised and

amortised over their useful life, which has been assessed to be 10

years. This amortisation charge is recurring over the life of the

intangible asset, though has been excluded from the core business

operating profit since it is a significant non-cash item.

Underlying profit, being adjusted operating profit, represents

largely cash-based earnings and more directly relates to the

financial reporting period.

Share-based payment charges

Share-based payments is a recurring item, though the value will

change depending on the estimation of the satisfaction of

performance obligations attached to certain awards. It has been

excluded from the core business operating profit since it is a

significant non-cash item. Underlying profit, being adjusted

operating profit, represents largely cash-based earnings and more

directly relates to the financial reporting period.

Exceptional items

Acquisition-related expenses in the prior year relate to the

Group acquiring 50% of the share capital of 8AM Global Limited and

also relate to one-off costs incurred on the acquisition of the

Verbatim funds. These costs were treated as exceptional items.

5. Taxation

Unaudited Unaudited Audited

six months six months year

ended ended ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

(GBP'000) (GBP'000) (GBP'000)

Current tax expense

Current tax on profits

for the Period 2,215 1,498 3,159

Share-based payment costs 139 (83) -

Adjustment for under-provision

in prior periods - - 14

-------------------------------- ------------ ------------ -----------

2,354 1,415 3,173

-------------------------------- ------------ ------------ -----------

Deferred tax expense

Share-based payment costs 83 (101) (371)

Origination and reversal

of temporary differences (78) (23) -

Adjustment in respect of

previous years - - (56)

Effect of changes in tax

rates (57) - (123)

-------------------------------- ------------ ------------ -----------

(52) (124) (550)

-------------------------------- ------------ ------------ -----------

Total tax expense 2,302 1,291 2,623

-------------------------------- ------------ ------------ -----------

The reasons for the difference between the actual tax charge for

the Period and the standard rate of corporation tax in the UK

applied to profit for the Period are as follows:

Unaudited Unaudited Audited

six months six months year

ended ended ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

(GBP'000) (GBP'000) (GBP'000)

Profit before taxation 7,693 6,624 15,996

Tax at UK corporation tax

rate of 25% (2022: 19%) 1,923 1,259 3,039

Expenses not deductible

for tax purposes 44 49 93

Capital allowances in excess

of depreciation 22 42 3

Adjustments in respect

of previous years - - (41)

Share-based payments 370 (59) 184

Income not taxable - - (533)

Effect of changes in tax

rates (57) - (122)

------------------------------ ------------ ------------ -----------

Total tax expense 2,302 1,291 2,623

------------------------------ ------------ ------------ -----------

An increase in the UK corporation tax rate from 19% to 25%

became effective 1 April 2023 and has increased the Company's

current tax charge accordingly. The deferred tax asset at 30

September 2023 has been calculated based on these rates, reflecting

the expected timing of reversal of the related temporary

differences (31 March 2023: 25%).

6. Earnings per Share and Dividends

Basic earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares during the Period.

Number of shares

Unaudited Unaudited Audited

six months six months year

ended ended ended

30-Sep 30-Sep 31-Mar

Number of shares 2023 2022 2023

Basic

Weighted average number

of shares in issue 60,127,572 59,220,759 59,608,203

Effect of own shares held

by an EBT (60,761) - -

---------------------------------- ------------ ------------ -----------

60,066,811 59,220,759 59,608,203

---------------------------------- ------------ ------------ -----------

Diluted

Effect of weighted average

number of options outstanding

for the year 2,182,144 1,909,700 2,006,603

---------------------------------- ------------ ------------ -----------

Weighted average number

of shares in issue (diluted)(1) 62,248,955 61,130,459 61,614,806

---------------------------------- ------------ ------------ -----------

Adjusted diluted

Effect of full dilution

of employee share options

which are contingently

issuable or have future

attributable service costs 1,012,719 1,305,290 1,192,528

---------------------------------- ------------ ------------ -----------

Adjusted diluted weighted

average number of options

and shares for the year(2) 63,261,674 62,435,749 62,807,334

---------------------------------- ------------ ------------ -----------

(1) The weighted average number of shares is diluted due to

the effect of potentially dilutive contingent issuable shares

from share option schemes.

(2) The dilutive shares used for this measure differ from those

used for statutory dilutive earnings per share; the future

value of service costs attributable to employee share options

is ignored and contingently issuable shares for Long-Term

Incentive Plan ("LTIP") options are assumed to fully vest.

The Directors have selected this measure as it represents

the underlying effective dilution by offsetting the impact

to the calculation of basic shares of the purchase of shares

by the Employee Benefit Trust ("EBT") to satisfy options.

Own shares held by an EBT represents the Company's own shares

purchased and held by the EBT, shown at cost. During the Period,

the EBT was gifted 346,896 of the Company's own shares. These

shares were fully utilised during the Period to satisfy the

exercise of employees' EMI options. The EBT subsequently purchased

a further 513,800 of the Company's own shares which remain

unutilised at the Period end. In the year ended 31 March 2023, the

EBT purchased 139,500 of the Company's own shares, which were fully

utilised during that year to satisfy the exercise of employee share

options.

Unaudited Unaudited

six months six months Audited

ended ended year ended

30-Sep 2023 30-Sep 2022 31-Mar 2023

Earnings attributable to ordinary

shareholders

Basic and diluted profit for the

Period 5,391 5,333 13,373

Share-based payments - IFRS 2 option

charges 829 495 1,511

Amortisation of customer relationship

intangibles 310 207 534

Exceptional costs (note 4) - 352 398

Gain arising on changes in the

fair value of contingent consideration - - (2,651)

Unwinding of discount on deferred

consideration 100 - 228

Tax impact of adjustments 27 (213) (447)

----------------------------------------- ------------- ------------- -------------

Adjusted basic and diluted profits

for the Period and attributable

earnings 6,657 6,174 12,946

----------------------------------------- ------------- ------------- -------------

Earnings per share - basic (pence) 8.97 9.01 22.43

Earnings per share - diluted (pence) 8.66 8.72 21.70

Adjusted earnings per share - basic

(pence)(1) 11.08 10.43 21.72

Adjusted earnings per share - diluted

(pence)(1) 10.52 9.89 20.61

----------------------------------------- ------------- ------------- -------------

1. Alternative performance measures are detailed in note 17.

Dividends

The Directors consider the Group's capital structure and

dividend policy at least twice a year ahead of announcing results

and do so in the context of its ability to continue as a going

concern, to execute the strategy and to invest in opportunities to

grow the business and enhance shareholder value.

In August 2023, Tatton Asset Management plc paid the final

dividend related to the year ended 31 March 2023 of GBP6,006,000,

representing a payment of 10.0p per share.

In the year ended 31 March 2023, Tatton Asset Management plc

paid the final dividend related to the year ended 31 March 2022 of

GBP5,012,000, representing a payment of 8.5p per share.

In addition, the Company paid an interim dividend of

GBP2,904,000 (2022: GBP2,357,000) to its equity shareholders. This

represents a payment of 4.5p per share (2022: 4.0p per share).

7. Goodwill

Intangible

assets

(GBP'000)

-------------------------------------- -----------

Cost and carrying value at 31 March

2022, 30 September 2022,

31 March 2023 and 30 September 2023 9,337

-------------------------------------- -----------

Impairment loss and subsequent reversal

Goodwill is subject to an annual impairment review based on an

assessment of the recoverable amount from future trading. Where, in

the opinion of the Directors, the recoverable amount from future

trading does not support the carrying value of the goodwill

relating to a subsidiary company then an impairment charge is made.

Such impairment is charged to the Consolidated Statement of Total

Comprehensive Income.

Goodwill impairment testing

For the purpose of impairment testing, goodwill is allocated to

the Group's operating companies, which represents the lowest level

within the Group at which the goodwill is monitored for internal

management accounts purposes.

Goodwill acquired in a business combination is allocated, at

acquisition, to the cash- generating units ("CGUs") or group of

units that are expected to benefit from that business combination.

The Directors test goodwill annually for impairment, or more

frequently if there are indicators that goodwill might be impaired.

The Directors have considered the carrying value of goodwill at 30

September 2023 and do not consider that it is impaired.

Growth rates

The value in use is calculated from cash flow projections based

on the Group's forecasts for the year ended 31 March 2024, which

are extrapolated for a further four years. The Group's latest

financial forecasts, which cover a three-year period, are reviewed

by the Board.

Discount rates

The pre-tax discount rate used to calculate value is 11.2%

(2022: 11.5%). The discount rate is derived from a benchmark

calculated from a number of comparable businesses.

Cash flow assumptions

The key assumptions used for the value in use calculations are

those regarding discount rate, growth rates and expected changes in

margins. Changes in prices and direct costs are based on past

experience and expectations of future changes in the market. The

growth rate used in the calculation reflects the average growth

rate experienced by the Group for the industry.

From the assessment performed, there are no reasonable

sensitivities that result in the recoverable amount being equal to

the carrying value of the goodwill attributed to the CGU.

8. Investment in Joint Ventures

Unaudited Unaudited

six months six months Audited

ended ended year ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

(GBP'000) (GBP'000) (GBP'000)

Opening Investment 6,762 - -

Additions in the Period - 6,956 6,765

Profit for the Period after tax 257 40 160

Amortisation of intangible assets

relating to joint ventures (103) - (121)

Deferred tax credit on amortisation

of intangible assets relating to

joint ventures 24 - 18

Distribution of profits (120) - (60)

------------------------------------- ------------ ------------ ------------

Closing Investment 6,820 6,996 6,762

------------------------------------- ------------ ------------ ------------

Additions in the prior period relates to the acquisition of 50%

of the share capital of 8AM Global Limited for an initial

consideration of GBP3,838,000 followed by discounted deferred

consideration of GBP3,118,000 (undiscounted deferred consideration

GBP3,501,000) based on certain performance measures. The initial

consideration was paid by way of shares in Tatton Asset

Management.

9. Intangibles

Computer Client

software relationships Brand Total

(GBP'000) (GBP'000) (GBP'000) (GBP'000)

Cost

Balance at 1 April 2022 1,006 4,034 98 5,138

Additions 114 - - 114

-------------------------- ----------- --------------- ----------- -----------

Balance at 30 September

2022 1,120 4,034 98 5,252

Additions 115 - - 115

-------------------------- ----------- --------------- ----------- -----------

Balance at 31 March 2023 1,235 4,034 98 5,367

Additions 120 - - 120

-------------------------- ----------- --------------- ----------- -----------

Balance at 30 September

2023 1,355 4,034 98 5,487

-------------------------- ----------- --------------- ----------- -----------

Accumulated amortisation

and impairment

Balance at 1 April 2022 (645) (441) (5) (1,091)

Charge for the Period (123) (202) (5) (330)

-------------------------- ----------- --------------- ----------- -----------

Balance at 30 September

2022 (768) (643) (10) (1,421)

Charge for the Period (124) (202) (5) (331)

-------------------------- ----------- --------------- ----------- -----------

Balance at 31 March 2023 (892) (845) (15) (1,752)

Charge for the Period (123) (202) (5) (330)

-------------------------- ----------- --------------- ----------- -----------

Balance at 30 September

2023 (1,015) (1,047) (20) (2,082)

-------------------------- ----------- --------------- ----------- -----------

Carrying amount

At 1 April 2022 361 3,593 93 4,047

At 30 September 2022 352 3,391 88 3,831

At 31 March 2023 343 3,189 83 3,615

-------------------------- ----------- --------------- ----------- -----------

At 30 September 2023 340 2,987 78 3,405

-------------------------- ----------- --------------- ----------- -----------

All amortisation charges on intangible assets are included

within Administrative expenses in the Consolidated Statement of

Total Comprehensive Income.

10. Property, Plant and Equipment

Computer,

office

equipment

and Fixtures

motor and Right-of-use

vehicles fittings assets Total

(GBP'000) (GBP'000) (GBP'000) (GBP'000)

Cost

Balance at 1 April

2022 345 477 991 1,813

Additions 31 3 - 34

-------------------------- ----------- ----------- ------------- -----------

Balance at 30 September

2022 376 480 991 1,847

Additions 55 - - 55

Disposals (77) - - (77)

-------------------------- ----------- ----------- ------------- -----------

Balance at 31 March

2023 354 480 991 1,825

Additions 58 8 - 66

-------------------------- ----------- ----------- ------------- -----------

Balance at 30 September

2023 412 488 991 1,891

-------------------------- ----------- ----------- ------------- -----------

Accumulated depreciation

and impairment

Balance at 1 April

2022 (239) (302) (523) (1,064)

Charge for the

Period (34) (48) (108) (190)

-------------------------- ----------- ----------- ------------- -----------

Balance at 30 September

2022 (273) (350) (631) (1,254)

Charge for the

Period (38) (48) (108) (194)

Disposals 77 - - 77

-------------------------- ----------- ----------- ------------- -----------

Balance at 31 March

2023 (234) (398) (739) (1,371)

Charge for the

Period (40) (44) (108) (192)

-------------------------- ----------- ----------- ------------- -----------

Balance at 30 September

2023 (274) (442) (847) (1,563)

-------------------------- ----------- ----------- ------------- -----------

Carrying amount

At 1 April 2022 106 175 468 749

At 30 September

2022 103 130 360 593

At 31 March 2023 120 82 252 454

-------------------------- ----------- ----------- ------------- -----------

At 30 September

2023 138 46 144 328

-------------------------- ----------- ----------- ------------- -----------

All depreciation charges are included within Administrative

expenses in the Consolidated Statement of Total Comprehensive

Income.

The Group leases buildings, IT equipment and a car. The Group

has applied the practical expedient for low value assets and so has

not recognised IT equipment within right-of-use assets.

The average lease term is five years. No leases have expired in

the current financial Period.

Right-of-use assets

Unaudited Unaudited Audited

six months six months year

ended ended ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

(GBP'000) (GBP'000) (GBP'000)

Amounts recognised in profit

and loss

Depreciation on right-of-use

assets (108) (108) (216)

Interest expense on lease

liabilities (3) (7) (14)

Expense relating to short-term

leases (33) (31) (59)

Expense relating to low

value assets (1) (1) -

-------------------------------- ------------ ------------ -----------

Total (145) (147) (289)

-------------------------------- ------------ ------------ -----------

At 30 September 2023, the Group is committed to GBP66,000 for

short-term leases. The total cash outflow for leases amounts to

GBP168,000.

11. Trade and Other Receivables

Unaudited Unaudited Audited

six months six months year

ended ended ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

(GBP'000) (GBP'000) (GBP'000)

Trade receivables 420 522 278

Prepayments and accrued

income 3,597 3,348 3,457

Amounts due from related

parties 2 - -

Other receivables 247 32 47

--------------------------- ------------ ------------ -----------

4,266 3,902 3,782

--------------------------- ------------ ------------ -----------

Less non-current portion:

Other receivables (188) - -

--------------------------- ------------ ------------ -----------

Total non-current trade

and other receivables (188) - -

--------------------------- ------------ ------------ -----------

Total current trade and

other receivables 4,078 3,902 3,782

--------------------------- ------------ ------------ -----------

The carrying value of trade receivables is considered a fair

approximation of their fair value. The Group applies the IFRS 9

simplified approach to measuring expected credit losses ("ECLs")

for trade receivables at an amount equal to lifetime ECLs. In line

with the Group's historical experience, and after consideration of

current credit exposures, the Group does not expect to incur any

credit losses and has not recognised any ECLs in the current year

(2022: GBPnil).

The amounts due from related parties are net of provisions. The

Group holds no provisions (2022: GBP1,311,000).

Trade receivable amounts are all held in sterling.

12. Trade and Other Payables

Unaudited Unaudited Audited

six months six months year

ended ended ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

(GBP'000) (GBP'000) (GBP'000)

Trade payables 720 913 397

Amounts due to related

parties - 234 234

Accruals 3,434 2,521 3,301

Deferred income 121 155 138

Contingent consideration 3,089 5,722 2,989

Other payables 2,964 2,939 3,106

--------------------------- ------------ ------------ -----------

Total 10,328 12,484 10,165

--------------------------- ------------ ------------ -----------

Less non-current portion:

Contingent consideration (2,315) (5,722) (2,209)

Other payables - (129) (45)

--------------------------- ------------ ------------ -----------

Total non-current trade

and other payables (2,315) (5,851) (2,254)

--------------------------- ------------ ------------ -----------

Total current trade and

other payables 8,013 6,633 7,911

--------------------------- ------------ ------------ -----------

The carrying values of trade payables, amounts due to related

parties, accruals and deferred income are considered reasonable

approximations of fair value. Trade payable amounts are all held in

sterling.

13. Financial Instruments

The Group finances its operations through a combination of cash

resources and other borrowings. Short-term flexibility could be

satisfied if required by overdraft facilities in Paradigm Partners

Limited which are repayable on demand.

Fair value estimation

IFRS 7 requires disclosure of fair value measurements of

financial instruments by level of the following fair value

measurement hierarchy:

-- Quoted prices (unadjusted) in active markets for identical

assets or liabilities (level 1).

-- Inputs other than quoted prices included within level 1 that

are observable for the asset or liability, either directly (that

is, as prices) or indirectly (that is, derived from prices) (level

2).

-- Inputs for the asset or liability that are not based on

observable market data (that is, unobservable inputs) (level

3).

All financial assets except for financial investments are

categorised as Loans and receivables and are classified as level 1.

Financial investments are categorised as Financial assets at fair

value through profit or loss and are classified as level 1 and the

fair value is determined directly by reference to published prices

in an active market.

Financial assets at fair value through profit or loss (level

1)

Unaudited Unaudited Audited

six months six months year

ended ended ended

30-Sep 30-Sep 31-Mar

2023 2022 2023

(GBP'000) (GBP'000) (GBP'000)

--------------------------- ------------ ------------ -----------

Financial investments in

regulated funds or model

portfolios 175 122 123

--------------------------- ------------ ------------ -----------

All financial liabilities except for contingent consideration

are categorised as Financial liabilities measured at amortised cost

and are also classified as level 1. The only financial liabilities

measured subsequently at fair value on level 3 fair value

measurement represent contingent consideration relating to a

business combination.

Financial liabilities at fair value through profit or loss

(level 3)

Contingent consideration GBP'000

Balance at 1 April 2022 2,486

Recognised on acquisition 3,118

Changes in the fair value of contingent

consideration 118

----------------------------------------- --------

Balance at 30 September 2022 5,722

Recognised on acquisition (192)

Unwinding of discount rate 228

Changes in the fair value of contingent

consideration (2,769)

----------------------------------------- --------

Balance at 31 March 2023 2,989

Unwinding of discount rate 100

----------------------------------------- --------

Balance at 30 September 2023 3,089

----------------------------------------- --------

14. Equity

Number

Authorised, called up and fully paid

At 1 April 2022 58,914,887

Issue of share capital on exercise of

employee share options 237,962

Issue of share capital as payment for

an acquisition 877,737

--------------------------------------- -----------

At 30 September 2022 60,030,586

Issue of share capital on exercise of

employee share options 25,136

--------------------------------------- -----------

At 31 March 2023 60,055,722

Issue of share capital on exercise of

employee share options 455,677

--------------------------------------- -----------

At 30 September 2023 60,511,399

--------------------------------------- -----------

15. Share- Based Payments

During the Period, a number of share-based payment schemes and

share options schemes have been utilised by the Company.

(A) Schemes

(I) Tatton Asset Management plc EMI scheme ("TAM EMI

scheme")

On 7 July 2017, the Group launched an EMI share option scheme

relating to shares in Tatton Asset Management plc to enable senior

management to participate in the equity of the Company. 3,022,735

options with a weighted average exercise price of GBP1.89 were

granted, exercisable in July 2020. There have been nil (2022: nil)

options exercised during the Period from this scheme.

The scheme was extended on 8 August 2018, 1 August 2019, 28 July

2020, 15 July 2021, 25 July 2022 and 24 July 2023, with 1,709,498,

193,000, 1,000,001, 279,858, 274,268 and 204,523 zero cost options

granted in each respective year. These options are exercisable on

the third anniversary of the grant date.

The options granted in 2018 vested and became exercisable in

August 2021. There have been 50,000 (2022: 50,000) options

exercised during the Period from this scheme. 168,193 of these

options lapsed in 2021.

The options granted in 2019 vested and became exercisable in

August 2022. There have been no options exercised during the Period

from this scheme (2022: 139,500).

The options granted in 2020 vested and became exercisable in

July 2023. There have been 296,896 options exercised during the

Period from this scheme. 27,919 of these options lapsed in the

Period.

The options granted in 2021, 2022 and 2023 vest in July 2024,

July 2025 and July 2026 respectively provided certain performance

conditions and targets, set prior to grant, have been met. If the

performance conditions are not met, the options lapse.

A total of 2,627,186 options remain outstanding at 30 September

2023, 1,878,861 of which are currently exercisable. 6,961 options

were forfeited in the Period (2022: 4,250). Within the accounts of

the Company, the fair value at grant date is estimated using the

appropriate models, including both the Black-Scholes and Monte

Carlo modelling methodologies.

Number

of share Weighted

options average

granted price

(number) (GBP)

Outstanding at 1 April 2022 2,726,026 0.60

Granted during the Period 274,268 -

Forfeited during the Period (4,250) -

Lapsed during the Period - -

Exercised during the Period (189,500) -

---------------------------------- ---------- ---------

Outstanding at 30 September 2022 2,806,544 0.59

---------------------------------- ---------- ---------

Exercisable at 30 September 2022 1,256,668 1.31

---------------------------------- ---------- ---------

Outstanding at 1 October 2022 2,806,544 0.59

Granted during the Period - -

Forfeited during the Period (2,105) -

Exercised during the Period - -

Lapsed during the Period - -

---------------------------------- ---------- ---------

Outstanding at 31 March 2023 2,804,439 0.59

---------------------------------- ---------- ---------

Exercisable at 31 March 2023 1,256,668 1.31

---------------------------------- ---------- ---------

Outstanding at 1 April 2023 2,804,439 0.59

Granted during the Period 204,523 -

Forfeited during the Period (6,961) -

Lapsed during the Period (27,919) -

Exercised during the Period (346,896) -

---------------------------------- ---------- ---------

Outstanding at 30 September 2023 2,627,186 0.63

---------------------------------- ---------- ---------

Exercisable at 30 September 2023 1,878,861 0.88

---------------------------------- ---------- ---------

(II) Tatton Asset Management plc Sharesave scheme ("TAM

Sharesave scheme")

On 7 July 2017, 5 July 2018, 3 July 2019, 6 July 2020, 2 August

2021, 4 August 2022 and 25 August 2023, the Group launched all

employee Sharesave schemes for options over shares in Tatton Asset

Management plc. Employees are able to save between GBP10 and GBP500

per month over the three-year life of each scheme, at which point

they each have the option to either acquire shares in the Company

or receive the cash saved.

The 2020 TAM Sharesave scheme vested in August 2023 and 108,781

shares options became exercisable. Over the life of the 2021, 2022

and 2023 TAM Sharesave schemes it is estimated that, based on

current savings rates, 39,160, 52,387 and 93,850 share options

respectively will be exercisable. The exercise price for these

schemes is shown below.

During the Period, 108,781 (2022: 48,462) options have been

exercised and 2,656 (2022: 2,494) options have been forfeited.

Within the accounts of the Company, the fair value at grant date

is estimated using the Black-Scholes methodology for 100% of the

options. Share price volatility has been estimated using the

historical share price volatility of the Company, the expected

volatility of the Company's share price over the life of the

options and the average volatility applying to a comparable group

of listed companies. Key valuation assumptions and the costs

recognised in the accounts during the Period are noted in (B) and

(C) respectively.

Number

of share Weighted

options average

granted price

(number) (GBP)

Outstanding at 1 April 2022 140,077 2.14

Granted during the Period 38,185 2.52

Forfeited during the Period (2,494) 3.03

Exercised during the Period (48,462) 1.79

---------------------------------- ---------- ---------

Outstanding at 30 September 2022 127,306 2.37

---------------------------------- ---------- ---------

Exercisable at 30 September 2022 25,137 1.79

---------------------------------- ---------- ---------

Outstanding at 1 October 2022 127,306 2.37

Granted during the Period 34,512 2.81

Forfeited during the Period (4,895) 2.55

Exercised during the Period (25,137) 1.79

---------------------------------- ---------- ---------

Outstanding at 31 March 2023 131,786 2.57