TIDMTRIN

RNS Number : 4721A

Trinity Exploration & Production

29 September 2015

Trinity Exploration & Production Plc

(the "Company" or "Trinity"; AIM:TRIN)

Interim Results

29(th) September 2015

Trinity, an independent E&P company focused on Trinidad and

Tobago, announces its interim results for the six months ended 30th

June 2015.

Operating highlights

-- Group average net production levels of 3,085 boepd for H1

2015 (H1 2014: 3,795 boepd)

-- Net Q2 production averaged 2,939 boepd

-- Continued progress made towards TGAL Field Development Plan

("FDP")

-- 45% reduction in General and Administrative ("G&A") costs

year-on-year to USD 5.7 million for H1 2015

-- Further G&A reductions post period end to take run rate

down by an additional USD1.6 million per annum

-- Development and exploration activities currently

suspended

Financial highlights

-- Trinity benefited from not being subject to Supplemental

Petroleum Taxes ("SPT") when the WTI oil price fell below USD

50.0/bbl

-- Revenues of USD 27.8 million (H1 2014: USD 62.3 million)

-- Reduced operating costs by 36% at USD 12.0 million (H1

2014:USD 18.7 million)

-- Impairment of USD 6.1 million pre acquisition costs to date

on Blocks 1(a) & 1(b)

-- EBITDA before exceptional items/ exploration costs written

off of USD 1.6 million (H1 2014: USD 12.5 million)

-- Operating loss before exceptional items/ exploration costs

write off of USD 1.3 million (H1 2014 : USD 3.8 million profit)

-- Cash outflow from operating activities USD 1.1 million (H1

2014 : USD 4.4 million inflow)

-- Net loss after tax of USD 15.8 million (H1 2014:USD 22.9

million)

-- Cash balance at period end of USD 8.2 million (H1 2014: 9.6

million)

-- Current extension for moratorium on principal repayments

relating to Trinity's outstanding debt extended to 9th October

2015

Strategic highlights

-- Trinity is currently conducting a strategic review of its

business in order to maximise value for shareholders. The Company

is subject to The City Code on Takeovers and Mergers and has opted

to conduct discussions with parties interested in making a proposal

to the Company under the framework for a "Formal Sales Process"

(FSP) of its assets

-- Post the period end, Trinity announced the sale of the

Company's 100% interest in the Guapo-1 block for a cash

consideration of USD 2.8 million, against a book value of USD 2.2

million. Proceeds from the sale will be used to service the

Company's senior debt

-- Trinity has been unable to extend the term of its agreement

to complete the purchase of 80% interest in Blocks 1(a) & 1(b)

from Centrica. Consequently, the Sale and Purchase Agreement

("SPA") between Trinity and two subsidiaries of Centrica was

terminated

-- The Tabaquite block, is currently classified as

'held-for-sale' with no proceeds as yet having been received from

LGO Energy plc ("LGO") despite signature of a binding Sale and

Purchase Agreement ("SPA") to acquire 100% of the issued shares of

Tabaquite Exploration & Production Company Limited ("TEPCL")

from Trinity for a total consideration of USD 2.0 million. Trinity

is yet to receive monies due under the SPA. The company is working

hard to bring this matter to a satisfactory conclusion.

Outlook

Key priorities for the Company are to:

-- Achieve a c. 20% reduction in full year production operating

expenditure to USD 26.0 million

-- Submission of the TGAL draft FDP

-- Identify and arrange financing to fund the Company's future

developments

Further to the strategic review and FSP that we announced in

April, Trinity is in discussions with a number of parties. Trinity

Shareholders are advised that there can be no certainty that any

offer or other transaction will result from the formal sales

process or as to the terms on which any offer or other transaction

may be made.

Discussion with the Group's bankers is ongoing and, under the

assumption that the Group's remaining external debt is not recalled

following expiry of the current moratorium on 9th October 2015, the

Group has sufficient cash flow to continue operating for at least

the next 12 months from the date of approval of these financial

statements and the Board of Directors continues to adopt the going

concern basis of preparing the financial statements (see note

1).

Joel "Monty" Pemberton, Chief Executive Officer of Trinity,

commented:

"We remain on track to reduce our operating costs by 20% this

year and have made good progress in cutting G&A by 45% for the

half year with further reductions post the period end. Despite the

significantly reduced levels of capital expenditure our production

levels have held up well, reflecting the robust nature of the asset

base.

We continue to explore all of the options for our business to

ensure we can maximise value for our shareholders. The SPA agreed

on the Guapo-1 block demonstrates the on-going attractiveness of

Trinity's portfolio. The FSP process remains competitive, with

discussions ongoing with several interested parties, and we look

forward to announcing additional news on the strategic review and

FSP in due course.

At oil prices below US$50/bbl we do not pay SPT which in

conjunction with on-going operational efficiencies and cost cutting

enhances our production economics and the value of Trinity's

portfolio."

Competent Person's Statement

The information contained in this Circular has been reviewed and

approved by Dr Ryan Ramsook, the Company's Head of Sub Surface, who

has 10 years of relevant experience in the oil industry. Dr Ramsook

holds a PhD in Geology.

Enquiries

Trinity Exploration & Production Tel: +44 (0)13 1240

Joel "Monty" Pemberton, Chief Executive 3860

Officer

Tracy Mackenzie, Head of Investor Relations

RBC Capital Markets (NOMAD & Broker) Tel: +44 (0) 20 7653

Matthew Coakes 4000

Daniel Conti

Oil & Gas Advisory Tel: +44 (0) 20 7653

Jakub Brogowski 4000

Roland Symonds

Brunswick Group LLP (PR Adviser) Tel: +44 (0) 20 7404

Patrick Handley 5959

William Medvei

About Trinity

Trinity is the largest independent E&P company focused on

Trinidad and Tobago. Trinity operates assets onshore and offshore

on both the West and East coasts. Trinity's portfolio includes

current production, significant near-term production growth

opportunities from low risk developments and multiple exploration

prospects with the potential to deliver meaningful

reserves/resources growth. The Company operates all of its licences

and has 2P reserves of 25 mmbbl. Trinity is listed on the AIM

market of the London Stock Exchange under the ticker TRIN.LN

OPERATIONS REVIEW

During the second quarter, Trinity's net production averaged

2,939 boepd, an average of 3,085 boepd for the first half of

2015.

Onshore operations

Average H1 2015 net production for Onshore was 1,691 boepd (H1

2014: 2,088 boepd). The decrease in production volumes resulted

from natural decline rates coupled with minimal workover activity.

There were 43 workovers conducted in H1, with the rate of workovers

limited by having only two rigs operational on the fields (versus

the three previously operational for the same period last year).

Due to lower oil prices new drilling operations have been suspended

since the close of H1 2014 and this has remained in effect. One RCP

was completed in H1 2015 yielding an initial production rate of 104

boepd partially offsetting the decline in production.

West Coast operations

Average H1 2015 net production from the West Coast assets was

384 boepd (H1 2014: 580 boepd). No drilling or RCPs were carried

out in H1 2015 and there were minimal workover activities. The

shortfall in West Coast production levels was largely due to the

temporary shut-in of the ABM-151 well (now back on production) and

compressor overhaul work at Brighton. At the Guapo Marine block

chemical treatment of some of the more viscous wells has been

deferred.

East Coast operations

At TGAL (TRIN: 65% WI), where management resource estimates on

Trinity's TGAL-1 discovery are 150.0 - 210.0 mmbbls (best estimate

186.0 mmbbls), work continues on the Field Development Plan with

submission expected during H2 2015. The subsurface evaluation has

been completed, the topside facility concept has been narrowed down

to two options and it seems practical to adopt a phased approach to

developing the field by bringing onto production the reserves

nearer to the Trintes field and putting it through a Trintes

facility to shore. Seventeen candidate drilling locations have been

identified with the potential to develop 22.0 mmbbls following

development. The initial revenues generated would then allow for

reinvestment in other facilities and pipeline.

FINANCIAL REVIEW

Income Statement Analysis

Trinity's financial results for the first half of 2015 showed a

Total Comprehensive Loss of USD 15.8 million (H1 2014: USD 22.8

million) on gross revenues of USD 27.8 million (H1 2014: USD 62.3

million).

Operating Revenues

Operating revenues of USD 27.8 million (H1 2014: USD 62.3

million). This 55% decrease was mainly attributable to (i) sharp

fall in oil prices, (ii) decreased production and (iii) suspension

of drilling operations across all assets.

-- Crude oil prices: Trinity was adversely affected from low oil

prices during the first half of 2015, with an average West Texas

Intermediate ("WTI") realised price of USD 49.5/bbl (H1 2014: USD

93.0/bbl)

-- Production: The group's average production for the six month

period was 3,085 boepd (H1 2014: 3,795 boepd) with 55% (1,691 bopd)

sold onshore, 12% (384 boepd) attributable to the West Coast and

33% (1,010 bopd) from the East Coast

Operating Expenses

Operating expenses of USD 29.1 million (H1 2014: USD 58.5

million) comprised of the following:

-- Royalties of USD 8.6 million (H1 2014: USD 20.7 million)

decreased due to lower oil prices

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 02:02 ET (06:02 GMT)

-- Production costs of USD 12.0 million (H1 2014: USD 18.7

million). The group adopted strategic and proactive measures to

reduce the production costs and bring it in line with current oil

prices

-- Depreciation, depletion and amortisation charges of USD 2.9

million (H1 2014: USD 8.7 million) were lower as the depreciable

asset pool was reduced due to asset impairment

-- General and administrative (G&A) expenditure of USD 5.7

million (H1 2014: USD 10.4 million). The favourable variance

reported in H1 2015 compared to H1 2014 is a result of reduced head

office charges due to organizational restructuring, reduced

overseas travel, only essential consultancy and professional fees

and lower business development and marketing expenditure

Operating Loss

Operating loss (before exceptional items) for the period

amounted to USD 1.3 million (H1 2014: USD 3.8 million profit)

mainly driven by fall in crude oil prices

Net Finance Costs

Finance costs for the period totalled USD 3.4 million (H1 2014:

USD 2.3 million) of which USD 0.6 million (H1 2014: USD 1.7

million) related to interest expense on loan facilities from

Citibank (Trinidad & Tobago) Limited, USD 1.6 million interest

on taxes and USD 0.4 million interest due to Centrica for 1(a)

& 1(b)

In addition, USD 0.8 million (H1 2014: USD 0.6 million) related

to the unwinding of the discount rate on the decommissioning

provision.

Taxation

The Group has a deferred tax asset of $27.6 million on its

Statement of Financial Position which it expects to recover in more

than 12 months based on the expected taxable profits generated by

Group companies.

For the first half of 2015 taxes amounted to USD 2.8 million (H1

2014: USD 7.0 million) which comprised of:

-- Production taxes which amounted to USD 2.1 million (H1 2014:

USD 10.3 million)

- PPT: USD 0.04 million (H1 2014: USD 3.2 million)

- SPT: USD 2.1 million (H1 2014: USD 7.1 million)

-- Other taxes:

- Corporation tax of USD 0.7 million (H1 2014: USD 0.7 million)

The total outstanding taxation balances at the end of H1 2015

stands at USD 22.9 million with minimum payments made in H1 2015.

Further payments are expected in H2 2015 once funding becomes

available through the realisation of the FSP. Trinity benefited

from not being subject to Supplemental Petroleum Taxes ("SPT") when

the WTI oil price fell below USD 50.0/bbl.

Total Comprehensive Income

Trinity recorded a Total Comprehensive Loss of USD 15.8 million

(H1 2014: USD 22.8 million) for the period ending 30th June 2015.

Adjusted for exceptional items, Trinity recorded Total

Comprehensive Loss of USD 7.5 million (H1 2014: USD 5.3

million).

Cash Flow Analysis

Initial Cash Position

Trinity started the year with an initial cash balance of USD

33.1 million (2014 USD 25.1 million).

Cash from Operating Activities

For the period ending 30th June 2015, Trinity's net cash outflow

was USD 1.1 million (H1 2014: USD 4.4 million inflow) of cash from

operating activities.

Changes in Working Capital

During the period Trinity experienced working capital outflows

of USD 1.1 million (H1 2014: USD 9.1 million) which was

substantially affected by payments for exploration drilling

activities, but compensated by VAT collection. Significant changes

are outlined in the table below.

All figures in USD'000 H1 2015 H1 2014

Uses of Cash Sources of Uses of Sources of

Cash Cash Cash

Inventory 5,238 405

Assets held-for-sale 104

Trade and other receivables 3,557 7,074

Trade and other payables 3,696 10,448

Taxation Paid 53 4,654

Change in Working

Capital (1,964) (8,433)

Trinity paid taxes of USD 0.05 million (comprising production

and corporate taxes) in the first half of 2015 (H1 2014: USD 4.7

million of which USD 4.0 million related to production taxes for

2013).

Investing Activities

For the first half of 2015, Trinity incurred capital

expenditures of USD 1.2 million (H1 2014: USD 21.3 million)

comprising exploration and evaluation assets of USD 1.1 million (H1

2014: USD 8.5 million) and property, plant and equipment acquired

for USD 0.1million (H1 2014: USD 12.8 million).

Financing Activities

-- Trinity made principal repayments totaling USD 20.0 million

(H1 2014: USD 2.0 million) on its Citibank (Trinidad & Tobago)

Limited USD 25.0 million loan facility in February 2015

-- Finance costs amounted to USD 2.5 million (H1 2014: USD 1.7 million)

Closing Cash Balance

Trinity's cash balances at 30th June 2015 were USD 8.2 million

(H1 2014: USD 9.6 million).

Bruce Dingwall Joel "Monty" Pemberton

Non-Executive Chairman Chief Executive Officer

STATEMENT OF DIRECTORS' RESPONSIBILITY

The directors' confirm that this condensed consolidated interim

financial information has been prepared in accordance with IAS 34

as adopted by the European Union and that the interim management

report includes a fair review of the information required by DTR

4.2.7 and DTR 4.2.8, namely:

-- an indication of important events that have occurred during

the first six months and their impact on the condensed set of

financial statements, and a description of the principal risks and

uncertainties for the remaining six months of the financial year;

and

-- the management report, which is incorporated into the

directors' report, includes a fair review of the development and

performance of the business and the position of the Company and the

undertakings included in the consolidation taken as a whole,

together with a description of the principal risks and

uncertainties that they face; and

-- material related party transactions in the first six months

and any material changes in the related-party transactions

described in the last annual report.

A list of the current Directors is maintained on the Trinity

Exploration & Production Plc website

www.trinityexploration.com

By order of the Board

Joel Pemberton

Chief Executive Officer

INDEPENDENT REVIEW REPORT TO TRINITY EXPLORATION &

PRODUCTION PLC

Introduction

We have been engaged by the company to review the condensed

consolidated interim financial statements in the half-yearly

financial report for the six months ended 30th June 2015, which

comprises the consolidated statement of comprehensive income,

consolidated statement of financial position, consolidated

statement of changes in equity, consolidated cash flow statement

and related notes. We have read the other information contained in

the half-yearly financial report and considered whether it contains

any apparent misstatements or material inconsistencies with the

information in the condensed set of financial statements.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the half-yearly financial report in accordance with

the AIM Rules for Companies which require that the financial

information must be presented and prepared in a form consistent

with that which will be adopted in the company's annual financial

statements.

As disclosed in note 1, the annual financial statements of the

group are prepared in accordance with IFRSs as adopted by the

European Union. The condensed set of financial statements included

in this half-yearly financial report has been prepared in

accordance with International Accounting Standard 34, "Interim

Financial Reporting", as adopted by the European Union.

Our responsibility

Our responsibility is to express to the company a conclusion on

the condensed set of financial statements in the half-yearly

financial report based on our review. This report, including the

conclusion, has been prepared for and only for the company for the

purpose of the AIM Rules for Companies and for no other purpose. We

do not, in producing this report, accept or assume responsibility

for any other purpose or to any other person to whom this report is

shown or into whose hands it may come save where expressly agreed

by our prior consent in writing.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410, 'Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity' issued by the Auditing Practices Board for use in

the United Kingdom. A review of interim financial information

consists of making enquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK and Ireland) and consequently does not enable us to

obtain assurance that we would become aware of all significant

matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

Emphasis of Matter

In forming our conclusion on the condensed consolidated

financial statements, which is not modified, we have considered the

adequacy of the disclosure made in note 1 to the condensed

consolidated financial statements concerning the Group and

Company's ability to continue as a going concern.

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 02:02 ET (06:02 GMT)

The Directors have commenced a formal sales process and as at

the date of approving the condensed consolidated financial

statements, certain asset deals have been executed and a number of

conditional proposals and expressions of interest had been received

but not concluded. The directors recognise that the Group and

Company have insufficient financial resources to operate the

business in the longer term in the absence of additional funding.

They believe, however, that there are reasonable future prospects

for a transaction to be completed. However, there is uncertainty as

to the ability to secure the additional funding required.

These conditions, along with the other matters explained in

note1 to the condensed consolidated financial statements, indicate

the existence of a material uncertainty which may cast significant

doubt about the Group's and Company's ability to continue as a

going concern. The condensed consolidated financial statements do

not include the adjustments that would result if the Group and

Company were unable to continue as a going concern.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly financial report for the six months ended 30th

June 2015 is not prepared, in all material respects, in accordance

with International Accounting Standard 34 as adopted by the

European Union and the AIM Rules for Companies.

PricewaterhouseCoopers LLP

Chartered Accountants

Aberdeen

28th September 2015

The maintenance and integrity of the Trinity Exploration &

Production Plc website is the responsibility of the directors; the

work carried out by the auditors does not involve consideration of

these matters and, accordingly, the auditors accept no

responsibility for any changes that may have occurred to the

financial statements since they were initially presented on the

website.

Legislation in the United Kingdom governing the preparation and

dissemination of financial statements may differ from legislation

in other jurisdictions.

Trinity Exploration & Production Plc

Condensed Consolidated Interim Financial Statements

For the period ended 30th June 2015

Trinity Exploration & Production Plc

Condensed Consolidated Statement of Comprehensive Income

for the period ended 30th June 2015

(Expressed in United States Dollars)

-----------------------------------------------------------------------------------------------------

Notes 6 months 6 months Year ended

to 30th June to 30th June December

2015 2014 2014

$'000 $'000 $'000

(unaudited) (unaudited) (audited)

Operating Revenues

Crude oil sales 27,752 62,240 113,319

Other income 66 41 144

-------------- -------------- ------------

27,818 62,281 113,463

Operating Expenses

Royalties (8,585) (20,688) (36,980)

Production costs (11,963) (18,663) (32,931)

Depreciation, depletion and amortisation 6 (2,897) (8,706) (16,335)

General and administrative expenses (5,678) (10,442) (15,019)

-------------- -------------- ------------

(29,123) (58,499) (101,265)

-------------- -------------- ------------

Operating (Loss)/Profit (1,305) 3,782 12,198

Exceptional items 4 (8,289) -- (120,939)

Exploration cost write off -- (17,463) (14,929)

Finance Income 1 2 33

Finance Costs (3,405) (2,260) (5,151)

--------------

Loss Before Taxation (12,998) (15,939) (128,789)

Taxation Charge 5 (2,846) (7,005) (12,657)

-------------- -------------- ------------

Loss for the period (15,844) (22,944) (141,446)

Other Comprehensive Income

Currency Translation 24 107 263

-------------- -------------- ------------

Total Comprehensive Loss for the

period (15,820) (22,837) (141,183)

============== ============== ============

Earnings per share (expressed

in dollars per share)

Basic 14 (0.17) (0.24) (1.49)

Diluted 14 (0.17) (0.24) (1.49)

------------------------------- ---

Trinity Exploration & Production Plc

Condensed Consolidated Statement of Financial Position

for the period ended 30th June 2015

(Expressed in United States Dollars)

-----------------------------------------------------------------------------------------

Notes As at 30th As at 30th As at 31st

June 2015 June 2014 December 2014

ASSETS $'000 $'000 $'000

(unaudited) (unaudited) (audited)

Non-current Assets

Property, plant and equipment 6 48,722 181,703 85,655

Intangible assets 7 26,805 50,024 25,676

Deferred tax asset 27,630 80,344 27,630

------------ ------------ ---------------

103,157 312,071 138,961

------------ ------------ ---------------

Current Assets

Inventories 11 6,671 12,434 11,909

Trade and other receivables 18,361 29,716 21,990

Assets held-for-sale 12 34,691 -- 672

Taxation recoverable 548 540 548

Cash and cash equivalents 8,197 9,594 33,084

------------ ------------ ---------------

68,468 52,284 68,203

------------ ------------ ---------------

Total Assets 171,625 364,355 207,164

============ ============ ===============

Equity

Capital and Reserves Attributable

to Equity Holders

Share capital 8 94,800 94,800 94,800

Share premium 8 116,395 116,395 116,395

Share warrants 71 71 71

Share based payment reserve 12,006 11,774 11,834

Reverse acquisition reserve (89,268) (89,268) (89,268)

Merger reserves 75,467 74,808 75,467

Translation reserve 287 674 527

Accumulated (deficit) (146,914) (12,569) (131,070)

------------ ------------ ---------------

Total Equity 62,844 196,685 78,756

Non-current Liabilities

Borrowings 9 -- 12,889 --

Provision for other liabilities 10 19,255 29,599 39,775

Deferred tax liability 3,751 58,030 3,778

------------ ------------ ---------------

23,006 100,518 43,553

------------ ------------ ---------------

Current Liabilities

Trade and other payables 28,547 50,669 33,374

Borrowings 9 13,000 6,000 33,000

Liabilities held-for-sale 12 21,286 -- --

Taxation payable 22,942 10,483 18,481

------------

85,775 67,152 84,855

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 02:02 ET (06:02 GMT)

------------ ------------ ---------------

Total Liabilities 108,781 167,670 128,408

------------ ------------ ---------------

Total Shareholders' Equity and

Liabilities 171,625 364,355 207,164

============ ============ ===============

Trinity Exploration & Production Plc

Condensed Consolidated Statement of Changes in Equity

for the period ended 30th June 2015

(Expressed in United States Dollars)

-----------------------------------------------------------------------------------------------------------------------

Share Share Share Share Reverse Merger Translation Accumulated Total

Capital Premium Warrant Based Acquisition Reserve Reserve Deficit

Payment Reserve

Reserve

$'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000 $'000

-------- -------- -------- -------- ------------ -------- ------------ ------------ ----------

Balance at

30th June

2014

(unaudited) 94,800 116,395 71 11,774 (89,268) 74,808 674 (12,569) 196,685

Share based

payment

charge -- -- -- (88) -- -- -- -- (88)

Translation

difference -- -- -- 148 -- 659 (303) -- 504

Comprehensive

Loss for

the year -- -- -- -- -- -- 156 (118,501) (118,345)

Balance at

end of 2014

(audited) 94,800 116,395 71 11,834 (89,268) 75,467 527 (131,070) 78,756

======== ======== ======== ======== ============ ======== ============ ============ ==========

Share based

payment

charge -- -- -- 172 -- -- -- -- 172

Translation

difference -- -- -- -- -- -- (264) -- (264)

Comprehensive

Loss for

the year -- -- -- -- -- -- 24 (15,844) (15,820)

Balance at

30th June

2015

(unaudited) 94,800 116,395 71 12,006 (89,268) 75,467 287 (146,914) 62,844

======== ======== ======== ======== ============ ======== ============ ============ ==========

Trinity Exploration & Production Plc

Condensed Consolidated Statement of Cashflows for the period ended 30th

June 2015

(Expressed in United States Dollars)

Notes 6 months to 6 months Year ended

30th June to 30th June 31st December

2015 2014 2014

$'000 $'000 $'000

(unaudited) (unaudited) (audited)

Operating Activities

Loss before taxation (12,998) (15,939) (128,788)

Adjustments for:

Translation difference (110) 133 (232)

Finance cost 2,639 1,687 3,985

Share options granted 172 251 163

Finance cost - decommissioning

provision 10 766 573 1,167

Finance income (1) (2) (33)

Depreciation, depletion and amortisation 5 2,897 8,706 16,335

Exploration cost write off 7 -- 17,463 14,929

Written off of 1(a) & 1(b) pre-acquisition

cost 4 6,055 -- --

Potential claim 4 -- -- 1,270

Loss on disposal of inventory 4 1,302 -- --

Loss on disposal of asset 4 108 -- --

Impairment on property, plant

and equipment 4 -- -- 96,242

Impairment of intangibles 4 -- -- 23,430

830 12,872 28,468

------------ -------------- ---------------

Changes In Working Capital

Inventory 5,238 (405) 121

Assets held for sale 12 104 -- --

Trade and other receivables (3,557) 7,074 14,792

Trade and other payables (3,695) (10,448) (27,742)

(1,080) 9,093 15,638

Taxation paid (53) (4,654) (3,837)

------------ -------------- ---------------

Net Cash (Outflow)/ Inflow From

Operating Activities (1,133) 4,439 11,801

------------ -------------- ---------------

Investing Activities

Purchase of exploration and evaluation

assets 7 (1,129) (8,478) (4,970)

Purchase of property, plant &

equipment 6 (87) (12,817) (11,941)

Net Cash (Outflow) From Investing

Activities (1,216) (21,295) (16,911)

------------ -------------- ---------------

Financing Activities

Finance income 1 2 33

Finance cost - borrowings (2,539) (1,687) (3,985)

Proceeds from borrowings 9 -- 5,000 25,000

Repayments of borrowings 9 (20,000) (2,010) (8,000)

------------ -------------- ---------------

Net Cash (Outflow)/Inflow From

Financing Activities (22,538) 1,305 13,048

------------ -------------- ---------------

(Decrease)/Increase in Cash and

Cash Equivalents (24,887) (15,551) 7,938

============ ============== ===============

Cash And Cash Equivalents

At beginning of period 33,084 25,145 25,145

Cash acquired in acquisition -- -- --

(Decrease)/Increase (24,887) (15,551) 7,939

------------ -------------- ---------------

At end of period 8,197 9,594 33,084

============ ============== ===============

Trinity Exploration & Production Plc

Notes to the Condensed Consolidated Financial Statements for the

period ended 30th June 2014

1 Background and Accounting Policies

Background

Trinity Exploration & Production Plc ("TEP Plc") is

incorporated and registered in England and trades on the

Alternative Investment Market ("AIM"), a market operated by London

Stock Exchange Plc. TEP Plc ("the Company") and its subsidiaries

(together "the Group") are involved in the exploration, development

and production of oil and gas reserves in Trinidad.

Basis of Preparation

These condensed interim financial statements for the six months

ended 30th June 2015 have been prepared in accordance with IAS 34,

'Interim financial reporting', as adopted by the European Union, on

a going concern basis. The condensed interim financial statements

should be read in conjunction with the annual financial statements

for the year ended 31st December 2014, which have been prepared in

accordance with IFRSs as adopted by the European Union.

The results for the six months ended 30th June 2015 and 30th

June 2014 are unaudited and do not comprise statutory accounts

within the meaning of section 434 of the Companies Act 2006.

Statutory accounts for the year ended 31st December 2014 were

approved by the board of directors and delivered to the Registrar

of Companies. The report of the auditors on those accounts was

unqualified, and contains an emphasis of matter paragraph.

Going Concern

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 02:02 ET (06:02 GMT)

In making their going concern assessment, the Directors have

considered the Group's budget and cash flow forecasts. Discussion

with the Group's bankers is ongoing and, under the assumption that

the Group's remaining external debt is not recalled following

expiry of the current moratorium on 9th October 2015, the Group has

sufficient cash flow to continue operating for at least the next 12

months from the date of approval of these financial statements.

The Company is progressing the formal sales process along with

consideration of alternative funding options including the sale of

one or more existing assets, a farm-out or corporate transaction.

At the date of approving the condensed consolidated financial

statements, certain asset deals have been executed and a number of

conditional proposals and expressions of interest had been received

but not concluded.

For this reason, the Board of Directors continues to adopt the

going concern basis of preparing the financial statements. However,

the need for additional funding indicates the existence of a

material uncertainty which may cast significant doubt on the

Company and the Group's ability to continue as a going concern and,

therefore the Group and Company may be unable to fully realise

their assets and discharge their liabilities in the normal course

of business. The financial statements do not include the

adjustments that would be necessary if the Group and Company were

unable to continue as a going concern.

Accounting policies

The accounting policies adopted are consistent with those of the

previous financial year, as set out in the consolidated financial

statements for the year ended 31st December 2014, except for income

taxes in the interim periods which are accrued using the tax rate

that would be applicable to the expected total annual profit and

loss. The business is not affected by seasonality.

There are no IFRSs or IFRIC interpretations that are effective

for the first time for the financial year beginning on or after 1st

January 2015 that would be expected to have a material impact on

the group.

Estimates

The preparation of interim financial statements requires

management to make judgements, estimates and assumptions that

affect the application of accounting policies and the reported

amounts of assets and liabilities, income and expenses. Actual

results may differ from these estimates.

In preparing these condensed interim financial statements, the

significant judgements made by management in applying the group's

accounting policies and the key sources of estimation uncertainty

were the same as those that applied to the consolidated financial

statements for the year ended 31st December 2014.

Non-current assets (or disposal Groups) held for sale

Non-current assets (or disposal Groups) classified as held for

sale are measured at the lower of carrying amount and fair value

less costs to sell. Non-current assets and disposal Groups are

classified as held for sale if their carrying amount will be

recovered through a sale transaction rather than through continuing

use. This condition is regarded as met only when the sale is highly

probable and the asset (or disposal Group) is available for

immediate sale in its present condition. Management must be

committed to the sale which should be expected to qualify for

recognition as a completed sale within one year from the date of

classification.

2 Financial risk management

Financial risk factors

The group's activities expose it to a variety of financial

risks: market risk (including currency risk, fair value interest

rate risk, cash flow interest rate risk and price risk), credit

risk and liquidity risk.

The condensed interim financial statements do not include all

financial risk management information and disclosures required in

the annual financial statements; they should be read in conjunction

with the group's annual financial statements for 2014, which can be

found at www.trinityexploration.com. There have been no changes in

the risk management department or in any risk management policies

since the year end.

Liquidity risk

Compared to year end, there was no material change in the

contractual undiscounted cash out flows for financial liabilities,

except for the net decrease in borrowings of $20.0 million.

3 Operating segment information

Operating segments are reported in a manner consistent with the

internal reporting provided to the chief operating decision maker.

The chief operating decision maker, who is responsible for

allocating resources and assessing performance of the operating

segments, has been identified as the steering committee that makes

strategic decisions. Management have considered the requirements of

IFRS 8, in regard to the determination of operating segments, and

concluded that the Group has only one significant operating segment

being the production, development and exploration and extraction of

hydrocarbons in Trinidad.

All revenue is generated from sales to one customer in Trinidad

& Tobago The Petroleum Company of Trinidad & Tobago

(PETROTRIN). All non-current assets of the Group are located in

Trinidad & Tobago.

4 Exceptional Items

Items that are material either because of their size, their

nature, or that are non-recurring are considered as exceptional

items and are presented within the line items to which they best

relate. During the current period, exceptional items as detailed

below have been included in the Statement of Comprehensive Income.

An analysis of the amounts presented as exceptional items in these

financial statements are highlighted below.

30th June 30th June 31st December

2015 2014 2014

$'000 $'000 $'000

Impairment of property, plant & equipment -- -- (96,242)

Impairment of intangibles -- -- (23,484)

Potential claim -- -- (1,270)

Loss on winding up of subsidiaries (214) -- --

Loss on disposal of asset (108) -- --

Loss on disposal of casing (1,302) -- --

Fees relating to Formal Sale Process (610) -- --

Written off of 1(a) & 1(b) pre-acquisition (6,055) -- --

cost (note 15 (4))

Translation difference -- -- 57

(8,289) -- (120,939)

========== ========== ==============

5 Taxation

30th June 30th June 31st December

2015 2014 2014

$'000 $'000 $'000

Current tax

* Current period

Petroleum profits tax 38 3,196 1,075

Corporation tax 750 734 2,182

Supplemental petroleum tax 2,086 7,115 14,931

Deferred tax

* Current period

Movement in asset due to tax losses -- (15,665) 37,063

Movement in liability due to accelerated

tax depreciation -- 11,125 (33,214)

Unwinding of deferred tax on fair value

uplift (27) 517 (9,396)

Translation differences (1) (17) 16

Tax charge 2,846 7,005 12,657

========== ========== ==============

The Group has a deferred tax asset of $27.6 million on its

Statement of Financial Position which it expects to recover in more

than 12 months based on the expected taxable profits generated by

Group companies.

6 Property, Plant and Equipment

Land & Oil & Gas Plant &

Buildings Property Equipment Total

$'000 $'000 $'000 $'000

----------- ---------- ----------- ----------

Opening net book amount at 1st January

2015 2,334 78,347 4,974 85,655

Additions 3 55 29 87

Depreciation, depletion and amortisation

charge for period (73) (2,231) (593) (2,897)

Transferred to disposal group held

for sale (note 12) (430) (33,236) (457) (34,123)

Closing net book amount 30th June

2015 1,834 42,935 3,953 48,722

=========== ========== =========== ==========

Period ended 30th June 2015

Cost 2,333 178,400 6,779 187,512

Accumulated depreciation, depletion,

amortisation and impairment (499) (135,465) (2,826) (138,790)

----------- ---------- ----------- ----------

Closing net book amount 1,834 42,935 3,953 48,722

=========== ========== =========== ==========

Land & Oil & Gas Plant &

Buildings Property Equipment Total

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 02:02 ET (06:02 GMT)

$'000 $'000 $'000 $'000

----------- ---------- ----------- ----------

Opening net book amount at 1st January

2014 2,558 168,901 6,133 177,592

Additions 7 12,776 30 12,813

Depreciation, depletion and amortisation

charge for period (68) (8,118) (520) (8,706)

Translation difference -- 4 -- 4

Closing net book amount 2,497 173,563 5,643 181,703

=========== ========== =========== ==========

Period ended 30th June 2014

Cost 3,215 268,327 12,142 283,684

Accumulated depreciation, depletion,

amortisation and impairment (718) (94,768) (6,499) (101,985)

Translation difference -- 4 -- 4

----------- ---------- ----------- ----------

Closing net book amount 2,497 173,563 5,643 181,703

=========== ========== =========== ==========

Land & Oil & Gas Plant &

Buildings Assets Equipment Total

$'000 $'000 $'000 $'000

----------- ---------- ----------- ----------

Year ended 31st December 2014

Opening net book amount at 1st

January 2014 2,558 168,901 6,133 177,592

Additions (106) 12,007 40 11,941

Impairment(1) -- (96,242) -- (96,242)

Transferred to available for sale -- (672) -- (672)

Adjustment to decommissioning estimate -- 8,156 -- 8,156

Depreciation, depletion and amortisation

charge for year (151) (14,914) (1,270) (16,335)

Translation difference 33 1,111 71 1,215

----------- ---------- ----------- ----------

Closing net book amount 31st December

2014 2,334 78,347 4,974 85,655

=========== ========== =========== ==========

At 31st December 2014

Cost 3,125 275,284 12,260 291,005

Accumulated depreciation, depletion,

amortisation and impairment (824) (198,048) (7,357) (206,565)

Translation difference 33 1,111 71 1,215

----------- ---------- ----------- ----------

Closing net book amount 2,334 79,347 4,974 85,655

=========== ========== =========== ==========

(1) No impairment loss was recognised in respect of period ended

30th June 2015, in 2014 several cash generating units ("CGU's")

were impaired, (2014: $96.2 million) as a result of a sharp fall in

oil prices combined with a downward revision in 2P reserve

estimates. The recoverable amount was determined by estimating its

fair value less costs to sell. In calculating this impairment,

management used a production profile based on proven and probable

reserves estimates and a range of assumptions, including third

party oil price assumptions and a discount rate assumption of

10%.

7 Intangible assets

Exploration and evaluation

assets

$'000

At 1st January 2015 25,676

Additions 1,129

At 30th June 2015 26,805

---------------------------

At 1st January 2014 59,002

Additions 8,478

Exploration cost write off (17,463)

Translation 7

---------------------------

At 30th June 2014 50,024

===========================

At 1st January 2014 59,002

Additions 4,969

Exploration cost write-off (14,929)

Impairment(1) (23,484)

Translation difference 118

---------------------------

At 31st December 2014 25,676

===========================

(1) An impairment loss of $23.5 million was recognised in 2014

following an impairment review on the carrying value of exploration

and evaluation assets which included:

EG-8: the EG-8 exploration well was drilled in 2012 on

north-east Galeota and suspended as an oil and gas discovery. A

technical study performed in 2014 indicated that the reserves

encountered were not commercial and cannot justify the cost of

developing either the gas or the oil resources encountered. This

led to the impairment of the costs $22.6 million to exceptional

items on the Statement of Comprehensive Income.

South Africa: costs of $0.9 million have been written off on the

basis that TEP Plc has no further exploration or evaluation

activities planned or budgeted for this licence and are in process

of relinquishing the licence for strategic reasons.

No further impairments was deemed necessary over the exploration

and evaluation assets of the Group.

8 Share capital

Number of Ordinary Share premium Total

shares shares $'000

$'000 $'000

As at 1st January 2015 94,799,986 94,800 116,395 211,195

As at 30th June 2015 94,799,986 94,800 116,395 211,195

=========== ========= ============== ========

9 Borrowings

30th June 30th June 31st December

2015 2014 2014

$'000 $'000 $'000

---------- ---------- --------------

Current 13,000 6,000 --

Non-Current -- 12,889 33,000

---------- ---------- --------------

13,000 18,889 33,000

========== ========== ==============

Movements in borrowings are analysed as follows:

$'000

6 months ended 30th June 2015

Opening amount as at 1st January 2015 33,000

Repayments of borrowings (20,000)

Closing amount as at 30th June 2015 13,000

------------

6 months ended 30th June 2014

Opening amount as at 1st January 2014 15,899

Proceeds from new borrowings 5,000

Repayments of borrowings (2,000)

Translation difference (10)

Closing amount as at 30th June 2014 18,889

------------

Year ended 31st December 2014

Opening amount as at 1st January 2014 15,899

Proceeds from new borrowings 25,000

Repayment of borrowings (8,000)

Translation difference 101

Closing balance at 31st December 2014 33,000

------------

Citibank (Trinidad & Tobago) Limited Loan 1

The key terms of the loan are as follows:

-- Principal amount $20.0 million

-- Interest rate is set at three month US LIBOR plus 600 basis points per annum

-- Debenture over the fixed and floating assets of Trinity

Exploration and Production (Trinidad and Tobago) Limited and its

subsidiaries.

-- Principal repayment in equal quarterly instalments commencing

on 20th March 2013 and ending on 20th December 2017

-- Interest payable monthly in arrears commencing on 20th March 2013

2015 Loan 1 Update

-- No principal payments were made between 1st January 2015 to

30th June, 2015 due to principal moratorium granted by Citibank

-- Quarterly interest payments remain in effect and were paid in March and June 2015

-- Outstanding balance of $12.0 million as at 30th June 2015

Citibank (Trinidad & Tobago) Limited Loan 2

The Group negotiated a floating rate medium term facility on

17th August, 2013 of $25.0 million with Citibank (Trinidad and

Tobago) Limited 'Citibank' which at 31st December, 2014 was fully

drawdown.

The key terms of the loan are as follows:

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 02:02 ET (06:02 GMT)

-- Principal amount $25.0 million. Initial drawdown on 22nd

January 2014 of $5.0 million and a second drawdown of $20.0 million

on 4th August 2014

-- Interest rate is set at three month US LIBOR plus 575 basis points per annum.

-- The negotiated principal repayments in two initial quarterly

instalments of 16.0% following 6.5% to 7.0% quarterly instalments

commencing on 21st November 2014 and ending on 21st August 2017

2015 Loan 2 Update

-- A $20.0 million principal repayment in February 2015

-- No principal payments were made between 1st January 2015 to

30th June 2015 due to principal moratorium granted by Citibank

-- Quarterly interest payments remain in effect and were paid in February and May 2015

-- Outstanding balance of $1.0 million as at 30th June 2015

Debt Covenants

Financial covenants applicable to each of the above facilities

are:

-- Minimum debt service coverage 1.4:1

-- Maximum total debt to EBITDA-Operating taxes 2.75:1

-- Minimum EBITDA-Operating taxes to Interest Expense 1.5:1

The carrying value of borrowings is not materially different

from their fair value. At the end of the half year 2015, Trinity's

results was non-compliant with the debt service coverage ratio (the

minimum requirement being 1.4:1, however the actual ratio was c.

0.8:1). The entire borrowings have been classified as current due

to the breach of the debt service coverage ratio. Subsequently, a

moratorium on repayment of the remaining principal has been agreed

until 9th October 2015.

Analysis of net debt

At 1st At 30th

January 2015 Cashflow June 2015

$'000 $'000 $'000

-------------- --------- ------------

Cash and cash equivalents 33,084 (15,551) 8,197

Financial liabilities - borrowings -- (2,011) --

current

Financial liabilities - borrowings

non-current (33,000) (979) (13,000)

84 (18,541) (4,803)

-------------- --------- ------------

10 Provisions and Other Liabilities

Potential Decommissioning Total

Claim cost

$'000 $'000 $'000

6 months ended 30th June 2015

Opening amount as at 1st January

2015 1,270 38,505 39,775

Unwinding of discount -- 766 766

Transferred to disposal groups

held for sale

(note 12) -- (21,286) (21,286)

---------- ---------------- ---------

Closing balance as at 30th June

2015 1,270 17,985 19,255

========== ================ =========

6 months ended 30th June 2014

Opening amount as at 1st January

2014 -- 29,027 29,027

Unwinding of discount -- 572 572

---------- ---------------- ---------

Closing balance as at 30th June

2014 -- 29,599 29,599

========== ================ =========

Year ended 31st December 2014

Opening amount as at 1st January

2014 -- 29,027 29,027

Adjustment to estimates -- 8,156 8,156

Record potential claim 1,270 -- 1,270

Unwinding of discount -- 1,167 1,167

Translation differences -- 155 155

------ ------- -------

Closing balance at 31st December

2014 1,270 38,505 39,775

====== ======= =======

Potential claim

The amounts represent a provision for a potential claim against

a subsidiary of the Group by a supplier of services in the oil and

gas industry. In management's opinion these claims will not give

rise to any significant losses beyond the amounts provided at 31st

December, 2014. The potential claim is anticipated to be settled no

later than September 2016.

11 Inventory

30th June 31st December

2015 30th June 2014 2014

$'000 $'000 $'000

---------- --------------- --------------

Crude oil 314 444 346

Materials and supplies 6,357 11,990 11,563

---------- --------------- --------------

6,671 12,434 11,909

========== =============== ==============

12 Non-current assets held for sale

Certain assets and liabilities relating to Trinity's oil and gas

fields owned and operated by its indirect subsidiary Trinity

Exploration and Production (Trinidad and Tobago) Limited have been

presented as held for sale following approval of management and

Board of Directors by way of a Formal Sales Process ("FSP") on 8th

April 2015. On 1st February 2015 The WD-16 block was sold and the

carrying value of $0.1 million has been removed from the 30th June

2015 assets held-for-sale. On 1st September Trinity announced the

sale of the Guapo-1 block (see note 15 (3)). The completion date

for the transaction is expected within one year of the reporting

date.

(a) Assets of the disposal Group classified as held for sale

30th June 30th June 31st December

2015 2014 2014

Property, plant & equipment $'000 $'000 $'000

---------- ---------- --------------

Net Book Value at 1 Jan 672 -- --

Disposal of WD 16 (104) -- --

Transferred from property,

plant & equipment 34,123 -- 672

---------- ---------- --------------

Net Book Value 34,691 -- 672

========== ========== ==============

(b) Liabilities of the disposal group classified as held for

sale

30th June 30th June 31st December

2015 2014 2014

Other provisions $'000 $'000 $'000

---------- ---------- --------------

Decommissioning provision 21,286 -- --

========== ========== ==============

In accordance with IFRS 5, the assets and liabilities held for

sale criteria were met between the balance sheet date and the date

that the condensed financial statements were authorised.

13 Related party transactions

The following transactions were carried out with the Group's

related parties during the six months to 30th June 2015. These

transactions comprised sales and purchase of goods and services in

the ordinary course of business.

The receivables from related parties arise mainly from sale

transactions and are due one month after the date of sales. The

receivables are unsecured and bear no interest. No provisions are

held against receivables from related parties.

The payables to related parties arise mainly from purchase

transactions and are due one month after the date of purchase. The

payables bear no interest. A legal claim was made by the related

party Well Services Petroleum Company Limited against a subsidiary

of the Group to recover the balance owed of $2.5 million at the end

of 2014. Subsequent to this a payment has been made on 7th July

2015 with negotiations to settle the balance thereafter. There were

no other related party transactions in the period.

30th June 30th June 31st December

2015 2014 2014

$'000 $'000 $'000

-------------------------------------------- --------- --------- -------------

Sales of goods and services to related

parties 3,999 -- 142

Purchase of goods and services from related

parties 1,464 8,816 10,700

Receivables from related parties -- -- --

Payables to related parties 2,801 4,830 5,563

-------------------------------------------- --------- --------- -------------

14 Earnings per Share

(MORE TO FOLLOW) Dow Jones Newswires

September 29, 2015 02:02 ET (06:02 GMT)

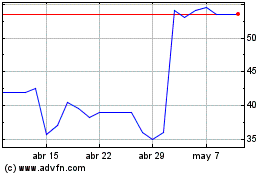

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jul 2024 a Ago 2024

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Ago 2023 a Ago 2024