TIDMVELA

RNS Number : 9151N

Vela Technologies PLC

28 September 2023

28 September 2023

Vela Technologies plc

("Vela" or "the Company")

Final results for the year ended 31 March 2023

The Board of Vela (AIM:VELA), an AIM-quoted investing company

focused on early-stage and pre-IPO disruptive technology

investments, is pleased to announce the Company's final results for

the year ended 31 March 2023 .

Vela's Annual Report and Accounts for the year ended 31 March

2023 ("Annual Report") will be sent to shareholders today.

The Company's Annual Report will be available shortly on the

Company's website at http://www.velatechplc.com/

Highlights

Financial:

-- Net assets decreased to GBP7,004,480 compared to GBP7,378,151 at 31 March 2022

-- Cash fell from GBP958,573 at the beginning of the period to

GBP723,576 at the balance sheet date.

-- Loss for the year of GBP378,516 compared to a loss of

GBP1,078,202 in the previous comparable period reflecting a smaller

reduction in the fair value of the investment portfolio against the

prior year.

Operational:

-- Vela invested approximately GBP575,000 in four companies and

realised gross proceeds of approximately GBP712,000 from the sale

of shares in five of its investee companies.

Post Period Highlights:

-- On 20 April Vela entered into a put option for the potential

sale of its economic interest in AZD1656 for a total consideration

of GBP4.0 million. The option was granted by Conduit

Pharmaceuticals Limited ("Conduit") and Murphy Canyon Acquisition

Corp ('Murphy'), a company listed on NASDAQ. Should the option be

exercised by Vela, the consideration that would be payable to Vela

would be satisfied through the issuance of new shares in the

combined company (now called Conduit Pharmaceuticals Inc.). Vela

paid Conduit GBP400,000 as the premium for the option.

-- Also in September, Conduit completed its merger with Murphy

and its shares listed on NASDAQ on 25 September 2023 as Conduit

Pharmaceuticals Inc. ("Conduit Inc."). The put option referred to

above is now exercisable. Accordingly, it is now open to Vela to

exchange its GBP2.75 million economic interest in AZD1656 for GBP4

million worth of Conduit Inc. shares.

-- In May 2023 the Company invested GBP250,000 in a pre-IPO

investment in Tribe Technology and the Board of Vela was pleased to

see Tribe Technology successfully list on AIM in September 2023 in

conjunction with a GBP4.6m fundraising.

The Board will continue to update investors on the portfolio

movements and valuation in the Company's quarterly updates, the

next one being due for the quarter ended 30 September 2023.

chairman's statement

for the year ended 31 March 2023

I am pleased to present the Chairman's statement for the year

ended 31 March 2023. In my half yearly statement for the period

ended 30 September 2022 I made reference to the continued war in

Ukraine, political issues at home, rising inflation and rising

interest rates.

These have not abated as the war in Ukraine intensifies and the

maelstrom surrounding the UK's mini budget in September 2022 which

crashed the Pound causing interest rates to rise to the highest

levels we have seen in more than a decade. At the year end,

interest rates had reached 4.25% alongside high inflation rates of

10.1%. Both of which continued rising into our new financial

year.

With this backdrop of persistently high inflation and rising

interest rates the excitement for listings on the public markets

has evaporated and many investors are choosing to place their funds

in cash instruments for safety and the security of a meaningful

rate of return.

Despite these negatives we maintain our belief that the economic

interest that the Company holds in AZD 1656 will create value for

shareholders. Post year end the Company invested a further

GBP400,000 into a put option agreement to give Vela the right, but

not the obligation, to sell its economic interest in the

commercialisation of the Covid-19 application of AZD1656 for a

total consideration of GBP4.0 million. The option was granted by

Conduit Pharmaceuticals Limited and its prospective parent company,

Murphy, a Company listed on NASDAQ. Conduit Pharmaceuticals

completed the business combination with Murphy and the enlarged

group, being Conduit Pharmaceuticals Inc. ("Conduit Inc."), began

trading on NASDAQ on 25 September 2023. Further to the announcement

made by the Company on 21 September 2023, the board intends to

exercise the option in due course, at the appropriate time. The

option has an expiry date of 7 February 2024. As previously

announced by Vela the consideration of GBP4.0 million, payable upon

exercise of the option, would be satisfied through the issue to

Vela of new shares in Conduit Inc. and the issue price of the

consideration shares will be based on the volume-weighted average

price per share of Conduit Inc. over the ten business days prior to

the date of notice of exercise, provided in no event shall the

issue price for the consideration shares be lower than $5 or higher

than $15.

EnSilica plc listed in the early part of the financial year

under review and its share price has proved resilient against poor

market conditions and at the appropriate junctures we have sold

shares in EnSilica to realise a gain whilst maintaining a sizeable

shareholding position in the company.

Whilst a number of the Company's stocks languish, such as

Skillcast Group plc, Northcoders Group plc and MTI Wireless Edge

Limited, these are quality growth companies whose value is not

truly reflected in their share price, which is a common theme

across the markets. And whilst the market appears sceptical of

TruSpine Technologies plc we believe its product is a game-changer

in spinal stabilisation and we continue our support for the

company.

Turning to the financials, Vela reported a loss for the year of

GBP378,516 compared to a loss of GBP1,078,202 in the previous

comparable period. Almost all of this difference, from an

accounting perspective, reflects a GBP25,780 reduction in fair

value of investments in the year being reported on, compared to a

much larger reduction in fair value in the previous financial year.

Net assets decreased to GBP7,004,480 compared to GBP7,378,151 at 31

March 2022 and cash fell from GBP958,573 at the beginning of the

period to GBP723,576 at the balance sheet date. As at 21 September

2023 Vela's cash reserves were approximately GBP43,000.

Since 31 March 2023, the Company has made two new investments

being a GBP250,000 pre-IPO investment in Tribe Technology and the

GBP400,000 investment made into the put option in relation to the

possible sale of Vela's economic interest in AZD1656. The Board of

Vela was pleased to see Tribe Technology successfully list on AIM

in September 2023 in conjunction with a GBP4.6m fundraising.

In August 2022 Antony Laiker rejoined the board, however, in

October 2022, Antony decided to stand down and sell his holding in

the Company. We were very grateful for Antony's input and market

wisdom during his time with us.

The board will continue to update shareholders, in line with

regulatory guidelines, via its quarterly investment updates and

regulatory announcements. The directors would like to thank

shareholders for their continued support.

strategic report

for the year ended 31 March 2023

Business review

At the period end, the Company held cash of approximately

GBP724,000 (31 March 2022: GBP958,000). It continues to keep

administrative costs to a minimum so that it has sufficient

resources to cover its ongoing running costs while retaining the

maximum funds for further investments.

The Company's loss for the year was approximately GBP378,000

(2022: loss of GBP1,078,000). This loss has arisen primarily from

fair value movements on the Company's investment portfolio. The

valuation of the investment portfolio at 31 March 2023 was

approximately GBP3,193,000 (31 March 2022: GBP2,603,000), an

increase of GBP590,000 on 2022. This resulted from the investment

of GBP575,000 in new and 'follow-on' investments, conversion of the

CLNs held in Ensilica plc, disposals generating proceeds of

GBP709,000, net of a decrease in the valuation of the portfolio of

GBP26,000. In addition to these investments the Company holds a

financial asset (St George Street Capital) valued at GBP2,350,000

as at 31 March 2023 (31 March 2022: GBP2,350,000).

We update shareholders on investee company performance through

the dissemination of investee company regulatory announcements,

together with, when available, information from private companies

which do not have the same disclosure requirements as listed

companies. Additionally, the Board has continued to publish

quarterly investment updates on the performance of the investment

portfolio and on acquisitions and sales. The quarterly investment

updates will continue. Moreover, detailed information on the

investment portfolio is maintained on the Company's website.

During the year the Company made investments in TruSpine

Technologies PLC (GBP300,000), a secondary placing in Northcoders

Group plc (GBP99,000), a further investment in EnSilica plc

(GBP125,000) and an investment in Ethernity Networks Ltd

(GBP49,000). Further details and key points of the investments made

and of the performance of the Company's investee companies are

detailed in note 8 to the financial statements.

The Company had two employees during the period (being two of

the directors) and a Board comprising one male Executive Director,

one female Executive Director and one male Non-Executive

Director.

Principal risks and uncertainties

The preservation of its cash balances and the management of its

capital resources remain the key concerns for the Company. Further

information about the Company's principal risks, covering credit,

liquidity, and capital, is detailed in note 15 to the financial

statements.

The Company remains committed to keeping operational costs to a

minimum.

Approved by the Board of Directors on 27 September 2023; and

signed on its behalf by:

Brent Fitzpatrick MBE

Chairman

For further information, please contact:

Vela Technologies plc Tel: +44 (0) 7421

Brent Fitzpatrick, Non-Executive Chairman 728875

James Normand, Executive Director

Allenby Capital Limited (Nominated Adviser) Tel: +44 (0) 20

3328 5656

Nick Athanas / Piers Shimwell

Peterhouse Capital Limited (Broker) Tel: +44 (0) 20

7469 0930

Lucy Williams / Duncan Vasey

Novus Communications (PR and IR Adviser) Tel: +44 (0) 20

7448 9839

Alan Green / Jacqueline Briscoe

About Vela Technologies

Vela Technologies plc (AIM: VELA) is an investing company

focused on early stage and pre-IPO long term disruptive technology

investments. Vela's investee companies have either developed ways

of utilising technology or are developing technology with a view to

disrupting the businesses or sector in which they operate. Vela

Technologies will also invest in already-listed companies where

valuations offer additional opportunities.

statement of comprehensive income

for the year ended 31 March 2023

Year ended Year ended

31 March 31 March

2023 2022

Notes GBP'000 GBP'000

------------------------------------------- ------ ----------- -----------

Revenue 1 - -

Administrative expenses 2 (401) (347)

Fair value movements

- on investments 8 (26) (685)

- on derivative instruments 11 9 (75)

Operating loss 2 (418) (1,107)

Finance income 4 40 29

Loss before tax (378) (1,078)

Income tax 6 - -

------------------------------------------- ------ ----------- -----------

Loss for the year and total comprehensive

income attributable to the equity

holders (378) (1,078)

------------------------------------------- ------ ----------- -----------

Loss per share

Basic and diluted loss per share

(pence) 7 (0.002) (0.007)

------------------------------------------- ------ ----------- -----------

statement of financial position

as at 31 March 2023

31 March 31 March

2023 2022

Notes GBP ' GBP '000

000

---------------------------------- ------ --------- ---------

Non-current assets

Investments 8 3,193 2,603

Trade and other receivables 9 3,054 3,024

---------------------------------- ------ --------- ---------

T otal non-current assets 6,247 5,627

Current assets

Trade and other receivables 10 - 751

Derivative financial instruments 11 72 63

Cash and cash equivalents 14 724 958

---------------------------------- ------ --------- ---------

Total current assets 796 1,772

---------------------------------- ------ --------- ---------

Total assets 7,043 7,399

---------------------------------- ------ --------- ---------

Equity and liabilities

Equity

Called up share capital 13 3,291 3,291

Share premium account 7,594 7,594

Share option reserve 46 65

Retained earnings (3,926) (3,572)

---------------------------------- ------ --------- ---------

Total equity 7,005 7,378

---------------------------------- ------ --------- ---------

Current liabilities

Trade and other payables 12 38 21

Total current liabilities 38 21

---------------------------------- ------ --------- ---------

Total equity and liabilities 7,043 7,399

---------------------------------- ------ --------- ---------

These financial statements were approved by the Board,

authorised for issue and signed on their behalf on 27 September

2023 by:

Brent Fitzpatrick MBE

Chairman

Company registration number: 03904195

cash flow statement

for the year ended 31 March 2023

Year ended Year ended

31 March 31 March

2 023 2022

Notes GBP'000 GBP'000

--------------------------------------- ------ ----------- -----------

Operating activities

Loss before tax (378) (1,078)

Share-based payment 5 20

Fair value movements on investments 8 26 685

Fair value movement on derivative

assets (9) 75

Finance income (40) (29)

Decrease in receivables 1 -

Increase / (Decrease) in payables 17 (27)

Total cash flow from operating

activities (378) (354)

--------------------------------------- ------ ----------- -----------

Investing activities

Interest received 10 -

Proceeds from disposal of investments 709 262

Acquisition of loan notes - (750)

Consideration for purchase of

investments (575) (1,581)

Total cash flow from investing

activities 144 (2,069)

--------------------------------------- ------ ----------- -----------

Financing activities

Proceeds from the issue of ordinary

share capital - 1,234

Total cash flow from financing

activities - 1,234

--------------------------------------- ------ ----------- -----------

Net (decrease) in cash and cash

equivalents (234) (1,189)

Cash and cash equivalents at start

of year 958 2,147

--------------------------------------- ------ ----------- -----------

Cash and cash equivalents at the

end of the year 14 724 958

--------------------------------------- ------ ----------- -----------

Cash and cash equivalents comprise:

Cash at bank 724 958

--------------------------------------- ------ ----------- -----------

Cash and cash equivalents at end

of year 14 724 958

--------------------------------------- ------ ----------- -----------

statement of changes in equity

for the year ended 31 March 2023

Share

Share Share Retained Option Total

Capital Premium Earnings Reserve Equity

GBP GBP '000 GBP GBP'000 GBP

'000 '000 '000

---------------------------- -------- --------- ----------- -------- --------

Balance at 1 April 2022 3,291 7,594 (3,572) 65 7,378

Transactions with owners

Share-based payment - - - 5 5

Lapse of share options in

the period - - 24 (24) -

Transactions with owners - - 24 (19) 5

---------------------------- -------- --------- ----------- -------- --------

Total comprehensive income

for the year - - (378) - (378)

Balance at 31 March 2023 3,291 7,594 (3,926) 46 7,005

---------------------------- -------- --------- ----------- -------- --------

Balance at 1 April 2021 3,048 6,603 (2,600) 151 7,202

---------------------------- -------- --------- ----------- -------- --------

Transactions with owners

Share-based payment - - - 20 20

Lapse of share options in

the period - - 106 (106) -

Issue of share capital 243 991 - - 1,234

Transactions with owners 243 991 106 (86) 1,254

Total comprehensive income

for the year - - (1,078) - (1,078)

Balance at 31 March 2022 3,291 7,594 (3,572) 65 7,378

---------------------------- -------- --------- ----------- -------- --------

1 Revenue and segmental information

The Company is an investing company and as such there is only

one identifiable operating segment, being the purchase, holding and

sale of investments. Similarly, the Company operates in only a

single geographic segment, being the United Kingdom. The results

and balances and cash flows of the segment are as presented in the

primary statements.

2 Loss from operations

The loss from operations is stated after charging:

31 March 31 March

2 023 2022

GBP'000 GBP'000

---------------------------------------- --------- ---------

Auditor's remuneration for the

audit 24 18

Auditor's remuneration for corporation

tax compliance services 2 2

Fair value movements on investments 26 685

Share-based payment 5 20

----------------------------------------- --------- ---------

3 Staff costs

The average number of persons employed or engaged by the Company

(including Directors) during the period was as follows:

31 March 31 March

2023 2022

--------------------------------- --------- ---------

Directors and senior management 3 3

Total 3 3

--------------------------------- --------- ---------

The above included two individuals (2022 - two) employed by the

Company and one (2022 - one) engaged under the terms of a letter of

appointment.

The aggregate amounts charged by these persons were as

follows:

31 March 31 March

2023 2022

GBP'000 GBP'000

---------------------------- --------- ---------

Wages and salaries 124 97

Social security costs 10 12

Amounts invoiced 69 62

Share-based payment charge 5 20

208 191

---------------------------- --------- ---------

The amounts noted above relate to the Company's directors.

Further details of directors' remuneration is provided in note

5.

4 Finance income and expense

Finance income

31 March 31 March

2023 2 022

GBP'000 GBP'000

--------------------------- --------- ---------

Other interest receivable 40 29

Total finance income 40 29

--------------------------- --------- ---------

Finance income includes GBP30,000 (2022: GBP29,000),

representing the unwinding of the discount on the Company's loan

receivable from BIXX Tech Limited. Further details are provided in

note 9.

5 Directors and senior management

Directors' remuneration

Year ended 31 March 2023

------------------------------------------------

Salary Fees Pension Equity Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

N B Fitzpatrick - 62 - - 62

A Laiker (appointed 21 July

2022 / resigned 19 October

2022) - 7 - - 7

J Normand 62 - - - 62

E Wilson 62 - - - 62

----------------------------- -------- -------- -------- -------- --------

124 69 - - 193

----------------------------- -------- -------- -------- -------- --------

Year ended 31 March 2022

------------------------------------------------

Salary Fees Pension Equity Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

N B Fitzpatrick - 62 - - 62

J Normand 62 - - - 62

E Wilson (appointed 1 September

2021) 35 - - - 35

--------------------------------- -------- -------- -------- -------- --------

97 62 - - 159

--------------------------------- -------- -------- -------- -------- --------

Directors ' and senior management ' s interests in shares

The Directors who held office at 31 March 2023 held the

following shares:

31 March 31 March

2023 2022

----------------- ---------- ----------

N B Fitzpatrick 1,500,000 1,500,000

J Normand - -

E Wilson - -

----------------- ---------- ----------

The total share-based payment costs in respect of options

granted are:

31 March 31 March

2 023 2022

GBP'000 GBP'000

Directors 5 20

----------- --------- ---------

As at 31 March 2023, the total number of outstanding options

held by the Directors over ordinary shares was 270,000,000 (2022:

278,444,780), representing 1.7 per cent of the Company's issued

share capital. A total of 8,444,780 options lapsed in the

period.

Further details regarding the options issued are provided in

note 17.

6 Tax

There was no charge to current or deferred taxation in the

current or prior period.

A deferred tax asset relating to losses carried forward has not

been recognised due to uncertainty over the existence of future

taxable profits against which the losses can be used. The Company

has unused tax losses of approximately GBP6.7m (2022: GBP6.5m).

Tax reconciliation

31 March 31 March

2023 2022

GBP'000 GBP'000

------------------------------- --------- ---------

Loss before tax (378) (1,078)

Tax at 19% on loss before tax (72) (205)

Effects of:

Loss relief carried forward 72 205

------------------------------- --------- ---------

Total tax expense - -

------------------------------- --------- ---------

7 Loss per share

Loss per share has been calculated on a loss after tax of

GBP378,000 (2022: loss after tax of GBP1,078,000) and the weighted

average number of shares in issue for the year of 16,252,335,184

(2022: 15,091,929,620).

8 Investments

31 March 31 March

2023 2022

GBP'000 GBP'000

------------------------------------------ --------- ---------

Opening fair value 2,603 1,969

Additions during the year at cost 1,325 1,581

Fair value of disposals made during

the year (709) (262)

Movement in fair value charged to profit

or loss (26) (685)

------------------------------------------ --------- ---------

Closing balance 3,193 2,603

------------------------------------------ --------- ---------

Investments are held at fair value through profit and loss using

a three-level hierarchy for estimating fair value. Note 15 provides

details of the three-level hierarchy used.

Additions during the year:

Investment in EnSilica plc ("EnSilica")

In May 2022 EnSilica plc's shares were admitted to trading on

AIM. Vela's investment of GBP750,000 in convertible loan notes,

together with the relevant interest, were converted into 1,764,788

shares representing 2.3% of the then issued share capital. In March

2023, the Company invested an additional GBP125,000 in EnSilica

through the purchase of 178,572 ordinary shares at 70 pence per

share. The investment was made as part of a GBP2.0 million placing

undertaken by EnSilica.

Investment in TruSpine Technologies Plc ("TruSpine")

In June 2022, the Company completed the subscription for

6,000,000 ordinary shares in TruSpine for a cost of GBP300,000,

representing 5.07% of TruSpine's then issued share capital.

8 Investments (continued)

Further Investment in Northcoders Plc ("Northcoders")

In November 2022, the Company invested an additional GBP99,999

in Northcoders at a price of GBP3 per share. The investment was

part of a secondary placing in Northcoders which was undertaken as

a result of excess demand following an oversubscribed placing that

raised GBP2.1 million for Northcoders. Following this investment,

Vela held 349,999 ordinary shares in Northcoders representing 4.6%

of the issued share capital of Northcoders.

Investment in Ethernity Networks Ltd ("Ethernity")

In January 2023, the Company completed the subscription for

700,000 ordinary shares in Ethernity for a cost of GBP49,000,

representing 0.68 per cent of Ethernity's issued share capital.

Disposals during the year:

Part disposal of Northcoders Group Plc

In September 2022, the Company disposed of 25,000 shares in

Northcoders at a price of GBP3.50 per share generating gross

proceeds of GBP87,500. Following the disposal Vela was interested

in 316,666 shares representing 4.6 per cent of the issued share

capital.

Part disposal of investment in Cornerstone FS PLC

("Cornerstone")

In July 2022 the Company disposed of 50,000 shares in

Cornerstone at a price of 14.2p per share, generating gross

proceeds of GBP7,115. Following the disposal Vela remained

interested in 595,902 shares representing 1.2% of the issued share

capital at the period end.

Part disposal of EnSilica Plc

Between May 2022 and the end of March 2023 the Company disposed

of a total of 833,653 shares in EnSilica at an average price of 61p

per share, generating gross proceeds of GBP587,345 for the Company.

Following the disposals and investment in March 2023, Vela remained

interested in 1,109,707 ordinary shares representing 1.42% of the

issued share capital at the period end.

Part disposal of investment in Ethernity Networks Ltd

In March 2023 the Company disposed of 350,000 shares in

Ethernity generating gross proceeds of GBP25,222. Following the

disposal Vela remains interested in 350,000 shares representing

0.34% of the current issued share capital.

Part disposal of investment in Kanabo Group PLC ("Kanabo")

In February 2023 the Company disposed of 150,000 shares in

Kanabo, generating gross proceeds of GBP5,000. Following the

disposal Vela remains interested in 1,157,692 shares representing

1.1% of the current issued share capital.

9 Trade and other receivables - non-current

31 March 31 March

2023 2022

GBP'000 GBP'000

--------------------------------- --------- ---------

Loan due from BIXX Tech Limited 704 674

Other financial asset 2,350 2,350

3,054 3,024

--------------------------------- --------- ---------

Loan due from BIXX Tech Limited

The loan represents the consideration receivable for the

disposal of certain investment assets in August 2020, as detailed

in previous financial statements. The total consideration

receivable is GBP855,000, which is receivable after seven years.

The consideration has been discounted at a market interest rate at

the time of the transaction of 4.5% to reflect the deferred payment

term. Income of GBP30,000 (2022: GBP29,000), represents the

unwinding of the discount and is recognised within finance income

in note 4.

Under the terms of the loan agreement, the Company has provided

an undertaking to distribute a sum equal to any repayment of the

loan to the holders of the Special Deferred Shares (see note 13).

This distribution will be by way of a dividend declared on the

Special Deferred Shares ("the Special Dividend"). In the event that

insufficient distributable reserves exist at the end of the

seven-year loan term, the repayment of the loan will be deferred

for a further year. This deferral will continue until such a time

as the Company has sufficient distributable reserves to be able to

pay the Special Dividend.

Other financial asset - Investment in St George Street

Capital

On 20 October 2020, the Company entered into a contract with St

George Street Capital ("SGSC") for an 8% economic interest in the

potential future commercialisation of SGSC's asset to treat

individuals with diabetes who are suffering with COVID-19 ("the

Asset"). The consideration payable under the terms of the contract

was GBP2.35m which was settled by cash of GBP1.25m and the issue of

1,100,000,000 locked-in consideration shares at a price of 0.1

pence per share. The directors considered that this represented the

fair value of the contract at the date of investment. The contract

gives the Company a right to future economic benefits and has been

classified as a financial asset measured at fair value through

profit and loss. The contract does not include a defined exit date

and so has been classified as non-current at the reporting date, as

the Company did not have an unconditional right to require

settlement of the contract within 12 months.

At the previous reporting date, SGSC had successfully completed

the Phase II trials and had moved on to the process of

investigating options for funding Phase III clinical trials (which

would involve a significantly larger sample of patients than Phase

II) and onward commercialisation of the Asset. The development of

the Asset continues to progress along the typical drug development

pipeline. However, the need for SGSC to raise further funding in

order to commence the Phase III trials, to successfully complete

those trials and achieve commercialisation of the drug gives rise

to an inherent level of risk in respect of the ultimate realisation

of the Asset, which the directors took into consideration when

estimating its fair value as at 31 March 2023. The directors

considered the position at the balance sheet date and were of the

view that there had not been any major developments (either

positive or negative) or milestones achieved in the period up to

the reporting date which would give rise to a material change in

the fair value of the contract during this time. Accordingly, the

original consideration payable under the contract represents the

directors' best estimate of its fair value, as a standalone

contract, as at 31 March 2023.

Post year end the Company entered into a put option for the

potential sale of its interest in the Asset. Further details are

disclosed at note 20.

10 Trade and other receivables

31 March 31 March

2023 2022

GBP'000 GBP'000

------------------- ---------- ---------

Other receivables - 1

Convertible loan - 750

- 751

------------------------------ ---------

In January 2022, the Company invested GBP750,000 by way of a

convertible loan note in EnSilica Limited. The loan notes attracted

interest at a rate of 10 per cent per annum and were repayable on 9

January 2023 unless they had been repaid or converted before this

date. The loan notes converted automatically on an IPO of Ensilica

into new ordinary shares at a discount of 12% of the shares

subscribed for in the IPO. EnSilica's shares were admitted to

trading on AIM in May 2022, at which point the Company exercised

its conversion rights and received 1,764,788 ordinary shares

representing 2.3 per cent of the issued share capital.

11 Derivative financial instruments

31 March 31 March

2023 2022

GBP'000 GBP'000

---------- --------- ---------

Warrants 72 63

72 63

---------- --------- ---------

The Company holds warrants providing it with the right to

acquire additional shares in certain of its investee companies at a

fixed price in the future, should the directors decide to exercise

them. The warrants have been recognised as an asset at fair value,

which has been calculated using an appropriate option pricing

model.

12 Trade and other payables

31 March 31 March

2023 2022

GBP'000 GBP'000

---------------- --------- ---------

Trade payables 3 1

Accruals 35 20

38 21

---------------- --------- ---------

13 Share capital

31 March 31 March

2 023 2022

GBP'000 GBP'000

-------------------------------------------- --------- ---------

Allotted, called up and fully paid capital

16,252,335,184 Ordinary Shares of 0.01

pence each 1,625 1,625

1,748,943,717 Deferred Shares of 0.08

pence each 1,399 1,399

2,665,610,370 Special Deferred Shares

of 0.01 pence each 267 267

3,291 3,291

-------------------------------------------- --------- ---------

Share rights

The Deferred and Special Deferred Shares are not listed on AIM

and do not carry any rights to receive notice of or attend or speak

or vote at any general meeting or class meeting. There are also no

dividend rights, other than the "Special Dividend" on the Special

Deferred Shares. As described in note 9, upon repayment to the

Company of any amount(s) owed to it pursuant to the loan agreement

between the Company and BIXX Tech Limited, the Company shall, in

priority to any payment of dividend to the holders of the ordinary

shares or any other class of shares, declare and pay to the holders

of the Special Deferred shares a Special Dividend of an aggregate

amount equal to the amount of such sum repaid, pro rata according

to the number of Special Deferred Shares paid up.

On a return of capital, the holders of the Special Deferred

Shares shall be entitled to receive only the amount paid up on such

shares up to a maximum of 0.01 pence per Special Deferred Share

after (i) the holders of the Ordinary Shares have received the sum

of GBP1,000,000 for each Ordinary Share held by them, and (ii) the

holders of the Deferred Shares have received the sum equal to the

amount paid up on such Deferred Shares.

14 Cash and cash equivalents

Cash and cash equivalents comprise the following:

31 March 31 March

2 023 2022

GBP'000 GBP'000

------------------------------------------ --------- ---------

Cash and cash in bank:

Pound sterling 724 958

Cash and cash equivalents at end of year 724 958

------------------------------------------ --------- ---------

15 Financial instruments

The Company uses various financial instruments which include

cash and cash equivalents, loans and borrowings and various items

such as trade receivables and trade payables that arise directly

from its operations. The main purpose of these financial

instruments is to raise finance for the Company's operations and

manage its working capital requirements.

The fair values of all financial instruments are considered

equal to their book values. The existence of these financial

instruments exposes the Company to a number of financial risks

which are described in more detail below.

The main risks arising from the Company's financial instruments

are credit risk and liquidity risk. The Directors review and agree

the policies for managing each of these risks and they are

summarised below. The Company does not have any borrowings on which

interest is charged at a variable rate. The Directors, therefore,

do not consider the Company to be exposed to material interest rate

risk.

Credit risk

This section, along with the liquidity risk and capital risk

management sections below, also forms part of the Strategic

Report.

The Company's exposure to credit risk is limited to the carrying

amount of financial assets recognised at the balance sheet date, as

summarised below:

31 March 31 March

2 023 2022

Classes of financial assets - carrying GBP'000 GBP'000

amounts

----------------------------------------- --------- ---------

Financial assets measured at fair value

through profit or loss 5,615 5,016

Financial assets measured at amortised

cost 704 1,425

----------------------------------------- --------- ---------

6,319 6,441

----------------------------------------- --------- ---------

The Company's management considers that all of the above

financial assets that are not impaired for each of the reporting

dates under review are of good credit quality.

The Company is required to report the category of fair value

measurements used in determining the value of its financial assets

measured at fair value through profit or loss, to be disclosed by

the source of its inputs, using a three-level hierarchy. There have

been no transfers between Levels in the fair value hierarchy.

Quoted market prices in active markets - "Level 1"

Inputs to Level 1 fair values are quoted prices in active

markets for identical assets. An active market is one in which

transactions occur with sufficient frequency and volume to provide

pricing information on an ongoing basis. The Company has eleven

(2022: eight) investments classified in this category all of which

are listed on a regulated exchange with publicly available market

prices used to determine the year end value.

The aggregate historic cost of the eleven investments is

GBP3,145,110 (2022: GBP2,343,803) and the fair value as at 31 March

2023 was GBP2,364,534 (2022: GBP1,738,769).

Valued using models with significant observable market

parameters - "Level 2"

Inputs to Level 2 fair values are inputs other than quoted

prices included within Level 1 that are observable for the asset,

either directly or indirectly. The Company has two (2022: two)

unquoted investments classified in this category. The historic cost

of these investments is GBP450,000 (2022: GBP450,000) and the fair

value as at 31 March 2023 was GBP828,186 (2022: GBP864,644). These

investments were valued using the latest transaction prices for

shares in the investee companies which were obtained through either

(a) publicly available information (e.g. registrar), (b)

information in respect of recent transactions which the Company was

invited to participate or, where available, (c) direct liaison with

the investee company. The Company also holds warrants for shares in

four investee companies, which have been valued using an option

pricing model with observable inputs. The fair value of these

assets as at 31 March 2023 was GBP71,827 (2022: GBP63,194).

Valued using models with significant unobservable market

parameters - "Level 3"

Inputs to Level 3 fair values are unobservable inputs for the

asset. Unobservable inputs may have been used to measure fair value

to the extent that observable inputs are not available, thereby

allowing for situations in which there is little, if any, market

activity for the asset at the measurement date (or market

information for the inputs to any valuation models). As such,

unobservable inputs reflect the assumptions the Company considers

that market participants would use in pricing the asset. The

Company has two (2022: two) unquoted investments classified in this

category. The historic cost of these investments is GBP300,000

(2022: GBP300,000) and the fair value as at 31 March 2023 was

GBPnil (2022: GBPnil). The nature of some of the investments that

the Company holds, i.e. minority shareholdings in private companies

with limited publicly available information, means that significant

judgement is required in estimating the value to be applied in the

year end accounts. Management uses knowledge of the sector and any

specific company information available to determine a valuation

estimate. The Company also holds a non-current financial asset

described in note 9 to the financial statements at a fair value of

GBP2,350,000, which is also the historic cost of the asset. Further

details regarding the determination of the fair value of this asset

are provided in note 9.

Liquidity risk

The Company maintains sufficient cash to meet its liquidity

requirements. Management monitors rolling forecasts of the

Company's liquidity on the basis of expected cash flow in

accordance with practice and limits set by the Company. In

addition, the Company's liquidity management policy involves

projecting cash flows and considering the level of liquid assets

necessary to meet these.

Maturity analysis for financial liabilities

31 March 2 023 31 March 2022

------------------ ------------------

Within Later Within Later

than than

1 year 1 year 1 year 1 year

GBP'000 GBP'000 GBP'000 GBP'000

------------------- -------- -------- -------- --------

At amortised cost 38 - 21 -

------------------- -------- -------- -------- --------

Capital risk management

The Company's objectives when managing capital are to safeguard

the Company's ability to continue as a going concern in order to

provide returns for shareholders and benefits for other

stakeholders and to maintain an optimal capital structure to reduce

the cost of capital. This is achieved by making investments

commensurate with the level of risk. The Company is performing in

line with the expectations of the Directors.

The Company monitors capital on the basis of the carrying amount

of equity. The Company policy is to set the amount of capital in

proportion to its overall financing structure, i.e. equity and

long-term loans. The Company manages the capital structure and

makes adjustments to it in the light of changes in economic

conditions and the risk characteristics of the underlying assets.

In order to maintain or adjust the capital structure, the Company

may adjust the amount of dividends paid to shareholders, issue new

shares or loan notes, or sell assets to reduce debt.

16 Reconciliation of net funds

A s

at 1 Cash As at

April flow Non-cash 31 March

2022 movement 2023

GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- -------- -------- ---------- ----------

Cash and cash equivalents 958 (234) - 724

958 (234) - 724

--------------------------- -------- -------- ---------- ----------

17 Share-based payments

On 26 August 2020 two of the Directors were granted equity

settled share-based payments. The principal terms of these grants

are as follows:

James Normand was granted 180,000,000 options to subscribe for

ordinary shares of 0.01p each in the Company. The options have an

exercise price of 0.024p and are exercisable for a period of ten

years from the date of the grant. Half the options became

exercisable 12 months after grant, subject to the Company's closing

mid-market share price being at least 0.048p per Ordinary Share for

30 consecutive business days, and the remaining half become

exercisable 24 months after grant, subject to the Company's closing

mid-market share price being at least 0.072p per Ordinary Share for

30 consecutive business days.

In addition, on the same date, Brent Fitzpatrick, Chairman of

the Company, was granted 90,000,000 options to subscribe for

Ordinary Shares in the Company. The options have an exercise price

of 0.024p and are exercisable for a period of ten years from the

date of the grant. Half the options became exercisable 12 months

after grant, subject to the Company's closing mid-market share

price being at least 0.048p per Ordinary Share for 30 consecutive

business days, and the remaining half become exercisable 24 months

after grant, subject to the Company's closing mid-market share

price being at least 0.072p per Ordinary Share for 30 consecutive

business days. Following this grant of options, Brent Fitzpatrick

held a total of 104,562,427 share options equivalent to 1.46 per

cent. of the issued share capital of the Company at the time.

None of the options granted have been exercised.

The options issued in August 2020 have been valued using the

Monte Carlo option pricing model. The amount of remuneration

expense in respect of the share options granted amounts to GBP5,000

(2022: GBP20,000).

Options were also granted to directors in September and October

2015. These options were not exercised and lapsed in September and

October 2022 respectively.

Details of the options outstanding at the year end and the

inputs to the option pricing model are as follows:

Options

granted

26 August

2020

------------------------------- ------------

Share price at grant date

(pence) 0.05

Exercise price (pence) 0.024

Expected life (years) 10

Annualised volatility (%) 86.9

Risk-free interest rate (%) 2.0

Fair value determined (pence) 0.03

Number of options granted 270,000,000

Options exercisable at 31

March 2022 270,000,000

--------------------------------- ------------

The expected future annualised volatility was calculated using

historic volatility data for the Company's share price.

During the period 6,400,000 options granted in October 2015 and

10,489,560 options granted in September 2015 lapsed. The fair value

of these options recorded in the financial statements and processed

as historic remuneration expense was GBP24,130.

18 Contingent liabilities

Under the terms of the Company's loan receivable from BIXX Tech

Limited, described in note 9, the Company has provided an

undertaking to distribute a sum equal to any repayment of the loan

to the holders of the Special Deferred Shares (see note 13). This

distribution will be by way of a dividend declared on the Special

Deferred Shares ("the Special Dividend"). In the event that

insufficient distributable reserves exist at the end of the

seven-year loan term, the repayment of the loan will be deferred

for a further year. This deferral will continue until such a time

as the Company has sufficient distributable reserves to be able to

pay the Special Dividend. As at 31 March 2023, the carrying value

of the loan receivable was GBP704,000 (2022: GBP674,000) and, at

the scheduled maturity date, the final settlement value will be

GBP855,000.

19 Related party transactions

During the period the Company entered into the following related

party transactions. All transactions were made on an arm's length

basis.

Ocean Park Developments Limited

Brent Fitzpatrick, Non-Executive Director, is also a Director of

Ocean Park Developments Limited. During the year, the Company paid

GBP62,000 (2022: GBP62,000) in respect of his Director's fees to

the Company. The balance due to Ocean Park Developments Limited at

the year-end was GBPnil (2022: GBPnil).

Widdington Limited

Antony Laiker, Non-Executive Director, is also a Director of

Widdington Limited. During the year, the Company paid GBP7,000

(2022: GBPnil) in respect of his Director's fees to the Company.

The balance due to Widdington Limited at the year-end was GBPnil

(2022: GBPnil).

BIXX Tech Limited

Antony Laiker, a significant shareholder of Vela and Director

during the period under review is also a director of BIXX Tech

Limited.

On 26 August 2020, the Company transferred certain investments

to a newly formed wholly owned subsidiary, BIXX Tech Limited, for

consideration totalling GBP855,000 repayable after seven years.

Following the transfer of the investments, BIXX Tech Limited was

sold to a newly formed company, BIXX Limited, with the same

shareholders as Vela Technologies Plc for consideration of GBP1. As

at 31 March 2023, the carrying value of the balance due from BIXX

Tech Limited was GBP704,000 (2022: GBP674,000).

The disposal constituted a related party transaction under the

AIM Rules as Antony Laiker, a director of the Company was the sole

shareholder of BIXX Limited prior to the disposal.

20 Events after the balance sheet date

Put Option for potential sale of Economic Interest in

AZD1656

In April 2023, the Company announced that it had entered into a

put option agreement to give the Company the right, but not the

obligation, to sell its economic interest in the commercialisation

of the Covid-19 application of AZD1656 for a total consideration of

GBP4.0 million. The Option was granted by Conduit Pharmaceuticals

Limited ("Conduit") and its prospective parent company, Murphy

Canyon Acquisition Corp ("Murphy"), a Company listed on NASDAQ.

Should the Option be exercised by Vela, the consideration that

would be payable to Vela will be satisfied through the issuance of

new shares of authorised common stock of par value $0.001 of

Murphy. The Option is exercisable solely at the discretion of Vela

and Vela paid Conduit GBP400,000 in cash as the premium for the

Option, with the consideration settled from Vela's existing cash

resources.

The Option is exercisable in whole at any time from the

completion of Conduit's merger with Murphy (being 25 September

2023) until 7(th) February 2024 at a price per share equal to the

volume-weighted average price per share over the ten business days

prior to the date of notice of exercise, provided, however, in no

event shall the price per share be lower than $5 or higher than

$15. Should Vela exercise the option, the Company will hold shares

in Murphy (now re-named Conduit Pharmaceuticals Inc.) as a publicly

traded company on NASDAQ.

Investment in Tribe Technology Group Limited ("Tribe Tech")

In May 2023, Vela invested GBP250,000 in Tribe Tech via an

advance subscription agreement as part of a pre-IPO funding round.

The IPO completed on 5 September 2023 and Vela was issued with

shares at a price of 8p per share which was equivalent to 80% of

the IPO issue price. Following the investment Vela is interested in

3,125,000 ordinary shares representing 1.41 per cent of Tribe

Tech's issued share capital.

Part Disposal of EnSilica Plc

Between May 2023 and September 2023 the Company disposed of a

total of 163,000 shares at an average price of 68p per share,

generating gross proceeds of GBP110,537 for the Company. Following

the disposals Vela remained interested in 946,707 ordinary shares

representing 1.9% of EnSilica's issued share capital.

Part Disposal of Kanabo Group Plc ("Kanabo")

In May 2023, Vela sold 500,000 shares in Kanabo, generating

gross proceeds of GBP15,460 for the Company.

Extraction of information in this announcement

The financial information, which comprises the statement of

comprehensive income, balance sheet, cashflow statement, statement

of changes in equity, and related notes to the financial

statements, is derived from the full Company financial statements

for the year ended 31 March 2023, which have been prepared under UK

endorsed International Financial Report Standards (IFRS) and those

parts of the Companies Act 2006 applicable to companies reporting

under IFRS. It does not constitute full financial statements within

the meaning of section 434 of the Companies Act 2006. This

financial information has been agreed with the auditor for

release.

The full annual report and financial statements for the year

ended 31 March 2023, on which the auditor has given an unqualified

report, and which does not contain a statement under section 498 of

the Companies Act 2006, will be delivered to the Registrar of

Companies in due course.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SELEFWEDSEDU

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

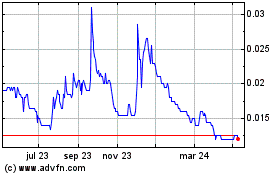

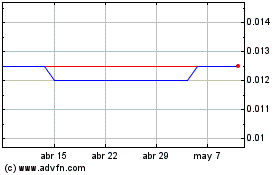

Vela Technologies (LSE:VELA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Vela Technologies (LSE:VELA)

Gráfica de Acción Histórica

De May 2023 a May 2024