TIDMXPF

RNS Number : 0623A

XP Factory PLC

18 January 2024

THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS STIPULATED

UNDER THE UK VERSION OF THE MARKET ABUSE REGULATION NO 596/2014

WHICH IS PART OF ENGLISH LAW BY VIRTUE OF THE EUROPEAN (WITHDRAWAL)

ACT 2018, AS AMENDED. ON PUBLICATION OF THIS ANNOUNCEMENT, THIS

INFORMATION IS CONSIDERED TO BE IN THE PUBLIC DOMAIN.

18 January 2024

XP Factory Plc

("XP Factory", the "Company" or the "Group")

Trading Update

"Very strong December trading underpins confidence for financial

year to 31 March 2024"

XP Factory, one of the UK's pre-eminent experiential leisure

businesses operating the Escape Hunt and Boom Battle Bar brands, is

pleased to provide an update on trading for the 52 week period to

31 December 2023.

Highlights:

Substantial growth sees XPF double revenues for the second year

in a row

-- Group turnover of circa GBP44.5m was 95% ahead of prior

year (2022: GBP22.8m)

-- Exceptional like for like sales growth delivered across

both brands in the 52 weeks to 31 December 2023:

-- Boom: up 29%

-- Escape Hunt: up 17%

-- Record corporate sales at Christmas drove strong like-for-like

sales in December 2023 :

-- Boom: up 50%

-- Escape Hunt: up 20%

-- Performance provides confidence of meeting market expectations

for the financial year to 31 March 2024

Operating metrics being delivered

-- Boom's continuing maturity profile, combined with strong

operating leverage in H2 2023, delivered site level EBITDA

margins in line with management's expectations (mature

target of 20% - 25%)

-- Escape Hunt site level EBITDA margins continue to exceed

40%

-- Both businesses continue to enjoy the highest customer

ratings in the industry

Strategic progress continuing

-- Boom former-franchise sites in Liverpool, Glasgow and

Watford all acquired in Q4 2023

-- New Boom owner-operated sites opened in Dubai, Canterbury

and Southend in H2 2023

-- New Escape Hunt owner-operated site opened in Woking in

H2 2023

Trading

The Group experienced a particularly strong end to the calendar

year, buoyed by robust corporate sales in December across both

brands. Group turnover for the twelve months to 31 December 2023

almost doubled to exceed GBP44.5m (2022: GBP22.8m). This notable

increase reflects robust like-for-like growth, the full year

inclusion and maturing of sites opened in the latter part of 2022,

and expansion of the owner operated estates of both Boom and Escape

Hunt. The performance is a culmination of the significant

operational and strategic progress made throughout the year which

has focused on implementing learnings from the rapid roll-out of

sites in 2022 in Boom, and further optimisation of performance in

Escape Hunt. The Group benefitted from operational leverage in the

final months of the year, supporting improved EBITDA margins in H2,

in line with management's expectations.

Escape Hunt

Escape Hunt had an exceptional twelve months. Like for like

sales growth within the Group's owner-operated estate was 17%(1)

for the twelve months to 31 December 2023, (19%(1) in the UK) which

rose to 20% in the final five weeks of the calendar year. Total

sales within the owner operated estate are expected to exceed GBP13

million, an increase of well over 30% on 2022. With the benefits of

operating leverage, site level EBITDA margins are once again

expected to exceed 40%, well above the internal benchmarks set for

the business.

A new site in Woking was opened in July 2023, bringing the owner

operated estate to 24 sites.

The Escape Hunt international franchise business is expected to

show a modest decline in revenue given the estate has reduced in

size.

Boom Battle Bar

Sales from the Boom owner operated estate exceeded GBP27.5m, a

near threefold increase on 2022 (2022: GBP9.5m), with like for like

sales up 29% in the 52 weeks to 31 December 2023. The maturing

nature of the young sites, combined with significant operational

focus, saw performance improve month on month, culminating in an

extraordinary Christmas period which delivered 50% like for like

sales in the final five weeks of the year. As sales continue to

grow, operating leverage continues to improve, and accordingly site

level EBITDA margins are expected to be significantly ahead of H1

2023 and in line with the board's expectations for the twelve

months to December 2023.

Three new owner operated sites were opened in the six-month

period to 31 December 2023; Dubai in July, Canterbury in September

and Southend in October. In addition, franchise sites in Liverpool

and Glasgow were bought back in November 2023 and Watford in

December 2023. As at 31 December 2023, the owner operated estate

comprised 19 sites.

Franchise revenue for the twelve month period is expected to be

broadly flat year on year (2022:GBP2.8m), reflecting underlying

growth offset by the smaller estate as sites have been bought

back.

Group

Overall performance is expected to be in line with market

expectations for the twelve months to 31 December 2023, and

provides confidence of achieving market expectations for the 15

month financial year to 31 March 2024.

The Company will publish an interim report for the 12 months to

31 December 2023 in March 2024, and audited financial statements

for the 15 months to 31 March 2024 during the summer.

Commenting, Richard Harpham, Chief Executive of XP Factory plc

said "We are delighted with the performance of the Group over

Christmas and for the twelve months to December 2023. Group

turnover in the second half of the year surpassed that of the

entirety of 2022, showcasing the substantial growth and

transformative step change in scale achieved . Our offerings

continue to resonate well with a broad spectrum of customers, whose

support and loyalty, combined with the trading momentum we are

carrying, positions the business favourably and underpins our

confidence in meeting market expectations for our 15 month

financial period to 31 March 2024."

(1) After normalising for the VAT benefit in Q1 2022

Enquiries:

XP Factory Plc

https://www.xpfactory.com/

Richard Harpham (Chief Executive

Officer)

Graham Bird (Chief Financial

Officer)

Kam Bansil (Investor Relations) +44 (0) 20 7846 3322

Singer Capital Markets, NOMAD

and Broker

https://www.singercm.com

Peter Steel

Alaina Wong

James Fischer +44 (0) 20 7496 3000

IFC Advisory - Financial PR

https://www.investor-focus.co.uk/

Graham Herring

Florence Chandler +44 (0) 20 3934 6630

Notes to Editors:

About XP Factory plc

The XP Factory Group is one of the UK's pre-eminent experiential

leisure businesses which currently operates two fast growing

leisure brands. Escape Hunt is a global leader in providing

escape-the-room experiences delivered through a network of

owner-operated sites in the UK, an international network of

franchised outlets in five continents, and through digitally

delivered games which can be played remotely.

Boom Battle Bar is a fast-growing network of owner-operated and

franchise sites in the UK that combine competitive socialising

activities with themed cocktails, drinks and street food in a high

energy, fun setting. Activities include a range of games such as

augmented reality darts, Bavarian axe throwing, 'crazier golf',

shuffleboard and others. The Group's products enjoy premium

customer ratings and cater for leisure or teambuilding, in small

groups or large, and are suitable for consumers, businesses and

other organisations. The Company has a strategy to expand the

network in the UK and internationally, creating high quality games

and experiences delivered through multiple formats and which can

incorporate branded IP content. ( https://xpfactory.com/ )

Facebook: EscapeHuntUK BoomBattleBar

Twitter: @EscapeHuntUK @boombattlebar

Instagram: @escapehuntuk @boombattlebar

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTGPUQPGUPCGMM

(END) Dow Jones Newswires

January 18, 2024 02:00 ET (07:00 GMT)

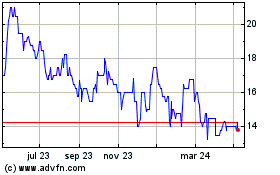

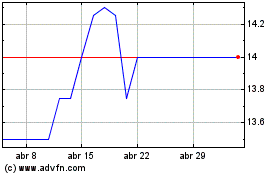

Xp Factory (LSE:XPF)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Xp Factory (LSE:XPF)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024