TIDMXSG

RNS Number : 7419N

Xeros Technology Group plc

27 September 2023

27 September 2023

Xeros Technology Group plc

('Xeros' or the 'Company' or the 'Group')

2023 INTERIM RESULTS

Sharper commercial focus driving momentum

Xeros Technology Group plc (AIM: XSG), the creator of

technologies that reduce the impact of clothing on the planet,

today announces its unaudited interim results for the six months

ended 30 June 2023, which show momentum building in all areas of

the business.

Operational highlights

-- Significant progress in all areas of the business with commercial momentum building:

Filtration (estimated addressable market GBP350m p.a.)

- Xeros now has multiple licensing agreements in place with approved manufacturers for XFilter

technology, covering all major global washing machine brands

- New external in-line filter, XF(3), launched successfully at IFA, the world's largest consumer

electronics and home appliances trade show in Berlin

- Legislation driving adoption of microplastic filtration technologies for washing machines

- First revenues expected in FY24

Finish (estimated addressable market GBP132m p.a.)

- New licensing agreement signed with global garment-finishing machine specialists, Yilmak,

and distributor, KRM, to provide denim processing technology, to minimise water, chemical,

and energy usage in the industry

- Revenue streams from both licensing agreement and ongoing supply of consumables - XOrb product

- Revenues expected FY23

Care (estimated addressable market GBP3bn p.a.)

- IFB Appliances' new domestic 9kg washing machine, featuring Xeros technology to save water

and prolong garment life, in progress for launch in India

- Progress with IFB and Indian Railways on commercial laundry partnership

- IFB / Xeros appoint 'Ecoprod' as new distributor for the UK

-- Awareness of Xeros' technologies is building, following successful launches at the two preeminent

industry trade shows, alongside ongoing leadership in engagement with global legislators

-- Meaningful conversations with four of the ten largest global domestic laundry OEMs and ongoing

engagement with another four of the top ten

Key financials

-- Revenue of GBP0.1m (H1 22: GBP0.04m) - increasing momentum towards revenue generation in Filtration

-- Administrative expenses at GBP2.6m down from GBP4.2m in same period last year

-- Significant reductions in costs with net cash outflow from operations reduced to GBP2.9m (H1

22: GBP3.9m) with cash at 31 August 2023 of GBP2.6m

Outlook

-- Commercial momentum gathering in target markets

-- New licensing agreements and progress made with pre-existing partnerships place us in a strong

position to deliver the successful commercialisation of our technologies

-- Month on month EBITDA and cash breakeven expected during the second half of FY24

Neil Austin, CEO said:

"Increasing climate awareness and conducive legislation is

creating a groundswell of opportunity for Xeros' technologies.

During the Period, the Group has signed three significant licensing

agreements taking our total to eight across all technology

platforms, as well as widening its product portfolio within

filtration."

Enquiries

Xeros Technology Group plc Tel: 0114 269 9656

Neil Austin, Chief Executive Officer

Alex Tristram, Director of Finance

Cavendish Capital Markets Limited (Nominated Adviser and Broker) Tel: 020 7220 0570

Julian Blunt/Teddy Whiley, Corporate Finance

Andrew Burdis/Sunila de Silva, ECM

Belvedere PR xeros@belvederepr.com

Cat Valentine Mob: 07715 769 078

Keeley Clarke Mob: 07967 816 525

About Xeros

Xeros Technology plc has developed patented and proven,

industry-leading technologies which reduce the environmental impact

of how industries make and care for clothes.

The traditional wet processing methods used in industrial and

domestic laundry and garment manufacturing consume billions of

litres of fresh water and large amounts of energy and chemicals, as

well as damaging and weakening clothing fibres and creating rising

levels of environmental pollution. It is estimated that washing

machines contribute 35% of the 171 trillion microplastic particles

in the ocean.

A range of actors, including consumers, the media NGOs and

regulators are exerting pressure on these industries, with

legislative action beginning to be taken.

Xeros' three main technologies, Filtration, Finish, and Care,

facilitate garment manufacturers, industrial laundries, domestic

washing machine manufacturers and consumers, to reduce their

environmental impact, whilst also significantly improving

efficiency in the process.

Xeros' model is to generate revenue from licensing its

technologies, generating royalties and the sale of consumables.

Currently there are 8 agreements in place. The addressable markets

in Filtration, Finish and Care are estimated to be valued at

GBP350m p.a., GBP132m p.a. and GBP3bn p.a. respectively.

CEO Statement

I am pleased to report on the significant operational and

commercial progress the Group has made in the six months to 30 June

2023.

The macro environment for our technologies continues to

strengthen in synchronicity with our commercialisation goals.

Global businesses are coming under increasing pressure to improve

their environmental practices, and governments are introducing new

regulations and legislation to protect against further ecological

damage and meet their global obligations.

In the Period under review, the Group signed new licensing

agreements in Filtration and Finish with the biggest brands in

their respective markets, which leave Xeros in prime position to

capitalise on demand for its micro-plastics filtration technology

and to lead the world on the delivery of ecological garment

processing technology in denim.

When I joined Xeros just over a year ago, I did so because the

Group's technologies were not only the right ones ecologically for

the planet but the right ones economically. Our technologies

actually reduce lifetime costs for the major appliance and garment

processing industries.

It is pleasing to note that our environmental contribution was

recognised in the Period, when we were awarded the much-prized

B-Corp accreditation. The application of this globally recognised

standard sets us apart. Xeros is the first in its peer group to

receive the accolade and only the second AIM listed company to

reach this standard.

The new management team, which has been put in place since I

joined, has focused on the singular goal of building commercial

partnerships, by promoting the benefits of our technologies to the

leading garment processing businesses globally, which can deliver

solutions at scale. Internally, there is a real sense of momentum

gathering and we look forward to the next 12 months with increasing

confidence in our technologies and strategy.

Summary of the results

As part of a sharpening of focus on commercial progression, it

was important to review costs within the business. To this end, we

reduced our rate of cash burn by GBP1m in the Period, while still

making significant progress on key licensing agreements. We take a

prudent and efficient approach, maintaining a keen eye on costs

throughout the business and will remain focused on ensuring

sufficient liquidity in the Group at all times.

At the time of our fundraising in September 2022, we stated that

we anticipated month on month EBITDA and cash breakeven during 2024

and stated that further clarity would emerge during the course of

2023. We believe the commercial progress made during the past 12

months and the significant inflection points expected to be

achieved during the second half of our financial year ended 31

December 2024 support this view and our guidance remains

unchanged.

Business update

Filtration

Even on an eco-setting, washing our clothes release 700,000

microfibres with every wash. Those tiny fibres can have a lasting

impact. They end up in our oceans, in our food chain and in our

water supply. Our filtration technology, XFilter, can be integrated

into a washing machine for the home or built at a large scale for

industry. It removes 99% of micro plastics from wastewater during a

washing machine cycle.

In the Period, we signed two further licensing agreements with

major European component manufacturers. These complement the

Hanning agreement, signed in June 2022, for the licensed

manufacture of Xeros' XF1 technology. We now have multiple approved

manufacturing options for all of the major global washing machine

brands, capable of delivering 99 million units per annum.

The legislative environment, which supports the take up of our

Filtration technology, continues to advance. There have been

further developments on legislative landscape in the Period, with

the mandated French deadline of 2025 set to be complemented by

movements, most notably, in the EU, the UK and California.

Post the Period end, we launched a new external filtration

product, called XF(3), for the domestic market. This is an

'outside-of-machine' microplastic filtration device, which can be

retrofitted to the existing domestic install base. The device

debuted at IFA Berlin, which is the largest OEM exhibition in the

world. The feedback from our customer base was excellent with clear

recognition of the product's ideal combination of price, efficacy,

and flexibility on positioning. XF(3) is the first product to come

from our Gen 2 XFilter platform, which is set to deliver new

propositions for the commercial laundry and Industrial

manufacturing sectors in future years.

Care

Our care technology uses XOrbs, reusable polymer spheres, to

wash and care for clothes. The technology is scalable for domestic

washes to heavy industrial use. It is designed to save tens of

millions of litres of water every year, use half the energy and

chemicals of traditional laundry processes and prolong the life of

fabrics.

IFB Appliances' new mass 9kg washing machine platform featuring

Xeros technology continues to progress for full scale launch for

domestic consumers across India. IFB is also continuing progress

with Indian Railways commercial laundry partnership.

Leading environmental solutions provider, Ecoprod, has been

appointed as a UK distributor for Xeros enabled products. Ecoprod

offers water management solutions to several thousand facilities in

five major industries - healthcare, hotels, the care market,

laundry companies and sports clubs.

Finish

Making one pair of jeans can use up to 10 years' worth of

drinking water for one person. Chemicals used in the process escape

with wastewater polluting our planet. Today, jeans are still made

using pumice stone, which constantly needs replacing and creates

chemically contaminated sludge. Our XFN1 technology uses patented

reusable XOrbs as a pumice alternative and reduces water and

chemistry use by up to 50%.

The new Xeros-enabled denim processing machine was launched by

our new partner Yilmak at ITMA, the foremost global garment

manufacturer trade show, in June 2023. We signed a licensing

agreement with Yilmak Makina / KRM, one of the World's largest and

best respected garment finishing manufacturers and distributors

respectively, in the Period. This complements our existing

licensing agreement with Ramsons, based in India. Trials of our

technology with multiple manufacturers are underway, making samples

and jeans for a number of high-street denim brands.

In denim finishing, Xeros has established its technology in

centres of excellence in Turkey, Bangladesh and the UK for regional

partner engagement in live production environment.

Multiple fashion brand collaborations using Xeros technology are

expected to develop further in the forthcoming period.

Strategy

Our technology provides cost-effective solutions for garment

manufacture and clothing care within the $2.5 trillion fashion

industry and the $55 billion domestic washing machine market. Our

annual addressable markets in Filtration, Finish and Care are

estimated to be GBP350 million, GBP132 million and GBP3 billion

respectively.

Our strategy to become an IP-rich, capital-light licensor of

proprietary technology solutions to multiple scale industries, all

of which deploy the same Xeros core technologies remains. We

identify and select partners across the globe with significant

market share, who are able to demonstrate a strategic intent to

deliver increased levels of sustainability, empowering them to

scale our innovations.

Our technologies are already in application in major global

industries through eight licensing and partner agreements, covering

commercial and home laundry, the cleaning of specialist workwear,

and garment manufacture. So far, our technology has saved millions

of litres of water and is proven to significantly increase the life

of clothes and fabrics. The implementation of our technologies

delivers major improvements in economic, operational, product and

environmental outcomes.

Drivers for growth

As the climate emergency continues to unfold, consumer sentiment

and demand for responsible products have never been stronger,

creating an urgency for manufacturers to react. A recent McKinsey

report stated: "The overall trend ... was clear ... products that

made ESG-related claims grew faster than those that didn't."

The realisation of the impact of clothing on the climate is

strong and growing. Garment production is a high energy and water

consumer, whilst also polluting air and water supplies during the

textile creation processes. "Fast fashion" is synonymous with

landfill problems and throw-away society, and narrative has shifted

towards sustainability and ethics, with a focus on slow fashion,

circular economy, transparency, and supply chain traceability. The

rental and second-hand fashion markets have grown and are predicted

to make up a significant percentage of apparel sales in the

future.

Xeros is actively involved with lobbying governments and

supporting NGOs lobbying for change in the UK, EU and US. Last year

we led the co-creation of a letter sent to the UK Environment

Secretary demanding legislation for filtration in washing machines.

This led to a direct discussion with the Minister and the

Department of Environment, Food and Rural Affairs and Xeros

continues to support a UK private members' bill on this topic. This

year we have provided evidence to coincide with the EU's

recommendations, currently scheduled to be published in Q4 2023, on

'Measures to Reduce the Impact of Microplastic Pollution on the

Environment'. This evidence is also being used to support a bill in

California to mandate microfibre filtration technology in washing

machines, and was introduced in February 2023 and has reached the

desk of Governor Gavin Newsom for approval. Xeros is working

closely with the NGO 5 Gyres, who co-authored the bill, to support

the filtration effectiveness and standards.

In addition, United Nations Environment Program is attempting to

bring about a global plastics treaty (initial draft published Sept

'23) in which: 'Nations should aim for the prevention, progressive

reduction and elimination of plastic pollution throughout the

lifecycle of plastic. Their approaches should be comprehensive and

cover all parts of the lifecycle.' which refers to the limitation

of microplastic pollution.

Xeros continues to be recognised for leading filtration

standards as highlighted by a Washington Post article earlier this

year that referenced the University of Plymouth study concluding

that XFilter is the most effective microfibre capture system for

the global laundry industry.

With France having established a precedent by mandating a

deadline of 1 January 2025 for a microfibre capture requirement for

all washing machines, the rest of the EU, the UK and California are

expected to follow suit. The Xeros view is that with XFilter

partnerships in place, we are well-positioned to respond to an

imminent need for five of the leading global washing machine

markets.

In addition to specific washing machine filtration legislation,

there are a number of other policies that highlight an accelerating

trend towards lower-impact goods and services, including extended

producer responsibility, consumer protection laws and environmental

labeling.

Sales pipeline

The Company's goal is mass implementation of its three

technologies and we have a clear strategy in place to help us

achieve this.

We are currently in active discussion with a number of retail

brands, garment manufacturers and OEMs, all of which have the

potential to lead to further agreements. Most recently, our

engagement with major domestic appliance washing machine brands has

escalated with active engagement with four of the 10 leading global

brands on both the Care and Filtration technologies.

We have plans to launch a domestic application in both Care

(XC1) and Filtration (XF(1) and XF(3) ) for the major markets in

Europe and Asia with several brands in the next 24-36 month

period.

Our manufacturing partnerships with Yilmak and Ramsons provide

the platform for the technology to permeate the market and our

extensive engagement and testing with multiple apparel brands

creates awareness and demand for the technology within the

industry. The expectation is that several of these brands will

prescribe that the Xeros Finish technology can be used for the

production of their core fashion ranges in the next 12-24

months.

Outlook

We are buoyed internally by the momentum gathering in our

markets. This, combined with the new licensing agreements and

progress made with pre-existing partnerships place us in a strong

position to deliver the successful commercialisation of our

technologies. The Group expects month on month EBITDA and cash

breakeven during the second half of our financial year to 2024.

Neil Austin

CEO

Financial review

Group revenue was generated as follows:

Unaudited Unaudited 12 months ended

6 months to 6 months to

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Licensing income 11 12 82

Service income 44 27 64

Sale of goods 57 - 18

Other revenue 1 1 -

Total revenue 113 40 164

The Group financial results for the six months ended 30 June

2023 reflect the reduction in costs over the previous 12 months,

alongside the periodic nature of the Group's contracts with

licensing partners, and remain in line with Board expectations,

reflecting Xeros' status as pre-revenue in its volume markets

pending the final stages of commercialisation. The Group recorded a

25.9% decrease in net cash outflow from operations to GBP2.9m in

the period (H1 2022: GBP3.9m). In the period the Group recorded an

adjusted EBITDA loss on continuing operations of GBP2.6m (2022:

loss GBP3.9m), a decrease of 32.2%.

Licensing income represents royalties from licence partners for

the sale of XDrum machines and revenue to Xeros for the sale of

XOrbs, which has remained broadly static against the previous

period. Service income and machine sales represents payments from

existing Xeros customers in the UK and Europe. The Group expects

that future revenues will be comprised mostly of licensing revenue

and revenue from the sale of goods, as it supplies XOrbs to

customers.

Gross profit for the six months ended 30 June 2023 rose to

GBP0.1m (2022: GBP0.0m) due to increased contribution from service

income and the sale of goods.

Administrative expenses decreased by 32.9% to GBP2.8m (2022:

GBP4.2m) reflecting a reduction in headcount alongside the timing

of the Group's major costs. Headcount fell in comparison with the

previous year, with 32 employees as of 31 August 2023 (2022:

42).

Adjusted EBITDA is considered one of the key financial

performance measures of the Group as it reflects the true nature of

our continuing trading activities. Adjusted EBITDA is defined as

the loss on ordinary activities before interest, tax, share-based

payment expense, non-operating exceptional costs, depreciation and

amortisation.

The Group decreased its operating loss to GBP2.7m (2022:

GBP4.2m), a decrease of 35.0%. The loss per share was 1.81p (2022:

loss 17.51p).

Net cash outflow from operations decreased to GBP2.9m (H1 2022:

GBP3.9m), a decrease of 25.8% in line with the decrease in adjusted

EBITDA in the period, with a small working capital outflow over the

prior period. The Group had existing cash resources (including cash

on deposit) as at 30 June 2023 of GBP3.5m (2022: GBP3.8m) and

remains debt free. Group cash as at 31 August 2023 is GBP2.6m.

Overall cash utilisation remains in line with the Board's

expectations at below GBP0.5m per month. The directors expect cash

utilisation to remain at the current level until such time as

higher licensing revenue is generated from our licence partners and

the Board will remain vigilant to ensure adequate liquidity in the

business until such time as the Group becomes cash generative

which, as stated above, we now believe will occur during the second

half of our financial year to 31 December 2024.

Alex Tristram

Director of Finance

Consolidated statement of profit or loss and other comprehensive

income

For the six months ended 30 June 2023

Unaudited Unaudited

Six months Six months 12 months

ended ended ended

30 June 30 June 31 December

2023 2022 2022

Note GBP'000 GBP'000 GBP'000

Revenue 113 40 164

Cost of sales (28) (43) (80)

_______ _______ _______

Gross profit/(loss) 85 (3) 84

Administrative expenses (2,791) (4,160) (7,518)

Adjusted EBITDA* (2,642) (3,899) (7,368)

Share based payment expense 9 (184) 79

Depreciation of tangible fixed

assets (73) (80) (145)

------------------------------------------------ ---------- ---------- -----------

Operating loss (2,706) (4,163) (7,434)

Finance income - 9 16

Finance expense (19) (10) (30)

_______ _______ _______

Loss before taxation (2,725) (4,164) (7,448)

Taxation 3 (1) (1) 515

_______ _______ _______

Loss after tax (2,726) (4,165) (6,933)

_______ _______ _______

Other comprehensive loss

Items that are or maybe reclassified

to profit or loss:

Foreign currency translation differences

- foreign operations 9 (6) (3)

___ ____ __ _____ _______

Total comprehensive expense for

the period (2,717) (4,171) (6,936)

___ ____ ____ _ __ _______

Loss per ordinary share

Basic and diluted on loss from

continuing operations 6 (1.81)p (17.51)p (14.29)p

_______ _______ _______

*Adjusted EBITDA comprises loss on ordinary activities before

interest, tax, share-based payment expense, depreciation and

amortisation.

Consolidated statement of changes in equity

For the six months ended 30 June 2023

Foreign

Deferred currency Retained

Share Share share Merger Warrant translation earnings

capital premium capital reserve reserve reserve deficit Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 January

2022 3,568 121,018 - 15,443 - (2,206) (130,761) 7,062

Loss for the

year - - - - - - (6,933) (6,933)

Other comprehensive

expense - - - - - (3) - (3)

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Loss and total

comprehensive

expense for the

period - - - - - (3) (6,933) (6,936)

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Transactions

with Owners recorded

directly in equity:

Change in nominal

value of ordinary

shares (3,544) - 3,544 - - - - -

Issue of shares

following placing

and open offer 127 6,234 - - - - - 6,361

Costs of share

issues - (539) - - - - - (539)

Warrant expense - 947 - (947) - - -

Share based payment

expense - - - - - - (79) (79)

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Total contributions

by and distributions

to owners (3,417) 6,642 3,544 - (947) - (79) 5,743

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

At 31 December

2022 151 127,660 3,544 15,443 (947) (2,209) (137,773) 5,869

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

At 1 January

2022 3,568 121,018 - 15,443 - (2,206) (130,761) 7,062

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Loss for the

period - - - - - - (4,165) (4,165)

Other comprehensive

expense - - - - - (6) - (6)

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Loss and total

comprehensive

expense for the

period - - - - (6) (4,165) (4,171)

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Transactions

with Owners recorded

directly in equity: -

Share based payment

expense - - - - - - 184 184

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Total contributions

by and distributions

to owners - - - - - - 184 184

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

At 30 June 2022 3,568 121,018 - 15,443 - (2,212) (134,742) 3,075

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Balance at 1

January 2023 151 127,660 3,544 15,443 (947) (2,209) (137,773) 5,869

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Loss for the

period - - - - - - (2,726) (2,726)

Other comprehensive

expense - - - - - 9 - 9

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Loss and total

comprehensive

income for the

period - - - - 9 (2,726) (2,717)

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Transactions

with Owners recorded

directly in equity:

Share based payment

expense - - - - - - (9) (9)

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Total contributions

by and distributions

to owners - - - - - (9) (9)

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

At 30 June 2023 151 127,660 3,544 15,443 (947) (2,200) (140,508) 3,143

---------------------- -------- -------- -------- -------- -------- ------------ --------- -------

Consolidated statement of financial position

As at 30 June 2023

Unaudited Unaudited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------ --------- --------- -----------

Assets

Non-current assets

Property, plant and equipment 934 834 821

Trade and other receivables - 17 6

------------------------------ --------- --------- -----------

934 851 827

------------------------------ --------- --------- -----------

Current assets

Inventories 162 111 164

Trade and other receivables 262 363 387

Cash on deposit 4 970 4

Cash and cash equivalents 3,494 2,840 6,465

------------------------------ --------- --------- -----------

3,922 4,284 7,020

------------------------------ --------- --------- -----------

Total assets 4,856 5,135 7,847

------------------------------ --------- --------- -----------

Liabilities

Non-current liabilities

Right of use liabilities (689) (653) (624)

Deferred tax (38) (38) (38)

(727) (691) (662)

Current liabilities

Trade and other payables (986) (1,369) (1,316)

(986) (1,369) (1,316)

------------------------------ --------- --------- -----------

Total liabilities (1,713) (2,060) (1,978)

------------------------------ --------- --------- -----------

Net assets 3,143 3,075 5,869

------------------------------ --------- --------- -----------

Equity

Share capital 151 3,568 151

Share premium 127,660 121,018 127,660

Deferred share capital 3,544 - 3,544

Merger reserve 15,443 15,443 15,443

Foreign currency translation

reserve (2,200) (2,212) (2,209)

Accumulated losses (140,508) (134,742) (137,773)

Warrant reserve (947) - (947)

------------------------------ --------- --------- -----------

Total equity 3,143 3,075 5,869

------------------------------ --------- --------- -----------

Consolidated statement of cash flows

For the six months ended 30 June 2023

Unaudited Unaudited

6 months to 6 months to 12 months to

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

---------------------------------------------------- ----------- ----------- ------------

Operating activities

Loss before tax (2,725) (4,164) (7,448)

Adjustment for non-cash items:

Depreciation of property, plant and equipment 73 80 145

Share based (credit)/expense (9) 184 (79)

(Increase)/decrease in inventories 2 (3) (56)

(Increase)/decrease in trade and other receivables 130 (3) (15)

Increase/(decrease) in trade and other payables (379) 5 (46)

Finance income - (9) (16)

Finance expense 19 10 30

Cash used in operations (2,889) (3,900) (7,485)

Tax (payments)/receipts (1) (1) 515

Net cash outflow used in operations (2,890) (3,901) (6,970)

---------------------------------------------------- ----------- ----------- ------------

Investing activities

Finance income - 9 15

Finance expense (19) (10) (30)

Cash withdrawn from/(placed on) deposit - 4,353 5,319

Purchases of property, plant and equipment (38) (12) (63)

Net cash inflow/(outflow) from investing activities (57) 4,340 5,241

---------------------------------------------------- ----------- ----------- ------------

Financing activities

Proceeds from issue of share capital, net of costs - - 5,821

Payment of lease liabilities (31) (86) (113)

Net cash (outflow)/inflow from financing activities (31) (86) 5,708

---------------------------------------------------- ----------- ----------- ------------

Increase/(decrease) in cash and cash equivalents (2,978) 353 3,979

Cash and cash equivalents at start of year 6,465 2,483 2,483

Effect of exchange rate fluctuations on cash held 7 4 3

Cash and cash equivalents at end of the period 3,494 2,840 6,465

---------------------------------------------------- ----------- ----------- ------------

Notes to the interim financial information

for the six months ended 30 June 2023

1. General information

The principal activity of Xeros Technology Group plc ("the

Company") and its subsidiary companies (together "Xeros" or the

"Group") is the development and licensing of platform technologies

which transform the sustainability and economics of clothing and

fabrics during their manufacture and over their lifetime of

use.

Xeros Technology Group plc is domiciled in the UK and

incorporated in England and Wales (registered number 8684474), and

its registered office address is Unit 2 Evolution, Advanced

Manufacturing Park, Whittle Way, Catcliffe, Rotherham, S60 5BL. The

Company's principal activity is that of a holding company.

The interim financial information was approved for issue on 27

September 2023.

2. Basis of preparation

The interim financial information has been prepared under the

historical cost convention and in accordance with the recognition

and measurement principles of UK-adopted International Accounting

Standards ("IFRSs").

The interim financial information has been prepared on a going

concern basis and is presented in Sterling to the nearest

GBP'000.

The accounting policies used in the interim financial

information are consistent with those used in the prior year.

The following adopted IFRSs have been issued but have not been

applied by the Group in this financial information. Their adoption

is not expected to have a material effect on the financial

information unless otherwise indicated:

-- Amendments to IAS 21, The Effects of Changes in Foreign Exchange

Rates, effective 1 January 2025

-- Amendments to IAS 7, Statements of Cashflows and IFRS 7, Financial

Instruments, Disclosures, effective 1 January 2024

-- Amendments to IAS 1, Presentation of Financial Statements,

effective 1 January 2024

-- Amendments to IFRS 16, Leases, effective 1 January 2024

Further IFRS standards or interpretations may be issued that

could apply to the Group's financial statements for the year ending

31 December 2023. If any such amendments, new standards or

interpretations are issued then these may require the financial

information provided in this report to be changed. The Group will

continue to review its accounting policies in light of emerging

industry consensus on the practical application of IFRS.

The preparation of financial information in conformity with the

recognition and measurement requirements of IFRS requires

management to make estimates and assumptions that affect the

reported amounts of assets and liabilities at the date of the

financial statements and the reported amounts of revenues and

expenses during the reporting period. Although these estimates are

based on management's best knowledge of the amount, event or

actions, actual events ultimately may differ from those

estimates.

The interim financial information does not include all financial

risk management information and disclosures required in annual

financial statements. There have been no significant changes in any

risk or risk management policies since 31 December 2022. The

principal risks and uncertainties are materially unchanged and are

as disclosed in the Annual Report for the year ended 31 December

2022.

The interim financial information for the six months ended 30

June 2023 and for the six months ended 30 June 2022 does not

constitute statutory financial statements as defined in Section 434

of the Companies Act 2006 and is neither reviewed nor audited. The

comparative figures for the year ended 31 December 2022 are not the

Group's consolidated statutory accounts for that financial year.

Those accounts have been reported on by the Group's auditor and

delivered to the Registrar of Companies. The report of the auditor

was (i) unmodified, (ii) did not contain a statement under Sections

498(2) or 498(3) of the Companies Act 2006. The report did contain

an emphasis of matter paragraph in relation to a material

uncertainty in respect of the going concern status of the Group as

at 31 December 2022. The circumstances that gave rise to this

emphasis of matter paragraph are unchanged as at the date of this

report.

The half year condensed consolidated financial statements do not

include all of the information and disclosures required for full

annual financial statements and should be read in conjunction with

the group's annual financial statements as at 31 December 2022,

which have been prepared in accordance with UK adopted

International Accounting Standards (IFRS).

IAS 34 'Interim financial reporting' is not applicable to these

half year condensed consolidated financial statements and has

therefore not been applied.

3. Taxation

Unaudited Unaudited

6 months

to 6 months to Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Current tax:

UK tax credits received in respect

of prior periods - - (517)

Foreign taxes paid 1 1 2

Total tax charge/(credit) 1 1 (515)

----------------------------------- ---------- ----------- -----------

The Group accounts for Research and Development tax credits

where there is certainty regarding HMRC approval. There is no

certainty regarding the claim for the year ended 31 December 2022

and as such no relevant credit or asset is recognised.

4. Trade and other receivables

Unaudited Unaudited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Due within 12 months:

Trade receivables 4 54 24

Other receivables 40 65 134

Prepayments and accrued income 218 244 229

262 363 387

-------------------------------- --------- --------- -----------

Due after more than 12 months

Other receivables - 17 6

-------------------------------- --------- --------- -----------

There is no material difference between the lease receivable

amounts as in other receivables noted above and the minimum lease

payments or gross investments in the lease as defined by IFRS

16.

The minimum lease payment is receivables as follows:

Unaudited Unaudited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Not later than one year 17 27 25

Later than one year not later

than five years - 17 6

17 44 31

------------------------------ --------- --------- -----------

Contractual payment terms with the Group's customers are

typically 30 to 60 days. The Directors believe that the carrying

value of trade and other receivables represents their fair value.

In determining the recoverability of trade receivables the

Directors consider and change in the credit quality of the

receivable from the date credit was granted up to the reporting

date.

5. Trade and other payables

Unaudited Unaudited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

----------------------------- --------- --------- -----------

Trade payables 211 368 528

Taxes and social security 115 120 98

Other creditors 26 34 33

Accruals and deferred income 554 793 600

Right of use liabilities 769 707 57

1,675 2,022 1,316

----------------------------- --------- --------- -----------

Current 986 1,369 1,316

Non-current 689 653 624

1,675 2,022 1,940

------------ ----- ----- -----

6. Loss per share

Basic loss per share is calculated by dividing the loss

attributable to equity holders by the weighted average number of

shares in issue during the period. The Group was loss-making for

the 6-month periods ended 30 June 2023 and 30 June 2022 and also

for the year ended 31 December 2022. Therefore, the dilutive effect

of share options has not been taken account of in the calculation

of diluted earnings per share, since this would decrease the loss

per share reported for each of the periods reported.

The calculation of basic and diluted loss per ordinary share is

based on the loss for the period, as set out below. Calculations of

loss per share are calculated to two decimal places.

Unaudited Unaudited

6 months

to 6 months to Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

------------------------------- --------- ----------- -----------

Total loss attributable to the

equity holders of the parent (2,726) (4,165) (6,933)

------------------------------- --------- ----------- -----------

Unaudited Unaudited

6 months

to 6 months to Year ended

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Issued ordinary shares at the

start of the period 150,982,535 23,784,483 23,784,483

Effect of shares issued for cash 2,412 - 24,742,166

---------------------------------- ----------- ----------- -----------

Weighted average number of shares

at the end of the period 150,984,947 23,784,483 48,526,649

---------------------------------- ----------- ----------- -----------

Unaudited Unaudited

6 months

to 6 months to Year ended

30 June 30 June 31 December

2023 2022 2022

------------------------------ --------- ----------- -----------

Basic and diluted on loss for

the period (1.81)p (17.51)p (14.29)p

------------------------------ --------- ----------- -----------

7. Leases

The Group has leases for office buildings and associated

warehousing and operational space. With the exception of short-term

leases and leases of low-value underlying assets, each lease is

reflected on the statement of financial position as a right-of-use

asset and a lease liability. The Group classifies its

right-of-use-assets in a manner consistent with its property, plant

and equipment.

Each lease generally imposes and restriction that, unless there

is a contractual right for the Group to sublet the asset to another

party, the right-of-use-asset can only be used by the Group. Leases

are either non-cancellable or may only be cancelled by incurring a

substantive termination fee. The Group is prohibited from selling

of pledging the underlying leased assets as security. For leases

over office buildings and warehousing and operations space, the

Group must keep those properties in a good state of repair and

return the properties in their original condition at the end of the

lease. Further, the Group must insure items of property, plant and

equipment and incur maintenance fees on such items in accordance

with the lease contracts.

The table below describes the nature of the Group's leasing

activities by type of right-of-use asset recognised on the

statement of financial position:

Remaining Average No. of leases

No. of right-of-use range remaining with termination

assets leased of term lease term options

Land and buildings 2 57 -104 months 81 months 2

------------------- ------------------- -------------- ----------- -----------------

Right-of-use assets

Additional information on the right-of-use assets by class is as

follows:

Land and buildings

GBP'000

Balance as at 31 December 2021 14

----------------------------------- ------------------

Additions in the period 775

----------------------------------- ------------------

Depreciation charged in the period (34)

----------------------------------- ------------------

Balance as at 30 June 2022 755

----------------------------------- ------------------

Depreciation charged in the period (37)

----------------------------------- ------------------

Balance as at 31 December 2022 718

----------------------------------- ------------------

Additions in the period 154

----------------------------------- ------------------

Depreciation charged in the period (64)

----------------------------------- ------------------

Balance as at 30 June 2023 808

----------------------------------- ------------------

Lease liabilities

Lease liabilities are presented in the statement of financial

position as follows:

Unaudited Unaudited

30 June 30 June 31 December

2023 2022 2022

GBP'000 GBP'000 GBP'000

Current 80 54 57

Non-current 689 653 624

769 707 681

------------ --------- --------- -----------

8. Seasonality

The Group experiences no material variations due to

seasonality.

9. Availability of interim statement

This interim statement will be available on Xeros' website at

www.xerostech.com .

Forward-looking statements

This announcement may include certain forward-looking

statements, beliefs or opinions, including statements with respect

to Xeros' business, financial condition and results of operations.

These forward-looking statements can be identified by the use of

forward-looking terminology, including the terms "believes",

"estimates", "plans", "anticipates", "targets", "aims",

"continues", "expects", "intends", "hopes", "may", "will", "would",

"could" or "should" or, in each case, their negative or other

various or comparable terminology. These statements are made by the

Xeros Directors in good faith based on the information available to

them at the date of this announcement and reflect the Xeros

Directors' beliefs and expectations. By their nature these

statements involve risk and uncertainty because they relate to

events and depend on circumstances that may or may not occur in the

future. A number of factors could cause actual results and

developments to differ materially from those expressed or implied

by the forward-looking statements, including, without limitation,

developments in the global economy, changes in government policies,

spending and procurement methodologies, and failure in health,

safety or environmental policies.

No representation or warranty is made that any of these

statements or forecasts will come to pass or that any forecast

results will be achieved. Forward-looking statements speak only as

at the date of this announcement and Xeros and its advisers

expressly disclaim any obligations or undertaking to release any

update of, or revisions to, any forward-looking statements in this

announcement. No statement in the announcement is intended to be,

or intended to be construed as, a profit forecast or to be

interpreted to mean that earnings per Xeros share for the current

or future financial years will necessarily match or exceed the

historical earnings. As a result, you are cautioned not to place

any undue reliance on such forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR PPUCABUPWGQQ

(END) Dow Jones Newswires

September 27, 2023 02:00 ET (06:00 GMT)

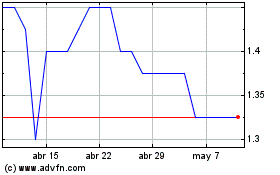

Xeros Technology (LSE:XSG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Xeros Technology (LSE:XSG)

Gráfica de Acción Histórica

De May 2023 a May 2024