UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

14A

Proxy

Statement Pursuant to Section 14(a) of the

Securities

Exchange Act of 1934

| Filed

by the Registrant ☒ |

Filed

by a Party other than the Registrant ☐ |

Check

the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of

the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ |

Definitive Proxy Statement |

| ☐ |

Definitive Additional Materials |

| ☐ |

Soliciting Material under

§ 240.14a-12 |

ALSET

INC.

(Name

of Registrant as Specified in Its Charter)

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No fee required. |

| ☐ |

Fee computed on table below

per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| |

(1) |

Title of each class of

securities to which transaction applies: |

| |

|

|

| |

(2) |

Aggregate number of securities

to which transaction applies: |

| |

|

|

| |

(3) |

Per unit price or other

underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated

and state how it was determined): |

| |

|

|

| |

(4) |

Proposed maximum aggregate

value of transaction: |

| |

|

|

| |

(5) |

Total fee paid: |

| ☐ |

Fee paid previously with

preliminary materials. |

| |

|

| ☐ |

Check box if any part of

the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| |

(1) |

Amount Previously Paid: |

| |

|

|

| |

(2) |

Form, Schedule or Registration

Statement No.: |

| |

|

|

| |

(3) |

Filing Party: |

| |

|

|

| |

(4) |

Date Filed: |

Alset

Inc.

4800

Montgomery Lane, Suite 210,

Bethesda,

MD 20814

October

17, 2024

NOTICE

OF ANNUAL MEETING OF STOCKHOLDERS

TO

BE HELD DECEMBER 5, 2024

9

A.M. EASTERN STANDARD TIME

Dear

Stockholder,

We

cordially invite you to attend our 2024 Annual Meeting of Stockholders to be held at 9:00 A.M. Eastern Standard Time on December 5, 2024.

The 2024 Annual Meeting of Stockholders will be held virtually via the Internet at https://agm.issuerdirect.com/AEI (the “Annual

Meeting”). The Annual Meeting will be a “virtual meeting” of stockholders, which will be conducted exclusively via

the Internet at a virtual web conference. There will not be a physical meeting location, and stockholders will not be able to attend

the annual meeting in person. Instructions on how to participate in the Annual Meeting and demonstrate proof of stock ownership are posted

at https://agm.issuerdirect.com/AEI and your proxy card. This means that you can attend the annual meeting online, vote your shares electronically

and submit questions during the online meeting by visiting the above-mentioned website. We believe that hosting a “virtual meeting”

will enable greater stockholder attendance and participation from any location around the world. The attached Notice of Annual Meeting

and Proxy Statement describes the business we will conduct at the meeting and provides information about Alset Inc. that you should consider

when you vote your shares.

Your

vote is very important, regardless of the number of shares you hold. Whether or not you plan to attend the meeting (via the virtual meeting),

please carefully review the enclosed Proxy Statement and then cast your vote.

We

hope that you will join us virtually on December 5, 2024.

| |

Sincerely, |

| |

|

| |

|

/s/

Chan Heng Fai |

| |

Name: |

Chan Heng Fai |

| |

Title: |

Chairman of the Board and |

| |

|

Chief Executive Officer |

Alset

Inc.

4800

Montgomery Lane, Suite 210

Bethesda,

MD 20814

Notice

of 2024 Annual Meeting of Stockholders

NOTICE

IS HEREBY GIVEN that the 2024 Annual Meeting (the “Annual Meeting”) of Stockholders of Alset Inc., a Texas corporation (the

“Company”), will be held on:

| Date: |

|

December 5,

2024 |

| |

|

|

|

|

| Time: |

|

9:00 A.M. Eastern

Standard Time |

| |

|

|

|

|

| Place: |

|

https://agm.issuerdirect.com/AEI |

| |

|

|

|

|

| Purpose: |

|

|

1. |

To elect seven (7) directors,

each to hold office until the 2025 annual meeting of stockholders and until his or her successor is elected and qualified; and |

| |

|

|

|

|

| |

|

|

2. |

To ratify the appointment

of Grassi & Co., CPAs, P.C. as our independent registered public accounting firm for the year ending December 31, 2024. |

| |

|

|

|

|

| Record Date: |

|

The Board of

Directors has fixed the close of business on October 8, 2024, as the record date for determining stockholders entitled to notice

of, and to vote at, the Annual Meeting or any adjournment or postponement thereof. |

The

proxy statement, the proxy card and the Annual Report are available on the Company’s website at https://www.alsetinc.com/.

Your

vote is important. Whether or not you plan to attend the Annual Meeting, we urge you to submit your proxy or voting instructions

as soon as possible. For specific instructions on how to vote your shares, please refer to the Notice of Internet Availability of Proxy

Materials you received in the mail, and the additional information in the accompanying proxy statement. If you requested to receive printed

proxy materials, you may also refer to the instructions on the proxy card enclosed with those materials.

| |

FOR THE BOARD OF DIRECTORS |

| |

|

| |

/s/ Chan

Heng Fai |

| |

Chan Heng Fai |

| |

Chairman of the Board and Chief Executive Officer |

Bethesda,

MD

October

17, 2024

TABLE

OF CONTENTS

Alset

Inc.

4800

Montgomery Lane, Suite 210

Bethesda,

MD 20814

PROXY

STATEMENT

ANNUAL

MEETING OF STOCKHOLDERS TO BE HELD DECEMBER 5, 2024

GENERAL

INFORMATION

This

Proxy Statement is furnished to stockholders of Alset Inc., a Texas corporation (“we,” “us,” or the “Company”),

in connection with the solicitation by our Board of Directors of proxies for use at our 2024 Annual Meeting of Stockholders (the “Annual

Meeting”). The Annual Meeting is scheduled to be held at 9:00 A.M. Eastern Standard Time on December 5, 2024, at a virtual location.

At

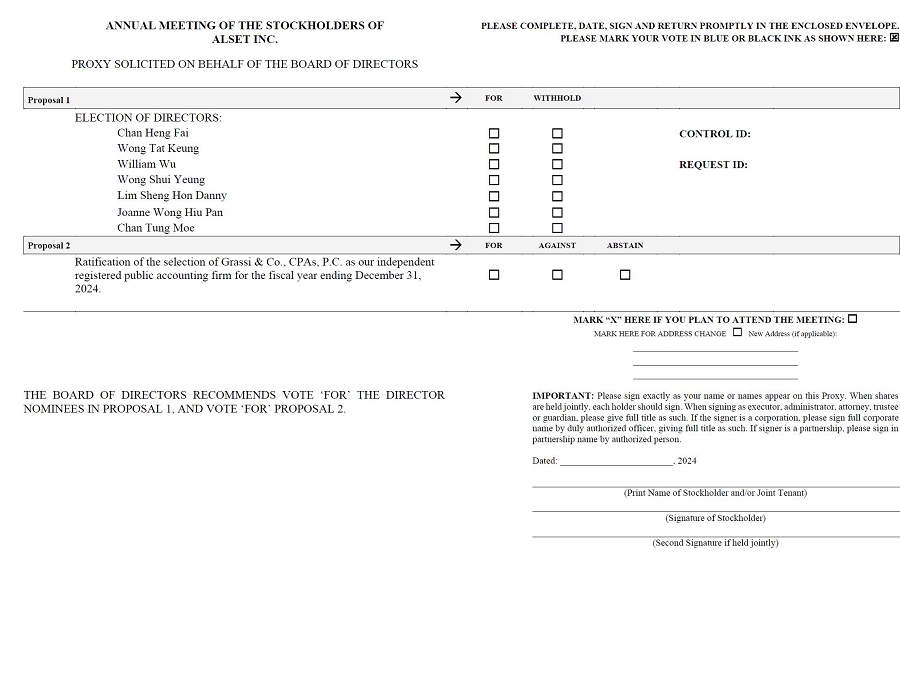

the Annual Meeting, stockholders will be asked to consider and vote upon: (1) the election of seven (7) directors, each to hold office

until the 2025 annual meeting of stockholders and until his or her successor is elected and qualified; and (2) the ratification of the

selection of Grassi & Co., CPAs, P.C. as our independent registered public accounting firm for the fiscal year ending December 31,

2024.

ABOUT

THE PROXY MATERIALS

IMPORTANT

NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE 2024 VIRTUAL ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON DECEMBER 5, 2024

This

Proxy Statement, the enclosed proxy card, and the Annual Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual

Report”) are available at https://www.alsetinc.com/. The Annual Report, however, is not a part of the proxy solicitation materials.

This

proxy is being solicited by the Board of Directors, and the cost of solicitation of the proxies will be paid by the Company. Our officers,

directors and regular employees, without additional compensation, also may solicit proxies by further mailing, by telephone or personal

conversations. We have no plans to retain any firms or otherwise incur any extraordinary expense in connection with the solicitation.

Questions

and Answers About the Annual Meeting and Voting

Why

did I receive a Notice of Internet Availability of Proxy Materials in the mail?

Under

rules adopted by the Securities and Exchange Commission (the “SEC”), we are providing access to the proxy materials for the

Annual Meeting via the Internet. Instead of mailing printed copies of our proxy materials to each of our stockholders, we have elected

to provide online access to the materials under the SEC’s “notice and access” rules. Accordingly, on or about October

22, 2024, we will mail a Notice of Internet Availability of Proxy Materials, or Notice, to each of our stockholders. The Notice

contains instructions on how to access our proxy materials, including this Proxy Statement and the Annual Report, and how to vote your

shares. We encourage you to read the proxy materials carefully prior to voting.

We

believe compliance with the SEC’s “notice and access” rules allows us to provide our stockholders with the materials

they need to make informed decisions, while lowering the costs of printing and delivering those materials and reducing the environmental

impact of the Annual Meeting. However, if you would prefer to receive printed proxy materials, please follow the instructions included

in the Notice.

The

Notice will be sent on or about October 22, 2024 to each of our stockholders of record entitled to vote at the Annual Meeting.

Voting

Rights and Votes Required

The

close of business on October 8, 2024, has been fixed as the record date for the determination of stockholders entitled to receive notice

of and to vote at the Annual Meeting. As of the close of business on such date, we had outstanding and entitled to vote 9,235,119 shares

of our common stock, par value $0.001 per share. You may vote your shares of common stock in person (all references to “present”

or “in person” in this proxy statement relate to the virtual presence at the Annual Meeting) or by proxy. You may submit

your proxy by telephone, via the Internet or if you requested printed proxy materials, by completing the proxy card and mailing it in

the envelope provided. Stockholders who hold shares in “street name” should refer to their proxy card or the information

forwarded by their bank, broker or other nominee for instructions on the voting options available to them. To vote in person at the virtual

meeting, you may attend the Annual Meeting and deliver your completed proxy card electronically or vote your shares electronically during

the virtual meeting.

The

presence at the Annual Meeting, whether in person or by valid proxy, of thirty-five percent (35%) of the shares of our common stock entitled

to vote will constitute a quorum, permitting us to conduct our business at the Annual Meeting. The record holder of each share of common

stock entitled to vote at the Annual Meeting will have one vote for each share so held. Abstentions and broker non-votes will count for

quorum purposes.

If

a broker that is a record holder of common stock does not return a signed proxy, the shares of common stock represented by such proxy

will not be considered present at the Annual Meeting and will not be counted toward establishing a quorum. If a broker that is a record

holder of common stock does return a signed proxy, but is not authorized to vote on one or more matters (with respect to each such matter,

a “broker non-vote”), the shares of common stock represented by such proxy will be considered present at the Annual Meeting

for purposes of determining the presence of a quorum. A broker that is a member of the New York Stock Exchange is prohibited, unless

the stockholder provides the broker with written instructions, from giving a proxy on non-routine matters. Consequently, your brokerage

firm or other nominee will have discretionary authority to vote your shares with respect to routine matters but may not vote your shares

with respect to non-routine matters.

Election

of Directors

Election

of directors is a non-routine matter and brokers do not have discretionary authority to vote on this matter. If you hold shares in a

brokerage account and wish to vote those shares on this proposal, then you should instruct on how to vote the shares using the voting

instructions provided.

Directors

are elected by a plurality of the votes cast when a quorum is present. Stockholders may not cumulate their votes. The seven candidates

receiving the highest number of votes will be elected. Because directors are elected by a plurality of the votes, votes withheld from

a director nominee and broker non-votes will have no effect on the outcome of the vote.

Ratification

of Independent Public Accounting Firm

The

affirmative vote of a majority of the votes cast is required to approve the proposal to ratify the selection of our independent registered

public accounting firm. Abstentions are not considered to be votes cast and will have no effect on the outcome of the vote. If you are

a stockholder of record and you return your signed and dated proxy card without providing specific voting instructions on this proposal,

or do not specify your vote on this proposal when voting using the telephone or Internet, your shares will be voted “For”

the ratification of the selection of our independent registered public accounting firm in accordance with the recommendations of the

Board of Directors. If you are a stockholder of record and you fail to return your proxy card, or to vote at all using the telephone

or Internet, it will have no effect.

We

believe that the proposal to ratify the selection of our independent registered public accounting firm is deemed to be a “routine”

matter. Therefore, if you are a beneficial owner of shares registered in the name of your broker or other nominee and you fail to provide

instructions to your broker or nominee as to how to vote your shares on this proposal, your broker or nominee will have the discretion

to vote your shares on this proposal.

Voting

of Proxies

Most

stockholders have three ways to submit a proxy: by telephone, via the Internet or if you requested proxy materials, by completing the

proxy card and mailing it in the envelope provided. To submit a proxy by telephone or via the Internet, follow the instructions set forth

on the Notice (or proxy card if you requested printed proxy materials). If you requested printed proxy materials, to vote by mail, sign

and date each proxy card you receive, mark the boxes indicating how you wish to vote and return the proxy card in the postage-paid envelope

provided. Do not return the proxy card if you submit your proxy via the Internet or by telephone.

Our

Board of Directors recommends a vote FOR the election of each director nominee, and FOR the ratification of the selection

of Grassi & Co., CPAs, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2024.

Revocation

of Proxies

Any

proxy given pursuant to this solicitation may be revoked by a stockholder at any time before it is exercised by providing written notice

to our Secretary at Alset Inc., 4800 Montgomery Lane, Suite 210, Bethesda, MD 20814, by delivery to us of a properly executed proxy bearing

a later date, or by virtually attending the meeting and voting in person electronically at the Annual Meeting.

Solicitation

of Proxies

We

will bear the cost of this solicitation, including amounts paid to banks, brokers and other nominees to reimburse them for their expenses

in forwarding solicitation materials regarding the Annual Meeting to beneficial owners of our common stock. The solicitation will be

by mail, with the materials being forwarded to stockholders of record and certain other beneficial owners of our common stock, and by

our officers and other regular employees (at no additional compensation). We have not engaged a proxy solicitor to distribute our proxy

materials and solicit proxies. Our officers and employees may solicit proxies from stockholders by personal contact, by telephone, or

by other means if necessary in order to assure sufficient representation at the Annual Meeting.

Issuer

Direct, our transfer agent, shall act as inspector of elections at the Annual Meeting.

PROPOSAL

ONE

ELECTION

OF DIRECTORS

Pursuant

to our bylaws, our directors are elected at each annual meeting of stockholders, and serve until their successors are elected and qualified

at the next annual meeting of stockholders, or until their prior death, resignation, retirement, disqualification or other removal.

Our

Board of Directors currently consists of seven directors. Our Board of Directors has nominated the seven (7) persons listed in the table

below for election as directors with terms expiring at the 2025 annual meeting of stockholders. Accordingly, our stockholders may not

vote their shares for a greater number of persons than the nominees named below. Unless a contrary direction is indicated, it is intended

that proxies received will be voted for the election as directors of the seven nominees, each to hold office until the 2025 annual meeting

of stockholders and until his or her successor is elected and qualified. Each of the nominees has consented to being named in this Proxy

Statement and to serve as a director if elected. In the event any nominee for director declines or is unable to serve, the proxies may

be voted for a substitute nominee selected by the Board of Directors.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” ALL NOMINEES.

All

of our directors bring to our Board of Directors executive leadership experience from their service as executives and/or directors of

our Company and/or other entities. The biography of each of the nominees below contains information regarding the person’s business

experience, director positions held currently or at any time during the last five years, and the experiences, qualifications, attributes

and skills that caused our Board of Directors to determine that the person should serve as a director, given our business and structure.

| Name |

|

Age |

|

Position(s)

with Alset Inc. |

|

Served

as

Director

From |

| Chan Heng Fai |

|

79 |

|

Founder, Chairman of the Board and Chief Executive

Officer |

|

2018 |

| Wong Tat Keung |

|

54 |

|

Director |

|

2020 |

| William Wu |

|

58 |

|

Director |

|

2020 |

| Wong Shui Yeung |

|

54 |

|

Director |

|

2021 |

| Lim Sheng Hon Danny |

|

32 |

|

Director |

|

2022 |

| Joanne Wong Hiu Pan |

|

48 |

|

Director |

|

2022 |

| Chan Tung Moe |

|

46 |

|

Director and Co-Chief Executive Officer |

|

2022 |

Chan

Heng Fai founded our company and has served as our Chairman of the Board and Chief Executive Officer since inception. Mr. Chan is

an expert in banking and finance, with 45 years of experience in these industries. He has restructured numerous companies in various

industries and countries during the past 40 years. Mr. Chan has served as the Chief Executive Officer of our subsidiary Alset International

Limited (“AIL”), an SGX listed company, since April 2014. Mr. Chan joined the Board of Directors of AIL in May 2013. Mr.

Chan has also served as the Chairman of HWH International Inc. (formerly known as Alset Capital Acquisition Corp.), a Nasdaq listed company,

since October 2021. From 1995 to 2015, Mr. Chan served as Managing Chairman of Hong Kong-listed Zensun Enterprises Limited (“Zensun”),

an investment holding company. Mr. Chan had previously served as a member of the Board of Zensun from September 1992 until July 2015.

Mr. Chan was formerly the Managing Director of SingHaiyi Group Pte. Ltd. (formerly known as SingHaiyi Group Ltd. which was listed with

SGX), a property development company, from March 2003 to September 2013, and the Executive Chairman of China Gas Holdings Limited, a

HKSE listed company, an investor and operator of city gas pipeline infrastructure in China from 1997 to 2002.

Mr.

Chan has served as an executive director of DSS, Inc., a NYSE listed company, since January 2017 and as Executive Chairman of the Board

since March 2019. Mr. Chan served as a member of the Board of Directors of OptimumBank Holdings, Inc., a Nasdaq listed company, from

June 2018 until April 2022. He has also served as a director of our subsidiary LiquidValue Development Inc., a public company reporting

to SEC, since January 2017. Mr. Chan has served as a director of our subsidiary Hapi Metaverse Inc. (formerly known as GigWorld Inc.),

since October 2014. Mr. Chan has served as a member of the Board of Directors of Sharing Services Global Corporation, an OTC Pink listed

company, since April 2020. Mr. Chan has served as a member of the Board of Value Exchange International Inc., an OTCQB listed company,

since December 2021. Mr. Chan also served as a director of Holista CollTech Ltd., an ASX listed company, from July 2013 until June 2021.

Mr.

Chan was formerly a director of Global Medical REIT Inc., a healthcare facility real estate company, from December 2013 to July 2015.

He also served as a director of Skywest Ltd., a public Australian airline company from 2005 to 2006. Additionally, Mr. Chan served as

a member of the Board of Directors of RSI International Systems, Inc., a Toronto Stock Exchange-listed company, the developer of RoomKeyPMS,

a web-based property management system, from June 2014 to February 2019.

Mr.

Chan has committed that the majority of his time will be devoted to managing the affairs of our company and its subsidiaries; however,

Mr. Chan may engage in other business ventures.

As

our founder, Chairman, Chief Executive Officer and our largest stockholder, Mr. Chan leads the board and guides our company. Mr.

Chan brings extensive real estate and digital transformation technology knowledge to our company and a deep background in growth companies,

emerging markets, mergers and acquisitions, and capital market activities. His service as Chairman and Chief Executive Officers creates

a critical link between management and the board.

Wong

Tat Keung joined the Board of Directors of our company in November 2020. Since 2010, Mr. Wong has served as the director of Aston

Wong CPA Limited. Mr. Wong has served as a member of the Board of Directors of HWH International Inc. (formerly known as Alset Capital

Acquisition Corp.) since January 2022. He has been an independent non-executive director of Alset International since January 2017. Mr.

Wong has been an independent non-executive director of Roma Group Limited, a valuation and technical advisory firm, since March 2016,

and has served as an independent non-executive director of Lerthai Group Limited, a property, investment, management and development

company, since December 2018. Previously, he served as the director and sole proprietor of Aston Wong & Co., a registered certified

public accounting firm, from January 2006 to February 2010. From January 2005 to December 2005, he was a Partner at Aston Wong, Chan

& Co., Certified Public Accountants. From April 2003 to December 2004, he served at Gary Cheng & Co., Certified Public Accountants

as Audit Senior. He served as an Audit Junior to Supervisor of Hui Sik Wing & Co., Certified Public Accountants from April 1993 to

December 1999. He served as an independent non-executive director of SingHaiyi from July 2009 to July 2013 and ZH Holdings from December

2009 to July 2015. Mr. Wong is a Certified Public Accountant admitted to practice in Hong Kong. He is a Fellow Member of Association

of Chartered Certified Accountants and an Associate Member of the Hong Kong Institute of Certified Public Accountants. He holds a Master

in Business Administration degree (financial services) from the University of Greenwich, London, England.

Mr.

Wong demonstrates extensive knowledge of complex, cross-border financial, accounting and tax matters highly relevant to our business,

as well as working experience in internal corporate controls, making him well-qualified to serve as an independent member of the board.

Mr. Wong serves on our Audit Committee, Nominations and Corporate Governance Committee and Compensation Committee.

William

Wu joined the Board of Directors of our company in November 2020. Mr. Wu, has served as the Responsible Officer for Corporate Finance

and Assets Management of Investment Banking at Glory Sun Securities Limited since January 2019. Mr. Wu has served as a member of the

Board of Directors of HWH International Inc. (formerly known as Alset Capital Acquisition Corp.) since January 2022. Mr. Wu previously

served as the executive director and chief executive officer of Power Financial Group Limited from November 2017 to January 2019. Mr.

Wu has served as a member of the Board of Directors of DSS, Inc. since October of 2019. Mr. Wu has served as a director of Asia Allied

Infrastructure Holdings Limited since February 2015. Mr. Wu previously served as a director and chief executive officer of RHB Hong Kong

Limited from April 2011 to October 2017. Mr. Wu served as the chief executive officer of SW Kingsway Capital Holdings Limited (now known

as Sunwah Kingsway Capital Holdings Limited) from April 2006 to September 2010. Mr. Wu holds a Bachelor of Business Administration degree

and a Master of Business Administration degree of Simon Fraser University in Canada. He was qualified as a chartered financial analyst

of The Institute of Chartered Financial Analysts in 1996.

Mr.

Wu previously worked for a number of international investment banks and possesses over 29 years of experience in the investment banking,

capital markets, institutional broking and direct investment businesses. He is a registered license holder to carry out Type 6 (advising

on corporate finance) and Type 9 (asset management) regulated activities under the Securities and Futures Ordinance (Chapter 571 of the

Laws of Hong Kong).

Mr.

Wu demonstrates extensive knowledge of complex, cross-border financial matters highly relevant to our business, making him well-qualified

to serve as an independent member of the board. Mr. Wu serves on our Audit Committee, Nominations and Corporate Governance Committee

and Compensation Committee.

Wong

Shui Yeung joined the Board of Directors of our company in November 2021. Mr. Wong is a practicing member and fellow member of Hong

Kong Institute of Certified Public Accountants and holds a bachelor’s degree in business administration. He has over 25 years’

experience in accounting, auditing, corporate finance, corporate investment and development, and company secretarial practice. Mr. Wong

has served as an independent non-executive director of Alset International Limited since June 2017, the shares of which are listed on

the Catalist Board of Singapore Stock Exchange. Mr. Wong is the Chairman of the Audit & Risk Management Committee and the Remuneration

Committee of Alset International Limited. Mr. Wong has served as a member of the Board of Directors of HWH International Inc. (formerly

known as Alset Capital Acquisition Corp.) since January 2022. Mr. Wong has served as a member of the Board of Value Exchange International

Inc. since April 2022, the shares of which are listed on OTC markets. Mr. Wong has served as a member of the Board of DSS, Inc. since

July 2022, the shares of which are listed on NYSE. Mr. Wong has served as a member of the Board of First Credit Finance Group Limited

since February 2024, the shares of which are listed on HKSE. Mr. Wong was an independent non-executive director of SMI Holdings Group

Limited from April 2017 to December 2020, the shares of which were listed on the Main Board of The Stock Exchange of Hong Kong Limited

and was an independent non-executive director of SMI Culture & Travel Group Holdings Limited from December 2019 to November 2020,

the shares of which were listed on the Main Board of The Stock Exchange of Hong Kong Limited.

Mr.

Wong’s knowledge of complex, cross-border financial, accounting and tax matters highly relevant to our business, as well as working

experience in internal corporate controls, qualify him to serve as an independent member of the board. Mr. Wong serves on our Audit Committee,

Nominations and Corporate Governance Committee and Compensation Committee.

Lim

Sheng Hon Danny joined the Company as a director in October 2022. Mr. Lim has served as Senior Vice President, Business Development

and as Executive Director of the Company’s subsidiary, Alset International Limited, an SGX listed company since 2020. Mr. Lim has

served as a member of the board of DSS, Inc., an NYSE listed company, since October 2023. Mr. Lim has served as Chief Operating Officer

and as Chief Strategic Officer of the Company’s subsidiary HWH International Inc. (formerly known as Alset Capital Acquisition

Corp.), a Nasdaq listed company, since February 2024. Mr. Lim has served as a member of the Board of Value Exchange International Inc.,

an OTCQB listed company, since December 2023.

Mr.

Lim has over 8 years of experience in business development, merger & acquisitions, corporate restructuring and strategic

planning and execution. Mr. Lim manages business development efforts for Alset International Limited, focusing on corporate

strategic planning, merger and acquisition and capital markets activities. He oversees and ensures the executional efficiency of the

Group and facilitates internal and external stakeholders on the implementation of the Group’s strategies. Mr. Lim liaises with

corporate partners or investment prospects for potential working/investment collaborations, and operational subsidiaries locally and

overseas to augment close parent-subsidiary working relationship. Mr. Lim graduated from Singapore Nanyang Technological University

with a Bachelor’s Degree with Honors in Business, specializing in Banking and Finance.

The board of directors appointed Mr. Lim in recognition of his extensive knowledge of our Company and its subsidiaries

and his ability to assist the Company in expanding its business.

Joanne

Wong Hiu Pan currently serves as Director and Responsible Officer of BMI Funds Management Limited, a Financial Advisor in Hong Kong.

In October 2022, she became a director of Alset Inc. Ms. Wong also serves as Director of A-link Services Limited, a consulting company

that brings together professionals with rich experience in different fields to provide the most suitable solutions to meet the needs

of different clients. In addition, Ms. Wong also serves as Senior Consultant of Global Intelligence Trust, which provides professional

trust service to individual, corporate and institutional customers. Ms. Wong has served as a member of the Board of Directors of DSS,

Inc., a NYSE listed company, since July of 2022. Ms. Wong graduated from the Chinese University of Hong Kong Faculty of Science with

a Bachelor’s degree in 1999.

Ms. Wong has extensive expertise in a wide array of strategic, business, turnaround and regulatory

matters across several industries as a result of her executive management, educational and operational experience, making her well-qualified

to serve as an independent member of the board.

Chan

Tung Moe was appointed Co-Chief Executive Officer of our Company in July 2021 and joined our Board of Directors in October 2022.

Chan Tung Moe also serves as the Co-Chief Executive Officer and Executive Director of Alset International. Chan Tung Moe is responsible

for Alset International’s international real estate business (including serving as Co-Chief Executive Officer and a member of the

Board of Alset International’s subsidiary LiquidValue Development Inc.). Chan Tung Moe has served as a director of DSS, Inc., a

NYSE listed company, since September 2020. From April 2014 to June 2015 Chan Tung Moe was the Chief Operating Officer of HKSE listed

Zensun Enterprises Limited (formerly known as Heng Fai Enterprises Limited) and was responsible for that company’s global business

operations consisting of REIT ownership and management, property development, hotels and hospitality, as well as property and securities

investment and trading. Prior to that, he was an executive director (from March 2006 to February 2014) and the Chief of Project Development

(from April 2013 to February 2014) of SingHaiyi Group Ltd, overseeing its property development projects. He was also a non-executive

director of the Toronto Stock Exchange-listed RSI International Systems Inc., a hotel software company, from July 2007 to August 2016.

Chan

Tung Moe has a diverse background and experience in the fields of property, hospitality, investment, technology and consumer finance.

He holds a Master’s Degree in Business Administration with honors from the University of Western Ontario, a Master’s Degree

in Electro-Mechanical Engineering with honors and a Bachelor’s Degree in Applied Science with honors from the University of British

Columbia. Chan Tung Moe is the son of Chan Heng Fai.

The

board of directors appointed Chan Tung Moe in recognition of his extensive knowledge of real estate and ability to assist the Company

in expanding its business.

Executive

Officers

The

following table sets forth certain information regarding our executive officers and key employees who are not also directors.

| Name |

|

Age |

|

Position(s)

with Alset Inc. |

| Lui Wai Leung Alan |

|

54 |

|

Co-Chief Financial Officer |

| Rongguo Wei |

|

53 |

|

Co-Chief Financial Officer |

| Charles MacKenzie |

|

53 |

|

Chief Development Officer |

| Michael Gershon |

|

52 |

|

Chief Legal Officer |

Lui

Wai Leung Alan has been our Co-Chief Financial Officer since March 2018. Mr. Lui has been the Chief Financial Officer of Alset International

since November 2016 and served as its Acting Chief Financial Officer since June 2016. Mr. Lui has served as an Executive Director of

Alset International since July 2020. Mr. Lui has served as a director and Chief Financial Officer of BMI Capital Partners International

Ltd, a Hong Kong investment consulting company, since October 2016. He has also served as a director of LiquidValue Asset Management

Pte Limited, a Singapore fund management company, since April 2018. Both companies are wholly owned subsidiaries of Alset International.

Mr. Lui has served as the Co-Chief Financial Officer of LiquidValue Development Inc. since December 2017 and has served as the Co-Chief

Financial Officer of Alset EHome Inc. since October 2017. Mr. Lui has served as Chief Financial Officer of Hapi Metaverse Inc. since

May 2016 and has served as a director of one of Hapi Metaverse’s subsidiaries since July 2016. From June 1997 through March 2016,

Mr. Lui served in various executive roles at Zensun Enterprises Limited (formerly known as Heng Fai Enterprises Limited), a Hong Kong-listed

company, including as Financial Controller. Mr. Lui oversaw the financial and management reporting focusing on its financing operations,

treasury investment and management. He has extensive experience in financial reporting, taxation and financial consultancy and management.

Mr. Lui is a certified practicing accountant in Australia and received a Bachelor’s degree in Business Administration from the

Hong Kong Baptist University.

Rongguo

Wei has been our Co-Chief Financial Officer since March 2018. Mr. Wei has served as the Chief Financial Officer of LiquidValue Development

Inc. since March 2017. Mr. Wei is a finance professional with more than 15 years of experience working in public and private corporations

in the United States. As the Chief Financial Officer of SeD Development Management LLC, Mr. Wei is responsible for oversight of all finance,

accounting, reporting and taxation activities for that company. Prior to joining SeD Development Management LLC in August 2016, Mr. Wei

worked for several different U.S. multinational and private companies including serving as Controller at American Silk Mill, LLC, a textile

manufacturing and distribution company, from August 2014 to July 2016, serving as a Senior Financial Analyst at Air Products & Chemicals,

Inc., a manufacturing company, from January 2013 to June 2014, and serving as a Financial/Accounting Analyst at First Quality Enterprise,

Inc., a personal products company, from 2011 to 2012. Mr. Wei served as a member of the Board of Directors of Amarantus Bioscience Holdings,

Inc., a biotech company, from February to May 2017, and has served as Chief Financial Officer of that company from February 2017 until

November 2017. Before Mr. Wei came to the United States, he worked as an equity analyst at Hong Yuan Securities, an investment bank in

Beijing, China, concentrating on industrial and public company research and analysis. Mr. Wei is a certified public accountant and received

his Master of Business Administration from the University of Maryland and a Master of Business Taxation from the University of Minnesota.

Mr. Wei also holds a Master in Business degree from Tsinghua University and a Bachelor’s degree from Beihang University.

Charles

MacKenzie was appointed our Chief Development Officer in December 2019. Mr. MacKenzie has served as a member of the Board of Directors

of LiquidValue Development Inc. since December 2017. He has served as Chief Executive Officer-United States of Alset EHome Inc. since

April 2020 and has served as the Chief Development Officer for SeD Development Management LLC, a subsidiary of Alset EHome Inc., since

July 2015. Mr. MacKenzie also serves as a member of the Board of Directors of Alset EHome Inc. since October 2017. He was previously

the Chief Development Officer for Inter-American Development (IAD), a subsidiary of Heng Fai Enterprises Limited (now known as Zensun

Enterprises Limited) from April 2014 to June 2015. Mr. MacKenzie is the Founder and President of MacKenzie Equity Partners, specializing

in mixed-use real estate investments since 2006, and served in various brokerage and development roles with MacKenzie Commercial Real

Estate Services from 1997 to 2006. Mr. MacKenzie was also the owner of Smartbox Portable Storage, a residential moving and storage company,

from October 2006 to a successful sale in February 2017. Mr. MacKenzie focuses on acquisitions and development of residential and mixed-use

projects within the United States. Mr. MacKenzie specializes in site selection, contract negotiations, marketing and feasibility analysis,

construction and management oversight, building design and investor relations. Mr. MacKenzie has developed over 1,300 residential units

including single family homes, multifamily, and senior living dwellings totaling more than $110 million and over 650,000 square feet

of commercial real estate valued at over $100 million. Mr. MacKenzie received a B.A. and graduate degree from St. Lawrence University,

where he served on Board of Trustees from 2003 to 2007.

Key

Employees

Michael

Gershon has been our Chief Legal Officer since October 2018. Mr. Gershon has served as Chief Legal Officer of our subsidiary SeD

Development Management LLC since April 2019 and from February 2017 until April 2019 served as Associate Corporate Counsel of that subsidiary.

Prior to joining our company, Mr. Gershon served as an attorney adviser with the Division of Corporation Finance at the U.S. Securities

and Exchange Commission from November 2015 until November 2016 and served as an associate at the law firm of Wuersch & Gering LLP

from August 2004 until January 2015. Mr. Gershon received a B.A. degree in economics from Boston College and a J.D. from Georgetown University

Law Center.

Director

Compensation

The

following table sets forth the cash and non-cash compensation awarded to or earned by the members of our Board of Directors during the

fiscal year ended December 31, 2023, except for Chan Heng Fai and Chan Tung Moe, whose information is set forth in the executive summary

compensation table further below in this proxy statement:

| Name | |

Salary | | |

Bonus | | |

Total Compensation | |

| Wong Tat Keung (1) | |

$ | 42,360 | | |

| - | | |

$ | 42,360 | |

| William Wu | |

$ | 20,000 | | |

| - | | |

$ | 20,000 | |

| Wong Shui Yeung (2) | |

$ | 42,360 | | |

| - | | |

$ | 42,360 | |

| Lim Sheng Hon Danny (3) | |

$ | 193,784 | | |

| - | | |

$ | 193,784 | |

| Joanne Wong Hiu Pan | |

$ | 18,000 | | |

| - | | |

$ | 18,000 | |

(1)

Wong Tat Keung is compensated as both a member of the Board of Directors of Alset International and a member of the Company’s Board

of Directors.

(2)

Wong Shui Yeung is compensated as both a member of the Board of Directors of Alset International and a member of the Company’s

Board of Directors.

(3)

Lim Sheng Hon Danny is compensated as both a member of the Board of Directors of the Company, and as a member of the Board of Directors

and officer of Alset International Limited.

We

intend to compensate each non-employee director through annual stock option grants and by paying a quarterly cash fee. In addition to

receiving compensation from our company, each of Chan Heng Fai, Chan Tung Moe and Lim Sheng Hon Danny has been compensated by our subsidiary,

Alset International, for their services as an officer, director or employee of that company. Certain members of our Board of Directors

are currently compensated by Alset International for their services as directors of that company. Our Board of Directors will review

director compensation annually and adjust it according to then current market conditions and good business practices.

On

February 16, 2022, our Board of Directors set the annual cash compensation for the independent members of our Board of Directors for

2022. In addition to their current compensation of $1,000 per month, independent members of the Board of Directors will also be paid

an additional payment of $2,000 for each Board or Board Committee meeting that such independent member shall attend during the fiscal

year ending December 31, 2023. In 2024 the compensation to members of our Board of Directors was increased to $5,000 per quarter.

Certain

of our directors are compensated for services on the Board of Directors of companies in which we are a stockholder, including but not

limited to DSS, Inc., which compensates William Wu, Wong Shui Yeung and Joanne Wong Hiu Pan.

Corporate

Governance

Board

Composition

Our

Board of Directors currently consists of seven members. Our Board of Directors has undertaken a review of the independence of our directors

and has determined that all of our current directors, except Chan Heng Fai, Chan Tung Moe and Lim Sheng Hon Danny, are independent within

the meaning of Section 5605(a)(2) of the Nasdaq Stock Market listing rules and Rule 10A-3 under the Securities Exchange Act of 1934,

as amended (the “Exchange Act”). Each director shall be elected to the Board of Directors to hold office until the next annual

meeting of stockholders and until his or her successor is elected and qualified.

Board

Leadership Structure and Role in Risk Oversight

The

Board of Directors does not have a formal policy on whether or not the roles of Chairman of the Board and Chief Executive Officer should

be separate and believes that it should retain the flexibility to make this determination in the manner it believes will provide the

most appropriate leadership for our company from time to time. Currently, Chan Heng Fai serves as Chairman of the Board and Chief Executive

Officer, working closely with the rest of the Board as well as Executives of the Company. Mr. Chan sets the strategic direction for the

Company and provides day-to-day leadership. As Chairman of the Board of Directors, Mr. Chan further oversees the agenda for board meetings

in collaboration with the other board members.

Risk

is inherent with every business, and how well a business manages risk can ultimately determine its success. Management is responsible

for the day-to-day management of risks we face, while our Board of Directors, as a whole and through its committees, has responsibility

for the oversight of risk management. In its risk oversight role, our Board of Directors has the responsibility to satisfy itself that

the risk management processes designed and implemented by management are adequate and functioning as designed. The Board of Directors

periodically consults with management regarding the Company’s risks.

Our

Board of Directors is actively involved in oversight of risks that could affect us. This oversight is conducted primarily through the

Audit Committee of our Board of Directors, but the full Board of Directors has retained responsibility for general oversight of risks.

Board

Committees

Our

Board of Directors has an Audit Committee, a Nominations and Corporate Governance Committee and a Compensation Committee. Each of these

committees is currently composed of Wong Tat Keung, Wong Shui Yeung and William Wu.

Our

Audit Committee and Compensation Committee each comply with the listing requirements of the Nasdaq Marketplace Rules. At least one member

of the Audit Committee will be an “audit committee financial expert,” as that term is defined in Item 407(d)(5)(ii) of Regulation

S-K, and each member will be “independent” as that term is defined in Rule 5605(a) of the Nasdaq Marketplace Rules. Our Board

of Directors has determined that each of Wong Tat Keung, Wong Shui Yeung, Joanne Wong Hiu Pan and William Wu is independent.

Audit

Committee

Our

Audit Committee was established in November of 2020 and met three times during the fiscal year ended December 31, 2023. The primary purpose

of our Audit Committee is to assist the Board of Directors in the oversight of the integrity of our accounting and financial reporting

process, the audits of our consolidated financial statements, and our compliance with legal and regulatory requirements. The functions

of our Audit Committee include, among other things:

| |

● |

hiring the independent

registered public accounting firm to conduct the annual audit of our consolidated financial statements and monitoring its independence

and performance; |

| |

|

|

| |

● |

reviewing and approving

the planned scope of the annual audit and the results of the annual audit; |

| |

|

|

| |

● |

pre-approving all audit

services and permissible non-audit services provided by our independent registered public accounting firm; |

| |

|

|

| |

● |

reviewing the significant

accounting and reporting principles to understand their impact on our consolidated financial statements; |

| |

|

|

| |

● |

reviewing our internal

financial, operating and accounting controls with management, our independent registered public accounting firm and our internal

audit provider; |

| |

|

|

| |

● |

reviewing with management

and our independent registered public accounting firm, as appropriate, our financial reports, earnings announcements and our compliance

with legal and regulatory requirements; |

| |

|

|

| |

● |

periodically reviewing

and discussing with management the effectiveness and adequacy of our system of internal controls; |

| |

|

|

| |

● |

in consultation with management

and the independent auditors, reviewing the integrity of our financial reporting process and adequacy of disclosure controls; |

| |

|

|

| |

● |

reviewing potential conflicts

of interest under and violations of our code of conduct; |

| |

● |

establishing procedures

for the treatment of complaints received by us regarding accounting, internal accounting controls or auditing matters and confidential

submissions by our employees of concerns regarding questionable accounting or auditing matters; |

| |

|

|

| |

● |

reviewing and approving

related-party transactions; and |

| |

|

|

| |

● |

reviewing and evaluating,

at least annually, our Audit Committee’s charter. |

With

respect to reviewing and approving related-party transactions, our Audit Committee reviews related-party transactions for potential conflicts

of interests or other improprieties. Under SEC rules, as a smaller reporting company, related-party transactions are those transactions

to which we are or may be a party in which the amount involved exceeds the lesser of $120,000 or 1% of the average of our total assets

at year-end for the last two completed fiscal years, and in which any of our directors or executive officers or any other related person

had or will have a direct or indirect material interest, excluding, among other things, compensation arrangements with respect to employment

and Board of Directors membership. Our Audit Committee could approve a related-party transaction if it determines that the transaction

is in our best interest. Our directors are required to disclose to this Committee or the full Board of Directors any potential conflict

of interest, or personal interest in a transaction that our Board of Directors is considering. Our executive officers are required to

disclose any related-party transaction to the Audit Committee. We also poll our directors on an annual basis with respect to related-party

transactions and their service as an officer or director of other entities. Any director involved in a related-party transaction that

is being reviewed or approved must recuse himself or herself from participation in any related deliberation or decision. Whenever possible,

the transaction should be approved in advance and if not approved in advance, must be submitted for ratification as promptly as practical.

The

financial literacy requirements of the SEC require that each member of our Audit Committee be able to read and understand fundamental

financial statements. In addition, at least one member of our Audit Committee must qualify as an audit committee financial expert, as

defined in Item 407(d)(5) of Regulation S-K promulgated under the Securities Act, and have financial sophistication in accordance with

the Nasdaq Stock Market listing rules. Our Board of Directors has determined that Wong Tat Keung qualifies as an Audit Committee financial

expert.

Both

our independent registered public accounting firm and management periodically will meet privately with our Audit Committee.

The

Board of Directors has adopted a charter for the Audit Committee, which is available in the corporate governance section of our website

at https://www.alsetinc.com/.

Nominations

and Corporate Governance Committee

The

primary purpose of our Nominations and Corporate Governance Committee is to assist our Board of Directors in promoting the best interest

of our company and our stockholders through the implementation of sound corporate governance principles and practices. Our Nominations

and Corporate Governance Committee was established in 2021 and met one time during the fiscal year ended December 31, 2023; prior to

its formation, the functions of this committee were addressed by the Board of Directors. The functions of our Nominations and Corporate

Governance Committee include, among other things:

| |

● |

identifying, reviewing

and evaluating candidates to serve on our Board of Directors; |

| |

|

|

| |

● |

determining the minimum

qualifications for service on our Board of Directors; |

| |

|

|

| |

● |

developing and recommending

to our Board of Directors an annual self-evaluation process for our Board of Directors and overseeing the annual self-evaluation

process; |

| |

|

|

| |

● |

developing, as appropriate,

a set of corporate governance principles, and reviewing and recommending to our Board of Directors any changes to such principles;

and |

| |

|

|

| |

● |

periodically reviewing

and evaluating our Nominations and Corporate Governance Committee’s charter. |

The

Board of Directors has adopted a charter for the Nominations and Corporate Governance Committee, which is available in the corporate

governance section of our website at https://www.alsetinc.com/.

Compensation

Committee

Our

Compensation Committee was established at the time of our initial public offering in November 2020 and met one time during the fiscal

year ended December 31, 2023. Prior to the establishment of the Compensation Committee, the functions of such committee were administered

by the entire Board of Directors. The primary purpose of our Compensation Committee is to assist our Board of Directors in exercising

its responsibilities relating to compensation of our executive officers and employees and to administer our equity compensation and other

benefit plans. In carrying out these responsibilities, this Committee reviews all components of executive officers and employees compensation

for consistency with its compensation philosophy, as in effect from time to time. The functions of our Compensation Committee include,

among other things:

| |

● |

designing and implementing

competitive compensation, retention and severance policies to attract and retain key personnel; |

| |

|

|

| |

● |

reviewing and formulating

policy and determining the compensation of our Chief Executive Officer, our other executive officers and employees; |

| |

|

|

| |

● |

reviewing and recommending

to our Board of Directors the compensation of our non-employee directors; |

| |

|

|

| |

● |

reviewing and evaluating

our compensation risk policies and procedures; |

| |

|

|

| |

● |

administering our equity

incentive plans and granting equity awards to our employees, consultants and directors under these plans; |

| |

|

|

| |

● |

administering our performance

bonus plans and granting bonus opportunities to our employees, consultants and non-employee directors under these plans; |

| |

|

|

| |

● |

if required from time to

time, preparing the analysis or reports on executive officer compensation required to be included in our annual proxy statement; |

| |

|

|

| |

● |

engaging compensation consultants

or other advisors it deems appropriate to assist with its duties; and |

| |

|

|

| |

● |

reviewing and evaluating,

at least annually, our Compensation Committee’s charter. |

The

Board of Directors has adopted a charter for the Compensation Committee, which is available in the corporate governance section of our

website at https://www.alsetinc.com/.

The

Compensation Committee retains sole authority to hire any compensation consultant, approve such consultant’s compensation, determine

the nature and scope of its services, evaluate its performance, and terminate its engagement.

The

Compensation Committee has reviewed our compensation policies and practices for all employees, including our named executive officers,

as they relate to risk management practices and risk-taking incentives, and has determined that there are no risks arising from these

policies and practices that are reasonably likely to have a material adverse effect on us.

Section

16(a) Beneficial Ownership Reporting Compliance

Section

16(a) of the Exchange Act requires our directors and executive officers, and persons who own more than ten percent of a registered class

of our equity securities, to file with the SEC initial reports of ownership and reports of changes in ownership of our common stock and

other equity securities. Officers, directors and greater than ten percent stockholders are required by SEC regulation to furnish us with

copies of all Section 16(a) forms they file.

To

our knowledge, based solely on a review of the copies of such reports furnished to us and written representations that no other reports

were required, during the fiscal year ended December 31, 2023, all Section 16(a) filing requirements applicable to our officers, directors

and greater than ten percent beneficial owners were complied with.

Code

of Conduct for Employees, Executive Officers and Directors

We

have adopted a code of conduct applicable to all of our employees, executive officers and directors. The code of conduct is available

in the corporate governance section of our website at https://www.alsetinc.com/.

The

Audit Committee of our Board of Directors is responsible for overseeing the code of conduct and must approve any waivers of the code

of conduct for employees, executive officers or directors.

Meetings

of the Board of Directors

The

Board of Directors held three meetings during the fiscal year ended December 31, 2023. During the fiscal year ended December 31, 2023,

each director attended the meetings of the Board of Directors.

Directors

are encouraged, but not required, to attend the annual meeting of stockholders.

Director

Nomination Process

The

process followed by Board of Directors to identify and evaluate director candidates includes requests to members of our Board of Directors

and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential

candidates and interviews of selected candidates by members of the Board of Directors.

In

determining whether to recommend any particular candidate for inclusion in the Board of Directors’ slate of recommended director

nominees, our Board of Directors considers the composition of the Board with respect to depth of experience, balance of professional

interests, required expertise and other factors. The Board of Directors considers the value of diversity when recommending candidates.

The Board views diversity broadly to include diversity of experience, skills and viewpoint. The Board of Directors does not assign specific

weights to particular criteria and no particular criterion is a prerequisite for each prospective nominee. Our Board of Directors believes

that the backgrounds and qualifications of its directors, considered as a group, should provide a composite mix of experience, knowledge

and abilities that will allow it to fulfill its responsibilities.

Stockholders

may recommend individuals to our Board for consideration as potential director candidates. The Board will evaluate stockholder-recommended

candidates by following the same process and applying the same criteria as it follows for candidates submitted by others.

Stockholders

may directly nominate a person for election to our Board of Directors by complying with the procedures set forth in Section 2.13 of our

bylaws, and with the rules and regulations of the SEC. Under our bylaws, for business (including, but not limited to, director nominations)

to be properly brought before an annual meeting by a stockholder, the stockholder or stockholders of record intending to propose the

business (the “proposing stockholder”) must have given written notice of the proposing stockholder’s nomination or

proposal, either by personal delivery or by United States mail to the Secretary not later than ninety (90) calendar days prior to the

date such annual meeting is to be held. If the current year’s meeting is called for a date that is not within thirty (30) days

of the anniversary of the previous year’s annual meeting, notice must be received not later than ten (10) calendar days following

the day on which public announcement of the date of the annual meeting is first made. In no event will an adjournment or postponement

of an annual meeting of stockholders begin a new time period for giving a proposing stockholder’s notice as provided above.

For

business to be properly brought before a special meeting of stockholders, the notice of the meeting sent by or at the direction of the

person calling the meeting must set forth the nature of the business to be considered. A person or persons who have made a written request

for a special meeting pursuant to our bylaws may provide the information required for notice of a stockholder proposal simultaneously

with the written request for the meeting submitted to the Secretary or within ten (10) calendar days after delivery of the written request

for the meeting to the Secretary.

A

proposing stockholder’s notice shall include as to each matter the proposing stockholder proposes to bring before either an annual

or special meeting:

(a)

The name and address of the proposing stockholder, and the classes and number of shares of the Corporation held by the proposing stockholder.

(b)

If the notice is in regard to a nomination of a candidate for election as director: (a) the name, age, and business and residence address

of the candidate; (b) the principal occupation or employment of the candidate; and (c) the class and number of shares of the Company

beneficially owned by the candidate.

Board

Diversity

The

Board of Directors does not have a formal policy regarding board diversity for our board of directors as a whole nor for each individual

member. The Nominations and Corporate Governance Committee does consider such factors as gender, race, ethnicity, experience and area

of expertise, as well as other individual attributes that contribute to the total diversity of viewpoints and experience represented

on the board of directors.

As

required by the Nasdaq Rules that were approved by the SEC in August 2021, the Company is providing information about the gender and

demographic diversity of its directors in the format required by Nasdaq Rules. The information in the matrix below is based solely on

information provided by our directors about their gender and demographic self-identification. Directors who did not answer or indicated

that they preferred not to answer a question are shown under “did not disclose demographic background” or “did not

disclose gender” below.

Board

Diversity Matrix (as of October 17, 2024)

| Total Number of Directors |

|

7 |

| |

|

|

| |

|

Female |

|

Male |

|

Non-Binary |

|

Did

Not Disclose

Gender |

| |

|

|

|

|

|

|

|

|

| Part I: Gender Identity |

|

|

|

|

|

|

|

|

| Directors |

|

1 |

|

6 |

|

- |

|

- |

| Part II: Demographic Background |

|

|

|

|

|

|

|

|

| African American or Black |

|

- |

|

- |

|

- |

|

- |

| Alaskan Native or Native American |

|

- |

|

- |

|

- |

|

- |

| Asian |

|

1 |

|

6 |

|

- |

|

- |

| Hispanic or Latinx |

|

- |

|

- |

|

- |

|

- |

| Native Hawaiian or Pacific Islander |

|

- |

|

- |

|

- |

|

- |

| White |

|

- |

|

- |

|

- |

|

- |

| Two or More Races or Ethnicities |

|

- |

|

- |

|

- |

|

- |

| LGBTQ+ |

|

- |

|

- |

|

- |

|

- |

| Did Not Disclose Demographic Background |

|

- |

|

- |

|

- |

|

- |

Stockholder

Communications with the Board of Directors

You

can contact our Board of Directors to provide comments, to report concerns, or to ask questions, at the following address:

Alset

Inc.

4800

Montgomery Lane, Suite 210

Bethesda,

MD 20814

You

may submit your concern anonymously or confidentially by postal mail. You may also indicate whether you are a stockholder, customer,

supplier or other interested party.

Communications

are distributed to our Board of Directors, or to any individual director, as appropriate, depending on the facts and circumstances outlined

in the communication.

PROPOSAL

TWO

RATIFICATION

OF THE SELECTION OF GRASSI & CO., CPAS, P.C. AS OUR INDEPENDENT

REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING

DECEMBER

31, 2024

Our

Board of Directors, acting upon the recommendation of the Audit Committee, has selected Grassi & Co., CPAs, P.C.to audit our consolidated

financial statements for the fiscal year ending December 31, 2024.

Although

stockholder approval of the selection of Grassi & Co., CPAs, P.C. is not required by law, our Board of Directors and the Audit Committee

believe it is advisable to give stockholders an opportunity to ratify this selection. If this proposal is not approved at the Annual

Meeting, the Audit Committee may reconsider its selection of Grassi & Co., CPAs, P.C. Additionally, we are considering various actions

to reduce our operating expenses. Even if this proposal is approved, the Audit Committee may reconsider its selection of Grassi &

Co., CPAs, P.C. as part of our expense reduction efforts.

During

the two most recent fiscal years and through December 22, 2021, the date on which the Company engaged Grassi & Co., CPAs, P.C.,

the Company has not consulted with Grassi & Co., CPAs, P.C. regarding either:

1.

The application of accounting principles to any specified transaction, either completed or proposed, or the type of audit opinion that

might be rendered on the Company’s financial statements, and neither a written report was provided to the Company nor oral advice

was provided that Grassi & Co., CPAs, P.C. concluded was an important factor considered by the Company in reaching a decision as

to the accounting, auditing or financial reporting issue; or

2.

Any matter that was either the subject of a disagreement (as defined in paragraph (a)(1)(iv) of Item 304 of Regulation S-K and the related

instructions thereto) or a reportable event (as described in paragraph (a)(1)(v) of Item 304 of Regulation S-K).

We

expect representatives of Grassi & Co., CPAs, P.C. to attend the annual meeting, to be available to respond to appropriate questions

from stockholders, and to have the opportunity to make a statement if so desired.

Fees

of Independent Registered Public Accounting Firm

The

following table indicates the fees paid by us for services performed for the years ended December 31, 2023 and December 31, 2022:

| | |

Year Ended

December 31,

2023 | | |

Year Ended

December 31,

2022 | |

| | |

| | |

| |

| Audit Fees | |

$ | 275,370 | | |

$ | 294,750 | |

| Audit-Related Fees | |

$ | 48,806 | | |

$ | 24,500 | |

| Tax Fees | |

$ | 6,165 | | |

$ | 6,000 | |

| All Other Fees | |

$ | 0 | | |

$ | 0 | |

| Total | |

$ | 330,341 | | |

$ | 325,250 | |

Audit

Fees. This category includes the aggregate fees billed for professional services rendered by the independent auditors

during the years ended December 31, 2023 and December 31, 2022 for the audit of our financial statements and review of our Form 10-Qs.

Tax

Fees. This category includes the aggregate fees billed for tax services rendered in the preparation of our federal and

state income tax returns.

All

Other Fees. This category includes the aggregate fees billed for all other services, exclusive of the fees disclosed above,

rendered during the years ended December 31, 2023 and December 31, 2022.

Pre-Approval

Policies and Procedures

Our

Audit Committee’s policy is that all audit services and all non-audit services to be provided to us by our independent registered

public accounting firm must be approved in advance by the Audit Committee. The Audit Committee’s approval procedures include the

review and approval of engagement letters from our independent registered public accounting firm that document the fees for all audit

services and non-audit services, primarily tax advice and tax return preparation and review.

All

audit services and all non-audit services in fiscal year ended December 31, 2023 were pre-approved by our Audit Committee. Our Audit

Committee has determined that the provision of the non-audit services for which these fees were rendered is compatible with maintaining

the independent auditor’s independence.

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE PROPOSAL TO RATIFY THE SELECTION OF GRASSI & CO., CPAS, P.C.

AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 31, 2024.

REPORT

OF AUDIT COMMITTEE

The

Audit Committee has reviewed the Company’s audited consolidated financial statements for the fiscal year ended December 31, 2023

and discussed them with the Company’s management.

The

Audit Committee has also received from, and discussed with, the Company’s independent registered public accounting firm various

communications that the Company’s independent registered public accounting firm is required to provide to the Audit Committee,

including the matters required to be discussed by Auditing Standard No. 1301, Communications with Audit Committees, as adopted

by the Public Company Accounting Oversight Board.

The

Audit Committee has received the written disclosures and the letter from the Company’s independent registered public accounting

firm required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s

communications with the Audit Committee concerning independence, and has discussed with the Company’s independent registered public

accounting firm their independence.

Based

on the review and discussions referred to above, the Audit Committee recommended to the Company’s Board of Directors that the audited

consolidated financial statements be included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023.

By

the Audit Committee of the Board of Directors of Alset Inc.

William

Wu

Wong

Tat Keung

Wong

Shui Yeung

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table and accompanying footnotes set forth certain information with respect to the beneficial ownership of our common stock

as of October 8, 2024, referred to in the table below as the “Beneficial Ownership Date,” by:

| ● |

each person who is known

to be the beneficial owner of 5% or more of the outstanding shares of our common stock; |

| |

|

| ● |

each member of our Board

of Directors, director nominees and each of our named executive officers individually; and |

| |

|

| ● |

all of our directors, director

nominees and executive officers as a group. |

Beneficial

ownership is determined in accordance with the rules of the SEC. In computing the number of shares beneficially owned by a person and

the percentage ownership of that person, shares of common stock subject to stock options or warrants held by that person that are currently

exercisable or exercisable within 60 days of the Beneficial Ownership Date and shares of restricted stock subject to vesting until the

occurrence of certain events, are deemed outstanding, but are not deemed outstanding for computing the percentage ownership of any other

person (however, neither the stockholder nor the directors and officers listed below own any stock options or warrants to purchase shares

of our common stock at the present time). The percentages of beneficial ownership are based on 9,235,119 shares of common stock outstanding

as of the Beneficial Ownership Date.

To

our knowledge, except as set forth in the footnotes to this table and subject to applicable community property laws, each person named

in the table has sole voting and investment power with respect to the shares set forth opposite such person’s name.

| Name and Address (1) | |

Number of

Common Shares

Beneficially

Owned | | |

Percentage of

Outstanding

Common Shares | |

| | |

| | |

| |

| Chan Heng Fai (2) | |

| 6,164,175 | | |

| 66.7 | % |

| Wong Tat Keung | |

| 0 | | |

| | |

| William Wu | |

| 0 | | |

| | |

| Wong Shui Yeung | |

| 0 | | |

| | |

| Chan Tung Moe | |

| 0 | | |

| | |

| Lim Sheng Hon Danny | |

| 0 | | |

| | |

| Joanne Wong Hiu Pan | |

| 0 | | |

| | |

| Lui Wai Leung Alan | |

| 0 | | |

| | |

| Rongguo Wei | |

| 0 | | |

| | |

| Charles MacKenzie | |

| 0 | | |

| | |

| All Directors and Officers (10 individuals) | |

| 6,164,175 | | |

| 66.7 | % |

| |

(1) |

Except as otherwise indicated,

the address of each of the persons in this table is c/o Alset Inc., 4800 Montgomery Lane, Suite 210, Bethesda, Maryland 20814. |

| |

|

|

| |

(2) |

Represents 319,000 shares

of common stock owned of record by HFE Holdings Limited, of which Chan Heng Fai has sole voting and investment power with respect

to such shares and 5,845,175 shares of common stock directly held by Chan Heng Fai. |

CERTAIN

RELATIONSHIPS AND RELATED PERSON TRANSACTIONS

Policies

and Procedures for Transactions with Related Persons

Our

Board of Directors intends to adopt a written related person transaction policy to set forth the policies and procedures for the review

and approval or ratification of related person transactions. Related persons include any executive officer, director or a holder of more

than 5% of our common stock, including any of their immediate family members and any entity owned or controlled by such persons. Related

person transactions refer to any transaction, arrangement or relationship, or any series of similar transactions, arrangements or relationships

in which (i) we were or are to be a participant, (ii) the amount involved exceeds $120,000, and (iii) a related person had or will have