Affirm Holdings, Inc. (Nasdaq: AFRM) (“Affirm” or the “Company”)

today announced the pricing of $800 million aggregate principal

amount of 0.75% Convertible Senior Notes due 2029 (the “Notes”) in

a private offering (the “Offering”). The size of the Offering was

increased from the previously announced $750 million in aggregate

principal amount. In connection with the Offering, Affirm has

granted the initial purchasers of the Notes an option to purchase,

within a 13-day period beginning on, and including, the date on

which the Notes are first issued, up to an additional $120 million

aggregate principal amount of the Notes on the same terms and

conditions. The sale of the Notes to the initial purchasers is

expected to settle on December 20, 2024, subject to customary

closing conditions.

The notes will bear interest at a rate of 0.75% per annum

payable semiannually in arrears on June 15 and December 15 of each

year, beginning on June 15, 2025. When issued, the Notes will be

senior, unsecured obligations of Affirm. The Notes will mature on

December 15, 2029, unless earlier repurchased, redeemed or

converted in accordance with their terms prior to such date. Affirm

may not redeem the Notes prior to December 20, 2027. Affirm may

redeem for cash all or any portion of the Notes, at its option, on

or after December 20, 2027, but only if the last reported sale

price per share of Affirm’s Class A common stock has been at least

130% of the conversion price for a specified period of time.

Holders of the Notes will have the right to require Affirm to

repurchase all or a portion of their Notes upon the occurrence of a

“fundamental change” in cash at a fundamental change repurchase

price of 100% of their principal amount plus accrued and unpaid

interest to, but not including, the fundamental change repurchase

date. Following certain corporate events or if Affirm calls the

Notes for redemption, Affirm will, under certain circumstances,

increase the conversion rate for holders who elect to convert their

Notes in connection with such corporate event or such

redemption.

The initial conversion rate of the Notes will be 9.8992 shares

of Affirm’s Class A common stock per $1,000 principal amount of

Notes (equivalent to an initial conversion price of approximately

$101.02 per share of Affirm’s Class A common stock, which

represents a conversion premium of approximately 42.5% to the last

reported sale price of Affirm’s Class A common stock on the Nasdaq

Global Select Market on December 17, 2024). Prior to the close of

business on the business day immediately preceding September 15,

2029, the Notes will be convertible at the option of the holders of

the Notes only upon the satisfaction of specified conditions and

during certain periods. On or after September 15, 2029 until the

close of business on the second scheduled trading day immediately

preceding the maturity date, the Notes will be convertible, at the

option of the holders of Notes, at any time regardless of such

conditions. Upon conversion, Affirm will pay cash up to the

aggregate principal amount of the Notes to be converted and pay or

deliver, as the case may be, cash, shares of Class A common stock

of Affirm or a combination of cash and shares of Class A common

stock of Affirm, at Affirm’s election, in respect of the remainder,

if any, of Affirm’s conversion obligation in excess of the

aggregate principal amount of the Notes being converted.

Affirm estimates that the net proceeds from the Offering will be

approximately $785.2 million (or approximately $903.1 million if

the initial purchasers exercise their option to purchase additional

Notes in full), after deducting fees and estimated expenses. Affirm

expects to use the net proceeds from the Offering, together with

cash on hand, to repurchase approximately $960 million aggregate

principal amount of Affirm’s 0% convertible senior notes due 2026

(the “2026 notes”) for $892.8 million of cash, in separate and

privately negotiated transactions with certain holders of the 2026

notes, effected through one of the initial purchasers of the Notes

or its affiliate. Affirm may also repurchase additional outstanding

2026 notes following the completion of the Offering.

In addition, Affirm expects to repurchase 3,526,590 shares of

its Class A common stock for approximately $250.0 million in cash

concurrently with the Offering in privately negotiated transactions

effected with or through one of the initial purchasers or its

affiliate, at a purchase price per share equal to the closing price

of Affirm’s Class A common stock on December 17, 2024, which was

$70.89 per share.

Affirm expects that holders of the 2026 notes that are

repurchased by Affirm as described above may enter into or unwind

various derivatives with respect to Affirm’s Class A common stock

(including entering into derivatives with one or more of the

initial purchasers in the Offering or their respective affiliates)

and/or purchase or sell shares of Affirm’s Class A common stock

concurrently with or shortly after the pricing of the Notes.

Repurchases of the 2026 notes, and the potential related market

activities by holders thereof, together with the repurchase by

Affirm of any of its Class A common stock, could increase (or

reduce the size of any decrease in) or decrease (or reduce the size

of any increase in) the market price of Affirm’s Class A common

stock, which may affect the trading price of the Notes offered in

the Offering at that time and, to the extent effected concurrently

with the pricing of the Offering, the initial conversion price of

the Notes. Affirm cannot predict the magnitude of such market

activity or such share repurchases or the overall effect they will

have on the price of the Notes offered in the Offering or Affirm’s

Class A common stock.

In addition, any share repurchases following this Offering could

affect the market price of the Notes and, if conducted during an

observation period for the conversion of any Notes, could affect

the amount and value of the consideration that is due upon such

conversion. However, Affirm does not have an authorized share

repurchase program other than the share repurchases expected to be

executed concurrently with the pricing of this Offering.

This press release is not an offer to repurchase the 2026 notes

or Affirm’s Class A common stock and the Offering of the Notes is

not contingent upon the repurchase of the 2026 notes or the

repurchase of Affirm’s Class A common stock.

The Notes were offered only to persons reasonably believed to be

qualified institutional buyers pursuant to Rule 144A under the

Securities Act of 1933, as amended (the “Securities Act”). The

offer and sale of the Notes and any shares of Class A common stock

of Affirm issuable upon conversion of the Notes, if any, have not

been, and will not be, registered under the Securities Act or the

securities laws of any other jurisdiction, and unless so

registered, the Notes and such shares, if any, may not be offered

or sold in the United States except pursuant to an applicable

exemption from such registration requirements.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy, nor shall there be any offer or

sale of, the Notes (or any shares of Class A common stock of Affirm

issuable upon conversion of the Notes) in any state or jurisdiction

in which the offer, solicitation, or sale would be unlawful prior

to the registration or qualification thereof under the securities

laws of any such state or jurisdiction.

About Affirm

Affirm’s mission is to deliver honest financial products that

improve lives. By building a new kind of payment network – one

based on trust, transparency and putting people first – we empower

millions of consumers to spend and save responsibly, and give

thousands of businesses the tools to fuel growth. Unlike most

credit cards and other pay-over-time options, we never charge any

late or hidden fees. Follow Affirm on social media: LinkedIn |

Instagram | Facebook | X.

Cautionary Note About Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as

amended (the “Securities Act”), and Section 21E of the Securities

Exchange Act of 1934, as amended, that involve risks and

uncertainties. All statements other than statements of historical

fact contained in this report, including statements regarding the

successful completion of the Offering, and the Company’s expected

use of proceeds from the Offering, are forward-looking statements.

In some cases, forward-looking statements may be identified by

words such as “anticipate,” “believe,” “continue,” “could,”

“design,” “estimate,” “expect,” “intend,” “may,” “plan,”

“potentially,” “predict,” “project,” “should,” “will,” “would,” or

the negative of these terms or other similar expressions.

Forward-looking statements are based on management’s beliefs and

assumptions and on information currently available. These

forward-looking statements are subject to a number of known and

unknown risks, uncertainties and assumptions, including risks

described under “Risk Factors” in the offering memorandum for the

Offering, the Company’s Annual Report on Form 10-K for the fiscal

year ended June 30, 2024 and the Company’s Quarterly Report on Form

10-Q for the fiscal quarter ended September 30, 2024. Except as

required by law, the Company undertakes no obligation to update

publicly any forward-looking statements for any reason after the

date of this press release or to conform these statements to actual

results or to changes in the Company’s expectations.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241217026965/en/

Investor Relations ir@affirm.com Media press@affirm.com

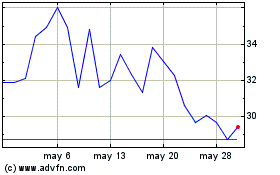

Affirm (NASDAQ:AFRM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Affirm (NASDAQ:AFRM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024