Filed

Pursuant to Rule 424(b)(5)

Registration No. 333-279306

PROSPECTUS

SUPPLEMENT

(To Prospectus dated May 20, 2024)

XIAO-I

CORPORATION

Up

to $2,175,000 American Depositary Shares representing Ordinary Shares

Issuable upon Conversion

of Convertible Promissory Note due October 30, 2025

550,000

Pre-Delivery American Depositary Shares Representing 1,650,000 Ordinary Shares

We are offering $2,175,000 of our American Depositary

Shares (“ADSs”) issuable upon conversion of our convertible promissory note due in 2025, which we refer to herein as the “Note”.

The Note shall be convertible into our ordinary shares (which we refer to as, “Conversion Shares”) in the form of American

Depositary Shares (which we refer to as “Conversion ADSs”). The Note is being sold pursuant to a private placement, and the

terms of a Securities Purchase Agreement dated as of October 30, 2024 between us and an investor (“Buyer”) in connection with

this offering (the “Securities Purchase Agreement”). This prospectus supplement covers the Conversion Shares issuable upon

conversion of the Note (as represented by Conversion ADSs). The ADSs are being issued pursuant to a registration statement on Form F-6

(Registration No. 333-269502).

We are also concurrently offering an additional

550,000 ADS (which we refer to as “Pre-Delivery ADSs”), at par 0.00005, representing 1,650,000 of our ordinary shares (which

we refer to as “Pre-Delivery Shares”), to Buyer of Note. Holder of Pre-Delivery Shares is not permitted to sell, assign or

transfer such Pre-Delivery ADSs except in connection with a conversion of the Note of the holder to facilitate T+1 delivery of Conversion

ADSs upon any conversion of a Note. Notwithstanding the foregoing, Citibank, N.A., the depositary for our ADS program (the “Depositary”),

is not obligated to issue and deliver Pre-Delivery ADSs or Conversion ADSs until we have complied with all applicable requirements of

the Depositary. For a description of the Depositary’s requirements, see the information under the heading “Description of

Pre-Delivery Shares” beginning on page S-27 of this prospectus supplement. At such time as the holder’s Note no longer remains

outstanding, such remaining Pre-Delivery ADSs shall be deemed surrendered and cancelled by the holder on the date the holder ceases to

hold any Note. See “Description of Pre-Delivery Shares” below.

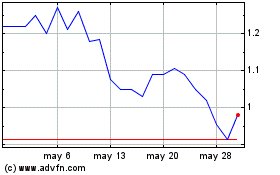

Our

American Depositary Shares are listed on the Nasdaq Global Market, or “Nasdaq,” under the symbol “AIXI.” On October

30, 2024, the last reported sale price of our ADSs on the Nasdaq was $4.44 per

ADS. The aggregate market value of our outstanding Ordinary Shares held by non-affiliates, or public float, as of October 30, 2024, was

approximately $40,397,961.6, which was calculated based on 27,295,920 Ordinary

Shares held by non-affiliates and the price of $4.44 per ADS (each ADS represents three Ordinary Shares), which was the closing price

of our ADS on Nasdaq on October 30, 2024. Pursuant to General Instruction I.B.5 of Form F-3, in no event will we sell our securities

in a public primary offering with a value exceeding one-third of our public float in any 12-month period so long as our public float

remains below $75 million. During the 12 calendar months prior to and including the date of the accompanying prospectus, except for the

$3,260,869.57 aggregate principal amount of our senior convertible notes sold to an institutional investor on June 17, 2024, we have

not offered or sold any other securities pursuant to General Instruction I.B.5 of Form F-3.

We

are an “emerging growth company” under applicable U.S. federal securities laws and is eligible for reduced public company

reporting requirements.

Investing

in our securities involves a high degree of risk. You should carefully consider the risks described under “Risk Factors”

starting on page S-22 and the “Risk Factors” in the accompanying prospectus and in the documents incorporated by reference

into this prospectus supplement before you invest in our securities.

Xiao-I

is a holding company incorporated in the Cayman Islands. As a holding company with no material operations of its own, Xiao-I conducts

a substantial majority of its operations through Shanghai Xiao-i Robot Technology Co., Ltd. (“Shanghai Xiao-i”), a variable

interest entity (the “VIE”), in the People’s Republic of China, or “PRC” or “China.” Investors

in Xiao-I’s ADSs should be aware that they may never hold equity interests in the VIE, but rather are purchasing equity interests

solely in Xiao-I, the Cayman Islands holding company, which does not own any of the business in China conducted by the VIE and the VIE’s

subsidiaries (“the PRC operating entities”). The ADSs offered in this offering represent shares of the Cayman Islands holding

company instead of shares of the VIE(s) in China.

Xiao-I’s

indirect wholly owned subsidiary, Zhizhen Artificial Intelligent Technology (Shanghai) Co. Ltd. (“Zhizhen Technology” or

“WFOE”) entered into a series of contractual arrangements that establish the VIE structure (the “VIE Agreements”).

The VIE structure is used to provide investors with exposure to foreign investment in China-based companies where Chinese law prohibits

direct foreign investment in certain industries. Xiao-I has evaluated the guidance in FASB ASC 810 and determined that Xiao-I is the

primary beneficiary of the VIE, for accounting purposes, based upon such contractual arrangements. ASC 810 requires a VIE to be consolidated

if the company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual

returns. A VIE is an entity in which a company or its WFOE, through contractual arrangements, is fully and exclusively responsible for

the management of the entity, absorbs all risk of losses of the entity (excluding non-controlling interests), receives the benefits of

the entity that could be significant to the entity (excluding non-controlling interests), and has the exclusive right to exercise all

voting rights of the entity, and therefore the company or its WFOE is the primary beneficiary of the entity for accounting purposes.

Under ASC 810, a reporting entity has a controlling financial interest in a VIE, and must consolidate that VIE, if the reporting entity

has both of the following characteristics: (a) the power to direct the activities of the VIE that most significantly affect the VIE’s

economic performance; and (b) the obligation to absorb losses, or the right to receive benefits, that could potentially be significant

to the VIE. Through the VIE Agreements, the Company is deemed the primary beneficiary of the VIE for accounting purposes. The VIE has

no assets that are collateral for or restricted solely to settle its obligations. The creditors of the VIE do not have recourse to the

Company’s general credit. Accordingly, under U.S. GAAP, the results of the PRC operating entities are consolidated in Xiao-I’s

financial statements. However, investors will not and may never hold equity interests in the PRC operating entities. The VIE Agreements

may not be effective in providing control over Shanghai Xiao-i. Uncertainties exist as to Xiao-I’s ability to enforce the VIE Agreements,

and the VIE Agreements have not been tested in a court of law. The Chinese regulatory authorities could disallow this VIE structure,

which would likely result in a material change in the PRC operating entities’ operations and the value of Xiao-I’s ADSs,

including that it could cause the value of such securities to significantly decline or become worthless. “Item 3. Key Information—D.

Risk Factors—Risks Relating to Our Corporate Structure” and “—Risks Relating to Doing Business in China”

in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference.

As

of the date of this prospectus supplement, except for the transfer of cash by Xiao-I to the WFOE described below, no cash transfer or

transfer of other assets by way of dividends or distributions have occurred among the Company, its subsidiaries, or the PRC operating

entities. Xiao-I intends to keep any future earnings to finance the expansion of its business, and it does not anticipate that any cash

dividends will be paid, or any funds will be transferred from one entity to another, in the foreseeable future. As such, Xiao-I has not

installed any cash management policies that dictate how funds are transferred among the Company, its subsidiaries, or investors, or the

PRC operating entities.

Xiao-I

is a holding company with no operations of its own. Xiao-I conducts its operations in China primarily through the PRC operating entities

in China. As a result, although other means are available for it to obtain financing at the holding company level, Xiao-I’s ability

to pay dividends and other distributions to its shareholders and to service any debt it may incur may depend upon dividends and other

distributions paid by Xiao-I’s PRC subsidiaries, which relies on dividends and other distributions paid by the PRC operating entities

pursuant to the VIE Agreements. If any of these entities incurs debt on its own in the future, the instruments governing such debt may

restrict its ability to pay dividends and other distributions to Xiao-I.

In

addition, dividends and distributions from Xiao-I’s PRC subsidiaries and the VIE are subject to regulations and restrictions on

dividends and payment to parties outside of China. Applicable PRC law permits payment of dividends to Xiao-I by WFOE only out of net

income, if any, determined in accordance with PRC accounting standards and regulations. A PRC company is not permitted to distribute

any profits until any losses from prior fiscal years have been offset by general reserve fund and profits (if general reserve fund is

not enough). Profits retained from prior fiscal years may be distributed together with distributable profits from the current fiscal

year. In addition, registered share capital and capital reserve accounts are also restricted from withdrawal in the PRC, up to the amount

of net assets held in each operating subsidiary. In contrast, there is presently no foreign exchange control or restrictions on capital

flows into and out of Hong Kong. Hence, Xiao-I’s Hong Kong subsidiary is able to transfer cash without any limitation to the Cayman

Islands under normal circumstances. As a result of these PRC laws and regulations, the PRC operating entities and WFOE are restricted

in their ability to transfer a portion of their net assets to the Company.

Further,

the PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the

PRC. Xiao-I’s WFOE generates primarily all of its revenue in Renminbi, which is not freely convertible into other currencies. As

a result, any restriction on currency exchange may limit the ability of Xiao-I’s WFOE to use its Renminbi revenues to pay dividends

to Xiao-I. The PRC government may continue to strengthen its capital controls, and more restrictions and substantial vetting process

may be put forward by State Administration of Foreign Exchange (the “SAFE”) for cross-border transactions falling under both

the current account and the capital account. Any limitation on the ability of Xiao-I’s WFOE to pay dividends or make other kinds

of payments to Xiao-I could materially and adversely limit its ability to grow, make investments or acquisitions that could be beneficial

to our business, pay dividends, or otherwise fund and conduct our business. Currently, seven of our shareholders did not register according

to the registration procedures stipulated in Circular 37 Registration of the SAFE when they conducted their other external investment

activities unrelated to us. As a result, these shareholders may be subject to penalties themselves, and WFOE may be unable to open a

new capital account with relevant banks within China according to their internal control policies and may be restricted from remitting

funds or handling other foreign exchange businesses within China unless and until we remediate the non-compliance. However, WFOE has

successfully opened a new capital account with Bank of Ningbo recently. Apart from a small amount of the IPO proceeds reserved for overseas

use, we were able to transfer the rest of the IPO proceeds from overseas to WFOE for VIE’s product development and operations through

both WFOE’s new capital account with Bank of Ningbo and WFOE’s pre-existing capital account with Agricultural Bank of China

where WFOE has reserved foreign exchange quota. So long as there are no changes to PRC laws and regulations, or internal control policies

of Bank of Ningbo, we are not aware of any substantial obstacles for WFOE to receive fund transfers to its capital account with Bank

of Ningbo from overseas in the near future. However, should there be any changes to PRC laws and regulations or internal control policies

of Bank of Ningbo in the future, WFOE then may be restricted from transferring funds from overseas to its capital account with Bank of

Ningbo as a result.

Moreover,

the transfer of funds among the PRC operating entities are subject to the Provisions of the Supreme People’s Court on Several Issues

Concerning the Application of Law in the Trial of Private Lending Cases (2020 Second Amendment Revision, the “Provisions on Private

Lending Cases”), which was implemented on January 1, 2021 to regulate the financing activities between natural persons, legal persons

and unincorporated organizations. As advised by Xiao-I’s PRC counsel, Jingtian & Gongcheng, the Provisions on Private Lending

Cases does not prohibit PRC operating entities from using cash generated from one PRC operating entity to fund another affiliated PRC

operating entity’s operations. Xiao-I or the PRC operating entities have not been notified of any other restriction which could

limit the PRC operating entities’ ability to transfer cash among each other. In the future, cash proceeds from overseas financing

activities, including this offering, may be transferred by Xiao-I to its wholly owned subsidiary AI Plus Holding Limited (“AI Plus”),

and then transferred to AI Plus’s wholly owned subsidiary Xiao-i Technology Limited (Xiao-i Technology”), and then transferred

to WFOE via capital contribution or shareholder loans, as the case may be. Cash proceeds may flow to Shanghai Xiao-i from WFOE pursuant

to certain contractual arrangements between WFOE and Shanghai Xiao-i as permitted by the applicable PRC regulations.

Under

Cayman Islands law, a Cayman Islands company may pay a dividend on its shares out of profit and/or premium account, provided that in

no circumstances may a dividend be paid out of share premium if this would result in the company being unable to pay its debts due in

the ordinary course of business. If Xiao-I determines to pay dividends on any of its Ordinary Shares in the future, as a holding company,

Xiao-I will rely on payments made from Shanghai Xiao-i to WFOE, pursuant to the VIE Agreements, and the distribution of such payments

to Xiao-i Technology from WFOE, and then to AI Plus from Xiao-i Technology, and then to Xiao-I from AI Plus as dividends, unless Xiao-I

receives proceeds from future offerings. Xiao-I does not expect to pay dividends in the foreseeable future. If, however, it declares

dividends on its Ordinary Shares, the depositary will pay you the cash dividends and other distributions it receives on Xiao-I’s

Ordinary Shares after deducting its fees and expenses in accordance with the terms set forth in the deposit agreement. See “Item

3. Key Information—D. Risk Factors—Risks Relating to Our Corporate Structure” in our annual report on Form 20-F for

the fiscal year ended December 31, 2023, which is incorporated herein by reference.

Additionally,

Xiao-I is subject to certain legal and operational risks associated with the operations of the PRC operating entities in China. PRC laws

and regulations governing the PRC operating entities’ current business operations are sometimes vague and uncertain, and therefore,

these risks may result in a material change in the PRC operating entities’ operations, significant depreciation of the value of

Xiao-I’s ADSs, or a complete hindrance of its ability to offer or continue to offer its securities to investors. Recently, the

PRC government initiated a series of regulatory actions and statements to regulate business operations in China with little advance notice,

including cracking down on illegal activities in the securities market, enhancing supervision over China-based companies listed overseas

using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity reviews and expanding the efforts

in anti-monopoly enforcement. We are required to make a filing with the China Securities Regulatory Commission (the “CSRC”)

for this offering. These risks could materially and adversely impact our operations and the value of our ADSs, significantly limit or

completely hinder our ability to continue to offer securities to investors, or cause the value of such securities to significantly decline

or become worthless, by existing or future laws and regulations relating to its business or industry or by intervene or interruption

by PRC governmental authorities, if the Company, or its subsidiaries or the PRC operating entities (i) do not receive or maintain such

permissions or approvals, (ii) inadvertently conclude that such permissions or approvals are not required, (iii) applicable laws, regulations,

or interpretations change and the Company, or its subsidiaries or the PRC operating entities are required to obtain such permissions

or approvals in the future, or (iv) any intervention or interruption by PRC governmental with little advance notice.

The

PRC operating entities’ operations in China are governed by PRC laws and regulations. Xiao-I’s PRC counsel, Jingtian &

Gongcheng, has advised Xiao-I that, as of the date of this prospectus, based on their understanding of the current PRC laws, regulations

and rules, Xiao-I, its subsidiaries, the PRC operating entities have received all requisite permissions and approvals from the PRC government

authorities for their business operations currently conducted in China.

Neither

Xiao-I nor its subsidiaries, nor the PRC operating entities received any denial of permissions for their business operations currently

conducted in China. These permissions and approvals include (without limitation) License for Value-added Telecommunications Services,

Business License, and Customs Declaration Entity Registration Certificate. Other than the CSRC filing procedure Xiao-I is required to

make after the completion of this offering, Xiao-I, its subsidiaries, the PRC operating entities, as advised by Jingtian & Gongcheng,

Xiao-I’s PRC counsel, (i) are not required to obtain permissions from the CSRC, and (ii) have not been asked to obtain or denied

such and other permissions by any PRC government authority, under current PRC laws, regulations and rules in connection with this offering

and as of the date of this prospectus.

However,

Xiao-I is subject to the risks of uncertainty of any future actions of the PRC government in this regard including the risk that Xiao-I

inadvertently concludes that the permissions or approvals discussed here are not required, that applicable laws, regulations or interpretations

change such that Xiao-I would be required to obtain approvals in the future, or that the PRC government could disallow Xiao-I’s

holding company structure, which would likely result in a material change in its operations, including its ability to continue its existing

holding company structure, carry on its current business, accept foreign investments, and offer or continue to offer securities to its

investors. These adverse actions could cause the value of Xiao-I’s ADSs to significantly decline or become worthless. Xiao-I may

also be subject to penalties and sanctions imposed by the PRC regulatory agencies, including the CSRC, if it fails to comply with such

rules and regulations, which would likely adversely affect the ability of Xiao-I’s securities to be listed on a U.S. exchange,

which would likely cause the value of Xiao-I’s securities to significantly decline or become worthless.

Permission

from Cyberspace Administration of China. Shanghai Xiao-i has applied for a cybersecurity review organized by the China Cybersecurity

Review Technology and Certification Center (the “Center”), which is authorized by the Cybersecurity Review Office of the

Cyberspace Administration of China (the “CAC”) to accept public consultation and cybersecurity review submissions, pursuant

to the Cybersecurity Review Measures, which became effective on February 15, 2022. On August 25, 2022, Shanghai Xiao-i received a written

notice from the Cybersecurity Review Office, pursuant to which cybersecurity review was not required for its initial public offering.

Our PRC counsel conducted a telephone consultation with the Center on March 6, 2024 (the “Consultation”). Based on the Consultation,

cybersecurity review is not required for any post-listing follow-on offering. As advised by Jingtian & Gongcheng, our PRC legal counsel,

based on the above, cybersecurity review is also not required for this offering.

PRC

Limitation on Overseas Listing and Share Issuances. The Regulations on Mergers and Acquisitions of Domestic Companies by Foreign

Investors, or the M&A Rules, adopted by six PRC regulatory agencies in 2006 and amended in 2009, requires an overseas special purpose

vehicle formed for listing purposes through acquisitions of PRC domestic companies, which are controlled by PRC companies or individuals

to obtain approval of the CSRC prior to the listing and trading of such special purpose vehicle’s securities on an overseas stock

exchange.

On

February 17, 2023, the CSRC published the Interim Administrative Measures on Overseas Securities Offering and Listing by Domestic Enterprises

(CSRC Announcement [2023] No. 43) (the “Overseas Listing Measures”), which took effect on March 31, 2023. Under the Overseas

Listing Measures, a filing-based regulatory system applies to “indirect overseas offerings and listings” of companies in

mainland China, which refers to securities offerings and listings in an overseas market made under the name of an offshore entity but

based on the underlying equity, assets, earnings or other similar rights of a company in mainland China that operates its main business

in mainland China. The Overseas Listing Measures states that, any post-listing follow-on offering by an issuer in an overseas market,

including issuance of shares, convertible notes and other similar securities, shall be subject to filing requirement within three business

days after the completion of the offering. In connection with the Overseas Listing Measures, on February 17, 2023 the CSRC also published

the Notice on the Administrative Arrangements for the Filing of Overseas Securities Offering and Listing by Domestic Enterprises (the

“Notice on Overseas Listing Measures”). According to the Notice on Overseas Listing Measures, issuers that have already been

listed in an overseas market by March 31, 2023, the date the Overseas Listing Measures became effective, are not required to make any

immediate filing and are only required to comply with the filing requirements under the Overseas Listing Measures when it subsequently

seeks to conduct a follow-on offering. Therefore, we are required to go through filing procedures with the CSRC after the completion

of this offering and for our future offerings and listing of our securities in an overseas market under the Overseas Listing Measures.

Other

than the CSRC filing procedure we are required to make after the completion of this offering, we and our PRC subsidiaries, as advised

by Jingtian & Gongcheng, our PRC legal counsel, (i) are not required to obtain permissions from the CSRC, and (ii) have not been

asked to obtain or denied such and other permissions by any PRC government authority, under current PRC laws, regulations and rules in

connection with this offering and as of the date of this prospectus. However, given (i) the uncertainties of interpretation and implementation

of relevant laws and regulations and the enforcement practice by relevant government authorities, (ii) the PRC government’s ability

to intervene or influence our operations at any time, and (iii) the rapid evolvement of PRC laws, regulations, and rules which may be

preceded with short advance notice, we may be required to obtain additional licenses, permits, registrations, filings or approvals for

our business operations, for this offering or offerings overseas in the future and our conclusion on the status of our licensing compliance

may prove to be mistaken. If (i) we do not receive or maintain any permission or approval required of us, (ii) we inadvertently concluded

that certain permissions or approvals have been acquired or are not required, or (iii) applicable laws, regulations, or interpretations

thereof change and we become subject to the requirement of additional permissions or approvals in the future, we may have to expend significant

time and costs to procure them. If we are unable to do so, on commercially reasonable terms, in a timely manner or otherwise, we may

become subject to sanctions imposed by the PRC regulatory authorities, which could include fines, penalties, and proceedings against

us, and other forms of sanctions, and our ability to conduct our business, invest into mainland China as foreign investments or accept

foreign investments, or list on a U.S. or other overseas exchange may be restricted, and our business, reputation, financial condition,

and results of operations may be materially and adversely affected.

For

more detailed information, see “Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China”

in our annual report on Form 20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference.

Pursuant

to the Holding Foreign Companies Accountable Act (the “HFCAA”), if the Public Company Accounting Oversight Board (the “PCAOB”),

is unable to inspect an issuer’s auditors for three consecutive years, the issuer’s securities are prohibited from trading

on a U.S. stock exchange. The PCAOB issued a Determination Report on December 16, 2021 (the “Determination Report”) which

found that the PCAOB is unable to inspect or investigate completely registered public accounting firms headquartered in: (1) mainland

China of the People’s Republic of China because of a position taken by one or more authorities in mainland China; and (2) Hong

Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more authorities in Hong Kong.

Furthermore, the Determination Report identified the specific registered public accounting firms which are subject to these determinations

(“PCAOB Identified Firms”). On June 22, 2021, United States Senate passed the Accelerating Holding Foreign Companies Accountable

Act (the “AHFCAA”), which, if enacted, would decrease the number of “non-inspection years” from three years to

two years, and thus, would reduce the time before Xiao-I’s securities may be prohibited from trading or delisted if the PCAOB determines

that it cannot inspect or investigate completely Xiao-I’s auditor. Our former auditor, Marcum Asia CPAs LLP (“Marcum Asia”),

the independent registered public accounting firm that issued the audit report for the years ended December 31, 2022 and 2021 incorporated

by reference in this prospectus, is a firm registered with the PCAOB and subject to laws in the U.S. pursuant to which the PCAOB conducts

regular inspections to assess its compliance with the applicable professional standards. Marcum Asia, is headquartered in New York, New

York, and, as of the date of this prospectus, was not included in the list of PCAOB Identified Firms in the Determination Report.

Xiao-I’s

current auditor, Assentsure PAC (“Assentsure”), the independent registered public accounting firm that issues the audit report

included elsewhere in this prospectus, as an auditor of companies that are traded publicly in the United States and a firm registered

with the PCAOB, is subject to laws in the U.S. pursuant to which the PCAOB conducts regular inspections to assess its compliance with

the applicable professional standards. Assentsure PAC, whose audit report is incorporated by reference in this prospectus, is headquartered

in Singapore, and, as of the date of this prospectus, was not included in the list of PCAOB Identified Firms in the Determination Report.

On

August 26, 2022, the PCAOB announced that it had signed a Statement of Protocol (the “Protocol”) with the CSRC and the Ministry

of Finance (“MOF”) of the People’s Republic of China, governing inspections and investigations of audit firms based

in mainland China and Hong Kong. Pursuant to the Protocol, the PCAOB conducted inspections on select registered public accounting firms

subject to the Determination Report in Hong Kong between September and November 2022.

On

December 15, 2022, the PCAOB board announced that it has completed the inspections, determined that it had complete access to inspect

or investigate completely registered public accounting firms headquartered in mainland China and Hong Kong, and voted to vacate the Determination

Report.

On

December 29, 2022, the Consolidated Appropriations Act, 2023 (the “CAA”) was signed into law by President Biden. The CAA

contained, among other things, an identical provision to the AHFCAA, which reduces the number of consecutive non-inspection years required

for triggering the prohibitions under the HFCAA from three years to two years.

Notwithstanding

the foregoing, Xiao-I’s ability to retain an auditor subject to the PCAOB inspection and investigation, including but not limited

to inspection of the audit working papers related to Xiao-I, may depend on the relevant positions of U.S. and Chinese regulators. Marcum

Asia’s audit working papers related to Xiao-I are located in China. With respect to audits of companies with operations in China,

such as the Company, there are uncertainties about the ability of its auditor to fully cooperate with a request by the PCAOB for audit

working papers in China without the approval of Chinese authorities. If the PCAOB is unable to inspect or investigate completely the

Company’s auditor because of a position taken by an authority in a foreign jurisdiction, or the PCAOB re-evaluates its determination

as a result of any obstruction with the implementation of the Protocol, then such lack of inspection or re-evaluation could cause trading

in the Company’s securities to be prohibited under the HFCAA, and ultimately result in a determination by a securities exchange

to delist the Company’s securities. Accordingly, the HFCAA calls for additional and more stringent criteria to be applied to emerging

market companies upon assessing the qualification of their auditors, especially the non-U.S. auditors who are not inspected by the PCAOB.

These developments could add uncertainties to Xiao-I’s offering.

See

“Item 3. Key Information—D. Risk Factors—Risks Relating to Doing Business in China” in our annual report on Form

20-F for the fiscal year ended December 31, 2023, which is incorporated herein by reference.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The total proceeds from the sale of Note, before

expenses is US$2,000,000. The total proceeds from the sale of the Pre-Delivery ADSs is $82.5, before expenses. We estimate the total expenses

of this offering and the sale of Note that will be payable by us, excluding certain expenses, will be approximately $107,332.

The Note, the Pre-Delivery ADSs and the Conversion

ADSs are a direct sale of securities to the Investor pursuant to a Securities Purchase Agreement dated October 30, 2024. There was no

placement agent for the sale of Note or in connection with this offering.

Prospectus Supplement dated October 31, 2024

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

document is in two parts. The first part is the prospectus supplement, which describes the specific terms of this offering of securities

and also adds to and updates information contained in the accompanying prospectus and the documents incorporated by reference into this

prospectus supplement and the accompanying prospectus. The second part is the accompanying prospectus dated May 20, 2024, included in

the registration statement on Form F-3 (No. 333-279306), including the documents incorporated by reference therein, which provides more

general information, some of which may not be applicable to this offering.

This

prospectus supplement provides specific terms of this offering of our ADSs, and other matters relating to us and our financial

condition. If the description of the offering varies between this prospectus supplement and the accompanying prospectus, you should rely

on the information in this prospectus supplement.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement and the accompanying prospectus

or any free writing prospectus provided in connection with this offering. We have not authorized any other person to provide you with

different information. If anyone provides you with different or inconsistent information, you should not rely on it. You should assume

that the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference

is accurate only as of their respective dates, regardless of the time of delivery of this prospectus supplement, the accompanying prospectus

or any other offering materials, or any sale of Convertible Promissory Note and ADSs. Our business, financial condition, results of operations

and prospects may have changed since those dates. We are not making an offer to sell these securities in any jurisdiction where the offer

or sale is not permitted. Neither this prospectus supplement nor the accompanying prospectus constitutes an offer, or an invitation on

behalf of us to subscribe for and purchase, any of the ADSs, and may not be used for or in connection with an offer or solicitation by

anyone, in any jurisdiction in which such an offer or solicitation is not authorized or to any person to whom it is unlawful to make

such an offer or solicitation.

It

is important for you to read and consider all the information contained or incorporated by reference in this prospectus supplement and

the accompanying prospectus in making your investment decision.

In

this prospectus supplement and the accompanying prospectus, unless otherwise indicated or unless the context otherwise requires, references

to:

| |

● |

“Shanghai Xiao-i”

or the “VIE” is to Shanghai Xiao-i Robot Technology Company Limited, a company limited by shares established and existing

under the laws of the PRC; |

| |

● |

“the PRC operating

entities” refers to the VIE, Shanghai Xiao-i, and its subsidiaries; |

| |

● |

“Memorandum and Articles

of Association” or “our memorandum and articles of association” means the amended and restated memorandum of association

(“Memorandum”) and the amended and restated articles of association (“Articles of Association”) of Xiao-I; |

| |

● |

“China” or

the “PRC” are to the People’s Republic of China, including the special administrative regions of Hong Kong and

Macau, and excluding Taiwan for the purposes of this annual report only; the term “Chinese” has a correlative meaning

for the purpose of this annual report; |

| |

● |

“mainland China”,

“mainland of PRC” or “mainland PRC” are to the mainland China of the PRC, excluding Taiwan, the special administrative

regions of Hong Kong and Macau for the purposes of this annual report only; the term “mainland Chinese” has a correlative

meaning for the purpose of this annual report; |

| |

● |

“Ordinary

Shares” are to the ordinary shares of the Company, par value US$0.00005 per share; |

| |

● |

“PRC

government”, “PRC regulatory authorities”, “PRC authorities”, “PRC governmental authorities”,

“Chinese government”, “Chinese authorities” or “Chinese governmental authorities” is to the government

of mainland China for the purposes of this annual report only; and the similar wordings have a correlative meaning for the purpose

of this annual report; |

| |

● |

“PRC

laws and regulations”, “PRC laws”, “laws of PRC”, “Chinese laws and regulations” or “Chinese

laws” are to the laws and regulations of mainland China; and the similar wordings have a correlative meaning for the purpose

of this annual report; |

| |

● |

“Preferred

Shares” are to the preferred shares of the Company, par value US$0.00005 per share; |

| |

● |

“$,”

“U.S.$,” “U.S. dollars,” “dollars” and “USD” are to U.S. dollars; |

| |

● |

“RMB”

and “¥” are to Renminbi; |

| |

● |

“Companies

Act” is to the Companies Act (As Revised) of the Cayman Islands. |

| |

● |

“ADSs”

refer to Xiao-I’s American depositary shares, each of which represents three Ordinary Shares. |

PROSPECTUS

SUPPLEMENT SUMMARY

This

prospectus supplement summary highlights selected information included elsewhere in or incorporated by reference into this prospectus

supplement and the accompanying prospectus and does not contain all the information that you should consider before making an investment

decision. You should read this entire prospectus supplement and the accompanying prospectus carefully, including the “Risk Factors”

sections and the financial statements and related notes and other information incorporated by reference, before making an investment

decision.

In

the following discussion of business, “we,” “us,” or “our” refer to Shanghai Xiao-i and its subsidiaries.

Business

Overview

Overview

Xiao-I

is a holding company incorporated in Cayman Islands. As a holding company with no material operation of its own, it conducts substantially

all our operations in China through a variable interest entity, or the VIE, Shanghai Xiao-i Robot Technology Co., Ltd., (“Shanghai

Xiao-i”) and its subsidiaries.

Shanghai

Yingsi Software Technology Co., Ltd. (“Incesoft”) was founded in 2001. Incesoft established the Xiaoi robot brand (Chinese:

小i机器人) and developed AI technology used to support its consumer-to-consumer business model. In 2009, Incesoft

transformed its business model from consumer-to-consumer to business-to-business. At the same time, founders of Incesoft founded Shanghai

Xiao-i, the VIE, which acquired the Xiaoi robot brand and Incesoft’s core AI technology. Following the acquisition, Incesoft was

dissolved by de-registering with local company registrar in accordance with PRC law in 2012. Since 2009, Shanghai Xiao-i has become a

leading artificial intelligence (“AI”) company by building on its wide technology commercialization, brand recognition and

culture of innovation in China.

Milestone

Accomplishments over 20 Years History

We

are a global leading cognitive artificial intelligence company. Since our establishment in 2001, We have been dedicated to continuous

innovation and breakthroughs in core technologies related to cognitive intelligence rooted in natural language processing. our development

goal is to achieve scalable implementation and commercialization of our innovative proprietary technologies.

We,

with over 22 years of technical accumulation and industry experiences, have become a leading force in the field of AI industrial application.

The company adheres to the mission of “serve and benefit more people with our AI technology” and focuses on the continuous

innovation and breakthrough of artificial intelligence technology development.

We

believe that we are the pioneer of virtual chatbot technology. We launched our first chatbot in 2004. Within two years, we applied chatbot

technology to the field of intelligent services and took the lead in creating industry application benchmark cases. We developed thousands

of business cases and provide our customers with a wide range of solutions from diversified products to superior customized services,

formulating a scale of business applications and a mature commercialization path, establishing our leading position in the artificial

intelligence industry.

As

a representative enterprise in the field of Cognitive AI, we led the development of the world’s first international standard in

affective computing, contributed to the drafting of the “China Artificial Intelligence Industry Intellectual Property White Paper”

for four consecutive years (from 2010 to 2013). As of June 9, 2024, Xiao-I have 334 authorized patents, along with 138 pieces of software

copyrights, 256 registered trademarks, and its accumulation of intellectual property demonstrates the company’s fruitful achievements

in technological innovation. We are also regarded by Gartner as the “representative of Conversational Al enterprises”, proving

the company’s outstanding position and influence in the industry worldwide.

On

June 29, 2023, we launched “Our Own ChatGPT” – Hua Zang Universal Large Language Model, which has a comprehensive coverage

of hundreds of capabilities of the LLM. It possesses the core features of “Controllable, Customizable, and Deliverable”,

solving the key challenges faced by global AI models. Building on the solid foundation of the Hua Zang Universal Large Language Model,

we launched the revolutionary Hua Zang Ecosystem on October 26, 2023 which carries significant implications in the industry. Based on

the Hua Zang Universal Large Language Model, through Hua Zang Developer Platform, it provides service guarantees such as cultivation,

marketing, and investment, connecting global ecosystem partners, customers, and developers. It constantly promotes the implementation

and commercialization of the customer application scenarios and use cases by Hua Zang LLM.

Currently,

dozens of co-created achievements have been successfully implemented, helping partners further commercialize in vertical fields. Hua

Zang Ecosystem is now continuously collaborating with thousands of ecosystem partners, covering 50+ industry fields, involving various

fields such as IoT, finance, healthcare, maternal and infant, automobile, manufacturing, operator etc. This validates the commercialization

path of the Hua Zang Ecosystem and lays a solid foundation for further promoting the large-scale implementation of Hua Zang Universal

Large Language Model in various industries.

Actively

expanding into the international markets is a key driver of future revenue growth for Xiao-I. We set up our APAC headquarter in Hong

Kong in 2018. In 2023, Xiao-I is publicly traded on the Nasdaq Stock Market (NASDAQ: AIXI). In addition, we established our wholly owned

subsidiaries both in the United States and the UAE to implement our global business expansion plan.

Product

and Technology Overview

Overall

Architecture of Xiao-i Products and Technologies

Prior

to the introduction of Hua Zang LLM in June 2023, the overall architecture of our products and technologies is divided into three layers:

(1) infrastructure, (2) aggregation empowerment platform and (3) domain application. With the participation of Hua Zang LLM, we reformed

the product line into Model as a service (MaaS) and non-MaaS.

Infrastructure

Layer

Our

infrastructure layer provides the informational support for our products and technologies. Typically built with third-party products

and technologies, we integrate the information into the infrastructure layer. Additional properties include:

| |

● |

Compatibility

with cloud native and private or third-party cloud platforms; |

| |

● |

Ubiquitous

perception layer connection enabling integration with the Internet of Things, the Internet, 5G, and dedicated networks; and |

| |

● |

Multidimensional

data collection and integration, including spatiotemporal, channels, and community. |

Aggregation

Empowerment Platform Layer

AI

Core Technology Platform — Cognitive Intelligence Artificial Intelligence (CIAI)

Using

proprietary intellectual property technologies, we have independently developed CIAI, our core technology platform. To date, we have

developed and commercialized six core technologies based on CIAI: (1) natural language processing, (2) speech processing, (3) computer

vision, (4) machine learning, (5) affective computing and (6) data intelligence and hyperautomation.

| |

● |

Natural

Language Processing |

| |

● |

CIAI’s

multilingual, natural language processing capability extracts and analyzes information, mines text, constructs knowledge, and performs

knowledge representation and reasoning based on words, phrases, sentences, and text, providing solutions to the human-computer interaction

needs of diverse enterprises and professional users. |

| |

● |

The hybrid

architecture of Time-Delay Neural Network + Deep Feedforward Sequential Memory Network + attention, in combination with our vast

corpus accumulation of more than ten years, has enabled us to train our intelligent voice technology for end-to-end application across

various scenarios in numerous fields. Based on these technologies, we have built a variety of intelligent voice solutions under the

Aviation Industry Computer-Based Training Committee framework, including intelligent Interactive Voice Response navigation, intelligent

outbound call, intelligent agent assistance, intelligent voice quality inspection, and intelligent coaching. |

| |

● |

We offer

various computer vision capabilities, including face recognition and analysis, multi-target tracking, human posture and action recognition,

and scene analysis capabilities such as semantic and instance segmentation. In terms of Optical Character Recognition (“OCR”),

we have general OCR and customized OCR for all types of cards, invoice, receipts, tickets, and more. In terms of construction drawing

analysis, we apply various capabilities including pattern recognition and computer vision to comprehensively analyze and process

CAD drawings, bringing to life standard review capability for construction drawings. Relating to engineering, we provide rapid engineering

customization through its internally-developed deep learning framework. We also offer model distillation and pruning solutions to

meet clients’ model compression requirements. This high performance framework is adaptable to various environments. |

| |

● |

Machine

learning methods offered by us include everything from traditional machine learning to the latest deep learning, reinforcement learning,

active learning, transfer learning, and generative adversarial networks (“GAN”). These methods are applied across multiple

fields such as natural language processing, speech recognition, vision recognition and analysis, and in business scenarios such as

precision marketing, personalized recommendation, and risk assessment in combination with massive data and distribution processing

algorithms to form an efficient human-computer collaborative learning system. |

| |

● |

Deep learning

technology is used to recognize, understand, process, and simulate human emotions, so as to realize multi-dimensional and multimodal

affective computing capabilities such as text, voice and vision. We have built affective computing, analysis, and interactive processing

capabilities that process real-time perception, intelligent planning, automatic simulation, and this technology has been widely used

in various practical business scenarios. |

| |

● |

Data

Intelligence and Hyperautomation |

| |

● |

Large-scale

machine learning technology mines, analyzes, and processes massive amounts of data, the assets of which are comprehensively integrated

to extract information contained therein. Business processes are automatically and quickly identified, reviewed, and executed in

combination with innovative technologies such as process automation and low code. The results enable enterprises to delegate simple

tasks with high repeatability, as well as complex tasks, to AI and data enhancement, thereby improving the quality and efficiency

of business operations. Applications include data monitoring, data analysis, user profiling, business process automation, financing

business automation, financial business automation, supply chain business automation, IT operation, and maintenance and integration

automation. |

Our

Product Platforms

We

have commercialized our six core technologies to create the following product platforms: (1) Conversational AI, (2) Knowledge Fusion,

(3) Intelligence Voice, (4) Hyperautomation, (5) Data Intelligence, (6) Cloud, (7) Intelligent Construction Support, (8) Vision Analysis,

(9) Intelligent Hardware Support, and (10) Metaverse.

| |

● |

Conversational

AI Platform |

| |

● |

Our conversational

AI platform makes full use of deep learning, data enhancement, and active learning technologies, employing flexible and diverse dialog

management and context processing mechanisms, and driven by a powerful learning system, the results of which achieve in-depth scenario

dialog processing, intent recognition, and complex logic reasoning in combination with structured knowledge and semantic analysis

capabilities. Additionally, the platform realizes the business value of conversational AI in a variety of application scenarios,

including intelligent customer service, smart marketing, intelligent hardware, intelligent assistant, agent assistance, and intelligent

human-computer training. |

| |

● |

Knowledge

Fusion Platform |

| |

● |

The knowledge

fusion platform integrates various types of knowledge such as Q&A, documents, multimedia, information forms, business processes,

knowledge graphs, and multimodal to assist enterprises in improving knowledge management capabilities, building intelligent service

cores, supporting intelligent knowledge management, retrieval, recommendation, application assistance, cognitive reasoning, and other

capabilities. It helps enterprise-level intelligent applications, improves work efficiency, optimizes user experience, and reduces

enterprise operating costs. |

| |

● |

Intelligent

Voice Platform |

| |

● |

Our intelligent

voice platform (“IVP”) uses natural language processing (“NLP”), automatic speech recognition, voiceprint

recognition, and text-to-speech technologies with human-computer interaction as its core, in combination with various business scenarios,

to comprehensively create or enhance business capabilities such as intelligent speech solutions, thereby realizing the macro processes

of intelligent IVP, intelligent outbound calls, speech analysis, agent assistance, and human-computer interaction. |

| |

● |

Hyperautomation

Platform |

| |

● |

The hyperautomation

platform innovatively uses low code technology in combination with agents to realize and expand vast capabilities of the traditional

low code platform and Robotic Process Automation. It integrates technologies such as OCR, NLP, and visualized data mining and analysis,

enables users to realize business and process automation, combines capabilities of knowledge base and imitation learning, and enables

realization of business and process intelligence with intelligent planning capabilities. |

| |

● |

Data

Intelligence Platform |

| |

● |

The data

intelligence platform comprehensively integrates data assets, manages the entire life cycle of data, realizes the entire cycles of

data integration, processing, transformation, analysis, and mining through What You See Is What You Get with the support of component-based

data visualization technology. It also helps clients extract valuable information contained in data, and provides assistance in business

and process automation, business prediction, decision support, among others, and improves the efficiency of data-driven business

intelligence and business intelligence services. |

| |

● |

The cloud

platform is a comprehensive platform that integrates our various core technical capabilities, such as NLP capability, speech recognition

capability, image recognition capability, data analysis capability, etc. The platform can provide fast and simple access to different

technical capabilities for various customers and can also provide independent technical capabilities for customers of different types

and even industries. Enterprises can flexibly configure according to the technical capabilities of the platform. The platform has

features such as rich capabilities, simple and easy to use, flexible structure, and strong scalability. Whether it is improving customer

service level, increasing service types and content, or expanding technical capabilities, the platform can easily expand and support. |

| |

● |

Intelligent

Construction Support Platform |

| |

● |

Our intelligent

construction support platform offers many capabilities such as parsing, reconstruction, visualization, and multi-dimensional analysis

of construction drawings. Combined with a variety of construction application scenarios, the platform can realize intelligent construction

drawings review, design assistance, online collaborative design, among other applications. It enables the construction industry to

reduce the cost of drawing review, improve per-capita energy efficiency, empowers the construction industry value chain, and facilitates

the transformation and upgrading of intelligence and automation. |

| |

● |

Vision

Analysis Platform |

| |

● |

The vision

analysis platform uses a variety of computer vision-related technologies to apply OCR, detection, video, and image analysis, helps

clients extract and mine valuable information contained in images, and realizes business automation, industrial defect detection,

monitoring analysis, and other innovative applications encountered in specific business scenarios. |

| |

● |

Intelligent

Hardware Support Platform |

| |

● |

The intelligent

hardware support platform provides the framework of signal collection, processing, analysis, prediction, and more. This framework

can be combined with various sensors to quickly process signal, select and adapt appropriate machine learning algorithms for business

modeling according to the intelligent requirements of various types of hardware, make full use of various machine learning capabilities

to make the equipment be more intelligent. |

| |

● |

We developed

the first virtual digital human in 2016 and released it for the first time at the Guiyang Digital Expo in 2017. We continue to innovate

and develop more advanced and smarter digital human products. Digital human with multimodal emotional interaction capabilities can

be widely used in various business scenarios including film and television production, media, games, financial services, culture,

tourism, education, healthcare, and retail. |

Domain

Application Layer

For

more than 20 years, we have applied our aggregation platform to form a number of mature application fields designed to address the business

needs of various fields, including (1) AI + Contact Center, (2) AI + Finance, (3) AI + Urban Public Service, (4) AI + Construction, (5)

AI + Metaverse, (6) AI + Manufacturing and (7) AI + Smart Healthcare.

Our

technologies are based, in significant part, upon our proprietary intellectual property portfolio. As of June 9, 2024, we have applied

for 578 patents, 334 of which have been granted and we have obtained 256 registered trademarks and 138 computer software copyrights.

In June 2020, the company passed the national intellectual property management system certification and obtained the certificate. This

certificate represents that the company’s intellectual property management system conforms to the GB/T 29490-2013 standard. We

continue to develop and improve our intellectual property portfolio through our deep R&D department. As of March 31, 2024, we have

158 R&D personnel, accounting for about 56.2% of our personnel, including 104 with bachelor’s degrees, 17 with master’s

degrees and 7 with doctorates.

Our

primary services are software services provided by our cloud platform. Software services refer to the sales of software products corresponding

to the Company’s obtained patents or software copyrights to customers for meeting the needs of different customers in different

industries for artificial intelligence:

(1)

Contact Center: We leverage contact center AI solutions to improve customer experience and operational efficiency. We offer AI-based

platforms, software tools and services that leverage voice-based assistants to facilitate strong interactions and engagement in different

industries, including both small and medium enterprises and large enterprises.

(2)

Architectural Design AI services We provide professional architectural drawing review solutions. By using computer vision, natural

language processing technology and our unique map, image morphology processing, pattern recognition, image segmentation, image target

detection, path planning, OCR and many other independent research and development technologies, combined with the rich professional experience

in architectural design, we have launched AI products for blueprint review to achieve automation and intelligence, enabling the architecture

industry to reduce the cost of reviewing blueprints, improving the efficiency, and cross-institution collaborative drawing review.

(3)

Smart City We use natural language processing, data intelligence and other technologies to build a cognitive brain for smart city

public services, and continuously improves the level of urban intelligence from social service efficiency and public experience. We provide

solutions such as smart city service hotline, smart public service and smart legal services.

With

the introduction of Hua Zang LLM in June 2023, we reformed our product line.

Hua

Zang LLM: Ecosystem and LLM Commercialization

Hua

Zang LLM

The

LLM is not a novel entity; rather, it represents an integrated system that combines a variety of cutting-edge technologies with established

AI technologies. With over two decades of technology accumulations in the field of cognitive intelligence, Xiao-I’s transition

from traditional AI products to LLM product is a natural progression.

In

the year 2023, our company has reaffirmed our position at the forefront of technological innovation with the introduction of the “Hua

Zang Universal Large Language Model” on June 29, 2023. This model is a comprehensive AI solution that encompasses a vast array

of capabilities, setting a new standard in the industry with its core attributes of being controllable, customizable, and deliverable.

It addresses prevalent challenges within the global AI landscape with innovative solutions. Leveraging the robust framework of the Hua

Zang Universal Large Language Model, we further expanded our technological impact with the unveiling of the transformative Hua Zang Ecosystem

on October 26, 2023. This ecosystem is expected to have a significant and lasting impact on the industry. The Hua Zang Developer Platform

serves as the backbone of this ecosystem, offering a suite of services including development support, market outreach, and financial

investment, thereby fostering a dynamic network that connects global partners, customers, and developers.

Hua

Zang Ecosystem and Commercialization

The

“1+1+3” framework of the Hua Zang ecosystem comprises a set of foundation models, a product support platform, and three service

guarantees.

The

“a set of foundation models” refers to the Xiao-i Hua Zang LLM, which possesses the core features of “controllability,

customizability, and deliverability.” It incorporates technical characteristics such as deep learning models, pre-training and

fine-tuning, multi-level attention mechanisms, context modeling and awareness, multi-task learning, and domain knowledge integration.

This enables efficient and accurate natural language processing capabilities, demonstrating excellent adaptability and scalability. Leveraging

its robust core technology, the Xiao-i Hua Zang LLM boasts hundreds of generic large model capabilities, including comprehension and

generation of complex texts, mathematical reasoning, among others. For instance, it can understand article information and intent, extract

key information based on requirements, and rapidly analyze emotional tones in texts. Moreover, through continuous iteration and innovation,

it achieves multi-modal capabilities such as text-to-image, text-to-edit image, and image-to-text conversions. Moreover, in response

to customers’ diverse business needs and budgets, Xiao-i offers a range of models of different sizes, enabling more flexible solutions

to meet the demands of different business scenarios.

The

“a product support platform” refers to the Hua Zang Developer Platform, comprising sections for development, applications,

and operations. It assists ecological partners in developing applications based on Hua Zang LLM, conveniently training their own LLMs

with lower costs, faster access and direct productization. This embodies the Hua Zang ecosystem’s principles of “faster,

lower, and more effective.”

The

“three service guarantees” refer to the resource empowerment provided by Xiao-i through cultivation, market development,

and investment. Hua Zang Ecosystem offers a wealth of courses and training services. Additionally, it offers integrated marketing and

promoting services, product co-developing and media. Furthermore, through the Hua Zang investment platform, it assists ecological partners

in achieving business growth and expanding commercial value.

The

key to the sustainable development and iteration of LLMs lies in commercialization, and the best way to achieve commercialization is

to create a complete industry application ecosystem. Hua Zang ecosystem not only signifies a significant step forward for Xiao-i in the

commercialization of LLMs but also marks an important exploration in the commercialization path for the entire artificial intelligence

large model industry.

Business

Model

We

offer two different product lines: (i) Model as a service (“MaaS”) and (ii) non-MaaS. The MaaS product line includes the

development and training, optimization and integration, service packaging and API design of the model, local deployments and subscription

of our model products. Additionally, the MaaS product line also includes service and others, as customization is required to catering

the demand of clients. The non-MaaS product line includes the needs assessment, solution design and architecture planning, development

and configuration, deployment and implementation of our non-model products.

Xiao-I’s

History and Corporate Structure

Xiao-I

was incorporated in the Cayman Islands on August 13, 2018, with limited liability under the Companies Act. Upon incorporation, the

authorized share capital of the Company was US$50,000 divided into 1,000,000,000 shares, par value of US$0.00005 each, comprising of

1,000,000,000 Ordinary Shares of a par value of US$0.00005 each.

As

a holding company with no material operations of its own, Xiao-I conducts a substantial majority of its operations through Shanghai Xiao-i

Robot Technology Co., Ltd. (“Shanghai Xiao-i”), a variable interest entity (the “VIE”), in the People’s

Republic of China, or “PRC” or “China.” Investors in Xiao-I’s ADSs should be aware that they may never

hold equity interests in the VIE, but rather purchasing equity interests solely in Xiao-I, the Cayman Islands holding company, which

does not own any of the business in China conducted by the VIE and the VIE’s subsidiaries (“the PRC operating entities”).

Xiao-I’s indirect wholly owned subsidiary, Zhizhen Artificial Intelligent Technology (Shanghai) Co. Ltd. (“Zhizhen Technology”

or “WFOE”) entered into a series of contractual arrangements that establish the VIE structure (the “VIE Agreements”).

The VIE structure is used to provide investors with exposure to foreign investment in China-based companies where Chinese law prohibits

direct foreign investment in the operating companies. Xiao-I has evaluated the guidance in FASB ASC 810 and determined that Xiao-I is

the primary beneficiary of the VIE, for accounting purposes, based upon such contractual arrangements. ASC 810 requires a VIE to be consolidated

if the company is subject to a majority of the risk of loss for the VIE or is entitled to receive a majority of the VIE’s residual

returns. A VIE is an entity in which a company or its WFOE, through contractual arrangements, is fully and exclusively responsible for

the management of the entity, absorbs all risk of losses of the entity (excluding non-controlling interests), receives the benefits of

the entity that could be significant to the entity (excluding non-controlling interests), and has the exclusive right to exercise all

voting rights of the entity, and therefore the company or its WFOE is the primary beneficiary of the entity for accounting purposes.

Under ASC 810, a reporting entity has a controlling financial interest in a VIE, and must consolidate that VIE, if the reporting entity

has both of the following characteristics: (a) the power to direct the activities of the VIE that most significantly affect the VIE’s

economic performance; and (b) the obligation to absorb losses, or the right to receive benefits, that could potentially be significant

to the VIE. Through the VIE Agreements, the Company is deemed the primary beneficiary of the VIE for accounting purposes. The VIE has

no assets that are collateral for or restricted solely to settle its obligations. The creditors of the VIE do not have recourse to the

Company’s general credit. Accordingly, under U.S. GAAP, the results of the PRC operating entities are consolidated in Xiao-I’s

financial statements. However, investors will not and may never hold equity interests in the PRC operating entities. The VIE Agreements

may not be effective in providing control over Shanghai Xiao-i. Uncertainties exist as to Xiao-I’s ability to enforce the VIE Agreements,

and the VIE Agreements have not been tested in a court of law. The Chinese regulatory authorities could disallow this VIE structure,

which would likely result in a material change in the PRC operating entities’ operations and the value of Xiao-I’s ADSs,

including that it could cause the value of such securities to significantly decline or become worthless. See “Item 3. Key Information—D.

Risk Factors —Risks Related to Our Corporate Structure” and “Item 7. Major Shareholders and Related Party Transactions

—B. Related Party Transactions —Consolidation” in our annual report Form 20-F filed with the SEC on April 30, 2024.

Xiao-I

is a holding company with no operations of its own. Xiao-I conducts its operations in China primarily through the PRC operating entities

in China. As a result, although other means are available for us to obtain financing at the holding company level, Xiao-I’s ability

to pay dividends and other distributions to its shareholders and to service any debt it may incur may depend upon dividends and other

distributions paid by Xiao-I’s PRC subsidiaries, which relies on dividends and other distributions paid by the PRC operating entities

pursuant to the VIE Agreements. If any of these entities incurs debt on its own in the future, the instruments governing such debt may

restrict its ability to pay dividends and other distributions to Xiao-I.

In

addition, dividends and distributions from WFOE and the VIE are subject to regulations and restrictions on dividends and payment to parties

outside of China. Applicable PRC law permits payment of dividends to Xiao-I by WFOE only out of net income, if any, determined in accordance

with PRC accounting standards and regulations. A PRC company is not permitted to distribute any profits until any losses from prior fiscal

years have been offset by general reserve fund and profits (if general reserve fund is not enough). Profits retained from prior fiscal

years may be distributed together with distributable profits from the current fiscal year. In addition, a wholly foreign-owned enterprise

is required to set aside at least 10% of its accumulated after-tax profits each year, if any, to fund a certain statutory reserve fund,

until the aggregate amount of such fund reaches 50% of its registered capital. Moreover, registered share capital and capital reserve

accounts are also restricted from withdrawal in the PRC, up to the amount of net assets held in each operating subsidiary. In contrast,

there is presently no foreign exchange control or restrictions on capital flows into and out of Hong Kong. Hence, Xiao-I’s Hong

Kong subsidiary is able to transfer cash without any limitation to the Cayman Islands under normal circumstances.

Further,

the PRC government also imposes controls on the conversion of RMB into foreign currencies and the remittance of currencies out of the

PRC. Xiao-I’s WFOE generates primarily all of its revenue in Renminbi, which is not freely convertible into other currencies. As

a result, any restriction on currency exchange may limit the ability of Xiao-I’s WFOE to use its Renminbi revenues to pay dividends

to Xiao-I. The PRC government may continue to strengthen its capital controls, and more restrictions and substantial vetting process

may be put forward by State Administration of Foreign Exchange (the “SAFE”) for cross-border transactions falling under both

the current account and the capital account. Any limitation on the ability of Xiao-I’s WFOE to pay dividends or make other kinds

of payments to Xiao-I could materially and adversely limit its ability to grow, make investments or acquisitions that could be beneficial

to our business, pay dividends, or otherwise fund and conduct our business. As of 2023, seven of our shareholders did not register according

to the registration procedures stipulated in Circular 37 Registration of the SAFE when they conducted their other external investment

activities unrelated to us. As a result, these shareholders may be subject to penalties themselves, and WFOE may be unable to open a

new capital account with relevant banks within China according to their internal control policies and may be restricted from remitting

funds or handling other foreign exchange businesses within China unless and until we remediate the non-compliance. In 2023, WFOE has

successfully opened a new capital account with Bank of Ningbo. Apart from a small amount of the IPO proceeds reserved for overseas use,

we were able to transfer the rest of the IPO proceeds from overseas to WFOE for VIE’s product development and operations through

both WFOE’s new capital account with Bank of Ningbo and WFOE’s pre-existing capital account with Agricultural Bank of China

where WFOE has reserved foreign exchange quota. So long as there are no changes to PRC laws and regulations, or internal control policies

of Bank of Ningbo, we are not aware of any substantial obstacles for WFOE to receive fund transfers to its capital account with Bank

of Ningbo from overseas in the near future. However, should there be any changes to PRC laws and regulations or internal control policies

of Bank of Ningbo in the future, WFOE then may be restricted from transferring funds from overseas to its capital account with Bank of

Ningbo as a result.

Additionally,

the transfer of funds among the PRC operating entities are subject to the Provisions on Private Lending Cases, which was implemented

on January 1, 2021, to regulate the financing activities between natural persons, legal persons and unincorporated organizations. The

Provisions on Private Lending Cases does not prohibit using cash generated from one PRC operating entity to fund another affiliated PRC

operating entity’s operations. Xiao-I or the PRC operating entities have not been notified of any other restriction which could

limit the PRC operating entities’ ability to transfer cash among each other.

Organizational

Structure.

The

following diagram illustrates the corporate legal structure of Xiao-I as of the date of this prospectus.

The

following diagram illustrates the ownership of the VIE, Shanghai Xiao-i as of the date of this prospectus.

Corporate

Information

Our

principal executive offices are located at 7th floor, Building 398, No. 1555 West, Jinshajiang Rd, Shanghai, China., People’s Republic

of China. The telephone number at our executive offices is +86 021-39512112. Our registered office in the Cayman Islands is located at

the office of ICS Corporate Services (Cayman) Limited, P.O. Box 30746, #3-212 Governors Square, 23 Lime Tree Bay Avenue, Cayman Islands.

Our agent for service of process in the United States is GKL Corporate/Search, Inc. One Capitol Mall, Suite 660 Sacramento, CA 95814.

We

are subject to the periodic reporting and other informational requirements of the Exchange Act as applicable to foreign private issuers.

Under the Exchange Act, we are required to file reports and other information with the SEC. Specifically, we are required to file annually

a Form 20-F within four months after the end of each fiscal year. The SEC also maintains a website at www.sec.gov that contains reports,

proxy and information statements, and other information regarding registrants that make electronic filings with the SEC using its EDGAR

system. Such information can also be found on our investor relations website at https://www. ir.xiaoi.com. Information on our website

is not incorporated by reference into this prospectus, any prospectus supplement or into any information incorporated herein by

reference. You should not consider information on our website to be part of this prospectus, prospectus supplement, any free writing

prospectus or any information incorporated by reference herein.

SUMMARY

OF RISK FACTORS

An

investment in our ADSs is subject to a number of risks, including but not limited to risks related to doing business in China, risks

related to our corporate structure, risks related to our business and industry, , and risks related to ownership of our ADSs. Investors

should carefully consider all of the information in this Annual Report before making an investment in the ADSs. The following list summarizes

some, but not all, of these risks. Please read the information in the section below entitled “Risk Factors” for a more thorough

description of these and other risks.

Risks

Related to This Offering

| ● | If

you purchase securities in this offering, you will suffer immediate dilution of your investment. |

| ● | Since

our management will have broad discretion in how we use the proceeds from this offering,