UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For the month of October 2024

Commission File Number 001-41631

Xiao-I Corporation

(Translation of registrant’s name into English)

5/F, Building 2, No. 2570

Hechuan Road, Minhang District

Shanghai, China 201101

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

INFORMATION CONTAINED IN THIS REPORT ON

FORM 6-K

On October 28, 2024, Xiao-I Corporation (“Xiao-I”)

released its unaudited semi-annual report for the six months ended June 30, 2024, which report is furnished as Exhibit 99.1 to this Report

on Form 6-K.

On June 26, 2024, a putative securities class

action lawsuit was filed in the Supreme Court of the State of New York, naming Xiao-I Corporation (the “Company”), Hui Yuan,

Wei Weng, Wenjing Chen, Xiaomei Wu, Jun Xu, Zhong Lin, and H. David Sherman, among others, as defendants. The case is captioned

Milev v. Xiao-I Corporation et al., Index No. 653294/2024. The initial complaint alleged violations of Sections 11 and 15 of the

Securities Act of 1933 (the “Securities Act”) based on allegedly false and misleading statements and material omissions in

the registration statement and prospectus the Company issued in connection with its March 13, 2023 initial public offering (the “Offering

Documents”). On September 13, 2024, the plaintiff filed an amended class action complaint against the same defendants.

The amended complaint alleges violations of Sections 11 and 15 of the Securities Act based on purportedly false and misleading statements

and material omissions in the Company’s Offering Documents. Specifically, it alleges that the Company did not disclose certain

line items in its statement of comprehensive income in violation of Section 210.5-03 of Regulation S-X. The purported class in the amended

complaint includes all persons who purchased or otherwise acquired Xiao-I securities in the initial public offering, or who purchased

Xiao-I securities thereafter pursuant and/or traceable to the Offering Documents. Defendants will move to dismiss the amended complaint

on or before October 31, 2024. While the Company cannot predict the outcome of this matter, it believes the putative class action

to be without merit and plans to vigorously defend itself. At this time, we cannot reasonably estimate the maximum potential exposure

or the range of possible loss for this matter.

On October 15, 2024, a putative securities class

action was filed in the United States District Court for the Southern District of New York, naming Xiao-I Corporation (the “Company”)

and certain of its officers and directors, among others, as defendants. The case is captioned Yunfan Fan v. Xiao-I Corporation et

al., 24-cv-07837. The operative complaint alleges violations of Sections 11 and 15 of the Securities Act of 1933 as well as violations

of Section 10(b) and 20(a) of the Securities Exchange Act of 1934 and Rule 10b-5 thereunder. The Complaint alleges that Xiao-I’s

Registration Statement and Prospectus filed in conjunction with its March 9, 2023 initial public offering (together, the “Offering

Documents”), as well as certain of its subsequent periodic reports, contained material misstatements and/or omissions concerning:

(i) certain of the Company’s Chinese stockholders’ compliance with Circular 37 Registration; (ii) the Company’s compliance

with GAAP; (iii) the Company’s efforts to remediate disclosed material weaknesses in its controls over financial reporting; (iv)

the impact of the Company’s research and development expenses on its business and financial results; and (v) the Company’s

compliance with the NASDAQ's Minimum Bid Price Requirement. The purported class in the operative complaint includes all persons who purchased

Xiao-I securities either (i) pursuant and/or traceable to the Offering Documents and/or (ii) between March 9, 2023 and July 12, 2024.

Motions for appointment as lead plaintiff must be filed on or before December 16, 2024. As of the date of this filing, Xiao-I

has not been formally served. While the Company cannot predict the outcome of this matter, it believes the putative class action to be

without merit and plans to vigorously defend itself. At this time, we cannot reasonably estimate the maximum potential exposure

or the range of possible loss for this matter.

INCORPORATION BY REFERENCE

The Form 6-K and the

exhibit to the Form 6-K, including any amendment and report filed for the purpose of updating such document, are incorporated by reference

into the registration statements on Form S-8 (SEC File No. 333-275743) and Form F-3 of Xiao-I Corporation (the “Company”),

as amended (SEC File No. 333-279306) (including any prospectuses forming part of such registration statements), and shall be a part thereof

from the date on which this report is furnished, to the extent not superseded by documents or reports subsequently filed or furnished.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| Date: October 28, 2024 |

Xiao-I Corporation |

| |

|

| |

By: |

/s/ Hui Yuan |

| |

|

Name: |

Hui Yuan |

| |

|

Title: |

Chief Executive Officer |

Exhibit 99.1

Xiao-I

Corporation Reports Unaudited 2024 First Half Financial Results

SHANGHAI, October

28, 2024 -- Xiao-I Corporation (NASDAQ: AIXI) (“Xiao-I” or the “Company”), a leading artificial intelligence

company, today reported its unaudited financial results for the six months ended June 30, 2024.

Financial and Business Highlights:

| ● | Net Revenues: Xiao-I posted net revenues of $32.95 million for H1 2024, an increase from

$26.48 million in H1 2023, representing a 24.5% YoY growth, driven primarily by strong contributions from Hua Zang LLM (large

language model) and Technology Development Services. |

| ● | Gross Margin: Gross margin declined to 64.5% in H1 2024, compared to 77.3% in H1

2023. The decrease was primarily due to the growing scale of Technology Development Services and the delivery phase of Hua Zang LLM, which

incurs higher costs during pre-training and fine-tuning. However, once models enter the subscription phase, gross margins are expected

to improve. Long-term gross margins are projected to stabilize at 60-70%. |

| ● | Total Operating Expenses: Operating expenses increased slightly to $36.10 million in H1

2024, up from $34.10 million in H1 2023. |

| ● | R&D Expenses: R&D expenses were reduced to $26.90 million in H1 2024 from $29.65

million in H1 2023, a 9.3% reduction, as AI systems reached maturity and development efforts became more efficient. |

| ● | Net Loss: Xiao-I reported a net loss of $15.54 million in H1 2024, compared to $18.77

million in H1 2023. |

Hua Zang LLM and Transition to MaaS:

Xiao-I’s Hua Zang LLM, with capabilities

similar to ChatGPT, has been a key driver behind the Company’s growth in the first half of 2024. Corporations are prioritizing AI

adoption, and we believe Hua Zang’s unique ability to deploy locally addresses critical security and confidentiality concerns. This

advantage, particularly appealing to organizations managing sensitive information, has fueled the growth of the Company’s Model-as-a-Service

(MaaS) solutions. By integrating customized AI models for large corporations, Xiao-I has established scalable, long-term revenue through

a subscription-based approach. Additionally, the transition of its AI Chatbot clients from upfront licensing to MaaS has further contributed

to predictable revenue streams.

Outlook for B2C and Overseas Expansion:

The Company is also enthusiastic about its B2C

initiatives, particularly the Hearview AI glasses, which offer cutting-edge AI technology intended to assist individuals with hearing

impairments. Xiao-I is committed to driving AI innovation in this market, with plans to expand its reach through strategic partnerships.

Furthermore, the Company is actively exploring overseas opportunities engaging in ongoing discussions with potential clients in the U.S.

for its Hua Zang LLM, which could position Xiao-I for significant international growth.

CEO’s Statement:

“Our performance in H1 2024 reflects the

increasing demand for secure, customizable AI solutions, particularly in our Hua Zang LLM, which addresses key security concerns for our

clients. We expect continued growth as we scale these services and transition more clients to our MaaS model,” said Mr. Hui Yuan.

Outlook for H2 2024:

Xiao-I maintains its full-year revenue projection

of $73 million and expects stronger performance in the second half, driven by continued MaaS adoption and customized AI services. The

Company anticipates that the net loss will be reduced through revenue growth and ongoing reduction in R&D expenses.

First Half 2024 Financial Results

Net Revenues

Net revenues were US$32.95 million for the first

half of 2024, up 24.5% year over year from US$26.48 million for the same period of 2023, driven primarily by strong contributions from

Hua Zang LLM and Technology Development Services.

By Revenue Type

| By Product lines | |

2023H1 | | |

2024H1 | | |

% Change YoY | |

| MaaS | |

$ | 22,958,930 | | |

$ | 24,768,850 | | |

| 7.9 | |

| Non-MaaS | |

| 3,516,489 | | |

| 8,184,915 | | |

| 132.8 | |

| Total | |

$ | 26,475,419 | | |

$ | 32,953,765 | | |

| 24.5 | |

| By Way of Delivery | |

2023H1 | | |

2024H1 | | |

% Change YoY | |

| Sale of software products | |

$ | 535,004 | | |

$ | 102,705 | | |

| (80.8 | ) |

| Sale of hardware products | |

| 30,175 | | |

| 2,539 | | |

| (91.6 | ) |

| Technology development service | |

| 1,763,797 | | |

| 8,039,536 | | |

| 355.8 | |

| M&S service | |

| 1,426,784 | | |

| 670,959 | | |

| (53.0 | ) |

| Sale of cloud platform products | |

| 22,719,659 | | |

| 24,138,026 | | |

| 6.2 | |

| Total | |

$ | 26,475,419 | | |

$ | 32,953,765 | | |

| 24.5 | |

Cost of Revenues

Cost of revenues was US$11.69 million for the

first half of 2024, up 94.6% year over year from US$6.01 million for the same period of 2023. The increase in the cost of revenue is primarily

impacted by the larger scale of revenue.

Gross Profit

Gross profit was US$21.27 million for the first

half of 2024, representing an increase of 3.9% year over year from US$20.47 million for the same period of 2023. Gross margin declined

to 64.5% in H1 2024, compared to 77.3% in H1 2023.

The decrease was primarily due to the increased

low margin business and the initial delivery of Hua Zang LLM. During the period, the revenue of Technology Development increased 355.8%

to US$8.0 million, which has relatively low gross margin due to its business nature. And with the ramp-up phase of Hua Zang LLM incurs

higher costs due to customization, fine-tuning, and deployment.

Operating Expenses

Total operating expenses were US$36.10 million

in the first half of 2024, representing a slight increase of 5.9% year over year from US$34.10 million for the same period of 2023. Although

the R&D expenses have gone down to US$2.75 million, it cannot offset the increment from general and administrative expenses of US$5.27

million. The major R&D investment finished with the delivery of Hua Zang LLM, which drove the R&D expenses to go down during the

period. However, the Company has adjusted the staff structure due to the application of Hua Zang LLM in daily operation, which caused

a temporary human optimization cost. The Company anticipate that with smaller coding team, higher productization and prompting team, the

operation efficiency would enhance accordingly.

Net Loss

Net loss narrowed down to US$15.54 million for

the first half of 2024, compared to US$18.77 million for the same period of 2023.

About

Xiao-I Corporation

Xiao-I

Corporation is a leading cognitive intelligence enterprise in China that offers a diverse range of business solutions and services in

artificial intelligence, covering natural language processing, voice and image recognition, machine learning, and affective computing.

Since its inception in 2001, the Company has developed an extensive portfolio of cognitive intelligence technologies that are highly suitable

and have been applied to a wide variety of business cases. Xiao-I powers its cognitive intelligence products and services with its cutting-edge,

proprietary AI technologies to enable and promote industrial digitization, intelligent upgrading, and transformation. For more information,

please visit: www.xiaoi.com.

Forward-Looking

Statements

This press

release contains forward-looking statements as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements

include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying assumptions and other

statements that are other than statements of historical facts. When The Company uses words such as “may,” “will,”

“intend,” “should,” “believe,” “expect,” “anticipate,” “project,”

“estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements.

Forward-looking statements are not guarantees of future performance and involve risks and uncertainties that may cause the actual results

to differ materially from the Company’s expectations discussed in the forward-looking statements. These statements are subject to

uncertainties and risks including, but not limited to, the following: the Company’s ability to achieve its goals and strategies,

the Company’s future business development and plans for future business development, including its financial conditions and results

of operations, product and service demand and acceptance, reputation and brand, the impact of competition and pricing, changes in technology,

government regulations, fluctuations in general economic and business conditions in China, and assumptions underlying or related to any

of the foregoing and other risks contained in reports filed by the Company with the U.S. Securities and Exchange Commission (“SEC”).

For these reasons, among others, investors are cautioned not to place undue reliance upon any forward-looking statements in this press

release. Additional factors are discussed in the Company’s filings with the SEC, including under the section entitled “Risk

Factors” in its annual report on Form 20-F filed with the SEC on April 30, 2024, as well as its current reports on Form 6-K and

other filings, all of which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise these forward-looking

statements to reflect events or circumstances that arise after the date hereof.

For

investor and media inquiries, please contact:

Ms. Berry

Xia

Email:

ir@xiaoi.com

XIAO-I CORPORATION

CONDENSED CONSLIDATED BALANCE SHEETS

(In U.S. dollars, except for share and per share

data, or otherwise noted)

| | |

As of

December 31,

2023 | | |

As of

June 30,

2024 | |

| | |

| | |

(Unaudited) | |

| Assets | |

| | |

| |

| Current assets: | |

| | |

| |

| Cash and cash equivalents | |

$ | 1,564,542 | | |

$ | 1,822,370 | |

| Restricted cash | |

| 20,676 | | |

| 27,107 | |

| Accounts receivable, net | |

| 28,326,985 | | |

| 47,052,282 | |

| Amounts due from related parties | |

| - | | |

| 157,616 | |

| Inventories | |

| 67,826 | | |

| 81,242 | |

| Contract costs | |

| 1,691,293 | | |

| 6,157,729 | |

| Advance to suppliers | |

| 1,149,642 | | |

| 1,317,003 | |

| Prepaid expenses and other current assets, net | |

| 5,233,553 | | |

| 4,837,217 | |

| Total current assets | |

| 38,054,517 | | |

| 61,452,566 | |

| | |

| | | |

| | |

| Non-current assets: | |

| | | |

| | |

| Property and equipment, net | |

| 2,125,629 | | |

| 2,121,020 | |

| Intangible assets, net | |

| 212,445 | | |

| 161,666 | |

| Long-term investments | |

| 2,650,458 | | |

| 2,552,384 | |

| Right of use assets | |

| 2,431,475 | | |

| 1,130,594 | |

| Prepaid expenses and other non-current assets | |

| 7,000,357 | | |

| 6,604,234 | |

| Amount due from related parties-non-current | |

| 13,859,350 | | |

| 13,540,291 | |

| Total non-current assets | |

| 28,279,714 | | |

| 26,110,189 | |

| | |

| | | |

| | |

| TOTAL ASSETS | |

$ | 66,334,231 | | |

$ | 87,562,755 | |

| | |

| | | |

| | |

| Commitments and Contingencies | |

| | | |

| | |

| | |

| | | |

| | |

| Liabilities | |

| | | |

| | |

| Current liabilities: | |

| | | |

| | |

| Short-term borrowings | |

$ | 26,760,940 | | |

$ | 33,023,723 | |

| Accounts payable | |

| 13,674,339 | | |

| 32,225,465 | |

| Amount due to related parties-current | |

| 704,947 | | |

| 206,716 | |

| Deferred revenue | |

| 1,654,145 | | |

| 7,562,248 | |

| Convertible loans | |

| - | | |

| 2,110,313 | |

| Derivative liabilities | |

| - | | |

| 163,958 | |

| Accrued expenses and other current liabilities | |

| 13,938,253 | | |

| 19,840,661 | |

| Lease liabilities, current | |

| 929,755 | | |

| 573,144 | |

| Total current liabilities | |

| 57,662,379 | | |

| 95,706,228 | |

| | |

| | | |

| | |

| Non-current liabilities: | |

| | | |

| | |

| Amount due to related parties-non-current | |

| 7,905,290 | | |

| 7,177,872 | |

| Accrued liabilities, non-current | |

| 7,759,474 | | |

| 7,297,449 | |

| Lease liabilities, non-current | |

| 1,473,950 | | |

| 504,547 | |

| Total non-current liabilities | |

| 17,138,714 | | |

| 14,979,868 | |

| | |

| | | |

| | |

| TOTAL LIABILITIES | |

| 74,801,093 | | |

| 110,686,096 | |

| | |

| | | |

| | |

| Shareholders’ deficit | |

| | | |

| | |

| Ordinary shares (par value of $0.00005 per share; 1,000,000,000 shares and 1,000,000,000 shares authorized as of December 31, 2023 and June 30, 2024, respectively; 24,015,592 shares and 24,778,926 shares issued and outstanding as of December 31, 2023 and June 30, 2024, respectively) | |

$ | 1,201 | | |

$ | 1,239 | |

| Preferred shares (par value of $0.00005 per share; nil and 3,700,000 preferred shares authorized as of December 31, 2023 and June 30, 2024; 3,700,000 and 3,700,000 preferred shares issued and outstanding as of December 31, 2023 and June 30, 2024) | |

| 185 | | |

| 185 | |

| Additional paid-in capital | |

| 108,729,047 | | |

| 109,361,437 | |

| Statutory reserve | |

| 237,486 | | |

| 237,486 | |

| Accumulated deficit | |

| (110,833,045 | ) | |

| (126,333,034 | ) |

| Accumulated other comprehensive loss | |

| (2,998,562 | ) | |

| (2,815,101 | ) |

| XIAO-I CORPORATION shareholders’ deficit | |

| (4,863,688 | ) | |

| (19,547,788 | ) |

| Non-controlling interests | |

| (3,603,174 | ) | |

| (3,575,553 | ) |

| Total shareholders’ deficit | |

| (8,466,862 | ) | |

| (23,123,341 | ) |

| TOTAL LIABILITIES AND SHAREHOLDERS’ DEFICIT | |

$ | 66,334,231 | | |

$ | 87,562,755 | |

XIAO-I CORPORATION

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE LOSS

(In U.S. dollars, except for share and per share data, or otherwise noted)

| | |

For the six months ended

June 30, | |

| | |

2023 | | |

2024 | |

| Sale of software products | |

$ | 535,004 | | |

$ | 102,705 | |

| Sale of hardware products | |

| 30,175 | | |

| 2,539 | |

| Technology development service | |

| 1,763,797 | | |

| 8,039,536 | |

| M&S service | |

| 1,426,784 | | |

| 670,959 | |

| Sale of cloud platform products | |

| 22,719,659 | | |

| 24,138,026 | |

| Net revenues | |

| 26,475,419 | | |

| 32,953,765 | |

| Cost of sale of software products | |

| (368,021 | ) | |

| (45,001 | ) |

| Cost of sale of hardware products | |

| (26,118 | ) | |

| (1,416 | ) |

| Cost of technology development service | |

| (1,286,290 | ) | |

| (5,429,050 | ) |

| Cost of M&S service | |

| (805,948 | ) | |

| (364,398 | ) |

| Cost of sale of cloud platform products | |

| (3,519,521 | ) | |

| (5,846,639 | ) |

| Cost of revenues | |

| (6,005,898 | ) | |

| (11,686,504 | ) |

| Gross profit | |

| 20,469,521 | | |

| 21,267,261 | |

| | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | |

| Selling expenses | |

| (2,377,409 | ) | |

| (1,862,535 | ) |

| General and administrative expenses | |

| (2,070,052 | ) | |

| (7,341,878 | ) |

| Research and development expenses | |

| (29,649,703 | ) | |

| (26,897,236 | ) |

| Total operating expenses | |

| (34,097,164 | ) | |

| (36,101,649 | ) |

| | |

| | | |

| | |

| Loss from operations | |

| (13,627,643 | ) | |

| (14,834,388 | ) |

| | |

| | | |

| | |

| Other loss: | |

| | | |

| | |

| Investment losses | |

| (225,351 | ) | |

| (37,326 | ) |

| Interest expenses | |

| (1,570,847 | ) | |

| (937,374 | ) |

| Fair value change of derivative liabilities | |

| - | | |

| 107,586 | |

| Other income, net | |

| 525,431 | | |

| 159,027 | |

| Total other loss | |

| (1,270,767 | ) | |

| (708,087 | ) |

| | |

| | | |

| | |

| Loss before income tax expense | |

| (14,898,410 | ) | |

| (15,542,475 | ) |

| Income tax expenses | |

| (3,871,118 | ) | |

| - | |

| Net loss | |

$ | (18,769,528 | ) | |

$ | (15,542,475 | ) |

| Net loss attributable to non-controlling interests | |

| (173,782 | ) | |

| (42,485 | ) |

| Net loss attributable to XIAO-I CORPORATION shareholders | |

| (18,595,746 | ) | |

| (15,499,990 | ) |

| Other comprehensive income | |

| | | |

| | |

| Foreign currency translation change, net of nil income taxes | |

| 507,422 | | |

| 253,567 | |

| Total other comprehensive income | |

| 507,422 | | |

| 253,567 | |

| Total comprehensive loss | |

$ | (18,262,106 | ) | |

$ | (15,288,908 | ) |

| Total comprehensive (loss)/income attributable to non-controlling interests | |

| (76,331 | ) | |

| 27,621 | |

| Total comprehensive loss attributable to XIAO-I CORPORATION shareholders | |

| (18,185,775 | ) | |

| (15,316,529 | ) |

| Earnings/(Loss) per ordinary share attributable to XIAO-I CORPORATION shareholders | |

| | | |

| | |

| Basic | |

| (0.80 | ) | |

| (0.64 | ) |

| Diluted | |

| (0.80 | ) | |

| (0.64 | ) |

| Weighted average number of ordinary shares outstanding | |

| | | |

| | |

| Basic | |

| 23,308,370 | | |

| 24,049,072 | |

| Diluted | |

| 23,308,370 | | |

| 24,049,072 | |

5

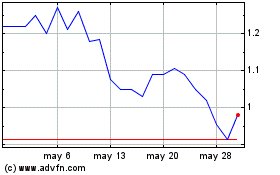

XIAO I (NASDAQ:AIXI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

XIAO I (NASDAQ:AIXI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024