UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November 2023

Commission File Number: 001-38764

APTORUM GROUP LIMITED

17 Hanover Square

London W1S 1BN, United Kingdom

(Address of principal executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

The

Registrant is filing this Report on Form 6-K to provide its proxy statement for its 2023 annual general meeting of shareholders. The 2023

annual general meeting of shareholders will be held on December 20, 2023, at 17 Hanover Square, Mayfair London, England W1S 1BN at 1 p.m.

London Time. The Registrant also issued a press release on November 16, 2023, disclosing the details about the 2023 annual general meeting

of shareholders. Copy of the proxy statement, proxy card and press release are attached hereto as Exhibit 99.1, 99.2 and 99.3, respectively.

Neither this report nor the

exhibits constitute an offer to sell, or the solicitation of an offer to buy our securities, nor shall there be any sale of our securities

in any state or jurisdiction in which such offer, solicitation or sale would be unlawful prior to the registration or qualification under

the securities laws of any such state or jurisdiction.

The information in this Form

6-K, including the exhibits shall not be deemed to be “filed” for the purposes of Section 18 of the Securities Exchange Act

of 1934, as amended, and shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, except as

shall be expressly set forth by specific reference in such filing.

This Form 6-K is hereby incorporated

by reference into the registration statements of the Company on Form S-8 (Registration Number 333-232591) and Form F-3 (Registration Number

333-268873) and into each prospectus outstanding under the foregoing registration statements, to the extent not superseded by documents

or reports subsequently filed or furnished by the Company under the Securities Act of 1933, as amended, or the Securities Exchange Act

of 1934, as amended.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

Aptorum Group Limited |

| |

|

|

| Date: November 16, 2023 |

By: |

/s/ Darren Lui |

| |

|

Name: |

Darren Lui |

| |

|

Title: |

Chief Executive Officer |

2

Exhibit 99.1

APTORUM GROUP LIMITED

(a Cayman Islands exempted company with limited

liability)

(NASDAQ: APM)

NOTICE OF ANNUAL GENERAL MEETING OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN THAT the annual

general meeting of shareholders (the “2023 Annual Meeting”) of Aptorum Group Limited (the “Company”) will be held

on December 20, 2023, at 1:00 p.m., London local time, at 17 Hanover Square, Mayfair London, England W1S 1BN for the following purposes:

| Item |

|

Board Vote

Recommendation |

| |

|

|

|

| 1. |

To re-elect all Class I directors named in this Proxy Statement to hold office until the third annual meeting of shareholders and until his respective successor is elected and duly qualified. |

|

“FOR” |

| |

|

|

|

| 2. |

To approve, ratify and confirm the re-appointment of Marcum Asia CPAs LLP as the Company’s independent auditors for the year ending December 31, 2023, and to authorize the Board of Directors to fix their remuneration. |

|

“FOR” |

As of the date of this Notice

of Annual Meeting of Shareholders (the “Notice”), we have not received notice of any other matters that may be properly presented

at the 2023 Annual Meeting.

The Board of Directors of

the Company has fixed the close of business on November 10, 2023 as the record date (the “Record Date”) for determining the

shareholders entitled to receive notice of and to vote at the 2023 Annual Meeting or any adjournment thereof. Only holders of Class A

Ordinary Shares and Class B Ordinary Shares of the Company on the Record Date are entitled to receive notice of and to vote at the 2023

Annual Meeting or any adjournment thereof.

In addition to mailing

the materials, shareholders may also obtain a copy of the proxy materials, including the Company’s 2022 Annual Report, from the

Company’s website at www.aptorumgroup.com or by contacting our Investor Relations Department at: investor.relations@aptorumgroup.com.

| By Order of the Board of Directors, |

|

| |

|

| /s/ Darren Lui |

|

| Darren Lui |

|

| Chief Executive Officer and Director |

|

London

November 16, 2023

IT IS IMPORTANT THAT YOU VOTE, SIGN AND RETURN

THE ACCOMPANYING PROXY CARD AS SOON AS POSSIBLE

[remainder of page intentionally left blank]

APTORUM GROUP LIMITED

2023 ANNUAL GENERAL MEETING OF SHAREHOLDERS

TO BE HELD ON DECEMBER 20, 2023

PROXY STATEMENT

The Board of Directors of

Aptorum Group Limited (the “Company”) is soliciting proxies for the annual general meeting of shareholders (the “2023

Annual Meeting”) of the Company to be held on Tuesday, December 20, 2023, at 1:00 p.m., London local time, at 17 Hanover Square,

Mayfair London, England W1S 1BN or any adjournment thereof. Only holders of the Class A Ordinary Shares and Class B Ordinary Shares of

the Company at the close of business on November 10, 2023 (the “Record Date”) are entitled to attend and vote at the 2023

Annual Meeting or at any adjournment thereof. Two shareholders entitled to vote and be present in person or by proxy or in the case of

a shareholder being a corporation, by its duly authorized representative one of whom must be the holder representing a majority of shares

in the Company throughout the 2023 Annual Meeting shall form a quorum.

Any shareholder entitled to

attend and vote at the 2023 Annual Meeting shall appoint the Chairman as his/her proxy to attend and vote on behalf of him/her. A proxy

need not be a shareholder of the Company. On a vote by way of poll, each holder of the Company’s Class A Ordinary Shares shall

be entitled to one (1) vote in respect of each Class A Ordinary Share held by him on the Record Date. Each holder of the Company’s

Class B Ordinary Shares shall be entitled to hundred (100) votes in respect of each Class B Ordinary Share held by him on the Record Date.

The polls will close at 11:59 p.m. EST on December 19, 2023.

A proxy statement describing

the matters to be voted upon at the 2023 Annual Meeting along with a proxy card enabling the shareholders to indicate their vote will

be mailed on or about November 16, 2023, to all shareholders entitled to vote at the 2023 Annual Meeting. Such proxy statement will also

be furnished to the U.S. Securities and Exchange Commission, or the SEC, under cover of Form 6-K and will be available on our website

at www.aptorumgroup.com on or about November 16, 2023. If you plan to attend the 2023 Annual Meeting and your shares are not registered

in your own name, please ask your broker, bank or other nominee that holds your shares to provide you with evidence of your share ownership.

Such proof of share ownership will be required to gain admission to the 2023 Annual Meeting.

Whether or not you plan to

attend the 2023 Annual Meeting, it is important that your shares be represented and voted at the 2023 Annual Meeting. Accordingly, after

reading the Notice and accompanying proxy statement, please sign, date and mail the enclosed proxy card in the envelope provided or vote

by telephone or over the Internet in accordance with the instructions on your proxy card. The proxy card must be received by Broadridge

Financial Solutions, Inc. no later than 11:59 p.m. EST on December 19, 2023 to be validly included in the tally of shares voted at the

2023 Annual Meeting. Detailed proxy voting instructions are provided both in the proxy statement and on the proxy card.

QUESTIONS AND ANSWERS ABOUT

THE 2023 ANNUAL MEETING, THE PROXY MATERIALS

AND VOTING YOUR SHARES

WHY AM I RECEIVING THESE MATERIALS?

Our Board has delivered the

Proxy Materials to you in connection with the solicitation of proxies for use at the 2023 Annual Meeting. As a shareholder, you are invited

to attend the 2023 Annual Meeting and are requested to vote on the items of business described in this Proxy Statement.

WHAT IS A PROXY?

Our Board is soliciting your

vote at the 2023 Annual Meeting. You may vote by proxy as explained in this Proxy Statement. A proxy is your formal legal designation

of another person to vote the shares you own. That other person is called a proxy. If you designate someone as your proxy in a written

document, that document also is called a proxy or a proxy card.

WHAT PROPOSALS WILL BE VOTED ON AT

THE 2023 ANNUAL MEETING?

There are two proposals that will be

voted on at the 2023 Annual Meeting:

| |

1. |

To re-elect all Class I directors named in this Proxy Statement to hold office until the third annual meeting of shareholders and until his respective successor is elected and duly qualified. |

| |

2. |

To approve, ratify and confirm the re-appointment of Marcum Asia CPAs LLP as the Company’s independent auditors for the year ending December 31, 2023, and to authorize the Board of Directors to fix their remuneration. |

We may also transact such other business as may properly

come before the 2023 Annual Meeting.

HOW DOES THE BOARD RECOMMEND I VOTE?

Our Board unanimously recommends that

you vote:

| |

● |

“FOR” the re-election of all Class I directors named in this Proxy Statement (Proposal No. 1). |

| |

● |

“FOR” the approval, ratification and confirmation of the re-appointment of Marcum Asia CPAs LLP as the Company’s independent auditors for the year ending December 31, 2023, and to authorize the Board of Directors to fix their remuneration (Proposal No. 2). |

WHAT HAPPENS IF ADDITIONAL MATTERS ARE PRESENTED AT THE 2023 ANNUAL

MEETING?

If any other matters are properly

presented for consideration at the 2023 Annual Meeting, including, among other things, consideration of a motion to adjourn or postpone

the 2023 Annual Meeting to another time or place (including, without limitation, for the purpose of soliciting additional proxies), the

persons named as proxy holders will have discretion to vote on those matters in accordance with their best judgment, unless you direct

them otherwise in your proxy instructions. We do not currently anticipate that any other matters will be raised at the 2023 Annual Meeting.

WHO CAN VOTE AT THE 2023 ANNUAL MEETING?

Shareholders of record at

the close of business on November 10, 2023, the date established by the Board for determining the shareholders entitled to vote at our

2023 Annual Meeting (the “Record Date”), are entitled to vote at the 2023 Annual Meeting.

On the Record Date,

2,937,921 shares of our Class A Ordinary Shares (representing 2,937,921 votes) and 22,437,754 shares of our Class B Ordinary Shares

(representing 2,243,775,400 votes) were outstanding and are entitled to vote at the 2023 Annual Meeting. Holders of Class A

Ordinary Shares and Class B Ordinary Shares will vote together as a single class on all proposals to be voted on at the 2023 Annual

Meeting.

On a vote by way of poll,

each holder of the Company’s Class A Ordinary Shares shall be entitled to one (1) vote in respect of each Class A Ordinary Share

held by him on the Record Date. Each holder of the Company’s Class B Ordinary Shares shall be entitled to on hundred (100) votes

in respect of each Class B Ordinary Share held by him on the Record Date. The polls will close at 11:59 p.m. EST on December 19, 2023.

A list of the shareholders

of record as of November 10, 2023 will be available for inspection at the 2023 Annual Meeting.

WHAT CONSTITUTES A QUORUM?

Two members, one of whom must

be the holder of a majority of our outstanding shares as of the Record Date must be present, in person or by proxy, at the 2023 Annual

Meeting in order to properly convene the 2023 Annual Meeting. This is called a quorum. If such members are not present in person or by

timely and properly submitted proxies to constitute a quorum, the 2023 Annual Meeting may be adjourned to such time and place determined

by the Directors. Both abstentions and broker non-votes are counted as present for the purpose of determining the presence of a quorum.

WHAT IS THE DIFFERENCE BETWEEN BEING A “SHAREHOLDER

OF RECORD” AND A “BENEFICIAL OWNER” HOLDING SHARES IN STREET NAME?

Shareholder of Record:

You are a “shareholder of record” if your shares are registered directly in your name with our transfer agent, Continental

Stock Transfer & Trust. The Proxy Materials are sent directly to a shareholder of record.

Beneficial Owner: If

your shares are held in a stock brokerage account or by a bank or other nominee, you are considered the “beneficial owner”

of shares held in “street name” and your bank or other nominee is considered the shareholder of record. Your bank or other

nominee forwarded the Proxy Materials to you. As the beneficial owner, you have the right to direct your bank or other nominee how to

vote your shares by completing a voting instruction form. Because a beneficial owner is not the shareholder of record, you are invited

to attend the 2023 Annual Meeting, but you may not vote these shares in person at the 2023 Annual Meeting unless you obtain a “legal

proxy” from the bank or other nominee that holds your shares, giving you the right to vote the shares at the 2023 Annual Meeting.

HOW DO I VOTE?

Shareholders of record can

vote their shares in person by attending the 2023 Annual Meeting, by telephone or over the Internet at www.proxyvote.com in accordance

with the instructions on your proxy card, or by mail, by completing, signing and mailing your proxy card. The proxy card must be received

by Broadridge Financial Solutions, Inc. no later than 11:59 p.m. EST on December 19, 2023 to be validly included in the tally of shares

voted at the 2023 Annual Meeting.

If you are a beneficial owner

whose Class A Ordinary Shares or Class B Ordinary Shares are held in “street name” (i.e. through a bank, broker or other nominee),

you will receive voting instructions from the institution holding your shares. The methods of voting will depend upon the institution’s

voting processes, including voting via the telephone or the Internet. Please contact the institution holding your Class A Ordinary Shares

or Class B Ordinary Shares for more information.

You may vote before the annual

meeting at www.proxyvote.com. Use your 16-digit control number, located on the Notice, and follow the instructions.

WHAT DOES IT MEAN IF I RECEIVE MORE THAN ONE PROXY CARD?

It means that your Class A

Ordinary Shares or Class B Ordinary Shares are registered differently or you have multiple accounts. Please vote all of these shares separately

to ensure all of the shares you hold are voted.

WHAT IF I DO NOT SPECIFY HOW MY SHARES ARE TO BE VOTED?

Shareholders of Record:

If you are a shareholder of record and you properly submit your proxy but do not give voting instructions, the persons named as proxies

will vote your shares as follows: “FOR” the re-election of all Class I directors of the Company named in this Proxy

Statement (Proposal No. 1), and “FOR” the approval, ratification and confirmation of the re-appointment of Marcum Asia

CPAs LLP as the Company’s independent auditors for the year ending December 31, 2023, and to authorize the Board of Directors to

fix their remuneration (Proposal No. 2). If you do not return a proxy, your shares will not be counted for purposes of determining whether

a quorum exists and your shares will not be voted at the 2023 Annual Meeting.

Beneficial Owners: If

you are a beneficial owner whose Class A Ordinary Shares or Class B Ordinary Shares are held in “street name” (i.e. through

a bank, broker or other nominee) and you do not give voting instructions to your bank, broker or other nominee, your bank, broker or other

nominee may exercise discretionary authority to vote on matters that the NASDAQ (“NASDAQ”) determines to be “routine.”

Your bank, broker or other nominee is not allowed to vote your shares on “non-routine” matters and this will result in a “broker

non-vote” on that non-routine matter, but the shares will be counted for purposes of determining whether a quorum exists. The only

item on the 2023 Annual Meeting agenda that may be considered routine is Proposal No. 2 relating to the Ratification of Appointment of

the Independent Registered Public Accounting Firm for the fiscal year ending December 31, 2023; however, we cannot be certain whether

this will be treated as a routine matter since our Proxy Statement is prepared in compliance with the laws of Cayman Islands rather than

the rules applicable to domestic U.S. reporting companies. We strongly encourage you to submit your voting instructions and exercise your

right to vote as a shareholder.

CAN I CHANGE MY VOTE OR REVOKE MY PROXY?

If you are a shareholder of

record, you may revoke your proxy at any time prior to the vote at the 2023 Annual Meeting. If you submitted your proxy by mail, you must

file with the Corporate Secretary of the Company a written notice of revocation or deliver, prior to the vote at the 2023 Annual Meeting,

a valid, later-dated proxy. Attendance at the 2023 Annual Meeting will not have the effect of revoking a proxy unless you give written

notice of revocation to the Corporate Secretary before the proxy is exercised or you vote by written ballot at the 2023 Annual Meeting.

If you are a beneficial owner whose Class A Ordinary Shares or Class B Ordinary Shares are held through a bank, broker or other nominee,

you may change your vote by submitting new voting instructions to your bank, broker or other nominee, or, if you have obtained a legal

proxy from your bank, broker or other nominee giving you the right to vote your shares, by attending the 2023 Annual Meeting and voting

in person.

For purposes of submitting

your vote, you may change your vote until 11:59 p.m. EST on December 19, 2023. After this deadline, the last vote submitted will be the

vote that is counted.

HOW WILL THE PROXIES BE SOLICITED AND WHO WILL BEAR THE COSTS?

We will pay the cost of soliciting

proxies for the 2023 Annual Meeting. Proxies may be solicited by our directors, executive officers and employees, without additional compensation,

in person, or by mail, courier, telephone, email or facsimile. We may also make arrangements with brokerage houses and other custodians,

nominees and fiduciaries for the forwarding of solicitation material to the beneficial owners of shares held of record by such persons.

We may reimburse such brokerage houses and other custodians, nominees and fiduciaries for reasonable out-of-pocket expenses incurred by

them in connection therewith.

WHO WILL COUNT THE VOTES AND HOW CAN I FIND THE VOTING RESULTS OF

THE 2023 ANNUAL MEETING?

Broadridge Financial Solutions,

Inc. will tabulate and certify the votes. We plan to announce preliminary voting results at the 2023 Annual Meeting, and we will report

the final results in a Current Report on Form 6-K, which we will file with the SEC shortly after the 2023 Annual Meeting.

WHAT VOTE IS REQUIRED TO APPROVE EACH ITEM?

The affirmative vote of a

simple majority of the votes of the shares entitled to vote on the proposal that were present and voted at the 2023 Annual Meeting is

required for both proposals presented herein.

WHAT ARE ABSTENTIONS AND BROKER NON-VOTES AND HOW WILL THEY BE TREATED?

An “abstention”

occurs when a shareholder chooses to abstain or refrain from voting their shares on one or more matters presented for a vote. For the

purpose of determining the presence of a quorum, abstentions are counted as present.

Abstentions will have no effect on the

outcome of either proposal.

A “broker non-vote”

occurs when a bank, broker or other holder of record holding shares for a beneficial owner attends the 2023 Annual Meeting in person or

by proxy but does not vote on a particular proposal because that holder does not have discretionary authority to vote on that particular

item and has not received instructions from the beneficial owner.

Broker non-votes will have

no effect on the outcome of either proposal.

WHAT DO I NEED TO DO TO ATTEND THE 2023 ANNUAL MEETING?

If you plan to attend the

2023 Annual Meeting in person, you will need to bring proof of your ownership of shares, such as your proxy card or transfer agent statement

and present an acceptable form of photo identification such as a passport or driver’s license. Cameras, recording devices and other

electronic devices will not be permitted at the 2023 Annual Meeting.

If you are a beneficial owner

holding shares in “street name” through a bank, broker or other nominee and you would like to attend the 2023 Annual Meeting,

you will need to bring an account statement or other acceptable evidence of ownership of shares as of the close of business EST on November

10, 2023. In order to vote at the 2023 Annual Meeting, you must contact your bank, broker or other nominee in whose name your shares are

registered and obtain a legal proxy from your bank, broker or other nominee and bring it to the 2023 Annual Meeting.

WHERE CAN I GET A COPY OF THE PROXY MATERIALS?

Copies of our 2022 Annual

Report, including consolidated financial statements as of and for the year ended December 31, 2022, the proxy card, the Notice and this

Proxy Statement are available on our Company’s website at www.aptorumgroup.com. The contents of that website are not a part

of this Proxy Statement.

Pursuant to NASDAQ’s

Marketplace Rules which permit companies to make available their annual report to shareholders on or through the company’s website,

the Company posts its annual reports on the Company’s website. The 2022 Annual Report for the year ended December 31, 2022, which

was filed on Form 20-F (the “2022 Annual Report”) has been filed with the U.S. Securities and Exchange Commission. The Company

adopted this practice to avoid the considerable expense associated with mailing physical copies of such report to record holders. You

may obtain a copy of our 2022 Annual Report by visiting the “Financial Information” heading under the “Investors”

section of the Company’s website at www.aptorumgroup.com. If you want to receive a paper or email copy of the Company’s

2022 Annual Report, you must request one. There is no charge to you for requesting a copy. Please make your request for a copy by contacting

our Investor Relations Department at: investor.relations@aptorumgroup.com.

PROPOSALS

PROPOSAL NO. 1

RE-ELECTION OF CLASS I DIRECTORS

The Board of Directors currently consists of seven

members. Only the terms of the Class I directors expire at this shareholder meeting and therefore only the Class I directors

need to be re-elected at the 2023 Annual Meeting. Class II and Class III directors will remain on the board until their respective

term expires.

As per our current Memorandum and Articles of

Incorporation, we have a staggered board of directors consisting of three classes of directors, with directors serving staggered three-year

terms. Our Board of Directors is divided into three classes of directors. At each annual general meeting of shareholders, one class of

directors will be elected for a three-year term to succeed the class whose terms are then expiring, to serve from the time of election

and qualification until the third annual meeting following their election or until their earlier death, resignation or removal, starting

with this shareholder meeting. The Class II and III directors will not stand for re-election until the respective shareholder meeting

to be held in 2024 or 2025. The division of our board of directors into three classes with staggered three-year terms may delay or prevent

a change of our management or a change in control.

The Class I directors who seek re-election atthis meeting are:

| Name |

|

Positions |

| |

|

|

| Charles Bathurst |

|

Independent Non-Executive Director |

| |

|

|

| Mirko Scherer |

|

Independent Non-Executive Director |

| |

|

|

| Justin Wu |

|

Independent Non-Executive Director |

| |

|

|

| Douglas Arner |

|

Independent Non-Executive Director |

MR. CHARLES BATHURST

Mr.

Bathurst is an Independent Non-Executive Director of Aptorum Group Limited, chairs the Audit Committee and is a member of both the Compensation

Committee and the Nominating and Corporate Governance Committee. He has over 46 years’ experience of management and senior executive

roles across the financial services, technology and healthcare industries. In 2011, he set up his own independent consultancy service,

Summerhill Advisors Limited, advising on management structure, business development, financial reporting, internal audit controls and

compliance to both emerging and multinational companies. Today he holds Non-Executive and Advisory board positions on fast-growing companies

in healthcare, technology and financial services.

Prior

to establishing Summerhill, he served as a Director for J.O. Hambro Investment Management from September 2008 to August 2011, where he

oversaw the restructuring and commercialization of a range of in-house investment funds. He was appointed to the management board and

supervised reporting teams including Business development, accounting, regulatory reporting and internal controls.

From

April 2004 to March 2008, Mr. Bathurst served in multiple roles at Old Mutual Asset Managers (UK), including being a member of the senior

management team and head of international sales. Duties included business development, launching new investment funds, recruitment, establishing

and supervision of regulatory and financial reporting teams, as well as ensuring compliance with funds’ regulatory requirements

and corporate governance standards.

Prior

to this, Mr. Bathurst was an advisor to Lion Capital Advisors Limited from April 2003 to March 2004, and from June 2002 to March 2003

business development consultant reporting to the board of management of LCF Rothschild Asset Management Limited.

From

April 1995 to March 2002, Mr. Bathurst joined a newly formed alternative investment management team at Credit Agricole Asset Management,

establishing the London Branch as the Managing Director in 1998. He was responsible for the recruitment and development strategy for marketing,

sales, investment, financial reporting, compliance and regulatory controls and investor relations.

Between

the period of September 1989 and December 1994, Mr. Bathurst worked for GNI, the largest futures and options execution and clearing broker

on the London International Financial Futures Exchange, where he focused on marketing to European and Middle East financial institutions.

In 1991, he joined a new management team to launch a series of specialist investment funds while serving as the Head of Sales and Product

Development.

Mr.

Bathurst graduated from the Royal Military Academy Sandhurst in November 1974 and commissioned into the British Army serving in the UK

and Germany.

DR. MIRKO SCHERER

Dr.

Mirko Scherer is an Independent Non-Executive Director of Aptorum Group Limited. Dr. Scherer has been serving as the Chief Executive Officer

at CoFeS China (formerly known as “TVM Capital China”) in Hong Kong since March 2015. CoFeS China focuses on cross-border

activities in the life science industry between China and the West. CoFeS China acts as a bridge between China and the West, assisting

Chinese investors and pharmaceutical companies accessing western innovations, while collaborating with innovative life science companies

from the West to enter the fast-growing China market.

Dr.

Scherer has served on the Board of the Frankfurt Stock Exchange from 2005 to 2007 and has been a board member of the Stichting Preferente

Aandelen QIAGEN since 2004. From August 2016 through July 2018, Dr. Scherer served as a Non-Executive board member of Quantapore Inc.

and from April 2015 through September 2017, he was a director of China BioPharma Capital I, (GP).

Dr.

Scherer is an experienced biotechnology executive and has led numerous financing M&A and licensing transactions, in both public and

private markets, in Europe and the U.S. for over 20 years. He consulted MPM Capital for the period between July 2012 and December 2014.

Dr. Scherer was also a co-founder and partner of KI Kapital from November 2008 to February 2014, a company which was specialized in providing

consultation in life science industry.

Prior

to working in the venture capital industry, Dr. Scherer co-founded GPC Biotech (Munich and Princeton, NJ) and served as the Chief Financial

Officer from October 1997 to December 2007. GPC Biotech engaged in numerous pharmaceutical alliances with companies such as Sanofi Aventis,

Boehringer Ingelheim, Altana (now part of Takeda), Yakult, and Pharmion (now part of Celgene). Over the past 20 years, Dr. Scherer has

established an extensive network in the U.S., European, and China’s biotechnology and venture capital industry. Prior to his time

at GPC Biotech, Dr. Scherer worked as a consultant from May 1993 to June 1994 at the Boston Consulting Group.

Dr.

Scherer earned a Doctorate in Finance from the European Business School in Oestrich-Winkel/Germany in 1998, a MBA from Harvard Business

School in June 1996, and a degree in Business Administration from the University of Mannheim/Germany in February 1993.

PROFESSOR JUSTIN WU

Professor

Justin Wu is an Independent Non-Executive Director of Aptorum Group Limited. He also has been serving as the Chief Operating Officer of

CUHK Medical Centre since August 2018. He served as the Associate Dean (Development) of the Faculty of Medicine at CUHK from July 2014

to June 2018 and the Associate Dean (Clinical) of the Faculty of Medicine at CUHK from December 2012 to July 2014, and has been serving

a Professor in the Department of Medicine and Therapeutics since 2009, also the Director of the S. H. Ho Center for Digestive Health,

a research center specializing in functional gastrointestinal diseases, reflux and motility disorders, and digestive endoscopy. Active

in research publications and assessments, Professor Wu served as the International Associate Editor of American Journal of Gastroenterology

(“AJG”), and Managing Editor of Journal of Gastroenterology and Hepatology (“JGH”). He is also the Secretary General

of the Asian Neurogastroenterology and Motility Association (“ANMA”), and Secretary General of the Asia Pacific Association

of Gastroenterology (“APAGE”).

Professor

Wu has won a number of awards including the Emerging Leader in Gastroenterology Award by the JGH Foundation, and the Vice Chancellor’s

Exemplary Teaching Award at CUHK. Aside from his expertise in gastroenterology, Professor Wu has an extensive interest in the development

of Integrative Medicine in Hong Kong. He is the Founding Director of the Hong Kong Institute of Integrative Medicine, working closely

with the School of Chinese Medicine to develop an integrative model at an international level. The institute aims at maximizing the strength

of Western and Chinese medicine to provide a safe and effective integrative treatment to patients.

Professor

Wu served as a consultant and an advisory board member for Takeda Pharmaceutical, AstraZeneca, Menarini, Reckitt Benckiser and Abbott

Laboratory. He earned his Bachelor of Medicine and Bachelor of Surgery Degree (1993), and his Doctor of Medicine Degree (2000) from CUHK.

Additionally, he attained Fellowships of the Royal College of Physicians of Edinburgh and London in 2007 and 2012 respectively, Fellowship

of the Hong Kong College of Physicians in 2002, Fellowship of the Hong Kong Academy of Medicine in 2002, and has been an American Gastroenterological

Association Fellow since 2012.

PROFESSOR DOUGLAS

ARNER

Professor

Douglas W. Arner is an Independent Non-Executive Director of Aptorum Group Limited. Douglas is the Kerry Holdings Professor in Law and

Director and co-founder of the Asian Institute of International Financial Law at the University of Hong Kong, as well as Faculty Director

and co-founder of the LLM in Compliance and Regulation, LLM in Corporate and Financial Law, and Law, Innovation, Technology and Entrepreneurship

(LITE) Programmes. He served as Head of the HKU Department of Law from 2011 to 2014 and as Co-Director of the Duke University-HKU Asia-America

Institute in Transnational Law from 2005 to 2016. Douglas has published eighteen books and more than 200 articles, chapters and reports

on international financial law and regulation, most recently Reconceptualising Global Finance and its Regulation (Cambridge 2016) (with

Ross Buckley and Emilios Avgouleas) and The RegTech Book (Wiley 2019 (Janos Barberis and Ross Buckley). His recent papers are available

on SSRN at https://papers.ssrn.com/sol3/cf_dev/AbsByAuth.cfm?per_id=524849, where he is among the top 75 authors in the world by total

downloads. Professor Arner led the development of Introduction to FinTech – launched with edX in May 2018 and now with over 80,000

learners spanning the world – and the foundation of the edx-HKU Online Professional Certificate in FinTech. He is a Senior Visiting

Fellow of Melbourne Law School, University of Melbourne and an Advisory Board Member of the Centre for Finance, Technology and Entrepreneurship

(CFTE). Professor Arner was an inaugural member of the Hong Kong Financial Services Development Council (2013-2019) and has served as

a consultant with, among others, the World Bank, Asian Development Bank, APEC, Alliance for Financial Inclusion, and European Bank for

Reconstruction and Development. He has lectured, co-organised conferences and seminars and been involved with financial sector reform

projects around the world. Professor Arner has been a visiting professor or fellow at Duke, Harvard, the Hong Kong Institute for Monetary

Research, IDC Herzliya, McGill, Melbourne, National University of Singapore, University of New South Wales, Shanghai University of Finance

and Economics, and Zurich, among others. Professor Arner is the Senior Regulatory & Strategic Advisor of Aeneas Group, a multi-disciplinary

financial services institution with technology-driven growth initiatives.

He

holds a BA from Drury College (where he studied literature, economics and political science) in 1992, a JD (cum laude) from Southern Methodist

University in 1995, an LLM (with distinction) in banking and finance law from the University of London (Queen Mary College) in 1996, and

a PhD from the University of London in 2005.

THE BOARD OF DIRECTORS RECOMMENDS A VOTE FOR

THE RE-ELECTION OF ALL CLASS I DIRECTORS NAMED

ABOVE

Our other directors are as follows, and will serve

until the expiration of his/her term noted below:

| Name & Class |

|

Positions |

|

Expiration of Director Term/Re-Election Year |

| |

|

|

|

|

| Class III |

|

|

|

|

| |

|

|

|

|

| Darren Lui |

|

Chief Executive Officer,

Chief Accounting Officer & Executive Director |

|

2025 |

| |

|

|

|

|

| Clark Cheng |

|

Chief Medical Officer & Executive Director |

|

2025 |

| |

|

|

|

|

| Class II |

|

|

|

|

| |

|

|

|

|

| Ian Huen |

|

Non-Executive Director |

|

2024 |

PROPOSAL NO. 2

APPROVAL, RATIFICATION AND CONFIRMATION OF

RE-APPOINTMENT OF INDEPENDENT AUDITORS AND

AUTHORIZATION OF BOARD OF DIRECTORS TO FIX THEIR

REMUNERATION

The Audit Committee of the

Board (the “Audit Committee”), which is composed entirely of independent directors, has selected Marcum Asia CPAs LLP, independent

registered public accounting firm, to audit our financial statements for the fiscal year ending December 31, 2023. Ratification of the

selection of Marcum Asia CPAs LLP by shareholders is not required by law. However, as a matter of good corporate practice, such selection

is being submitted to the shareholders for ratification at the 2023 Annual Meeting. If the shareholders do not ratify the selection, the

Board and the Audit Committee will reconsider whether or not to retain Marcum Asia CPAs LLP, but may, in their discretion, retain Marcum

Asia CPAs LLP. Even if the selection is ratified, the Audit Committee, in its discretion, may change the appointment at any time during

the year if it determines that such change would be in the best interests of the Company and its shareholders.

Marcum Asia CPAs LLP (formerly

known as Marcum Bernstein & Pinchuk LLP), has been auditing the Company since 2018.

A Representative from Marcum

Asia CPAs LLP will be in attendance at the 2023 Annual Meeting via teleconference to respond to any appropriate questions and will have

the opportunity to make a statement, if they so desire.

Changes in and

Disagreements with Accountants on Accounting and Financial Disclosure

None.

Independent Registered Public Accounting Firm

Fees and Other Matters

The following table sets forth,

for each of the years indicated, the fees expensed by our independent registered public accounting firm:

| |

|

For the years ended

December 31, |

|

| |

|

2022 |

|

|

2021 |

|

| |

|

(In thousand) |

|

| Audit fees |

|

US$ |

258 |

|

|

US$ |

258 |

|

| Audit-related fees |

|

|

42 |

|

|

|

37 |

|

| Tax fees |

|

|

- |

|

|

|

- |

|

| All other fees |

|

|

- |

|

|

|

- |

|

| Total |

|

US$ |

300 |

|

|

US$ |

295 |

|

“Audit fees” represents

the aggregate fees billed or to be billed for each of the fiscal years listed for professional services rendered by our principal auditor

for the audit of our annual financial statements.

“Audit-related fees”

are the aggregate fees billed for assurance and related services that are reasonably related to the performance of the audit and are not

reported under audit fees. These fees primarily include issuance of comfort letters.

“Tax fees” include

fees for professional services rendered by our principal auditor for tax compliance and tax advice on actual or contemplated transactions.

“Other fees” include

fees for services rendered by our independent registered public accounting firm with respect to other matters not reported under “Audit

fees”, “Audit-related fees” and “Tax fees”.

The policy of our audit committee

is to pre-approve all audit and non-audit services provided by our principal auditor including audit services, audit-related services,

tax services and other services.

THE BOARD OF DIRECTORS AND THE AUDIT COMMITTEE

RECOMMEND

A VOTE FOR APPROVAL, RATIFICATION AND

CONFIRMATION OF THE RE-APPOINTMENT OF

MARCUM ASIA CPAS LLP

AS THE COMPANY’S INDEPENDENT AUDITORS

FOR THE YEAR ENDING DECEMBER 31, 2023 AND

AUTHORIZATION OF BOARD OF DIRECTORS TO FIX THEIR

REMUNERATION

The Board of Directors is

not aware of any other matters to be submitted to the 2023 Annual Meeting. If any other matters properly come before the 2023 Annual Meeting,

it is the intention of the persons named in the enclosed form of proxy to vote the shares they represent as the Board of Directors may

recommend.

| |

By order of the Board of Directors |

| |

|

| |

/s/ Darren Lui |

| |

Darren Lui |

| |

Chief Executive Officer And Director |

| |

|

| November 16, 2023 |

|

12

Exhibit 99.2

Exhibit 99.3

Aptorum Group Limited to Hold Annual General

Meeting of Shareholders on December 20, 2023

NEW YORK & LONDON --(BUSINESS

WIRE)--November 16, 2023

Aptorum Group Limited (Nasdaq:

APM) (“Aptorum Group” or “Aptorum”), a clinical stage biopharmaceutical company dedicated to meeting unmet medical

needs in oncology, autoimmune diseases and infectious diseases, today announced that it will hold its 2023 annual general meeting

of shareholders at its London office located at 17 Hanover Square, Mayfair London, England W1S 1BN at 1:00 p.m. London Time on December

20, 2023 (8:00 a.m. Eastern Standard Time on December 20, 2023).

Shareholders of record as of November 10, 2023

are entitled to receive notice of and vote at the annual general meeting. Aptorum filed its annual report on Form 20-F, including its

audited financial statements for the fiscal year ended December 31, 2022, with the U.S. Securities and Exchange Commission (the “SEC”)

on April 28, 2023. Aptorum Group’s annual report on Form 20-F can be accessed in the investor section of Aptorum’s website at www.aptorumgroup.com,

as well as on the SEC’s website at www.sec.gov. Shareholders may request a meeting notice, proxy card or hard copy of the annual report

on Form 20-F, free of charge, by contacting investor.relations@aptorumgroup.com.

About Aptorum

Group

Aptorum Group Limited

(Nasdaq: APM) is a clinical stage biopharmaceutical company dedicated to the discovery, development and commercialization of therapeutic

assets to treat diseases with unmet medical needs, particularly in oncology (including orphan oncology indications), autoimmune and infectious

diseases. Aptorum has completed two phase I clinical trials for its ALS-4 (MRSA) and orphan drug designated SACT-1 (Neuroblastoma) small

molecule drugs and commercializing its NLS-2 NativusWell® nutraceutical (menopause). The pipeline of Aptorum is also enriched

through (i) the establishment of drug discovery platforms that enable the discovery of new therapeutics assets through, e.g. systematic

screening of existing approved drug molecules, and microbiome-based research platform for treatments of metabolic diseases; and (ii) the

co-development and ongoing clinical validation of its novel molecular-based rapid pathogen identification and detection diagnostics technology

with Singapore’s Agency for Science, Technology and Research.

For more information about the Company, please

visit www.aptorumgroup.com.

Disclaimer and Forward-Looking

Statements

This press release does

not constitute an offer to sell or a solicitation of offers to buy any securities of Aptorum Group.

This press release includes

statements concerning Aptorum Group Limited and its future expectations, plans and prospects that constitute “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. For this purpose, any statements contained

herein that are not statements of historical fact may be deemed to be forward-looking statements. In some cases, you can identify forward-looking

statements by terms such as “may,” “should,” “expects,” “plans,” “anticipates,”

“could,” “intends,” “target,” “projects,” “contemplates,” “believes,”

“estimates,” “predicts,” “potential,” or “continue,” or the negative of these terms or

other similar expressions. Aptorum Group has based these forward-looking statements, which include statements regarding projected

timelines for application submissions and trials, largely on its current expectations and projections about future events and trends that

it believes may affect its business, financial condition and results of operations. These forward-looking statements speak only as of

the date of this press release and are subject to a number of risks, uncertainties and assumptions including, without limitation, risks

related to its announced management and organizational changes, the continued service and availability of key personnel, its ability to

expand its product assortments by offering additional products for additional consumer segments, development results, the company’s

anticipated growth strategies, anticipated trends and challenges in its business, and its expectations regarding, and the stability of,

its supply chain, and the risks more fully described in Aptorum Group’s Form 20-F and other filings that Aptorum Group may

make with the SEC in the future.

As a result, the projections

included in such forward-looking statements are subject to change and actual results may differ materially from those described herein. Aptorum

Group assumes no obligation to update any forward-looking statements contained in this press release as a result of new information,

future events or otherwise.

This press release is

provided “as is” without any representation or warranty of any kind.

Contacts

Aptorum Group Limited

Investor Relations Department

investor.relations@aptorumgroup.com

+44 20 80929299

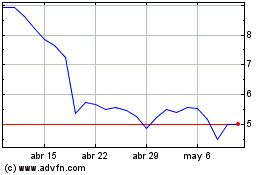

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Mar 2024 a Abr 2024

Aptorum (NASDAQ:APM)

Gráfica de Acción Histórica

De Abr 2023 a Abr 2024