0001723580FALSE200 East Las Olas Blvd., Suite 1400Fort LauderdaleFL00017235802024-09-112024-09-110001723580bfi:CommonStockParValue00001PerShareMember2024-09-112024-09-110001723580bfi:RedeemableWarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember2024-09-112024-09-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

_______________________________________

FORM 8-K

_______________________________________

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): September 11, 2024

_______________________________________

BurgerFi International, Inc.

(Exact name of registrant as specified in its charter)

_______________________________________

| | | | | | | | |

| 001-38417 | Delaware | 82-2418815 |

(Commission File Number) | (State or Other Jurisdiction of Incorporation) | (I.R.S. Employer Identification No.) |

| | | | | |

200 East Las Olas Blvd., Suite 1400 Fort Lauderdale, FL | 33301 |

| (Address of Principal Executive Offices) | (Zip Code) |

(954) 618-2000

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, If Changed Since Last Report)

_______________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4 (c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common stock, par value $0.0001 per share | | BFI | | The Nasdaq Stock Market LLC |

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share | | BFIIW | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

The information set forth below in Item 1.03 of this Current Report on Form 8-K (this “Form 8-K) regarding the DIP Financing Agreement (as defined below) is incorporated herein by reference.

Item 1.03 Bankruptcy or Receivership.

On September 11, 2024, BurgerFi International, Inc. (the “Company”) and one hundred fourteen (114) affiliates (the “Affiliates” and collectively the Company and the Affiliates, the “Debtors”) each filed a voluntary petition for relief (the “Bankruptcy Petition”) under chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”). All such chapter 11 cases in the Company’s bankruptcy case are being jointly administered by the Bankruptcy Court under the caption In re BurgerFi International, Inc., et al., Case No. 24-12017 (CTG). The Company is continuing to operate its business as a debtor in possession under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code and orders of the Bankruptcy Court. Further information about the Bankruptcy Petition and the Company’s chapter 11 case is available free of charge at the website maintained by Company’s claims and noticing agent at https://cases.stretto.com/BFI.

In connection with the Bankruptcy Petition, the Debtors filed motions seeking Bankruptcy Court approval of debtor-in-possession financing on the terms set forth in that certain Secured Super-Priority Debtor-in-Possession Credit Agreement, dated on September 14, 2024, as amended, restated, supplemented, or otherwise modified from time to time (the “DIP Financing Agreement”), by and among the (i) the Company, (ii) Plastic Tripod, Inc., a Delaware corporation and a subsidiary of the Company (together with the Company, each a “Borrower” and collectively, “Borrowers”), (iii) the other subsidiaries of the Company party thereto (each a “Guarantor” and collectively, the “Guarantors” and together with Borrowers, the “Credit Parties”), and (iv) TREW Capital Management Private Credit 2 LLC, a Delaware limited liability company, as the sole lender under the Credit Agreement (“Lender”) and also as administrative agent and collateral agent (in such capacities, together with its successors and permitted assigns, the “Senior Administrative Agent” and together with the Lender and the Senior Administrative Agent, the “Lender Parties”).The DIP Financing Agreement provides for senior secured superpriority debtor-in-possession financing facilities (the “DIP Financing”) consisting of a $5,180,000 senior secured, multiple-draw credit facility to the Debtors comprised of (x) (i) an Interim New Money DIP Loan in the aggregate principal amount of up to $3,500,000 and (ii) an Interim Roll Up DIP Loan in the aggregate principal amount of $7,000,000, each of which will be available to be drawn or deemed drawn, as applicable, after entry of the Interim Order (as defined below) and (y) (i) an Additional New Money DIP Loan in the aggregate principal amount of up to $1,680,000, and (ii) an Additional Roll Up DIP Loan in the aggregate principal amount of $3,360,000, each of which will be available to be drawn or deemed drawn after entry of the Final Order.

The Borrowers shall repay to the Lender on the Maturity Date the aggregate principal amount of all Loans outstanding on such date, together with all accrued and unpaid interest thereon, any outstanding fees, in each case, payable in accordance with the DIP Loan Documents. Use of proceeds of the Loans shall only be used in accordance with the Budget and the DIP Order. The DIP Financing is subject to certain customary covenants and events of default as set forth in the DIP Financing Agreement.

The foregoing description and any undefined terms of the DIP Financing Agreement are qualified in its entirety by reference to the DIP Order entered by the Bankruptcy Court and the DIP Financing Agreement filed with the Bankruptcy Court.

Item 2.04. Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation Under an Off-Balance Sheet Arrangement.

The filing of the Bankruptcy Petition described in Item 1.03 above constitutes an event of default that accelerates the Company’s obligations under the following agreements: that certain Credit Agreement, dated as of December 15, 2015, by and among (i) the Credit Parties, and (ii) TREW Capital Management Private Credit 2 LLC, a Delaware limited liability company, as the sole lender (“Senior Secured Lender”) and as administrative agent (the “Senior Administrative Agent”) and collateral agent (in such capacities and together with the Senior Secured Lender and the Senior Administrative Agent, the “Senior Secured Lender Parties”) (as amended from time to time, the “Existing Credit Agreement”); that certain Secured Promissory Note (the “Note”), dated February 24, 2024, by and between the Borrowers and CP7 Warming Bag, L.P. (“Junior Lender”), as amended by Amendment No.1 to the Note, dated May 30, 2024; and that certain Emergency Protective Advance Agreement (the “Advance Agreement”), dated August 8, 2024, by and between the Credit Parties, the Senior Secured Lender Parties, and the Junior Lender (collectively, the Existing Credit Agreement, the Note, and the Advance Agreement are referred to as the “Financial Obligation Agreements”). The Financial Obligation Agreements provide that as a result of the Bankruptcy Petition described in Item 1.03 above, all obligations to pay any debts, principal,

interest, fees, expenses, and other amounts due thereunder shall be immediately due and payable. Any efforts to enforce such payment obligations under the Financial Obligation Agreements are automatically stayed as a result of the Bankruptcy Petition, and the creditors’ rights of enforcement in respect of the Financial Obligation Agreements are subject to the applicable provisions of the Bankruptcy Code.

Item 3.01. Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

On September 12, 2024, the Company received written notice from the director of the Listing Qualifications department of The Nasdaq Stock Market (“Nasdaq”), notifying the Company that the Company’s securities will be delisted from Nasdaq in accordance with Listing Rules 5101, 5110(b), and IM-5101-1, and for failure to satisfy Listing Rules 5550(a)(2), 5250(c)(1), and 5605. Accordingly, trading of the Company’s Common Stock will be suspended at the opening of business on September 23, 2024, and a Form 25-NSE will be filed with the Securities and Exchange Commission (the “SEC”), which will remove the Company’s securities from listing and registration on Nasdaq. The Company does not intend to appeal Nasdaq’s determination.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On September 16, 2024, David Heidecorn resigned from the board of directors of the Company, effective immediately. Mr. Heidecorn’s resignation was not a result of any disagreements with the Company on any matter relating to the Company’s operations, policies, or practices.

Item 7.01 Regulation FD Disclosure.

On September 11, 2024, the Company issued a press release announcing the filing of the Bankruptcy Petition described in Item 1.03 above. A copy of the press release is being filed as Exhibit 99.1 to this Form 8-K and is incorporated herein by reference.

On September 16, 2024, the Company issued a press release announcing the DIP Financing described in Item 1.03 above. A copy of the press release is being filed as Exhibit 99.2 to this Form 8-K and is incorporated herein by reference.

The information contained in this Item 7.01 is being furnished under Item 7.01 of Current Report on Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information and exhibit be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits. | | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Dated: September 17, 2024

| | | | | | | | |

| BURGERFI INTERNATIONAL, INC. | |

| | |

| By: | /s/ Jeremy Rosenthal | |

| Jeremy Rosenthal, Chief Restructuring Officer | |

September 11, 2024 BurgerFi International Files for Protection Under Chapter 11 All 144 locations remain open and continue normal operations FORT LAUDERDALE, Fla., Sept. 11, 2024 /PRNewswire/ -- BurgerFi International, Inc. (NASDAQ: BFI, BFIIW) ("BurgerFi" or the "Company"), owner of the high-quality, casual dining chain Anthony's Coal Fired Pizza & Wings ("Anthony's") and one of the nation's leading fast-casual "better burger" dining concepts, BurgerFi, announced today that it has filed voluntary petitions for reorganization under Chapter 11 of the U.S. Bankruptcy Code in order to preserve the value of its brands for all stakeholders. All 144 locations of the Company's two brands throughout the United States, including in Puerto Rico, and in Saudi Arabia, (both corporate-owned and franchised) will continue normal, uninterrupted operations. The Chapter 11 filing by the Company includes only the 67 corporate-owned locations of both brands. Franchisee-owned locations of BurgerFi and Anthony's Coal Fired Pizza & Wings are excluded from the bankruptcy proceedings. "BurgerFi and Anthony's Coal Fired Pizza & Wings are dynamic and beloved brands, and in the face of a drastic decline in post-pandemic consumer spending amidst sustained inflation and increasing food and labor costs, we need to stabilize the business in a structured process," said Jeremy Rosenthal, Chief Restructuring Officer of BurgerFi International, Inc. "We are confident that this process will allow us to protect and grow our brands and to continue the operational turnaround started less than 12 months ago and secure additional capital." The Board brought in Carl Bachmann as chief executive officer and Christopher E. Jones, chief financial officer in July 2023 to turnaround and strengthen the brands and operations. Faced with legacy operational challenges, they quickly developed and implemented a strategic plan to address foundational issues including declining same store sales, high employee turnover and a stale menu. As part of the turnaround efforts, the Company initiated a top-to-bottom evaluation of its operations, which is continuing. As a result, the Company has aligned its footprint with current business standards through the closure of 19 underperforming corporate-owned stores and reduced related operating costs. The Company's current platform is primed for success. "Despite the early positive indicators of the turnaround plan initiated less than a year ago, the legacy challenges facing the business necessitated today's filing," said Carl Bachmann. "We are grateful for the continued support of our loyal customers, vendors, business

partners and our dedicated team members, who are the heart of the company." The Company will be filing customary "first day" motions in the Chapter 11 cases, to ensure normal operations. These motions, subject to court approval, will enable the timely payment of employee wages and benefits, the continuation of customer programs and other relief. The expedited relief being sought by the Company includes permitting guests to continue to use rewards and gift cards at participating locations to enjoy the exceptional food and service we are proud to provide through BurgerFi and Anthony's Coal Fired Pizza & Wings. Court filings and other documents related to the restructuring are available on a separate website administered by the Company's claims agent, Stretto, Inc. at cases.stretto.com/BFI. Stakeholders with questions can call (855) 492-7450 or (714) 881-5915 or email BurgerFiInquiries@stretto.com. Proposed advisors to the Company are Raines Feldman Littrell LLP, Force Ten Partners, with Jeremy Rosenthal as the Company's Chief Restructuring Officer, and Sitrick And Company as strategic communications advisor to the Company. About BurgerFi International (Nasdaq: BFI, BFIIW) BurgerFi International, Inc. is a leading multi-brand restaurant company that develops, markets, and acquires fast-casual and premium-casual dining restaurant concepts around the world, including corporate-owned stores and franchises. BurgerFi International, Inc. is the owner and franchisor of the two following brands with a combined 144 locations. Anthony's. Anthony's is a premium pizza and wing brand with 51 restaurants (50 corporate- owned casual restaurant locations and one dual brand franchise location), as of September 10, 2024. Known for serving fresh, never frozen and quality ingredients, Anthony's is centered around a 900-degree coal-fired oven with menu offerings including "well-done" pizza, coal-fired chicken wings, homemade meatballs, and a variety of handcrafted sandwiches and salads. Anthony's was named "The Best Pizza Chain in America" by USA Today's Great American Bites, "Top 3 Best Major Pizza Chain" by Mashed in 2021, "The Absolute Best Wings in the U.S." by Mashed in 2022, and named in "America's Favorite Restaurant Chains of 2022" by Newsweek. BurgerFi. BurgerFi is among the nation's fast-casual better burger concepts with 93 BurgerFi restaurants (76 franchised and 17 corporate-owned) as of September 10, 2024. BurgerFi is chef-founded and committed to serving fresh, all-natural and quality food at all locations, online and via first-party and third-party deliveries. BurgerFi uses 100% American Angus Beef with no steroids, antibiotics, growth hormones, chemicals or additives. BurgerFi's menu also includes high-quality Wagyu Beef Blend Burgers, All-Natural Chicken offerings, Hand-Cut Sides, and Frozen Custard Shakes. BurgerFi was named "The Very Best Burger" at the 2023 edition of the nationally acclaimed SOBE Wine and Food Festival and "Best Fast Food Burger" in USA Today's 10Best 2023 Readers' Choice Awards for its BBQ Rodeo Burger, "Best Fast Casual Restaurant" in USA Today's 10Best 2023 Readers' Choice Awards for the third consecutive year, QSR Magazine's Breakout Brand of 2020 and Fast Casual's 2021 #1 Brand of the Year. In 2021, Consumer Reports awarded BurgerFi an "A Grade Angus Beef" rating for the third consecutive year. To learn more about BurgerFi or to find a full list of locations, please visit www.burgerfi.com. BurgerFi® is a Registered Trademark of BurgerFi IP, LLC, a wholly-owned subsidiary of BurgerFi.

Forward-Looking Statements This press release may contain "forward-looking statements" as defined in the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements generally can be identified by words such as "anticipates," "believes," "estimates," "expects," "intends," "plans," "predicts," "projects," "will be," "will continue," "will likely result," and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those risks and uncertainties described under the heading "Risk Factors" in the Company's Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on April 10, 2024, the Company's Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission on May 16, 2024, and in any other filings made by the Company with the U.S. Securities and Exchange Commission, which are available at www.sec.gov, and the risks attendant to the bankruptcy process, including the Company's ability to obtain court approval from the Court with respect to motions or other requests made to the Court throughout the course of the Chapter 11 cases; the effects of the Chapter 11 cases, including increased legal and other professional costs; results of operations or business prospects; the effects of the Chapter 11 cases on the interests of various constituents and financial stakeholders; the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of the Chapter 11 cases; objections to the Company's restructuring process or other pleadings filed that could protract the Chapter 11 cases; risks associated with third-party motions in the Chapter 11 cases; Court rulings in the Chapter 11 cases and the outcome of the Chapter 11 cases in general. All subsequent written and oral forward-looking statements attributable to BurgerFi or persons acting on BurgerFi's behalf are expressly qualified in their entirety by the cautionary statements included in this press release. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. View original content:https://www.prnewswire.com/news-releases/burgerfi-international-files- for-protection-under-chapter-11-302245295.html SOURCE BurgerFi International

BurgerFi International Receives Approval of First Day Motions to Support Business Operations Secures Interim Approval to Access New Financing FORT LAUDERDALE, FL -- September 16, 2024 -- BurgerFi International, Inc. (NASDAQ: BFI, BFIIW) (“BurgerFi” or the “Company”), owner of the high-quality, casual dining chain Anthony’s Coal Fired Pizza & Wings (“Anthony’s”) and one of the nation’s leading fast-casual “better burger” dining concepts, BurgerFi, today announced that it received interim Court approval of its “first day” motions designed to facilitate and ensure the continued and uninterrupted operations of the Company’s 144 locations, as requested. The Court granted interim approval for the Company to immediately access $3.5 million of the debtor-in-possession (DIP) financing provided by an affiliate of TREW Capital Management. The Court also approved the use of the Company’s existing employee benefits, cash management systems, and customer programs. With the DIP financing approved by the Court, the Company has the liquidity to stabilize its operations and work with its vendors and landlords to meet the high standards for the BurgerFi and Anthony’s brands. “The Company has worked very hard to ensure that the transition into Chapter 11 would have no impact on our valued employees, customers and franchise partners,” said Carl Bachmann, Chief Executive Officer of BurgerFi International, Inc. “We are very pleased that we received approval of our key motions to support our continued operations including employee wages and benefits, cash management and customer programs.” As part of the financing agreement, the Company intends to propose a sale process and bidding procedures for a sale with the support of its lenders. The “second day” hearing seeking final approval for the Company’s requests is scheduled for October 7, 2024. “Receipt of interim approval of our DIP financing provides the Company with liquidity to fund operating expenses and meet obligations while we restructure. We now have the liquidity for operations at BurgerFi and Anthony’s to continue as usual,” concluded Jeremy Rosenthal, Chief Restructuring Officer. The Company filed its voluntary petitions on September 11, 2024, in the U.S. Bankruptcy Court for the District of Delaware in Wilmington. The case number is 21-12017. David Heidecorn served notice to the Board of Directors of his resignation as an independent member of the Board of Directors and as Chairman of the Board, effective immediately. Court filings and other documents related to the restructuring are available on a separate website administered by the Company’s claims agent, Stretto, Inc. at cases.stretto.com/BFI.

Stakeholders with questions can call (855) 492-7450 or (714) 881-5915 or email BurgerFiInquiries@stretto.com Proposed advisors to the Company are Raines Feldman Littrell LLP, Force Ten Partners LLC, with Jeremy Rosenthal as the Company’s Chief Restructuring Officer, and Sitrick And Company as strategic communications advisor to the Company. About BurgerFi International (Nasdaq: BFI, BFIIW) BurgerFi International, Inc. is a leading multi-brand restaurant company that develops, markets, and acquires fast-casual and premium-casual dining restaurant concepts around the world, including corporate-owned stores and franchises. BurgerFi International, Inc. is the owner and franchisor of the two following brands with a combined 144 locations. Anthony’s. Anthony’s is a premium pizza and wing brand with 51 restaurants (50 corporate- owned casual restaurant locations and one dual brand franchise location), as of September 10, 2024. Known for serving fresh, never frozen and quality ingredients, Anthony’s is centered around a 900-degree coal-fired oven with menu offerings including “well-done” pizza, coal- fired chicken wings, homemade meatballs, and a variety of handcrafted sandwiches and salads. Anthony’s was named “The Best Pizza Chain in America" by USA Today's Great American Bites, “Top 3 Best Major Pizza Chain” by Mashed in 2021, “The Absolute Best Wings in the U.S.” by Mashed in 2022, and named in “America's Favorite Restaurant Chains of 2022” by Newsweek. BurgerFi. BurgerFi is among the nation’s fast-casual better burger concepts with 93 BurgerFi restaurants (76 franchised and 17 corporate-owned) as of September 10, 2024. BurgerFi is chef-founded and committed to serving fresh, all-natural and quality food at all locations, online and via first-party and third-party deliveries. BurgerFi uses 100% American Angus Beef with no steroids, antibiotics, growth hormones, chemicals or additives. BurgerFi's menu also includes high-quality Wagyu Beef Blend Burgers, All-Natural Chicken offerings, Hand-Cut Sides, and Frozen Custard Shakes. BurgerFi was named "The Very Best Burger" at the 2023 edition of the nationally acclaimed SOBE Wine and Food Festival and “Best Fast Food Burger” in USA Today’s 10Best 2023 Readers’ Choice Awards for its BBQ Rodeo Burger, "Best Fast Casual Restaurant" in USA Today's 10Best 2023 Readers' Choice Awards for the third consecutive year, QSR Magazine's Breakout Brand of 2020 and Fast Casual's 2021 #1 Brand of the Year. In 2021, Consumer Reports awarded BurgerFi an “A Grade Angus Beef” rating for the third consecutive year. To learn more about BurgerFi or to find a full list of locations, please visit www.burgerfi.com. BurgerFi® is a Registered Trademark of BurgerFi IP, LLC, a wholly-owned subsidiary of BurgerFi. Forward-Looking Statements This press release may contain “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking statements generally can be identified by words such as “anticipates,” “believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,” “projects,” “will be,” “will

continue,” “will likely result,” and similar expressions. These forward-looking statements are based on current expectations and assumptions that are subject to risks and uncertainties, which could cause our actual results to differ materially from those reflected in the forward-looking statements. Factors that could cause or contribute to such differences include, but are not limited to, those risks and uncertainties described under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission on April 10, 2024, the Company’s Quarterly Report on Form 10-Q filed with the U.S. Securities and Exchange Commission on May 16, 2024, and in any other filings made by the Company with the U.S. Securities and Exchange Commission, which are available at www.sec.gov, and the risks attendant to the bankruptcy process, including the Company's ability to obtain court approval from the Court with respect to motions or other requests made to the Court throughout the course of the Chapter 11 cases; the effects of the Chapter 11 cases, including increased legal and other professional costs; results of operations or business prospects; the effects of the Chapter 11 cases on the interests of various constituents and financial stakeholders; the length of time that the Company will operate under Chapter 11 protection and the continued availability of operating capital during the pendency of the Chapter 11 cases; objections to the Company's restructuring process or other pleadings filed that could protract the Chapter 11 cases; risks associated with third-party motions in the Chapter 11 cases; Court rulings in the Chapter 11 cases and the outcome of the Chapter 11 cases in general. All subsequent written and oral forward-looking statements attributable to BurgerFi or persons acting on BurgerFi’s behalf are expressly qualified in their entirety by the cautionary statements included in this press release. We undertake no obligation to revise or publicly release the results of any revision to these forward-looking statements, except as required by law. Given these risks and uncertainties, readers are cautioned not to place undue reliance on such forward-looking statements. Media Contact: Anita-Marie Laurie anitamarie@sitrick.com (310) 663-3036 Rich Wilner rwilner@sitrick.com (917) 952-8023

v3.24.3

Cover

|

Sep. 11, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 11, 2024

|

| Entity Registrant Name |

BurgerFi International, Inc.

|

| Entity File Number |

001-38417

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

82-2418815

|

| Entity Address, Address Line One |

200 East Las Olas Blvd., Suite 1400

|

| Entity Address, City or Town |

Fort Lauderdale

|

| Entity Address, State or Province |

FL

|

| Entity Address, Postal Zip Code |

33301

|

| City Area Code |

(954)

|

| Local Phone Number |

618-2000

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001723580

|

| Common stock, par value $0.0001 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

BFI

|

| Security Exchange Name |

NASDAQ

|

| Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Redeemable warrants, each exercisable for one share of common stock at an exercise price of $11.50 per share

|

| Trading Symbol |

BFIIW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bfi_CommonStockParValue00001PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bfi_RedeemableWarrantsEachExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

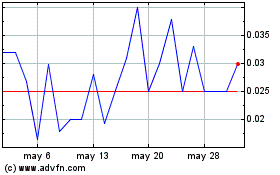

BurgerFi (NASDAQ:BFIIW)

Gráfica de Acción Histórica

De Ago 2024 a Sep 2024

BurgerFi (NASDAQ:BFIIW)

Gráfica de Acción Histórica

De Sep 2023 a Sep 2024