false

0001485003

0001485003

2024-12-07

2024-12-07

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

December 7, 2024

Carisma Therapeutics Inc.

(Exact Name of Registrant as Specified in its

Charter)

| Delaware |

|

001-36296 |

|

26-2025616 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

| |

|

|

|

|

3675 Market Street, Suite 401

Philadelphia, PA |

|

|

|

19104 |

| (Address of Principal Executive Offices) |

|

|

|

( Zip Code) |

Registrant’s telephone number, including

area code: (267) 491-6422

(Former Name or Former Address, if Changed

Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction

A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| |

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of exchange

on which registered |

| Common Stock, $0.001 par value |

|

CARM |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 2.05 Costs Associated with Exit or Disposal Activities.

On December 7, 2024, after consideration by the board of directors

of Carisma Therapeutics Inc. (the “Company”) of the Company’s current cash runway and operating plan, the board of directors

approved a revised operating plan, which includes a reduction in workforce. Affected employees were informed of the reduction in workforce

on December 9, 2024. The reduction in workforce includes 23 full-time employees (representing approximately 34% of the Company’s

total workforce), including certain employees engaged in research and development, manufacturing, finance and corporate activities.

The Company expects to incur approximately $2.7 million in connection

with the reduction in workforce, which primarily represents one-time employee termination benefits directly associated with the workforce

reduction. The Company expects the reduction in workforce to be substantially complete and to pay the majority of related reduction in

workforce amounts by the end of the first quarter of 2025. The Company may also incur other charges or cash expenditures not currently

contemplated due to events that may occur as a result of, or associated with, the reduction in workforce.

Item 5.02 Departure of Directors or Certain Officers; Election of

Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On December 7, 2024, as part of the reduction in workforce, the

Company notified Richard Morris, the Company’s Chief Financial Officer, that his employment with the Company will terminate without

cause effective December 31, 2024. Under his existing employment agreement with the Company and based on his termination without

cause, Mr. Morris is entitled to receive, subject to his execution and non-revocation of a release of claims in favor of the Company

and compliance with all post-employment obligations under law or any restrictive covenant agreement with the Company, (1) twelve months

of base salary, which the Company plans to pay in a lump sum rather than over time, (2) a lump sum payment equal to 100% of his target

bonus for the year of termination based on his departure date of December 31, 2024, and (3) COBRA health continuation for up

to twelve months. In addition, the board of directors of the Company approved the acceleration of the first 50% installment

of the special retention option to purchase 85,000 shares of common stock granted to Mr. Morris with an effective grant date of June 17,

2024, which would have vested in June 2025 and was intended to serve as an incentive to retain key members of management during the

continuing implementation of the Company’s revised operating plan approved in March 2024, as well as in recognition of the

management team’s performance and contributions throughout the implementation process. The Company expects to appoint a consultant

to serve as the Company’s principal financial officer and principal accounting officer.

Item 8.01 Other Events.

In connection with the revised operating plan, the Company has elected

to cease further development of the Company’s lead product candidate, CT-0525, which is intended to treat solid tumors that overexpress

HER2. The Company’s decision was based on an assessment of the competitive landscape in anti-HER2 treatments, including the impact

of recently approved anti-HER2 therapies on HER2 antigen loss/downregulation, and the effects on the future development strategy of any

anti-HER2 product. Although the Company plans to complete ongoing activities under the Phase 1 clinical trial of CT-0525, the final patient

has already been enrolled in the clinical trial.

The revised operating plan approved by the board of directors focuses

the Company’s clinical development efforts on in vivo mRNA/lipid nanoparticle CAR-M programs in collaboration with ModernaTX

Inc. and contemplates continuing research and development of multiple assets for the potential treatment of diseases beyond oncology,

including fibrosis, neurodegeneration and other immunologic and inflammatory diseases, as well as the potential development of CT-1119,

a mesothelin-targeted CAR-Monocyte. As previously disclosed, the Company expects to nominate a development candidate in its liver fibrosis

program in the first quarter of 2025.

Cautionary Note on Forward-Looking Statements

Statements in this Current Report on Form 8-K about future expectations,

plans and prospects, as well as any other statements regarding matters that are not historical facts, may constitute “forward-looking

statements” within the meaning of The Private Securities Litigation Reform Act of 1995. These statements include, but are not limited

to, statements relating to the Company’s intentions, beliefs, projections, outlook, analyses or current expectations concerning,

among other things, the expected timing for the completion of the reduction in workforce; the expected charges to be incurred and the

related cash payments and the timing thereof; future employment relationships; the future development focus of the Company and related

timelines; and other statements that are not historical fact. The words “continue,” “estimate,” “expect,”

“may,” “plan,” “will,” and similar expressions are intended to identify forward-looking statements,

although not all forward-looking statements contain these identifying words. Any forward-looking statements are based on management’s

current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ

materially and adversely from those set forth in, or implied by, such forward-looking statements. These risks and uncertainties include,

but are not limited to, changes to the assumptions on which the estimated charges associated with the reduction in workforce are based;

the “at-will” nature of employment relationships; changes in the macroeconomic environment or competitive landscape that impact

the Company’s business; and risks related to the Company’s business and the Company’s ongoing evaluation of strategic

alternatives. For a discussion of these risks and uncertainties, and other important factors, any of which could cause the Company’s

actual results to differ from those contained in the forward-looking statements, see the “Risk Factors” set forth in the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023, its Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024, as well as discussions of potential risks, uncertainties, and other important factors in the Company’s

other recent filings with the Securities and Exchange Commission. Any forward-looking statements that are made in this press release speak

as of the date of this press release. The Company undertakes no obligation to revise the forward-looking statements or to update them

to reflect events or circumstances occurring after the date of this press release, whether as a result of new information, future developments

or otherwise, except as required by the federal securities laws.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CARISMA THERAPEUTICS INC. |

| |

|

|

| |

By: |

/s/ Steven Kelly |

| Date: December 9, 2024 |

|

Steven Kelly |

| |

|

President and Chief Executive Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

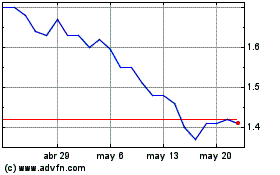

Carisma Therapeutics (NASDAQ:CARM)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Carisma Therapeutics (NASDAQ:CARM)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024