UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

13E-3

RULE

13e-3 TRANSACTION STATEMENT

UNDER

SECTION 13(e) OF

THE SECURITIES

EXCHANGE ACT OF 1934

Cepton

Inc.

(Name

of the Issuer)

Cepton

Inc.

KOITO MANUFACTURING CO., LTD.

Project

Camaro Holdings, LLC

Project

Camaro Merger Sub, Inc.

(Names

of Persons Filing Statement)

Common

Stock, $0.00001 par value per share

(Title

of Class of Securities)

15673X200

(CUSIP Number of Class of Securities)

Jun

Pei

Chairman,

President and Chief Executive Officer

Cepton, Inc.

399 West Trimble Road

San

Jose, California 95131

(408) 459-7579

|

Satoshi

Kabashima

KOITO

MANUFACTURING CO., LTD.

Project

Camaro Holdings, LLC

Project

Camaro Merger Sub, Inc.

Sumitomo

Fudosan Osaki Twin Bldg. East, 5-1-18,

Kitashinagawa, Shinagawa-ku,

Tokyo

141-0001, Japan

+81-3-3443-7111 |

(Name,

Address and Telephone Number of Persons Authorized to

Receive Notices and Communications on Behalf of Persons Filing Statement)

Copies

to:

Paul

Sieben

Viq

Shariff

O’Melveny & Myers LLP

2765 Sand Hill Road

Menlo Park, California 94025

(650) 473-2600

|

Ken

Lebrun

Davis

Polk & Wardwell LLP

Izumi

Garden Tower 33F

1-6-1

Roppongi

Minato-ku

Tokyo

106-6033,Japan |

This statement

is filed in connection with (check the appropriate box):

| a. | ☒

The filing of solicitation materials or an information statement subject to Regulation 14A,

Regulation 14C, or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

| b. | ☐

The filing of a registration statement under the Securities Act of 1933. |

Check the

following box if the soliciting materials or information statement referred to in checking box (a) are preliminary copies: ☒

Check the

following box if the filing is a final amendment reporting the results of the transaction: ☐

RULE

13e-3 TRANSACTION STATEMENT INTRODUCTION

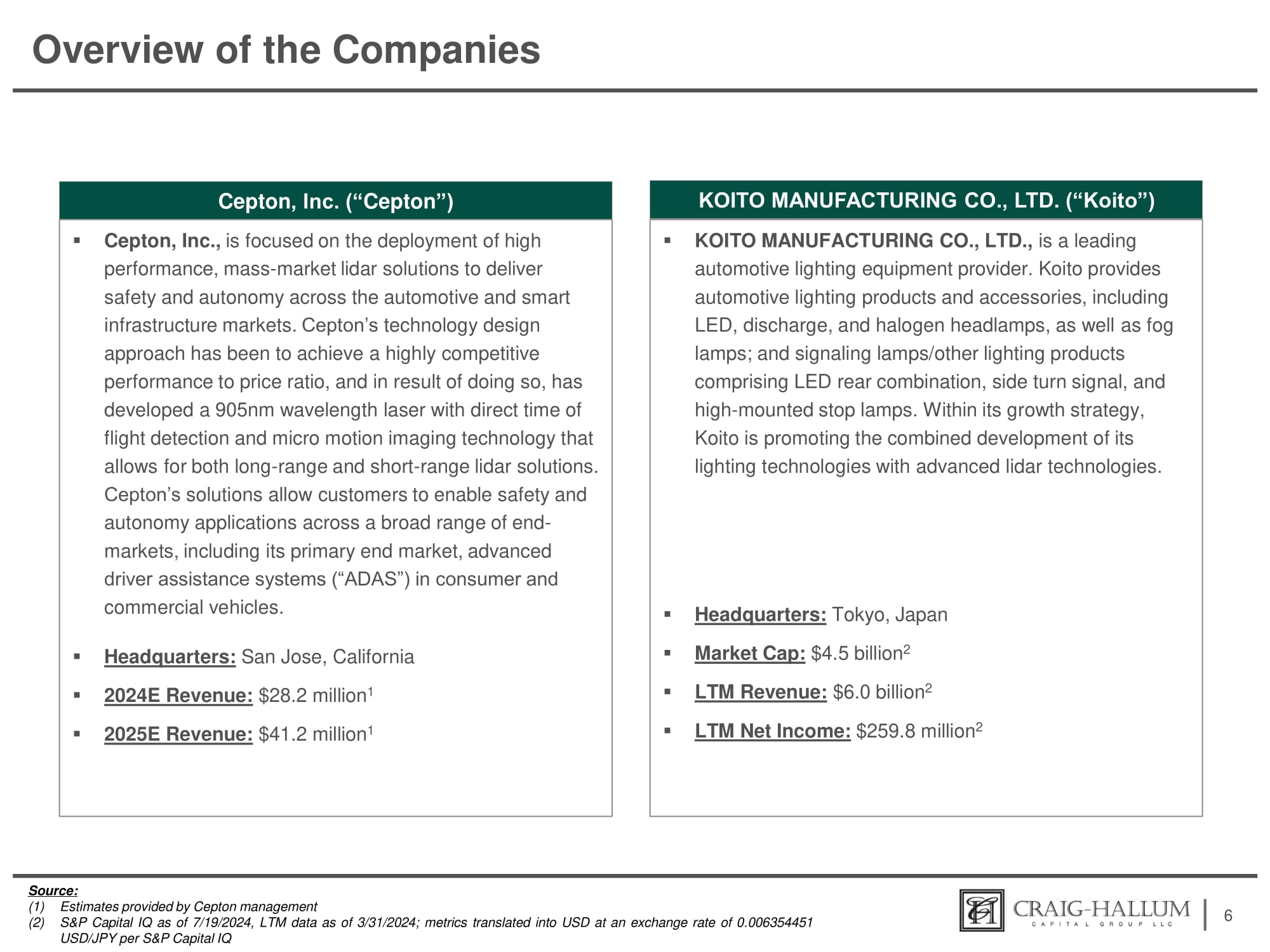

This

Rule 13e-3 Transaction Statement on Schedule 13E-3 (this “Transaction Statement”) is being filed with the U.S. Securities

and Exchange Commission (the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), by (1) Cepton Inc. (the “Company”), a Delaware corporation (2) KOITO MANUFACTURING

CO., LTD., a corporation organized under the laws of Japan (“Parent” or “Koito”), (3) Project Camaro

Holdings, LLC, a Delaware limited liability company and wholly owned subsidiary of Parent (“Holdco”), and (4) Project

Camaro Merger Sub, Inc., a Delaware corporation and a wholly owned subsidiary of Holdco (“Merger Sub” and, together

with Parent and Holdco, the “Koito Entities”) (each of (1) through (4) a “Filing Person,” and collectively,

the “Filing Persons”).

This

Transaction Statement is being filed with the SEC concurrently with the filing of the Company’s preliminary proxy statement on

Schedule 14A (the “Proxy Statement”) pursuant to Regulation 14A under the Exchange Act. The information contained

in the Proxy Statement, including all annexes thereto, is expressly incorporated herein by reference and the responses to each item of

this Transaction Statement are qualified in their entirety by reference to the information contained in the Proxy Statement. As of the

date hereof, the Proxy Statement is in preliminary form and is subject to completion or amendment. This Transaction Statement will be

amended to reflect such completion or amendment of the Proxy Statement. Capitalized terms used and not otherwise defined herein have

the meanings ascribed to such terms in the Proxy Statement.

The

Company proposes to hold a special meeting of its stockholders to consider approval of the Agreement and Plan of Merger, dated July 29,

2024 (the “Merger Agreement”), by and among the Company, Parent, and Merger Sub, pursuant to which, among other things,

Merger Sub will merge with and into the Company (the “merger”). As a result of the Merger, the separate corporate

existence of Merger Sub will cease, and the Company will continue as the surviving corporation of the Merger and as an indirect controlled

subsidiary of Parent and a wholly owned subsidiary of Holdco.

The

Board of Directors of the Company (the “Board”) referred consideration of any potential transaction involving the

Company to a Special Committee of the Board (the “Special Committee”), including the authority to, among other things,

review, evaluate, negotiate, and make a recommendation to the Board whether to approve any proposal made by Parent.

After

careful consideration, including a thorough review of the Merger Agreement, the other transaction documents and the terms of the merger,

and taking into account the presentations made to the Special Committee and various other factors discussed and considered by the Special

Committee, and after due consideration of its fiduciary duties under applicable law, the Special Committee has determined that the terms

of the Merger Agreement, the other transaction documents and the merger, including the Merger Consideration (as defined below) payable

in connection therewith, are advisable, fair to, and in the best interests of, the Company and the stockholders of the Company (other

than the Parent or Merger Sub or any of their respective affiliates or the Rolling Participants (as defined in the Proxy Statement).

Accordingly, the Special Committee unanimously recommended that the Board approve, adopt and declare advisable and in the best interests

of the Company and its stockholders the Merger Agreement, the other transaction documents and the merger.

The

Board (acting on the recommendation of the Special Committee, whose analyses and determinations the Board adopted as its own in its evaluation

of the fairness of the merger), after considering the factors more fully described in the enclosed Proxy Statement: (1) determined that

the merger, and the other transactions contemplated by the Merger Agreement are advisable and in the best interests of the Company and

its stockholders including the unaffiliated security holders as defined under Rule 13e-3 under the Exchange Act and (2) approved the

Merger Agreement, the merger and the other transactions contemplated by the Merger Agreement.

The

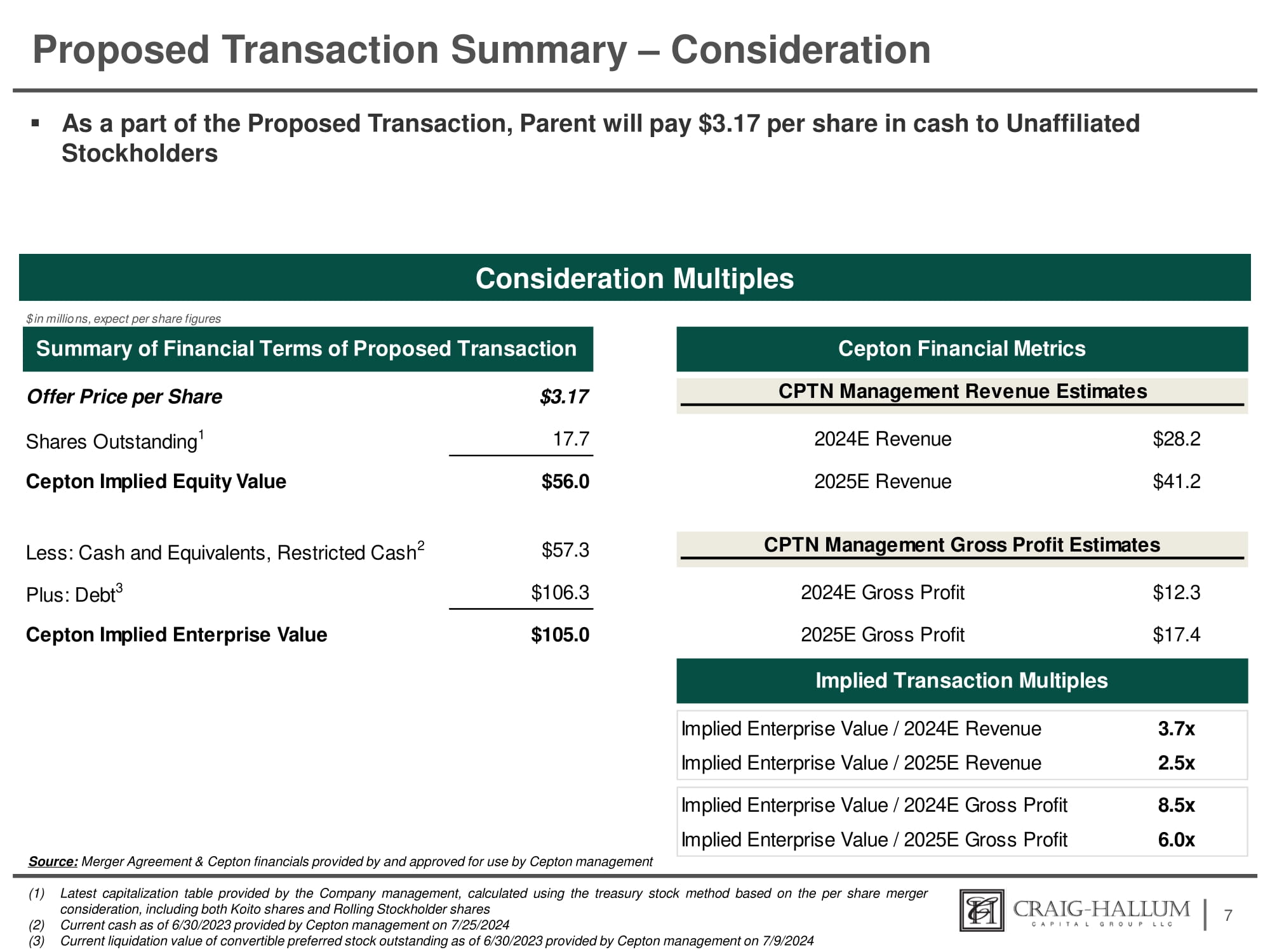

Merger Agreement provides that each share of the Company’s common stock (the “Common Stock”) outstanding immediately

prior to the date of the filing of the Certificate of Merger with the Secretary of State of the State of Delaware (the “Effective

Time”) (other than certain excluded shares of Common Stock) will be converted into the right to receive, subject to the terms

and conditions contained in the Merger Agreement, an amount in cash equal to $3.17 per share, without interest (the “Merger

Consideration”). At the Effective Time, each share of Preferred Stock issued and outstanding immediately prior to the Effective

Time shall remain outstanding and shall not be cancelled.

The

Merger Agreement also provides that at or immediately prior to the Effective Time:

| ● | each

compensatory option to purchase shares of Common Stock (a “Company Option”)

that is outstanding immediately prior to the Effective Time, whether or not vested or exercisable,

shall be cancelled, and the holder of any such option shall be entitled to receive, at or

promptly after the merger, an amount in cash, less any withholding taxes, determined by multiplying

(a) the excess, if any, of the per share price over the applicable exercise price per share

of the Company Option by (b) the number of shares of Common Stock subject to such Company

Option immediately prior to the Effective Time; |

| ● | each

service-based restricted stock unit or deferred stock unit of the Company (“Company

RSU”) that is outstanding immediately prior to the Effective Time, whether or not

vested, shall be canceled, and the holder of any such Company RSU will be entitled to receive

(without interest), at or promptly after the Effective Time, for each such Company RSU an

amount in cash, less any withholding taxes, determined by multiplying the per share price

by the number of shares of Common Stock underlying such Company RSU immediately prior to

the Effective Time; provided, that as to any such Company RSU that is not vested as of the

Effective Time, the per share price for such unvested Company RSU will remain subject to

the vesting conditions that applied to such Company RSU immediately prior to the Effective

Time (including any provisions for accelerated vesting of such Company RSU in connection

with a termination of the holder’s employment) and shall be payable only if and to

the extent such vesting conditions are satisfied; |

| ● | each

award of performance-based restricted stock units of the Company (“Company PSU”)

that is outstanding immediately prior to the Effective Time shall vest as to the number of

Company PSUs determined in accordance with the applicable award agreement and shall be canceled

and converted into the right to receive (without interest), at or promptly after the Effective

Time, an amount in cash (without interest) determined by multiplying the per share price

by the number of shares of Common Stock underlying such vested Company PSUs, less any withholding

taxes. Any Company PSU that is not vested as of immediately prior to the Effective Time shall

be canceled at the Effective Time without payment of any consideration therefor; and |

| ● | each

outstanding warrant shall, in accordance with its terms under the Warrant Agreement, automatically

and without any required action on the part of the holder thereof, cease to represent a warrant

exercisable for shares of Common Stock and shall become a warrant exercisable for the merger

consideration. If a holder properly exercises a warrant within thirty (30) days following

the public disclosure of the consummation of the merger pursuant to a Current Report on Form

8-K filed with the SEC, the Warrant Price, as defined in the Warrant Agreement, with respect

to such exercise shall be reduced by an amount (in dollars and in no event less than zero)

equal to the difference of (a) the Warrant Price in effect prior to such reduction minus

(b) (i) the per share merger consideration minus (ii) the Black-Scholes Warrant Value (as

defined in the Warrant Agreement). |

Concurrently

with the execution of the Merger Agreement, Dr. Jun Pei, Dr. Mark McCord and Mr. Yupeng Cui, as stockholders of the Company holding

[●]% of the outstanding Common Stock as of the record date for the special meeting of the stockholders of the Company, entered

into a rollover agreement with Parent and Holdco (the “Rollover Agreement”), pursuant to which, immediately prior

to the Effective Time, Dr. Jun Pei, Dr. Mark McCord and Mr. Yupeng Cui 1,291,810, 515,886 and 476,549 shares of the Company’s

common stock, respectively, and Parent will separately contribute its 1,962,474 shares of the Company’s common stock and

100,000 shares of its Series A Convertible Preferred Stock, par value $0.00001 per share (“Preferred Stock”) as

contemplated therein, to Holdco in exchange for equity interests in Holdco.

In

addition, Koito and each of Dr. Pei, Dr. Jun Ye and Dr. McCord (collectively, the “Supporting Stockholders”) entered

into voting support agreements (the “Voting Support Agreements”), pursuant to which, among other things, each of the

Supporting Stockholders agreed, subject to the terms thereof, to vote or cause to be voted, all of the shares of the Company’s

common stock beneficially owned by such Supporting Stockholders in favor of the adoption of the Merger Agreement at the special meeting

of the Company’s stockholders. The aggregate number of shares of the Company’s common stock beneficially owned by the Supporting

Stockholders and required to be voted or cause to be voted in favor of the adoption of the Merger Agreement pursuant to the Voting Support

Agreements represents approximately 38.7% of the shares of the Company’s common stock outstanding.

While

each of the Filing Persons acknowledges that the Merger is a going private transaction for purposes of Rule 13E-3 under the Exchange

Act, the filing of this Transaction Statement shall not be construed as an admission by any Filing Person, or by any affiliate of a Filing

Person, that the Company is “controlled” by any of the Filing Persons and/or their respective affiliates.

The

information concerning the Company contained in, or incorporated by reference into, this Transaction Statement and the Proxy Statement

was supplied by the Company. Similarly, all information concerning each other Filing Person contained in, or incorporated by reference

into, this Transaction Statement and the Proxy Statement was supplied by such Filing Person. No Filing Person is responsible for the

accuracy of any information supplied by any other Filing Person.

Item 1.

Summary Term Sheet

The information

set forth in the Proxy Statement under the captions “Summary Term Sheet” and “About the Special Meeting and the Transaction”

is incorporated herein by reference.

Item 2.

Subject Company Information

(a) Name

and Address. The name of the subject company is Cepton Inc., a Delaware corporation. The Company’s principal executive offices

are located at 399 West Trimble Road, San Jose, California, 95131. The Company’s telephone number is (408) 459-7579.

(b) Securities.

The subject class of equity securities to which this Transaction Statement relates is the Company’s common stock, $0.00001 par

value per share, of which [●] shares were outstanding as of [●], 2024. The information set forth in the Proxy Statement under

“Market Price of Common Stock” is incorporated herein by reference.

(c) Trading

Market and Price. The information set forth in the Proxy Statement under “Market Price of Common Stock” is incorporated

herein by reference.

(d) Dividends.

The information set forth in the Proxy Statement under “Market Price of Common Stock” is incorporated herein by reference.

(e) Prior

Public Offerings. None of the Filing Persons have made an underwritten public offering of Common Stock for cash during the three

years preceding the date of the filing of this Transaction Statement.

(f) Prior

Stock Purchases. None of the Filing Persons have purchased any shares of the Company’s common stock within the past two years.

On January 19, 2023, the Company issued 100,000 shares of its Preferred Stock to Koito for a purchase price of $100.0 million pursuant

to an investment agreement, dated October 27, 2022. The Preferred Stock is convertible into shares of the Company’s common stock

at an approximate conversion price of $25.85 per share (subject to adjustment). During the past two years, certain executive compensation

awards have been granted to affiliates under the Company’s 2022 Equity Incentive Plan. All such awards have been previously reported

in filings with the SEC on Form 4.

Item 3.

Identity and Background of Filing Person

(a) - (c)

Name and Address; Business and Background of Entities; Business and Background of Natural Persons. The information set forth in the

Information Statement under “The Transaction—Parties Involved in the Merger” and “Interests of Certain Persons

in the Transaction” is incorporated herein by reference.

Neither the

Company nor to the Company’s knowledge, none of the Company’s directors or executive officers has been convicted in a criminal

proceeding during the past five years (excluding traffic violations or similar misdemeanors) or has been a party to any judicial or administrative

proceeding during the past five years (except for matters that were dismissed without sanction or settlement) that resulted in a judgment,

decree or final order enjoining the person from future violations of, or prohibiting activities subject to, federal or state securities

laws, or a finding of any violation of federal or state securities laws.

Other

than Dong (Dennis) Chang, Xiaogang (Jason) Zhang, and George Syllantavos, each of the Company’s directors and executive

officers is a citizen of the United States.

Holdco, a

Delaware limited liability company, was formed on July 22, 2024, as a wholly owned subsidiary of Parent, solely for the purpose of facilitating

the Rollover in connection with the Merger and has conducted no business activities other than those related to the structuring and negotiation

of the Rollover. The principal executive office address of Holdco is Sumitomo Fudosan Osaki Twin Bldg. East, 5-1-18, Kitashinagawa, Shinagawa-ku,

Tokyo 141-0001, Japan. The telephone number for the principal office of Holdco is +81-3-3443-7111. The sole member of Holdco is Parent.

Holdo does not presently have any directors or officers.

Item 4.

Terms of the Transaction

(a) Material

Terms. The information set forth in the Proxy Statement under “About the Special Meeting and the Transaction,” “The

Transaction—Effect of the Merger,” “The Transaction—Effect of the Merger on Our Capital Stock and Equity Awards,”

“The Transaction—Background of the Merger,” “The Transaction—Reasons for the Transaction; Recommendations

of the Special Committee and the Board,” “The Transaction—Opinion of Craig-Hallum to the Special Committee,”

“The Transaction—Position of the Koito Entities as to the Fairness of the Merger,” “The Transaction—Reasons

of the Koito Entities for the Merger,” “The Transaction—Plans for the Company After the Merger,” “The Transaction—Delisting

and Deregistration of Our Common Stock,” “The Transaction—Accounting Treatment,” “The Merger Agreement—The

Merger,” “The Merger Agreement—Requisite Stockholder Approval,” “The Merger Agreement—Consents, Approvals

and Filings,” “The Merger Agreement—Other Covenants and Agreements,” “The Merger Agreement—Company

Material Adverse Effect,” “The Merger Agreement—Termination of the Merger Agreement,” “The Merger Agreement—Termination

Fee; Effect of Termination,” “The Merger Agreement—Fees and Expenses,” “The Merger Agreement—Material

U.S. Federal Income Tax Consequences of the Transaction,” “The Merger Agreement—Conditions to the Transaction,”

“Voting Support Agreements” and “Rollover Agreement” is incorporated herein by reference. Further, the information

set forth in Annex A of the Proxy Statement, the Merger Agreement, Annex B of the Proxy Statement, the Form of Voting Support Agreement,

and Annex C of the Proxy Statement, the Rollover Agreement are incorporated herein by reference.

(c) Different

Terms. The information set forth in the Proxy Statement under “About the Special Meeting and the Transaction,” “The

Transaction—Effect of the Merger on Our Capital Stock and Equity Awards,” “Voting Support Agreements,” “Rollover

Agreement” and “Interests of Certain Persons in the Transaction” is incorporated herein by reference. Further, the

information set forth in Annex A of the Proxy Statement, the Merger Agreement, Annex B of the Proxy Statement, the Form of Voting Support

Agreement, and Annex C of the Proxy Statement, the Rollover Agreement is incorporated herein by reference.

(d) Appraisal

Rights. The information set forth in the Proxy Statement under “The Transaction—Appraisal Rights” is incorporated

herein by reference.

(e) Provisions

for Unaffiliated Security Holders. No provision has been made by the Filing Persons (i) to grant the Company’s unaffiliated

security holders access to its corporate files, any other party to the merger or any of their respective affiliates, or (ii) to obtain

counsel or appraisal services at the expense of the Company, any other party to the merger or any of their respective affiliates.

(f) Eligibility

for Listing or Trading. Not applicable.

Item 5.

Past Contracts, Transactions, Negotiations and Agreements

(a) Transactions.

The information set forth in the Proxy Statement under “The Transaction—Background of the Merger,” “The Transaction—Reasons

for the Transaction; Recommendations of the Special Committee and the Board,” “The Transaction—Reasons of the Koito

Entities for the Merger,” “The Merger Agreement,” “Voting Support Agreements,” “Rollover Agreement,”

“Interests of Certain Persons in the Transaction—Relationship with Koito,” “Interests of Certain Persons in the

Transaction—Interests of Directors and Executive Officers in the Merger,” and “Interests of Certain Persons in the

Transaction—Section 280G Mitigation Actions” is incorporated herein by reference.

(b)-(c) Significant

Corporate Events; Negotiations or Contacts. The information set forth in the Proxy Statement under “The Transaction—Background

of the Merger,” “The Transaction—Reasons for the Transaction; Recommendations of the Special Committee and the Board,”

“The Transaction—Reasons of the Koito Entities for the Merger,” “The Merger Agreement,” “Voting Support

Agreements,” “Rollover Agreement,” “Interests of Certain Persons in the Transaction—Relationship with Koito,”

“Interests of Certain Persons in the Transaction—Interests of Directors and Executive Officers in the Merger,” and

“Interests of Certain Persons in the Transaction—Section 280G Mitigation Actions” is incorporated herein by reference.

Further, the information set forth in Annex A of the Proxy Statement, the Merger Agreement, Annex B of the Proxy Statement, the Form

of Voting Support Agreement, and Annex C of the Proxy Statement, the Rollover Agreement is incorporated herein by reference.

(e) Agreements

Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under “The Merger Agreement,”

“Voting Support Agreements,” “Rollover Agreement,” “Interests of Certain Persons in the Transaction—Relationship

with Koito,” “Interests of Certain Persons in the Transaction—Interests of Directors and Executive Officers in the

Merger” and “Security Ownership of Certain Beneficial Owners and Management” is incorporated herein by reference. Further,

the information set forth in Annex A of the Proxy Statement, the Merger Agreement, Annex B of the Proxy Statement, the Form of Voting

Support Agreement, and Annex C of the Proxy Statement, the Rollover Agreement are incorporated herein by reference.

Item 6.

Purposes of the Transaction and Plans or Proposals

(b) Use

of Securities Acquired. The information set forth in the Proxy Statement under “The Transaction—Effect of the Merger,”

“The Transaction—Effect of the Merger on Our Capital Stock and Equity Awards,” “The Transaction—Delisting

and Deregistration of Our Common Stock” and “Rollover Agreement” is incorporated herein by reference.

(c) Plans.

The information set forth in the Proxy Statement under “About the Special Meeting and the Transaction,” “The Transaction—Effect

of the Merger,” “The Transaction—Effect of the Merger on Our Capital Stock and Equity Awards,” “The Transaction—Delisting

and Deregistration of Our Common Stock,” “The Transaction—Effect on Cepton if the Merger is Not Completed,” “The

Transaction—Plans for the Company After the Merger,” “The Merger Agreement” and “Rollover Agreement”

is incorporated herein by reference.

Item 7.

Purposes, Alternatives, Reasons and Effects

(a) Purposes.

The information set forth in the Proxy Statement under “About the Special Meeting and The Transaction,” “The Transaction—Background

of the Merger,” “The Transaction—Opinion of Craig-Hallum to the Special Committee,” “The Transaction—Position

of the Koito Entities as to the Fairness of the Merger,” “The Transaction—Reasons of the Koito Entities for the Merger”

and “The Transaction—Plans for the Company After the Merger,” is incorporated herein by reference.

(b) Alternatives.

The information set forth in the Proxy Statement under “About the Special Meeting and the Transaction,” “The Transaction—Effect

on Cepton if the Merger is Not Completed” “The Transaction—Background of the Merger,” The Transaction—Reasons

for the Transaction; Recommendations of the Special Committee and the Board,” “The Transaction—Opinion of Craig-Hallum

to the Special Committee,” “The Transaction—Position of the Koito Entities as to the Fairness of the Merger”

and “The Transaction—Reasons of the Koito Entities for the Merger” is incorporated herein by reference.

(c) Reasons.

The information set forth in the Proxy Statement under “About the Special Meeting and the Transaction,” “The Transaction—Background

of the Merger,” The Transaction—Reasons for the Transaction; Recommendations of the Special Committee and the Board,”

“The Transaction—Opinion of Craig-Hallum to the Special Committee,” “The Transaction—Position of the Koito

Entities as to the Fairness of the Merger” and “The Transaction—Reasons of the Koito Entities for the Merger”

is incorporated herein by reference.

(d) Effects.

The information set forth in the Proxy Statement under “About the Special Meeting and the Transaction,” “The Transaction—Effect

of the Merger,” “The Transaction—Effect of the Merger on Our Capital Stock and Equity Awards,” “The Transaction—Delisting

and Deregistration of Our Common Stock,” “The Transaction—Background of the Merger,” “The Transaction—Reasons

for the Transaction; Recommendations of the Special Committee and the Board,” “The Transaction—Opinion of Craig-Hallum

to the Special Committee,” “The Transaction—Position of the Koito Entities as to the Fairness of the Merger,”

“The Transaction—Reasons of the Koito Entities for the Merger,” “The Transaction—Plans for the Company

After the Merger,” “The Merger Agreement—Material U.S. Federal Income Tax Consequences of the Transaction,” “Voting

Support Agreements,” “Rollover Agreement” is incorporated herein by reference. Further, the information set forth in

Annex A of the Proxy Statement, the Merger Agreement, Annex B of the Proxy Statement, the Form of Voting Support Agreement, Annex C of

the Proxy Statement, and the Rollover Agreement is incorporated herein by reference.

Item 8.

Fairness of the Transaction

(a) Fairness.

The information set forth in the Proxy Statement under “The Transaction—Background of the Merger,” “The Transaction—Reasons

for the Transaction; Recommendations of the Special Committee and the Board,” “The Transaction—Opinion of Craig-Hallum

to the Special Committee,” “The Transaction—Position of the Koito Entities as to the Fairness of the Merger,”

and “The Transaction—Reasons of the Koito Entities for the Merger” is incorporated herein by reference. Further the

information set forth in Annex D of the Proxy Statement and the Fairness Opinion of Craig-Hallum Capital Group, LLC (“Craig-Hallum”)

is incorporated herein by reference.

(b) Factors

Considered in Determining Fairness. The information set forth in the Proxy Statement under “The Transaction—Background

of the Merger,” “The Transaction—Reasons for the Transaction; Recommendations of the Special Committee and the Board,”

“The Transaction—Opinion of Craig-Hallum to the Special Committee,” “The Transaction—Position of the Koito

Entities as to the Fairness of the Merger,” and “The Transaction—Reasons of the Koito Entities for the Merger”

is incorporated herein by reference. Further, the information set forth in Annex D of the Proxy Statement, the Fairness Opinion of Craig-Hallum,

is incorporated herein by reference.

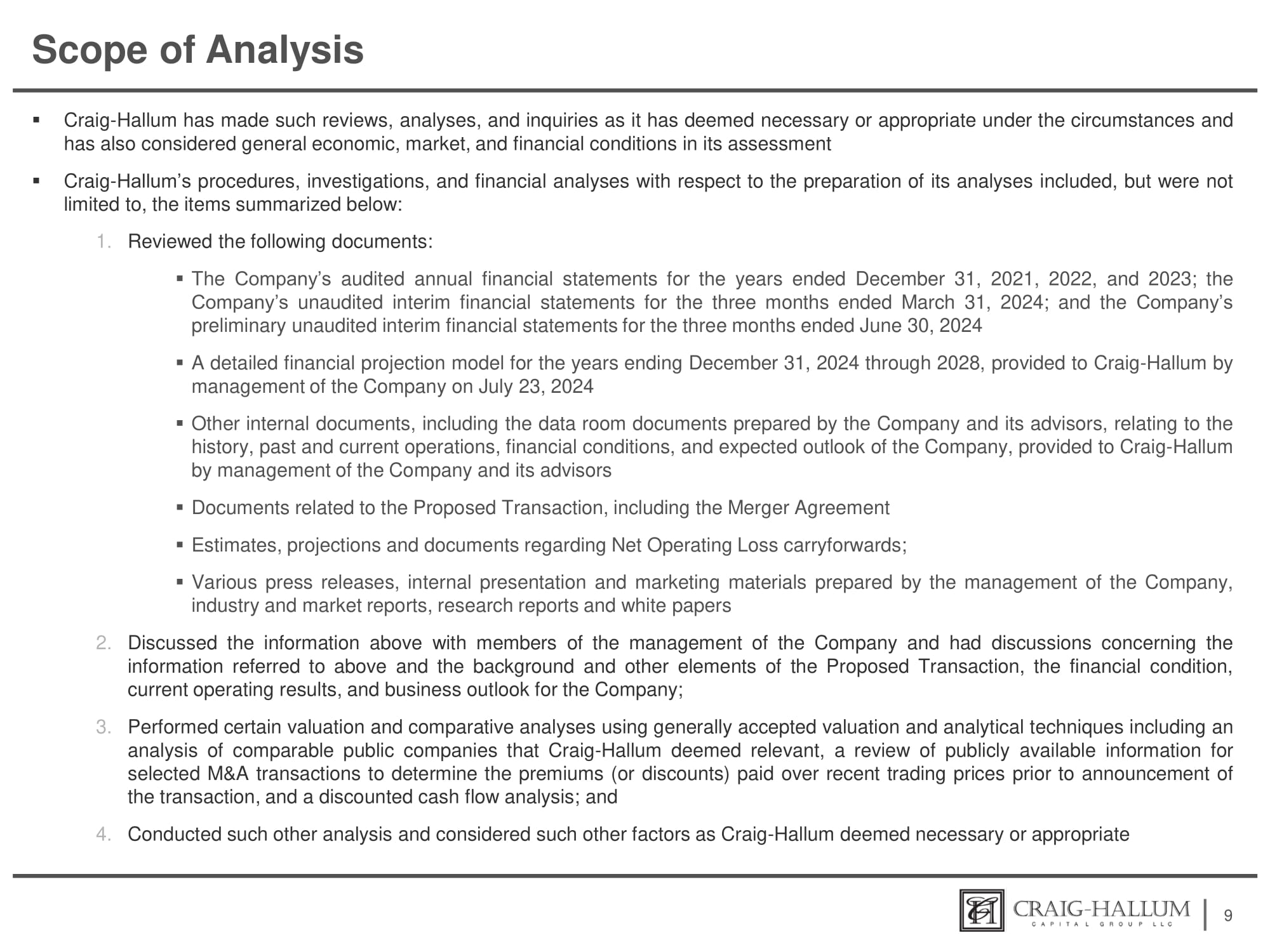

The confidential

discussion materials prepared by Craig-Hallum Capital Group, LLC and provided to the Special Committee, dated January 23, 2024, February13,

2024, June 26, 2024 and July 28, 2024, are attached hereto as Exhibits (c)(2) through (c)(5) and are incorporated by reference herein.

(c) Approval

of Security Holders. The information set forth in the Proxy Statement under “Special Meeting Agenda—Record Date; Shares

Entitled to Vote; Quorum,” “Special Meeting Agenda—Vote Required; Abstentions and Broker Non-Votes,” “About

the Special Meeting and the Transaction,” “The Merger Agreement—Conditions to the Transaction,” “The Merger

Agreement—Requisite Stockholder Approval,” “Proposal 1: Approval of the Transaction” and “Proposal 2: Vote

on Adjournment” is incorporated herein by reference. Further, the information set forth in Annex A of the Proxy Statement, the

Merger Agreement, and Annex B of the Proxy Statement, the Form of Voting Support Agreement, is incorporated herein by reference.

(d) Unaffiliated

Representatives. The information set forth in the Proxy Statement under “The Transaction—Reasons for the Transaction;

Recommendations of the Special Committee and the Board” is incorporated herein by reference.

(e) Approval

of Directors. The information set forth in the Proxy Statement under “The Transaction—Background of the Merger,”

“The Transaction—Reasons for the Transaction; Recommendations of the Special Committee and the Board,” “The Transaction—Position

of the Koito Entities as to the Fairness of the Merger,” and “The Transaction—Reasons of the Koito Entities for the

Merger” is incorporated herein by reference.

(f) Other

Offers. The information set forth in the Proxy Statement under “The Transaction—Background of the Merger,” “The

Transaction—Reasons for the Transaction; Recommendations of the Special Committee and the Board,” “The Transaction—Position

of the Koito Entities as to the Fairness of the Merger,” “The Transaction—Reasons of the Koito Entities for the Merger,”

“The Merger Agreement—No Solicitation; Company Board Recommendation Change” is incorporated herein by reference.

Item 9.

Reports, Opinions, Appraisals and Negotiations

(a) Report,

Opinion or Appraisal. The information set forth in the Proxy Statement under “The Transaction—Background of the Merger,”

“The Transaction—Reasons for the Transaction; Recommendations of the Special Committee and the Board,” “The Transaction—Opinion

of Craig-Hallum to the Special Committee,” “The Transaction—Certain Unaudited Prospective Financial Information,”

“The Transaction—Position of the Koito Entities as to the Fairness of the Merger,” and “The Transaction—Reasons

of the Koito Entities for the Merger” is incorporated herein by reference. Further the information set forth in Annex D of the

Proxy Statement and the Fairness Opinion of Craig-Hallum is incorporated herein by reference.

(b) Preparer

and Summary of the Report, Opinion or Appraisal. The information set forth in the Proxy Statement under “The Transaction—Background

of the Merger,” “The Transaction—Reasons for the Transaction; Recommendations of the Special Committee and the Board,”

“The Transaction—Opinion of Craig-Hallum to the Special Committee,” “The Transaction—Certain Unaudited

Prospective Financial Information,” “The Transaction—Position of the Koito Entities as to the Fairness of the Merger,”

and “The Transaction—Reasons of the Koito Entities for the Merger” is incorporated herein by reference. Further, the

information set forth in Annex D of the Proxy Statement and the Fairness Opinion of Craig-Hallum is incorporated herein by reference.

The confidential

discussion materials prepared by Craig-Hallum and provided to the Special Committee, dated January 23, 2024, February13, 2024, June 26,

2024 and July 28, 2024, are attached hereto as Exhibits (c)(2) through (c)(5) and are incorporated by reference herein.

(c) Availability

of Documents. The full text of the Fairness Opinion of Craig-Hallum dated July 28, 2024, is attached as Annex D to the Proxy Statement.

The opinion is available for inspection and copying during its regular business hours at the Company’s principal executive offices,

399 West Trimble Road, San Jose, California, 95131, by any interested holder of the Company’s common stock or representative who

has been designated in writing, and copies may be obtained by requesting them in writing from the Company at the email address provided

under the caption “Where You Can Find More Information” in the Proxy Statement, which is incorporated herein by reference.

Item 10.

Source and Amounts of Funds or Other Consideration

(a) Source

of Funds. The information set forth in the Proxy Statement under “The Transaction—Financing of the Merger,” “The

Merger Agreement—Fees and Expenses” is incorporated herein by reference.

(b) Conditions.

None.

(c) Expenses.

The information set forth in the Proxy Statement under “The Transaction—Financing of the Merger,” “The Merger

Agreement—Fees and Expenses,” is incorporated herein by reference.

(d) Borrowed

Funds. Not applicable.

Item 11.

Interest in Securities of the Subject Company

(a) Securities

Ownership. The information set forth in the Proxy Statement under “Security Ownership of Certain Beneficial Owners and Management”

is incorporated herein by reference.

(b) Securities

Transactions. The information set forth in the Proxy Statement under “Security Ownership of Certain Beneficial Owners and Management,”

“Interests of Certain Persons in the Transaction—Relationship with Koito,” “Interests of Certain Persons in the

Transaction—Interests of Directors and Executive Officers in the Merger,” and “Interests of Certain Persons in the

Transaction—Section 280G Mitigation Actions” is incorporated herein by reference.

Item 12.

The Solicitation or Recommendation

(d) Intent

to Tender or Vote in a Going Private Transaction. The information set forth in the Proxy Statement under “About the Special

Meeting and the Transaction,” “The Transaction—Reasons for the Transaction; Recommendations of the Special Committee

and the Board,” “The Transaction—Position of the Koito Entities as to the Fairness of the Merger,” “The

Transaction—Reasons of the Koito Entities for the Merger,” “The Merger Agreement,” “Voting Support Agreements,”

“Rollover Agreement,” “Interests of Certain Persons in the Transaction—Relationship with Koito” and “Interests

of Certain Persons in the Transaction—Interests of Directors and Executive Officers in the Merger” is incorporated herein

by reference. Further, the information set forth in Annex A of the Proxy Statement, the Merger Agreement, Annex B of the Proxy Statement,

the Form of Voting Support Agreement, and Annex C of the Proxy Statement, the Rollover Agreement, is incorporated herein by reference.

(e) Recommendation

of Others. The information set forth in the Proxy Statement under “About the Special Meeting and the Transaction,” “The

Transaction—Reasons for the Transaction; Recommendations of the Special Committee and the Board,” “The Transaction—Position

of the Koito Entities as to the Fairness of the Merger,” “Voting Support Agreements,” “Rollover Agreement,”

“Proposal 1: Approval of the Transaction” and “Proposal 2: Vote on Adjournment” is incorporated herein by reference.

Item 13.

Financial Statements

(a) Financial

Information. The audited financial statements and unaudited interim financial statements are incorporated by reference in the Proxy

Statement from the Company’s Annual Report on Form 10-K for the years ended December 31, 2023 and the Company’s Quarterly

Report on Form 10-Q for the three months ended June 30, 2024, in each case, filed with the SEC and can be found on its website is www.sec.gov.

The Company’s reports can also be reviewed on its website at http://investors.cepton.com. Additionally, the information set forth

in the Proxy Statement under “Market Price of Common Stock” is incorporated herein by reference.

(b) Pro

forma Information. No pro forma data giving effect to the merger has been provided. The Filing Parties do not believe that such information

is material to stockholders in evaluating the merger and the Merger Agreement because (i) the Merger Consideration consists only of cash,

and (ii) if the merger is consummated, the Company’s common stock will cease to be publicly traded.

Item 14.

Persons/Assets, Retained, Employed, Compensated or Used

(a) Solicitation

or Recommendation. The information set forth in the Proxy Statement under “About the Special Meeting and the Transaction”

is incorporated herein by reference.

(b) Employees

and Corporate Assets. The information set forth in the Proxy Statement under “About the Special Meeting and the Transaction,”

“The Transaction—Financing of the Merger,” “The Merger Agreement—Fees and Expenses,” and “Interests

of Certain Persons in the Transaction—Interests of Directors and Executive Officers in the Merger” is incorporated herein

by reference.

Item 15.

Additional Information

(b) Golden

Parachute Compensation. The information set forth in the Proxy Statement under Interests of Certain Persons in the Transaction—Interests

of Directors and Executive Officers in the Merger—Golden Parachute Compensation” is incorporated herein by reference.

(c) Other

Material Information. The information contained in the Proxy Statement, including all annexes attached thereto, is incorporated herein

by reference.

Item 16.

Exhibits

Exhibit

No. |

|

Description |

| (a)(1) |

|

Preliminary Proxy Statement of Cepton, Inc., incorporated herein by reference to the Proxy Statement filed with the SEC on September 25, 2024. |

| |

|

|

| (a)(2) |

|

Form of Proxy Card, incorporated herein by reference to the Proxy Statement filed with the SEC on September 25, 2024. |

| |

|

|

| (a)(3) |

|

Letter to Cepton, Inc. Stockholders, incorporated herein by reference to the Proxy Statement filed with the SEC on September 25, 2024. |

| |

|

|

| (a)(4) |

|

Notice of Special Meeting of Stockholders, incorporated herein by reference to the Proxy Statement filed with the SEC on September 25, 2024. |

| |

|

|

| (a)(5) |

|

Press Release issued by Cepton, Inc., dated July 29, 2024, incorporated herein by reference to Cepton, Inc.’s Schedule 14A filed with the SEC on July 29, 2024. |

| |

|

|

| (a)(6) |

|

Letter to Employees from the Chief Executive Officer of Cepton, Inc., dated July 29, 2024, incorporated herein by reference to Cepton, Inc.’s Schedule 14A filed with the SEC on July 29, 2024. |

| |

|

|

| (a)(7) |

|

Cepton,

Inc.’s Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024, incorporated herein

by reference. |

| |

|

|

| (a)(8) |

|

Cepton,

Inc.’s Quarterly Report on Form 10-Q for the quarterly period ended March 31, 2024, filed with the SEC on May 14, 2024, incorporated

herein by reference. |

| |

|

|

| (a)(9) |

|

Definitive

Proxy Statement of Cepton, Inc., incorporated herein by reference to the Proxy Statement filed with the SEC on May 15, 2024. |

| |

|

|

| (a)(10) |

|

Cepton,

Inc.’s Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, filed with the SEC on August 13, 2024, incorporated

herein by reference. |

| |

|

|

| (b) |

|

Not Applicable |

| |

|

|

| (c)(1) |

|

Opinion of Craig-Hallum Capital Group, LLC to the Special Committee of the Board of Directors of Cepton, Inc. dated July 29, 2024, incorporated herein by reference to Annex D to the Proxy Statement filed with the SEC on September 25, 2024. |

| |

|

|

| (c)(2)* |

|

Confidential Special Committee Presentation prepared by Craig-Hallum Capital Group, LLC, dated January 23, 2024, for the Special Committee of the Board of Directors of Cepton, Inc. |

| |

|

|

| (c)(3)* |

|

Confidential Special Committee Presentation prepared by Craig-Hallum Capital Group, LLC, dated February 13, 2024, for the Special Committee of the Board of Directors of Cepton, Inc. |

| |

|

|

| (c)(4)* |

|

Confidential Special

Committee Presentation prepared by Craig-Hallum Capital Group, LLC, dated June 26, 2024, for the Special Committee of the Board of

Directors of Cepton, Inc. |

| |

|

|

| (c)(5) |

|

Confidential Special Committee Presentation prepared by

Craig-Hallum Capital Group, LLC, dated July 28, 2024, for the Special Committee of the Board of Directors of Cepton, Inc. |

| |

|

|

| (d)(1) |

|

Agreement and Plan of Merger, dated as of July 29, 2024, by and among Cepton, Inc., KOITO MANUFACTURING CO., LTD. and Project Camaro Merger Sub, Inc., incorporated herein by reference to Annex A to the Proxy Statement filed with the SEC on September 25, 2024. |

| |

|

|

| (d)(2) |

|

Form of Voting Support Agreement, incorporated herein by reference to Annex B to the Proxy Statement filed with the SEC on September 25, 2024. |

| |

|

|

| (d)(3) |

|

Rollover Agreement, by and among Dr. Jun Pei, Dr. Mark McCord, Mr. Yupeng Cui, KOITO MANUFACTURING CO., LTD. and Project Camaro Holdings, LLC, incorporated herein by reference to Annex C to the Proxy Statement filed with the SEC on September 25, 2024. |

| |

|

|

| (f)(1) |

|

Section 262 of the General Corporation Law of Delaware. |

| |

|

|

| (g)(1) |

|

Not applicable. |

| |

|

|

| 107 |

|

Filing Fee Tables. |

| * | Certain portions of this exhibit have been redacted and separately filed with the SEC pursuant to a

request for confidential treatment. |

SIGNATURES

After due

inquiry and to the best of its knowledge and belief, the undersigned certifies that the information set forth in this statement is true,

complete and correct.

Dated: September 25,

2024

| |

CEPTON, INC. |

| |

|

|

| |

By: |

/s/ Jun Pei |

| |

|

Jun Pei |

| |

|

Chairman, President and Chief Executive Officer |

| |

|

|

| |

KOITO MANUFACTURING CO., LTD. |

| |

|

|

| |

By: |

/s/ Takahito Otake |

| |

|

Takahito Otake |

| |

|

Senior Managing Corporate Officer |

| |

|

|

| |

Project Camaro Holdings, LLC |

| |

|

|

| |

By: |

KOITO MANUFACTURING CO., LTD., its sole member |

| |

|

|

| |

By: |

/s/ Hideharu Konagaya |

| |

|

Hideharu Konagaya |

| |

|

Executive Vice President |

| |

|

|

| |

Project Camaro MERGER SUB, INC. |

| |

|

|

| |

By: |

/s/ Hideharu Konagaya |

| |

|

Hideharu Konagaya |

| |

|

President |

10

Exhibit (C)(2)

Private & Confidential [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24 b - 2 of the Securities Exchange Act of 1934 , as amended . This information has been filed separately with the Securities and Exchange Commission . Project Cheetah Special Committee Materials for Discussion January 23, 2024

Agenda Ag e n d a I t e m s ▪ Review of [***] Offer ▪ Preliminary M&A Premiums Paid Analysis ▪ Potential Process Alternatives ▪ Discussion of Potential Response to [***] 2

Review of [***] Offer S u m m a r y O ve r v i e w of O f f e r ▪ Acquisition : 100% acquisition of the common shares outstanding, all cash at $3.17/share ‒ No financing condition ▪ Rollover Participants : CEO and potentially other executive officers to roll over all outstanding common shares of Cheetah ▪ Diligence/Timing : 6 weeks to complete diligence ▪ Key Employees : Key employees (and Rollover participants) expected to enter into employment agreements prior to entering into a definitive agreement ▪ Definitive Agreement : Simple majority of outstanding common shares of Cheetah for approval and expect other principal shareholders to enter into support agreements with respect to the [***] acquisition ▪ [***] Approvals : Approval from board of directors will be required to execute definitive agreement, [***] shareholder approval will not be required ▪ Interim Financing : [***] has stated their willingness to provide interim financing prior to closing if required 3

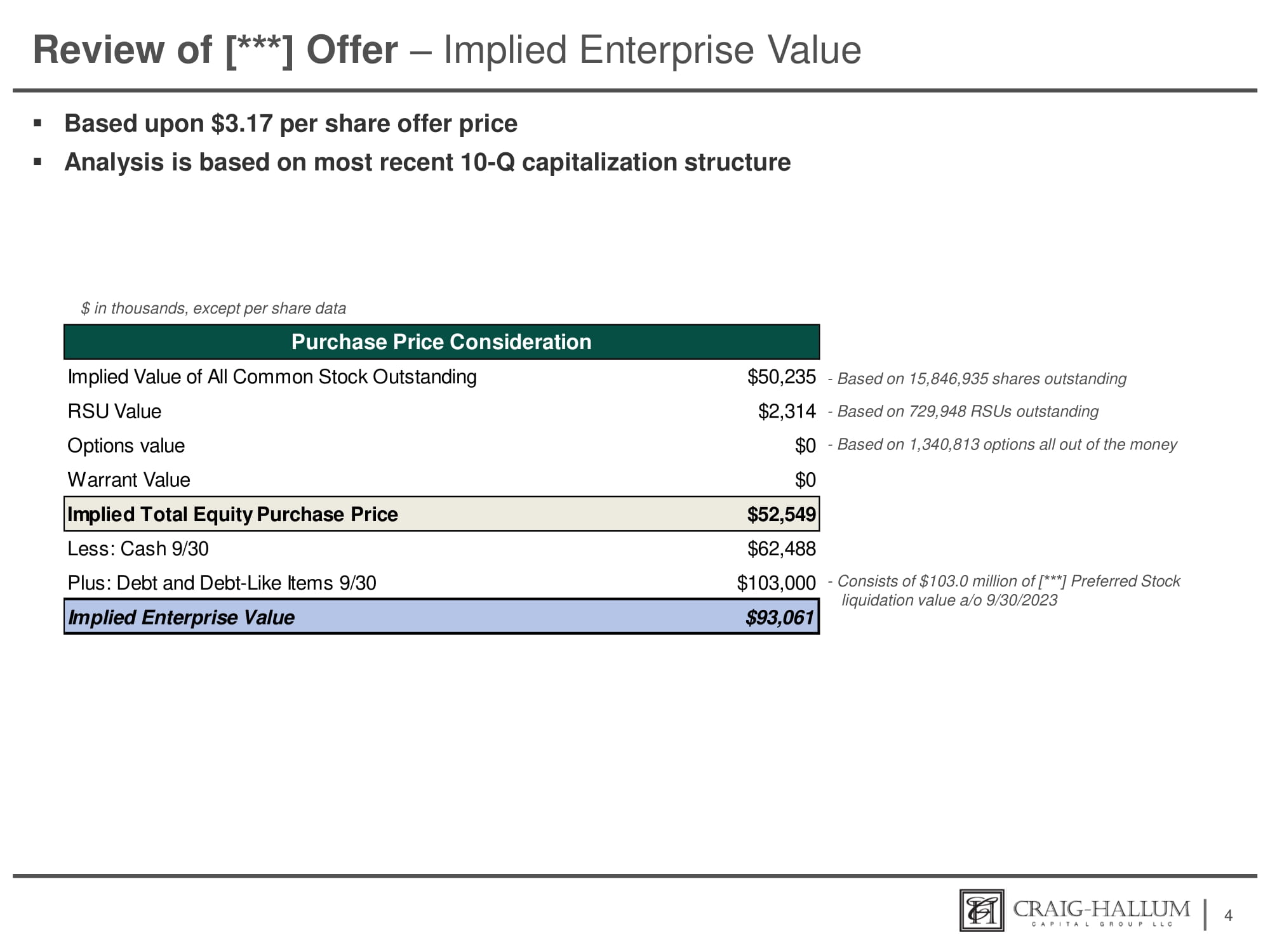

Review of [***] Offer – Implied Enterprise Value ▪ Based upon $3.17 per share offer price ▪ Analysis is based on most recent 10 - Q capitalization structure - Based on 15,846,935 shares outstanding $50,235 Implied Value of All Common Stock Outstanding - Based on 729,948 RSUs outstanding $2,314 RSU Value - Based on 1,340,813 options all out of the money $0 Options value $0 Warrant Value $52,549 Implied Total Equity Purchase Price $62,488 Less: Cash 9/30 - Consists of $103.0 million of [***] Preferred Stock $103,000 Plus: Debt and Debt - Like Items 9/30 liquidation value a/o 9/30/2023 Implied Enterprise Value $93,061 4 Purchase Price Consideration $ in thousands, except per share data

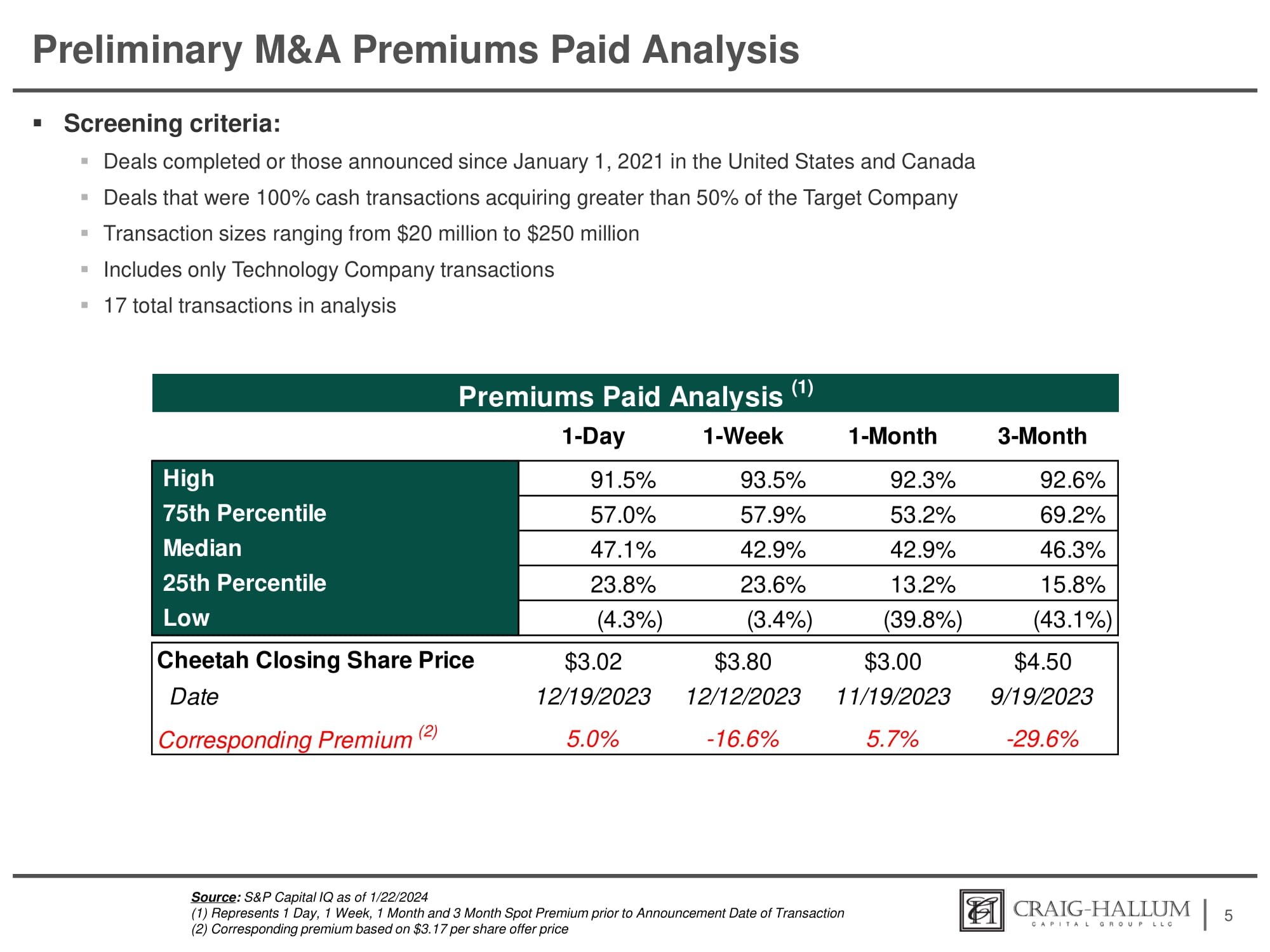

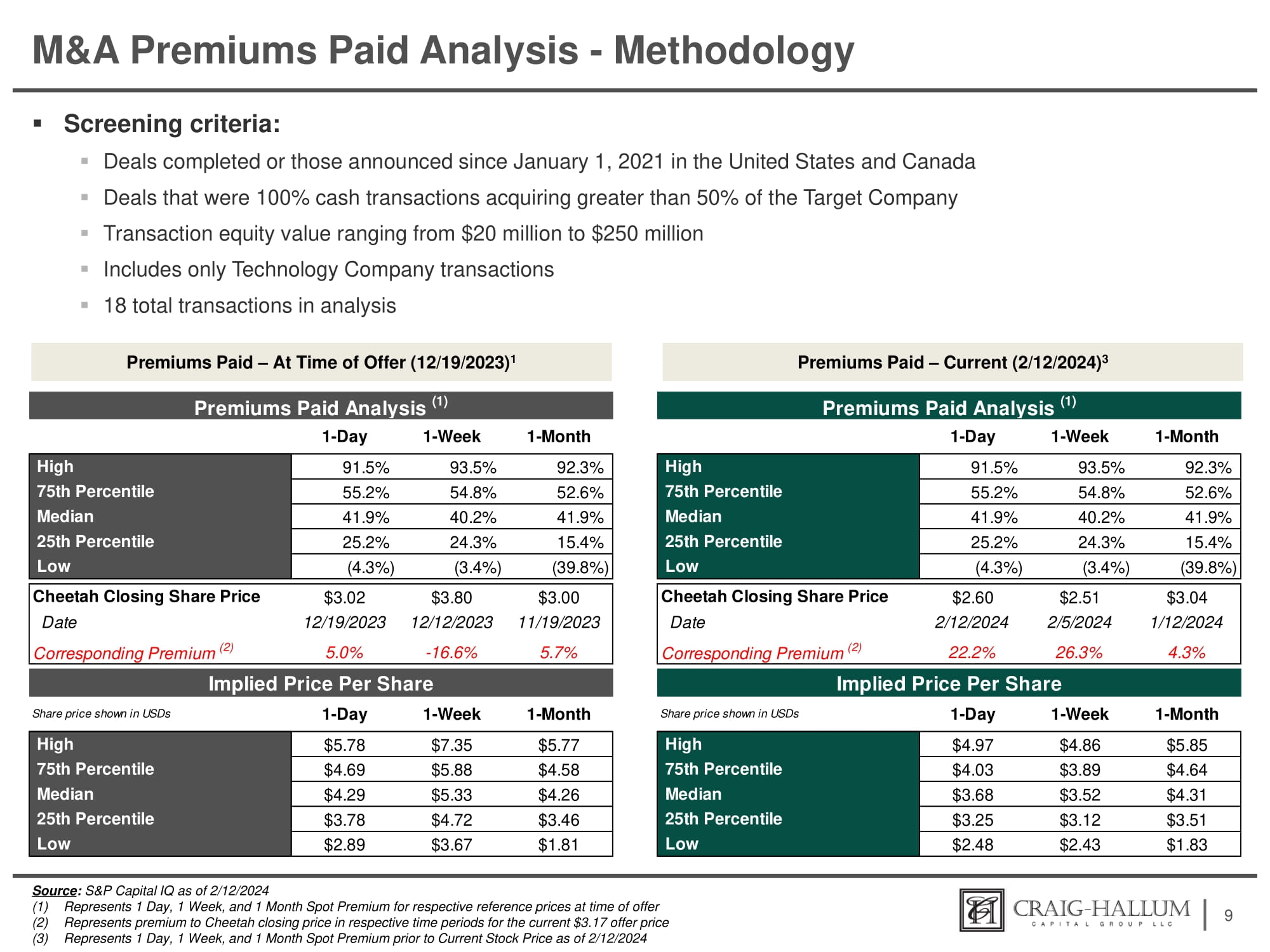

Preliminary M&A Premiums Paid Analysis (2) Corresponding premium based on $3.17 per share offer price ▪ Screening criteria: ▪ Deals completed or those announced since January 1, 2021 in the United States and Canada ▪ Deals that were 100% cash transactions acquiring greater than 50% of the Target Company ▪ Transaction sizes ranging from $20 million to $250 million ▪ Includes only Technology Company transactions ▪ 17 total transactions in analysis 5 Source : S&P Capital IQ as of 1/22/2024 (1) Represents 1 Day, 1 Week, 1 Month and 3 Month Spot Premium prior to Announcement Date of Transaction 92.6% 92.3% 93.5% 91.5% High 69.2% 53.2% 57.9% 57.0% 75th Percentile 46.3% 42.9% 42.9% 47.1% Median 15.8% 13.2% 23.6% 23.8% 25th Percentile (43.1%) (39.8%) (3.4%) (4.3%) Low $4.50 9/19/2023 $3.00 11/19/2023 $3.80 12/12/2023 $3.02 12/19/2023 Cheetah Closing Share Price Date - 29.6% 5.7% - 16.6% 5.0% Corresponding Premium (2) Premiums Paid Analysis (1) 1 - Day 1 - Week 1 - Month 3 - Month

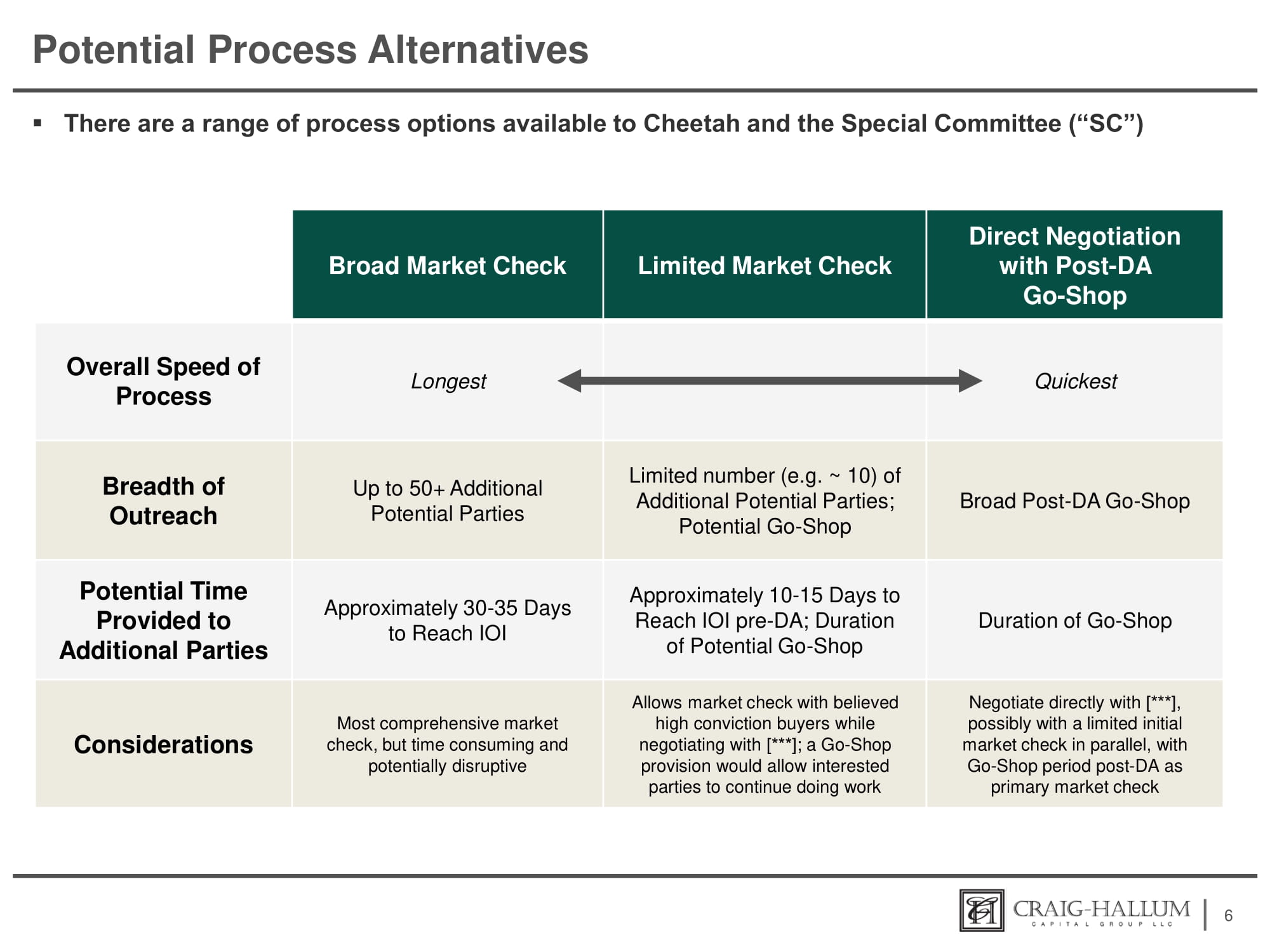

Potential Process Alternatives ▪ There are a range of process options available to Cheetah and the Special Committee (“SC”) Direct Negotiation with Post - DA Go - Shop Limited Market Check Broad Market Check Quickest Longest Overall Speed of Process Broad Post - DA Go - Shop Limited number (e.g. ~ 10) of Additional Potential Parties; Potential Go - Shop Up to 50+ Additional Potential Parties Breadth of Outreach Duration of Go - Shop Approximately 10 - 15 Days to Reach IOI pre - DA; Duration of Potential Go - Shop Approximately 30 - 35 Days to Reach IOI Potential Time Provided to Additional Parties Negotiate directly with [***], possibly with a limited initial market check in parallel, with Go - Shop period post - DA as primary market check Allows market check with believed high conviction buyers while negotiating with [***]; a Go - Shop provision would allow interested parties to continue doing work Most comprehensive market check, but time consuming and potentially disruptive Considerations 6

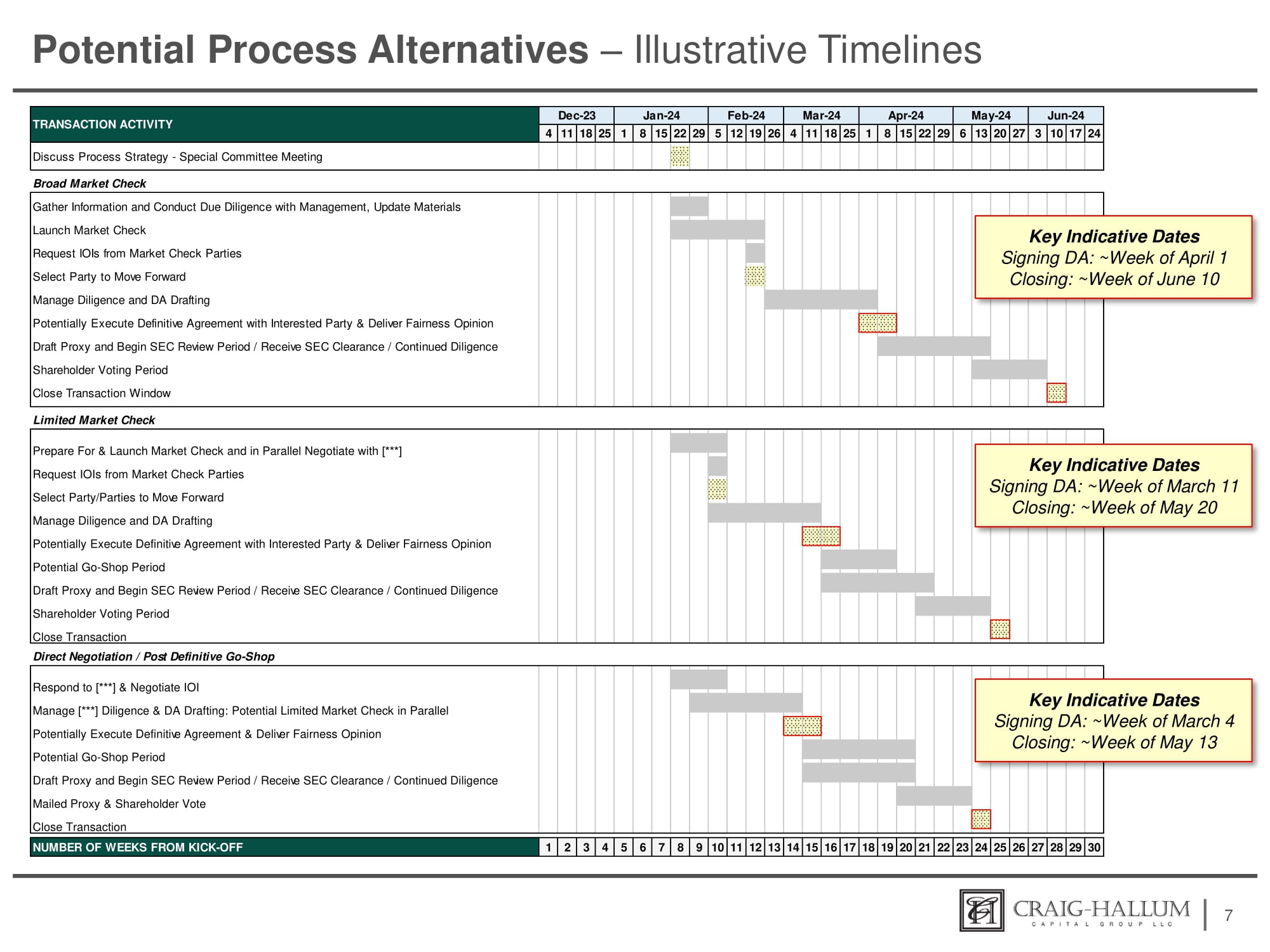

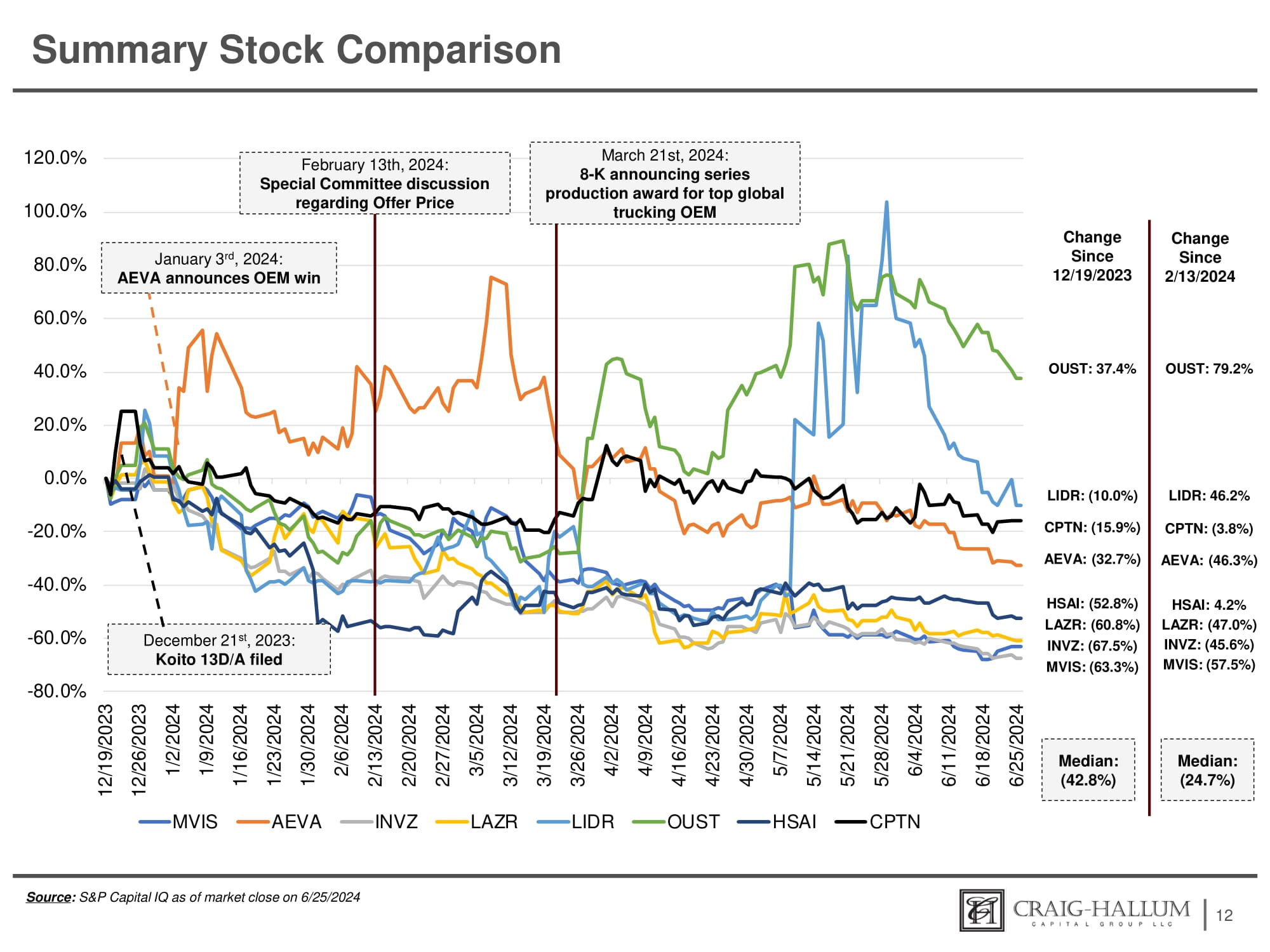

Jun - 24 May - 24 Apr - 24 Mar - 24 Feb - 24 Jan - 24 Dec - 23 TRANSACTION ACTIVITY 24 17 10 3 27 20 13 6 29 22 15 8 1 25 18 11 4 26 19 12 5 29 22 15 8 1 25 18 11 4 Discuss Process Strategy - Special Committee Meeting Broad Market Check Gather Information and Conduct Due Diligence with Management, Update Materials Launch Market Check Request IOIs from Market Check Parties Select Party to Move Forward Manage Diligence and DA Drafting Potentially Execute Definitive Agreement with Interested Party & Deliver Fairness Opinion Draft Proxy and Begin SEC Review Period / Receive SEC Clearance / Continued Diligence Shareholder Voting Period Close Transaction Window Limited Market Check Prepare For & Launch Market Check and in Parallel Negotiate with [***] Request IOIs from Market Check Parties Select Party/Parties to Move Forward Manage Diligence and DA Drafting Potentially Execute Definitive Agreement with Interested Party & Deliver Fairness Opinion Potential Go - Shop Period Draft Proxy and Begin SEC Review Period / Receive SEC Clearance / Continued Diligence Shareholder Voting Period Close Transaction Direct Negotiation / Post Definitive Go - Shop Respond to [***] & Negotiate IOI Manage [***] Diligence & DA Drafting: Potential Limited Market Check in Parallel Potentially Execute Definitive Agreement & Deliver Fairness Opinion Potential Go - Shop Period Draft Proxy and Begin SEC Review Period / Receive SEC Clearance / Continued Diligence Mailed Proxy & Shareholder Vote Close Transaction NUMBER OF WEEKS FROM KICK - OFF 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Potential Process Alternatives – Illustrative Timelines 7 Si Key Indicative Dates gning DA: ~Week of April 1 Closing: ~Week of June 10 Key Indicative Dates Si ng DA: ~Week of March 4 gni Cl osing: ~Week of May 13 Key Indicative Dates Signing DA: ~Week of March 11 Closing: ~Week of May 20

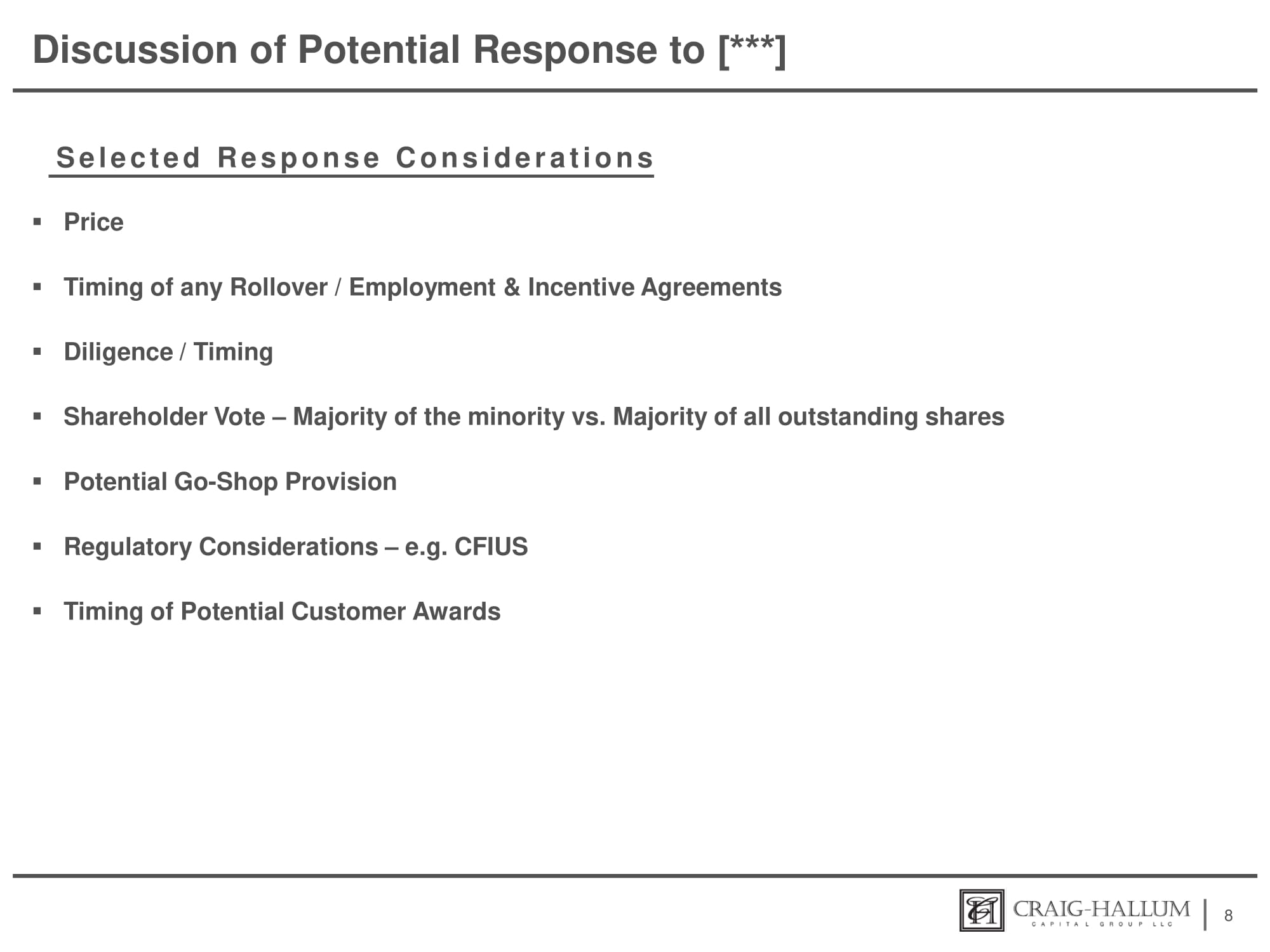

Discussion of Potential Response to [***] S e l e c t e d R e s p o n s e C o n s i d e r a t i o n s ▪ Price ▪ Timing of any Rollover / Employment & Incentive Agreements ▪ Diligence / Timing ▪ Shareholder Vote – Majority of the minority vs. Majority of all outstanding shares ▪ Potential Go - Shop Provision ▪ Regulatory Considerations – e.g. CFIUS ▪ Timing of Potential Customer Awards 8

Exhibit (C)(3)

Private & Confidential [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24 b - 2 of the Securities Exchange Act of 1934 , as amended . This information has been filed separately with the Securities and Exchange Commission . Project Cheetah Special Committee Materials for Discussion February 13, 2024

Agenda & Participants 2 ▪ When: Tuesday, February 13 – 9:00pm PT ▪ Where: Online Zoom Meeting A g e n d a I t e m s ▪ Status Update ▪ Valuation Discussion ▪ Attendees ‒ Special Committee ‒ Cooley ‒ Craig - Hallum

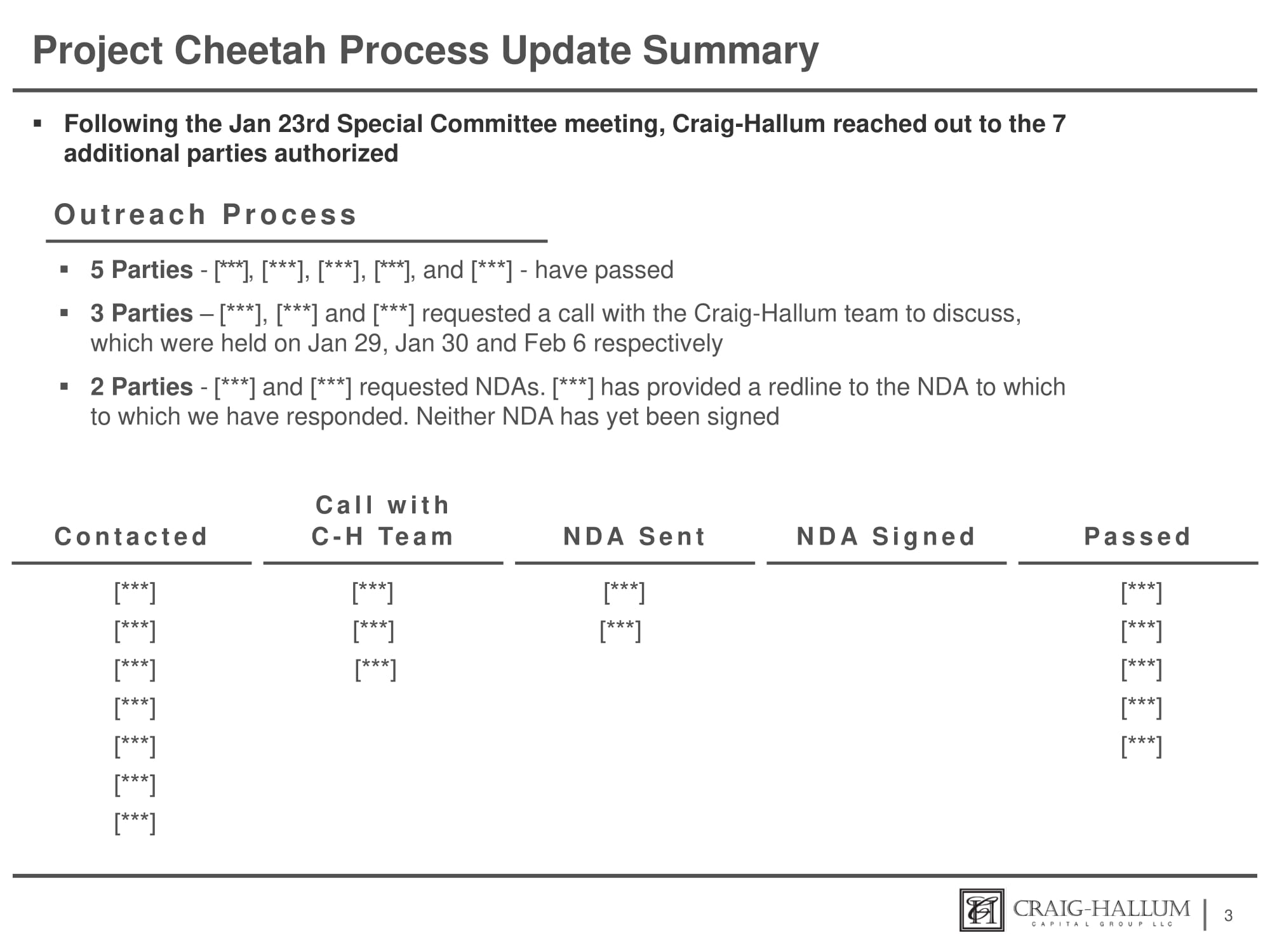

Project Cheetah Process Update Summary ▪ Following the Jan 23rd Special Committee meeting, Craig - Hallum reached out to the 7 additional parties authorized O u t r e a c h P r o c e s s ▪ 5 Parties - [***], [***], [***], [***], and [***] - have passed ▪ 3 Parties – [***], [***] and [***] requested a call with the Craig - Hallum team to discuss, which were held on Jan 29, Jan 30 and Feb 6 respectively ▪ 2 Parties - [***] and [***] requested NDAs. [***] has provided a redline to the NDA to which to which we have responded. Neither NDA has yet been signed 3 C o n t a c t e d C a l l w i t h C - H Te a m N D A S e n t P a s s e d [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] [***] N D A S i g n e d [***] [***] [***]

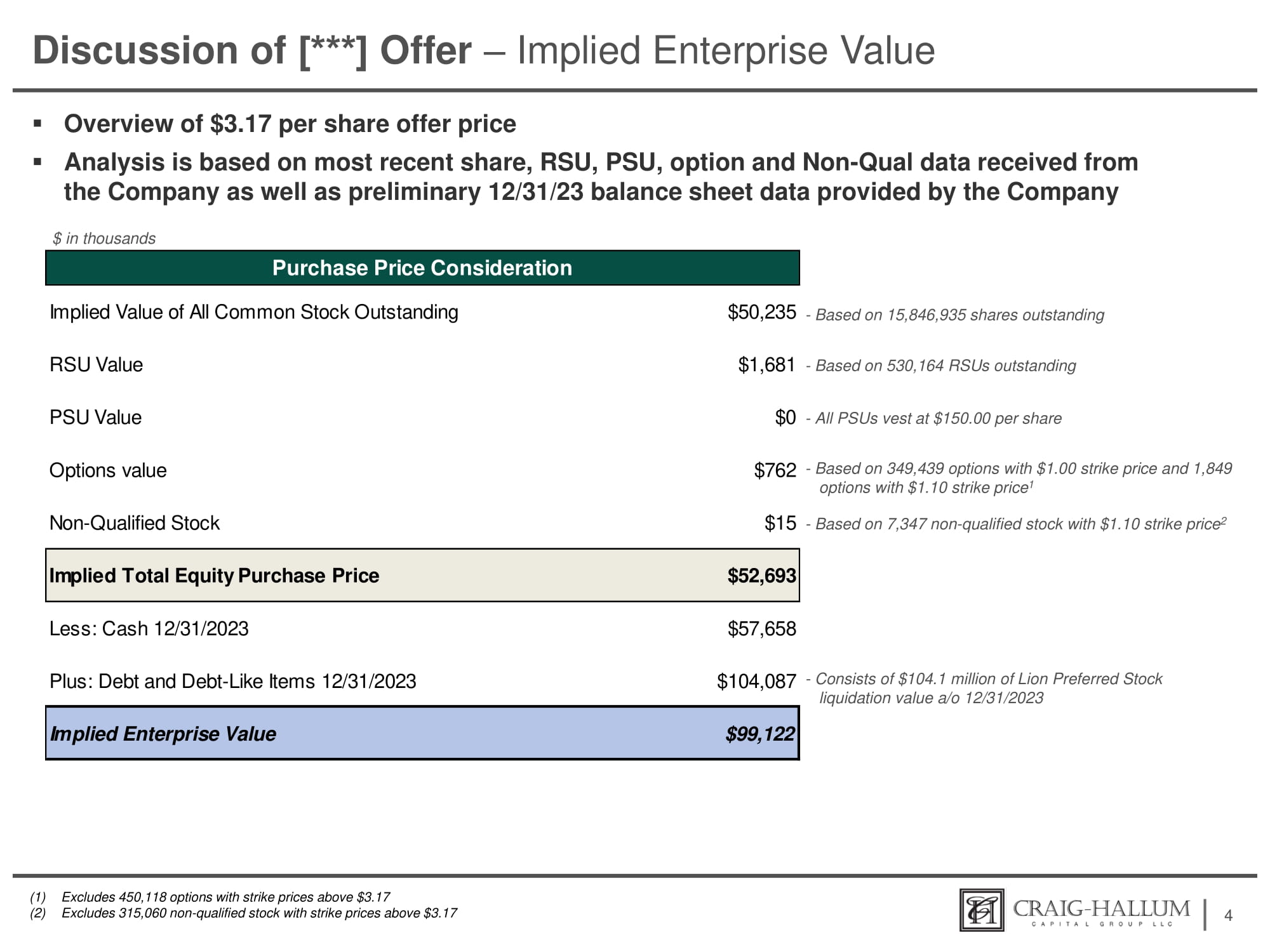

Discussion of [***] Offer – Implied Enterprise Value ▪ Overview of $3.17 per share offer price ▪ Analysis is based on most recent share, RSU, PSU, option and Non - Qual data received from the Company as well as preliminary 12/31/23 balance sheet data provided by the Company 4 $ in thousands, except per share data Purchase Price Consideration Options value $762 - Based on 349,439 options with $1.00 strike price and 1,849 Implied Total Equity Purchase Price $52,693 options with $1.10 strike price 1 Non - Qualified Stock $15 - Based on 7,347 non - qualified stock with $1.10 strike price 2 Implied Value of All Common Stock Outstanding $50,235 - Based on 15,846,935 shares outstanding RSU Value $1,681 - Based on 530,164 RSUs outstanding PSU Value $0 - All PSUs vest at $150.00 per share Less: Cash 12/31/2023 $57,658 Plus: Debt and Debt - Like Items 12/31/2023 $104,087 - Consists of $104.1 million of Lion Preferred Stock liquidation value a/o 12/31/2023 Implied Enterprise Value $99,122 (1) Excludes 450,118 options with strike prices above $3.17 (2) Excludes 315,060 non - qualified stock with strike prices above $3.17 $ in thousands

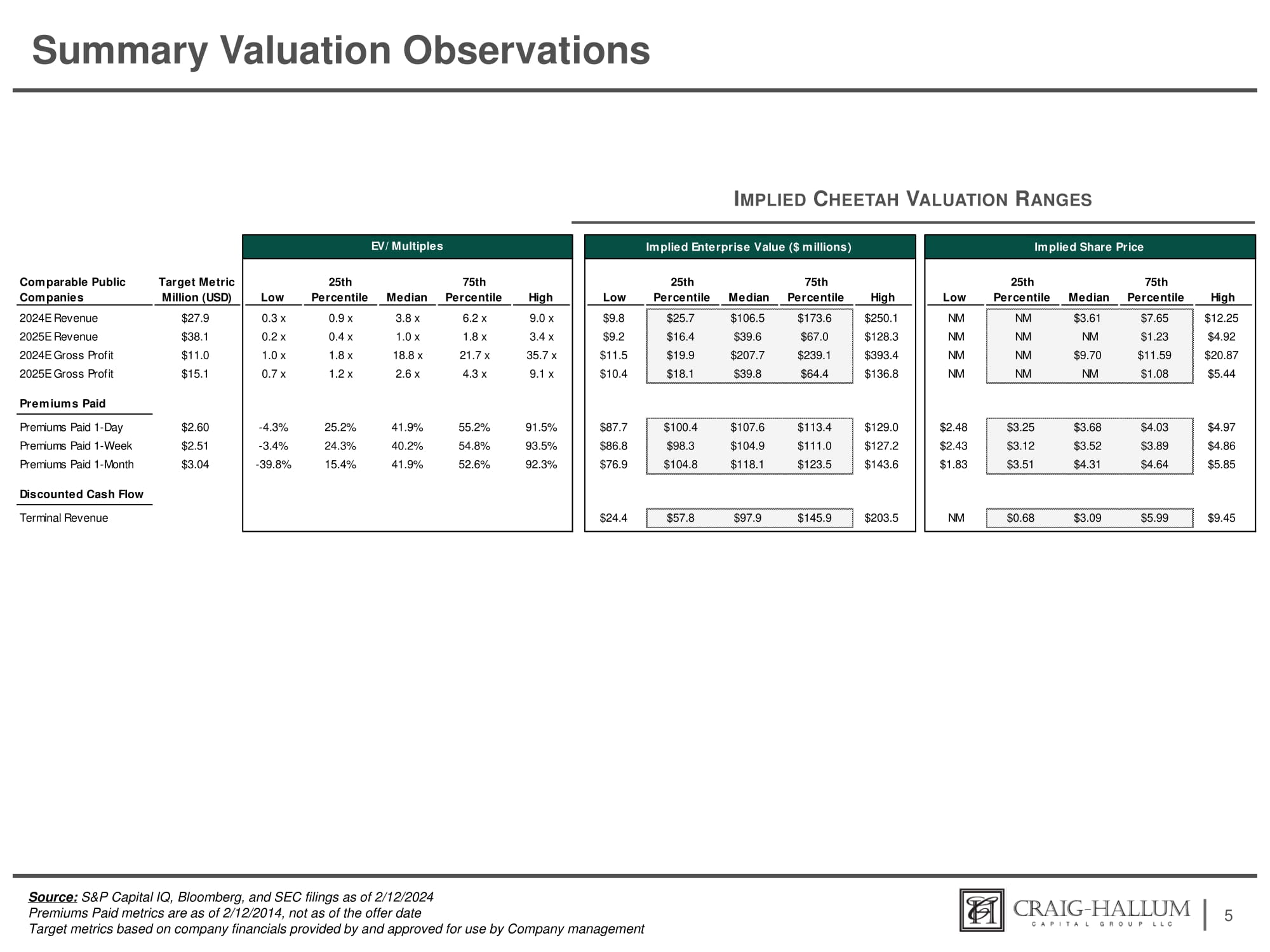

Summary Valuation Observations 5 I MPLIED C HEETAH V ALUATION R ANGES Source: S&P Capital IQ, Bloomberg, and SEC filings as of 2/12/2024 Premiums Paid metrics are as of 2/12/2014, not as of the offer date Target metrics based on company financials provided by and approved for use by Company management Implied Enterprise Value ($ millions) 25th 75th Low Percentile Median Percentile High $250.1 $128.3 $393.4 $136.8 $25.7 $106.5 $173.6 $16.4 $39.6 $67.0 $19.9 $207.7 $239.1 $18.1 $39.8 $64.4 $9.8 $9.2 $11.5 $10.4 $87.7 $100.4 $107.6 $113.4 $129.0 $86.8 $98.3 $104.9 $111.0 $127.2 $76.9 $104.8 $118.1 $123.5 $143.6 $203.5 $57.8 $97.9 $145.9 $24.4 Implied Share Price High 75th Percentile Median 25th Percentile Low $12.25 $7.65 $3.61 NM NM $4.92 $1.23 NM NM NM $20.87 $11.59 $9.70 NM NM $5.44 $1.08 NM NM NM $4.97 $4.86 $5.85 $4.03 $3.89 $4.64 $3.68 $3.52 $4.31 $3.25 $3.12 $3.51 $2.48 $2.43 $1.83 $9.45 $5.99 $3.09 $0.68 NM Comparable Public Companies Target Metric Million (USD) Low 25th Percentile Median 75th Percentile High 2024E Revenue 2025E Revenue 2024E Gross Profit 2025E Gross Profit $27.9 $38.1 $11.0 $15.1 0.3 x 0.2 x 1.0 x 0.7 x 0.9 x 0.4 x 1.8 x 1.2 x 3.8 x 1.0 x 18.8 x 2.6 x 6.2 x 1.8 x 21.7 x 4.3 x 9.0 x 3.4 x 35.7 x 9.1 x Premiums Paid Premiums Paid 1 - Day Premiums Paid 1 - Week Premiums Paid 1 - Month $2.60 $2.51 $3.04 - 4.3% - 3.4% - 39.8% 25.2% 24.3% 15.4% 41.9% 40.2% 41.9% 55.2% 54.8% 52.6% 91.5% 93.5% 92.3% Discounted Cash Flow Terminal Revenue EV/ Multiples

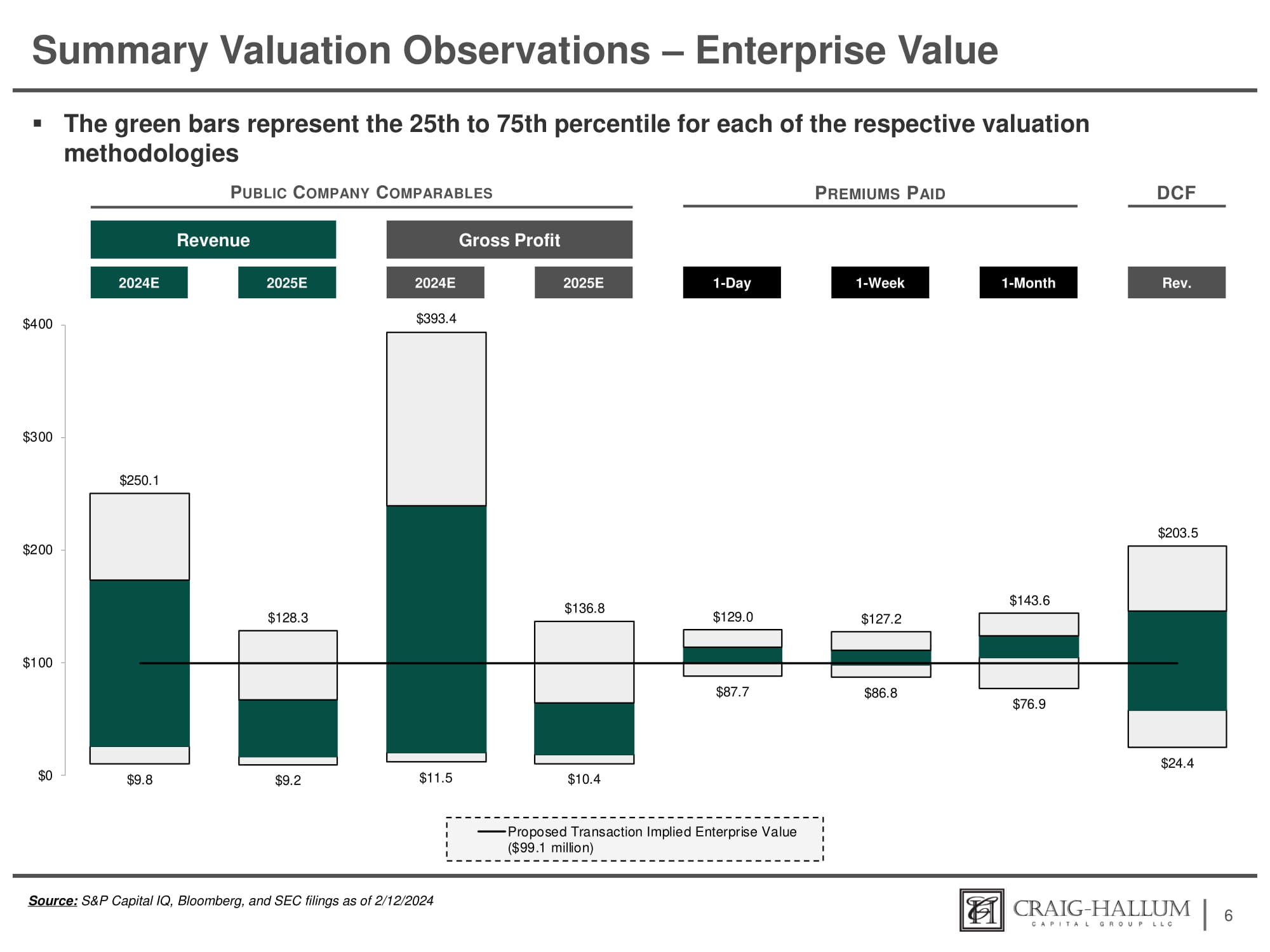

Summary Valuation Observations – Enterprise Value ▪ The green bars represent the 25th to 75th percentile for each of the respective valuation methodologies P UBLIC C OMPANY C OMPARABLES P REMIUMS P AID 6 Revenue 2024E 2025E Gross Profit 2024E 2025E DCF Rev. 1 - Day 1 - Month 1 - Week Source: S&P Capital IQ, Bloomberg, and SEC filings as of 2/12/2024 $9.8 $9.2 $11.5 $10.4 $87.7 $86.8 $76.9 $24.4 $128.3 $393.4 $136.8 $129.0 $127.2 $143.6 $203.5 $300 $250.1 $0 $100 $200 $400 Proposed Transaction Implied Enterprise Value ($99.1 million)

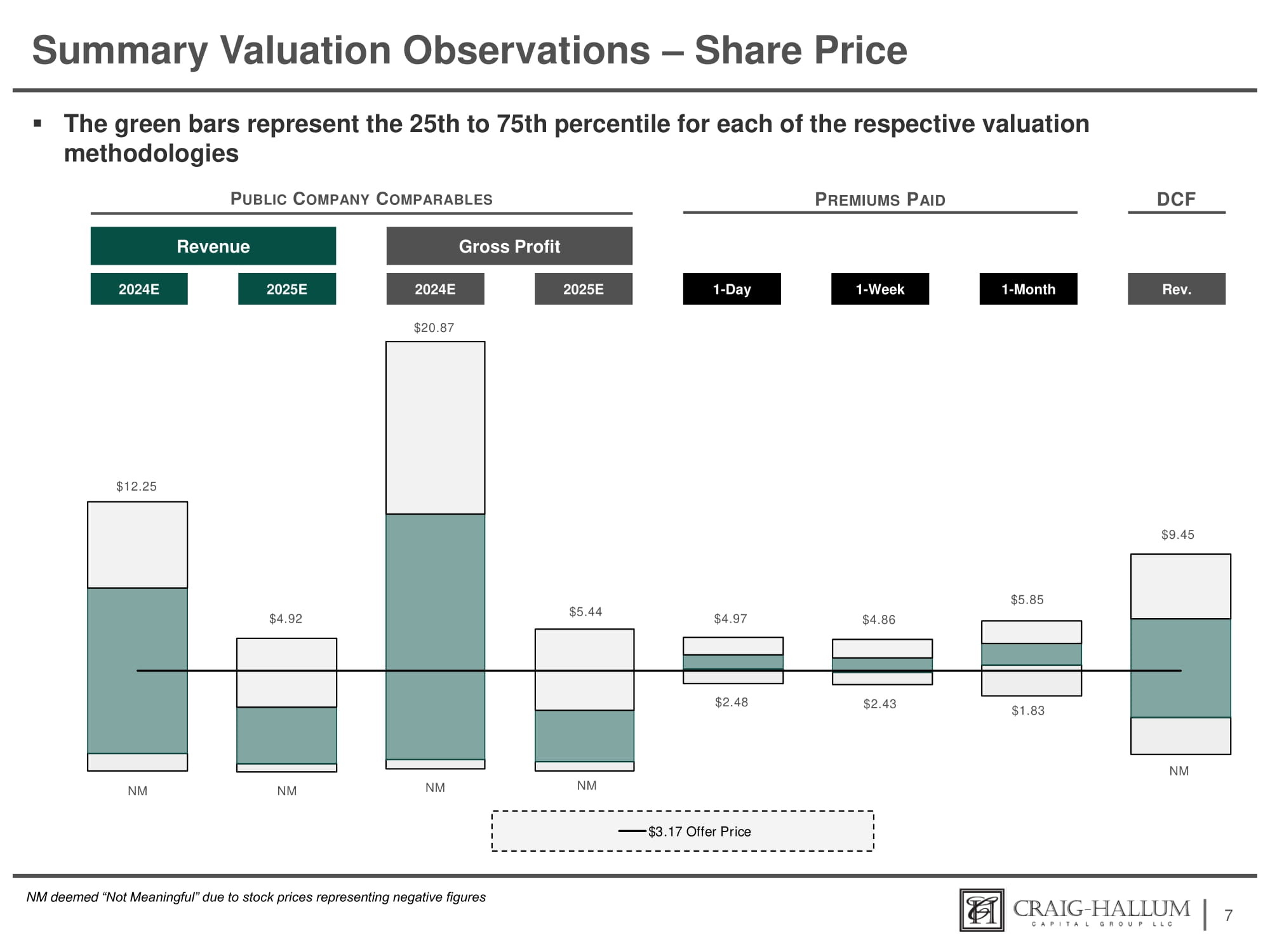

Summary Valuation Observations – Share Price ▪ The green bars represent the 25th to 75th percentile for each of the respective valuation methodologies P UBLIC C OMPANY C OMPARABLES P REMIUMS P AID 7 $3.17 Offer Price Revenue 2024E 2025E Gross Profit 2024E 2025E DCF Rev. 1 - Day 1 - Month 1 - Week NM deemed “Not Meaningful” due to stock prices representing negative figures NM NM NM NM NM $2.48 $2.43 $1.83 $12.25 $4.92 $20.87 $5.44 $9.45 $4.97 $4.86 $5.85

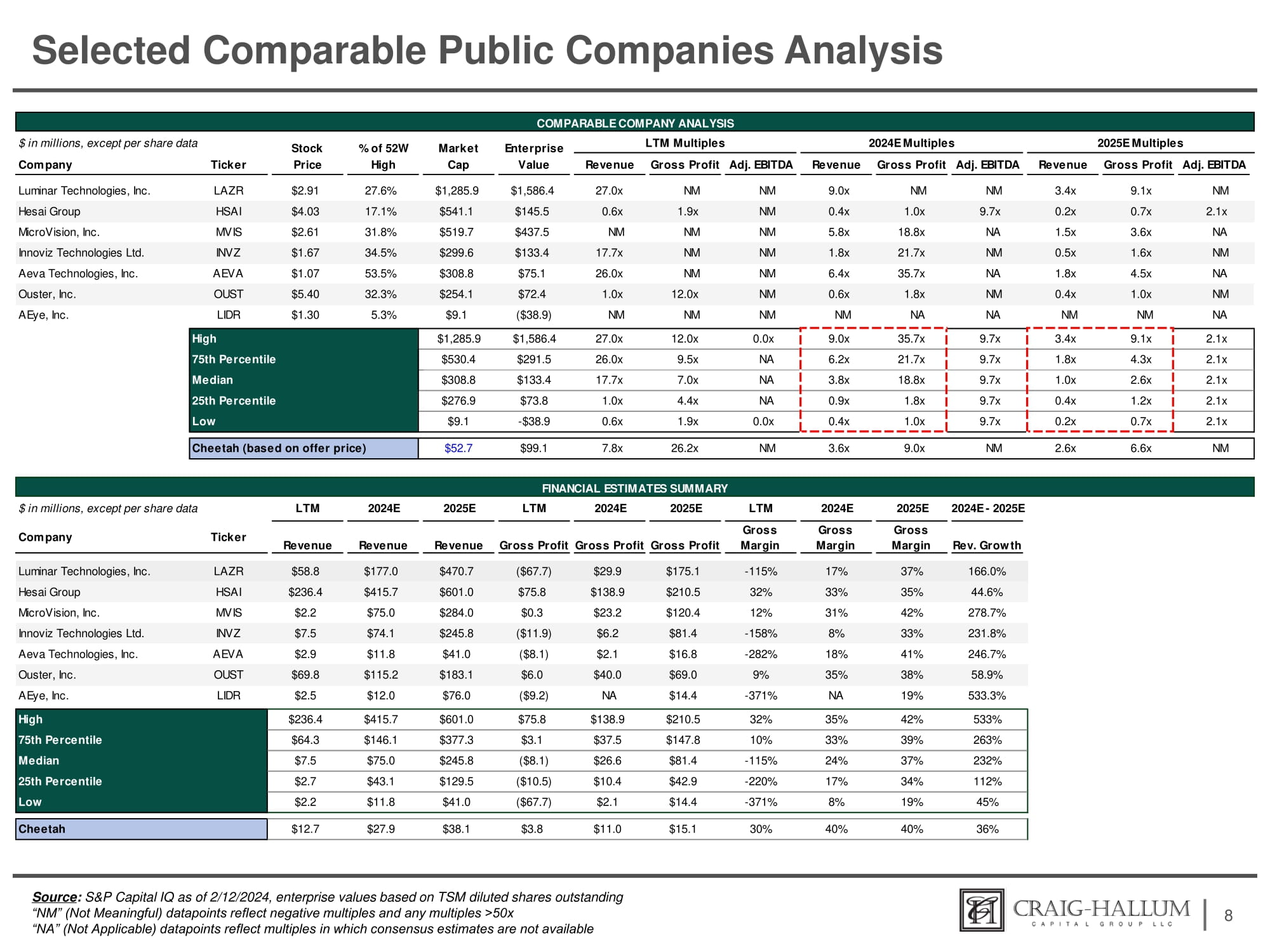

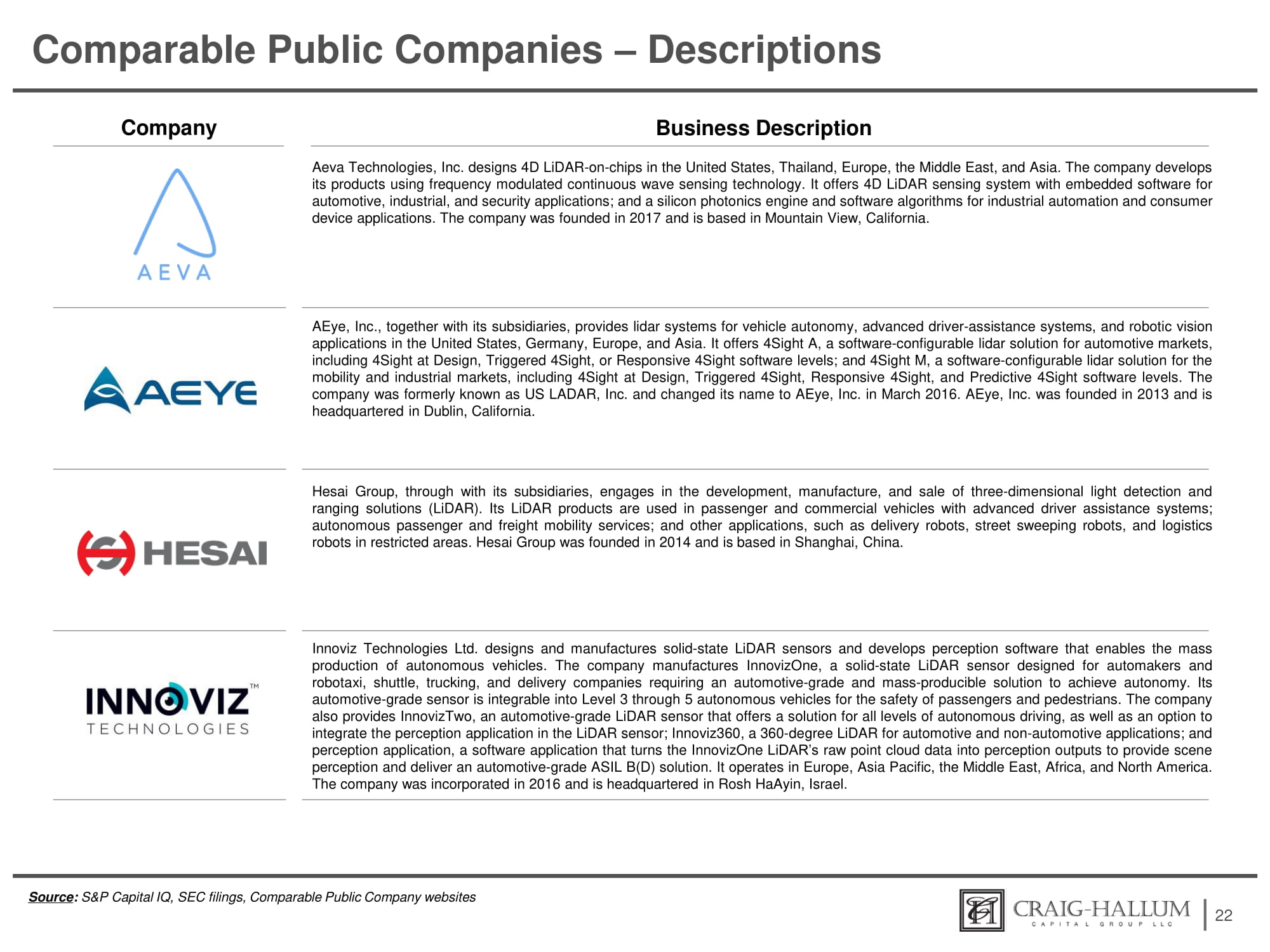

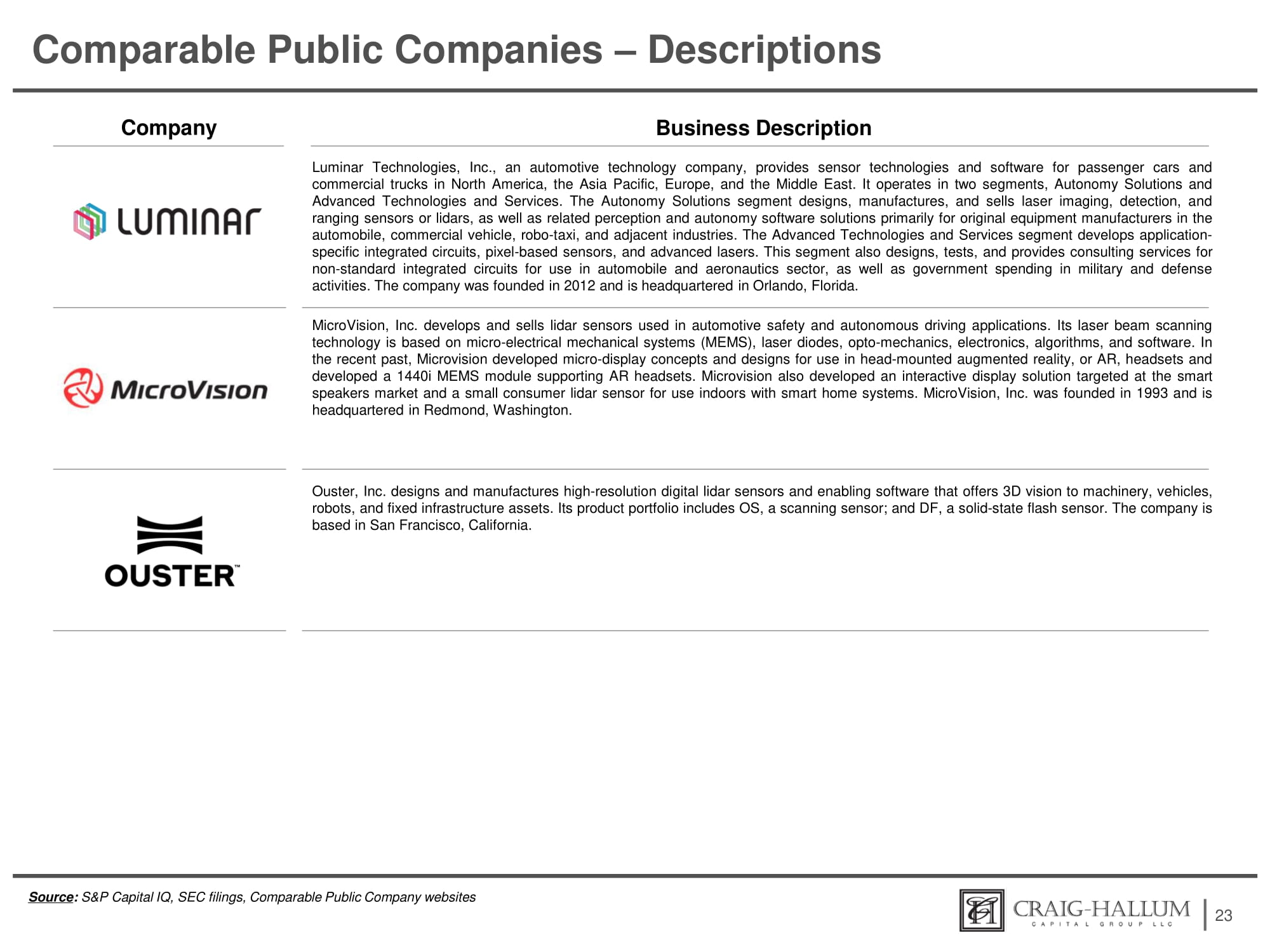

Selected Comparable Public Companies Analysis 8 Source : S&P Capital IQ as of 2/12/2024, enterprise values based on TSM diluted shares outstanding “NM” (Not Meaningful) datapoints reflect negative multiples and any multiples >50x “NA” (Not Applicable) datapoints reflect multiples in which consensus estimates are not available Adj. EBITDA Gross Profit Revenue Adj. EBITDA Gross Profit Revenue Adj. EBITDA Gross Profit Revenue Value Cap High Price Ticker Company NM 9.1x 3.4x NM NM 9.0x NM NM 27.0x $1,586.4 $1,285.9 27.6% $2.91 LAZR Luminar Technologies, Inc. 2.1x 0.7x 0.2x 9.7x 1.0x 0.4x NM 1.9x 0.6x $145.5 $541.1 17.1% $4.03 HSAI Hesai Group NA 3.6x 1.5x NA 18.8x 5.8x NM NM NM $437.5 $519.7 31.8% $2.61 MVIS MicroVision, Inc. NM 1.6x 0.5x NM 21.7x 1.8x NM NM 17.7x $133.4 $299.6 34.5% $1.67 INVZ Innoviz Technologies Ltd. NA 4.5x 1.8x NA 35.7x 6.4x NM NM 26.0x $75.1 $308.8 53.5% $1.07 AEVA Aeva Technologies, Inc. NM 1.0x 0.4x NM 1.8x 0.6x NM 12.0x 1.0x $72.4 $254.1 32.3% $5.40 OUST Ouster, Inc. NA NM NM NA NA NM NM NM NM ($38.9) $9.1 5.3% $1.30 LIDR AEye, Inc. 2.1x 9.1x 3.4x 9.7x 35.7x 9.0x 0.0x 12.0x 27.0x $1,586.4 $1,285.9 High 2.1x 4.3x 1.8x 9.7x 21.7x 6.2x NA 9.5x 26.0x $291.5 $530.4 75th Percentile Median 25th Percentile Low 2.1x 2.6x 1.0x 9.7x 18.8x 3.8x NA 7.0x 17.7x $133.4 $308.8 2.1x 1.2x 0.4x 9.7x 1.8x 0.9x NA 4.4x 1.0x $73.8 $276.9 2.1x 0.7x 0.2x 9.7x 1.0x 0.4x 0.0x 1.9x 0.6x - $38.9 $9.1 2024E - 2025E 2025E 2024E LTM 2025E 2024E LTM 2025E 2024E LTM $ in millions, except per share data Rev. Grow th Gross Margin Gross Margin Gross Margin Gross Profit Gross Profit Gross Profit Revenue Revenue Revenue Company Ticker 166.0% 37% 17% - 115% $175.1 $29.9 ($67.7) $470.7 $177.0 $58.8 LAZR Luminar Technologies, Inc. 44.6% 35% 33% 32% $210.5 $138.9 $75.8 $601.0 $415.7 $236.4 HSAI Hesai Group 278.7% 42% 31% 12% $120.4 $23.2 $0.3 $284.0 $75.0 $2.2 MVIS MicroVision, Inc. 231.8% 33% 8% - 158% $81.4 $6.2 ($11.9) $245.8 $74.1 $7.5 INVZ Innoviz Technologies Ltd. 246.7% 41% 18% - 282% $16.8 $2.1 ($8.1) $41.0 $11.8 $2.9 AEVA Aeva Technologies, Inc. 58.9% 38% 35% 9% $69.0 $40.0 $6.0 $183.1 $115.2 $69.8 OUST Ouster, Inc. 533.3% 19% NA - 371% $14.4 NA ($9.2) $76.0 $12.0 $2.5 LIDR AEye, Inc. 533% 42% 35% 32% $210.5 $138.9 $75.8 $601.0 $415.7 $236.4 High 263% 39% 33% 10% $147.8 $37.5 $3.1 $377.3 $146.1 $64.3 75th Percentile 232% 37% 24% - 115% $81.4 $26.6 ($8.1) $245.8 $75.0 $7.5 Median 112% 34% 17% - 220% $42.9 $10.4 ($10.5) $129.5 $43.1 $2.7 25th Percentile 45% 19% 8% - 371% $14.4 $2.1 ($67.7) $41.0 $11.8 $2.2 Low COMPARABLE COMPANY ANALYSIS $ in millions, except per share data Stock % of 52W Market Enterprise LTM Multiples 2024E Multiples 2025E Multiples Cheetah (based on offer price) $52.7 $99.1 7.8x 26.2x NM 3.6x 9.0x NM 2.6x 6.6x NM FINANCIAL ESTIMATES SUMMARY Cheetah $12.7 $27.9 $38.1 $3.8 $11.0 $15.1 30% 40% 40% 36%

92.3% 93.5% 91.5% High 52.6% 54.8% 55.2% 75th Percentile 41.9% 40.2% 41.9% Median 15.4% 24.3% 25.2% 25th Percentile (39.8%) (3.4%) (4.3%) Low $3.04 1/12/2024 $2.51 2/5/2024 $2.60 2/12/2024 Cheetah Closing Share Price Date 4.3% 26.3% 22.2% Corresponding Premium (2) Implied Price Per Share $5.85 $4.86 $4.97 High $4.64 $3.89 $4.03 75th Percentile $4.31 $3.52 $3.68 Median $3.51 $3.12 $3.25 25th Percentile $1.83 $2.43 $2.48 Low Premiums Paid Analysis (1) 1 - Day 1 - Week 1 - Month Share price shown in USDs 1 - Day 1 - Week 1 - Month 92.3% 93.5% 91.5% High 52.6% 54.8% 55.2% 75th Percentile 41.9% 40.2% 41.9% Median 15.4% 24.3% 25.2% 25th Percentile (39.8%) (3.4%) (4.3%) Low $3.00 11/19/2023 $3.80 12/12/2023 $3.02 12/19/2023 Cheetah Closing Share Price Date 5.7% - 16.6% 5.0% Corresponding Premium (2) Implied Price Per Share $5.77 $7.35 $5.78 High $4.58 $5.88 $4.69 75th Percentile $4.26 $5.33 $4.29 Median $3.46 $4.72 $3.78 25th Percentile $1.81 $3.67 $2.89 Low Premiums Paid Analysis (1) 1 - Day 1 - Week 1 - Month Share price shown in USDs 1 - Day 1 - Week 1 - Month M&A Premiums Paid Analysis - Methodology ▪ Screening criteria: ▪ Deals completed or those announced since January 1, 2021 in the United States and Canada ▪ Deals that were 100% cash transactions acquiring greater than 50% of the Target Company ▪ Transaction equity value ranging from $20 million to $250 million ▪ Includes only Technology Company transactions ▪ 18 total transactions in analysis 9 Source : S&P Capital IQ as of 2/12/2024 (1) Represents 1 Day, 1 Week, and 1 Month Spot Premium for respective reference prices at time of offer (2) Represents premium to Cheetah closing price in respective time periods for the current $3.17 offer price (3) Represents 1 Day, 1 Week, and 1 Month Spot Premium prior to Current Stock Price as of 2/12/2024 Premiums Paid – At Time of Offer (12/19/2023) 1 Premiums Paid – Current (2/12/2024) 3

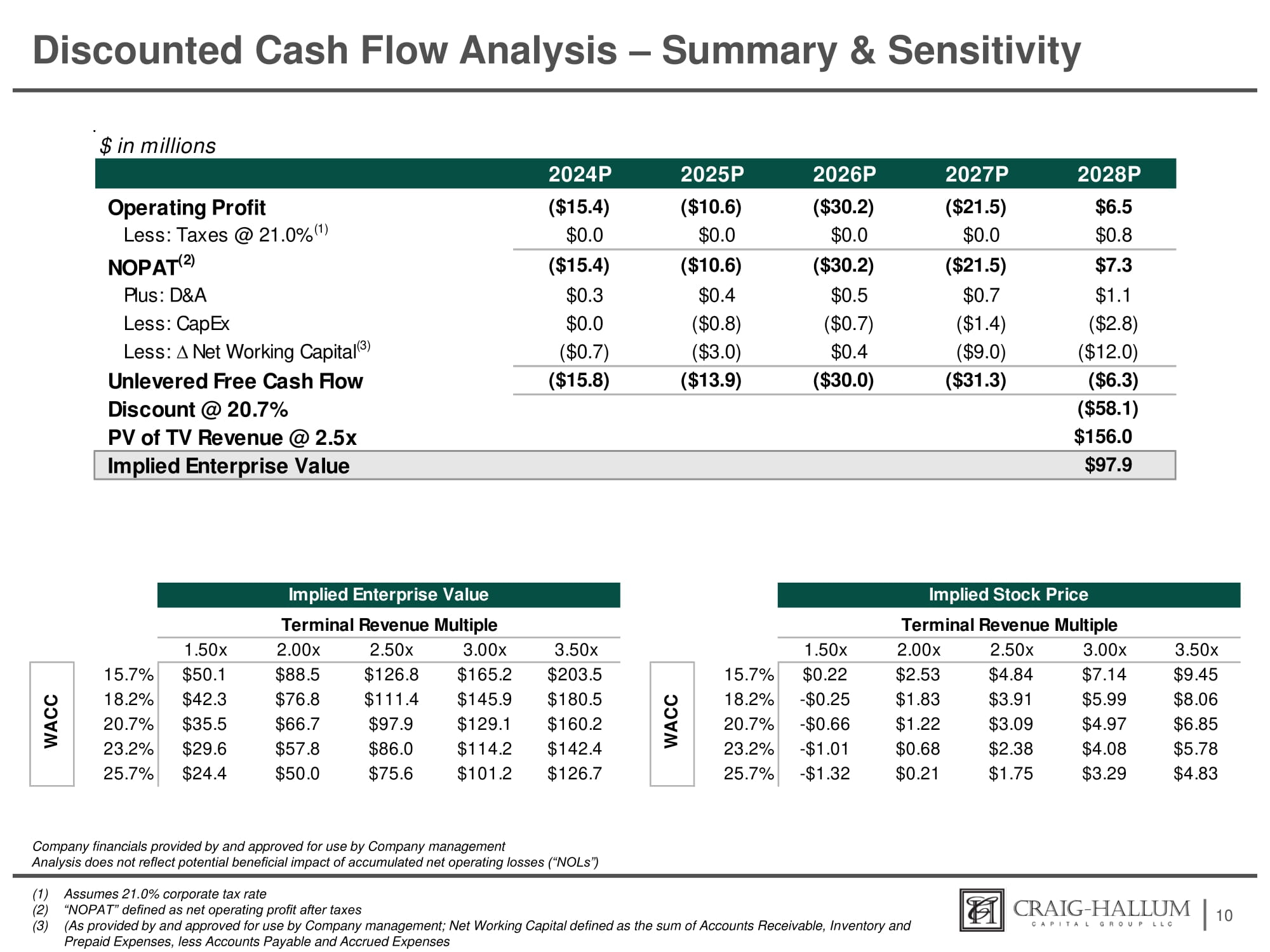

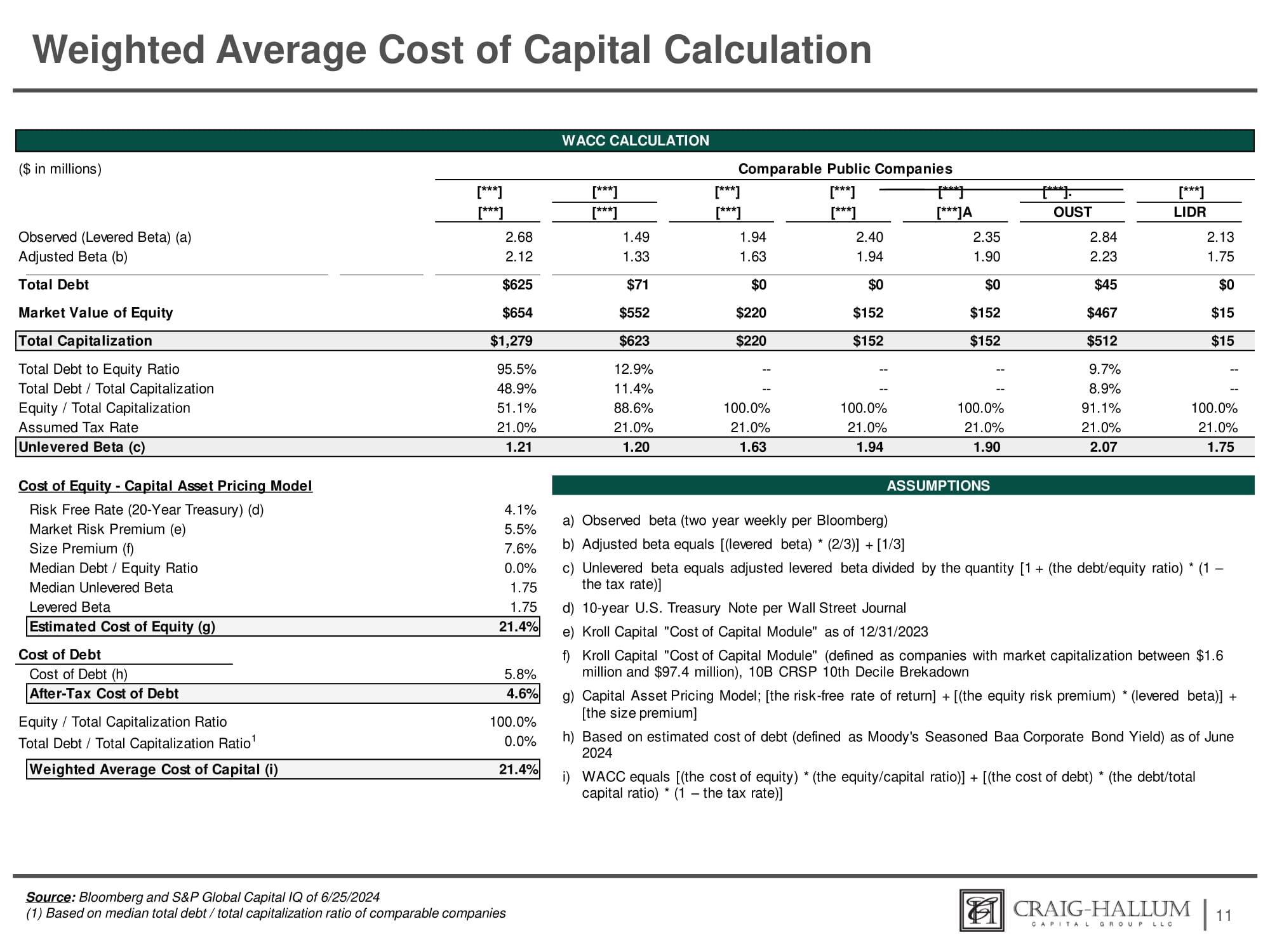

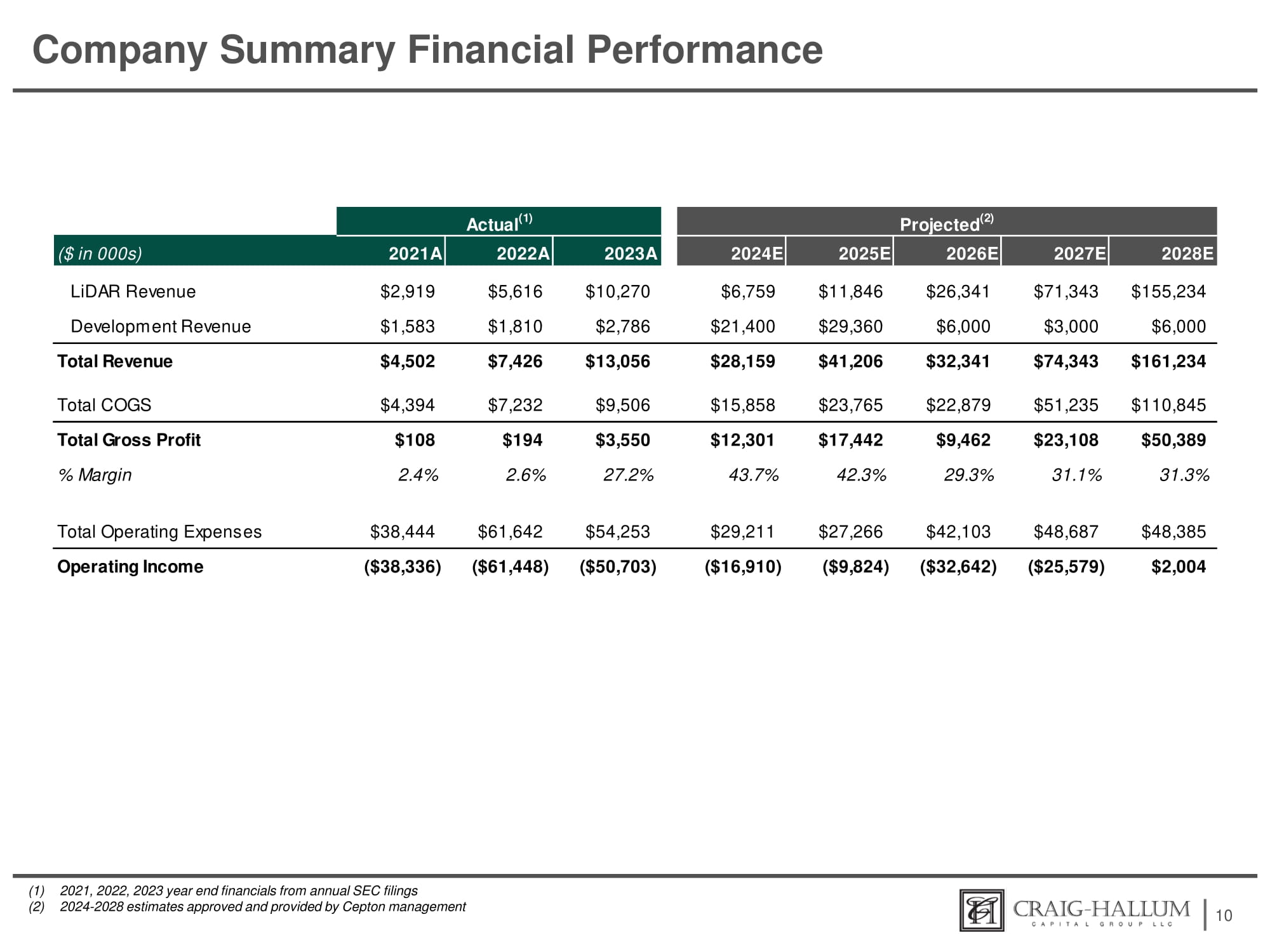

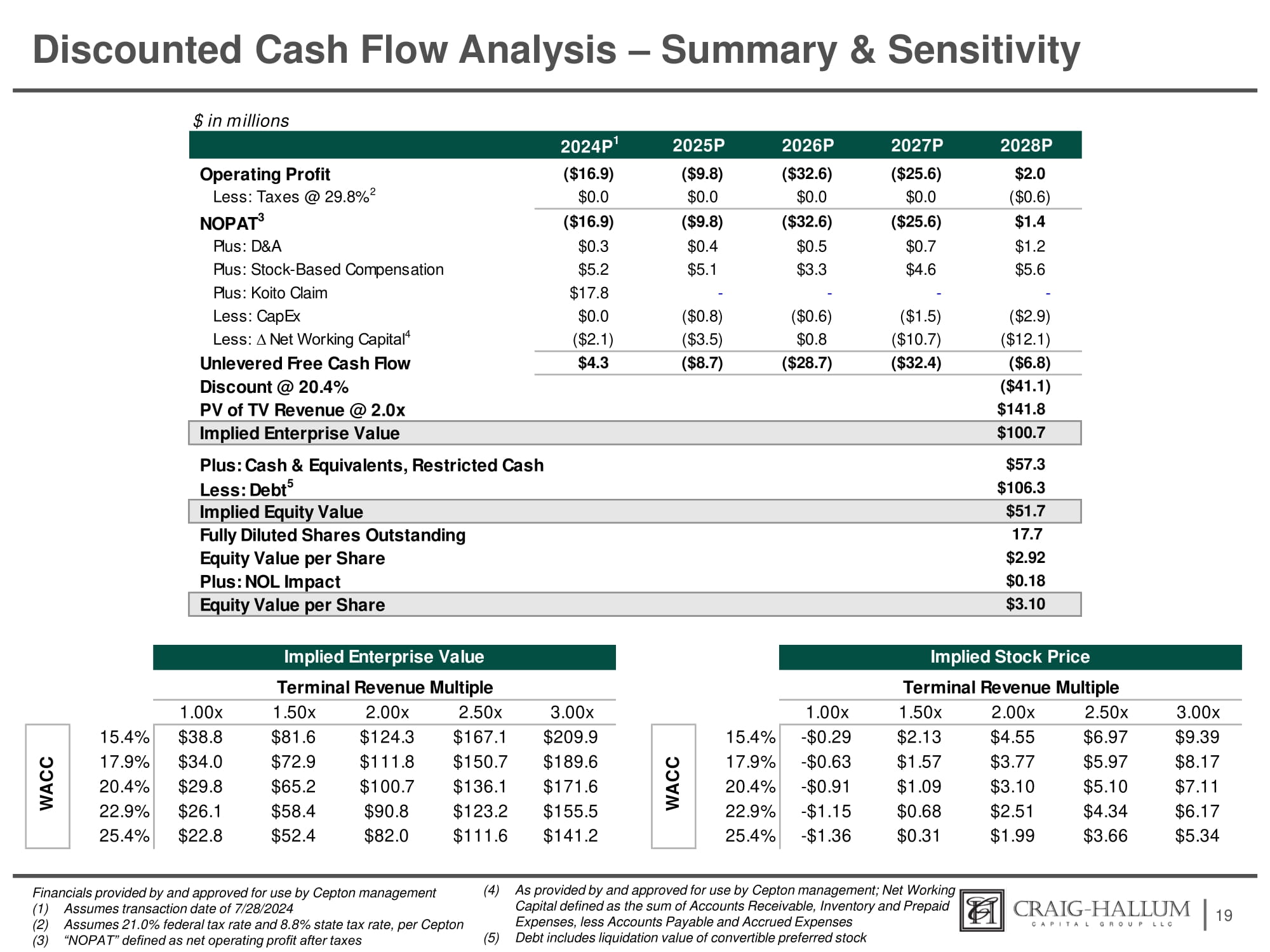

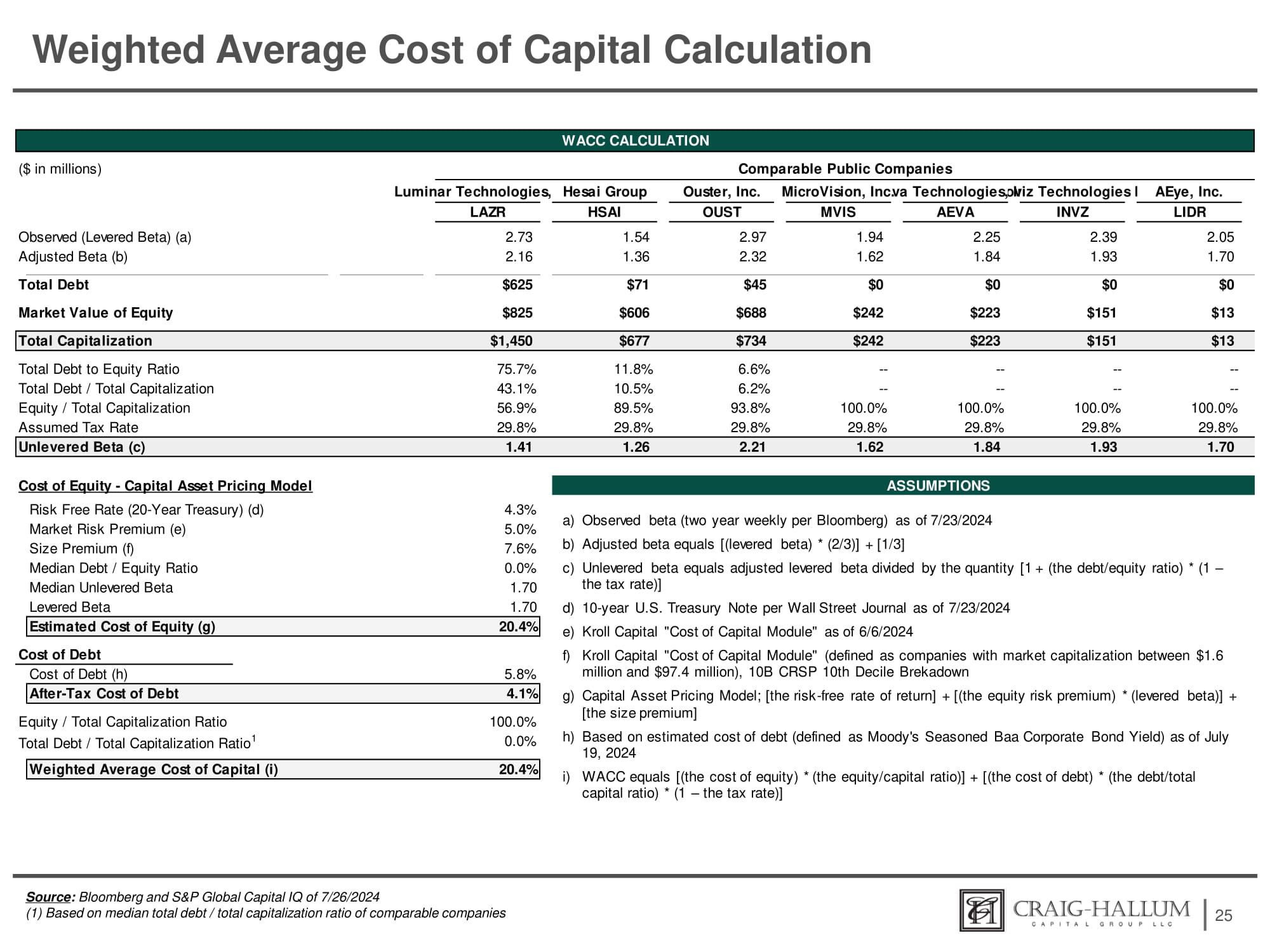

Discounted Cash Flow Analysis – Summary & Sensitivity 10 Company financials provided by and approved for use by Company management Analysis does not reflect potential beneficial impact of accumulated net operating losses (“NOLs”) (1) Assumes 21.0% corporate tax rate (2) “NOPAT” defined as net operating profit after taxes (3) (As provided by and approved for use by Company management; Net Working Capital defined as the sum of Accounts Receivable, Inventory and Prepaid Expenses, less Accounts Payable and Accrued Expenses $ in millions 2028P 2027P 2026P 2025P 2024P $6.5 ($21.5) ($30.2) ($10.6) ($15.4) Operating Profit $0.8 $0.0 $0.0 $0.0 $0.0 Less: Taxes @ 21.0% (1) $7.3 ($21.5) ($30.2) ($10.6) ($15.4) NOPAT (2) $1.1 $0.7 $0.5 $0.4 $0.3 Plus: D&A ($2.8) ($1.4) ($0.7) ($0.8) $0.0 Less: CapEx ($12.0) ($9.0) $0.4 ($3.0) ($0.7) Less: ∆ Net Working Capital (3) ($6.3) ($31.3) ($30.0) ($13.9) ($15.8) Unlevered Free Cash Flow ($58.1) Discount @ 20.7% $156.0 PV of TV Revenue @ 2.5x $97.9 Implied Enterprise Value 3.50x 3.00x 2.50x 2.00x 1.50x 3.50x 3.00x 2.50x 2.00x 1.50x $9.45 $7.14 $4.84 $2.53 $0.22 15.7% $203.5 $165.2 $126.8 $88.5 $50.1 15.7% $8.06 $5.99 $3.91 $1.83 - $0.25 18.2% C $180.5 $145.9 $111.4 $76.8 $42.3 18.2% $6.85 $4.97 $3.09 $1.22 - $0.66 20.7% A C $160.2 $129.1 $97.9 $66.7 $35.5 20.7% $5.78 $4.08 $2.38 $0.68 - $1.01 23.2% W $142.4 $114.2 $86.0 $57.8 $29.6 23.2% $4.83 $3.29 $1.75 $0.21 - $1.32 25.7% $126.7 $101.2 $75.6 $50.0 $24.4 25.7% Implied Enterprise Value Terminal Revenue Multiple WACC Implied Stock Price Terminal Revenue Multiple

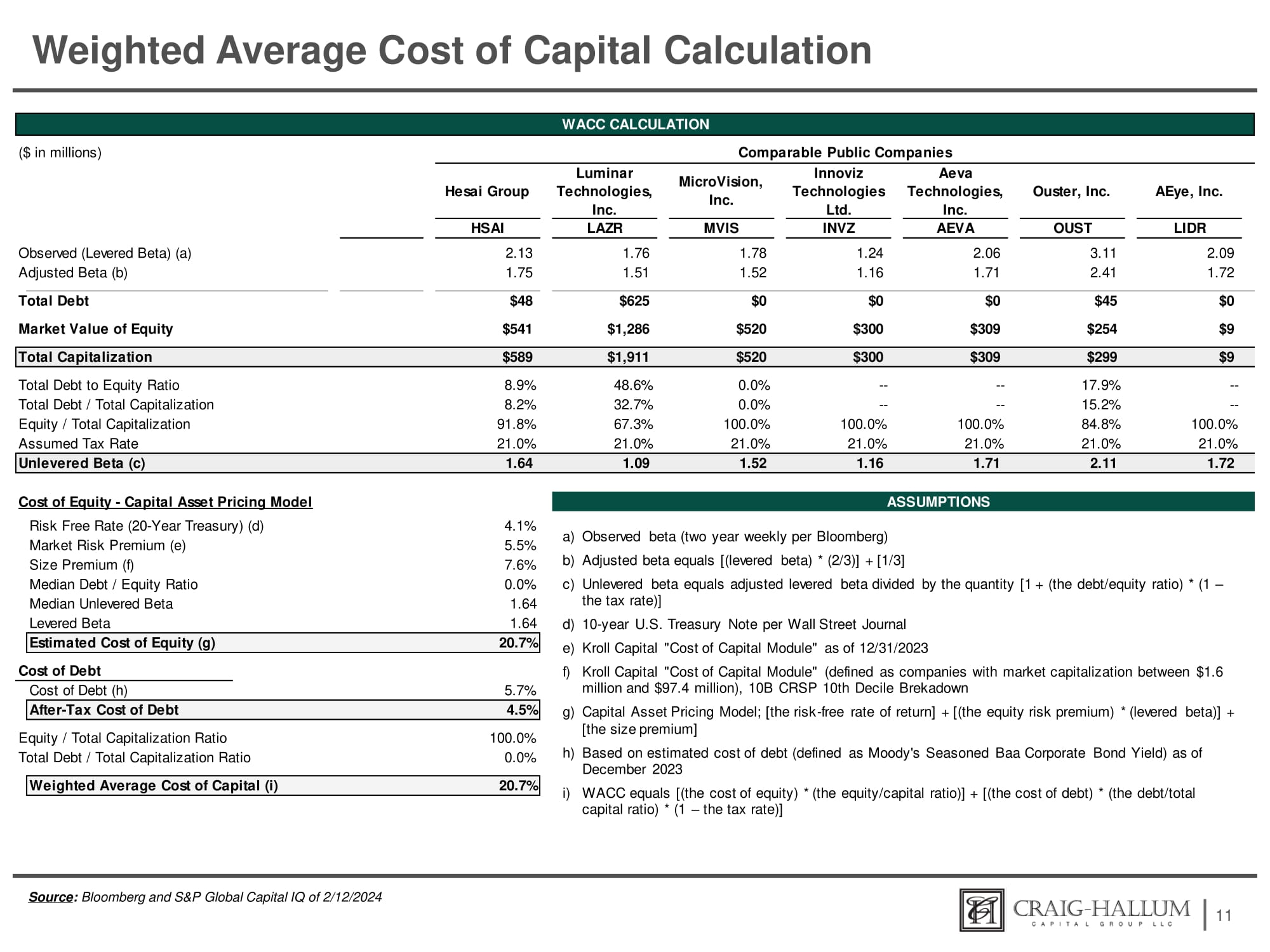

Weighted Average Cost of Capital Calculation 11 Source : Bloomberg and S&P Global Capital IQ of 2/12/2024 AEye, Inc. Ouster, Inc. Aeva Technologies, Inc. Innoviz Technologies Ltd. MicroVision, Inc. Luminar Technologies, Inc. Hesai Group LIDR OUST AEVA INVZ MVIS LAZR HSAI 2.09 3.11 2.06 1.24 1.78 1.76 2.13 Observed (Levered Beta) (a) 1.72 2.41 1.71 1.16 1.52 1.51 1.75 Adjusted Beta (b) $0 $45 $0 $0 $0 $625 $48 Total Debt $9 $254 $309 $300 $520 $1,286 $541 Market Value of Equity $9 $299 $309 $300 $520 $1,911 $589 Total Capitalization - - 17.9% - - - - 0.0% 48.6% 8.9% Total Debt to Equity Ratio - - 15.2% - - - - 0.0% 32.7% 8.2% Total Debt / Total Capitalization 100.0% 84.8% 100.0% 100.0% 100.0% 67.3% 91.8% Equity / Total Capitalization 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% 21.0% Assumed Tax Rate 1.72 2.11 1.71 1.16 1.52 1.09 1.64 Unlevered Beta (c) WACC CALCULATION ($ in millions) Comparable Public Companies Cost of Equity - Capital Asset Pricing Model Risk Free Rate (20 - Year Treasury) (d) Market Risk Premium (e) Size Premium (f) Median Debt / Equity Ratio Median Unlevered Beta Levered Beta ASSUMPTIONS 4.1% 5.5% 7.6% 0.0% 1.64 1.64 Estimated Cost of Equity (g) 20.7% Cost of Debt Cost of Debt (h) 5.7% After - Tax Cost of Debt 4.5% Equity / Total Capitalization Ratio Total Debt / Total Capitalization Ratio 100.0% 0.0% Weighted Average Cost of Capital (i) 20.7% a) Observed beta (two year weekly per Bloomberg) b) Adjusted beta equals [(levered beta) * (2/3)] + [1/3] c) Unlevered beta equals adjusted levered beta divided by the quantity [1 + (the debt/equity ratio) * (1 – the tax rate)] d) 10 - year U.S. Treasury Note per Wall Street Journal e) Kroll Capital "Cost of Capital Module" as of 12/31/2023 f) Kroll Capital "Cost of Capital Module" (defined as companies with market capitalization between $1.6 million and $97.4 million), 10B CRSP 10th Decile Brekadown g) Capital Asset Pricing Model; [the risk - free rate of return] + [(the equity risk premium) * (levered beta)] + [the size premium] h) Based on estimated cost of debt (defined as Moody's Seasoned Baa Corporate Bond Yield) as of December 2023 i) WACC equals [(the cost of equity) * (the equity/capital ratio)] + [(the cost of debt) * (the debt/total capital ratio) * (1 – the tax rate)]

Private & Confidential Appendix 12

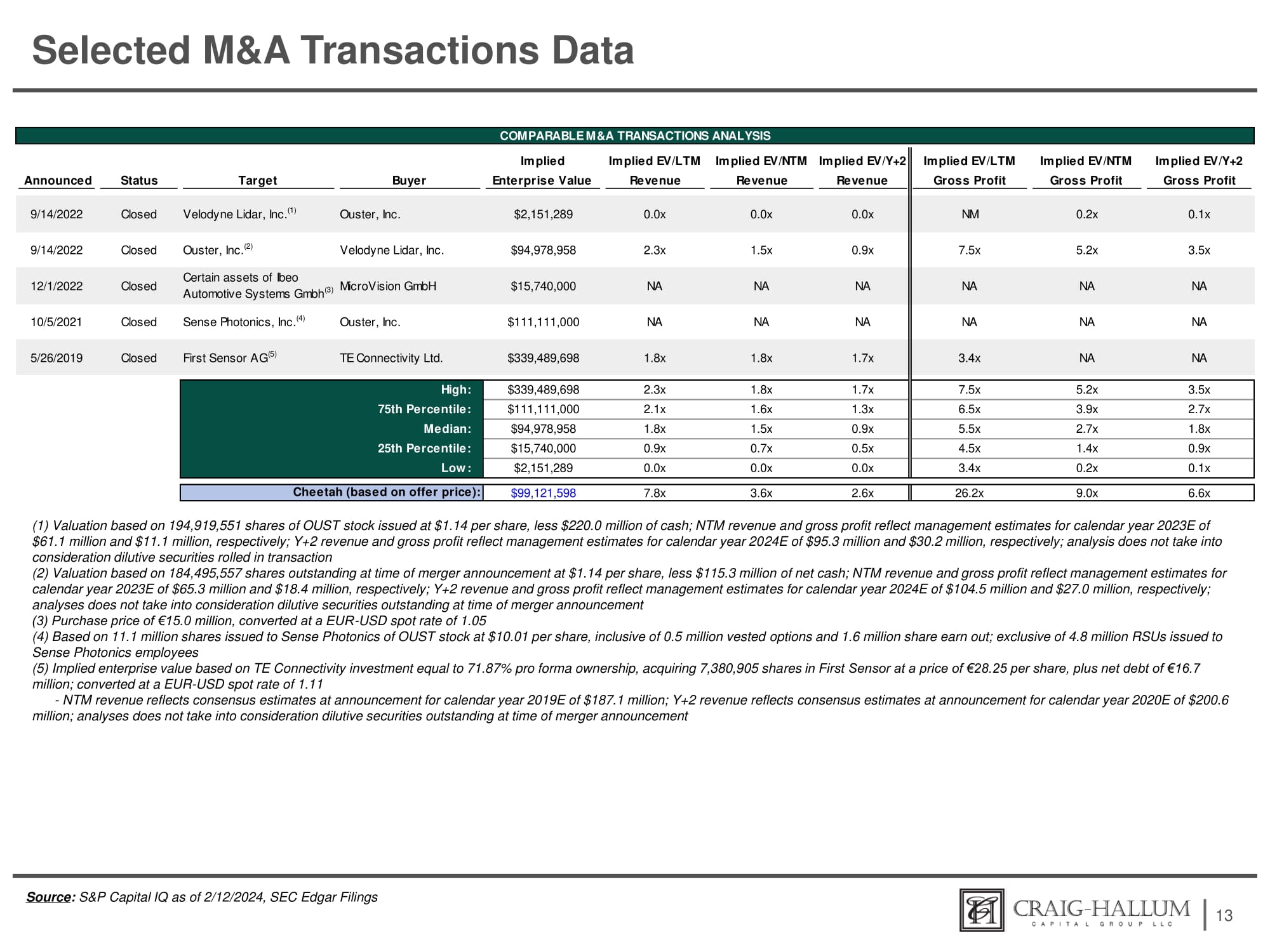

Selected M&A Transactions Data 13 Source : S&P Capital IQ as of 2/12/2024, SEC Edgar Filings (1) Valuation based on 194,919,551 shares of OUST stock issued at $1.14 per share, less $220.0 million of cash; NTM revenue and gross profit reflect management estimates for calendar year 2023E of $61.1 million and $11.1 million, respectively; Y+2 revenue and gross profit reflect management estimates for calendar year 2024E of $95.3 million and $30.2 million, respectively; analysis does not take into consideration dilutive securities rolled in transaction (2) Valuation based on 184,495,557 shares outstanding at time of merger announcement at $1.14 per share, less $115.3 million of net cash; NTM revenue and gross profit reflect management estimates for calendar year 2023E of $65.3 million and $18.4 million, respectively; Y+2 revenue and gross profit reflect management estimates for calendar year 2024E of $104.5 million and $27.0 million, respectively; analyses does not take into consideration dilutive securities outstanding at time of merger announcement (3) Purchase price of €15.0 million, converted at a EUR - USD spot rate of 1.05 (4) Based on 11.1 million shares issued to Sense Photonics of OUST stock at $10.01 per share, inclusive of 0.5 million vested options and 1.6 million share earn out; exclusive of 4.8 million RSUs issued to Sense Photonics employees (5) Implied enterprise value based on TE Connectivity investment equal to 71.87% pro forma ownership, acquiring 7,380,905 shares in First Sensor at a price of €28.25 per share, plus net debt of €16.7 million; converted at a EUR - USD spot rate of 1.11 - NTM revenue reflects consensus estimates at announcement for calendar year 2019E of $187.1 million; Y+2 revenue reflects consensus estimates at announcement for calendar year 2020E of $200.6 million; analyses does not take into consideration dilutive securities outstanding at time of merger announcement COMPARABLE M&A TRANSACTIONS ANALYSIS Implied EV/LTM Implied EV/NTM Implied EV/Y+2 Gross Profit Gross Profit Gross Profit Implied Implied EV/LTM Implied EV/NTM Implied EV/Y+2 Announced Status Target Buyer Enterprise Value Revenue Revenue Revenue NM 0.2x 0.1x 9/14/2022 Closed Velodyne Lidar, Inc. (1) Ouster, Inc. $2,151,289 0.0x 0.0x 0.0x 7.5x 5.2x 3.5x 9/14/2022 Closed Ouster, Inc. (2) Velodyne Lidar, Inc. $94,978,958 2.3x 1.5x 0.9x NA NA NA 12/1/2022 Closed Certain assets of Ibeo MicroVision GmbH $15,740,000 NA NA NA Automotive Systems Gmbh (3) NA NA NA 10/5/2021 Closed Sense Photonics, Inc. (4) Ouster, Inc. $111,111,000 NA NA NA 3.4x NA NA 5/26/2019 Closed First Sensor AG (5) TE Connectivity Ltd. $339,489,698 1.8x 1.8x 1.7x 7.5x 5.2x 3.5x $339,489,698 2.3x 1.8x 1.7x High: 75th Percentile: Median: 25th Percentile: Low : 6.5x 3.9x 2.7x $111,111,000 2.1x 1.6x 1.3x 5.5x 2.7x 1.8x $94,978,958 1.8x 1.5x 0.9x 4.5x 1.4x 0.9x $15,740,000 0.9x 0.7x 0.5x 3.4x 0.2x 0.1x $2,151,289 0.0x 0.0x 0.0x 26.2x 9.0x 6.6x $99,121,598 7.8x 3.6x 2.6x Cheetah (based on offer price):

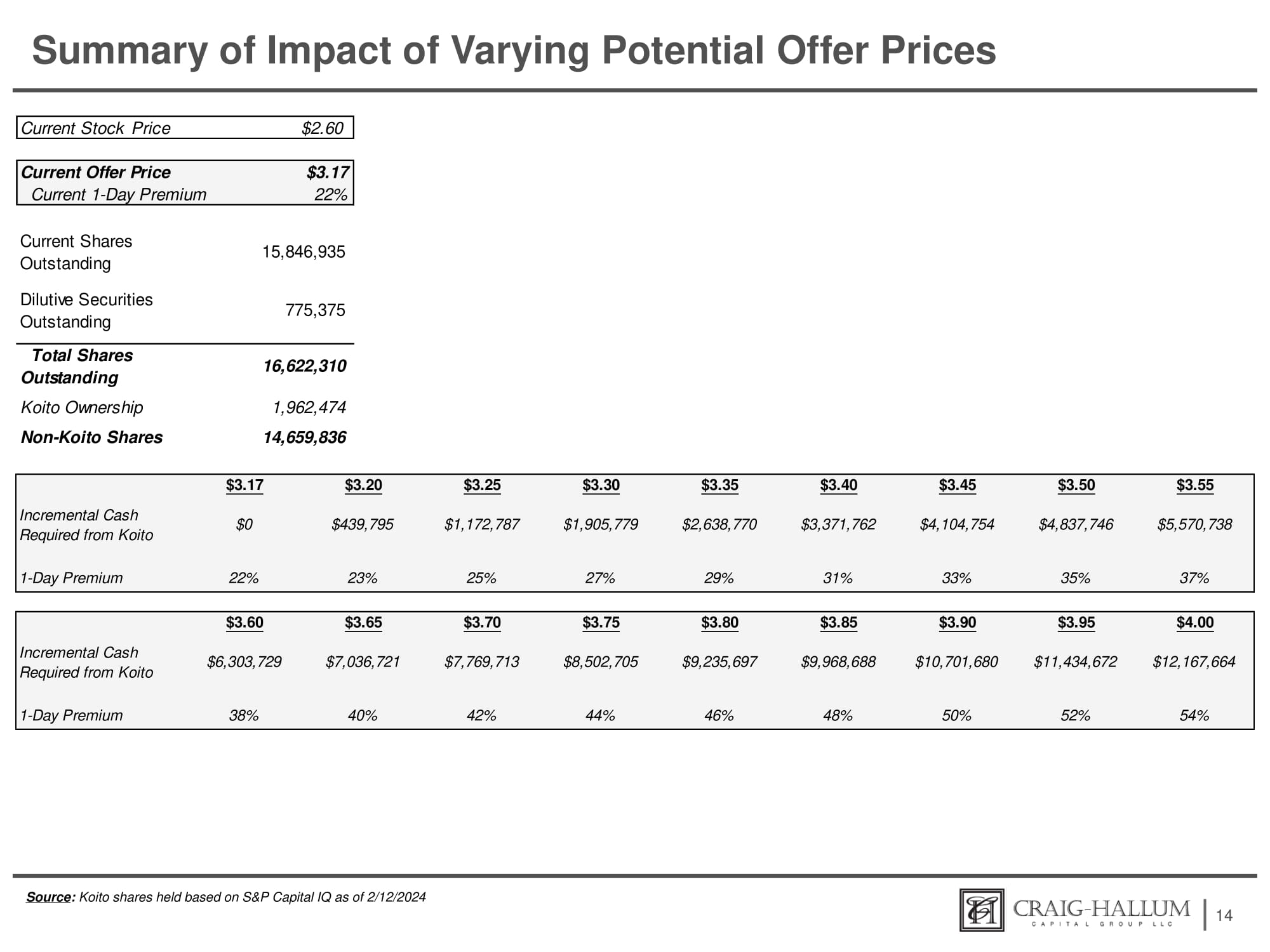

Summary of Impact of Varying Potential Offer Prices 14 $2.60 Current Stock Price $3.17 Current Offer Price 22% Current 1 - Day Premium Current Shares Outstanding 15,846,935 Dilutive Securities Outstanding 775,375 16,622,310 Total Shares Outstanding 1,962,474 Koito Ownership 14,659,836 Non - Koito Shares Required from Koito Required from Koito $3.55 $3.50 $3.45 $3.40 $3.35 $3.30 $3.25 $3.20 $3.17 $5,570,738 $4,837,746 $4,104,754 $3,371,762 $2,638,770 $1,905,779 $1,172,787 $439,795 Incremental Cash $0 37% 35% 33% 31% 29% 27% 25% 23% 1 - Day Premium 22% $4.00 $3.95 $3.90 $3.85 $3.80 $3.75 $3.70 $3.65 $3.60 $12,167,664 $11,434,672 $10,701,680 $9,968,688 $9,235,697 $8,502,705 $7,769,713 $7,036,721 Incremental Cash $6,303,729 54% 52% 50% 48% 46% 44% 42% 40% 1 - Day Premium 38% Source : Koito shares held based on S&P Capital IQ as of 2/12/2024

Exhibit (C)(4)

Private & Confidential [***] indicates information has been omitted on the basis of a confidential treatment request pursuant to Rule 24b - 2 of the Securities Exchange Act of 1934, as amended. This information has been filed separately with the Securities and Exchange Commission. Project Cheetah Special Committee Materials for Discussion June 26, 2024

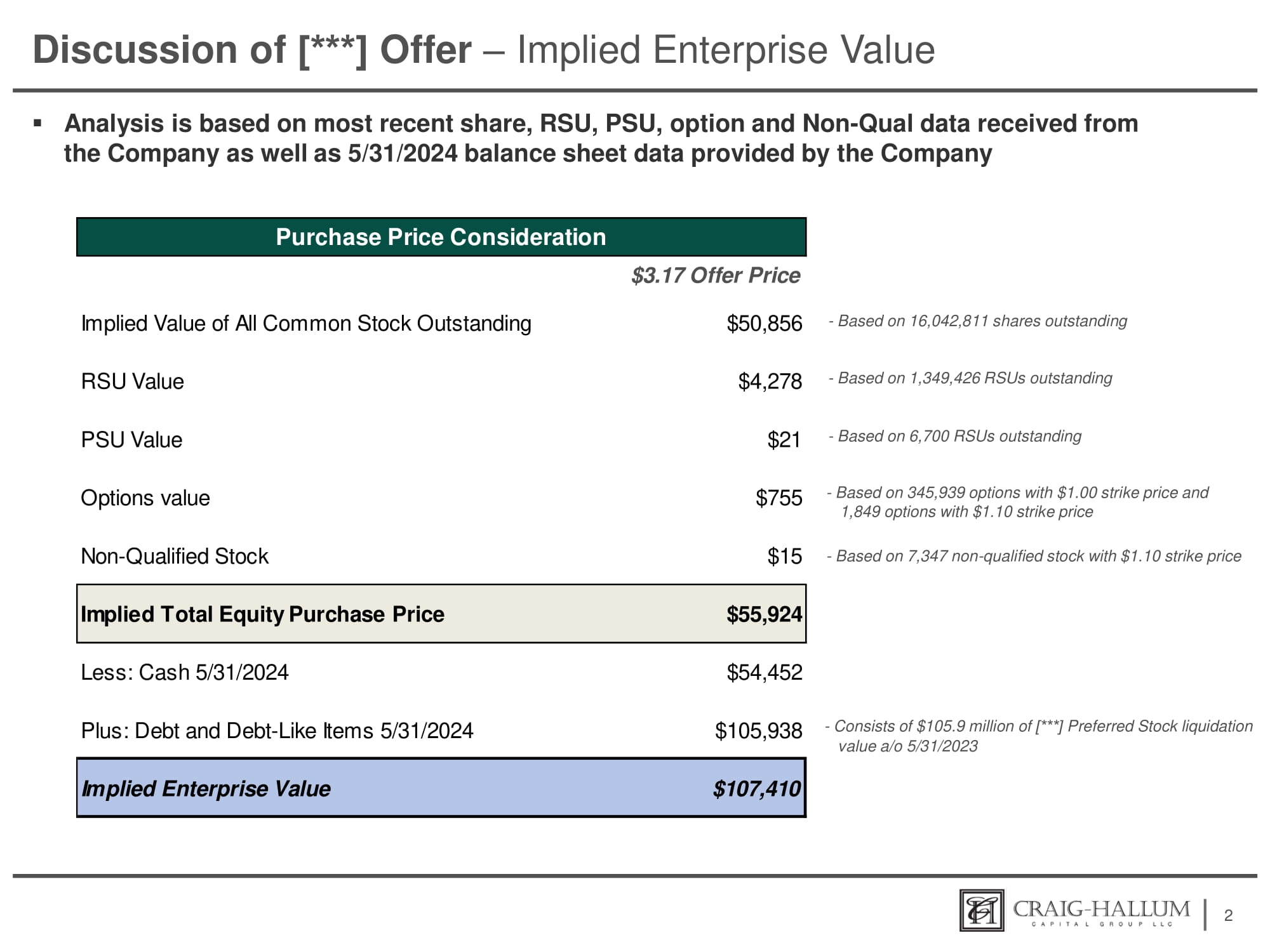

Discussion of [***] Offer – Implied Enterprise Value ▪ Analysis is based on most recent share, RSU, PSU, option and Non - Qual data received from the Company as well as 5/31/2024 balance sheet data provided by the Company 2 - Based on 16,042,811 shares outstanding - Based on 1,349,426 RSUs outstanding - Based on 6,700 RSUs outstanding - Based on 345,939 options with $1.00 strike price and 1,849 options with $1.10 strike price - Based on 7,347 non - qualified stock with $1.10 strike price - Consists of $105.9 million of [***] Preferred Stock liquidation value a/o 5/31/2023 Purchase Price Consideration $3.17 Offer Price $50,856 Implied Value of All Common Stock Outstanding $4,278 RSU Value $21 PSU Value $755 Options value $15 Non - Qualified Stock $55,924 Implied Total Equity Purchase Price $54,452 Less: Cash 5/31/2024 $105,938 Plus: Debt and Debt - Like Items 5/31/2024 $107,410 Implied Enterprise Value

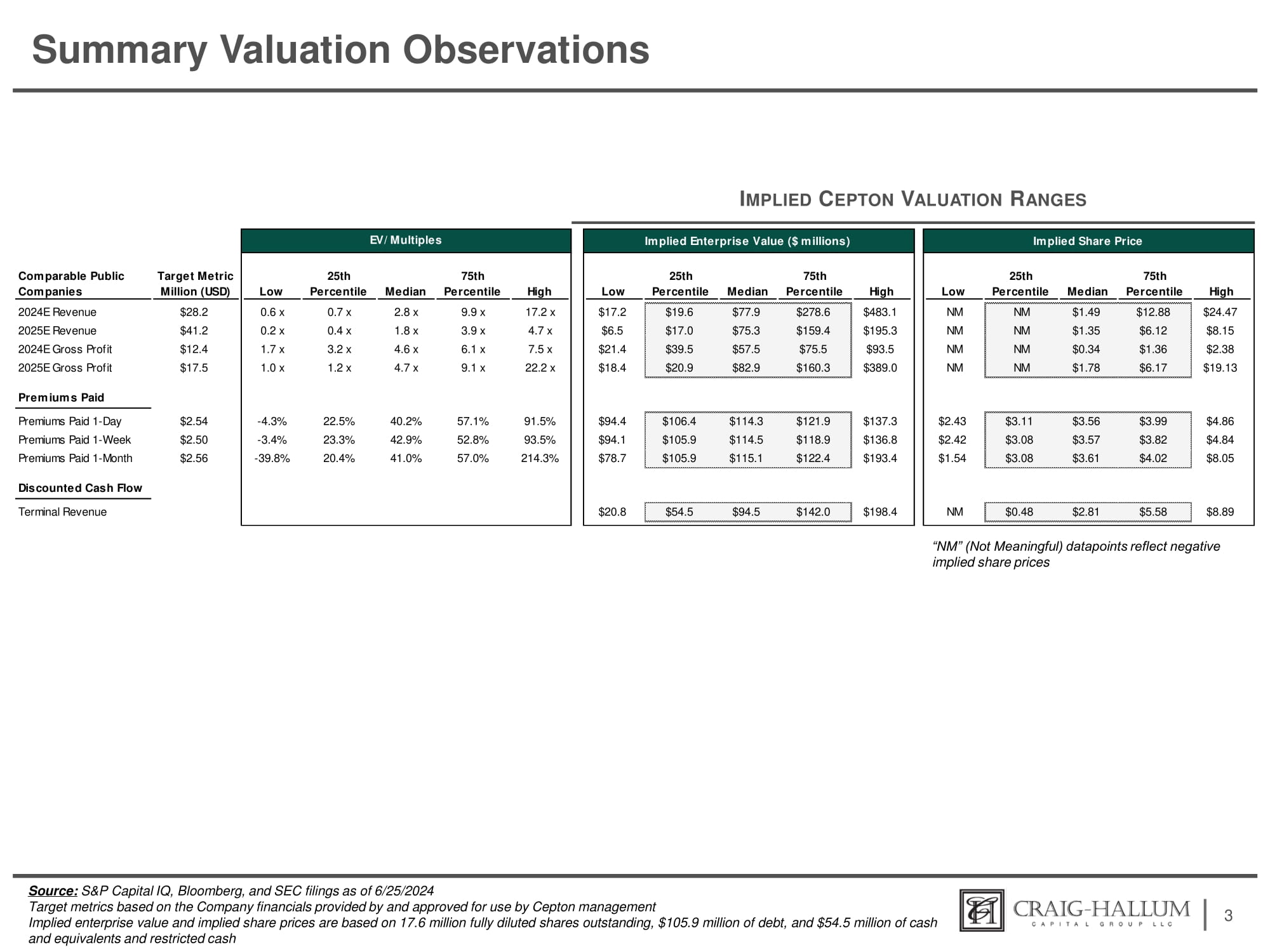

Summary Valuation Observations 3 I MPLIED C EPTON V ALUATION R ANGES Source: S&P Capital IQ, Bloomberg, and SEC filings as of 6/25/2024 Target metrics based on the Company financials provided by and approved for use by Cepton management Implied enterprise value and implied share prices are based on 17.6 million fully diluted shares outstanding, $105.9 million of debt, and $54.5 million of cash and equivalents and restricted cash “NM” (Not Meaningful) datapoints reflect negative implied share prices Comparable Public Companies Target Metric Million (USD) 25th 75th Low Percentile Median Percentile High 2024E Revenue 2025E Revenue 2024E Gross Profit 2025E Gross Profit $28.2 $41.2 $12.4 $17.5 0.6 x 0.2 x 1.7 x 1.0 x 0.7 x 0.4 x 3.2 x 1.2 x 2.8 x 1.8 x 4.6 x 4.7 x 9.9 x 3.9 x 6.1 x 9.1 x 17.2 x 4.7 x 7.5 x 22.2 x Premiums Paid Premiums Paid 1 - Day Premiums Paid 1 - Week Premiums Paid 1 - Month $2.54 $2.50 $2.56 - 4.3% 22.5% 40.2% 57.1% 91.5% - 3.4% 23.3% 42.9% 52.8% 93.5% - 39.8% 20.4% 41.0% 57.0% 214.3% Discounted Cash Flow Terminal Revenue Implied Enterprise Value ($ millions) 25th 75th Low Percentile Median Percentile High $483.1 $195.3 $93.5 $389.0 $19.6 $77.9 $278.6 $17.0 $75.3 $159.4 $39.5 $57.5 $75.5 $20.9 $82.9 $160.3 $17.2 $6.5 $21.4 $18.4 $94.4 $106.4 $114.3 $121.9 $137.3 $94.1 $105.9 $114.5 $118.9 $136.8 $78.7 $105.9 $115.1 $122.4 $193.4 $198.4 $54.5 $94.5 $142.0 $20.8 Implied Share Price High 75th Percentile Median 25th Percentile Low $24.47 $12.88 $1.49 NM NM $8.15 $6.12 $1.35 NM NM $2.38 $1.36 $0.34 NM NM $19.13 $6.17 $1.78 NM NM $4.86 $4.84 $8.05 $3.99 $3.82 $4.02 $3.56 $3.57 $3.61 $3.11 $3.08 $3.08 $2.43 $2.42 $1.54 $8.89 $5.58 $2.81 $0.48 NM EV/ Multiples

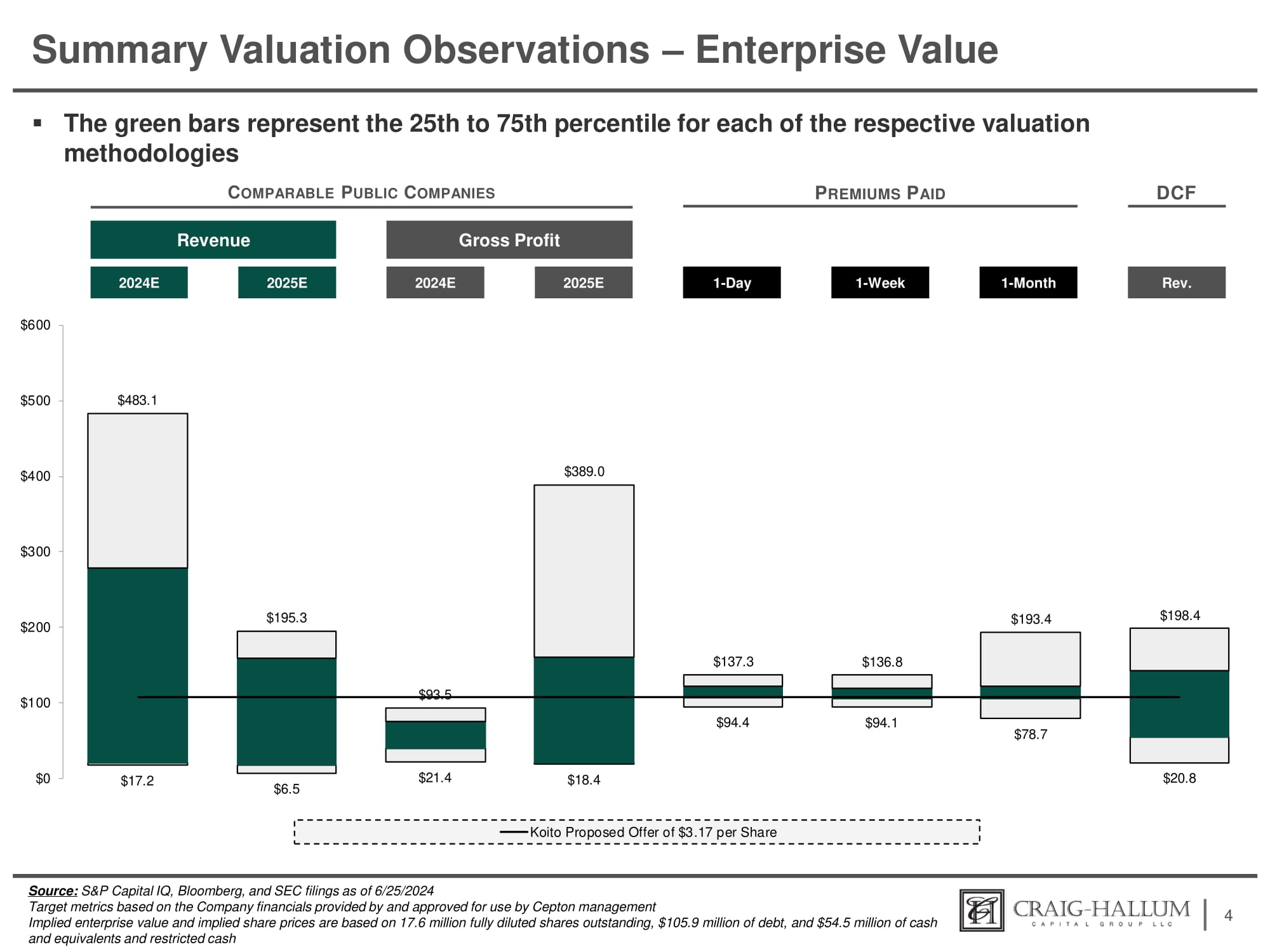

Summary Valuation Observations – Enterprise Value ▪ The green bars represent the 25th to 75th percentile for each of the respective valuation methodologies C OMPARABLE P UBLIC C OMPANIES P REMIUMS P AID 4 Revenue 2024E 2025E Gross Profit 2024E 2025E DCF Rev. 1 - Day 1 - Month 1 - Week Source: S&P Capital IQ, Bloomberg, and SEC filings as of 6/25/2024 Target metrics based on the Company financials provided by and approved for use by Cepton management Implied enterprise value and implied share prices are based on 17.6 million fully diluted shares outstanding, $105.9 million of debt, and $54.5 million of cash and equivalents and restricted cash $17.2 $6.5 $21.4 $18.4 $94.4 $94.1 $78.7 $20.8 $483.1 $195.3 $93.5 $389.0 $137.3 $136.8 $193.4 $198.4 $0 $100 $200 $300 $400 $500 $600 Koito Proposed Offer of $3.17 per Share

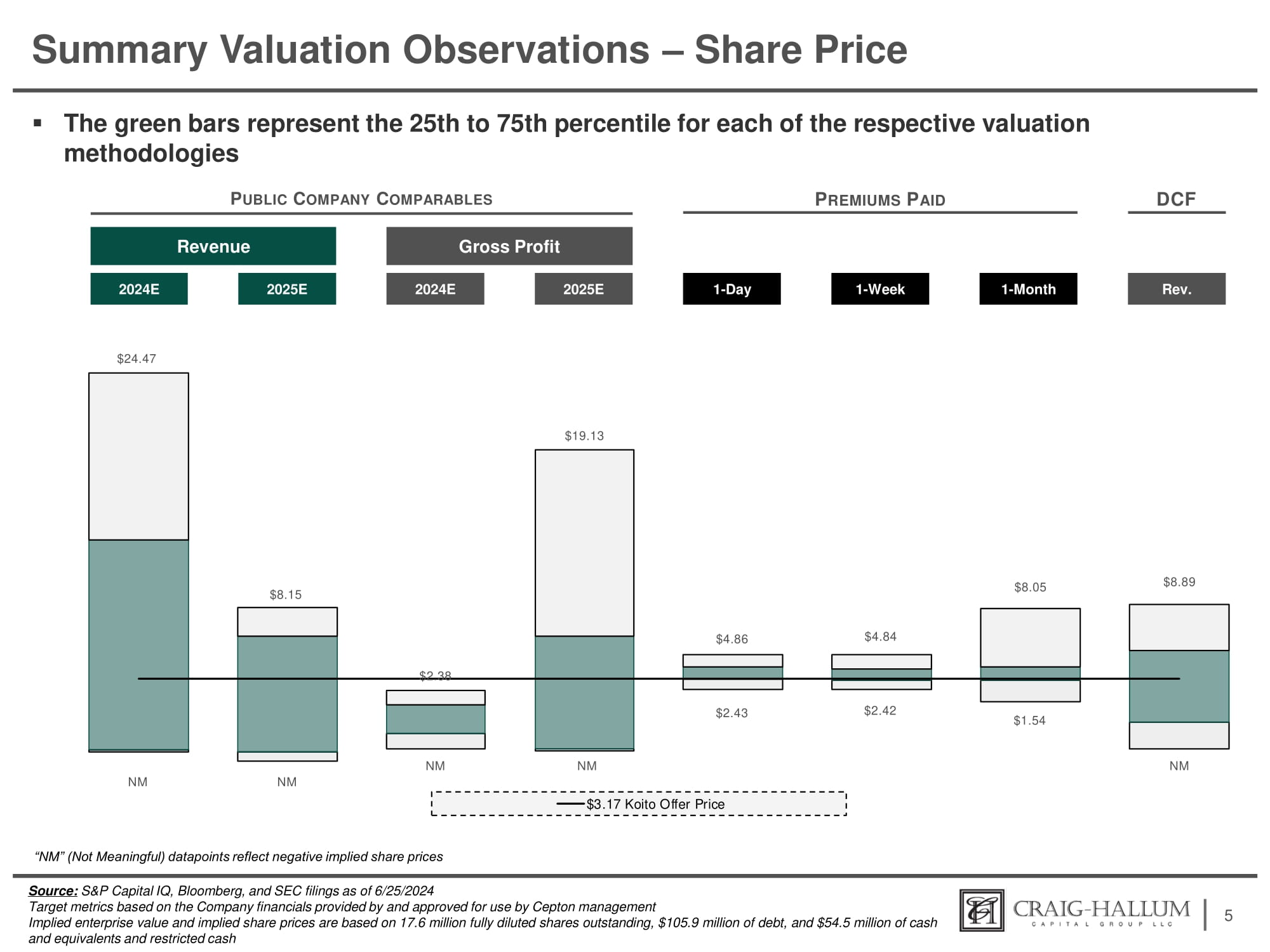

$3.17 Koito Offer Price Summary Valuation Observations – Share Price ▪ The green bars represent the 25th to 75th percentile for each of the respective valuation methodologies P UBLIC C OMPANY C OMPARABLES P REMIUMS P AID 5 Revenue 2024E 2025E Gross Profit 2024E 2025E DCF Rev. 1 - Day 1 - Month 1 - Week NM NM NM NM NM $2.43 $2.42 $1.54 $24.47 $8.15 $2.38 $19.13 $8.89 $4.86 $4.84 $8.05 Source: S&P Capital IQ, Bloomberg, and SEC filings as of 6/25/2024 Target metrics based on the Company financials provided by and approved for use by Cepton management Implied enterprise value and implied share prices are based on 17.6 million fully diluted shares outstanding, $105.9 million of debt, and $54.5 million of cash and equivalents and restricted cash “NM” (Not Meaningful) datapoints reflect negative implied share prices

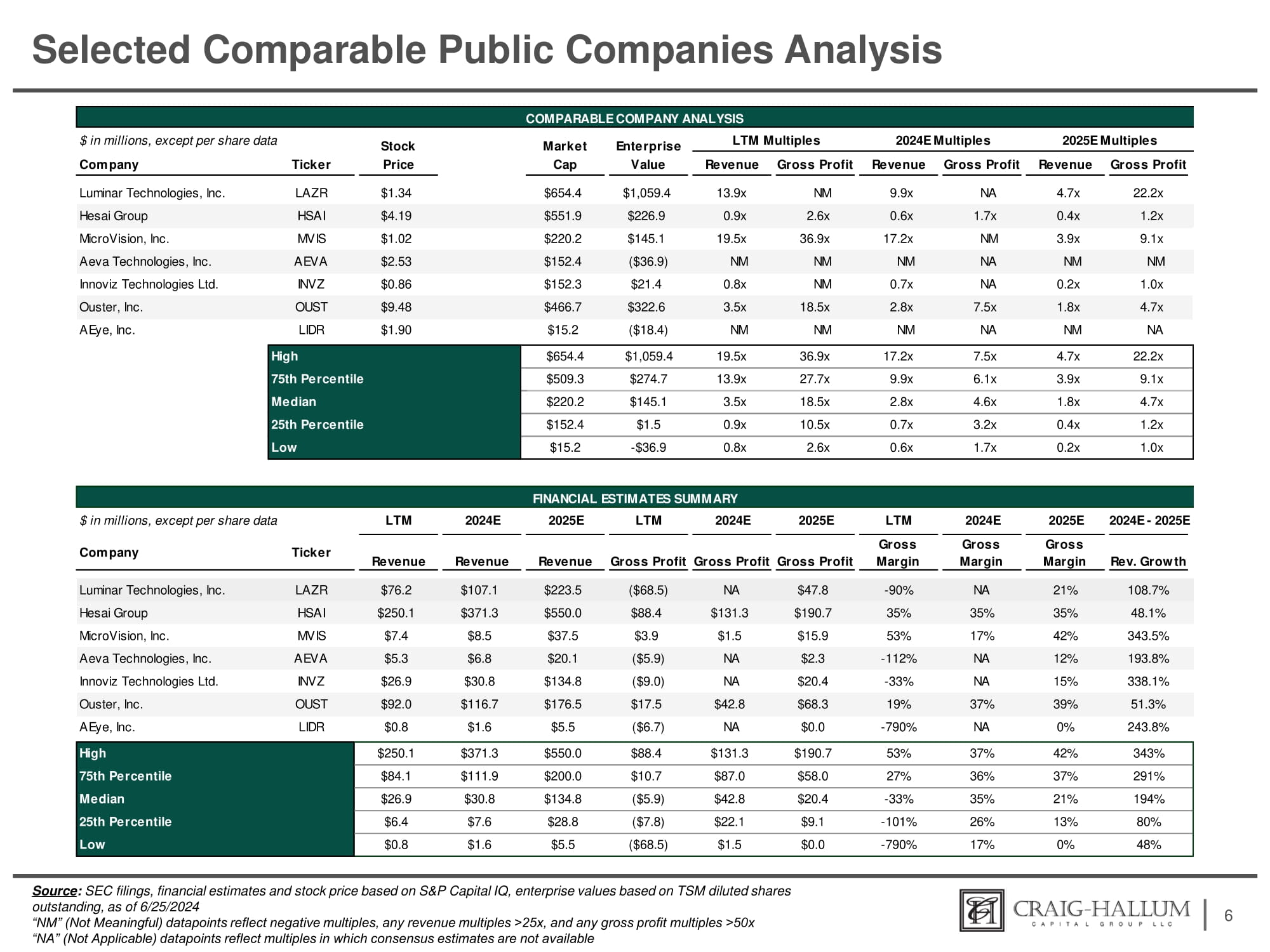

Selected Comparable Public Companies Analysis 6 Source : SEC filings, financial estimates and stock price based on S&P Capital IQ, enterprise values based on TSM diluted shares outstanding, as of 6/25/2024 “NM” (Not Meaningful) datapoints reflect negative multiples, any revenue multiples >25x, and any gross profit multiples >50x “NA” (Not Applicable) datapoints reflect multiples in which consensus estimates are not available Gross Profit Revenue Gross Profit Revenue Gross Profit Revenue Value Cap Price Ticker Company 22.2x 4.7x NA 9.9x NM 13.9x $1,059.4 $654.4 $1.34 LAZR Luminar Technologies, Inc. 1.2x 0.4x 1.7x 0.6x 2.6x 0.9x $226.9 $551.9 $4.19 HSAI Hesai Group 9.1x 3.9x NM 17.2x 36.9x 19.5x $145.1 $220.2 $1.02 MVIS MicroVision, Inc. NM NM NA NM NM NM ($36.9) $152.4 $2.53 AEVA Aeva Technologies, Inc. 1.0x 0.2x NA 0.7x NM 0.8x $21.4 $152.3 $0.86 INVZ Innoviz Technologies Ltd. 4.7x 1.8x 7.5x 2.8x 18.5x 3.5x $322.6 $466.7 $9.48 OUST Ouster, Inc. NA NM NA NM NM NM ($18.4) $15.2 $1.90 LIDR AEye, Inc. 22.2x 4.7x 7.5x 17.2x 36.9x 19.5x $1,059.4 $654.4 High 9.1x 3.9x 6.1x 9.9x 27.7x 13.9x $274.7 $509.3 75th Percentile 4.7x 1.8x 4.6x 2.8x 18.5x 3.5x $145.1 $220.2 Median 1.2x 0.4x 3.2x 0.7x 10.5x 0.9x $1.5 $152.4 25th Percentile 1.0x 0.2x 1.7x 0.6x 2.6x 0.8x - $36.9 $15.2 Low 108.7% 21% NA - 90% $47.8 NA ($68.5) $223.5 $107.1 $76.2 LAZR Luminar Technologies, Inc. 48.1% 35% 35% 35% $190.7 $131.3 $88.4 $550.0 $371.3 $250.1 HSAI Hesai Group 343.5% 42% 17% 53% $15.9 $1.5 $3.9 $37.5 $8.5 $7.4 MVIS MicroVision, Inc. 193.8% 12% NA - 112% $2.3 NA ($5.9) $20.1 $6.8 $5.3 AEVA Aeva Technologies, Inc. 338.1% 15% NA - 33% $20.4 NA ($9.0) $134.8 $30.8 $26.9 INVZ Innoviz Technologies Ltd. 51.3% 39% 37% 19% $68.3 $42.8 $17.5 $176.5 $116.7 $92.0 OUST Ouster, Inc. 243.8% 0% NA - 790% $0.0 NA ($6.7) $5.5 $1.6 $0.8 LIDR AEye, Inc. 343% 42% 37% 53% $190.7 $131.3 $88.4 $550.0 $371.3 $250.1 High 291% 37% 36% 27% $58.0 $87.0 $10.7 $200.0 $111.9 $84.1 75th Percentile 194% 21% 35% - 33% $20.4 $42.8 ($5.9) $134.8 $30.8 $26.9 Median 80% 13% 26% - 101% $9.1 $22.1 ($7.8) $28.8 $7.6 $6.4 25th Percentile 48% 0% 17% - 790% $0.0 $1.5 ($68.5) $5.5 $1.6 $0.8 Low COMPARABLE COMPANY ANALYSIS $ in millions, except per share data LTM Multiples 2024E Multiples 2025E Multiples FINANCIAL ESTIMATES SUMMARY 2024E - 2025E 2025E 2024E LTM 2025E 2024E LTM 2025E 2024E LTM $ in millions, except per share data Gross Gross Gross Company Ticker Revenue Revenue Revenue Gross Profit Gross Profit Gross Profit Margin Margin Margin Rev. Grow th Stock Market Enterprise

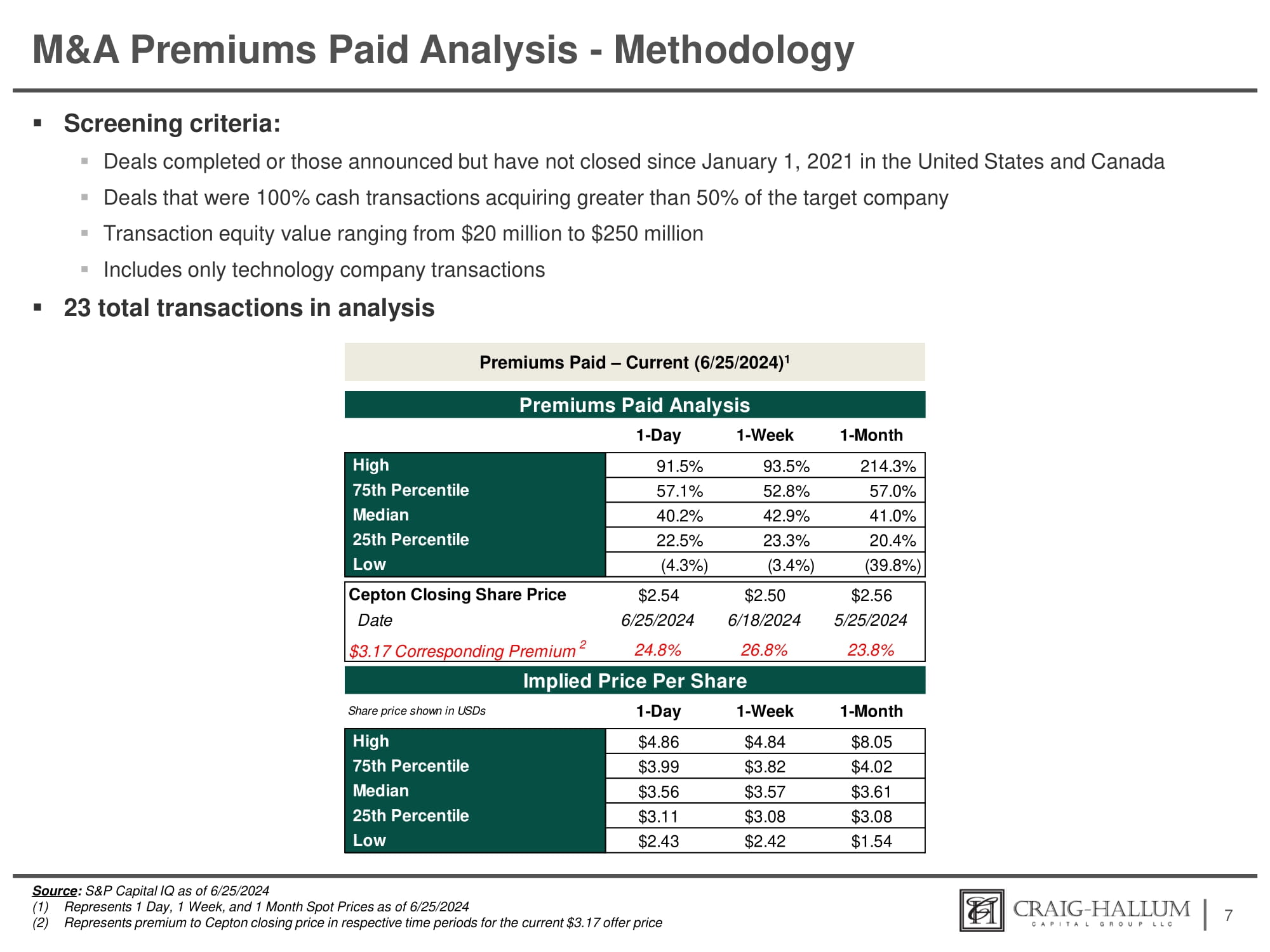

M&A Premiums Paid Analysis - Methodology ▪ Screening criteria: ▪ Deals completed or those announced but have not closed since January 1, 2021 in the United States and Canada ▪ Deals that were 100% cash transactions acquiring greater than 50% of the target company ▪ Transaction equity value ranging from $20 million to $250 million ▪ Includes only technology company transactions ▪ 23 total transactions in analysis 7 Source : S&P Capital IQ as of 6/25/2024 (1) Represents 1 Day, 1 Week, and 1 Month Spot Prices as of 6/25/2024 (2) Represents premium to Cepton closing price in respective time periods for the current $3.17 offer price Premiums Paid – Current (6/25/2024) 1 214.3% 93.5% 91.5% High 57.0% 52.8% 57.1% 75th Percentile 41.0% 42.9% 40.2% Median 20.4% 23.3% 22.5% 25th Percentile (39.8%) (3.4%) (4.3%) Low $2.56 5/25/2024 $2.50 6/18/2024 $2.54 6/25/2024 Cepton Closing Share Price Date 23.8% 26.8% 24.8% $3.17 Corresponding Premium 2 Implied Price Per Share $8.05 $4.84 $4.86 High $4.02 $3.82 $3.99 75th Percentile $3.61 $3.57 $3.56 Median $3.08 $3.08 $3.11 25th Percentile $1.54 $2.42 $2.43 Low Premiums Paid Analysis 1 - Day 1 - Week 1 - Month Share price shown in USDs 1 - Day 1 - Week 1 - Month

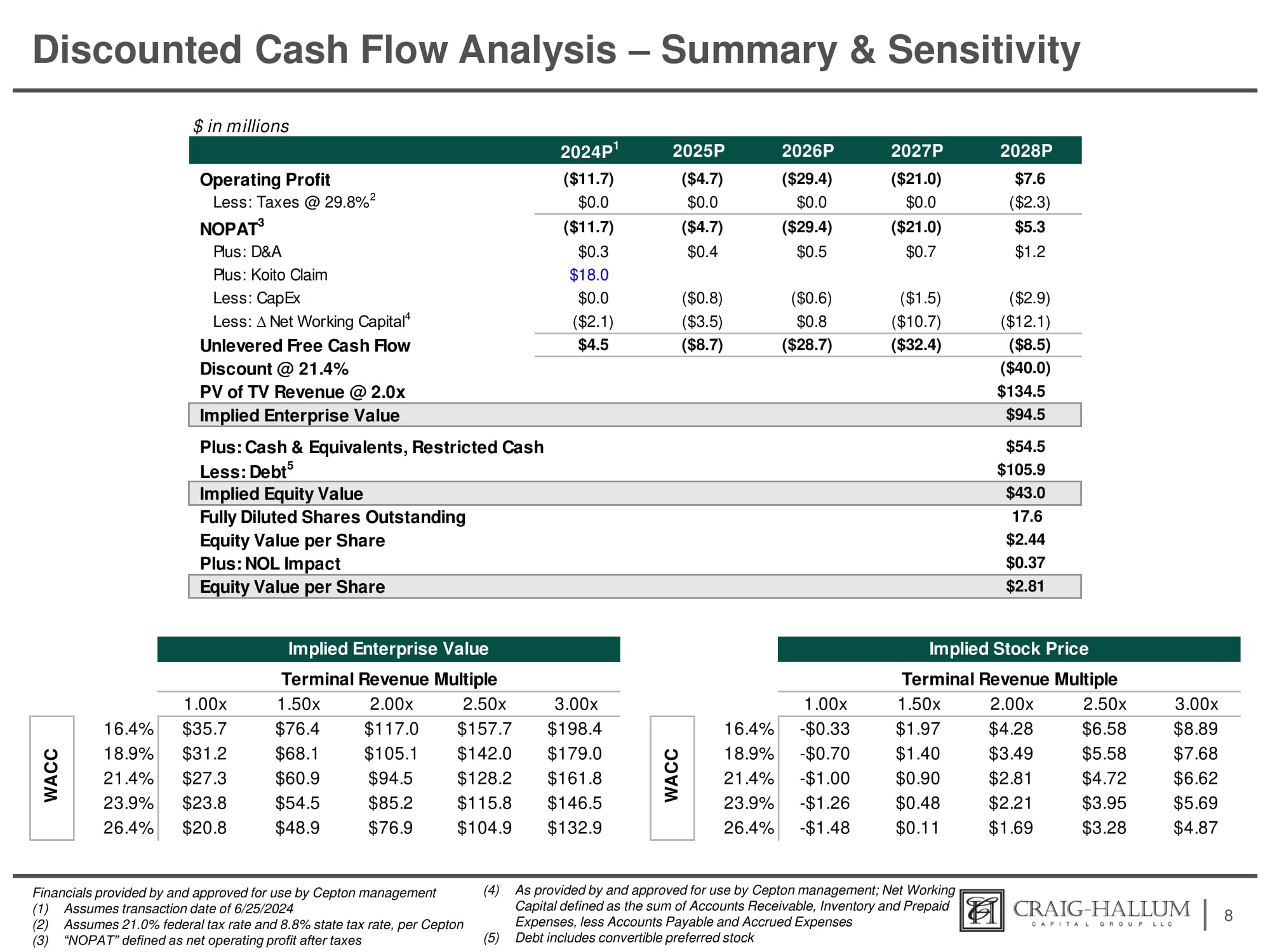

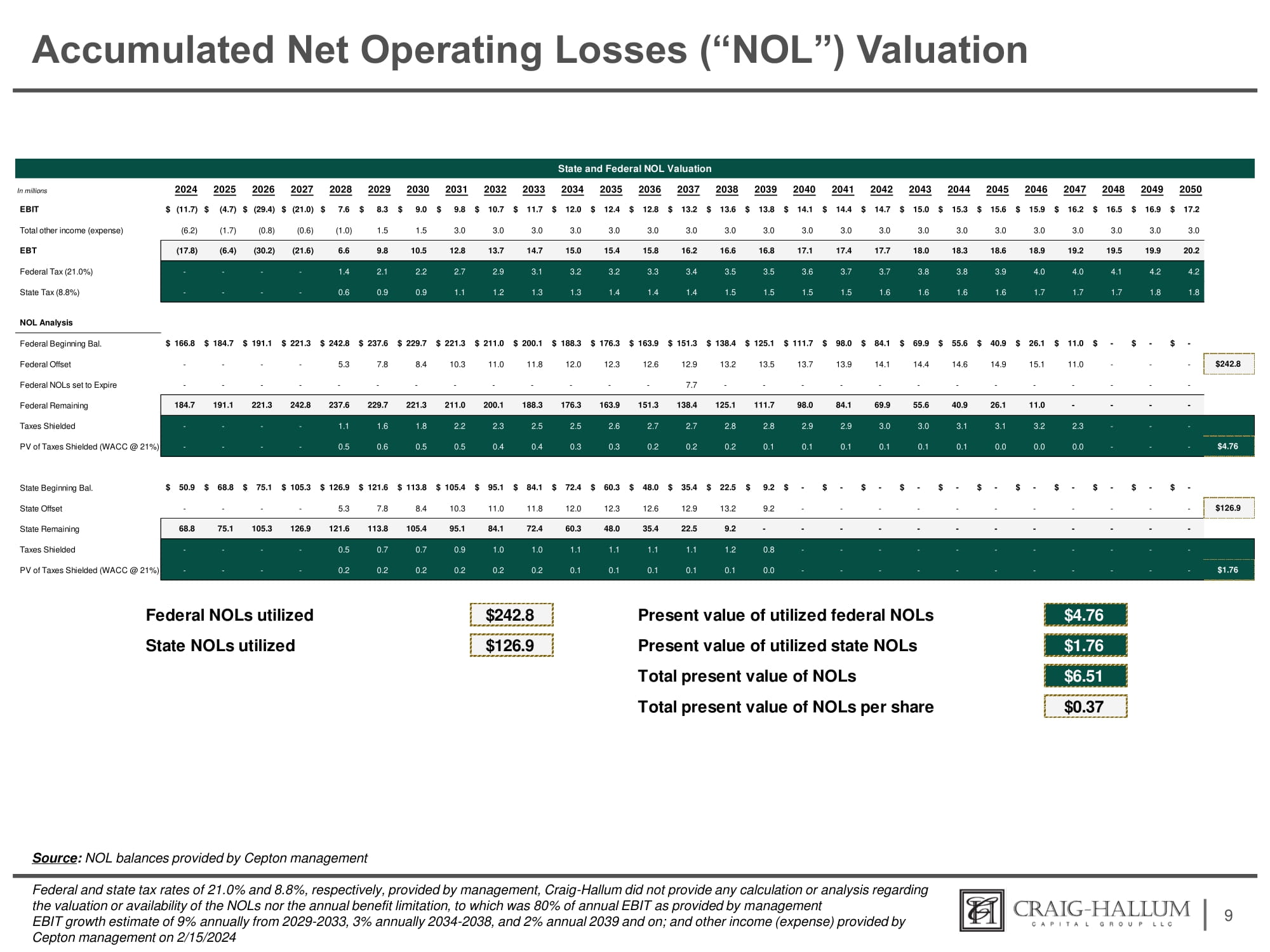

Discounted Cash Flow Analysis – Summary & Sensitivity 8 Financials provided by and approved for use by Cepton management (1) Assumes transaction date of 6/25/2024 (2) Assumes 21.0% federal tax rate and 8.8% state tax rate, per Cepton (3) “NOPAT” defined as net operating profit after taxes (4) As provided by and approved for use by Cepton management; Net Working Capital defined as the sum of Accounts Receivable, Inventory and Prepaid Expenses, less Accounts Payable and Accrued Expenses (5) Debt includes convertible preferred stock $ in millions 2028P 2027P 2026P 2025P 2024P 1 $7.6 ($21.0) ($29.4) ($4.7) ($11.7) Operating Profit ($2.3) $0.0 $0.0 $0.0 $0.0 Less: Taxes @ 29.8% 2 $5.3 ($21.0) ($29.4) ($4.7) ($11.7) NOPAT 3 $1.2 $0.7 $0.5 $0.4 $0.3 Plus: D&A $18.0 Plus: Koito Claim ($2.9) ($1.5) ($0.6) ($0.8) $0.0 Less: CapEx ($12.1) ($10.7) $0.8 ($3.5) ($2.1) Less: ∆ Net Working Capital 4 ($8.5) ($32.4) ($28.7) ($8.7) $4.5 Unlevered Free Cash Flow ($40.0) Discount @ 21.4% $134.5 PV of TV Revenue @ 2.0x $94.5 Implied Enterprise Value $54.5 Plus: Cash & Equivalents, Restricted Cash $105.9 Less: Debt 5 $43.0 Implied Equity Value 17.6 Fully Diluted Shares Outstanding $2.44 Equity Value per Share $0.37 Plus: NOL Impact $2.81 Equity Value per Share 3.00x 2.50x 2.00x 1.50x 1.00x 3.00x 2.50x 2.00x 1.50x 1.00x $8.89 $6.58 $4.28 $1.97 - $0.33 16.4% $198.4 $157.7 $117.0 $76.4 $35.7 16.4% $7.68 $5.58 $3.49 $1.40 - $0.70 18.9% C $179.0 $142.0 $105.1 $68.1 $31.2 18.9% $6.62 $4.72 $2.81 $0.90 - $1.00 21.4% A C $161.8 $128.2 $94.5 $60.9 $27.3 21.4% $5.69 $3.95 $2.21 $0.48 - $1.26 23.9% W $146.5 $115.8 $85.2 $54.5 $23.8 23.9% $4.87 $3.28 $1.69 $0.11 - $1.48 26.4% $132.9 $104.9 $76.9 $48.9 $20.8 26.4% Implied Enterprise Value Terminal Revenue Multiple WACC Implied Stock Price Terminal Revenue Multiple