Denny’s Corporation (the "Company") (NASDAQ: DENN), owner and

operator of Denny's Inc. ("Denny's") and Keke's Inc. ("Keke's")

today reported results for its second quarter ended June 26,

2024 and provided a business update on the Company’s operations.

Kelli Valade, Chief Executive Officer, stated, "I am very

pleased that for the second quarter in a row Denny's outperformed

BBI Family Dining same-restaurant sales, and Keke's continued to

close the gap in Florida all while navigating a very competitive

environment. We are also encouraged to see these trends continuing

into July, which is being bolstered by our incremental advertising

investments and the expansion of our third virtual brand.

Additionally, we opened our second Keke's cafe in Tennessee, as

well as completed our first remodel test at our highest volume

Keke's corporate location. Despite these results and staying ahead

of the competition, we know the overall industry is pressured and

therefore we have updated our guidance accordingly and remain

confident in our strategies and initiatives.”

Second Quarter

2024

Highlights(1)

- Total operating

revenue was $115.9 million compared to $116.9 million for the prior

year quarter.

- Denny's domestic

system-wide same-restaurant sales** were (0.6%) compared to the

equivalent fiscal period in 2023, including (0.4%) at domestic

franchised restaurants and (2.6%) at company restaurants.

- Opened four

restaurants, including one Keke's company location.

- Operating income was

$9.1 million compared to $14.9 million for the prior year

quarter.

- Adjusted franchise

operating margin* was $30.8 million, or 50.0% of franchise and

license revenue, and Adjusted company restaurant operating margin*

was $7.2 million, or 13.2% of company restaurant sales.

- Net income was $3.6

million, or $0.07 per diluted share.

- Adjusted net income*

and adjusted net income per share* were $6.9 million and $0.13,

respectively.

- Adjusted EBITDA* was

$20.3 million.

(1) Beginning fiscal 2024, the

Company has evolved its definition of non-GAAP measures. Please see

the definitions, explanations, and reconciliations further in this

release.

Second Quarter 2024

Results

Total operating revenue was $115.9 million compared to $116.9

million for the prior year quarter.

Franchise and license revenue was $61.6 million compared to

$62.0 million for the prior year quarter. This change was driven by

decreases in franchise occupancy revenue and franchise sales,

partially offset by an increase in franchise advertising revenue

primarily related to higher local advertising co-op contributions

for the current quarter.

Company restaurant sales were $54.3 million compared to $54.9

million for the prior year quarter primarily driven by a decrease

in same-restaurant sales, partially offset by three additional

Keke's equivalent units for the current quarter.

Adjusted franchise operating margin* was $30.8 million, or 50.0%

of franchise and license revenue, compared to $31.6 million, or

50.9% for the prior year quarter. This margin change was primarily

driven by the impact of lower sales on royalty and advertising

revenues and lease terminations.

Adjusted company restaurant operating margin* was $7.2 million,

or 13.2% of company restaurant sales, compared to $8.5 million, or

15.4% for the prior year quarter. This margin change was primarily

due to a decrease in same-restaurant sales and increases in

marketing and general liability insurance costs for the current

quarter.

Total general and administrative expenses were $20.5 million

compared to $20.2 million in the prior year quarter. This change

was primarily due to an increase in corporate administration

expense.

The provision for income taxes was $1.2 million, reflecting an

effective tax rate of 25.1% for the current quarter.

Net income was $3.6 million, or $0.07 per diluted share.

Adjusted net income* per share was $0.13.

The Company ended the quarter with $267.4 million of total debt

outstanding, including $257.5 million of borrowings under its

credit facility.

Capital Allocation

The Company invested $5.0 million in cash capital expenditures,

primarily related to Keke's development.

During the quarter, the Company allocated $4.7 million to share

repurchases resulting in approximately $91.0 million remaining

under its existing repurchase authorization.

Business Outlook

The following full year 2024 expectations reflect management's

expectations that the current consumer and economic environment

will not change materially.

- Denny's domestic

system-wide same-restaurant sales** between (1%) and 1% (vs.

between 0% and 3%).

- Consolidated

restaurant openings of 30 to 40 (vs. 40 to 50), including 12 to 16

new Keke's restaurants, with a consolidated net decline of 20 to 30

(vs. 10 to 20).

- Commodity inflation

between 0% and 2%.

- Labor inflation

between 3% and 4% (vs. between 4% and 5%).

- Total general and

administrative expenses between $82 million and $85 million (vs.

between $83 million and $86 million), including approximately $11

million (vs. $12 million) related to share-based compensation

expense which does not impact Adjusted EBITDA*.

- Adjusted EBITDA*

between $83 million and $87 million (vs. between $87 million and

$91 million).

* Please refer to the

Reconciliation of Net Income to Non-GAAP Financial Measures, as

well as the Reconciliation of Operating Income to Non-GAAP

Financial Measures included in the tables below. The Company is not

able to reconcile the forward-looking non-GAAP estimate set forth

above to its most directly comparable U.S. generally accepted

accounting principles (GAAP) estimates without unreasonable efforts

because it is unable to predict, forecast or determine the probable

significance of the items impacting these estimates, including

gains, losses and other charges, with a reasonable degree of

accuracy. Accordingly, the most directly comparable forward-looking

GAAP estimate is not provided.

** Same-restaurant sales include

sales at company restaurants and non-consolidated franchised and

licensed restaurants that were open during the comparable periods

noted. Total operating revenue is limited to company restaurant

sales and royalties, advertising revenue, initial and other fees

and occupancy revenue from non-consolidated franchised and licensed

restaurants. Accordingly, domestic franchise same-restaurant sales

and domestic system-wide same-restaurant sales should be considered

as a supplement to, not a substitute for, the Company's results as

reported under GAAP.

Conference Call and Webcast Information

The Company will provide further commentary on the results for

the second quarter ended June 26, 2024 on its quarterly

investor conference call today, Tuesday, July 30, 2024 at 4:30

p.m. Eastern Time. Interested parties are invited to listen to a

live broadcast of the conference call accessible through the

Company's investor relations website at investor.dennys.com.

About Denny's Corporation

Denny’s Corporation is one of America’s largest full-service

restaurant chains based on number of restaurants. As of

June 26, 2024, the Company consisted of 1,603 restaurants,

1,528 of which were franchised and licensed restaurants and 75 of

which were company operated.

Denny's Corporation consists of the Denny’s brand and the Keke’s

brand. As of June 26, 2024, the Denny's brand consisted of

1,541 global restaurants, 1,477 of which were franchised and

licensed restaurants and 64 of which were company operated. As of

June 26, 2024, the Keke's brand consisted of 62 restaurants,

51 of which were franchised restaurants and 11 of which were

company operated.

For further information on Denny's Corporation, including news

releases, links to SEC filings, and other financial information,

please visit investor.dennys.com.

Non-GAAP Definition Changes

The Company has evolved its definition of non-GAAP financial

measures starting in fiscal 2024 to provide more clarity and

comparability relative to peers. Denny's Corporation management

uses certain non-GAAP measures in analyzing operating performance

and believes that the presentation of these measures provides

investors and analysts with information that is beneficial to

gaining an understanding of the Company's financial results.

Non-GAAP disclosures should not be viewed as a substitute for

financial results determined in accordance with GAAP.

The Company will begin excluding legal settlement expenses,

pre-opening expenses, and other items management does not consider

in the evaluation of its ongoing core operating performance from

adjusted operating margin*, adjusted net income*, adjusted net

income per share*, and adjusted EBITDA*. In addition, the Company

will no longer deduct cash payments for restructuring and exit

costs, or cash payments for share-based compensation from adjusted

EBITDA*. Lastly, the Company will transition to utilizing GAAP cash

flows included in its SEC filed documents in lieu of a non-GAAP

financial measure.

Reconciliations of these non-GAAP measures are included in the

tables of this press release and a recast of historical non-GAAP

financial measures can be found on the Company's website, or its

most recent investor presentation.

Cautionary Language Regarding Forward-Looking

Statements

The Company urges caution in considering its current trends and

any outlook on earnings disclosed in this press release. In

addition, certain matters discussed in this release may constitute

forward-looking statements. These forward-looking statements, which

reflect management's best judgment based on factors currently

known, are intended to speak only as of the date such statements

are made and involve risks, uncertainties, and other factors that

may cause the actual performance of Denny’s Corporation, its

subsidiaries, and underlying restaurants to be materially different

from the performance indicated or implied by such statements. Words

such as “expect”, “anticipate”, “believe”, “intend”, “plan”,

“hope”, "will", and variations of such words and similar

expressions are intended to identify such forward-looking

statements. Except as may be required by law, the Company expressly

disclaims any obligation to update these forward-looking statements

to reflect events or circumstances after the date of this release

or to reflect the occurrence of unanticipated events. Factors that

could cause actual performance to differ materially from the

performance indicated by these forward-looking statements include,

among others: economic, public health and political conditions that

impact consumer confidence and spending, commodity and labor

inflation; the ability to effectively staff restaurants and support

personnel; the Company's ability to maintain adequate levels of

liquidity for its cash needs, including debt obligations, payment

of dividends, planned share repurchases and capital expenditures as

well as the ability of its customers, suppliers, franchisees and

lenders to access sources of liquidity to provide for their own

cash needs; competitive pressures from within the restaurant

industry; the Company's ability to integrate and derive the

expected benefits from its acquisition of Keke's Breakfast Cafe;

the level of success of the Company’s operating initiatives and

advertising and promotional efforts; adverse publicity; health

concerns arising from food-related pandemics, outbreaks of flu

viruses or other diseases; changes in business strategy or

development plans; terms and availability of capital; regional

weather conditions; overall changes in the general economy

(including with regard to energy costs), particularly at the retail

level; political environment and geopolitical events (including

acts of war and terrorism); and other factors from time to time set

forth in the Company’s SEC reports and other filings, including but

not limited to the discussion in Management’s Discussion and

Analysis and the risks identified in Item 1A. Risk Factors

contained in the Company’s Annual Report on Form 10-K for the year

ended December 27, 2023 (and in the Company’s subsequent Quarterly

Reports on Form 10-Q and Current Reports on Form 8-K).

|

DENNY’S CORPORATION |

|

Consolidated Balance Sheets |

|

(Unaudited) |

| |

|

|

|

| ($ in thousands) |

6/26/24 |

|

12/27/23 |

| Assets |

|

|

|

|

Current assets |

|

|

|

|

Cash and cash equivalents |

$ |

1,166 |

|

|

$ |

4,893 |

|

|

Investments |

|

2,796 |

|

|

|

1,281 |

|

|

Receivables, net |

|

19,784 |

|

|

|

21,391 |

|

|

Inventories |

|

1,895 |

|

|

|

2,175 |

|

|

Assets held for sale |

|

350 |

|

|

|

1,455 |

|

|

Prepaid and other current assets |

|

9,215 |

|

|

|

12,855 |

|

|

Total current assets |

|

35,206 |

|

|

|

44,050 |

|

|

Property, net |

|

96,957 |

|

|

|

93,494 |

|

|

Finance lease right-of-use assets, net |

|

5,499 |

|

|

|

6,098 |

|

|

Operating lease right-of-use assets, net |

|

110,554 |

|

|

|

116,795 |

|

|

Goodwill |

|

66,357 |

|

|

|

65,908 |

|

|

Intangible assets, net |

|

92,563 |

|

|

|

93,428 |

|

|

Deferred financing costs, net |

|

1,384 |

|

|

|

1,702 |

|

|

Other noncurrent assets |

|

51,418 |

|

|

|

43,343 |

|

|

Total assets |

$ |

459,938 |

|

|

$ |

464,818 |

|

| |

|

|

|

|

Liabilities |

|

|

|

|

Current liabilities |

|

|

|

|

Current finance lease liabilities |

$ |

1,372 |

|

|

$ |

1,383 |

|

|

Current operating lease liabilities |

|

14,931 |

|

|

|

14,779 |

|

|

Accounts payable |

|

17,224 |

|

|

|

24,070 |

|

|

Other current liabilities |

|

62,600 |

|

|

|

63,068 |

|

|

Total current liabilities |

|

96,127 |

|

|

|

103,300 |

|

|

Long-term liabilities |

|

|

|

|

Long-term debt |

|

257,500 |

|

|

|

255,500 |

|

|

Noncurrent finance lease liabilities |

|

8,552 |

|

|

|

9,150 |

|

|

Noncurrent operating lease liabilities |

|

107,168 |

|

|

|

114,451 |

|

|

Liability for insurance claims, less current portion |

|

7,069 |

|

|

|

6,929 |

|

|

Deferred income taxes, net |

|

7,029 |

|

|

|

6,582 |

|

|

Other noncurrent liabilities |

|

29,736 |

|

|

|

31,592 |

|

|

Total long-term liabilities |

|

417,054 |

|

|

|

424,204 |

|

|

Total liabilities |

|

513,181 |

|

|

|

527,504 |

|

| |

|

|

|

| Shareholders'

deficit |

|

|

|

|

Common stock |

|

533 |

|

|

|

529 |

|

|

Paid-in capital |

|

10,135 |

|

|

|

6,688 |

|

|

Deficit |

|

(13,525 |

) |

|

|

(21,784 |

) |

|

Accumulated other comprehensive loss, net |

|

(34,461 |

) |

|

|

(41,659 |

) |

|

Treasury stock |

|

(15,925 |

) |

|

|

(6,460 |

) |

|

Total shareholders' deficit |

|

(53,243 |

) |

|

|

(62,686 |

) |

|

Total liabilities and shareholders' deficit |

$ |

459,938 |

|

|

$ |

464,818 |

|

| |

|

|

|

| Debt

Balances |

|

Credit facility revolver due 2026 |

$ |

257,500 |

|

|

$ |

255,500 |

|

|

Finance lease liabilities |

|

9,924 |

|

|

|

10,533 |

|

|

Total debt |

$ |

267,424 |

|

|

$ |

266,033 |

|

| |

|

|

|

|

|

|

|

|

DENNY’S CORPORATION |

|

Condensed Consolidated Statements of Income |

|

(Unaudited) |

| |

|

|

|

| |

Quarter Ended |

| ($ in

thousands, except per share amounts) |

6/26/24 |

|

6/28/23 |

|

Revenue: |

|

|

|

|

Company restaurant sales |

$ |

54,348 |

|

|

$ |

54,881 |

|

|

Franchise and license revenue |

|

61,579 |

|

|

|

62,034 |

|

|

Total operating revenue |

|

115,927 |

|

|

|

116,915 |

|

| Costs

of company restaurant sales, excluding depreciation and

amortization |

|

47,578 |

|

|

|

46,568 |

|

| Costs

of franchise and license revenue, excluding depreciation and

amortization |

|

33,428 |

|

|

|

30,460 |

|

|

General and administrative expenses |

|

20,486 |

|

|

|

20,160 |

|

|

Depreciation and amortization |

|

3,735 |

|

|

|

3,617 |

|

|

Goodwill impairment charges |

|

20 |

|

|

|

— |

|

|

Operating (gains), losses and other charges, net |

|

1,565 |

|

|

|

1,176 |

|

|

Total operating costs and expenses, net |

|

106,812 |

|

|

|

101,981 |

|

|

Operating income |

|

9,115 |

|

|

|

14,934 |

|

|

Interest expense, net |

|

4,573 |

|

|

|

4,402 |

|

| Other

nonoperating income, net |

|

(224 |

) |

|

|

(666 |

) |

|

Income before income taxes |

|

4,766 |

|

|

|

11,198 |

|

|

Provision for income taxes |

|

1,198 |

|

|

|

2,660 |

|

| Net

income |

$ |

3,568 |

|

|

$ |

8,538 |

|

| |

|

|

|

| Net

income per share - basic |

$ |

0.07 |

|

|

$ |

0.15 |

|

| Net

income per share - diluted |

$ |

0.07 |

|

|

$ |

0.15 |

|

| |

|

|

|

| Basic

weighted average shares outstanding |

|

52,689 |

|

|

|

56,787 |

|

|

Diluted weighted average shares outstanding |

|

52,787 |

|

|

|

57,051 |

|

| |

|

|

|

|

Comprehensive income |

$ |

4,602 |

|

|

$ |

10,557 |

|

| |

|

|

|

|

General and Administrative Expenses |

|

|

Corporate administrative expenses |

$ |

15,776 |

|

|

$ |

15,160 |

|

|

Share-based compensation |

|

2,624 |

|

|

|

2,519 |

|

|

Incentive compensation |

|

1,898 |

|

|

|

1,899 |

|

|

Deferred compensation valuation adjustments |

|

188 |

|

|

|

582 |

|

|

Total general and administrative expenses |

$ |

20,486 |

|

|

$ |

20,160 |

|

|

|

|

|

|

|

|

|

|

|

DENNY’S CORPORATION |

|

Condensed Consolidated Statements of Income |

|

(Unaudited) |

| |

|

|

|

| |

Two Quarters Ended |

| ($ in

thousands, except per share amounts) |

6/26/24 |

|

6/28/23 |

|

Revenue: |

|

|

|

|

Company restaurant sales |

$ |

106,690 |

|

|

$ |

108,333 |

|

|

Franchise and license revenue |

|

119,211 |

|

|

|

126,053 |

|

|

Total operating revenue |

|

225,901 |

|

|

|

234,386 |

|

| Costs

of company restaurant sales, excluding depreciation and

amortization |

|

95,696 |

|

|

|

93,060 |

|

| Costs

of franchise and license revenue, excluding depreciation and

amortization |

|

60,802 |

|

|

|

62,847 |

|

|

General and administrative expenses |

|

41,708 |

|

|

|

40,278 |

|

|

Depreciation and amortization |

|

7,316 |

|

|

|

7,273 |

|

|

Goodwill impairment charges |

|

20 |

|

|

|

— |

|

|

Operating (gains), losses and other charges, net |

|

1,238 |

|

|

|

(153 |

) |

|

Total operating costs and expenses, net |

|

206,780 |

|

|

|

203,305 |

|

|

Operating income |

|

19,121 |

|

|

|

31,081 |

|

|

Interest expense, net |

|

8,993 |

|

|

|

8,907 |

|

| Other

nonoperating (income) expense, net |

|

(861 |

) |

|

|

9,427 |

|

|

Income before income taxes |

|

10,989 |

|

|

|

12,747 |

|

|

Provision for income taxes |

|

2,730 |

|

|

|

3,612 |

|

| Net

income |

$ |

8,259 |

|

|

$ |

9,135 |

|

| |

|

|

|

| Net

income per share - basic |

$ |

0.16 |

|

|

$ |

0.16 |

|

| Net

income per share - diluted |

$ |

0.16 |

|

|

$ |

0.16 |

|

| |

|

|

|

| Basic

weighted average shares outstanding |

|

52,879 |

|

|

|

57,212 |

|

|

Diluted weighted average shares outstanding |

|

53,002 |

|

|

|

57,423 |

|

| |

|

|

|

|

Comprehensive income |

$ |

15,457 |

|

|

$ |

11,511 |

|

| |

|

|

|

|

General and Administrative Expenses |

|

|

Corporate administrative expenses |

$ |

30,968 |

|

|

$ |

29,339 |

|

|

Share-based compensation |

|

5,400 |

|

|

|

5,613 |

|

|

Incentive compensation |

|

4,421 |

|

|

|

4,286 |

|

|

Deferred compensation valuation adjustments |

|

919 |

|

|

|

1,040 |

|

|

Total general and administrative expenses |

$ |

41,708 |

|

|

$ |

40,278 |

|

|

|

|

|

|

|

|

|

|

|

DENNY’S CORPORATION |

|

Reconciliation of Net Income to Non-GAAP Financial

Measures |

|

(Unaudited) |

|

|

The Company believes that, in addition to GAAP measures, certain

non-GAAP financial measures are useful information to investors and

analysts to assist in the evaluation of operating performance on a

period-to-period basis. However, non-GAAP measures should be

considered as a supplement to, not a substitute for, operating

income, net income, and net income per share, or other financial

performance measures prepared in accordance with GAAP. The Company

uses adjusted EBITDA, adjusted net income and adjusted net income

per share internally as performance measures for planning purposes,

including the preparation of annual operating budgets, and for

compensation purposes, including incentive compensation for certain

employees. These non-GAAP measures are adjusted for certain items

the Company does not consider in the evaluation of its ongoing core

operating performance. These adjustments are either non-recurring

in nature or vary from period to period without correlation to the

Company's ongoing core operating performance.

| |

Quarter Ended |

|

Two Quarters Ended |

| ($ in

thousands, except per share amounts) |

6/26/24 |

|

6/28/23 |

|

6/26/24 |

|

6/28/23 |

|

Net income |

$ |

3,568 |

|

|

$ |

8,538 |

|

|

$ |

8,259 |

|

|

$ |

9,135 |

|

|

Provision for income taxes |

|

1,198 |

|

|

|

2,660 |

|

|

|

2,730 |

|

|

|

3,612 |

|

|

Goodwill impairment charges |

|

20 |

|

|

|

— |

|

|

|

20 |

|

|

|

— |

|

|

Operating (gains), losses and other charges, net |

|

1,565 |

|

|

|

1,176 |

|

|

|

1,238 |

|

|

|

(153 |

) |

| Other

nonoperating (income) expense, net |

|

(224 |

) |

|

|

(666 |

) |

|

|

(861 |

) |

|

|

9,427 |

|

|

Share-based compensation expense |

|

2,624 |

|

|

|

2,519 |

|

|

|

5,400 |

|

|

|

5,613 |

|

|

Deferred compensation plan valuation adjustments |

|

188 |

|

|

|

582 |

|

|

|

919 |

|

|

|

1,040 |

|

|

Interest expense, net |

|

4,573 |

|

|

|

4,402 |

|

|

|

8,993 |

|

|

|

8,907 |

|

|

Depreciation and amortization |

|

3,735 |

|

|

|

3,617 |

|

|

|

7,316 |

|

|

|

7,273 |

|

| Legal

settlement expenses |

|

208 |

|

|

|

121 |

|

|

|

1,657 |

|

|

|

230 |

|

|

Pre-opening expenses |

|

191 |

|

|

|

25 |

|

|

|

557 |

|

|

|

25 |

|

| Other

adjustments |

|

2,640 |

|

|

|

11 |

|

|

|

2,492 |

|

|

|

3 |

|

|

Adjusted EBITDA |

$ |

20,286 |

|

|

$ |

22,985 |

|

|

$ |

38,720 |

|

|

$ |

45,112 |

|

| |

|

|

|

|

|

|

|

| Net

income |

$ |

3,568 |

|

|

$ |

8,538 |

|

|

$ |

8,259 |

|

|

$ |

9,135 |

|

|

Losses and amortization on interest rate swap derivatives, net |

|

167 |

|

|

|

82 |

|

|

|

308 |

|

|

|

10,744 |

|

|

Losses (gains) on sales of assets and other charges, net |

|

526 |

|

|

|

(522 |

) |

|

|

(94 |

) |

|

|

(2,044 |

) |

|

Impairment charges (1) |

|

639 |

|

|

|

— |

|

|

|

734 |

|

|

|

129 |

|

| Legal

settlement expenses |

|

208 |

|

|

|

121 |

|

|

|

1,657 |

|

|

|

230 |

|

|

Pre-opening expenses |

|

191 |

|

|

|

25 |

|

|

|

557 |

|

|

|

25 |

|

| Other

adjustments |

|

2,640 |

|

|

|

11 |

|

|

|

2,492 |

|

|

|

3 |

|

| Tax

effect (2) |

|

(1,086 |

) |

|

|

92 |

|

|

|

(1,402 |

) |

|

|

(2,344 |

) |

|

Adjusted net income |

$ |

6,853 |

|

|

$ |

8,347 |

|

|

$ |

12,511 |

|

|

$ |

15,878 |

|

| |

|

|

|

|

|

|

|

|

Diluted weighted average shares outstanding |

|

52,787 |

|

|

|

57,051 |

|

|

|

53,002 |

|

|

|

57,423 |

|

| |

|

|

|

|

|

|

|

| Net

income per share - diluted |

$ |

0.07 |

|

|

$ |

0.15 |

|

|

$ |

0.16 |

|

|

$ |

0.16 |

|

|

Adjustments per share |

|

0.06 |

|

|

|

— |

|

|

|

0.08 |

|

|

|

0.12 |

|

|

Adjusted net income per share |

$ |

0.13 |

|

|

$ |

0.15 |

|

|

$ |

0.24 |

|

|

$ |

0.28 |

|

|

(1) |

|

Impairment charges include goodwill impairment charges of less than

$0.1 million for the quarter and year-to-date period ended June 26,

2024. |

|

(2) |

|

Tax adjustments for the quarter and year-to-date period ended June

26, 2024 reflect effective tax rates of 24.8%. Tax adjustments for

the quarter and year-to-date period ended June 28, 2023 reflect

effective tax rates of 32.5% and 25.8%, respectively. |

|

|

|

|

|

DENNY’S CORPORATION |

|

Reconciliation of Operating Income to Non-GAAP Financial

Measures |

|

(Unaudited) |

|

|

The Company believes that, in addition to GAAP measures, certain

other non-GAAP financial measures are useful information to

investors and analysts to assist in the evaluation of

restaurant-level operating efficiency and performance of ongoing

restaurant-level operations. However, non-GAAP measures should be

considered as a supplement to, not a substitute for, operating

income, net income, and net income per share, or other financial

performance measures prepared in accordance with GAAP. The Company

uses restaurant-level operating margin, company restaurant

operating margin and franchise operating margin internally as

performance measures for planning purposes, including the

preparation of annual operating budgets, and for compensation

purposes, including incentive compensation for certain

employees.

Restaurant-level operating margin is the total of company

restaurant operating margin and franchise operating margin and

excludes: (i) general and administrative expenses, which include

primarily non-restaurant-level costs associated with support of

company and franchised restaurants and other activities at their

corporate office; (ii) depreciation and amortization expense,

substantially all of which is related to company restaurant-level

assets, because such expenses represent historical sunk costs which

do not reflect current cash outlays for the restaurants; (iii)

special items, included within operating (gains), losses and other

charges, net, to provide investors with a clearer perspective of

its ongoing operating performance and a more relevant comparison to

prior period results.

Company restaurant operating margin is defined as company

restaurant sales less costs of company restaurant sales (which

include product costs, company restaurant level payroll and

benefits, occupancy costs, and other operating costs including

utilities, repairs and maintenance, marketing and other expenses)

and presents it as a percent of company restaurant sales. Adjusted

company operating restaurant margin is defined as company

restaurant operating margin less certain items such as legal

settlement expenses, pre-opening expenses, and other items the

Company does not consider in the evaluation of its ongoing core

operating performance.

Franchise operating margin is defined as franchise and license

revenue (which includes franchise royalties and other non-food and

beverage revenue streams such as initial franchise and other fees,

advertising revenue and occupancy revenue) less costs of franchise

and license revenue and presents it as a percent of franchise and

license revenue. Adjusted franchise operating margin is defined as

franchise operating margin less certain items the Company does not

consider in the evaluation of its ongoing core operating

performance.

Adjusted restaurant-level operating margin is the total of

adjusted company restaurant operating margin and adjusted franchise

operating margin and is defined as restaurant-level operating

margin adjusted for certain items the Company does not consider in

the evaluation of its ongoing core operating performance. These

adjustments are either non-recurring in nature or vary from period

to period without correlation to the Company's ongoing core

operating performance.

| |

Quarter Ended |

|

Two Quarters Ended |

| ($ in

thousands) |

6/26/24 |

|

6/28/23 |

|

6/26/24 |

|

6/28/23 |

|

Operating income |

$ |

9,115 |

|

|

$ |

14,934 |

|

|

$ |

19,121 |

|

|

$ |

31,081 |

|

|

General and administrative expenses |

|

20,486 |

|

|

|

20,160 |

|

|

|

41,708 |

|

|

|

40,278 |

|

|

Depreciation and amortization |

|

3,735 |

|

|

|

3,617 |

|

|

|

7,316 |

|

|

|

7,273 |

|

|

Goodwill impairment charges |

|

20 |

|

|

|

— |

|

|

|

20 |

|

|

|

— |

|

|

Operating (gains), losses and other charges, net |

|

1,565 |

|

|

|

1,176 |

|

|

|

1,238 |

|

|

|

(153 |

) |

|

Restaurant-level operating margin |

$ |

34,921 |

|

|

$ |

39,887 |

|

|

$ |

69,403 |

|

|

$ |

78,479 |

|

| |

|

|

|

|

|

|

|

|

Restaurant-level operating margin consists of: |

|

|

|

|

|

|

|

|

Company restaurant operating margin (1) |

$ |

6,770 |

|

|

$ |

8,313 |

|

|

$ |

10,994 |

|

|

$ |

15,273 |

|

|

Franchise operating margin (2) |

|

28,151 |

|

|

|

31,574 |

|

|

|

58,409 |

|

|

|

63,206 |

|

|

Restaurant-level operating margin |

$ |

34,921 |

|

|

$ |

39,887 |

|

|

$ |

69,403 |

|

|

$ |

78,479 |

|

|

Adjustments (3) |

|

3,039 |

|

|

|

157 |

|

|

|

4,706 |

|

|

|

258 |

|

|

Adjusted restaurant-level operating margin |

$ |

37,960 |

|

|

$ |

40,044 |

|

|

$ |

74,109 |

|

|

$ |

78,737 |

|

|

(1) |

|

Company restaurant operating margin is calculated as operating

income plus general and administrative expenses; depreciation and

amortization; operating (gains), losses and other charges, net; and

costs of franchise and license revenue, excluding depreciation and

amortization; less franchise and license revenue. |

|

(2) |

|

Franchise operating margin is calculated as operating income plus

general and administrative expenses; depreciation and amortization;

operating (gains), losses and other charges, net; and costs of

company restaurant sales, excluding depreciation and amortization;

less company restaurant sales. |

|

(3) |

|

Adjustments include legal settlement expenses, pre-opening costs,

and other adjustments the Company does not consider in the

evaluation of its ongoing core operating performance. Adjustments

for the quarter and year-to-date period ended June 26, 2024 include

a $2.6 million distribution to franchisees related to a review of

advertising costs. |

|

|

|

|

|

DENNY’S CORPORATION |

|

Operating Margins |

|

(Unaudited) |

| |

|

|

|

| |

Quarter Ended |

| ($ in

thousands) |

6/26/24 |

|

6/28/23 |

|

Company restaurant operations: (1) |

|

|

|

|

|

|

Company restaurant sales |

$ |

54,348 |

|

|

100.0 |

% |

|

$ |

54,881 |

|

|

100.0 |

% |

|

Costs of company restaurant sales, excluding depreciation and

amortization: |

|

|

|

|

|

|

Product costs |

|

13,632 |

|

|

25.1 |

% |

|

|

14,170 |

|

|

25.8 |

% |

|

Payroll and benefits |

|

20,493 |

|

|

37.7 |

% |

|

|

20,488 |

|

|

37.3 |

% |

|

Occupancy |

|

4,671 |

|

|

8.6 |

% |

|

|

4,080 |

|

|

7.4 |

% |

|

Other operating costs: |

|

|

|

|

|

|

Utilities |

|

1,695 |

|

|

3.1 |

% |

|

|

1,860 |

|

|

3.4 |

% |

|

Repairs and maintenance |

|

1,008 |

|

|

1.9 |

% |

|

|

782 |

|

|

1.4 |

% |

|

Marketing |

|

1,876 |

|

|

3.5 |

% |

|

|

1,419 |

|

|

2.6 |

% |

|

Legal settlements |

|

208 |

|

|

0.4 |

% |

|

|

121 |

|

|

0.2 |

% |

|

Pre-opening costs |

|

191 |

|

|

0.4 |

% |

|

|

25 |

|

|

0.0 |

% |

|

Other direct costs |

|

3,804 |

|

|

7.0 |

% |

|

|

3,623 |

|

|

6.6 |

% |

|

Total costs of company restaurant sales, excluding depreciation and

amortization |

$ |

47,578 |

|

|

87.5 |

% |

|

$ |

46,568 |

|

|

84.9 |

% |

|

Company restaurant operating margin (non-GAAP) (2) |

$ |

6,770 |

|

|

12.5 |

% |

|

$ |

8,313 |

|

|

15.1 |

% |

|

Adjustments (3) |

|

399 |

|

|

0.7 |

% |

|

|

146 |

|

|

0.3 |

% |

|

Adjusted company restaurant operating margin (non-GAAP) (2) |

$ |

7,169 |

|

|

13.2 |

% |

|

$ |

8,459 |

|

|

15.4 |

% |

| |

|

|

|

|

|

|

Franchise operations: (4) |

|

|

|

|

|

|

Franchise and license revenue: |

|

|

|

|

|

|

Royalties |

$ |

30,014 |

|

|

48.7 |

% |

|

$ |

30,376 |

|

|

49.0 |

% |

|

Advertising revenue |

|

20,788 |

|

|

33.8 |

% |

|

|

19,853 |

|

|

32.0 |

% |

|

Initial and other fees |

|

2,448 |

|

|

4.0 |

% |

|

|

2,616 |

|

|

4.2 |

% |

|

Occupancy revenue |

|

8,329 |

|

|

13.5 |

% |

|

|

9,189 |

|

|

14.8 |

% |

|

Total franchise and license revenue |

$ |

61,579 |

|

|

100.0 |

% |

|

$ |

62,034 |

|

|

100.0 |

% |

| |

|

|

|

|

|

|

Costs of franchise and license revenue, excluding depreciation and

amortization: |

|

|

|

|

|

|

Advertising costs |

$ |

20,788 |

|

|

33.8 |

% |

|

$ |

19,853 |

|

|

32.0 |

% |

|

Occupancy costs |

|

5,094 |

|

|

8.3 |

% |

|

|

5,792 |

|

|

9.3 |

% |

|

Other direct costs |

|

7,546 |

|

|

12.3 |

% |

|

|

4,815 |

|

|

7.8 |

% |

|

Total costs of franchise and license revenue, excluding

depreciation and amortization |

$ |

33,428 |

|

|

54.3 |

% |

|

$ |

30,460 |

|

|

49.1 |

% |

|

Franchise operating margin (non-GAAP) (2) |

$ |

28,151 |

|

|

45.7 |

% |

|

$ |

31,574 |

|

|

50.9 |

% |

|

Adjustments (3) |

|

2,640 |

|

|

4.3 |

% |

|

|

11 |

|

|

0.0 |

% |

|

Adjusted franchise operating margin (non-GAAP) (2) |

$ |

30,791 |

|

|

50.0 |

% |

|

$ |

31,585 |

|

|

50.9 |

% |

| |

|

|

|

|

|

| Total

operating revenue (5) |

$ |

115,927 |

|

|

100.0 |

% |

|

$ |

116,915 |

|

|

100.0 |

% |

| Total

costs of operating revenue (5) |

|

81,006 |

|

|

69.9 |

% |

|

|

77,028 |

|

|

65.9 |

% |

|

Restaurant-level operating margin (non-GAAP) (5) |

$ |

34,921 |

|

|

30.1 |

% |

|

$ |

39,887 |

|

|

34.1 |

% |

|

(1) |

|

As a percentage of company restaurant sales. |

|

(2) |

|

Other operating expenses such as general and administrative

expenses and depreciation and amortization relate to both company

and franchise operations and are not allocated to costs of company

restaurant sales and costs of franchise and license revenue. As

such, operating margin and adjusted operating margin are considered

non-GAAP financial measures and should be considered as a

supplement to, not as a substitute for, operating income, net

income or other financial measures prepared in accordance with

GAAP. |

|

(3) |

|

Adjustments include legal settlement expenses, pre-opening costs,

and other adjustments the Company does not consider in the

evaluation of its ongoing core operating performance. Adjustments

for the quarter ended June 26, 2024 include a $2.6 million

distribution to franchisees related to a review of advertising

costs. |

|

(4) |

|

As a percentage of franchise and license revenue. |

|

(5) |

|

As a percentage of total operating revenue. |

|

|

|

|

|

DENNY’S CORPORATION |

|

Operating Margins |

|

(Unaudited) |

| |

|

|

|

| |

Two Quarters Ended |

| ($ in thousands) |

6/26/24 |

|

6/28/23 |

| Company restaurant operations:

(1) |

|

|

|

|

|

|

Company restaurant sales |

$ |

106,690 |

|

|

100.0 |

% |

|

$ |

108,333 |

|

|

100.0 |

% |

|

Costs of company restaurant sales, excluding depreciation and

amortization: |

|

|

|

|

|

|

Product costs |

|

26,943 |

|

|

25.3 |

% |

|

|

28,209 |

|

|

26.0 |

% |

|

Payroll and benefits |

|

40,967 |

|

|

38.4 |

% |

|

|

40,728 |

|

|

37.6 |

% |

|

Occupancy |

|

9,244 |

|

|

8.7 |

% |

|

|

8,174 |

|

|

7.5 |

% |

|

Other operating costs: |

|

|

|

|

|

|

Utilities |

|

3,350 |

|

|

3.1 |

% |

|

|

3,917 |

|

|

3.6 |

% |

|

Repairs and maintenance |

|

2,013 |

|

|

1.9 |

% |

|

|

1,671 |

|

|

1.5 |

% |

|

Marketing |

|

3,480 |

|

|

3.3 |

% |

|

|

2,814 |

|

|

2.6 |

% |

|

Legal settlements |

|

1,657 |

|

|

1.6 |

% |

|

|

230 |

|

|

0.2 |

% |

|

Pre-opening costs |

|

557 |

|

|

0.5 |

% |

|

|

25 |

|

|

0.0 |

% |

|

Other direct costs |

|

7,485 |

|

|

7.0 |

% |

|

|

7,292 |

|

|

6.7 |

% |

|

Total costs of company restaurant sales, excluding depreciation and

amortization |

$ |

95,696 |

|

|

89.7 |

% |

|

$ |

93,060 |

|

|

85.9 |

% |

|

Company restaurant operating margin (non-GAAP) (2) |

$ |

10,994 |

|

|

10.3 |

% |

|

$ |

15,273 |

|

|

14.1 |

% |

|

Adjustments (3) |

|

2,214 |

|

|

2.1 |

% |

|

|

255 |

|

|

0.2 |

% |

|

Adjusted company restaurant operating margin (non-GAAP) (2) |

$ |

13,208 |

|

|

12.4 |

% |

|

$ |

15,528 |

|

|

14.3 |

% |

| |

|

|

|

|

|

| Franchise operations: (4) |

|

|

|

|

|

|

Franchise and license revenue: |

|

|

|

|

|

|

Royalties |

$ |

59,320 |

|

|

49.8 |

% |

|

$ |

60,403 |

|

|

47.9 |

% |

|

Advertising revenue |

|

38,926 |

|

|

32.7 |

% |

|

|

39,521 |

|

|

31.4 |

% |

|

Initial and other fees |

|

4,264 |

|

|

3.6 |

% |

|

|

7,606 |

|

|

6.0 |

% |

|

Occupancy revenue |

|

16,701 |

|

|

14.0 |

% |

|

|

18,523 |

|

|

14.7 |

% |

|

Total franchise and license revenue |

$ |

119,211 |

|

|

100.0 |

% |

|

$ |

126,053 |

|

|

100.0 |

% |

| |

|

|

|

|

|

|

Costs of franchise and license revenue, excluding depreciation and

amortization: |

|

|

|

|

|

|

Advertising costs |

$ |

38,926 |

|

|

32.7 |

% |

|

$ |

39,521 |

|

|

31.4 |

% |

|

Occupancy costs |

|

10,226 |

|

|

8.6 |

% |

|

|

11,464 |

|

|

9.1 |

% |

|

Other direct costs |

|

11,650 |

|

|

9.8 |

% |

|

|

11,862 |

|

|

9.4 |

% |

|

Total costs of franchise and license revenue, excluding

depreciation and amortization |

$ |

60,802 |

|

|

51.0 |

% |

|

$ |

62,847 |

|

|

49.9 |

% |

|

Franchise operating margin (non-GAAP) (2) |

$ |

58,409 |

|

|

49.0 |

% |

|

$ |

63,206 |

|

|

50.1 |

% |

|

Adjustments (3) |

|

2,492 |

|

|

2.1 |

% |

|

|

3 |

|

|

0.0 |

% |

|

Adjusted franchise operating margin (non-GAAP) (2) |

$ |

60,901 |

|

|

51.1 |

% |

|

$ |

63,209 |

|

|

50.1 |

% |

| |

|

|

|

|

|

| Total operating revenue

(5) |

$ |

225,901 |

|

|

100.0 |

% |

|

$ |

234,386 |

|

|

100.0 |

% |

| Total costs of operating

revenue (5) |

|

156,498 |

|

|

69.3 |

% |

|

|

155,907 |

|

|

66.5 |

% |

| Restaurant-level operating

margin (non-GAAP) (5) |

$ |

69,403 |

|

|

30.7 |

% |

|

$ |

78,479 |

|

|

33.5 |

% |

|

(1) |

|

As a percentage of company restaurant sales. |

|

(2) |

|

Other operating expenses such as general and administrative

expenses and depreciation and amortization relate to both company

and franchise operations and are not allocated to costs of company

restaurant sales and costs of franchise and license revenue. As

such, operating margin and adjusted operating margin are considered

non-GAAP financial measures and should be considered as a

supplement to, not as a substitute for, operating income, net

income or other financial measures prepared in accordance with

GAAP. |

|

(3) |

|

Adjustments include legal settlement expenses, pre-opening costs,

and other adjustments the Company does not consider in the

evaluation of its ongoing core operating performance. Adjustments

for the year-to-date period ended June 26, 2024 include a $2.6

million distribution to franchisees related to a review of

advertising costs. |

|

(4) |

|

As a percentage of franchise and license revenue. |

|

(5) |

|

As a percentage of total operating revenue. |

|

|

|

|

|

DENNY’S CORPORATION |

|

Statistical Data |

|

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Denny's |

|

Keke's |

| Changes in

Same-Restaurant Sales (1) |

Quarter Ended |

|

Two Quarters Ended |

|

Quarter Ended |

|

Two Quarters Ended |

| (Increase

(decrease) vs. prior year) |

6/26/24 |

|

6/28/23 |

|

6/26/24 |

|

6/28/23 |

|

6/26/24 |

|

6/28/23 |

|

6/26/24 |

|

6/28/23 |

|

Company Restaurants |

|

(2.6 |

)% |

|

|

3.0 |

% |

|

|

(2.8 |

%) |

|

|

7.0 |

% |

|

|

(4.4 |

)% |

|

|

N/A |

|

|

|

(2.7 |

%) |

|

|

N/A |

|

|

Domestic Franchise Restaurants |

|

(0.4 |

)% |

|

|

3.0 |

% |

|

|

(0.8 |

%) |

|

|

5.5 |

% |

|

|

(4.6 |

)% |

|

|

N/A |

|

|

|

(4.3 |

%) |

|

|

N/A |

|

|

Domestic System-wide Restaurants |

|

(0.6 |

)% |

|

|

3.0 |

% |

|

|

(0.9 |

%) |

|

|

5.6 |

% |

|

|

(4.6 |

)% |

|

|

N/A |

|

|

|

(4.1 |

%) |

|

|

N/A |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Average

Unit Sales |

|

|

|

|

|

|

|

| ($ in

thousands) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Company Restaurants |

$ |

774 |

|

|

$ |

786 |

|

|

$ |

1,517 |

|

|

$ |

1,548 |

|

|

$ |

447 |

|

|

$ |

459 |

|

|

$ |

902 |

|

|

$ |

925 |

|

|

Franchised Restaurants |

$ |

473 |

|

|

$ |

466 |

|

|

$ |

930 |

|

|

$ |

918 |

|

|

$ |

457 |

|

|

$ |

476 |

|

|

$ |

929 |

|

|

$ |

967 |

|

|

(1) |

|

Same-restaurant sales include sales at company restaurants and

non-consolidated franchised and licensed restaurants that were open

during the comparable periods noted. Total operating revenue is

limited to company restaurant sales and royalties, advertising

revenue, initial and other fees and occupancy revenue from

non-consolidated franchised and licensed restaurants. Accordingly,

domestic franchise same-restaurant sales and domestic system-wide

same-restaurant sales should be considered as a supplement to, not

a substitute for, the Company's results as reported under

GAAP. |

|

|

|

|

|

Restaurant Unit Activity |

Denny's |

|

Keke's |

| |

Company |

|

Franchised & Licensed |

|

Total |

|

Company |

|

|

Franchised & Licensed |

|

|

|

Total |

|

|

Ending Units March 27, 2024 |

|

64 |

|

|

|

1,489 |

|

|

|

1,553 |

|

|

|

11 |

|

|

|

50 |

|

|

|

61 |

|

|

Units Opened |

|

— |

|

|

|

3 |

|

|

|

3 |

|

|

|

1 |

|

|

|

— |

|

|

|

1 |

|

|

Units Refranchised |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

1 |

|

|

|

— |

|

|

Units Closed |

|

— |

|

|

|

(15 |

) |

|

|

(15 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net Change |

|

— |

|

|

|

(12 |

) |

|

|

(12 |

) |

|

|

— |

|

|

|

1 |

|

|

|

1 |

|

|

Ending Units June 26, 2024 |

|

64 |

|

|

|

1,477 |

|

|

|

1,541 |

|

|

|

11 |

|

|

|

51 |

|

|

|

62 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equivalent Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Second Quarter 2024 |

|

64 |

|

|

|

1,485 |

|

|

|

1,549 |

|

|

|

11 |

|

|

|

51 |

|

|

|

62 |

|

|

Second Quarter 2023 |

|

65 |

|

|

|

1,525 |

|

|

|

1,590 |

|

|

|

8 |

|

|

|

47 |

|

|

|

55 |

|

|

Net Change |

|

(1 |

) |

|

|

(40 |

) |

|

|

(41 |

) |

|

|

3 |

|

|

|

4 |

|

|

|

7 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Ending Units December 27, 2023 |

|

65 |

|

|

|

1,508 |

|

|

|

1,573 |

|

|

|

8 |

|

|

|

50 |

|

|

|

58 |

|

|

Units Opened |

|

— |

|

|

|

8 |

|

|

|

8 |

|

|

|

4 |

|

|

|

— |

|

|

|

4 |

|

|

Units Refranchised |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

1 |

|

|

|

— |

|

|

Units Closed |

|

(1 |

) |

|

|

(39 |

) |

|

|

(40 |

) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Net Change |

|

(1 |

) |

|

|

(31 |

) |

|

|

(32 |

) |

|

|

3 |

|

|

|

1 |

|

|

|

4 |

|

|

Ending Units June 26, 2024 |

|

64 |

|

|

|

1,477 |

|

|

|

1,541 |

|

|

|

11 |

|

|

|

51 |

|

|

|

62 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equivalent Units |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Year-to-Date 2024 |

|

64 |

|

|

|

1,493 |

|

|

|

1,557 |

|

|

|

10 |

|

|

|

50 |

|

|

|

60 |

|

|

Year-to-Date 2023 |

|

65 |

|

|

|

1,527 |

|

|

|

1,592 |

|

|

|

8 |

|

|

|

46 |

|

|

|

54 |

|

|

Net Change |

|

(1 |

) |

|

|

(34 |

) |

|

|

(35 |

) |

|

|

2 |

|

|

|

4 |

|

|

|

6 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Investor Contact: 877-784-7167

Media Contact: 864-597-8005

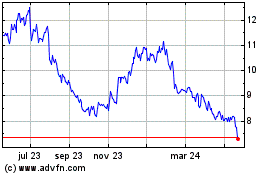

Dennys (NASDAQ:DENN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

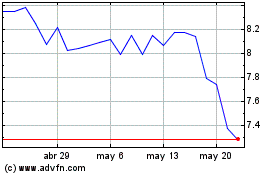

Dennys (NASDAQ:DENN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024