Ebang International Holdings Inc. (Nasdaq: EBON, the “Company,”

“we” or “our”), a global blockchain technology company, today

announced its financial results for the fiscal year ended December

31, 2021.

Operational and Financial Highlights for

Fiscal Year 2021

Total computing power

sold in fiscal year 2021 was 1.50 million Thash/s,

representing a year-over-year increase of 200% from 0.50 million

Thash/s in fiscal year 2020.

Total net revenues in

fiscal year 2021 were US$51.45 million representing an 170.73%

year-over-year increase from US$19.00 million in fiscal year

2020.

Gross profit in fiscal year

2021 was US$29.22 million compared to the gross loss of US$2.90

million in fiscal year 2020.

Net income in fiscal year

2021 was US$2.77 million compared to net loss of US$32.11 million

in fiscal year 2020.

Mr. Dong Hu, Chairman and Chief Executive

Officer of the Company, commented, “2021 was a challenging year for

us due to raw material supplies shortages as a result of supply

chain disruptions caused by the COVID-19 pandemic. The achievement

of sales growth is contributed to the efforts of our professional

research and development team, who optimized the hardware structure

of our products and designed a new framework with limited

resources. 2021 was also an exciting year for us as we made

considerable progress in connecting with the upstream and

downstream markets of blockchain financial services. For example,

we have completed initial preparations for our global business

development, including but not limited to setting up a legal

structure, building a professional team, initiating product

development, and obtaining or seeking to obtain licenses or

authorizations in the countries and regions into which we are

expanding. Moreover, we officially launched Ebonex, our

self-developed digital assets trading platform, which is designed

to provide secure, fast, efficient, and stable trading services in

multiple currencies and modes to a global audience. Our goal

is for Ebonex to become one of the premier markets in the

cryptocurrency space and become a trusted platform for its

users.”

Mr. Hu continued, “We made outstanding

achievements in 2021. We recruited many talents from various

professional fields to join us and expand our teams, which allowed

us to develop and increase the scale of our business efficiently.

Despite the market turmoil across the world, investors have shown

their interest in the cryptocurrency industry, and we remain

confident in our business and the blockchain industry. Our

objective is to drive our products and services further into the

entire market ecosystem to help propel this industry forward.”

Financial Results for Fiscal Year

2021

Total net revenues in fiscal

year 2021 were US$51.45 million representing an 170.73%

year-over-year increase from US$19.00 million in fiscal year 2020.

The year-over-year increase in total net revenues was primarily due

to, among others, the continued fluctuation of the Bitcoin price in

the high range in 2021, which has driven the enthusiasm and

attention of investors. However, our chip suppliers have reduced

their production capacity due to the impact of COVID-19, resulting

in our inability to produce at full capacity, insufficient

inventory and inability to meet the market demand. With limited raw

materials, we optimized the hardware structure, used a new

framework and launched new models, which accelerated the sales

growth.

Cost of revenues in fiscal

year 2021 was US$22.23 million representing an 1.47% year-over-year

increase from US$21.90 million in fiscal year 2020. The

year-over-year increase in cost of revenues was primarily because

we have been able to utilize some of the slow-moving inventories

impaired in previous years to manufacture products sold in 2021 as

a result of our hardware optimization.

Gross profit in fiscal year

2021 was US$29.22 million compared to the gross loss of US$2.90

million in fiscal year 2020.

Total operating

expenses in fiscal year 2021 were US$27.19 million

compared to US$23.75 million in fiscal year 2020.

-

Selling expenses in fiscal year 2021 were

US$1.42 million compared to US$0.93 million in fiscal year 2020.

The year-over-year increase in selling expenses was in line with

the increase in the Company’s sales.

-

General and administrative expenses in fiscal

year 2021 were US$25.77 million compared to US$22.82 million in

fiscal year 2020. The year-over-year increase in general and

administrative expenses was primarily due to increase in overseas

expansion.

Income from operations in

fiscal year 2021 was US$2.03 million compared to loss from

operations of US$26.65 million in fiscal year 2020.

Interest income in fiscal

year 2021 was US$1.78 million compared to US$0.82 million in fiscal

year 2020. The year-over-year increase in interest income was

primarily due to the interest income from our investments in time

deposit and financing products in 2021.

Government grants in

fiscal year 2021 were US$0.44 million compared to US$4.01 million

in fiscal year 2020. The year-over-year decrease in government

grants was primarily due to the decrease of non-recurring rebates

from local government.

Net income in fiscal year

2021 was US$2.77 million compared to net loss of US$32.11 million

in fiscal year 2020.

Net income attributable to Ebang

International Holdings Inc. in fiscal year 2021 was

US$4.43 million compared to net loss attributable to Ebang

International Holdings Inc. of US$30.68 million in fiscal year

2020.

Basic and diluted net income per

shares in fiscal year 2021 was US$0.02 compared to

basic and diluted net loss per shares of US$0.25 in fiscal year

2020.

Cash and cash equivalents

were US$239.87 million as of December 31, 2021,

compared with US$13.67 million as of December 31, 2020.

About Ebang International Holdings

Inc.

Ebang International Holdings Inc. is a

blockchain technology company with strong application-specific

integrated circuit (ASIC) chip design capability. With years of

industry experience and expertise in ASIC chip design, it has

become a global bitcoin mining machine producer with steady access

to wafer foundry capacity. With its licensed and registered

entities in various jurisdictions, the Company intends to launch a

professional, convenient and innovative digital asset financial

service platform to expand into the upstream and the downstream of

blockchain and cryptocurrency industry value chain. For more

information, please visit https://ir.ebang.com.

Forward-Looking Statement

This press release contains forward-looking

statements within the meaning of Section 21E of the Securities

Exchange Act of 1934, as amended, and as defined in the U.S.

Private Securities Litigation Reform Act of 1995. These

forward-looking statements include, without limitation, the

Company’s development plans and business outlook, which can be

identified by terminology such as “may,” “will,” “expects,”

“anticipates,” “aims,” “potential,” “future,” “intends,” “plans,”

“believes,” “estimates,” “continue,” “likely to” and other similar

expressions intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. Such statements are not historical facts, and

are based upon the Company’s current beliefs, plans and

expectations, and the current market and operating conditions.

Forward-looking statements involve inherent known or unknown risks,

uncertainties and other factors, all of which are difficult to

predict and many of which are beyond the Company’s control, which

may cause the Company’s actual results, performance and

achievements to differ materially from those contained in any

forward-looking statement. Further information regarding these and

other risks, uncertainties or factors is included in the Company's

filings with the U.S. Securities and Exchange Commission. These

forward-looking statements are made only as of the date indicated,

and the Company undertakes no obligation to update or revise the

information contained in any forward-looking statements as a result

of new information, future events or otherwise, except as required

under applicable law.

Investor Relations Contact

For investor and media inquiries, please

contact:

Ebang International Holdings Inc.Email:

ir@ebang.com

Ascent Investor Relations

LLCMs. Tina XiaoTel: (917) 609-0333Email:

tina.xiao@ascent-ir.com

|

EBANG INTERNATIONAL HOLDINGS

INC.CONSOLIDATED BALANCE SHEETS

(Stated in US dollars) |

|

|

|

|

|

|

December 31,2021 |

|

|

December 31,2020 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

|

$ |

239,872,316 |

|

|

$ |

13,669,439 |

|

|

Restricted cash, current |

|

|

|

171,156 |

|

|

|

406,857 |

|

|

Short-term investments |

|

|

|

35,443,246 |

|

|

|

40,835,000 |

|

|

Accounts receivable, net |

|

|

|

9,872,746 |

|

|

|

7,205,113 |

|

|

Notes receivable |

|

|

|

- |

|

|

|

765,967 |

|

|

Advances to suppliers |

|

|

|

1,057,096 |

|

|

|

221,186 |

|

|

Inventories, net |

|

|

|

7,137,538 |

|

|

|

3,845,091 |

|

|

Prepayments |

|

|

|

283,776 |

|

|

|

522,808 |

|

|

Other current assets, net |

|

|

|

4,994,271 |

|

|

|

1,128,599 |

|

|

Total current assets |

|

|

|

298,832,145 |

|

|

|

68,600,060 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net |

|

|

|

33,329,610 |

|

|

|

29,123,243 |

|

|

Intangible assets, net |

|

|

|

22,512,208 |

|

|

|

23,077,435 |

|

|

Operating lease right-of-use assets |

|

|

|

2,132,247 |

|

|

|

898,335 |

|

|

Operating lease right-of-use assets - related parties |

|

|

|

1,136,775 |

|

|

|

17,701 |

|

|

Restricted cash, non-current |

|

|

|

883,130 |

|

|

|

47,455 |

|

|

VAT recoverable |

|

|

|

26,332,231 |

|

|

|

21,897,063 |

|

|

Other assets |

|

|

|

705,825 |

|

|

|

538,934 |

|

|

Total non-current assets |

|

|

|

87,032,026 |

|

|

|

75,600,166 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total assets |

|

|

$ |

385,864,171 |

|

|

$ |

144,200,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

|

|

Accounts payable |

|

|

$ |

3,387,836 |

|

|

$ |

2,762,187 |

|

|

Notes payable |

|

|

|

- |

|

|

|

1,087,673 |

|

|

Accrued liabilities and other payables |

|

|

|

8,962,716 |

|

|

|

21,921,614 |

|

|

Loan due within one year |

|

|

|

- |

|

|

|

765,967 |

|

|

Operating lease liabilities, current |

|

|

|

851,936 |

|

|

|

659,807 |

|

|

Operating lease liabilities - related parties, current |

|

|

|

595,424 |

|

|

|

17,701 |

|

|

Income taxes payable |

|

|

|

13,272 |

|

|

|

556,137 |

|

|

Due to related party |

|

|

|

- |

|

|

|

5,652,833 |

|

|

Advances from customers |

|

|

|

894,174 |

|

|

|

832,842 |

|

|

Total current liabilities |

|

|

|

14,705,358 |

|

|

|

34,256,761 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

|

|

Operating lease liabilities – related party, non-current |

|

|

|

288,563 |

|

|

|

- |

|

|

Deferred tax liabilities |

|

|

|

178,582 |

|

|

|

872 |

|

|

Operating lease liabilities, non-current |

|

|

|

1,712,303 |

|

|

|

118,827 |

|

|

Total non-current liabilities |

|

|

|

2,179,448 |

|

|

|

119,699 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities |

|

|

|

16,884,806 |

|

|

|

34,376,460 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

|

|

Class A ordinary share, HKD0.001 par value, 333,374,217 shares

authorized, 139,209,554 and 89,009,554 shares issued and

outstanding as of December 31, 2021 and 2020, respectively |

|

|

|

17,848 |

|

|

|

11,411 |

|

|

Class B ordinary share, HKD0.001 par value, 46,625,783 shares

authorized, issued and outstanding as of December 31, 2021 and

2020, respectively |

|

|

|

5,978 |

|

|

|

5,978 |

|

|

Additional paid-in capital |

|

|

|

393,717,189 |

|

|

|

138,288,921 |

|

|

Statutory reserves |

|

|

|

11,079,649 |

|

|

|

11,049,847 |

|

|

Accumulated deficit |

|

|

|

(34,180,280 |

) |

|

|

(38,581,419 |

) |

|

Accumulated other comprehensive loss |

|

|

|

(6,897,005 |

) |

|

|

(7,648,332 |

) |

|

Total Ebang International Holdings Inc. shareholders’

equity |

|

|

|

363,743,379 |

|

|

|

103,126,406 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-controlling interest |

|

|

|

5,235,986 |

|

|

|

6,697,360 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total equity |

|

|

|

368,979,365 |

|

|

|

109,823,766 |

|

|

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and equity |

|

|

$ |

385,864,171 |

|

|

$ |

144,200,226 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBANG INTERNATIONAL HOLDINGS

INC.CONSOLIDATED STATEMENTS OF OPERATIONS AND

COMPREHENSIVE INCOME (LOSS)(Stated in US

dollars) |

|

|

|

|

|

For the year

endedDecember 31,2021 |

|

|

For the year

endedDecember 31,2020 |

|

|

For the year

endedDecember 31,2019 |

|

|

Product revenue |

|

$ |

48,323,022 |

|

|

$ |

9,677,278 |

|

|

$ |

93,255,813 |

|

| Service revenue |

|

|

3,127,225 |

|

|

|

9,327,023 |

|

|

|

15,804,253 |

|

| Total

revenues |

|

|

51,450,247 |

|

|

|

19,004,301 |

|

|

|

109,060,066 |

|

| Cost of revenues |

|

|

22,227,055 |

|

|

|

21,903,644 |

|

|

|

139,623,799 |

|

| Gross profit

(loss) |

|

|

29,223,192 |

|

|

|

(2,899,343 |

) |

|

|

(30,563,733 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Operating

expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

| Selling expenses |

|

|

1,418,586 |

|

|

|

925,373 |

|

|

|

1,213,294 |

|

| General and administrative

expenses |

|

|

25,774,237 |

|

|

|

22,822,085 |

|

|

|

18,870,794 |

|

| Total operating

expenses |

|

|

27,192,823 |

|

|

|

23,747,458 |

|

|

|

20,084,088 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) from

operations |

|

|

2,030,369 |

|

|

|

(26,646,801 |

) |

|

|

(50,647,821 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Other income

(expenses): |

|

|

|

|

|

|

|

|

|

|

|

|

| Interest income |

|

|

1,779,672 |

|

|

|

824,435 |

|

|

|

217,200 |

|

| Interest expenses |

|

|

(4,383 |

) |

|

|

(728,346 |

) |

|

|

(2,041,491 |

) |

| Other income |

|

|

133,477 |

|

|

|

81,733 |

|

|

|

84,992 |

|

| Loss from investment |

|

|

(3,656,520 |

) |

|

|

- |

|

|

|

- |

|

| Exchange gain (loss) |

|

|

1,780,087 |

|

|

|

(288,346 |

) |

|

|

5,693,798 |

|

| Government grants |

|

|

434,604 |

|

|

|

4,006,567 |

|

|

|

6,298,893 |

|

| VAT refund |

|

|

- |

|

|

|

- |

|

|

|

9,138 |

|

| Other expenses |

|

|

(108,328 |

) |

|

|

(108,624 |

) |

|

|

(287,530 |

) |

| Total other

income |

|

|

358,609 |

|

|

|

3,787,419 |

|

|

|

9,975,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Income (loss) before

income taxes provision (benefit) |

|

|

2,388,978 |

|

|

|

(22,859,382 |

) |

|

|

(40,672,821 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Income taxes provision

(benefit) |

|

|

(378,843 |

) |

|

|

9,251,542 |

|

|

|

400,311 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

|

2,767,821 |

|

|

|

(32,110,924 |

) |

|

|

(41,073,132 |

) |

| Less: net income (loss)

attributable to non-controlling interest |

|

|

(1,663,120 |

) |

|

|

(1,435,504 |

) |

|

|

1,330,237 |

|

| Net income (loss)

attributable to Ebang International Holdings Inc. |

|

$ |

4,430,941 |

|

|

$ |

(30,675,420 |

) |

|

$ |

(42,403,369 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Comprehensive income

(loss) |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) |

|

$ |

2,767,821 |

|

|

$ |

(32,110,924 |

) |

|

$ |

(41,073,132 |

) |

| Other comprehensive

income (loss): |

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign currency translation

adjustment |

|

|

953,073 |

|

|

|

1,960,109 |

|

|

|

(1,188,488 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Total comprehensive

income (loss) |

|

|

3,720,894 |

|

|

|

(30,150,815 |

) |

|

|

(42,261,620 |

) |

| Less: comprehensive income

(loss) attributable to non-controlling interest |

|

|

(1,461,374 |

) |

|

|

(893,905 |

) |

|

|

1,330,237 |

|

| Comprehensive income

(loss) attributable to Ebang International Holdings

Inc. |

|

$ |

5,182,268 |

|

|

$ |

(29,256,910 |

) |

|

$ |

(43,591,857 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income (loss) per

ordinary share attributable to Ebang International Holdings

Inc. |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.02 |

|

|

$ |

(0.25 |

) |

|

$ |

(0.38 |

) |

|

Diluted |

|

$ |

0.02 |

|

|

$ |

(0.25 |

) |

|

$ |

(0.38 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Weighted average

ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic |

|

|

177,715,336 |

|

|

|

121,941,226 |

|

|

|

111,771,000 |

|

|

Diluted |

|

|

177,865,730 |

|

|

|

121,941,226 |

|

|

|

111,771,000 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

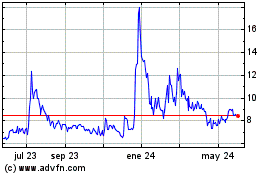

Ebang (NASDAQ:EBON)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

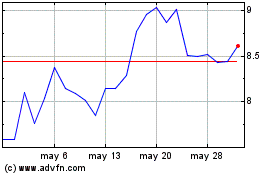

Ebang (NASDAQ:EBON)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024