Diamondback Energy, Inc. (NASDAQ: FANG) (“Diamondback” or the

“Company”) today announced financial and operating results for the

third quarter ended September 30, 2024.

THIRD QUARTER 2024

HIGHLIGHTS

- As previously announced, closed

merger with Endeavor Energy Resources, L.P. ("Endeavor") on

September 10, 2024

- Average production of 321.1 MBO/d

(571.1 MBOE/d)

- Net cash provided by operating

activities of $1.2 billion; Operating Cash Flow Before Working

Capital Changes (as defined and reconciled below) of $1.4

billion

- Cash capital expenditures of $688

million

- Free Cash Flow (as defined and

reconciled below) of $708 million; Adjusted Free Cash Flow (as

defined and reconciled below) of $1.0 billion

- Declared Q3 2024 base cash dividend

of $0.90 per share payable on November 21, 2024; implies a

2.0% annualized yield based on November 1, 2024 closing share

price of $175.81

- Repurchased 2,919,763 shares of

common stock in Q3 2024 for $515 million, excluding excise tax (at

a weighted average price of $176.40 per share); repurchased

1,029,191 shares of common stock to date in Q4 2024 for $185

million, excluding excise tax (at a weighted average price of

$180.13 per share)

- Total Q3 2024 return of capital of

$780 million; represents ~78% of Adjusted Free Cash Flow (as

defined and reconciled below) from stock repurchases and the

declared Q3 2024 base dividend

- As previously announced, Board

approved a $2.0 billion increase to share repurchase authorization

to $6.0 billion from $4.0 billion previously

TRP ENERGY (“TRP”) TRADE

- On November 3rd, Diamondback and TRP entered into a definitive

agreement under which Diamondback will trade certain Delaware Basin

assets and pay approximately $238 million in cash to TRP in

exchange for TRP’s Midland Basin assets

- TRP’s Midland Basin assets are made up of ~15,000 net acres

across Upton and Reagan counties and consist of 55 remaining

undeveloped operated locations, the majority of which immediately

compete for capital

- The asset also includes 18 Drilled Uncompleted Wells

("DUCs") which provide for additional capital allocation

flexibility

- The trade is expected to be accretive to both Cash Flow

and Free Cash Flow per share and enhances Diamondback's near-term

oil production profile

- Expected to close in December 2024, subject to customary

regulatory approvals and closing conditions

- Jefferies LLC is serving as financial advisor to Diamondback.

Kirkland & Ellis LLP is serving as legal advisor to

Diamondback. J.P. Morgan Securities LLC, Moelis & Company and

RBC Capital Markets are acting as financial advisors to TRP.

Clifford Chance US LLP is serving as legal advisor to TRP.

OPERATIONS UPDATE

The tables below provide a summary of operating

activity for the third quarter of 2024.

|

|

Total Activity (Gross Operated): |

|

|

|

|

| |

|

Number of WellsDrilled |

|

Number of WellsCompleted |

|

| |

Midland Basin |

71 |

|

87 |

|

| |

Delaware Basin |

5 |

|

8 |

|

|

|

Total |

76 |

|

95 |

|

|

|

Total Activity (Net Operated): |

|

|

|

|

| |

|

Number of WellsDrilled(1) |

|

Number of WellsCompleted(1) |

|

| |

Midland Basin |

67 |

|

95 |

|

| |

Delaware Basin |

4 |

|

7 |

|

|

|

Total |

71 |

|

102 |

|

|

|

(1) Includes two additional net wells drilled and nine additional

net wells completed, respectively, from interests acquired in the

Endeavor Acquisition during the first six months of 2024. |

|

|

|

|

|

|

|

|

During the third quarter of 2024, Diamondback

drilled 71 gross wells in the Midland Basin and five gross wells in

the Delaware Basin. The Company turned 87 operated wells to

production in the Midland Basin and eight gross wells in the

Delaware Basin, with an average lateral length of 12,238 feet.

Operated completions during the third quarter consisted of 22

Wolfcamp A wells, 21 Lower Spraberry wells, 15 Jo Mill wells, 14

Wolfcamp B wells, 12 Middle Spraberry wells, four Dean wells, four

Third Bone Spring wells and three Upper Spraberry wells.

For the first nine months of 2024, Diamondback

drilled 211 gross wells in the Midland Basin and 24 gross wells in

the Delaware Basin. The Company turned 267 operated wells to

production in the Midland Basin and 15 operated wells to production

in the Delaware Basin. The average lateral length for wells

completed during the first nine months of 2024 was 11,645 feet, and

consisted of 72 Lower Spraberry wells, 61 Wolfcamp A wells, 45

Wolfcamp B wells, 40 Jo Mill wells, 34 Middle Spraberry wells, nine

Wolfcamp D wells, nine Dean wells, six Upper Spraberry wells, four

Third Bone Spring wells, one Second Bone Spring well and one

Barnett well.

FINANCIAL UPDATE

Diamondback's third quarter 2024 net income was

$659 million, or $3.19 per diluted share. Adjusted net income (as

defined and reconciled below) for the third quarter was $698

million, or $3.38 per diluted share.

Third quarter 2024 net cash provided by

operating activities was $1.2 billion. Through the first nine

months of 2024, Diamondback's net cash provided by operating

activities was $4.1 billion.

During the third quarter of 2024, Diamondback

spent $633 million on operated and non-operated drilling and

completions, $52 million on infrastructure and environmental and $3

million on midstream, for total cash capital expenditures of $688

million. Through the first nine months of 2024, Diamondback spent

$1.8 billion on operated and non-operated drilling and

completions, $128 million on infrastructure and environmental and

$8 million on midstream, for total cash capital expenditures of

$1.9 billion.

Third quarter 2024 Consolidated Adjusted EBITDA

(as defined and reconciled below) was $1.8 billion. Adjusted

EBITDA net of non-controlling interest (as defined and reconciled

below) for the third quarter was $1.7 billion.

Diamondback's third quarter 2024 Free Cash Flow

(as defined and reconciled below) was $708 million. Adjusted

Free Cash Flow (as reconciled and defined below) for the third

quarter was $1.0 billion. Through September 30, 2024,

Diamondback's Free Cash Flow was $2.3 billion, with $2.7 billion of

Adjusted Free Cash Flow over the same period.

Third quarter 2024 average unhedged realized

prices were $73.13 per barrel of oil, $(0.26) per Mcf of natural

gas and $17.70 per barrel of natural gas liquids ("NGLs"),

resulting in a total equivalent unhedged realized price of $44.80

per BOE.

Diamondback's cash operating costs for the third

quarter of 2024 were $11.49 per BOE, including lease operating

expenses ("LOE") of $6.01 per BOE, cash general and administrative

("G&A") expenses of $0.63 per BOE, production and ad valorem

taxes of $2.91 per BOE and gathering, processing and transportation

expenses of $1.94 per BOE.

As of September 30, 2024, Diamondback had

$201 million in standalone cash and $115 million in

borrowings outstanding under its revolving credit facility, with

approximately $2.4 billion available for future borrowings under

the facility and approximately $2.6 billion of total liquidity. As

of September 30, 2024, the Company had consolidated total debt

of $13.1 billion and consolidated net debt (as defined and

reconciled below) of $12.7 billion, up from consolidated total debt

of $12.2 billion and up from consolidated net debt of $5.3 billion

as of June 30, 2024. Effective in September 2024, the Company's

borrowing base and elected commitment was increased to $2.5 billion

from $1.6 billion previously.

DIVIDEND DECLARATIONS

Diamondback announced today that the Company's

Board of Directors declared a base cash dividend of $0.90 per

common share for the third quarter of 2024 payable on

November 21, 2024 to stockholders of record at the close of

business on November 14, 2024.

Future base and variable dividends remain

subject to review and approval at the discretion of the Company's

Board of Directors.

COMMON STOCK REPURCHASE PROGRAM

During the third quarter of 2024, Diamondback

repurchased ~2.9 million shares of common stock at an average share

price of $176.40 for a total cost of approximately $515 million,

excluding excise tax. To date, Diamondback has repurchased ~23.3

million shares of common stock at an average share price of $133.48

for a total cost of approximately $3.1 billion and has

approximately $2.9 billion remaining on its current share buyback

authorization. Subject to factors discussed below, Diamondback

intends to continue to purchase common stock under the common stock

repurchase program opportunistically with cash on hand, free cash

flow from operations and proceeds from potential liquidity events

such as the sale of assets. This repurchase program has no time

limit and may be suspended from time to time, modified, extended or

discontinued by the Board at any time. Purchases under the

repurchase program may be made from time to time in privately

negotiated transactions, or in open market transactions in

compliance with Rule 10b-18 under the Securities Exchange Act of

1934, as amended, and will be subject to market conditions,

applicable regulatory and legal requirements and other factors. Any

common stock purchased as part of this program will be retired.

UPDATED 2024 GUIDANCE

Below is Diamondback's guidance for the full

year 2024, which includes fourth quarter production, unit costs and

capital guidance. The Company's production and capital guidance for

the full year 2024 has been updated to give effect to the Endeavor

merger, which was completed on September 10, 2024.

|

|

2024 Guidance |

2024 Guidance |

|

|

Diamondback Energy, Inc. |

Viper Energy, Inc. |

|

|

|

|

| 2024 Net production -

MBOE/d |

587 - 590 (from 462 - 470) |

48.75 - 49.25 |

| 2024 Oil production -

MBO/d |

335 - 337 (from 273 - 276) |

27.00 - 27.25 |

| Q4 2024 Oil production - MBO/d

(total - MBOE/d) |

470 - 475 (840 - 850) |

29.25 - 29.75 (52.50 - 53.00) |

| |

|

|

| Q4 2024 Unit costs

($/BOE) |

|

|

| Lease operating expenses,

including workovers |

$5.90 - $6.20 |

|

| G&A |

|

|

|

Cash G&A |

$0.55 - $0.65 |

|

|

Non-cash equity-based compensation |

$0.25 - $0.40 |

|

| DD&A |

$14.00 - $15.00 |

|

| Interest expense (net of

interest income) |

$0.25 - $0.50 |

|

| Gathering, processing and

transportation |

$1.60 - $1.80 |

|

| |

|

|

| Production and ad valorem

taxes (% of revenue) |

~7% |

|

| Corporate tax rate (% of

pre-tax income) |

23% |

|

| Cash tax rate (% of pre-tax

income) |

15% - 18% |

|

| Cash taxes ($ - million) |

$240 - $300 |

$13 - $18 |

| |

|

|

| Capital Budget ($ -

million) |

|

|

| 2024 Total capital

expenditures |

$2,875 - $3,000 (from $2,350 - $2,450) |

|

| Q4 2024 Capital

expenditures |

$950 - $1,050 |

|

| |

|

|

| Q4 2024 Gross horizontal wells

drilled (net) |

105 - 125 (100 - 118) |

|

| Q4 2024 Gross horizontal wells

completed (net) |

110 - 130 (102 - 120) |

|

| |

|

|

CONFERENCE CALL

Diamondback will host a conference call and

webcast for investors and analysts to discuss its results for the

third quarter of 2024 on Tuesday, November 5, 2024 at 8:00 a.m. CT.

Access to the webcast, and replay which will be available following

the call, may be found here. The live webcast of the earnings

conference call will also be available via Diamondback’s website at

www.diamondbackenergy.com under the “Investor Relations” section of

the site.

About Diamondback Energy, Inc.

Diamondback is an independent oil and natural

gas company headquartered in Midland, Texas focused on the

acquisition, development, exploration and exploitation of

unconventional, onshore oil and natural gas reserves primarily in

the Permian Basin in West Texas. For more information, please visit

www.diamondbackenergy.com.

Forward-Looking Statements

This news release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

and Section 21E of the Exchange Act, which involve risks,

uncertainties, and assumptions. All statements, other than

statements of historical fact, including statements regarding

Diamondback’s: future performance; business strategy; future

operations (including drilling plans and capital plans); estimates

and projections of revenues, losses, costs, expenses, returns, cash

flow, and financial position; reserve estimates and its ability to

replace or increase reserves; anticipated benefits or other effects

of strategic transactions (including the recently completed

Endeavor merger and other acquisitions or divestitures); and plans

and objectives of management (including plans for future cash flow

from operations and for executing environmental strategies) are

forward-looking statements. When used in this news release, the

words “aim,” “anticipate,” “believe,” “continue,” “could,”

“estimate,” “expect,” “forecast,” “future,” “guidance,” “intend,”

“may,” “model,” “outlook,” “plan,” “positioned,” “potential,”

“predict,” “project,” “seek,” “should,” “target,” “will,” “would,”

and similar expressions (including the negative of such terms) as

they relate to Diamondback are intended to identify forward-looking

statements, although not all forward-looking statements contain

such identifying words. Although Diamondback believes that the

expectations and assumptions reflected in its forward-looking

statements are reasonable as and when made, they involve risks and

uncertainties that are difficult to predict and, in many cases,

beyond Diamondback’s control. Accordingly, forward-looking

statements are not guarantees of future performance and

Diamondback’s actual outcomes could differ materially from what

Diamondback has expressed in its forward-looking statements.

Factors that could cause the outcomes to differ

materially include (but are not limited to) the following: changes

in supply and demand levels for oil, natural gas, and natural gas

liquids, and the resulting impact on the price for those

commodities; the impact of public health crises, including epidemic

or pandemic diseases and any related company or government policies

or actions; actions taken by the members of OPEC and Russia

affecting the production and pricing of oil, as well as other

domestic and global political, economic, or diplomatic

developments, including any impact of the ongoing war in Ukraine

and the Israel-Hamas war on the global energy markets and

geopolitical stability; instability in the financial markets;

inflationary pressures; higher interest rates and their impact on

the cost of capital; regional supply and demand factors, including

delays, curtailment delays or interruptions of production, or

governmental orders, rules or regulations that impose production

limits; federal and state legislative and regulatory initiatives

relating to hydraulic fracturing, including the effect of existing

and future laws and governmental regulations; physical and

transition risks relating to climate change; those risks described

in Item 1A of Diamondback’s Annual Report on Form 10-K, filed with

the SEC on February 22, 2024, and those risks disclosed in its

subsequent filings on Forms 10-Q and 8-K, which can be obtained

free of charge on the SEC’s website at http://www.sec.gov and

Diamondback’s website at www.diamondbackenergy.com/investors.

In light of these factors, the events

anticipated by Diamondback’s forward-looking statements may not

occur at the time anticipated or at all. Moreover, Diamondback

operates in a very competitive and rapidly changing environment and

new risks emerge from time to time. Diamondback cannot predict all

risks, nor can it assess the impact of all factors on its business

or the extent to which any factor, or combination of factors, may

cause actual results to differ materially from those anticipated by

any forward-looking statements it may make. Accordingly, you should

not place undue reliance on any forward-looking statements. All

forward-looking statements speak only as of the date of this letter

or, if earlier, as of the date they were made. Diamondback does not

intend to, and disclaims any obligation to, update or revise any

forward-looking statements unless required by applicable law.

|

|

|

Diamondback Energy, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(unaudited, in millions, except share

amounts) |

|

|

|

|

|

|

|

September 30, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash and cash equivalents ($169 million and $26 million related to

Viper) |

$ |

370 |

|

|

$ |

582 |

|

|

Restricted cash |

|

3 |

|

|

|

3 |

|

|

Accounts receivable: |

|

|

|

|

Joint interest and other, net |

|

233 |

|

|

|

192 |

|

|

Oil and natural gas sales, net ($109 million and $109 million

related to Viper) |

|

1,197 |

|

|

|

654 |

|

|

Inventories |

|

126 |

|

|

|

63 |

|

|

Derivative instruments |

|

42 |

|

|

|

17 |

|

|

Prepaid expenses and other current assets |

|

51 |

|

|

|

110 |

|

|

Total current assets |

|

2,022 |

|

|

|

1,621 |

|

| Property and equipment: |

|

|

|

|

Oil and natural gas properties, full cost method of accounting

($21,971 million and $8,659 million excluded from amortization at

September 30, 2024 and December 31, 2023, respectively)

($4,771 million and $4,629 million related to Viper and $1,623

million and $1,769 million excluded from amortization related to

Viper) |

|

79,718 |

|

|

|

42,430 |

|

|

Other property, equipment and land |

|

1,417 |

|

|

|

673 |

|

|

Accumulated depletion, depreciation, amortization and impairment

($1,016 million and $866 million related to Viper) |

|

(18,082 |

) |

|

|

(16,429 |

) |

|

Property and equipment, net |

|

63,053 |

|

|

|

26,674 |

|

| Funds held in escrow |

|

43 |

|

|

|

— |

|

| Equity method investments |

|

377 |

|

|

|

529 |

|

| Derivative instruments |

|

38 |

|

|

|

1 |

|

| Deferred income taxes,

net |

|

62 |

|

|

|

45 |

|

| Investment in real estate,

net |

|

81 |

|

|

|

84 |

|

| Other assets |

|

71 |

|

|

|

47 |

|

|

Total assets |

$ |

65,747 |

|

|

$ |

29,001 |

|

|

Liabilities and Stockholders’ Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable - trade |

$ |

198 |

|

|

$ |

261 |

|

|

Accrued capital expenditures |

|

641 |

|

|

|

493 |

|

|

Current maturities of long-term debt |

|

1,000 |

|

|

|

— |

|

|

Other accrued liabilities |

|

857 |

|

|

|

475 |

|

|

Revenues and royalties payable |

|

1,444 |

|

|

|

764 |

|

|

Derivative instruments |

|

34 |

|

|

|

86 |

|

|

Income taxes payable |

|

289 |

|

|

|

29 |

|

|

Total current liabilities |

|

4,463 |

|

|

|

2,108 |

|

| Long-term debt ($822 million

and $1,083 million related to Viper) |

|

11,923 |

|

|

|

6,641 |

|

| Derivative instruments |

|

79 |

|

|

|

122 |

|

| Asset retirement

obligations |

|

493 |

|

|

|

239 |

|

| Deferred income taxes |

|

9,952 |

|

|

|

2,449 |

|

| Other long-term

liabilities |

|

18 |

|

|

|

12 |

|

|

Total liabilities |

|

26,928 |

|

|

|

11,571 |

|

| Stockholders’ equity: |

|

|

|

|

Common stock, $0.01 par value; 800,000,000 shares authorized;

292,742,664 and 178,723,871 shares issued and outstanding at

September 30, 2024 and December 31, 2023,

respectively |

|

3 |

|

|

|

2 |

|

|

Additional paid-in capital |

|

34,007 |

|

|

|

14,142 |

|

|

Retained earnings (accumulated deficit) |

|

3,427 |

|

|

|

2,489 |

|

|

Accumulated other comprehensive income (loss) |

|

(8 |

) |

|

|

(8 |

) |

|

Total Diamondback Energy, Inc. stockholders’ equity |

|

37,429 |

|

|

|

16,625 |

|

| Non-controlling interest |

|

1,390 |

|

|

|

805 |

|

|

Total equity |

|

38,819 |

|

|

|

17,430 |

|

|

Total liabilities and stockholders' equity |

$ |

65,747 |

|

|

$ |

29,001 |

|

|

|

|

Diamondback Energy, Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(unaudited, $ in millions except per share data, shares in

thousands) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenues: |

|

|

|

|

|

|

|

|

Oil, natural gas and natural gas liquid sales |

$ |

2,354 |

|

|

$ |

2,265 |

|

|

$ |

6,629 |

|

|

$ |

6,063 |

|

|

Sales of purchased oil |

|

282 |

|

|

|

59 |

|

|

|

698 |

|

|

|

59 |

|

|

Other operating income |

|

9 |

|

|

|

16 |

|

|

|

28 |

|

|

|

62 |

|

|

Total revenues |

|

2,645 |

|

|

|

2,340 |

|

|

|

7,355 |

|

|

|

6,184 |

|

| Costs and

expenses: |

|

|

|

|

|

|

|

|

Lease operating expenses |

|

316 |

|

|

|

226 |

|

|

|

825 |

|

|

|

618 |

|

|

Production and ad valorem taxes |

|

153 |

|

|

|

118 |

|

|

|

413 |

|

|

|

421 |

|

|

Gathering, processing and transportation |

|

102 |

|

|

|

73 |

|

|

|

261 |

|

|

|

209 |

|

|

Purchased oil expense |

|

280 |

|

|

|

59 |

|

|

|

696 |

|

|

|

59 |

|

|

Depreciation, depletion, amortization and accretion |

|

742 |

|

|

|

442 |

|

|

|

1,694 |

|

|

|

1,277 |

|

|

General and administrative expenses |

|

49 |

|

|

|

34 |

|

|

|

141 |

|

|

|

111 |

|

|

Merger and integration expense |

|

258 |

|

|

|

1 |

|

|

|

273 |

|

|

|

11 |

|

|

Other operating expenses |

|

35 |

|

|

|

47 |

|

|

|

68 |

|

|

|

113 |

|

|

Total costs and expenses |

|

1,935 |

|

|

|

1,000 |

|

|

|

4,371 |

|

|

|

2,819 |

|

| Income (loss) from

operations |

|

710 |

|

|

|

1,340 |

|

|

|

2,984 |

|

|

|

3,365 |

|

| Other income

(expense): |

|

|

|

|

|

|

|

|

Interest expense, net |

|

(18 |

) |

|

|

(37 |

) |

|

|

(101 |

) |

|

|

(130 |

) |

|

Other income (expense), net |

|

89 |

|

|

|

33 |

|

|

|

87 |

|

|

|

61 |

|

|

Gain (loss) on derivative instruments, net |

|

131 |

|

|

|

(76 |

) |

|

|

101 |

|

|

|

(358 |

) |

|

Gain (loss) on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

2 |

|

|

|

(4 |

) |

|

Income (loss) from equity investments, net |

|

6 |

|

|

|

9 |

|

|

|

23 |

|

|

|

39 |

|

|

Total other income (expense), net |

|

208 |

|

|

|

(71 |

) |

|

|

112 |

|

|

|

(392 |

) |

| Income (loss) before

income taxes |

|

918 |

|

|

|

1,269 |

|

|

|

3,096 |

|

|

|

2,973 |

|

|

Provision for (benefit from) income taxes |

|

210 |

|

|

|

276 |

|

|

|

685 |

|

|

|

648 |

|

| Net income

(loss) |

|

708 |

|

|

|

993 |

|

|

|

2,411 |

|

|

|

2,325 |

|

|

Net income (loss) attributable to non-controlling interest |

|

49 |

|

|

|

78 |

|

|

|

147 |

|

|

|

142 |

|

| Net income (loss)

attributable to Diamondback Energy, Inc. |

$ |

659 |

|

|

$ |

915 |

|

|

$ |

2,264 |

|

|

$ |

2,183 |

|

| |

|

|

|

|

|

|

|

| Earnings (loss) per

common share: |

|

|

|

|

|

|

|

|

Basic |

$ |

3.19 |

|

|

$ |

5.07 |

|

|

$ |

12.00 |

|

|

$ |

12.01 |

|

|

Diluted |

$ |

3.19 |

|

|

$ |

5.07 |

|

|

$ |

12.00 |

|

|

$ |

12.01 |

|

| Weighted average

common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

204,730 |

|

|

|

178,872 |

|

|

|

187,253 |

|

|

|

180,400 |

|

|

Diluted |

|

204,730 |

|

|

|

178,872 |

|

|

|

187,253 |

|

|

|

180,400 |

|

|

|

|

Diamondback Energy, Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(unaudited, in millions) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Cash flows from operating

activities: |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

708 |

|

|

$ |

993 |

|

|

$ |

2,411 |

|

|

$ |

2,325 |

|

|

Adjustments to reconcile net income (loss) to net cash provided by

(used in) operating activities: |

|

|

|

|

|

|

|

|

Provision for (benefit from) deferred income taxes |

|

51 |

|

|

|

10 |

|

|

|

180 |

|

|

|

185 |

|

|

Depreciation, depletion, amortization and accretion |

|

742 |

|

|

|

442 |

|

|

|

1,694 |

|

|

|

1,277 |

|

|

(Gain) loss on extinguishment of debt |

|

— |

|

|

|

— |

|

|

|

(2 |

) |

|

|

4 |

|

|

(Gain) loss on derivative instruments, net |

|

(131 |

) |

|

|

76 |

|

|

|

(101 |

) |

|

|

358 |

|

|

Cash received (paid) on settlement of derivative instruments |

|

(4 |

) |

|

|

(24 |

) |

|

|

(36 |

) |

|

|

(62 |

) |

|

(Income) loss from equity investment, net |

|

(6 |

) |

|

|

(9 |

) |

|

|

(23 |

) |

|

|

(39 |

) |

|

Equity-based compensation expense |

|

16 |

|

|

|

13 |

|

|

|

49 |

|

|

|

40 |

|

|

Other |

|

20 |

|

|

|

3 |

|

|

|

77 |

|

|

|

(23 |

) |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

106 |

|

|

|

(256 |

) |

|

|

61 |

|

|

|

(218 |

) |

|

Income tax receivable |

|

— |

|

|

|

103 |

|

|

|

12 |

|

|

|

267 |

|

|

Prepaid expenses and other current assets |

|

(11 |

) |

|

|

(8 |

) |

|

|

78 |

|

|

|

5 |

|

|

Accounts payable and accrued liabilities |

|

(395 |

) |

|

|

(28 |

) |

|

|

(490 |

) |

|

|

46 |

|

|

Income taxes payable |

|

(36 |

) |

|

|

23 |

|

|

|

(51 |

) |

|

|

4 |

|

|

Revenues and royalties payable |

|

95 |

|

|

|

53 |

|

|

|

109 |

|

|

|

139 |

|

|

Other |

|

54 |

|

|

|

(33 |

) |

|

|

104 |

|

|

|

(12 |

) |

|

Net cash provided by (used in) operating

activities |

|

1,209 |

|

|

|

1,358 |

|

|

|

4,072 |

|

|

|

4,296 |

|

| Cash flows from investing

activities: |

|

|

|

|

|

|

|

|

Drilling, completions, infrastructure and midstream additions to

oil and natural gas properties |

|

(688 |

) |

|

|

(684 |

) |

|

|

(1,934 |

) |

|

|

(2,052 |

) |

|

Property acquisitions |

|

(7,791 |

) |

|

|

(168 |

) |

|

|

(7,994 |

) |

|

|

(1,193 |

) |

|

Proceeds from sale of assets |

|

207 |

|

|

|

868 |

|

|

|

459 |

|

|

|

1,400 |

|

|

Other |

|

106 |

|

|

|

(1 |

) |

|

|

103 |

|

|

|

(14 |

) |

|

Net cash provided by (used in) investing

activities |

|

(8,166 |

) |

|

|

15 |

|

|

|

(9,366 |

) |

|

|

(1,859 |

) |

| Cash flows from financing

activities: |

|

|

|

|

|

|

|

|

Proceeds under term loan agreement |

|

1,000 |

|

|

|

— |

|

|

|

1,000 |

|

|

|

— |

|

|

Proceeds from borrowings under credit facilities |

|

1,011 |

|

|

|

1,015 |

|

|

|

1,185 |

|

|

|

4,466 |

|

|

Repayments under credit facilities |

|

(1,073 |

) |

|

|

(1,332 |

) |

|

|

(1,333 |

) |

|

|

(4,368 |

) |

|

Proceeds from senior notes |

|

— |

|

|

|

— |

|

|

|

5,500 |

|

|

|

— |

|

|

Repayment of senior notes |

|

— |

|

|

|

— |

|

|

|

(25 |

) |

|

|

(134 |

) |

|

Repurchased shares under buyback program |

|

(515 |

) |

|

|

(56 |

) |

|

|

(557 |

) |

|

|

(709 |

) |

|

Repurchased shares/units under Viper's buyback program |

|

— |

|

|

|

(10 |

) |

|

|

— |

|

|

|

(67 |

) |

|

Proceeds from partial sale of investment in Viper Energy, Inc. |

|

— |

|

|

|

— |

|

|

|

451 |

|

|

|

— |

|

|

Net proceeds from Viper's issuance of common stock |

|

476 |

|

|

|

— |

|

|

|

476 |

|

|

|

— |

|

|

Dividends paid to stockholders |

|

(416 |

) |

|

|

(149 |

) |

|

|

(1,316 |

) |

|

|

(841 |

) |

|

Dividends/distributions to non-controlling interest |

|

(59 |

) |

|

|

(25 |

) |

|

|

(157 |

) |

|

|

(84 |

) |

|

Other |

|

(5 |

) |

|

|

(7 |

) |

|

|

(142 |

) |

|

|

(34 |

) |

|

Net cash provided by (used in) financing

activities |

|

419 |

|

|

|

(564 |

) |

|

|

5,082 |

|

|

|

(1,771 |

) |

| Net increase (decrease) in

cash and cash equivalents |

|

(6,538 |

) |

|

|

809 |

|

|

|

(212 |

) |

|

|

666 |

|

| Cash, cash equivalents and

restricted cash at beginning of period |

|

6,911 |

|

|

|

21 |

|

|

|

585 |

|

|

|

164 |

|

| Cash, cash equivalents and

restricted cash at end of period |

$ |

373 |

|

|

$ |

830 |

|

|

$ |

373 |

|

|

$ |

830 |

|

|

|

|

Diamondback Energy, Inc. |

|

Selected Operating Data |

|

(unaudited) |

| |

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, 2024 |

|

June 30, 2024 |

|

September 30, 2023 |

| Production

Data: |

|

|

|

|

|

|

Oil (MBbls) |

|

29,537 |

|

|

|

25,129 |

|

|

|

24,482 |

|

|

Natural gas (MMcf) |

|

66,519 |

|

|

|

51,310 |

|

|

|

49,423 |

|

|

Natural gas liquids (MBbls) |

|

11,918 |

|

|

|

9,514 |

|

|

|

8,943 |

|

|

Combined volumes (MBOE)(1) |

|

52,541 |

|

|

|

43,195 |

|

|

|

41,662 |

|

| |

|

|

|

|

|

|

Daily oil volumes (BO/d) |

|

321,054 |

|

|

|

276,143 |

|

|

|

266,109 |

|

|

Daily combined volumes (BOE/d) |

|

571,098 |

|

|

|

474,670 |

|

|

|

452,848 |

|

| |

|

|

|

|

|

| Average

Prices: |

|

|

|

|

|

|

Oil ($ per Bbl) |

$ |

73.13 |

|

|

$ |

79.51 |

|

|

$ |

81.57 |

|

|

Natural gas ($ per Mcf) |

$ |

(0.26 |

) |

|

$ |

0.10 |

|

|

$ |

1.62 |

|

|

Natural gas liquids ($ per Bbl) |

$ |

17.70 |

|

|

$ |

17.97 |

|

|

$ |

21.02 |

|

|

Combined ($ per BOE) |

$ |

44.80 |

|

|

$ |

50.33 |

|

|

$ |

54.37 |

|

| |

|

|

|

|

|

|

Oil, hedged ($ per Bbl)(2) |

$ |

72.32 |

|

|

$ |

78.55 |

|

|

$ |

80.51 |

|

|

Natural gas, hedged ($ per Mcf)(2) |

$ |

0.60 |

|

|

$ |

1.03 |

|

|

$ |

1.62 |

|

|

Natural gas liquids, hedged ($ per Bbl)(2) |

$ |

17.70 |

|

|

$ |

17.97 |

|

|

$ |

21.02 |

|

|

Average price, hedged ($ per BOE)(2) |

$ |

45.43 |

|

|

$ |

50.89 |

|

|

$ |

53.74 |

|

| |

|

|

|

|

|

| Average Costs per

BOE: |

|

|

|

|

|

|

Lease operating expenses |

$ |

6.01 |

|

|

$ |

5.88 |

|

|

$ |

5.42 |

|

|

Production and ad valorem taxes |

|

2.91 |

|

|

|

3.26 |

|

|

|

2.83 |

|

|

Gathering, processing and transportation expense |

|

1.94 |

|

|

|

1.90 |

|

|

|

1.75 |

|

|

General and administrative - cash component |

|

0.63 |

|

|

|

0.63 |

|

|

|

0.51 |

|

|

Total operating expense - cash |

$ |

11.49 |

|

|

$ |

11.67 |

|

|

$ |

10.51 |

|

| |

|

|

|

|

|

|

General and administrative - non-cash component |

$ |

0.30 |

|

|

$ |

0.44 |

|

|

$ |

0.31 |

|

|

Depreciation, depletion, amortization and accretion per BOE |

$ |

14.12 |

|

|

$ |

11.18 |

|

|

$ |

10.61 |

|

|

Interest expense, net |

$ |

0.34 |

|

|

$ |

1.02 |

|

|

$ |

0.89 |

|

(1) Bbl equivalents are

calculated using a conversion rate of six Mcf per one

Bbl.(2) Hedged prices reflect the effect of our

commodity derivative transactions on our average sales prices and

include gains and losses on cash settlements for matured commodity

derivatives, which we do not designate for hedge accounting. Hedged

prices exclude gains or losses resulting from the early settlement

of commodity derivative contracts.

NON-GAAP FINANCIAL MEASURES

ADJUSTED EBITDA

Adjusted EBITDA is a supplemental non-GAAP

financial measure that is used by management and external users of

our financial statements, such as industry analysts, investors,

lenders and rating agencies. The Company defines Adjusted EBITDA as

net income (loss) attributable to Diamondback Energy, Inc., plus

net income (loss) attributable to non-controlling interest ("net

income (loss)") before non-cash (gain) loss on derivative

instruments, net, interest expense, net, depreciation, depletion,

amortization and accretion, depreciation and interest expense

related to equity method investments, (gain) loss on extinguishment

of debt, if any, non-cash equity-based compensation expense,

capitalized equity-based compensation expense, merger and

integration expenses, other non-cash transactions and provision for

(benefit from) income taxes, if any. Adjusted EBITDA is not a

measure of net income as determined by United States generally

accepted accounting principles ("GAAP"). Management believes

Adjusted EBITDA is useful because the measure allows it to more

effectively evaluate the Company’s operating performance and

compare the results of its operations from period to period without

regard to its financing methods or capital structure. The Company

adds the items listed above to net income (loss) to determine

Adjusted EBITDA because these amounts can vary substantially from

company to company within its industry depending upon accounting

methods and book values of assets, capital structures and the

method by which the assets were acquired. Further, the Company

excludes the effects of significant transactions that may affect

earnings but are unpredictable in nature, timing and amount,

although they may recur in different reporting periods. Adjusted

EBITDA should not be considered as an alternative to, or more

meaningful than, net income as determined in accordance with GAAP

or as an indicator of the Company’s operating performance or

liquidity. Certain items excluded from Adjusted EBITDA are

significant components in understanding and assessing a company’s

financial performance, such as a company’s cost of capital and tax

structure, as well as the historic costs of depreciable assets. The

Company’s computation of Adjusted EBITDA may not be comparable to

other similarly titled measures of other companies or to such

measure in our credit facility or any of our other contracts.

The following tables present a reconciliation of

the GAAP financial measure of net income (loss) attributable to

Diamondback Energy, Inc. to the non-GAAP financial measure of

Adjusted EBITDA:

|

Diamondback Energy, Inc. |

|

Reconciliation of Net Income (Loss) to Adjusted

EBITDA |

|

(unaudited, in millions) |

| |

|

|

|

|

|

| |

Three Months Ended |

| |

September 30, 2024 |

|

June 30, 2024 |

|

September 30, 2023 |

|

Net income (loss) attributable to Diamondback Energy,

Inc. |

$ |

659 |

|

|

$ |

837 |

|

|

$ |

915 |

|

|

Net income (loss) attributable to non-controlling interest |

|

49 |

|

|

|

57 |

|

|

|

78 |

|

| Net income

(loss) |

|

708 |

|

|

|

894 |

|

|

|

993 |

|

|

Non-cash (gain) loss on derivative instruments, net |

|

(135 |

) |

|

|

(46 |

) |

|

|

52 |

|

|

Interest expense, net |

|

18 |

|

|

|

44 |

|

|

|

37 |

|

|

Depreciation, depletion, amortization and accretion |

|

742 |

|

|

|

483 |

|

|

|

442 |

|

|

Depreciation and interest expense related to equity method

investments |

|

15 |

|

|

|

23 |

|

|

|

18 |

|

|

Non-cash equity-based compensation expense |

|

24 |

|

|

|

26 |

|

|

|

21 |

|

|

Capitalized equity-based compensation expense |

|

(8 |

) |

|

|

(7 |

) |

|

|

(8 |

) |

|

Merger and integration expenses |

|

258 |

|

|

|

3 |

|

|

|

1 |

|

|

Other non-cash transactions |

|

(72 |

) |

|

|

6 |

|

|

|

(12 |

) |

|

Provision for (benefit from) income taxes |

|

210 |

|

|

|

252 |

|

|

|

276 |

|

| Consolidated Adjusted

EBITDA |

|

1,760 |

|

|

|

1,678 |

|

|

|

1,820 |

|

|

Less: Adjustment for non-controlling interest |

|

104 |

|

|

|

103 |

|

|

|

78 |

|

| Adjusted EBITDA

attributable to Diamondback Energy, Inc. |

$ |

1,656 |

|

|

$ |

1,575 |

|

|

$ |

1,742 |

|

ADJUSTED NET INCOME

Adjusted net income is a non-GAAP financial

measure equal to net income (loss) attributable to Diamondback

Energy, Inc. plus net income (loss) attributable to non-controlling

interest ("net income (loss)") adjusted for non-cash (gain) loss on

derivative instruments, net, (gain) loss on extinguishment of debt,

if any, merger and integration expense, other non-cash transactions

and related income tax adjustments, if any. The Company’s

computation of adjusted net income may not be comparable to other

similarly titled measures of other companies or to such measure in

our credit facility or any of our other contracts. Management

believes adjusted net income helps investors in the oil and natural

gas industry to measure and compare the Company's performance to

other oil and natural gas companies by excluding from the

calculation items that can vary significantly from company to

company depending upon accounting methods, the book value of assets

and other non-operational factors. Further, in order to allow

investors to compare the Company's performance across periods, the

Company excludes the effects of significant transactions that may

affect earnings but are unpredictable in nature, timing and amount,

although they may recur in different reporting periods.

The following table presents a reconciliation of

the GAAP financial measure of net income (loss) attributable to

Diamondback Energy, Inc. to the non-GAAP measure of adjusted net

income:

|

Diamondback Energy, Inc. |

|

Adjusted Net Income |

|

(unaudited, $ in millions except per share data, shares in

thousands) |

| |

|

| |

Three Months Ended September 30, 2024 |

| |

Amounts |

|

Amounts PerDiluted Share |

|

Net income (loss) attributable to Diamondback Energy,

Inc.(1) |

$ |

659 |

|

|

$ |

3.19 |

|

|

Net income (loss) attributable to non-controlling interest |

|

49 |

|

|

|

0.24 |

|

| Net income

(loss)(1) |

|

708 |

|

|

|

3.43 |

|

|

Non-cash (gain) loss on derivative instruments, net |

|

(135 |

) |

|

|

(0.66 |

) |

|

Merger and integration expense |

|

258 |

|

|

|

1.26 |

|

|

Other non-cash transactions |

|

(72 |

) |

|

|

(0.35 |

) |

|

Adjusted net income excluding above items(1) |

|

759 |

|

|

|

3.68 |

|

|

Income tax adjustment for above items |

|

(12 |

) |

|

|

(0.06 |

) |

| Adjusted net

income(1) |

|

747 |

|

|

|

3.62 |

|

|

Less: Adjusted net income attributable to non-controlling

interest |

|

49 |

|

|

|

0.24 |

|

| Adjusted net income

attributable to Diamondback Energy,

Inc.(1) |

$ |

698 |

|

|

$ |

3.38 |

|

| |

|

|

|

| Weighted average

common shares outstanding: |

|

|

|

|

Basic |

|

|

204,730 |

|

|

Diluted |

|

|

204,730 |

|

(1) The Company’s earnings (loss) per diluted

share amount has been computed using the two-class method in

accordance with GAAP. The two-class method is an earnings

allocation which reflects the respective ownership among holders of

common stock and participating securities. Diluted earnings per

share using the two-class method is calculated as (i) net income

attributable to Diamondback Energy, Inc, (ii) less the reallocation

of $6 million in earnings attributable to participating securities,

(iii) divided by diluted weighted average common shares

outstanding.

OPERATING CASH FLOW BEFORE WORKING

CAPITAL CHANGES AND FREE CASH FLOW

Operating cash flow before working capital

changes, which is a non-GAAP financial measure, represents net cash

provided by operating activities as determined under GAAP without

regard to changes in operating assets and liabilities. The Company

believes operating cash flow before working capital changes is a

useful measure of an oil and natural gas company’s ability to

generate cash used to fund exploration, development and acquisition

activities and service debt or pay dividends. The Company also uses

this measure because changes in operating assets and liabilities

relate to the timing of cash receipts and disbursements that the

Company may not control and may not relate to the period in which

the operating activities occurred. This allows the Company to

compare its operating performance with that of other companies

without regard to financing methods and capital structure.

Free Cash Flow, which is a non-GAAP financial

measure, is cash flow from operating activities before changes in

working capital in excess of cash capital expenditures. The Company

believes that Free Cash Flow is useful to investors as it provides

measures to compare both cash flow from operating activities and

additions to oil and natural gas properties across periods on a

consistent basis as adjusted for non-recurring tax impacts from

divestitures, merger and integration expenses, the early

termination of derivative contracts and settlements of treasury

locks. These measures should not be considered as an alternative

to, or more meaningful than, net cash provided by operating

activities as an indicator of operating performance. The Company's

computation of Free Cash Flow may not be comparable to other

similarly titled measures of other companies. The Company uses Free

Cash Flow to reduce debt, as well as return capital to stockholders

as determined by the Board of Directors.

The following tables present a reconciliation of the GAAP

financial measure of net cash provided by operating activities to

the non-GAAP measure of operating cash flow before working capital

changes and to the non-GAAP measure of Free Cash Flow:

|

Diamondback Energy, Inc. |

|

Operating Cash Flow Before Working Capital Changes and Free

Cash Flow |

|

(unaudited, in millions) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net cash provided by

operating activities |

$ |

1,209 |

|

|

$ |

1,358 |

|

|

$ |

4,072 |

|

|

$ |

4,296 |

|

| Less: Changes in cash due to

changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

106 |

|

|

|

(256 |

) |

|

|

61 |

|

|

|

(218 |

) |

|

Income tax receivable |

|

— |

|

|

|

103 |

|

|

|

12 |

|

|

|

267 |

|

|

Prepaid expenses and other current assets |

|

(11 |

) |

|

|

(8 |

) |

|

|

78 |

|

|

|

5 |

|

|

Accounts payable and accrued liabilities |

|

(395 |

) |

|

|

(28 |

) |

|

|

(490 |

) |

|

|

46 |

|

|

Income taxes payable |

|

(36 |

) |

|

|

23 |

|

|

|

(51 |

) |

|

|

4 |

|

|

Revenues and royalties payable |

|

95 |

|

|

|

53 |

|

|

|

109 |

|

|

|

139 |

|

|

Other |

|

54 |

|

|

|

(33 |

) |

|

|

104 |

|

|

|

(12 |

) |

| Total working capital

changes |

|

(187 |

) |

|

|

(146 |

) |

|

|

(177 |

) |

|

|

231 |

|

| Operating cash flow

before working capital changes |

|

1,396 |

|

|

|

1,504 |

|

|

|

4,249 |

|

|

|

4,065 |

|

|

Drilling, completions, infrastructure and midstream additions to

oil and natural gas properties |

|

(688 |

) |

|

|

(684 |

) |

|

|

(1,934 |

) |

|

|

(2,052 |

) |

| Total Cash

CAPEX |

|

(688 |

) |

|

|

(684 |

) |

|

|

(1,934 |

) |

|

|

(2,052 |

) |

| Free Cash

Flow |

|

708 |

|

|

|

820 |

|

|

|

2,315 |

|

|

|

2,013 |

|

|

Tax impact from divestitures(1) |

|

— |

|

|

|

64 |

|

|

|

— |

|

|

|

64 |

|

|

Merger and integration expenses |

|

258 |

|

|

|

— |

|

|

|

273 |

|

|

|

— |

|

|

Early termination of derivatives |

|

37 |

|

|

|

— |

|

|

|

37 |

|

|

|

— |

|

|

Treasury locks |

|

— |

|

|

|

— |

|

|

|

25 |

|

|

|

— |

|

| Adjusted Free Cash

Flow |

$ |

1,003 |

|

|

$ |

884 |

|

|

$ |

2,650 |

|

|

$ |

2,077 |

|

(1) Includes the tax impact for the disposal of

certain Midland Basin water assets and Delaware Basin oil gathering

assets.

NET DEBT

The Company defines the non-GAAP measure of net

debt as total debt (excluding debt issuance costs, discounts,

premiums and unamortized basis adjustments) less cash and cash

equivalents. Net debt should not be considered an alternative to,

or more meaningful than, total debt, the most directly comparable

GAAP measure. Management uses net debt to determine the Company's

outstanding debt obligations that would not be readily satisfied by

its cash and cash equivalents on hand. The Company believes this

metric is useful to analysts and investors in determining the

Company's leverage position because the Company has the ability to,

and may decide to, use a portion of its cash and cash equivalents

to reduce debt.

|

Diamondback Energy, Inc. |

|

Net Debt |

|

(unaudited, in millions) |

| |

|

|

|

|

|

|

|

|

|

|

|

| |

September 30,2024 |

|

Net

Q3PrincipalBorrowings/(Repayments) |

|

June 30,2024 |

|

March 31,2024 |

|

December 31,2023 |

|

September 30,2023 |

| |

(in millions) |

|

Diamondback Energy, Inc.(1) |

$ |

12,284 |

|

|

$ |

1,115 |

|

|

$ |

11,169 |

|

|

$ |

5,669 |

|

|

$ |

5,697 |

|

|

$ |

5,697 |

|

| Viper Energy, Inc.(1) |

|

830 |

|

|

|

(177 |

) |

|

|

1,007 |

|

|

|

1,103 |

|

|

|

1,093 |

|

|

|

680 |

|

| Total

debt |

|

13,114 |

|

|

$ |

938 |

|

|

|

12,176 |

|

|

|

6,772 |

|

|

|

6,790 |

|

|

|

6,377 |

|

|

Cash and cash equivalents |

|

(370 |

) |

|

|

|

|

(6,908 |

) |

|

|

(896 |

) |

|

|

(582 |

) |

|

|

(827 |

) |

| Net debt |

$ |

12,744 |

|

|

|

|

$ |

5,268 |

|

|

$ |

5,876 |

|

|

$ |

6,208 |

|

|

$ |

5,550 |

|

(1) Excludes debt issuance costs, discounts, premiums

and unamortized basis adjustments.

DERIVATIVES

As of November 1, 2024, the Company had the

following outstanding consolidated derivative contracts, including

derivative contracts at Viper Energy, Inc. The Company’s derivative

contracts are based upon reported settlement prices on commodity

exchanges, with crude oil derivative settlements based on New York

Mercantile Exchange West Texas Intermediate pricing and Crude Oil

Brent pricing and with natural gas derivative settlements based on

the New York Mercantile Exchange Henry Hub pricing. When

aggregating multiple contracts, the weighted average contract price

is disclosed.

| |

Crude Oil (Bbls/day, $/Bbl) |

|

|

Q4 2024 |

|

Q1 2025 |

|

Q2 2025 |

|

Q3 2025 |

|

Q4 2025 |

|

FY2026 |

|

Long Puts - Crude Brent Oil |

82,000 |

|

52,000 |

|

33,000 |

|

10,000 |

|

— |

|

— |

|

Long Put Price ($/Bbl) |

$57.44 |

|

$60.00 |

|

$60.00 |

|

$60.00 |

|

— |

|

— |

|

Deferred Premium ($/Bbl) |

$-1.52 |

|

$-1.48 |

|

$-1.50 |

|

$-1.63 |

|

— |

|

— |

|

Long Puts - WTI (Magellan East Houston) |

35,000 |

|

58,000 |

|

46,000 |

|

22,000 |

|

— |

|

— |

|

Long Put Price ($/Bbl) |

$57.57 |

|

$56.21 |

|

$55.22 |

|

$55.00 |

|

— |

|

— |

|

Deferred Premium ($/Bbl) |

$-1.61 |

|

$-1.58 |

|

$-1.56 |

|

$-1.64 |

|

— |

|

— |

|

Long Puts - WTI (Cushing) |

125,000 |

|

138,000 |

|

109,000 |

|

38,000 |

|

— |

|

— |

|

Long Put Price ($/Bbl) |

$57.28 |

|

$56.63 |

|

$55.73 |

|

$55.00 |

|

— |

|

— |

|

Deferred Premium ($/Bbl) |

$-1.61 |

|

$-1.58 |

|

$-1.56 |

|

$-1.50 |

|

— |

|

— |

|

Costless Collars - WTI (Cushing) |

46,000 |

|

13,000 |

|

— |

|

— |

|

— |

|

— |

|

Long Put Price ($/Bbl) |

$60.87 |

|

$60.00 |

|

— |

|

— |

|

— |

|

— |

|

Short Call Price ($/Bbl) |

$89.91 |

|

$89.55 |

|

— |

|

— |

|

— |

|

— |

|

Basis Swaps - WTI (Midland) |

43,000 |

|

58,000 |

|

45,000 |

|

45,000 |

|

45,000 |

|

— |

|

$1.18 |

|

$1.10 |

|

$1.08 |

|

$1.08 |

|

$1.08 |

|

— |

|

Roll Swaps - WTI |

40,000 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

$0.82 |

|

— |

|

— |

|

— |

|

— |

|

— |

| |

Natural Gas (Mmbtu/day, $/Mmbtu) |

|

|

Q4 2024 |

|

Q1 2025 |

|

Q2 2025 |

|

Q3 2025 |

|

Q4 2025 |

|

FY 2026 |

|

Costless Collars - Henry Hub |

398,261 |

|

690,000 |

|

630,000 |

|

630,000 |

|

630,000 |

|

80,000 |

|

Long Put Price ($/Mmbtu) |

$2.78 |

|

$2.53 |

|

$2.49 |

|

$2.49 |

|

$2.49 |

|

$2.50 |

|

Ceiling Price ($/Mmbtu) |

$6.53 |

|

$5.41 |

|

$5.46 |

|

$5.46 |

|

$5.46 |

|

$5.95 |

|

Natural Gas Swaps - Henry Hub |

13,370 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

$3.23 |

|

— |

|

— |

|

— |

|

— |

|

— |

|

Natural Gas Basis Swaps - Waha Hub |

471,630 |

|

650,000 |

|

590,000 |

|

590,000 |

|

590,000 |

|

10,000 |

|

$-1.11 |

|

$-0.80 |

|

$-0.83 |

|

$-0.83 |

|

$-0.83 |

|

$-1.25 |

Investor Contact:Adam Lawlis+1

432.221.7467alawlis@diamondbackenergy.com

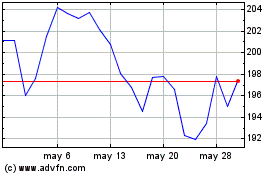

Diamondback Energy (NASDAQ:FANG)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Diamondback Energy (NASDAQ:FANG)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024