0001434316false00014343162024-11-122024-11-12

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): November 12, 2024 |

FATE THERAPEUTICS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-36076 |

65-1311552 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

12278 Scripps Summit Drive |

|

San Diego, California |

|

92131 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: 858 875-1800 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.001 par value |

|

FATE |

|

Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On November 12, 2024, Fate Therapeutics, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1.

The information in this Item 2.02 of this Current Report on Form 8-K, including Exhibit 99.1, is being furnished and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (“Exchange Act”) or otherwise subject to the liability of that section, nor shall such information be deemed incorporated by reference in any filing under the Exchange Act or the Securities Act of 1933, as amended, regardless of the general incorporation language of such filing, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

FATE THERAPEUTICS, INC. |

|

|

|

|

Date: |

November 12, 2024 |

By: |

/s/ J. Scott Wolchko |

|

|

|

J. Scott Wolchko

President and Chief Executive Officer |

Fate Therapeutics Reports Third Quarter 2024 Financial Results and Business Updates

Initial Clinical Data from Phase 1 Autoimmunity Study of FT819 1XX CAR T-cell Product Candidate to be Presented in 4Q24; Second Treatment Arm Adding FT819 to Maintenance Therapy without Conditioning Chemotherapy Opened for Enrollment

FT522 Multi-indication IND Application for Conditioning-free Treatment of B Cell-mediated Autoimmune Diseases Allowed by FDA; Initial Phase 1 Clinical Data in B-cell Lymphoma to be Presented at ACR Convergence

Initial Low-Dose Cohort of FT825 / ONO-8250 Shows Favorable Safety Profile in Phase 1 Solid Tumor Study; Peripheral Blood from First Three Patients Demonstrates CAR T-cell Expansion with Maintenance of Activated State

$331 Million in Cash, Cash Equivalents and Investments with Projected Operating Runway

through YE26

San Diego, CA – November 12, 2024 – Fate Therapeutics, Inc. (NASDAQ: FATE), a clinical-stage biopharmaceutical company dedicated to bringing a first-in-class pipeline of induced pluripotent stem cell (iPSC)-derived cellular immunotherapies to patients with cancer and autoimmune diseases, today reported business highlights and financial results for the third quarter ended September 30, 2024.

“We look forward to sharing initial Phase 1 clinical data of our off-the-shelf FT819 CAR T-cell product candidate in systemic lupus erythematosus at ACR Convergence and ASH. We continue to make great strides in our pursuit of therapeutic differentiation for patients with B cell-mediated autoimmune diseases, and patient enrollment is ongoing assessing FT819 with fludarabine-free conditioning as well as in a new treatment arm as add-on to maintenance therapy without conditioning chemotherapy,” said Scott Wolchko, President and Chief Executive Officer of Fate Therapeutics. “In addition, we are very pleased with the Phase 1 study design allowed by the FDA for our FT522 ADR-armed CAR NK cell product candidate in autoimmunity, which is designed to assess multiple doses of FT522 without conditioning chemotherapy across a basket of B cell-mediated autoimmune diseases, and we look forward to presenting an initial look at the clinical and translational data of FT522 in B-cell lymphoma at ACR.”

FT819 iPSC-derived 1XX CAR T-cell Program

•Three Patients Treated in Phase 1 Autoimmunity Study using Fludarabine-free Conditioning. The ongoing multi-center, Phase 1 clinical trial for patients with moderate-to-severe systemic lupus erythematosus (SLE) is designed to evaluate the safety, pharmacokinetics, and anti-B cell activity of FT819, the Company’s off-the-shelf CD8αβ+ T-cell product candidate that incorporates a CD19-targeted chimeric antigen receptor (CAR) with a novel 1XX costimulatory domain into the T-cell receptor alpha constant (TRAC) locus (NCT06308978). The first three patients, all of whom presented with active lupus

nephritis (LN) despite having been treated with multiple standard-of-care therapies, received fludarabine-free conditioning consisting of either bendamustine alone or cyclophosphamide alone, followed by a single dose of FT819 at 360 million cells (Regimen A). All three patients remain on-study, and there have been no dose-limiting toxicities (DLTs) and no events of any grade of cytokine release syndrome (CRS), immune effector-cell associated neurotoxicity syndrome (ICANS), or graft-versus-host disease (GvHD). The Company plans to present clinical and translational data from the first three patients at the American Society of Hematology (ASH) Annual Meeting being held in San Diego, CA on December 7-10.

•First SLE Patient Case Study to be Presented at ACR Convergence. The first patient treated in the ongoing FT819 Phase 1 Autoimmunity study was a 27 year-old woman diagnosed with LN over ten years ago who received fludarabine-free conditioning followed by a single dose of FT819 at 360 million cells. The first patient has completed six-month follow-up and remains on-study. The Company plans to present clinical and translational data from the first patient at the American College of Rheumatology (ACR) Convergence being held in Washington, D.C. on November 16-19.

•Initiated Second Treatment Arm Adding FT819 to Maintenance Therapy without Conditioning. The Company amended the clinical protocol of its FT819 Phase 1 Autoimmunity study to include a second treatment arm (Regimen B) to assess the safety, pharmacokinetics, and anti-B cell activity of a single dose of FT819 as an add-on to maintenance therapy without conditioning chemotherapy in patients with SLE. The new arm is open for enrollment at a starting cell dose of 360 million cells, and is being conducted in parallel with Regimen A.

FT825 / ONO-8250 iPSC-derived CAR T-cell Program

•Initial Phase 1 Clinical Data Presented at 2024 SITC. Under its collaboration with Ono Pharmaceutical Co., Ltd. (Ono), the Company is conducting a multi-center, Phase 1 study to assess the safety, pharmacokinetics, and activity of FT825 / ONO-8250, a multiplexed-engineered CAR T-cell product candidate targeting human epidermal growth factor receptor 2 (HER2), in patients with advanced solid tumors (NCT06241456). At the 2024 Society of Immunotherapy of Cancer (SITC) 39thAnnual Meeting, the Company presented initial clinical data from three heavily pre-treated patients, all of whom were previously treated with at least five prior lines of therapy including HER2-targeted therapy. Each patient was administered conditioning chemotherapy and a single dose of FT825 / ONO-8250 at the first dose level of 100 million cells. As of a data cutoff date of October 25, 2024, FT825 / ONO-8250 demonstrated a favorable safety profile with no DLTs and no events of any grade of CRS, ICANS, or GvHD. In addition, at Day 8 following treatment, peak CAR T-cell expansion was observed and phenotyping of FT825 / ONO-8250 sourced from the patients’ peripheral blood was indicative of an activated state (as evidenced by high levels of Granzyme B expression and maintenance of CAR expression) with no evidence of exhaustion (as evidenced by low levels of PD-1 and TIM3 expression). Enrollment is currently ongoing at the second dose level of 300 million cells as monotherapy and at the first dose level of 100 million cells in combination with epidermal growth factor receptor (EGFR)-targeted monoclonal antibody therapy.

•New Preclinical Data Demonstrates Cancer-selectivity of Novel H2CasMab-2 CAR. FT825 / ONO-8250 incorporates seven synthetic controls of cell function including a novel cancer-selective H2CasMab-2 CAR, which has exhibited similar potency with greater specificity for cancer cells expressing HER2 compared to trastuzumab in preclinical studies. New preclinical data presented at SITC demonstrated potent HER2-specific, anti-tumor activity in both in vitro and in vivo settings with limited cytolytic

targeting of HER2+ normal cells. The on-tumor selectivity of FT825 / ONO-8250 was attributed to its incorporation of a novel HER2-targeted antigen binding domain, which was derived from a cancer-specific monoclonal antibody H2CasMab-2 (Kaneko et al., 2024), that was shown to differentially and preferentially recognize both locally misfolded HER2 and p95 truncation variants of HER2 as compared to trastuzumab.

FT522 iPSC-derived CAR NK Cell Program

•Initial Clinical Data from Phase 1 BCL Study to be Presented at ACR Convergence. FT522 is the Company’s off-the-shelf, CD19-targeted CAR NK cell product candidate and its first to incorporate Alloimmune Defense Receptor (ADR) technology, which is designed to reduce or eliminate the need for administration of conditioning chemotherapy to patients receiving cell therapies. In its ongoing multi-center, Phase 1 clinical trial of FT522 in patients with relapsed / refractory B-cell lymphoma (BCL) (NCT05950334), the Company is currently enrolling patients in the second three-dose cohort at 900 million cells per dose with conditioning chemotherapy (Regimen A) and in the first three-dose cohort at 300 million cells per dose without conditioning chemotherapy (Regimen B). No DLTs, and no events of any grade of CRS, ICANS, or GvHD, have been reported in the Phase 1 study. The Company plans to present initial clinical and translational data from the Phase 1 BCL study at ACR Convergence.

•IND Application for Phase 1 Basket Study in Autoimmunity Allowed by FDA. The U.S. Food and Drug Administration (FDA) has allowed the Company’s Investigational New Drug (IND) application to assess the safety, pharmacokinetics, and activity of FT522 across a basket of B cell-mediated autoimmune diseases. The Phase 1 study is intended to treat patients with multiple doses of FT522 without conditioning chemotherapy as an add-on to rituximab induction therapy (Regimen A) and as an add-on to maintenance therapy in combination with rituximab (Regimen B). Dose escalation is expected to commence at 900 million cells per dose. The Company previously presented preclinical data from a novel re-challenge assay using peripheral blood mononuclear cells (PBMCs) from unmatched SLE donors, showing that FT522 uniquely drove rapid and deep CD19+ B cell depletion, maintained functional persistence, and eliminated alloreactive T cells, indicating that FT522 has the potential to function effectively in the presence of an unmatched host immune system.

Third Quarter 2024 Financial Results

•Cash & Investment Position: Cash, cash equivalents, and investments as of September 30, 2024 were $330.5 million.

•Total Revenue: Revenue was $3.1 million for the third quarter of 2024, which was derived from the conduct of preclinical development activities for a second collaboration candidate targeting an undisclosed solid tumor antigen under its collaboration with Ono.

•Total Operating Expenses: Total operating expenses were $55.5 million for the third quarter of 2024, including research and development expenses of $34.7 million and general and administrative expenses of $20.8 million. Such amounts included $11.8 million of non-cash stock-based compensation expense.

•Shares Outstanding: As of September 30, 2024, common shares outstanding were 113.9 million, pre-funded warrants outstanding were 3.9 million, and preferred shares outstanding were 2.8 million. Each preferred share is convertible into five common shares.

About Fate Therapeutics’ iPSC Product Platform

Human induced pluripotent stem cells (iPSCs) possess the unique dual properties of unlimited self-renewal and differentiation potential into all cell types of the body. The Company’s proprietary iPSC product platform combines multiplexed-engineering of human iPSCs with single-cell selection to create clonal master iPSC lines. Analogous to master cell lines used to mass produce biopharmaceutical drug products such as monoclonal antibodies, the Company utilizes its clonal master iPSC lines as a starting cell source to manufacture engineered cell products which are well-defined and uniform in composition, can be stored in inventory for off-the-shelf availability, can be combined and administered with other therapies, and can potentially reach a broad patient population. As a result, the Company’s platform is uniquely designed to overcome numerous limitations associated with the manufacture of cell therapies using patient- or donor-sourced cells. Fate Therapeutics’ iPSC product platform is supported by an intellectual property portfolio of over 500 issued patents and 500 pending patent applications.

About Fate Therapeutics, Inc.

Fate Therapeutics is a clinical-stage biopharmaceutical company dedicated to bringing a first-in-class pipeline of induced pluripotent stem cell (iPSC)-derived cellular immunotherapies to patients with cancer and autoimmune diseases. Using its proprietary iPSC product platform, the Company has established a leadership position in creating multiplexed-engineered master iPSC lines and in the manufacture and clinical development of off-the-shelf, iPSC-derived cell products. The Company’s pipeline includes iPSC-derived natural killer (NK) cell and T-cell product candidates, which are selectively designed, incorporate novel synthetic controls of cell function, and are intended to deliver multiple therapeutic mechanisms to patients. Fate Therapeutics is headquartered in San Diego, CA. For more information, please visit www.fatetherapeutics.com.

Forward-Looking Statements

This release contains "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995 including statements regarding the Company’s results of operations, financial condition, anticipated operating expenses and cash runway, and sufficiency of its cash and cash equivalents to fund its operations, as well as statements regarding the advancement of and plans related to the Company's product candidates, clinical studies and preclinical research and development programs, the Company’s progress, plans and timelines for the clinical investigation of its product candidates, including the initiation and continuation of enrollment in the Company’s clinical trials, the initiation of additional clinical trials and additional dose cohorts in ongoing clinical trials of the Company’s product candidates, the availability of data from the Company’s clinical trials, the therapeutic and market potential of the Company’s research and development programs and product candidates, the Company’s clinical and product development strategy, and the Company’s expectations regarding progress and timelines, and the objectives, plans and goals of its collaboration with Ono. These and any other forward-looking statements in this release are based on management's current expectations of future events and are subject to a number of risks and uncertainties that could cause actual results to differ materially and adversely from those set forth in or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to, the risk that the Company’s research and development programs and product candidates, including those product candidates in clinical investigation, may not demonstrate the requisite safety, efficacy, or other attributes to warrant further development or to achieve regulatory approval, the risk that results observed in prior studies of the Company’s product candidates, including preclinical studies and clinical trials, will not be observed in ongoing or future

studies involving these product candidates, the risk of a delay or difficulties in the manufacturing of the Company’s product candidates or in the initiation and conduct of, or enrollment of patients in, any clinical trials, the risk that the Company may cease or delay preclinical or clinical development of any of its product candidates for a variety of reasons (including requirements that may be imposed by regulatory authorities on the initiation or conduct of clinical trials, changes in the therapeutic, regulatory, or competitive landscape for which the Company’s product candidates are being developed, the amount and type of data to be generated or otherwise to support regulatory approval, difficulties or delays in patient enrollment and continuation in the Company’s ongoing and planned clinical trials, difficulties in manufacturing or supplying the Company’s product candidates for clinical testing, failure to demonstrate that a product candidate has the requisite safety, efficacy, or other attributes to warrant further development, and any adverse events or other negative results that may be observed during preclinical or clinical development), the risk that its product candidates may not produce therapeutic benefits or may cause other unanticipated adverse effects, the risk that the Company may not comply with its obligations under and otherwise maintain its collaboration agreement with Ono, the risk that research funding and milestone payments received by the Company under its collaboration may be less than expected, and the risk that the Company may incur operating expenses in amounts greater than anticipated. For a discussion of other risks and uncertainties, and other important factors, any of which could cause the Company’s actual results to differ from those contained in the forward-looking statements, see the risks and uncertainties detailed in the Company’s periodic filings with the Securities and Exchange Commission, including but not limited to the Company’s most recently filed periodic report, and from time to time in the Company’s press releases and other investor communications. Fate Therapeutics is providing the information in this release as of this date and does not undertake any obligation to update any forward-looking statements contained in this release as a result of new information, future events or otherwise.

Condensed Consolidated Statements of Operations and Comprehensive Loss

(in thousands, except share and per share data)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

Collaboration revenue |

|

$ |

3,074 |

|

|

$ |

1,944 |

|

|

$ |

11,771 |

|

|

$ |

61,857 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

34,650 |

|

|

|

34,275 |

|

|

|

101,392 |

|

|

|

140,780 |

|

General and administrative |

|

|

20,801 |

|

|

|

18,948 |

|

|

|

58,907 |

|

|

|

63,513 |

|

Total operating expenses |

|

|

55,451 |

|

|

|

53,223 |

|

|

|

160,299 |

|

|

|

204,293 |

|

Loss from operations |

|

$ |

(52,377 |

) |

|

$ |

(51,279 |

) |

|

$ |

(148,528 |

) |

|

$ |

(142,436 |

) |

Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

4,438 |

|

|

|

4,697 |

|

|

|

13,414 |

|

|

|

12,772 |

|

Change in fair value of stock price appreciation milestones |

|

|

(13 |

) |

|

|

1,049 |

|

|

|

149 |

|

|

|

3,160 |

|

Other Income |

|

|

274 |

|

|

|

363 |

|

|

|

856 |

|

|

|

9,698 |

|

Total other income, net |

|

|

4,699 |

|

|

|

6,109 |

|

|

|

14,419 |

|

|

|

25,630 |

|

Net loss |

|

$ |

(47,678 |

) |

|

$ |

(45,170 |

) |

|

$ |

(134,109 |

) |

|

$ |

(116,806 |

) |

Other comprehensive income: |

|

|

|

|

|

|

|

|

|

|

|

|

Unrealized gain on available-for-sale securities, net |

|

|

1,257 |

|

|

|

88 |

|

|

|

820 |

|

|

|

1,355 |

|

Comprehensive loss |

|

$ |

(46,421 |

) |

|

$ |

(45,082 |

) |

|

$ |

(133,289 |

) |

|

$ |

(115,451 |

) |

Net loss per common share, basic and diluted |

|

$ |

(0.40 |

) |

|

$ |

(0.46 |

) |

|

$ |

(1.19 |

) |

|

$ |

(1.19 |

) |

Weighted–average common shares used to

compute basic and diluted net loss per share |

|

|

117,769,161 |

|

|

|

98,568,012 |

|

|

|

112,305,430 |

|

|

|

98,342,898 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

|

|

|

|

|

Assets |

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

37,909 |

|

|

$ |

41,870 |

|

Accounts receivable |

|

|

4,127 |

|

|

|

1,826 |

|

Short-term investments |

|

|

259,014 |

|

|

|

273,305 |

|

Prepaid expenses and other current assets |

|

|

9,244 |

|

|

|

14,539 |

|

Total current assets |

|

$ |

310,294 |

|

|

$ |

331,540 |

|

Long-term investments |

|

|

33,607 |

|

|

|

980 |

|

Operating lease right-of-use asset |

|

|

58,441 |

|

|

|

61,675 |

|

Other long-term assets |

|

|

92,628 |

|

|

|

112,022 |

|

Total assets |

|

$ |

494,970 |

|

|

$ |

506,217 |

|

|

|

|

|

|

|

|

Liabilities and stockholders’ equity |

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable and accrued expenses |

|

$ |

29,929 |

|

|

$ |

32,233 |

|

Deferred revenue |

|

|

600 |

|

|

|

685 |

|

Operating lease liability, current portion |

|

|

6,893 |

|

|

|

6,176 |

|

Total current liabilities |

|

$ |

37,422 |

|

|

$ |

39,094 |

|

CIRM award liability |

|

|

1,940 |

|

|

|

— |

|

Operating lease liability, net of current portion |

|

|

92,085 |

|

|

|

97,360 |

|

Stock price appreciation milestones |

|

|

1,197 |

|

|

|

1,346 |

|

Stockholders’ equity |

|

|

362,326 |

|

|

|

368,417 |

|

Total liabilities and stockholders’ equity |

|

$ |

494,970 |

|

|

$ |

506,217 |

|

|

|

|

|

|

|

|

Contact:

Christina Tartaglia

Precision AQ

212.362.1200

christina.tartaglia@precisionaq.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

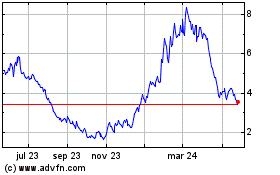

Fate Therapeutics (NASDAQ:FATE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

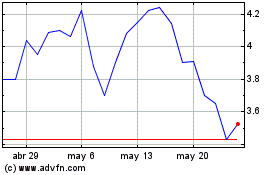

Fate Therapeutics (NASDAQ:FATE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024