Fifth Third Empowers Next Generation with Financial Literacy Solutions

19 Noviembre 2024 - 7:00AM

Business Wire

Developed by and for students, the new

REP4®FinLit tool will launch in 2025

Extending its longstanding commitment to financial literacy, the

Fifth Third Foundation is proud to support the development of a new

tool that aims to make personal finance more accessible to young

adults.

Developed by and for students, REP4®FinLit will include a

variety of digital tools to help young adults become more

comfortable with their personal finances, including a quiz

identifying a “Money Mindset” that provides insights about spending

habits and relationships with money.

“Fifth Third is deeply committed to helping young people develop

the skills they need to manage their finances and prepare for

financial independence,” said Kala Gibson, chief corporate

responsibility officer for Fifth Third. “Our latest solution,

REP4®FinLit, was created by students for students, using proven

research and expert advice to change the way young people think

about money, spending habits, savings, investments and other key

aspects of their finances.”

For more than 20 years, Fifth Third has had a strong commitment

to empowering the next generation to take control of their

financial future. The Fifth Third Bank Finance Academy® and Young

Bankers Club® programs are offered to elementary and high schools

at no charge to help teach students the basics of budgeting,

banking, borrowing, saving, investing, entrepreneurship and

more.

The Fifth Third Financial Empowerment Mobile, known as the

“eBus”, brings financial access, social services and education

directly into communities across the Bank’s 11-state footprint,

especially in underserved areas.

REP4®FinLit is an extension of this commitment to financial

empowerment. It began as an idea pitch through REP4®, a national

alliance founded by Grand Valley State University in Allendale,

Mich. and other higher education partners across the country. It is

designed to empower high school and college students to

collaboratively design the future of higher education through idea

generation and the creation of prototypes such as REP4®FinLit.

“We are incredibly grateful to the Fifth Third Foundation for

their generous support of this program,” said Grand Valley State

University President Philomena V. Mantella. “Thanks to their

partnership, our students will be able to build out and share this

engaging and important digital experience with students across the

country.”

Students have been designers of the project since its inception,

from the high school group that developed the initial prototype

through REP4 in 2021, to the team of GVSU students who are

designing, developing and testing the program.

“As a first-generation college student, seeing my university

implement REP4 ideas, especially FinLit, means a lot to me,” said

GVSU sophomore Joy Murerwa, a finance and accounting double major

who is serving as a content expert on the REP4®FinLit team.

“Navigating the world of personal finance can be overwhelming. This

prototype represents more than just learning how to budget or

manage debt; it is about peer-to-peer empowerment and closing the

knowledge gap that many students face.”

With financial support from the Fifth Third Foundation,

REP4®FinLit is expected to launch statewide in Michigan in 2025 and

nationally in 2026.

About the Fifth Third Foundation

Established in 1948, the Fifth Third Foundation was one of the

first charitable foundations created by a financial institution.

The Fifth Third Foundation supports worthy causes in the areas of

health and human services, education, community development and the

arts in the states where Fifth Third Bank operates.

About Fifth Third

Fifth Third is a bank that’s as long on innovation as it is on

history. Since 1858, we’ve been helping individuals, families,

businesses and communities grow through smart financial services

that improve lives. Our list of firsts is extensive, and it’s one

that continues to expand as we explore the intersection of

tech-driven innovation, dedicated people and focused community

impact. Fifth Third is one of the few U.S.-based banks to have been

named among Ethisphere’s World’s Most Ethical Companies® for

several years. With a commitment to taking care of our customers,

employees, communities and shareholders, our goal is not only to be

the nation’s highest performing regional bank, but to be the bank

people most value and trust.

Fifth Third Bank, National Association is a federally chartered

institution. Fifth Third Bancorp is the indirect parent company of

Fifth Third Bank and its common stock is traded on the NASDAQ®

Global Select Market under the symbol "FITB." Investor information

and press releases can be viewed at https://www.53.com. Deposit and

credit products provided by Fifth Third Bank, National Association.

Member FDIC.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241119496863/en/

Amanda Nageleisen (Media Relations) amanda.nageleisen@53.com

Matt Curoe (Investor Relations) matt.curoe@53.com |

513-534-2345

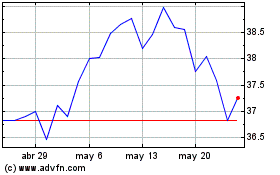

Fifth Third Bancorp (NASDAQ:FITB)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

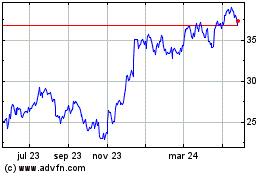

Fifth Third Bancorp (NASDAQ:FITB)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024