0001275168FALSE00012751682024-07-242024-07-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 24, 2024

FIVE STAR BANCORP

(Exact Name of Registrant as Specified in Charter)

| | | | | | | | | | | | | | |

| | | | |

| California | | 001-40379 | | 75-3100966 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

| | |

3100 Zinfandel Drive, Suite 100, Rancho Cordova, California, 95670

(Address of Principal Executive Offices, and Zip Code)

(916) 626-5000

Registrant’s Telephone Number, Including Area Code

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| | ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| | ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| | ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| | ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

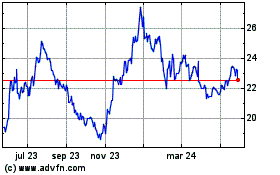

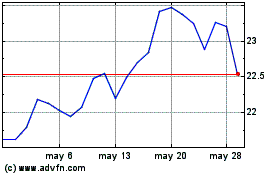

| Common Stock, no par value per share | FSBC | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2). Emerging growth company ☑

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition

On July 24, 2024, Five Star Bancorp (the “Company”) issued a press release announcing its results of operations and financial condition for the quarter ended June 30, 2024. A copy of the press release is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

This information (including Exhibit 99.1) is being furnished under Item 2.02 hereof and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and such information shall not be deemed incorporated by reference into any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure

The Company is conducting an earnings call on July 25, 2024 at 10:00 am PT/1:00 pm ET to discuss its second quarter 2024 financial results. A copy of the investor presentation to be used during the earnings call is attached to this Current Report on Form 8-K as Exhibit 99.2 and is incorporated herein by reference.

This information (including Exhibit 99.2) is being furnished under Item 7.01 hereof and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and such information shall not be deemed incorporated by reference into any filing under the Securities Act, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | | | | |

Number | | | Description |

99.1

| | | |

| 99.2 | | | |

| 104 | | | Cover Page Interactive Data File (embedded within the Inline XBRL) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

|

| | |

| | FIVE STAR BANCORP |

| | |

| | By: | /s/ Heather C. Luck |

| | | Name: Heather C. Luck |

| | | Title: Senior Vice President and Chief Financial Officer |

| | |

| Date: July 25, 2024 | |

| | | | | |

| PRESS RELEASE | FOR IMMEDIATE RELEASE |

Five Star Bancorp Announces Second Quarter 2024 Results

RANCHO CORDOVA, CA July 24, 2024 (GLOBE NEWSWIRE) – Five Star Bancorp (Nasdaq: FSBC) (“Five Star” or the “Company”), a holding company that operates through its wholly owned banking subsidiary, Five Star Bank (the “Bank”), today reported net income of $10.8 million for the three months ended June 30, 2024, as compared to $10.6 million for the three months ended March 31, 2024 and $12.7 million for the three months ended June 30, 2023.

Second Quarter Highlights

Performance and operating highlights for the Company for the periods noted below included the following:

| | | | | | | | | | | | | | | | | |

| | Three months ended |

(in thousands, except per share and share data) | June 30,

2024 | | March 31,

2024 | | June 30,

2023 |

| Return on average assets (“ROAA”) | 1.23 | % | | 1.22 | % | | 1.55 | % |

| Return on average equity (“ROAE”) | 11.72 | % | | 14.84 | % | | 19.29 | % |

| Pre-tax income | $ | 15,152 | | | $ | 14,961 | | | $ | 17,169 | |

Pre-tax, pre-provision income(1) | 17,152 | | | 15,861 | | | 18,419 | |

| Net income | 10,782 | | | 10,631 | | | 12,729 | |

| Basic earnings per common share | $ | 0.51 | | | $ | 0.62 | | | $ | 0.74 | |

| Diluted earnings per common share | 0.51 | | | 0.62 | | | 0.74 | |

| Weighted average basic common shares outstanding | 21,039,798 | | | 17,190,867 | | | 17,165,344 | |

| Weighted average diluted common shares outstanding | 21,058,085 | | | 17,272,994 | | | 17,168,995 | |

| Shares outstanding at end of period | 21,319,583 | | | 17,353,251 | | | 17,257,357 | |

(1) See the section entitled “Non-GAAP Reconciliation (Unaudited)” for a reconciliation of this non-GAAP financial measure.

James E. Beckwith, President and Chief Executive Officer, commented on the financial results:

“We delivered strong second quarter results driven by continued momentum in the markets we serve. Total loans increased by $157.2 million, or 20.2% when annualized, and total deposits increased by $193.9 million, or 26.2% when annualized, which we attribute to the growing demand for our differentiated customer experience and the strength of our team.

We are seeing a positive turn in net interest margin with a 25 basis point increase from 3.14% in the first quarter to 3.39% in the second quarter of 2024. We are pleased to have decreased short-term borrowings from $120.0 million to zero. We are also pleased that, in addition to a first quarter cash dividend in 2024, we declared a second quarter cash dividend of $0.20 per share, exemplifying our focus on shareholder value. To safeguard this value, we diligently monitor changing market conditions and are confident in the Bank’s resilience in any interest rate environment.

In the second quarter, our successful public offering resulted in the issuance of 3,967,500 additional shares of common stock with net proceeds of approximately $80.9 million, allowing us to execute on our organic growth strategy and maintain momentum in the San Francisco Bay Area. We now have 19 employees in the San Francisco Bay Area who have contributed $161.3 million in deposits since the expansion began in June 2023. We expect this momentum to continue and to benefit our shareholders, employees, clients, and community.

In the first half of 2024, the Company and our employees received numerous awards and recognition.

The employee awards include a:

•Sacramento Business Journal’s Women Who Mean Business award

•Sacramento Business Journal C-Suite award

•National Association of Women Business Owners Outstanding Women Leader’s Executive award

•Independent Community Bankers of American 40 Under 40: Emerging Community Bank Leaders award

The Company awards include:

•The 2024 Greater Sacramento Economic Council’s Sustainability award

•The 2023 Raymond James Community Bankers Cup

•Being listed among the S&P Global Market Intelligence 2023 Top 20 Best-Performing Community Banks in the nation (banks with assets between $3 billion and $10 billion).”

Financial highlights during the quarter included the following:

•The Company sold an aggregate of 3,967,500 shares of its common stock at a public offering price of $21.75 per share in a public offering that closed in April 2024. The net proceeds to the Company, after deducting underwriting discounts, commissions, and offering expenses, were approximately $80.9 million.

•The Company’s San Francisco Bay Area team increased from 15 to 19 employees who generated deposit balances totaling $161.3 million at June 30, 2024, an increase of $65.1 million from March 31, 2024.

•Cash and cash equivalents were $190.4 million, representing 6.04% of total deposits at June 30, 2024, as compared to 6.27% at March 31, 2024.

•Total deposits increased by $193.9 million, or 6.56%, during the three months ended June 30, 2024, due to increases in both non-wholesale and wholesale deposits, which the Company defines as brokered deposits and public time deposits. During the three months ended June 30, 2024, non-wholesale deposits increased by $118.3 million, or 4.26%, and wholesale deposits increased by $75.5 million.

•The Company had no short-term borrowings at June 30, 2024, a decrease from $120.0 million at March 31, 2024.

•Consistent, disciplined management of expenses contributed to our efficiency ratio of 44.07% for the three months ended June 30, 2024, as compared to 44.50% for the three months ended March 31, 2024.

•For the three months ended June 30, 2024, net interest margin was 3.39%, as compared to 3.14% for the three months ended March 31, 2024 and 3.45% for the three months ended June 30, 2023. The effective Federal Funds rate remained at 5.33% as of June 30, 2024 and March 31, 2024 and increased from 5.08% as of June 30, 2023.

•Other comprehensive income was $0.2 million during the three months ended June 30, 2024. Unrealized losses, net of tax effect, on available-for-sale securities were $12.2 million as of June 30, 2024. Total carrying value of held-to-maturity and available-for-sale securities represented 0.08% and 2.91% of total interest-earning assets, respectively, as of June 30, 2024.

•The Company’s common equity Tier 1 capital ratio was 11.28% and 9.13% as of June 30, 2024 and March 31, 2024, respectively, with the additional common stock issued through the public offering that closed in April 2024 as the leading driver of the increase. The Bank continues to meet all requirements to be considered “well-capitalized” under applicable regulatory guidelines.

•Loan and deposit growth in the three and twelve months ended June 30, 2024 was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | June 30,

2024 | | March 31,

2024 | | $ Change | | % Change |

Loans held for investment | $ | 3,266,291 | | | $ | 3,104,130 | | | $ | 162,161 | | | 5.22 | % |

Non-interest-bearing deposits | 825,733 | | | 817,388 | | | 8,345 | | | 1.02 | % |

Interest-bearing deposits | 2,323,898 | | | 2,138,384 | | | 185,514 | | | 8.68 | % |

| | | | | | | |

| (in thousands) | June 30,

2024 | | June 30,

2023 | | $ Change | | % Change |

| Loans held for investment | $ | 3,266,291 | | | $ | 2,927,411 | | | $ | 338,880 | | | 11.58 | % |

| Non-interest-bearing deposits | 825,733 | | | 833,707 | | | (7,974) | | | (0.96) | % |

| Interest-bearing deposits | 2,323,898 | | | 2,096,032 | | | 227,866 | | | 10.87 | % |

•The ratio of nonperforming loans to loans held for investment at period end remained at 0.06% at June 30, 2024 and March 31, 2024.

•The Company’s Board of Directors declared, and the Company subsequently paid, a cash dividend of $0.20 per share during the three months ended June 30, 2024. The Company’s Board of Directors subsequently declared another cash dividend of $0.20 per share on July 18, 2024, which the Company expects to pay on August 12, 2024 to shareholders of record as of August 5, 2024.

Summary Results

Three months ended June 30, 2024, as compared to three months ended March 31, 2024

The Company’s net income was $10.8 million for the three months ended June 30, 2024, as compared to $10.6 million for the three months ended March 31, 2024. Net interest income increased by $2.3 million, primarily due to an increase in interest income due to loan growth at higher yields bolstered by a decrease in interest expense due to lower average wholesale deposit balances, as compared to the three months ended March 31, 2024. The provision for credit losses increased by $1.1 million, with loan growth and increases in net charge-offs in the three months ended June 30, 2024 as the leading drivers. Non-interest income decreased by $0.3 million, primarily due to a reduction in gains from distributions received on equity investments in venture-backed funds during the three months ended June 30, 2024, as compared to the three months ended March 31, 2024. Non-interest expense increased by $0.8 million, primarily related to increases in: (i) commissions related primarily to higher loan production; (ii) travel, conferences, and professional membership fees; and (iii) sponsorships and donations, as compared to the three months ended March 31, 2024.

Three months ended June 30, 2024, as compared to three months ended June 30, 2023

The Company’s net income was $10.8 million for the three months ended June 30, 2024, as compared to $12.7 million for the three months ended June 30, 2023. Net interest income increased by $1.5 million as increases in interest income due to loan growth at higher yields more than offset increases in interest expense due to larger average deposit balances at higher rates. The provision for credit losses increased by $0.8 million primarily due to loan growth and increases in net charge-offs in the three months ended June 30, 2024, as compared to the three months ended June 30, 2023. Non-interest income decreased by $1.2 million, primarily due to a reduction in gains from distributions received on equity investments in venture-backed funds during the three months ended June 30, 2024, as compared to the three months ended June 30, 2023. Non-interest expense increased by $1.5 million, with an increase in salaries and employee benefits related to the Company’s expansion into the San Francisco Bay Area as the leading driver.

The following is a summary of the components of the Company’s operating results and performance ratios for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | | | |

| (in thousands, except per share data) | | June 30,

2024 | | March 31,

2024 | | $ Change | | % Change |

| Selected operating data: | | | | | | | | |

| Net interest income | | $ | 29,092 | | | $ | 26,744 | | | $ | 2,348 | | | 8.78 | % |

| Provision for credit losses | | 2,000 | | | 900 | | | 1,100 | | | 122.22 | % |

| Non-interest income | | 1,573 | | | 1,833 | | | (260) | | | (14.18) | % |

| Non-interest expense | | 13,513 | | | 12,716 | | | 797 | | | 6.27 | % |

| Pre-tax income | | 15,152 | | | 14,961 | | | 191 | | | 1.28 | % |

| Provision for income taxes | | 4,370 | | | 4,330 | | | 40 | | | 0.92 | % |

| Net income | | $ | 10,782 | | | $ | 10,631 | | | $ | 151 | | | 1.42 | % |

| Earnings per common share: | | | | | | | | |

| Basic | | $ | 0.51 | | | $ | 0.62 | | | $ | (0.11) | | | (17.74) | % |

| Diluted | | 0.51 | | | 0.62 | | | (0.11) | | | (17.74) | % |

| Performance and other financial ratios: | | | | | | | | |

| ROAA | | 1.23 | % | | 1.22 | % | | | | |

| ROAE | | 11.72 | % | | 14.84 | % | | | | |

| Net interest margin | | 3.39 | % | | 3.14 | % | | | | |

| Cost of funds | | 2.56 | % | | 2.62 | % | | | | |

| Efficiency ratio | | 44.07 | % | | 44.50 | % | | | | |

| | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | | | |

| (in thousands, except per share data) | | June 30,

2024 | | June 30,

2023 | | $ Change | | % Change |

| Selected operating data: | | | | | | | | |

| Net interest income | | $ | 29,092 | | | $ | 27,578 | | | $ | 1,514 | | | 5.49 | % |

| Provision for credit losses | | 2,000 | | | 1,250 | | | 750 | | | 60.00 | % |

| Non-interest income | | 1,573 | | | 2,820 | | | (1,247) | | | (44.22) | % |

| Non-interest expense | | 13,513 | | | 11,979 | | | 1,534 | | | 12.81 | % |

| Pre-tax income | | 15,152 | | | 17,169 | | | (2,017) | | | (11.75) | % |

| Provision for income taxes | | 4,370 | | | 4,440 | | | (70) | | | (1.58) | % |

| Net income | | $ | 10,782 | | | $ | 12,729 | | | $ | (1,947) | | | (15.30) | % |

| Earnings per common share: | | | | | | | | |

| Basic | | $ | 0.51 | | | $ | 0.74 | | | $ | (0.23) | | | (31.08) | % |

| Diluted | | 0.51 | | | 0.74 | | | (0.23) | | | (31.08) | % |

| Performance and other financial ratios: | | | | | | | | |

| ROAA | | 1.23 | % | | 1.55 | % | | | | |

| ROAE | | 11.72 | % | | 19.29 | % | | | | |

| Net interest margin | | 3.39 | % | | 3.45 | % | | | | |

| Cost of funds | | 2.56 | % | | 2.04 | % | | | | |

| Efficiency ratio | | 44.07 | % | | 39.41 | % | | | | |

Balance Sheet Summary

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | June 30,

2024 | | December 31,

2023 | | $ Change | | % Change |

| Selected financial condition data: | | | | | | | | |

| Total assets | | $ | 3,634,217 | | | $ | 3,593,125 | | | $ | 41,092 | | | 1.14 | % |

| Cash and cash equivalents | | 190,359 | | | 321,576 | | | (131,217) | | | (40.80) | % |

| Total loans held for investment | | 3,266,291 | | | 3,081,719 | | | 184,572 | | | 5.99 | % |

| Total investments | | 106,177 | | | 111,160 | | | (4,983) | | | (4.48) | % |

| Total liabilities | | 3,253,747 | | | 3,307,351 | | | (53,604) | | | (1.62) | % |

| Total deposits | | 3,149,631 | | | 3,026,896 | | | 122,735 | | | 4.05 | % |

| Subordinated notes, net | | 73,822 | | | 73,749 | | | 73 | | | 0.10 | % |

| Total shareholders’ equity | | 380,470 | | | 285,774 | | | 94,696 | | | 33.14 | % |

•Insured and collateralized deposits were approximately $2.0 billion, representing approximately 64.70% of total deposits as of June 30, 2024. Net uninsured and uncollateralized deposits were approximately $1.1 billion as of June 30, 2024.

•Commercial and consumer deposit accounts constituted approximately 78% of total deposits. Deposit relationships of at least $5 million represented approximately 60% of total deposits and had an average age of approximately 8.46 years as of June 30, 2024.

•Cash and cash equivalents as of June 30, 2024 were $190.4 million, representing 6.04% of total deposits at June 30, 2024, as compared to 6.27% as of March 31, 2024.

•Total liquidity (consisting of cash and cash equivalents and unused and immediately available borrowing capacity as set forth below) was approximately $1.6 billion as of June 30, 2024.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | June 30, 2024 | | Available |

| (in thousands) | | Line of Credit | | Letters of Credit Issued | | Borrowings | |

FHLB advances | | $ | 1,004,397 | | | $ | 571,500 | | | $ | — | | | $ | 432,897 | |

| Federal Reserve Discount Window | | 829,179 | | | — | | | — | | | 829,179 | |

| Correspondent bank lines of credit | | 175,000 | | | — | | | — | | | 175,000 | |

| | | | | | | | |

| Cash and cash equivalents | | — | | | — | | | — | | | 190,359 | |

| Total | | $ | 2,008,576 | | | $ | 571,500 | | | $ | — | | | $ | 1,627,435 | |

The increase in total assets from December 31, 2023 to June 30, 2024 was primarily due to a $184.6 million increase in total loans held for investment, partially offset by a $131.2 million decrease in cash and cash equivalents. The $184.6 million increase in total loans held for investment between December 31, 2023 and June 30, 2024 was a result of $539.9 million in loan originations and advances, partially offset by $150.0 million and $205.3 million in loan payoffs and paydowns, respectively. The $184.6 million increase in total loans held for investment included a purchase of loans within the consumer concentration of the loan portfolio, representing $73.3 million. The $131.2 million decrease in cash and cash equivalents primarily resulted from net cash outflows related to investing activities of $173.4 million, partially offset by net cash inflows related to financing and operating activities of $25.9 million and $16.3 million, respectively.

The decrease in total liabilities from December 31, 2023 to June 30, 2024 was primarily due to a decrease in other borrowings of $170.0 million, partially offset by an increase in interest-bearing deposits of $128.1 million. The increase in interest-bearing deposits was largely due to an increase in money market deposits of $281.8 million, partially offset by decreases in time deposits and interest-bearing demand deposits of $133.1 million and $20.5 million, respectively.

The increase in total shareholders’ equity from December 31, 2023 to June 30, 2024 was primarily a result of $80.9 million of additional common stock outstanding and net income recognized of $21.4 million, partially offset by $7.7 million in cash distributions paid during the period.

Net Interest Income and Net Interest Margin

The following is a summary of the components of net interest income for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | | | |

| (in thousands) | | June 30,

2024 | | March 31,

2024 | | $ Change | | % Change |

| Interest and fee income | | $ | 48,998 | | | $ | 47,541 | | | $ | 1,457 | | | 3.06 | % |

| Interest expense | | 19,906 | | | 20,797 | | | (891) | | | (4.28) | % |

| Net interest income | | $ | 29,092 | | | $ | 26,744 | | | $ | 2,348 | | | 8.78 | % |

| Net interest margin | | 3.39 | % | | 3.14 | % | | | | |

| | | | | | | | | |

| | | Three months ended | | | | |

| (in thousands) | | June 30,

2024 | | June 30,

2023 | | $ Change | | % Change |

| Interest and fee income | | $ | 48,998 | | | $ | 42,793 | | | $ | 6,205 | | | 14.50 | % |

| Interest expense | | 19,906 | | | 15,215 | | | 4,691 | | | 30.83 | % |

| Net interest income | | $ | 29,092 | | | $ | 27,578 | | | $ | 1,514 | | | 5.49 | % |

| Net interest margin | | 3.39 | % | | 3.45 | % | | | | |

The following table shows the components of net interest income and net interest margin for the quarterly periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

| | June 30, 2024 | | March 31, 2024 | | June 30, 2023 |

(in thousands) | | Average

Balance | | Interest

Income/

Expense | | Yield/ Rate | | Average

Balance | | Interest

Income/

Expense | | Yield/ Rate | | Average

Balance | | Interest

Income/

Expense | | Yield/ Rate |

Assets | | | | | | | | | | | | | | | | | | |

Interest-earning deposits in banks | | $ | 148,936 | | | $ | 1,986 | | | 5.36 | % | | $ | 233,002 | | | $ | 3,102 | | | 5.35 | % | | $ | 179,894 | | | $ | 2,218 | | | 4.95 | % |

Investment securities | | 105,819 | | | 650 | | | 2.47 | % | | 109,177 | | | 653 | | | 2.41 | % | | 116,107 | | | 646 | | | 2.23 | % |

Loans held for investment and sale | | 3,197,921 | | | 46,362 | | | 5.83 | % | | 3,082,290 | | | 43,786 | | | 5.71 | % | | 2,914,388 | | | 39,929 | | | 5.50 | % |

Total interest-earning assets | | 3,452,676 | | | 48,998 | | | 5.71 | % | | 3,424,469 | | | 47,541 | | | 5.58 | % | | 3,210,389 | | | 42,793 | | | 5.35 | % |

Interest receivable and other assets, net | | 84,554 | | | | | | | 93,983 | | | | | | | 75,416 | | | | | |

Total assets | | $ | 3,537,230 | | | | | | | $ | 3,518,452 | | | | | | | $ | 3,285,805 | | | | | |

| | | | | | | | | | | | | | | | | | |

Liabilities and shareholders’ equity | | | | | | | | | | | | | | | | | | |

Interest-bearing demand | | $ | 291,470 | | | $ | 1,104 | | | 1.52 | % | | $ | 300,325 | | | $ | 1,126 | | | 1.51 | % | | $ | 290,404 | | | $ | 825 | | | 1.14 | % |

Savings | | 120,080 | | | 856 | | | 2.87 | % | | 124,561 | | | 861 | | | 2.78 | % | | 139,522 | | | 758 | | | 2.18 | % |

Money market | | 1,547,814 | | | 13,388 | | | 3.48 | % | | 1,410,264 | | | 12,155 | | | 3.47 | % | | 1,283,353 | | | 8,136 | | | 2.54 | % |

Time | | 272,887 | | | 3,369 | | | 4.96 | % | | 429,586 | | | 5,369 | | | 5.03 | % | | 370,864 | | | 4,250 | | | 4.60 | % |

Subordinated debt and other borrowings | | 75,747 | | | 1,189 | | | 6.31 | % | | 82,775 | | | 1,286 | | | 6.25 | % | | 80,192 | | | 1,246 | | | 6.23 | % |

Total interest-bearing liabilities | | 2,307,998 | | | 19,906 | | | 3.47 | % | | 2,347,511 | | | 20,797 | | | 3.56 | % | | 2,164,335 | | | 15,215 | | | 2.82 | % |

Demand accounts | | 817,668 | | | | | | | 842,105 | | | | | | | 828,748 | | | | | |

Interest payable and other liabilities | | 41,429 | | | | | | | 40,730 | | | | | | | 28,034 | | | | | |

Shareholders’ equity | | 370,135 | | | | | | | 288,106 | | | | | | | 264,688 | | | | | |

Total liabilities & shareholders’ equity | | $ | 3,537,230 | | | | | | | $ | 3,518,452 | | | | | | | $ | 3,285,805 | | | | | |

| | | | | | | | | | | | | | | | | | |

Net interest spread | | | | | | 2.24 | % | | | | | | 2.02 | % | | | | | | 2.53 | % |

Net interest income/margin | | | | $ | 29,092 | | | 3.39 | % | | | | $ | 26,744 | | | 3.14 | % | | | | $ | 27,578 | | | 3.45 | % |

Net interest income during the three months ended June 30, 2024 increased $2.3 million and net interest margin increased 25 basis points compared to the three months ended March 31, 2024. Interest income increased $1.5 million compared to the prior quarter, primarily due to loan growth at higher yields. Average loan yields increased 12 basis points compared to the prior quarter, while average balances increased 3.75%. The increase in interest income compared to the prior quarter was bolstered by a $0.9 million decrease in interest expense, primarily due to lower average wholesale deposit balances. Average cost of wholesale deposits, individually, decreased 11 basis points compared to the prior quarter, while average balances decreased 38.93%. Average cost of total deposits, including wholesale deposits, decreased 6 basis points compared to the prior quarter, while average balances decreased 1.83%.

As compared to the three months ended June 30, 2023, net interest income increased $1.5 million and net interest margin decreased 6 basis points. The increase in net interest income is primarily attributable to loan growth at higher yields, partially offset by deposit growth at higher interest rates. Interest income increased by $6.2 million, as compared to the same quarter of the prior year. Average loan yields increased 33 basis points while average balances increased 9.73%, as compared to the same quarter of the prior year. The increase in interest income was partially offset by an additional $4.7 million in interest expense compared to the same quarter of the prior year. Average cost of total deposits, including wholesale deposits, increased 55 basis points compared to the same quarter of the prior year, while average balances increased 4.70%. Average cost of wholesale deposits, individually, increased 23 basis points compared to the same quarter of the prior year, while average balances decreased 29.52%. In addition, the average balance of non-interest-bearing deposits decreased by $11.1 million compared to the same quarter of the prior year.

Loans by Type

The following table provides loan balances, excluding deferred loan fees, by type as of June 30, 2024:

| | | | | | | | |

| (in thousands) | | |

| Real estate: | | |

| Commercial | | $ | 2,774,001 | |

| Commercial land and development | | 4,766 |

| Commercial construction | | 72,444 |

| Residential construction | | 9,011 |

| Residential | | 29,641 |

| Farmland | | 48,852 |

| Commercial: | | |

| Secured | | 154,080 |

| Unsecured | | 23,198 |

| Consumer and other | | 152,564 |

| Net deferred loan fees | | (2,266) | |

| Total loans held for investment | | $ | 3,266,291 | |

Interest-bearing Deposits

The following table provides interest-bearing deposit balances by type as of June 30, 2024:

| | | | | | | | |

| (in thousands) | | |

Interest-bearing demand accounts | | $ | 299,815 | |

Money market accounts | | 1,564,120 | |

Savings accounts | | 126,532 | |

Time accounts | | 333,431 | |

Total interest-bearing deposits | | $ | 2,323,898 | |

Asset Quality

Allowance for Credit Losses

At June 30, 2024, the Company’s allowance for credit losses was $35.4 million, as compared to $34.4 million at December 31, 2023. The $1.0 million increase in the allowance is due to a $3.0 million provision for credit losses recorded during the six months ended June 30, 2024, partially offset by net charge-offs of $2.0 million, mainly attributable to commercial and industrial loans, during the same period.

The Company’s ratio of nonperforming loans to loans held for investment remained at 0.06% between June 30, 2024 and December 31, 2023. Loans designated as watch increased from $39.6 million to $58.0 million between December 31, 2023 and June 30, 2024. Loans designated as substandard decreased from $2.0 million to $1.9 million between December 31, 2023 and June 30, 2024. There were no loans with doubtful risk grades at June 30, 2024 or December 31, 2023.

A summary of the allowance for credit losses by loan class is as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | June 30, 2024 | | December 31, 2023 |

| (in thousands) | | Amount | | % of Total | | Amount | | % of Total |

| Real estate: | | | | | | | | |

| Commercial | | $ | 24,708 | | | 69.79 | % | | $ | 29,015 | | | 84.27 | % |

| Commercial land and development | | 72 | | | 0.20 | % | | 178 | | | 0.52 | % |

| Commercial construction | | 1,097 | | | 3.10 | % | | 718 | | | 2.08 | % |

| Residential construction | | 100 | | | 0.28 | % | | 89 | | | 0.26 | % |

| Residential | | 195 | | | 0.55 | % | | 151 | | | 0.44 | % |

| Farmland | | 402 | | | 1.14 | % | | 399 | | | 1.16 | % |

| | 26,574 | | | 75.06 | % | | 30,550 | | | 88.73 | % |

| Commercial: | | | | | | | | |

| Secured | | 7,386 | | | 20.86 | % | | 3,314 | | | 9.62 | % |

| Unsecured | | 214 | | | 0.60 | % | | 189 | | | 0.55 | % |

| | 7,600 | | | 21.46 | % | | 3,503 | | | 10.17 | % |

| Consumer and other | | 1,232 | | | 3.48 | % | | 378 | | | 1.10 | % |

| Total allowance for credit losses | | $ | 35,406 | | | 100.00 | % | | $ | 34,431 | | | 100.00 | % |

The ratio of allowance for credit losses to loans held for investment was 1.08% at June 30, 2024, as compared to 1.12% at December 31, 2023.

Non-interest Income

The following table presents the key components of non-interest income for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | | | |

| (in thousands) | | June 30,

2024 | | March 31,

2024 | | $ Change | | % Change |

| Service charges on deposit accounts | | $ | 189 | | | $ | 188 | | | $ | 1 | | | 0.53 | % |

| | | | | | | | |

| Gain on sale of loans | | 449 | | | 369 | | | 80 | | | 21.68 | % |

| Loan-related fees | | 370 | | | 429 | | | (59) | | | (13.75) | % |

| FHLB stock dividends | | 329 | | | 332 | | | (3) | | | (0.90) | % |

| Earnings on bank-owned life insurance | | 158 | | | 142 | | | 16 | | | 11.27 | % |

| Other income | | 78 | | | 373 | | | (295) | | | (79.09) | % |

| Total non-interest income | | $ | 1,573 | | | $ | 1,833 | | | $ | (260) | | | (14.18) | % |

Gain on sale of loans. The increase resulted from an increase in the volume of loans sold, partially offset by a decline in the effective yield of loans sold. During the three months ended June 30, 2024, approximately $6.8

million of loans were sold with an effective yield of 6.60%, as compared to approximately $5.2 million of loans sold with an effective yield of 7.08% during the three months ended March 31, 2024.

Other income. The decrease resulted primarily from a $0.3 million gain from distributions received on equity investments in venture-backed funds during the three months ended March 31, 2024, which did not occur during the three months ended June 30, 2024.

The following table presents the key components of non-interest income for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | |

| (in thousands) | | June 30,

2024 | | June 30,

2023 | | $ Change | | % Change |

| Service charges on deposit accounts | | $ | 189 | | | $ | 135 | | | $ | 54 | | | 40.00 | % |

| | | | | | | | |

| Gain on sale of loans | | 449 | | | 641 | | | (192) | | | (29.95) | % |

| Loan-related fees | | 370 | | | 389 | | | (19) | | | (4.88) | % |

| FHLB stock dividends | | 329 | | | 189 | | | 140 | | | 74.07 | % |

| Earnings on bank-owned life insurance | | 158 | | | 126 | | | 32 | | | 25.40 | % |

| Other income | | 78 | | | 1,340 | | | (1,262) | | | (94.18) | % |

| Total non-interest income | | $ | 1,573 | | | $ | 2,820 | | | $ | (1,247) | | | (44.22) | % |

Gain on sale of loans. The decrease related primarily to an overall decline in the volume of loans sold, partially offset by an improvement in the effective yield of loans sold. During the three months ended June 30, 2024, approximately $6.8 million of loans were sold with an effective yield of 6.60%, as compared to approximately $10.9 million of loans sold with an effective yield of 5.89% during the three months ended June 30, 2023.

FHLB stock dividends. The increase related to increases in the annualized dividend rate and total average shares outstanding to 8.75% and 150,000 for the three months ended June 30, 2024 from 7.00% and 108,901 shares for the three months ended June 30, 2023.

Other income. The decrease related to a $1.3 million gain from distributions received on equity investments in venture-backed funds during the three months ended June 30, 2023, which did not occur during the three months ended June 30, 2024.

Non-interest Expense

The following table presents the key components of non-interest expense for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three months ended | | | | |

(in thousands) | | June 30,

2024 | | March 31,

2024 | | $ Change | | % Change |

Salaries and employee benefits | | $ | 7,803 | | | $ | 7,577 | | | $ | 226 | | | 2.98 | % |

Occupancy and equipment | | 646 | | | 626 | | | 20 | | | 3.19 | % |

Data processing and software | | 1,235 | | | 1,157 | | | 78 | | | 6.74 | % |

Federal Deposit Insurance Corporation (“FDIC”) insurance | | 390 | | | 400 | | | (10) | | | (2.50) | % |

Professional services | | 767 | | | 707 | | | 60 | | | 8.49 | % |

Advertising and promotional | | 615 | | | 460 | | | 155 | | | 33.70 | % |

Loan-related expenses | | 297 | | | 297 | | | — | | | — | % |

Other operating expenses | | 1,760 | | | 1,492 | | | 268 | | | 17.96 | % |

Total non-interest expense | | $ | 13,513 | | | $ | 12,716 | | | $ | 797 | | | 6.27 | % |

Salaries and employee benefits. The increase related primarily to: (i) a $0.5 million increase in commissions related primarily to higher loan production; and (ii) a $0.3 million increase in salaries, benefits, and bonus expense related to a 2.75% increase in headcount during the quarter. These increases were partially offset by a $0.6 million increase in loan origination costs due to higher loan production.

Advertising and promotional. The increase related primarily to an overall increase in in sponsorships and donations made, as more events were sponsored and attended compared to the three months ended March 31, 2024.

Other operating expenses. The increase in other operating expenses was primarily due to a $0.2 million increase in travel, conference fees, and professional membership fees, as compared to the three months ended March 31, 2024.

The following table presents the key components of non-interest expense for the periods indicated:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Three months ended | | | | |

| (in thousands) | | June 30,

2024 | | June 30,

2023 | | $ Change | | % Change |

| Salaries and employee benefits | | $ | 7,803 | | | $ | 6,421 | | | $ | 1,382 | | | 21.52 | % |

| Occupancy and equipment | | 646 | | | 551 | | | 95 | | | 17.24 | % |

| Data processing and software | | 1,235 | | | 1,013 | | | 222 | | | 21.92 | % |

| FDIC insurance | | 390 | | | 410 | | | (20) | | | (4.88) | % |

| Professional services | | 767 | | | 586 | | | 181 | | | 30.89 | % |

| Advertising and promotional | | 615 | | | 733 | | | (118) | | | (16.10) | % |

| Loan-related expenses | | 297 | | | 324 | | | (27) | | | (8.33) | % |

| Other operating expenses | | 1,760 | | | 1,941 | | | (181) | | | (9.33) | % |

| Total non-interest expense | | $ | 13,513 | | | $ | 11,979 | | | $ | 1,534 | | | 12.81 | % |

Salaries and employee benefits. The increase during the three months ended June 30, 2024 compared to the three months ended June 30, 2023 related primarily to: (i) a $0.9 million increase in salaries, benefits, and bonus expense for new employees hired since June 2023 to support expansion into the San Francisco Bay Area; (ii) a $0.3 million increase in commissions earned, largely due to commissions paid to the San Francisco Bay Area team, which did not occur during the three months ended June 30, 2023; and (iii) a $0.2 million decrease in loan origination costs due to lower loan production period-over-period.

Data processing and software. The increase was primarily due to: (i) increased usage of our digital banking platform; (ii) higher transaction volumes related to the increased number of loan and deposit accounts; and (iii) an increased number of licenses required for new users on our loan origination and documentation system.

Professional services. The increase was primarily due to: (i) a $0.1 million increase of audit fees for 2024 audits; and (ii) a $0.1 million increase in IT consulting services due to an overall increase in service charges.

Advertising and promotional. The decrease related primarily to an overall decline in sponsorships and donations made, as fewer events were sponsored and attended compared to the three months ended June 30, 2023.

Other operating expenses. The decrease was primarily due to a $0.2 million decrease in travel, conference fees, and professional membership fees, as compared to the three months ended June 30, 2023.

Provision for Income Taxes

Three months ended June 30, 2024, as compared to three months ended March 31, 2024

Provision for income taxes increased slightly to $4.4 million for the three months ended June 30, 2024 from $4.3 million for the three months ended March 31, 2024, primarily driven by an overall increase in pre-tax income. The effective tax rates were 28.84% and 28.94% for the three months ended June 30, 2024 and March 31, 2024, respectively.

Three months ended June 30, 2024, as compared to three months ended June 30, 2023

Provision for income taxes decreased by $0.1 million, or 1.58%, for the three months ended June 30, 2024 compared to the three months ended June 30, 2023, primarily driven by a $0.5 million state tax benefit recorded during the three months ended June 30, 2023 relating to an overall reduction in the state tax blended rate for the Company since its transition to a C Corporation, which did not occur during the three months ended June 30, 2024. The effective tax rates for the three months ended June 30, 2024 and June 30, 2023, were 28.84% and 25.86% respectively.

Webcast Details

Five Star Bancorp will host a live webcast for analysts and investors on Thursday, July 25, 2024 at 1:00 p.m. ET (10:00 a.m. PT) to discuss its second quarter financial results. To view the live webcast, visit the “News & Events”

section of the Company’s website under “Events” at https://investors.fivestarbank.com/news-events/events. The webcast will be archived on the Company’s website for a period of 90 days.

About Five Star Bancorp

Five Star is a bank holding company headquartered in Rancho Cordova, California. Five Star operates through its wholly owned banking subsidiary, Five Star Bank. The Bank has seven branches in Northern California.

Forward-Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results, and the assumptions upon which those statements are based. Forward-looking statements include without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on the Company’s expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company’s control) and are subject to risks and uncertainties, which change over time, and other factors, which could cause actual results to differ materially from those currently anticipated. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. If one or more of the factors affecting the Company’s forward-looking information and statements proves incorrect, then the Company’s actual results, performance, or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements contained in this press release. Therefore, the Company cautions you not to place undue reliance on the Company’s forward-looking information and statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the three months ended March 31, 2024, in each case under the section entitled “Risk Factors,” and other documents filed by the Company with the Securities and Exchange Commission from time to time.

The Company disclaims any duty to revise or update the forward-looking statements, whether written or oral, to reflect actual results or changes in the factors affecting the forward-looking statements, except as specifically required by law.

Condensed Financial Data (Unaudited)

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

(in thousands, except per share and share data) | | June 30,

2024 | | March 31,

2024 | | June 30,

2023 |

Revenue and Expense Data | | | | | | |

Interest and fee income | | $ | 48,998 | | | $ | 47,541 | | | $ | 42,793 | |

Interest expense | | 19,906 | | | 20,797 | | | 15,215 | |

Net interest income | | 29,092 | | | 26,744 | | | 27,578 | |

Provision for credit losses | | 2,000 | | | 900 | | | 1,250 | |

Net interest income after provision | | 27,092 | | | 25,844 | | | 26,328 | |

Non-interest income: | | | | | | |

Service charges on deposit accounts | | 189 | | | 188 | | | 135 | |

| | | | | | |

Gain on sale of loans | | 449 | | | 369 | | | 641 | |

Loan-related fees | | 370 | | | 429 | | | 389 | |

FHLB stock dividends | | 329 | | | 332 | | | 189 | |

Earnings on bank-owned life insurance | | 158 | | | 142 | | | 126 | |

Other income | | 78 | | | 373 | | | 1,340 | |

Total non-interest income | | 1,573 | | | 1,833 | | | 2,820 | |

Non-interest expense: | | | | | | |

Salaries and employee benefits | | 7,803 | | | 7,577 | | | 6,421 | |

Occupancy and equipment | | 646 | | | 626 | | | 551 | |

Data processing and software | | 1,235 | | | 1,157 | | | 1,013 | |

FDIC insurance | | 390 | | | 400 | | | 410 | |

Professional services | | 767 | | | 707 | | | 586 | |

Advertising and promotional | | 615 | | | 460 | | | 733 | |

Loan-related expenses | | 297 | | | 297 | | | 324 | |

Other operating expenses | | 1,760 | | | 1,492 | | | 1,941 | |

Total non-interest expense | | 13,513 | | | 12,716 | | | 11,979 | |

Income before provision for income taxes | | 15,152 | | | 14,961 | | | 17,169 | |

Provision for income taxes | | 4,370 | | | 4,330 | | | 4,440 | |

Net income | | $ | 10,782 | | | $ | 10,631 | | | $ | 12,729 | |

| | | | | | |

| Comprehensive Income | | | | | | |

| Net income | | $ | 10,782 | | | $ | 10,631 | | | $ | 12,729 | |

Net unrealized holding gain (loss) on securities available-for-sale during the period | | 295 | | | (955) | | | (1,462) | |

| | | | | | |

Less: Income tax expense (benefit) related to other comprehensive income (loss) | | 87 | | | (282) | | | (432) | |

Other comprehensive income (loss) | | 208 | | | (673) | | | (1,030) | |

| Total comprehensive income | | $ | 10,990 | | | $ | 9,958 | | | $ | 11,699 | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

(in thousands, except per share and share data) | | June 30,

2024 | | March 31,

2024 | | June 30,

2023 |

Share and Per Share Data | | | | | | |

Earnings per common share: | | | | | | |

Basic | | $ | 0.51 | | | $ | 0.62 | | | $ | 0.74 | |

Diluted | | 0.51 | | | 0.62 | | | 0.74 | |

Book value per share | | 17.85 | | | 16.86 | | | 15.60 | |

Tangible book value per share(1) | | 17.85 | | | 16.86 | | | 15.60 | |

Weighted average basic common shares outstanding | | 21,039,798 | | | 17,190,867 | | | 17,165,344 | |

Weighted average diluted common shares outstanding | | 21,058,085 | | | 17,272,994 | | | 17,168,995 | |

Shares outstanding at end of period | | 21,319,583 | | | 17,353,251 | | | 17,257,357 | |

| | | | | | |

Credit Quality | | | | | | |

Allowance for credit losses to period end nonperforming loans | | 1,882.30 | % | | 1,806.73 | % | | 11,839.25 | % |

Nonperforming loans to loans held for investment | | 0.06 | % | | 0.06 | % | | 0.01 | % |

Nonperforming assets to total assets | | 0.05 | % | | 0.06 | % | | 0.01 | % |

Nonperforming loans plus performing loan modifications to loans held for investment | | 0.06 | % | | 0.06 | % | | 0.01 | % |

| | | | | | |

Selected Financial Ratios | | | | | | |

ROAA | | 1.23 | % | | 1.22 | % | | 1.55 | % |

ROAE | | 11.72 | % | | 14.84 | % | | 19.29 | % |

Net interest margin | | 3.39 | % | | 3.14 | % | | 3.45 | % |

Loan to deposit | | 103.87 | % | | 105.37 | % | | 100.21 | % |

(1) See the section entitled “Non-GAAP Reconciliation (Unaudited)” for a reconciliation of this non-GAAP financial measure.

| | | | | | | | | | | | | | | | | | | | |

(in thousands) | | June 30,

2024 | | March 31,

2024 | | June 30,

2023 |

Balance Sheet Data | | | | | | |

Cash and due from financial institutions | | $ | 28,572 | | | $ | 29,750 | | | $ | 28,568 | |

Interest-bearing deposits in banks | | 161,787 | | | 155,575 | | | 271,555 | |

Time deposits in banks | | 4,097 | | | 5,878 | | | 7,343 | |

Securities - available-for-sale, at fair value | | 103,204 | | | 105,006 | | | 110,794 | |

Securities - held-to-maturity, at amortized cost | | 2,973 | | | 3,000 | | | 3,486 | |

Loans held for sale | | 5,322 | | | 10,243 | | | 8,559 | |

Loans held for investment | | 3,266,291 | | | 3,104,130 | | | 2,927,411 | |

Allowance for credit losses | | (35,406) | | | (34,653) | | | (33,984) | |

Loans held for investment, net of allowance for credit losses | | 3,230,885 | | | 3,069,477 | | | 2,893,427 | |

FHLB stock | | 15,000 | | | 15,000 | | | 15,000 | |

| Operating leases, right-of-use asset | | 6,630 | | | 6,932 | | | 5,032 | |

Premises and equipment, net | | 1,610 | | | 1,569 | | | 1,599 | |

Bank-owned life insurance | | 19,030 | | | 18,872 | | | 16,897 | |

Interest receivable and other assets | | 55,107 | | | 55,058 | | | 40,441 | |

Total assets | | $ | 3,634,217 | | | $ | 3,476,360 | | | $ | 3,402,701 | |

| | | | | | |

Non-interest-bearing deposits | | $ | 825,733 | | | $ | 817,388 | | | $ | 833,707 | |

Interest-bearing deposits | | 2,323,898 | | | 2,138,384 | | | 2,096,032 | |

Total deposits | | 3,149,631 | | | 2,955,772 | | | 2,929,739 | |

Subordinated notes, net | | 73,822 | | | 73,786 | | | 73,677 | |

| Other borrowings | | — | | | 120,000 | | | 100,000 | |

Operating lease liability | | 7,077 | | | 7,320 | | | 5,275 | |

Interest payable and other liabilities | | 23,217 | | | 26,902 | | | 24,870 | |

Total liabilities | | 3,253,747 | | | 3,183,780 | | | 3,133,561 | |

| | | | | | |

Common stock | | 301,968 | | | 220,804 | | | 220,021 | |

Retained earnings | | 90,734 | | | 84,216 | | | 62,095 | |

Accumulated other comprehensive loss, net of taxes | | (12,232) | | | (12,440) | | | (12,976) | |

Total shareholders’ equity | | 380,470 | | | 292,580 | | | 269,140 | |

| Total liabilities and shareholders’ equity | | $ | 3,634,217 | | | $ | 3,476,360 | | | $ | 3,402,701 | |

| | | | | | |

Quarterly Average Balance Data | | | | | | |

Average loans held for investment and sale | | $ | 3,197,921 | | | $ | 3,082,290 | | | $ | 2,914,388 | |

Average interest-earning assets | | 3,452,676 | | | 3,424,469 | | | 3,210,389 | |

Average total assets | | 3,537,230 | | | 3,518,452 | | | 3,285,805 | |

Average deposits | | 3,049,919 | | | 3,106,841 | | | 2,912,891 | |

Average total equity | | 370,135 | | | 288,106 | | | 264,688 | |

| | | | | | |

Capital Ratios | | | | | | |

Total shareholders’ equity to total assets | | 10.47 | % | | 8.42 | % | | 7.91 | % |

Tangible shareholders’ equity to tangible assets(1) | | 10.47 | % | | 8.42 | % | | 7.91 | % |

Total capital (to risk-weighted assets) | | 14.38 | % | | 12.34 | % | | 12.43 | % |

Tier 1 capital (to risk-weighted assets) | | 11.28 | % | | 9.13 | % | | 9.05 | % |

Common equity Tier 1 capital (to risk-weighted assets) | | 11.28 | % | | 9.13 | % | | 9.05 | % |

Tier 1 leverage ratio | | 11.05 | % | | 8.63 | % | | 8.66 | % |

(1) See the section entitled “Non-GAAP Reconciliation (Unaudited)” for a reconciliation of this non-GAAP financial measure.

Non-GAAP Reconciliation (Unaudited)

The Company uses financial information in its analysis of the Company’s performance that is not in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Company believes that these non-GAAP financial measures provide useful information to management and investors that is supplementary to the Company’s financial condition, results of operations, and cash flows computed in accordance with GAAP. However, the Company acknowledges that its non-GAAP financial measures have a number of limitations. As such, investors should not view these disclosures as a substitute for results determined in accordance with GAAP. Additionally, these non-GAAP measures are not necessarily comparable to non-GAAP financial measures that other banking companies use. Other banking companies may use names similar to those the Company uses for the non-GAAP financial measures the Company discloses, but may calculate them differently. Investors should understand how the Company and other companies each calculate their non-GAAP financial measures when making comparisons.

Tangible shareholders’ equity to tangible assets is defined as total equity less goodwill and other intangible assets, divided by total assets less goodwill and other intangible assets. The most directly comparable GAAP financial measure is total shareholders’ equity to total assets. We had no goodwill or other intangible assets at the end of any period indicated. As a result, tangible shareholders’ equity to tangible assets is the same as total shareholders’ equity to total assets at the end of each of the periods indicated.

Tangible book value per share is defined as total shareholders’ equity less goodwill and other intangible assets, divided by the outstanding number of common shares at the end of the period. The most directly comparable GAAP financial measure is book value per share. We had no goodwill or other intangible assets at the end of any period indicated. As a result, tangible book value per share is the same as book value per share at the end of each of the periods indicated.

Pre-tax, pre-provision income is defined as pre-tax income plus provision for credit losses. The most directly comparable GAAP financial measure is pre-tax income.

The following reconciliation table provides a more detailed analysis of this non-GAAP financial measure:

| | | | | | | | | | | | | | | | | | | | |

| | Three months ended |

(in thousands) | | June 30,

2024 | | March 31,

2024 | | June 30,

2023 |

Pre-tax, pre-provision income | | | | | | |

| Pre-tax income | | $ | 15,152 | | | $ | 14,961 | | | $ | 17,169 | |

| Add: provision for credit losses | | 2,000 | | | 900 | | | 1,250 | |

| Pre-tax, pre-provision income | | $ | 17,152 | | | $ | 15,861 | | | $ | 18,419 | |

Investor Contact:

Heather C. Luck, Chief Financial Officer

Five Star Bancorp

(916) 626-5008

hluck@fivestarbank.com

Media Contact:

Shelley R. Wetton, Chief Marketing Officer

Five Star Bancorp

(916) 284-7827

swetton@fivestarbank.com

Investor Presentation Second Quarter 2024

Safe Harbor Statement and Disclaimer Forward-Looking Statements In this presentation, “we,” “our,” “us,” “Five Star,” or “the Company” refers to Five Star Bancorp, a California corporation, and our consolidated subsidiaries, including Five Star Bank, a California state- chartered bank, unless the context indicates that we refer only to the parent company, Five Star Bancorp. This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements represent plans, estimates, objectives, goals, guidelines, expectations, intentions, projections, and statements of the Company’s beliefs concerning future events, business plans, objectives, expected operating results, and the assumptions upon which those statements are based. Forward-looking statements include without limitation, any statement that may predict, forecast, indicate, or imply future results, performance, or achievements, and are typically identified with words such as “may,” “could,” “should,” “will,” “would,” “believe,” “anticipate,” “estimate,” “expect,” “aim,” “intend,” “plan,” or words or phases of similar meaning. The Company cautions that the forward-looking statements are based largely on the Company’s expectations and are subject to a number of known and unknown risks and uncertainties that are subject to change based on factors which are, in many instances, beyond the Company’s control. Such forward-looking statements are based on various assumptions (some of which may be beyond the Company’s control) and are subject to risks and uncertainties, which change over time, and other factors which could cause actual results to differ materially from those currently anticipated. New risks and uncertainties may emerge from time to time, and it is not possible for the Company to predict their occurrence or how they will affect the Company. If one or more of the factors affecting the Company’s forward-looking information and statements proves incorrect, then the Company’s actual results, performance, or achievements could differ materially from those expressed in, or implied by, forward-looking information and statements contained in this press release. Therefore, the Company cautions you not to place undue reliance on the Company’s forward-looking information and statements. Important factors that could cause actual results to differ materially from those in the forward-looking statements are set forth in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 and Quarterly Report on Form 10-Q for the three months ended March 31, 2024, in each case under the section entitled “Risk Factors,” and other documents filed by the Company with the Securities and Exchange Commission from time to time. The Company disclaims any duty to revise or update the forward-looking statements, whether written or oral, to reflect actual results or changes in the factors affecting the forward-looking statements, except as specifically required by law. Industry Information This presentation includes statistical and other industry and market data that we obtained from government reports and other third-party sources. Our internal data, estimates, and forecasts are based on information obtained from government reports, trade, and business organizations and other contacts in the markets in which we operate and our management’s understanding of industry conditions. Although we believe that this information (including the industry publications and third-party research, surveys, and studies) is accurate and reliable, we have not independently verified such information. In addition, estimates, forecasts, and assumptions are necessarily subject to a high degree of uncertainty and risk due to a variety of factors. Finally, forward-looking information obtained from these sources is subject to the same qualifications and the additional uncertainties regarding the other forward-looking statements in this presentation. Unaudited Financial Data Numbers contained in this presentation for the quarter ended June 30, 2024 and for other quarterly periods are unaudited. Additionally, all figures presented as year-to-date, except for periods that represent a full fiscal year ended December 31, represent unaudited results. As a result, subsequent information may cause a change in certain accounting estimates and other financial information, including the Company’s allowance for credit losses, fair values, and income taxes. Non-GAAP Financial Measures The Company uses financial information in its analysis of the Company’s performance that is not in conformity with accounting principles generally accepted in the United States of America (“GAAP”). The Company believes that these non-GAAP financial measures provide useful information to management and investors that is supplementary to the Company’s financial condition, results of operations, and cash flows computed in accordance with GAAP. However, the Company acknowledges that its non-GAAP financial measures have a number of limitations. See the appendix to this presentation for a reconciliation of these non-GAAP measures to the most directly comparable GAAP financial measures. Second Quarter 2024 Investor Presentation | 2

Agenda Second Quarter 2024 Investor Presentation | 3 •Company Overview •Financial Highlights •Loans and Credit Quality •Deposit and Capital Overview •Financial Results

Company Overview Second Quarter 2024 Investor Presentation | 4

Company Overview Nasdaq: Headquarters: Asset Size: Loans HFI: Deposits: Bank Branches: Second Quarter 2024 Investor Presentation | 5 FSBC Rancho Cordova, CA $3.6 billion $3.3 billion $3.1 billion 7 Note: Balances are as of June 30, 2024. References to loans HFI are loans held for investment. Five Star is a community business bank that was founded to serve the commercial real estate industry. Today, the markets we serve have expanded to meet customer demand and now include manufactured housing and storage, faith-based, government, nonprofits, and more.

Executive Team Second Quarter 2024 Investor Presentation | 6 James Beckwith President and Chief Executive Officer Five Star since 2003 John Dalton Senior Vice President and Chief Credit Officer Five Star since 2011 Mike Lee Senior Vice President and Chief Regulatory Officer Five Star since 2005 Michael Rizzo Senior Vice President and Chief Banking Officer Five Star since 2005 Brett Wait Senior Vice President and Chief Information Officer Five Star since 2011 Lydia Ramirez Senior Vice President and Chief Operations and Chief DE&I Officer Five Star since 2017 Heather Luck Senior Vice President and Chief Financial Officer Five Star since 2018 Shelley Wetton Senior Vice President and Chief Marketing Officer Five Star since 2015

Financial Highlights Second Quarter 2024 Investor Presentation | 7

$604 $811 $840 $973 $1,272 $1,480 $1,954 $2,557 $3,227 $3,593 $3,634 $1,806 $2,535 $148 $22 Total Assets Excluding PPP Loans PPP Loans 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 Q2 2024 Consistent and Organic Asset Growth Second Quarter 2024 Investor Presentation | 8 Note: Dollars are in millions. Balances are end of period. References to PPP are the Paycheck Protection Program. 1. CAGR is based upon balances as of June 30, 2024. 2. A reconciliation of this non-GAAP measure is set forth in the appendix. (2) CAGR (1) 5 years 10 years Total Assets 22.10 % 20.80 %

Financial Highlights Second Quarter 2024 Investor Presentation | 9 (in thousands, except per share data) For the three months ended 6/30/2024 3/31/2024 6/30/2023 Profitability Net income $ 10,782 $ 10,631 $ 12,729 Return on average assets ("ROAA") 1.23 % 1.22 % 1.55 % Return on average equity ("ROAE") 11.72 % 14.84 % 19.29 % Earnings per share (basic and diluted) $ 0.51 $ 0.62 $ 0.74 Net Interest Margin Net interest margin 3.39 % 3.14 % 3.45 % Average loan yield 5.83 % 5.71 % 5.50 % Average cost of interest-bearing deposits 3.37 % 3.46 % 2.69 % Average cost of total deposits 2.47 % 2.53 % 1.92 % Total cost of funds 2.56 % 2.62 % 2.04 % 6/30/2024 12/31/2023 Deposits and Securities Non-interest-bearing deposits $ 825,733 $ 831,101 Interest-bearing deposits 2,323,898 2,195,795 Total deposits 3,149,631 3,026,896 Total securities 106,177 111,160 Total securities to interest-earning assets 3.00 % 3.17 % Asset Quality Nonperforming loans to loans held for investment 0.06 % 0.06 % Allowance for credit losses to loans held for investment 1.08 % 1.12 % Note: Yields are based on average balance and annualized quarterly interest income. Costs are based on average balance and annualized quarterly interest expense.

Financial Highlights - June 30, 2024 Second Quarter 2024 Investor Presentation | 10 Growth • Continued balance sheet growth with increases in loans held for investment of $162.2 million and non-wholesale deposits of $118.3 million since March 31, 2024. Funding • Non-interest-bearing deposits comprised 26.22% of total deposits, as compared to 27.65% of total deposits as of March 31, 2024. • Deposits comprised 96.80% of total liabilities, as compared to 92.84% of total liabilities as of March 31, 2024. Liquidity • Insured and collateralized deposits were approximately $2.0 billion, representing 64.70% of total deposits, compared to 63.02% as of March 31, 2024. • Cash and cash equivalents were $190.4 million, representing 6.04% of total deposits, compared to 6.27% as of March 31, 2024. Capital • All capital ratios were above well-capitalized regulatory thresholds. • On April 18, 2024 and July 18, 2024, the Company declared cash dividends of $0.20 per share for the three months ended March 31, 2024 and June 30, 2024, respectively.

Loans and Credit Quality Second Quarter 2024 Investor Presentation | 11

To ta l L oa ns (M ill io ns ) $1,180 $1,355 $1,912 $2,791 $2,870 $2,927 $3,010 $3,082 $3,104 $3,266 $148 $22 5.45% 4.96% 4.82% 4.75% 5.36% 5.50% 5.57% 5.64% 5.71% 5.83% Non-PPP Loans PPP Loans Average Loan Yield Average Loan Yield Excluding PPP Loans 2019 2020 2021 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $0 $250 $500 $750 $1,000 $1,250 $1,500 $1,750 $2,000 $2,250 $2,500 $2,750 $3,000 $3,250 Consistent Loan Growth Second Quarter 2024 Investor Presentation | 12 Note: Loan balances are end of period loans held for investment. Yields are based on average balance and annualized quarterly interest income. 1. CAGR is based upon balances as of June 30, 2024. 2. A reconciliation of this non-GAAP measure is set forth in the appendix. (2) CAGR (1) 5 years Total Loans 25.38 %

Loan Portfolio Composition Second Quarter 2024 Investor Presentation | 13 Commercial real estate, 84.9% Commercial land and development, 0.1% Commercial construction, 2.2% Residential construction, 0.3% Residential, 0.9% Farmland, 1.5% Secured, 4.7% Unsecured, 0.7% PPP, 0.0% Consumer and other, 4.7% Types of collateral securing commercial real estate ("CRE") loans Loan Balance ($000s) # of Loans % of CRE Manufactured home community $ 868,198 392 31.28 % RV Park 358,070 119 12.91 % Retail 272,274 93 9.82 % Industrial 206,832 134 7.46 % Faith-based 183,625 99 6.62 % Multifamily 179,419 95 6.47 % Mini storage 177,173 47 6.39 % All other types (1) 528,410 262 19.05 % Total $ 2,774,001 1,241 100.00 % Note: Balances are net book value as of June 30, 2024, before allowance for credit losses, before deferred loan fees, and exclude loans held for sale. 1. Types of collateral in “all other types” are those that individually make up less than 5% CRE concentration.

$868M $358M $272M $207M $184M $179M $177M $528M $1,548M $627M $544M $461M $490M $375M $359M $1,132M 61.75% 61.22% 56.27% 51.50% 46.04% 52.97% 56.61% 54.55% Loan Balance Collateral Value Weighted Average Loan-to-Value Manufactured home community RV Park Retail Industrial Faith-based Multifamily Mini storage All other types $0M $250M $500M $750M $1,000M $1,250M $1,500M $1,750M CRE Collateral Values Second Quarter 2024 Investor Presentation | 14 (1) Note: Balances are net book value as of June 30, 2024, before allowance for credit losses, before deferred loan fees, and exclude loans held for sale. 1. Types of collateral in “all other types” are those that individually make up less than 5% CRE concentration.

Loan Portfolio Diversification We focus primarily on commercial lending, with an emphasis on commercial real estate. We offer a variety of loans to small and medium-sized businesses, professionals, and individuals, including commercial real estate, commercial land and construction, and farmland loans. To a lesser extent, we also offer residential real estate, construction real estate, and consumer loans. Second Quarter 2024 Investor Presentation | 15Note: Balances are net book value as of June 30, 2024, before allowance for credit losses, before deferred loan fees, and exclude loans held for sale. Loans by Product Loans by Purpose Real Estate Loans by Geography CML Term CRE NOO, 37.6% CML Term Multifamily, 32.0% CML Term CRE OO, 15.1% CSM Unsecured, 4.4% CML Secured, 2.7% CML Const CRE, 2.2%CML Term Ag RE, 1.5% SBA 7A Secured, 1.4% Others, 3.1% CA, 57.7% TX, 7.3% NC, 3.2% AZ, 3.2% FL, 2.5% OR, 2.4% NV, 2.3% GA, 1.6%TN, 1.5%CO, 1.4% MO, 1.3% PA, 1.2% WA, 1.1% WI, 1.1% OH, 1.0% Other, 11.2% CRE Manufactured Home, 26.6% CRE Other, 14.4% CRE RV Park, 11.0% CRE Retail, 8.3% CRE Industrial, 6.3% CRE Faith-based, 5.6% CRE Multifamily, 5.5% CRE Mini Storage, 5.4% Commercial Other, 5.3% Consumer Unsecured, 4.4%CRE Office, 4.2% Commercial Construction, 2.5% Others, 0.5%

Loan Rollforward Second Quarter 2024 Investor Presentation | 16Note: Dollars are in millions. Beginning and ending balances are end of period, before allowance for credit losses, including deferred loan fees, and exclude loans held for sale. $135 $254 $135 $144 $150 $390 $(38) $(158) $(39) $(59) $(51) $(155) $(18) $(39) $(13) $(13) $(77) $(73) Originations & Advances Paydowns Payoffs Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 Beginning Balance $ 2,791 $ 2,870 $ 2,927 $ 3,010 $ 3,082 $ 3,104 Ending Balance $ 2,870 $ 2,927 $ 3,010 $ 3,082 $ 3,104 $ 3,266

Asset Quality Our primary objective is to maintain a high level of asset quality in our loan portfolio. Therefore, we: – Place emphasis on our commercial portfolio, where we reevaluate risk assessments as a result of reviewing commercial property operating statements and borrower financials – Monitor payment performance, delinquencies, and tax and property insurance compliance – Design our practices to facilitate the early detection and remediation of problems within our loan portfolio – Employ the use of an outside, independent consulting firm to evaluate our underwriting and risk assessment process Second Quarter 2024 Investor Presentation | 17 Nonperforming Loan Trend Allowance for Credit Losses and Net Charge-off Trend Note: References to loans HFI are loans held for investment, which are the equivalent of total loans outstanding at each period end. References to average loans HFI are average loans held for investment during the period. $0.8M $0.5M $0.6M $0.4M $2.0M $1.9M $1.9M 0.07% 0.03% 0.03% 0.01% 0.06% 0.06% 0.06% Nonperforming Loans Nonperforming Loans to Loans HFI 2019 2020 2021 2022 2023 Q1 2024 Q2 2024 1.26% 1.48% 1.20% 1.02% 1.12% 1.12% 1.08% 0.21% 0.12% 0.04% 0.07% 0.11% 0.03% 0.04% Allowance for Credit Losses to Loans HFI Net Charge-offs to Average Loans HFI 2019 2020 2021 2022 2023 Q1 2024 Q2 2024

Allocation of Allowance for Credit Losses Second Quarter 2024 Investor Presentation | 18 (in thousands) December 31, 2023 March 31, 2024 June 30, 2024 Allowance for Credit Losses Amount % of Total Amount % of Total Amount % of Total Real estate: Commercial $ 29,015 84.27 % $ 28,895 83.40 % $ 24,708 69.79 % Commercial land & development 178 0.52 % 164 0.47 % 72 0.20 % Commercial construction 718 2.08 % 697 2.01 % 1,097 3.10 % Residential construction 89 0.26 % 114 0.33 % 100 0.28 % Residential 151 0.44 % 164 0.47 % 195 0.55 % Farmland 399 1.16 % 438 1.26 % 402 1.14 % Total real estate loans 30,550 88.73 % 30,472 87.94 % 26,574 75.06 % Commercial: Secured 3,314 9.62 % 3,262 9.41 % 7,386 20.86 % Unsecured 189 0.55 % 259 0.75 % 214 0.60 % Total commercial loans 3,503 10.17 % 3,521 10.16 % 7,600 21.46 % Consumer and other 378 1.10 % 660 1.90 % 1,232 3.48 % Total allowance for credit losses $ 34,431 100.00 % $ 34,653 100.00 % $ 35,406 100.00 %

Risk Grade Migration Second Quarter 2024 Investor Presentation | 19 Classified Loans (Loans Rated Substandard or Doubtful) (in thousands) 2022 2023 Q1 2024 Q2 2024 Real estate: Commercial $ 106 $ 1,892 $ 1,852 $ 1,822 Commercial land and development — — — — Commercial construction — — — — Residential construction — — — — Residential 175 — — — Farmland — — — — Commercial: Secured 123 72 66 60 Unsecured — — — — Consumer and other 26 12 11 10 Total $ 430 $ 1,976 $ 1,929 $ 1,892 % of Loan Portfolio Outstanding by Risk Grade: Pass 99.20 % 98.66 % 98.27 % 98.17 % Watch 0.78 % 1.28 % 1.67 % 1.77 % Substandard 0.02 % 0.06 % 0.06 % 0.06 % Note: Loan portfolio outstanding is the total balance of loans outstanding at period end, before deferred loan fees, before allowance for credit losses, and exclude loans held for sale.

Deposit and Capital Overview Second Quarter 2024 Investor Presentation | 20

Government, 21.80% Other, 15.45% Commercial Real Estate & Construction, 12.75% Small to Medium Sized Business, 12.46% Professional Service Practice, 9.35% Non- profit, 8.20% Manufactured Home Community, 7.83% Healthcare & Practice, 6.77%Venture Banking, 2.25% Faith-based, 2.20% Agriculture & Ag Tech, 0.94% Deposit Composition 8.46 Years Average Age of Relationships > $5 million Note: Balances are as of June 30, 2024 and include time and wholesale deposits. 1. Types of accounts in “Other” are individuals, trusts, estates, and market verticals that individually make up less than 0.4% of all deposits. 2. Local Agency Depositors includes State of California. $250,000 Average Deposit Account Balance Relationships > $5 million, 59.53% Relationships ≤ $5 million, 40.47% Total Deposits by Relationship Size Local Agency BreakoutTotal Deposits by Market Vertical Local Agency Depositors, 21.66% All Other Depositors, 78.34% Second Quarter 2024 Investor Presentation | 21 (2) (1)

Diversified Funding Second Quarter 2024 Investor Presentation | 22 Total Deposits(1) = $3.1 billion 96.8% of Total Liabilities Liability Mix 1. Balance as of June 30, 2024. 2. Loan balance in loan to deposit ratio is total loans held for investment and sale at period end. Loan(2) to Deposit Ratio Non-Interest-Bearing Deposits to Total Deposits 90.5% 84.5% 85.1% 100.7% 102.2% 105.4% 103.9% 2019 2020 2021 2022 2023 Q1 2024 Q2 2024 29.6% 39.3% 39.5% 34.9% 27.5% 27.7% 26.2% 2019 2020 2021 2022 2023 Q1 2024 Q2 2024 Money Market, 48.1% Non-Interest- Bearing Demand, 25.4% Time Deposits, 10.2% Interest- Bearing Demand, 9.2% Savings, 3.9% Borrowings & Subordinated Notes, 2.3% Other Liabilities, 0.9%

$1.3B $1.8B $2.3B $2.8B $3.0B $3.0B $3.1B $708M $889M $1,001M $1,228M $1,409M $1,554M $1,691M$389M $701M $902M $971M $831M $817M $826M $119M $146M $279M $240M $320M $296M $300M $97M $48M $104M $343M $467M $288M $333M Money Market & Savings Non-Interest-Bearing Demand Interest-Bearing Demand Time Deposits 2019 2020 2021 2022 2023 Q1 2024 Q2 2024 Strong Deposit Growth Second Quarter 2024 Investor Presentation | 23 Note: Balances are end of period. Cost of total deposits is based on total average balance of interest-bearing and non-interest-bearing deposits and annualized quarterly deposit interest expense. 1. CAGR is based upon balances as of June 30, 2024. Cost of Total Deposits 0.81% 0.44% 0.11% 0.43% 1.97% 2.53% 2.47% CAGR (1) 5 years Total Deposits 21.49 %

Capital Ratios Second Quarter 2024 Investor Presentation | 24 Tier 1 Leverage Ratio Tier 1 Capital to RWA Total Capital to RWA Common Equity Tier 1 to RWA Note: References to RWA are risk-weighted assets. 7.51% 6.58% 9.47% 8.60% 8.73% 11.05% 2019 2020 2021 2022 2023 Q2 2024 8.21% 8.98% 11.44% 8.99% 9.07% 11.28% 2019 2020 2021 2022 2023 Q2 2024 8.21% 8.98% 11.44% 8.99% 9.07% 11.28% 2019 2020 2021 2022 2023 Q2 2024 11.52% 12.18% 13.98% 12.46% 12.30% 14.38% 2019 2020 2021 2022 2023 Q2 2024

Financial Results Second Quarter 2024 Investor Presentation | 25

Earnings Track Record Second Quarter 2024 Investor Presentation | 26 $19.4M $18.4M $16.8M $16.0M $15.9M $17.2M $18.5M $17.2M $15.8M $15.2M $15.0M $15.2M Pre-tax, pre-provision income Pre-tax income Q1 2023 Q2 2023 Q3 2023 Q4 2023 Q1 2024 Q2 2024 $0.0M $2.5M $5.0M $7.5M $10.0M $12.5M $15.0M $17.5M $20.0M $22.5M 1. A reconciliation of this non-GAAP measure is set forth in the appendix. (1)

Operating Metrics Second Quarter 2024 Investor Presentation | 27 Efficiency RatioNet Interest Margin 3.98% 3.68% 3.64% 3.75% 3.42% 3.27% 2019 2020 2021 2022 2023 2024 YTD 38.63% 37.92% 42.46% 36.90% 40.35% 44.27% 2019 2020 2021 2022 2023 2024 YTD Note: All 2024 figures are through June 30, 2024.

Non-interest Income and Expense Comparison Second Quarter 2024 Investor Presentation | 28 (in thousands) For the three months ended 6/30/2024 3/31/2024 6/30/2023 Non-interest Income Service charges on deposit accounts $ 189 $ 188 $ 135 Gain on sale of loans 449 369 641 Loan-related fees 370 429 389 FHLB stock dividends 329 332 189 Earnings on bank-owned life insurance 158 142 126 Other income 78 373 1,340 Total non-interest income $ 1,573 $ 1,833 $ 2,820 Non-interest Expense Salaries and employee benefits $ 7,803 $ 7,577 $ 6,421 Occupancy and equipment 646 626 551 Data processing and software 1,235 1,157 1,013 Federal Deposit Insurance Corporation insurance 390 400 410 Professional services 767 707 586 Advertising and promotional 615 460 733 Loan-related expenses 297 297 324 Other operating expenses 1,760 1,492 1,941 Total non-interest expense $ 13,513 $ 12,716 $ 11,979

Shareholder Returns Second Quarter 2024 Investor Presentation | 29 ROAA ROAE Value per Share (book and tangible book(1)) Note: All 2024 figures are through June 30, 2024. 1. A reconciliation of this non-GAAP measure is set forth in the appendix. 2.15% 1.95% 1.86% 1.57% 1.44% 1.22% 2019 2020 2021 2022 2023 2024 YTD 31.40% 31.16% 22.49% 18.80% 17.85% 13.08% 2019 2020 2021 2022 2023 2024 YTD $11.25 $12.16 $13.65 $14.66 $16.56 $17.85 2019 2020 2021 2022 2023 2024