Pursuant to this prospectus supplement and the

accompanying prospectus, we are offering, from time to time, shares of our common stock, par value 0.001 par value per share, for an aggregate

offering price of up to US$1,500,000, issuable upon the conversion of US$1,500,000 principal amount of 10% convertible note due 2024 (the

“Note”) and interest accrued thereon to Streeterville Capital, LLC (“Streeterville Capital” or the “Investor”).

The Note was purchased by the Investor from us

pursuant to a securities purchase agreement on March 13, 2023. The Note has a principal amount of US$3,320,000.00 (the “Principal”)

and bears an interest rate that equals to ten percent (10%) per annum. The purchase price for the Note is $3,000,000.00 (the “Purchase

Price”, and the date on which the Purchase Price is delivered by Streeterville Capital to the Company, the “Purchase Price

Date”). The Principal and the interest payable under the Note will become due and payable twelve (12) months from the Purchase Price

Date (the “Maturity Date”), unless earlier converted or prepaid by us. The Note has a conversion price (the “Redemption

Conversion Price”) equal to eighty percent (80%) multiplied by the lowest VWAP (the dollar volume-weighted average price for shares

of our common stock on the Nasdaq Capital Market) during the fifteen (15) trading days immediately preceding the date a redemption notice

is delivered (the “Redemption Date”). In this prospectus supplement, we refer to all shares issued by us pursuant to conversion

of the Note as “Conversion Shares.” The Investor has the right to redeem the Note at any time beginning on the date that is

ninety (90) days from the Purchase Price Date until the outstanding balance has been paid in full, subject to the maximum monthly redemption

amount of $375,000.00 (the “Maximum Monthly Redemption Amount”). Redemptions may be satisfied in cash, common stock at the

Redemption Conversion Price, or any combination of the foregoing. We have the right, but not the obligation, to prepay all or any portion

of the outstanding balance under this Note prior to the Maturity Date at a cash prepayment price equal to 125% of the outstanding balance

to be prepaid. For a more detailed description of the Note, see the section entitled “Description of Securities We Are Offering”

beginning on page S-11.

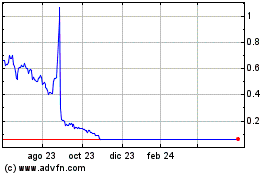

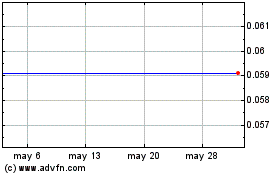

Our shares of common stock are currently traded

on the NASDAQ Capital Market under the symbol “GLG.” On March 13, 2023, the closing sale price of our shares of common stock

was US$1.16 per share.

The aggregate market value of our outstanding

shares of common stock held by non-affiliates was approximately US$144,363,405 based on 144, 416,101 outstanding shares of common stock,

of which 116,422,101 shares are held by non-affiliates, and per share price of US$1.24,

which was the last reported price on the NASDAQ Capital Market of our common stock on March 3, 2023. We have offered US$559,072.97 of

securities pursuant to General Instruction I.B.6. of Form S-3 during the prior 12 calendar month period that ends on and includes the

date of this prospectus supplement and we may sell up to approximately US$100 million of securities hereunder.

Investing in our securities involves a high degree

of risk. You should purchase our securities only if you can afford a complete loss of your investment. See “Risk Factors”

beginning on page S-5 of this prospectus supplement and on page 5 of the accompanying prospectus.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus

supplement or the accompanying prospectus. Any representation to the contrary is a criminal offense.

CAUTIONARY NOTE REGARDING FORWARD LOOKING STATEMENTS

Certain statements contained or incorporated by

reference in this prospectus supplement, including the documents referred to or incorporated by reference in this prospectus supplement

or statements of our management referring to our summarizing the contents of this prospectus supplement, include “forward-looking

statements”. We have based these forward-looking statements on our current expectations and projections about future events. Our

actual results may differ materially or perhaps significantly from those discussed herein, or implied by, these forward-looking statements.

Forward-looking statements are identified by words such as “believe,” “expect,” “anticipate,” “intend,”

“estimate,” “plan,” “project” and other similar expressions. In addition, any statements that refer

to expectations or other characterizations of future events or circumstances are forward-looking statements. Forward-looking statements

included or incorporated by reference in this prospectus supplement or our other filings with the Securities and Exchange Commission,

or the SEC, include, but are not necessarily limited to, those relating to:

| ● | expand

our customer base; |

| ● | broaden

our service and product offerings; |

| ● | enhance

our risk management capabilities; |

| ● | improve

our operational efficiency; |

| ● | our

ability to raise sufficient funds to expand our operations; |

| ● | attract,

retain and motivate talented employees; |

| ● | the

impact of COVID-19 on our business operations; |

| |

● |

a decrease in demand for commodities trading and weakness in the commodities trading industry generally; |

| |

|

|

| |

● |

navigate an evolving regulatory environment; |

| |

● |

defend ourselves against litigation, regulatory, privacy or other claims; |

| |

● |

development of a liquid trading market for our securities; |

| |

● |

our plan to maintain compliance with NASDAQ continue listing requirements; |

| |

|

|

| |

● |

financial market volatility and declines in financial market prices of equity securities; |

| |

|

|

| |

● |

liquidity and/or capital resources changes and the impact of any changes or limitations, including, without limitation, ability to borrow funds and/or renew or rollover existing indebtedness; and |

| |

|

|

| |

● |

ongoing or new supply chain and product distribution/logistics issues |

The foregoing does not represent an exhaustive

list of matters that may be covered by the forward-looking statements contained herein or risk factors with which we are faced that may

cause our actual results to differ from those anticipated in our forward-looking statements. Please see “Risk Factors” in

our reports filed with the SEC or in this prospectus supplement and the accompanying prospectus for additional risks which could adversely

impact our business and financial performance.

Moreover, new risks regularly emerge and it is

not possible for our management to predict or articulate all risks we face, nor can we assess the impact of all risks on our business

or the extent to which any risk, or combination of risks, may cause actual results to differ from those contained in any forward-looking

statements. All forward-looking statements included in this prospectus supplement and the accompanying prospectus are based on information

available to us on the date of this prospectus supplement or the accompanying prospectus, as applicable. Except to the extent required

by applicable laws or rules, we undertake no obligation to publicly update or revise any forward-looking statement, whether as a result

of new information, future events or otherwise. All subsequent written and oral forward-looking statements attributable to us or persons

acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout (or incorporated

by reference in) this prospectus supplement and the accompanying prospectus.

You should not place undue reliance on these forward-looking

statements. Although we believe that our plans, objectives, expectations and intentions reflected in or suggested by the forward-looking

statements we make in this supplement prospectus are reasonable, we can give no assurance that these plans, objectives, expectations or

intentions will be achieved. Important factors that could cause our actual results to differ materially from our expectations are disclosed

and described under “Risk Factors”, elsewhere in this supplement prospectus, the accompanying prospectus, and in filings incorporated

by reference.

PROSPECTUS SUPPLEMENT SUMMARY

The following summary highlights selected information

contained or incorporated by reference in this prospectus supplement. This summary does not contain all of the information you should

consider before investing in securities. Before making an investment decision, you should read the entire prospectus and any supplement

hereto carefully, including the risk factors section as well as the financial statements and the notes to the financial statements incorporated

herein by reference.

Our Company

TD Holdings, Inc. (formerly known as Bat Group,

Inc.) currently engages in the commodity trading business (the “Commodities Trading Business”) and supply chain service business

(the “Supply Chain Service Business”) in China. The Commodities Trading Business primarily involves purchasing non-ferrous

metal products from upstream metal and mineral suppliers and then selling to downstream customers. The Supply Chain Service Business primarily

has served as a one-stop commodity supply chain service and digital intelligence supply chain platform integrating upstream and downstream

enterprises, warehouses, logistics, information, and futures trading.

The following diagram illustrates our corporate

structure as of the date of this prospectus supplement.

Our Business

Commodities Trading Business

We have operated the Commodities

Trading Business through Shenzhen Huamucheng Trading Co., Ltd. (“Huamucheng”) since November 2019, which was renamed Shenzhen

Baiyu Jucheng Data Technology Co., Ltd. (“Shenzhen Baiyu Jucheng”) in 2021. On November 22, 2019, Hao Limo Technology (Beijing)

Co., Ltd. (“Hao Limo”), our indirectly wholly owned subsidiary, entered into a series of agreements with Huamucheng and the

shareholders of Huamucheng pursuant to which we obtained control of Huamucheng (the “VIE Agreements”). On June 25, 2020, Hao

Limo and Huamucheng entered into certain VIE termination agreements to terminate the Huamucheng VIE Agreements. As such, Hao Limo no longer

has the control rights and rights to the assets, property and revenue of Huamucheng. At the same time, Shanghai Jianchi Supply Chain Company

Limited (“Shanghai Jianchi”), our wholly-owned subsidiary incorporated in China, acquired 100% equity interest of Huamucheng

from the Huamucheng shareholders for nominal consideration.

The Commodity Trading

Business primarily involves purchasing non-ferrous metal products, such as aluminum ingots, copper, silver, and gold, from upstream metal

and mineral suppliers and then selling to downstream customers. In connection with the Company’s commodity sales, in order to help

customers to obtain sufficient funds to purchase various metal products and also help upstream metal and mineral suppliers to sell their

metal products, the Company launched its Supply Chain Service Business in December 2019. The Company primarily generates revenues from

bulk non-ferrous commodity products, and from providing related supply chain management services in the PRC.

Through Huamucheng’s

business, we source bulk commodity products from non-ferrous metal and mines or its designated distributors and then sells to manufacturers

who need these metals in large quantity. We also work with upstream suppliers in the sourcing of commodities.

Supply Chain Service Business

Our Supply Chain Service Business is conducted

through Shenzhen Qianhai Baiyu Supply Chain Co., Ltd. (“Qianhai Baiyu”), our wholly-owned subsidiary incorporated in China.

On October 26, 2020, Huamucheng entered into certain share purchase agreements to acquire 100% shares of Qianhai Baiyu. Qianhai Baiyu

is engaged in the supply chain service business and covers a full range of commodities, including non-ferrous metals, ferrous metals,

coal, metallurgical raw materials, soybean oils, oils, rubber, wood and various other types of commodities. It also has a supply chain

infrastructure, which includes processing, logistics, warehousing and terminals. Utilizing its customer base, industry experience, and

expertise in the commodity trading industry, Qianhai Baiyu serves as a one-stop commodity supply chain service and digital intelligence

supply chain platform integrating upstream and downstream enterprises, warehouses, logistics, information, and futures trading.

The acquisition of Qianhai Baiyu has laid a solid

foundation for the Company to further expand its operations in the commodity supply chain field. The Company plans to strengthen and upgrade

its supply chain services platform by introducing a systematic quantitative risk control system, which will be based on the Qianhai Baiyu’s

massive historical market data and complex data analysis models. The platform is expected to establish a quantitative risk management

system utilizing ETL data integration (Extract, Transform, Load) as its core, and then optimize trading portfolios by incorporating a

combination of various factors and strategies in order to effectively control risks and sustain business development.

Disposition of the Used Luxury Car Leasing Business

Historically,

one of our core businesses has been the used luxury car leasing business conducted through Beijing Tianxing Kunlun Technology Co. Ltd

(“Beijing Tianxing”), an entity we controlled via certain contractual arrangements. Beijing Tianxing offers our customers

the opportunity to rent luxury pre-owned automobiles in Beijing, Shanghai, Zhejiang and Chengdu, China.

On August 28, 2020, the Company, Vision Loyal Limited

(“Vision Loyal”), HC High Summit Limited (“HC High HK”) and HC High Summit Holding Limited (“HC High BVI”)

entered into a certain share purchase agreement (the “Disposition SPA”). HC High BVI, our wholly-owned subsidiary, is the

sole shareholder of HC High HK, a company incorporated under the laws of the Hong Kong S.A.R. of the PRC. HC High HK is the sole shareholder

of Hao Limo which, via a series of contractual arrangements, controls Beijing Tianxing. Pursuant to the Disposition SPA, HC High BVI agreed

to sell HC High HK in exchange for a nominal consideration of US$1.00, based on a valuation report rendered by an independent third party

valuation firm, Beijing North Asia Asset Assessment Firm The transaction contemplated by the Disposition SPA is hereby referred as the Disposition.

Upon the closing of the Disposition on August 28,

2020, Vision Loyal became the sole shareholder of HC High HK and, as a result, assumed all assets and liabilities of all the subsidiaries

and variable interest entities owned or controlled by HC High HK.

Competition

We mainly compete against other large domestic

commodity metal product trading service providers such as Xiamen International Trade Group Corp, Ltd. Currently, the principal competitive

factors in the non-ferrous metals commodities trading business are price, product availability, quantity, service, and financing terms

for purchases and sales of commodities.

Applicable Government Regulations

Huamucheng has obtained all material approvals,

permits, licenses and certificates required for our non-ferrous metals commodities trading operations, including registrations from the

local business and administrative department authorizing the purchase of raw materials.

Qianhai Baiyu has obtained all material approvals,

permits, licenses and certificates required for providing supply chain management, design, consultation and related services, including

registrations from the local business and administrative department authorizing the purchase of raw materials.

Corporate Information

TD Holdings, Inc. is a holding company that was

incorporated under the laws of the State of Delaware on December 19, 2011.

Our principal executive offices are located at

139, Xinzhou 11th Street, Futian District, Shenzhen, Guangdong, China 518000. Our telephone number is +86 (0755) 82792111. Our NASDAQ

symbol is GLG, and we make our SEC filings available on our website, https://www.tdglg.com/home. Information contained on our website

is not part of this prospectus.

THE OFFERING

| Issuer: |

|

TD Holdings, Inc., a Delaware corporation. |

| |

|

|

| Shares of common stock offered by us: |

|

Shares of common stock of the Company, par value 0.001 per share, with an aggregate offering price of up to US$1,500,000, issuable upon the conversion of US$1,500,000 principal amount of 10% convertible note due 2024 (the “Note”). |

| |

|

|

| Purchaser: |

|

Streeterville Capital, LLC, a Utah limited liability company. |

| |

|

|

| Redemption Conversion Price of the Note: |

|

The Note is convertible into shares of our common stock at a Redemption Conversion Price equal to eighty percent (80%) multiplied by the lowest VWAP (the dollar volume-weighted average price for shares of our common stock on the Nasdaq Capital Market) during the fifteen (15) trading days immediately preceding the date the applicable redemption notice is delivered. |

| |

|

|

| Conversion Rights: |

|

Investor may convert all or a portion of the Note at their option after the date that is ninety (90) days from the Purchase Price Date and before the Maturity Date, unless the outstanding balance is not repaid in full. |

| |

|

|

| Interest of the Note: |

|

10% per annum payable on the Maturity Date. |

| |

|

|

| Ranking: |

|

The Note will be our general unsecured obligation and will be equal in right of payment to any of our unsecured indebtedness that is not so subordinated and effectively junior in right of payment to any of our secured indebtedness. |

| |

|

|

| Proceeds, before expenses,

to us: |

|

US$3,000,000 |

| |

|

|

| Net Proceeds to us: |

|

Approximately US$2,965,000 (representing approximately $1,482,500 allocable to the amount of shares registered hereinunder) |

| |

|

|

| Optional Prepayment of the Note: |

|

We have the right, but not the obligation, to prepay a portion or all of the outstanding balance under this Note prior to the Maturity Date at a cash prepayment price equal to 125% of the outstanding balance to be prepaid. |

| |

|

|

| Events of Default: |

|

If an Event of Default (as defined in the Note) occurs, upon written notice given by Investor to the Company, interest of the outstanding balance will accrue at a rate equal to the lesser of 22% per annum or the maximum rate permitted under applicable law. The Investor will have the right to increase the outstanding balance by 15% for each occurrence of any Major Default (as defined in the Note) and 5% for each occurrence of any Minor Default (as defined in the Note). |

|

Use of Proceeds:

|

|

We anticipate using the net proceeds of this issuance primarily for

general corporate purposes and working capital. |

| Transfer agent and registrar: |

|

VStock Transfer, LLC |

| |

|

|

| Risk factors: |

|

Investing in our securities involves a high degree of risk. For a discussion of factors you should consider carefully before deciding to invest in our shares of common stock, see the information contained in or incorporated by reference under the heading “Risk Factors” beginning on page S-5 of this prospectus supplement, on page 5 of the accompanying prospectus, and in the other documents incorporated by reference into this prospectus supplement. |

| |

|

|

| NASDAQ Capital Market Symbol: |

|

GLG |

RISK FACTORS

Before you make a decision to invest in our

securities, you should consider carefully the risks described below, together with other information in this prospectus supplement, the

accompanying prospectus and the information incorporated by reference herein and therein. If any of the following events actually occur,

our business, operating results, prospects or financial condition could be materially and adversely affected. This could cause the trading

price of our common stock to decline and you may lose all or part of your investment. The risks described below are not the only ones

that we face. Additional risks not presently known to us or that we currently deem immaterial may also significantly impair our business

operations and could result in a complete loss of your investment.

Risk Factors Relating to This Offering

Issuance of our common stock to the Investor may cause substantial

dilution to our existing stockholders and could cause the price of our common stock to decline.

It is anticipated that Conversion Shares offered

to the Investor will be sold from time to time. Depending upon market liquidity at the time, the sale of the Conversion Shares under the

Purchase Agreement may cause the trading price of our common stock to decline.

Since our management will have broad discretion in how we use

the proceeds from this offering, we may use the proceeds in ways with which you disagree.

Our

management will have significant flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our

management with regard to the use of these net proceeds, and you will not have the opportunity, as part of your investment decision, to

influence how the proceeds are being used. It is possible that the net proceeds will be invested in a way that does not yield a favorable,

or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on our business,

financial condition, operating results and cash flow.

Because we are a smaller reporting company, the requirements

of being a public company, including compliance with the reporting requirements of the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), and the requirements of the Sarbanes-Oxley Act and the Dodd-Frank Act, may strain our resources, increase

our costs and distract management, and we may be unable to comply with these requirements in a timely or cost-effective manner.

As a public company with listed equity securities,

we must comply with the federal securities laws, rules and regulations, including certain corporate governance provisions of the Sarbanes-Oxley

Act of 2002 (the “Sarbanes-Oxley Act”) and the Dodd-Frank Act, related rules and regulations of the SEC and the NASDAQ, with

which a private company is not required to comply. Complying with these laws, rules and regulations occupies a significant amount of the

time of our Board of Directors and management and significantly increases our costs and expenses. Among other things, we must:

| ● | maintain

a system of internal control over financial reporting in compliance with the requirements of Section 404 of the Sarbanes-Oxley Act and

the related rules and regulations of the SEC and the Public Company Accounting Oversight Board; |

| ● | comply

with rules and regulations promulgated by the NASDAQ; |

| ● | prepare

and distribute periodic public reports in compliance with our obligations under the federal securities laws; |

| ● | maintain

various internal compliance and disclosures policies, such as those relating to disclosure controls and procedures and insider trading

in our common stock; |

| ● | involve

and retain to a greater degree outside counsel and accountants in the above activities; |

| ● | maintain

a comprehensive internal audit function; and |

| ● | maintain

an investor relations function. |

Future sales of our common stock, whether by us or our stockholders,

could cause our stock price to decline.

If our existing shareholders sell, or indicate

an intent to sell, substantial amounts of our common stock in the public market, the trading price of our common stock could decline significantly.

Similarly, the perception in the public market that our shareholders might sell shares of our common stock could also depress the market

price of our common stock. A decline in the price of shares of our common stock might impede our ability to raise capital through the

issuance of additional shares of our common stock or other equity securities. In addition, the issuance and sale by us of additional shares

of our common stock or securities convertible into or exercisable for shares of our common stock, or the perception that we will issue

such securities, could reduce the trading price for our common stock as well as make future sales of equity securities by us less attractive

or not feasible. The sale of shares of common stock issued upon the exercise of our outstanding options and warrants could further dilute

the holdings of our then existing shareholders.

Securities analysts may not cover our common stock and this may

have a negative impact on the market price of our common stock.

The trading market for our common stock will depend,

in part, on the research and reports that securities or industry analysts publish about us or our business. We do not have any control

over independent analysts (provided that we have engaged various non-independent analysts). We do not currently have and may never obtain

research coverage by independent securities and industry analysts. If no independent securities or industry analysts commence coverage

of us, the trading price for our common stock would be negatively impacted. If we obtain independent securities or industry analyst coverage

and if one or more of the analysts who covers us downgrades our common stock, changes their opinion of our shares or publishes inaccurate

or unfavorable research about our business, our stock price would likely decline. If one or more of these analysts ceases coverage of

us or fails to publish reports on us regularly, demand for our common stock could decrease and we could lose visibility in the financial

markets, which could cause our stock price and trading volume to decline.

You may experience future dilution as a result of future equity

offerings or other equity issuances.

We may in the future issue additional shares of

our common stock or other securities convertible into or exchangeable for shares of our common stock. We cannot assure you that we will

be able to sell shares of our common stock or other securities in any other offering or other transactions at a price per share that is

equal to or greater than the price per share paid by investors in this offering. The price per share at which we sell additional shares

of our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or

lower than the price per share in this offering.

The price of our common stock may be volatile or may decline,

which may make it difficult for investors to resell shares of our common stock at prices they find attractive.

The trading price of our common stock may fluctuate

widely as a result of a number of factors, many of which are outside our control. In addition, the stock market is subject to fluctuations

in the share prices and trading volumes that affect the market prices of the shares of many companies. These broad market fluctuations

could adversely affect the market price of our common stock. Among the factors that could affect our stock price are:

| ● | the

perception of U.S. investors and regulators of U.S. listed Chinese companies; |

| ● | actual

or anticipated fluctuations in our quarterly operating results; |

| ● | changes

in financial estimates by securities research analysts; |

| ● | negative

publicity, studies or reports; |

| ● | changes

in the economic performance or market valuations of other microcredit companies; |

| ● | announcements

by us or our competitors of acquisitions, strategic partnerships, joint ventures or capital commitments; |

| ● | addition

or departure of key personnel; |

| ● | fluctuations

of exchange rates between RMB and the U.S. dollar; |

| ● | general

economic or political conditions in China. |

| ● | actual

or anticipated quarterly fluctuations in our operating results and financial condition, and, in particular, further deterioration of

asset quality; |

| |

● |

changes in revenue or earnings estimates or publication of research reports and recommendations by financial analysts; |

| ● | failure

to meet analysts’ revenue or earnings estimates; |

| ● | speculation

in the press or investment community; |

| ● | strategic

actions by us or our competitors, such as acquisitions or restructurings; |

| ● | actions

by institutional shareholders; |

| ● | fluctuations

in the stock price and operating results of our competitors; |

| ● | general

market conditions and, in particular, developments related to market conditions for the financial services industry; |

| ● | proposed

or adopted regulatory changes or developments; |

| ● | anticipated

or pending investigations, proceedings or litigation that involve or affect us; or |

| ● | domestic

and international economic factors unrelated to our performance. |

The

stock market has experienced significant volatility recently. As a result, the market price of our common stock may be volatile. In addition,

the trading volume in our common stock may fluctuate more than usual and cause significant price variations to occur. The trading price

of the shares of our common stock and the value of our other securities will depend on many factors, which may change from time to time,

including, without limitation, our financial condition, performance, creditworthiness and prospects, future sales of our equity or equity

related securities, and other factors identified above in “Forward-Looking Statements.”

Accordingly, the shares of our common stock that

an investor purchases, whether in this offering or in the secondary market, may trade at a price lower than that at which they were purchased,

and, similarly, the value of our other securities may decline. Current levels of market volatility are unprecedented. The capital and

credit markets have been experiencing volatility and disruption for more than a year. In some cases, the markets have produced downward

pressure on stock prices and credit availability for certain issuers without regard to those issuers’ underlying financial strength.

A significant decline in our stock price could

result in substantial losses for individual shareholders and could lead to costly and disruptive securities litigation.

Volatility in our common stock price may subject us to securities

litigation.

The market for our common stock may have, when

compared to seasoned issuers, significant price volatility and we expect that our share price may continue to be more volatile than that

of a seasoned issuer for the indefinite future. In the past, plaintiffs have often initiated securities class action litigation against

a company following periods of volatility in the market price of its securities. We may, in the future, be the target of similar litigation.

Securities litigation could result in substantial costs and liabilities and could divert management’s attention and resources.

Our certificate of incorporation allows our board of directors

to create new series of preferred stock without further approval by our stockholders, which could adversely affect the rights of the holders

of our common stock.

Our board of directors has the authority to fix

and determine the relative rights and preferences of preferred stock. Our board of directors has the authority to issue up to 600,000,000

shares of our common stock and up to 50,000,000 shares of our preferred stock without further stockholder approval. As a result, our board

of directors could authorize the issuance of preferred stock that would grant to holders the preferred right to our assets upon liquidation,

dissolution or winding up, the right to receive dividend payments before dividends are distributed to the holders of common stock and

the right to the redemption of the shares, together with a premium, prior to the redemption of our common stock. In addition, our board

of directors could authorize the issuance of a series of preferred stock that has greater voting power than our common stock or that is

convertible into our common stock, which could decrease the relative voting power of our common stock or result in dilution to our existing

stockholders. Although we have no present intention to issue any additional shares of preferred stock or to create any additional series

of preferred stock, we may issue such shares in the future.

Risk Factors Relating to Our Newly Acquired of Supply Chain Service

Business

Acquisitions or strategic investments we have made or may make

could turn out to be unsuccessful.

As part of our strategy, we frequently monitor

and analyze acquisition or investment opportunities that we believe will create value for our shareholders. For example, in October 2020,

we acquired Qianhai Baiyu and plan to leverage Qianhai Baiyu’s experiences and techniques to expand our operations in the commodity

supply chain service field.

However, our acquisition of Qianhai Baiyu or future

acquisitions and investments could involve numerous risks that may prevent us from fully realizing the benefits that we anticipated as

a result of the transaction. These risks include the failure to derive any commercial value from the acquired technology, products and

intellectual property including as a result of the failure to obtain regulatory approval or to monetize products once approved, as well

as risks from lengthy product development and high upfront development costs without guarantee of successful results. Patents and other

intellectual property rights covering acquired technology and/or intellectual property may not be obtained, and if obtained, may not be

sufficient to fully protect the technology or intellectual property. We may be subject to liabilities, including unanticipated litigation

costs, that are not covered by indemnification protection we may obtain. As we pursue or consummate a strategic acquisition or investment,

we may value the acquired or funded company incorrectly, fail to successfully manage our operations as our asset diversity increases,

expend unforeseen costs during the acquisition or integration process, or encounter other unanticipated risks or challenges. Once an investment

is made, we may fail to value it accurately, properly account for it in our consolidated financial statements, or successfully divest

it or otherwise realize the value which we originally invested or have subsequently reflected in our consolidated financial statements.

Any failure by us to effectively limit such risks as we implement our acquisitions or strategic investments could have a material adverse

effect on our business, financial condition or results of operations and may negatively impact our net income and cause the price of our

securities to fall.

Our Commodity Trading and Supply Chain Service Businesses are

susceptible to volatility due to ongoing uncertainty as a result of ongoing international and domestic pandemic response and recovery

efforts.

Our Commodities Trading and Supply Chain Services

Businesses have been relatively stable since May 2020 when the COVID-19 pandemic has been brought under control in Shenzhen China. As

of the date of this prospectus, we are continuing to execute our pandemic response plan and planning to best position our company to emerge

as strong as possible when the COVID-19 pandemic officially ends. However, our Commodities Trading and Supply Chain Services Businesses

are still susceptible to volatility due to ongoing international and domestic pandemic response and recovery efforts. Despite our diligent

efforts to monitor and respond as appropriate to the impacts of the pandemic on our Commodities Trading and Supply Chain Services Businesses,

there remains a fair degree of uncertainty regarding the potential impact of the pandemic on our business, from both a financial and operational

perspective, and the scope and costs associated with additional measures that may be necessary in response to the pandemic going forward.

If customers of our supply chain services are able to reduce

their logistics and supply chain costs or increase utilization of their internal solutions, our supply chain services business and operating

results may be materially and adversely affected.

Qianhai Baiyu has a supply chain infrastructure,

which includes processing, logistics, warehousing and terminals. Utilizing its customer base, industry experience, and expertise in the

commodity trading industry, Qianhai Baiyu serves as a one-stop commodity supply chain service and digital intelligence supply chain platform

integrating upstream and downstream enterprises, warehouses, logistics, information, and futures trading.

A major driver for merchants and other customers

to use third-party logistics and supply chain service providers is the high cost and degree of difficulty associated with developing in-house

logistics and supply chain expertise and operational efficiencies. If, however, our customers are able to develop their own logistics

and supply chain solutions, increase utilization of their in-house supply chain, reduce their logistics spending, or otherwise choose

to terminate our services, our logistics and supply chain management business and operating results may be materially and adversely affected.

USE OF PROCEEDS

We will not receive any proceeds from the

issuance of Conversion Shares by the Investor. However, we estimate that we will receive a total of US$3.0 million gross proceeds

from the sale of the Convertible Promissory Note issued on March 13, 2023 to the Investor. The Conversion Shares are shares that may

be issued to the Investor upon conversion of all or any portion of the Note.

Any net proceeds we have received will be used

for working capital and other general corporate purposes.

The

amounts and timing of our use of proceeds will vary depending on a number of factors, including the amount of cash generated or used by

our operations, and the rate of growth, if any, of our business. As a result, we will retain broad discretion in the timing and allocation

of the net proceeds of this offering. In addition, while we have not entered into any agreements, commitments or understandings relating

to any significant transaction as of the date of this prospectus supplement, we may use a portion of the net proceeds to pursue acquisitions,

joint ventures and other strategic transactions.

See “Plan of Distribution” elsewhere

in this prospectus for more information.

CAPITALIZATION

The following table sets

forth our capitalization as of December 31, 2022 presented on:

| |

● |

on an as adjusted basis to give effect to the sale of the Note, after deducting the estimated offering expenses payable by us. |

You should read this table together with “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and note included

in the information incorporated by reference into this prospectus supplement and the accompanying prospectus.

| | |

As

of December 31, 2022 | |

| | |

Actual | | |

As

adjusted | |

| Convertible

note | |

$ | 4,208,141 | | |

$ | - | |

| Shareholders’

Equity: | |

| | | |

| - | |

| Common Stock, par

value $ 0.001 per share, 600,000,000 shares authorized, 106,742,117 shares issued and outstanding as of December 31, 2022 | |

| 106,742 | | |

| - | |

| Additional

paid-in capital | |

| 344,295,992 | | |

| - | |

| Accumulated

deficit | |

| (38,800,375 | ) | |

| - | |

| Accumulated

other comprehensive loss | |

| (8,984,925 | ) | |

| - | |

| Total

Shareholders’ Equity | |

| 299,220,101 | | |

| - | |

| Total

Capitalization | |

$ | 303,428,242 | | |

$ | - | |

Note: Total capitalization equals the sum of convertible note and total

shareholders’ equity.

DESCRIPTION OF SECURITIES WE ARE OFFERING

Convertible Note

On March 13, 2023, we entered into a Securities

Purchase Agreement (the “Purchase Agreement”) with the Investor, pursuant to which the Company has issued a Convertible Promissory

Note (the “Note”) to the Investor.

The Note bears interest at a rate of ten percent

(10%) per annum. All outstanding principal and accrued interest on the Note will become due and

payable twelve (12) months after the date the purchase price is delivered by the Investor to the Company (the “Purchase Price Date”).

The Note carries an original issue discount of US$300,000.00 along with US$20,000.00 for the Investor’s legal fees, accounting

costs, due diligence, monitoring and other transaction costs incurred in connection with the purchase and sale of the Note. The Company

may prepay all or a portion of the Note at any time by paying 125% of the outstanding balance elected for pre-payment. The Investor has

the right to redeem the Note at any time beginning on the date that is ninety (90) days from the Purchase

Price Date, subject to the maximum monthly redemption amount of US$375,000.00. Redemptions may be satisfied in cash, common stock

or any combination of the foregoing. The Company will be required to pay the Redemption Amount (as defined in the Note) in cash, in the

event there is an Equity Conditions Failure (as defined in the Note) and such failure is not waived in writing by the Investor. If the

Investor converts such Note into the common stock, such Conversion Shares will be issued at 80% of the average of the lowest volume weighted

average price of the common stock on the principal market for a particular trading day or set of trading days, as the case may be, as

reported by Bloomberg during the fifteen (15) trading days immediately preceding Redemption Date.

Upon the occurrence of an Event of Default, the

Investor will have the right to increase the outstanding balance of the Note by 15% for Major Defaults and 5% for Minor Defaults. In addition,

the Note provides that upon occurrence of an Event of Default, the interest rate will accrue on the outstanding balance at the rate equal

to the lesser of 22% per annum or the maximum rate permitted under applicable law.

Pursuant to the Purchase Agreement, while the Note

is outstanding, the Company agreed to keep adequate public information available and maintain its Nasdaq listing. The Company is required

to reserve 11,500,000 shares of common stock from its authorized and unissued common stock to provide for all issuances of common stock

under the Note (the “Share Reserve”), and will add additional shares of common stock to the Share Reserve in increments of

1,000,000 shares as and when requested by the Investor if as of the date of any such request the number of shares being held in the Share

Reserve is less than three (3) times the number of shares of common stock obtained by dividing the outstanding balance as of the date

of the request by the Redemption Conversion Price. The Company is required to further require the Transfer Agent to hold the shares of

common stock reserved pursuant to the Share Reserve exclusively for the benefit of the Investor and to issue such shares to the Investor

promptly upon the Investor’s delivery of a redemption notice under the Note. The Company is required to also request the Transfer

Agent to issue shares of common stock pursuant to the Note to the Investor out of its authorized and unissued shares, and not the Share

Reserve, to the extent shares of common stock have been authorized, but not issued, and are not included in the Share Reserve.

DIVIDEND POLICY

We did not declare or pay any dividend in 2022

and do not plan to do so in the foreseeable future. Although we intend to retain our earnings, if any, to finance the growth of our business,

our board of directors will have the discretion to declare and pay dividends in the future, subject to applicable PRC regulations and

restrictions as described below. Payment of dividends in the future will depend upon our earnings, capital requirements, and other factors,

which our board of directors may deem relevant.

In addition, due to various restrictions under

PRC laws on the distribution of dividends by wholly foreign-owned enterprise, we may not be able to pay dividends to our stockholders.

The Foreign Investment Law, promulgated on March 15, 2019 and became effective on January 1, 2020, and the Implementation Regulations

for the Foreign Investment Law, promulgated on December 26, 2019 and became effective on January 1, 2020, are the key regulations governing

distribution of dividends of foreign-invested enterprises. According to the applicable regulations, a wholly foreign-owned enterprise

in China, or a WFOE, may pay dividends only out of its accumulated profits, if any, determined in accordance with PRC accounting standards

and regulations. In addition, a WFOE is required to allocate at least 10% of its accumulated after-tax profits each year, if any, to statutory

reserve funds unless its reserves have reached 50% of the registered capital of the enterprises. These reserves are not distributable

as cash dividends. The proportional ratio for withdrawal of rewards and welfare funds for employees will be determined at the discretion

of the WFOE. Profits of a WFOE will not be distributed before the losses thereof before the previous accounting years have been made up.

Any undistributed profit for the previous accounting years may be distributed together with the distributable profit for the current accounting

year. If we or our subsidiaries and affiliates are unable to receive all of the revenues from our operations through the current contractual

arrangements, we may be unable to pay dividends on our common stock.

PLAN OF DISTRIBUTION

We have not entered into any underwriting agreement,

arrangement or understanding for the sale of the Note being offered.

We have entered into a Securities Purchase Agreement

with the Investor pursuant to which we will sell to the Investor the Note in the principal amount of US$3,320,000 at the purchase price

of US$3,000,000 to us. We negotiated the price for the securities offered in this offering with the Investor. The factors considered in

determining the price included the recent market price of our shares, the general condition of the securities market at the time of this

offering, the history of, and the prospects, for the industry in which we compete, our past and present operations, and our prospects

for future revenues.

We entered into the Securities Purchase Agreement

with the Investor on March 13, 2023 and expect to deliver the Note being offered pursuant to this prospectus supplement on or about March

13, 2023, subject to customary closing conditions.

LEGAL MATTERS

Certain legal matters governed by the laws of the

State of Delaware with respect to the validity of the offered securities will be passed upon for us by MagStone Law, LLP.

EXPERTS

The consolidated financial statements of our Company

appearing in our annual report on Form 10-K for the fiscal years ended December 31, 2022 and 2021 have been audited by Audit Alliance

LLP, independent registered public accounting firm, as set forth in the reports thereon included therein and incorporated herein by reference.

Such consolidated financial statements are incorporated herein by reference in reliance upon such reports given on the authority of such

firms as experts in accounting and auditing.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

We incorporate by reference into this prospectus

supplement the filed documents listed below, except as superseded, supplemented or modified by this prospectus supplement:

| |

● |

our Annual Report on Form

10-K for the fiscal year ended December 31, 2021, filed with the SEC on March 16, 2022; |

| |

|

|

| |

● |

our Annual Report on Form

10-K for the fiscal year ended December 31, 2022, filed with the SEC on March 10, 2023; |

| |

|

|

| |

● |

our Current Reports on Form 8-K filed with the SEC on March 13, 2023; and |

| |

● |

the description of the Common Stock, US$0.001 par value per share, contained in the Registrant’s registration statement on Form 8-A (File No. 001-36055) filed with the Commission on August 12, 2013, pursuant to Section 12(b) of the Exchange Act and all amendments or reports filed by us for the purpose of updating those descriptions. |

We also incorporate by reference all additional

documents that we file with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act that are filed after the filing

date of the registration statement of which this prospectus supplement is a part and prior to effectiveness of that registration statement.

We are not, however, incorporating, in each case, any documents or information that we are deemed to “furnish” and not file

in accordance with SEC rules.

You may obtain a copy of these filings, without

charge, by writing or calling us at:

TD Holdings, Inc.

139, Xinzhou 11th Street, Futian District

Shenzhen, Guangdong, PRC 518000

+86 (0755) 82792111

Attn: Investor Relations

You should rely only on the information incorporated

by reference or provided in this prospectus supplement or the accompanying prospectus. We have not authorized anyone else to provide you

with different information. You should not assume that the information in this prospectus supplement or the accompanying prospectus is

accurate as of any date other than the date on the front page of those documents.

DISCLOSURE OF COMMISSION POSITION ON

INDEMNIFICATION FOR SECURITIES LAW VIOLATIONS

Under Section 145 of the Delaware General Corporation

Law, the Company has broad powers to indemnify its directors and officers against liabilities they may incur in such capacities, including

liabilities under the Securities Act. The Company’s Bylaws provide that the Company will indemnify its directors and officers to

the fullest extent permitted by Delaware law. The Bylaws require the Company to advance litigation expenses in the case of stockholder

derivative actions or other actions, against an undertaking by the directors and officers to repay such advances if it is ultimately determined

that the directors and officers are not entitled to indemnification. The Bylaws further provide that rights conferred under such Bylaws

shall not be deemed to be exclusive of any other right such persons may have or acquire under any agreement, vote of stockholders or disinterested

directors, or otherwise. The Company believes that indemnification under its Bylaws covers at least negligence and gross negligence.

In addition, our certificate of incorporation contains

provisions which states that the Company shall, to the fullest extent permitted by Section 145 of the General Corporation Law of the State

of Delaware, as the same may be amended and supplemented, indemnify any and all persons whom it shall have power to indemnify under said

section from and against any and all of the expenses, liabilities or other matters referred to in or covered by said section. The Company

shall advance expenses to the fullest extent permitted by said section. Such right to indemnification and advancement of expenses shall

continue as to a person who has ceased to be a director, officer, employee or agent and shall inure to the benefit of the heirs, executors

and administrators of such a person. The indemnification and advancement of expenses provided for herein shall not be deemed exclusive

of any other rights to which those seeking indemnification or advancement of expenses may be entitled under any By-Law, agreement, vote

of stockholder or disinterested directors or otherwise.

Insofar as indemnification for liabilities arising

under the Securities Act may be permitted to our directors, officers or controlling persons, we have been advised that in the opinion

of the SEC this indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable.

WHERE YOU CAN FIND MORE INFORMATION

We have filed a registration statement with the

SEC under the Securities Act with respect to the shares of common stock offered by this prospectus supplement. This prospectus supplement

is part of that registration statement and does not contain all the information included in the registration statement. We are a reporting

company and file annual, quarterly and current reports, proxy statements and other information with the SEC. The SEC maintains an Internet

site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the

SEC. The SEC’s Internet site can be found at http://www.sec.gov.

For further information with respect to our shares

of common stock and us, you should refer to the registration statement, its exhibits and the material incorporated by reference therein.

Portions of the exhibits have been omitted as permitted by the rules and regulations of the SEC. Statements made in this prospectus supplement

and the accompanying prospectus as to the contents of any contract, agreement or other document referred to are not necessarily complete.

In each instance, we refer you to the copy of the contracts or other documents filed as an exhibit to the registration statement, and

these statements are hereby qualified in their entirety by reference to the contract or document.

PROSPECTUS

TD Holdings, Inc.

$100,000,000

Common Stock

Preferred Stock

Debt Securities

Warrants

Rights

Units

We may offer to the public from time to time in one or more series

or issuances of common stock, preferred stock, debt securities, warrants to purchase our common stock, preferred stock or debt securities,

debt securities consisting of debentures, notes or other evidences of indebtedness, units consisting of a combination of the foregoing

securities, or any combination of these securities

The securities may be sold by us to or through underwriters or dealers,

directly to purchasers or through agents designated from time to time. For additional information on the methods of sale, see the section

entitled “Plan of Distribution” on page 7.

Our Common Stock is currently listed on the Nasdaq Capital Market under

the symbol “GLG.” On July 29, 2020, the last reported sale price of our Common Stock on the Nasdaq Capital Market was $2.89

per share. The applicable prospectus supplement will contain information, where applicable, as to other listings, if any, on the Nasdaq

Capital Market or other securities exchange of the securities covered by the prospectus supplement.

The aggregate market value of our outstanding voting and nonvoting

common equity held by non-affiliates is approximately $176.61 million. We have not offered any securities pursuant to General Instruction

I.B.6 of Form S-3 during the prior 12-month calendar period that ends on, and includes, the date of this prospectus.

If any underwriters are involved in the sale of the securities with

respect to which this prospectus is being delivered, the names of such underwriters and any applicable discounts or commissions and over-allotment

options will be set forth in the applicable prospectus supplement. This prospectus also describes the general manner in which the Warrants

may be offered and sold. If necessary, the specific manner in which the Warrants may be offered and sold will be described in a supplement

to this prospectus.

Investing in our Common Stock involves risks. You should carefully

review the risks described under the heading “Risk Factors” beginning on page 5 and in the documents which are incorporated

by reference herein before you invest in our securities.

Neither the Securities and Exchange Commission nor any state securities

commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus is August 4, 2020.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is a part of a registration statement that we filed

with the Securities and Exchange Commission, or the Commission, using a “shelf” registration process. Under this shelf registration

process, we may offer to sell any of the securities, or any combination of the securities, described in this prospectus, in each case

in one or more offerings, up to a total amount of $100,000,000. You should rely only on the information contained in this prospectus and

the related exhibits, any prospectus supplement or amendment thereto and the documents incorporated by reference, or to which we have

referred you, before making your investment decision. We have not authorized anyone to provide you with different information. If anyone

provides you with different or inconsistent information, you should not rely on it. This prospectus, any prospectus supplement or amendments

thereto do not constitute an offer to sell, or a solicitation of an offer to purchase, the Common Stock offered by this prospectus, any

prospectus supplement or amendments thereto in any jurisdiction to or from any person to whom or from whom it is unlawful to make such

offer or solicitation of an offer in such jurisdiction. You should not assume that the information contained in this prospectus, any prospectus

supplement or amendments thereto, as well as information we have previously filed with the U.S. Securities and Exchange Commission (the

“SEC”), is accurate as of any date other than the date on the front cover of the applicable document.

If necessary, the specific manner in which the securities may be offered

and sold will be described in a supplement to this prospectus, which supplement may also add, update or change any of the information

contained in this prospectus. To the extent there is a conflict between the information contained in this prospectus and the prospectus

supplement, you should rely on the information in the prospectus supplement, provided that if any statement in one of these documents

is inconsistent with a statement in another document having a later date-for example, a document incorporated by reference in this prospectus

or any prospectus supplement-the statement in the document having the later date modifies or supersedes the earlier statement.

Neither the delivery of this prospectus nor any distribution of Common

Stock pursuant to this prospectus shall, under any circumstances, create any implication that there has been no change in the information

set forth or incorporated by reference into this prospectus or in our affairs since the date of this prospectus. Our business, financial

condition, results of operations and prospects may have changed since such date.

When used herein, unless the context requires otherwise, references

to the “TD Holdings,” “Company,” “we,” “our” and “us” refer to TD Holdings,

Inc., a Delaware corporation.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, the applicable prospectus supplement or amendment

and the information incorporated by reference in this prospectus contain various forward-looking statements within the meaning of Section

27A of the Securities Act and Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), which

represent our expectations or beliefs concerning future events. Forward-looking statements include statements that are predictive in nature,

which depend upon or refer to future events or conditions, and/or which include words such as “believes,” “plans,”

“intends,” “anticipates,” “estimates,” “expects,” “may,” “will”

or similar expressions. In addition, any statements concerning future financial performance, ongoing strategies or prospects, and possible

future actions, which may be provided by our management, are also forward-looking statements. Forward-looking statements are based on

current expectations and projections about future events and are subject to risks, uncertainties, and assumptions about our company, economic

and market factors, and the industry in which we do business, among other things. These statements are not guarantees of future performance,

and we undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events,

or otherwise, except as required by law. Actual events and results may differ materially from those expressed or forecasted in forward-looking

statements due to a number of factors. Factors that could cause our actual performance, future results and actions to differ materially

from any forward-looking statements include, but are not limited to, those discussed under the heading “Risk Factors” in any

of our filings with the SEC pursuant to Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act. The forward-looking statements in this

prospectus, the applicable prospectus supplement or any amendments thereto and the information incorporated by reference in this prospectus

represent our views as of the date such statements are made. These forward-looking statements should not be relied upon as representing

our views as of any date subsequent to the date such statements are made.

OUR COMPANY

This summary highlights information contained in the documents incorporated

herein by reference. Before making an investment decision, you should read the entire prospectus, and our other filings with the SEC,

including those filings incorporated herein by reference, carefully, including the sections entitled “Risk Factors” and “Special

Note Regarding Forward-Looking Statements.”

Overview

TD Holdings, Inc., (formerly known as Bat Group, Inc.) has become a

used luxurious car leasing business as well as a commodities trading business operating in China since the disposition of its direct loans,

loan guarantees and financial leasing services to small-to-medium sized businesses, farmers and individuals (the “Micro-lending

Business”) in July 2018. Our current operations consist of leasing of luxurious pre-owned automobiles and operation of a non-ferrous

metal commodities trading business.

The Company operates a luxurious car business that is conducted under

the brand name “Batcar” through the Company’s VIE entity, Beijing Tianxing Kunlun Technology Co. Ltd (“Beijing

Tianxing”), from its headquarters in Beijing. The Company also conducts a commodities trading business via its other VIE entity,

Shenzhen Huamucheng Trading Co., Ltd. (“Huamucheng”).

Our Business

Used Luxurious Car Leasing Business

During the twelve months ended December 31, 2019, the Company, through

Beijing Tianxing, offers our customers the opportunity to rent luxurious pre-owned automobiles in Beijing, Shanghai, Zhejiang and Chengdu,

China. Currently the Company has eleven used luxurious cars with net book value of approximately US$ 2.43 million. To determine the model

of vehicles to be purchased, we collect data related to customers’ demands and preferences through sales and online promotions.

Our professional procurement personnel will then compare models of vehicles offered by different sellers. The decision to purchase a specific

vehicle is based on a number of considerations including time of delivery, vehicle condition, vehicle safety feature, mileage, repairing

and maintenance history, accidents history, market scarcity, and etc. For the years ended December 31, 2019 and 2018, the Company earned

income from operating lease of $1,830,148 and $488,062, respectively.

Commodities Trading Business

In order to diversify the Company’s business, on

November 22, 2019, the Company’s indirectly wholly owned subsidiary

Hao Limo Technology (Beijing) Co., Ltd. (“Hao Limo”) entered into a series of agreements (the “Huamucheng VIE

Agreements”) with Huamucheng and the

shareholders of Huamucheng who collectively hold 100% of Huamucheng.

Through Huamucheng’s VIE structure, the Company launched its

commodities trading operations. Huamucheng focuses on trading of non-ferrous metal commodities such as aluminum, copper, silver, and gold,

and is striving to become an emerging platform in the non-ferrous metal e-commerce industry by offering all participants in the non-ferrous

metal e-commerce industry a seamless, one-stop transaction experience. In connection with the commodity trading business, the Company

primarily generates revenues from sales of commodities products and providing of supply chain management services such as loan recommendation

and distribution services to customers in the PRC.

In December 2019, the Company

generated revenue of $100,427 from commodities trading business and $562,586 from supply

chain management services (including loan recommendation service fee of $323,623 and distribution service fee of $238,963),

respectively.

Our Services

Used Luxurious Car Leasing Business

Renting Service

We rent our luxurious cars to both our individual and corporate customers

from our stores in Beijing, Shanghai, Zhejiang and Chengdu. The rental price varies based on the rental term which ranges from one day

to one month; the longer the rental term, the cheaper the price. The daily rental price is the highest, while the average weekly rental

prices and average monthly rental prices are 10% to 20% and 20% to 30% cheaper, respectively, than that of the daily rental price.

Customers can confirm the time and place for vehicle delivery and rental

term via SMS messages, phone calls or face-to-face communication with our sales personnel, as well as through our website and WeChat Applet.

Our sales personnel will then deliver the vehicle to the customers as designated. The customer, before signing the car rental agreement,

will inspect the vehicle in person and pay the rent along with the deposit with their credit card, Wechat Pay or Alipay. The customer

is responsible for the gas, toll, and any other expenses related to the use of the vehicle during the rental term.

Our operations for our luxury vehicle leasing business consists of

the following 7 steps:

|

1) |

Pre-lease Preparation: Our asset management personnel are regularly scheduled to conduct comprehensive inspections, repairs, maintenance, and cleaning of the vehicles. |

| 2) | Lease

Preparation: Our sales personnel will introduce to the customer in detail information regarding our car rental conditions, price, distance

and time limit, required procedures, the main contents of the rental contract terms, other rental instructions, and related services. |

| 3) | Paperwork

Preparation: Individual customers are required to provide their original identification card, driver’s license, and house or land

ownership certificate. Corporate customers are required to provide their company’s business license, enterprise organization code

certificate, and the legal person’s power of attorney and driver’s license. |

| 4) | Signing

the Contract: Before signing the contract, our personnel will repeat to the customer material terms of the rental contract. After filling

in the vehicle’s information and other rental terms, the customer will be required to enter their personal information and sign

the contract. |

| 5) | Rent

and Deposit Prepayment: The prepayment of rental fees and the deposit must be paid by the customer prior to renting the vehicle. The

amount of the prepayment is determined by the rental duration and price of the vehicle. |

| 6) | Delivery

Inspection: When the vehicle is delivered to the customer, the sales personnel will hand over the vehicle key, instructions, and other

accessories such as data cables and mobile phone holders. The sales personnel will then guide the customer through a thorough vehicle

inspection including the exterior, steering system, braking system, lubrication system, coolant, tires, and lights. After the vehicle

inspection is completed, the customer will be asked to fill in an inspection form, of which both the customer and the sales department

will retain a copy. |

| 7) | Guidance

on Operating the Luxury Vehicle: The sales personnel will explain the operation of the luxury vehicle to the customer according to its

performance and characteristics so as to mitigate any damage caused by mishandling. Customers will also be reminded to keep their communications

open at all times during the rental period. |

Car Pooling Service with Peer Companies

In addition to directly renting to customers, we also rent to other

auto rental companies in a similar fashion but at a discounted rate. We and our peer companies have formed a vehicle pool consisting of

all available pre-owned vehicles. In the scenario where a customer places a rental order with a company which does not currently have

the requested vehicle in stock, another company in the vehicle pool possessing the requested vehicle will rent it to the company at a

discounted price upon its request.

Commodities Trading Business

Business Model

We source bulk commodity from non-ferrous metal mines or its designated

distributors and sell to manufactures who need these metals in large quantities. We work with many upstream suppliers in the sourcing

of commodities. Suppliers we source from include various metal and mineral suppliers such as Kunsteel Group, Baosteel Group, Aluminum

Corporate of China Limited, Yunnan Benyuan, Yunnan Tin, and Shanghai Copper. Potential customers include large infrastructure companies

such as China National Electricity, Datang Power, China Aluminum Foshan International Trade, Tooke Investment (China), CSSC International

Trade Co., Ltd., Shenye Group, and Keliyuan.

The Company has entered into a Warehousing Agreement with Foshan Nanchu

to designate it as the Company’s warehouse. The Company’s criteria for choosing its warehouse is based primarily on the convenience

of its location for transportation, which is highly conducive to the transportation of non-ferrous metal commodities, and secondarily

based on its storage price.

Our

inventory management procedure involves (1) an Application for Storage, (2) Storage of the Commodities, (3) an Application for Shipment,

and (4) Shipment of Commodities, which are further described below.

| 1) | Application

for Storage |

| ● | The

upstream suppliers apply for storage with the Company’s leased warehouse center upon

the sale of commodities to the Company. The application requires information including the

commodities’ production company, brand, specifications, weight, quantity, and storage

time. |

| 2) | Storage

of the Commodities |

| ● | Upon

the arrival of the commodities at the warehouse, the warehouse checks and accepts the commodities

according to the delivery instructions provided by the transportation company, ensuring that

the delivery instructions, storage application, and the delivered commodities are all consistent. |

| ● | Upon

acceptance, the warehouse scans and places the commodities into sorted storage. The warehouse

then issues a certificate of inspection, which includes information such as the brand name,

specifications, weight, quantity, packaging information, arrival time, storage location and

other information of the received commodities. The certificate of inspection is then signed

and stamped by the delivery driver, the warehouse manager, and the warehouse. Four copies

of the certificate of inspection are made, two of which are provided to the transportation

company and the supplier. |

| 3) | Application

for Shipment |

| ● | The

downstream customers apply for shipment with the warehouse upon the purchase of Commodities

from the Company. The application requires information including the production company,

brand, specifications, weight, quantity, delivery time, and storage location number. |

| ● | The

downstream customers also fill in a delivery entrustment letter, including the name of the

delivery company, the name of the delivery person, his or her ID number, the delivery vehicle’s

license plate number, the time, quantity, and information regarding the warehouse for delivery. |

| 4) | Shipment

of Commodities |

| ● | The

warehouse prepares the commodities in advance according to the pick-up time and the Application

for Shipment. |

| ● | Upon

arrival of the pick-up driver at the warehouse, the Company reviews the identity of the pick-up

driver according to the delivery entrustment letter. |

| ● | Upon

completing the loading of the commodities for shipment, the warehouse issues a certificate

of sale, which includes information such as the brand name, specifications, weight, quantity,

delivery time, and storage location number. The pick-up driver, warehouse manager, and the

warehouse signs and stamps the certificate of sale. Four copies of the certificate of sale

are made, two of which are provided to the transportation company and the customer. |

Distribution Services

We offer a distribution service to bulk suppliers of precious metals by

acting as a sales intermediary, procuring small to medium-sized buyers through our own professional sales team and channels and distributing

to them the bulk precious metals of the suppliers. Upon the execution of a purchase order from our sourced buyers, we charge the suppliers

with a commission fee ranging from 1% to 1.5% of the distribution order, depending on the size of the order. In December 2019, the

Company generated revenue of $238,963 from its distribution services.

Loan Recommendation and Referral Services

We offer to our downstream customers who require additional funding

for the purchase of precious metals recommendations and referrals to third-party licensed financial institutions and small credit providers

while assuming no credit risks ourselves. When our recommendation and referrals are accepted and our downstream customers proceed with

the loan, we charge our downstream customers between 2% to 5% of the loan principal as our referral fee. In December 2019, the

Company generated revenue of $323,623 from its loan recommendation services.

RISK FACTORS

An investment in our Common Stock involves significant risks. You should

carefully consider the risk factors contained in any prospectus supplement and in our filings with the SEC, as well as all of the information

contained in this prospectus and the related exhibits, any prospectus supplement or amendments thereto, and the documents incorporated

by reference herein or therein, before you decide to invest in our Common Stock. Our business, prospects, financial condition and results

of operations may be materially and adversely affected as a result of any of such risks. The value of our Common Stock could decline as

a result of any of these risks. You could lose all or part of your investment in our Common Stock. Some of our statements in sections