Filed Pursuant to Rule 424(b)(5)

Registration No. 333-276259

PROSPECTUS SUPPLEMENT

(to Prospectus dated January 5, 2024)

KARTOON STUDIOS, INC.

Up to $7,000,000 in Shares of Common Stock and/or

Pre-Funded Warrants

We are offering shares of

our common stock, $0.001 par value per share, and/or pre-funded warrants to purchase common stock (“Pre-funded Warrants”)

at an aggregate offering price of up to $7,000,000 pursuant to this prospectus supplement and the accompanying prospectus. In the initial

closing, we are offering 3,900,000 shares of common stock and 100,000 Pre-funded Warrants directly to an institutional investor pursuant

to a securities purchase agreement dated April 18, 2024 between us and such investor, or the Purchase Agreement. The offering price per

share of common stock in this offering is $1.00 per share. The offering price is $0.99 per Pre-funded Warrant, which is equal to the offering

price per share of common stock less $0.01. The total gross proceeds to us from the initial closing, before placement agent fees and expenses,

will be approximately $4,000,000.

A holder of Pre-funded Warrants

will not have the right to exercise any portion of its Pre-funded Warrants if the holder, together with its affiliates and certain related

parties, would beneficially own in excess of 4.99% (or, at the election of the purchaser, 9.99%) of the number of shares of common stock

outstanding immediately after giving effect to such exercise. Each Pre-funded Warrant will be exercisable for one share of common stock

at an exercise price of $0.01 per share. Each Pre-funded Warrant will be exercisable upon issuance and will expire when exercised in full.

In up to three additional

subsequent closings, we will sell up to an additional 3,000,000 shares of our common stock and/or Pre-funded Warrants to such investor

pursuant to the Purchase Agreement at the same offering price per share of common stock and/or per Pre-funded Warrant as sold in the initial

closing. For each Pre-funded Warrant we sell in a subsequent closing, the number of shares of common stock we are offering will be decreased

on a one-for-one basis. The date(s) of each of the potential additional closings, if any, will occur no later than one-hundred and eighty

(180) days following the date of the Purchase Agreement, at such time that is mutually agreed up on by the Company and such investor,

subject to certain conditions set forth in the Purchase Agreement.

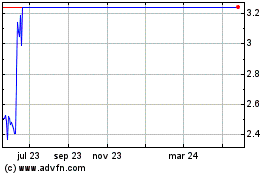

Our common stock is

listed on the NYSE American LLC (“NYSE American”) under the symbol “TOON”. On April 17, 2024, the last reported

sale price of our common stock on the NYSE American was $1.48 per share. There is no established public trading market for the Pre-funded

Warrants, and we do not expect a market to develop. We do not intend to apply for listing of the Pre-funded Warrants on the NYSE American

or any other securities exchange or nationally recognized trading system. Without an active trading market, the liquidity of the Pre-funded

Warrants will be limited. This offering also relates to the shares of common stock issuable upon exercise of the Pre-funded Warrants being

offered by this prospectus supplement and the accompanying prospectus.

As of April 18, 2024, the

aggregate market value of our outstanding common stock held by non-affiliates was approximately $55,037,718 based on 33,155,252 shares

of common stock held by such non-affiliates, and a per share price of $1.66, the closing sale price of our common stock on February 29,

2024. During the 12-calendar month period that ends on, and includes, the date of this prospectus supplement (but excluding this offering),

we have not sold any securities pursuant to General Instruction I.B.6 of Form S-3. We are thus currently eligible to offer and sell up

to an aggregate of approximately $18,341,838 of our securities pursuant to General Instruction I.B.6 of Form S-3.

Investing in our securities

involves a high degree of risk. See “Risk Factors” beginning on page S-9 of this prospectus supplement and under similar headings

in the documents incorporated by reference into this prospectus supplement and the accompanying prospectus for a discussion of certain

risks you should consider before investing in our securities.

| | |

Per Share | | |

Per Pre-funded Warrant | | |

Total(2) | |

| Public offering price | |

$ | 1.00 | | |

$ | 0.99 | | |

$ | 7,000,000 | |

| Placement agent fees(1) | |

$ | 0.07 | | |

$ | 0.069 | | |

$ | 490,000 | |

| Proceeds to us, before expenses | |

$ | 0.93 | | |

$ | 0.921 | | |

$ | 6,510,000 | |

| |

(1) |

Excludes the placement agent’s out-of-pocket expenses we have agreed to reimburse and excludes a non-accountable expense reimbursement which we have agreed to pay to the placement agent equal to 1% of the gross proceeds raised from this offering. See the section of this prospectus supplement titled “Plan of Distribution” for additional disclosure regarding the placement agent fees. |

| |

(2) |

Based on 3,900,000 shares of common stock and 100,000 Pre-funded Warrants being sold in the first closing of this offering and 3,000,000 shares of common stock and/or Pre-funded Warrants that may be sold in the potential additional closings of this offering, and assuming full exercise of the Pre-funded Warrants. |

We have retained EF Hutton LLC to act as our

placement agent in connection with this offering. The placement agent has agreed to use its reasonable best efforts to arrange for

the sale of the securities offered by this prospectus supplement. The placement agent is not purchasing or selling any of the

securities we are offering and the placement agent is not required to arrange the purchase or sale of any specific number of

securities or dollar amount.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the shares of

common stock and Pre-funded Warrants being issued in the initial closing pursuant to this prospectus supplement and the accompanying prospectus

is expected to be made on or about April 22, 2024.

The date of this prospectus supplement is

April 18, 2024.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS SUPPLEMENT

This prospectus supplement

and the accompanying base prospectus are part of a “shelf” registration statement on Form S-3 that we filed with the U.S.

Securities and Exchange Commission (the “SEC”), using a “shelf” registration process on December 22, 2023 (File

No. 333-276259) (the “Registration Statement”), using a “shelf” registration process. Under this process, we may

sell from time to time in one or more offerings up to an aggregate of $75,000,000 in our securities described in the accompanying prospectus.

The Registration Statement was declared effective by the SEC on January 5, 2024.

This prospectus supplement

describes the specific terms of this offering. The accompanying base prospectus, including the documents incorporated by reference therein,

provides general information about us, some of which, such as the section therein titled “Plan of Distribution,” may not apply

to this offering. Generally, when we refer to this prospectus supplement, we are referring to both this prospectus supplement and the

accompanying base prospectus, combined.

We urge you to carefully read

this prospectus supplement, the accompanying base prospectus, the documents incorporated by reference herein and therein and the additional

information under the headings “Where You Can Find More Information” and “Information Incorporated by Reference”

before buying any of the securities being offered under this prospectus supplement. These documents contain information you should consider

when making your investment decision.

You should rely only on the

information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus. We have not, and

the placement agent have not, authorized anyone to provide you with different information. If anyone provides you with different or inconsistent

information, you should not rely on it. This prospectus supplement may add, update or change information contained in the accompanying

base prospectus. To the extent any information in this prospectus supplement is inconsistent with the accompanying base prospectus, you

should rely on the information in this prospectus supplement. The information in this prospectus supplement will be deemed to modify or

supersede the information in the accompanying base prospectus and the documents incorporated by reference therein, except for those documents

incorporated by reference therein which we file with the SEC after the date of this prospectus supplement.

You should not assume that

the information contained or incorporated by reference in this prospectus supplement and the accompanying base prospectus is accurate

on any date subsequent to the date set forth on the front cover of this prospectus supplement and the accompanying base prospectus or

on any date subsequent to the date of the document incorporated by reference herein or therein, as applicable. Our business, financial

condition, results of operations and prospects may have changed since those dates.

We are offering to sell, and

seeking offers to buy, the securities described in this prospectus supplement only in jurisdictions where offers and sales are permitted.

The distribution of this prospectus supplement and the offering of the securities in certain jurisdictions may be restricted by law. Persons

outside the United States who come into possession of this prospectus supplement must inform themselves about, and observe any restrictions

relating to, the offering of the securities and the distribution of this prospectus supplement outside the United States. This prospectus

supplement does not constitute, and may not be used in connection with, an offer to sell, or a solicitation of an offer to buy, any securities

offered by this prospectus supplement by any person in any jurisdiction in which it is unlawful for such person to make such an offer

or solicitation.

We further note that the representations,

warranties and covenants made by us in any agreement that is filed as an exhibit to any document that is incorporated by reference into

this prospectus supplement or the accompanying base prospectus were made solely for the benefit of the parties to such agreement, including,

in some cases, for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation,

warranty or covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly,

such representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

Our logo and other trade names, trademarks, and

service marks of Kartoon Studios, Inc. appearing in this prospectus supplement and the accompanying prospectus are the property of our

company. Other trade names, trademarks, and service marks appearing in this prospectus supplement and the accompanying prospectus are

the property of their respective holders.

In this prospectus supplement,

unless otherwise indicated or required by the context, the terms “Kartoon,” “we,” “our,” “us”

and the “Company” refer to Kartoon Studios, Inc. and its subsidiaries.

MARKET AND INDUSTRY DATA

Unless otherwise indicated, we have based the information

concerning our industry contained in this prospectus supplement and incorporated by reference herein on our general knowledge of and expectations

concerning the industry, which involve risks and uncertainties and are subject to change based on various factors, including those discussed

in the “Risk Factors” section of this prospectus supplement and in the other information contained or incorporated by reference

in this prospectus supplement. These and other factors could cause the information concerning our industry to differ materially from those

expressed in this prospectus supplement and incorporated by reference herein.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section

21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), that involve substantial risks and uncertainties.

You can identify these statements by the fact that they do not relate strictly to historic or current facts. They use words, such as “anticipate,”

“could,” “continue,” “contemplate,” “estimate,” “expect,” “will,”

“may,” “potential,” “intend,” “plan,” “believe,” and other words and terms

of similar meaning. These include, among other things, statements regarding:

| · |

our ability to generate revenue or achieve profitability; |

| |

|

| · |

our ability to obtain additional financing on acceptable terms, if at all; |

| |

|

| · |

fluctuations in the results of our operations from period to period; |

| |

|

| · |

general economic and financial conditions; the adverse effects of public health epidemics, including the recent coronavirus outbreak, on our business, results of operations and financial condition; |

| |

|

| · |

our ability to anticipate changes in popular culture, media and movies, fashion and technology; |

| |

|

| · |

competitive pressure from other distributors of content and within the retail market; |

| |

|

| · |

our reliance on and relationships with third-party production and animation studios; |

| |

|

| · |

our ability to market and advertise our products; |

| |

|

| · |

our reliance on third-parties to promote our products; |

| |

|

| · |

our ability to keep pace with technological advances; |

| |

|

| · |

performance of our information technology and storage systems; |

| |

|

| · |

a disruption or breach of our internal computer systems; |

| |

|

| · |

our ability to retain key personnel; |

| |

|

| · |

our ability to successfully identify appropriate acquisition targets, successfully acquire identified targets and successfully integrate the business of acquired companies; |

| |

|

| · |

the impact of federal, state or local regulations on us or our vendors and licensees; |

| |

|

| · |

our ability to protect and defend against litigation, including intellectual property claims; |

| |

|

| · |

the volatility of our stock price; |

| |

|

| · |

the marketability of our stock; |

| |

|

| · |

our broad discretion to invest or spend the proceeds of our financings in ways with which our stockholders may not agree and may have limited ability to influence; and |

| |

|

| · |

other risks and uncertainties, including those listed in the section on “Risk Factors.” |

PROSPECTUS SUPPLEMENT SUMMARY

This summary contains basic

information about us and this offering. This summary highlights selected information contained elsewhere in, or incorporated by reference

into, this prospectus supplement. This summary is not complete and may not contain all of the information that is important to you and

that you should consider before deciding whether or not to invest in our securities. For a more complete understanding of our Company

and this offering, you should carefully read this prospectus supplement, including any information incorporated by reference into this

prospectus supplement, in its entirety. Investing in our securities involves risks that are described in this prospectus supplement under

the heading “Risk Factors,” under the headings “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the

year ended December 31, 2023 and in our other filings with the SEC.

Our Company

Overview

Kartoon Studios, Inc. (formerly

known as Genius Brands International, Inc.) is a global content and brand management company that creates, produces, licenses, and broadcasts

timeless and educational, multimedia animated content for children. Led by experienced industry personnel, we distribute our content primarily

on streaming platforms and television and license our properties for a broad range of consumer products based on our characters. We are

a “work for hire” producer for many of the streaming outlets and animated content intellectual property (“IP”)

holders. In the children’s media sector, our portfolio features “content with a purpose” for toddlers to tweens, providing

enrichment as well as entertainment. With the exception of selected WOW Unlimited Media Inc. (“Wow”) titles, our programs,

along with licensed programs, are being broadcast in the United States on our wholly-owned advertisement supported video on demand (“AVOD”)

service, its free ad supported TV channels and subscription video on demand (“SVOD”) outlets, Kartoon Channel! and Ameba TV

(as defined below), as well as linear streaming platforms. These streaming platforms include Comcast, Cox, DISH, Sling TV, Amazon Prime

Video, Amazon Fire, Roku, Apple TV, Apple iOS, Android TV, Android mobile, Pluto TV, Xumo, Tubi, Youtube, and Youtube Kids and via KartoonChannel.com,

as well as Samsung and LG smart TVs. Our in-house owned and produced animated shows include Stan Lee’s Superhero Kindergarten starring

Arnold Schwarzenegger, Llama starring Jennifer Garner, Rainbow Rangers, KC Pop Quiz and Shaq’s Garage starring Shaquille O’Neal.

Our library titles include the award-winning Baby Genius, adventure comedy Thomas Edison’s Secret Lab®, and Warren Buffett’s

Secret Millionaires Club, created with and starring iconic investor Warren Buffett, Team Zenko Go!, Reboot, Bee & PuppyCat: Lazy in

Space and Castlevania.

We also license our programs

to other services worldwide, in addition to the operation of our own channels, including but not limited to Netflix, Paramount+, Max,

Nickelodeon, and satellite, cable and terrestrial broadcasters around the world.

Through our investments in

Germany’s Your Family Entertainment AG, a publicly traded company on the Frankfurt Stock Exchange (RTV-Frankfurt), we have gained

access to one of the largest animation catalogues in Europe with over 50 titles consisting of over 1,600 episodes, and a global distribution

network which currently covers over 60 territories worldwide.

Through the ownership of Wow,

we established an affiliate relationship with Mainframe Studios, which is one of the largest animation producers in the world. In addition,

Wow owns Frederator Networks Inc. (“Frederator”) and its Channel Frederator Network (together with Kartoon Channel! and Ameba

TV (the “TOON Media Networks”), the largest animation focused multi-channel network on YouTube with over 2,500 channels. Frederator

also owns Frederator Studios, focused on developing and producing shorts and series for and with partners, including Nickelodeon, Nick

Jr., Netflix, Sony Pictures Animation and Amazon.

We have rights to a select

amount of valuable IP, including among them a controlling interest in Stan Lee Universe, LLC (“SLU”), through which we control

the name, likeness, signature, and all consumer product and IP rights to Stan Lee (the “Stan Lee Assets”).

We also own Beacon Media Group,

LLC (“Beacon Media Group”) and Beacon Communications, Ltd. (“Beacon Communications,” together with Beacon Media

Group, “Beacon”), a leading North American marketing and media agency and its first-class media research, planning and buying

division. Beacon represents over 30 major toy companies, including Playmobil, Bandai Namco, Bazooka Candy Brands, and Moose Toys.

In addition, we own the Canadian

company Ameba Inc., which distributes SVOD service for kids (“Ameba TV”) and has become the focal point of revenue growth

for our TOON Media Networks’ subscription offering.

We and our affiliates provide

world class animation production studios a catalogue representing thousands of hours of premium global content for children, a broadcast

system for delivering that content and an in-house consumer products licensing infrastructure to fully exploit the content.

On June 23, 2023, the Company

was renamed Kartoon Studios, Inc. On June 26, 2023, we transferred our listing to NYSE American. In connection with listing on NYSE American,

we voluntary delisted from the Nasdaq Capital Market. Our stock began trading on NYSE American under the new symbol “TOON”

on June 26, 2023.

Historically, the Company

has incurred net losses. For the years ended December 31, 2023 and 2022, the Company reported net losses of $77.2 million and $44.5 million,

respectively. The Company reported net cash used in operating activities of $16.1 million and $25.9 million for the years ended December

31, 2023 and 2022, respectively. As of December 31, 2023, the Company had an accumulated deficit of $718.5 million and total

stockholders’ equity of $53.3 million. As of December 31, 2023, the Company had current assets of $57.1 million, including

cash of $4.1 million and marketable securities of $11.9 million, and current liabilities of $45.6 million. The Company had working

capital of $11.5 million as of December 31, 2023, compared to working capital of $28.6 million as of December 31, 2022. Management

has evaluated the significance of these conditions in relation to the Company’s ability to meet its obligations and noted the Company

has sufficient marketable securities and investments to fund operations for the next 12 months. In addition, the Company has the ability

to reduce operating costs and use equity and equity-linked instruments to pay for services and compensation.

Recent Developments

At a special meeting of stockholders

of the Company held on November 1, 2023 (the “Special Meeting”), the Company’s stockholders approved an increase to

the number of authorized shares of the Company’s common stock, from 40,000,000 shares to 190,000,000 shares and to reflect a corresponding

increase in the total number of shares the Company is authorized to issue from 50,000,000 shares to 200,000,000 shares (the “Authorized

Share Increase”). To effectuate the Authorized Share Increase, on November 9, 2023, the Company filed a Certificate of Change to

the Company’s Articles of Incorporation with the Secretary of State of the state of Nevada, which became effective immediately upon

filing.

In February 2024, the Company

partnered with Penguin Young Readers and KOHL’s to launch retail promotions featuring book and plush products from the “Llama

Llama” franchise, as part of the Kohl’s Cares program.

Through the end of 2023

and in the first quarter of 2024, Kartoon Channel!’s U.S. paid subscribers increased along with free trial sign-up doubling

compared to the previous year. In addition, the Company reduced customer acquisition costs over 50% from the first half to the

second half of 2023, driving bigger margins through improved media efficiency and a content strategy. Additionally, the

Company’s subsidiary, Beacon Media Group, specializing in kids and family, announced growth in revenue and expansion of its

client base with six new advertisers. For further information, copies of these press releases are contained in the Current Report on

Form 8-K dated February 13, 2024, which are incorporated herein by reference.

In April 2024, the Company

launched a new storefront on Amazon dedicated to Stan Lee, offering a collection of branded apparel and merchandise. The Company also

announced the launch of the “Stan Lee Presents” channel on YouTube, with over 300,000 subscribers. The newly branded channel,

formerly “Cinematica,” will be managed by Frederator, one of the largest animation networks on YouTube, with millions of subscribers

and billions of views annually. The channel is curated by longtime Stan Lee collaborator, originator and executive producer of the Batman

movie franchise, and comic book historian Michael Uslan and former POW! Entertainment editorial chief Kim Luperi. “Stan Lee Presents”

focuses on all things Stan Lee, including content from Stan’s personal archives, digital Stan Lee comic books, interviews, behind-the-scenes

footage, rarely seen historical materials, as well as sneak peaks of upcoming Stan Lee Universe projects, clips, trailers, interviews,

and more, available exclusively on the channel. We launched the channel to showcase content directly to Stan Lee’s broad fanbase,

including his 27+ million passionate followers across social media.

This month, the Company also

partnered with the world’s largest digital collectibles platform, VeVe, and Multiverse Clothing Company Inc. for the Stan Lee limited-edition

digital and physical collectibles to be included in launches aimed for June and July of 2024 around San Diego Comic-Con. These exclusive

collections will feature artwork created by three of the most renowned contemporary pop culture artists, Rob Prior, Burton Morris, and

Punk Me Tender. The “phygital” collections will blend fine art with smart fashion and include special digital collectibles

by VeVe. The Company is also developing a new proprietary generative artificial intelligence (“A.I.”) toolkit and workflow,

“GADGET A.I.”, that integrates NVIDIA Omniverse and utilizes Bria.ai, and is designed to enable development, production, and

post-production of animated content and upgrade the quality and distribution reach of thousands of existing catalog episodes and acquisitions.

Gadget A.I. leverages NVIDIA Omniverse’s core technologies for universal scene description, OpenUSD, and for ray tracing, RTX, to

facilitate seamless collaboration, real-time simulation, and rendering, and will encompass a spectrum of other production services, including

character design, scriptwriting, music, animation, resolution enhancement, and dubbing, all unified to enhance workflow efficiencies.

As part of our ethical A,I. use and to protect our own IP, we plan to use Bria.ai, that employs licensed, certified datasets, to ensure

our A.I.-driven animation production respects copyright and upholds the integrity of original content. We anticipate substantial cost

savings, including a saving of 75% of current animation production costs; accelerated time-to-market; and the fostering of job growth.

We anticipate this new cutting-edge approach will enable our products to become far more profitable, while offering a better experience

for viewers.

Company Information

We were incorporated in California

on January 3, 2006 and reincorporated in Nevada in October 2011. We commenced operations in January 2006, assuming all of the rights and

obligations of our then Chief Executive Officer, under an Asset Purchase Agreement between us and Genius Products, Inc., in which we obtained

all rights, copyrights, and trademarks to the brands “Baby Genius,” “Kid Genius,” “123 Favorite Music”

and “Wee Worship,” and all then existing productions under those titles. In October 2011, we (i) changed our domicile to Nevada

from California, and (ii) changed our name to Genius Brands International, Inc. from Pacific Entertainment Corporation (the “Reincorporation”).

In connection with the Reincorporation, we changed our trading symbol from “PENT” to “GNUS.” In June 2023, we

changed our name to Kartoon Studios, Inc. from Genius Brands International, Inc. along with our trading symbol “GNUS” to “TOON.”

Our principal executive offices

are located at 190 N Canon Drive, 4th Floor, Beverly Hills, California 90210. Our telephone number is 310-273-4222. We maintain

an Internet website at www.kartoonstudios.com. The information contained on, connected to or that can be accessed via our website is not

part of this prospectus.

THE OFFERING

| Common stock and Pre-funded Warrants offered by us |

|

Shares of our common stock and/or Pre-funded

Warrants having an aggregate offering price of up to $7,000,000, which are being offered in up to four closings as follows:

|

| |

|

· |

In the initial closing of this offering, we are selling 3,900,000 shares of

common stock and 100,000 Pre-funded Warrants at a price of $1.00 per share, or $0.99 per Pre-funded Warrant, to an institutional investor

pursuant to the Purchase Agreement; and |

| |

|

· |

In up to three additional subsequent closings, we may sell up to an additional

3,000,000 shares of our common stock and/or Pre-funded Warrants at the same price as the shares of common stock and/or Pre-funded Warrants

sold in the initial closing to the institutional investor pursuant to the Purchase Agreement. For each Pre-funded Warrant we sell in

a subsequent closing, the number of shares of common stock we are offering will be decreased on a one-for-one basis The date of the additional

closings, if any, will occur no later than one hundred and eighty (180) days following the date of the Purchase Agreement, at such time

that is mutually agreed up on by the Company and such investor. |

| |

|

|

| |

|

The Pre-funded Warrants have an exercise price of $0.01 per share. The

Pre-funded Warrants are being offered to the investor to the extent that the purchase of our common stock in this offering by the investor

would result in the investor, together with its affiliates and certain related parties, beneficially owning more than 4.99% (or at the

election of the purchaser, 9.99%) of our outstanding common stock immediately following the consummation of this offering. The Pre-funded

Warrants are immediately exercisable and may be exercised at any time until all of the Pre-funded Warrants are exercised in full. |

| |

|

|

|

Common stock outstanding before this offering

|

|

35,375,005 shares |

| Common stock to be outstanding immediately after the initial closing of this offering |

|

39,375,005 shares |

| |

|

|

| Common stock to be outstanding immediately after the potential additional closings of this

offering |

|

42,775,005 shares, assuming sales of (i) 3,900,000 shares of common stock and

100,000 Pre-funded Warrants in the initial closing of this offering, (ii) 3,000,000 shares of common stock and/or Pre-funded Warrants

in the potential additional closings of this offering, and (iii) the full exercise of the Pre-funded Warrants, in each case the shares

of common stock are being sold at a price of $1.00 per share, and the Pre-funded Warrants are being sold at a price of $0.99 per Pre-funded

Warrant. The actual number of shares of common stock and/or Pre-funded Warrants issued will vary depending on the number of shares of

our common stock and/or Pre-funded Warrants issued in the potential additional closings of this offering that the investor elects to purchase

and whether we complete the potential additional closings, as further described in this prospectus supplement. |

| |

|

|

| Offering price |

|

$1.00 per share of common stock and $0.99 per Pre-funded

Warrant |

| |

|

|

| Use of proceeds |

|

We estimate the net proceeds from this offering will be approximately

$6.5 million from the initial closing of this offering, after deducting placement agent fees and estimated offering expenses payable by

us. We intend to use the net proceeds from this offering for general corporate purposes. See “Use of Proceeds” beginning on page S-13 of this prospectus supplement for additional detail. |

| Lock-Up agreements |

|

We and our executive officers and directors have agreed, that subject to certain exceptions, we and our directors and officers will not, until ninety (90) days pursuant to the Purchase Agreement, and one-hundred and eighty (180) days pursuant to the placement agent agreement, after the closing of this offering, offer, pledge, sell, contract to sell, grant, lend, or otherwise transfer or dispose of, directly or indirectly of any of our shares of common stock. |

| |

|

|

| Trading symbol |

|

Our common stock is listed on the NYSE American

under the symbol “TOON.”

There is no established trading market for the

Pre-funded Warrants, and we do not expect a trading market to develop. We do not intend to list the Pre-funded Warrants on any securities

exchange or nationally recognized trading system. |

| |

|

|

| Risk factors |

|

Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page S-8 of this prospectus supplement and other information included or incorporated by reference into this prospectus supplement for a discussion of factors you should carefully consider before investing in our securities. |

The number of shares of our

common stock outstanding before this offering and to be outstanding immediately after this offering is based on 35,775,005 shares of

our common stock issued and outstanding as of April 18, 2024, and excludes, as of April 18, 2024, the following:

| |

● |

1,060,139 shares of our common stock issuable upon the

exercise of stock options outstanding under our 2020 Incentive Plan, at a weighted-average exercise price of $15.28 per share; |

| |

|

|

| |

● |

996,106 shares of common stock issuable upon vesting of restricted

stock units outstanding; |

| |

|

|

| |

● |

31,902 shares of common stock reserved for future issuance under our

2020 Incentive Plan; and |

| |

|

|

| |

● |

6,826,952 shares of our common stock issuable upon the exercise of

outstanding warrants, at a weighted-average exercise price of $8.12 per share. |

Except as otherwise indicated,

all information in this prospectus supplement assumes no exercise of the outstanding options or warrants or vesting of restricted stock

units described above.

RISK FACTORS

Our Annual Report on Form

10-K for the year ended December 31, 2023, which is incorporated by reference into this prospectus supplement, as well as our other filings

with the SEC, include material risk factors relating to our business. Those risks and uncertainties and the risks and uncertainties described

below are not the only risks and uncertainties that we face. Additional risks and uncertainties that are not presently known to us or

that we currently deem immaterial or that are not specific to us, such as general economic conditions, may also materially and adversely

affect our business and operations. If any of those risks and uncertainties or the risks and uncertainties described below actually occurs,

our business, financial condition or results of operations could be harmed substantially. In such a case, you may lose all or part of

your investment. You should carefully consider the risks and uncertainties described below and those risks and uncertainties incorporated

by reference into this prospectus supplement, as well as the other information included in this prospectus supplement, before making an

investment decision with respect to our common stock.

Risks Related to this Offering

We cannot guarantee that the potential additional closings of

this offering will be completed or, if so, at what price.

Whether we complete any additional subsequent closings

of this offering depends on certain conditions being met. There can be no assurance that these conditions will be met. If we complete

additional subsequent closings, the amount of shares sold in the additional subsequent closings and the gross proceeds that we will receive

will depend on the amount of shares that the investor elects to purchase at the time of additional subsequent closings.

If we fail to raise sufficient capital in this

offering, we may need to seek alternative financing when market conditions permit. Such financing may not be available on favorable terms,

or at all. The actual amount of funds that we will need and the timing of any such investment will be determined by many factors, some

of which are beyond our control.

You will experience immediate dilution in the book value per

share of the common stock purchased in this offering.

The price per share of our common stock and/or

Pre-funded Warrants being offered in the initial closing may be higher than the net tangible book value per share of our common stock

outstanding prior to the initial closing. Based on the offering price of $1.00 per share or $0.99 per Pre-funded Warrant in the initial

closing and our net tangible book value as of December 31, 2023 of $0.86 per share, if you purchase shares of 3,900,000 common stock and

100,000 Pre-funded Warrants in the initial closing of this offering, and after deducting estimated placement agent fees and offering expenses

payable by us, you will suffer immediate and substantial dilution of $0.14 per share, representing the difference between the as adjusted

net tangible book value per share of our common stock as of December 31, 2023 after giving effect to the initial closing of this offering.

The price per share of our common stock and/or

Pre-funded Warrants being offered in the potential additional closings may be higher than the net tangible book value per share of our

common stock outstanding prior to any such closings. Assuming that an aggregate of 3,000,000 shares of common stock and/or Pre-funded

Warrants are sold in the potential additional closing(s) at a price of $1.00 per share, and after deducting estimated placement agent

fees and offering expenses payable by us, you will suffer immediate and substantial dilution of $0.14 per share, representing the difference

between the as adjusted net tangible book value per share of our common stock as of December 31, 2023 after giving effect to the potential

additional closings of this offering at the $1.00 per share offering price. The foregoing calculation is based on net tangible book value

as of December 31, 2023, and net tangible book value as of the date(s) of the potential additional closings could be substantially different.

You will experience additional dilution upon the

exercise of options, as well as upon the vesting of outstanding stock options, including those options currently outstanding and those

granted in the future, and the issuance of restricted stock or other equity awards under our stock incentive plans. See the section titled

“Dilution” beginning on page S-18 for a more detailed discussion of the dilution you will incur if you purchase shares in

this offering.

You may experience future dilution as a result of future equity

offerings.

In order to raise additional

capital, we may in the future offer additional shares of our common stock or other securities convertible into or exchangeable for our

common stock. We cannot assure you that we will be able to sell shares or other securities in any other offering at a price per share

that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing our shares or other

securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares of

our common stock or other securities convertible into or exchangeable for our common stock in future transactions may be higher or lower

than the price per share in this offering.

Future sales or resales of our common stock,

or the perception that such future sales may occur, may cause our stock price to decline.

Sales of a substantial number

of shares of our common stock in this offering and the subsequent resale of the substantial number of our commons stock in the public

market, or the perception that these sales could occur, following this offering could cause the market price of our common stock to decline.

A substantial majority of the outstanding shares of our common stock are, and the shares of common stock sold in this offering upon issuance,

will be freely tradable without restriction or further registration under the Securities Act.

There is no established public trading market

for the Pre-funded Warrants, and we do not expect a market to develop.

We do not intend to apply for listing of the Pre-funded

Warrants on the NYSE American or any other securities exchange or nationally recognized trading system. Without an active trading market,

the liquidity of the Pre-funded Warrants will be limited. This offering also relates to the shares of common stock issuable upon exercise

of the Pre-funded Warrants being offered by this prospectus supplement and the accompanying prospectus.

The Pre-funded Warrants are speculative

in nature.

Except as otherwise provided in the Pre-funded

Warrants, until holders of Pre-funded Warrants acquire our common stock upon exercise of the Pre-funded Warrants, holders of Pre-funded

Warrants will have no rights with respect to our common stock underlying such Pre-funded Warrants. Upon exercise of the Pre-funded Warrants,

the holders will be entitled to exercise the rights of a stockholder of our Common Stock only as to matters for which the record date

occurs after the exercise date.

Moreover, following this offering the market

value of the Pre-funded Warrants is uncertain. There can be no assurance that the market price of our common stock will ever equal or

exceed the price of the Pre-funded Warrants, and, consequently, whether it will ever be profitable for investors to exercise their Pre-funded

Warrants.

We will not receive any meaningful amount

of additional funds upon the exercise of the Pre-funded Warrants.

Each Pre-funded Warrant will be exercisable

until it is fully exercised and by means of payment of the nominal cash purchase price upon exercise or through a “cashless exercise”

procedure. Accordingly, we will not receive any meaningful additional funds upon the exercise of the Pre-funded Warrants.

Holders of the Pre-funded Warrants

will have no rights as common stockholders until such holders exercise their Pre-funded Warrants and acquire shares of our Common

Stock.

Until holders of the Pre-funded Warrants

exercise their Pre-funded Warrants and acquire shares of our common stock, such holders will have no rights with respect to the shares

of our common stock underlying such Pre-funded Warrants. Upon exercise of the Pre-funded Warrants, the holders will be entitled

to exercise the rights of a common stockholder only as to matters for which the record date occurs after the exercise date.

Significant holders or beneficial holders

of shares of our Common Stock may not be permitted to exercise the Pre-funded Warrants that they hold.

A holder of the Pre-funded Warrants will

not be entitled to exercise any portion of any Pre-funded Warrant that, upon giving effect to such exercise, would cause the aggregate

number of shares of our common stock beneficially owned by such holder (together with its affiliates) to exceed 4.99% (or 9.99% at the

election of the holder) of the number of shares of our common stock immediately after giving effect to the exercise. As a result, you

may not be able to exercise your Pre-funded Warrants for shares of our common stock at a time when it would be financially beneficial

for you to do so. In such a circumstance, you could seek to sell your Pre-funded Warrants to realize value, but you may be unable

to do so in the absence of an established trading market and due to applicable transfer restrictions.

We have broad discretion to determine how

to use the funds raised in this offering, and may use them in ways that may not enhance our operating results or the price of our common

stock.

Our management will have broad

discretion over the use of proceeds from this offering, and we could spend the proceeds from this offering in ways our stockholders may

not agree with or that do not yield a favorable return, if at all. We intend to use the net proceeds from this offering for general corporate

purposes. See “Use of Proceeds” beginning on page S-13 of this prospectus supplement for additional detail. However, our use

of these proceeds may differ substantially from our current plans. If we do not invest or apply the proceeds from this offering in ways

that improve our operating results, we may fail to achieve expected financial results, which could cause our stock price to decline.

We do not expect to pay dividends in the

foreseeable future. As a result, you must rely on stock appreciation for any return on your investment.

We have never declared or

paid cash dividends on our common stock and do not anticipate paying cash dividends on our common stock in the foreseeable future. Any

payment of cash dividends will also depend on our financial condition, results of operations, capital requirements and other factors and

will be at the discretion of our board of directors, subject to limitations under applicable law. Accordingly, you will have to rely on

capital appreciation, if any, to earn a return on your investment in our common stock.

Our common stock price is likely to be highly

volatile because of several factors, including a limited public float.

The market price of

our common stock has been volatile in the past and the market price of our common stock is likely to be highly volatile in the future.

You may not be able to resell shares of our common stock following periods of volatility because of the market’s adverse reaction

to volatility.

Other factors that could cause

such volatility may include, among other things:

| |

● |

actual or anticipated fluctuations in our operating results; |

| |

|

|

| |

● |

the absence of securities analysts covering us and distributing research and recommendations about us; |

| |

|

|

| |

● |

we may have a low trading volume; |

| |

|

|

| |

● |

overall stock market fluctuations; |

| |

|

|

| |

● |

announcements concerning our business or those of our competitors; |

| |

|

|

| |

● |

actual or perceived limitations on our ability to raise capital when we require it, and to raise such capital on favorable terms; |

| |

|

|

| |

● |

conditions or trends in our industry; |

| |

|

|

| |

● |

litigation; |

| |

|

|

| |

● |

changes in market valuations of other similar companies; |

| |

|

|

| |

● |

future sales of common stock; |

| |

|

|

| |

● |

departure of key personnel or failure to hire key personnel; and |

| |

|

|

| |

● |

general market conditions. |

Any of these factors could

have a significant and adverse impact on the market price of our common stock. In addition, the stock market in general has at times

experienced extreme volatility and rapid decline that has often been unrelated or disproportionate to the operating performance of particular

companies. These broad market fluctuations may adversely affect the trading price of our common stock, regardless of our actual operating

performance.

USE OF PROCEEDS

We estimate that the net proceeds

from the sale of the common stock and/or Pre-funded Warrants will be approximately $3.7 million for the initial closing of this offering,

after deducting placement agent fees and estimated offering expenses payable by us, and assuming no exercise of Pre-funded Warrants. Assuming

that an aggregate of 3,000,000 shares of common stock and/or Pre-funded Warrants are sold in the potential additional closings at a price

of $1.00 per share, and after deducting estimated placement agent fees and offering expenses payable by us, we estimate that the total

net proceeds from the sale of the common stock and/or Pre-funded Warrants will be approximately $6.4 million.

We intend to use the net proceeds

from this offering for general corporate purposes.

The precise amount and timing

of the application of these proceeds will depend upon a number of factors, such as our funding requirements and the availability and costs

of other funds. As of the date of this prospectus supplement, we cannot specify with certainty all of the particular uses for the net

proceeds to us from this offering. Depending on the outcome of our efforts and other unforeseen events, our plans and priorities may change

and we may apply the net proceeds of this offering in different manners than we currently anticipate. Accordingly, our management will

have broad discretion in the timing and application of these proceeds.

DIVIDEND POLICY

We have never declared or

paid dividends on our common stock and we do not anticipate paying any cash dividends on our common stock in the foreseeable future.

Payment of cash dividends, if any, in the future will be at the discretion of our board of directors and will depend on applicable law

and then-existing conditions, including our financial condition, operating results, contractual restrictions, capital requirements, business

prospects and other factors our board of directors may deem relevant. We currently intend to retain all available funds and any future

earnings to fund the development and growth of our business.

DESCRIPTION OF SECURITIES WE ARE OFFERING

The following

description is a summary of some of the terms of our securities, our organizational documents and Nevada law. The descriptions in this

prospectus supplement and the accompanying prospectus of our securities and our organizational documents do not purport to be complete

and are subject to, and qualified in their entirety by reference to, our organizational documents, copies of which have been or will be

filed or incorporated by reference as exhibits to the registration statement of which this prospectus supplement and the accompanying

prospectus form a part. This summary supplements the description of our capital stock in the accompanying prospectus and, to the extent

it is inconsistent, replaces the description in the accompanying prospectus.

We are offering 3,900,000 shares of common stock

and 100,000 Pre-funded Warrants in the initial closing and up to 3,000,000 shares of common stock and/or Pre-funded Warrants in up to

three additional subsequent closings. The shares of common stock or Pre-funded Warrants will be issued separately. We are also registering

the shares of common stock issuable from time to time upon exercise of the Pre-funded Warrants offered hereby.

Common Stock

A description of the Common Stock that we are

offering pursuant to this prospectus supplement is set forth hereunder and under the heading “Description of Capital Stock”

starting on page 10 of the accompanying prospectus. As of the date of this prospectus supplement, we had 35,375,005 shares

of common stock outstanding.

Pre-funded Warrants

The following summary of certain terms and provisions

of the Pre-funded Warrants that are being offered hereby is not complete and is subject to, and qualified in its entirety by, the provisions

of the Pre-funded Warrant, the form of which will be filed as an exhibit to a Current Report on Form 8-K that we will file with the SEC.

Prospective investors should carefully review the terms and provisions of the form of Pre-funded Warrant for a complete description of

the terms and conditions of the Pre-funded Warrants.

Term

The Pre-funded Warrants will not expire until

they are fully exercised.

Exercisability

The Pre-funded Warrants are exercisable at any

time until they are fully exercised. The Pre-funded Warrants will be exercisable, at the option of each holder, in whole or in part by

delivering to us a duly executed exercise notice and payment of the exercise price. No fractional shares of Common Stock will be issued

in connection with the exercise of a Pre-funded Warrant. The holder of the Pre-funded Warrant may also satisfy its obligation to pay the

exercise price through a “cashless exercise,” in which the holder receives the net value of the Pre-funded Warrants in shares

of Common Stock determined according to the formula set forth in the Pre-funded Warrant.

Exercise Limitations

Under the terms of the Pre-funded Warrants, the

Company may not effect the exercise of any such warrant, and a holder will not be entitled to exercise any portion of any such warrant,

if, upon giving effect to such exercise, the aggregate number of shares of Common Stock beneficially owned by the holder (together with

its affiliates, any other persons acting as a group together with the holder or any of the holder’s affiliates, and any other persons

whose beneficial ownership of Common Stock would or could be aggregated with the holder’s for purposes of Section 13(d) or Section

16 of the Securities Exchange Act of 1934, as amended) would exceed 4.99% of the number of shares of Common Stock outstanding immediately

after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of such warrant, which percentage

may be increased or decreased at the holder’s election upon 61 days’ notice to the Company subject to the terms of such warrants, provided

that such percentage may in no event exceed 9.99%.

Exercise Price

The exercise price of our shares of Common Stock

purchasable upon the exercise of the Pre-funded Warrants is $0.01 per share. The exercise price of the Pre-funded Warrants and the number

of shares of Common Stock issuable upon exercise of the Pre-funded Warrants is subject to appropriate adjustment in the event of certain

stock dividends and distributions, stock splits, stock combinations, reclassifications or similar events affecting our shares of Common

Stock, as well as upon any distribution of assets, including cash, stock or other property, to our stockholders.

Transferability

Subject to applicable laws, the Pre-funded Warrants

may be offered for sale, sold, transferred or assigned without our consent.

Exchange Listing

We do not intend to list the Pre-funded Warrants

on the NYSE American, any other national securities exchange or any other nationally recognized trading system.

Fundamental Transactions

Upon the consummation of a fundamental transaction

(as described in the Pre-funded Warrants, and generally including any reorganization, recapitalization or reclassification of our shares

of Common Stock, the sale, transfer or other disposition of all or substantially all of our properties or assets, our consolidation or

merger with or into another person, the acquisition of more than 50% of our outstanding shares of Common Stock, or any person or group

becoming the beneficial owner of 50% of the voting power of our outstanding shares of Common Stock), the holders of the Pre-funded Warrants

will be entitled to receive, upon exercise of the Pre-funded Warrants, the kind and amount of securities, cash or other property that

such holders would have received had they exercised the Pre-funded Warrants immediately prior to such fundamental transaction, without

regard to any limitations on exercise contained in the Pre-funded Warrants. Notwithstanding the foregoing, in the event of a fundamental

transaction where the consideration consists solely of cash, solely of marketable securities or a combination of cash and marketable securities,

then each Pre-funded Warrants shall automatically be deemed to be exercised in full in a cashless exercise effective immediately prior

to and contingent upon the consummation of such fundamental transaction.

No Rights as a Stockholder

Except by virtue of such holder’s ownership

of shares of Common Stock, the holder of a Pre-funded Warrant does not have the rights or privileges of a holder of our shares of Common

Stock, including any voting rights, until such holder exercises the Pre-funded Warrant.

CAPITALIZATION

The following table sets forth our consolidated cash and cash equivalents,

equity and total capitalization as of December 31, 2023:

| · | on an actual basis; |

| · | on an as-adjusted basis, to give effect to the

sale by us, in the initial closing this offering, of 3,900,000 shares of common and 100,000 Pre-funded Warrants stock at an offering price

of $1.00 per share or $0.99 per Pre-funded Warrant, after deducting placement agent fees and estimated offering expenses payable by us

and assuming full exercise of Pre-funded Warrants; and |

| · | on a further as-adjusted basis, to give effect to the sale by us, in the

potential additional closings this offering, of 3,000,000 shares of common and/or Pre-funded Warrants stock at an offering price of $1.00

per share or $0.99 per Pre-funded Warrant, after deducting placement agent fees and estimated offering expenses payable by us and assuming

full exercise of Pre-funded Warrants. |

You should read this table together with the “Use

of Proceeds” section included in this prospectus, the “Management’s Discussion and Analysis of Financial Condition

and Results of Operations” section and our consolidated financial statements and related notes included in our Annual Report on

Form 10-K for the year ended December 31, 2023, which is incorporated by reference into this prospectus.

| | |

As of December 31, 2023 | |

| (in thousands, except share and par value data) | |

Actual (audited) | | |

As Adjusted For Initial Closing | | |

As Adjusted For Additional Closings | |

| Cash and cash equivalents | |

$ | 4,095 | | |

$ | 7,775 | | |

$ | 10,535 | |

| Stockholders’ equity: | |

| – | | |

| – | | |

| – | |

| Preferred Stock | |

| – | | |

| – | | |

| – | |

| Preferred Stock, 9,943,999 shares authorized, 0 shares issued and outstanding as of December 31, 2023 | |

| – | | |

| – | | |

| – | |

| 0% Series A Convertible Preferred Stock, $0.001 par value, 6,000 shares authorized, 0 shares issued and outstanding as of December 31, 2023 | |

| – | | |

| – | | |

| – | |

| Series B Preferred Stock, $0.001 par value, 1 share authorized, 1 share issued and outstanding as of December 31, 2023 | |

| – | | |

| – | | |

| – | |

| Series C Preferred Stock, $0.001 par value, 50,000 shares authorized, 0 shares issued and outstanding as of December 31, 2023 | |

| – | | |

| – | | |

| – | |

| Common Stock, $0.001 par value, 190,000,000 shares authorized, 35,323,217 shares issued and 35,247,744 shares outstanding as of December 31, 2023 | |

| 352 | | |

| 391 | | |

| 394 | |

| Treasury Stock at Cost, 75,473 shares of common stock as of December 31, 2023 | |

| (339 | ) | |

| (339 | ) | |

| (339 | ) |

| Additional Paid-in Capital | |

| 773,986 | | |

| 777,947 | | |

| 780,944 | |

| Accumulated Deficit | |

| (718,546 | ) | |

| (718,546 | ) | |

| (718,546 | ) |

| Accumulated Other Comprehensive Loss | |

| (3,883 | ) | |

| (3,883 | ) | |

| (3,883 | ) |

| Total Kartoon Studios, Inc. Stockholders' Equity | |

| 51,570 | | |

| 55,570 | | |

| 58,570 | |

| Non-Controlling Interests in Consolidated Subsidiaries | |

| 1,691 | | |

| 1,691 | | |

| 1,691 | |

| Total Stockholders’ Equity | |

$ | 53,261 | | |

$ | 57,261 | | |

$ | 60,261 | |

The as adjusted

information discussed above is illustrative only.

The above table is based on 35,247,744 shares

of common stock issued and outstanding as of December 31, 2023.

The number of shares of our

common stock outstanding before this offering and to be outstanding immediately after this offering is based on 35,247,744 shares of our

common stock issued and outstanding as of December 31, 2023, and excludes, as of December 31, 2023, the following:

| |

· |

1,183,908 shares of our common stock issuable upon the exercise of stock options outstanding under our 2020 Incentive Plan, at a weighted-average exercise price of $14.96 per share; |

| |

|

|

| |

· |

1,020,067 shares of common stock issuable upon vesting of restricted stock units outstanding; |

| |

|

|

| |

· |

87,045 shares of common stock reserved for future issuance under our 2020 Incentive Plan; and |

| |

|

|

| |

· |

6,852,952 shares of our common stock issuable upon the exercise of

outstanding warrants, at a weighted-average exercise price of $8.19 per share. |

Except as otherwise indicated,

all information in this prospectus supplement assumes no exercise of the outstanding options or warrants or vesting of restricted stock

units described above.

To the extent that options or warrants are exercised, new options are issued under our 2020

Incentive Plan, or we issue additional shares of common stock in the future, there may be further dilution to investors participating

in this offering. In addition, we may choose to raise additional capital because of market conditions or strategic considerations, even

if we believe that we have sufficient funds for our current or future operating plans. If we raise additional capital through the sale

of equity or convertible debt securities, the issuance of these securities could result in further dilution to our stockholders.

DILUTION

If you invest in our common

stock, you will experience dilution to the extent of the difference between the public offering price per share and the net tangible book

value per share of our common stock immediately after this offering.

Our net tangible book value

(deficit) as of December 31, 2023, was approximately $30,268,000, or $0.86 per share of our common stock, based upon the number of shares

of our common stock outstanding as of that date. Net tangible book value per share is determined by dividing our total tangible assets,

less total liabilities, by the number of shares of our common stock outstanding as of December 31, 2023. Dilution in net tangible book

value per share represents the difference between the amount per share paid by purchasers of shares of common stock in this offering and

the net tangible book value per share of our common stock immediately after this offering.

Initial Closing

After giving effect to the

sale of shares of 3,900,000 shares of our common stock and 100,000 Pre-funded Warrants in the initial closing of this offering, at the

offering price of $1.00 per share and $0.99 per Pre-funded Warrants, and after deducting the estimated placement agent fees and estimated

offering expenses payable by us, our as adjusted net tangible book value as of December 31, 2023, would have been approximately $33,948,000,

or $0.86 per share. This represents an immediate increase in net tangible book value of $0.00 per share to existing stockholders and immediate

dilution in net tangible book value of $0.14 per share to the new investor purchasing our common stock in the initial closing of this

offering at the public offering price. The following table illustrates this dilution on a per share basis:

| Offering price per share of common stock |

|

$ |

1.00 |

|

| Net tangible book value (deficit) per share as of December 31, 2023 |

|

$ |

0.86 |

|

| Increase in net tangible book value per share attributable to the investor in the initial closing of this offering |

|

$ |

0.00 |

|

| As adjusted net tangible book value per share after the initial closing of this offering |

|

$ |

0.86 |

|

| Dilution per share to the investor purchasing shares in the initial closing of this offering |

|

$ |

0.14 |

|

Initial and Potential Additional Closings

After giving effect to the

sale of shares of (i) 3,900,000 shares of our common stock and 100,000 Pre-funded Warrants in the initial closing of this offering and

(ii) up to 3,000,000 shares of our common stock and/or Pre-funded Warrants in the potential additional closings of this offering, if any,

in each case at the offering price of $1.00 per share or $0.99 per Pre-funded Warrant and after deducting the estimated placement agent

fees and estimated offering expenses payable by us, our as adjusted net tangible book value as of December 31, 2023, would have been approximately

$36,708,000, or $0.87 per share. This represents an immediate increase in net tangible book value of $0.01 per share to existing stockholders

and immediate dilution in net tangible book value of $0.13 per share to the investor purchasing our common stock in this offering at the

public offering price. The following table illustrates this dilution on a per share basis:

| Public offering price per share of common stock | |

$ | 1.00 | |

| Net tangible book value (deficit) per share as of December 31, 2023 | |

$ | 0.86 | |

| Increase in net tangible book value per share attributable to the investor in this offering | |

$ | 0.00 | |

| As adjusted net tangible book value per share after the initial and additional subsequent closings of this offering | |

$ | 0.87 | |

| Dilution per share to the investor purchasing shares in the initial and additional subsequent closings of this offering | |

$ | 0.14 | |

The number of shares of our

common stock outstanding before this offering and to be outstanding immediately after this offering is based on 35,247,744 shares of our

common stock issued and outstanding as of December 31, 2023, and excludes, as of December 31, 2023, the following:

| |

· |

1,183,908 shares of our common stock issuable upon the exercise of stock options outstanding under our 2020 Incentive Plan, at a weighted-average exercise price of $14.96 per share; |

| |

|

|

| |

· |

1,020,067 shares of common stock issuable upon vesting of restricted stock units outstanding; |

| |

|

|

| |

· |

87,045 shares of common stock reserved for future issuance under our 2020 Incentive Plan; and |

| |

|

|

| |

· |

6,852,952 shares of our common stock issuable upon the exercise of outstanding warrants, at a weighted-average exercise price of $8.19 per share. |

Except as otherwise indicated,

all information in this prospectus supplement assumes no exercise of the outstanding options or warrants or vesting of restricted stock

units described above.

To the extent that options

or warrants are exercised, new options are issued under our 2020 Incentive Plan, or we issue additional shares of common stock in the

future, there may be further dilution to investors participating in this offering. In addition, we may choose to raise additional capital

because of market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating

plans. If we raise additional capital through the sale of equity or convertible debt securities, the issuance of these securities could

result in further dilution to our stockholders.

PLAN OF DISTRIBUTION

EF Hutton LLC, which we refer to as the

Placement Agent, has agreed to act as the exclusive placement agent in connection with this offering. The Placement Agent is not

purchasing or selling securities offered by this prospectus supplement, nor is the Placement Agent required to arrange the purchase

or sale of any specific number or dollar amount of securities, but has agreed to use its best efforts to arrange for the sale of all

of the securities offered hereby. We are offering shares of our common stock and/or Pre-funded Warrants having an aggregate offering

price of up to $7,000,000, which are being offered in up to four closings. In the initial closing of this offering, we are selling

3,900,000 shares of common stock and 100,000 Pre-funded Warrants at a price of $1.00 per share, or $0.99 per Pre-funded Warrant, to

an institutional investor pursuant a securities purchase agreement dated April 18, 2024 between us and such investor, or the

Purchase Agreement; and in up to three additional subsequent closings, we may sell up to an additional 3,000,000 shares of our

common stock and/or Pre-funded Warrants at the same price as the shares of common stock and/or Pre-funded Warrants sold in the

initial closing to the institutional investor pursuant to the Purchase Agreement. For each Pre-funded Warrant, we sell in a

subsequent closing, the number of shares of common stock we are offering will be decreased on a one-for-one basis The date of the

additional closings, if any, will occur no later than one hundred and eighty (180) days following the date of the Purchase

Agreement, at such time that is mutually agreed up on by the Company and such investor. We negotiated the price for the securities

offered in this offering with the investor. The factors considered in determining the price included the recent market price of our

common stock, the general condition of the securities market at the time of this offering, the history of, and the prospects, for

the industry in which we compete, our past and present operations, and our prospects for future revenues.

The Placement Agent is not purchasing or selling

any securities, nor are they required to arrange for the purchase and sale of any specific number or dollar amount of securities, other

than to use their “reasonable best efforts” to arrange for the sale of the securities by us. Therefore, we may not sell the

entire amount of securities being offered. The Placement Agent may engage one or more subagents or selected dealers in connection with

this offering.

We have entered into a placement agency agreement,

dated April 18, 2024 (“Placement Agreement”), with the Placement Agent, which provides that the Placement Agent’s obligations

are subject to conditions contained in the Placement Agreement.

We will deliver the securities being issued to

the investor upon receipt of investor funds for the purchase of the securities offered pursuant to this prospectus.

Placement Agent, Commissions and Expenses

Upon the closing of this offering, we will pay

the Placement Agent a cash transaction fee equal to seven percent (7.0%) of the aggregate gross cash proceeds to us from the sale of the

securities in the offering. In addition, we will reimburse the Placement Agent for its out-of-pocket expenses incurred in connection with

this offering, including the fees and expenses of the counsel for the Placement Agent of up to $75,000.

The following table shows the public offering

price, Placement Agent fees and proceeds, before expenses, to us.

| | |

Per Common Stock | | |

Per Pre-funded Warrant | | |

Total | |

| Public offering price | |

$ | 1.00 | | |

$ | 0.99 | | |

$ | 7,000,000 | |

| Placement agent fees (7%) | |

$ | 0.07 | | |

$ | 0.069 | | |

$ | 490,000 | |

| Non-accountable expense allowance (1.0%) (1) | |

$ | 0.01 | | |

$ | 0.0099 | | |

$ | 70,000 | |

| Proceeds, before expenses, to us | |

$ | 0.92 | | |

$ | 0.9111 | | |

$ | 6,440,000 | |

(1) We have also agreed to pay the Placement Agent

a non-accountable expense reimbursement of 1% of the gross proceeds received by us from the sale of the securities at each closing.

We estimate that the total expenses of the offering,

including registration, filing and listing fees, the Placement Agent’s accountable expense, printing fees and legal and accounting

expenses, but excluding Placement Agent fees, will be approximately $[____] all of which are payable by us.

Lock-Up Agreements

We and our executive officers and directors have

agreed, that subject to certain exceptions, we and our directors and officers will not, until ninety (90) days pursuant to the Purchase

Agreement, and one hundred and eighty (180) days pursuant to the placement agent agreement, after the closing of this offering, offer,

pledge, sell, contract to sell, grant, lend, or otherwise transfer or dispose of, directly or indirectly of any of our shares of common

stock.

The Placement Agent may in its sole discretion

and at any time without notice release some or all of the shares subject to lock-up agreements prior to the expiration of the lock-up

period. When determining whether or not to release shares from the lock-up agreements, the Placement Agent will consider, among other

factors, the security holder’s reasons for requesting the release, the number of shares for which the release is being requested

and market conditions at the time.

Indemnification

We have agreed to indemnify the Placement Agent

against certain liabilities, including liabilities under the Securities Act, and to contribute to payments that the Placement Agent may

be required to make for these liabilities.

Regulation M

The Placement Agent may be deemed to be an underwriter

within the meaning of Section 2(a)(11) of the Securities Act, and any commissions received by it and any profit realized on the resale

of the securities sold by it while acting as principal might be deemed to be underwriting discounts or commissions under the Securities

Act. As an underwriter, the Placement Agent would be required to comply with the requirements of the Securities Act and the Exchange Act,

including, without limitation, Rule 10b-5 and Regulation M under the Exchange Act. These rules and regulations may limit the timing of

purchases and sales of our securities by the placement agent acting as principal. Under these rules and regulations, the Placement Agent

(i) may not engage in any stabilization activity in connection with our securities and (ii) may not bid for or purchase any of our securities

or attempt to induce any person to purchase any of our securities, other than as permitted under the Exchange Act, until it has completed

its participation in the distribution.

Determination of Offering Price

The actual offering price of the securities were

negotiated between us, the Placement Agent and the investors in the offering based on the trading of our common stock prior to the offering,

among other things. Other factors considered in determining the public offering price of the Securities we are offering, include our history

and prospects, the stage of development of our business, our business plans for the future and the extent to which they have been implemented,

an assessment of our management, the general conditions of the securities markets at the time of the offering and such other factors as

were deemed relevant.

Electronic Distribution

A prospectus in electronic format may be made

available on a website maintained by the Placement Agent. In connection with the offering, the Placement Agent or selected dealers may

distribute prospectuses electronically. No forms of electronic prospectus other than prospectuses that are printable as Adobe® PDF

will be used in connection with this offering.

Other than the prospectus in electronic format,

the information on the Placement Agent’s website and any information contained in any other website maintained by the Placement

Agent is not part of the prospectus or the registration statement of which this prospectus forms a part, has not been approved and/or

endorsed by us or the Placement Agent in its capacity as placement agent and should not be relied upon by investors.