GRI Bio Announces Closing of $4.0 Million Public Offering

28 Junio 2024 - 3:05PM

GRI Bio, Inc. (NASDAQ: GRI) (“GRI Bio” or the “Company”), a

biotechnology company advancing an innovative pipeline of Natural

Killer T (“NKT”) cell modulators for the treatment of inflammatory,

fibrotic and autoimmune diseases, today announced the closing of

its previously announced public offering for the purchase and sale

of an aggregate of 2,185,793 shares of its common stock (or common

stock equivalents in lieu thereof), Series C-1 warrants to purchase

up to 2,185,793 shares of common stock and Series C-2 warrants to

purchase up to 2,185,793 shares of common stock (all the warrants,

collectively, the "Series Warrants"), at a combined purchase price

of $1.83 per share (or per common stock equivalent in lieu thereof)

and accompanying Series Warrants. The Series Warrants have an

exercise price of $1.83 per share and will be exercisable beginning

on the effective date of stockholder approval of the issuance of

the shares upon exercise of the Series Warrants. The Series C-1

warrants expire on the five-year anniversary of the initial

exercise date. The Series C-2 warrants expire on the eighteen-month

anniversary of the initial exercise date.

H.C. Wainwright & Co. acted as the exclusive

placement agent for the offering.

The gross proceeds to the Company from the

offering, before deducting the placement agent's fees and other

offering expenses payable by the Company, were approximately $4.0

million. The potential additional gross proceeds to the Company

from the Series Warrants, if fully exercised on a cash basis, will

be approximately $8.0 million. No assurance can be given that any

of the Series Warrants will be exercised for cash. The Company

intends to use the net proceeds from this offering for its product

candidate development, working capital and general corporate

purposes.

The securities described above were offered

pursuant to a registration statement on Form S-1 (File No.

333-280323), as amended, which was declared effective by the

Securities and Exchange Commission (the "SEC") on June 26, 2024.

The offering was made only by means of a prospectus forming part of

the effective registration statement relating to the offering.

Electronic copies of the final prospectus may be obtained on the

SEC's website at http://www.sec.gov and may also be obtained by

contacting H.C. Wainwright & Co., LLC at 430 Park Avenue, 3rd

Floor, New York, NY 10022, by phone at (212) 856-5711 or e-mail at

placements@hcwco.com.

This press release shall not constitute an offer

to sell or a solicitation of an offer to buy any of the securities

described herein, nor shall there be any sale of these securities

in any state or other jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification under the securities laws of any such state or other

jurisdiction.

About GRI Bio, Inc.

GRI Bio is a clinical-stage biopharmaceutical

company focused on fundamentally changing the way inflammatory,

fibrotic and autoimmune diseases are treated. GRI Bio’s therapies

are designed to target the activity of NKT cells, which are key

regulators earlier in the inflammatory cascade, to interrupt

disease progression and restore the immune system to homeostasis.

NKT cells are innate-like T cells that share properties of both NK

and T cells and are a functional link between the innate and

adaptive immune responses. Type I invariant NKT (“iNKT”) cells play

a critical role in propagating the injury, inflammatory response,

and fibrosis observed in inflammatory and fibrotic indications. GRI

Bio’s lead program, GRI-0621, is an inhibitor of iNKT cell activity

and is being developed as a novel oral therapeutic for the

treatment of idiopathic pulmonary fibrosis, a serious disease with

significant unmet need. The Company is also developing a pipeline

of novel type 2 NKT agonists for the treatment of systemic lupus

erythematosus. Additionally, with a library of over 500 proprietary

compounds, GRI Bio has the ability to fuel a growing pipeline.

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of the “safe harbor” provisions of

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by the use of words

such as “anticipate,” “believe,” “contemplate,” “could,”

“estimate,” “expect,” “intend,” “seek,” “may,” “might,” “plan,”

“potential,” “predict,” “project,” “target,” “aim,” “should,”

“will,” “would,” or the negative of these words or other similar

expressions. These forward-looking statements are based on the

Company’s current beliefs and expectations. Forward-looking

statements include, but are not limited to, statements regarding:

the anticipated use of proceeds from the offering; the Company’s

ability to regain and maintain compliance with Nasdaq’s listing

requirements; the Company’s expectations with respect to

development and commercialization of the Company’s product

candidates, the timing of initiation or completion of clinical

trials and availability of resulting data, the potential benefits

and impact of the Company’s clinical trials and product candidates

and any implication that the data or results observed in

preclinical trials or earlier studies or trials will be indicative

of results of later studies or clinical trials, the Company’s

beliefs and expectations regarding potential stakeholder value and

future financial performance and the Company’s beliefs about the

timing and outcome of regulatory approvals and potential regulatory

approval pathways. Actual results may differ from the

forward-looking statements expressed by the Company in this press

release and consequently, you should not rely on these

forward-looking statements as predictions of future events. These

forward-looking statements are subject to inherent uncertainties,

risks and assumptions that are difficult to predict, including,

without limitation: (1) the inability to maintain the listing of

the Company’s common stock on Nasdaq and to comply with applicable

listing requirements; (2) changes in applicable laws or

regulations; (3) the inability of the Company to raise financing in

the future; (4) the success, cost and timing of the Company’s

product development activities; (5) the inability of the Company to

obtain and maintain regulatory clearance or approval for its

respective products, and any related restrictions and limitations

of any cleared or approved product; (6) the inability of the

Company to identify, in-license or acquire additional technology;

(7) the inability of the Company to compete with other companies

currently marketing or engaged in the development of products and

services that the Company is currently developing; (8) the size and

growth potential of the markets for the Company’s products and

services, and their respective ability to serve those markets,

either alone or in partnership with others; (9) the failure to

achieve any milestones or receive any milestone payments under any

agreements; (10) inaccuracy in the Company’s estimates regarding

expenses, future revenue, capital requirements and needs for and

the ability to obtain additional financing; (11) the Company’s

ability to protect and enforce its intellectual property portfolio,

including any newly issued patents; and (12) other risks and

uncertainties indicated from time to time in the Company’s filings

with the SEC, including the risks and uncertainties described in

the “Risk Factors” section of the Company’s most recent Annual

Report on Form 10-K filed with the SEC on March 28, 2024, and

subsequently filed reports. Forward-looking statements contained in

this announcement are made as of this date, and the Company

undertakes no duty to update such information except as required

under applicable law.

Investor Contact:JTC Team, LLCJenene

Thomas(833) 475-8247GRI@jtcir.com

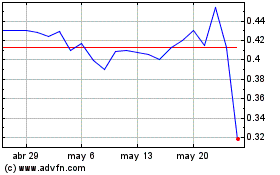

GRI Bio (NASDAQ:GRI)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

GRI Bio (NASDAQ:GRI)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024