H&E Equipment Services, Inc. (NASDAQ: HEES) (“H&E”, the

“Company”) today reported strong financial results for the second

quarter ended June 30, 2023, and updated its outlook for 2023,

increasing gross capital expenditures and branch additions. The

Company sold its crane business (the "Crane Sale") in October 2021

and completed associated closing adjustments during the second

quarter of 2022. As such, results and comparisons for the prior

period are presented on a continuing operations basis with the

Crane Sale reported as discontinued operations in certain

statements and schedules accompanying this report, in accordance

with Generally Accepted Accounting Principles ("GAAP"). The Company

also completed its acquisition of One Source Equipment Rentals,

Inc. ("One Source") on October 1, 2022, which added 10 branch

locations.

SECOND QUARTER 2023 SUMMARY WITH A

COMPARISON TO SECOND QUARTER 2022

- Revenues increased 22.2% to $360.2 million compared to $294.7

million.

- Net income was $41.2 million compared to $27.9 million. The

effective income tax rate was 26.3% compared to 26.8%.

- EBITDA totaled $166.5 million, an increase of 36.6% compared to

$121.9 million.

- Total equipment rental revenues were $291.5 million, an

increase of $63.9 million, or 28.1%, compared to $227.6 million.

Rental revenues were $258.7 million, an increase of $57.5 million,

or 28.6%, compared to $201.2 million.

- Used equipment sales increased 110.6% to $39.7 million compared

to $18.8 million.

- Gross margin improved to 46.7% compared to 44.9%.

- Total equipment rental gross margins were 46.8% compared to

48.6%. Rental gross margins were 51.8% compared to 53.7%.

- EBITDA gross margins improved to 46.2% of revenues compared to

41.4%.

- Average time utilization (based on original equipment cost) was

69.3% compared to 73.2%. The Company’s rental fleet, based on

original acquisition cost, closed the second quarter of 2023 at

just over $2.6 billion, an increase of $601.6 million, or

30.0%.

- Average rental rates, excluding One Source, increased 7.1%

compared to the second quarter of 2022, and 1.1% compared to the

first quarter of 2023.

- Dollar utilization of 40.6% compared to 40.9% in the second

quarter of 2022 and 38.6% in the first quarter of 2023.

- Average rental fleet age on June 30, 2023, was 42.5 months

compared to an industry average age of 50.3 months.

- Paid regular quarterly cash dividend of $0.275 per share of

common stock.

“Further rental rate improvement and strong execution of growth

initiatives led to another quarter of superb financial

achievement," noted Brad Barber, chief executive officer of

H&E. "Our second quarter results included records for rental

revenues, which increased 28.6% from the year-ago measure, and

gross profit. Rental rates were 7.1% better than the same quarter

in 2022, while improving 1.1% on a sequential quarterly basis.

Through the first six months of 2023, rental rates were up 8.2%

compared to the same period in 2022. Our rate performance, which

excludes One Source, remains among the best in the industry.

Physical utilization in the quarter reached 69.3%, 390 basis points

below the extraordinary measure of 73.2% recorded in the year-ago

quarter, while increasing 200 basis points on a sequential

quarterly basis. Dollar utilization of 40.6% in the quarter was

essentially unchanged from the year-ago measure, while improving

200 basis points from the first quarter of 2023. Finally, robust

revenues and gross margin in our used equipment sales underscore

the exceptional opportunities available for this segment of our

business.”

Continuing, Mr. Barber added, "We achieved substantial progress

in the quarter with business expansion initiatives focused on our

rental fleet and branch network. Gross capital investment in our

rental fleet totaled approximately $247 million, representing a

record quarterly outlay for the Company. At the close of the second

quarter, the size of our rental fleet, as measured by original

equipment cost ("OEC"), totaled approximately $2.6 billion, a 30%

increase when compared to our OEC on June 30, 2022. Also, we

continued our focus on branch expansion with the opening of six new

locations in the quarter. These locations, which improved our

branch density in the Mid-Atlantic, Southeast, Gulf Coast, and

Intermountain regions, increased our branch count on June 30, 2023,

to 126 locations across 29 states, representing branch growth over

the last year of 19%.”

Mr. Barber closed with an encouraging assessment of the industry

and the Company's prospects for additional growth, stating,

"Resilient nonresidential construction demand through May 2023

resulted in a 17% improvement in year-over-year customer spending

growth, according to the U.S. Census Bureau. As a result, healthy

project backlogs remain in place, and we expect them to be

sustained through 2023, with positive implications for 2024. Also,

an increase in the number of large-scale projects serve as a likely

catalyst for further construction spending and expansion across the

equipment rental industry. Construction of these private and

federally funded projects, which include sizable manufacturing

installations and public infrastructure programs, are active

throughout our geographic footprint and represent a growing

component of our project mix. We expect the combination of strong

industry fundamentals and the stimulus from major projects to

produce solid business opportunities through the balance of 2023

and into 2024. As an indication of our confidence in the

continuation of this favorable industry environment, we have raised

our 2023 gross capital expenditures to a range of $600 million to

$650 million, up from a previous range of $500 million to $550

million. Also, we have raised our anticipated 2023 branch additions

to a range of 12 to 15 locations, up from 10 to 15 locations."

FINANCIAL DISCUSSION FOR SECOND QUARTER

2023

Revenue

Total revenues improved to $360.2 million, or 22.2%, in the

second quarter of 2023 from $294.7 million in the second quarter of

2022. Total equipment rental revenues of $291.5 million improved

28.1% compared to $227.6 million in the second quarter of 2022.

Rental revenues of $258.7 million increased 28.6% compared to

$201.2 million in the second quarter of 2022. Used equipment sales

totaled $39.7 million, an increase of 110.6% compared to $18.8

million in the second quarter of 2022. New equipment sales of $8.9

million declined 58.8% compared to $21.5 million in the same

quarter of 2022. Parts sales of $12.0 million declined 25.6% when

compared to the second quarter of 2022, while service revenues of

$7.1 million declined 19.8% over the same period of comparison.

Gross Profit

Gross profit totaled $168.4 million in the second quarter of

2023, increasing 27.2% compared to $132.3 million in the second

quarter of 2022. Gross margin improved to 46.7% for the second

quarter of 2023 compared to 44.9% for the same quarter in 2022. On

a segment basis, gross margin on total equipment rentals was 46.8%

in the second quarter of 2023 compared to 48.6% in the second

quarter of 2022. Rental margins were 51.8% compared to 53.7% over

the same period of comparison. Rental rates in the second quarter

of 2023, excluding One Source, were 7.1% better than rates in the

second quarter of 2022. Time utilization (based on original

equipment cost) was 69.3% in the second quarter of 2023 compared to

73.2% in the second quarter of 2022. Gross margins on used

equipment sales improved to a record 59.1% in the second quarter of

2023 compared to 47.6% in second quarter of 2022. Gross margins on

new equipment sales were 14.9% in the second quarter of 2023

compared to 15.0% over the same period of comparison. Gross margins

on parts sales were 29.6% in the second quarter of 2023, compared

to 26.8% in the second quarter of 2022, while gross margins on

service revenues were 62.2% compared to 64.6% over the same period

of comparison.

Rental Fleet

The original equipment cost of the Company’s rental fleet as of

June 30, 2023, was just over $2.6 billion, representing an increase

of $601.6 million, or 30.0%, from the end of the second quarter of

2022. Dollar utilization for the second quarter of 2023 of 40.6%

compared to 40.9% in the second quarter of 2022.

Selling, General and Administrative

Expenses

Selling, General, and Administrative ("SG&A") expenses for

the second quarter of 2023 were $99.3 million, an increase of $16.6

million, or 20.1%, compared to $82.7 million in the second quarter

of 2022. The higher expenses were primarily due to an increase in

employee salaries, wages, payroll taxes, and other related employee

expenses. In addition, higher facilities expenses, professional

fees, and depreciation contributed to the rise in costs. SG&A

expenses in the second quarter of 2023 as a percentage of total

revenues declined to 27.6% compared to 28.1% in the second quarter

of 2022. Approximately $7.4 million of the increase in SG&A

expenses in the second quarter of 2023 were attributable to

branches opened or acquired during or after the second quarter of

2022.

Income from Operations

Income from operations for the second quarter of 2023 was $69.5

million, or 19.3% of revenues, compared to $50.7 million, or 17.2%

of revenues, in the second quarter of 2022.

Interest Expense

Interest expense was $14.7 million for the second quarter of

2023, compared to $13.5 million in the second quarter of 2022.

Net Income

Net income in the second quarter of 2023 was $41.2 million, or

$1.14 per diluted share, compared to net income in the second

quarter of 2022 of $27.9 million, or $0.76 per diluted share. The

effective income tax rate for the second quarter of 2023 was 26.3%

compared to an effective income tax rate of 26.8% in the same

quarter of 2022.

EBITDA

EBITDA in the second quarter of 2023 increased to $166.5

million, or 46.2% of revenues, compared to $121.9 million, or 41.4%

of revenues, in the same quarter of 2022.

Non-GAAP Financial Measures

This press release contains certain non-GAAP measures (EBITDA,

and the disaggregation of equipment rental revenues and cost of

sales numbers) detailed below. EBITDA is a non-GAAP measure as

defined under the rules of the Securities and Exchange Commission

("SEC").

We use EBITDA in our business operations to, among other things,

evaluate the performance of our business, develop budgets and

measure our performance against those budgets. We also believe that

analysts and investors use EBITDA as supplemental measures to

evaluate a company’s overall operating performance. However, EBITDA

has material limitations as an analytical tool and you should not

consider the measure in isolation, or as a substitute for analysis

of our results as reported under GAAP. We consider EBITDA a useful

tool to assist us in evaluating performance because it eliminates

items related to components of our capital structure, taxes and

non-cash charges. The items that we have eliminated in determining

EBITDA for the periods presented are interest expense, income

taxes, depreciation of fixed assets (which includes rental

equipment and property and equipment) and amortization of

intangible assets. However, some of these eliminated items are

significant to our business. For example, (i) interest expense is a

necessary element of our costs and ability to generate revenue

because we incur a significant amount of interest expense related

to our outstanding indebtedness; (ii) payment of income taxes is a

necessary element of our costs; and (iii) depreciation is a

necessary element of our costs and ability to generate revenue

because rental equipment is the single largest component of our

total assets and we recognize a significant amount of depreciation

expense over the estimated useful life of this equipment. Any

measure that eliminates components of our capital structure and

costs associated with carrying significant amounts of fixed assets

on our consolidated balance sheet has material limitations as a

performance measure. In light of the foregoing limitations, we do

not rely solely on EBITDA as a performance measure and also

consider our GAAP results. EBITDA is not a measurement of our

financial performance or liquidity under GAAP and, accordingly,

should not be considered an alternative to net income, operating

income or any other measures derived in accordance with GAAP.

Because EBITDA may not be calculated in the same manner by all

companies, the measure may not be comparable to other similarly

titled measures used by other companies.

Conference Call

The Company’s management will hold a conference call to discuss

second quarter 2023 results today, July 27, 2023, at 10:00 a.m.

(Eastern Time). To listen to the call, participants should dial

844-887-9400 approximately 10 minutes prior to the start of the

call. A telephonic replay will become available after 1:00 p.m.

(Eastern Time) on July 27, 2023, and will continue through August

3, 2023, by dialing 877-344-7529 and entering the confirmation code

6189104.

The live broadcast of H&E Equipment Services' quarterly

conference call will be available online at www.he-equipment.com on

July 27, 2023, beginning at 10:00 a.m. (Eastern Time) and will

remain available for 30 days. Related presentation materials will

be posted to the “Investor Relations” section of the Company’s web

site at www.he-equipment.com prior to the call. The presentation

materials will be in Adobe Acrobat format.

About H&E Equipment Services, Inc.

Founded in 1961, H&E Equipment Services, Inc. is one of the

largest rental equipment companies in the nation. The Company’s

fleet is among the industry’s youngest and most versatile with a

superior equipment mix comprised of aerial work platforms,

earthmoving, material handling, and other general and specialty

lines. H&E serves a diverse set of end markets in many

high-growth geographies including branches throughout the Pacific

Northwest, West Coast, Intermountain, Southwest, Gulf Coast,

Southeast, Midwest, and Mid-Atlantic regions.

Forward-Looking Statements

Statements contained in this press release that are not

historical facts, including statements about H&E’s beliefs and

expectations, are “forward-looking statements” within the meaning

of the federal securities laws. Statements containing the words

“may,” “could,” “would,” “should,” “believe,” “expect,”

“anticipate,” “plan,” “estimate,” “target,” “project,” “intend,”

“foresee” and similar expressions constitute forward-looking

statements. Forward-looking statements involve known and unknown

risks and uncertainties, which could cause actual results to differ

materially from those contained in any forward-looking statement.

Such factors include, but are not limited to, the following: (1)

risks related to a global pandemic and similar health concerns,

such as the scope and duration of the outbreak, government actions

and restrictive measures implemented in response to the pandemic,

material delays and cancellations of construction or infrastructure

projects, labor shortages, supply chain disruptions and other

impacts to the business; (2) general economic conditions and

construction and industrial activity in the markets where we

operate in North America; (3) our ability to forecast trends in our

business accurately, and the impact of economic downturns and

economic uncertainty on the markets we serve (including as a result

of current uncertainty due to inflation and increasing interest

rates); (4) the impact of conditions in the global credit and

commodity markets and their effect on construction spending and the

economy in general; (5) trends in oil and natural gas which could

adversely affect the demand for our services and products; (6) our

inability to obtain equipment and other supplies for our business

from our key suppliers on acceptable terms or at all, as a result

of supply chain disruptions, insolvency, financial difficulties,

supplier relationships or other factors; (7) increased maintenance

and repair costs as we age our fleet and decreases in our

equipment’s residual value; (8) our indebtedness; (9) risks

associated with the expansion of our business and any potential

acquisitions we may make, including any related capital

expenditures, or our ability to consummate such acquisitions; (10)

our possible inability to integrate any businesses we acquire; (11)

competitive pressures; (12) security breaches, cybersecurity

attacks, failure to protect personal information, compliance with

data protection laws and other disruptions in our information

technology systems; (13) adverse weather events or natural

disasters; (14) risks related to climate change and climate change

regulation; (15) compliance with laws and regulations, including

those relating to environmental matters, corporate governance

matters and tax matters, as well as any future changes to such laws

and regulations; and (16) other factors discussed in our public

filings, including the risk factors included in the Company’s most

recent Annual Report on Form 10-K. Investors, potential investors

and other readers are urged to consider these factors carefully in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements. Except as

required by applicable law, including the securities laws of the

United States and the rules and regulations of the SEC, we are

under no obligation to publicly update or revise any

forward-looking statements after the date of this release, whether

as a result of any new information, future events or otherwise.

These statements are based on the current beliefs and assumptions

of H&E’s management, which in turn are based on currently

available information and important, underlying assumptions.

Investors, potential investors, security holders and other readers

are urged to consider the above-mentioned factors carefully in

evaluating the forward-looking statements and are cautioned not to

place undue reliance on such forward-looking statements.

H&E EQUIPMENT SERVICES,

INC.

CONSOLIDATED STATEMENTS OF

INCOME (unaudited)

(Amounts in thousands, except

per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Revenues:

Equipment rentals

$

291,459

$

227,577

$

553,467

$

426,802

Used equipment sales

39,653

18,833

71,768

40,359

New equipment sales

8,857

21,486

16,675

47,522

Parts sales

12,028

16,172

24,185

32,231

Services revenues

7,133

8,889

14,319

17,023

Other

1,102

1,714

2,300

3,184

Total revenues

360,232

294,671

682,714

567,121

Cost of revenues:

Rental depreciation

85,913

62,288

167,785

122,309

Rental expense

38,757

30,815

76,624

59,574

Rental other

30,350

23,873

58,325

44,786

155,020

116,976

302,734

226,669

Used equipment sales

16,215

9,871

29,503

22,419

New equipment sales

7,535

18,271

14,316

40,600

Parts sales

8,464

11,832

17,116

23,536

Services revenues

2,698

3,143

5,288

5,957

Other

1,939

2,244

4,018

4,026

Total cost of revenues

191,871

162,337

372,975

323,207

Gross profit

168,361

132,334

309,739

243,914

Selling, general and administrative

expenses

99,259

82,664

194,594

160,942

Gain on sales of property and equipment,

net

436

996

1,103

2,382

Income from operations

69,538

50,666

116,248

85,354

Other income (expense):

Interest expense

(14,700

)

(13,500

)

(28,397

)

(26,947

)

Other, net

1,064

893

2,780

1,773

Total other expense, net

(13,636

)

(12,607

)

(25,617

)

(25,174

)

Income from operations before provision

for income taxes

55,902

38,059

90,631

60,180

Provision for income taxes

14,686

10,189

23,741

16,014

Net income from continuing operations

$

41,216

$

27,870

$

66,890

$

44,166

Discontinued Operations:

Loss from discontinued operations before

benefit from income taxes

$

—

$

(2,049

)

$

—

$

(2,049

)

Benefit from income taxes

—

(525

)

—

(525

)

Net loss from discontinued operations

$

—

$

(1,524

)

$

—

$

(1,524

)

Net income

$

41,216

$

26,346

$

66,890

$

42,642

H&E EQUIPMENT SERVICES,

INC.

CONSOLIDATED STATEMENTS OF

INCOME (unaudited)

(Amounts in thousands, except

per share amounts)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Net income from continuing operations per

common share:

Basic

$

1.14

$

0.77

$

1.86

$

1.21

Diluted

$

1.14

$

0.76

$

1.84

$

1.21

Net loss from discontinued operations per

common share:

Basic

$

—

$

(0.04

)

$

—

$

(0.04

)

Diluted

$

—

$

(0.04

)

$

—

$

(0.04

)

Net income per common share:

Basic

$

1.14

$

0.72

$

1.86

$

1.17

Diluted

$

1.14

$

0.72

$

1.84

$

1.17

Weighted average common shares

outstanding:

Basic

36,075

36,382

36,050

36,373

Diluted

36,302

36,541

36,327

36,540

Dividends declared per common share

outstanding

$

0.275

$

0.275

$

0.55

$

0.55

H&E EQUIPMENT SERVICES,

INC.

SELECTED BALANCE SHEET DATA

(unaudited)

(Amounts in thousands)

June 30, 2023

December 31, 2022

Cash and cash equivalents

$

46,902

$

81,330

Rental equipment, net

1,597,265

1,418,951

Total assets

2,560,198

2,291,699

Total debt (1)

1,379,549

1,251,594

Total liabilities

2,110,302

1,890,657

Stockholders' equity

449,896

401,042

Total liabilities and stockholders'

equity

$

2,560,198

$

2,291,699

(1)

Total debt consists of the aggregate

amounts on the senior unsecured notes, senior secured credit

facility, and finance lease obligations.

H&E EQUIPMENT SERVICES,

INC.

UNAUDITED RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES

(Amounts in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

Net Income

$

41,216

$

26,346

$

66,890

$

42,642

Net Loss from discontinued operations

—

(1,524

)

—

(1,524

)

Net Income from continuing operations

41,216

27,870

66,890

44,166

Interest Expense

14,700

13,500

28,397

26,947

Provision for income taxes

14,686

10,189

23,741

16,014

Depreciation

94,247

69,336

184,192

136,214

Amortization of intangibles

1,682

992

3,365

1,985

EBITDA from continuing operations

$

166,531

$

121,887

$

306,585

$

225,326

Net Loss from discontinued operations

$

—

$

(1,524

)

$

—

$

(1,524

)

Benefit from income taxes

—

(525

)

—

(525

)

EBITDA from discontinued operations

$

—

$

(2,049

)

$

—

$

(2,049

)

Loss on sale of discontinued

operations

—

1,917

—

1,917

Adjusted EBITDA from discontinued

operations

$

—

$

(132

)

$

—

$

(132

)

Adjusted EBITDA

$

166,531

$

121,755

$

306,585

$

225,194

H&E EQUIPMENT SERVICES,

INC.

UNAUDITED RECONCILIATION OF

NON-GAAP FINANCIAL MEASURES

(Amounts in thousands)

Three Months Ended June

30,

Six Months Ended June

30,

2023

2022

2023

2022

RENTAL

Equipment rentals (1)

$

258,723

$

201,243

$

490,799

$

378,425

Rental other

32,736

26,334

62,668

48,377

Total equipment rentals

291,459

227,577

553,467

426,802

RENTAL COST OF SALES

Rental depreciation

85,913

62,288

167,785

122,309

Rental expense

38,757

30,815

76,624

59,574

Rental other

30,350

23,873

58,325

44,786

Total rental cost of sales

155,020

116,976

302,734

226,669

RENTAL REVENUES GROSS PROFIT

Equipment rentals

134,053

108,140

246,390

196,542

Rentals other

2,386

2,461

4,343

3,591

Total rental revenues gross profit

$

136,439

$

110,601

$

250,733

$

200,133

RENTAL REVENUES GROSS MARGIN

Equipment rentals

51.8

%

53.7

%

50.2

%

51.9

%

Rentals other

7.3

%

9.3

%

6.9

%

7.4

%

Total rental revenues gross margin

46.8

%

48.6

%

45.3

%

46.9

%

(1)

Pursuant to SEC Regulation S-X, the

Company's equipment rental revenues are aggregated and presented in

our unaudited condensed consolidated statements of operations in

this press release as a single line item, “Equipment Rentals.” The

above table disaggregates the Company's equipment rental revenues

for discussion and analysis purposes only.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230727414633/en/

Leslie S. Magee Chief Financial Officer 225-298-5261

lmagee@he-equipment.com

Jeffrey L. Chastain Vice President of Investor Relations

225-952-2308 jchastain@he-equipment.com

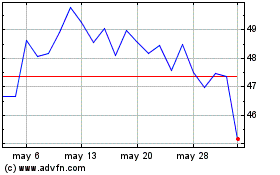

H and E Equipment Services (NASDAQ:HEES)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

H and E Equipment Services (NASDAQ:HEES)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024