RPO Bookings Increase 27% over Prior Year on

Strong Demand

Leading Supply Chain and Omnichannel Commerce Solutions provider

Manhattan Associates Inc. (NASDAQ: MANH) today reported revenue of

$266.7 million for the third quarter ended September 30, 2024. GAAP

diluted earnings per share for Q3 2024 was $1.03 compared to $0.79

in Q3 2023. Non-GAAP adjusted diluted earnings per share for Q3

2024 was $1.35 compared to $1.05 in Q3 2023.

“Manhattan delivered record third quarter and year-to-date

results. Our fundamentals are strong, and we continue to deliver a

balanced financial performance across top-line growth and

profitability and industry leading innovation each quarter,” said

Manhattan Associates president and CEO Eddie Capel.

“While we remain appropriately cautious on the global economy,

we are optimistic on our growing market opportunity and our

long-term strategy. Our fourth quarter is off to a solid start, and

we are providing responsible 2025 parameters,” Mr. Capel

concluded.

THIRD QUARTER 2024 FINANCIAL SUMMARY:

- Consolidated total revenue was $266.7 million for Q3 2024,

compared to $238.4 million for Q3 2023.

- Cloud subscription revenue was $86.5 million for Q3 2024,

compared to $65.0 million for Q3 2023.

- License revenue was $3.8 million for Q3 2024, compared to $3.9

million for Q3 2023.

- Services revenue was $137.0 million for Q3 2024, compared to

$128.0 million for Q3 2023.

- GAAP diluted earnings per share was $1.03 for Q3 2024, compared

to $0.79 for Q3 2023.

- Adjusted diluted earnings per share, a non-GAAP measure, was

$1.35 for Q3 2024, compared to $1.05 for Q3 2023.

- GAAP operating income was $75.1 million for Q3 2024, compared

to $53.4 million for Q3 2023.

- Adjusted operating income, a non-GAAP measure, was $98.9

million for Q3 2024, compared to $72.5 million for Q3 2023.

- Cash flow from operations was $62.3 million for Q3 2024,

compared to $58.6 million for Q3 2023. Days Sales Outstanding was

69 days at September 30, 2024, compared to 66 days at June 30,

2024.

- Cash totaled $215.0 million at September 30, 2024, compared to

$202.7 million at June 30, 2024.

- During the three months ended September 30, 2024, the Company

repurchased 194,712 shares of Manhattan Associates common stock

under the share repurchase program authorized by our Board of

Directors for a total investment of $49.7 million. In October 2024,

our Board of Directors approved replenishing the Company’s

remaining share repurchase authority to an aggregate of $75.0

million of our common stock.

NINE MONTH 2024 FINANCIAL SUMMARY:

- Consolidated total revenue for the nine months ended September

30, 2024, was $786.6 million, compared to $690.5 million for the

nine months ended September 30, 2023.

- Cloud subscription revenue was $246.9 million for the nine

months ended September 30, 2024, compared to $183.2 million for the

nine months ended September 30, 2023.

- License revenue was $9.6 million for the nine months ended

September 30, 2024, compared to $13.0 million for the nine months

ended September 30, 2023.

- Services revenue was $406.0 million for the nine months ended

September 30, 2024, compared to $368.7 million for the nine months

ended September 30, 2023.

- GAAP diluted earnings per share for the nine months ended

September 30, 2024, was $2.74, compared to $2.05 for the nine

months ended September 30, 2023.

- Adjusted diluted earnings per share, a non-GAAP measure, was

$3.55 for the nine months ended September 30, 2024, compared to

$2.72 for the nine months ended September 30, 2023.

- GAAP operating income was $200.9 million for the nine months

ended September 30, 2024, compared to $151.0 million for the nine

months ended September 30, 2023.

- Adjusted operating income, a non-GAAP measure, was $271.5

million for the nine months ended September 30, 2024, compared to

$204.6 million for the nine months ended September 30, 2023.

- Cash flow from operations was $190.3 million for the nine

months ended September 30, 2024, compared to $157.9 million for the

nine months ended September 30, 2023.

- During the nine months ended September 30, 2024, the Company

repurchased 831,111 shares of Manhattan Associates common stock

under the share repurchase program authorized by our Board of

Directors, for a total investment of $198.1 million. In October

2024, our Board of Directors approved replenishing the Company’s

remaining share repurchase authority to an aggregate of $75.0

million of our common stock.

2024 GUIDANCE

Manhattan Associates provides the following revenue, operating

margin and diluted earnings per share guidance for the full year

2024:

Guidance Range - 2024 Full

Year

($'s in millions, except operating

margin and EPS)

$ Range

% Growth Range

Total revenue - current

guidance

$1,039

$1,041

12%

12%

Operating margin:

GAAP operating margin - current

guidance

24.9%

25.0%

Equity-based compensation

9.1%

9.1%

Adjusted operating margin(1) - current

guidance

34.0%

34.1%

Diluted earnings per share

(EPS):

GAAP EPS - current guidance

$3.47

$3.49

23%

24%

Equity-based compensation, net of

tax

1.28

1.28

Excess tax benefit on stock

vesting(2)

(0.15)

(0.15)

Adjusted EPS(1) - current

guidance

$4.60

$4.62

23%

24%

(1) Adjusted operating margin and adjusted

EPS are non-GAAP measures that exclude the impact of

equity-based

compensation and related income tax

effects.

(2) Excess tax benefit on stock vesting

expected to occur primarily in the first quarter of 2024.

Manhattan Associates currently intends to publish in each

quarterly earnings release certain expectations with respect to

future financial performance. Those statements, including the

guidance provided above, are forward looking. Actual results may

differ materially. See our cautionary note regarding

“forward-looking statements” below.

Manhattan Associates will make this earnings release and

published expectations available on the investor relations section

of the Manhattan Associates website at ir.manh.com. Following

publication of this earnings release, any expectations with respect

to future financial performance contained in this release,

including the guidance, should be considered historical only, and

Manhattan Associates disclaims any obligation to update them.

CONFERENCE CALL

Manhattan Associates’ conference call regarding its third

quarter financial results will be held today, October 22, 2024, at

4:30 p.m. Eastern Time. The Company will also discuss its business

and expectations for the year and next quarter in additional detail

during the call. We invite investors to a live webcast of the

conference call through the Investor Relations section of the

Manhattan Associates website at ir.manh.com. To listen to the live

webcast, please go to the website at least 15 minutes before the

call to download and install any necessary audio software. The

Internet webcast will be available until Manhattan Associates’

fourth quarter 2024 earnings release.

GAAP VERSUS NON-GAAP PRESENTATION

Manhattan Associates provides adjusted operating income and

margin, adjusted income tax provision, adjusted net income, and

adjusted diluted earnings per share in this press release as

additional information regarding the Company’s historical and

projected operating results. These measures are not in accordance

with, or alternatives to, GAAP, and may be different from similarly

titled non-GAAP measures used by other companies. The Company

believes the presentation of these non-GAAP financial measures

facilitates investors’ ability to understand and compare the

Company’s results and guidance, because the measures provide

supplemental information in evaluating the operating results of its

business, as distinct from results that include items not

indicative of ongoing operating results, and because the Company

believes its peers typically publish similar non-GAAP measures.

This release should be read in conjunction with the Company’s Form

8-K earnings release filing for the three and nine months ended

September 30, 2024.

Non-GAAP adjusted operating income and margin, adjusted income

tax provision, adjusted net income and adjusted diluted earnings

per share exclude the impact of equity-based compensation – net of

income tax effects. They also exclude the tax benefits or

deficiencies of vested stock awards caused by differences in the

amount deductible for tax purposes from the compensation expense

recorded for financial reporting purposes. We include

reconciliations of the Company’s GAAP financial measures to

non-GAAP adjustments in the supplemental information attached to

this release.

ABOUT MANHATTAN ASSOCIATES

Manhattan Associates is a global technology leader in supply

chain and omnichannel commerce. We unite information across the

enterprise, converging front-end sales with back-end supply chain

execution. Our software, platform technology and unmatched

experience help drive both top-line growth and bottom-line

profitability for our customers.

Manhattan Associates designs, builds and delivers leading edge

cloud solutions so that across the store, through your network or

from your fulfillment center, you are ready to reap the rewards of

the omnichannel marketplace. For more information, please visit

www.manh.com.

This press release contains “forward-looking statements”

relating to Manhattan Associates, Inc. Forward-looking statements

in this press release include, without limitation, the information

set forth under “2024 Guidance” and statements identified by words

such as “may,” “expect,” “forecast,” “anticipate,” “intend,”

“plan,” “believe,” “could,” “seek,” “project,” “estimate” and

similar expressions. Prospective investors are cautioned that any

of those forward-looking statements are not guarantees of future

performance and involve risks and uncertainties, and that actual

results may differ materially from those contemplated by those

forward-looking statements. Among the important factors that could

cause actual results to differ materially from those indicated by

those forward-looking statements are: economic conditions,

including inflation; disruption and transformation in the retail

sector and our vertical markets; delays in product development;

competitive and pricing pressures; software errors and information

technology failures, disruption and security breaches; risks

related to our products’ technology and customer implementations;

global instability, including the wars in Ukraine and the Middle

East; and the other risk factors set forth in Item 1A of the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023, and in Item 1A of Part II in subsequent Quarterly Reports

on Form 10-Q. Manhattan Associates undertakes no obligation to

update or revise forward-looking statements to reflect changed

assumptions, the occurrence of unanticipated events or changes in

future operating results.

MANHATTAN ASSOCIATES, INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Income

(in thousands, except per

share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

(unaudited)

(unaudited)

(unaudited)

(unaudited)

Revenue:

Cloud subscriptions

$86,485

$65,033

$246,873

$183,196

Software license

3,762

3,870

9,633

12,967

Maintenance

34,491

35,296

104,736

106,772

Services

137,009

127,965

406,035

368,744

Hardware

4,934

6,277

19,274

18,791

Total revenue

266,681

238,441

786,551

690,470

Costs and expenses:

Cost of cloud subscriptions, maintenance

and services

118,269

111,142

356,920

322,914

Cost of software license

391

297

1,068

967

Research and development

34,349

33,093

104,693

95,487

Sales and marketing

16,586

17,650

55,669

54,278

General and administrative

20,308

21,371

62,623

61,561

Depreciation and amortization

1,688

1,440

4,670

4,247

Total costs and expenses

191,591

184,993

585,643

539,454

Operating income

75,090

53,448

200,908

151,016

Other income, net

1,312

1,739

3,222

2,923

Income before income taxes

76,402

55,187

204,130

153,939

Income tax provision

12,621

5,766

33,782

26,107

Net income

$63,781

$49,421

$170,348

$127,832

Basic earnings per share

$1.04

$0.80

$2.77

$2.07

Diluted earnings per share

$1.03

$0.79

$2.74

$2.05

Weighted average number of shares:

Basic

61,169

61,639

61,404

61,902

Diluted

61,948

62,310

62,186

62,501

MANHATTAN ASSOCIATES, INC. AND

SUBSIDIARIES

Reconciliation of Selected

GAAP to Non-GAAP Measures

(in thousands, except per

share amounts)

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Operating income

$75,090

$53,448

$200,908

$151,016

Equity-based compensation (a)

23,853

19,030

70,614

53,598

Adjusted operating income (Non-GAAP)

$98,943

$72,478

$271,522

$204,614

Income tax provision

$12,621

$5,766

$33,782

$26,107

Equity-based compensation (a)

3,683

3,030

10,967

8,067

Tax benefit of stock awards vested (b)

579

218

9,063

3,454

Adjusted income tax provision

(Non-GAAP)

$16,883

$9,014

$53,812

$37,628

Net income

$63,781

$49,421

$170,348

$127,832

Equity-based compensation (a)

20,170

16,000

59,647

45,531

Tax benefit of stock awards vested (b)

(579)

(218)

(9,063)

(3,454)

Adjusted net income (Non-GAAP)

$83,372

$65,203

$220,932

$169,909

Diluted EPS

$1.03

$0.79

$2.74

$2.05

Equity-based compensation (a)

0.33

0.26

0.96

0.73

Tax benefit of stock awards vested (b)

(0.01)

-

(0.15)

(0.06)

Adjusted diluted EPS (Non-GAAP)

$1.35

$1.05

$3.55

$2.72

Fully diluted shares

61,948

62,310

62,186

62,501

(a)

Adjusted results exclude all equity-based

compensation, as detailed below, to facilitate comparison with our

peers and for the other reasons explained in our Current Report on

Form 8-K filed with the SEC. We do not receive a GAAP tax benefit

for a portion of our equity-based compensation, mainly because of

Section 162(m) of the Internal Revenue Code, which limits tax

deductions for compensation granted to certain executives.

Three Months Ended September

30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cost of services

$10,835

$7,643

$31,482

$21,337

Research and development

5,117

4,141

15,812

11,711

Sales and marketing

2,189

1,878

6,295

5,333

General and administrative

5,712

5,368

17,025

15,217

Total equity-based compensation

$23,853

$19,030

$70,614

$53,598

(b)

Adjustments represent the excess tax

benefits and tax deficiencies of the equity awards vested during

the period. Excess tax benefits (deficiencies) occur when the

amount deductible on our tax return for an equity award is more

(less) than the cumulative compensation cost recognized for

financial reporting purposes. As discussed above, we exclude

equity-based compensation from adjusted non-GAAP results to be

consistent with other companies in the software industry and for

the other reasons explained in our Current Report on Form 8-K filed

with the SEC. Therefore, we also exclude the related tax benefit

(expense) generated upon their vesting.

MANHATTAN ASSOCIATES, INC. AND

SUBSIDIARIES

Condensed Consolidated Balance

Sheets

(in thousands, except share

and per share data)

September 30, 2024

December 31, 2023

(unaudited)

ASSETS

Current assets:

Cash and cash equivalents

$

214,952

$

270,741

Accounts receivable, net

199,756

181,173

Prepaid expenses and other current

assets

37,605

27,276

Total current assets

452,313

479,190

Property and equipment, net

12,809

11,795

Operating lease right-of-use assets

50,094

21,645

Goodwill, net

62,236

62,235

Deferred income taxes

86,551

66,043

Other assets

34,137

32,445

Total assets

$

698,140

$

673,353

LIABILITIES AND SHAREHOLDERS'

EQUITY

Current liabilities:

Accounts payable

$

23,183

$

24,508

Accrued compensation and benefits

63,010

73,210

Accrued and other liabilities

23,227

27,374

Deferred revenue

252,537

237,793

Income taxes payable

286

3,030

Total current liabilities

362,243

365,915

Operating lease liabilities, long-term

50,028

17,694

Other non-current liabilities

7,918

11,466

Shareholders' equity:

Preferred stock, no par value; 20,000,000

shares authorized, no shares issued or outstanding in 2024 and

2023

-

-

Common stock, $0.01 par value; 200,000,000

shares authorized; 61,072,619 and 61,566,037 shares issued and

outstanding at September 30, 2024 and December 31, 2023,

respectively

610

615

Retained earnings

303,361

304,701

Accumulated other comprehensive loss

(26,020

)

(27,038

)

Total shareholders' equity

277,951

278,278

Total liabilities and shareholders'

equity

$

698,140

$

673,353

MANHATTAN ASSOCIATES, INC. AND

SUBSIDIARIES

Condensed Consolidated

Statements of Cash Flows

(in thousands)

Nine Months Ended September

30,

2024

2023

(unaudited)

(unaudited)

Operating activities:

Net income

$

170,348

$

127,832

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

4,670

4,247

Equity-based compensation

70,614

53,598

(Gain) loss on disposal of equipment

(131

)

42

Deferred income taxes

(20,544

)

(18,359

)

Unrealized foreign currency loss

906

922

Changes in operating assets and

liabilities:

Accounts receivable, net

(17,515

)

(17,168

)

Other assets

(9,688

)

(7,747

)

Accounts payable, accrued and other

liabilities

(13,367

)

13,477

Income taxes

(7,956

)

(4,347

)

Deferred revenue

12,962

5,362

Net cash provided by operating

activities

190,299

157,859

Investing activities:

Purchase of property and equipment

(5,547

)

(2,761

)

Net cash used in investing activities

(5,547

)

(2,761

)

Financing activities:

Repurchase of common stock

(241,150

)

(195,716

)

Net cash used in financing activities

(241,150

)

(195,716

)

Foreign currency impact on cash

609

(2,533

)

Net change in cash and cash

equivalents

(55,789

)

(43,151

)

Cash and cash equivalents at beginning of

period

270,741

225,463

Cash and cash equivalents at end of

period

$

214,952

$

182,312

MANHATTAN ASSOCIATES, INC.

SUPPLEMENTAL INFORMATION

1. GAAP and adjusted earnings per share

by quarter are as follows:

2023

2024

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

3rd Qtr

YTD

GAAP Diluted EPS

$0.62

$0.63

$0.79

$0.78

$2.82

$0.86

$0.85

$1.03

$2.74

Adjustments to GAAP:

Equity-based compensation

0.23

0.25

0.26

0.25

0.97

0.30

0.34

0.33

0.96

Tax benefit of stock awards vested

(0.05)

-

-

-

(0.06)

(0.13)

(0.01)

(0.01)

(0.15)

Adjusted Diluted EPS

$0.80

$0.88

$1.05

$1.03

$3.74

$1.03

$1.18

$1.35

$3.55

Fully Diluted Shares

62,767

62,432

62,310

62,555

62,608

62,493

62,118

61,948

62,186

2. Revenues and operating income by

reportable segment are as follows (in thousands):

2023

2024

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

3rd Qtr

YTD

Revenue:

Americas

$170,759

$179,208

$186,564

$182,664

$719,195

$196,312

$205,955

$205,852

$608,119

EMEA

39,658

40,902

41,204

44,874

166,638

46,620

46,918

48,082

141,620

APAC

10,596

10,906

10,673

10,717

42,892

11,620

12,445

12,747

36,812

$221,013

$231,016

$238,441

$238,255

$928,725

$254,552

$265,318

$266,681

$786,551

GAAP Operating Income:

Americas

$29,647

$32,326

$34,655

$38,530

$135,158

$36,687

$45,300

$49,033

$131,020

EMEA

12,793

13,556

14,415

15,959

56,723

15,884

17,195

20,521

53,600

APAC

4,645

4,601

4,378

4,376

18,000

5,059

5,693

5,536

16,288

$47,085

$50,483

$53,448

$58,865

$209,881

$57,630

$68,188

$75,090

$200,908

Adjustments (pre-tax):

Americas:

Equity-based compensation

$16,640

$17,928

$19,030

$17,973

$71,571

$22,095

$24,666

$23,853

$70,614

$16,640

$17,928

$19,030

$17,973

$71,571

$22,095

$24,666

$23,853

$70,614

Adjusted non-GAAP Operating

Income:

Americas

$46,287

$50,254

$53,685

$56,503

$206,729

$58,782

$69,966

$72,886

$201,634

EMEA

12,793

13,556

14,415

15,959

56,723

15,884

17,195

20,521

53,600

APAC

4,645

4,601

4,378

4,376

18,000

5,059

5,693

5,536

16,288

$63,725

$68,411

$72,478

$76,838

$281,452

$79,725

$92,854

$98,943

$271,522

3. Impact of Currency

Fluctuation

The following table reflects the increases

(decreases) in the results of operations for each period

attributable to the change in foreign currency exchange rates from

the prior period as well as foreign currency gains (losses)

included in other income, net for each period (in thousands):

2023

2024

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

3rd Qtr

YTD

Revenue

$(3,084)

$104

$2,755

$2,341

$2,116

$648

$(531)

$936

$1,053

Costs and expenses

(3,616)

(1,133)

1,033

1,212

(2,504)

176

(673)

211

(286)

Operating income

532

1,237

1,722

1,129

4,620

472

142

725

1,339

Foreign currency gains (losses) in other

income

(810)

(516)

387

(527)

(1,466)

(564)

(577)

(331)

$(1,472)

$(278)

$721

$2,109

$602

$3,154

$(92)

$(435)

$394

$(133)

Manhattan Associates has a large research

and development center in Bangalore, India. The following table

reflects the increases (decreases) in the financial results for

each period attributable to changes in the Indian Rupee exchange

rate (in thousands):

2023

2024

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

3rd Qtr

YTD

Operating income

$1,632

$1,222

$728

$267

$3,849

$185

$307

$261

$753

Foreign currency gains (losses) in other

income

(283)

(31)

812

(105)

393

164

41

284

489

Total impact of changes in the Indian

Rupee

$1,349

$1,191

$1,540

$162

$4,242

$349

$348

$545

$1,242

4. Other income includes the following

components (in thousands):

2023

2024

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

3rd Qtr

YTD

Interest income

$969

$1,555

$1,371

$1,409

$5,304

$1,414

$1,503

$1,636

$4,553

Foreign currency gains (losses)

(810)

(516)

387

(527)

(1,466)

(564)

(577)

(331)

(1,472)

Other non-operating income (expense)

(16)

2

(19)

(15)

(48)

146

(12)

7

141

Total other income (loss)

$143

$1,041

$1,739

$867

$3,790

$996

$914

$1,312

$3,222

5. Capital expenditures are as follows

(in thousands):

2023

2024

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

3rd Qtr

YTD

Capital expenditures

$666

$1,009

$1,086

$1,969

$4,730

$2,321

$2,217

$1,009

$5,547

6. Stock Repurchase Activity (in

thousands):

2023

2024

1st Qtr

2nd Qtr

3rd Qtr

4th Qtr

Full Year

1st Qtr

2nd Qtr

3rd Qtr

YTD

Shares purchased under publicly announced

buy-back program

515

381

128

-

1,024

294

343

194

831

Shares withheld for taxes due upon vesting

of restricted stock units

208

4

8

2

222

165

3

8

176

Total shares purchased

723

385

136

2

1,246

459

346

202

1,007

Total cash paid for shares purchased under

publicly announced buy-back program

$74,177

$66,769

$25,072

$0

$166,018

$73,411

$74,999

$49,687

$198,097

Total cash paid for shares withheld for

taxes due upon vesting of restricted stock units

27,511

658

1,529

331

30,029

40,423

713

1,917

43,053

Total cash paid for shares repurchased

$101,688

$67,427

$26,601

$331

$196,047

$113,834

$75,712

$51,604

$241,150

7. Remaining Performance

Obligations

We disclose revenue we expect to recognize

from our remaining performance obligations ("RPO"). Over 98% of our

RPO represents cloud native subscriptions with non-cancelable terms

greater than one year (including cloud-deferred revenue as well as

amounts we will invoice and recognize as revenue from our

performance of cloud services in future periods). Maintenance

contracts are typically one year and not included in the RPO. Our

RPO as of the end of each period appears below (in thousands):

March 31, 2023

June 30, 2023

September 30, 2023

December 31, 2023

March 31, 2024

June 30, 2024

September 30, 2024

Remaining Performance Obligations

$1,153,404

$1,238,672

$1,324,861

$1,427,854

$1,516,430

$1,601,531

$1,686,421

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241022598637/en/

Michael Bauer Senior Director, Investor Relations Manhattan

Associates, Inc. 678-597-7538 mbauer@manh.com

Rick Fernandez Director, Corporate Communications Manhattan

Associates, Inc. 678-597-6988 rfernandez@manh.com

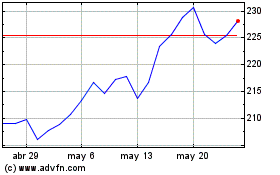

Manhattan Associates (NASDAQ:MANH)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Manhattan Associates (NASDAQ:MANH)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024