0000937556false00009375562024-09-252024-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

________________________________________________

FORM 8-K

________________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2024, (September 19, 2024)

MASIMO CORPORATION

(Exact name of registrant as specified in its charter)

________________________________________________

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DE | | 001-33642 | | 33-0368882 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| 52 Discovery | | Irvine, | | CA | | | | | 92618 |

| (Address of Principal Executive Offices) | | | | | (Zip Code) |

| | | | | | (949) | 297-7000 | | | |

Registrant’s telephone number, including area code: |

Not Applicable |

(Former name or former address, if changed since last report) |

| | | | | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2 (b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | |

| Securities Registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.001 par value | | MASI | | The Nasdaq Stock Market LLC |

| | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). |

| Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

| Item 2.02. | Results of Operations and Financial Condition. |

On September 25, 2024, Masimo Corporation (the “Company”) issued a press release reaffirming certain guidance. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instructions B.2 of Form 8-K, the information in Item 2.02 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

Item 5.02......Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Chief Executive Officer

The Company held its annual meeting of the shareholders (the “Meeting”) on September 19, 2024. The same day, Mr. Joe Kiani delivered a notification (the “Notice”) to the Board of Directors (the “Board”) of the Company stating his decision to resign from his position of Chief Executive Officer of the Company.

Additionally, later on September 19, 2024, Mr. Kiani filed a claim in California state court relating to his employment agreement, as amended, seeking declaratory relief that he had validly terminated his employment for “Good Reason.” The Board is evaluating Mr. Kiani’s Notice as well as his lawsuit against the Company.

Interim Chief Executive Officer

On September 24, 2024, the Board appointed Board member Michelle Brennan to serve as the Company’s interim chief executive officer (“Interim CEO”) effective immediately. This decision was made in light of the matters involving Mr. Kiani set forth above under the heading “Chief Executive Officer” in this Item 5.02. The Board is retaining Korn Ferry to assist with chief executive officer succession planning.

Michelle Brennan, age 59, has over 30 years of business experience in the healthcare industry, and currently serves on the boards of Cardinal Health, Inc., where she sits on the Audit Committee and the Human Resources & Compensation Committee, and Perosphere Technologies Inc. Before her retirement, Ms. Brennan held various positions of increasing responsibility over 32 years at Johnson & Johnson, a researcher, developer, and manufacturer in the healthcare and consumer packaged goods fields, where she most recently served as Global Value Creation Leader from January 2019 to August 2020. Prior to that role, she served as Company Group Chair of Medical Devices in Europe, the Middle East, and Africa (“EMEA”) from 2015 to December 2018, and from 2007 to 2014 she held various senior management positions including President of Enterprise Standards & Productivity, Worldwide President of Ethicon Energy, Regional President of Ethicon Endo Surgery for EMEA, the Mediterranean and Iberia, and Worldwide Vice President of Business Development & Strategy for Ethicon Endo Surgery. Throughout her time at Johnson & Johnson, Ms. Brennan held significant board roles for the company, including Chair of the Board for Medtech Europe Trade Association. She was also previously a member of the UK’s Office of Life Sciences Council and Chairman of the Council’s Health Technology Partnership Committee. Ms. Brennan earned a B.S. in Business Administration from the University of Kansas.

None of the Ms. Brennan’s employers during the last five years is a parent, subsidiary or other affiliate of the Company. Ms. Brennan has not been employed by the Company prior to her appointment as Interim CEO; she has served as a director of the Company since 2023. There is no material plan, contract or arrangement to which Ms. Brennan is a party, or in which she participates, that is entered into, or material amendment thereto, in connection with her appointment as Interim CEO, or any grant or award to Ms. Brennan (or modification thereto) under any such plan, contract or arrangement in connection with her appointment as Interim CEO.

There are no arrangements or understandings between Ms. Brennan and any other persons pursuant to which Ms. Brennan was selected as Interim CEO. There are no family relationships between Ms. Brennan and any director or any executive officer of the Company. Ms. Brennan has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

The information set forth below under Item 5.07 of this Current Report on Form 8-K is hereby incorporated by reference into this Item 5.02.

| | | | | |

| Item 5.07. | Submission of Matters to a Vote of Security Holders. |

The Company held the Meeting on September 19, 2024. At the Meeting, a total of 48,749,948 shares, or approximately 91% of the Company’s common stock issued and outstanding as of the record date, were represented in person or by proxy. At the Meeting, the Company’s stockholders considered four proposals, each of which is described in more detail in the Company’s revised definitive proxy statement filed with the Securities and Exchange Commission on August 22, 2024 (the “Proxy Statement”).

On September 24, 2024, First Coast Results, Inc. (the “Inspector of Election”) issued its final report, which certified the final voting results for the Meeting. Set forth below is a brief description of each matter voted upon at the Meeting, which are more fully described in the Proxy Statement, and the final voting results with respect to each matter as provided by the Inspector of Election.

Proposal No. 1: To elect two Class II nominees for director to serve until the Company’s 2025 Annual Meeting of Stockholders, or until his or her respective successor is duly elected and qualified.

Company Nominees:

| | | | | | | | | | | | | | | | |

| Nominee | | For | | Withhold | | |

| Christopher Chavez | | 14,041,676 | | 34,706,178 | | |

| Joe Kiani | | 19,484,844 | | 29,263,821 | | |

Politan Group Nominees:

| | | | | | | | | | | | | | | | |

| Nominee | | For | | Withhold | | |

| William Jellison | | 34,080,277 | | 14,668,350 | | |

| Darlene Solomon | | 29,813,741 | | 18,934,883 | | |

The Company’s stockholders voted to elect William Jellison and Darlene Solomon as directors to serve until the Company’s 2025 Annual Meeting of Stockholders, or until his or her respective successor is duly elected and qualified.

Proposal No. 2: To ratify the selection of Grant Thornton LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 28, 2024.

| | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstentions | | Broker Non Votes |

| 47,817,976 | | 856,797 | | 75,175 | | — |

The Company’s stockholders voted to approve the ratification of the selection of Grant Thornton LLP as the Company’s independent registered public accounting firm.

Proposal No. 3: To provide an advisory vote to approve the compensation of the Company’s named executive officers.

| | | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstentions | | Broker Non Votes | |

| 31,525,446 | | 17,074,692 | | 149,809 | | — | |

The Company’s stockholders voted for the advisory vote to approve the compensation of the Company’s named executive officers.

Stockholder Proposal:

Proposal No. 4: To approve a stockholder proposal to repeal any provision of, or amendment to, the Company’s Bylaws adopted by the Board of Directors without stockholder approval subsequent to April 20, 2023 and up to and including the date of the Meeting.

| | | | | | | | | | | | | | | | | | | | | |

| For | | Against | | Abstentions | | Broker Non Votes | |

| 34,821,698 | | 13,788,696 | | 139,554 | | — | |

In order to be approved, this proposal required the affirmative vote of the holders of at least seventy-five percent (75%) of the voting power of all of the then-outstanding shares of our common stock entitled to vote generally in the election of directors, voting together as a single class. Accordingly, the stockholder proposal was not approved by the Company’s stockholders.

| | | | | |

| Item 7.01. | Regulation FD Disclosure. |

On September 25, 2024, the Company issued a press release discussing certain matters relating to the consumer audio and consumer healthcare businesses. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

In accordance with General Instructions B.2 of Form 8-K, the information in Item 7.01 of this Current Report on Form 8-K shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

| | | | | |

| Item 9.01. | Financial Statements and Exhibits. |

(d) The following items are filed as exhibits to the Current Report on Form 8-K.

| | | | | |

Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Masimo Corporation has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | MASIMO CORPORATION |

| | | | | |

| Date: September 25, 2024 | | | | By: | | /s/ MICAH YOUNG |

| | | | | | Micah Young |

| | | | | | Executive Vice President & Chief Financial Officer |

| | | | | | (Principal Financial Officer) |

Masimo Provides Leadership and Business Updates

Appoints Michelle Brennan as Interim CEO Following Joe Kiani’s Decision to Resign

Continues to Be Committed to Review of Strategic Alternatives for Consumer Businesses, With Assistance From Leading Financial and Legal Advisors

Reaffirms Financial Guidance for Third Quarter 2024

IRVINE, Calif.—Today the Board of Directors (the “Board”) of Masimo (NASDAQ: MASI) a leading global medical innovator, provided a series of leadership and business updates:

Leadership Appointments

Michelle Brennan, a current member of Masimo’s Board, has been appointed interim Chief Executive Officer (“CEO”) following Chairman and CEO Joe Kiani informing the Board of his decision to resign as CEO. After being elected by shareholders at the recent Annual Meeting, Darlene Solomon and Bill Jellison have been officially appointed to the Board. These changes are all effective immediately.

The Board has retained nationally recognized search firm Korn Ferry to assist in CEO succession planning.

Ms. Brennan was elected to the Board in 2023, and previously served as a senior executive at Johnson & Johnson (“J&J”) for more than 30 years, where she oversaw medical device businesses globally as well as consumer pharmaceutical businesses. At J&J, Michelle successfully scaled multiple businesses to achieve market-leading growth and led efforts to invest in innovation that resulted in successful new product launches.

Ms. Brennan commented:

“I am grateful for the trust of the Board and excited by the opportunity to help Masimo continue to grow and lead as an innovation-focused company. As we go through this transition, the Board and management team are excited to learn from and work with our employees, while focusing on ensuring seamless service and support for our customers.”

Consumer Business Review

The Board remains committed to the previously announced review of alternatives for both the consumer audio and consumer healthcare businesses. The Board has engaged Centerview Partners and Morgan Stanley as financial advisors and Sullivan & Cromwell as a legal advisor. The Board looks forward to providing updates in the near-term regarding value-creation initiatives, including this strategic review.

Reaffirming Guidance

For the third quarter of 2024, Masimo is reiterating its non-GAAP financial guidance previously provided on August 6, 2024. Masimo’s previous guidance can be found here.

Chief Financial Officer Micah Young and Chief Operating Officer Bilal Muhsin, added:

“We are excited about the strong momentum of the business and its future prospects for growth. We look forward to providing more details on the upcoming third quarter earnings call next month.”

About Masimo

Masimo (NASDAQ: MASI) is a global medical technology company that develops and produces a wide array of industry-leading monitoring technologies, including innovative measurements, sensors, patient monitors, and automation and connectivity solutions. In addition, Masimo Consumer Audio is home to eight legendary audio brands, including Bowers & Wilkins, Denon, Marantz, and Polk Audio. Our mission is to improve life, improve patient outcomes, and reduce the cost of care.

Forward-Looking Statements

This press release includes forward-looking statements as defined in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, in connection with the Private Securities Litigation Reform Act of 1995. These forward-looking statements include, among others, statements regarding the review of alternatives for both the consumer audio and healthcare businesses and our earnings guidance. These forward-looking statements are based on current expectations about future events affecting us and are subject to risks and uncertainties, all of which are difficult to predict and many of which are beyond our control and could cause our actual results to differ materially and adversely from those expressed in our forward-looking statements as a result of various risk factors, including, but not limited to: risks related to our leadership appointments, our assumptions regarding the consumer audio and healthcare business review, the guidance for the third quarter of 2024 and the full year; as well as other factors discussed in the “Risk Factors” section of our most recent reports filed with the Securities and Exchange Commission (“SEC”), which may be obtained for free at the SEC's website at www.sec.gov. Although we believe that the expectations reflected in our forward-looking statements are reasonable, we do not know whether our expectations will prove correct. All forward-looking statements included in this press release are expressly qualified in their entirety by the foregoing cautionary statements. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of today’s date. We do not undertake any obligation to update, amend or clarify these statements or the “Risk Factors” contained in our most recent reports filed with the SEC, whether as a result of new information, future events or otherwise, except as may be required under the applicable securities laws.

| | | | | |

| Investor Contact | Media Contact |

| Eli Kammerman | Evan Lamb |

| (949) 297-7077 | (949) 396-3376 |

| ekammerman@masimo.com | elamb@masimo.com |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

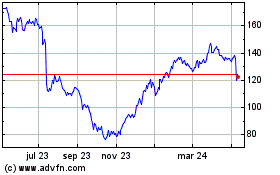

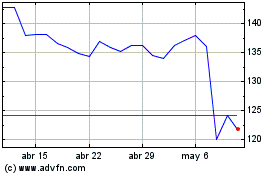

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Masimo (NASDAQ:MASI)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024