false

0000723125

0000723125

2024-12-09

2024-12-09

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of The Securities Exchange Act of 1934

December 9, 2024

Date of Report (date of earliest event reported)

Micron

Technology, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

1-10658 |

|

75-1618004 |

(State or

other jurisdiction of

incorporation) |

|

(Commission

File

Number) |

|

(IRS Employer

Identification No.) |

8000

South Federal Way

Boise,

Idaho 83716-9632

| |

(Address

of principal executive offices and Zip Code) |

|

(208)

368-4000

| |

(Registrant’s

telephone number, including area code) |

|

Check the appropriate

box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ¨ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

symbol |

|

Name

of each exchange on which

registered |

| Common

Stock, par value $0.10 per share |

|

MU |

|

Nasdaq

Global Select Market |

Indicate by check mark whether the

registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth

company ¨

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any

new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

| Item 1.01 |

Entry into a Material Definitive Agreement. |

Direct Funding Agreements

On December 9, 2024 (the “Award Date”), two wholly-owned

subsidiaries of Micron Technology, Inc. (the “Company”), Micron Idaho Semiconductor Manufacturing (Triton) LLC, a Delaware

limited liability company (“Micron Idaho”), and Micron New York Semiconductor Manufacturing LLC, a Delaware limited liability

company (“Micron New York”) entered into direct funding agreements (each, a “Funding Agreement” and, collectively,

the “Funding Agreements”) with the United States Department of Commerce (the “Department”) under the Department’s

CHIPS Incentives Program established pursuant to the CHIPS and Science Act of 2022 (the “CHIPS Act”). In addition, the Company

entered into a guarantee and equity contribution agreement (the “Guarantee”) with the Department. Micron Idaho and Micron

New York are, collectively, referred to as the “Project Subsidiaries.”

Under the Funding Agreement with Micron Idaho (the “Idaho Funding

Agreement”), the Department has awarded Micron Idaho a grant in a maximum funding amount of $1.5 billion (the “Idaho Award”)

for the construction of a fab facility in Boise, Idaho. Under the Funding Agreement with Micron New York (the “NY Funding Agreement”)

the Department has awarded Micron New York grants in a maximum funding amount of $4.6 billion for the construction of two fab facilities

in Clay, New York (the “NY Award” and together with the Idaho Award, the “Project Awards”). The construction of

the fab facilities is referred to collectively as the “Projects.” The Funding Agreements also include an additional grant

of up to $65 million for workforce development activities related to the Projects.

The Company elected not to pursue the government loans proposed by

the Department for the Projects, which were previously disclosed as included in the non-binding preliminary memorandum of terms between

the Company and the Department.

Under the Funding Agreements, the Department

will disburse the funding of the Project Awards to the respective Project Subsidiaries based on the achievement of construction, tool

installation and wafer production milestones for the applicable Project, with each disbursement reimbursing the applicable Project Subsidiary

for eligible Project costs. The Company retains discretion with respect to capacity and production volume ramp of each Project. Disbursements

are subject to various conditions precedent, including compliance with representations, warranties, covenants and the absence of defaults

under the applicable Funding Agreement and related documents.

The Funding Agreements contain representations,

warranties and affirmative and negative covenants applicable to the Project Subsidiaries (and in certain cases the Company and/or its

affiliates), including representations, warranties, and covenants customary for project financing agreements, that relate to compliance

with requirements for award recipients expressly provided for in the CHIPS Act, and that relate to compliance with other CHIPS program

requirements of the Department.

Most obligations of the Project Subsidiaries and the Company pursuant

to the Funding Agreements are binding with respect to a Project for a period of five years following the Project completion date. Certain

obligations specified under the CHIPS Act (and certain other related obligations) are binding on the Project Subsidiaries and the Company

for a period of ten years following the Award Date.

The Funding Agreements contain certain events of default and related

rights and remedies. Events of default include:

| · | Clawback events such as (i) the failure to complete a Project by an

agreed upon completion date, (ii) violation of CHIPS Act restrictions on certain activities involving foreign countries and entities

of concern, and (iii) impermissible use or disposition of a Project; |

| · | Certain significant events of default such as (i) violation

of specified covenants with respect to the CHIPS program’s economic and national security objectives, (ii) abandonment

of a Project, and (iii) bankruptcy or insolvency of the Company or applicable Project Subsidiary prior to a Project completion date;

and |

| · | Other events of default that are not clawback events or significant events

as described above, including breaches of certain representations, warranties and covenants and the occurrence of other events of default

customary in a project financing agreement. |

Rights and remedies in connection with

events of default include: (i) requiring the repayment of some or all of the Project Award amounts previously disbursed with respect

to a Project and/or terminating the Funding Agreement and Project Award funding (in the case of clawback events and significant events

of default only) (a “clawback”), (ii) imposing additional conditions on the Project Award funding; (iii) withholding

or suspending a disbursement of the Project Awards; and (iv) exercising other legal remedies available to the Department.

There are also certain cross-Project funding conditions in which achievement of a particular Project milestone is a funding condition

for certain Project milestones for a different Project, and cross-Project clawback events under which failure to achieve a particular

Project milestone by a particular date for one Project is a clawback event for a different Project.

In the event of an acquisition of 35% or more of the ownership of or

voting rights of the Company by a person or group, the Department may impose additional conditions on the Project Award, withhold or suspend

one or more disbursements or exercise other legal remedies. Such an acquisition of the Company does not give rise to a clawback unless

the acquiring person or group is a foreign entity of concern or is controlled by a person subject to US government sanctions, suspension

or debarment. A change of control of Micron New York or Micron Idaho could give rise to a clawback or other legal remedies.

The Funding Agreements contain restrictions on the payment of

special and one-time dividends by the Company and restrictions on share repurchases by the Project Subsidiaries and the Company that

may be applicable during the five-year period following the Award Date, subject to certain exceptions. Share repurchases are

permitted during the first two years of such five-year period up to amounts specified in the Funding Agreements to help offset the

dilutive effect of employee stock compensation or as otherwise permitted by the Department. Share repurchases are not restricted

during the final three years of such five-year period if certain financial and other conditions are satisfied. The Company is

permitted to make its customary and ordinary course recurring dividends (and reasonable ordinary course increases thereof)

consistent with the Company’s past practice.

Pursuant to a Funding Agreement, the applicable Project Subsidiary

may be required to pay the Department upside sharing amounts for a period of up to ten years following the first year in which the cumulative

cash flow from a Project is positive. Upside sharing amounts for a Project are only payable if cumulative cash flows from the Project

exceed a threshold level that is at a significant premium to the baseline projected cumulative cash flows from a Project. The upside sharing

amount would equal a modest sharing percentage of the excess cash flows above the threshold level, but not to exceed 75% of the Project

Award disbursements for a Project, after taking into account any clawbacks or other repayments.

Guarantee

In connection with the Funding Agreements, the Company entered into

the Guarantee pursuant to which the Company agreed to guarantee any financial obligations owing by a Project Subsidiary to the Department

pursuant to the Funding Agreements and related documents. The Company also agreed to make equity contributions or intercompany loans to

the Project Subsidiaries as required to pay Project costs and satisfy other obligations of the Project Subsidiaries. The Guarantee also

contains the agreement of the Company to comply with certain provisions of the Funding Agreements that apply to the Company and/or certain

Company affiliates, including (i) the restrictions on dividends and share repurchases as described above and (ii) restrictions

on certain activities involving foreign countries and entities of concern as required under the CHIPS Act.

| Item 7.01 |

Regulation FD Disclosure |

On December 9, 2024, a subsidiary of the Company, Micron Virginia

Semiconductor Manufacturing LLC, a Delaware limited liability company (“Micron Virginia”), signed a non-binding Preliminary

Memorandum of Terms (“PMT”) with the Department for a grant of up to $275 million pursuant to Micron Virginia’s application

for funding under the Department’s CHIPS Incentive Program (“Virginia Award”). The grant will support modernization

of production of long-lifecycle DRAM products at the Company’s existing semiconductor manufacturing facility in Manassas, Virginia

to address future demand primarily for defense, aerospace, automotive, and industrial customers. The Virginia Award, combined with the

NY Award, Idaho Award, and workforce development grants described above represent total CHIPS grants of up to $6.44 billion in connection

with the Company’s U.S. manufacturing expansion projects.

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

Date:

December 10, 2024

| MICRON

TECHNOLOGY, INC. |

| |

|

| |

By:

|

/s/

Michael Ray |

| |

Name: |

Michael

Ray |

| |

Title: |

Senior

Vice President, Chief Legal Officer and Corporate Secretary |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

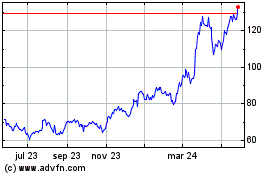

Micron Technology (NASDAQ:MU)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

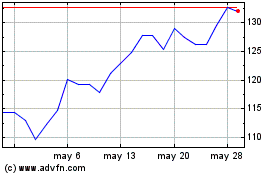

Micron Technology (NASDAQ:MU)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024