FALSE000174972300017497232024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 6, 2024

New Fortress Energy Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Delaware | 001-38790 | 83-1482060 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

| | | | | | | | |

111 W. 19th Street, 8th Floor New York, NY | | 10011 |

| (Address of Principal Executive Offices) | | (Zip Code) |

Registrant’s Telephone Number, Including Area Code: (516) 268-7400

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Class A Common Stock, par value $0.01 per share

| “NFE”

| NASDAQ Global Select Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

☐ Emerging growth company

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act ☐

Item 1.01. Entry into a Material Definitive Agreement.

On September 30, 2024, New Fortress Energy Inc. (the “Company”) entered into a Transaction Support Agreement (the “TSA”) with certain holders (the “Supporting Holders”) of the Company’s outstanding 6.500% Senior Secured Notes due 2026 (the “2026 Existing Notes”) and 8.750% Senior Secured Notes due 2029 (the “2029 Existing Notes” and together with the 2026 Notes, the “Existing Notes”), which was previously disclosed in the Company’s Current Report on Form 8-K filed on October 1, 2024.

Exchange and Subscription Agreement

On November 6, 2024, the Company entered into a privately negotiated exchange and subscription agreement (the “Exchange and Subscription Agreement”) with the Supporting Holders to implement the transactions described in the TSA. Pursuant to the Exchange and Subscription Agreement, (i) NFE Financing LLC (“NFE Financing”), an indirectly owned subsidiary of the Company and the issuer of the New Notes (as defined herein), will sell to the Supporting Holders approximately $1.2 billion aggregate principal amount of NFE Financing’s 12.000% Senior Secured Notes due 2029 (the “New Notes”) (the transactions described in clause (i), the “Subscription Transactions”) and (ii) NFE Financing will issue to the Supporting Holders approximately $1.5 billion aggregate principal amount of New Notes in a dollar-for-dollar exchange for the Company’s 2026 Existing Notes and 2029 Existing Notes (the transactions described in clause (ii), the “Exchange Transactions” and together with the Subscription Transactions, the “Transactions”). In each case, the New Notes will be issued in private placements in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended (the “Securities Act”). The New Notes will be issued pursuant to an indenture (the “New Notes Indenture”). The Transactions are expected to close in approximately one week, subject to customary closing conditions.

Pursuant to the Exchange and Subscription Agreement, upon consummation of the Transactions, the Supporting Holders may elect to receive, in addition to the New Notes, a commitment fee equal to either (i) 5% of the aggregate principal amount of such Supporting Holder’s New Notes, payable in shares of Class A common stock of the Company, at a price of $8.63 per share (the “Commitment Fee Shares”), (ii) 2% of the aggregate principal amount of such Supporting Holder’s New Notes, payable in kind in the form of additional New Notes (the “Commitment Fee Notes”), or (iii) a combination of the foregoing. Additionally, to the extent any Supporting Holder elects to receive Commitment Fee Notes, the equivalent value in Commitment Fee Shares will be ratably reallocated amongst the other Supporting Holders, such that the Supporting Holders will in any case receive 5% of the total amount of New Notes payable in Commitment Fee Shares. In the event any Supporting Holder elects to receive the Commitment Fee Shares, such Supporting Holder will enter into a Registration Rights Agreement with the Company (the “Registration Rights Agreement”), pursuant to which such Supporting Holder is entitled to certain registration rights and subject to certain lock-up restrictions. Any investor who receives the Commitment Fee Shares may not, subject to customary exceptions, offer, sell, contract to sell, pledge or otherwise dispose of such shares for a period of six months from the date of the Registration Rights Agreement without the prior written consent of the Company.

The New Notes Indenture

The New Notes will be senior, secured obligations of NFE Financing, and interest will be payable semi-annually in arrears at a rate of 12.000% per annum on May 15 and November 15 of each year, beginning on May 15, 2025. The New Notes will mature on November 15, 2029, unless earlier repurchased or redeemed.

At any time prior to November 15, 2026, NFE Financing may redeem some or all of the New Notes at a redemption price equal to 100% of the aggregate principal amount of the New Notes redeemed, plus accrued and unpaid interest thereon, if any, to, but excluding, the redemption date, plus a “make-whole” premium. On or after November 15, 2026, NFE Financing may redeem some or all of the New Notes at the redemption prices set forth in the New Notes Indenture, plus accrued and unpaid interest thereon, if any, to, but excluding, the redemption date. Upon the occurrence of certain events constituting a change of control, NFE Financing may be required to make an offer to repurchase all of the New Notes at a price equal to 101% of the principal amount thereof, plus accrued and unpaid interest thereon, if any, to, but excluding, the repurchase date. Prior to November 15, 2025, on or after November 15, 2025 but prior to November 15, 2026, and on or after November 15, 2026 but prior to November 15, 2027, NFE Financing may be required to make an offer to repurchase all of the New Notes at a price equal to 103%, 102% or 101%, respectively, of the principal amount thereof, plus accrued and unpaid interest, if any, to, but excluding, the repurchase date, upon the occurrence of other specified events, such as a “Brazil Proceeds Event,” (defined as the receipt by NFE Financing of any dividends, distributions or subordinated intercompany loans from NFE Brazil Holdings Limited (“NFE Brazil Holdings”) after the issue date of the New Notes) in accordance with the procedures and conditions outlined in the New Notes Indenture. Additionally, the New Notes will be subject to a par repurchase offer in connection with any “Pass Through Prepayment

Event” (defined as any prepayment made under the Brazil Parent Credit Agreement or the Series II Credit Agreement (each, as defined below)).

The Company intends to use $875 million of the net proceeds from the notes issued pursuant to the Subscription Transactions, which will be lent by NFE Financing to Brazil Parent (as defined below) and subsequently by NFE Brazil Investments LLC (“Brazil Parent”) to the Company, to repay in full the outstanding aggregate principal amount of the Company’s 6.750% Senior Secured Notes due 2025 (the “2025 Existing Notes”). The Company intends to use the remainder of the net proceeds from the notes issued pursuant to the Subscription Transactions for general corporate purposes, which will be paid as a dividend by NFE Financing to Brazil Parent, and subsequently from Brazil Parent to the Company.

In consideration for NFE Financing issuing the New Notes in the Exchange Transactions, the Company will: (i) enter into an approximately $1.4 billion Series II Credit Agreement (as defined below) with NFE Financing and (ii) enter into an approximately $970 million Series I Credit Agreement (as defined below) with Brazil Parent, an indirectly owned, restricted subsidiary of the Company and the direct parent of NFE Financing, and (iii) further cause Brazil Parent to enter into the approximately $970 million Brazil Parent Credit Agreement with NFE Financing.

The New Notes will be guaranteed by NFE Financing’s wholly-owned subsidiary, Bradford County Real Estate Partners LLC (the “New Notes Guarantor”) which owns the Company’s land in Wyalusing, Pennsylvania (the “Bradford County Property”). The New Notes will: (i) subject to permitted liens and certain other exceptions described in the New Notes Indenture, be secured by first-priority liens on (a) all assets of NFE Financing, including the promissory note evidencing indebtedness under the Series II Credit Agreement, the promissory note evidencing indebtedness under the Brazil Parent Credit Agreement, approximately 45% of the equity in NFE Brazil Holdings, which owns the Company’s Brazil business, and 100% of the equity in the New Notes Guarantor and (b) all assets of the New Notes Guarantor, which owns the Bradford County Property (clauses (a) and (b), collectively, the “Collateral”); and (ii) rank equal in right of payment with all of NFE Financing’s existing and future senior indebtedness. In addition, the New Notes will be senior in right of payment to any future subordinated indebtedness of NFE Financing and structurally subordinated to all of the existing and future indebtedness and other liabilities (including trade payables) of any of NFE Financing’s subsidiaries that do not guarantee the New Notes.

Intercompany Loans

Brazil Parent Credit Agreement

NFE Financing, as lender, will enter into a credit agreement (the “Brazil Parent Credit Agreement”), with Brazil Parent, as the borrower, and Wilmington Savings Funds Society, FSB (“WSFS”), as administrative agent and collateral agent.

The Brazil Parent Credit Agreement will provide for a senior secured term loan of approximately $970 million (the “Brazil Parent Term Loan”), which will mature in November 2029. The obligations under the Brazil Parent Credit Agreement will be secured by substantially all assets of Brazil Parent (including a pledge of the equity interests held by Brazil Parent in NFE Brazil Holdings).

The Brazil Parent Term Loan may be voluntarily prepaid by Brazil Parent, subject to prepayment premiums as follows: (i) with respect to any prepayment occurring prior to November 15, 2026, a make-whole amount, (ii) with respect to any prepayment occurring on and after November 15, 2026 and prior to November 15, 2027, 6% of the aggregate principal amount of the term loans prepaid, and (iii) with respect to any prepayment occurring on and after November 15, 2027 and prior to November 15, 2028, 3% of the aggregate principal amount of such term loan prepaid, in each case, plus accrued and unpaid interest. On and after November 15, 2028, all prepayments can be made at par plus accrued and unpaid interest. In addition, Brazil Parent will be required to prepay the Brazil Parent Term Loan upon the occurrence of certain events (subject to certain premiums as applicable and set forth in the Brazil Parent Credit Agreement), including any change of control and receipt of net proceeds from any prepayment under the Series I Credit Agreement (as defined below).

The Brazil Parent Credit Agreement is expected to contain usual and customary representations and warranties, covenants and events of default for financings of this type.

Series I Credit Agreement

Brazil Parent, as lender, WSFS, as the administrative agent and as collateral agent, the Company, as borrower, and certain subsidiaries of the Company, as guarantors, will enter into a senior secured term loan credit agreement (“Series I Credit Agreement”) in an aggregate principal amount of approximately $970 million (the loan made under the term loan

facility, the “Series I Term Loan”). The Company expects to use such proceeds to (i) redeem the 2025 Existing Notes in full and (ii) consummate a portion of the Exchange Transactions.

The Series I Term Loan will mature in November 2029 and will be payable in full on the maturity date. The obligations under the Series I Credit Agreement will be guaranteed, jointly and severally, on a senior secured basis by each subsidiary that is a guarantor under the 2026 Existing Notes and the 2029 Existing Notes. The obligations under the Series I Credit Agreement will be secured by substantially the same collateral as the collateral that currently secures the 2026 Existing Notes and the 2029 Existing Notes. An equal priority intercreditor agreement will govern the treatment of the collateral.

The Series I Term Loan may be voluntarily prepaid by the Company, in whole or in part, subject to prepayment premiums as follows: (i) with respect to any prepayment occurring prior to November 15, 2026, a make-whole amount, (ii) with respect to any prepayment occurring on and after November 15, 2026 and prior to November 15, 2027, 6% of the aggregate principal amount of the term loan prepaid, and (iii) with respect to any prepayment occurring on and after November 15, 2027 and prior to November 15, 2028, 3% of the aggregate principal amount of such term loan prepaid, in each case, plus accrued and unpaid interest. On and after November 15, 2028, all prepayments can be made at par plus accrued and unpaid interest.

The Company will be required to prepay the Series I Term Loan upon the occurrence of any change of control (which shall include any change of control as defined in the New Notes Indenture and the Brazil Parent Credit Agreement), and with the net proceeds of certain asset sales, condemnations and debt and convertible securities issuances.

The Series I Credit Agreement is expected to include customary representations, warranties, covenants (such as limits on liens, indebtedness, dispositions, restricted payments and affiliate transactions) and events of default (including nonpayment, material breaches, debt acceleration, bankruptcy, judgments and change of control), subject to certain thresholds and grace periods, in each case, typical for financings of this type.

Series II Credit Agreement

NFE Financing, as lender, WSFS, as the administrative agent and as collateral agent, and the Company, as borrower, and certain subsidiaries of the Company from time to time party thereto as guarantors, will enter into a senior secured term loan credit agreement (“Series II Credit Agreement”) in an aggregate principal amount of approximately $1.4 billion (the loan made under the term loan facility, the “Series II Term Loan”). The proceeds will be used by the Company to consummate the Exchange Transactions.

The Series II Term Loan will mature in November 2029 and is payable in full on the maturity date. The obligations under the Series II Credit Agreement will be guaranteed, jointly and severally, on a senior secured basis by each subsidiary that is a guarantor under the 2026 Existing Notes and the 2029 Existing Notes. The obligations under the Series II Credit Agreement will be secured by substantially the same collateral as the collateral that currently secures the 2026 Existing Notes and the 2029 Existing Notes. An equal priority intercreditor agreement will govern the treatment of the collateral.

The Series II Term Loan may be voluntarily prepaid by the Company, in whole or in part, subject to prepayment premiums as follows: (i) with respect to any prepayment occurring prior to November 15, 2026, a make-whole amount, (ii) with respect to any prepayment occurring on and after November 15, 2026 and prior to November 15, 2027, 6% of the aggregate principal amount of the term loan prepaid, and (iii) with respect to any prepayment occurring on and after November 15, 2027 and prior to November 15, 2028, 3% of the aggregate principal amount of such term loan prepaid, in each case, plus accrued and unpaid interest. On and after November 15, 2028, all prepayments can be made at par plus accrued and unpaid interest.

The Company will be required to prepay the Series II Term Loan upon the occurrence of any change of control (which shall include any change of control as defined in the New Notes Indenture and the Brazil Parent Credit Agreement), and with the net proceeds of certain asset sales, condemnations and debt and convertible securities issuances.

The Series II Credit Agreement is expected to include customary representations, warranties, covenants (such as limits on liens, indebtedness, dispositions, restricted payments and affiliate transactions) and events of default (including nonpayment, material breaches, debt acceleration, bankruptcy, judgments and change of control), subject to certain thresholds and grace periods, in each case, typical for financings of this type.

Credit Agreement Amendments

On November 6, 2024, the Company entered into the Ninth Amendment to Credit Agreement (the “Ninth Amendment”), by and among the Company, as the borrower, the guarantors party thereto, the lenders party thereto and MUFG Bank Ltd., as administrative agent and as collateral agent, which amends that certain Credit Agreement, dated as of April 15, 2021 (as amended, restated or otherwise modified from time to time, the “Existing RCF” and the Existing RCF as amended by the Ninth Amendment, the “Amended RCF”), by and among the Company, as the borrower, the guarantors from time to time party thereto, the several lenders and issuing banks from time to time party thereto and MUFG Bank Ltd., as administrative agent and as collateral agent.

On November 6, 2024, the Company entered into the Fifth Amendment to Uncommitted Letter of Credit and Reimbursement Agreement (the “Fifth Amendment”), by and among the Company, as the borrower, the guarantors party thereto, Natixis, New York Branch, and each of the other financial institutions party thereto, as lenders, which amends that certain Uncommitted Letter of Credit and Reimbursement Agreement, dated as of July 16, 2021 (as amended, restated or otherwise modified from time to time, the “Existing ULCA” and the Existing ULCA as amended by the Fifth Amendment, the “Amended ULCA”), by and among the Company, the guarantors from time to time party thereto, Natixis, New York Branch, as administrative agent, Natixis, New York Branch, as collateral agent, Natixis, New York Branch and each of the other financial institutions party thereto, as lenders and issuing banks.

The Ninth Amendment and the Fifth Amendment are referred to herein collectively as the “Amendments,” and each, an “Amendment;” the Amended RCF and the Amended ULCA are referred to herein collectively as the “Amended Credit Agreements,” and each, an “Amended Credit Agreement.” The Existing RCF and Existing ULCA are referred to herein collectively as the “Existing Credit Agreements.” Each Amendment will become effective upon the satisfaction of certain conditions specified therein (including consummation of certain of the Transactions).

The Amendments, among other things, modify the definition of Excluded Assets (as such term is defined in each Existing Credit Agreement) to permit the pledge of equity in certain subsidiaries that are Unrestricted Subsidiaries under each Existing Credit Agreement to secure the obligations thereunder. The Amended Credit Agreements exclude certain assets of the Company’s Brazil business from the definition of Excluded Assets.

The Amended Credit Agreements amend the financial covenant that tests the consolidated first lien debt ratio (including certain of the components thereof). The consolidated first lien debt ratio cannot exceed (i) 9.50 to 1.00, for the fiscal quarters ending March 31, 2025 through June 30, 2024, (ii) 8.50 to 1.00, for the fiscal quarters ending September 30, 2025 through December 31, 2025, (iii) 8.00 to 1.00, for the fiscal quarters ending March 31, 2026 through June 30, 2026, and (iv) 7.50 to 1.00, for the fiscal quarters ending September 30, 2026 and each fiscal quarter thereafter. The Amended Credit Agreements also add a fixed charge coverage ratio test. Commencing with the fiscal quarter ending March 31, 2025, the Company cannot permit the fixed charge coverage ratio (the ratio of consolidated EBITDA to fixed charges) for the Company and its restricted subsidiaries to be less than 0.80 to 1.00 for the fiscal quarter ending March 31, 2025 and, for the fiscal quarter ending June 30, 2025 and each fiscal quarter thereafter, 1.00 to 1.00. The Amended RCF and the Amended ULCA modify how consolidated EBITDA is calculated to more closely align with the calculation in certain of the Company’s existing term loan facilities, as more further described therein. The Amended Credit Agreements also remove the Debt to Total Capitalization Ratio (as defined in each Amended Credit Agreement).

The Amended RCF extends the maturity date of the Existing RCF for consenting lenders from April 15, 2026, to October 15, 2027, subject to certain events that would cause the maturity to spring to an earlier date as described further therein.

Lumina Note Purchase Agreement

On November 6, 2024, NFE Brazil Financing Limited (“NFE Brazil”), a wholly-owned, indirect subsidiary of the Company, entered into a note purchase agreement (the “Note Purchase Agreement”) with certain funds managed by Lumina Fund I GP Ltd., and Lumina Fund II GP Ltd., as the purchasers (the “Purchasers”). Pursuant to the Note Purchase Agreement and subject to the satisfaction of certain conditions precedent, NFE Brazil may issue and sell to the Purchasers, on one or more closing dates, up to $350 million aggregate principal amount of its 15.000% Senior Secured Notes due 2029 (the “NFE Brazil Notes”) at a purchase price of 97.75% of the principal amount thereof. Concurrently with any initial issuance of the NFE Brazil Notes, the Company and certain subsidiaries of NFE Brazil will guarantee the obligations under the NFE Brazil Notes, and NFE Brazil, its subsidiary guarantors and certain of its other subsidiaries will grant security interests in certain of their assets to secure the NFE Brazil Notes.

Registration Rights Agreement

Under the terms of the Registration Rights Agreement, the Company is required to prepare and file a registration statement, or a prospectus supplement to an effective registration statement, with the Securities and Exchange Commission

(the “SEC”) no later than thirty (30) days following the closing of the Transactions, with respect to the Commitment Fee Shares.

Under the Registration Rights Agreement, the Company will agree to indemnify the applicable Supporting Holder and certain indemnified persons against any losses, claims, damages, liabilities or expenses resulting from any untrue statement or omission of material fact in any registration statement pursuant to which it sells the Company’s common stock, unless such liability arose from the applicable Supporting Holder’s misstatement or omission, and the applicable Supporting Holder will agree to indemnify the Company against all losses caused by its misstatements or omissions. The Company will generally pay all reasonable expenses incurred in connection with registrations, filings or qualifications pursuant to its performance under the Registration Rights Agreement, other than underwriting discounts and commissions, if any, relating to the sale of its common stock under the Registration Rights Agreement.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information included in Item 1.01 is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth above under Item 1.01 is hereby incorporated by reference into this Item 3.02. The Commitment Fee Shares will be issued pursuant to the exemption from registration provided by Section 4(a)(2), Regulation D of the Securities Act.

Cautionary Statement Regarding Forward-Looking Statements

This report contains certain statements and information that may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. All statements contained in this communication other than historical information are forward-looking statements that involve known and unknown risks and relate to future events, the Company’s future financial performance or the Company’s projected business results. You can identify these forward-looking statements by the use of forward-looking words such as “expects,” “may,” “will,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates,” or the negative version of those words or other comparable words. It is uncertain whether any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do, what impact they will have on the results of operations and financial condition or the stock prices of the Company. These forward-looking statements represent the Company’s expectations or beliefs concerning future events, and it is possible that the results described herein will not be achieved. These forward-looking statements are necessarily estimates based upon current information and are subject to risks, uncertainties and other factors, many of which are outside of the Company’s control, that could cause actual results to differ materially from the results discussed in the forward-looking statements. Any forward-looking statement speaks only as of the date on which it is made, and, except as required by law, the Company does not undertake any obligation to update or revise any forward-looking statement, whether as a result of new information, future events or otherwise. New factors emerge from time to time, and it is not possible for the Company to predict all such factors. When considering these forward-looking statements, you should keep in mind the risk factors and other cautionary statements in the Company’s annual report, quarterly and other reports filed with the SEC, which could cause its actual results to differ materially from those contained in any forward-looking statement. The Company undertakes no duty to update these forward-looking statements, even though its situation may change in the future.

Item 9.01. Financial Statements and Exhibits.

| | | | | | | | |

Exhibit

No. | | Description |

| 104 | | Cover Page Interactive Data File - the cover page XBRL tags are embedded within the Inline XBRL document. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

| | | | | | | | |

| | NEW FORTRESS ENERGY INC. |

| | |

| Date: November 7, 2024 | By: | /s/ Christopher S. Guinta |

| | Name: | Christopher S. Guinta |

| | Title: | Chief Financial Officer |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

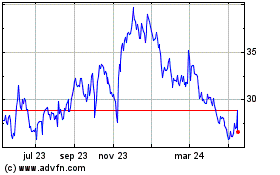

New Fortress Energy (NASDAQ:NFE)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

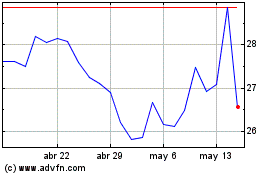

New Fortress Energy (NASDAQ:NFE)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024