NVIDIA Announces Financial Results for Third Quarter Fiscal 2025

20 Noviembre 2024 - 3:20PM

NVIDIA (NASDAQ: NVDA) today reported revenue for the third quarter

ended October 27, 2024, of $35.1 billion, up 17% from the previous

quarter and up 94% from a year ago.

For the quarter, GAAP earnings per diluted share was $0.78, up

16% from the previous quarter and up 111% from a year ago. Non-GAAP

earnings per diluted share was $0.81, up 19% from the previous

quarter and up 103% from a year ago.

“The age of AI is in full steam, propelling a global shift to

NVIDIA computing,” said Jensen Huang, founder and CEO of NVIDIA.

“Demand for Hopper and anticipation for Blackwell — in full

production — are incredible as foundation model makers scale

pretraining, post-training and inference.

“AI is transforming every industry, company and country.

Enterprises are adopting agentic AI to revolutionize workflows.

Industrial robotics investments are surging with breakthroughs in

physical AI. And countries have awakened to the importance of

developing their national AI and infrastructure,” he said.

NVIDIA will pay its next quarterly cash dividend of $0.01 per

share on December 27, 2024, to all shareholders of record on

December 5, 2024.

Q3 Fiscal 2025 Summary

|

GAAP |

|

($ in millions, except earnings per share) |

Q3 FY25 |

Q2 FY25 |

Q3 FY24 |

Q/Q |

Y/Y |

|

Revenue |

$ |

35,082 |

|

$ |

30,040 |

|

$ |

18,120 |

|

Up 17% |

Up 94% |

| Gross margin |

|

74.6 |

% |

|

75.1 |

% |

|

74.0 |

% |

Down 0.5 pts |

Up 0.6 pts |

| Operating expenses |

$ |

4,287 |

|

$ |

3,932 |

|

$ |

2,983 |

|

Up 9% |

Up 44% |

| Operating income |

$ |

21,869 |

|

$ |

18,642 |

|

$ |

10,417 |

|

Up 17% |

Up 110% |

| Net income |

$ |

19,309 |

|

$ |

16,599 |

|

$ |

9,243 |

|

Up 16% |

Up 109% |

| Diluted earnings per

share* |

$ |

0.78 |

|

$ |

0.67 |

|

$ |

0.37 |

|

Up 16% |

Up 111% |

|

Non-GAAP |

|

($ in millions, except earnings per share) |

Q3 FY25 |

Q2 FY25 |

Q3 FY24 |

Q/Q |

Y/Y |

|

Revenue |

$ |

35,082 |

|

$ |

30,040 |

|

$ |

18,120 |

|

Up 17% |

Up 94% |

| Gross margin |

|

75.0 |

% |

|

75.7 |

% |

|

75.0 |

% |

Down 0.7 pts |

-- |

| Operating expenses |

$ |

3,046 |

|

$ |

2,792 |

|

$ |

2,026 |

|

Up 9% |

Up 50% |

| Operating income |

$ |

23,276 |

|

$ |

19,937 |

|

$ |

11,557 |

|

Up 17% |

Up 101% |

| Net income |

$ |

20,010 |

|

$ |

16,952 |

|

$ |

10,020 |

|

Up 18% |

Up 100% |

| Diluted earnings per

share* |

$ |

0.81 |

|

$ |

0.68 |

|

$ |

0.40 |

|

Up 19% |

Up 103% |

*All per share amounts presented herein have

been retroactively adjusted to reflect the ten-for-one stock split,

which was effective June 7, 2024.

OutlookNVIDIA’s outlook for the fourth quarter

of fiscal 2025 is as follows:

- Revenue is expected to be $37.5 billion, plus or minus 2%.

- GAAP and non-GAAP gross margins are expected to be 73.0% and

73.5%, respectively, plus or minus 50 basis points.

- GAAP and non-GAAP operating expenses are expected to be

approximately $4.8 billion and $3.4 billion, respectively.

- GAAP and non-GAAP other income and expense are expected to be

an income of approximately $400 million, excluding gains and losses

from non-affiliated investments and publicly-held equity

securities.

- GAAP and non-GAAP tax rates are

expected to be 16.5%, plus or minus 1%, excluding any discrete

items.

Highlights

NVIDIA achieved progress since its previous earnings

announcement in these areas:

Data Center

- Third-quarter revenue was a record

$30.8 billion, up 17% from the previous quarter and up 112% from a

year ago.

- Announced the availability of NVIDIA

Hopper H200-powered instances in several cloud services, including

AWS, CoreWeave and Microsoft Azure, with Google Cloud and Oracle

Cloud Infrastructure coming soon.

- Launched Denmark’s largest sovereign

AI supercomputer, an NVIDIA® DGX SuperPOD™ driven by 1,528 NVIDIA

H100 Tensor Core GPUs and interconnected using NVIDIA Quantum-2

InfiniBand networking.

- Introduced the NVIDIA AI Aerial

platform for telecommunications providers and began working with

T-Mobile, Ericsson and Nokia to accelerate the commercialization of

AI-RAN.

- Announced that SoftBank Corp. is

building Japan’s most powerful AI supercomputer with the NVIDIA

Blackwell platform and has successfully piloted the world’s first

combined AI and 5G telecom network using NVIDIA AI Aerial.

- Revealed that cloud leaders in India, Japan and Indonesia are

building AI infrastructure with NVIDIA accelerated computing, while

consulting leaders are helping speed AI adoption across industries

with NVIDIA AI Enterprise software.

- Accelerated xAI’s Colossus supercomputer cluster, using 100,000

NVIDIA Hopper GPUs, with the NVIDIA Spectrum-X™ Ethernet networking

platform.

- Unveiled a partnership with Foxconn to build Taiwan’s fastest

AI supercomputer with NVIDIA Blackwell.

- Announced that Blackwell debuted on MLPerf Training, completed

all tests and delivered up to 2.2x performance gains on large

language model benchmarks.

- Contributed foundational elements of the NVIDIA Blackwell

design to the Open Compute Project and broadened NVIDIA Spectrum-X

support for OCP standards.

- Revealed that U.S. technology companies including Accenture,

Deloitte and Google Cloud are tapping NVIDIA AI software to create

custom AI applications, transforming industries worldwide.

- Announced the expansion of a partnership with Lenovo to launch

new hybrid AI solutions and systems optimized to run NVIDIA AI

Enterprise software.

Gaming and AI PC

- Third-quarter Gaming revenue was $3.3 billion, up 14% from the

previous quarter and up 15% from a year ago.

- Celebrated the 25th anniversary of GeForce® 256, the world’s

first GPU, which marked a breakthrough for gaming and laid the

foundation for an AI-driven future.

- Demonstrated NVIDIA ACE and digital human technologies in Mecha

BREAK, featuring the Minitron 4B model for better in-game character

responses, at Gamescom.

- Introduced 20 GeForce RTX and DLSS titles, including Indiana

Jones and the Great Circle and Dragon Age: The Veilguard.

- Began shipping new RTX AI PCs with 321 AI trillion operations

per second of performance from ASUS and MSI, with Microsoft

Copilot+ capabilities anticipated next quarter.

Professional Visualization

- Third-quarter revenue was $486 million, up 7% from the previous

quarter and up 17% from a year ago.

- Announced that Foxconn is using digital twins and industrial AI

built on NVIDIA Omniverse™ to bring online faster three factories

used to manufacture NVIDIA GB200 Grace Blackwell Superchips.

- Revealed that leading industrial manufacturers in India,

including Reliance and Ola Motors, and Japan, including Toyota,

Yaskawa, and Seven and I Holdings, are using NVIDIA AI and

Omniverse to automate workflows and drive more efficient

operations.

- Unveiled NVIDIA Holoscan for Media, an AI-enabled,

software-defined platform that allows live media and video

pipelines to run on the same infrastructure as AI, enhancing

production delivery.

Automotive and Robotics

- Third-quarter Automotive revenue was $449 million, up 30% from

the previous quarter and up 72% from a year ago.

- Revealed that Volvo is releasing a new electric SUV built on

NVIDIA accelerated computing.

- Introduced Project GR00T AI and simulation tools for robot

learning and humanoid development, and new generative AI tools and

perception workflows for robotics developers.

- Announced that Japanese and Indian companies including Toyota

and Ola Motors are using NVIDIA Isaac™ and Omniverse to build the

next wave of physical AI.

CFO CommentaryCommentary on the quarter by

Colette Kress, NVIDIA’s executive vice president and chief

financial officer, is available at https://investor.nvidia.com.

Conference Call and Webcast InformationNVIDIA

will conduct a conference call with analysts and investors to

discuss its third quarter fiscal 2025 financial results and current

financial prospects today at 2 p.m. Pacific time (5 p.m. Eastern

time). A live webcast (listen-only mode) of the conference call

will be accessible at NVIDIA’s investor relations website,

https://investor.nvidia.com. The webcast will be recorded and

available for replay until NVIDIA’s conference call to discuss its

financial results for its fourth quarter and fiscal 2025.

Non-GAAP MeasuresTo supplement NVIDIA’s

condensed consolidated financial statements presented in accordance

with GAAP, the company uses non-GAAP measures of certain components

of financial performance. These non-GAAP measures include non-GAAP

gross profit, non-GAAP gross margin, non-GAAP operating expenses,

non-GAAP operating income, non-GAAP other income (expense), net,

non-GAAP net income, non-GAAP net income, or earnings, per diluted

share, and free cash flow. For NVIDIA’s investors to be better able

to compare its current results with those of previous periods, the

company has shown a reconciliation of GAAP to non-GAAP financial

measures. These reconciliations adjust the related GAAP financial

measures to exclude stock-based compensation expense,

acquisition-related and other costs, other, gains and losses from

non-affiliated investments and publicly-held equity securities,

net, interest expense related to amortization of debt discount, and

the associated tax impact of these items where applicable. Free

cash flow is calculated as GAAP net cash provided by operating

activities less both purchases related to property and equipment

and intangible assets and principal payments on property and

equipment and intangible assets. NVIDIA believes the presentation

of its non-GAAP financial measures enhances the user’s overall

understanding of the company’s historical financial performance.

The presentation of the company’s non-GAAP financial measures is

not meant to be considered in isolation or as a substitute for the

company’s financial results prepared in accordance with GAAP, and

the company’s non-GAAP measures may be different from non-GAAP

measures used by other companies.

| NVIDIA

CORPORATION |

|

CONDENSED CONSOLIDATED STATEMENTS OF

INCOME |

| (In millions, except

per share data) |

| (Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

October

27, |

|

October

29, |

|

October

27, |

|

October

29, |

| |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

Revenue |

$ |

35,082 |

|

|

$ |

18,120 |

|

|

$ |

91,166 |

|

|

$ |

38,819 |

|

|

Cost of revenue |

|

8,926 |

|

|

|

4,720 |

|

|

|

22,031 |

|

|

|

11,309 |

|

|

Gross profit |

|

26,156 |

|

|

|

13,400 |

|

|

|

69,135 |

|

|

|

27,510 |

|

| |

|

|

|

|

|

|

|

|

|

|

Operating expenses |

|

|

|

|

|

|

|

| |

Research and development |

|

3,390 |

|

|

|

2,294 |

|

|

|

9,200 |

|

|

|

6,210 |

|

|

|

Sales, general and administrative |

|

897 |

|

|

|

689 |

|

|

|

2,516 |

|

|

|

1,942 |

|

| |

|

Total operating expenses |

|

4,287 |

|

|

|

2,983 |

|

|

|

11,716 |

|

|

|

8,152 |

|

| |

|

|

|

|

|

|

|

|

|

|

Operating Income |

|

21,869 |

|

|

|

10,417 |

|

|

|

57,419 |

|

|

|

19,358 |

|

| |

Interest income |

|

472 |

|

|

|

234 |

|

|

|

1,275 |

|

|

|

572 |

|

| |

Interest expense |

|

(61 |

) |

|

|

(63 |

) |

|

|

(186 |

) |

|

|

(194 |

) |

|

|

Other, net |

|

36 |

|

|

|

(66 |

) |

|

|

301 |

|

|

|

(24 |

) |

| |

|

Other income (expense), net |

|

447 |

|

|

|

105 |

|

|

|

1,390 |

|

|

|

354 |

|

| |

|

|

|

|

|

|

|

|

|

|

Income before income tax |

|

22,316 |

|

|

|

10,522 |

|

|

|

58,809 |

|

|

|

19,712 |

|

|

Income tax expense |

|

3,007 |

|

|

|

1,279 |

|

|

|

8,020 |

|

|

|

2,237 |

|

|

Net income |

$ |

19,309 |

|

|

$ |

9,243 |

|

|

$ |

50,789 |

|

|

$ |

17,475 |

|

| |

|

|

|

|

|

|

|

|

|

|

Net income per share (A): |

|

|

|

|

|

|

|

| |

Basic |

$ |

0.79 |

|

|

$ |

0.37 |

|

|

$ |

2.07 |

|

|

$ |

0.71 |

|

| |

Diluted |

$ |

0.78 |

|

|

$ |

0.37 |

|

|

$ |

2.04 |

|

|

$ |

0.70 |

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted average shares used in per share computation (A): |

|

|

|

|

|

|

| |

Basic |

|

24,533 |

|

|

|

24,680 |

|

|

|

24,577 |

|

|

|

24,700 |

|

| |

Diluted |

|

24,774 |

|

|

|

24,940 |

|

|

|

24,837 |

|

|

|

24,940 |

|

| |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

(A) Reflects a ten-for-one stock split on June 7, 2024. |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

| NVIDIA

CORPORATION |

|

| CONDENSED

CONSOLIDATED BALANCE SHEETS |

|

| (In millions) |

|

| (Unaudited) |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| |

|

|

|

October

27, |

|

January

28, |

|

| |

|

|

|

2024 |

|

2024 |

|

|

ASSETS |

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

Current assets: |

|

|

|

|

|

| |

Cash, cash equivalents and marketable securities |

|

$ |

38,487 |

|

$ |

25,984 |

|

| |

Accounts receivable, net |

|

|

17,693 |

|

|

9,999 |

|

| |

Inventories |

|

|

7,654 |

|

|

5,282 |

|

|

|

Prepaid expenses and other current assets |

|

|

3,806 |

|

|

3,080 |

|

| |

|

Total current assets |

|

|

67,640 |

|

|

44,345 |

|

| |

|

|

|

|

|

|

|

|

Property and equipment, net |

|

|

5,343 |

|

|

3,914 |

|

|

Operating lease assets |

|

|

1,755 |

|

|

1,346 |

|

|

Goodwill |

|

|

4,724 |

|

|

4,430 |

|

|

Intangible assets, net |

|

|

838 |

|

|

1,112 |

|

|

Deferred income tax assets |

|

|

10,276 |

|

|

6,081 |

|

|

Other assets |

|

|

5,437 |

|

|

4,500 |

|

| |

|

Total assets |

|

$ |

96,013 |

|

$ |

65,728 |

|

| |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS’ EQUITY |

|

| |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

| |

Accounts payable |

|

$ |

5,353 |

|

$ |

2,699 |

|

| |

Accrued and other current liabilities |

|

|

11,126 |

|

|

6,682 |

|

|

|

Short-term debt |

|

|

- |

|

|

1,250 |

|

| |

|

Total current liabilities |

|

|

16,479 |

|

|

10,631 |

|

| |

|

|

|

|

|

|

|

|

Long-term debt |

|

|

8,462 |

|

|

8,459 |

|

|

Long-term operating lease liabilities |

|

|

1,490 |

|

|

1,119 |

|

|

Other long-term liabilities |

|

|

3,683 |

|

|

2,541 |

|

| |

|

Total liabilities |

|

|

30,114 |

|

|

22,750 |

|

| |

|

|

|

|

|

|

|

|

Shareholders’ equity |

|

|

65,899 |

|

|

42,978 |

|

| |

|

Total liabilities and shareholders’ equity |

|

$ |

96,013 |

|

$ |

65,728 |

|

| |

|

|

|

|

|

|

|

| NVIDIA

CORPORATION |

|

| CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

| (In millions) |

|

| (Unaudited) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Nine Months Ended |

|

| |

|

|

October

27, |

|

October

29, |

|

October

27, |

|

October

29, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

|

Net income |

$ |

19,309 |

|

|

$ |

9,243 |

|

|

$ |

50,789 |

|

|

$ |

17,475 |

|

|

|

Adjustments to reconcile net income to net cash |

|

|

|

|

|

|

|

|

|

provided by operating activities: |

|

|

|

|

|

|

|

|

| |

Stock-based compensation expense |

|

1,252 |

|

|

|

979 |

|

|

|

3,416 |

|

|

|

2,555 |

|

|

| |

Depreciation and amortization |

|

478 |

|

|

|

372 |

|

|

|

1,321 |

|

|

|

1,121 |

|

|

| |

(Gains) losses on investments in non-affiliated entities and

publicly-held equity securities, net |

|

(37 |

) |

|

|

69 |

|

|

|

(302 |

) |

|

|

24 |

|

|

| |

Deferred income taxes |

|

(602 |

) |

|

|

(529 |

) |

|

|

(3,879 |

) |

|

|

(2,411 |

) |

|

| |

Other |

|

(79 |

) |

|

|

(66 |

) |

|

|

(365 |

) |

|

|

(170 |

) |

|

|

Changes in operating assets and liabilities, net of

acquisitions: |

|

|

|

|

|

|

|

|

| |

Accounts receivable |

|

(3,561 |

) |

|

|

(1,243 |

) |

|

|

(7,694 |

) |

|

|

(4,482 |

) |

|

| |

Inventories |

|

(978 |

) |

|

|

(457 |

) |

|

|

(2,357 |

) |

|

|

405 |

|

|

| |

Prepaid expenses and other assets |

|

(714 |

) |

|

|

254 |

|

|

|

(726 |

) |

|

|

(337 |

) |

|

| |

Accounts payable |

|

1,689 |

|

|

|

461 |

|

|

|

2,490 |

|

|

|

1,250 |

|

|

| |

Accrued and other current liabilities |

|

606 |

|

|

|

(1,722 |

) |

|

|

3,918 |

|

|

|

953 |

|

|

|

|

Other long-term liabilities |

|

266 |

|

|

|

(28 |

) |

|

|

849 |

|

|

|

208 |

|

|

|

Net cash provided by operating activities |

|

17,629 |

|

|

|

7,333 |

|

|

|

47,460 |

|

|

|

16,591 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

| |

Proceeds from maturities of marketable securities |

|

1,386 |

|

|

|

2,891 |

|

|

|

9,485 |

|

|

|

8,001 |

|

|

| |

Proceeds from sales of marketable securities |

|

154 |

|

|

|

- |

|

|

|

318 |

|

|

|

- |

|

|

| |

Purchases of marketable securities |

|

(4,518 |

) |

|

|

(5,345 |

) |

|

|

(19,565 |

) |

|

|

(10,688 |

) |

|

| |

Purchase related to property and equipment and intangible

assets |

|

(813 |

) |

|

|

(278 |

) |

|

|

(2,159 |

) |

|

|

(815 |

) |

|

| |

Acquisitions, net of cash acquired |

|

(147 |

) |

|

|

- |

|

|

|

(465 |

) |

|

|

(83 |

) |

|

| |

Purchases of investments in non-affiliated entities |

|

(473 |

) |

|

|

(441 |

) |

|

|

(1,008 |

) |

|

|

(897 |

) |

|

| |

Proceeds from sales of investments in non-affiliated entities |

|

66 |

|

|

|

- |

|

|

|

171 |

|

|

|

- |

|

|

|

|

Other |

|

- |

|

|

|

4 |

|

|

|

- |

|

|

|

25 |

|

|

|

Net cash used in investing activities |

|

(4,345 |

) |

|

|

(3,169 |

) |

|

|

(13,223 |

) |

|

|

(4,457 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

| |

Proceeds related to employee stock plans |

|

204 |

|

|

|

156 |

|

|

|

489 |

|

|

|

403 |

|

|

| |

Payments related to repurchases of common stock |

|

(10,998 |

) |

|

|

(3,806 |

) |

|

|

(25,895 |

) |

|

|

(6,874 |

) |

|

| |

Repayment of debt |

|

- |

|

|

|

- |

|

|

|

(1,250 |

) |

|

|

(1,250 |

) |

|

| |

Payments related to tax on restricted stock units |

|

(1,680 |

) |

|

|

(764 |

) |

|

|

(5,068 |

) |

|

|

(1,942 |

) |

|

| |

Dividends paid |

|

(245 |

) |

|

|

(99 |

) |

|

|

(589 |

) |

|

|

(296 |

) |

|

| |

Principal payments on property and equipment and intangible

assets |

|

(29 |

) |

|

|

(13 |

) |

|

|

(97 |

) |

|

|

(44 |

) |

|

|

|

Other |

|

- |

|

|

|

(1 |

) |

|

|

- |

|

|

|

(1 |

) |

|

|

Net cash used in financing activities |

|

(12,748 |

) |

|

|

(4,527 |

) |

|

|

(32,410 |

) |

|

|

(10,004 |

) |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Change in cash, cash equivalents, and restricted cash |

|

536 |

|

|

|

(363 |

) |

|

|

1,827 |

|

|

|

2,130 |

|

|

|

Cash, cash equivalents, and restricted cash at beginning of

period |

|

8,571 |

|

|

|

5,882 |

|

|

|

7,280 |

|

|

|

3,389 |

|

|

|

Cash, cash equivalents, and restricted cash at end of

period |

$ |

9,107 |

|

|

$ |

5,519 |

|

|

$ |

9,107 |

|

|

$ |

5,519 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Supplemental disclosures of cash flow

information: |

|

|

|

|

|

|

|

|

|

Cash paid for income taxes, net |

$ |

3,540 |

|

|

$ |

4,348 |

|

|

$ |

10,989 |

|

|

$ |

4,676 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

NVIDIA

CORPORATION |

| |

RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL

MEASURES |

| |

(In millions, except

per share data) |

| |

(Unaudited) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

|

October

27, |

|

July

28, |

|

October

29, |

|

October

27, |

|

October

29, |

| |

|

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP gross profit |

$ |

26,156 |

|

|

$ |

22,574 |

|

|

$ |

13,400 |

|

|

$ |

69,135 |

|

|

$ |

27,510 |

|

| |

GAAP gross margin |

|

74.6 |

% |

|

|

75.1 |

% |

|

|

74.0 |

% |

|

|

75.8 |

% |

|

|

70.9 |

% |

| |

|

Acquisition-related and other costs (A) |

|

116 |

|

|

|

118 |

|

|

|

119 |

|

|

|

355 |

|

|

|

358 |

|

| |

|

Stock-based compensation expense (B) |

|

50 |

|

|

|

40 |

|

|

|

38 |

|

|

|

125 |

|

|

|

96 |

|

| |

|

Other (C) |

|

|

- |

|

|

|

(3 |

) |

|

|

26 |

|

|

|

(4 |

) |

|

|

36 |

|

| |

Non-GAAP gross profit |

$ |

26,322 |

|

|

$ |

22,729 |

|

|

$ |

13,583 |

|

|

$ |

69,611 |

|

|

$ |

28,000 |

|

| |

Non-GAAP gross margin |

|

75.0 |

% |

|

|

75.7 |

% |

|

|

75.0 |

% |

|

|

76.4 |

% |

|

|

72.1 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP operating expenses |

$ |

4,287 |

|

|

$ |

3,932 |

|

|

$ |

2,983 |

|

|

$ |

11,716 |

|

|

$ |

8,152 |

|

| |

|

Stock-based compensation expense (B) |

|

(1,202 |

) |

|

|

(1,114 |

) |

|

|

(941 |

) |

|

|

(3,291 |

) |

|

|

(2,459 |

) |

| |

|

Acquisition-related and other costs (A) |

|

(39 |

) |

|

|

(26 |

) |

|

|

(16 |

) |

|

|

(86 |

) |

|

|

(88 |

) |

| |

|

Other (C) |

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

10 |

|

| |

Non-GAAP operating expenses |

$ |

3,046 |

|

|

$ |

2,792 |

|

|

$ |

2,026 |

|

|

$ |

8,339 |

|

|

$ |

5,615 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP operating income |

$ |

21,869 |

|

|

$ |

18,642 |

|

|

$ |

10,417 |

|

|

$ |

57,419 |

|

|

$ |

19,358 |

|

| |

|

Total impact of non-GAAP adjustments to operating income |

|

1,407 |

|

|

|

1,295 |

|

|

|

1,140 |

|

|

|

3,853 |

|

|

|

3,027 |

|

| |

Non-GAAP operating income |

$ |

23,276 |

|

|

$ |

19,937 |

|

|

$ |

11,557 |

|

|

$ |

61,272 |

|

|

$ |

22,385 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP other income (expense), net |

$ |

447 |

|

|

$ |

572 |

|

|

$ |

105 |

|

|

$ |

1,390 |

|

|

$ |

354 |

|

| |

|

(Gains) losses from non-affiliated investments and publicly-held

equity securities, net |

|

(37 |

) |

|

|

(193 |

) |

|

|

69 |

|

|

|

(302 |

) |

|

|

23 |

|

| |

|

Interest expense related to amortization of debt discount |

|

1 |

|

|

|

1 |

|

|

|

1 |

|

|

|

3 |

|

|

|

3 |

|

| |

Non-GAAP other income (expense), net |

$ |

411 |

|

|

$ |

380 |

|

|

$ |

175 |

|

|

$ |

1,091 |

|

|

$ |

380 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP net income |

$ |

19,309 |

|

|

$ |

16,599 |

|

|

$ |

9,243 |

|

|

$ |

50,789 |

|

|

$ |

17,475 |

|

| |

|

Total pre-tax impact of non-GAAP adjustments |

|

1,371 |

|

|

|

1,103 |

|

|

|

1,210 |

|

|

|

3,554 |

|

|

|

3,053 |

|

| |

|

Income tax impact of non-GAAP adjustments (D) |

|

(670 |

) |

|

|

(750 |

) |

|

|

(433 |

) |

|

|

(2,144 |

) |

|

|

(1,055 |

) |

| |

Non-GAAP net income |

$ |

20,010 |

|

|

$ |

16,952 |

|

|

$ |

10,020 |

|

|

$ |

52,199 |

|

|

$ |

19,473 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Diluted net income per share (E) |

|

|

|

|

|

|

|

|

|

| |

|

GAAP |

|

$ |

0.78 |

|

|

$ |

0.67 |

|

|

$ |

0.37 |

|

|

$ |

2.04 |

|

|

$ |

0.70 |

|

| |

|

Non-GAAP |

|

$ |

0.81 |

|

|

$ |

0.68 |

|

|

$ |

0.40 |

|

|

$ |

2.10 |

|

|

$ |

0.78 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

Weighted average shares used in diluted net income per share

computation (E) |

|

24,774 |

|

|

|

24,848 |

|

|

|

24,940 |

|

|

|

24,837 |

|

|

|

24,940 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

GAAP net cash provided by operating activities |

$ |

17,629 |

|

|

$ |

14,489 |

|

|

$ |

7,333 |

|

|

$ |

47,460 |

|

|

$ |

16,591 |

|

| |

|

Purchases related to property and equipment and intangible

assets |

|

(813 |

) |

|

|

(977 |

) |

|

|

(278 |

) |

|

|

(2,159 |

) |

|

|

(815 |

) |

| |

|

Principal payments on property and equipment and intangible

assets |

|

(29 |

) |

|

|

(29 |

) |

|

|

(13 |

) |

|

|

(97 |

) |

|

|

(44 |

) |

| |

Free cash flow |

|

$ |

16,787 |

|

|

$ |

13,483 |

|

|

$ |

7,042 |

|

|

$ |

45,204 |

|

|

$ |

15,732 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(A) Acquisition-related and other costs are comprised of

amortization of intangible assets, transaction costs, and certain

compensation charges and are included in the following line

items: |

| |

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

|

October

27, |

|

July

28, |

|

October

29, |

|

October

27, |

|

October 29, |

| |

|

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

Cost of revenue |

$ |

116 |

|

|

$ |

118 |

|

|

$ |

119 |

|

|

$ |

355 |

|

|

$ |

358 |

|

| |

|

Research and development |

$ |

23 |

|

|

$ |

17 |

|

|

$ |

12 |

|

|

$ |

52 |

|

|

$ |

37 |

|

| |

|

Sales, general and administrative |

$ |

16 |

|

|

$ |

9 |

|

|

$ |

4 |

|

|

$ |

34 |

|

|

$ |

51 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(B) Stock-based compensation consists of the following: |

|

|

|

| |

|

|

|

Three Months Ended |

|

Nine Months Ended |

| |

|

|

|

October

27, |

|

July

28, |

|

October

29, |

|

October

27, |

|

October 29, |

| |

|

|

|

|

2024 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| |

|

Cost of revenue |

$ |

50 |

|

|

$ |

40 |

|

|

$ |

38 |

|

|

$ |

125 |

|

|

$ |

96 |

|

| |

|

Research and development |

$ |

910 |

|

|

$ |

832 |

|

|

$ |

701 |

|

|

$ |

2,469 |

|

|

$ |

1,826 |

|

| |

|

Sales, general and administrative |

$ |

292 |

|

|

$ |

282 |

|

|

$ |

240 |

|

|

$ |

822 |

|

|

$ |

633 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(C) Other consists of IP-related costs and assets held for sale

related adjustments |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(D) Income tax impact of non-GAAP adjustments, including the

recognition of excess tax benefits or deficiencies related to

stock-based compensation under GAAP accounting standard (ASU

2016-09). |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

(E) Reflects a ten-for-one stock split on June 7, 2024 |

| |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| NVIDIA

CORPORATION |

|

|

|

RECONCILIATION OF GAAP TO NON-GAAP OUTLOOK |

|

|

|

|

|

|

|

|

| |

|

|

| |

|

Q4 FY2025 Outlook |

|

|

| |

|

($ in millions) |

|

| |

|

|

|

|

|

GAAP gross margin |

|

73.0 |

% |

|

|

|

|

Impact of stock-based compensation expense, acquisition-related

costs, and other costs |

|

0.5 |

% |

|

|

|

Non-GAAP gross margin |

|

73.5 |

% |

|

|

| |

|

|

|

|

|

GAAP operating expenses |

$ |

4,750 |

|

|

|

|

|

Stock-based compensation expense, acquisition-related costs, and

other costs |

|

(1,350 |

) |

|

|

|

Non-GAAP operating expenses |

$ |

3,400 |

|

|

|

| |

|

|

|

|

About NVIDIANVIDIA (NASDAQ: NVDA) is the world

leader in accelerated computing.

| For further

information, contact: |

|

| |

|

| Stewart SteckerInvestor RelationsNVIDIA

Corporationsstecker@nvidia.com |

Mylene MangalindanCorporate CommunicationsNVIDIA

Corporationmmangalindan@nvidia.com |

Certain statements in this press release including, but not

limited to, statements as to: the age of AI in full steam,

propelling a global shift to NVIDIA computing; demand for Hopper

and anticipation for Blackwell — in full production — being

incredible as foundation model makers scale pretraining,

post-training and inference; AI transforming every industry,

company and country; enterprises adopting agentic AI to

revolutionize workflows; industrial robotics investments surging

with breakthroughs in physical AI; countries awakening to the

importance of developing their national AI and infrastructure;

NVIDIA’s next quarterly cash dividend; and NVIDIA’s financial

outlook and expected tax rates for the fourth quarter of fiscal

2025 are risks and uncertainties that could cause results to be

materially different than expectations. Important factors that

could cause actual results to differ materially include: global

economic conditions; our reliance on third parties to manufacture,

assemble, package and test our products; the impact of

technological development and competition; development of new

products and technologies or enhancements to our existing product

and technologies; market acceptance of our products or our

partners’ products; design, manufacturing or software defects;

changes in consumer preferences or demands; changes in industry

standards and interfaces; and unexpected loss of performance of our

products or technologies when integrated into systems, as well as

other factors detailed from time to time in the most recent reports

NVIDIA files with the Securities and Exchange Commission, or SEC,

including, but not limited to, its annual report on Form 10-K and

quarterly reports on Form 10-Q. Copies of reports filed with the

SEC are posted on the company’s website and are available from

NVIDIA without charge. These forward-looking statements are not

guarantees of future performance and speak only as of the date

hereof, and, except as required by law, NVIDIA disclaims any

obligation to update these forward-looking statements to reflect

future events or circumstances.

© 2024 NVIDIA Corporation. All rights reserved. NVIDIA, the

NVIDIA logo, GeForce, NVIDIA DGX SuperPOD, NVIDIA Isaac, NVIDIA

Omniverse and NVIDIA Spectrum-X are trademarks and/or registered

trademarks of NVIDIA Corporation in the U.S. and/or other

countries. Other company and product names may be trademarks of the

respective companies with which they are associated. Features,

pricing, availability and specifications are subject to change

without notice.

A photo accompanying this announcement is available

at https://www.globenewswire.com/NewsRoom/AttachmentNg/24a5522e-6258-4e72-9c8a-a57178db4b41

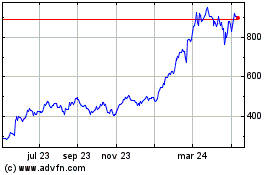

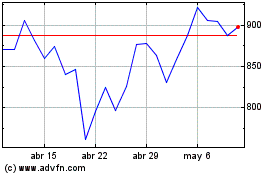

NVIDIA (NASDAQ:NVDA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

NVIDIA (NASDAQ:NVDA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024