Elliott Mails Materials to NXP Retail Shareholders

01 Febrero 2018 - 7:00AM

Business Wire

Discloses increased economic interest in NXP,

now at 7.2%

Materials can be viewed at dedicated

website:www.FairValueForNXP.com

Elliott Advisors (UK) Limited (“Elliott”), which advises funds

which now collectively hold an increased economic interest in NXP

Semiconductors N.V. (NASDAQ: NXPI) (“NXP”) of approximately 7.2%,

today mailed materials to NXP retail shareholders in the United

States, which can be viewed at www.FairValueForNXP.com.

Elliott’s increasing economic interest in NXP, which has current

market value of approximately $2.9 billion, underscores the firm’s

significant level of conviction in the value opportunity present at

NXP today, as well as its alignment of interest with its fellow NXP

shareholders.

About Elliott

Founded in 1977, Elliott Management Corporation is one of the

oldest private investment firms of its kind under continuous

management. The firm’s investors include pension funds, private

endowments, charitable foundations, family offices, and employees

of the firm. Elliott Advisors (UK) Limited is an affiliate of

Elliott Management Corporation.

Our approach to NXP is consistent with our approach to many of

our current and previous investments. We have invested a

significant amount of time and resources into understanding NXP,

including hiring numerous advisors and consultants with whom we

have worked together to receive input from over 50 industry

participants. We believe strongly in the value conclusions that we

have drawn as a result of this effort.

View source

version on businesswire.com: http://www.businesswire.com/news/home/20180201005652/en/

Media:Elliott Advisors (UK) LimitedSarah Rajani CFA, +44

(0) 20 3009 1475srajani@elliottadvisors.co.uk

Elliott Management CorporationStephen Spruiell, +1

212-478-2017sspruiell@elliottmgmt.com

Information Agent:Okapi Partners LLCPat McHugh, +1

212-297-0720info@okapipartners.com

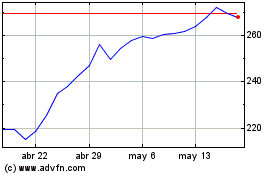

NXP Semiconductors NV (NASDAQ:NXPI)

Gráfica de Acción Histórica

De Ago 2024 a Sep 2024

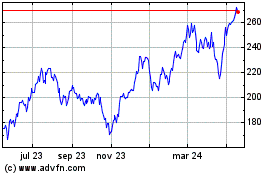

NXP Semiconductors NV (NASDAQ:NXPI)

Gráfica de Acción Histórica

De Sep 2023 a Sep 2024