Office Properties Income Trust Third Quarter 2023 Financial Results and Supplemental Information October 30, 2023 Chicago, IL Exhibit 99.2

Q3 2023 2 Table of Contents QUARTERLY RESULTS Office Properties Income Trust Announces Third Quarter 2023 Financial Results ............................................................................... 4 Third Quarter 2023 Highlights ........................................................................................................................................................................ 5 Third Quarter 2023 Results .............................................................................................................................................................................. 6 FINANCIALS Key Financial Data.............................................................................................................................................................................................. 8 Condensed Consolidated Statements of Income (Loss) ............................................................................................................................ 9 Condensed Consolidated Balance Sheets ................................................................................................................................................... 10 Debt Summary .................................................................................................................................................................................................... 11 Debt Maturity Schedule .................................................................................................................................................................................... 12 Leverage Ratios, Coverage Ratios and Public Debt Covenants ............................................................................................................... 13 Capital Expenditures Summary and Significant Redevelopment Information ...................................................................................... 14 Property Acquisitions and Dispositions Information Since January 1, 2023 .......................................................................................... 15 Investments in Unconsolidated Joint Ventures ............................................................................................................................................ 16 PORTFOLIO INFORMATION Summary Same Property Results .................................................................................................................................................................... 18 Occupancy and Leasing Summary ................................................................................................................................................................. 19 Tenant Diversity and Credit Characteristics.................................................................................................................................................. 20 Tenants Representing 1% or More of Total Annualized Rental Income .................................................................................................. 21 Lease Expiration Schedule ............................................................................................................................................................................... 22 APPENDIX Company Profile and Research Coverage .................................................................................................................................................... 24 Governance Information ................................................................................................................................................................................... 25 Non-GAAP Financial Measures and Certain Definitions ............................................................................................................................ 26 Calculation and Reconciliation of NOI and Cash Basis NOI ...................................................................................................................... 28 Reconciliation and Calculation of Same Property NOI and Same Property Cash Basis NOI .............................................................. 29 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre ....................................................................................................................... 30 Calculation of FFO, Normalized FFO and CAD ........................................................................................................................................... 31 WARNING CONCERNING FORWARD-LOOKING STATEMENTS ............................................................................................................................. 32 Trading Symbols: Common Shares: OPI Senior Unsecured Notes due 2050: OPINL Investor Relations Contact: Kevin Barry, Senior Director (617) 219-1410 kbarry@opireit.com ir@opireit.com Corporate Headquarters: Two Newton Place 255 Washington Street, Suite 300 Newton, Massachusetts 02458-1634 www.opireit.com All amounts in this presentation are unaudited. Unless otherwise noted, all data presented in this presentation excludes three properties, which are encumbered by $82.0 million of mortgage notes, owned by two unconsolidated joint ventures in which OPI owns a 51% and 50% interest. See page 16 for information regarding these joint ventures and related mortgage notes. Please refer to Non-GAAP Financial Measures and Certain Definitions for terms used throughout this presentation.

Q3 2023 3RETURN TO TABLE OF CONTENTS Quarterly Results

Q3 2023 4RETURN TO TABLE OF CONTENTS OFFICE PROPERTIES INCOME TRUST ANNOUNCES THIRD QUARTER 2023 FINANCIAL RESULTS “During the third quarter, OPI continued to advance its business strategies while navigating challenging market conditions facing the commercial office market. Normalized FFO of $1.02 per share for the quarter exceeded the high end of our guidance range. Leasing across the portfolio remained active with 586,000 square feet of new and renewal leasing in the quarter and now totals more than 1.5 million square feet year to date. While office utilization remains well below historical levels, our leasing pipeline is active, and we estimate our portfolio- wide utilization trends improved to approximately 70%. We closed on two mortgage loans for proceeds of $69 million, bringing our total mortgage proceeds this year to more than $177 million. We believe these transactions illustrate the financing opportunities available within our diversified portfolio. Looking forward, we remain focused on addressing OPI’s upcoming debt maturities, executing on select asset sales, actively engaging with our tenants to renew leases and converting prospects in our lease pipeline to fill vacancies." Christopher Bilotto, President and Chief Executive Officer Newton, MA (October 30, 2023). Office Properties Income Trust (Nasdaq: OPI) today announced its financial results for the quarter ended September 30, 2023. Dividend OPI has declared a quarterly dividend on its common shares of $0.25 per share to shareholders of record as of the close of business on October 23, 2023. This dividend will be paid on or about November 16, 2023. Conference Call A conference call to discuss OPI's third quarter results will be held on Tuesday, October 31, 2023 at 10:00 a.m. Eastern Time. The conference call may be accessed by dialing (877) 328-1172 or (412) 317-5418 (if calling from outside the United States and Canada); a pass code is not required. A replay will be available for one week by dialing (412) 317-0088; the replay pass code is 9984412. A live audio webcast of the conference call will also be available in a listen-only-mode on OPI’s website, at www.opireit.com. The archived webcast will be available for replay on OPI’s website after the call. The transcription, recording and retransmission in any way are strictly prohibited without the prior written consent of OPI. About Office Properties Income Trust OPI is a national REIT focused on owning and leasing high quality office and mixed-use properties in select growth-oriented U.S. markets. As of September 30, 2023, approximately 64% of OPI's revenues were from investment grade rated tenants. OPI owned and leased 154 properties as of September 30, 2023, with approximately 20.7 million square feet located in 30 states and Washington, D.C. In 2023, OPI was named as an Energy Star® Partner of the Year for the sixth consecutive year. OPI is managed by The RMR Group (Nasdaq: RMR), a leading U.S. alternative asset management company with approximately $36 billion in assets under management as of September 30, 2023, and more than 35 years of institutional experience in buying, selling, financing and operating commercial real estate. OPI is headquartered in Newton, MA. For more information, visit opireit.com.

Q3 2023 5RETURN TO TABLE OF CONTENTS Third Quarter 2023 Highlights Financial Results • Net loss of $19.6 million, or $0.41 per common share. • Normalized FFO of $49.4 million, or $1.02 per common share. Portfolio Update • Leased 586,000 sq. ft. with a 7.4 year weighted average lease term. • Leased 1,502,000 sq. ft. year-to-date with an 8.7 year weighted average lease term. Investment Activity • Sold one property containing approximately 80,000 rentable square feet for a sales price of $10.5 million, excluding closing costs. • As of October 27, 2023, OPI has entered into agreements to sell two properties containing approximately 177,000 rentable square feet for an aggregate sales price of $21.3 million, excluding closing costs. Financing Activities • Closed two mortgage loans with an aggregate principal balance of $69.2 million. The net proceeds from these mortgage loans were used to repay amounts outstanding under OPI's revolving credit facility. • Extended the maturity date of the mortgage loan secured by one of OPI's unconsolidated joint venture properties, in which OPI owns a 50% interest, by three years at the same interest rate in effect prior to the extension.

Q3 2023 6RETURN TO TABLE OF CONTENTS Third Quarter 2023 Results Washington, D.C. (dollars in thousands, except per share and per sq. ft. data) Three Months Ended September 30, Financial Results 2023 2022 Net (loss) income $ (19,593) $ 16,964 Net (loss) income per common share $ (0.41) $ 0.35 Normalized FFO $ 49,404 $ 53,802 Normalized FFO per common share $ 1.02 $ 1.11 Same Property Cash Basis NOI $ 73,630 $ 81,130 Three Months Ended Leasing Activity September 30, 2023 Leasing activity for new and renewal leases (rentable square feet) 586,000 Weighted average rental rate change (by rentable square feet) (2.7%) Weighted average lease term (by rentable square feet) 7.4 years Leasing concessions and capital commitments (per square foot per lease year) $ 5.89 As of Percent Leased September 30, 2023 June 30, 2023 September 30, 2022 All properties 89.9% 90.6% 90.7% Same properties 93.3% 94.4% 94.7%

Q3 2023 7RETURN TO TABLE OF CONTENTS Financials

Q3 2023 8RETURN TO TABLE OF CONTENTS As of and for the Three Months Ended As of 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 Selected Income Statement Data: Capitalization: Rental income $ 133,361 $ 133,997 $ 132,422 $ 127,922 $ 137,683 Total common shares (at end of period) 48,757,246 Net (loss) income $ (19,593) $ (12,242) $ (446) $ 6,390 $ 16,964 Closing price (at end of period) $ 4.10 NOI $ 83,698 $ 85,720 $ 83,772 $ 84,617 $ 85,546 Equity market capitalization (at end of period) $ 199,905 Adjusted EBITDAre $ 78,910 $ 81,013 $ 78,487 $ 79,479 $ 79,957 Debt (principal balance) 2,589,320 FFO $ 33,269 $ 42,532 $ 49,528 $ 55,186 $ 53,802 Total market capitalization $ 2,789,225 Normalized FFO $ 49,404 $ 53,713 $ 52,746 $ 54,495 $ 53,802 CAD $ 17,353 $ 15,782 $ 31,178 $ 9,800 $ 28,072 Liquidity: Rolling four quarter CAD $ 74,113 $ 84,832 $ 106,873 $ 126,701 $ 159,550 Cash and cash equivalents $ 24,358 Availability under $750,000 unsecured revolving credit facility (2) 550,000 Per Common Share Data (basic and diluted): Net (loss) income $ (0.41) $ (0.25) $ (0.01) $ 0.13 $ 0.35 Total liquidity $ 574,358 FFO $ 0.69 $ 0.88 $ 1.02 $ 1.14 $ 1.11 Normalized FFO $ 1.02 $ 1.11 $ 1.09 $ 1.13 $ 1.11 CAD $ 0.36 $ 0.33 $ 0.65 $ 0.20 $ 0.58 Rolling four quarter CAD $ 1.54 $ 1.76 $ 2.21 $ 2.62 $ 3.30 Dividends: Annualized dividends paid per common share during the period $ 1.00 $ 1.00 $ 2.20 $ 2.20 $ 2.20 Annualized dividend yield (at end of period) 24.4% 13.0% 17.9% 16.5% 15.7% Annualized normalized FFO payout ratio 24.5% 22.5% 50.5% 48.7% 49.5% Rolling four quarter CAD payout ratio (1) 64.9% 56.8% 99.5% 84.0% 66.7% Selected Balance Sheet Data: Total gross assets $ 4,672,646 $ 4,633,357 $ 4,591,512 $ 4,541,435 $ 4,507,422 Total assets $ 4,044,990 $ 4,027,568 $ 4,007,000 $ 3,979,977 $ 3,968,986 Total liabilities $ 2,740,357 $ 2,691,613 $ 2,647,359 $ 2,593,642 $ 2,562,821 Total shareholders' equity $ 1,304,633 $ 1,335,955 $ 1,359,641 $ 1,386,335 $ 1,406,165 (dollars in thousands, except per share data) Key Financial Data (1) Reflects the annualized dividends paid per common share during the period as a percentage of rolling four quarter CAD per common share. (2) Availability under OPI's revolving credit facility is subject to meeting required financial covenants.

Q3 2023 9RETURN TO TABLE OF CONTENTS Three Months Ended September 30, Nine Months Ended September 30, 2023 2022 2023 2022 Rental income $ 133,361 $ 137,683 $ 399,780 $ 426,353 Expenses: Real estate taxes 14,257 16,414 45,491 49,642 Utility expenses 7,460 7,986 20,462 20,671 Other operating expenses 27,946 27,737 80,637 81,597 Depreciation and amortization 52,266 52,988 155,559 170,993 Loss on impairment of real estate — — — 21,820 Acquisition and transaction related costs (1) 16,135 — 30,534 224 General and administrative 5,720 6,564 17,430 19,353 Total expenses 123,784 111,689 350,113 364,300 Gain on sale of real estate 244 16,925 487 7,437 Interest and other income 281 56 782 73 Interest expense (including net amortization of debt premiums, discounts and issuance costs of $2,276, $2,176, $6,808 and $6,946, respectively) (28,835) (24,969) (80,591) (78,923) Loss on early extinguishment of debt — — — (77) (Loss) income before income tax expense and equity in net losses of investees (18,733) 18,006 (29,655) (9,437) Income tax expense (95) (90) (336) (431) Equity in net losses of investees (765) (952) (2,290) (2,631) Net (loss) income $ (19,593) $ 16,964 $ (32,281) $ (12,499) Weighted average common shares outstanding (basic and diluted) 48,403 48,286 48,365 48,260 Per common share amounts (basic and diluted): Net (loss) income $ (0.41) $ 0.35 $ (0.67) $ (0.27) Additional Data: General and administrative expenses / total assets (at end of period) 0.14% 0.17% 0.43% 0.49% Non-cash straight line rent adjustments included in rental income $ 8,691 $ 1,765 $ 17,120 $ 7,226 Lease value amortization included in rental income $ 56 $ (204) $ 196 $ (780) Lease termination fees included in rental income $ 1,576 $ 83 $ 3,160 $ 7,200 Non-cash amortization included in other operating expenses (2) $ 121 $ 121 $ 363 $ 363 Non-cash amortization included in general and administrative expenses (2) $ 151 $ 151 $ 453 $ 453 (amounts in thousands, except per share data) (1) Acquisition and transaction related costs consist of costs related to OPI's evaluation of potential acquisitions, dispositions, financing and other strategic transactions, including costs incurred in connection with OPI's terminated merger with Diversified Healthcare Trust, or DHC, and related transactions. (2) OPI recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price OPI paid for its former investment in The RMR Group Inc., or RMR Inc., common stock in June 2015. This liability is being amortized on a straight line basis through December 31, 2035 as an allocated reduction to business management fee expense and property management fee expense, which are included in general and administrative and other operating expenses, respectively. Condensed Consolidated Statements of Income (Loss)

Q3 2023 10RETURN TO TABLE OF CONTENTS September 30, December 31, 2023 2022 ASSETS Real estate properties: Land $ 802,904 $ 821,238 Buildings and improvements 3,260,732 3,114,836 Total real estate properties, gross 4,063,636 3,936,074 Accumulated depreciation (627,656) (561,458) Total real estate properties, net 3,435,980 3,374,616 Assets of properties held for sale 16,942 2,516 Investments in unconsolidated joint ventures 36,602 35,129 Acquired real estate leases, net 295,195 369,333 Cash and cash equivalents 24,358 12,249 Restricted cash 15,270 — Rents receivable 124,043 105,639 Deferred leasing costs, net 85,087 73,098 Other assets, net 11,513 7,397 Total assets $ 4,044,990 $ 3,979,977 LIABILITIES AND SHAREHOLDERS’ EQUITY Unsecured revolving credit facility $ 200,000 $ 195,000 Senior unsecured notes, net 2,193,577 2,187,875 Mortgage notes payable, net 172,331 49,917 Liabilities of properties held for sale 346 73 Accounts payable and other liabilities 154,061 140,151 Due to related persons 7,766 6,469 Assumed real estate lease obligations, net 12,276 14,157 Total liabilities 2,740,357 2,593,642 Commitments and contingencies Shareholders’ equity: Common shares of beneficial interest, $.01 par value: 200,000,000 shares authorized, 48,757,246 and 48,565,644 shares issued and outstanding, respectively 488 486 Additional paid in capital 2,621,107 2,619,532 Cumulative net income 137,325 169,606 Cumulative common distributions (1,454,287) (1,403,289) Total shareholders’ equity 1,304,633 1,386,335 Total liabilities and shareholders’ equity $ 4,044,990 $ 3,979,977 Condensed Consolidated Balance Sheets (dollars in thousands, except per share data) Indianapolis, IN

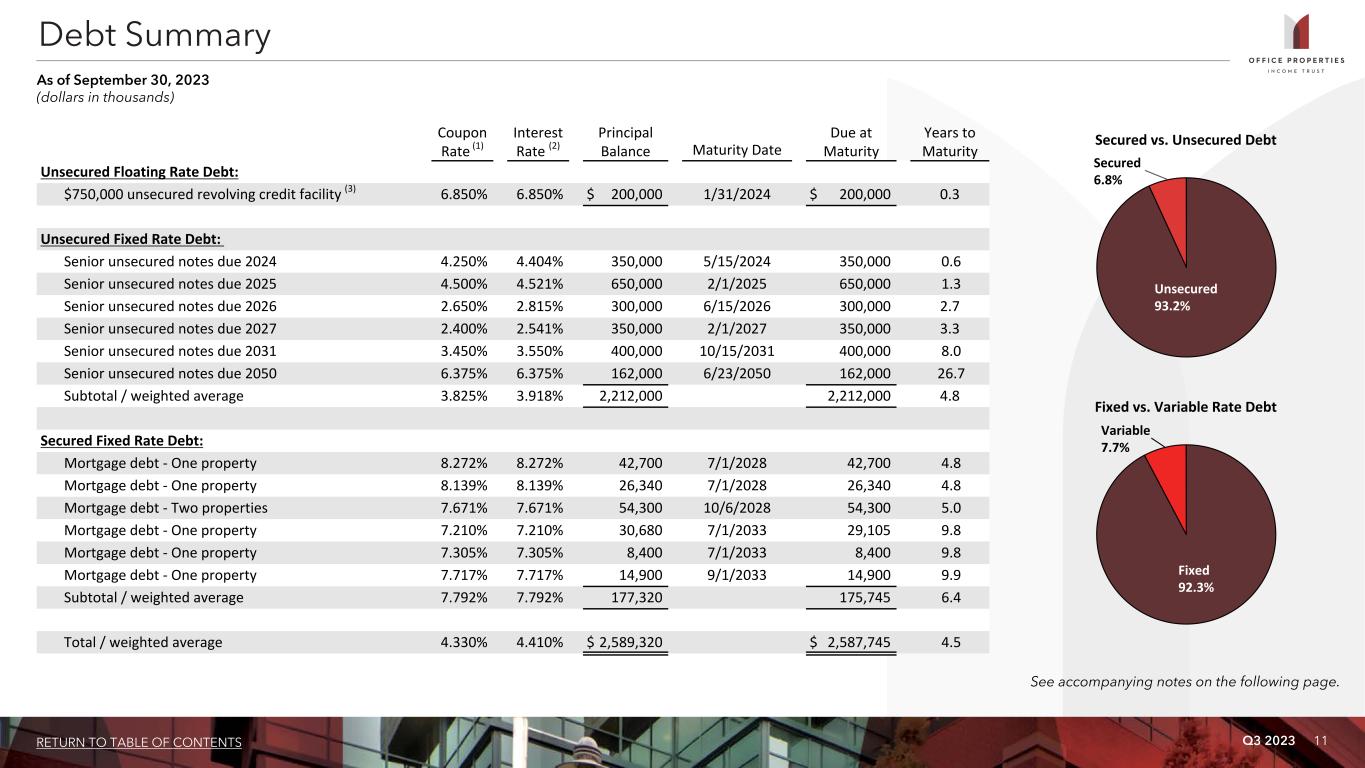

Q3 2023 11RETURN TO TABLE OF CONTENTS Fixed vs. Variable Rate Debt Fixed 92.3% Variable 7.7% Coupon Rate (1) Interest Rate (2) Principal Balance Maturity Date Due at Maturity Years to Maturity Unsecured Floating Rate Debt: $750,000 unsecured revolving credit facility (3) 6.850% 6.850% $ 200,000 1/31/2024 $ 200,000 0.3 Unsecured Fixed Rate Debt: Senior unsecured notes due 2024 4.250% 4.404% 350,000 5/15/2024 350,000 0.6 Senior unsecured notes due 2025 4.500% 4.521% 650,000 2/1/2025 650,000 1.3 Senior unsecured notes due 2026 2.650% 2.815% 300,000 6/15/2026 300,000 2.7 Senior unsecured notes due 2027 2.400% 2.541% 350,000 2/1/2027 350,000 3.3 Senior unsecured notes due 2031 3.450% 3.550% 400,000 10/15/2031 400,000 8.0 Senior unsecured notes due 2050 6.375% 6.375% 162,000 6/23/2050 162,000 26.7 Subtotal / weighted average 3.825% 3.918% 2,212,000 2,212,000 4.8 Secured Fixed Rate Debt: Mortgage debt - One property 8.272% 8.272% 42,700 7/1/2028 42,700 4.8 Mortgage debt - One property 8.139% 8.139% 26,340 7/1/2028 26,340 4.8 Mortgage debt - Two properties 7.671% 7.671% 54,300 10/6/2028 54,300 5.0 Mortgage debt - One property 7.210% 7.210% 30,680 7/1/2033 29,105 9.8 Mortgage debt - One property 7.305% 7.305% 8,400 7/1/2033 8,400 9.8 Mortgage debt - One property 7.717% 7.717% 14,900 9/1/2033 14,900 9.9 Subtotal / weighted average 7.792% 7.792% 177,320 175,745 6.4 Total / weighted average 4.330% 4.410% $ 2,589,320 $ 2,587,745 4.5 See accompanying notes on the following page. Secured vs. Unsecured Debt Unsecured 93.2% Secured 6.8% Debt Summary As of September 30, 2023 (dollars in thousands)

Q3 2023 12RETURN TO TABLE OF CONTENTS $— $350,000 $650,000 $300,000 $350,000 $562,000 $200,000 $177,320 Unsecured Fixed Rate Debt Unsecured Floating Rate Debt Secured Fixed Rate Debt 2023 2024 2025 2026 2027 2028 and thereafter $0 $200,000 $400,000 $600,000 $800,000 Year Unsecured Floating Rate Debt Unsecured Fixed Rate Debt Secured Fixed Rate Debt Total Debt % of Total Debt 2023 $ — $ — $ — $ — —% 2024 200,000 350,000 — 550,000 21.2% 2025 — 650,000 — 650,000 25.1% 2026 — 300,000 — 300,000 11.6% 2027 — 350,000 — 350,000 13.5% 2028 and thereafter — 562,000 177,320 739,320 28.6% Total principal balance $ 200,000 $ 2,212,000 $ 177,320 $ 2,589,320 100.0% Percent of total principal balance 7.7% 85.4% 6.9% 100.0% Debt Maturity Schedule As of September 30, 2023 (dollars in thousands) (1) Reflects the interest rate stated in, or determined pursuant to, the contract terms. (2) Includes the effect of discounts and premiums on senior unsecured notes. Excludes the effect of debt issuance costs amortization. (3) OPI is required to pay interest at a rate of SOFR plus a premium, which was 145 basis points per annum as of September 30, 2023. OPI also pays a facility fee, which was 30 basis points per annum on the total amount of lending commitments under its revolving credit facility as of September 30, 2023. Both the interest rate premium and facility fee are subject to adjustment based upon changes to OPI's credit ratings. The interest rate listed is as of September 30, 2023 and excludes the 30 basis point facility fee. (4) Represents the amount outstanding under OPI's revolving credit facility at September 30, 2023. (4)

Q3 2023 13RETURN TO TABLE OF CONTENTS Leverage Ratios, Coverage Ratios and Public Debt Covenants As of and for the Three Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Leverage Ratios: Net debt / total gross assets 54.9% 54.7% 54.1% 53.8% 53.4% Net debt / gross book value of real estate assets 49.1% 48.9% 48.2% 48.0% 47.7% Secured debt / total assets 4.4% 2.7% 1.2% 1.3% 1.8% Variable rate debt / net debt 7.8% 9.5% 9.9% 8.0% 5.6% Coverage Ratios: Adjusted EBITDAre / interest expense 2.7x 3.1x 3.1x 3.2x 3.2x Net debt / rolling four quarter Adjusted EBITDAre (1) 8.1x 7.9x 7.7x 7.3x 7.0x Public Debt Covenants: Maintenance Covenant Total unencumbered assets / unsecured debt (minimum 150.0%) 206.2% 206.2% 208.6% 210.2% 209.5% Incurrence Covenants Total debt / adjusted total assets (maximum 60.0%) 48.5% 48.4% 47.9% 47.6% 47.4% Secured debt / adjusted total assets (maximum 40.0%) 3.3% 2.0% 1.0% 1.0% 1.4% Consolidated income available for debt service / debt service (minimum 1.50x) 2.9x 3.0x 3.1x 3.2x 3.2x (1) The ratio of net debt / annualized Adjusted EBITDAre for the three months ended September 30, 2023 was 8.2x. Chicago, IL

Q3 2023 14RETURN TO TABLE OF CONTENTS For the Three Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 Lease related costs $ 15,677 $ 28,252 $ 13,041 $ 24,776 $ 17,297 Building improvements 8,516 5,355 4,582 17,323 8,585 Recurring capital expenditures 24,193 33,607 17,623 42,099 25,882 Development, redevelopment and other activities (1) 28,326 40,435 49,471 44,552 36,811 Total capital expenditures $ 52,519 $ 74,042 $ 67,094 $ 86,651 $ 62,693 Average rentable sq. ft. during period 20,745 20,840 20,932 21,090 21,851 Building improvements per average sq. ft. during period $ 0.41 $ 0.26 $ 0.22 $ 0.82 $ 0.39 Capital Expenditures Summary and Significant Redevelopment Information (dollars and sq. ft. in thousands, except per sq. ft. data) Address Location Sq. Ft. % Leased Estimated Project Costs (2) Total Costs Incurred Estimated Completion (3) 20 Massachusetts Avenue (4) Washington, D.C. 427 55% $ 227,000 $ 182,839 Substantially Complete 351, 401, 501 Elliott Ave West Seattle, WA 300 28% 162,000 117,873 Q1 2024 Total significant redevelopment projects 727 $ 389,000 $ 300,712 Significant Redevelopment Information as of September 30, 2023 (1) Includes capitalized interest and other operating costs of $13,207 since July 1, 2022. (2) Estimated project costs include future, estimated lease related costs associated with achieving stabilized occupancy that will be incurred subsequent to the estimated completion date. (3) Estimated completion date can depend on various factors, including when lease agreements are signed with tenants. Therefore, the actual completion dates may vary. (4) Physical improvements made at this project were substantially completed during the second quarter of 2023. OPI expects to incur additional, lease related costs subsequent to substantial completion. Capital Expenditures Summary Carlsbad, CA

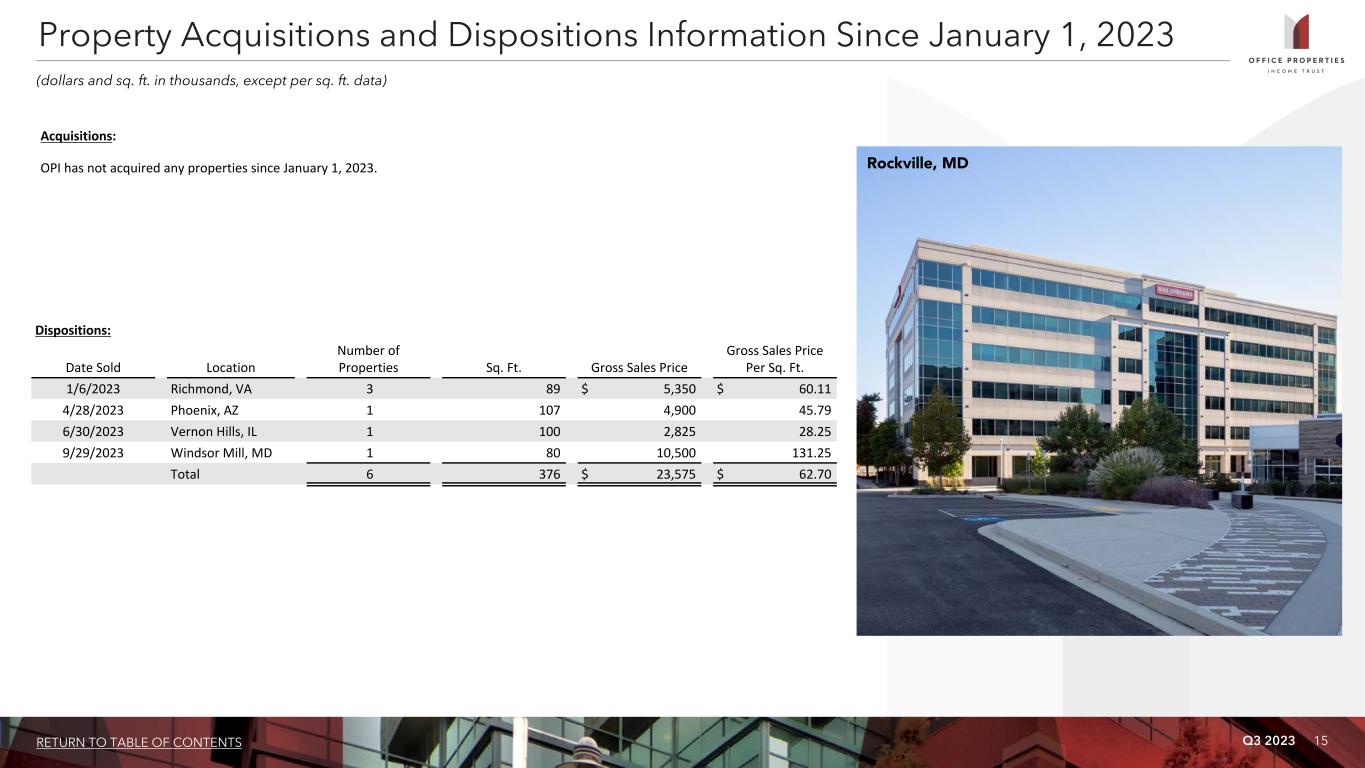

Q3 2023 15RETURN TO TABLE OF CONTENTS Acquisitions: OPI has not acquired any properties since January 1, 2023. Dispositions: Date Sold Location Number of Properties Sq. Ft. Gross Sales Price Gross Sales Price Per Sq. Ft. 1/6/2023 Richmond, VA 3 89 $ 5,350 $ 60.11 4/28/2023 Phoenix, AZ 1 107 4,900 45.79 6/30/2023 Vernon Hills, IL 1 100 2,825 28.25 9/29/2023 Windsor Mill, MD 1 80 10,500 131.25 Total 6 376 $ 23,575 $ 62.70 Property Acquisitions and Dispositions Information Since January 1, 2023 (dollars and sq. ft. in thousands, except per sq. ft. data) Rockville, MD

Q3 2023 16RETURN TO TABLE OF CONTENTS Unconsolidated Joint Ventures: Joint Venture OPI Ownership OPI Investment Number of Properties Location Sq. Ft. Occupancy Weighted Average Remaining Lease Term (1) Prosperity Metro Plaza 51% $ 18,455 2 Fairfax, VA 329 69.7% 2.9 years 1750 H Street, NW 50% 18,147 1 Washington, D.C. 122 41.5% 9.7 years Total / Weighted Average $ 36,602 3 451 62.0% 4.4 years (1) Lease term is weighted based on annualized rental income. (2) Includes the effect of interest rate protection and mark to market accounting. (3) Reflects OPI's proportionate share of the principal debt balances based on its ownership percentage of the applicable joint venture; none of the debt is recourse to OPI. (4) The mortgage loan requires interest-only payments through December 2024, at which time the loan requires principal and interest payments through its maturity date. (5) In July 2023, the maturity date of this mortgage loan was extended by three years at the same interest rate. (6) Reflects OPI's proportionate share of operating results based on its ownership percentage of the respective joint ventures. (7) Includes interest expense, net of other income. (8) OPI's unconsolidated joint ventures report rental income on a straight line basis over the terms of the respective leases; accordingly, rental income includes non-cash straight line rent adjustments. Rental income also includes expense reimbursements, tax escalations, parking revenues, service income and other fixed and variable charges paid to the unconsolidated joint ventures by their tenants, as well as the net effect of non- cash amortization of intangible lease assets and liabilities. Investments in Unconsolidated Joint Ventures As of September 30, 2023 (dollars and sq. ft. in thousands) Results of Operations - Unconsolidated Joint Ventures: (6) For the Three Months Ended September 30, 2023 For the Nine Months Ended September 30, 2023 Prosperity Metro Plaza 1750 H Street, NW Total Prosperity Metro Plaza 1750 H Street, NW Total Equity in losses $ (355) $ (410) $ (765) $ (782) $ (1,508) $ (2,290) Depreciation and amortization 656 184 840 1,996 542 2,538 Other expenses, net (7) 233 149 382 640 446 1,086 NOI 534 (77) 457 1,854 (520) 1,334 Lease value amortization included in rental income (8) (1) — (1) (3) — (3) Non-cash straight line rent adjustments included in rental income (8) (55) (223) (278) (189) (386) (575) Cash Basis NOI $ 478 $ (300) $ 178 $ 1,662 $ (906) $ 756 Contributions paid by OPI $ — $ — $ — $ — $ (3,763) $ (3,763) Outstanding Unconsolidated Debt: Joint Venture OPI Ownership Interest Rate (2) Maturity Date Principal Balance Annualized Debt Service Principal Balance at Maturity OPI Share of Principal Balance (3) Prosperity Metro Plaza (4) 51% 4.090% 12/1/2029 $ 50,000 $ 2,045 $ 45,246 $ 25,500 1750 H Street, NW (5) 50% 3.690% 8/1/2027 32,000 1,181 32,000 16,000 Total / Weighted Average 3.934% $ 82,000 $ 3,226 $ 77,246 $ 41,500

Q3 2023 17RETURN TO TABLE OF CONTENTS Portfolio Information

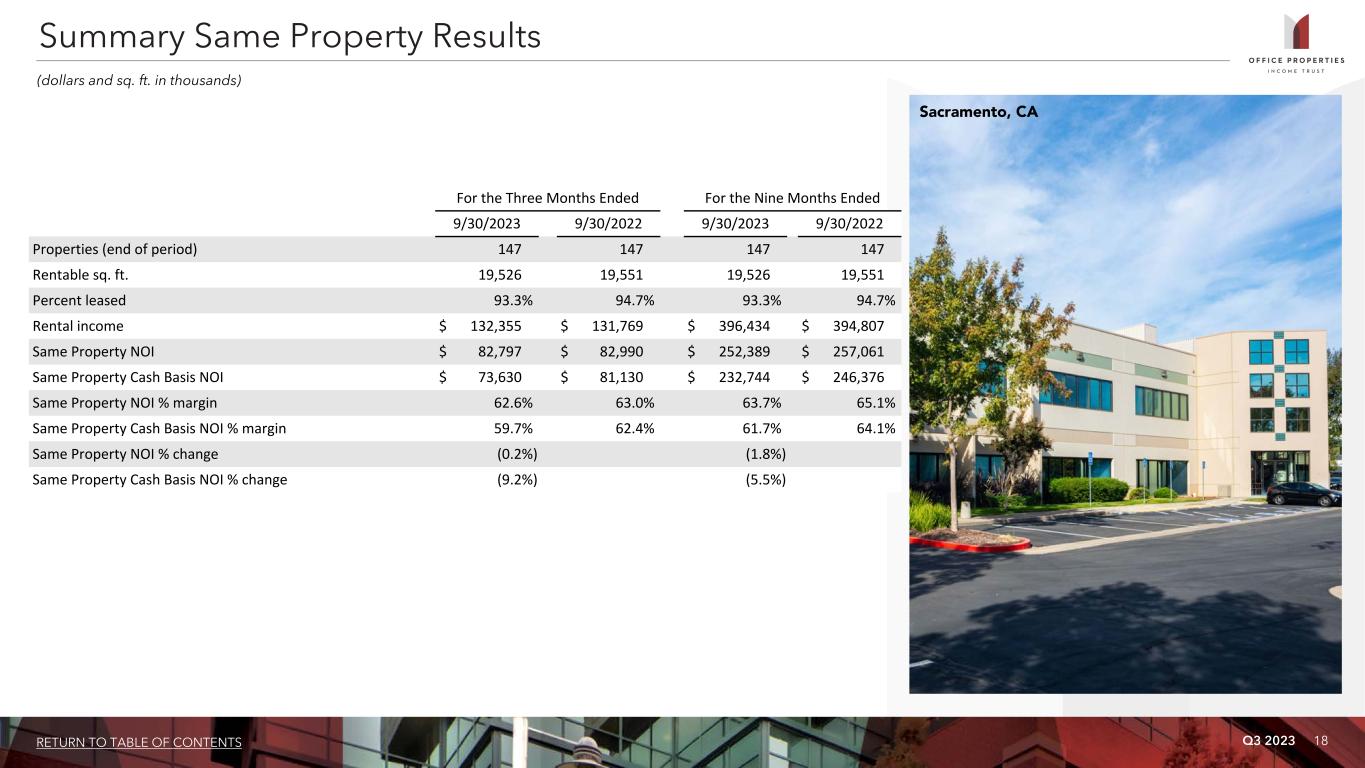

Q3 2023 18RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Nine Months Ended 9/30/2023 9/30/2022 9/30/2023 9/30/2022 Properties (end of period) 147 147 147 147 Rentable sq. ft. 19,526 19,551 19,526 19,551 Percent leased 93.3% 94.7% 93.3% 94.7% Rental income $ 132,355 $ 131,769 $ 396,434 $ 394,807 Same Property NOI $ 82,797 $ 82,990 $ 252,389 $ 257,061 Same Property Cash Basis NOI $ 73,630 $ 81,130 $ 232,744 $ 246,376 Same Property NOI % margin 62.6% 63.0% 63.7% 65.1% Same Property Cash Basis NOI % margin 59.7% 62.4% 61.7% 64.1% Same Property NOI % change (0.2%) (1.8%) Same Property Cash Basis NOI % change (9.2%) (5.5%) Summary Same Property Results (dollars and sq. ft. in thousands) Sacramento, CA

Q3 2023 19RETURN TO TABLE OF CONTENTS As of and for the Three Months Ended As of and for the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 Properties (end of period) (1) 154 155 157 160 162 154 Rentable sq. ft. (1) 20,705 20,784 20,895 20,969 21,211 20,705 Percentage leased 89.9% 90.6% 90.5% 90.6% 90.7% 89.9% Leasing Activity (sq. ft.): New leases 104 196 91 3 223 391 Renewals 482 517 112 702 383 1,111 Total 586 713 203 705 606 1,502 % Change in GAAP Rent: (2) New leases 1.9% 6.1% (16.8%) 0.0% 59.1% (1.3%) Renewals (3.7%) 2.8% (19.7%) (7.1%) 0.2% (3.7%) Total (2.7%) 3.7% (18.5%) (6.7%) 21.6% (3.1%) Weighted Average Lease Term by Sq. Ft. (years): New leases 9.5 8.9 7.2 5.0 9.9 8.7 Renewals 6.9 10.8 6.4 10.1 5.5 8.7 Total 7.4 10.3 6.8 10.1 7.2 8.7 Leasing Cost and Concession Commitments: New leases $ 13,623 $ 15,894 $ 4,995 $ 213 $ 33,957 $ 34,512 Renewals 11,736 24,744 3,752 60,076 9,056 40,232 Total $ 25,359 $ 40,638 $ 8,747 $ 60,289 $ 43,013 $ 74,744 Leasing Cost and Concession Commitments per Sq. Ft.: New leases $ 131.54 $ 81.10 $ 55.17 $ 92.00 $ 152.13 $ 88.47 Renewals $ 24.36 $ 47.87 $ 33.52 $ 85.55 $ 23.66 $ 36.23 Total $ 43.33 $ 57.01 $ 43.20 $ 85.57 $ 70.98 $ 49.81 Leasing Cost and Concession Commitments per Sq. Ft. per Year: New leases $ 13.84 $ 9.08 $ 7.67 $ 18.40 $ 15.33 $ 10.19 Renewals $ 3.53 $ 4.42 $ 5.20 $ 8.44 $ 4.27 $ 4.17 Total $ 5.89 $ 5.53 $ 6.37 $ 8.46 $ 9.92 $ 5.74 (1) Includes one leasable land parcel for periods prior to December 31, 2022. (2) Percent difference in prior rents charged for same space or, in the case of space acquired vacant, market rental rates for similar space in the building at the date of acquisition. Rents include estimated recurring expense reimbursements paid to us, exclude lease value amortization and are net of lease concessions. Occupancy and Leasing Summary (dollars and sq. ft. in thousands, except per sq. ft. data) This leasing summary is based on leases entered during the periods indicated.

Q3 2023 20RETURN TO TABLE OF CONTENTS Investment Grade 64.0% Non-Investment Grade 5.9% Not Rated 30.1% Percentage of Total Annualized Rental Income Tenant Credit Characteristics ( 4 ) (3) Tenant Industry Tenant Diversity and Credit Characteristics As of September 30, 2023 (1) (1) Includes state governments and municipalities. US Government: 20.0% Real Estate & Financials: 15.5% Technology & Communications: 15.3% Legal & Other Professional Services: 12.4% Manufacturing & Transportation: 10.8% Other Government: 8.1% Government Contractors: 6.9% Life Sciences and Medical: 3.1% Food: 2.8% Hospitality: 2.2% Energy Services: 1.4% Other: 1.5% (1) Irving, TX

Q3 2023 21RETURN TO TABLE OF CONTENTS Tenant Credit Rating Sq. Ft. % of Leased Sq. Ft. Annualized Rental Income % of Total Annualized Rental Income 1 U.S. Government Investment Grade 3,822 20.5% $ 105,955 20.0% 2 Alphabet Inc. (Google) Investment Grade 386 2.1% 22,119 4.2% 3 Shook, Hardy & Bacon L.L.P. Not Rated 596 3.2% 19,216 3.6% 4 Bank of America Corporation Investment Grade 577 3.1% 18,159 3.4% 5 IG Investments Holdings LLC Not Rated 339 1.8% 17,303 3.3% 6 State of California Investment Grade 519 2.8% 15,893 3.0% 7 Tyson Foods, Inc. (1) Investment Grade 248 1.3% 11,954 2.3% 8 Northrop Grumman Corporation Investment Grade 337 1.8% 10,795 2.0% 9 Sonesta International Hotels Corporation Not Rated 234 1.3% 10,745 2.0% 10 CommScope Holding Company Inc. Non Investment Grade 228 1.2% 9,582 1.8% 11 Sonoma Biotherapeutics, Inc. (2) Not Rated 107 0.6% 7,634 1.4% 12 State of Georgia Investment Grade 308 1.7% 7,345 1.4% 13 Commonwealth of Massachusetts Investment Grade 212 1.1% 7,269 1.4% 14 PNC Bank Investment Grade 441 2.4% 6,960 1.3% 15 Micro Focus International plc Non Investment Grade 215 1.2% 6,836 1.3% 16 Compass Group plc Investment Grade 267 1.4% 6,697 1.3% 17 ServiceNow, Inc. Investment Grade 149 0.8% 6,675 1.3% 18 Allstate Insurance Co. Investment Grade 468 2.5% 6,484 1.2% 19 Automatic Data Processing, Inc. Investment Grade 289 1.6% 6,079 1.1% 20 Church & Dwight Co., Inc. Investment Grade 250 1.3% 6,043 1.1% 21 Leidos Holdings Inc. Investment Grade 159 0.9% 5,950 1.1% 22 Primerica, Inc. Investment Grade 344 1.8% 5,737 1.1% 10,495 56.4% $ 321,430 60.6% Tenants Representing 1% or More of Total Annualized Rental Income As of September 30, 2023 (dollars and sq. ft. in thousands) (1) In July 2023, OPI received notice from Tyson Foods, Inc. exercising its option to terminate its lease at a property OPI owns in Chicago, IL effective January 2025, prior to the stated lease expiration date of January 31, 2028. OPI is amortizing termination fees of approximately $1.4 million per quarter through January 2025 as a result of this early termination. (2) In August 2022, OPI entered into an approximately 10-year lease with Sonoma Biotherapeutics, Inc. The lease is at a property OPI owns in Seattle, WA that is currently undergoing redevelopment. The term of the lease is estimated to commence in the first quarter of 2024.

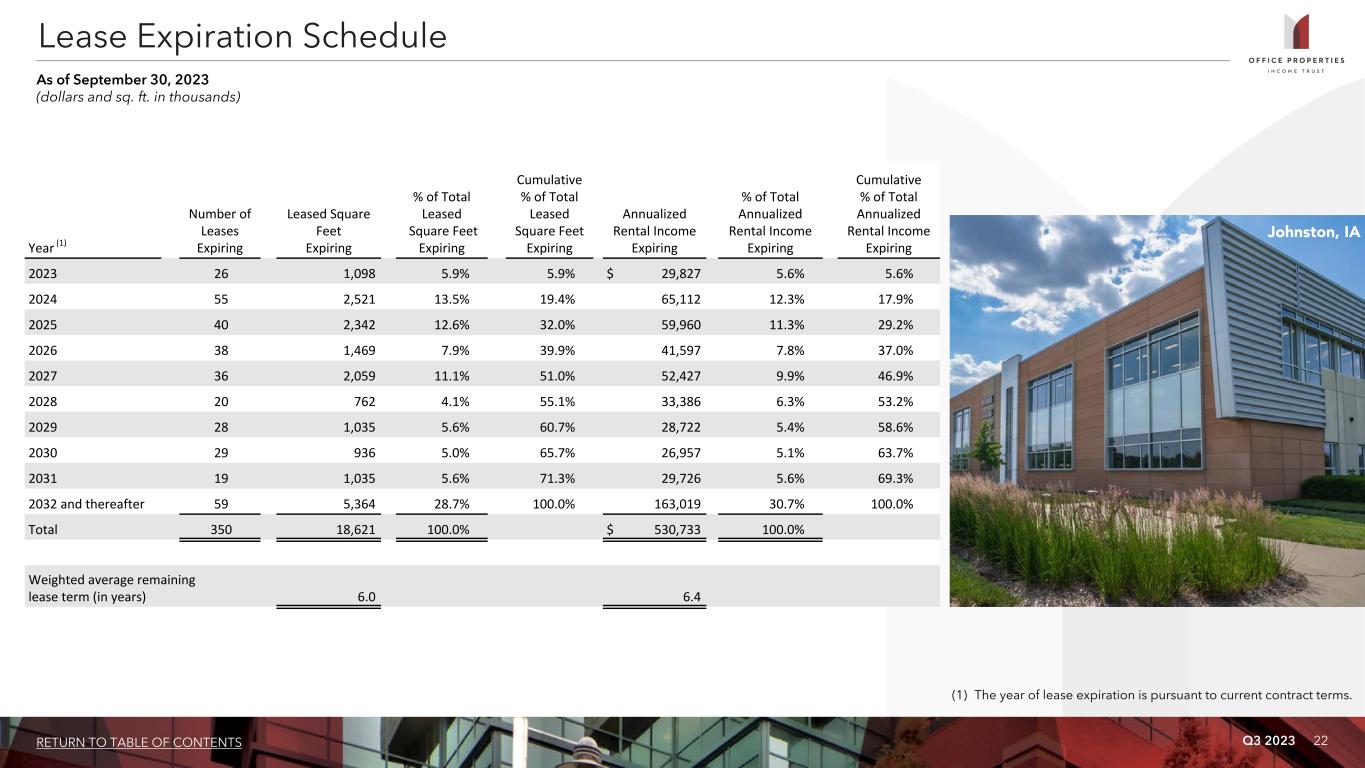

Q3 2023 22RETURN TO TABLE OF CONTENTS Year (1) Number of Leases Expiring Leased Square Feet Expiring % of Total Leased Square Feet Expiring Cumulative % of Total Leased Square Feet Expiring Annualized Rental Income Expiring % of Total Annualized Rental Income Expiring Cumulative % of Total Annualized Rental Income Expiring 2023 26 1,098 5.9% 5.9% $ 29,827 5.6% 5.6% 2024 55 2,521 13.5% 19.4% 65,112 12.3% 17.9% 2025 40 2,342 12.6% 32.0% 59,960 11.3% 29.2% 2026 38 1,469 7.9% 39.9% 41,597 7.8% 37.0% 2027 36 2,059 11.1% 51.0% 52,427 9.9% 46.9% 2028 20 762 4.1% 55.1% 33,386 6.3% 53.2% 2029 28 1,035 5.6% 60.7% 28,722 5.4% 58.6% 2030 29 936 5.0% 65.7% 26,957 5.1% 63.7% 2031 19 1,035 5.6% 71.3% 29,726 5.6% 69.3% 2032 and thereafter 59 5,364 28.7% 100.0% 163,019 30.7% 100.0% Total 350 18,621 100.0% $ 530,733 100.0% Weighted average remaining lease term (in years) 6.0 6.4 (1) The year of lease expiration is pursuant to current contract terms. Lease Expiration Schedule As of September 30, 2023 (dollars and sq. ft. in thousands) Johnston, IA

Q3 2023 23RETURN TO TABLE OF CONTENTS Appendix

Q3 2023 24RETURN TO TABLE OF CONTENTS The Company: OPI is included in 153 market indices and comprises more than 1% of the following indices as of September 30, 2023: Bloomberg US Micro Cap Real Estate Price Return Index (BMICR), Invesco S&P SmallCap High Dividend Low Volatility ETF INAV Index (XSHDIV), BI North America Office REIT Valuation Peers (BROFFRTV), Bloomberg Real Estate Investment Trust Small Cap Index (BBRESMLC) and Invesco KBW Premium Yield Equity REIT ETF INAV Index (KBWYIV). Management: OPI is managed by The RMR Group (Nasdaq: RMR). RMR is an alternative asset management company that is focused on commercial real estate and related businesses. RMR primarily provides management services to publicly traded real estate companies, privately held real estate funds and real estate related operating businesses. As of September 30, 2023, RMR had approximately $36 billion of real estate assets under management and the combined RMR managed companies had more than $5 billion of annual revenues, over 2,000 properties and over 20,000 employees. OPI believes that being managed by RMR is a competitive advantage for OPI because of RMR’s depth of management and experience in the real estate industry. OPI also believes RMR provides management services to it at costs that are lower than OPI would have to pay for similar quality services if OPI were self managed. Company Profile and Research Coverage Equity Research Coverage B. Riley Securities, Inc. RBC Capital Markets Bryan Maher Michael Carroll bmaher@brileyfin.com michael.carroll@rbccm.com (646) 885-5423 (440) 715-2649 Morgan Stanley Ronald Kamdem ronald.kamdem@morganstanley.com (212) 296-8319 Rating Agencies and Issuer Ratings Moody's Investors Service S&P Global Ranjini Venkatesan Alan Zigman Ranjini.Venkatesan@moodys.com alan.zigman@spglobal.com (212) 553-3828 (416) 507-2556 Rating: B2 Rating: BB- OPI is followed by the analysts and its credit is rated by the rating agencies listed on this page. Please note that any opinions, estimates or forecasts regarding OPI’s performance made by these analysts or agencies do not represent opinions, forecasts or predictions of OPI or its management. OPI does not by its reference above imply its endorsement of or concurrence with any information, conclusions or recommendations provided by any of these analysts or agencies.

Q3 2023 25RETURN TO TABLE OF CONTENTS San Diego, CA Governance Information Board of Trustees Donna D. Fraiche Barbara D. Gilmore John L. Harrington Independent Trustee Independent Trustee Independent Trustee William A. Lamkin Elena B. Poptodorova Jeffrey P. Somers Independent Trustee Lead Independent Trustee Independent Trustee Mark A. Talley Jennifer B. Clark Adam D. Portnoy Independent Trustee Managing Trustee Chair of the Board & Managing Trustee Executive Officers Christopher J. Bilotto Brian E. Donley President and Chief Executive Officer Chief Financial Officer and Treasurer

Q3 2023 26RETURN TO TABLE OF CONTENTS Non-GAAP Financial Measures OPI presents certain “non-GAAP financial measures” within the meaning of the applicable rules of the Securities and Exchange Commission, or the SEC, including NOI, Cash Basis NOI, Same Property NOI, Same Property Cash Basis NOI, EBITDA, EBITDAre, Adjusted EBITDAre, FFO, Normalized FFO and CAD. These measures do not represent cash generated by operating activities in accordance with GAAP and should not be considered alternatives to net (loss) income as indicators of OPI's operating performance or as measures of OPI's liquidity. These measures should be considered in conjunction with net (loss) income as presented in OPI's condensed consolidated statements of income (loss). OPI considers these non-GAAP measures to be appropriate supplemental measures of operating performance for a REIT, along with net (loss) income. OPI believes these measures provide useful information to investors because by excluding the effects of certain historical amounts, such as depreciation and amortization expense, they may facilitate a comparison of OPI's operating performance between periods and with other REITs and, in the case of NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI reflecting only those income and expense items that are generated and incurred at the property level may help both investors and management to understand the operations of OPI's properties. NOI and Cash Basis NOI The calculations of net operating income, or NOI, and Cash Basis NOI exclude certain components of net (loss) income in order to provide results that are more closely related to OPI's property level results of operations. OPI calculates NOI and Cash Basis NOI as shown on page 28 and Same Property NOI and Same Property Cash Basis NOI as shown on page 29. OPI defines NOI as income from OPI's rental of real estate less OPI's property operating expenses. NOI excludes amortization of capitalized tenant improvement costs and leasing commissions that OPI records as depreciation and amortization expense. OPI defines Cash Basis NOI as NOI excluding non-cash straight line rent adjustments, lease value amortization, lease termination fees, if any, and non-cash amortization included in other operating expenses. OPI calculates Same Property NOI and Same Property Cash Basis NOI in the same manner that OPI calculates the corresponding NOI and Cash Basis NOI amounts, except that OPI only includes same properties in calculating Same Property NOI and Same Property Cash Basis NOI. OPI uses NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI to evaluate individual and company-wide property level performance. Other real estate companies and REITs may calculate NOI, Cash Basis NOI, Same Property NOI and Same Property Cash Basis NOI differently than OPI does. EBITDA, EBITDAre and Adjusted EBITDAre OPI calculates earnings before interest, taxes, depreciation and amortization, or EBITDA, EBITDA for real estate, or EBITDAre, and Adjusted EBITDAre as shown on page 30. EBITDAre is calculated on the basis defined by The National Association of Real Estate Investment Trusts, or Nareit, which is EBITDA, excluding gains and losses on the sale of real estate, loss on impairment of real estate assets and adjustments to reflect OPI's share of EBITDAre of its unconsolidated joint ventures. In calculating Adjusted EBITDAre, OPI adjusts for the items shown on page 30 and include business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of OPI's core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. Other real estate companies and REITs may calculate EBITDA, EBITDAre and Adjusted EBITDAre differently than OPI does. FFO and Normalized FFO OPI calculates funds from operations, or FFO, and Normalized FFO as shown on page 31. FFO is calculated on the basis defined by Nareit, which is net (loss) income, calculated in accordance with GAAP, plus real estate depreciation and amortization of consolidated properties and OPI's proportionate share of the real estate depreciation and amortization of unconsolidated joint venture properties, but excluding impairment charges on real estate assets and any gain or loss on sale of real estate, as well as certain other adjustments currently not applicable to us. In calculating Normalized FFO, OPI adjusts for the other items shown on page 31 and includes business management incentive fees, if any, only in the fourth quarter versus the quarter when they are recognized as an expense in accordance with GAAP due to their quarterly volatility not necessarily being indicative of OPI's core operating performance and the uncertainty as to whether any such business management incentive fees will be payable when all contingencies for determining such fees are known at the end of the calendar year. FFO and Normalized FFO are among the factors considered by OPI's Board of Trustees when determining the amount of distributions to OPI's shareholders. Other factors include, but are not limited to, requirements to maintain OPI's qualification for taxation as a REIT, limitations in OPI's credit agreement and public debt covenants, the availability to OPI of debt and equity capital, OPI's expectation of its future capital requirements and operating performance and OPI's expected needs for and availability of cash to pay its obligations. Other real estate companies and REITs may calculate FFO and Normalized FFO differently than OPI does. Cash Available for Distribution OPI calculates cash available for distribution, or CAD, as shown on page 31. OPI defines CAD as Normalized FFO minus recurring real estate related capital expenditures and adjusted for other non-cash and non- recurring items and certain amounts excluded from Normalized FFO but settled in cash. CAD is among the factors considered by OPI's Board of Trustees when determining the amount of distributions to OPI's shareholders. Other real estate companies and REITs may calculate CAD differently than OPI does. Non-GAAP Financial Measures and Certain Definitions

Q3 2023 27RETURN TO TABLE OF CONTENTS Adjusted total assets and total unencumbered assets include the original cost of real estate assets calculated in accordance with GAAP before impairment writedowns, if any, and exclude depreciation and amortization, accounts receivable and intangible assets. Annualized dividend yield is the annualized dividend per common share paid during the period divided by the closing price of OPI's common shares at the end of the period. Annualized rental income is calculated using the annualized contractual base rents from OPI's tenants pursuant to its lease agreements as of September 30, 2023, plus straight line rent adjustments and estimated recurring expense reimbursements to be paid to OPI, and excluding lease value amortization. Building improvements generally include expenditures to replace obsolete building components and expenditures that extend the useful life of existing assets. Cap rate represents the ratio of (x) annual straight line rental income, excluding the impact of above and below market lease amortization, based on existing leases at the acquisition date, less estimated annual property operating expenses as of the date of the acquisition, excluding depreciation and amortization expense, to (y) the acquisition purchase price. Consolidated income available for debt service is earnings from operations excluding interest expense, depreciation and amortization, loss on asset impairment, gains and losses on early extinguishment of debt, gains and losses on sales of properties and equity in earnings of unconsolidated joint ventures and including distributions from OPI's unconsolidated joint ventures, if any, determined together with debt service for the period presented. Development, redevelopment and other activities generally include capital expenditure projects that reposition a property or result in new sources of revenue. GAAP is U.S. generally accepted accounting principles. Gross book value of real estate assets is real estate properties at cost, plus certain acquisition costs, if any, before depreciation and purchase price allocations, less impairment writedowns, if any. Gross sales price is equal to the gross contract price and excludes closing costs. Investment grade tenants include: (a) investment grade rated tenants; (b) tenants with investment grade rated parent entities that guarantee the tenant's lease obligations; and/or (c) tenants with investment grade rated parent entities that do not guarantee the tenant's lease obligations. Tenants contributing 53.6% of annualized rental income as of September 30, 2023 were investment grade rated (or their payment obligations were guaranteed by an investment grade rated parent) and tenants contributing an additional 10.4% of annualized rental income as of September 30, 2023 were subsidiaries of an investment grade rated parent (although these parent entities are not liable for the payment of rents). Lease related costs generally include capital expenditures used to improve tenants' space or amounts paid directly to tenants to improve their space and leasing related costs, such as brokerage commissions and tenant inducements. Leased square feet is pursuant to leases existing as of September 30, 2023, and includes (i) space being fitted out for tenant occupancy pursuant to OPI's lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by tenants, if any. Square footage measurements are subject to changes when space is remeasured or reconfigured for new tenants. Leasing cost and concession commitments include commitments made for leasing expenditures and concessions, such as tenant improvements, leasing commissions, tenant reimbursements and free rent. Net debt is total debt less cash. Percent leased includes (i) space being fitted out for occupancy pursuant to OPI's lease agreements, if any, and (ii) space which is leased, but is not occupied or is being offered for sublease by tenants, if any, as of the measurement date. Purchase price represents the gross purchase price, including assumed debt, if any, and excludes acquisition related costs and purchase price adjustments and allocations. Rentable square feet represents total square feet available for lease as of the measurement date. Square footage measurements are subject to changes when space is remeasured or reconfigured for new tenants. Rolling four quarter CAD represents CAD for the preceding twelve month period as of the respective quarter end date. Same properties for the three months ended September 30, 2023 is based on properties OPI owned continuously since July 1, 2022; excludes properties classified as held for sale and properties undergoing significant redevelopment, if any, and three properties owned by two unconsolidated joint ventures in which OPI owns a 51% and 50% interest. Same properties for the nine months ended September 30, 2023 is based on properties OPI owned continuously since January 1, 2022; excludes properties classified as held for sale and properties undergoing significant redevelopment, if any, and three properties owned by two unconsolidated joint ventures in which OPI owns a 51% and 50% interest. Same property cash basis NOI % margin is Same Property Cash Basis NOI as a percentage of same property cash basis rental income. Cash basis rental income excludes non-cash straightline rent adjustments, the net effect of non-cash amortization of intangible lease assets and liabilities and lease termination fees, if any. Same property NOI % margin is Same Property NOI as a percentage of same property rental income. SOFR is the secured overnight financing rate. Total debt represents the outstanding principal balance as of the date reported. Total gross assets is total assets plus accumulated depreciation. Weighted average remaining lease term is the average remaining lease term in years weighted based on annualized rental income. Non-GAAP Financial Measures and Certain Definitions (Continued)

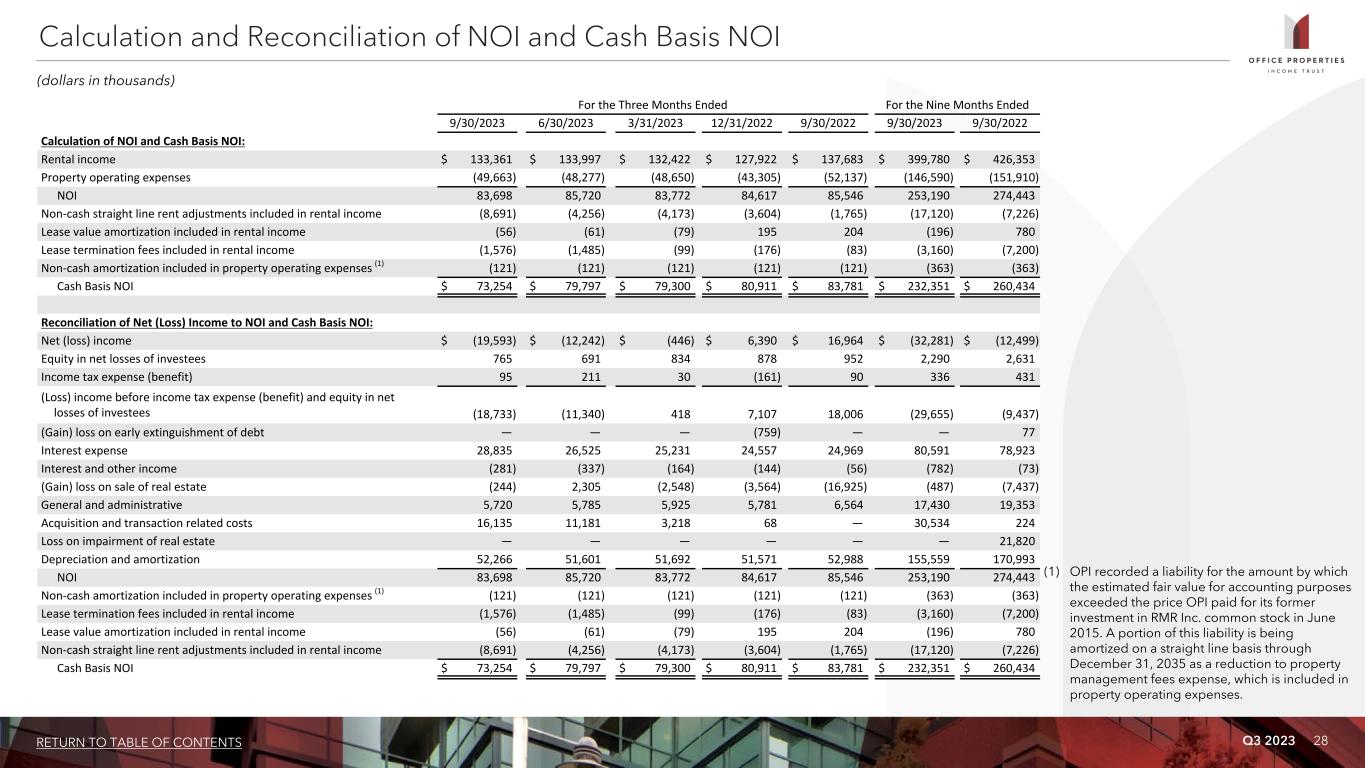

Q3 2023 28RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Calculation of NOI and Cash Basis NOI: Rental income $ 133,361 $ 133,997 $ 132,422 $ 127,922 $ 137,683 $ 399,780 $ 426,353 Property operating expenses (49,663) (48,277) (48,650) (43,305) (52,137) (146,590) (151,910) NOI 83,698 85,720 83,772 84,617 85,546 253,190 274,443 Non-cash straight line rent adjustments included in rental income (8,691) (4,256) (4,173) (3,604) (1,765) (17,120) (7,226) Lease value amortization included in rental income (56) (61) (79) 195 204 (196) 780 Lease termination fees included in rental income (1,576) (1,485) (99) (176) (83) (3,160) (7,200) Non-cash amortization included in property operating expenses (1) (121) (121) (121) (121) (121) (363) (363) Cash Basis NOI $ 73,254 $ 79,797 $ 79,300 $ 80,911 $ 83,781 $ 232,351 $ 260,434 Reconciliation of Net (Loss) Income to NOI and Cash Basis NOI: Net (loss) income $ (19,593) $ (12,242) $ (446) $ 6,390 $ 16,964 $ (32,281) $ (12,499) Equity in net losses of investees 765 691 834 878 952 2,290 2,631 Income tax expense (benefit) 95 211 30 (161) 90 336 431 (Loss) income before income tax expense (benefit) and equity in net losses of investees (18,733) (11,340) 418 7,107 18,006 (29,655) (9,437) (Gain) loss on early extinguishment of debt — — — (759) — — 77 Interest expense 28,835 26,525 25,231 24,557 24,969 80,591 78,923 Interest and other income (281) (337) (164) (144) (56) (782) (73) (Gain) loss on sale of real estate (244) 2,305 (2,548) (3,564) (16,925) (487) (7,437) General and administrative 5,720 5,785 5,925 5,781 6,564 17,430 19,353 Acquisition and transaction related costs 16,135 11,181 3,218 68 — 30,534 224 Loss on impairment of real estate — — — — — — 21,820 Depreciation and amortization 52,266 51,601 51,692 51,571 52,988 155,559 170,993 NOI 83,698 85,720 83,772 84,617 85,546 253,190 274,443 Non-cash amortization included in property operating expenses (1) (121) (121) (121) (121) (121) (363) (363) Lease termination fees included in rental income (1,576) (1,485) (99) (176) (83) (3,160) (7,200) Lease value amortization included in rental income (56) (61) (79) 195 204 (196) 780 Non-cash straight line rent adjustments included in rental income (8,691) (4,256) (4,173) (3,604) (1,765) (17,120) (7,226) Cash Basis NOI $ 73,254 $ 79,797 $ 79,300 $ 80,911 $ 83,781 $ 232,351 $ 260,434 (1) OPI recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price OPI paid for its former investment in RMR Inc. common stock in June 2015. A portion of this liability is being amortized on a straight line basis through December 31, 2035 as a reduction to property management fees expense, which is included in property operating expenses. Calculation and Reconciliation of NOI and Cash Basis NOI (dollars in thousands)

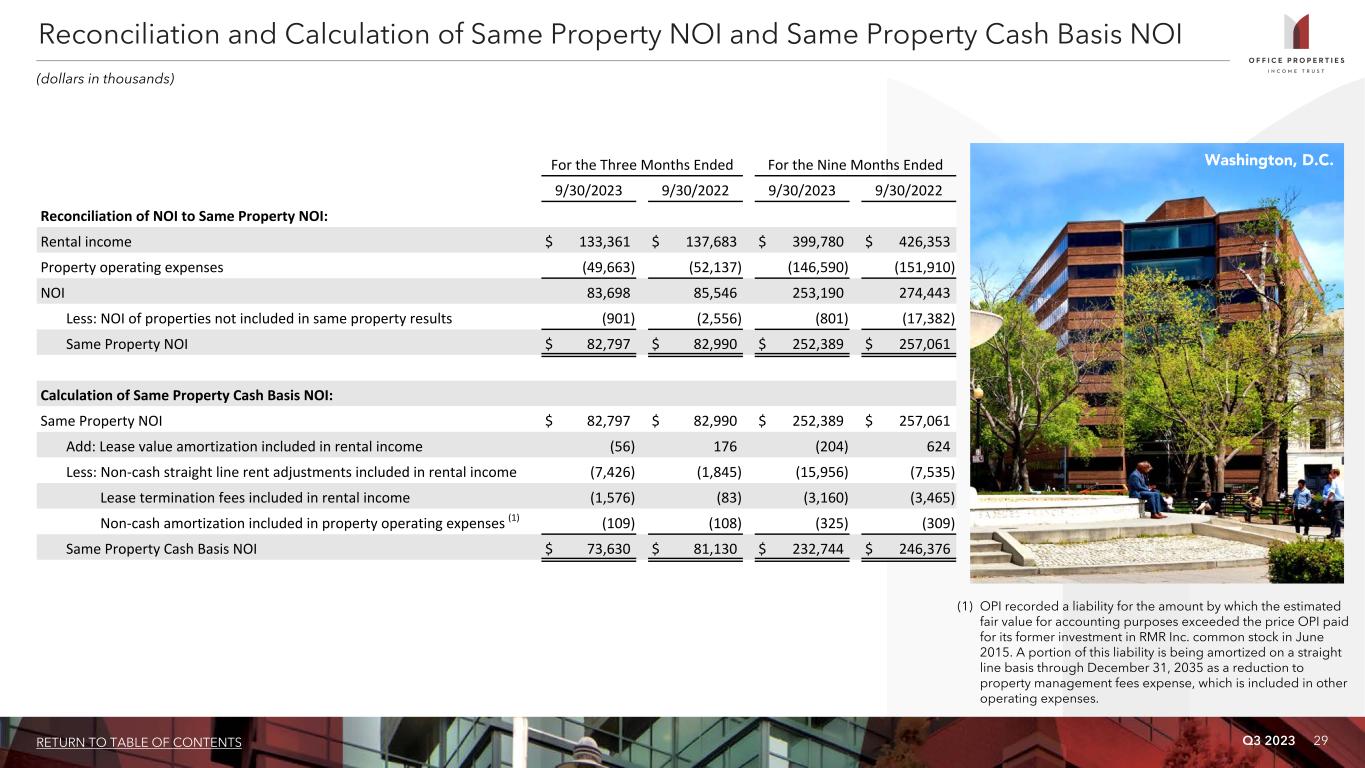

Q3 2023 29RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Nine Months Ended 9/30/2023 9/30/2022 9/30/2023 9/30/2022 Reconciliation of NOI to Same Property NOI: Rental income $ 133,361 $ 137,683 $ 399,780 $ 426,353 Property operating expenses (49,663) (52,137) (146,590) (151,910) NOI 83,698 85,546 253,190 274,443 Less: NOI of properties not included in same property results (901) (2,556) (801) (17,382) Same Property NOI $ 82,797 $ 82,990 $ 252,389 $ 257,061 Calculation of Same Property Cash Basis NOI: Same Property NOI $ 82,797 $ 82,990 $ 252,389 $ 257,061 Add: Lease value amortization included in rental income (56) 176 (204) 624 Less: Non-cash straight line rent adjustments included in rental income (7,426) (1,845) (15,956) (7,535) Lease termination fees included in rental income (1,576) (83) (3,160) (3,465) Non-cash amortization included in property operating expenses (1) (109) (108) (325) (309) Same Property Cash Basis NOI $ 73,630 $ 81,130 $ 232,744 $ 246,376 (1) OPI recorded a liability for the amount by which the estimated fair value for accounting purposes exceeded the price OPI paid for its former investment in RMR Inc. common stock in June 2015. A portion of this liability is being amortized on a straight line basis through December 31, 2035 as a reduction to property management fees expense, which is included in other operating expenses. Reconciliation and Calculation of Same Property NOI and Same Property Cash Basis NOI (dollars in thousands) Washington, D.C.

Q3 2023 30RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Net (loss) income $ (19,593) $ (12,242) $ (446) $ 6,390 $ 16,964 $ (32,281) $ (12,499) Add (less): Interest expense 28,835 26,525 25,231 24,557 24,969 80,591 78,923 Income tax expense (benefit) 95 211 30 (161) 90 336 431 Depreciation and amortization 52,266 51,601 51,692 51,571 52,988 155,559 170,993 EBITDA 61,603 66,095 76,507 82,357 95,011 204,205 237,848 Add (less): Loss on impairment of real estate — — — — — — 21,820 (Gain) loss on sale of real estate (244) 2,305 (2,548) (3,564) (16,925) (487) (7,437) Distributions received from unconsolidated joint ventures — — — — — — 51 Equity in losses of unconsolidated joint ventures 765 691 834 878 952 2,290 2,631 EBITDAre 62,124 69,091 74,793 79,671 79,038 206,008 254,913 Add (less): Acquisition and transaction related costs 16,135 11,181 3,218 68 — 30,534 224 General and administrative expense paid in common shares (1) 651 741 476 499 919 1,868 2,406 (Gain) loss on early extinguishment of debt — — — (759) — — 77 Adjusted EBITDAre $ 78,910 $ 81,013 $ 78,487 $ 79,479 $ 79,957 $ 238,410 $ 257,620 Calculation of EBITDA, EBITDAre and Adjusted EBITDAre (dollars in thousands) (1) Amounts represent equity based compensation to OPI's Trustees, OPI's officers and certain other employees of RMR.

Q3 2023 31RETURN TO TABLE OF CONTENTS For the Three Months Ended For the Nine Months Ended 9/30/2023 6/30/2023 3/31/2023 12/31/2022 9/30/2022 9/30/2023 9/30/2022 Net (loss) income $ (19,593) $ (12,242) $ (446) $ 6,390 $ 16,964 $ (32,281) $ (12,499) Add (less): Depreciation and amortization: Consolidated properties 52,266 51,601 51,692 51,571 52,988 155,559 170,993 Unconsolidated joint venture properties 840 868 830 789 775 2,538 2,269 Loss on impairment of real estate — — — — — — 21,820 (Gain) loss on sale of real estate (244) 2,305 (2,548) (3,564) (16,925) (487) (7,437) FFO 33,269 42,532 49,528 55,186 53,802 125,329 175,146 Add (less): Acquisition and transaction related costs 16,135 11,181 3,218 68 — 30,534 224 (Gain) loss on early extinguishment of debt — — — (759) — — 77 Normalized FFO 49,404 53,713 52,746 54,495 53,802 155,863 175,447 Add (less): Non-cash expenses (1) (1,312) (2,157) (1,902) (1,464) (640) (5,371) (1,297) Distributions from unconsolidated joint ventures — — — — — — 51 Depreciation and amortization - unconsolidated joint ventures (840) (868) (830) (789) (775) (2,538) (2,269) Equity in net losses of investees 765 691 834 878 952 2,290 2,631 Non-cash straight line rent adjustments included in rental income (8,691) (4,256) (4,173) (3,604) (1,765) (17,120) (7,226) Lease value amortization included in rental income (56) (61) (79) 195 204 (196) 780 Net amortization of debt premiums, discounts and issuance costs 2,276 2,327 2,205 2,188 2,176 6,808 6,946 Recurring capital expenditures (24,193) (33,607) (17,623) (42,099) (25,882) (75,423) (58,162) CAD $ 17,353 $ 15,782 $ 31,178 $ 9,800 $ 28,072 $ 64,313 $ 116,901 Weighted average common shares outstanding (basic and diluted) 48,403 48,354 48,336 48,334 48,286 48,365 48,260 Per common share amounts (basic and diluted): Net (loss) income $ (0.41) $ (0.25) $ (0.01) $ 0.13 $ 0.35 $ (0.67) $ (0.27) FFO $ 0.69 $ 0.88 $ 1.02 $ 1.14 $ 1.11 $ 2.59 $ 3.63 Normalized FFO $ 1.02 $ 1.11 $ 1.09 $ 1.13 $ 1.11 $ 3.22 $ 3.64 CAD $ 0.36 $ 0.33 $ 0.65 $ 0.20 $ 0.58 $ 1.33 $ 2.42 (1) Non-cash expenses include equity based compensation, adjustments recorded to capitalize interest expense and amortization of the liability for the amount by which the estimated fair value for accounting purposes exceeded the price OPI paid for its former investment in RMR Inc. common stock in June 2015. This liability is being amortized on a straight line basis through December 31, 2035 as an allocated reduction to business management fee expense and property management fee expense, which are included in general and administrative and other operating expenses, respectively. Calculation of FFO, Normalized FFO and CAD (amounts in thousands, except per share data)

Q3 2023 32RETURN TO TABLE OF CONTENTS Warning Concerning Forward-Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and other securities laws that are subject to risks and uncertainties. These statements may include words such as “believe”, “expect”, “anticipate”, “intend”, “plan”, “estimate”, “will”, “may” and negatives or derivatives of these or similar expressions. These forward-looking statements include, among others, statements about: OPI's operating trends; OPI's business initiatives; economic and market conditions; demand for office lease space; utilization of OPI's properties; OPI's future leasing activity and pipeline, including lease renewals and OPI's ability to fill vacancies; OPI's leverage levels and future financing opportunities; acquisitions and dispositions; OPI's redevelopment and construction activities and plans; and the amount and timing of future distributions. Forward-looking statements reflect OPI's current expectations, are based on judgments and assumptions, are inherently uncertain and are subject to risks, uncertainties and other factors, which could cause OPI's actual results, performance or achievements to differ materially from expected future results, performance or achievements expressed or implied in those forward- looking statements. Some of the risks, uncertainties and other factors that may cause OPI's actual results, performance or achievements to differ materially from those expressed or implied by forward-looking statements include, but are not limited to, the following: the impact of increasing or sustained high interest rates, inflation, labor market challenges, disruption and volatility in the public equity and debt markets, conditions in the commercial real estate industry generally and in the sectors OPI operates, geopolitical instability and economic downturns or recessions on OPI and its tenants; the extent to which changes and trends in office space utilization and needs, including due to remote work arrangements, may impact demand for office space at OPI's properties; the financial strength of OPI's tenants; risks and uncertainties regarding the costs and timing of development, redevelopment and repositioning activities, including as a result of inflation, cost overruns, supply chain challenges, labor shortages, construction delays or inability to obtain necessary permits; whether OPI's tenants will renew or extend their leases and not exercise early termination options pursuant to their leases or that OPI will obtain replacement tenants on terms as favorable to OPI as its prior leases; OPI's ability to successfully recycle and deploy capital; the likelihood that OPI's tenants will pay rent or be negatively affected by cyclical economic conditions or government budget constraints; OPI's ability to pay distributions to its shareholders and to maintain or increase the amount of such distributions; OPI's ability to increase or maintain occupancy at its properties on terms desirable to it; OPI's ability to increase rents when its leases expire or renew; OPI's tenant and geographic concentration; OPI's ability to manage its capital expenditures and other operating costs effectively and to maintain and enhance its properties and their appeal to tenants; OPI's ability to acquire properties that realize its targeted returns; OPI's ability to sell properties at prices it targets; OPI's ability to cost effectively raise and balance its use of debt and equity capital; OPI's ability to make required payments on debt; OPI's ability to maintain sufficient liquidity, including the availability of borrowings under its revolving credit facility and otherwise manage leverage; OPI's credit ratings; the ability of OPI's manager, RMR, to successfully manage OPI; competition within the commercial real estate industry, particularly in those markets in which OPI's properties are located; compliance with, and changes to, federal, state and local laws and regulations, accounting rules, tax laws and similar matters; the impact of any U.S. government shutdown or failure to increase the government debt ceiling on OPI's ability to collect rents and pay its operating expenses, debt obligations and distributions to shareholders on a timely basis; actual and potential conflicts of interest with OPI's related parties, including its Managing Trustees, RMR, Sonesta and others affiliated with them; limitations imposed by and OPI's ability to satisfy complex rules to maintain OPI's qualification for taxation as a REIT for U.S. federal income tax purposes; acts of terrorism, outbreaks or continuation of pandemics or other public health safety events or conditions, war or other hostilities, material or prolonged disruption to supply chains, climate change, or other manmade or natural disasters beyond OPI's control; and other matters. These risks, uncertainties and other factors are not exhaustive and should be read in conjunction with other cautionary statements that are included in OPI's periodic filings. The information contained in OPI's filings with the SEC, including under the caption "Risk Factors" in its periodic reports, or incorporated therein, identifies important factors that could cause differences from the forward-looking statements in this presentation. OPI's filings with the SEC are available on the SEC's website at www.sec.gov. You should not place undue reliance upon OPI's forward-looking statements. Except as required by law, OPI does not intend to update or change any forward-looking statements as a result of new information, future events or otherwise.