Project Energy Reimagined Acquisition Corp. (Nasdaq: PEGR)

(“PERAC”) today announced that its proposed business combination

(the “Business Combination”) pursuant to the Business Combination

Agreement, dated as of October 2, 2023 (the “Business Combination

Agreement”), by and among PERAC, Heramba Electric plc (“Holdco”),

Heramba Merger Corp., Heramba Limited and Heramba GmbH (“Heramba”),

is anticipated to close in early July 2024, subject to the

satisfaction or waiver of all applicable closing conditions.

About Project Energy Reimagined Acquisition

Corp.

PERAC is a blank check company formed for the

purpose of effecting a merger, share exchange, asset acquisition,

share purchase, reorganization or similar business combination with

one or more businesses.

Important Information About the Business

Combination and Where to Find It

This communication does not contain all the

information that should be considered concerning the Business

Combination and is not intended to form the basis of any investment

decision or any other decision in respect of the Business

Combination. In connection with the Business Combination, Heramba

and PERAC, through Holdco, filed with the Securities and Exchange

Commission (the “SEC”) a registration statement on Form F-4 (File

No. 333-275903) (as amended, the “Registration Statement”), which

contains a proxy statement/prospectus that constitutes (i) a proxy

statement relating to the Business Combination in connection with

PERAC’s solicitation of proxies for the vote by PERAC’s

shareholders regarding the Business Combination and related

matters, as described in the Registration Statement, and (ii) a

prospectus relating to, among other things, the offer of the

securities to be issued by Holdco in connection with the Business

Combination. On March 19, 2024, the Registration Statement was

declared effective by the SEC, and Holdco and PERAC filed the

definitive proxy statement/prospectus with the SEC. On or about

March 19, 2024, PERAC commenced the mailing of the definitive proxy

statement/prospectus and other relevant documents to its

shareholders as of March 1, 2024, the record date established for

voting on the Business Combination. On March 28, 2024, the

shareholders of PERAC approved the Business Combination and related

matters. INVESTORS AND SECURITY HOLDERS AND OTHER INTERESTED

PARTIES ARE URGED TO READ THE REGISTRATION STATEMENT, DEFINITIVE

PROXY STATEMENT/PROSPECTUS, AND ANY AMENDMENTS OR SUPPLEMENTS

THERETO AND ANY OTHER RELATED DOCUMENTS FILED WITH THE SEC BY PERAC

OR HOLDCO WHEN THEY BECOME AVAILABLE, CAREFULLY AND IN THEIR

ENTIRETY BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION

ABOUT HERAMBA, PERAC, HOLDCO AND THE BUSINESS COMBINATION,

INCLUDING WITH RESPECT TO THE PRO FORMA IMPLIED ENTERPRISE VALUE OF

THE COMBINED COMPANY. Investors and security holders may obtain

free copies of the Registration Statement, definitive proxy

statement/prospectus and any amendments or supplements thereto and

other related documents filed with the SEC by PERAC or Holdco (in

each case, when available) through the website maintained by the

SEC at http://www.sec.gov. These documents (when available) can

also be obtained free of charge from PERAC upon written request to

PERAC at: Project Energy Reimagined Acquisition Corp., 1280 El

Camino Real, Suite 200, Menlo Park, California 94025.

INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN

HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER

REGULATORY AUTHORITY, NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED

THE MERITS OF THE BUSINESS COMBINATION PURSUANT TO WHICH ANY

SECURITIES ARE TO BE OFFERED OR THE ACCURACY OR ADEQUACY OF THE

INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS

A CRIMINAL OFFENSE.

Cautionary Statement Regarding Forward-Looking

Statements

Certain statements included in this

communication that are not historical facts are forward-looking

statements for purposes of the safe harbor provisions under the

United States Private Securities Litigation Reform Act of 1995.

Forward-looking statements generally are accompanied by words such

as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,”

“intend,” “expect,” “should,” “would,” “plan,” “predict,”

“potential,” “seem,” “seek,” “future,” “outlook,” and similar

expressions that predict or indicate future events or trends or

events that are not statements of historical matters. These

forward-looking statements include, but are not limited to,

statements regarding the consummation of the Business Combination

and related transactions and the listing of Holdco’s securities on

Nasdaq. These statements are based on various assumptions, whether

or not identified in this communication, and on the current

expectations of Heramba, PERAC and Holdco management and are not

predictions of actual performance. These forward-looking statements

are provided for illustrative purposes only and are not intended to

serve as, and must not be relied on by any investor as, a

guarantee, an assurance, a prediction or a definitive statement of

fact or probability. Actual events and circumstances are difficult

or impossible to predict and will differ from assumptions. Many

actual events and circumstances are beyond the control of Heramba,

PERAC and Holdco. These forward-looking statements are subject to a

number of risks and uncertainties, including (i) changes in

domestic and foreign business, market, financial, political and

legal conditions; (ii) the inability of the parties to successfully

or timely consummate the Business Combination, including the risk

that any required regulatory approvals are not obtained, are

delayed or are subject to unanticipated conditions that could

adversely affect the combined company, the expected benefits of the

Business Combination or that redemptions by shareholders of PERAC

reduce the funds in trust or available to the combined company

following the Business Combination, any of the other conditions to

closing are not satisfied or that events or other circumstances

give rise to the termination of the Business Combination Agreement;

(iii) changes to the structure of the Business Combination that may

be required or appropriate as a result of applicable laws or

regulations or as a condition to obtaining the necessary regulatory

approvals; (iv) the ability to meet stock exchange listing

standards following the consummation of the Business Combination;

(v) the risk that the Business Combination disrupts current plans

and operations of Heramba as a result of the announcement and

consummation of the Business Combination; (vi) failure to realize

the anticipated benefits of the Business Combination, which may be

affected by, among other things, competition, the ability of the

combined company to grow and manage growth profitably, maintain

relationships with customers and suppliers and retain its

management and key employees; (vii) costs related to the Business

Combination; (viii) changes in applicable law or regulations; (ix)

the outcome of any legal proceedings that may be instituted against

Heramba, PERAC or Holdco; (x) the effects of competition on

Heramba’s future business; (xi) the ability of PERAC, Heramba or

Holdco to issue equity or equity-linked securities or obtain debt

financing in connection with the Business Combination or in the

future; (xii) the enforceability of Heramba’s intellectual property

rights, including its copyrights, patents, trademarks and trade

secrets, and the potential infringement on the intellectual

property rights of others; and (xiii) those factors discussed under

the heading “Risk Factors” in PERAC’s Annual Report on Form 10-K

for the fiscal year ended December 31, 2023, filed with the SEC on

April 17, 2024, and any subsequent Quarterly Reports on Form 10-Q,

the Registration Statement and the definitive proxy

statement/prospectus, and other documents filed, or to be filed, by

PERAC and/or Holdco, with the SEC. If any of these risks

materialize or the assumptions of Heramba, PERAC and Holdco

management prove incorrect, actual results could differ materially

from the results implied by these forward-looking statements. There

may be additional risks that none of Heramba, PERAC nor Holdco

presently know or that Heramba, PERAC or Holdco currently believe

are immaterial that could also cause actual results to differ from

those contained in the forward-looking statements. In addition,

forward-looking statements reflect Heramba’s, PERAC’s or Holdco’s

expectations, plans or forecasts of future events and views as of

the date of this communication. Heramba, PERAC and Holdco

anticipate that subsequent events and developments may cause

Heramba’s, PERAC’s or Holdco’s assessments to change. However,

while Heramba, PERAC and Holdco may elect to update these

forward-looking statements at some point in the future, Heramba,

PERAC and Holdco specifically disclaim any obligation to do so.

Nothing in this communication should be regarded as a

representation by any person that the forward-looking statements

set forth herein will be achieved or that any of the contemplated

results of such forward-looking statements will be achieved.

Accordingly, undue reliance should not be placed upon the

forward-looking statements.

No Offer or Solicitation

This communication is for informational purposes

only and is not intended to and shall not constitute an offer to

sell or exchange, or the solicitation of an offer to sell,

exchange, buy or subscribe for any securities or a solicitation of

any vote of approval, nor shall there be any sale, issuance or

transfer of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended (the “Securities Act”), or pursuant to an

exemption from the Securities Act, and otherwise in accordance with

applicable law.

No Assurances

There can be no assurance that the Business

Combination will be completed, nor can there be any assurance, if

the Business Combination is completed, that the potential benefits

of the Business Combination will be realized.

Contacts

Media:Tom Murphypera@paragonpr.com

Investors: Prakash

Ramachandranprakash.r@smilodonai.com

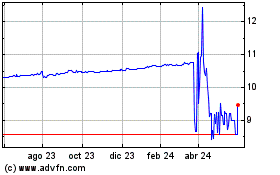

Project Energy Reimagine... (NASDAQ:PEGR)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

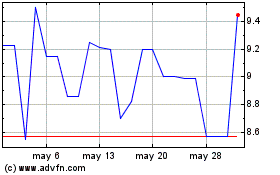

Project Energy Reimagine... (NASDAQ:PEGR)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024