false000105074300010507432025-01-282025-01-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

____________

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

|

|

Date of report (Date of earliest event reported) |

January 28, 2025 |

PEAPACK-GLADSTONE FINANCIAL CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

|

|

New Jersey |

001-16197 |

22-3537895 |

(State or Other Jurisdiction |

(Commission |

(I.R.S. Employer |

of Incorporation) |

File Number) |

Identification No.) |

|

|

500 Hills Drive, Suite 300, Bedminster, New Jersey |

07921 |

(Address of Principal Executive Offices) |

(Zip Code) |

|

|

Registrant’s telephone number, including area code |

(908) 234-0700 |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, no par value |

|

PGC |

|

The NASDAQ Stock Market, LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

|

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13 (a) of the Exchange Act. ☐

INFORMATION TO BE INCLUDED IN THE REPORT

Item 7.01 Regulation FD Disclosure

Peapack-Gladstone Financial Corporation (the “Company”) is furnishing presentation materials included as Exhibit 99.1 to this report. The Company is not undertaking to update this presentation. The information in this report (including Exhibit 99.1) is being furnished pursuant to Item 7.01 and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section. This report will not be deemed an admission as to the materiality of any information herein (including Exhibit 99.1).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

The press release disclosed in this Item 9.01 as Exhibit 99.1 shall be considered “furnished” but not “filed” for purposes of the Securities Exchange Act of 1934, as amended.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

PEAPACK-GLADSTONE FINANCIAL CORPORATION |

|

|

|

Dated: January 28, 2025 |

By: |

/s/ Frank A. Cavallaro |

|

Frank A. Cavallaro |

|

Senior Executive Vice President and Chief Financial Officer |

The Q4 2024 Investor Update should be read in conjunction with the Q4 2024 Earnings Release issued on January 28, 2025. Peapack Gladstone Bank rebranded to Peapack Private Bank & Trust, effective January 1, 2025. Investor Update Q4 2024 Exhibit 99.1

This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements are not historical facts and may include expressions about Management’s strategies and Management’s expectations about financial results, new and existing programs and products, investments, relationships, opportunities and market conditions. These statements may be identified by such forward-looking terminology as “expect,” “look,” “believe,” “anticipate,” “may,” or similar statements or variations of such terms. Actual results may differ materially from such forward-looking statements. Factors that may cause actual results to differ materially from those contemplated by such forward-looking statements include, but are not limited to: 1) our ability to successfully grow our business and implement our strategic plan including our entry into New York City, and our ability to generate revenues to offset the increased personnel and other costs related to the strategic plan; 2) the current or anticipated impact of military conflict, terrorism or other geopolitical events; 3) the impact of anticipated higher operating expenses in 2025 and beyond; 4) our ability to successfully integrate wealth management firm and team acquisitions; 5) our ability to manage our growth; 6) a decline in the economy, in particular in our New Jersey and New York market areas; 7) declines in our net interest margin caused by the interest rate environment (including the shape of the yield curve) and our highly competitive market; 8) declines in the value in our investment portfolio; 9) higher than expected increases in our allowance for credit losses; 10) higher than expected increases in loan and lease losses or in the level of nonperforming, classified or criticized loans or charge-offs; 11) changes in interest rates and the effects of inflation; 12) a decline in real estate values within our market areas; 13) legislative and regulatory actions (including the impact of the Dodd-Frank Wall Street Reform and Consumer Protection Act, Basel III and related regulations) that may result in increased compliance costs; 14) changes in monetary policy by the Federal Reserve Board; 15) changes to tax or accounting matters; 16) successful cyberattacks against our IT infrastructure and that of our IT providers; 17) higher than expected FDIC insurance premiums; 18) adverse weather conditions; 19) a reduction in our lower-cost funding sources; 20) changes in liquidity, including the size and composition of our deposit portfolio, and the percentage of uninsured deposits in the portfolio; 21) our ability to adapt to technological changes; 22) claims and litigation pertaining to fiduciary responsibility, environmental laws and other matters; 23) the imposition of tariffs or other domestic or international governmental policies impacting the value of the products of our borrowers; 24) our ability to retain key employees; 25) demands for loans and deposits in our market areas; 26) adverse changes in securities markets; 27) changes in New York City rent regulation law; and 28) other unexpected material adverse changes in our operations or earnings. The Company undertakes no duty to update any forward-looking statement to conform the statement to actual results or changes in the Company’s expectations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, the Company cannot guarantee future results, levels of activity, performance or achievements. Statement Regarding�Forward-Looking Information

Performance Highlights Strategic Update Balance sheet continues to transform while fully absorbing 100+ new team members and delivering our highest quarterly earnings in 2024. Metro NY expansion is performing significantly above plan; opened 550 new relationships, totaling $948MM in deposits. Based on consistent quarter-over-quarter results and a robust pipeline, we anticipate adding additional teams in 2025. Rebranded to “Peapack Private Bank & Trust” on January 1, 2025, a pivotal step in our private banking journey2. Balance Sheet Total core relationship deposits1 increased $438MM (36% annualized) in the quarter, driven by production from both our NY and NJ teams. Core relationship deposits are up $1.2B (30%) for the year and pipelines remain robust. Noninterest-bearing deposits increased $155MM (16%) for the year. Balance sheet liquidity totaled 17% of total assets as of year-end3. Total available liquidity increased $218MM on a linked quarter basis to $4.4B4. Loans grew $201MM (15% annualized) in the quarter, driven by C&I; new business pipelines heading into 2025 are strong. Asset quality trends have stabilized with no evidence of systemic deterioration in asset quality. Allowance for credit losses is 1.32% of total loans. Earnings Net income increased $1.7MM (22%) on a linked-quarter basis to $9.2MM, continuing to demonstrate positive operating leverage as we successfully expand our franchise. Successful core deposit growth combined with rate cuts has led to net interest income growth of $4.2MM (11%) on a linked-quarter basis and $5.2MM (14%) year over year. Net interest margin increased 12 basis points to 2.46%. Loan originations for the quarter carried a marginal NIM5 of greater than 4.00%. Total fee income represented 32% of total revenue, driven by wealth management fee income. New inflows totaled $163MM for the quarter; $142MM managed. See page 18 for notes and important information. 45% Net Interest Income Annualized Growth $0.52 Earnings Per Share 36% Core Relationship Deposit1 Annualized Growth 15% Annualized Loan Growth 17% Balance Sheet Liquidity2 4th Quarter Financials

Quarterly Financial Results See page 18 for notes and important information.

Balance Sheet Transformation �Excellent Liquidity Profile Continuing to rapidly strengthen our liquidity profile. Core relationship deposits have grown 30% over the past 12 months. $404MM of overnight borrowings eliminated, increasing available borrowing capacity. Cash represented 6% of total assets at year-end; Cash and Available-for-Sale (“AFS”) securities totaled 17% of total assets. Conservative approach to liquidity management4. Total available liquidity2 of $4.4B represents 282% of uninsured/uncollateralized deposits. Strong momentum and pipelines headed into 2025 allows the company to actively replace higher priced liabilities with lower cost core funding. See page 18 for notes and important information.

Metro NY Expansion�Results to Date Hiring across critical support areas to support our growth. Investments in products, technology and enhanced processes focused on reducing client friction points and supporting our “branch light” model. 550+ Relationships $948MM Total Deposits 28% Noninterest-bearing1 $311MM Outstanding Loans Our Metro New York expansion continues to deliver solid results. Onboarding fully-banked core relationships. Average relationship size $1.7MM. Noninterest-bearing deposits1 were 28% of total deposits. Vast majority of clients are utilizing our Treasury Management platform. $311MM of outstanding loans plus an additional $83MM of commitments. Strong loan and deposit pipelines going into 2025. Continue to explore additional regional locations with opportunistic hires. Strong Net Promoter Score & Employee Engagement Continuous Improvement Creating Franchise Value Client feedback is validating our best-in-class service culture. New York teams have received an 81 Net Promoter Score, in-line with world-class service organizations like The Ritz Carlton, USAA, and Nordstrom. Strong NYC employee engagement – voted one of “Crain’s 2024 Best Places to Work in NYC”. Our expansion is building a strong foundation for future value creation. Higher growth trajectory. Vastly improved liquidity profile. Ability to re-trade higher cost funds for core relationships, establishing a strong foundation to capitalize on rate reductions. Greater operating leverage and profitability. See page 18 for notes and important information.

Net Interest Income�Core Deposit Growth Leading to Margin Expansion Net interest income has grown in each quarter throughout 2024, driven by successful core deposit growth from both NJ and NY teams combined with rate cuts. NII increased $4.2MM (11%) on a linked-quarter basis and $5.2MM (14%) year-over-year. Net interest margin increased by 12 basis points on a linked-quarter basis to 2.46%. Ability to successfully deploy liquidity into sound lending opportunities will dictate the pace of margin expansion. Loan originations in the fourth quarter carried a weighted average coupon more than 4.00% above current cost of funds. $37MM $34MM $35MM $38MM $42MM

Deposit Trends�Strong Growth at a Favorable Mix Significant deposit growth has allowed for a reduction in borrowings. Core relationship deposits1 increased $438MM in Q4, up $1.2B for the year. Noninterest-bearing deposits increased $33MM in Q4, up $155MM for the year. See page 18 for notes and important information.

Wealth Management�Strong Operating Margin; Proven Asset Growth AUM/AUA (in millions) Revenue (in millions) $11.9B AUM/AUA 36% EBITDA Margin 2024 FY 11% Revenue CAGR1 $4.2MM Average Relationship $163MM Q4 2024 Gross New Business Inflows See page 18 for notes and important information.

Stable Fee Revenue�Driven by Wealth Management Noninterest Income as a % of Total Revenue 32% Q4 2023 38% Q2 2024 Q3 2024 Q1 2024 35% Q4 2024 33% 32% See page 18 for notes and important information.

Diversified Lending Business�Loan Mix as of 12/31/2024 Gross Loans1: $5.5 billion See page 18 for notes and important information. $528 million of loan originations2 in Q4 netted $201 million of loan growth. Continued to focus on managing the CRE concentration ratio through minimal originations. Weighted average coupon remains favorable compared to cost of funds. Q4 Loan Originations

Commercial Banking1�Continuing to Focus on C&I Lending See page 18 for notes and important information.

Multifamily Loan Portfolio�Stable with Improving Trends – No MFL Delinquencies Multifamily (“MFL”) constitutes 33% ($1.8B) of the total loan portfolio.

Credit Metrics�Positive Asset Quality Trends 30-89 Days Past Due / Gross Loans (%) Classified Loans / Gross Loans (%) NPAs / Assets (%) Special Mention / Gross Loans (%)

Personal Banking�Expansion into NYC with Track Record of Successfully Competing against Large Banks Growing New Jersey market share in a shrinking market, continuing to outperform peers NYC4 Deposit Market $2.8 trillion See page 18 for notes and important information.

Creating Shareholder Value Positioning Peapack Private as the boutique alternative to large banks in the Metro NYC region. Attractive geographic franchise enhanced with our entry into NYC, which is delivering growth, additional core liquidity, and a foundation for future positive operating leverage and increased shareholder value creation. Metro NYC expansion results are exceeding expectations and momentum is strong. Continuing to evaluate opportunities to further our private bank regional expansion. Business model anchored by a $11.9B AUM/AUA wealth management business. Continue to invest in human capital, products, technology, and processes, which will create sustainable long-term value creation. Robust commercial lending, treasury management business, and sell-side advisory services, which caters to clients throughout their business lifecycle. Focused on growing tangible book value while prudently returning capital to shareholders. Enhanced credit risk oversight and tightened underwriting standards. Continuously investing in human capital and retention; recognized as an ABA Best Banks To Work For seven years in a row; recognized as a Crain’s 2024 Best Places to Work in NYC.

Appendix

Notes Performance Highlights slide 1) Core relationship deposits defined as deposit relationships that are not custodial, brokered, or listing service. 2) All references to “Bank”, “Peapack Private Bank & Trust”, or “Peapack Private” refer to the name of the Bank, which changed from Peapack Gladstone Bank to Peapack Private Bank & Trust, effective 1/1/2025. 3) Cash + Cash Equivalents + AFS Securities. 4) Total available liquidity defined as Cash + Cash Equivalents + AFS Securities + Remaining Borrowing Capacity, Letters of Credit, and Pledged AFS securities. 5) Marginal NIM is defined as the weighted average loan coupon of loans originated in the quarter less the average cost of funds for the quarter. Quarterly Financial Results slide 1) Capital Markets consists of Mortgage Banking, SBA Lending, Corporate Advisory and Back-to-Back Swap fee income. Balance Sheet Transformation slide 1) Core relationship deposits defined as deposit relationships that are not custodial, brokered, or listing service. 2) Cash + Cash Equivalents + AFS Securities + Remaining Borrowing Capacity, Letters of Credit, and Pledged AFS Securities. 3) (Cash + Cash Equivalents + AFS Securities) / Total Assets. 4) Majority of the loan and securities portfolios are pledged to either the FHLBNY or FRB. Metro NY Expansion Results slide 1) Noninterest-bearing deposits on this slide is defined as all deposits paid 0% interest, including reciprocal insured cash sweeps. Deposit Trends slide 1) Core relationship deposits defined as deposit relationships that are not custodial, brokered, or listing service. Wealth Management slide 1) 6-Year compounded annual growth rate calculated from December 31, 2018 through December 31, 2024. Stable Fee Revenue slide 1) Capital Markets income consists of Corporate Advisory, Mortgage Banking, SBA Lending, and Back-to-Back Swap fee income. Diversified Lending Business slide 1) Gross loans include loans held for sale. 2) Q4 loan originations include funded loans and unfunded commitments. Commercial Banking slide 1) Commercial banking includes CRE and Commercial & Industrial Loans. CRE excludes MFL, which totaled $1.8B as of 12/31/2024. 2) 6-Year compounded annual growth rate calculated from December 31, 2018 through December 31, 2024. Personal Banking slide 1) Natural Market Area defined within boundaries in map as geography within 5 miles of all NJ branch locations. 2) Loans as of 12/31/2024. 3) Provident Financial Services Inc. acquired Lakeland Bancorp Inc. between the referenced time periods. 2023 deposits reflect the combination of the two entities prior to their merger. 4) NYC Deposit Market defined as New York County. Total market share defined utilizing S&P Capital IQ Pro “As Reported” FDIC data as of 6/30/2024.

Balance Sheet & AUM/AUA Summary

Asset Quality 1) Amounts reflect modifications that are paying according to modified terms. 2) Excludes modifications included in nonaccrual loans of $3.6 million at December 31, 2024, $3.7 million at September 30, 2024, and $3.0 million at December 31, 2023. 3) Excludes a credit of $15,000 at December 31, 2024, a credit of $3,000 at September 30, 2024, and a credit of $55,000 at December 31, 2023 related to off-balance sheet commitments. 4) Net charge-offs for the quarter ended December 31, 2023 included charge-offs of $2.2 million of a previously established reserve to loans individually evaluated on one multifamily loan and $5.6 million on one equipment finance relationship. 5) Total ACL less reserves to loans individually evaluated equals collectively evaluated ACL.

Capital Summary 1) Tangible equity and tangible assets are calculated by excluding the balance of intangible assets from shareholders’ equity and total assets, respectively. Tangible equity as a percentage of tangible assets at period end is calculated by dividing tangible equity by tangible assets at period end. See Non-GAAP financial measures reconciliation table. 2) Tangible book value per share excludes intangible assets. Tangible book value per share is calculated by dividing tangible equity by period end common shares outstanding. See Non-GAAP financial measures reconciliation table. 3) Excludes other comprehensive loss of $66.4 million for the quarter ended December 31, 2024, $54.8 million for the quarter ended September 30, 2024, and $64.9 million for the quarter ended December 31, 2023. See Non- GAAP financial measures reconciliation included in these tables.

Quarterly Income Statement Summary 1) Return on average tangible common equity is calculated by dividing tangible common equity by annualized net income. See Non-GAAP financial measures reconciliation table.

Quarterly Non-GAAP Financial Measures Reconciliation We believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our financial position, results and ratios. Our management internally assesses our performance based, in part, on these measures. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies.

Annual Income Statement Summary 1) Return on average tangible common equity is calculated by dividing tangible common equity by annualized net income. See Non-GAAP financial measures reconciliation table.

Annual Non-GAAP Financial Measures Reconciliation We believe that these non-GAAP financial measures provide information that is important to investors and that is useful in understanding our financial position, results and ratios. Our management internally assesses our performance based, in part, on these measures. However, these non-GAAP financial measures are supplemental and are not a substitute for an analysis based on GAAP measures. As other companies may use different calculations for these measures, this presentation may not be comparable to other similarly titled measures reported by other companies.

500 Hills Drive, Suite 300 P.O. Box 700 Bedminster, New Jersey 07921 (908) 234-0700 peapackprivate.com Douglas L. Kennedy President & Chief Executive Officer (908) 719-6554 dkennedy@peapackprivate.com Frank A. Cavallaro Senior EVP & Chief Financial Officer (908) 306-8933 fcavallaro@peapackprivate.com CONTACTS CORPORATE HEADQUARTERS 26 John P. Babcock Senior EVP & President of Peapack Private Wealth Management (908) 719-3301 jbabcock@peapackprivate.com Matthew P. Remo SVP | Managing Principal – Treasurer & Head of Corporate Finance (908) 872-9899 mremo@peapackprivate.com

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

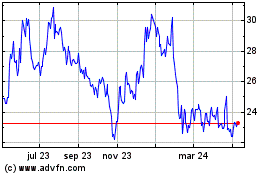

Peapack Gladstone Financ... (NASDAQ:PGC)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

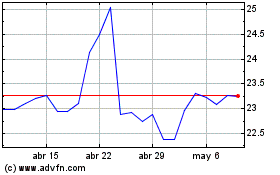

Peapack Gladstone Financ... (NASDAQ:PGC)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025