Rocket Lab USA, Inc. (Nasdaq: RKLB) (“Rocket Lab” or “the

Company”), a global leader in launch services and space systems,

today shared the financial results for fiscal second quarter, ended

June 30, 2024.

Rocket Lab founder and CEO, Sir Peter Beck, said: “This year’s

second quarter was Rocket Lab’s highest revenue quarter in Company

history at $106 million. This 71% year-on-year revenue increase

demonstrates the strong and growing demand for our launch services

and space systems products, and importantly, our team’s ability to

execute against it. Meanwhile, we reached a critical milestone in

the development of our new medium lift rocket Neutron, with the

successful completion of the first hot fire for the Archimedes

engine. Over the same period, we made significant progress in

Neutron production and launch infrastructure with the scaling of

engine production facilities, installation of the automated fiber

placement machine that will produce Neutron’s largest carbon fiber

structures, and we furthered development of Launch Complex 3 and

the integration and assembly facility on site in Wallops, Virginia.

On the small launch front, Electron remains the leading small

rocket globally with successful launches in the quarter for

government and commercial customers, and demand for it continues to

grow with 17 new launches signed so far this year. We also continue

to reach development and production milestones across our space

systems programs, in which we have more than $720 million in

spacecraft under contract. Some significant achievements on this

front include the completion of twin Rocket Lab-designed and built

satellites for a NASA mission to Mars, as well as completing

successful development reviews for the government and commercial

constellations we have in work.”

Business Highlights for the Second Quarter 2024, plus updates

since June 30, 2024:

- Achieved our highest revenue quarter in Company history at $106

million.

- Successful Electron launches for NASA, commercial constellation

operators Synspective, Kineis, and the Korea Advanced Institute of

Science and Technology (KAIST). Electron remains the most

frequently launched small rocket globally and Electron launches

have accounted for 64% of all non-SpaceX orbital U.S. launches in

2024 to date.

- Successfully launched our 50th Electron mission, reaching 50

launches faster than any commercially developed rocket in

history.

- Demonstrated pinpoint deployment accuracy by launching customer

payload to within eight meters of target orbit (accepted industry

tolerance is typically 15 kilometers).

- Signed 17 new launch contracts year-to-date, including

multi-launch deals with commercial constellation operators, a HASTE

(Hypersonic Accelerator Suborbital Test Electron) launch for a

government customer, and two highly complex missions for the

Department of Defense, including a responsive launch demonstration

in which Rocket Lab will build a spacecraft, as well as launch and

operate it as an end-to-end space service.

- Reached major development milestone with successful completion

of first Archimedes engine hot fire. Now moving into full

production for remaining flight engines.

- Significant progress made in development and flight hardware of

Neutron structures, fairing, avionics, and flight software.

- Infrastructure development progressing to support first Neutron

flight and operational launch cadence, including scaling Archimedes

engine production line, arrival of long lead cryogenic systems at

launch site, installation of automated fiber placement machine for

Neutron production, and entering final construction phase of

establishing final assembly facility at Wallops, Virginia.

- Completed production of two spacecraft for NASA’s ESCAPADE

mission to Mars, scheduled to launch this year.

- Signed preliminary terms for $49.4m in state and federal

funding, including a portion under the CHIPS Act, to expand

production of solar cells in Albuquerque, New Mexico.

- Progressing development and production of spacecraft for Varda

Space Industries, as well as constellations on contract for the

Space Development Agency and MDA/Globalstar.

- Introduced a new satellite dispenser at the Small Satellite

Conference in Utah to provide customers with more flexibility when

designing spacecraft.

Third Quarter 2024 Guidance

For the third quarter of 2024, Rocket Lab expects:

- Revenue between $100 million and $105 million.

- Space Systems revenue between $79 million and $84 million.

- Launch Services revenue of approximately $21 million.

- GAAP Gross Margins between 25% and 27%.

- Non-GAAP Gross Margins between 30% and 32%.

- GAAP Operating Expenses between $80 million and $82

million.

- Non-GAAP Operating Expenses between $69 million and $71

million.

- Expected Interest Expense (Income), net $1 million.

- Adjusted EBITDA loss of $31 million to $33 million.

- Basic Shares Outstanding of 498 million.

See “Use of Non-GAAP Financial Measures” below for an

explanation of our use of Non-GAAP financial measures, and

the reconciliation of historical Non-GAAP measures to the

comparable GAAP measures in the tables attached to this press

release. We have not provided a reconciliation for the

forward-looking Non-GAAP Gross Margin, Non-GAAP Operating Expenses

or Adjusted EBITDA expectations for Q3 2024 described above

because, without unreasonable efforts, we are unable to predict

with reasonable certainty the amount and timing of adjustments that

are used to calculate these non-GAAP financial measures,

particularly related to stock-based compensation and its related

tax effects. Stock-based compensation is currently expected to

range from $12 million to $14 million in Q3 2024.

Conference Call Information

Rocket Lab will host a conference call for investors at 2 p.m.

PT (5 p.m. ET) today to discuss these business highlights and

financial results for our second quarter, to provide our outlook

for the third quarter, and other updates.

The live webcast and a replay of the webcast will be available

on Rocket Lab’s Investor Relations website:

https://investors.rocketlabusa.com/events-and-presentations/events

About Rocket Lab

Founded in 2006, Rocket Lab is an end-to-end space company with

an established track record of mission success. We deliver reliable

launch services, satellite manufacture, spacecraft components, and

on-orbit management solutions that make it faster, easier and more

affordable to access space. Headquartered in Long Beach,

California, Rocket Lab designs and manufactures the Electron small

orbital launch vehicle, various satellite platforms, and is

developing the Neutron launch vehicle for large spacecraft and

constellation deployment. From its first orbital launch in January

2018 to date, Rocket Lab’s Electron launch vehicle has become the

second most frequently launched U.S. rocket annually and has

delivered 191 satellites to orbit for private and public sector

organizations, enabling operations in national security, scientific

research, space debris mitigation, Earth observation, climate

monitoring, and communications. Rocket Lab’s Photon spacecraft

platform has been selected to support NASA missions to the Moon and

Mars, as well as the first private commercial mission to Venus.

Rocket Lab has three launch pads at two launch sites, including two

launch pads at a private orbital launch site located in New Zealand

and a third launch site in Virginia, USA. To learn more, visit

www.rocketlabusa.com.

+ FORWARD-LOOKING STATEMENTS

This press release may contain certain “forward-looking

statements” within the meaning of the Private Securities Litigation

Reform Act of 1995, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. All statements, other than statements of historical facts,

contained in this press release, including statements regarding our

expectations of financial results for the third quarter of 2024,

strategy, future operations, future financial position, projected

costs, prospects, plans and objectives of management, are

forward-looking statements. Words such as, but not limited to,

“anticipate,” “aim,” “believe,” “contemplate,” “continue,” “could,”

“design,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,”

“possible,” “potential,” “predict,” “project,” “seek,” “should,”

“suggest,” “strategy,” “target,” “will,” “would,” and similar

expressions or phrases, or the negative of those expressions or

phrases, are intended to identify forward-looking statements,

although not all forward-looking statements contain these

identifying words. These forward-looking statements are based on

Rocket Lab’s current expectations and beliefs concerning future

developments and their potential effects. These forward-looking

statements involve a number of risks, uncertainties (many of which

are beyond Rocket Lab’s control), or other assumptions that may

cause actual results or performance to be materially different from

those expressed or implied by these forward-looking statements.

Many factors could cause actual future events to differ materially

from the forward-looking statements in this release, including

risks related to delays and disruptions in expansion efforts;

delays in the development of our Neutron rocket; our dependence on

a limited number of customers; the harsh and unpredictable

environment of space in which our products operate which could

adversely affect our launch vehicle and spacecraft; increased

competition in our industry due in part to rapid technological

development; technological change in our industry which we may not

be able to keep up with or which may render our services

uncompetitive; average selling price trends; general economic

uncertainty and turbulence which could impact our customers’

ability to pay what we are owed; failure of our launch vehicles,

spacecraft and components to operate as intended either due to our

error in design, in engineering, in production or through no fault

of our own; launch schedule disruptions; supply chain disruptions,

product delays or failures; launch failures; natural disasters and

epidemics or pandemics; any inability to effectively integrate

recently acquired assets; a US government shutdown or delays in

government funding; changes in governmental regulations including

with respect to trade and export restrictions, or in the status of

our regulatory approvals or applications; or other events that

force us to cancel or reschedule launches, including customer

contractual rescheduling and termination rights; risks that

acquisitions may not be completed on the anticipated time frame or

at all or do not achieve the anticipated benefits and results; and

the other risks detailed from time to time in Rocket Lab’s filings

with the Securities and Exchange Commission (the “SEC”), including

under the heading “Risk Factors” in Rocket Lab’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2023, which was

filed with the SEC on February 28, 2024, and elsewhere. There can

be no assurance that the future developments affecting Rocket Lab

will be those that we have anticipated. Except as required by law,

Rocket Lab is not undertaking any obligation to update or revise

any forward-looking statements whether as a result of new

information, future events or otherwise.

Notes to Editor: All dollar amounts in this press release

are expressed in U.S. dollars, unless otherwise stated.

+ USE OF NON-GAAP FINANCIAL MEASURES

We supplement the reporting of our financial information

determined under Generally Accepted Accounting Principles in the

United States of America (“GAAP”) with certain non-GAAP financial

information. The non-GAAP financial information presented excludes

certain significant items that may not be indicative of, or are

unrelated to, results from our ongoing business operations. We

believe that these non-GAAP measures provide investors with

additional insight into the company's ongoing business performance.

These non-GAAP measures should not be considered in isolation or as

a substitute for the related GAAP measures, and other companies may

define such measures differently. We encourage investors to review

our financial statements and publicly filed reports in their

entirety and not to rely on any single financial measure.

Reconciliation of the non-GAAP financial information to the

corresponding GAAP measures for the historical periods disclosed

are included at the end of the tables in this press release. We

have not provided a reconciliation for forward-looking non-GAAP

financial measures because, without unreasonable efforts, we are

unable to predict with reasonable certainty the amount and timing

of adjustments that are used to calculate these non-GAAP financial

measures, particularly related to stock-based compensation and its

related tax effects. The following definitions are provided:

+ ADJUSTED EBITDA

EBITDA is defined as earnings before interest, taxes,

depreciation and amortization. Adjusted EBITDA further excludes

items of income or loss that we characterize as unrepresentative of

our ongoing operations. Such items are excluded from net income or

loss to determine Adjusted EBITDA. Management believes this measure

provides investors meaningful insight into results from ongoing

operations.

+ OTHER NON-GAAP FINANCIAL MEASURES

Non-GAAP gross profit, research and development, net, selling,

general and administrative, operating expenses, operating loss and

total other income (expense), net, further excludes items of income

or loss that we characterize as unrepresentative of our ongoing

operations. Such items are excluded from the applicable GAAP

financial measure. Management believes these non-GAAP measures

provide investors meaningful insight into results from ongoing

operations.

ROCKET LAB U.S.A., INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

OPERATIONS

FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2024 AND 2023

(unaudited; in thousands,

except share and per share data)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

Revenues

$

106,251

$

62,045

$

199,018

$

116,940

Cost of revenues

79,089

47,452

147,682

95,990

Gross profit

27,162

14,593

51,336

20,950

Operating expenses:

Research and development, net

39,912

31,035

78,416

54,940

Selling, general and administrative

30,524

28,717

59,273

57,186

Total operating expenses

70,436

59,752

137,689

112,126

Operating loss

(43,274

)

(45,159

)

(86,353

)

(91,176

)

Other income (expense):

Interest expense, net

(824

)

(745

)

(1,722

)

(1,430

)

(Loss) gain on foreign exchange

(286

)

(90

)

25

44

Other income, net

1,893

866

1,304

2,343

Total other income (expense), net

783

31

(393

)

957

Loss before income taxes

(42,491

)

(45,128

)

(86,746

)

(90,219

)

Benefit (provision) for income taxes

860

(761

)

855

(1,287

)

Net loss

$

(41,631

)

$

(45,889

)

$

(85,891

)

$

(91,506

)

Net loss per share attributable to Rocket

Lab USA, Inc.:

Basic and diluted

$

(0.08

)

$

(0.10

)

$

(0.17

)

$

(0.19

)

Weighted-average common shares

outstanding:

Basic and diluted

494,190,708

479,735,858

492,092,709

477,977,551

ROCKET LAB U.S.A., INC. AND

SUBSIDIARIES

CONSOLIDATED BALANCE

SHEETS

AS OF JUNE 30, 2024 AND

DECEMBER 31, 2023

(unaudited; in thousands,

except share and per share data)

June 30, 2024

(unaudited)

December 31,

2023

Assets

Current assets:

Cash and cash equivalents

$

340,911

$

162,518

Marketable securities, current

155,844

82,255

Accounts receivable, net

50,476

35,176

Contract assets

18,744

12,951

Inventories

104,539

107,857

Prepaids and other current assets

81,322

66,949

Assets held for sale

—

9,016

Total current assets

751,836

476,722

Non-current assets:

Property, plant and equipment, net

155,894

145,409

Intangible assets, net

64,243

68,094

Goodwill

71,020

71,020

Right-of-use assets - operating leases

55,283

59,401

Right-of-use assets - finance leases

14,667

14,987

Marketable securities, non-current

46,411

79,247

Restricted cash

3,640

3,916

Deferred income tax assets, net

1,573

3,501

Other non-current assets

24,031

18,914

Total assets

$

1,188,598

$

941,211

Liabilities and Stockholders’

Equity

Current liabilities:

Trade payables

$

26,468

$

29,303

Accrued expenses

11,937

5,590

Employee benefits payable

13,918

16,342

Contract liabilities

184,042

139,338

Current installments of long-term

borrowings

11,345

17,764

Other current liabilities

18,731

15,036

Total current liabilities

266,441

223,373

Non-current liabilities:

Convertible senior notes, net

344,344

—

Long-term borrowings, net, excluding

current installments

50,061

87,587

Non-current operating lease

liabilities

52,888

56,099

Non-current finance lease liabilities

15,112

15,238

Deferred tax liabilities

619

426

Other non-current liabilities

3,953

3,944

Total liabilities

733,418

386,667

COMMITMENTS AND CONTINGENCIES

Stockholders’ equity:

Common stock, $0.0001 par value;

authorized shares: 2,500,000,000; issued and outstanding shares:

496,500,849 and 488,923,055 at June 30, 2024 and December 31, 2023,

respectively

50

49

Additional paid-in capital

1,165,322

1,176,484

Accumulated deficit

(709,417

)

(623,526

)

Accumulated other comprehensive income

(loss)

(775

)

1,537

Total stockholders’ equity

455,180

554,544

Total liabilities and stockholders’

equity

$

1,188,598

$

941,211

ROCKET LAB U.S.A., INC. AND

SUBSIDIARIES

CONSOLIDATED STATEMENTS OF

CASH FLOWS

FOR THE SIX MONTHS ENDED JUNE

30, 2024 AND 2023

(unaudited; in

thousands)

For the Six Months Ended June

30,

2024

2023

CASH FLOWS FROM OPERATING

ACTIVITIES:

Net loss

$

(85,891

)

$

(91,506

)

Adjustments to reconcile net loss to net

cash used in operating activities:

Depreciation and amortization

16,421

13,785

Stock-based compensation expense

27,048

29,300

(Gain) loss on disposal of assets

(1,192

)

27

Loss on extinguishment of long-term

debt

1,330

—

Amortization of debt issuance costs and

discount

1,454

1,431

Noncash lease expense

2,959

2,026

Change in the fair value of contingent

consideration

(218

)

1,600

Accretion of marketable securities

purchased at a discount

(1,605

)

(2,116

)

Deferred income taxes

2,000

248

Changes in operating assets and

liabilities:

Accounts receivable, net

(15,420

)

11,433

Contract assets

(5,793

)

(7,264

)

Inventories

2,530

(10,611

)

Prepaids and other current assets

(4,638

)

(10,839

)

Other non-current assets

(5,289

)

(5,634

)

Trade payables

(1,930

)

13,234

Accrued expenses

6,566

(2,845

)

Employee benefits payables

(1,064

)

4,116

Contract liabilities

44,718

26,230

Other current liabilities

4,222

(1,881

)

Non-current lease liabilities

(2,860

)

(1,942

)

Other non-current liabilities

1,064

(241

)

Net cash used in operating activities

(15,588

)

(31,449

)

CASH FLOWS FROM INVESTING

ACTIVITIES:

Purchases of property, equipment and

software

(34,521

)

(23,246

)

Proceeds on disposal of assets, net

10,815

—

Cash paid for asset acquisition

—

(16,119

)

Purchases of marketable securities

(113,274

)

(132,000

)

Maturities of marketable securities

73,883

154,176

Net cash used in investing activities

(63,097

)

(17,189

)

CASH FLOWS FROM FINANCING

ACTIVITIES:

Proceeds from the exercise of stock

options and public warrants

1,159

1,808

Proceeds from Employee Stock Purchase

Plan

2,665

2,522

Proceeds from sale of employees restricted

stock units to cover taxes

9,270

7,801

Minimum tax withholding paid on behalf of

employees for restricted stock units

(9,479

)

(6,968

)

Payment of contingent consideration

—

(1,000

)

Purchase of capped calls related to

issuance of convertible senior notes

(43,168

)

—

Proceeds from issuance of convertible

senior notes

355,000

—

Repayments on Trinity Loan Agreement

(45,822

)

—

Payment of debt issuance costs

(12,205

)

—

Finance lease principal payments

(477

)

(160

)

Net cash provided by financing

activities

256,943

4,003

Effect of exchange rate changes on cash

and cash equivalents

(141

)

(482

)

Net increase (decrease) in cash and cash

equivalents and restricted cash

178,117

(45,117

)

Cash and cash equivalents, and restricted

cash, beginning of period

166,434

245,871

Cash and cash equivalents, and restricted

cash, end of period

$

344,551

$

200,754

ROCKET LAB U.S.A., INC. AND

SUBSIDIARIES

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES

FOR THE THREE AND SIX MONTHS

ENDED JUNE 30, 2024 AND 2023

(unaudited; in

thousands)

The tables provided below reconcile the

non-GAAP financial measures Adjusted EBITDA, Non-GAAP gross profit,

Non-GAAP research and development, net, Non-GAAP selling, general

and administrative, Non-GAAP operating expenses, Non-GAAP operating

loss and Non-GAAP total other income (expense), net with the most

directly comparable GAAP financial measures. See above for

additional information on the use of these non-GAAP financial

measures.

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

NET LOSS

$

(41,631

)

$

(45,889

)

$

(85,891

)

$

(91,506

)

Depreciation

4,796

3,513

9,720

7,226

Amortization

3,312

3,239

6,701

6,559

Stock-based compensation expense

13,955

15,264

27,048

29,300

Transaction costs

12

4

384

169

Interest expense, net

824

745

1,722

1,430

Change in fair value of contingent

consideration

53

1,300

(218

)

1,600

Performance reserve escrow

—

1,788

—

3,626

(Benefit) provision for income taxes

(860

)

761

(855

)

1,287

Loss (gain) on foreign exchange

286

90

(25

)

(44

)

Accretion of marketable securities

purchased at a discount

(764

)

(989

)

(1,606

)

(2,154

)

(Gain) loss on disposal of assets

(1,195

)

22

(1,192

)

27

Employee retention credit

—

—

—

(3,841

)

Loss on extinguishment of debt

—

—

1,330

—

ADJUSTED EBITDA

$

(21,212

)

$

(20,152

)

$

(42,882

)

$

(46,321

)

Three Months Ended June

30,

Six Months Ended June

30,

2024

2023

2024

2023

GAAP Gross profit

$

27,162

$

14,593

$

51,336

$

20,950

Stock-based compensation

3,673

3,330

7,176

7,143

Amortization of purchased intangibles and

favorable lease

1,741

1,709

3,484

3,419

Performance reserve escrow

—

76

—

133

Employee retention credit

—

—

—

(2,130

)

Non-GAAP Gross profit

$

32,576

$

19,708

$

61,996

$

29,515

Non-GAAP Gross margin

30.7

%

31.8

%

31.2

%

25.2

%

GAAP Research and development,

net

$

39,912

$

31,035

$

78,416

$

54,940

Stock-based compensation

(5,049

)

(6,652

)

(9,034

)

(11,674

)

Amortization of purchased intangibles and

favorable lease

(155

)

(9

)

(384

)

(18

)

Employee retention credit

—

—

—

631

Non-GAAP Research and development,

net

$

34,708

$

24,374

$

68,998

$

43,879

GAAP Selling, general and

administrative

$

30,524

$

28,717

$

59,273

$

57,186

Stock-based compensation

(5,233

)

(5,282

)

(10,838

)

(10,483

)

Amortization of purchased intangibles and

favorable lease

(1,382

)

(1,395

)

(2,314

)

(2,829

)

Transaction costs

(12

)

(4

)

(384

)

(169

)

Performance reserve escrow

—

(1,712

)

—

(3,493

)

Change in fair value of contingent

consideration

(53

)

(1,300

)

218

(1,600

)

Employee retention credit

—

—

—

1,080

Non-GAAP Selling, general and

administrative

$

23,844

$

19,024

$

45,955

$

39,692

GAAP Operating expenses

$

70,436

$

59,752

$

137,689

$

112,126

Stock-based compensation

(10,282

)

(11,934

)

(19,872

)

(22,157

)

Amortization of purchased intangibles and

favorable lease

(1,537

)

(1,404

)

(2,698

)

(2,847

)

Transaction costs

(12

)

(4

)

(384

)

(169

)

Performance reserve escrow

—

(1,712

)

—

(3,493

)

Change in fair value of contingent

consideration

(53

)

(1,300

)

218

(1,600

)

Employee retention credit

—

—

—

1,711

Non-GAAP Operating expenses

$

58,552

$

43,398

$

114,953

$

83,571

GAAP Operating loss

$

(43,274

)

$

(45,159

)

$

(86,353

)

$

(91,176

)

Total non-GAAP adjustments

17,298

21,469

33,396

37,120

Non-GAAP Operating loss

$

(25,976

)

$

(23,690

)

$

(52,957

)

$

(54,056

)

GAAP Total other income (expense),

net

$

783

$

31

$

(393

)

$

957

Loss (gain) on foreign exchange

286

90

(25

)

(44

)

(Gain) loss on disposal of assets

(1,195

)

22

(1,192

)

27

Loss on extinguishment of debt

—

—

1,330

—

Non-GAAP Total other income (expense),

net

$

(126

)

$

143

$

(280

)

$

940

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808283474/en/

+ Rocket Lab Investor Relations investors@rocketlabusa.com

+ Rocket Lab Media Contact Morgan Connaughton

media@rocketlabusa.com

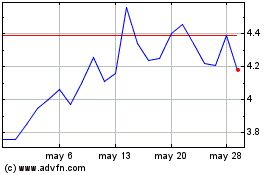

Rocket Lab USA (NASDAQ:RKLB)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Rocket Lab USA (NASDAQ:RKLB)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024