0001785056false00017850562025-01-232025-01-23

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

Date of Report (Date of earliest event reported): January 23, 2025 |

INTERACTIVE STRENGTH INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

|

Delaware |

001-41610 |

82-1432916 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

1005 Congress Avenue, Suite 925 |

|

Austin, Texas |

|

78701 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

|

Registrant’s Telephone Number, Including Area Code: 512 885-0035 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common stock, $0.0001 par value per share |

|

TRNR |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously disclosed, on February 1, 2024, Interactive Strength Inc. (the "Company") entered into a Credit Agreement (the “Credit Agreement”) with Vertical Investors, LLC (the “Lender”), pursuant to which the Company received a term loan from the Lender in the original principal amount of $7,968,977.74 (the “Loan”). As previously disclosed, on March 29, 2024, the Company issued to the Lender 1,500,000 shares of the Company’s Series A Preferred Stock, par value $0.0001 per share (“Series A Preferred Stock”), upon the conversion of $3.0 million of the Loan.

As previously disclosed, on April 24, 2024, the Company entered into a Loan Modification Agreement (the “Modification Agreement”) with the Lender, pursuant to which the Lender was issued 1,500,000 shares of Series A Preferred Stock in exchange for which the principal amount of the Loan was reduced by $3,000,000.

As previously disclosed, on April 24, 2024, the Company entered into a Loan Restoration Agreement (the “Restoration Agreement”) with the Lender. Pursuant to the Restoration Agreement, in the event the aggregate amount of funds received by the Lender (net of all commissions, transfer fees or other transaction fees of any kind and taxes paid or payable as a result thereof) arising out of the disposition of the Preferred Stock, shares of the Company’s Common Stock issuable upon conversion of the Preferred Stock, if converted by the Lender, or any other securities of the Company issued to the Lender as a result of its holding the Preferred Stock (the aggregate amount of funds, the “Net Trade Value”) received by the Lender on or before December 31, 2024 is less than $3.0 million within ten (10) business days of written demand therefor, the Company shall pay the Lender the amount that is equal to $3.0 million less the Net Trade Value.

As of December 31, 2024, the Net Trade Value was $992,492.

On January 23, 2025, the Company and the Lender entered into a Settlement Agreement (the “Settlement Agreement”), pursuant to which the Company issued 496,246 shares of the Company’s Series C Preferred Stock, par value $0.0001 per share (“Series C Preferred Stock”), to the Lender as payment of the $992,492 Net Trade Value.

On January 23, 2025, the Lender was issued 126,515 shares of Series C Preferred Stock as a dividend in kind on the shares of Series C Preferred Stock owned by the Lender (2,861,128 Series C Preferred Stock shares owned prior to the issuance of the shares pursuant to the Settlement Agreement). The 496,246 shares of Series C Preferred Stock issued pursuant to the Settlement Agreement combined with the 126,515 shares of Series C Preferred Stock issued as a dividend is referred to herein as the “Series C Preferred Shares”.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report on Form 8-K with respect to the issuance of the Series C Preferred Shares is incorporated by reference into this Item 3.02.

Pursuant to the Certificate of Designations of Series A Preferred Stock, on January 23, 2025, the Board of Directors of the Company declared a dividend on the shares of Series A Preferred Stock issued and outstanding as of the record date for such dividend, as a dividend in kind, in the form of 112,334 shares of Series A Preferred Stock in the aggregate (the “Dividend Shares”). The Company issued the Dividend Shares on January 23, 2025.

The issuance of the Dividend Shares and the Series C Preferred Shares was exempt from registration under the Securities Act of 1933, as amended, pursuant to Section 4(a)(2).

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

Interactive Strength Inc. |

|

|

|

|

Date: |

January 29, 2025 |

By: |

/s/ Michael J. Madigan |

|

|

|

Chief Financial Officer

(Principal Financial Officer and Principal Accounting Officer) |

DECEMBER 2024 SETTLEMENT AGREEMENT

THIS DECEMBER 2024 SETTLEMENT AGREEMENT (this “Agreement”) is dated as of January 23, 2025 (the “Effective Date”), by and between Interactive Strength Inc., a Delaware corporation (the “Company”) and Vertical Investors, LLC, a Mississippi limited liability company (“Vertical” and together with the Company, the “Parties”).

WHEREAS, on April 24, 2024, the Company and Vertical entered into that certain Loan Modification Agreement (the “Loan Modification Agreement”), pursuant to which Vertical was issued 1,500,000 shares of the Company’s Series A Preferred Stock;

WHEREAS, on April 24, 2024, the Company and Vertical entered into that certain Loan Restoration Agreement (as subsequently amended and modified, the “Loan Restoration Agreement”);

WHEREAS, the Company has authorized and designated a Series C Preferred Stock (the “Series C”) pursuant to the terms of a Certificate of Designation in respect of thereof (the “Series C COD”) which provides for each share of Series C to have an original issue price of $2.00 (the “Original Issue Price”);

WHEREAS, the Company and Vertical are parties to that certain Credit Agreement, dated as of February 1, 2024, as modified by the Loan Modification Agreement (as amended heretofore, herein and hereafter, collectively, the “Credit Agreement”) and

WHEREAS, the Company and Vertical have agreed to issue certain “Series C Preferred Shares” in exchange for payment owed under the terms and conditions of Section 2 of the Loan Restoration Agreement;

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereto, intending to be legally bound hereby, agree as follows:

1.Settlement. Effective as of the Effective Date, in settlement of the amount owed to Vertical under the terms and conditions of Section 2 of the Loan Restoration Agreement, based upon the Net Trade Value (as defined in the Loan Restoration Agreement) of ($992,492), as of December 31, 2024, the Company shall issue 496,246 Series C Preferred Shares. In connection with the foregoing, the Company and Vertical shall direct the Company’s transfer agent to issue to Vertical the Series C Preferred Shares.

2.Representations and Warranties of the Company. The Company hereby represents and warrants to Vertical that:

(a)the Company is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware;

(b)all corporate action on the part of the Company necessary for the authorization, execution and delivery of this Agreement, and the performance of all obligations hereunder, have been taken on or prior to the date hereof. This Agreement has been validly

authorized, executed and delivered by the Company, and constitutes the legal, valid and binding obligations of the Company, enforceable against them in accordance with their terms, except as such enforceability may be limited by general principles of equity or by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies; and

(c)the Series C Preferred Shares issued in accordance herewith have been duly authorized and validly issued and are fully paid and non-assessable.

3.Representations and Warranties of Vertical. Vertical hereby represents and warrants to the Company that:

(a)Vertical is a limited liability company duly organized, validly existing and in good standing under the laws of the State of Mississippi;

(b)all actions on the part of Vertical necessary for the authorization, execution and delivery of this Agreement, and the performance of all obligations hereunder, have been taken on or prior to the date hereof; this Agreement is validly authorized, executed and delivered by Vertical and constitutes the legal, valid and binding obligations of Vertical, enforceable against Vertical in accordance with its terms, except as such enforcement may be limited by general principles of equity or by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation and other similar laws relating to, or affecting generally, the enforcement of applicable creditors’ rights and remedies;

(c)Vertical is acquiring the Series C Preferred Shares for its own account only and not with view towards, or for sale in connection with, the public sale or distribution thereof;

(d)Vertical is an “accredited investor” as that term is defined in Rule 501 of Regulation D, as promulgated under the Securities Act;

(e)Vertical understands that until such time as the Series C Preferred Shares have been registered under the Securities Act of 1933 or may be sold pursuant to Rule 144 or Regulation S or other applicable exemption without any restriction as to the number of securities as of a particular date that can then be immediately sold, the Series C Preferred Shares may bear a restrictive legend;

(f)Vertical and its advisors, if any, have been furnished with all materials relating to the business, finances and operations of the Company and materials relating to the offer and issuance of the Series C Preferred Shares; Vertical has had the opportunity to review the Company’s filings with the Securities and Exchange Commission; Vertical and its advisors, if any, have been afforded the opportunity to ask questions of the Company; neither such inquiries nor any other due diligence investigations conducted by Vertical or its advisors, if any, or its representatives shall modify, amend or affect Vertical’s right to rely on the Company’s representations and warranties contained herein; Vertical has sought such accounting, legal and tax advice as it has considered necessary to make an informed investment decision with respect to its acquisition of the Series C Preferred Shares; Vertical is relying solely on its own accounting, legal and tax advisors, and not on any statements of the Company or any of its agents or

representatives, for such accounting, legal and tax advice with respect to its acquisition of the Series C Preferred Shares and the transactions contemplated by this Agreement;

(g)Vertical understands that no United States federal or state agency or any other government or governmental agency has passed on or made any recommendation or endorsement of the Series C Preferred Shares or the fairness or suitability of the investment nor have such authorities passed upon or endorsed the merits of the offering of the Series C Preferred Shares; and

(h)Vertical understands and acknowledges that, upon its execution of this Agreement, any and all due and owing to it will be automatically extinguished, without further action on the part of the Company or Vertical except as otherwise set forth herein, and Vertical releases the Company from any and all obligations of the Company to Vertical under the Liability owed to it; without limiting the generality of the preceding sentence, Vertical hereby surrenders and waives all rights that it has in respect of all of its owed Liability.

4.Additional Covenants. Notwithstanding anything herein or in the Loan Modification Agreement, the Loan Restoration Agreement, or any other agreement between the Company and Vertical, so long as Vertical is a holder of Series C Preferred Shares, the Company shall not (i) incur any indebtedness, or (ii) issue any preferred securities or other securities with a liquidation or conversion preference with superiority over Series C Preferred Shares, unless, in each case, Vertical’s prior written consent is first obtained.

(a)Governing Law. This Agreement will be governed by and construed in accordance with the laws of the State of Delaware without giving effect to principles of conflicts of law.

(b)Entire Agreement. This Agreement contains the entire agreement between the Parties regarding the subject matter hereof and supersedes all prior agreements or understandings between the Parties with respect thereto.

(c)Successors. This Agreement will inure to the benefit of any successor in interest to a party or any person that after the date hereof may acquire any subsidiary or division of a party.

(d)Counterparts. This Agreement may be executed in counterparts, each of which will be deemed an original, and all of which will constitute the same agreement.

[Signature Page(s) Follow this Page]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed as of the date and year set forth above.

INTERACTIVE STRENGTH INC.

By: /s/ Trent Ward

Name: Trent Ward

Title: Chief Executive Officer

VERTICAL INVESTORS, LLC

By: Addicus Private Equity, LLC, its Manager

By: /s/ Andrew B. Adams

Name: Andrew B. Adams

Title: Manager

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

Interactive Strength (NASDAQ:TRNR)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

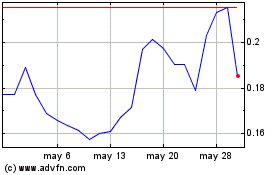

Interactive Strength (NASDAQ:TRNR)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025