Combination with Informa Tech’s Digital

Businesses Remains On Track to Close in the Fourth Quarter of

2024

TechTarget (Nasdaq: TTGT), the global leader in B2B technology

purchase intent data and services, today announced that it has

rescheduled its previously announced Investor Day to take place

after the closure of the transaction with Informa Tech’s Digital

Businesses. This continues to be expected in the fourth quarter of

2024, subject to approval by TechTarget shareholders and the

satisfaction of other customary closing conditions. The later date

will ensure the event can fully focus on the newly combined

company’s vision, growth outlook and new product opportunities.

TechTarget will confirm the new date and time once the transaction

timetable is finalized.

Additional Information and Where to Find It

In connection with the proposed transaction (the “proposed

transaction”), Toro CombineCo, Inc. (“NewCo”) filed with the

Securities and Exchange Commission (the “SEC”) a registration

statement on Form S-4 (File No. 333-280529) containing a

preliminary proxy statement of TechTarget, Inc. (“TechTarget”) that

also constitutes a preliminary prospectus of NewCo (the “Proxy

Statement/Prospectus”). The Proxy Statement/Prospectus is not final

and may be amended. A definitive Proxy Statement/Prospectus will be

mailed to stockholders of TechTarget. TechTarget and NewCo may also

file other documents with the SEC regarding the proposed

transaction. This communication is not a substitute for any proxy

statement, registration statement or prospectus, or any other

document that TechTarget or NewCo (as applicable) may file with the

SEC in connection with the proposed transaction. BEFORE MAKING ANY

VOTING OR INVESTMENT DECISION, TECHTARGET INVESTORS AND SECURITY

HOLDERS ARE URGED TO READ CAREFULLY AND IN THEIR ENTIRETY THE

PRELIMINARY PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT

DOCUMENTS THAT ARE FILED OR WILL BE FILED BY TECHTARGET OR NEWCO

WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE

DOCUMENTS, IN CONNECTION WITH THE PROPOSED TRANSACTION WHEN THEY

BECOME AVAILABLE, BECAUSE THESE DOCUMENTS CONTAIN OR WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED

MATTERS. TechTarget investors and security holders may obtain free

copies of the preliminary Proxy Statement/Prospectus filed on June

27, 2024 (as amended on September 4, 2024) and will be able to

obtain copies of the definitive Proxy Statement/Prospectus (when it

becomes available), as well as other filings containing important

information about TechTarget, NewCo, and other parties to the

proposed transaction (including Informa PLC (“Informa”)), without

charge through the website maintained by the SEC at www.sec.gov.

Copies of the documents filed with the SEC by TechTarget will be

available free of charge under the tab “Financials” on the

“Investor Relations” page of TechTarget’s internet website at

investor.techtarget.com or by contacting TechTarget’s Investor

Relations Department at investor@techtarget.com.

Participants in the Solicitation

TechTarget, NewCo and Informa, and their respective directors

and certain of their respective executive officers and employees

may be deemed to be participants in the solicitation of proxies

from TechTarget’s stockholders in connection with the proposed

transaction. Information regarding the directors of Informa is

contained in Informa’s annual reports and accounts available on

Informa’s website at https://www.informa.com/investors and in the

National Storage Mechanism at

data.fca.org.uk/#/nsm/nationalstoragemechanism. Information

regarding the directors and executive officers of TechTarget is

contained in TechTarget’s proxy statement for its 2024 annual

meeting of stockholders, filed with the SEC on April 17, 2024, and

in other documents subsequently filed with the SEC. Additional

information regarding the participants in the proxy solicitations

and a description of their direct or indirect interests, by

security holdings or otherwise, is included in the preliminary

Proxy Statement/Prospectus filed on June 27, 2024 (as amended on

September 4, 2024), and will be contained in the definitive Proxy

Statement/Prospectus and other relevant materials that are filed or

will be filed with the SEC (when they become available). These

documents can be obtained free of charge from the sources indicated

above.

No Offer or Solicitation

This press release is for informational purposes only and is not

intended to and does not constitute an offer to sell or the

solicitation of an offer to buy any securities, or a solicitation

of any vote or approval, nor shall there be any offer, solicitation

or sale of securities in any jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction.

No offer of securities shall be made except by means of a

prospectus meeting the requirements of Section 10 of the Securities

Act of 1933, as amended.

Cautionary Note Regarding Forward-Looking Statements

This press release contains “forward-looking” statements within

the meaning of Section 27A of the Securities Act of 1933 and

Section 21E of the Securities Exchange Act of 1934 that involve

substantial risks and uncertainties. All statements, other than

historical facts, are forward-looking statements, including:

statements regarding the expected timing and structure of the

proposed transaction; the ability of the parties to complete the

proposed transaction considering the various closing conditions;

the expected benefits of the proposed transaction, such as improved

operations, enhanced revenues and cash flow, synergies, growth

potential, market profile, business plans, expanded portfolio and

financial strength; the competitive ability and position of NewCo

following completion of the proposed transaction; legal, economic,

and regulatory conditions; and any assumptions underlying any of

the foregoing. Forward-looking statements concern future

circumstances and results and other statements that are not

historical facts and are sometimes identified by the words “may,”

“will,” “should,” “potential,” “intend,” “expect,” “endeavor,”

“seek,” “anticipate,” “estimate,” “overestimate,” “underestimate,”

“believe,” “plan,” “could,” “would,” “project,” “predict,”

“continue,” “target,” or the negatives of these words or other

similar terms or expressions that concern TechTarget’s or NewCo’s

expectations, strategy, priorities, plans, or intentions.

Forward-looking statements are based upon current plans, estimates,

and expectations that are subject to risks, uncertainties, and

assumptions. Should one or more of these risks or uncertainties

materialize, or should underlying assumptions prove incorrect,

actual results may vary materially from those indicated or

anticipated by such forward-looking statements. We can give no

assurance that such plans, estimates, or expectations will be

achieved, and therefore, actual results may differ materially from

any plans, estimates, or expectations in such forward-looking

statements.

Important factors that could cause actual results to differ

materially from such plans, estimates, or expectations include,

among others: that one or more closing conditions to the proposed

transaction, including certain regulatory approvals, may not be

satisfied or waived, on a timely basis or otherwise, including that

a governmental entity may prohibit, delay, or refuse to grant

approval for the consummation of the proposed transaction, may

require conditions, limitations, or restrictions in connection with

such approvals or that the required approval by the shareholders of

TechTarget may not be obtained; the risk that the proposed

transaction may not be completed in the time frame expected by

TechTarget, NewCo or Informa, or at all; unexpected costs, charges,

or expenses resulting from the proposed transaction; uncertainty of

the expected financial performance of NewCo following completion of

the proposed transaction; failure to realize the anticipated

benefits of the proposed transaction, including as a result of

delay in completing the proposed transaction or integrating the

relevant portion of Informa tech digital businesses with the

business of TechTarget; the ability of NewCo to implement its

business strategy; difficulties and delays in achieving revenue and

cost synergies of NewCo; the occurrence of any event that could

give rise to termination of the proposed transaction; potential

litigation in connection with the proposed transaction or other

settlements or investigations that may affect the timing or

occurrence of the proposed transaction or result in significant

costs of defense, indemnification, and liability; evolving legal,

regulatory, and tax regimes; changes in economic, financial,

political, and regulatory conditions, in the United States and

elsewhere, and other factors that contribute to uncertainty and

volatility, natural and man-made disasters, civil unrest,

pandemics, geopolitical uncertainty, and conditions that may result

from legislative, regulatory, trade, and policy changes associated

with the current or subsequent U.S. administration; risks related

to disruption of management time from ongoing business operations

due to the proposed transaction; certain restrictions during the

pendency of the proposed transaction that may impact TechTarget’s

ability to pursue certain business opportunities or strategic

transactions; TechTarget’s, NewCo’s and Informa’s ability to meet

expectations regarding the accounting and tax treatments of the

proposed transaction; the risk that any announcements relating to

the proposed transaction could have adverse effects on the market

price of TechTarget’s common stock; the risk that the proposed

transaction and its announcement could have an adverse effect on

the ability of TechTarget to retain customers and retain and hire

key personnel and maintain relationships with customers, suppliers,

employees, stockholders, strategic partners and other business

relationships and on its operating results and business generally;

market acceptance of TechTarget’s and the relevant portion of

Informa Tech digital businesses’ products and services; the impact

of pandemics and future health epidemics and any related economic

downturns, on TechTarget’s business and the markets in which it and

its customers operate; changes in economic or regulatory conditions

or other trends affecting the internet, internet advertising and

information technology industries; data privacy and artificial

intelligence laws, rules, and regulations; the impact of foreign

currency exchange rates; certain macroeconomic factors facing the

global economy, including instability in the regional banking

sector, disruptions in the capital markets, economic sanctions and

economic slowdowns or recessions, rising inflation and interest

rate fluctuations on TechTarget’s and the relevant portion of

Informa Tech digital businesses’ results and other matters included

in TechTarget’s filings with the SEC, including in Item 1A of its

Annual Report on Form 10-K for the year ended December 31, 2023.

These risks, as well as other risks associated with the proposed

transaction, are more fully discussed the preliminary Proxy

Statement/Prospectus filed on June 27, 2024 (as amended on

September 4, 2024), and will be contained in the definitive Proxy

Statement/Prospectus and other relevant materials that are filed or

will be filed with the SEC (when they become available). While the

list of factors presented here and in the preliminary Proxy

Statement/Prospectus are, and the list of factors to be presented

in definitive Proxy Statement/Prospectus will be, considered

representative, no such list should be considered to be a complete

statement of all potential risks and uncertainties. Unlisted

factors may present significant additional obstacles to the

realization of forward-looking statements. We caution you not to

place undue reliance on any of these forward-looking statements as

they are not guarantees of future performance or outcomes and that

actual performance and outcomes, including, without limitation, our

actual results of operations, financial condition and liquidity,

and the development of new markets or market segments in which we

operate, may differ materially from those made in or suggested by

the forward-looking statements contained in this communication.

Any forward-looking statements speak only as of the date of this

communication. None of TechTarget, NewCo or Informa undertakes any

obligation to update any forward-looking statements, whether as a

result of new information or developments, future events, or

otherwise, except as required by law. Neither future distribution

of this communication nor the continued availability of this

communication in archive form on TechTarget’s website at

investor.techtarget.com or Informa’s website at

www.informa.com/investors should be deemed to constitute an update

or re-affirmation of these statements as of any future date.

About TechTarget

TechTarget (Nasdaq: TTGT) is the global leader in purchase

intent-driven marketing and sales services that deliver business

impact for enterprise technology companies. By creating abundant,

high-quality editorial content across approximately 150 websites

and 1,000 webinars and virtual event channels, TechTarget attracts

and nurtures communities of technology buyers researching their

companies’ information technology needs. By understanding these

buyers’ content consumption behaviors, TechTarget creates the

purchase intent insights that fuel efficient and effective

marketing and sales activities for clients around the world.

TechTarget has offices in Boston, London, Munich, New York,

Paris, Singapore and Sydney. For more information, visit

techtarget.com and follow us on Twitter @TechTarget.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904265717/en/

TechTarget, Media Contact: Chris Kittredge or Ben

Spicehandler techtarget@fgsglobal.com

TechTarget, Investor Relations: Dan Noreck

dnoreck@techtarget.com

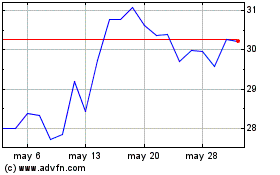

TechTarget (NASDAQ:TTGT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

TechTarget (NASDAQ:TTGT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025