UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER

THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of September 2024

Commission

File Number: 001-38527

Uxin

Limited

21/F,

Donghuang Building,

No.

16 Guangshun South Avenue

Chaoyang

District,

Beijing 100102

People’s Republic of China

(Address

of principal executive offices)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):________________

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):________________

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

UXIN

LIMITED |

| |

|

| |

By: |

/s/

Feng Lin |

| |

Name: |

Feng

Lin |

| |

Title: |

Chief

Financial Officer |

Date:

September 23, 2024

Exhibit

Index

Exhibit 99.1—Press Release

Exhibit

99.1

Uxin

Reports Unaudited First Quarter of Fiscal Year 2025 Financial Results

BEIJING,

September 23, 2024 –Uxin Limited (“Uxin” or the “Company”) (Nasdaq: UXIN), China’s leading used car

retailer, today announced its unaudited financial results for the first quarter ended June 30, 2024.

Highlights

for the Quarter Ended June 30, 2024

| ● | Transaction

volume was 5,605 units for the three months ended June 30, 2024, an increase of 38.1%

from 4,058 units in the last quarter and an increase of 72.2% from 3,254 units in the same

period last year. |

| | |

| ● | Retail

transaction volume was 4,090 units, an increase of 30.9% from 3,124 units in the last

quarter and an increase of 142.4% from 1,687 units in the same period last year. |

| | |

| ● | Total

revenues were RMB401.2 million (US$55.2 million) for the three months ended June 30,

2024, an increase of 25.7% from RMB319.2 million in the last quarter and an increase of 38.8%

from RMB289.0 million in the same period last year. |

| | |

| ● | Gross

margin was 6.4% for the three months ended June 30, 2024, compared with 6.6% in the last

quarter and 6.1% in the same period last year. |

| | |

| ● | Loss

from operations was RMB62.5 million (US$8.6 million) for the three months ended June

30, 2024, compared with RMB109.8 million in the last quarter and RMB63.2 million in the same

period last year. |

| | |

| ● | Non-GAAP

adjusted EBITDA1 was a loss of RMB33.9 million (US$4.7 million), compared

with a loss of RMB39.7 million in the last quarter and a loss of RMB46.6 million in the same

period last year. |

Mr.

Kun Dai, Founder, Chairman and Chief Executive Officer of Uxin, commented, “We are pleased to deliver another quarter of strong

performance, with retail transaction volume reaching 4,090 units, representing a 31% increase sequentially and a 142% increase year-over-year.

Our vehicle turnover efficiency remains healthy, with inventory turnover days around 30. Alongside our robust sales growth, customer

satisfaction has also improved, as our Net Promoter Score reached 65 during the quarter, the highest level in the industry.”

Mr.

Dai continued, “Our integrated online and offline model continues to demonstrate its strong competitiveness and growth potential.

We have already begun expanding our inventory, and we expect sales to continue growing rapidly over the coming quarters. In addition,

we are actively expanding our network of superstores, with a recent strategic partnership in Zhengzhou and ongoing discussions with several

other cities. This expansion will significantly enhance Uxin’s market presence in new regions, driving continued sales growth and

improving overall business performance.”

1

This is a non-GAAP measure. We believe non-GAAP measures help investors and users of our financial information understand the effect

of adjusting items on our selected reported results and provide alternate measurements of our performance, both in the current period

and across periods. See our Financial Supplement, filed as Exhibit 99.1 to our Current Report on Form 6-K on September 23, 2024 with

the SEC, “Unaudited Reconciliations of GAAP And Non-GAAP Results” for a reconciliation and additional information on non-GAAP

measures.

Mr.

Feng Lin, Chief Financial Officer of Uxin, commented: “During the quarter, our retail vehicle sales revenue totaled RMB325 million,

reflecting a 74% year-over-year increase, while we maintained a stable gross margin amid intense market competition. At the same time,

through disciplined cost control, we reduced our adjusted EBITDA loss to RMB33.9 million, narrowing it by 27% compared to the same period

last year. Our business is now on a rapid growth trajectory, and we expect our retail transaction volume for the next quarter to be in

the range of 5,800 to 6,000 units, representing over 40% sequential growth. We also expect to further narrow our adjusted EBITDA loss

to under RMB10 million for the next quarter and remain confident in achieving EBITDA profitability for the December quarter of 2024.”

Financial

Results for the Quarter Ended June 30, 2024

Total

revenues were RMB401.2 million (US$55.2 million) for the three months ended June 30, 2024, an increase of 25.7% from RMB319.2 million

in the last quarter and an increase of 38.8% from RMB289.0 million in the same period last year. The increases were mainly due to the

increase of retail vehicle sales revenue.

Retail

vehicle sales revenue was RMB325.0 million (US$44.7 million) for the three months ended June 30, 2024, representing an increase

of 20.6% from RMB269.4 million in the last quarter and an increase of 73.9% from RMB186.8 million in the same period last year. For the

three months ended June 30, 2024, retail transaction volume was 4,090 units, an increase of 30.9% from 3,124 units last quarter and an

increase of 142.4% from 1,687 units in the same period last year. The increases in retail vehicle sales revenue were mainly due to the

increase of retail transaction volume. By offering superior products and services, the Company’s superstores have built strong

customer trust and established Uxin as the leading brand in regional markets. This further boosted the in-store customer conversion rate

and improved the retail vehicle inventory turnover rate, enabling the Company to achieve higher retail transaction volumes with a relatively

stable inventory size. Additionally, in response to the new car price wars and intense industry competition in the past fiscal year,

the Company has significantly enhanced its pricing capabilities. By promptly adjusting prices to align with actual market demand, the

Company mitigated the effects of new car price reductions and accelerated vehicle sales.

Wholesale

vehicle sales revenue was RMB63.9 million (US$8.8 million) for the three months ended June 30, 2024, compared with RMB39.7 million

in the last quarter and RMB94.6 million in the same period last year. For the three months ended June 30, 2024, wholesale transaction

volume was 1,515 units, representing an increase of 62.2% from 934 units last quarter and a decrease of 3.3% from 1,567 units in the

same period last year. Wholesale vehicle sales refer to vehicles purchased by the Company from individuals that do not meet the Company’s

retail standards and are subsequently sold through online and offline channels. The quarter-over-quarter increase in wholesale transaction

volume was a natural growth after the traditional off-season for used car sales due to the Chinese New Year last quarter. Compared with

the same period last year, as the Company continued to improve its inventory capacity and reconditioning capabilities, an increased number

of acquired vehicles were reconditioned to meet the Company’s retail standards, rather than being sold through wholesale channels.

As a result, the wholesale vehicle sales revenue declined year-over-year.

Other

revenue was RMB12.3 million (US$1.7 million) for the three months ended June 30, 2024, compared with RMB10.0 million in the last

quarter and RMB7.6 million in the same period last year. Other revenues mainly consist of revenue from value-added services.

Cost

of revenues was RMB375.6 million (US$51.7 million) for the three months ended June 30, 2024, compared with RMB298.1 million in the

last quarter and RMB271.4 million in the same period last year.

Gross

margin was 6.4% for the three months ended June 30, 2024, compared with 6.6% in the last quarter and 6.1% in the same period last

year. The Company’s gross margin remained stable quarter-over-quarter.

Total

operating expenses were RMB90.9 million (US$12.5 million) for the three months ended June 30, 2024. Total operating expenses excluding

the impact of share-based compensation were RMB78.9 million.

| ● | Sales

and marketing expenses were RMB59.4 million (US$8.2 million) for the three months

ended June 30, 2024, an increase of 16.8% from RMB50.8 million in the last quarter and an

increase of 27.5% from RMB46.5 million in the same period last year. The quarter-over-quarter

increase was mainly due to the increased salaries for the sales teams. Compared with the

same period last year, in addition to the increased salaries for the sales teams, the year-over-year

increase was also attributed to the increase in right-of-use assets depreciation expenses

as a result of relocation to the Company’s Hefei Superstore in September 2023. |

| ● | General

and administrative expenses were RMB28.1 million (US$3.9 million) for the three months

ended June 30, 2024, representing a decrease of 62.7% from RMB75.3 million in the last quarter

and a decrease of 15.1% from RMB33.1 million in the same period last year. The decrease was

mainly due to a decrease of the share-based compensation expense. Additionally, due to the

execution of a series of initiatives to realign its organizational structure and reduce the

company-wide costs and expenses last quarter, salaries and benefits expenses for personnel

performing general and administrative functions decreased accordingly. |

| ● | Research

and development expenses were RMB3.4 million (US$0.4 million) for the three months

ended June 30, 2024, representing a decrease of 43.9% from RMB6.0 million in the last quarter

and a decrease of 61.9% from RMB8.9 million in the same period last year. The decrease was

mainly due to a decrease of the salaries and benefits expenses of employees engaged in research

and development as a result of the decrease in headcount. |

Other

operating income, net was RMB2.8 million (US$0.4million) for the three months ended June 30, 2024, compared with RMB0.9 million for

the last quarter and RMB 7.0 million in the same period last year.

Loss

from operations was RMB62.5 million (US$8.6 million) for the three months ended June 30, 2024, compared with RMB109.8 million for

the last quarter and RMB63.2 million in the same period last year.

Interest

expenses were RMB22.9 million (US$3.1 million) for the three months ended June 30, 2024, representing a decrease of 4.6% from RMB24.0

million in the last quarter and an increase of 346.4% from RMB5.1 million in the same period last year. The quarter-over-quarter decrease

was mainly due to the repayment of long-term borrowings in April, 2024. The year-over-year increase was mainly due to the increase of

interest expenses on finance lease liabilities relating to the lease of Changfeng Superstore in September, 2023.

Net

loss from operations was net loss of RMB49.8 million (US$6.9 million) for the three months ended June 30, 2024, compared with net

loss of RMB142.7 million for the last quarter

and net loss of RMB91.6 million for the same period last year.

Non-GAAP

adjusted EBITDA was a loss of RMB33.9 million (US$4.7 million) for the three months ended June 30, 2024, compared with a loss of

RMB39.7 million in the last quarter and a loss of RMB46.6 million in the same period last year.

Liquidity

As

of June 30, 2024, the Company had cash and cash equivalents of RMB17.2 million, compared to RMB23.3 million as of March 31, 2024.

The

Company has incurred accumulated and recurring losses from operations, and cash outflows from operating activities. In addition, the

Company’s current liabilities exceeded its current assets by approximately RMB315.6 million as of June 30, 2024.

The

Company’s ability to continue as a going concern is dependent on management’s ability to increase sales, achieve higher gross

profit margin and control operating costs and expenses to reduce the cash that will be used in operating cash flows, and to enter into

financing arrangements, including but not limited to renewal of the existing borrowings and obtaining new debt and equity financings.

There is uncertainty regarding the implementation of these business and financing plans, which raises substantial doubt about the Company’s

ability to continue as a going concern. The accompanying unaudited financial information does not include any adjustment that is reflective

of these uncertainties.

Recent

Development

On

September 13, 2024, Uxin announced that it entered into a memorandum of understanding (MOU) with Pintu (Beijing) Information Technology

Co., Ltd. (the “Investor”), an indirect wholly-owned subsidiary of Dida Inc. (HKEX: 2559), regarding a proposed investment

of US$7.5 million in Uxin. The Investor intends to subscribe for 1.54 billion Class A ordinary shares of the Company at a subscription

price of US$0.004858 per share (or US$1.4575 per ADS).

Additionally,

the Investor has extended a loan of the RMB equivalent of US$7.5 million to Youxin (Anhui) Industrial Investment Co., Ltd., a wholly-owned

subsidiary of Uxin. The proposed investment is subject to the execution of definitive agreements and the satisfaction of customary closing

conditions. This strategic investment marks an important step in strengthening Uxin’s financial position and supporting its future

growth initiatives.

Business

Outlook

For

the three months ending September 30, 2024, the Company expects its retail transaction volume to be within the range of 5,800 units to

6,000 units. The Company estimates that its total revenues including retail vehicle sales revenue, wholesale vehicle sales revenue and

other revenue to be within the range of RMB480 million to RMB500 million. The Company expects its Non-GAAP adjusted EBITDA to be less

than a loss of RMB10 million. These forecasts reflect the Company’s current and preliminary views on the market and operational

conditions, which are subject to changes.

Conference

Call

Uxin’s

management team will host a conference call on Monday, September 23, 2024, at 8:00 A.M. U.S. Eastern Time (8:00 P.M. Beijing/Hong Kong

time on the same day) to discuss the financial results. In advance of the conference call, all participants must use the following link

to complete the online registration process. Upon registering, each participant will receive access details for this conference including

an event passcode, a unique access PIN, dial-in numbers, and an e-mail with detailed instructions to join the conference call.

Conference

Call Preregistration:https://dpregister.com/sreg/10192717/fd80b45d74

A

telephone replay of the call will be available after the conclusion of the conference call until September 30, 2024. The dial-in details

for the replay are as follows:

| International: |

+1 412 317 0088 |

A

live webcast and archive of the conference call will be available on the Investor Relations section of Uxin’s website at http://ir.xin.com.

About

Uxin

Uxin

is China’s leading used car retailer, pioneering industry transformation with advanced production, new retail experiences, and

digital empowerment. We offer high-quality and value-for-money vehicles as well as superior after-sales services through a reliable,

one-stop, and hassle-free transaction experience. Under our omni-channel strategy, we are able to leverage our pioneering online platform

to serve customers nationwide and establish market leadership in selected regions through offline inspection and reconditioning centers.

Leveraging our extensive industry data and continuous technology innovation throughout more than ten years of operation, we have established

strong used car management and operation capabilities. We are committed to upholding our customer-centric approach and driving the healthy

development of the used car industry.

Use

of Non-GAAP Financial Measures

In

evaluating the business, the Company considers and uses certain non-GAAP measures, including Adjusted EBITDA and adjusted net loss from

operations per share – basic and diluted, as supplemental measures to review and assess its operating performance. The presentation

of the non-GAAP financial measure is not intended to be considered in isolation or as a substitute for the financial information prepared

and presented in accordance with U.S. GAAP. The Company defines Adjusted EBITDA as EBITDA excluding share-based compensation, fair value

impact of the issuance of senior convertible preferred shares, foreign exchange (losses)/gains, other income/(expenses), dividend from

long-term investment, net gain from extinguishment of debt. The Company defines adjusted net loss attributable to ordinary shareholders

per share – basic and diluted as net loss attributable to ordinary shareholders per share excluding impact of share-based compensation,

fair value impact of the issuance of senior convertible preferred shares and accretion on redeemable non-controlling interests. The Company

presents the non-GAAP financial measures because they are used by the management to evaluate the operating performance and formulate

business plans. The Company also believes that the use of the non-GAAP measures facilitates investors’ assessment of its operating

performance as this measure excludes certain finance or non-cash items that the Company does not believe directly reflect its core operations.

The Company believes that excluding these items enables us to evaluate our performance period-over-period more effectively and relative

to our competitors.

The

non-GAAP financial measures are not defined under U.S. GAAP and are not presented in accordance with U.S. GAAP. The non-GAAP financial

measures have limitations as analytical tools. One of the key limitations of using Adjusted EBITDA is that it does not reflect all items

of income and expenses that affect the Company’s operations. Share-based compensation, foreign exchange (losses)/gains and other

income/(expenses) have been and may continue to be incurred in the business. Further, the non-GAAP measures may differ from the non-GAAP

information used by other companies, including peer companies, and therefore their comparability may be limited.

The

Company compensates for these limitations by reconciling the non-GAAP financial measure to the nearest U.S. GAAP performance measure,

all of which should be considered when evaluating the Company’s performance. The Company encourages you to review its financial

information in its entirety and not rely on a single financial measure.

Reconciliations

of Uxin’s non-GAAP financial measures to the most comparable U.S. GAAP measure are included at the end of this press release.

Exchange

Rate Information

This

announcement contains translations of certain RMB amounts into U.S. dollars (“US$”) at specified rates solely for the convenience

of the reader, except for those transaction amounts that were actually settled in U.S. dollars. Unless otherwise stated, all translations

from RMB to US$ were made at the rate of RMB7.2672 to US$1.00, representing the index rate as of June 28, 2024 set forth in the H.10

statistical release of the Board of Governors of the Federal Reserve System. The Company makes no representation that the RMB or US$

amounts referred could be converted into US$ or RMB, as the case may be, at any particular rate or at all.

Safe

Harbor Statement

This

announcement contains forward-looking statements. These statements are made under the “safe harbor” provisions of the United

States Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by terminology such as “will,”

“expects,” “anticipates,” “future,” “intends,” “plans,” “believes,”

“estimates” and similar statements. Among other things, the business outlook and quotations from management in this announcement,

as well as Uxin’s strategic and operational plans, contain forward-looking statements. Uxin may also make written or oral forward-looking

statements in its periodic reports to the SEC, in its annual report to shareholders, in press releases and other written materials and

in oral statements made by its officers, directors or employees to third parties. Statements that are not historical facts, including

statements about Uxin’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks

and uncertainties. A number of factors could cause actual results to differ materially from those contained in any forward-looking statement,

including but not limited to the following: impact of the COVID-19 pandemic, Uxin’s goal and strategies; its expansion plans; its

future business development, financial condition and results of operations; Uxin’s expectations regarding demand for, and market

acceptance of, its services; its ability to provide differentiated and superior customer experience, maintain and enhance customer trust

in its platform, and assess and mitigate various risks, including credit; its expectations regarding maintaining and expanding its relationships

with business partners, including financing partners; trends and competition in China’s used car e-commerce industry; the laws

and regulations relating to Uxin’s industry; the general economic and business conditions; and assumptions underlying or related

to any of the foregoing. Further information regarding these and other risks is included in Uxin’s filings with the SEC. All information

provided in this press release and in the attachments is as of the date of this press release, and Uxin does not undertake any obligation

to update any forward-looking statement, except as required under applicable law.

For

investor and media enquiries, please contact:

Uxin

Limited Investor Relations

Uxin

Limited

Phone:

+86 10 5691-6765

Email:

ir@xin.com

The

Blueshirt Group

Mr.

Jack Wang

Phone:

+86 166-0115-0429

Email:

Jack@blueshirtgroup.com

Uxin

Limited

Unaudited

Consolidated Statements of Comprehensive Loss

(In

thousands except for number of shares and per share data)

| | |

For the three months ended June 30, | |

| | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Revenues | |

| | | |

| | | |

| | |

| Retail vehicle sales | |

| 186,849 | | |

| 324,967 | | |

| 44,717 | |

| Wholesale vehicle sales | |

| 94,647 | | |

| 63,897 | | |

| 8,793 | |

| Others | |

| 7,526 | | |

| 12,320 | | |

| 1,695 | |

| Total revenues | |

| 289,022 | | |

| 401,184 | | |

| 55,205 | |

| | |

| | | |

| | | |

| | |

| Cost of revenues | |

| (271,381 | ) | |

| (375,599 | ) | |

| (51,684 | ) |

| Gross profit | |

| 17,641 | | |

| 25,585 | | |

| 3,521 | |

| | |

| | | |

| | | |

| | |

| Operating expenses | |

| | | |

| | | |

| | |

| Sales and marketing | |

| (46,548 | ) | |

| (59,353 | ) | |

| (8,167 | ) |

| General and administrative | |

| (33,103 | ) | |

| (28,119 | ) | |

| (3,869 | ) |

| Research and development | |

| (8,861 | ) | |

| (3,380 | ) | |

| (465 | ) |

| Reversal of credit losses, net | |

| 696 | | |

| - | | |

| - | |

| Total operating expenses | |

| (87,816 | ) | |

| (90,852 | ) | |

| (12,501 | ) |

| | |

| | | |

| | | |

| | |

| Other operating income, net | |

| 6,985 | | |

| 2,783 | | |

| 383 | |

| | |

| | | |

| | | |

| | |

| Loss from operations | |

| (63,190 | ) | |

| (62,484 | ) | |

| (8,597 | ) |

| | |

| | | |

| | | |

| | |

| Interest income | |

| 102 | | |

| 16 | | |

| 2 | |

| Interest expenses | |

| (5,120 | ) | |

| (22,858 | ) | |

| (3,145 | ) |

| Other income | |

| 2,367 | | |

| 633 | | |

| 87 | |

| Other expenses | |

| (272 | ) | |

| (800 | ) | |

| (110 | ) |

| Net gain from extinguishment of debt (i) | |

| - | | |

| 35,222 | | |

| 4,847 | |

| Foreign exchange (losses)/gains | |

| (425 | ) | |

| 479 | | |

| 66 | |

| Fair value impact of the issuance of senior convertible preferred shares | |

| (36,869 | ) | |

| - | | |

| - | |

| Loss before income tax expense | |

| (103,407 | ) | |

| (49,792 | ) | |

| (6,850 | ) |

| Income tax expense | |

| (165 | ) | |

| (38 | ) | |

| (5 | ) |

| Dividend from long-term investment | |

| 11,970 | | |

| - | | |

| - | |

| Net loss, net of tax | |

| (91,602 | ) | |

| (49,830 | ) | |

| (6,855 | ) |

| Add: net loss/(profit) attribute to redeemable non-controlling interests and non-controlling interests shareholders | |

| 2 | | |

| (1,641 | ) | |

| (226 | ) |

| Net loss attributable to UXIN LIMITED | |

| (91,600 | ) | |

| (51,471 | ) | |

| (7,081 | ) |

| Net loss attributable to ordinary shareholders | |

| (91,600 | ) | |

| (51,471 | ) | |

| (7,081 | ) |

| | |

| | | |

| | | |

| | |

| Net loss | |

| (91,602 | ) | |

| (49,830 | ) | |

| (6,855 | ) |

| Foreign currency translation, net of tax nil | |

| 3,314 | | |

| (1,216 | ) | |

| (167 | ) |

| Total comprehensive loss | |

| (88,288 | ) | |

| (51,046 | ) | |

| (7,022 | ) |

| Add: net loss/(profit) attribute to redeemable non-controlling interests and non-controlling interests shareholders | |

| 2 | | |

| (1,641 | ) | |

| (226 | ) |

| Total comprehensive loss attributable to UXIN LIMITED | |

| (88,286 | ) | |

| (52,687 | ) | |

| (7,248 | ) |

| | |

| | | |

| | | |

| | |

| Net loss attributable to ordinary shareholders | |

| (91,600 | ) | |

| (51,471 | ) | |

| (7,081 | ) |

| Weighted average shares outstanding – basic | |

| 1,423,659,403 | | |

| 56,412,679,304 | | |

| 56,412,679,304 | |

| Weighted average shares outstanding – diluted | |

| 1,423,659,403 | | |

| 56,412,679,304 | | |

| 56,412,679,304 | |

| | |

| | | |

| | | |

| | |

| Net loss per share for ordinary shareholders, basic | |

| (0.06 | ) | |

| - | | |

| - | |

| Net loss per share for ordinary shareholders, diluted | |

| (0.06 | ) | |

| - | | |

| - | |

(i)

Please refer to Note (i) in the Unaudited Consolidated Balance Sheets for details of the transaction.

*

Share-based compensation charges included are as follows:

| | |

For the three months ended June 30, | |

| | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Sales and marketing | |

| 332 | | |

| 136 | | |

| 19 | |

| General and administrative | |

| 9,425 | | |

| 11,784 | | |

| 1,622 | |

| Research and development | |

| 394 | | |

| 128 | | |

| 18 | |

Uxin

Limited

Unaudited

Consolidated Balance Sheets

(In

thousands except for number of shares and per share data)

| | |

As of March 31, | | |

As of June 30, | |

| | |

2024 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| ASSETS | |

| | | |

| | | |

| | |

| Current assets | |

| | | |

| | | |

| | |

| Cash and cash equivalents | |

| 23,339 | | |

| 17,162 | | |

| 2,362 | |

| Restricted cash | |

| 594 | | |

| 744 | | |

| 102 | |

| Accounts receivable, net | |

| 2,089 | | |

| 3,104 | | |

| 427 | |

| Loans recognized as a result of payments under guarantees, net of provision for credit losses of RMB7,995 and RMB7,995 as of March 31, 2024 and June 30, 2024, respectively | |

| - | | |

| - | | |

| - | |

| Other receivables, net of provision for credit losses of RMB22,739 and RMB22,739 as of March 31, 2024 and June 30, 2024, respectively | |

| 18,080 | | |

| 25,592 | | |

| 3,522 | |

| Inventory, net | |

| 110,494 | | |

| 143,356 | | |

| 19,726 | |

| Prepaid expenses and other current assets | |

| 71,787 | | |

| 72,106 | | |

| 9,922 | |

| Total current assets | |

| 226,383 | | |

| 262,064 | | |

| 36,061 | |

| | |

| | | |

| | | |

| | |

| Non-current assets | |

| | | |

| | | |

| | |

| Property, equipment and software, net | |

| 74,243 | | |

| 70,095 | | |

| 9,645 | |

| Long-term investments (i) | |

| 279,300 | | |

| - | | |

| - | |

| Other non-current assets | |

| 268 | | |

| 107 | | |

| 15 | |

| Finance lease right-of-use assets, net | |

| 1,339,537 | | |

| 1,332,768 | | |

| 183,395 | |

| Operating lease right-of-use assets, net | |

| 168,418 | | |

| 164,347 | | |

| 22,614 | |

| Total non-current assets | |

| 1,861,766 | | |

| 1,567,317 | | |

| 215,669 | |

| | |

| | | |

| | | |

| | |

| Total assets | |

| 2,088,149 | | |

| 1,829,381 | | |

| 251,730 | |

| | |

| | | |

| | | |

| | |

| LIABILITIES, MEZZANINE EQUITY AND SHAREHOLDERS’ DEFICIT | |

| | | |

| | | |

| | |

| Current liabilities | |

| | | |

| | | |

| | |

| Accounts payable | |

| 80,745 | | |

| 83,970 | | |

| 11,555 | |

| Other payables and other current liabilities | |

| 370,802 | | |

| 315,535 | | |

| 43,418 | |

| Current portion of operating lease liabilities | |

| 12,310 | | |

| 11,047 | | |

| 1,520 | |

| Current portion of finance lease liabilities | |

| 51,160 | | |

| 51,984 | | |

| 7,153 | |

| Short-term borrowing from third parties | |

| 71,181 | | |

| 105,584 | | |

| 14,529 | |

| Short-term borrowing from related party | |

| 7,000 | | |

| 9,500 | | |

| 1,307 | |

| Current portion of long-term debt (i) | |

| 291,950 | | |

| - | | |

| - | |

| Total current liabilities | |

| 885,148 | | |

| 577,620 | | |

| 79,482 | |

| | |

| | | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | | |

| | |

| Consideration payable to WeBank (ii) | |

| - | | |

| 41,947 | | |

| 5,772 | |

| Finance lease liabilities | |

| 1,191,246 | | |

| 1,210,420 | | |

| 166,559 | |

| Operating lease liabilities | |

| 154,846 | | |

| 153,171 | | |

| 21,077 | |

| Total non-current liabilities | |

| 1,346,092 | | |

| 1,405,538 | | |

| 193,408 | |

| | |

| | | |

| | | |

| | |

| Total liabilities | |

| 2,231,240 | | |

| 1,983,158 | | |

| 272,890 | |

| | |

| | | |

| | | |

| | |

| Mezzanine equity | |

| | | |

| | | |

| | |

| Redeemable non-controlling interests | |

| 149,991 | | |

| 151,641 | | |

| 20,866 | |

| Total Mezzanine equity | |

| 149,991 | | |

| 151,641 | | |

| 20,866 | |

| | |

| | | |

| | | |

| | |

| Shareholders’ deficit | |

| | | |

| | | |

| | |

| Ordinary shares | |

| 39,806 | | |

| 39,807 | | |

| 5,478 | |

| Additional paid-in capital | |

| 18,928,837 | | |

| 18,942,103 | | |

| 2,606,521 | |

| Subscription receivable from shareholders | |

| (107,879 | ) | |

| (80,786 | ) | |

| (11,117 | ) |

| Accumulated other comprehensive income | |

| 225,090 | | |

| 223,874 | | |

| 30,806 | |

| Accumulated deficit | |

| (19,378,705 | ) | |

| (19,430,176 | ) | |

| (2,673,681 | ) |

| Total Uxin’s shareholders’ deficit | |

| (292,851 | ) | |

| (305,178 | ) | |

| (41,993 | ) |

| Non-controlling interests | |

| (231 | ) | |

| (240 | ) | |

| (33 | ) |

| Total shareholders’ deficit | |

| (293,082 | ) | |

| (305,418 | ) | |

| (42,026 | ) |

| | |

| | | |

| | | |

| | |

| Total liabilities, mezzanine equity and shareholders’ deficit | |

| 2,088,149 | | |

| 1,829,381 | | |

| 251,730 | |

(i)

Long-term borrowing outstanding as of March 31, 2024 was pledged with the equity interest the Group holds in an investment. The long-term

borrowing will be due in December 2024. In December 2023, the Group entered into a supplementary agreement with the borrower, mutually

agreed that if the Group successfully disposes the investment pledged and pays the borrower cash proceeds of RMB240.0 million, the remaining

principal and interests will be waived. In conjunction with the sale of investment transaction, the Group also entered into a financial

advisory agreement and a supplement agreement in which the Group will incur the advisory expense of RMB36.9 million upon the successful

completion of the sale of investment. However, if the sale of investment transaction fails, the Group is still obligated to repay all

the principal and interests under the original borrowing agreement. Given the uncertainty of the sale of investment, the Group did not

account for the extinguishment of the borrowing as a result of a troubled debt restructuring until the completion of the sale of investment

and settlement of the borrowing in April 2024. As of the settlement date, the investment was disposed at a consideration of RMB271.3

million, whereas the Group still entitled a cash dividend of RMB8.0 million from the investee that was subsequently received in July

2024. Accordingly, the Group derecognized the investment with a carrying value of RMB279.3 million with no gains/losses from the disposal

recognized. Concurrently, the Group also repaid the borrower RMB240.0 million and incurred the advisory expense of RMB36.9 million. Accordingly,

the Group recognized the net gain from extinguishment of debt amounting to RMB35.2 million, which is the difference between the total

amount of borrowing of RMB312.1 million derecognized (including principal of RMB292.0 million and interests of RMB20.1 million) and the

aggregate amount of RMB240.0 million repaid and the advisory expense of RMB36.9 million.

(ii)

On June 21, 2024, the Company entered into another supplemental agreement with WeBank which revised and extended the repayment schedule

of RMB30.0 million each due on June 30, 2024 and December 31, 2024 respectively to the monthly repayments of RMB2.5 million for each

month from December 2024 to November 2026. As a result of this modification, the Group classified the payables to Webank amounting to

RMB41.9 million repayable after twelve months from June 30, 2024 as “Consideration payable to WeBank” in non-current liabilities.

Uxin

Limited

Unaudited

Reconciliations of GAAP And Non-GAAP Results

(In

thousands except for number of shares and per share data)

| | |

For the three months ended June 30, | |

| | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Net loss, net of tax | |

| (91,602 | ) | |

| (49,830 | ) | |

| (6,855 | ) |

| | |

| | | |

| | | |

| | |

| Add: Income tax expense | |

| 165 | | |

| 38 | | |

| 5 | |

| Interest income | |

| (102 | ) | |

| (16 | ) | |

| (2 | ) |

| Interest expenses | |

| 5,120 | | |

| 22,858 | | |

| 3,145 | |

| Depreciation | |

| 6,413 | | |

| 16,577 | | |

| 2,281 | |

| EBITDA | |

| (80,006 | ) | |

| (10,373 | ) | |

| (1,426 | ) |

| | |

| | | |

| | | |

| | |

| Add: Share-based compensation expenses | |

| 10,151 | | |

| 12,048 | | |

| 1,659 | |

| - Sales and marketing | |

| 332 | | |

| 136 | | |

| 19 | |

| - General and administrative | |

| 9,425 | | |

| 11,784 | | |

| 1,622 | |

| - Research and development | |

| 394 | | |

| 128 | | |

| 18 | |

| Other income | |

| (2,367 | ) | |

| (633 | ) | |

| (87 | ) |

| Other expenses | |

| 272 | | |

| 800 | | |

| 110 | |

| Foreign exchange (losses)/gains | |

| 425 | | |

| (479 | ) | |

| (66 | ) |

| Dividend from long-term investment | |

| (11,970 | ) | |

| - | | |

| - | |

| Net gain from extinguishment of debt | |

| - | | |

| (35,222 | ) | |

| (4,847 | ) |

| Fair value impact of the issuance of senior convertible preferred shares | |

| 36,869 | | |

| - | | |

| - | |

| | |

| | | |

| | | |

| | |

| Non-GAAP adjusted EBITDA | |

| (46,626 | ) | |

| (33,859 | ) | |

| (4,657 | ) |

| | |

For the three months ended June 30, | |

| | |

2023 | | |

2024 | |

| | |

RMB | | |

RMB | | |

US$ | |

| Net loss attributable to ordinary shareholders | |

| (91,600 | ) | |

| (51,471 | ) | |

| (7,081 | ) |

| Add: Share-based compensation expenses | |

| 10,151 | | |

| 12,048 | | |

| 1,659 | |

| - Sales and marketing | |

| 332 | | |

| 136 | | |

| 19 | |

| - General and administrative | |

| 9,425 | | |

| 11,784 | | |

| 1,622 | |

| - Research and development | |

| 394 | | |

| 128 | | |

| 18 | |

| Fair value impact of the issuance of senior convertible preferred shares | |

| 36,869 | | |

| - | | |

| - | |

| Add: accretion on redeemable non-controlling interests | |

| - | | |

| 1,650 | | |

| 227 | |

| | |

| | | |

| | | |

| | |

| Non-GAAP adjusted net loss attributable to ordinary shareholders | |

| (44,580 | ) | |

| (37,773 | ) | |

| (5,195 | ) |

| | |

| | | |

| | | |

| | |

| Net loss per share for ordinary shareholders - basic | |

| (0.06 | ) | |

| - | | |

| - | |

| Net loss per share for ordinary shareholders - diluted | |

| (0.06 | ) | |

| - | | |

| - | |

| Non-GAAP adjusted net loss to ordinary shareholders per share – basic and diluted | |

| (0.03 | ) | |

| - | | |

| - | |

| Weighted average shares outstanding - basic | |

| 1,423,659,403 | | |

| 56,412,679,304 | | |

| 56,412,679,304 | |

| Weighted average shares outstanding - diluted | |

| 1,423,659,403 | | |

| 56,412,679,304 | | |

| 56,412,679,304 | |

Note:

The conversion of Renminbi (RMB) into U.S. dollars (USD) is based on the certified exchange rate of USD1.00 = RMB7.2672 as of June 28,

2024 set forth in the H.10 statistical release of the Board of Governors of the Federal Reserve System.

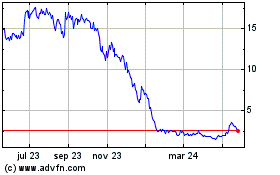

Uxin (NASDAQ:UXIN)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

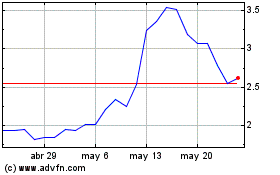

Uxin (NASDAQ:UXIN)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025