UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE

13D

Under

the Securities Exchange Act of 1934

(Amendment

No. 10)*

| |

Uxin

Limited

|

|

| |

(Name

of Issuer) |

|

| |

|

|

| |

Class

A ordinary shares, par value $0.0001 per share |

|

| |

(Title

of Class of Securities) |

|

| |

|

|

| |

91818X108** |

|

| |

(CUSIP

Number) |

|

| |

|

|

| |

Ning

Zhang

Morgan,

Lewis & Bockius

19th Floor, Edinburgh Tower

The

Landmark, 15 Queen’s Road Central, Hong Kong |

|

| |

(Name,

Address and Telephone Number of Person

Authorized to Receive Notices and Communications) |

|

| |

|

|

| |

November

5, 2024 |

|

| |

(Date

of Event which Requires Filing of this Statement) |

|

| |

|

|

If

the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D,

and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box. ☐

*

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject

class of securities, and for any subsequent amendment containing information which would alter the disclosures provided in a prior cover

page.

**

This CUSIP number pertains to the Issuer’s American Depositary Shares, each representing three hundred Class A Ordinary Shares.

The

information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of section 18

of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

| CUSIP No. 91818X108 | 13D | Page 2 of 10 |

| 1 |

NameS

of Reporting PersonS.

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Abundant

Grace Investment Limited |

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(a) |

☐ |

| |

(b) |

☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE

OF FUNDS* (See Instructions)

OO |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

_________☐

|

| 6 |

citizenship

or place of organization

BVI |

NUMBER OF SHARES BENEFICIALLY

OWNED BY EACH REPORTING PERSON WITH |

7 |

sole voting power

32,935,364,3471 |

| 8 |

shared voting power

|

| 9 |

sole dispositive power

32,935,364,347 |

| 10 |

shared dispositive power

|

| 11 |

aggregate amount beneficially owned by each reporting person

32,935,364,347 |

| 12 |

check if the aggregate amount in row (11) excludes certain shares (See INstructions)* _________☐

|

| 13 |

percent

of class represented by amount in row (11)

58.5%2 |

| 14 |

type

of reporting person*

CO |

*SEE

INSTRUCTION BEFORE FILLING OUT

1

Represents 32,935,364,347 Class A Ordinary Shares of the Issuer held of record by Abundant, which is the sum of (i) 12,350,761,630

Class A Ordinary Shares converted from 174,774,250 Senior Convertible Preferred Shares issued to Abundant pursuant to the 2021 Subscription

Agreement (as described in Item 2 in the Initial Statements), and (ii) 20,584,602,717 Class A Ordinary Shares converted from 714,285,714

Senior Convertible Preferred Shares issued to Abundant pursuant to the 2022 Subscription Agreement (as described in Item 2 in the Initial

Statements).

2

The calculation assumes that there is a total of 56,343,198,438 Class A Ordinary Shares outstanding (excluding 19,218,592 Class

A Ordinary Shares issued to the Issuer’s depositary bank for bulk issuance of ADSs reserved for future issuances upon the exercise

or vesting of awards granted under the Issuer’s share incentive plan) as disclosed by the Issuer on its Form F-3/A filed with the

U.S. Securities and Exchange Commission on August 6, 2024.

| CUSIP No. 91818X108 | 13D | Page 3 of 10 |

| 1 |

NameS

of Reporting PersonS.

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

NBNW Investment Limited |

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(a) |

☐ |

| |

(b) |

☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE

OF FUNDS* (See Instructions)

OO |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

_________☐

|

| 6 |

citizenship

or place of organization

BVI |

NUMBER OF SHARES BENEFICIALLY

OWNED BY EACH REPORTING PERSON WITH |

7 |

sole voting power

|

| 8 |

shared voting power

32,935,364,347 |

| 9 |

sole dispositive power

|

| 10 |

shared dispositive power

32,935,364,347

|

| 11 |

aggregate amount beneficially owned by each reporting person

32,935,364,347 |

| 12 |

check if the aggregate amount in row (11) excludes certain shares (See INstructions)* _________☐

|

| 13 |

percent

of class represented by amount in row (11)

58.5% |

| 14 |

type

of reporting person*

CO |

*SEE

INSTRUCTION BEFORE FILLING OUT

| CUSIP No. 91818X108 | 13D | Page 4 of 10 |

| 1 |

NameS

of Reporting PersonS.

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Eve One Fund II L.P. |

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(a) |

☐ |

| |

(b) |

☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE

OF FUNDS* (See Instructions)

OO |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

_________☐

|

| 6 |

citizenship

or place of organization

Cayman Islands |

NUMBER OF SHARES BENEFICIALLY

OWNED BY EACH REPORTING PERSON WITH |

7 |

sole voting power

|

| 8 |

shared voting power

32,935,364,347 |

| 9 |

sole dispositive power

|

| 10 |

shared dispositive power

32,935,364,347

|

| 11 |

aggregate amount beneficially owned by each reporting person

32,935,364,347 |

| 12 |

check if the aggregate amount in row (11) excludes certain shares (See INstructions)* _________☐

|

| 13 |

percent

of class represented by amount in row (11)

58.5% |

| 14 |

type

of reporting person*

PN |

*SEE

INSTRUCTION BEFORE FILLING OUT

| CUSIP No. 91818X108 | 13D | Page 5 of 10 |

| 1 |

NameS

of Reporting PersonS.

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Nio Capital II LLC |

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(a) |

☐ |

| |

(b) |

☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE

OF FUNDS* (See Instructions)

OO |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

_________☐

|

| 6 |

citizenship

or place of organization

Cayman Islands |

NUMBER OF SHARES BENEFICIALLY

OWNED BY EACH REPORTING PERSON WITH |

7 |

sole voting power

|

| 8 |

shared voting power

33,552,902,4293 |

| 9 |

sole dispositive power

|

| 10 |

shared dispositive power

33,552,902,429

|

| 11 |

aggregate amount beneficially owned by each reporting person

33,552,902,429 |

| 12 |

check if the aggregate amount in row (11) excludes certain shares (See INstructions)* _________☐

|

| 13 |

percent

of class represented by amount in row (11)

59.6%4 |

| 14 |

type

of reporting person*

CO |

*SEE

INSTRUCTION BEFORE FILLING OUT

3

Represents 33,552,902,429 Class A Ordinary Shares of the Issuer held of record by Abundant and Glory respectively, which is the

sum of (i) 32,935,364,347 Class A Ordinary Shares held by Abundant converted from 889,059,964 Senior Convertible Preferred Shares, and

(ii) 617,538,082 Class A Ordinary Shares held by Glory converted from 8,738,712 Senior Convertible Preferred Shares.

4

The calculation assumes that there is a total of 56,343,198,438 Class A Ordinary Shares outstanding (excluding 19,218,592 Class

A Ordinary Shares issued to the Issuer’s depositary bank for bulk issuance of ADSs reserved for future issuances upon the exercise

or vesting of awards granted under the Issuer’s share incentive plan) as disclosed by the Issuer on its Form F-3/A filed with the

U.S. Securities and Exchange Commission on August 6, 2024.

| CUSIP No. 91818X108 | 13D | Page 6 of 10 |

| 1 |

NameS

of Reporting PersonS.

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Bin Li |

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(a) |

☐ |

| |

(b) |

☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE

OF FUNDS* (See Instructions)

OO |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

_________☐

|

| 6 |

citizenship

or place of organization

People’s Republic of China |

NUMBER OF SHARES BENEFICIALLY

OWNED BY EACH REPORTING PERSON WITH |

7 |

sole voting power

|

| 8 |

shared voting power

33,552,902,429 |

| 9 |

sole dispositive power

|

| 10 |

shared dispositive power

33,552,902,429

|

| 11 |

aggregate amount beneficially owned by each reporting person

33,552,902,429 |

| 12 |

check if the aggregate amount in row (11) excludes certain shares (See INstructions)* _________☐

|

| 13 |

percent

of class represented by amount in row (11)

59.6% |

| 14 |

type

of reporting person*

IN |

*SEE

INSTRUCTION BEFORE FILLING OUT

| CUSIP No. 91818X108 | 13D | Page 7 of 10 |

| 1 |

NameS

of Reporting PersonS.

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Abundant

Glory Investment L.P. |

2

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP* |

|

|

| |

(a) |

☐ |

| |

(b) |

☐ |

| 3 |

SEC USE ONLY

|

| 4 |

SOURCE

OF FUNDS* (See Instructions)

OO |

| 5 |

CHECK

IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

_________☐

|

| 6 |

citizenship

or place of organization

BVI |

NUMBER OF SHARES BENEFICIALLY

OWNED BY EACH REPORTING PERSON WITH |

7 |

sole voting power

617,538,0825 |

| 8 |

shared voting power

|

| 9 |

sole dispositive power

617,538,082 |

| 10 |

shared dispositive power

|

| 11 |

aggregate amount beneficially owned by each reporting person

617,538,082 |

| 12 |

check if the aggregate amount in row (11) excludes certain shares (See INstructions)* _________☐

|

| 13 |

percent

of class represented by amount in row (11)

1.1%6 |

| 14 |

type

of reporting person*

PN |

*SEE

INSTRUCTION BEFORE FILLING OUT

5

Represents 617,538,082 Class A Ordinary Shares of the Issuer held of record by Glory which were converted from 8,738,712 Senior

Convertible Preferred Shares issued to Glory pursuant to the 2021 Subscription Agreement (as described in Item 2 in the Initial Statements).

6

The calculation assumes that there is a total of 56,343,198,438 Class A Ordinary Shares outstanding (excluding 19,218,592 Class

A Ordinary Shares issued to the Issuer’s depositary bank for bulk issuance of ADSs reserved for future issuances upon the exercise

or vesting of awards granted under the Issuer’s share incentive plan) as disclosed by the Issuer on its Form F-3/A filed with the

U.S. Securities and Exchange Commission on August 6, 2024.

| CUSIP No. 91818X108 | 13D | Page 8 of 10 |

| Item

1. | Security

and Issuer |

This

Amendment No. 10 to the statement on Schedule 13D (this “Amendment”) relates to the Class A ordinary shares, par value

US$0.0001 per share (the “Class A Ordinary Shares”), of Uxin Limited, a company organized under the laws of the Cayman

Islands (the “Issuer”), whose principal executive offices are located at 21/F, Donghuang Building, No. 16 Guangshun

South Avenue, Chaoyang District, Beijing 100102, People’s Republic of China.

This

Amendment supplements and amends the statement on Schedule 13D, Schedule 13D Amendment No. 1, Schedule 13D Amendment No. 2, Schedule

13D Amendment No. 3, Schedule 13D Amendment No. 4, Schedule 13D Amendment No. 5, Schedule 13D Amendment No. 6, Schedule 13D Amendment

No. 7, Schedule 13D Amendment No. 8 and Schedule 13D Amendment No. 9 filed on July 22, 2021, November 16, 2021, January 26, 2022, July

7, 2022, August 2, 2022, January 19, 2023, April 7, 2023, July 7, 2023, August 23, 2023 and March 28, 2024 respectively (as amended,

the “Initial Statements”). Capitalized terms used in this Amendment, but not otherwise defined, have the meanings

given to them in the Initial Statements.

Other

than as amended by this Amendment, the disclosures in the Initial Statements are unchanged. Responses to each item of this Amendment

are incorporated by reference into the responses to each other item, as applicable.

| Item

2. | Identity

and Background |

(a)

Name of Person Filing

Item

2 (a) of the Initial Statements is hereby amended by (i) adding the first paragraph below before the second paragraph from the bottom

of Item 2 (a) of the Initial Statements, and (ii) restating the last paragraph of Item 2 (a) of the Initial Statements with the second

paragraph below:

To

date, Abundant has fulfilled its payment obligations under the 2022 Subscription Agreement in an aggregate amount of US$90,600,000. As

separately agreed in writing by Abundant and the Issuer, Abundant shall pay the remaining purchaser price of US$9,400,000 no later than

December 31, 2024, unless otherwise agreed in writing by Abundant and the Issuer.

Item

5 (a-b), other than the first paragraph thereof, is incorporated by reference into this Item 2 (a).

| Item

5. | Interest

in Securities of the Issuer |

Item

5 (a-b) of the Initial Statements is hereby amended by (i) restating the first paragraph of Item 5 (a-b) of the Initial Statements with

the first paragraph below, (ii) deleting the first sentence of the second paragraph of Item 5 (a-b) of the Initial Statements, and (iii)

adding the second paragraph below to the end:

| CUSIP No. 91818X108 | 13D | Page 9 of 10 |

The

information in the cover pages of this Schedule 13D is incorporated by reference. The calculation of the beneficial ownership percentage

of the outstanding Class A Ordinary Shares is made pursuant to the requirements of Rule 13d-3(d)(1)(i) under the Exchange Act and assumes

that there is a total of 56,343,198,438 Class A Ordinary Shares outstanding (excluding 19,218,592 Class A Ordinary Shares issued to the

Issuer’s depositary bank for bulk issuance of ADSs reserved for future issuances upon the exercise or vesting of awards granted

under the Issuer’s share incentive plan) as disclosed by the Issuer on its Form F-3/A filed with the U.S. Securities and Exchange

Commission on August 6, 2024. The Reporting Persons’ beneficial ownership of the Class A Ordinary Shares reported as beneficially

owned herein includes (i) 12,350,761,630 Class A Ordinary Shares converted from 174,774,250 Senior Convertible Preferred Shares held

and acquired by Abundant pursuant to the 2021 Subscription Agreement, at a conversion price of US$0.004858 per share pursuant to the

Conversion (as defined in the Initial Statements), (ii) upon the completion of the In-kind Distribution (as defined below), 617,538,082

Class A Ordinary Shares converted from 8,738,712 Senior Convertible Preferred Shares held and acquired by Glory pursuant to the 2021

Subscription Agreement (by assignment from Abundant the right to purchase such Senior Convertible Preferred Shares), at a conversion

price of US$0.004858 per share pursuant to the Conversion, and (iii) 20,584,602,717 Class A Ordinary Shares converted from 714,285,714

Senior Convertible Preferred Shares held and acquired by Abundant pursuant to the 2022 Subscription Agreement, at a conversion price

of US$0.004858 per share pursuant to the Conversion.

On

November 5, 2024, Glory distributed 1,440,922,190 Class A Ordinary Shares held by it to its sole limited partner that is not affiliated

with any of the Reporting Persons (the “In-kind Distribution”). The 1,440,922,190 Class A Ordinary Shares represented

the entirety of such sole limited partner’s interest in Glory before the In-kind Distribution, and after the In-kind Distribution,

the remaining 617,538,082 Class A Ordinary Shares held by Glory are all beneficially owned by Nio Capital II LLC, general partner of

Glory.

Item

5 (C) of the Initial Statements is hereby amended and restated with the following:

None

of the Reporting Persons has engaged in any transaction in the Issuer’s securities in the last 60 days other than the In-kind Distribution.

| CUSIP No. 91818X108 | 13D | Page 10 of 10 |

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete

and correct.

Dated:

November 6, 2024

| |

NBNW

Investment Limited |

| |

|

|

| |

By: |

/s/

Bin Li |

| |

|

Bin

Li, Director |

| |

|

|

| |

Eve

One Fund II L.P. |

| |

|

|

| |

By:

|

NIO

CAPITAL II LLC |

| |

Its:

|

general

partner |

| |

|

|

| |

By: |

/s/

Yan Zhu |

| |

|

Yan

Zhu, Authorized Signatory |

| |

|

|

| |

NIO CAPITAL II LLC |

| |

|

|

| |

By: |

/s/

Yan Zhu |

| |

|

Yan

Zhu, Authorized Signatory |

| |

|

|

| |

Bin Li |

| |

|

|

| |

By: |

/s/

Bin Li |

| |

|

|

| |

Abundant

Grace Investment Limited |

| |

|

|

| |

By: |

/s/

Wei Mao |

| |

|

Wei

Mao, Director |

| |

|

|

| |

Abundant

Glory Investment L.P. |

| |

|

|

| |

By:

|

NIO

CAPITAL II LLC |

| |

Its: |

general partner |

| |

|

|

| |

By: |

/s/

Yan Zhu |

| |

|

Yan

Zhu, Authorized Signatory |

Attention:

Intentional misstatements or omissions of fact constitute Federal criminal violations

(See 18 U.S.C. 1001)

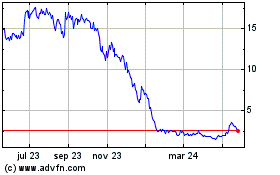

Uxin (NASDAQ:UXIN)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

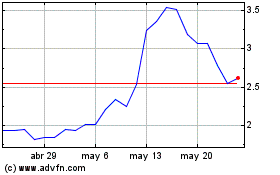

Uxin (NASDAQ:UXIN)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024