Filed

Pursuant to Rule 424(b)(5)

Registration

Statement No. 333-279521

Prospectus

Supplement

(To

Prospectus dated May 28, 2024)

Up to $26,077,348

Ordinary Shares

This prospectus supplement relates to the issuance

and sale of up to $20,077,348 of our ordinary shares, no par value per share (the “Purchase Shares”), to Alumni Capital

LP (“Alumni Capital”) upon the satisfaction of certain conditions set forth in the Purchase Agreement (the “Purchase

Agreement”) dated August 1, 2024 and amended on September 23, 2024 between us and Alumni Capital, at a purchase price per share

calculated under the Purchase Agreement. We have also issued to Alumni Capital as a commitment fee, a three-year ordinary share purchase

warrant (the “Commitment Warrant”) to purchase up to $7,000,000 of ordinary shares. This prospectus supplement also relates

to the exercise of up to $6,000,000 of our ordinary shares (the “Warrant Shares” and together with the Purchase Shares,

the “Offered Shares”) at an exercise price determined by a formula that is described under “Alumni Capital

Transaction” under the Purchase Warrant Agreement dated August 1, 2024 between us and Alumni Capital.

Alumni Capital is an underwriter within the meaning

of Section 2(a)(11) of the U.S. Securities Act of 1933, as amended (the “Securities Act”). The registration of the

Offered Shares hereunder does not mean that Alumni Capital will actually purchase or that the Company will actually issue and sell all

or any of the Offered Shares being registered pursuant to the registration statement related to this prospectus supplement.

You should read this prospectus supplement, the

base prospectus, and any additional prospectus supplement or amendment carefully before you invest in our securities.

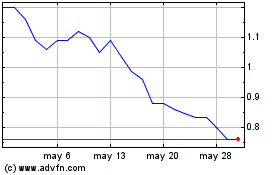

Our ordinary shares are listed on the Nasdaq Capital

Market (“Nasdaq”) under the symbols “VCIG.” On December 16, 2024, the last reported sale price of our ordinary

shares on Nasdaq was $1.63 per share.

Investing in our securities involves a high

degree of risk. See “Risk Factors” section beginning on page S-6.

We are an “emerging growth company,”

as that term is defined under the federal securities laws and, as such, we have elected to comply with certain reduced public company

reporting requirements and may elect to do so in future filings.

Neither the SEC nor any state securities commission has approved

or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation to the contrary

is a criminal offense.

The date of this prospectus supplement is December

17, 2024.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying base prospectus are part of a “shelf” registration statement on Form F-3

that we filed with the Securities and Exchange Commission, or the SEC or Commission, on May 17, 2024. This document is in two parts.

The first part is this prospectus supplement, which describes the terms of this offering of our ordinary shares and adds to and updates

the information contained in the accompanying base prospectus. The second part, the accompanying base prospectus, provides more general

information, some of which may not apply to this offering. Generally, when we refer to this prospectus, we are referring to both parts

of this document combined. To the extent there is a conflict between the information contained in this prospectus supplement and the

information contained in the accompanying base prospectus, you should rely on the information in this prospectus supplement.

This

prospectus supplement and the accompanying base prospectus relate to the offering of our ordinary shares. Before buying any of the ordinary

shares offered hereby, we urge you to read carefully this prospectus supplement and the accompanying base prospectus, together with the

information incorporated herein by reference as described below under the heading “Incorporation of Certain Information by Reference.”

This prospectus supplement contains information about the ordinary shares offered hereby and may add to, update or change information

in the accompanying base prospectus.

You

should rely only on the information contained in, or incorporated by reference into, this prospectus supplement and the accompanying

base prospectus. We have not, and the Manager has not, authorized anyone to provide you with different or additional information.

We

are not making offers to sell or solicitations to buy our ordinary shares in any jurisdiction in which an offer or solicitation is not

authorized or in which the person making that offer or solicitation is not qualified to do so or to anyone to whom it is unlawful to

make an offer or solicitation. You should assume that the information in this prospectus supplement and the accompanying base prospectus

is accurate only as of the date on the front of the respective document and that any information that we have incorporated by reference

is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus supplement

or the accompanying base prospectus or the time of any sale of our ordinary shares.

This

prospectus supplement and the accompanying base prospectus contain summaries of certain provisions contained in some of the documents

described herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their

entirety by the actual documents. Copies of some of the documents referred to herein have been filed, will be filed or will be incorporated

herein by reference as exhibits to the registration statement, and you may obtain copies of those documents as described below under

the section entitled “Where You Can Find More Information.”

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference herein were made solely for the benefit of the parties to such agreement, including, in some cases,

for the purpose of allocating risk among the parties to such agreements, and should not be deemed to be a representation, warranty or

covenant to you. Moreover, such representations, warranties or covenants were accurate only as of the date when made. Accordingly, such

representations, warranties and covenants should not be relied on as accurately representing the current state of our affairs.

This

prospectus supplement and the accompanying base prospectus contain and incorporate by reference market data and industry statistics and

forecasts that are based on independent industry publications and other publicly available information. Although we believe these sources

are reliable, we do not guarantee the accuracy or completeness of this information and we have not independently verified this information.

Although we are not aware of any misstatements regarding the market and industry data presented in this prospectus supplement, the accompanying

base prospectus or the documents incorporated herein by reference, these estimates involve risks and uncertainties and are subject to

change based on various factors, including those discussed under the headings “Risk Factors” in this prospectus supplement

and the accompanying base prospectus, and under similar headings in the other documents that are incorporated herein by reference. Accordingly,

investors should not place undue reliance on this information.

References

in this prospectus to the terms references to the “Company,” the “registrant,” “VCI,” “VCI

Global,” “we,” “our,” or “us” in this prospectus mean VCI Global Limited, a BVI business company,

unless we state otherwise or the context indicates otherwise.

All ordinary share numbers and per share price amounts contained in this prospectus supplement are stated on

a post 1:49 reverse stock split basis.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus and the documents incorporated by reference herein contain forward-looking statements within the meaning of Section 27A

of the Securities Act, and Section 21E of the Exchange Act. All statements other than statements of historical facts contained in

this prospectus and the documents incorporated by reference herein, including statements regarding our future results of operations and

financial position, business strategy, research and development plans, the anticipated timing, costs, design and conduct of our ongoing

and planned research and development for our products and services, our ability to commercialize our products, the impact of the COVID-19

pandemic and global geopolitical events, such as the ongoing conflict between Russia and Ukraine and the Middle East conflicts, on our

business, the potential benefits of strategic agreements and our intent to enter into any strategic arrangements, the timing and likelihood

of success, plans and objectives of management for future operations, and future results of anticipated product development efforts,

are forward-looking statements. These statements involve known and unknown risks, uncertainties and other important factors that may

cause our actual results, performance or achievements to be materially different from any future results, performance or achievements

expressed or implied by the forward-looking statements. This prospectus and the documents incorporated by reference herein also contain

estimates and other statistical data made by independent parties and by us relating to market size and growth and other data about our

industry. This data involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates.

In addition, projections, assumptions and estimates of our future performance and the future performance of the markets in which we operate

are necessarily subject to a high degree of uncertainty and risk.

In

some cases, you can identify forward-looking statements by terms such as “may,” “will,” “would,”

“could,” “should,” “expect,” “plan,” “anticipate,” “intend,”

“target,” “project,” “contemplates,” “believes,” “estimates,” “predicts,”

“potential” or “continue” or the negative of these terms or other similar expressions. The forward-looking statements

in this prospectus and the documents incorporated by reference herein are only predictions. We have based these forward-looking statements

largely on our current expectations and projections about future events and financial trends that we believe may affect our business,

financial condition, and results of operations. These forward-looking statements speak only as of the date of this prospectus and are

subject to a number of risks, uncertainties and assumptions, which we discuss in greater detail in the documents incorporated by reference

herein, including under the heading “Risk Factors” and elsewhere in this prospectus. The events and circumstances

reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected

in the forward-looking statements. Moreover, we operate in an evolving environment. New risk factors and uncertainties may emerge from

time to time, and it is not possible for management to predict all risk factors and uncertainties. Given these risks and uncertainties,

you should not place undue reliance on these forward-looking statements. Except as required by applicable law, we do not plan to publicly

update or revise any forward-looking statements contained in this prospectus or the documents incorporated by reference herein, whether

as a result of any new information, future events, changed circumstances or otherwise. For all forward-looking statements, we claim the

protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995.

MARKET,

INDUSTRY AND OTHER DATA

This

prospectus and any applicable prospectus supplement and the documents incorporated by reference herein and therein contain estimates,

projections, market research and other information concerning, among other things, our industry, our business and markets for our products

and services. Unless otherwise expressly stated, we obtain this information from reports, research surveys, studies and similar data

prepared by market research firms and other third parties, industry, medical and general publications, government data and similar sources

as well as from our own internal estimates and research and from publications, research, surveys and studies conducted by third parties

on our behalf. Information that is based on estimates, projections, market research or similar methodologies is inherently subject to

uncertainties and actual events or circumstances may differ materially from events and circumstances that are reflected in this information.

As a result, you are cautioned not to give undue weight to such information.

PROSPECTUS

SUPPLEMENT SUMMARY

The

following summary highlights selected information contained or incorporated by reference in this prospectus supplement. This summary

does not contain all of the information you should consider before investing in the securities. Before making an investment decision,

you should read the entire prospectus supplement and the accompanying base prospectus carefully, including the risk factors section,

the financial statements and the notes to the financial statements incorporated herein by reference, and the documents that we incorporate

by reference herein.

Overview

We

are a multi-disciplinary consulting group with key advisory practices in the areas of business and technology. Each of our segments and

practices is staffed with consultants recognized for their wealth of knowledge and established track records of delivering impact. With

our core group of experts experienced in corporate finance, capital markets, legal, and investor relations, we illuminate our clients’

paths to success by helping them foresee impending challenges and identify business opportunities. We leverage our in-depth expertise

to assist clients in creating value by providing profitable business ideas, customizing bold strategic options, offering sector intelligence,

and equipping clients with cost-saving solutions for lasting growth.

Since

our inception in 2013, we have been delivering our services to companies ranging from small-medium enterprises and government-linked

agencies to publicly traded conglomerates across a broad array of industries. Our business operates solely in Malaysia, with clients

predominantly from Malaysia, and some engagements with clients from China, Singapore and the United States.

We

have segregated our services in the following segments:

Business

Strategy Segment

Business

Strategy Consultancy – We focus on listing solutions, investors relations and boardroom strategies consultancy. We have

established a diverse local and international clientele, providing them with our services in both local and cross-border listings. Our

roles begin from pre-listing diagnosis and planning to the finalization of the entire listing process. To better serve our clients, we

extended our services line to include investor relations consultation, where we help our clients effectively handle investors’

expectations and manage communications. Further, we also offer services in attaining effective boardroom strategies for value creation

and inclusive growth. Over the years, our consulting services have successfully propelled our clients’ businesses to the next level

with strategic options, including mergers and acquisitions, initial public offerings, restructuring and transformation.

Our

business strategy consultancy segment performs the following functions:

| ● | Advise

clients on multitrack approaches to capital raising strategies; |

| ● | Evaluate

and assess clients’ businesses and perform initial public offering (“IPO”)

readiness diagnostic, including health checks on the company’s management, financial

and legal structure; |

| ● | Assemble

external professionals for the IPO process and assist in building a quality management team,

robust financial and corporate governance; |

| ● | Assist

in fine-tuning business plans, articulate compelling equity stories and advise on strategic

options to maximize clients’ business values; |

| ● | Manage

due diligence investigations and peer industry analysis; |

| ● | Prepare

pre-IPO investment presentations materials for clients; |

| ● | Liaise

with investors for pre-IPO capital raising; |

| ● | Design

marketing strategy and promote the company’s business; |

| ● | Assist

with cross-border listing in countries including but not limited to, Malaysia, China, Singapore,

and the United States. |

Our

Investor Relations Services

In

January 2021, our direct subsidiary V Capital Kronos Berhad acquired Imej Jiwa, an investor and public relations consultancy firm, which

will allow us to better serve companies seeking to list and trade on public exchanges. Imej Jiwa’s highly-skilled investor relations

(“IR”) professionals help companies that are preparing for a successful IPO set up an effective IR team. To date, we are

serving more than 40 public-listed Malaysian companies, which represent more than 4% of total Malaysian publicly listed companies.1 For

instance, we have been engaged by Malaysia’s largest home improvement retailer who consummated the biggest IPO in Malaysia since

2017, and the Malaysian leading dairy producer who consummated the second largest IPO in Malaysia since 2017 to provide IR consultancy

services. Our IR team builds strategies and communicates effectively to drive stakeholder and media engagement throughout the IPO roadshow

and post-IPO process. We are equally committed to sharpen client’s investment narratives and to deliver it to the right investors

through the best channel.

Our

Boardroom Strategy Services

We

leverage our multiple practices and our connections with professionals across an array of industries to complement clients’ businesses

by offering a holistic approach to achieve sustainable growth with high return on capital. Given the exponentially rising expectations

from investors, unprecedented economic disruptions, and fragmentation of traditional markets, we believe more companies need carefully

planned strategies to stay ahead of the trend and the competition through restructuring or transformation. We help our clients make the

right moves by being involved in boardroom discussions and advising them on strategic options, particularly when it comes to exploring

opportunities in offshoring, partnering, merger and acquisitions (“M&A”), deals outsourcing and initial public offerings.

We have recently been engaged to consult on boardroom strategies for one of the largest hospitality groups in Malaysia as well as company

that is a pioneer in human resources technology provider in Malaysia.

Technology

Consultancy Services & Solutions

Our

technology consultancy services and solutions keep our clients ahead of major technology and industry trends, including next-generation

digital transformation, software development, blockchain solutions and the industry restructuring brought upon by the convergence of

these technologies.

We

capitalize the transformative power of technology to push companies through to the next level. With the increasing global significance

of data analytics and digital transformation in enhancing existing business models, we have established relationships with technology

experts to provide the following services:

| Ø | Digital Development – We

evaluate our clients’ businesses and offer structured digitalization strategies to ensure their businesses achieve target business

objectives. At times, the business digitalization journey from vision to execution can be complex. Our experts illuminate the paths for

our clients by mapping their digitalization journeys in detail using deep domain expertise to define focused and effective strategic

responses. We emphasize rich content, focused delivery, and innovative and result-driven strategies as we guide our clients toward a

cost-saving path that increases efficiency and distinctive competitive advantage. Our technology experts coupled with our established

relationship with data analytic pioneers allow us to deliver efficient and innovative tailored digital solutions to resolve clients’

problems. We strive to provide the best solutions to clients across sectors. |

| Ø | Fintech Solution –

We offer fintech solutions, insights, and a multidimensional approach to advising and collaborating to help companies adapt to the ever-evolving

business environment and provide support to organizations. One of our subsidiary companies, Accuventures Sdn Bhd (“Accuventures”)

is a dynamic and experienced information technology (IT) and financial technology (fintech) provider founded by a group of international

industry professionals with years of knowledge and experience in the fintech and IT industry. With Credilab Sdn Bhd (a fully owned subsidiary

of Accuventures) (“Credilab”), Accuventures is capable of offering its clients the easiest and fastest route to obtain instant

cash loans. Credilab is currently operating a licensed money lending business in Malaysia with the approval granted by the Ministry of

Housing and Local Governments. Their financial services are designed to address everyday needs of Malaysians in an innovative way by

utilizing cutting-edge technology to enable easy access hassle-free to money lending services. |

| Ø | Software Solutions –

We offer custom software to a wide range of clients, from small to midsize companies that are both private and public-listed companies.

Our software solutions team aims to assist clients in identifying upcoming technology trends and opportunities while offering tailored

software, designed to meet the specific needs of every client. Our solutions services begin with an analysis of problems followed by

the designing, customizing, building, integrating, and scaling of software. With our vast network of relationships with software industry

experts, we are able to help clients source for the most suitable technology that matches their business needs. |

| Ø | Upcoming SaaS –

Moving forward, we plan to offer SaaS management software for our clients to provide automated management, critical insights and intuitive

data security. With our SaaS platform, clients can closely monitor the SaaS subscriptions and stay on top of key usage data across their

organizations. |

| 1 | As of 2022, there were 991 publicly listed companies in Malaysia

(Refer: http://www.bursamalaysia.com/listing/listing_resources/ipo/listing_statistic) |

Recent

Developments

Reverse

Stock Split

On

November 5, 2024, we effectuated a 1 for 49 share consolidation of its authorized share capital, such that every 49 ordinary shares,

no par value, in the authorized share capital of the Company be consolidated into 1 ordinary share, no par value (the “Reverse

Split”). The Reverse Stock Split was primarily intended to increase the market price per share of the Company’s ordinary

shares to regain compliance with the minimum bid price required for continued listing on the Nasdaq Capital Market.

Recent

Offerings

Senior

Secured Convertible Note. On September 2, 2024, we entered the Purchase Agreement with Advance Opportunities Fund I (“AOF”)

whereby AOF purchased from us a $1,000,000 Senior Convertible Note. On September 24, 2024, AOF converted the AOF Note into 9,099,181

Ordinary Shares.

Offering with Alumni Capital LP.

On August 1, 2024, we initially entered into the Purchase Agreement with Alumni Capital. Prior to the amendment of the Purchase Agreement

on September 23, 2024, the Company had the right, but not the obligation to cause Alumni Capital to purchase up to $5 million of our Ordinary

Shares (the “Commitment Amount”), no par value, at the Purchase Price (defined below) during the period beginning on the execution

date of the Purchase Agreement and ending on the earlier of (i) the date on which Alumni Capital has purchased $5 million of our Ordinary

Shares pursuant to the Purchase Agreement or (ii) June 30, 2025. On August 5, 2024, we filed a prospectus supplement, dated as of August

5, 2024 (the “Prospectus Supplement”) under its registration statement on Form F-3 (File No. 333-279521), in respect of the

financing with Alumni in the amount of $4,600,000. The Commitment amount was increased to $35,000,000 by the September 23, 2024, amendment

to the Purchase Agreement. On October 1, 2024, we filed a Form F-1 registration statement covering up to 5,640,074 shares that could be

sold to Alumni Capital and under the Purchase Agreement and up to 4,081,632 shares that could be exercised under the Commitment Warrant.

See “Alumni Capital Transaction” for a description of the Purchase Agreement and Commitment Warrant.

Registered

Direct Offerings.

On

July 12, 2024, we entered into a securities purchase agreement with certain investors (the “July 12 Purchasers”),

pursuant to which we agreed to issue and sell to the July 12 Purchasers an aggregate of 4,000,000 Ordinary Shares in a registered direct

offering. The Ordinary Shares were sold at a purchase price of $0.50 per Ordinary Share. For a more detailed description of this offering,

see our Report of Foreign Private Issuer on Form 6-K filed with the SEC on July 17, 2024.

On

July 15, 2024, we entered into a securities purchase agreement with certain investors (the “July 15 Purchasers”),

pursuant to which we agreed to issue and sell to the July 15 Purchasers an aggregate of 2,700,000 Ordinary Shares in a registered direct

offering. The Ordinary Shares were sold at a purchase price of $0.37 per ordinary share. For a more detailed description of this offering,

see our Report of Foreign Private Issuer on Form 6-K filed with the SEC on July 17, 2024.

On

July 25, 2024, we entered into two securities purchase agreements with certain accredited investors (the “July 25 Purchasers”),

pursuant to which we agreed to issue and sell to the July 25 Purchasers an aggregate of 3,568,035 Ordinary Shares, no par value per share,

in a registered direct offering. The Ordinary Shares were sold at a purchase price of $0.40 per Ordinary Share. For a more detailed description

of this offering, see our Report of Foreign Private Issuer on Form 6-K filed with the SEC on July 26, 2024.

On December 4, 2024, we entered into two securities

purchase agreements with certain accredited investors (the “December 4 Purchasers”), pursuant to which we agreed to

issue and sell to the December 4 Purchasers an aggregate of 2,133,334 Ordinary Shares, no par value per share, in a registered direct

offering. The Ordinary Shares were sold at a purchase price of $1.875 per Ordinary Share. For a more detailed description of this offering,

see our Report of Foreign Private Issuer on Form 6-K filed with the SEC on December 5, 2024.

On December 5, 2024, we entered into one securities purchase agreement

with certain accredited investor (the “December 5 Purchaser”), pursuant to which we agreed to issue and sell to the

December 5 Purchaser an aggregate of 533,333 Ordinary Shares, no par value per share, in a registered direct offering. The Ordinary Shares

were sold at a purchase price of $1.875 per Ordinary Share. For a more detailed description of this offering, see our second Report of

Foreign Private Issuer on Form 6-K filed with the SEC on December 5, 2024.

Share

Repurchase Program

On

August 19, 2024, VCI Global Limited (the “Company”) announced that its Board of Directors has approved a share repurchase

program with authorization to purchase up to $10 million of the Company’s outstanding ordinary share (the “Repurchase Program”).

The volume and timing of any repurchases will be subject to general market conditions, as well as the Company’s management of capital,

other investment opportunities, and other factors. The Repurchase Program does not obligate the Company to repurchase any specific number

of shares, and may be modified, suspended, or discontinued at any time at the Company’s discretion. For a more detailed description

of the Repurchase Program see our Report of Foreign Private Issuer on Form 6-K filed with the SEC on August 22, 2024.

Transaction

Shares

On

July 2, 2024, we issued a total of 3,465,820 ordinary shares to Cogia GmbH pursuant to an asset purchase agreement we had entered with

them on 18 March 2024. In return for the issuance of our shares to them, we had acquired the Socializer Messenger from Cogia GmbH, a

highly secure messenger platform currently serving the government of a European Union country.

Disposition of Shares

Since the filing of our Annual Report on Form 20-F on April 30, 2024,

our Chairman and Chief Executive Officer, Victor Hoo has acquired 681,472 Ordinary Shares and is, as of the date of this prospectus supplement,

the beneficial owner of 1,079,880 Ordinary Shares.

Compensation

of Directors

In

August 2024, we issued an aggregate of 227,762 Ordinary Shares to our directors as compensation.

Change

in Directors.

Our

Board of Directors appointed Ms. Yu Ying Liew as an independent director to the Board, effective as of August 8, 2024. For a more detailed

description of this appointment, see our Report of Foreign Private Issuer on Form 6-K filed with the SEC on August 13, 2024.

On

October 21, 2024, Mr. Marco Baccanello resigned as the executive director of the Board of Directors (the “Board”) of VCI

Global Limited (the “Company”), Mr. Fern Ellen Thomas resigned as a director of the Board and Mr. Jeremy Roberts resigned

as the director of the Board and chair of the Nominating & Corporate Governance Committee, effective October 21, 2024. Mr. Baccanello,

Mr. Thomas and Mr. Roberts resigned for personal reasons and have no disagreements with the Company on any matter relating to the Company’s

operations, policies or practices.

On

October 21, 2024, the Board appointed a new executive director, Victor Lee, effective November 1, 2024. For a more detailed description

of this appointment, see our Report of Foreign Private Issuer on Form 6-K filed with the SEC on October 21, 2024.

Corporate

Information

Our principal executive offices are located at B03-C-8 Menara 3A, KL

Eco City, No. 3 Jalan Bangsar, 59200 Kuala Lumpur, Malaysia, and our registered address in BVI is Vistra Corporate Services Centre, Wickhams

Cay II, Road Town, Tortola, British Virgin Islands. Our telephone number is +6037717 3089. The address of our website is http://v-capital.co/.

Information contained on, or available through, our website does not constitute part of, and is not deemed incorporated by reference into,

this prospectus supplement. Our agent for service of process in the United States is Sichenzia Ross Ference Carmel LLP, 1185 6th Ave 31st

Fl, New York, NY 10036.

Implications

of Being an Emerging Growth Company

We

are an “emerging growth company,” as defined in the Jobs Act. We will remain an emerging growth company until the earlier

of (i) the last day of the fiscal year following the fifth anniversary of the date of the first sale of our ordinary shares pursuant

to an effective registration statement under the Securities Act; (ii) the last day of the fiscal year in which we have total annual gross

revenues of $1.235 billion or more; (iii) the date on which we have issued more than $1 billion in nonconvertible debt during the previous

three years; or (iv) the date on which we are deemed to be a large accelerated filer under applicable SEC rules. We expect that we will

remain an emerging growth company for the foreseeable future, but cannot retain our emerging growth company status indefinitely and will

no longer qualify as an emerging growth company on or before the last day of the fiscal year following the fifth anniversary of the date

of the first sale of our ordinary shares pursuant to an effective registration statement under the Securities Act. For so long as we

remain an emerging growth company, we are permitted and intend to rely on exemptions from specified disclosure requirements that are

applicable to other public companies that are not emerging growth companies.

These

exemptions include:

| ● | being

permitted to provide only two years of audited financial statements, in addition to any required

unaudited interim financial statements, with correspondingly reduced “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” disclosure; |

| ● | not

being required to comply with the requirement of auditor attestation of our internal controls

over financial reporting; |

| ● | not

being required to comply with any requirement that may be adopted by the Public Company Accounting

Oversight Board regarding mandatory audit firm rotation or a supplement to the auditor’s

report providing additional information about the audit and the financial statements; |

| ● | reduced

disclosure obligations regarding executive compensation; and |

| ● | not

being required to hold a nonbinding advisory vote on executive compensation and shareholder

approval of any golden parachute payments not previously approved. |

We

have taken advantage of certain reduced reporting requirements in this prospectus supplement and the accompanying base prospectus. Accordingly,

the information contained herein may be different than the information you receive from other public companies in which you hold stock.

An

emerging growth company can take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act for

complying with new or revised accounting standards. This allows an emerging growth company to delay the adoption of certain accounting

standards until those standards would otherwise apply to private companies. We have irrevocably elected to avail ourselves of this extended

transition period and, as a result, we will not be required to adopt new or revised accounting standards on the dates on which adoption

of such standards is required for other public reporting companies.

We

are also a “smaller reporting company” as defined in Rule 12b-2 of the Exchange Act, and have elected to take advantage of

certain of the scaled disclosure available for smaller reporting companies.

THE

OFFERING

| Ordinary shares offered by us pursuant to this prospectus supplement |

|

$26,077,348 ordinary shares. |

| |

|

|

| Ordinary shares outstanding as of December 17, 2024 |

|

13,323,211 |

| |

|

|

| Ordinary shares to be outstanding after this offering |

|

33,814,259 ordinary shares, which includes (i) 14,491,049 Purchase

Shares, assuming issuance of all of the Purchase Shares under the Purchase Agreement at a price of $1.3855 per ordinary share (the “Assumed

Offering Price”), which is 85% of the last reported sale price of our ordinary shares on Nasdaq on December 16, 2024 and (ii)

6,000,000 Warrant Shares, assuming exercise of the $6,000,000 of Warrant Shares at an average exercise price of $1.00 per share. The actual

number of Purchase Shares sold and issued and Warrant Shares exercised and issued will vary as the sales prices and exercise prices under

this offering depend on a variety of factors. See “Alumni Capital Transaction”. |

| |

|

|

| Use of Proceeds |

|

We intend to use the net proceeds from this offering for general corporate purposes and working capital. See “Use of Proceeds” on page S-8 of this prospectus supplement. |

| |

|

|

| Risk Factors |

|

An investment in our ordinary shares involves a high degree of risk. See the information contained in or incorporated by reference under “Risk Factors” on page S-6 of this prospectus supplement and under similar headings in the other documents that are incorporated by reference herein, as well as the other information included in or incorporated by reference in this prospectus supplement and the accompanying base prospectus. |

| |

|

|

| The Nasdaq Capital Market symbol |

|

VCIG |

The number of our ordinary shares to be outstanding after this offering

is based on 13,323,211 ordinary shares outstanding as of December 17, 2024. Unless specifically stated otherwise, the information in this

prospectus supplement is as of December 17, 2024 and excludes:

| |

● |

5,102 ordinary shares issuable upon the exercise of warrants issued to Exchange Listing, LLC, at an exercise price of $196.00 per ordinary share; |

| |

● |

38,388 ordinary shares issuable upon the exercise of the warrants offered in the Company’s offering in January 2024, at an exercise price of $61.25 per ordinary share; and |

| |

● |

3,591 ordinary shares issuable upon the exercise of the warrants issued to StockBlock Securities, LLC, at an exercise price of $76.56 per ordinary share. |

| ● | Undetermined number of ordinary

shares issuable upon the exercise of the warrant issued to Alumni Capital, at variable exercise prices. |

RISK

FACTORS

Investing

in our securities involves a high degree of risk. Before deciding whether to purchase any of our securities, you should carefully consider

the risks and uncertainties described below, in the section titled “Risk Factors” in our Annual Report on Form 20-F, and

in other documents that we subsequently file with the SEC that update, supersede or supplement such information, which are incorporated

by reference into this prospectus supplement and accompanying base prospectus, and in any free writing prospectus that we have authorized

for use in connection with this offering. If any of these risks actually occur, our business, financial condition and results of operations

could be materially and adversely affected and we may not be able to achieve our goals, the value of our securities could decline and

you could lose some or all of your investment. Additional risks not presently known to us or that we currently deem immaterial may also

impair our business operations. If any of these risks occur, the trading price of our ordinary shares could decline materially and you

could lose all or part of your investment. If any of these risks actually occur, our business, financial condition, results of operations

or cash flow could be harmed. This could cause the trading price of our securities to decline, resulting in a loss of all or part of

your investment. Please also read carefully the section above titled “Cautionary Note Regarding Forward-Looking Statements.”

Risks

Related to this Offering

If

we were deemed to be an investment company under the Investment Company Act of 1940, applicable restrictions could make it impractical

for us to continue our business as contemplated and could have a material adverse effect on our business and the price of our ordinary

shares.

An

entity will generally be deemed an “investment company” under Section 3(a)(1) of the Investment Company Act of 1940, as amended

(the “1940 Act”) if: (a) it is or holds itself out as being engaged primarily, or proposes to engage primarily, in the business

of investing, reinvesting or trading in securities, or (b) absent an applicable exemption, it owns or proposes to acquire investment

securities having a value exceeding 40% of the value of its total assets (exclusive of U.S. government securities and cash items) on

an unconsolidated basis. We believe that we are engaged primarily in the business of providing business and technology consulting services

and not in the business of investing, reinvesting or trading in securities. We hold ourselves out as a business consulting firm and do

not propose to engage primarily in the business of investing, reinvesting or trading in securities. In that respect, we do not believe

that we fall within the definition of an “investment company” under the 1940 Act because substantially all of our revenue

has come from consulting fees and other factors such as the history of the Company, how the Company has represented itself in the marketplace

and the lack of investing expertise by almost all of senior management.

The

1940 Act and the rules thereunder contain detailed parameters for the organization and operation of investment companies. Among other

things, the 1940 Act and the rules thereunder limit or prohibit transactions with affiliates, impose limitations on the issuance of debt

and equity securities, generally prohibit the issuance of options and impose certain governance requirements. We intend to conduct our

operations so that we will not be deemed an investment company. However, if we were to be deemed an investment company, restrictions

imposed by the 1940 Act, including limitations on our capital structure and our ability to transact business with affiliates, could make

it impractical for us to continue our business as currently conducted and would have a material adverse effect on our business, financial

condition, results of operations and the price of our ordinary shares. In addition, we may be required to limit the amount of investments

that we make as a principal or otherwise conduct our business in a manner that does not subject us to the registration and other requirements

on the 1940 Act.

In the

event we are required to register as a broker-dealer, our business model could be harmed.

We

do not believe our current business practices or operations require us to register as a broker-dealer under US federal and state laws.

We restrict our activities and services so as to not be deemed a broker-dealer under US state and federal regulations. However, if we

were deemed by a relevant authority to be acting as a broker-dealer, we could be subject to a variety of penalties, including fines and

rescission offers and could be required to register as a broker-dealer, which would increase our costs, especially our compliance costs.

If in those circumstances we decided not to register as a broker-dealer or act in association with a broker-dealer in our transactions,

we may not be able to continue to operate under our current business model which could have a material adverse effect on our business

and financial prospects.

You

may experience future dilution as a result of future equity offerings.

In

order to raise additional capital, we may in the future offer additional shares of our ordinary shares or other securities convertible

into or exchangeable for our ordinary shares. We may not be able to sell shares or other securities in any other offering at a price

per share that is equal to or greater than the price per share paid by investors in this offering, and investors purchasing shares or

other securities in the future could have rights superior to existing stockholders. The price per share at which we sell additional shares

of our ordinary shares or other securities convertible into or exchangeable for our ordinary shares in future transactions may be higher

or lower than the price per share in this offering.

Our

management will have broad discretion over the use of the net proceeds from this offering, you may not agree with how we use the proceeds,

and the proceeds may not be invested successfully.

Our

management will have broad discretion in the application of the net proceeds from this offering, and our shareholders will not have the

opportunity as part of their investment decision to assess whether the net proceeds are being used appropriately. Because of the number

and variability of factors that will determine our use of the net proceeds from this offering, their ultimate use may vary substantially

from their currently intended use. The failure by our management to apply these funds effectively could harm our business. See “Use

of Proceeds” on page S-8 of this prospectus supplement for a description of our proposed use of proceeds from this offering.

We

may be or become a passive foreign investment company, which could result in adverse U.S. federal income tax consequences to U.S. Holders.

The

rules governing passive foreign investment companies (“PFICs”) can have adverse effects for U.S. federal income tax purposes.

The tests for determining PFIC status for a taxable year depend upon the relative values of certain categories of assets and the relative

amounts of certain kinds of income. The determination of whether we are a PFIC, which must be made annually after the close of each taxable

year, depends on the particular facts and circumstances (such as the valuation of our assets, including goodwill and other intangible

assets) and may also be affected by the application of the PFIC rules, which are subject to differing interpretations. The fair market

value of our assets is expected to relate, in part, to (a) the market price of our ordinary shares and (b) the composition of our income

and assets, which will be affected by how, and how quickly, we spend any cash that is raised in any financing transaction. Moreover,

our ability to earn specific types of income that we currently treat as non-passive for purposes of the PFIC rules is uncertain with

respect to future years. Because the value of our assets for the purpose of determining PFIC status will depend in part on the market

price of our ordinary shares, which may fluctuate significantly. We do not expect to be a PFIC for our current taxable year or in the

foreseeable future. However, there can be no assurance that we will not be considered a PFIC for any taxable year.

If

we are a PFIC, a U.S. Holder (as defined below) would be subject to adverse U.S. federal income tax consequences, such as ineligibility

for any preferred tax rates on capital gains or on actual or deemed dividends, interest charges on certain taxes treated as deferred,

and additional reporting requirements under U.S. federal income tax laws and regulations. A U.S. Holder may in certain circumstances

mitigate adverse tax consequences of the PFIC rules by filing an election to treat the PFIC as a qualified electing fund (“QEF”)

or, if shares of the PFIC are “marketable stock” for purposes of the PFIC rules, by making a mark-to-market election with

respect to the shares of the PFIC. We do not intend to comply with the reporting requirements necessary to permit U.S. Holders to elect

to treat us as a QEF. If a U.S. Holder makes a mark-to-market election with respect to its ordinary shares, the U.S. Holder is in its

U.S. federal taxable income an amount reflecting any year end increase in the value of its ordinary shares. For purposes of this discussion,

a “U.S. Holder” is a beneficial owner of ordinary shares that is for U.S. federal income tax purposes: (i) an individual

who is a citizen or resident of the United States; (ii) a corporation (or other entity taxable as a corporation for U.S. federal income

tax purposes) created or organized in or under the laws of the United States, any state thereof or the District of Columbia; (iii) an

estate the income of which is subject to U.S. federal income taxation regardless of its source; or (iv) a trust (a) if a court within

the U.S. can exercise primary supervision over its administration, and one or more U.S. persons have the authority to control all of

the substantial decisions of that trust, or (b) that was in existence on August 20, 1996, and validly elected under applicable Treasury

Regulations to continue to be treated as a domestic trust.

Investors

should consult their own legal and tax advisors regarding all aspects of the application of the PFIC rules to ordinary shares.

If

tax authorities were to successfully challenge our transfer pricing, there could be an increase in our overall tax liability, which could

adversely affect our financial condition, results of operations and cash flows. In addition, the tax laws in the jurisdictions in which

we operate are subject to differing interpretations. Tax authorities may challenge our tax positions, and if successful, such challenges

could increase our overall tax liability. In addition, the tax laws in the jurisdiction in which we operate are subject to change. We

cannot predict the timing or content of such potential changes, and such changes could increase our overall tax liability, which could

adversely affect our financial condition, results of operations and cash flows.

IN

ADDITION TO THE ABOVE RISKS, BUSINESSES ARE OFTEN SUBJECT TO RISKS NOT FORESEEN OR FULLY APPRECIATED BY MANAGEMENT. IN REVIEWING THIS

FILING, POTENTIAL INVESTORS SHOULD KEEP IN MIND THAT OTHER POSSIBLE RISKS MAY ADVERSELY IMPACT THE COMPANY’S BUSINESS OPERATIONS

AND THE VALUE OF THE COMPANY’S SECURITIES.

USE

OF PROCEEDS

The estimated net proceeds to the Company from this offering, assuming

issuance of all of the Offered Shares and after deducting the expenses of this offering (estimated to be approximately $60,000), will

be approximately $26,017,438.

We

intend to use the net proceeds from this offering for general corporate purposes and working capital. We may also use a portion of the

net proceeds from this offering to acquire or invest in complementary businesses, technologies, products or other intellectual property,

although we have no present commitments or agreements to do so.

The

amounts and timing of our use of the net proceeds from this offering will depend on a number of factors, such as the timing and progress

of our commercialization efforts, research and development efforts, the timing and progress of any partnering efforts, technological

advances and the competitive environment for our products. As of the date of this prospectus supplement, we cannot specify with certainty

all of the particular uses for the net proceeds to us from the sale of the ordinary share offered by us hereunder. Accordingly, our management

will have broad discretion in the timing and application of these proceeds. Pending application of the net proceeds as described above,

we intend to temporarily invest the proceeds in short-term, interest-bearing instruments.

DIVIDEND

POLICY

On

June 6, 2023, we declared a first single tier interim dividend of $0.01 per ordinary share. The dividend was paid out on July 31, 2023,

to the shareholders whose names were on the record at the close of business on July 3, 2023. On July 31, 2023, we paid out dividends

in the amount of $104,557.28 to our shareholders.

We

expect to pay dividends to shareholders on a regular basis at the end of each financial year, irrespective of any interim dividends,

which may be declared intermittently. Our Board of Directors shall have the sole discretion on the annual amount of dividend to be paid

to the shareholders.

Any

future determination relating to our dividend policy will be made at the discretion of our Board and will depend on then existing conditions.

Under BVI law, the directors of the company can approve a distribution at any time and of such amount as they think fit, provided that

the resolution of directors authorizing the distribution must include a Solvency Statement that, in the opinion of the directors, the

company will, immediately after the distribution, satisfy the solvency test set out in the BVI Business Companies Act, 2004, being that:

| i. | the

value of the company’s assets exceeds its liabilities; and |

| ii. | the

company is able to pay its debts as they fall due. |

ALUMNI CAPITAL TRANSACTION

On August 1, 2024, we entered into the Purchase Agreement and Commitment

Warrant with Alumni Capital. Pursuant to the terms of the Purchase Agreement, Alumni Capital has agreed to purchase from us up to $35,000,000

(the “Commitment Amount”) of our ordinary shares from time to time during the term of the Purchase Agreement. Pursuant to

the terms of the Purchase Agreement, we have filed with the SEC this prospectus supplement regarding the sale and issuance of Offered

Shares under the Securities Act. In connection with the execution of the Purchase Agreement, we have issued the Commitment Warrant to

Alumni Capital as a commitment fee. The Commitment Warrant provides Alumni Capital with the right to purchase at any time until August

1, 2027, up to a number of Warrant Shares equal to (i) 20% of the Commitment Amount less the aggregate Exercise Values (as defined below)

of all previous partial exercises of the Commitment Warrant, divided by (ii) the Exercise Price (as defined below) on the date of exercise.

As of the date of this prospectus supplement, a total of $14,922,652.77 of our ordinary have been sold to Alumni Capital under the Purchase

Agreement, of which $4,584,363.21 were covered by our prospectus supplement dated August 5, 2024 and related to our registration statement

on Form F-3 (File No. 333-279521) and $10,338,289.56 of which were covered by our prospectus dated October 11, 2024 and related to our

registration statement on Form F-1 (File No. 333-282454). Alumni Capital has partially exercised the Commitment Warrant for an aggregate

Exercise Value of $550,000. The ordinary shares issued pursuant to such exercises were covered by our prospectus dated October 11, 2024,

and related to our registration statement on Form F-1 (File No. 333-282454). This prospectus supplement covers up to $26,077,348 of Offered

Shares, which includes (i) up to $20,077,348 of Purchase Shares to be sold to Alumni Capital under the Purchase Agreement and (ii) up

to $6,000,000 of Warrant Shares to be sold to Alumni Capital under the Commitment Warrant.

“Exercise Value” means with respect

to any exercise of the Commitment Warrant, the number of ordinary shares received upon such exercise multiplied by the Exercise Price

applicable to such exercise.

“Exercise Price” means with respect

to any exercise of the Commitment Warrant, $15,000,000 divided by the number of outstanding ordinary shares on the date of such exercise.

We may, from time to time and at our sole discretion,

direct Alumni Capital to purchase the Purchase Shares upon the satisfaction of certain conditions set forth in the Purchase Agreement

at a purchase price per share based on the market price of our Common Shares at the time of sale as computed under the Purchase Agreement.

Alumni Capital may not assign its rights and obligations under the Purchase Agreement.

The Purchase Agreement prohibits us from directing

Alumni Capital to purchase any Purchase Notice Securities if those shares, when aggregated with all other ordinary shares then beneficially

owned by Alumni Capital, would result in Alumni Capital and its affiliates owning in excess of 4.99%, of our then issued and outstanding

ordinary shares (the “Beneficial Ownership Limitation”).

Purchase of Purchase Shares Under the Purchase

Agreement

Commencing on the date that the Commitment Warrants

are delivered and ending at the end of the Commitment Period we may, from time to time direct Alumni Capital to purchase such number of

Purchase Shares set forth on a written notice from us (the “Purchase Notice”) at a price equal to the Purchase Price, provided,

however, that the amount of Purchase Shares cannot exceed $1,000,000 or the Beneficial Ownership Limitation. We will deliver the Purchase

Shares concurrently with the delivery of a Purchase Notice, which will be deemed delivered on the same business day if Alumni Capital

receives the Purchase Shares and the Purchase Notice by 8:00 a.m., New York time, or on the next business day if Alumni Capital receives

the Purchase Shares and the Purchase Notice after 8:00 a.m., New York time. Within five Business Days after the Purchase Notice Date,

Alumni Capital shall pay to the Company an amount equal to the Purchase Notice Securities multiplied by the Purchase Price (the “Closing

Date”).

“Purchase Price” means with respect

to any Closing Date, the lowest traded price for the ordinary shares for the five (5) consecutive Business Days immediately prior to such

Closing Date multiplied by 85%.

Effect of Performance of the Purchase Agreement

and Commitment Warrant on our Shareholders

The Offered Shares registered in this offering

that may be issued or sold by us to Alumni Capital under the Purchase Agreement and Commitment Warrant are expected to be freely tradable.

The Purchase Shares registered in this offering may be sold until the end of the Commitment Period and Alumni Capital may purchase Warrant

Shares until August 1, 2027. The sale by Alumni Capital of a significant number of our ordinary shares at any given time could cause the

market price of our Common Shares to decline and to be highly volatile. Sales of our ordinary shares to Alumni Capital under the Purchase

Agreement or Commitment Warrant, if any, will depend upon market conditions and other factors to be determined by us, in our sole discretion,

in the case of the Purchase Shares or Alumni Capital, in the case of the Warrant Shares. We may ultimately decide to sell to Alumni Capital

all, some or none of the Purchase Shares that may be available for us to sell pursuant to the Purchase Agreement and Alumni Capital may

decide purchase all, some or none of the Warrant Shares. If and when we do sell the Purchase Shares to Alumni Capital or when Alumni Capital

purchases Warrant Shares, Alumni Capital may resell all, some or none of those shares at any time or from time to time in its discretion.

Therefore, sales to Alumni Capital by us under the Purchase Agreement or Commitment Warrant may result in substantial dilution to the

interests of our other shareholders. In addition, if we sell a substantial number of the Offered Shares to Alumni Capital under the Purchase

Agreement and Commitment Warrant, or if investors expect that we will do so, the actual sales of Offered Shares or the mere existence

of our arrangement with Alumni Capital may make it more difficult for us to sell equity or equity-related securities in the future at

a time and at a price that we might otherwise wish to effect such sales. However, we have the right to control the timing and amount of

any sales of the Purchase Shares to Alumni Capital.

Pursuant to the terms of the Purchase Agreement,

we have the right, but not the obligation, to direct Alumni Capital to purchase up to $35,000,000 of our ordinary shares, which is exclusive

of the Commitment Warrants issued to Alumni Capital as consideration for its commitment to purchase our ordinary shares under the Purchase

Agreement. The Purchase Agreement generally prohibits us from issuing or selling to Alumni Capital under the Purchase Agreement any of

our ordinary shares that, when aggregated with all other of our ordinary shares then beneficially owned by Alumni Capital and its affiliates,

would exceed the Beneficial Ownership Limitation.

Capitalized terms that are not defined herein may have meanings assigned

to them in the Purchase Agreement.

PLAN

OF DISTRIBUTION

Pursuant to this prospectus supplement and the accompanying prospectus,

we are offering up to (i) $20,077,348 of Purchase Shares that may be sold and issued by us directly to Alumni Capital from time to time

until the end of the Commitment Period pursuant to the terms of the Purchase Agreement, subject to the terms and subject to the conditions

set forth therein and (ii) $6,000,000 of Warrant Shares that may be purchased by Alumni Capital until August 1, 2027, pursuant to the

terms of the Commitment Warrant, subject to the terms and subject to the conditions set forth therein.

The Offered Shares that we may from time to time

issue to Alumni Capital may be subsequently sold or distributed from time to time by Alumni Capital directly to one or more purchasers

or through brokers, dealers, or underwriters who may act solely as agents at market prices prevailing at the time of sale, at prices related

to the prevailing market prices, at negotiated prices, or at fixed prices, which may be changed. Any resale of the Offered Shares could

be effected in one or more of the following methods:

| ● | ordinary brokerage transactions

and transactions in which the broker-dealer solicits purchasers; |

| ● | block trades in which the broker-dealer

will attempt to sell the shares as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| ● | purchases by a broker-dealer

as principal and resale by the broker-dealer for its account; |

| ● | an exchange distribution in

accordance with the rules of the applicable exchange; |

| ● | privately negotiated transactions; |

| ● | in transactions through broker-dealers

that agree with Alumni Capital to sell a specified number of such securities at a stipulated price per security; |

| ● | through the writing or settlement

of options, whether through an options exchange or otherwise; |

| ● | a combination of any such methods

of sale; or |

| ● | any other method permitted

pursuant to applicable law. |

In order to comply with the securities laws of

certain states, if applicable, the Offered Shares may be sold through registered or licensed brokers or dealers. In addition, in certain

states, the Offered Shares may not be sold unless they have been registered or qualified for sale in the state or an exemption from the

state’s registration or qualification requirement is available and complied with.

Brokers, dealers, underwriters or agents participating

in any distribution of the Offered Shares may receive compensation in the form of commissions, discounts, or concessions from the seller

and/or purchasers of the Common Shares for whom the broker-dealers may act as agent. The compensation paid to a particular broker-dealer

may be less than or in excess of customary commissions. Neither we nor Alumni Capital can presently estimate the amount of compensation

that any agent will receive.

Alumni Capital is an “underwriter”

within the meaning of Section 2(a)(11) of the Securities Act. Alumni Capital has informed us that it will use an unaffiliated broker-dealer

to effectuate all sales, if any, of the ordinary shares that it may purchase from us pursuant to the Purchase Agreement. Such sales will

be made on Nasdaq at prices and at terms then prevailing or at prices related to the then current market price. Each such unaffiliated

broker-dealer will be an underwriter within the meaning of Section 2(a)(11) of the Securities Act. Alumni Capital has informed us that

each such broker-dealer will receive commissions from Alumni Capital that will not exceed customary brokerage commissions.

We know of no existing arrangements between Alumni

Capital and any of our other shareholders, broker, dealer, underwriter, or agent relating to the sale or distribution of the Offered Shares

offered by this prospectus supplement.

We will pay all of our expenses incident to the

registration, offering, and sale of the shares to Alumni Capital.

We have agreed to indemnify Alumni Capital and

certain other persons against certain liabilities in connection with the offering of the Offered Shares, including liabilities arising

under the Securities Act.

Alumni Capital represented to us that at no time

prior to the date of the Purchase Agreement has Alumni Capital or its agents, representatives or affiliates engaged in or effected, in

any manner whatsoever, directly or indirectly, any short sale (as such term is defined in Section 242.200 of Regulation SHO of the U.S.

Exchange Act) of our Common Shares or any hedging transaction which establishes a net short position with respect to the Common Shares

or any other Company securities. Alumni Capital agreed that during the term of the Purchase Agreement, neither it nor its affiliates acting

on its behalf or pursuant to any understanding with it will execute any of the foregoing transactions.

We have advised Alumni Capital that it is required

to comply with Regulation M promulgated under the U.S. Exchange Act. With certain exceptions, Regulation M precludes Alumni Capital, any

affiliated purchasers, and any broker-dealer or other person who participates in the distribution from bidding for or purchasing or attempting

to induce any person to bid for or purchase any security which is the subject of the distribution until the entire distribution is complete.

Regulation M also prohibits any bids or purchases made in order to stabilize the price of a security in connection with the distribution

of that security. All of the foregoing may affect the marketability of the shares offered by this prospectus supplement.

The transfer agent and registrar for our ordinary

shares is VStock LLC, 18 Lafayette Place, Woodmere, NY 11598. Their telephone number is (212) 828-8436.

Our ordinary shares are listed on The Nasdaq Capital

Market under the symbol “VCIG.”

LEGAL

MATTERS

The

validity of the issuance of the securities offered hereby will be passed upon for us by Carey Olsen (BVI) L.P.

EXPERTS

WWC,

P.C., our independent registered public accounting firm, has audited our consolidated financial statements included in our Annual Report

on Form 20-F for the year ended December 31, 2023, as set forth in their report, which is incorporated by reference in this prospectus

supplement and elsewhere in the registration statement of which this prospectus supplement forms a part. Our consolidated financial statements

are incorporated by reference in reliance on WWC, P.C.’s report for the consolidated financial statements for the fiscal year ended

December 31, 2023 given on its authority as experts in accounting and auditing.

WHERE

YOU CAN FIND MORE INFORMATION

As

permitted by SEC rules, this prospectus supplement and accompanying base prospectus omits certain information and exhibits that are included

in the registration statement of which this prospectus and accompanying base prospectus form a part. Since this prospectus supplement

may not contain all of the information that you may find important, you should review the full text of these documents. If we have filed

a contract, agreement, or other document as an exhibit to the registration statement of which this prospectus supplement forms a part,

you should read the exhibit for a more complete understanding of the document or matter involved. Each statement in this prospectus supplement,

including statements incorporated by reference as discussed above, regarding a contract, agreement, or other document is qualified in

its entirety by reference to the actual document.

We

are subject to periodic reporting and other informational requirements of the Exchange Act as applicable to foreign private issuers.

Accordingly, we are required to file reports, including annual reports on Form 20-F, and other information with the SEC. All information

filed with the SEC can be inspected over the Internet at the SEC’s website at www.sec.gov.

As

a foreign private issuer, we are exempt under the Exchange Act from, among other things, the rules prescribing the furnishing and content

of proxy statements, and our executive officers, directors, and principal shareholders are exempt from the reporting and short-swing

profit recovery provisions contained in Section 16 of the Exchange Act. In addition, we will not be required under the Exchange Act to

file periodic or current reports and financial statements with the SEC as frequently or as promptly as U.S. companies whose securities

are registered under the Exchange Act.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information that we file with it into this prospectus supplement, which means

that we can disclose important information to you by referring you to those documents. The information incorporated by reference is an

important part of this prospectus. The information incorporated by reference into this prospectus supplement is deemed to be part of

this prospectus, and any information filed with the SEC after the date of this prospectus supplement will automatically be deemed to

update and supersede information contained in this prospectus supplement and accompanying base prospectus.

The

following documents previously filed with the SEC are incorporated by reference in this prospectus supplement:

| ● | our

Annual Report on Form

20-F for the year ended December 31, 2023, filed on April 30, 2024; |

| ● | our reports of foreign

private issuer on Form 6-K, filed on January

19, 2024, January 26,

2024, April 5, 2024, May

31, 2024, July 5,

2024, July 17, 2024, July

17, 2024, July

26, 2024 and July 29,

2024, August 6, 2024, August

13, 2024, August 19,

2024, August 22,

2024, September 6,

2024, September 27,

2024, October 21,

2024, November 5, 2024, November

27, 2024, December

5, 2024 and December

5, 2024; |

| ● | the

description of our ordinary shares which is registered under Section 12 of the Exchange Act,

in our Registration Statement on Form

8-A, filed on March 31, 2023 |

All

filings filed by us pursuant to the Exchange Act after the date of the initial filing of the registration statement of which this prospectus

supplement is a part and prior to effectiveness of the registration statement shall be deemed to be incorporated by reference into this

prospectus supplement.

We

also incorporate by reference all additional documents that we file with the Securities and Exchange Commission under the terms of Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act that are made after the date of the initial registration statement but prior to effectiveness

of the registration statement and after the date of this prospectus supplement but prior to the termination of the offering of the securities

covered by this prospectus supplement. We are not, however, incorporating, in each case, any documents or information that we are deemed

to furnish and not file in accordance with Securities and Exchange Commission rules.

You

should rely only on the information contained or incorporated by reference in this prospectus supplement. We have not authorized any

other person to provide you with different information. If anyone provides you with different or inconsistent information, you should

not rely on it. You should assume that the information appearing in this prospectus supplement is accurate only as of the date of this

prospectus supplement. Our business, financial condition, results of operations and prospects may have changed since that date.

Any

statement contained in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be deemed

to be modified or superseded for the purposes of this prospectus supplement to the extent that a statement contained herein, or in any

other subsequently filed document which also is or is deemed to be incorporated by reference herein, modifies or supersedes that statement.

The modifying or superseding statement need not state it has modified or superseded a prior statement or include any other information

set forth in the document that it modifies or supersedes. The making of a modifying or superseding statement is not an admission for

any purposes that the modified or superseded statement, when made, constituted a misrepresentation, an untrue statement of a material

fact or an omission to state a material fact that is required to be stated or that is necessary to make a statement not misleading in

light of the circumstances in which it was made. Any statement so modified or superseded will not be deemed, except as so modified or

superseded, to constitute a part of this prospectus supplement.

You

may request, and we will provide you with, a copy of these filings, at no cost, by calling us or by writing to us at the following address:

VCI Global Limited B03-C-8 Menara 3A

KL

Eco City, No. 3 Jalan Bangsar

59200

Kuala Lumpur

+603

7717 3089

PROSPECTUS

$200,000,000

Ordinary

Shares

Warrants

Debt

Securities

Units

VCI

GLOBAL Limited

From

time to time, we may offer and sell ordinary shares, debt securities or warrants to purchase ordinary shares or any combination of these

securities, either separately or in units, in one or more offerings in amounts, at prices and on terms that we will determine at the

time of the offering. The debt securities and warrants may be convertible into or exercisable or exchangeable for ordinary shares or

debt securities shares may be convertible into or exchangeable for ordinary shares. The aggregate initial offering price of all securities

sold by us under this prospectus will not exceed $200,000,000.

We

may offer securities through underwriting syndicates managed or co-managed by one or more underwriters or dealers, through agents or

directly to purchasers. The prospectus supplement for each offering of securities will describe in detail the plan of distribution for

that offering. For general information about the distribution of securities offered, please see “Plan of Distribution”

in this prospectus. Each time our securities are offered, we will provide a prospectus supplement containing more specific information

about the particular offering and attach it to this prospectus. The prospectus supplements may also add, update or change information

contained in this prospectus. This prospectus may not be used to offer or sell securities without a prospectus supplement that

includes a description of the method and terms of that offering.

Our

ordinary shares are quoted on The Nasdaq Capital Market under the symbol “VCIG.” The last reported sale price of our ordinary

shares on The Nasdaq Capital Market on May 16, 2024 was $0.96 per share.

The

aggregate market value of our outstanding ordinary shares held by non-affiliates is $23,367,813, based on 49,186,286 ordinary shares

outstanding, of which 18,694,250 shares are held by non-affiliates, and a share price of $1.25 per share, which was the closing sale

price of our ordinary shares as quoted on Nasdaq on April 29, 2024. Pursuant to General Instruction I.B.5 of Form F-3, in no event

will we sell our securities in a public primary offering with a value exceeding more than one-third of our public float in any

12-month period so long as our public float remains below $75,000,000. As of the date of this prospectus, we have not offered any securities

during the past twelve months pursuant to General Instruction I.B.5 of Form F-3. You are urged to obtain current market quotations

of our ordinary shares.

If

we decide to seek a listing of any purchase contracts, warrants, subscriptions rights, depositary shares or units offered by this prospectus,

the related prospectus supplement will disclose the exchange or market on which the securities will be listed, if any, or where we have

made an application for listing, if any.

Other

than our ordinary shares, we have not yet determined whether the other securities that may be offered by this prospectus will be listed

on any exchange, interdealer quotation system or over-the-counter market. If we decide to seek the listing of any such securities upon

issuance, the prospectus supplement relating to those securities will disclose the exchange, quotation system or market on which those

securities will be listed.

We