UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO SECTION 13a-16 OR 15d-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number: 001-41678

VCI Global Limited

(Translation of registrant’s name into English)

B03-C-8 Menara 3A

KL, Eco City, No.3 Jalan Bangsar

59200 Kuala Lumpur

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F:

Form 20-F ☒ Form 40-F ☐

As previously disclosed, on August 1, 2024, VCI

Global Limited (the “Company”) entered into a Share Purchase Agreement (the “Purchase Agreement”), as amended

on September 27, 2024, with Alumni Capital LP (“Alumni Capital”), a Delaware limited partnership. Pursuant to the Purchase

Agreement, the Company has the right, but not the obligation to cause Alumni Capital to purchase up to $35,000,00of our ordinary shares

(the “Commitment Amount”), no par value, at the Purchase Price (defined below) during the period beginning on the execution

date of the Purchase Agreement and ending on the earlier of (i) the date on which Alumni Capital has purchased $$35,000,00of our common

stock shares pursuant to the Purchase Agreement or (ii) June 30, 2025.

Pursuant to the Purchase Agreement, the “Purchase

Price” means eighty-five percent (85%) of the lowest daily VWAP of the ordinary shares five business days prior to the Closing of

a Purchase Notice. No Purchase Notice will be made without an effective registration statement and no Purchase Notice will be in an amount

greater than $1,000,000 (“Purchase Notice Limitation”).

The Purchase Agreement provides that the number

of our ordinary shares to be sold to Alumni Capital will not exceed the number of shares that, when aggregated together with all other

shares of our ordinary shares which Alumni Capital is deemed to beneficially own, would result in Alumni Capital owning more than 4.99%

of our outstanding ordinary shares (the “Beneficial Ownership Limitation”).

In consideration for Alumni Capital’s execution

and performance under the Purchase Agreement, the Company issued to Alumni Capital a Share Purchase Warrant dated August 1, 2024 (the

“Commitment Warrant”), to purchase up to a number of our ordinary shares equal to (i) 20% of the Commitment Amount less the

aggregate Exercise Values of all previous partial exercises of the Commitment Warrant, divided by (ii) the Exercise Price on the date

of exercise.

On January 13, 2025, the Company entered into

an Amended Modification Agreement to the Purchase Agreement with Alumni Capital (the “Modification Agreement”) to increase

the Commitment Amount to $135,000,000. In addition, the Purchase Notice Limitation shall be amended to a number of shares equal to $1,000,000

or up to the Commitment Amount if mutually agreed upon by the Company and Alumni Capital. The Purchase Price definition shall be amended

to the lowest traded price for the ordinary shares for the five (5) consecutive business days immediately prior to the Closing Date with

respect to the Purchase Notice multiplied by 90%. The Purchase Notice Date shall be amended to the next business day if the conditions

are met after 8:00 a.m. New York time on a Business Day or at any time on a day which is not a business say, unless waived by Alumni Capital.

Pursuant to the Modification Agreement, the Beneficial Ownership Limitation shall be 4.99% of the number of ordinary shares outstanding

immediately prior to the issuance of Purchase Notice Securities issuable pursuant to a Purchase Notice, unless mutually waived by Company

and Investor up to 9.9%. The Warrant Shares underlying the Commitment Warrant shall be amended to equal 15% of the Commitment Amount.

Capitalized terms used but not defined in this Agreement will have the meaning(s) ascribed thereto in the Modification Agreement.

On January 22, 2025, we filed a prospectus supplement,

dated as of January 22, 2025 (the “Prospectus Supplement”) under its registration statement on Form F-3 (File No. 333-279521),

in respect of the financing with Alumni Capital LP (the “Offering”). In addition, the Company is filing, as exhibits hereto,

the Modification Agreement in respect of the Offering and an opinion of counsel of Carey Olsen (BVI) L. P.

This Report on Form 6-K shall not constitute an

offer to sell or the solicitation of an offer to buy the Company’s securities, nor shall there be any offer, solicitation, or sale

of the Company’s securities in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification

under the securities laws of any such state.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: January 22, 2025 |

VCI Global Limited |

| |

|

|

| |

By: |

/s/ Victor Hoo |

| |

Name: |

Victor Hoo |

| |

Title: |

Chairman and Chief Executive Officer |

Exhibit Index

Exhibit 5.1

|

Rodus Building

PO Box 3093

Road Town

Tortola VG1110

British Virgin Islands |

| |

|

| |

T +1 284 394 4030 |

| |

F +1 284 494 4155 |

| |

E bvi@careyolsen.com |

DRAFT: 22 January 2025

VCI Global Limited

B03-C-8 Menara 3A

KL Eco City, No. 3 Jalan Bangsar

59200 Kuala Lumpur

Dear Sir / Madam

Re: VCI Global Limited (the “Company”)

We are lawyers qualified to practise in the British

Virgin Islands and have acted as British Virgin Islands legal counsel to the Company. We have been asked to issue this legal opinion in

connection with a prospectus supplement dated 22 January 2025 (the “Prospectus Supplement” and together with the base

prospectus included in the Registration Statement (as defined below), the “Prospectus”) forming part of the registration

statement on Form 6-K with the U.S. Securities and Exchange Commission (the “Commission”) (the “Registration

Statement”), under the Securities Act of 1933, as amended (the “Securities Act”) relating to the offering

of the following securities of the Company having an aggregate offering price of up to (i) $120,077,348 in Ordinary Shares and (ii) $19,250,000

in Warrant Shares (as defined below) , or the equivalent in foreign or composite currencies.

The Prospectus Supplement relates to the registration

of: (a) $120,077,348 in Ordinary Shares which may be purchased by Alumni Capital LP pursuant to the Securities Purchase Agreement at a

price per share as more particularly set out in the Securities Purchase Agreement, and (b) up to $19,250,000 in Ordinary Shares to be

exercised pursuant to a share purchase warrant (the “Purchase Warrant”) entered into between the Company and Alumni Capital

LP (the “Warrant Shares”), (a) and (b) together the “Take-Down Shares”..

We hereby consent to the filing of this opinion

letter as an exhibit to the Registration Statement and to the references to our firm under the heading “Legal Matters” in

the Prospectus. In providing our consent, we do not thereby admit that we are in the category of persons whose consent is required under

Section 7 of the Securities Act or the Rules and Regulations of the Commission thereunder.

BERMUDA BRITISH VIRGIN ISLANDS CAYMAN ISLANDS GUERNSEY JERSEY

CAPE TOWN HONG KONG LONDON SINGAPORE |

|

This

Opinion is given only on the laws of the British Virgin Islands in force at the date hereof and is based solely on matters of fact known

to us at the date hereof. We have not investigated the laws or regulations of any jurisdiction other than the British Virgin Islands (collectively,

“Foreign Laws”).

We express no opinion as to matters of fact or, unless expressly stated otherwise, the veracity of any representations or warranties given

in or in connection with any of the documents set out in Schedule 1.

| 2. | DOCUMENTS REVIEWED AND ENQUIRIES MADE |

In

giving this Opinion, we have undertaken the Searches and reviewed originals, copies, drafts, conformed copies, certified copies or notarised

copies of the documents set out in Schedule 1.

| 3. | ASSUMPTIONS AND QUALIFICATIONS |

This

Opinion is given on the basis that the assumptions set out in Schedule 2 (which

we have not independently investigated or verified) are true, complete and accurate in all respects. In addition, this Opinion is subject

to the qualifications set out in Schedule 3.

Having regard to such legal considerations

as we deem relevant, we are of the opinion that:

| 4.1 | Due incorporation, existence and status |

The

Company has been duly incorporated as a BVI business company, limited by shares, under the BVI Business Companies Act 2004 (as amended)

(the “Act”), is validly existing and was in good

standing with the Registrar of Corporate Affairs in the British Virgin Islands at the date of the Certificate of Good Standing (the “Registrar”).

The Company has full

power (including both capacity and authority) under its Memorandum and Articles to enter into, deliver and perform its obligations under

the Documents and to offer the Take-Down Shares under the Securities Purchase Agreements.

The execution and

delivery of the Documents by the Company and the performance of its obligations thereunder do not contravene:

| (a) | any law to which the Company is currently subject in the British Virgin Islands; or |

| (b) | any provision of the Memorandum and Articles. |

Shares

| (c) | Based solely on the Memorandum and Articles, the Company is authorised to issue an unlimited number of

Ordinary Shares, no par value per share. |

| (d) | The Take-Down Shares, to be issued and sold by the Company pursuant to the terms of the Securities Purchase

Agreements or the Purchase Warrant, have been duly authorised for issuance and when: (a) the board of directors of the Company has taken

all necessary corporate action to approve the issue thereof, the terms of the offering thereof and related matters; (b) the issue of such

Take-Down Shares have been recorded in the Company’s register of members; and (c) the subscription price of such Take-Down Shares

have been fully paid in cash or other consideration approved by the board of directors of the Company, the Take-Down Shares will be duly

authorised, validly issued, fully-paid and non-assessable, and free of any pre-emptive or similar rights. As a matter of British Virgin

Islands law, a share is only issued when it has been entered in the register of members. |

| (e) | With respect to the Ordinary Shares, when: (a) the board of directors of the Company has taken all necessary

corporate action to approve the issue thereof, the terms of the offering thereof and related matters; (b) the issue of such Ordinary Shares

have been recorded in the Company’s register of members; and (c) the subscription price of such Ordinary Shares have been fully

paid in cash or other consideration approved by the board of directors of the Company, the Ordinary Shares will be duly authorised, validly

issued, fully-paid and non-assessable. Non-assessable in this opinion means when used herein, that a shareholder shall not, solely by

virtue of its status as a shareholder, be liable for additional assessments or calls on the Shares by the Company or its creditors except

in exceptional circumstances, such as involving fraud, the establishment of an agency relationship or an illegal or improper purpose or

other circumstances in which a court may be prepared to pierce or lift the corporate veil). As a matter of British Virgin Islands law,

a share is only issued when it has been entered in the register of members. |

| (f) | The description of the Ordinary Shares in the Registration Statement and Prospectus is correct in all

material aspects. |

The execution and

delivery of the Securities Purchase Agreements and the performance by the Company of its obligations thereunder have been authorised by

the Company and, the Securities Purchase Agreements has been duly executed on behalf of the Company constitutes the legal, valid and binding

obligations of the Company enforceable in accordance with its terms.

| 5.1 | Except as specifically referred to in this Opinion we have not examined, and give no opinion on, any contracts,

instruments or other documents (whether or not referred to in, or contemplated by, the Documents). We do not give any opinion on the commercial

merits of any transaction contemplated or entered into under or pursuant to the Documents. |

| 5.2 | This Opinion (and any obligations arising out of or in connection with it) is given on the basis that

it shall be governed by and construed in accordance with the laws of the British Virgin Islands. By relying on the opinions set out in

this Opinion the addressee(s) hereby irrevocably agree(s) that the courts of the British Virgin Islands are to have exclusive jurisdiction

to settle any disputes which may arise in connection with this Opinion. |

| 5.3 | We assume no responsibility to advise any person entitled to rely on this Opinion, or to undertake any

investigations, as to any change in British Virgin Islands law (or its application) or factual matters arising after the date of this

Opinion, which might affect the opinions set out herein. |

| 5.4 | This opinion deals only with the specified legal issues expressly addressed herein, and you should not

infer any opinion that is not explicitly stated herein from any matter addressed in this opinion. |

| 5.5 | This opinion is issued solely in connection with the Registration Statement and Prospectus and the offering

of the Take-Down Shares by the Company and is not to be relied upon in respect of any other matter. |

Yours faithfully

| /s/ Carey Olsen |

|

| |

|

| Carey Olsen |

|

Schedule 1

Documents

Reviewed and ENQUIRIES made

For the purpose of this Opinion,

we have reviewed originals, copies, drafts or conformed copies of the following documents:

| 1. | The certificate of incorporation of the Company obtained by us pursuant to the Company Searches. |

| 2. | The memorandum and articles of association of the Company (the “Memorandum and Articles”)

obtained by us pursuant to the Company Searches. |

| 3. | A certificate of good standing relating to the Company issued by the Registrar, dated 3 December 2024

(the “Certificate of Good Standing”). |

| 4. | A registered agent’s certificate dated 13 January 2025 (the “Certificate”) issued by

the Registered Agent. |

The information revealed

by our search of the Company’s public records on file and available for public inspection from the Registrar at the time of our search

on 21 January 2025 (the “Company Searches”), including all relevant forms and charges (if any) created by the Company

and filed with the Registrar pursuant to section 163 of the BVI Business Companies Act (the “Act”).

| 1. | A final copy of the Prospectus Supplement, the Prospectus and the Registration Statement. |

| 2. | A copy of the amended modification agreement dated 13 January 2025 between the Company and Alumni Capital

LP (as investor) in relation to a previous purchase agreement dated 1 August 2024 and a purchase warrant agreement dated 1 August 2024

(and each as amended by a purchase modification agreement dated 27 September 2024 (the “Securities and Purchase Agreement”). |

The documents listed

in paragraph C of this Schedule are together, the “Documents”.

The documents listed

in this Schedule are the only documents and/or records we have examined and the only searches and enquiries we have carried out for the

purposes of this Opinion.

SCHEDULE

2

Assumptions

We

have assumed:

| (a) | the

genuineness and authenticity of all signatures and the conformity to the originals of all

copies (whether or not certified) examined by us and the authenticity and completeness of

the originals from which such copies were taken; |

| (b) | that

where a document has been examined by us in draft form, it will be or has been executed and/or

filed in the form of that draft, and where a number of drafts of a document have been examined

by us all changes thereto have been marked or otherwise drawn to our attention; |

| (c) | the

accuracy and completeness of all factual representations made in the Registration Statement

and the Documents reviewed by us; |

| (d) | that

the public records of the Company we have examined are accurate and that the information

disclosed by the Searches is true and complete. |

| (e) | that

the Resolutions were signed by all or a majority of the directors, as the case may be, in

the manner prescribed in the Company’s articles of association, remain in full force

and effect and have not been rescinded or amended; |

| (f) | that

there is no provision of the law of any jurisdiction, other than the British Virgin Islands,

which would have any implication in relation to the opinions expressed herein; |

| (g) | that

upon issue of any shares to be sold by the Company, the Company will receive consideration

for the full issue price thereof which shall be equal to at least the par value thereof; |

| (h) | the

Company’s issuance of any Ordinary Shares is or will be in compliance with its Memorandum

and Articles; |

| (i) | that

Memorandum and Articles will not be amended in any manner that would affect the opinions

set forth herein; |

| (j) | that

the Registration Statement has been declared effective by the Commission prior to, or concurrent

with, the sale of the Take-Down Shares pursuant to the Registration Statement; |

| (k) | the

Registration Statement and the transactions contemplated thereunder complies with the requirements

of the applicable rules of the Nasdaq Capital Market and the Securities Act; |

| (l) | the

capacity, power and authority of each of the parties to the Documents, as the case may be,

other than the Company, to enter into and perform its respective obligations thereunder; |

| (m) | the

due execution and delivery of the Documents by each of the parties thereto, other than the

Company, and the physical delivery thereof by the Company with an intention to be bound thereby; |

| (n) | the

validity and binding effect under the laws of such jurisdiction (the “Foreign Laws”)

of the Documents in accordance with its terms; |

| (o) | the

validity and binding effect under the Documents of the submission by the Company to the exclusive

jurisdiction of the relevant state and federal courts of the United States of America (the

“Foreign Courts”); |

| (p) | no

invitation has been or will be made by or on behalf of the Company to the public in the British

Virgin Islands to subscribe for any shares of the Company; |

| (q) | that

on the date of entering into the Documents the Company is, and after entering into the Documents

the Company is and will be able to, pay its liabilities as they become due; and |

| (r) | none

of the parties to the Documents is carrying on unauthorised financial services business for

the purposes of the Financial Services Commission Act of the British Virgin Islands, and

|

| (s) | that

the contents of the Registered Agent’s Certificate are true and correct as of the date

hereof. |

SCHEDULE

3

qualifications

| 1. | The

obligations under the Documents will not necessarily be legal, valid, binding or enforceable

in all circumstances and this Opinion is not to be taken to imply that each obligation would

necessarily be capable of enforcement or be enforced in all circumstances in accordance with

its terms. In particular, but without limitation: |

| (a) | the

binding effect, validity and enforceability of obligations may be limited by laws relating

to bankruptcy, insolvency, moratorium, liquidation, dissolution, re-organisation and other

laws of general application relating to, or affecting the rights of, creditors; |

| (b) | enforcement

may be limited by general principles of equity (for example, equitable remedies such as specific

performance or the issuing of an injunction are available only at the discretion of the court

and may not be available where damages are considered to be an adequate alternative and we

therefore express no opinion on whether such remedies will be granted if sought); |

| (c) | claims

may be or become barred under the laws relating to the prescription and limitation of actions

or may become subject to the general doctrine of estoppel or waiver in relation to representations,

acts or omissions of any relevant party or may become subject to defences of set-off or counterclaim; |

| (d) | where

obligations are to be performed in a jurisdiction outside the British Virgin Islands, they

may not be enforceable in the British Virgin Islands to the extent that performance would

be illegal under the laws of that jurisdiction; |

| (e) | the

courts of the British Virgin Islands have jurisdiction to give judgment in the currency of

the relevant obligation; |

| (f) | obligations

to make payments that may be regarded as penalties will not be enforceable; |

| (g) | a

company cannot, by agreement or in its articles of association, restrict the exercise of

a statutory power; |

| (h) | there

exists doubt as to enforceability of any provision whereby the Company covenants not to exercise

powers specifically given to its Members by the Act; |

| (i) | the

enforcement of contractual obligations may be limited by the provisions of British Virgin

Islands law applicable to agreements or contracts held to have been frustrated by events

happening after the relevant agreement or contract was entered into; |

| (j) | the

enforcement of obligations may be invalidated or vitiated by reason of fraud, duress, undue

influence, mistake, illegality or misrepresentation; |

| (k) | the

courts of the British Virgin Islands may: |

| (i) | refuse

to enforce a provision that amounts to an indemnity in respect of the costs of enforcement

or of unsuccessful proceedings brought in the British Virgin Islands where such courts have

already made an order to that effect; |

| (ii) | decline

to exercise jurisdiction in relation to substantive proceedings brought under or in relation

to the Documents in matters where they determine that such proceedings may be tried in a

more appropriate forum; and/or |

| (iii) | find

that a hybrid dispute resolution clause, though generally recognised under British Virgin

Islands law, is unenforceable on the grounds, amongst others, that it confers concurrent

jurisdiction on an arbitral tribunal and the courts of the British Virgin Islands; |

| (l) | provisions

that purport to require parties to reach agreement in the future may be unenforceable for

lack of certainty; |

| (m) | an

agreement made by a person in the course of carrying on unauthorised financial services business

is unenforceable against the other party to the agreement under section 50F of the Financial

Services Commission Act, 2001; |

| (n) | where

the courts of the British Virgin Islands determine that a contractual term may be interpreted

in more than one manner the courts may employ the one that is deemed to be most consistent

with business and common sense; |

| (o) | it

is possible that a judgment (in the British Virgin Islands or elsewhere) relating to a particular

agreement or instrument would be held to supersede the terms of such agreement or instrument

with the effect that, notwithstanding any express term to the contrary in such agreement

or instrument, such terms would cease to be binding; and |

| (p) | there

is a presumption that the courts of the British Virgin Islands will give effect to an exclusive

jurisdiction clause in an agreement and upon application, may stay proceedings brought in

the British Virgin Islands or grant an anti-suit injunction against a party that commences

proceedings elsewhere where such proceedings are in breach of the exclusive jurisdiction

clause, unless a party can satisfy the courts of the British Virgin Islands that it would

be just and equitable to depart from that presumption (for example, not to do so would deprive

one party of access to justice). |

| 2. | To

maintain the Company in good standing under the laws of the British Virgin Islands, the Company

must inter alia pay annual filing fees to the Registrar, comply with its economic substance

requirements and obligations under the Virgin Islands Economic Substance (Companies and Limited

Partnerships) Act, 2018 and file a copy of its register of directors with the Registrar. |

| 3. | We

make no comment on references to any Foreign Laws or to any representations or warranties

made in any agreement or document. |

| 4. | We

express no view as to the commercial terms of the Documents or whether such terms represent

the intentions of the parties and make no comment with regard to the representations that

may be made by the Company. |

| 5. | We

offer no opinion as to whether the acceptance of, or the execution or performance of, the

Company’s obligations under the Documents will or may result in the breach or infringement

of any other deed, contract or document entered into by, or binding upon, the Company (other

than the Memorandum and Articles). |

Page 9 / 9

Exhibit

10.1

AMENDED

MODIFICATION AGREEMENT

THIS

AMENDED MODIFICATION AGREEMENT (this “Amended Modification Agreement”) is made and entered into effective as of January 13,

2025 (the “Effective Date”), by and between VCI GLOBAL LIMITED, a British Virgin Islands corporation (“Company”),

and ALUMNI CAPITAL LP, a Delaware limited partnership (“Investor”).

Recitals

A.

Company and Investor are parties to a Purchase Agreement dated as of August 1, 2024 (the “Purchase Agreement”), a Purchase

Warrant Agreement (“Warrant Agreement”) dated as of August 1, 2024, and pursuant to a Purchase Agreement Modification Agreement

dated as of September 27, 2024 (“the Modification Agreement”).

B.

Pursuant to the Purchase Agreement and Modification Agreement, the Company and Investor entered into an agreement whereby the Investor

shall purchase up to Thirty Five Million Dollars ($35,000,000) of the Company’s Ordinary Shares from time to time, subject to the

terms and conditions in the agreements, with the Commitment Period beginning on the Execution Date of August 1, 2024 and ending on December

31, 2025.

C.

Company and Investor have agreed to modify the Purchase Agreement, Modification Agreement, and Warrant Agreement in accordance with the

terms and conditions set forth in this Amended Modification Agreement.

Amended

Modification Agreement

In

consideration of the mutual covenants and agreements set forth in this Amended Modification Agreement, and for other good and valuable

consideration, the receipt and sufficiency of which are hereby acknowledged, Company and Investor hereby agree as follows:

| 1. | Amendment

to Purchase Agreement. |

1.1

Commitment Amount. Pursuant to Section 1 of the Purchase Agreement titled “Certain Definitions”, “Commitment

Amount” shall be” $135,000,000”.

1.2

Purchase Notice Limitation. Pursuant to Section 1 of the Purchase Agreement titled “Certain Definitions”, “Purchase

Notice Limitation” shall be “a number of shares equal to $1,000,000 or up to the Commitment Amount if mutually agreed upon

by the Company and Investor.”.

1.3

Purchase Price. Pursuant to Section 1 of the Purchase Agreement titled “Certain Definitions”, the first sentence of

the “Purchase Price” definition shall be amended to: “shall mean the lowest traded price for the Ordinary Shares for

the five (5) consecutive Business Days immediately prior to the Closing Date with respect to the Purchase Notice multiplied by 90%. The

Purchase Notice will be subject to the Purchase Notice Limitation. When mutually agreed upon by Company and Investor, pricing commencing

from when the Purchase Notice Shares are deposited in the Investor’s brokerage account up until Closing of the said Purchase Notice

shall be utilized to calculate the lowest traded price.”.

1.4

Purchase Notice Date. Pursuant to Section 2.2 of the Purchase Agreement titled “Mechanics”, the second sentence of

Section 2.2(a) titled “Purchase Notice.” shall be amended to “… (ii) the next Business Day if the conditions

are met after 8:00 a.m. New York time on a Business Day or at any time on a day which is not a Business Day, unless waived by Investor

(the “Purchase Notice Date”).

1.5

Registration. Pursuant to Section 7.1 of the Purchase Agreement titled “Registration”, Section 7.1(a) shall be “The

Company shall file a Prospectus Supplement on effective Form F-3 for the resale of the Purchase Notice Securities & Warrant Shares,

not later than fourteen (14) calendar days after the Effective Date. The Company shall use its commercially reasonable efforts to (i)

cause every Registration Statement (as defined below) to be declared effective by the SEC as soon as practicable, and (ii) keep the Registration

Statement continuously effective under the Securities Act until the Investor ceases to hold Registrable Securities. The Registration

Statement shall provide for any method or combination of methods of resale of Registrable Securities legally available to, and requested

by, the Investor, and shall comply with the relevant provisions of the Securities Act and Exchange Act. The Investor acknowledges that

it will be identified in the Registration Statement as an underwriter within the meaning of Section 2(a)(11) of the Securities Act with

respect to the resale of the Purchase Notice Securities, and the Investor shall furnish all information reasonably requested by the Company

for inclusion therein. If Form F-3 becomes available for the registration of the resale of all of the Registrable Securities hereunder,

the Company shall use such Form; provided, however, if Form F-3 is not available for the registration of the resale of all of the Registrable

Securities hereunder, the Company shall maintain the effectiveness of the Registration Statement then in effect until such time as a

registration statement on Form F-3 or F-1 covering all of the Registrable Securities has been declared effective by the SEC.”.

1.6

Beneficial Ownership Limitation. Pursuant to Section 8.1 of the Purchase Agreement titled “Conditions Precedent to the Obligation

of Investor to Purchase the Purchase Notice Securities.”, the second to last sentence of Section 8.2(f) titled “Beneficial

Ownership Limitation” shall be “…. The “Beneficial Ownership Limitation” shall be 4.99% of the

number of Ordinary Shares outstanding immediately prior to the issuance of Purchase Notice Securities issuable pursuant to a Purchase

Notice, unless mutually waived by Company and Investor up to 9.9%.”.

| 2. | Amendment

to Warrant Agreement |

2.1

Number of Warrant Shares. Pursuant to Section 2 of the Warrant Agreement titled “Exercise.”, Section 2(b) titled “Number

of Warrant Shares.” shall be “Subject to the terms and conditions set forth herein, the Holder shall have the right to purchase

from the Company a number of Warrant Shares equal to (i) fifteen percent (15%) of the Commitment Amount, less the Exercise Value of all

partial exercises of this Warrant in accordance with Section 2(a) prior to the Exercise Date, divided by (ii) the Exercise Price on the

Exercise Date.”.

3.

Other Provisions in Full Force. Except as specifically provided herein, the Purchase Agreement, Modification Agreement,

and Warrant Agreement shall remain in full force and effect in accordance with the original terms and conditions.

4.

Notices. Any notice required, permitted or contemplated hereunder shall be in accordance with the applicable “Notices”

provision in the Purchase Agreement and Warrant Agreement.

5.

Miscellaneous. This Amended Modification Agreement sets forth the entire agreement of the parties with respect to the subject

matter of this Amended Modification Agreement and supersedes all previous understandings, written or oral, in respect of this Amended

Modification Agreement. This Amended Modification Agreement may be signed by facsimile signatures or other electronic delivery of an

image file reflecting the execution hereof, and if so signed, (a) may be relied on by each party as if the document were a manually signed

original and (b) will be binding on each party for all purposes. This Amended Modification Agreement shall be binding upon and shall

inure to the benefit of the parties hereto and their respective successors and assigns. This Amended Modification Agreement may be executed

in multiple counterparts, each of which shall constitute an original, but all which together shall constitute one and the same agreement.

If any term of this Amended Modification Agreement is found invalid by a court of competent jurisdiction, the invalid term will be considered

excluded from this Amended Modification Agreement and will not invalidate the remaining terms of this Amended Modification Agreement.

At no time shall the prior or subsequent course of conduct by Company or Investor directly or indirectly limit, impair, or otherwise

adversely affect any of the parties’ rights or remedies in connection with this Amended Modification Agreement or any of the documents,

instruments and agreements executed in connection herewith, as Investor and Company agree that this Amended Modification Agreement and

the documents, instruments, and agreements executed in connection herewith shall only be amended by written instruments executed by Investor

and Company. This Amended Modification Agreement is made and entered into for the protection and benefit of Investor and Company and

their permitted successors and assigns, and no other person, association, authority or entity shall be a direct or indirect beneficiary

of or have any direct or indirect cause of action or claim in connection with this Amended Modification Agreement.

IN

WITNESS WHEREOF, Investor and Company have executed this Amended Modification Agreement to be effective as of the Effective Date.

| |

|

|

| VCI GLOBAL LIMITED |

|

| |

|

|

| By: |

/s/ Victor Hoo |

| |

Dato’ Victor Hoo, Chief Executive Officer |

|

| |

|

|

| Accepted as of the Effective Date. |

|

| |

|

|

| ALUMNI CAPITAL LP |

|

| |

|

|

| By: |

/s/ Ashkan Mapar |

|

| |

Ashkan

Mapar, General Partner |

|

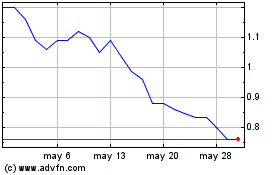

VCI Global (NASDAQ:VCIG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

VCI Global (NASDAQ:VCIG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025