Form 424B5 - Prospectus [Rule 424(b)(5)]

22 Enero 2025 - 11:36AM

Edgar (US Regulatory)

Filed Pursuant to Rule 424(b)(5)

Registration Statement No. 333-279521

Prospectus Supplement

(To Prospectus dated May 28, 2024)

Up to $139,327,348

Ordinary Shares

This prospectus supplement amends and supplements

the prospectus supplement dated December 17, 2024 and accompanying prospectus dated May 28, 2024 (collectively the “ELOC Prospectus”)

relating to (i) the issuance and sale of our ordinary shares, no par value per share (the “Purchase Shares”), to Alumni

Capital LP (“Alumni Capital”) upon the satisfaction of certain conditions set forth in the Purchase Agreement (the

“Purchase Agreement”) dated August 1, 2024, between us and Alumni Capital and amended by a Modification Agreement

dated as of September 27, 2024 and the Amended Modification Agreement dated as of January 13, 2025, at a purchase price per share calculated

under the Purchase Agreement and (ii) a three-year ordinary share purchase warrant issued on August 1, 2024 (the “Commitment

Warrant”) to purchase ordinary shares (the “Warrant Shares” and together with the Purchase Shares, the “Offered

Shares”) pursuant to the Commitment Warrant at an exercise price determined by a formula that is described under “Alumni

Capital Transaction.”

We are filing the Prospectus Supplement to amend the

ELOC Prospectus to update (i) the maximum amount of our ordinary shares that may be sold to Alumni Capital under the ELOC Prospectus and

Purchase Agreement from $20,077,348 to $120,077,348; (ii) the maximum amount of Warrant Share that may be issued and sold to Alumni Capital

under the ELOC Prospectus and Commitment Warrant from $6,000,000 to $19,250,000; (iii) the definition “Purchase Price”

to mean with respect to any Closing Date, the lowest traded price for the ordinary shares for the five (5) consecutive Business Days immediately

prior to such Closing Date multiplied by 90% (previously 85%) and (iv) the amount of Warrant Shares underlying the Commitment Warrant

from 20% of the Commitment Amount to 15% of the Commitment Amount.

Alumni Capital is an underwriter within the meaning of Section 2(a)(11)

of the U.S. Securities Act of 1933, as amended (the “Securities Act”). The registration of the Offered Shares hereunder

does not mean that Alumni Capital will actually purchase or that the Company will actually issue and sell all or any of the Offered Shares

being registered pursuant to the registration statement related to this prospectus supplement.

You should read this prospectus supplement, the

base prospectus, and any additional prospectus supplement or amendment carefully before you invest in our securities.

Our ordinary shares are listed on the Nasdaq Capital

Market (“Nasdaq”) under the symbols “VCIG.” On January 17, 2025, the last reported sale price of our ordinary

shares on Nasdaq was $1.30 per share.

Investing in our securities involves a high

degree of risk. See “Risk Factors” section beginning on page S-6.

We are an “emerging growth company,”

as that term is defined under the federal securities laws and, as such, we have elected to comply with certain reduced public company

reporting requirements and may elect to do so in future filings.

Neither the SEC nor any state securities commission

has approved or disapproved of these securities or determined if this prospectus supplement is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this prospectus supplement is January

22, 2025.

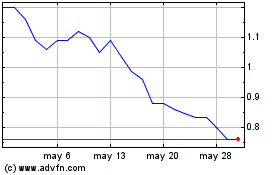

VCI Global (NASDAQ:VCIG)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

VCI Global (NASDAQ:VCIG)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025