0001527541FALSE12-3100015275412024-11-152024-11-150001527541us-gaap:CommonStockMember2024-11-152024-11-150001527541us-gaap:SeriesBPreferredStockMember2024-11-152024-11-150001527541us-gaap:SeriesDPreferredStockMember2024-11-152024-11-150001527541us-gaap:ConvertibleSubordinatedDebtMember2024-11-152024-11-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (date of earliest event reported): November 15, 2024

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Maryland | | 001-35713 | | 45-2681082 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | |

2529 Virginia Beach Blvd. Virginia Beach, VA | | 23452 |

| (Address of principal executive offices) | | (Zip code) |

Registrant’s telephone number, including area code: (757) 627-9088

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $0.01 par value per share | | WHLR | | Nasdaq Capital Market |

| Series B Convertible Preferred Stock | | WHLRP | | Nasdaq Capital Market |

| Series D Cumulative Convertible Preferred Stock | | WHLRD | | Nasdaq Capital Market |

| 7.00% Subordinated Convertible Notes due 2031 | | WHLRL | | Nasdaq Capital Market |

Item 3.03. Material Modification to Rights of Security Holders.

To the extent required by Item 3.03 of Form 8-K, the information contained in Item 5.03 of this Current Report on Form 8-K is incorporated herein by reference.

Item 5.03. Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year.

Charter Amendments for One-for-Two Reverse Stock Split

On November 15, 2024, in connection with a one-for-two reverse stock split (the “Reverse Stock Split”) of the common stock, $0.01 par value per share (the “Common Stock”) of Wheeler Real Estate Investment Trust, Inc. (the “Company”), to be effective on November 18, 2024, the Company filed two Articles of Amendment to its charter with the State Department of Assessments and Taxation of Maryland that provide for:

i.a one-for-two Reverse Stock Split of the Common Stock, to be effective at 5:00 p.m. Eastern Time (the “Effective Time”) on November 18, 2024 (the “First Amendment”); and

ii.the par value of the Common Stock to be decreased from $0.02 per share (as a result of the one-for-two Reverse Stock Split) to $0.01 per share, to be effective at 5:01 p.m. Eastern Time on November 18, 2024 (the “Second Amendment”).

Pursuant to the First Amendment, no fractional shares will be issued in connection with the Reverse Stock Split; rather, stockholders who would have otherwise been issued a fractional share of the Common Stock as a result of the Reverse Stock Split will instead receive a cash payment in lieu of such fractional share in an amount equal to the applicable fraction multiplied by the closing price of the Company’s Common Stock on The Nasdaq Capital Market on November 18, 2024 (as adjusted for the Reverse Stock Split), without any interest.

The foregoing descriptions of the amendments to the Company’s charter do not purport to be complete and are qualified in their entirety by reference to each amendment, copies of which are filed as Exhibit 3.1 and Exhibit 3.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

Effect of Reverse Stock Split on Common Stock

At the market open on November 19, 2024 (the first business day after the Effective Time), the Common Stock will begin trading on a split-adjusted basis on The Nasdaq Capital Market under a new CUSIP number (963025846).

The Reverse Stock Split will apply to all of the outstanding shares of Common Stock as of the Effective Time, with a corresponding adjustment to the outstanding partnership units of the Company’s operating partnership, Wheeler REIT, L.P. It therefore will not affect any particular stockholder’s relative ownership percentage of shares of Common Stock, except for de minimis changes resulting from the payment of cash in lieu of fractional shares. The Reverse Stock Split will also not affect the relative voting or other rights that accompany the shares of Common Stock, except to the extent that it results from a stockholder receiving cash in lieu of fractional shares. There will be no change to the number of authorized shares of the Common Stock as a result of the Reverse Stock Split. The Company’s trading symbol will remain unchanged, but the CUSIP number for the Company’s registered Common Stock will be changed to 963025846.

In connection with the Reverse Stock Split, adjustments will be made to the number of shares of Common Stock issuable upon conversion of the Company’s convertible securities.

Effect of Reverse Stock Split on 7.00% Subordinated Convertible Notes Due 2031

As a result of the Reverse Stock Split, pursuant to and in accordance with Section 14.05(c) of that certain indenture, dated as of August 13, 2021, between the Company and Wilmington Savings Fund Society, FSB as trustee, pertaining to the Company’s 7.00% subordinated convertible notes due 2031 (the “Notes”), the conversion rate of the Notes will be proportionately reduced from approximately 10.53 shares of Common Stock per each $25.00 principal amount of the Notes to approximately 5.27 shares of Common Stock per each $25.00 principal amount of the Notes.

Effect of Reverse Stock Split on Preferred Stock

As a result of the Reverse Stock Split, the conversion price of the Company’s Series B Convertible Preferred Stock will proportionally increase from $144,000 per share of Common Stock to $288,000 per share of Common Stock, and one (1) share of Series B Convertible Preferred Stock will be convertible into 0.000087 shares of Common Stock.

As a result of the Reverse Stock Split, the conversion price of the Company’s Series D Cumulative Convertible Preferred Stock will proportionally increase from $61,056 per share of Common Stock to $122,112 per share of Common Stock, and one (1) share of Series D Cumulative Convertible Preferred Stock will be convertible into 0.000205 shares of Common Stock.

Effect of Reverse Stock Split on Incentive Plans

As a result of the Reverse Stock Split, (i) the number of shares of Common Stock authorized for issuance under the Company’s 2015 Long-Term Incentive Plan and the 2016 Long-Term Incentive Plan, (ii) any maximum number of shares of Common Stock with respect to which equity awards may be granted to any participant under any such plan, (iii) each equity award outstanding thereunder on the effective date of the Reverse Stock Split, and (iv) any performance metric related to the price per share of Common Stock applicable to any award outstanding on the effective date of the Reverse Stock Split, will, in each case, be adjusted proportionately to reflect the Reverse Stock Split.

Forward-Looking Statements.

This Current Report on Form 8-K includes forward-looking statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995. These statements may be identified by words such as “will” and “would”, or the negative of such terms, or other comparable terminology, and include statements about the Reverse Stock Split and the impact, if any, of the Reverse Stock Split on the Company and the trading price of the Common Stock. Forward-looking statements are statements that are not historical facts. Such forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties, which could cause actual results to differ materially from the forward-looking statements contained herein due to many factors. These forward-looking statements and such risks, uncertainties and other factors speak only as of the date of this Current Report on Form 8-K, and the Company expressly disclaims any obligation or undertaking to update or revise any forward-looking statement contained herein, or to reflect any change in our expectations with regard thereto or any other change in events, conditions or circumstances on which any such statement is based, except to the extent otherwise required by applicable law.

Item 9.01 Financial Statements and Exhibits

(d) Exhibits.

| | | | | | | | |

Exhibit No. | | Description |

| 3.1 | | |

| 3.2 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| WHEELER REAL ESTATE INVESTMENT TRUST, INC. |

| |

| By: | | /s/ M. Andrew Franklin |

| | Name: M. Andrew Franklin |

| | Title: Chief Executive Officer and President |

Dated: November 15, 2024

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

ARTICLES OF AMENDMENT

Wheeler Real Estate Investment Trust, Inc., a Maryland corporation (the “Corporation”), hereby certifies to the State Department of Assessments and Taxation of Maryland that:

FIRST: The charter of the Corporation (the “Charter”) is hereby amended to provide that (a) at the Effective Time (as defined below), every two shares of common stock, $0.01 par value per share, of the Corporation that were issued and outstanding immediately prior to the Effective Time shall be converted into one issued and outstanding share of common stock, $.02 par value per share (the “Reverse Stock Split”), and (b) no fractional shares will be issued in connection with the Reverse Stock Split; rather, stockholders who would have otherwise been issued a fractional share of the Corporation’s common stock as a result of the Reverse Stock Split will instead receive a cash payment in lieu of such fractional share in an amount equal to the applicable fraction multiplied by the closing price of the Corporation’s common stock on the date that includes the Effective Time (as adjusted for the Reverse Stock Split) as reported on the Nasdaq Stock Market, without any interest.

SECOND: The foregoing amendment (the “Amendment”) was duly advised by the Board of Directors of the Corporation and duly approved by the stockholders of the Corporation in the manner and by the vote required by the Maryland General Corporation Law and the Charter. The manner in which the Amendment was advised and approved is set forth below.

(a) At a meeting thereof duly held on November 7, 2024, the Board of Directors of the Corporation adopted resolutions that (i) set forth the Amendment, (ii) declared the Amendment advisable, and (iii) directed that the Amendment be submitted to the stockholders of the Corporation for consideration.

(b) At a meeting thereof duly held on May 6, 2024, the stockholders of the Corporation approved the Amendment.

THIRD: The Amendment does not increase the authorized stock of the Corporation.

FOURTH: These Articles of Amendment shall be effective (the “Effective Time”) at 5:00 p.m., Eastern Time, on November 18, 2024.

[Signatures Appear on the Next Page]

IN WITNESS WHEREOF, the Corporation has caused these Articles of Amendment to be signed and acknowledged in its name and on its behalf by its Chief Executive Officer and President and witnessed and attested by its Secretary on November 15, 2024 and such persons acknowledged the same to be the act of said corporation, and that to the best of their knowledge, information and belief, all matters and facts stated herein are true in all material respects and that this statement is made under the penalties of perjury.

ATTEST: WHEELER REAL ESTATE INVESTMENT TRUST, INC.

By: /s/ Ross Barr By: /s/ M. Andrew Franklin

Name: Ross Barr Name: M. Andrew Franklin

Title: Secretary Title: Chief Executive Officer and President

[Signature Page to Articles of Amendment - Wheeler Real Estate Investment Trust, Inc.]

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

ARTICLES OF AMENDMENT

Wheeler Real Estate Investment Trust, Inc., a Maryland corporation (the “Corporation”), hereby certifies to the State Department of Assessments and Taxation of Maryland that:

FIRST: Immediately prior to the Effective Time (as defined below) of these Articles of Amendment, the charter of the Corporation (the “Charter”) was amended to effect a one-for-two reverse stock split (the “Reverse Stock Split”) such that every two (2) shares of common stock of the Corporation that were issued and outstanding immediately prior to the effective time of the Reverse Stock Split were automatically converted into and classified as one (1) issued and outstanding share of common stock of the Corporation, with the result that the par value of the issued and outstanding shares of common stock was automatically increased from $0.01 per share to $.02 per share, and the Corporation’s Board of Directors desires to reduce the par value of the issued and outstanding shares of common stock back down to $0.01 per share so that the per share par value and the aggregate par value of the issued and outstanding shares of common stock remain the same as they were immediately prior to the Reverse Stock Split.

SECOND: The Charter is hereby amended to change the par value of the shares of common stock that are issued and outstanding as of the Effective Time to $0.01 per share.

THIRD: The effect of the amendment to the Charter set forth in ARTICLE SECOND hereof (the “Amendment”) is that the Corporation shall continue to have authority to issue 200,000,000 shares of common stock, $0.01 par value per share, and 15,000,000 shares of preferred stock, without par value per share, for an aggregate par value of all authorized shares of stock, both immediately prior to and after the Reverse Stock Split, of $2,000,000.

FOURTH: The Amendment was approved by a majority of the entire Board of Directors of the Corporation at a meeting thereof duly held on November 7, 2024 and is limited to a change expressly authorized by Section 2-605(a)(2) of the Maryland General Corporation Law to be made without action by the stockholders of the Corporation.

FIFTH: The Amendment does not increase the authorized stock of the Corporation.

SIXTH: These Articles of Amendment shall be effective (the “Effective Time”) at 5:01 p.m., Eastern Time, on November 18, 2024.

[Signatures Appear on the Next Page]

IN WITNESS WHEREOF, the Corporation has caused these Articles of Amendment to be signed and acknowledged in its name and on its behalf by its Chief Executive Officer and President and witnessed and attested by its Secretary on November 15, 2024 and such persons acknowledged the same to be the act of said corporation, and that to the best of their knowledge, information and belief, all matters and facts stated herein are true in all material respects and that this statement is made under the penalties of perjury.

ATTEST: WHEELER REAL ESTATE INVESTMENT TRUST, INC.

By: /s/ Ross Barr By: /s/ M. Andrew Franklin

Name: Ross Barr Name: M. Andrew Franklin

Title: Secretary Title: Chief Executive Officer and President

[Signature Page to Articles of Amendment - Wheeler Real Estate Investment Trust, Inc.]

Cover

|

Nov. 15, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 15, 2024

|

| Entity Registrant Name |

WHEELER REAL ESTATE INVESTMENT TRUST, INC.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-35713

|

| Entity Tax Identification Number |

45-2681082

|

| Entity Address, Address Line One |

2529 Virginia Beach Blvd

|

| Entity Address, City or Town |

Virginia Beach

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23452

|

| City Area Code |

757

|

| Local Phone Number |

627-9088

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001527541

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| Common Stock, $0.01 par value per share |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.01 par value per share

|

| Trading Symbol |

WHLR

|

| Security Exchange Name |

NASDAQ

|

| Series B Convertible Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series B Convertible Preferred Stock

|

| Trading Symbol |

WHLRP

|

| Security Exchange Name |

NASDAQ

|

| Series D Cumulative Convertible Preferred Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series D Cumulative Convertible Preferred Stock

|

| Trading Symbol |

WHLRD

|

| Security Exchange Name |

NASDAQ

|

| 7.00% Subordinated Convertible Notes due 2031 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

7.00% Subordinated Convertible Notes due 2031

|

| Trading Symbol |

WHLRL

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesBPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesDPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_ConvertibleSubordinatedDebtMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

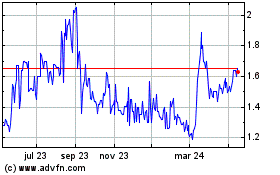

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

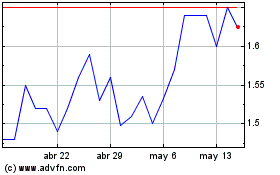

Wheeler Real Estate Inve... (NASDAQ:WHLRP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024