- Positions ALLETE to Execute Clean-Energy Future for Customers,

Communities and Employees as a Private Company

- ALLETE to Remain Locally Managed and Operated with Headquarters

in Duluth, Minnesota

- Agreement Contains Meaningful Commitments to Retain ALLETE’s

Workforce and Maintain Compensation Levels and Benefits

Programs

- Utilities Minnesota Power and Superior Water, Light and Power

to Continue Being Regulated by Minnesota Public Utilities

Commission (MPUC) and Public Service Commission of Wisconsin

(PSCW)

- Union Agreements to be Honored

- Shareholders to Receive $67.00 Per Share in Cash

ALLETE, Inc. (NYSE: ALE) and a partnership led by Canada Pension

Plan Investment Board (“CPP Investments”) and Global Infrastructure

Partners (“GIP”), (the “partnership”), today jointly announced that

they have entered into a definitive agreement under which the

partnership will acquire ALLETE for $67.00 per share in cash, or

$6.2 billion including the assumption of debt.

ALLETE is a leading energy company and provider of safe,

reliable, and competitively priced energy with a national

footprint. Together, ALLETE and its family of companies, which

includes regulated utilities and renewable energy companies, are

focused on driving the clean-energy transition by expanding

renewables, reducing carbon, enhancing grid resiliency, and driving

innovation.

“Our ‘Sustainability-in-Action' strategy has secured ALLETE’s

place as a clean-energy leader. Through this transaction with CPP

Investments and GIP, we will have access to the capital we need

while keeping our customers, communities and co-workers at the

forefront of all that we do, with continuity of our day-to-day

operations, strategy and shared purpose and values,” said ALLETE

Chair, President, and Chief Executive Officer Bethany Owen. “CPP

Investments and GIP have a successful track record of long-term

partnerships with infrastructure businesses, and they recognize the

important role our ALLETE companies serve in our communities as

well as our nation’s energy future. Together, we will continue to

invest in the clean-energy transition and build on our 100

plus-year history of providing safe, reliable, affordable energy to

our customers."

CPP Investments and GIP are premier, well-resourced

infrastructure investors at a global scale with deep industry

expertise and long-term outlooks. Together, they bring over four

decades of experience investing in large-scale infrastructure

businesses across sectors to support sustainable, long-term growth.

Both CPP Investments and GIP pride themselves on their responsible

investment approach, which is centered on delivering value to their

organizations and the communities in which they operate.

Owen continued, “Our ‘Sustainability-in-Action' strategy will

require focused execution and significant capital. Transitioning to

a private company with these strong partners will not only limit

our exposure to volatile financial markets, it also will ensure

ALLETE has access to the significant capital needed for our planned

investments now and over the long term. Importantly, CPP

Investments and GIP are aligned with ALLETE’s values of safety,

integrity, planet and people. They also recognize the importance of

our employees and our ties to the communities we serve and in which

we operate. To that end, we are proud to remain locally managed as

we enter this next chapter as committed as ever to our customers,

our communities and our employees. I look forward to all we will

achieve together.”

“ALLETE’s management team has done an excellent job leading the

company toward a truly sustainable clean- energy future. Together

with GIP, we look forward to bringing our sector expertise and

long-term capital to support ALLETE’s strong management team as

they continue to deliver safe, reliable, affordable energy services

to their customers,” said James Bryce, Managing Director and Global

Head of Infrastructure, CPP Investments. “ALLETE is at the

forefront of the clean energy transition and we are thrilled to

support the delivery of the company’s ‘Sustainability-in-Action’

strategy, which we believe will generate substantial value both for

ALLETE’s customers and CPP contributors and beneficiaries.”

“We are excited to work with Bethany Owen and the full ALLETE

team as they continue to supply affordable and reliable energy

services,” said Bayo Ogunlesi, GIP’s Chairman and Chief Executive

Officer. “GIP, alongside CPP Investments, look forward to

partnering to provide ALLETE with additional capital so they can

continue to decarbonize their business to benefit the customers and

communities they serve. Bringing together ALLETE, with its

demonstrated commitment to clean energy, with GIP, one of the

world’s premier developers of renewable power, furthers our

commitment to serve growing market needs for affordable,

carbon-free and more secure sources of energy.”

Commitment to Employees, Customers and Communities

Under the terms of the merger agreement governing the proposed

transaction, several commitments have been made by CPP Investments

and GIP to align with ALLETE’s shared purpose, culture and values,

including:

- Retaining Workforce: The agreement provides commitments

with respect to workforce retention, as well as maintaining

compensation levels and benefits programs. The agreement also

honors union contracts including our strong partnership with the

International Brotherhood of Electrical Workers.

- Maintaining Current Headquarters and Leadership:

ALLETE’s Minnesota Power and Superior Water, Light and Power

(SWL&P) will continue as independently operated, locally

managed, regulated utilities. Bethany Owen will continue as Chief

Executive Officer, and the current management team will continue to

lead ALLETE and remain as the primary points of contact for

customers, regulators and other stakeholders. ALLETE will continue

to be headquartered in Duluth, Minnesota.

- Contributing to Community: ALLETE and its family of

businesses and the Minnesota Power Foundation will continue to make

economic and charitable contributions in its service territories to

support vibrant and sustainable communities, close opportunity

gaps, and help people of all ages live with purpose and passion.

ALLETE will continue to invest corporate resources and employee

volunteer hours to help build thriving communities.

In addition, the transaction will support existing commitments

made by ALLETE such as:

- ALLETE’s Clean-Energy Goals: All ALLETE companies will

remain committed to advancing a clean-energy future, through solar,

wind, storage and transmission infrastructure and achieving

carbon-free goals of the respective states in which the companies

operate.

- Retail or Municipal Rates for Utility Customers:

Following the close of the acquisition, Minnesota Power and

SWL&P will continue to be regulated by the Minnesota Public

Utilities Commission (MPUC), the Public Service Commission of

Wisconsin (PSCW) and the Federal Energy Regulatory Commission

(FERC). The acquisition is not expected to impact retail or

municipal rates for utility customers.

Terms, Approvals and Timing

In connection with the merger, CPP Investments and GIP will

acquire all of the outstanding common shares of ALLETE for $67.00

per share in cash representing an enterprise value of approximately

$6.2 billion, including ALLETE’s net debt. This represents a

premium of approximately 19.1% to ALLETE’s closing share price on

December 4, 2023, the date prior to a media article reporting that

ALLETE was exploring a sale. The consideration also represents a

22.1% premium to the 30-day volume weighted average share price

prior to that date.

The acquisition was unanimously approved by ALLETE’s Board of

Directors and is expected to close in mid-2025, subject to the

approval of ALLETE’s shareholders, the receipt of regulatory

approvals, including by the MPUC, PSCW and FERC, and other

customary closing conditions. Dividends payable to ALLETE

shareholders are expected to continue in the ordinary course until

the closing, subject to approval by ALLETE’s Board of Directors.

Upon completion of the acquisition, ALLETE’s shares will no longer

trade on the New York Stock Exchange, and ALLETE will become a

private company.

Advisors

J.P. Morgan Securities LLC is acting as lead financial advisor

and provided a fairness opinion to ALLETE, and Houlihan Lokey

Capital, Inc. also provided a fairness opinion to ALLETE. Skadden,

Arps, Slate, Meagher & Flom LLP is acting as legal advisor to

ALLETE.

Cancellation of First Quarter 2024 Earnings Conference

Call

ALLETE will release its financial results for the first quarter

as scheduled before the stock markets open on Thursday, May 9,

2024. In light of the announced transaction with CPP Investments

and GIP, ALLETE will be cancelling its scheduled earnings

conference call.

Additional Resources

Additional information and stakeholder resources are also

available on ALLETE’s dedicated transaction website at

www.ALLETEforward.com.

About ALLETE, Inc.

ALLETE, Inc. is an energy company headquartered in Duluth,

Minnesota. ALLETE’s largest business unit, Minnesota Power, is an

electric utility which serves 150,000 residents, 14 municipalities,

and some of the nation’s largest industrial customers. In addition

to Minnesota Power, ALLETE owns Superior Water, Light and Power,

based in Superior, Wisconsin, ALLETE Clean Energy, based in Duluth;

BNI Energy in Bismarck, N.D.; and New Energy Equity, headquartered

in Annapolis, Maryland; and has an 8% equity interest in the

American Transmission Co. More information about ALLETE is

available at www.allete.com. ALE-CORP

ALLETE calculates and reports carbon emissions based on the GHG

Protocol. Details in ALLETE’s Corporate Sustainability Report.

About CPP Investments

Canada Pension Plan Investment Board (CPP Investments™) is a

professional investment management organization that manages the

Fund in the best interest of the more than 22 million contributors

and beneficiaries of the Canada Pension Plan. In order to build

diversified portfolios of assets, investments are made around the

world in public equities, private equities, real estate,

infrastructure and fixed income. Headquartered in Toronto, with

offices in Hong Kong, London, Luxembourg, Mumbai, New York City,

San Francisco, São Paulo and Sydney, CPP Investments is governed

and managed independently of the Canada Pension Plan and at arm’s

length from governments. At December 31, 2023, the Fund totaled

C$590.8 billion. For more information, please visit

www.cppinvestments.com or follow us on LinkedIn, Instagram or on X

@CPPInvestments.

About Global Infrastructure Partners (GIP)

Global Infrastructure Partners (GIP) is a leading infrastructure

investor that specializes in investing in, owning and operating

some of the largest and most complex assets across the energy,

transport, digital infrastructure and water and waste management

sectors. With decarbonization central to our investment thesis, we

are well positioned to support the global energy transition.

Headquartered in New York, GIP has offices in Brisbane, Dallas,

Hong Kong, London, Melbourne, Mumbai, Singapore, Stamford and

Sydney.

GIP has approximately $112 billion in assets under management.

Our portfolio companies have combined annual revenues of

approximately $73 billion and employ over 115,000 people. We

believe that our focus on real infrastructure assets, combined with

our deep proprietary origination network and comprehensive

operational expertise, enables us to be responsible stewards of our

investors' capital and to create positive economic impact for

communities. For more information, visit www.global-infra.com.

Important Information and Where to Find It

This communication may be deemed to be solicitation material in

respect of the proposed transaction. In connection with the

proposed transaction, ALLETE, Inc. (“ALLETE”) expects to file a

proxy statement on Schedule 14A with the Securities and Exchange

Commission (“SEC”). ALLETE also may file other documents with the

SEC regarding the merger. INVESTORS AND SECURITY HOLDERS ARE URGED

TO READ THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT

ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS

OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY

BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT

THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors are or will

be able to obtain such documents (if and when available) free of

charge at http://www.sec.gov, the SEC’s website, or from ALLETE’s

website (http://www.investor.allete.com).

Participants in the Solicitation

ALLETE and its directors, executive officers, other members of

management, and employees may be deemed to be participants in the

solicitation of proxies in respect of the proposed merger.

Information regarding ALLETE’s directors and executive officers is

contained in (i) the “Directors, Executive Officers and Corporate

Governance,” “Executive Compensation” and “Security Ownership of

Certain Beneficial Owners and Management and Related Stockholder

Matters” sections of the Annual Report on Form 10-K for the fiscal

year ended December 31, 2023 of ALLETE, which was filed with the

SEC on February 20, 2024 and (ii) the “Item No. 1 – Election of

Directors,” “Compensation Discussion and Analysis,” and “Ownership

of ALLETE Common Stock” sections in the definitive proxy statement

for the 2024 annual meeting of shareholders of ALLETE, which was

filed with the SEC on March 28, 2024. To the extent the holdings of

ALLETE’s securities by ALLETE’s directors and executive officers

have changed since the amounts set forth in the proxy statement for

its 2024 annual meeting of shareholders, such changes have been or

will be reflected on Statements of Changes in Beneficial Ownership

on Form 4 filed with the SEC. More detailed information regarding

the identity of potential participants, and their direct or

indirect interests, by securities, holdings or otherwise, will be

set forth in the proxy statement and other materials relating to

the merger when they are filed with the SEC. You may obtain free

copies of these documents using the sources indicated above.

Cautionary Statement Regarding Forward-Looking

Information

This communication contains “forward-looking statements” within

the meaning of the federal securities laws, including safe harbor

provisions of the Private Securities Litigation Reform Act of 1995,

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended, including

statements regarding the proposed acquisition of ALLETE,

shareholder and regulatory approvals, the expected timetable for

completing the proposed transaction and any other statements

regarding ALLETE’s future expectations, beliefs, plans, objectives,

financial conditions, assumptions or future events or performance

that are not historical facts. This information may involve risks

and uncertainties that could cause actual results to differ

materially from such forward-looking statements. These risks and

uncertainties include, but are not limited to: failure to obtain

the required vote of ALLETE’s shareholders; the timing to

consummate the proposed transaction; the risk that the conditions

to closing of the proposed transaction may not be satisfied; the

risk that a regulatory approval that may be required for the

proposed transaction is not obtained or is obtained subject to

conditions that are not anticipated; and the diversion of

management’s time on transaction-related issues.

When used in this communication, or any other documents, words

such as “anticipate,” “believe,” “estimate,” “expect,” “forecast,”

“target,” “could,” “goal,” “intend,” “objective,” “plan,”

“project,” “seek,” “strategy,” “target,” “may,” “will” and similar

expressions are intended to identify forward-looking statements.

These forward-looking statements are based on the beliefs and

assumptions of management at the time that these statements were

prepared and are inherently uncertain. Such forward-looking

statements are subject to risks and uncertainties that could cause

actual results to differ materially from those expressed or implied

in the forward-looking statements. These risks and uncertainties,

as well as other risks and uncertainties that could cause ALLETE’s

actual results to differ materially from those expressed in the

forward-looking statements, are described in greater detail under

the heading “Item 1A. Risk Factors” in ALLETE’s Form 10-K for the

year ended December 31, 2023 and in subsequently filed Forms 10-Q

and 8-K, and in any other SEC filings made by ALLETE. These risks

should not be considered a complete statement of all potential

risks and uncertainty, and will be discussed more fully, along with

other risks associated with the proposed transaction, in the proxy

statement to be filed with the SEC in connection with the proposed

transaction. Management cautions against putting undue reliance on

forward-looking statements or projecting any future results based

on such statements or present or prior earnings levels. Forward-

looking statements speak only as of the date hereof, and ALLETE

does not undertake any obligation to update or supplement any

forward-looking statements to reflect actual results, new

information, future events, changes in its expectations or other

circumstances that exist after the date as of which the

forward-looking statements were made, except as required by

applicable law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240506154719/en/

Investor Contact: Vince Meyer Director - Investor

Relations & Treasury 218-723-3952 vmeyer@allete.com Media

Contact: Amy Rutledge Director - Corporate Communications

218-723-7400 arutledge@allete.com CPP Investments Contact:

Asher Levine Managing Director, Corporate Communications

alevine@cppib.com Global Infrastructure Partners (GIP)

Contact: Mustafa Riffat Managing Director & Global Head of

Communications mustafa.riffat@global-infra.com

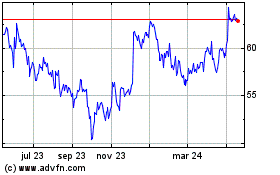

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

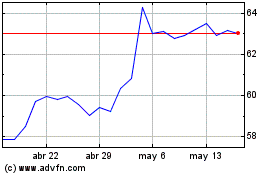

Allete (NYSE:ALE)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024