0001766478false00017664782024-11-062024-11-060001766478us-gaap:CommonStockMember2024-11-062024-11-060001766478aomr:A9.500SeniorNotesDue2029Member2024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (date of earliest event reported): November 6, 2024

Angel Oak Mortgage REIT, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | |

Maryland | 001-40495 | 37-1892154 |

(State or other jurisdiction of incorporation or organization) | (Commission File Number) | (I.R.S. Employer Identification No.) |

3344 Peachtree Road Northeast, Suite 1725, Atlanta, Georgia 30326

(Address of Principal Executive Offices and Zip Code)

Registrant’s telephone number, including area code: (404) 953-4900

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, $0.01 par value per share | AOMR | New York Stock Exchange |

| 9.500% Senior Notes due 2029 | AOMN | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | |

| Emerging growth company | ☐ |

| |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

Item 2.02. Results of Operations and Financial Condition.

On November 6, 2024, Angel Oak Mortgage REIT, Inc. (the “Company”) issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this current report on Form 8-K and incorporated herein by reference.

Also on November 6, 2024, the Company will hold a teleconference and audio webcast to discuss its financial results for the quarter ended September 30, 2024. A copy of the supplementary materials that will be referred to on the teleconference and webcast, and which will be posted to the Company’s website, is furnished as Exhibit 99.2 to this current report on Form 8-K and incorporated herein by reference.

The information contained in this Item 2.02 and the attached Exhibits 99.1 and 99.2 is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. The information in this Item 2.02 and the attached Exhibits 99.1 and 99.2 shall not be incorporated by reference into any registration statement or other document pursuant to the Securities Act of 1933, as amended, or the Exchange Act, unless it is specifically incorporated by reference therein.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

Exhibit No.

Exhibit 104 Cover Page Interactive Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

Date: November 6, 2024 | | | ANGEL OAK MORTGAGE REIT, INC. |

| | | |

| | | By: /s/ Brandon Filson |

| | | Name: Brandon Filson |

| | | Title: Chief Financial Officer and Treasurer |

| | | |

| | | |

| | | |

| | | |

| | | |

Angel Oak Mortgage REIT, Inc. Reports Third Quarter 2024 Financial Results

ATLANTA – November 6, 2024 -- Angel Oak Mortgage REIT, Inc. (NYSE: AOMR) (the “Company,” “we,” and “our”), a leading real estate finance company focused on acquiring and investing in first lien non-QM loans and other mortgage-related assets in the U.S. mortgage market, today reported financial results for the third quarter of 2024.

Third Quarter and Year-to-Date Highlights

•Q3 2024 net interest income of $9.0 million, an increase of 22% versus $7.4 million in Q3 2023.

•Net interest income of $27.1 million in the first nine months of 2024, an increase of 31% versus net interest income of $20.7 million in the first nine months of 2023.

•Q3 2024 GAAP net income of $31.2 million, or $1.29 per diluted share of common stock.

•Q3 2024 Distributable Earnings loss of ($3.4) million, or ($0.14) per diluted share of common stock.

•GAAP book value of $11.28 per share of common stock as of September 30, 2024, up 10.3% from $10.23 per share of common stock as of June 30, 2024.

•Economic book value of $14.02 per share of common stock as of September 30, 2024, up 6.5% from $13.16 per share of common stock as of June 30, 2024.

•Issued $50 million of 9.50% senior unsecured notes due 2029 on July 25, 2024. Deployed majority of the net proceeds for general corporate purposes, including the acquisition of non-QM loans; used the remainder of the net proceeds to repurchase approximately 1.7 million shares of our common stock.

Sreeni Prabhu, Chief Executive Officer and President of Angel Oak Mortgage REIT, Inc., said "Our positive third quarter results reflect the strength of our portfolio's position in what has become a more positive macroeconomic landscape in the second half of the year. Throughout the quarter, we quickly deployed the majority of the net proceeds from our July senior unsecured notes issuance into accretive purchases of newly originated, high-quality non-QM loans. As of today's date, the earnings from these investments have exceeded the incremental interest expense associated with the notes issuance and are now driving meaningful net interest income expansion, which underscores the efficiency and reliability of AOMR's distinctive operational strategy and approach. This, in combination with October's securitization and the September rate cut, are expected to drive continued portfolio and earnings growth in the fourth quarter and beyond. We believe a constructive macroeconomic landscape is developing and remain dedicated to capitalizing on emerging strategic opportunities while executing on our repeatable, streamlined, and focused strategy to drive enhanced value for our stakeholders.”

Portfolio and Investment Activity

•Following quarter end in October 2024, the Company executed the AOMT 2024-10 securitization as the sole contributor of loans. The Company contributed loans with a scheduled unpaid principal balance of approximately $316.8 million and a 7.79% weighted average coupon. This securitization reduced the Company’s whole loan warehouse debt by approximately $260 million and reduced weighted average funding costs for the loans underlying the securitization by over 110 basis points, which is incremental to the 50 basis points of warehouse funding cost relief from the Federal Reserve Bank’s September rate cut.

•During the quarter, we purchased $264.8 million of newly-originated, current market coupon non-QM residential mortgage loans, with a weighted average coupon of 7.74%, weighted average LTV of 70.0% and weighted average credit score of 754.

•As of September 30, 2024, the weighted average coupon of our residential whole loans portfolio increased to 7.73%, relatively flat compared to the second quarter 2024 and 189 basis points higher than at the end of the third quarter of 2023.

Capital Markets Activity

•On July 25, 2024, the Company issued $50 million of senior unsecured notes due 2029 with a coupon of 9.50%. This issuance is expected to be accretive, driving incremental asset expansion and earnings growth. During the third quarter, the Company used the majority of the net proceeds from the offering for general corporate purposes, which included the acquisition of non-QM loans. Additionally, the Company used the net proceeds from the offering to repurchase 1,707,922 shares of the Company's common stock owned by Xylem Finance, LLC, an affiliate of Davidson Kempner Capital Management LP, for an aggregate repurchase price of approximately $20.0 million.

•As of September 30, 2024, the Company was a party to three loan financing lines which permit borrowings in an aggregate amount of up to $1.1 billion, of which approximately $333.0 million is drawn, leaving capacity of approximately $720 million for new loan purchases.

Balance Sheet

•Target assets totaled $2.2 billion as of September 30, 2024.

•The Company held residential mortgage whole loans with fair value of $428.9 million as of September 30, 2024.

•The recourse debt to equity ratio was 1.8x as of September 30, 2024.

oAs of today’s date, our recourse debt to equity ratio is approximately 0.7x. This reflects the impact of the AOMT 2024-10 securitization subsequent to quarter end, as well as the maturity of short-term U.S. Treasuries held at the end of the third quarter.

oOur recourse debt to equity ratio is expected to increase as current-market coupon loans are purchased, but is expected to remain below 2.5x.

Dividend

On November 6, 2024, the Company declared a dividend of $0.32 per share of common stock, which will be paid on November 27, 2024, to common stockholders of record as of November 19, 2024.

Conference Call and Webcast Information

The Company will host a live conference call and webcast today, November 6, 2024 at 8:30 a.m. Eastern time. To listen to the live webcast, go to the Investors section of the Company’s website at www.angeloakreit.com at least 15 minutes prior to the scheduled start time in order to register and install any necessary audio software.

To Participate in the Telephone Conference Call:

Dial in at least 15 minutes prior to start time.

Domestic: 1-844-826-3033

International: 1-412-317-5185

Conference Call Playback:

Domestic: 1-844-512-2921

International: 1-412-317-6671

Pass code: 10192449

The playback can be accessed through November 20, 2024.

Non-GAAP Metrics

Distributable Earnings is a non‑GAAP measure and is defined as net income (loss) allocable to common stockholders as calculated in accordance with generally accepted accounting principles in the United States of America (“GAAP”), excluding (1) unrealized gains and losses on our aggregate portfolio, (2) impairment losses, (3) extinguishment of debt, (4) non-cash equity compensation expense, (5) the incentive fee earned by Falcons I, LLC, our external manager (our “Manager”), (6) realized gains or losses on swap terminations and (7) certain other nonrecurring gains or losses. We believe that the presentation of Distributable Earnings provides investors with a useful measure to facilitate comparisons of financial performance among our real estate investment trust (“REIT”) peers, but has important limitations. We believe Distributable Earnings as described above helps evaluate our financial performance without the impact of certain transactions but is of limited usefulness as an analytical tool. Therefore, Distributable Earnings should not be viewed in isolation and is not a substitute for net income computed in accordance with GAAP. Our methodology for calculating Distributable Earnings may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, our Distributable Earnings may not be comparable to similar measures presented by other REITs.

Distributable Earnings Return on Average Equity is a non-GAAP measure and is defined as annual or annualized Distributable Earnings divided by average total stockholders’ equity. We believe that the presentation of Distributable Earnings Return on Average Equity provides investors with a useful measure to facilitate comparisons of financial performance among our REIT peers, but has important limitations. Additionally, we believe Distributable Earnings Return on Average Equity provides investors with additional detail on the Distributable Earnings generated by our invested equity capital. We believe Distributable Earnings Return on Average Equity as described above helps evaluate our financial performance without the impact of certain transactions but is of limited usefulness as an analytical tool. Therefore, Distributable Earnings Return on Average Equity should not be viewed in isolation and is not a substitute for net income computed in accordance with GAAP. Our methodology for calculating Distributable Earnings Return on Average Equity may differ from the methodologies employed by other REITs to calculate the same or similar supplemental performance measures, and as a result, our Distributable Earnings Return on Average Equity may not be comparable to similar measures presented by other REITs.

Economic book value is a non-GAAP financial measure of our financial position. To calculate our economic book value, the portions of our non-recourse financing obligation held at amortized cost are adjusted to fair value. These adjustments are also reflected in our end of period total stockholders’ equity. Management considers economic book value to provide investors with a useful supplemental measure to evaluate our financial position as it reflects the impact of fair value changes for our legally held retained bonds, irrespective of the accounting model applied for GAAP reporting purposes. Economic book value does not represent and should not be considered as a substitute for book value per share of common stock or stockholders’ equity, as determined in accordance with GAAP, and our calculation of this measure may not be comparable to similarly titled measures reported by other companies.

Forward-Looking Statements

This press release contains certain forward-looking statements that are subject to various risks and uncertainties, including, without limitation, statements relating to the performance of the Company’s investments. Forward-looking statements are generally identifiable by use of forward-looking terminology such as “may,” “will,” “should,” “potential,” “intend,” “expect,” “endeavor,” “seek,” “anticipate,” “estimate,” “believe,” “could,” “project,” “predict,” “continue,” or by the negative of these words and phrases or other similar words or expressions. Forward-looking statements are based on certain assumptions, discuss future expectations, describe existing or future plans and strategies, contain projections of results of operations, liquidity and/or financial condition, or state other forward-looking information. The Company’s ability to predict future events or conditions or their impact or the actual effect of existing or future plans or strategies is inherently uncertain. Although the Company believes that such forward-looking statements are based on reasonable assumptions, actual results and performance in the future could differ materially from those set forth in or implied by such forward-looking statements. You are cautioned not to place undue reliance on these forward‐looking statements, which reflect the Company’s views only as of the date of this press release. Additional information concerning factors that could cause actual results and performance to differ materially from these forward-looking statements is contained from time to time in the Company’s filings with the Securities and Exchange Commission. Except as required by applicable law, neither the Company nor any other person

assumes responsibility for the accuracy and completeness of the forward‐looking statements. The Company does not undertake any obligation to update any forward-looking statements contained in this press release as a result of new information, future events or otherwise.

About Angel Oak Mortgage REIT, Inc.

Angel Oak Mortgage REIT, Inc. is a real estate finance company focused on acquiring and investing in first lien non-QM loans and other mortgage-related assets in the U.S. mortgage market. The Company’s objective is to generate attractive risk-adjusted returns for its stockholders through cash distributions and capital appreciation across interest rate and credit cycles. The Company is externally managed and advised by an affiliate of Angel Oak Capital Advisors, LLC, which, collectively with its affiliates, is a leading alternative credit manager with market leadership in mortgage credit that includes asset management, lending, and capital markets. Additional information about the Company is available at www.angeloakreit.com

Angel Oak Mortgage REIT, Inc.

Condensed Consolidated Statements of Operations and Comprehensive Income (Loss)

(Unaudited)

(in thousands, except for share and per share data)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| INTEREST INCOME, NET | | | | | | | |

| Interest income | $ | 27,444 | | | $ | 23,900 | | | $ | 78,558 | | | $ | 71,403 | |

| Interest expense | 18,424 | | | 16,490 | | | 51,495 | | | 50,742 | |

| NET INTEREST INCOME | $ | 9,020 | | | $ | 7,410 | | | $ | 27,063 | | | $ | 20,661 | |

| | | | | | | |

| REALIZED AND UNREALIZED GAINS (LOSSES), NET | | | | | | | |

| Net realized gain (loss) on mortgage loans, derivative contracts, RMBS, and CMBS | $ | (6,335) | | | $ | (12,044) | | | $ | (14,527) | | | $ | (27,056) | |

| Net unrealized gain (loss) on trading securities, mortgage loans, portion of debt at fair value option, and derivative contracts | 35,172 | | | 17,299 | | | 48,514 | | | 27,868 | |

| TOTAL REALIZED AND UNREALIZED GAINS (LOSSES), NET | $ | 28,837 | | | $ | 5,255 | | | $ | 33,987 | | | $ | 812 | |

| | | | | | | |

| EXPENSES | | | | | | | |

Operating expenses | $ | 1,287 | | | $ | 1,370 | | | $ | 4,619 | | | $ | 5,788 | |

| Operating expenses incurred with affiliate | 472 | | | 599 | | | 1,444 | | | 1,672 | |

| Due diligence and transaction costs | 254 | | | 115 | | | 663 | | | 136 | |

| Stock compensation | 604 | | | 447 | | | 1,864 | | | 1,195 | |

| Securitization costs | — | | | 416 | | | 1,583 | | | 2,326 | |

| Management fee incurred with affiliate | 1,204 | | | 1,445 | | | 3,810 | | | 4,460 | |

| Total operating expenses | $ | 3,821 | | | $ | 4,392 | | | $ | 13,983 | | | $ | 15,577 | |

| | | | | | | |

| INCOME (LOSS) BEFORE INCOME TAXES | $ | 34,036 | | | $ | 8,273 | | | $ | 47,067 | | | $ | 5,896 | |

| Income tax expense | 2,832 | | | — | | | 3,261 | | | 781 | |

| | | | | | | |

| | | | | | | |

| NET INCOME (LOSS) ALLOCABLE TO COMMON STOCKHOLDERS | $ | 31,204 | | | $ | 8,273 | | | $ | 43,806 | | | $ | 5,115 | |

| Other comprehensive income (loss) | 2,706 | | | (1,607) | | | 4,534 | | | 12,955 | |

| TOTAL COMPREHENSIVE INCOME (LOSS) | $ | 33,910 | | | $ | 6,666 | | | $ | 48,340 | | | $ | 18,070 | |

| | | | | | | |

| Basic earnings (loss) per common share | $ | 1.31 | | | $ | 0.33 | | | $ | 1.79 | | | $ | 0.20 | |

| Diluted earnings (loss) per common share | $ | 1.29 | | | $ | 0.33 | | | $ | 1.76 | | | $ | 0.20 | |

| | | | | | | |

| Weighted average number of common shares outstanding: | | | | | | | |

| Basic | 23,757,039 | | | 24,768,921 | | | 24,445,105 | | | 24,706,568 | |

| Diluted | 24,079,247 | | | 24,957,668 | | | 24,778,465 | | | 24,933,833 | |

Angel Oak Mortgage REIT, Inc.

Condensed Consolidated Balance Sheets

(Unaudited)

(in thousands, except for share and per share data)

| | | | | | | | | | | |

| As of: |

| September 30, 2024 | | December 31, 2023 |

| ASSETS | | | |

| Residential mortgage loans - at fair value | $ | 428,909 | | | $ | 380,040 | |

| Residential mortgage loans in securitization trusts - at fair value | 1,452,907 | | | 1,221,067 | |

| RMBS - at fair value | 283,105 | | | 472,058 | |

| U.S. Treasury securities - at fair value | 49,971 | | | 149,927 | |

| Cash and cash equivalents | 42,052 | | | 41,625 | |

| Restricted cash | 2,679 | | | 2,871 | |

| Principal and interest receivable | 6,630 | | | 7,501 | |

| Unrealized appreciation on TBAs and interest rate futures contracts - at fair value | 1,651 | | | — | |

| Other assets | 35,962 | | | 32,922 | |

| Total assets | $ | 2,303,866 | | | $ | 2,308,011 | |

| | | |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| LIABILITIES | | | |

| Notes payable | $ | 333,042 | | | $ | 290,610 | |

| Non-recourse securitization obligation, collateralized by residential mortgage loans in securitization trusts | 1,353,758 | | | 1,169,154 | |

| Securities sold under agreements to repurchase | 102,876 | | | 193,656 | |

| Senior unsecured notes | 47,616 | | | — | |

| Unrealized depreciation on TBAs and interest rate futures contracts - at fair value | — | | | 1,334 | |

| Due to broker | 194,697 | | | 391,964 | |

| Accrued expenses | 2,000 | | | 985 | |

| Accrued expenses payable to affiliate | 657 | | | 748 | |

| Interest payable | 1,312 | | | 820 | |

| Income taxes payable | 2,785 | | | 1,241 | |

| Management fee payable to affiliate | 25 | | | 1,393 | |

| Total liabilities | $ | 2,038,768 | | | $ | 2,051,905 | |

| | | |

| | | |

| | | |

| STOCKHOLDERS’ EQUITY | | | |

| Common stock, $0.01 par value. As of September 30, 2024: 350,000,000 shares authorized, 23,511,272 shares issued and outstanding. As of December 31, 2023: 350,000,000 shares authorized, 24,965,274 shares issued and outstanding. | $ | 234 | | | $ | 249 | |

| Additional paid-in capital | 461,249 | | | 477,068 | |

| Accumulated other comprehensive income (loss) | (441) | | | (4,975) | |

| Retained earnings (deficit) | (195,944) | | | (216,236) | |

| Total stockholders’ equity | $ | 265,098 | | | $ | 256,106 | |

| Total liabilities and stockholders’ equity | $ | 2,303,866 | | | $ | 2,308,011 | |

Angel Oak Mortgage REIT, Inc.

Reconciliation of Net Income (Loss) to Distributable Earnings

and Distributable Earnings Return on Average Equity

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| (in thousands) | | | | |

| Net income (loss) allocable to common stockholders | $ | 31,204 | | | $ | 8,273 | | | $ | 43,806 | | | $ | 5,115 | |

| Adjustments: | | | | | | | |

| Net unrealized (gains) losses on trading securities | (984) | | | 4,857 | | | 829 | | | 7,134 | |

| Net unrealized (gains) losses on derivatives | 51 | | | (4,563) | | | (2,985) | | | 7,794 | |

| Net unrealized (gains) losses on residential loans in securitization trusts and non-recourse securitization obligation | (26,305) | | | (5,319) | | | (28,872) | | | 5,784 | |

| Net unrealized (gains) losses on residential loans | (7,935) | | | (12,338) | | | (17,438) | | | (48,497) | |

| Net unrealized (gains) losses on commercial loans | — | | | 64 | | | (49) | | | (83) | |

| Non-cash equity compensation expense | 604 | | | 447 | | | 1,864 | | | 1,195 | |

| Distributable Earnings | $ | (3,365) | | | $ | (8,579) | | | $ | (2,845) | | | $ | (21,558) | |

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2023 | | September 30, 2024 | | September 30, 2023 |

| ($ in thousands) | | | | |

| Annualized Distributable Earnings | $ | (13,460) | | $ | (34,315) | | $ | (3,793) | | $ | (28,747) |

| Average total stockholders’ equity | $ | 260,452 | | $ | 232,575 | | $ | 260,083 | | $ | 236,629 |

| Distributable Earnings Return on Average Equity | (5.2)% | | (14.8)% | | (1.5)% | | (12.1)% |

Angel Oak Mortgage REIT, Inc.

Reconciliation of Stockholders’ Equity to Stockholders’ Equity Including Economic Book Value Adjustments

and Economic Book Value per Share of Common Stock

(Unaudited)

| | | | | | | | | | | | | | | | | | |

| September 30,

2024 | June 30,

2024 | March 31,

2024 | December 31,

2023 | September 30,

2023 | |

| (in thousands, except for share and per share data) |

| GAAP total stockholders’ equity | $ | 265,098 | | $ | 255,806 | | $ | 263,324 | | $ | 256,106 | | $ | 231,802 | | |

| Adjustments: | | | | | | |

| Fair value adjustment for securitized debt held at amortized cost | 64,522 | | 73,053 | | 80,599 | | 81,942 | | 97,592 | | |

| Stockholders’ equity including economic book value adjustments | $ | 329,620 | | $ | 328,859 | | $ | 343,923 | | $ | 338,048 | | $ | 329,394 | | |

| | | | | | |

| Number of shares of common stock outstanding at period end | 23,511,272 | | 24,998,549 | | 24,965,274 | | 24,965,274 | | 24,955,566 | | |

| Book value per share of common stock | $ | 11.28 | | $ | 10.23 | | $ | 10.55 | | $ | 10.26 | | $ | 9.29 | | |

| Economic book value per share of common stock | $ | 14.02 | | $ | 13.16 | | $ | 13.78 | | $ | 13.54 | | $ | 13.20 | | |

Contacts

Investors:

investorrelations@angeloakreit.com

855-502-3920

IR Agency Contact:

Nick Teves or Joseph Caminiti, Alpha IR Group

312-445-2870

AOMR@alpha-ir.com

Company Contact:

KC Kelleher, Head of Corporate Finance & Investor Relations

404-528-2684

kc.kelleher@angeloakcapital.com

• • • • • • • • • • • • • • • • • • • • • • • •

• • • • • •

▪

• • • •

• • •

▪ ▪

▪ ▪

• •

0 40 80 120 160 200 240 280 # o f Lo an s Coupon Rate (%) 0 50 100 150 200 # o f Lo an s Credit Score

Investor Loans, 34% Just Missed Prime, 9% Loans Made to Bank Statement Borrowers, 57%

FL, 22% CA, 35% TX, 7% GA, 3% Other, 34%

FL, 20% CA, 36% TX, 8%GA, 4% Other, 31%

• • • ‒ ‒ • • • •

• • • ‒ • • •

v3.24.3

Cover

|

Nov. 06, 2024 |

| Document Information [Line Items] |

|

| Entity Central Index Key |

0001766478

|

| Amendment Flag |

false

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

Angel Oak Mortgage REIT, Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-40495

|

| Entity Tax Identification Number |

37-1892154

|

| Entity Address, Address Line One |

3344 Peachtree Road Northeast

|

| Entity Address, Address Line Two |

Suite 1725

|

| Entity Address, City or Town |

Atlanta

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30326

|

| City Area Code |

404

|

| Local Phone Number |

953-4900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, $0.01 par value per share

|

| Trading Symbol |

AOMR

|

| Security Exchange Name |

NYSE

|

| 9.500% Senior Notes Due 2029 |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

9.500% Senior Notes due 2029

|

| Trading Symbol |

AOMN

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=aomr_A9.500SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

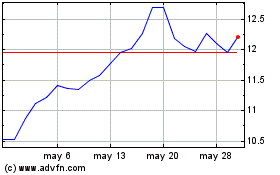

Angel Oak Mortgage REIT (NYSE:AOMR)

Gráfica de Acción Histórica

De Feb 2025 a Mar 2025

Angel Oak Mortgage REIT (NYSE:AOMR)

Gráfica de Acción Histórica

De Mar 2024 a Mar 2025