New Bally’s Chicago Architectural Redesign

to Complement Chicago Skyline and Feature 500-Room Hotel

Tower as a Single-Phase Development Project

Access to Site and Beginning Construction of

Chicago Permanent Casino and Entertainment Complex

Bally’s and Gaming and Leisure Properties to

Jointly Develop Bally’s Chicago Permanent Casino and Entertainment

Complex Targeted to Open September 2026

Construction Financing is Key Milestone

Towards Bally’s Chicago Initial Public Offering of 25% Qualified

Minority Ownership Pursuant to Host Community Agreement with City

of Chicago

Bally’s Corporation (NYSE: BALY) ("Bally’s”) today announced it

has entered into a binding term sheet for a strategic construction

and financing arrangement with Gaming and Leisure Properties, Inc.

(NASDAQ: GLPI) (“GLPI”) including funding to complete the

construction of Bally’s permanent casino development in the City of

Chicago (the “Project”).

Transaction Details

An affiliate of Gaming and Leisure Properties has reached an

agreement to acquire the real estate underlying the Project and has

agreed to amend the existing land lease via a new master lease

agreement (“Chicago MLA”) with Bally’s Chicago Operating Company,

LLC (“Bally’s Chicago” or the “Company”) as tenant, where the rent

will be amended to $20.0 million per annum, subject to annual

escalators, reflecting the purchase price paid by GLPI for the

land. The Chicago MLA can provide up to additional $940 million of

construction financing funding for the Project’s “hard costs”

through monthly draws, subject to certain conditions and requisite

approvals. The Chicago MLA will have an initial term of 15 years,

with a specified number of successive options for renewal. Amounts

funded by GLPI under the construction funding facility will result

in additional rent based upon an 8.5% cap rate for the incremental

amounts funded.

The binding term sheet also provides for Gaming and Leisure

Properties to acquire and lease back certain real property

interests underlying Bally’s Kansas City and Bally’s Shreveport for

$395 million in total consideration, in exchange for $32.2 million

in initial annual rent with annual escalators consistent with

Bally’s existing master lease agreement with GLPI (“Sale Leaseback

Transactions”). Bally’s expects to use all the proceeds from the

Sale Leaseback Transactions to repay amounts currently drawn under

its $620 million revolving credit facility and for general

corporate purposes.

Bally’s also expects to amend its Contribution Agreement with

Gaming and Leisure Properties and has reiterated its intention to

sell and lease back its Twin River Lincoln property to GLPI prior

to the end of 2026 for $735 million, with related initial annual

rent of $58.8 million (the “Lincoln Transaction”). As a part of the

amendment, GLPI will be granted a right to call the Lincoln

Transaction beginning in October 2026, coinciding with the

scheduled maturity of Bally’s revolving credit facility. All such

transactions are subject to required regulatory approvals.

The Chicago MLA and construction funding arrangement will be

obligations of Bally’s Chicago, as tenant. The arrangement is

expected to contain customary representations by Bally’s Chicago

and is expected to contain funding conditions, in each case, which

are customary and reasonable for large scale casino resort

developments of this type.

Reflecting these transactions, GLPI will provide in aggregate up

to $2.07 billion of financing to Bally’s, thereby further cementing

the companies’ long-term strategic alliance. GLPI has a strong

history of successful development experience and construction

oversight of casino resort projects, and Bally’s looks forward to

benefitting from their experience and expertise as a strategic

stakeholder for the Project.

Bally’s Chicago Full Financing Details

Bally’s expects the new funding and development agreements with

Gaming and Leisure Properties, combined with certain proceeds from

the expected Sale Leaseback Transactions, the planned, previously

announced, initial public offering of Bally’s Chicago, Inc., and

Bally’s financial resources including cash flows from operations,

will fully fund the development expenditures necessary to complete

the Project.

New Chicago Casino Entertainment Complex Design

Details

Today Bally’s Chicago announced its intention to build the

500-unit hotel tower concurrent with its casino entertainment

complex by locating the hotel tower on the southern end of the

development site. Originally intended for the northern end, the

plan was revised due to potential risks of damage to portions of

Chicago’s underground infrastructure. The new plans resolve those

concerns, and Bally’s Chicago has re-imagined the new integrated

complex across a single phase of construction. Renderings of the

new design are available at

http://ballyschicago.com/renderings.

Initial Public Offering of Bally’s Chicago, Inc.

The contemplated initial public offering of Bally’s Chicago,

Inc. will offer individuals and minority-owned and women-owned

businesses that meet the qualification requirements contemplated by

the Host Community Agreement with the City of Chicago to

participate in 25% equity ownership in the Bally’s Chicago project.

Bally’s may also pursue other complementary financings at Bally’s

Chicago to supplement the project financing as market conditions

allow.

Management Comments

Soo Kim, Chairman of Bally’s Corp., commented, “Our agreements

with GLPI fulfill the construction financing requirements, allowing

us to bring the Bally’s Chicago permanent casino and entertainment

complex to River North by the fall of 2026. We are delighted to

continue our strong partnership with GLPI and to leverage its

skilled resources and 30 years of experience developing and

constructing successful gaming facilities. This is an amazing

partnership that continues to pay strong dividends for both

parties.”

Peter Carlino, Chairman and CEO of GLPI commented, “We are

excited to partner in Bally’s Chicago marquee development project

which will be the flagship of Bally’s platform, and an iconic

addition to the Chicago skyline. We are appreciative of Bally’s

trust in GLPI as its selected strategic financing partner. This is

a natural extension of our corporate growth strategy to work

closely with tenants and finance the construction of development

projects, and to pursue built-to-suit partnerships in the gaming

sector where we have experience and can contribute GLPI’s

extensive, proven development and construction capabilities.

Strategically, this is a means to grow our asset portfolio within

the gaming sector that we know well and allows us to create value

for our shareholders. We have strong confidence in Bally’s team and

will be working hand-in-hand with Bally’s to bring this project to

fruition on time and on budget.”

About Bally’s Corporation

Bally's Corporation is a global casino-entertainment company

with a growing omni-channel presence. It currently owns and manages

15 casinos across 10 states, a golf course in New York, a horse

racetrack in Colorado, and has access to OSB licenses in 18 states.

It also owns Bally's Interactive International, formerly Gamesys

Group, a leading, global, online gaming operator, Bally Bet, a

first-in-class sports betting platform, and Bally Casino, a growing

iCasino platform.

With 10,600 employees, the Company's casino operations include

approximately 15,300 slot machines, 580 table games and 3,800 hotel

rooms. Upon completing the construction of a permanent casino

facility in Chicago, IL, and a land-based casino near the Nittany

Mall in State College, PA, Bally's will own and/or manage 16

casinos across 11 states. Bally’s also has rights to developable

land in Las Vegas post the closure of the Tropicana. Its shares

trade on the New York Stock Exchange under the ticker symbol

"BALY".

About Bally’s Chicago

The Bally’s Chicago resort will harness the beauty of the urban

Chicago riverfront site, located at 777 W. Chicago Avenue, to

create inclusive, dynamic spaces, including plans for a 3,000-seat

theater, a 2-acre public park and open outdoor spaces, six

restaurants, cafes and a food hall. The lower riverbank will be

connected to the property with an approximately 2,000-foot

extension of the riverwalk. The casino will offer space for

approximately 3,300 slots, 173 table games and VIP gaming areas,

while the hotel tower will include a large pool spa, fitness center

and sun deck, as well as a rooftop restaurant bar to enjoy the

Chicago skyline. The planned 500-room, 34-story hotel tower will

now be located on the south end of the site. The development will

generate approximately 3,000 construction jobs and 3,000 casino

jobs when Bally’s Chicago becomes operational.

The references included herein to the contemplated initial

public offering of Bally’s Chicago, Inc. do not constitute an offer

of any securities for sale. Such securities may not be sold nor may

offers to buy be accepted prior to the time a registration

statement filed with the U.S. Securities and Exchange Commission

has become effective.

Cautionary Note Regarding Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the federal securities laws. Forward-looking

statements may generally be identified by the use of words such as

“anticipate,” “believe,” “expect,” “intend,” “plan” and “will” or,

in each case, their negative, or other variations or comparable

terminology. These forward-looking statements include all matters

that are not historical facts. By their nature, forward-looking

statements involve risks and uncertainties because they relate to

events and depend on circumstances that may or may not occur in the

future. As a result, these statements are not guarantees of future

performance and actual events may differ materially from those

expressed in or suggested by the forward-looking statements. Any

forward-looking statement made by Bally’s in this press release,

its reports filed with the Securities and Exchange Commission

(“SEC”) and other public statements made from time-to-time speak

only as of the date made. New risks and uncertainties come up from

time to time, and it is impossible for Bally’s to predict or

identify all such events or how they may affect it. Bally’s has no

obligation, and does not intend, to update any forward-looking

statements after the date hereof, except as required by federal

securities laws. Factors that could cause these differences include

those included in Bally’s Annual Report on Form 10-K, Quarterly

Reports on Form 10-Q and other reports filed by Bally’s with the

SEC. These statements constitute Bally’s cautionary statements

under the Private Securities Litigation Reform Act of 1995.

About Gaming and Leisure Properties, Inc.

GLPI is engaged in the business of acquiring, financing, and

owning real estate property to be leased to gaming operators in

triple-net lease arrangements, pursuant to which the tenant is

responsible for all facility maintenance, insurance required in

connection with the leased properties and the business conducted on

the leased properties, taxes levied on or with respect to the

leased properties and all utilities and other services necessary or

appropriate for the leased properties and the business conducted on

the leased properties.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240711105791/en/

Investor Contact Marcus Glover Executive Vice President

and Chief Financial Officer 401-475-8564 IR@ballys.com Media

Contact Diane Spiers VP Marketing & PR

PressInquiries@ballys.com Investor Contact Matthew Demchyk

Chief Investment Officer 610-401-2900

investorinquiries@glpropinc.com Investor Relations JCIR

Joseph Jaffoni James Leahy Richard Land 212-835-8500

GLPI@jcir.com

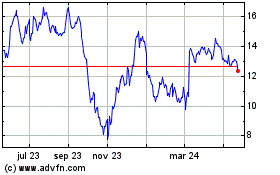

Ballys (NYSE:BALY)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

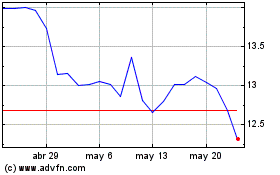

Ballys (NYSE:BALY)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025