Franklin Templeton Announces Liquidation of ClearBridge Focus Value ESG ETF

06 Septiembre 2024 - 3:40PM

Business Wire

Franklin Templeton today announced it will liquidate and

dissolve ClearBridge Focus Value ESG ETF (CFCV). The liquidation is

anticipated to occur on or about November 5, 2024.

The liquidation of CFCV was approved by the Fund’s board of

trustees on September 5, 2024, and does not require the approval of

shareholders.

After the close of business on October 8, 2024, the Fund will no

longer accept creation orders. Trading in the Fund on Cboe BZX

Exchange, Inc. (“Cboe”) will be halted prior to market open on

October 30, 2024. Proceeds of the liquidation are currently

scheduled to be sent to shareholders on or about November 5,

2024.

When the Fund is in the process of liquidating its portfolio,

which is anticipated to commence prior to October 30, 2024, the

Fund will hold cash and securities that may not be consistent with

the Fund’s investment objective and strategies.

Shareholders may sell their shares of the Fund on Cboe until the

market close on October 29, 2024, and may incur the usual and

customary brokerage commissions associated with the sale of Fund

shares. The Fund’s shares will no longer trade on Cboe after market

close on October 29, 2024, and the shares will be subsequently

delisted.

At the time the liquidation of the Fund is complete, shares of

the Fund will be individually redeemed. Shareholders who do not

sell their shares of the Fund before market close on October 29,

2024 will receive cash equal to the amount of the net asset value

of their shares, which will include any capital gains and

dividends, on or about November 5, 2024.

For those shareholders with taxable accounts and for Federal,

state and local income tax purposes: (a) any liquidation proceeds

paid to such shareholder should generally be treated as received by

such shareholder in exchange for the shareholder’s shares and the

shareholder will therefore generally recognize a taxable gain or

loss; and (b) in connection with the liquidation, the Fund may

declare taxable distributions of its income and/or capital gain.

Shareholders should consult their tax advisers regarding the effect

of the Fund’s liquidation in light of their individual

circumstances.

About Franklin Templeton

Franklin Resources, Inc. [NYSE:BEN] is a global investment

management organization with subsidiaries operating as Franklin

Templeton and serving clients in over 150 countries. Franklin

Templeton’s mission is to help clients achieve better outcomes

through investment management expertise, wealth management and

technology solutions. Through its specialist investment managers,

the company offers specialization on a global scale, bringing

extensive capabilities in fixed income, equity, alternatives and

multi-asset solutions. With more than 1,500 investment

professionals, and offices in major financial markets around the

world, the California-based company has over 75 years of investment

experience and over $1.6 trillion in assets under management as of

July 31, 2024. For more information, please visit

franklintempleton.com and follow us on LinkedIn, X and

Facebook.

All investments involve risks, including possible loss of

principal. Equity securities are subject to price fluctuation

and possible loss of principal. Derivative instruments can

be illiquid, may disproportionately increase losses, and have a

potentially large impact on performance. The investment

style may become out of favor, which may have a negative impact

on performance. The managers’ environmental, social and

governance (ESG) strategies may limit the types and number of

investments available and, as a result, may forgo favorable market

opportunities or underperform strategies that are not subject to

such criteria. There is no guarantee that the strategy's ESG

directives will be successful or will result in better performance.

These and other risks are discussed in the fund’s prospectus. These

and other risks are discussed in the fund’s prospectus.

Before investing, carefully consider a fund’s investment

objectives, risks, charges and expenses. You can find this and

other information in each prospectus, or summary prospectus, if

available, at www.franklintempleton.com. Please read

it carefully.

Franklin Distributors, LLC. Member FINRA/SIPC. ClearBridge

Investments, LLC, and Franklin Distributors, LLC, are Franklin

Templeton affiliated companies.

Copyright © 2024. Franklin Templeton. All rights reserved.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240906872804/en/

Franklin Templeton Corporate Communications: Lisa Tibbitts,

(904) 942-4451, Lisa.Tibbitts@franklintempleton.com

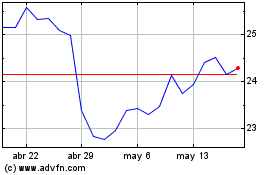

Franklin Resources (NYSE:BEN)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

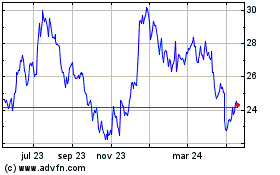

Franklin Resources (NYSE:BEN)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024