false

N-CSRS

N-2

Blackstone Senior Floating Rate 2027 Term Fund

0001486298

0001486298

2024-01-01

2024-06-30

0001486298

bsl:CommonSharesMember

2024-01-01

2024-06-30

0001486298

2024-06-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

xbrli:pure

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

N-CSR

CERTIFIED

SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment

Company Act file number: 811-22393

Blackstone

Senior Floating Rate 2027 Term Fund

(exact

name of Registrant as specified in charter)

345

Park Avenue, 31st Floor

New

York, New York 10154

(Address

of principal executive offices) (Zip code)

(Name

and address of agent for service)

Marisa

Beeney

Blackstone

Alternative Credit Advisors LP

345

Park Avenue, 31st Floor

New

York, New York 10154

Registrant’s

telephone number, including area code: (877) 876-1121

Date

of fiscal year end: December 31

Date

of reporting period: June 30, 2024

Item

1. Report to Stockholders.

Table

of Contents

| Manager Commentary |

2 |

| Fund Summary |

4 |

| Portfolio of Investments |

13 |

| Statements of Assets and Liabilities |

72 |

| Statements of Operations |

73 |

| Statements of Changes in Net Assets |

74 |

| Statements of Cash Flows |

75 |

| Financial Highlights |

76 |

| Notes to Financial Statements |

86 |

| Summary of Dividend Reinvestment Plan |

103 |

| Additional Information |

104 |

| Privacy Procedures |

106 |

| Approval of Investment Advisory Agreement |

116 |

| Trustees & Officers |

120 |

| Blackstone Credit &

Insurance Funds |

Manager Commentary |

June

30, 2024 (Unaudited)

To

Our Shareholders:

Strong

market technicals, resilient fundamentals and the potential to earn historically elevated total returns ensured positive performance

across the US loan and high yield markets over the first half of 2024. Loans beat high yield, gaining 1.90% over the second quarter

and 4.38% over the first six months, with gains of 1.09% and 2.58%, respectively, for high yield.1 Both asset classes

outperformed investment grade bonds and US Treasuries, although lagged equites, and also lagged respective gains made through

the first half of 2023.2

A

generally supportive macroeconomic backdrop underpinned performance, as hopes for a potential soft landing replaced last year’s

recession concerns at the start of the year. As the quarter progressed, markets took their cue from economic growth, the continuous

stream of economic data releases and any sign that the U.S. Federal Reserve (the “Fed”) sufficiently subdued inflation

to ease restrictive monetary policy. Although inflation slowed through the second half of 2023, it turned sticky with a series

of upside surprises as 2024 got underway, despite the Fed holding base rates at their highest level in 22 years (5.25%-5.50%)

since July 2023.3 The prospect of delays to the Fed pivot, which may cause the economy to slow too quickly, sparked

greater rate volatility, which impacted fixed rate investment grade performance and high yield performance over the second quarter.4

Renewed disinflation and moderating growth toward the end of the first half of 2024 reinvigorated hopes for a Fed pivot

and the start of looser monetary conditions later this year.5

6-Month

Total Returns as of June 30, 2024

| US

Loans (Morningstar LSTA Leveraged Loan Index) |

4.40% |

| US High

Yield Bonds (Bloomberg High Yield US High Yield Index) |

2.58% |

| 3-month Treasury Bills (Bloomberg U.S. Treasury

Bellwethers: 3 Month) |

2.65% |

| 10-year Treasuries (Bloomberg U.S. Treasury

Bellwethers: 10 Year) |

-2.03% |

| US

Aggregate Bonds (Bloomberg U.S. Aggregate Index) |

-0.71% |

| US Investment Grade Bonds (Bloomberg U.S. Corporate

Investment Grade Index) |

-0.49% |

| Emerging

Markets (Bloomberg EM USD Aggregate Index) |

2.22% |

| US

Large Cap Equities (S&P 500® Index) |

15.29% |

Sources:

Bloomberg, Barclays, S&P/LCD

Past

Performance is no guarantee of future results. Index performance is shown for illustrative purposes only. You cannot invest directly

in an index.

Higher

base rates ensured coupon-clipping or “carry” was the primary driver of returns across credit markets over the first

half of 2024, fueling demand, which pushed credit spreads close to the lowest levels recorded.6 Strong appetite lifted

average loan prices to an annual high of $97 in May, continuing the rally underway since November 2023.7 The percentage

of the loan market priced above par topped 60% in May, a high since 20188— triggering a record $372 billion repricing

wave.9 Meanwhile, the high yield Index yield-to-worst rose to the widest levels so far in 2024 of 8.3% post April CPI,

from 7.48% at the start of the year, before hovering along at ~8% for the rest of the first half of 2024.10

Loan

and high yield retail funds secured inflows—of $12 billion and $5.5 billion respectively—over the first half of 2024,

reversing the significant outflows over the same period in 2023.11 CLO creation, at just over $100 billion in the year-to-date

period, almost doubled issuance in the same period in 2023,12 although elevated redemption activity significantly reduced

net CLO supply and sent cash back to investors.13 Heavy demand from investors, including US and European banks and

insurance companies and Japanese banks, also drove CLO liability spreads lower.14

On

the other side of the technical ledger, capital markets reopened in earnest in 2024, and the subsequent heavy issuance pushed

high yield supply 79% ahead of last year, and institutional loan supply a hefty 182% ahead of last year.15 New money

supply remained scarce, but loan and high yield borrowers shored up balance sheets by cutting interest expense and bolstering

free cash flow through refinancings, repricings and by extending maturities as record pace.16 As a result, just $40

billion of loans are due to mature by the end of 2025, while $111 billion of high yield bonds are due in 2024-2025, down from

$159 billion at the start of 2024.17

Tightening

loan spreads enabled borrowers to refinance more expensive direct lending loans in the cheaper syndicated loan market. The market

refinanced $6.3 billion of privately placed second-lien debt with syndicated first-lien term loans in the first six months of

2024, compared to less than $400 million in the first six months of 2023.18

Headwinds

remain as we move into the second half of the year, including a more challenging fundamental backdrop due to slower growth, higher

rates and the potential for ongoing volatility, as well as the US presidential election in November, and other geopolitical concerns.

Corporate

fundamentals have weakened but remain resilient due to earnings growth and refinancing/repricing efforts. Credit defaults have

mostly been confined to idiosyncratic situations and remain close to the long-term averages.19 Liability management

exercises remain elevated, and their potential to erode value for investors is something we continue to monitor closely.20

We

expect appetite for CCC-rated assets to remain limited and very credit specific in this tougher environment,21 but

believe that managers able to target cash-flow-positive credits in sectors that are more resilient through the cycle can seek

safer yield in leveraged finance markets and avoid secularly challenged CCCs.22 Managers may also have the opportunity

to differentiate themselves through this period of increased credit and performance dispersion.

| 2 |

www.blackstone-credit.com |

| Blackstone Credit & Insurance

Funds |

Manager

Commentary |

June

30, 2024 (Unaudited)

We

believe that moderating growth and ongoing disinflation should provide the Fed with air cover to finally bring rates down. Lower

rates are likely to reduce the cost of capital for corporate borrowers, alleviating the pressure on those more highly levered

entities, setting up a supportive environment for risk assets, in our view.

At

Blackstone Credit & Insurance, we value your continued investment and confidence in us and in our family of funds. Additional

information about our funds is available on our website at www.blackstone-credit.com.

Sincerely,

Blackstone

Liquid Credit Strategies LLC

All

figures are approximate and as of June 30, 2024, unless otherwise indicated. The words “we”, “us”, and

“our” refer to BSL, BGX and BGB, unless the context requires otherwise. In all other instances, including with respect

to current and forward-looking views and opinions of the market and BSL, BGX and BGB 's portfolio and performance positioning,

these terms refer to BSL’s, BGX’s and BGB’s adviser, Blackstone Liquid Credit Strategies LLC.

Certain

information contained in this communication constitutes “forward-looking statements” within the meaning of the federal

securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by

the use of forward-looking terminology, such as “outlook,” “indicator,” “believes,” “expects,”

“potential,” “continues,” “may,” “can,” “will,” “should,”

“seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,”

“anticipates”, “confident,” “conviction,” “identified” or the negative versions

of these words or other comparable words thereof. These may include BSL’s, BGX’s and BGB’s financial estimates

and their underlying assumptions, statements about plans, objectives and expectations with respect to future operations, statements

regarding future performance, statements regarding economic and market trends and statements regarding identified but not yet

closed investments. Such forward-looking statements are inherently uncertain and there are or may be important factors that could

cause actual outcomes or results to differ materially from those indicated in such statements. BSL, BGX and BGB believe these

factors include but are not limited to those described under the section entitled “Risk Factors” in their prospectuses

and annual reports for the most recent fiscal year, and any such updated factors included in their periodic filings with the Securities

and Exchange Commission (the “SEC”), which are accessible on the SEC’s website at www.sec.gov. These factors

should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included

in this document (or BSL’s, BGX’s and BGB’s prospectus and other filings). Except as otherwise required by federal

securities laws, BSL, BGX and BGB undertake no obligation to publicly update or revise any forward-looking statements, whether

as a result of new information, future developments or otherwise.

| 1 | Morningstar

LSTA Leveraged Loan Index, Bloomberg High Yield Index, as of June 30, 2024. |

| 2 | BBG

S&P 500 Index, Morningstar LSTA Leveraged Loan Index, Bloomberg High Yield Index,

Bloomberg US Corporate Index, as of June 30, 2024, and as of June 30, 2023. |

| 3 | BBC

News, Fed raises interest rates to highest in 22 years, as of July 26, 2024. |

| 4 | Bloomberg

High Yield Index, Bloomberg US Corporate Index, as of June 30, 2024. |

| 5 | BXCI

Views and Beliefs, as of June 2024. |

| 6 | BBG

US HY Index and US Corporate IG Index, as of June 30, 2024. |

| 7 | Morningstar

LSTA Leveraged Loan Index, Bloomberg High Yield Index, as of June 30, 2024. |

| 8 | Morningstar

LSTA US Loan Index, as of May 31, 2024. |

| 9 | Pitchbook

LCD data, as of June 25, 2024. (Q2 US Leveraged Loan Market Wrap: Demand surges, leading

to record activity, as of June 26, 2024.) |

| 10 | BBG

HY Corporate Index, as of June 30, 2024. |

| 11 | JP

Morgan High Yield and Leveraged Loan Morning Intelligence, as of June 28, 2024. |

| 12 | Pitchbook

LCD CLO Data, as of June 25, 2024. |

| 13 | Pitchbook

LCD, Q2 US CLO Wrap: Tailwinds strengthen as market sets record pace of new issuance,

as of June 27, 2024. |

| 14 | Pitchbook

LCD, Q2 US CLO Wrap: Tailwinds strengthen as market sets record pace of new issuance,

as of June 27, 2024. |

| 15 | Pitchbook

LCD data, as of June 30, 2024. |

| 16 | Pitchbook

LCD, Q2 US Leveraged Loan Market Wrap, as of June 26, 2024. Barclays CLO Research, as

of June 21, 2024. |

| 17 | Pitchbook

LCD, Q2 US Leveraged Loan Market Wrap, as of June 26, 2024. |

| 18 | Pitchbook

LCD, Q2 Private Credit Wrap: Lenders strengthen defences against refi, repricing wave,

as of June 20, 2024. |

| 19 | JP

Morgan Default Monitor, as of June 3, 2024. |

| 20 | JP

Morgan Mid-Year Outlook, as of May 26, 2024. |

| 21 | Fed

dot plot, BBG US High Yield Corporate Index, as of June 30, 2024. |

| 22 | BXCI

Views and Beliefs, as of June 2024. JP Morgan Default Monitor, as of August 1, 2024.

Pitchbook LCD, Quick Take: Lower-rated loans fare worst in Monday's market plunge, as

of August 7, 2024. |

| Semi-Annual

Report | June 30, 2024 |

3 |

| Blackstone

Senior Floating Rate 2027 Term Fund |

Fund

Summary |

June

30, 2024 (Unaudited)

Blackstone

Senior Floating Rate 2027 Term Fund

Fund

Overview

Blackstone

Senior Floating Rate 2027 Term Fund (“BSL” or herein, the “Fund”) is a closed-end term fund that trades

on the New York Stock Exchange under the symbol “BSL”. BSL’s primary investment objective is to seek high current

income, with a secondary objective to seek preservation of capital, consistent with its primary goal of high current income. Under

normal market conditions, the Fund invests at least 80% of its Managed Assets in senior, secured floating rate loans (“Senior

Loans”). BSL may also invest in second-lien loans and high yield bonds and employs financial leverage, which may increase

risk to the Fund. The Fund has a limited term, and absent shareholder approval to extend the life of the Fund, the Fund will dissolve

on or about May 31, 2027.

Portfolio

Management Commentary

Fund

Performance

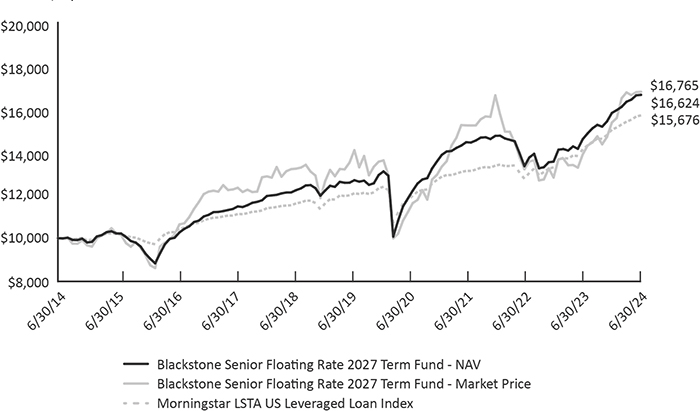

As

of June 30, 2024, BSL outperformed its benchmark, the Morningstar LSTA Leveraged Loan Index (“Morningstar LLI”), on

a Net Asset Value (“NAV”) per share basis for the six-month, one-year, five-year, ten-year, and since inception periods

and underperformed its benchmark for the three-year period. On a share price basis, the Fund underperformed its benchmark for

the three-year, five-year, and since inception periods. The shares of the Fund traded at an average discount to NAV of 5.2% for

the six months ended June 30, 2024, compared to its peer group average discount of 3.4% over the same period.

NAV

Performance Factors

The

Fund’s outperformance relative to the benchmark for the six months ended June 30, 2024 was primarily attributable to the

Fund’s leverage and credit selection within the Fund’s loan allocation. The Fund’s allocation to CLO securities

also contributed to the Fund’s outperformance for the period. By issuer, the largest positive contributors to performance

were Global Medical Response Inc, Radiology Partners Inc, and Covenant Surgical Partners Inc. The most significant detractors

were Atlas CC Acquisition Corp, Magenta Buyer LLC, and Ivanti Software Inc.

Portfolio

Activity and Positioning

During

the period, we continued to dynamically manage the Fund. The Fund’s largest sector overweights were financial services,

commercial & professional services, and capital goods; the largest sector underweights included materials, media & entertainment,

and consumer discretionary & retail. The Fund’s asset allocation remained stable during the period.

| 4 |

www.blackstone-credit.com |

| Blackstone Senior Floating

Rate 2027 Term Fund |

Fund Summary |

June

30, 2024 (Unaudited)

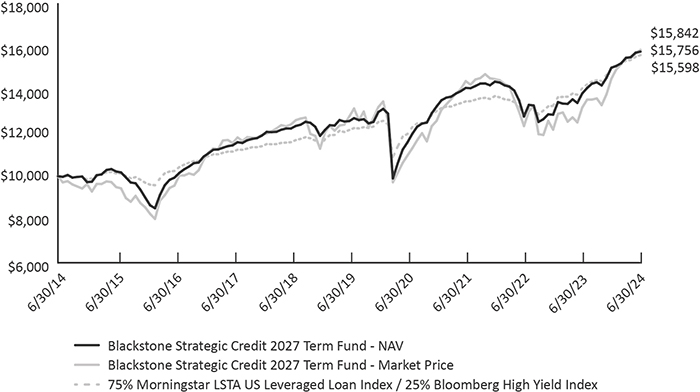

Performance

Summary

Performance

quoted represents past performance, which may be higher or lower than current performance. Past performance is not indicative

of future results. The returns shown do not reflect taxes that an investor would pay on Fund distributions or on the sale of Fund

shares. To obtain the most recent month-end performance, visit www.blackstone-credit.com.

Value

of a $10,000 Investment

BSL

Total Return (as of June 30, 2024)

| |

6

Month |

1

Year |

3

Year |

5

Year |

10

Year |

Since

Inception |

| NAV* |

5.29%** |

14.04% |

4.82% |

5.76% |

5.21% |

5.72% |

| Market

Price* |

9.22% |

20.84% |

3.28% |

4.43% |

5.30% |

4.97% |

| Morningstar

LSTA US Leveraged Loan Index |

4.40% |

11.11% |

6.14% |

5.53% |

4.60% |

5.05% |

| * | NAV

is equal to the total assets attributable to common shareholders less liabilities divided by the number of common shares outstanding.

Market Price is the price at which a share can currently be traded in the market. Market Price is based on the close price at

4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times. Return assumes distributions

are reinvested pursuant to the Fund’s dividend reinvestment plan. Performance data quoted represents past performance and

does not guarantee future results. |

| ** | Excludes

adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset

value and total return for shareholder transactions reported to the market as of June 30, 2024 may differ from the net asset value

for financial reporting purposes. |

| Semi-Annual Report | June

30, 2024 |

5 |

| Blackstone Senior Floating

Rate 2027 Term Fund |

Fund Summary |

June

30, 2024 (Unaudited)

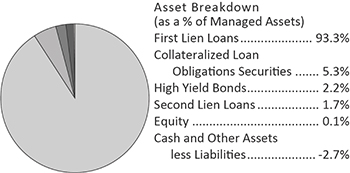

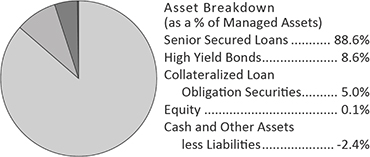

BSL’s

Portfolio Composition*

| * | Numbers

may not sum to 100.00% due to rounding. The Fund’s Cash and Other represents net

cash and other assets and liabilities, which includes amounts payable for investments

purchased but not yet settled and amounts receivable for investments sold but not yet

settled. At period end, the amounts payable for investments purchased but not yet settled

exceeded the amount of cash on hand. The Fund uses sales proceeds or funds from its leverage

program to settle amounts payable for investments purchased, but such amounts are not

reflected in the Fund’s net cash. |

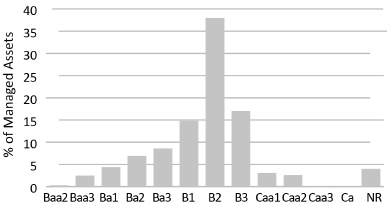

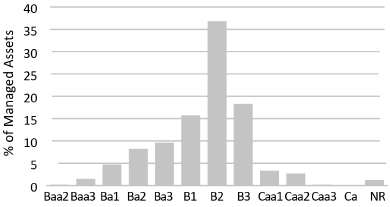

BSL’s

Moody’s Rating*

| * | For

more information on Moody's ratings and descriptions refer to https://ratings.moodys.io/ratings.

|

Portfolio

Characteristics

| Average

All-In Rate |

8.66% |

| Current Dividend Yield^ |

9.76% |

| Effective

Duration^^ |

0.19

yr |

| Average

Position* |

0.19% |

| Leverage* |

31.99% |

| ^ | Using current dividend rate of $0.114/share and market

price/share as of June 30, 2024. |

| ^^ | Loan

durations are based on the actual remaining time until the underlying base rate is reset for each individual loan. |

| * | As

a percentage of Managed Assets. |

Top

10 Issuers*

| Focus

Financial Partners LLC |

0.9% |

| Delta Topco Inc |

0.9% |

| Peraton

Corp. |

0.8% |

| Endurance International Group Holdings Inc |

0.8% |

| Trans

Union LLC |

0.7% |

| Bain

Capital Credit Clo, Limited |

0.7% |

| Genesee

& Wyoming Inc |

0.7% |

| Auris

Luxembourg III SARL |

0.7% |

| Cifc

Funding Ltd |

0.7% |

| Global

Medical Response |

0.7% |

| Top

10 Issuer |

7.6% |

| * | As

a percentage of Managed Assets. |

Portfolio

holdings and distributions are subject to change and are not recommendations to buy or sell any security.

Top

5 Industries*^

| Software |

12.5% |

| Professional Services |

8.5% |

| Financial

Services |

6.7% |

| Health

Care Providers & Services |

5.7% |

| Commercial

Services & Supplies |

5.0% |

| Top

5 Industries |

38.4% |

| * | As

a percentage of Managed Assets. |

| ^ | GICS

Industry Classification Schema. |

| 6 |

www.blackstone-credit.com |

| Blackstone Long-Short Credit

Income Fund |

Fund Summary |

June

30, 2024 (Unaudited)

Blackstone

Long-Short Credit Income Fund

Fund

Overview

Blackstone

Long Short Credit Income Fund (“BGX” or herein, the “Fund”) is a closed-end fund that trades on the

New York Stock Exchange under the symbol “BGX”. BGX’s primary investment objective is to provide current

income, with a secondary objective of capital appreciation. BGX will take long positions in investments which we believe

offer the potential for attractive returns under various economic and interest rate environments. BGX may also take short

positions in investments which we believe will under-perform due to a greater sensitivity to earnings growth of the issuer,

default risk or the general level and direction of interest rates. BGX must hold no less than 70% of its Managed Assets in

first- and second-lien secured loans (“Secured Loans”), but may also invest in unsecured loans and high yield

bonds.

Portfolio

Management Commentary

Fund

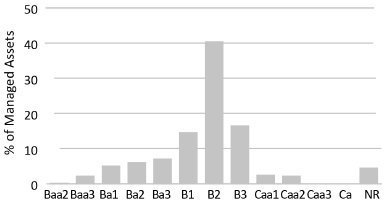

Performance

As

of June 30, 2024, BGX outperformed a composite weighting of the Morningstar LLI and the Bloomberg U.S. High Yield Index (“Bloomberg

HYI”) (85% loans, 15% high yield bonds) on a NAV per share basis for the six-month, one-year, five-year, ten-year, and since

inception periods and underperformed its benchmark for the three-year period. On a share price basis, the Fund underperformed

its benchmark for the three-year and five-year periods. The shares of the Fund traded at an average discount to NAV of 7.7% for

the six months ended June 30, 2024, compared to its peer group average discount of 3.5% over the same period.

NAV

Performance Factors

The

Fund’s outperformance relative to the benchmark for the six months ended June 30, 2024 was primarily attributable to the

Fund’s leverage and credit selection within the Fund’s loan allocation. The Fund’s allocation to CLO securities

also contributed to the Fund’s outperformance for the period. By issuer, the largest positive contributors to performance

were Global Medical Response, Radiology Partners Inc, and Covenant Surgical Partners Inc. The most significant detractors were

Atlas CC Acquisition Corp, Magenta Buyer LLC, and Carestream Health Holdings Inc.

Portfolio

Activity and Positioning

During

the period, we continued to dynamically manage the Fund. The Fund’s largest sector overweights were financial services,

commercial & professional services, and capital goods; the largest sector underweights included media & entertainment,

materials, and energy. The Fund’s asset allocation remained stable during the period.

| Semi-Annual Report | June

30, 2024 |

7 |

| Blackstone Long-Short Credit

Income Fund |

Fund Summary |

June

30, 2024 (Unaudited)

Performance

Summary

Performance

quoted represents past performance, which may be higher or lower than current performance. Past performance is not indicative

of future results. The returns shown do not reflect taxes that an investor would pay on Fund distributions or on the sale of Fund

shares. To obtain the most recent month-end performance, visit www.blackstone-credit.com.

Value

of a $10,000 Investment

BGX

Total Return (as of June 30, 2024)

| |

6

Month |

1

Year |

3

Year |

5

Year |

10

Year |

Since

Inception |

| NAV* |

5.39%** |

14.32% |

4.00% |

5.53% |

5.41% |

5.82% |

| Market

Price* |

13.21% |

21.91% |

2.67% |

4.54% |

5.46% |

4.94% |

| 70% Morningstar LSTA US LLI / 30% Bloomberg

U.S. HYI |

3.86% |

10.94% |

4.82% |

5.07% |

4.53% |

4.97% |

| 85% Morningstar LLI / 15% Bloomberg HYI*** |

4.13% |

11.03% |

5.48% |

5.30% |

4.57% |

4.83% |

| * | NAV

is equal to the total assets attributable to common shareholders less liabilities divided by the number of common shares outstanding.

Market Price is the price at which a share can currently be traded in the market. Market Price is based on the close price at

4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times. Return assumes distributions

are reinvested pursuant to the Fund’s dividend reinvestment plan. Performance data quoted represents past performance and

does not guarantee future results. |

| ** | Excludes

adjustments in accordance with accounting principles generally accepted in the United

States of America and as such, the net asset value and total return for shareholder transactions

reported to the market as of June 30, 2024 may differ from the net asset value for financial

reporting purposes. |

| *** | Effective

June 1, 2023, BGX changed its benchmark from a composite weighting of the Morningstar

LLI and the Bloomberg U.S. High Yield Index (“Bloomberg HYI”) (70% loans,

30% high yield bonds) to a composite weighting of the Morningstar LLI and the Bloomberg

HYI (85% loans, 15% high yield bonds) in order to reflect the midpoint of the Fund’s

possible exposure to high yield bond investments, rather than the maximum level. |

| 8 |

www.blackstone-credit.com |

| Blackstone Long-Short Credit

Income Fund |

Fund Summary |

June

30, 2024 (Unaudited)

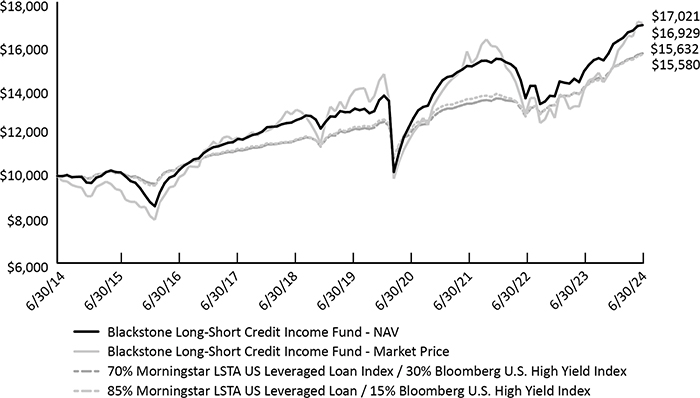

BGX’s

Portfolio Composition*

| * | Numbers

may not sum to 100.00% due to rounding. The Fund’s Cash and Other represents net

cash and other assets and liabilities, which includes amounts payable for investments

purchased but not yet settled and amounts receivable for investments sold but not yet

settled. At period end, the amounts payable for investments purchased but not yet settled

exceeded the amount of cash on hand. The Fund uses sales proceeds or funds from its leverage

program to settle amounts payable for investments purchased, but such amounts are not

reflected in the Fund’s net cash. |

BGX’s

Moody’s Rating Distribution*

| * | For

more information on Moody's ratings and descriptions refer to https://ratings.moodys.io/ratings.

|

Portfolio

Characteristics

| Average

All-In Rate |

8.54% |

| Current Dividend Yield^ |

10.14% |

| Effective

Duration^^ |

0.40

yr |

| Average

Position* |

0.20% |

| Leverage* |

31.95% |

| ^ | Using current dividend rate of $0.105/share and market

price/share as of June 30, 2024. |

| ^^ | Loan

durations are based on the actual remaining time until the underlying base rate is reset for each individual loan. |

| * | As

a percentage of Managed Assets. |

Top

10 Issuers*

| Clover

Clo |

0.8% |

| Peraton

Corp. |

0.8% |

| Focus

Financial Partners LLC |

0.8% |

| Allied Universal Holdco LLC |

0.8% |

| LTI

Holdings, Inc. |

0.8% |

| Genuine

Financial Holdings LLC |

0.7% |

| Genesee

& Wyoming Inc |

0.7% |

| Cotiviti

Corporation |

0.7% |

| First

Brands Group LLC |

0.7% |

| Citco

Funding LLC |

0.7% |

| Top

10 Issuer |

7.5% |

| * | As

a percentage of Managed Assets. |

Portfolio

holdings and distributions are subject to change and are not recommendations to buy or sell any security.

Top

5 Industries*^

| Software |

11.0% |

| Professional Services |

7.4% |

| Financial

Services |

6.4% |

| Health

Care Providers & Services |

5.9% |

| Commercial

Services & Supplies |

4.8% |

| Top

5 Industries |

35.5% |

| * | As

a percentage of Managed Assets. |

| ^ | GICS

Industry Classification Schema. |

| Semi-Annual Report | June

30, 2024 |

9 |

| Blackstone Strategic Credit

2027 Term Fund |

Fund Summary |

June

30, 2024 (Unaudited)

Blackstone

Strategic Credit 2027 Term Fund

Fund

Overview

Blackstone

Strategic Credit 2027 Term Fund (“BGB” or herein, the “Fund”) is a closed-end term fund that trades on

the New York Stock Exchange under the symbol “BGB”. BGB’s primary investment objective is to seek high current

income, with a secondary objective to seek preservation of capital, consistent with its primary goal of high current income. BGB

invests primarily in a diversified portfolio of loans and other fixed income instruments of predominantly U.S. corporate issuers,

including first- and second-lien loans (“Senior Secured Loans”) and high yield corporate bonds of varying maturities.

BGB must hold no less than 80% of its Managed Assets in credit investments comprised of corporate fixed income instruments and

other investments (including derivatives) with similar economic characteristics. The Fund has a limited term and will dissolve

on or about September 15, 2027, absent shareholder approval to extend such term.

Portfolio

Management Commentary

Fund

Performance

As

of June 30, 2024, BGB outperformed a composite weighting of the Morningstar LLI and the Bloomberg HYI (75% loans, 25% high yield

bonds) on a NAV per share basis for the six-month, one-year, ten-year, and since inception periods and underperformed its benchmark

for the three-year and five-year periods. On a share price basis, the Fund underperformed for the three-year, five-year, and since

inception periods. The shares of the Fund traded at an average discount to NAV of 7.6% for the six months ended June 30, 2024,

compared to its peer group average discount of 3.5% over the same period.

NAV

Performance Factors

The

Fund’s outperformance relative to the benchmark for the six months ended June 30, 2024 was primarily attributable to the

Fund’s leverage and credit selection within the Fund’s loan allocation. The Fund’s credit selection within its

high yield bond allocation also contributed to the Fund’s outperformance for the period. By issuer, the largest positive

contributors to performance were Global Medical Response Inc, Radiology partners Inc, and Covenant Surgical Partners Inc. The

most significant detractors were Atlas CC Acquisition Corp, Magenta Buyer LLC, and CSC Holdings LLC.

Portfolio

Activity and Positioning

During

the period, we continued to dynamically manage the Fund. The Fund’s largest sector overweights were commercial & professional

services, capital goods, and financial services; the largest sector underweights included materials, media & entertainment,

and consumer services. The Fund’s asset allocation remained stable during the period.

| 10 |

www.blackstone-credit.com |

| Blackstone Strategic Credit

2027 Term Fund |

Fund Summary |

June

30, 2024 (Unaudited)

Performance

Summary

Performance

quoted represents past performance, which may be higher or lower than current performance. Past performance is not indicative

of future results. The returns shown do not reflect taxes that an investor would pay on Fund distributions or on the sale of Fund

shares. To obtain the most recent month-end performance, visit www.blackstone-credit.com.

Value

of a $10,000 Investment

BGB

Total Return (as of June 30, 2024)

| |

6

Month |

1

Year |

3

Year |

5

Year |

10

Year |

Since

Inception |

| NAV* |

4.95%** |

13.97% |

3.82% |

4.66% |

4.65% |

5.09% |

| Market

Price* |

9.28% |

20.29% |

3.26% |

4.44% |

4.71% |

4.05% |

| 75% Morningstar

LSTA US LLI / 25% Bloomberg HYI |

3.95% |

10.97% |

5.04% |

5.15% |

4.55% |

4.80% |

| * | NAV

is equal to the total assets attributable to common shareholders less liabilities divided by the number of common shares outstanding.

Market Price is the price at which a share can currently be traded in the market. Market Price is based on the close price at

4 p.m. ET and does not represent the returns an investor would receive if shares were traded at other times. Return assumes distributions

are reinvested pursuant to the Fund’s dividend reinvestment plan. Performance data quoted represents past performance and

does not guarantee future results. |

| ** | Excludes

adjustments in accordance with accounting principles generally accepted in the United States of America and as such, the net asset

value and total return for shareholder transactions reported to the market as of June 30, 2024 may differ from the net asset value

for financial reporting purposes. |

| Semi-Annual Report | June

30, 2024 |

11 |

| Blackstone Strategic Credit

2027 Term Fund |

Fund Summary |

June

30, 2024 (Unaudited)

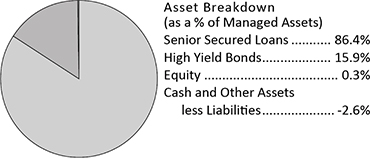

BGB’s

Portfolio Composition*

| * | Numbers

may not sum to 100.00% due to rounding. The Fund’s Cash and Other represents net cash and other assets and liabilities,

which includes amounts payable for investments purchased but not yet settled and amounts receivable for investments sold but not

yet settled. At period end, the amounts payable for investments purchased but not yet settled exceeded the amount of cash on hand.

The Fund uses sales proceeds or funds from its leverage program to settle amounts payable for investments purchased, but such

amounts are not reflected in the Fund’s net cash. |

BGB’s

Moody’s Rating Distribution*

| * | For

more information on Moody's ratings and descriptions refer to https://ratings.moodys.io/ratings. |

Portfolio

Characteristics

| Average All-In

Rate |

8.18% |

| Current Dividend Yield^ |

10.19% |

| Effective

Duration^^ |

0.62

yr |

| Average Position* |

0.19% |

| Leverage* |

37.08% |

| ^ | Using current dividend rate of $0.101/share and market

price/share as of June 30, 2024. |

| ^^ | Loan

durations are based on the actual remaining time until the underlying base rate is reset for each individual loan. |

| * | As

a percentage of Managed Assets. |

Top

10 Issuers*

| Peraton

Corp. |

0.8% |

| Caesars Entertain Inc |

0.7% |

| Trans

Union LLC |

0.7% |

| Genesee

& Wyoming Inc |

0.7% |

| Cotiviti

Corporation |

0.7% |

| Genuine

Financial Holdings LLC |

0.7% |

| Focus

Financial Partners LLC |

0.7% |

| LTI Holdings,

Inc. |

0.7% |

| Pro Mach

Group, Inc. |

0.7% |

| Transdigm

Inc |

0.7% |

| Top

10 Issuer |

7.1% |

| * | As

a percentage of Managed Assets. |

Portfolio

holdings and distributions are subject to change and are not recommendations to buy or sell any security.

Top

5 Industries*^

| Software |

10.5% |

| Professional

Services |

7.7% |

| Health Care Providers & Services |

5.9% |

| Commercial

Services & Supplies |

4.5% |

| Hotels,

Restaurants & Leisure |

4.4% |

| Top

5 Industries |

33.0% |

| * | As

a percentage of Managed Assets. |

| ^ | GICS

Industry Classification Schema. |

| 12 |

www.blackstone-credit.com |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

June

30, 2024 (Unaudited)

| | |

Principal

Amount | | |

Value | |

| FLOATING RATE LOAN INTERESTS(a) - 139.78% | |

| | | |

| | |

| Aerospace & Defense - 4.50% | |

| | | |

| | |

| Atlas CC Acquisition Corp., First Lien B Term Loan, 3M CME TERM SOFR + 4.25%, 0.75% Floor, 05/25/2028 | |

$ | 1,331,077 | | |

$ | 987,400 | |

| Atlas CC Acquisition Corp., First Lien C Term Loan, 3M CME TERM SOFR + 4.25%, 0.75% Floor, 05/25/2028 | |

| 270,032 | | |

| 200,311 | |

| Dynasty Acquisition Co Inc., First Lien Term Loan, 1M US SOFR + 3.50%, 08/24/2028 | |

| 162,911 | | |

| 163,688 | |

| Nordam Group LLC, First Lien Initial Term Loan, 1M US SOFR + 5.50%, 04/09/2026 | |

| 1,667,600 | | |

| 1,609,234 | |

| Novaria Holdings, LLC, First Lien Term Loan, 1M US SOFR + 4.25%, 06/05/2031(b) | |

| 547,222 | | |

| 551,326 | |

| Peraton Corp., First Lien B Term Loan, 1M US SOFR + 3.75%, 0.75% Floor, 02/01/2028 | |

| 2,269,683 | | |

| 2,272,690 | |

| Standard Aero, Ltd., First Lien Term Loan, 1M US SOFR + 3.50%, 08/24/2028 | |

| 62,814 | | |

| 63,114 | |

| TransDigm, Inc., First Lien Term Loan, 3M CME TERM SOFR + 3.25%, 02/28/2031 | |

| 1,509,172 | | |

| 1,514,077 | |

| Vertex Aerospace Corp., First Lien Term Loan, 1M US SOFR + 2.75%, 12/06/2030 | |

| 849,993 | | |

| 852,042 | |

| World Wide Technology Holding Co LLC, First Lien Term Loan, 3M CME TERM SOFR + 3.50%, 0.50%

Floor, 04/21/2031 | |

| 445,386 | | |

| 448,170 | |

| | |

| | | |

| 8,662,052 | |

| | |

| | | |

| | |

| Air Freight & Logistics - 2.20% | |

| | | |

| | |

| ASP LS Acquisition Corp., First Lien Term Loan, 3M CME TERM SOFR + 4.50%, 0.75% Floor, 05/07/2028 | |

| 482,595 | | |

| 412,554 | |

| Clue Opco LLC, First Lien Term Loan, 3M CME TERM SOFR + 4.50%, 12/19/2030 | |

| 1,188,978 | | |

| 1,111,843 | |

| Rinchem Company, Inc., First Lien Term Loan, 3M CME TERM SOFR + 4.25%, 03/02/2029 | |

| 1,349,677 | | |

| 1,169,252 | |

| Savage Enterprises LLC, First Lien Term Loan, 3M US L + 3.25%, 0.50% Floor, 09/15/2028 | |

| 592,689 | | |

| 594,775 | |

| WWEX UNI TopCo Holdings LLC, First Lien Initial Term Loan, 3M CME TERM SOFR + 4.00%, 0.75% Floor, 07/26/2028 | |

| 946,812 | | |

| 950,741 | |

| | |

| | | |

| 4,239,165 | |

| | |

| | | |

| | |

| Automobile Components - 2.34% | |

| | | |

| | |

| Belron Finance US LLC, First Lien Term Loan, 3M CME TERM SOFR + 2.25%, 0.50% Floor, 04/18/2029 | |

| 361,249 | | |

| 362,528 | |

| Clarios Glob LP, First Lien Term Loan, 6M CME TERM SOFR + 2.75%, 06/05/2030 | |

| 1,402,650 | | |

| 1,407,692 | |

| First Brands Group LLC, First Lien Term Loan, 3M CME TERM SOFR + 5.00%, 1.00% Floor, 03/30/2027 | |

| 1,095,531 | | |

| 1,090,738 | |

| First Brands Group, LLC, First Lien 2018 New Tranche E Term Loan, 3M CME TERM SOFR + 5.00%, 03/30/2027 | |

| 797,095 | | |

| 793,237 | |

| LTI Holdings, Inc., First Lien Term Loan, 1M US SOFR + 4.75%, 07/24/2026 | |

| 411,906 | | |

| 408,277 | |

| LTI Holdings, Inc., Second Lien Initial Term Loan, 1M US SOFR + 6.75%, 09/06/2026 | |

| 468,085 | | |

| 444,096 | |

| | |

| | | |

| 4,506,568 | |

| | |

| | | |

| | |

| Beverages - 0.64% | |

| | | |

| | |

| Triton Water Holdings, Inc., First Lien Initial Term Loan, 3M CME TERM SOFR + 3.25%, 0.50% Floor, 03/31/2028 | |

| 1,226,544 | | |

| 1,228,384 | |

| | |

| | | |

| | |

| Biotechnology - 0.94% | |

| | | |

| | |

| Grifols Worldwide Operations, First Lien Term Loan, 1M US SOFR + 2.00%, 11/15/2027 | |

| 1,836,439 | | |

| 1,808,893 | |

| | |

| | | |

| | |

| Broadline Retail - 0.20% | |

| | | |

| | |

| Peer Hldg III BV, First Lien Term Loan, 6M CME TERM SOFR + 3.00%, 06/23/2031 | |

| 381,229 | | |

| 382,103 | |

| | |

| | | |

| | |

| Building Products - 3.62% | |

| | | |

| | |

| Gulfside Supply Inc, First Lien Term Loan, 6M CME TERM SOFR + 3.50%, 05/29/2031(b) | |

| 262,418 | | |

| 262,910 | |

| LBM Acquisition LLC, First Lien Term Loan, 1M US SOFR + 3.75%, 05/30/2031 | |

| 1,484,336 | | |

| 1,461,551 | |

| LHS Borrower, LLC, First Lien Term Loan, 1M US SOFR + 4.75%, 0.50% Floor, 02/16/2029 | |

| 816,918 | | |

| 775,255 | |

| Miter Brands Acquisition Holdco Inc., First Lien Term Loan, 1M US SOFR + 3.50%, 03/28/2031 | |

| 964,311 | | |

| 971,346 | |

See

Notes to Financial Statements.

| Semi-Annual Report | June

30, 2024 |

13 |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

June

30, 2024 (Unaudited)

| | |

Principal

Amount | | |

Value | |

| Building Products (continued) | |

| | |

| |

| Oscar Acquisitionco LLC, First Lien Term Loan, 3M CME TERM SOFR + 4.25%, 0.50% Floor, 04/29/2029 | |

$ | 1,104,946 | | |

$ | 1,105,725 | |

| Resideo Funding Inc, First Lien Term Loan, 6M CME TERM SOFR + 2.25%, 06/13/2031 | |

| 151,862 | | |

| 151,863 | |

| Tailwind Smith Cooper Intermediate Corp., First Lien Initial Term Loan, 3M CME TERM SOFR + 5.00%, 05/28/2026 | |

| 1,458,624 | | |

| 1,459,536 | |

| Trulite Holding Corp., First Lien Term Loan, 1M US SOFR + 6.00%, 03/01/2030 | |

| 799,298 | | |

| 777,317 | |

| | |

| | | |

| 6,965,503 | |

| | |

| | | |

| | |

| Capital Markets - 5.79% | |

| | | |

| | |

| Apex Group Treasury, Ltd., First Lien USD Term Loan, 3M CME TERM SOFR + 3.75%, 0.50% Floor, 07/27/2028 | |

| 1,436,153 | | |

| 1,439,744 | |

| AssetMark 6/24 TLB 1L, First Lien Term Loan, 6M CME TERM SOFR + 3.25%, 06/03/2031 | |

| 609,074 | | |

| 610,216 | |

| Cetera Financial 5/24 TLB 1L, First Lien Term Loan, 3M CME TERM SOFR + 9.34%, 08/09/2030 | |

| 1,596,407 | | |

| 1,604,557 | |

| Citadel Securities LP, First Lien Term Loan, 1M US SOFR + 2.25%, 07/29/2030 | |

| 435,195 | | |

| 436,936 | |

| CITCO FDG LLC, First Lien Term Loan, 3M CME TERM SOFR + 2.75%, 04/27/2028 | |

| 1,930,650 | | |

| 1,939,502 | |

| CPI Holdco B LLC, First Lien Term Loan, 1M US SOFR + 2.00%, 05/17/2031 | |

| 507,229 | | |

| 507,310 | |

| Edelman Financial Engines Center LLC, First Lien Term Loan, 1M US SOFR + 3.25%, 04/07/2028 | |

| 60,900 | | |

| 61,057 | |

| Focus Financial Partners LLC, First Lien Term Loan, 1M US SOFR + 2.50%, 0.50% Floor, 06/30/2028 | |

| 1,968,304 | | |

| 1,968,766 | |

| Focus Financial Partners, LLC, First Lien Term Loan, 1M US SOFR + 2.75%, 06/30/2028 | |

| 534,741 | | |

| 534,819 | |

| Kestra Advisor Services Holdings A INC, First Lien Term Loan, 1M US SOFR + 4.00%, 03/22/2031 | |

| 610,720 | | |

| 613,697 | |

| Osaic Holdings Inc aka Advisor Group, First Lien Term Loan, 1M US SOFR + 4.00%, 08/17/2028 | |

| 1,424,594 | | |

| 1,430,741 | |

| | |

| | | |

| 11,147,345 | |

| | |

| | | |

| | |

| Chemicals - 2.35% | |

| | | |

| | |

| CI Maroon Holdings LLC, First Lien Term Loan, 3M CME TERM SOFR + 4.00%, 03/01/2031 | |

| 369,000 | | |

| 371,306 | |

| Ecovyst Catalyst Technologies LLC, First Lien Term Loan, 6M CME TERM SOFR + 2.25%, 06/12/2031 | |

| 1,631,438 | | |

| 1,633,037 | |

| Geon Performance Solutions LLC, First Lien Term Loan, 3M CME TERM SOFR + 4.25%, 0.75% Floor, 08/18/2028 | |

| 1,136,361 | | |

| 1,142,759 | |

| Nouryon USA Ltarfruit US TLB 1L, First Lien Term Loan, 3M CME TERM SOFR + 3.50%, 04/03/2028 | |

| 942,875 | | |

| 946,529 | |

| Starfruit US Holdco LLC TLB 1L, First Lien Term Loan, 3M CME TERM SOFR + 3.50%, 04/03/2028 | |

| 422,340 | | |

| 424,980 | |

| | |

| | | |

| 4,518,611 | |

| | |

| | | |

| | |

| Commercial Services & Supplies - 7.34% | |

| | | |

| | |

| Action Environmental Group, Inc., First Lien Term Loan: | |

| | | |

| | |

| 3M CME TERM SOFR + 4.00%, 0.50% Floor, 10/24/2030(b) | |

| 1,249,416 | | |

| 1,258,786 | |

| 6M CME TERM SOFR + 4.00%, 0.50% Floor, 10/24/2030(b) | |

| 92,430 | | |

| 93,123 | |

| 6M CME TERM SOFR + 4.00%, 0.50% Floor, 10/24/2030(b) | |

| 123,240 | | |

| 124,165 | |

| Allied Universal Holdco LLC, First Lien Initial U.S. Dollar Term Loan, 1M US SOFR + 3.75%, 0.50% Floor, 05/12/2028 | |

| 1,496,154 | | |

| 1,492,092 | |

| Aramark Intermediate HoldCo Corp., First Lien U.S. B-4 Term Loan, 1M US SOFR + 1.75%, 01/15/2027 | |

| 700,000 | | |

| 700,788 | |

| Belfor Holdings, Inc., First Lien Term Loan, 1M US SOFR + 3.75%, 0.50% Floor, 11/01/2030 | |

| 276,889 | | |

| 278,966 | |

| Equiniti Group PLC, First Lien Term Loan, 6M CME TERM SOFR + 4.50%, 12/11/2028 | |

| 1,465,385 | | |

| 1,473,628 | |

| Garda World Security Corp., First Lien Term Loan, 3M CME TERM SOFR + 4.25%, 02/01/2029 | |

| 1,805,846 | | |

| 1,819,389 | |

| GFL Environmental, Inc., First Lien Term Loan, 6M US L + 0.00%, 0.50% Floor, 06/27/2031(b) | |

| 163,333 | | |

| 163,742 | |

| Justrite Safety Group, First Lien Delayed Draw Term Loan, 1M US SOFR + 4.50%, 06/28/2026 | |

| 73,695 | | |

| 73,742 | |

| Justrite Safety Group, First Lien Initial Term Loan, 1M US SOFR + 4.50%, 06/28/2026 | |

| 1,363,125 | | |

| 1,363,984 | |

See

Notes to Financial Statements.

| 14 |

www.blackstone-credit.com |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

June

30, 2024 (Unaudited)

| | |

Principal

Amount | | |

Value | |

| Commercial Services & Supplies (continued) | |

| | |

| |

| Omnia Partners, LLC, First Lien Term Loan, L + 3.75%, 07/25/2030 | |

$ | 1,557,039 | | |

$ | 1,559,709 | |

| Prime Sec Services Borrower LLC, TL, First Lien Term Loan, 3M CME TERM SOFR + 2.25%, 10/13/2030 | |

| 1,212,153 | | |

| 1,213,002 | |

| Strategic Materials Holding Corp., Second Lien Initial Term Loan, 3M CME TERM SOFR + 7.75%, 1.00% Floor, 10/31/2025(b) | |

| 800,000 | | |

| 16,000 | |

| TMF Sapphire US LLC aka TMF Group TLB 1L, First Lien Term Loan 05/03/2028 | |

| 289,455 | | |

$ | 290,586 | |

| TRC Companies, First Lien Term Loan, 1M US SOFR + 3.75%, 12/08/2028 | |

| 1,118,855 | | |

| 1,122,631 | |

| United Site Cov-Lite, First Lien Term Loan, 3M CME TERM SOFR + 4.25%, 12/15/2028 | |

| 1,068,493 | | |

| 715,297 | |

| Vestis Corp, First Lien Term Loan, 3M CME TERM SOFR + 2.25%, 02/22/2031 | |

| 374,063 | | |

| 372,738 | |

| | |

| | | |

| 14,132,368 | |

| | |

| | | |

| | |

| Communications Equipment - 0.05% | |

| | | |

| | |

| MLN US HoldCo LLC, First Lien B Term Loan, 3M CME TERM SOFR + 4.50%, 11/30/2025 | |

| 854,492 | | |

| 96,130 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Construction & Engineering - 2.12% | |

| | | |

| | |

| Amentum Government Services Holdings LLC, First Lien Term Loan, 1M US SOFR + 4.00%, 02/15/2029 | |

| 1,080,378 | | |

| 1,086,456 | |

| Artera Services LLC aka PowerTeam, First Lien Term Loan, 3M CME TERM SOFR + 4.50%, 02/15/2031 | |

| 307,522 | | |

| 309,525 | |

| Azuria Water Solutions Inc aka Aegion TLB 1L, First Lien Term Loan 05/17/2028 | |

| 1,420,703 | | |

| 1,428,190 | |

| Groundworks LLC, First Lien Term Loan: | |

| | | |

| | |

| 1M US SOFR + 3.50%, 03/14/2031 | |

| 544,898 | | |

| 545,238 | |

| 6M CME TERM SOFR + 4.00%, 03/14/2031(c) | |

| 5,516 | | |

| 5,519 | |

| Touchdown Acquirer Inc aka TenCate, First Lien Term Loan, 3M CME TERM SOFR + 4.00%, 02/21/2031 | |

| 401,639 | | |

| 404,024 | |

| Tutor Perini Corp., First Lien B Term Loan, 1M US SOFR + 4.75%, 1.00% Floor, 08/18/2027 | |

| 300,960 | | |

| 302,027 | |

| | |

| | | |

| 4,080,979 | |

| | |

| | | |

| | |

| Construction Materials - 1.01% | |

| | | |

| | |

| Quikrete Holdings, Inc., First Lien Term Loan, 1M US SOFR + 2.50%, 04/14/2031 | |

| 1,476,968 | | |

| 1,481,968 | |

| Summit Materials LLC, First Lien Term Loan, 3M CME TERM SOFR + 2.50%, 01/12/2029 | |

| 203,447 | | |

| 205,100 | |

| Tamko Building Products LLC, First Lien Term Loan, 1M US SOFR + 3.25%, 09/20/2030 | |

| 249,873 | | |

| 250,185 | |

| | |

| | | |

| 1,937,253 | |

| | |

| | | |

| | |

| Containers & Packaging - 2.84% | |

| | | |

| | |

| Altium Packaging LLC, First Lien Term Loan, 1M US SOFR + 2.50%, 06/11/2031 | |

| 131,250 | | |

| 131,250 | |

| Anchor Packaging LLC, First Lien Term Loan, 1M US SOFR + 3.75%, 07/18/2029 | |

| 414,000 | | |

| 414,813 | |

| Berlin Packaging LLC, First Lien Term Loan, 6M CME TERM SOFR + 4.00%, 06/07/2031 | |

| 575,620 | | |

| 577,583 | |

| ProAmpac PG Borrower LLC, First Lien Term Loan, 3M CME TERM SOFR + 4.00%, 0.75% Floor, 09/15/2028 | |

| 495,360 | | |

| 497,156 | |

| Reynolds Consumer Products LLC, First Lien Initial Term Loan, 1M US SOFR + 1.75%, 02/04/2027 | |

| 1,443,718 | | |

| 1,448,114 | |

| Supplyone 3/24, First Lien Term Loan, 6M CME TERM SOFR + 4.50%, 04/19/2031 | |

| 774,245 | | |

| 776,425 | |

| Trident TPI Holdings, Inc., First Lien Term Loan, 3M CME TERM SOFR + 9.33%, 0.50% Floor, 09/15/2028 | |

| 1,615,642 | | |

| 1,620,021 | |

| | |

| | | |

| 5,465,362 | |

| Distributors - 1.51% | |

| | | |

| | |

| Burgess Point Purchaser Corp., First Lien Term Loan, 1M US SOFR + 5.25%, 07/25/2029 | |

| 1,449,920 | | |

| 1,409,141 | |

| Johnstone Supply LLC, First Lien Term Loan, 3M CME TERM SOFR + 3.00%, 05/16/2031 | |

| 547,000 | | |

| 548,367 | |

| S&S Holdings LLC, First Lien Initial Term Loan, 1M US SOFR + 5.00%, 0.50% Floor, 03/11/2028 | |

| 959,055 | | |

| 961,453 | |

| | |

| | | |

| 2,918,961 | |

See

Notes to Financial Statements.

| Semi-Annual Report | June

30, 2024 |

15 |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

June

30, 2024 (Unaudited)

| | |

Principal

Amount | | |

Value | |

| Diversified Consumer Services - 3.15% | |

| | |

| |

| Cengage Learning, Inc., First Lien Term Loan, 6M CME TERM SOFR + 4.25%, 1.00% Floor, 03/24/2031 | |

$ | 804,974 | | |

$ | 808,246 | |

| Fugue Finance LLC aka Nord Anglia, First Lien Term Loan, 3M CME TERM SOFR + 3.75%, 02/26/2031 | |

| 340,095 | | |

| 343,369 | |

| Imagine Learning LLC, First Lien Term Loan, 1M US SOFR + 3.50%, 12/21/2029 | |

| 1,147,125 | | |

| 1,148,375 | |

| Loyalty Ventures, Inc., First Lien Term Loan, 3M Prime + 3.50%, 11/03/2027(b) | |

| 462,410 | | |

| 4,624 | |

| McKissock Investment Holdings, LLC, First Lien Term Loan, 3M CME TERM SOFR + 5.00%, 03/12/2029 | |

| 227,367 | | |

| 228,528 | |

| Mister Car Wash 3/24, First Lien Term Loan, 1M US SOFR + 3.00%, 03/27/2031 | |

| 379,673 | | |

| 381,266 | |

| Spring Education Group, Inc., First Lien Term Loan, 3M CME TERM SOFR + 4.00%, 10/04/2030 | |

| 850,400 | | |

| 855,626 | |

| St. George's University Scholastic Services LLC, First Lien Term Loan B Term Loan, 1M US SOFR + 2.75%, 0.50% Floor, 02/10/2029 | |

| 1,030,176 | | |

| 1,030,820 | |

| TruGreen LP, First Lien Term Loan, 1M US SOFR + 4.00%, 0.75% Floor, 11/02/2027 | |

| 435,762 | | |

| 420,946 | |

| Wand NewCo 3 Inc aka Caliber Collision, First Lien Term Loan, 1M US SOFR + 3.75%, 01/30/2031 | |

| 847,764 | | |

| 854,347 | |

| | |

| | | |

| 6,076,147 | |

| | |

| | | |

| | |

| Diversified REITs - 0.38% | |

| | | |

| | |

| Iron Mountain Information Management LLC, First Lien Term Loan, 3M CME TERM SOFR + 2.25%, 01/31/2031 | |

| 466,200 | | |

| 464,839 | |

| Opry Entertainment/OEG, First Lien Term Loan, 6M CME TERM SOFR + 3.75%, 06/25/2031(b) | |

| 262,160 | | |

| 262,815 | |

| | |

| | | |

| 727,654 | |

| | |

| | | |

| | |

| Diversified Telecommunication Services - 3.48% | |

| | | |

| | |

| Coral-US Co-Borrower LLC, First Lien B-5 Term Loan, 1M US SOFR + 2.25%, 01/31/2028 | |

| 804,325 | | |

| 778,812 | |

| Level 3 Financing Inc., First Lien Term Loan: | |

| | | |

| | |

| 1M US SOFR + 6.56%, 04/15/2029 | |

| 410,203 | | |

| 402,577 | |

| 1M US SOFR + 6.56%, 04/15/2030 | |

| 413,212 | | |

| 403,295 | |

| Lorca Finco PLC, First Lien Term Loan, 6M CME TERM SOFR + 3.50%, 04/17/2031 | |

| 326,667 | | |

| 327,892 | |

| Lumen Technologies Inc, First Lien Term Loan, 1M US SOFR + 2.25%, 04/15/2029 | |

| 1,504 | | |

| 1,042 | |

| Lumen Technologies, Inc., First Lien Term Loan, 1M US SOFR + 6.00%, 06/01/2028 | |

| 39,971 | | |

| 33,309 | |

| Radiate Holdco, LLC,, First Lien Term Loan, 1M US SOFR + 3.25%, 09/25/2026 | |

| 1,277,078 | | |

| 1,037,894 | |

| Telenet Financing USD LLC, First Lien Term Loan, 1M US SOFR + 2.00%, 04/30/2028 | |

| 1,056,336 | | |

| 1,007,703 | |

| UPC Financing Partnership, First Lien Facility AT Term Loan, 1M US SOFR + 2.25%, 04/30/2028 | |

| 1,331,027 | | |

| 1,309,750 | |

| Zacapa S.A.R.L., First Lien Term Loan, 3M CME TERM SOFR + 4.00%, 03/22/2029 | |

| 1,402,395 | | |

| 1,403,054 | |

| | |

| | | |

| 6,705,328 | |

| | |

| | | |

| | |

| Electric Utilities - 1.48% | |

| | | |

| | |

| Generation Bridge Northeast LLC, First Lien Term Loan, 1M US SOFR + 3.50%, 08/22/2029 | |

| 589,794 | | |

| 594,217 | |

| NRG Energy 3/24 Cov-Lite, First Lien Term Loan, 1M US SOFR + 2.00%, 04/16/2031 | |

| 815,049 | | |

| 816,170 | |

| Vistra Operations Co. LLC, First Lien 2018 Incremental Term Loan, 1M US SOFR + 2.00%, 12/20/2030 | |

| 1,439,824 | | |

| 1,442,602 | |

| | |

| | | |

| 2,852,989 | |

| | |

| | | |

| | |

| Electrical Equipment - 0.68% | |

| | | |

| | |

| WEC US Holdings Ltd., First Lien Term Loan, 1M US SOFR + 2.75%, 01/27/2031 | |

| 1,315,697 | | |

| 1,318,454 | |

| | |

| | | |

| | |

| Electronic Equipment, Instruments & Components - 2.07% | |

| | | |

| | |

| Celestica 5/24 TLB 1L, First Lien Term Loan, 1M US SOFR + 1.75%, 05/23/2031 | |

| 199,662 | | |

| 199,662 | |

| Coherent Corp., First Lien Term Loan, 1M US SOFR + 2.50%, 0.50% Floor, 07/02/2029 | |

| 1,005,831 | | |

| 1,007,843 | |

| DG Investment Intermediate Holdings 2, Inc., Second Lien Initial Term Loan, 1M US SOFR + 6.75%, 0.75% Floor, 03/30/2029 | |

| 601,071 | | |

| 590,835 | |

| Discovery Energy Corp., First Lien Term Loan, 3M CME TERM SOFR + 4.75%, 05/01/2031 | |

| 784,467 | | |

| 788,758 | |

See

Notes to Financial Statements.

| 16 |

www.blackstone-credit.com |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

June

30, 2024 (Unaudited)

| | |

Principal

Amount | | |

Value | |

| Electronic Equipment, Instruments & Components (continued) | |

| | |

| |

| Mirion Technologies US, Inc., First Lien Term Loan, 3M CME TERM SOFR + 2.25%, 0.50% Floor, 10/20/2028 | |

$ | 1,391,584 | | |

$ | 1,395,285 | |

| | |

| | | |

| 3,982,383 | |

| | |

| | | |

| | |

| Energy Equipment & Services - 0.33% | |

| | | |

| | |

| Ursa Minor US Bidco LLC aka Rosen, First Lien Term Loan, 3M CME TERM SOFR + 3.50%, 03/26/2031 | |

| 639,507 | | |

| 644,572 | |

| | |

| | | |

| | |

| Entertainment - 1.24% | |

| | | |

| | |

| CE Intermediate I LLC, First Lien Term Loan, 3M CME TERM SOFR + 3.50%, 0.50% Floor, 11/10/2028 | |

| 853,689 | | |

| 856,625 | |

| EP Purcasher, LLC, First Lien Term Loan, 3M CME TERM SOFR + 3.50%, 11/06/2028 | |

| 1,533,929 | | |

| 1,536,675 | |

| | |

| | | |

| 2,393,300 | |

| | |

| | | |

| | |

| Financial Services - 1.79% | |

| | | |

| | |

| FleetCor Technologies Operating Co. LLC, First Lien Term Loan, 1M US SOFR + 1.75%, 04/28/2028 | |

| 1,178,755 | | |

| 1,180,800 | |

| Mitchell International, First Lien Term Loan, 6M CME TERM SOFR + 3.25%, 06/17/2031 | |

| 1,646,975 | | |

| 1,635,018 | |

| Planet US Buyer, LLC, First Lien Term Loan, 3M CME TERM SOFR + 3.50%, 02/07/2031 | |

| 627,705 | | |

| 632,491 | |

| Polaris Newco LLC, First Lien Dollar Term Loan, 3M CME TERM SOFR + 4.00%, 0.50% Floor, 06/02/2028 | |

| 684 | | |

| 685 | |

| | |

| | | |

| 3,448,994 | |

| | |

| | | |

| | |

| Food Products - 1.58% | |

| | | |

| | |

| CH Guenther 11/21, First Lien Term Loan, 3M CME TERM SOFR + 3.00%, 12/08/2028 | |

| 567,236 | | |

| 569,012 | |

| Froneri International, Ltd., First Lien Facility B2 Term Loan, 1M US SOFR + 2.25%, 01/29/2027 | |

| 1,016,692 | | |

| 1,017,271 | |

| Saratoga Food Specialties LLC, First Lien Term Loan, 3M CME TERM SOFR + 3.75%, 03/07/2029 | |

| 296,456 | | |

| 298,495 | |

| Snacking Investments BidCo Pty, Ltd., First Lien Initial US Term Loan, 3M CME TERM SOFR + 4.00%, 1.00% Floor, 12/18/2026 | |

| 1,148,006 | | |

| 1,150,876 | |

| | |

| | | |

| 3,035,654 | |

| | |

| | | |

| | |

| Ground Transportation - 2.60% | |

| | | |

| | |

| Genesee & WY Inc, First Lien Term Loan, 3M CME TERM SOFR + 2.00%, 04/10/2031 | |

| 2,020,158 | | |

| 2,020,349 | |

| Uber Technologies, Inc., First Lien Term Loan, 3M CME TERM SOFR + 2.75%, 03/03/2030 | |

| 1,235,058 | | |

| 1,242,426 | |

| XPO, Inc., First Lien Term Loan, 1M US SOFR + 2.00%, 05/24/2028 | |

| 1,731,298 | | |

| 1,738,388 | |

| | |

| | | |

| 5,001,163 | |

| | |

| | | |

| | |

| Health Care Equipment & Supplies - 1.56% | |

| | | |

| | |

| Resonetics LLC, First Lien Term Loan, 3M CME TERM SOFR + 9.08%, 06/06/2031 | |

| 983,970 | | |

| 987,045 | |

| Siemens/SivantosWS Audiology, First Lien Term Loan, 6M CME TERM SOFR + 4.25%, 02/28/2029 | |

| 2,012,288 | | |

| 2,019,835 | |

| | |

| | | |

| 3,006,880 | |

| | |

| | | |

| | |

| Health Care Providers & Services - 8.16% | |

| | | |

| | |

| DaVita, Inc., First Lien B Term Loan, 3M CME TERM SOFR + 1.75%, 08/12/2026 | |

| 563,555 | | |

| 564,025 | |

| Global Medical Response, Inc., First Lien Term Loan, 3M CME TERM SOFR + 5.50%, 1.00% Floor, 10/31/2028(d) | |

| 2,062,708 | | |

| 2,001,858 | |

| Heartland Dental LLC, First Lien Term Loan, 6M CME TERM SOFR + 4.50%, 0.75% Floor, 04/28/2028 | |

| 1,159,158 | | |

| 1,163,581 | |

| IVI America LLC aka IVIRMA, First Lien Term Loan, 6M CME TERM SOFR + 4.50%, 04/18/2031 | |

| 512,500 | | |

| 516,264 | |

| MED ParentCo, LP, First Lien Term Loan, 1M US SOFR + 4.00%, 04/15/2031 | |

| 520,534 | | |

| 520,976 | |

| Medical Solutions LLC, First Lien Term Loan, 1M US SOFR + 3.25%, 11/01/2028 | |

| 1,120,353 | | |

| 854,068 | |

See

Notes to Financial Statements.

| Semi-Annual Report | June

30, 2024 |

17 |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

June

30, 2024 (Unaudited)

| | |

Principal

Amount | | |

Value | |

| Health Care Providers & Services (continued) | |

| | |

| |

| Midwest Physcn Admin Srvcs LLC, First Lien Term Loan, 3M CME TERM SOFR + 3.25%, 03/12/2028 | |

$ | 1,380,341 | | |

$ | 1,212,975 | |

| NAPA Management Services Corp., First Lien Term Loan, 1M US SOFR + 5.25%, 0.75% Floor, 02/23/2029 | |

| 1,139,661 | | |

| 1,093,482 | |

| Onex TSG Intermediate Corp., First Lien Initial Term Loan, 3M CME TERM SOFR + 4.75%, 0.75% Floor, 02/28/2028 | |

| 1,374,167 | | |

| 1,373,019 | |

| Outcomes Group Holdings, Inc., First Lien Term Loan, 3M US L + 4.25%, 05/06/2031 | |

| 894,490 | | |

| 898,474 | |

| Pathway Vet Alliance LLC, First Lien 2021 Replacement Term Loan, 1M US SOFR + 3.75%, 03/31/2027 | |

| 1,499,697 | | |

| 1,185,323 | |

| Pediatric Associates Holding Co. LLC, First Lien Term Loan, 1M US SOFR + 3.25%, 0.50% Floor, 12/29/2028 | |

| 1,409,406 | | |

| 1,365,651 | |

| Radiology Partners Inc, First Lien Term Loan, 6M CME TERM SOFR + 5.00%, 01/31/2029 | |

| 1,472,242 | | |

| 1,400,102 | |

| Surgery Center Holdings Inc, First Lien Term Loan, 1M US SOFR + 2.75%, 12/19/2030 | |

| 342,132 | | |

| 343,438 | |

| U.S. Anesthesia Partners, Inc., First Lien Term Loan, 3M CME TERM SOFR + 4.25%, 0.50% Floor, 10/01/2028 | |

| 1,271,565 | | |

| 1,222,997 | |

| | |

| | | |

| 15,716,233 | |

| | |

| | | |

| | |

| Health Care Technology - 2.86% | |

| | | |

| | |

| Cotiviti Inc., First Lien Term Loan, 6M US L + 0.00%, 05/01/2031 | |

| 2,008,027 | | |

| 2,000,920 | |

| Gainwell Acquisition Corp., First Lien Term Loan, 3M CME TERM SOFR + 4.00%, 0.75% Floor, 10/01/2027 | |

| 1,446,038 | | |

| 1,403,857 | |

| GHX Ultimate Parent Corp., First Lien Term Loan, 3M CME TERM SOFR + 4.00%, 0.50% Floor, 06/30/2027(b) | |

| 1,188,103 | | |

| 1,197,014 | |

| Project Ruby Ultimate Parent Corp., First Lien Closing Date Term Loan, 1M US SOFR + 3.25%, 0.75% Floor, 03/10/2028 | |

| 728,431 | | |

| 730,401 | |

| Waystar Technologies, Inc., First Lien Term Loan, 6M CME TERM SOFR + 3.00%, 10/22/2029 | |

| 169,962 | | |

| 170,387 | |

| | |

| | | |

| 5,502,579 | |

| | |

| | | |

| | |

| Hotels, Restaurants & Leisure - 5.88% | |

| | | |

| | |

| 1011778 BC UNLIMITED LIABILITY CO, First Lien Term Loan, 1M US SOFR + 1.75%, 09/20/2030 | |

| 1,772,296 | | |

| 1,770,054 | |

| Bally's Corp., First Lien Term Loan, 3M CME TERM SOFR + 3.25%, 0.50% Floor, 10/02/2028 | |

| 1,361,499 | | |

| 1,296,120 | |

| Caesars Entertainment, Inc., First Lien Term Loan: | |

| | | |

| | |

| 3M CME TERM SOFR + 2.75%, 0.50% Floor, 02/06/2030 | |

| 1,260,725 | | |

| 1,263,184 | |

| 3M CME TERM SOFR + 2.75%, 0.50% Floor, 02/06/2031 | |

| 437,756 | | |

| 438,645 | |

| Cedar Fair LP, First Lien Term Loan, 1M US SOFR + 2.00%, 05/01/2031 | |

| 340,018 | | |

| 339,860 | |

| Entain plc, First Lien Term Loan, 3M CME TERM SOFR + 2.75%, 10/31/2029 | |

| 1,294,233 | | |

| 1,297,928 | |

| Fertitta Entertainment, LLC, First Lien Term Loan, 1M US SOFR + 3.75%, 01/27/2029 | |

| 645,744 | | |

| 647,235 | |

| Flutter Financing B.V., First Lien Term Loan, 3M CME TERM SOFR + 2.25%, 11/25/2030 | |

| 1,805,069 | | |

| 1,808,273 | |

| Hilton Grand Vacations Borrower, LLC, First Lien Term Loan, 1M US SOFR + 2.75%, 01/17/2031 | |

| 233,324 | | |

| 233,616 | |

| IRB Holding Corporation, First Lien Term Loan, 1M US SOFR + 2.75%, 12/15/2027 | |

| 836,626 | | |

| 837,254 | |

| LC Ahab US Bidco LLC, First Lien Term Loan, 1M US SOFR + 3.50%, 05/01/2031 | |

| 313,752 | | |

| 314,734 | |

| OVG Business Services, LLC TLB 1L, First Lien Term Loan, 6M US L + 0.00%, 06/13/2031 | |

| 521,709 | | |

| 521,385 | |

| Tacala Investment Corp, First Lien Term Loan, 1M US SOFR + 4.00%, 01/31/2031 | |

| 561,624 | | |

| 564,727 | |

| | |

| | | |

| 11,333,015 | |

| | |

| | | |

| | |

| Household Durables - 0.91% | |

| | | |

| | |

| ACProducts Holdings, Inc., First Lien Term Loan, 3M US L + 4.25%, 0.50% Floor, 05/17/2028 | |

| 2,068,715 | | |

| 1,759,266 | |

| | |

| | | |

| | |

| Independent Power and Renewable Electricity Producers - 0.69% | |

| | | |

| | |

| Calpine Corp., First Lien Term Loan, 1M US SOFR + 2.00%, 01/31/2031 | |

| 1,332,558 | | |

| 1,329,920 | |

| | |

| | | |

| | |

| Insurance - 3.27% | |

| | | |

| | |

| AmWINS Group, Inc., First Lien Term Loan, 1M US SOFR + 2.25%, 0.75% Floor, 02/19/2028 | |

| 660,303 | | |

| 660,561 | |

See

Notes to Financial Statements.

| 18 |

www.blackstone-credit.com |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

June

30, 2024 (Unaudited)

| | |

Principal

Amount | | |

Value | |

| Insurance (continued) | |

| | |

| |

| AssuredPartners, Inc., First Lien Term Loan, 1M US SOFR + 3.50%, 02/14/2031 | |

$ | 347,410 | | |

$ | 348,713 | |

| Baldwin Insurance Group Holdings LLC, First Lien Term Loan, 6M CME TERM SOFR + 3.50%, 05/26/2031(b) | |

| 878,178 | | |

| 879,275 | |

| BroadStreet Partners Inc, First Lien Term Loan, 6M CME TERM SOFR + 3.25%, 06/13/2031 | |

| 1,115,759 | | |

| 1,114,085 | |

| Hyperion Refinance Sarl, First Lien Term Loan: | |

| | | |

| | |

| 1M US SOFR + 4.00%, 0.50% Floor, 04/18/2030 | |

| 1,456,842 | | |

| 1,460,856 | |

| 1M US SOFR + 3.50%, 0.50% Floor, 02/15/2031 | |

| 487,595 | | |

| 489,260 | |

| Truist Insurance 3/24 2nd Lien Cov-Lite, Second Lien Term Loan, 3M CME TERM SOFR + 4.75%, 05/06/2032 | |

| 567,317 | | |

| 580,081 | |

| USI Inc/NY aka Compass Investors TLB, First Lien Term Loan, 3M CME TERM SOFR + 2.75%, 09/27/2030 | |

| 770,019 | | |

| 770,982 | |

| | |

| | | |

| 6,303,813 | |

| | |

| | | |

| | |

| Interactive Media & Services - 0.68% | |

| | | |

| | |

| Foundational Education Group, Inc., First Lien Term Loan, 3M CME TERM SOFR + 3.75%, 08/31/2028(b) | |

| 34,218 | | |

| 33,362 | |

| LI Group Holdings, Inc., First Lien 2021 Term Loan, 1M US SOFR + 3.50%, 0.75% Floor, 03/11/2028(b) | |

| 1,282,560 | | |

| 1,285,766 | |

| | |

| | | |

| 1,319,128 | |

| | |

| | | |

| | |

| IT Services - 5.77% | |

| | | |

| | |

| Access CIG LLC, First Lien Term Loan, 3M CME TERM SOFR + 5.00%, 0.50% Floor, 08/18/2028 | |

| 900,955 | | |

| 907,856 | |

| Ahead DB Holdings, LLC, First Lien Term Loan, 3M CME TERM SOFR + 4.25%, 02/01/2031 | |

| 1,340,314 | | |

| 1,346,393 | |

| Asurion LLC, Second Lien Term Loan, 1M US SOFR + 5.25%, 01/20/2029 | |

| 61,459 | | |

| 56,874 | |

| Blackhawk Network Holdings Inc, First Lien Term Loan, 1M US SOFR + 5.00%, 03/12/2029 | |

| 1,000,000 | | |

| 1,003,440 | |

| Chrysaor Bidco Sarl DDTL 1L, First Lien Term Loan, 6M CME TERM SOFR + 4.00%, 05/14/2031 | |

| 22,473 | | |

| 22,599 | |

| Chrysaor Bidco Sarl TLB 1L, First Lien Term Loan, 6M CME TERM SOFR + 4.00%, 05/14/2031 | |

| 303,869 | | |

| 305,580 | |

| Dcert Buyer, Inc., Second Lien First Amendment Refinancing Term Loan, 1M US SOFR + 7.00%, 02/19/2029 | |

| 1,881,655 | | |

| 1,688,785 | |

| Go Daddy Oper Co LLC, First Lien Term Loan, 1M US SOFR + 1.75%, 05/30/2031 | |

| 472,500 | | |

| 472,637 | |

| Newfold Digital Holdings Group, Inc., First Lien Initial Term Loan, 1M US SOFR + 3.50%, 0.75% Floor, 02/10/2028 | |

| 2,326,630 | | |

| 2,166,674 | |

| Presidio/Fortress Intermediate 4/24 TLB 1L, First Lien Term Loan, 6M CME TERM SOFR + 4.00%, 05/09/2031(b) | |

| 1,242,000 | | |

| 1,245,105 | |

| Skopima Merger Sub Inc., First Lien Initial Term Loan, 1M US SOFR + 4.00%, 05/12/2028 | |

| 599,786 | | |

| 600,053 | |

| Virtusa Corp., First Lien Term Loan, 1M US SOFR + 3.25%, 0.75% Floor, 02/15/2029 | |

| 918,491 | | |

| 922,078 | |

| World Wide Technology 3/24, First Lien Term Loan, 1M US SOFR + 2.75%, 03/01/2030(b) | |

| 366,285 | | |

| 368,117 | |

| | |

| | | |

| 11,106,191 | |

| | |

| | | |

| | |

| Leisure Products - 0.08% | |

| | | |

| | |

| Amer Sports Co, First Lien Term Loan, 3M CME TERM SOFR + 3.25%, 02/17/2031(b) | |

| 153,933 | | |

| 155,087 | |

| | |

| | | |

| | |

| Life Sciences Tools & Services - 2.22% | |

| | | |

| | |

| Catalent Pharma Solutions, Inc., First Lien Term Loan, 1M US SOFR + 2.00%, 0.50% Floor, 02/22/2028 | |

| 1,150,433 | | |

| 1,151,296 | |

| Curia Global, Inc., First Lien 2021 Term Loan, 3M CME TERM SOFR + 3.75%, 0.75% Floor, 08/30/2026 | |

| 1,505,395 | | |

| 1,421,823 | |

| IQVIA INC., First Lien Term Loan, 3M CME TERM SOFR + 2.00%, 01/02/2031 | |

| 194,216 | | |

| 195,248 | |

| Loire UK Midco 3, Ltd., First Lien Facility B2 Term Loan, 1M US SOFR + 3.75%, 0.75% Floor, 04/21/2027 | |

| 923,260 | | |

| 918,260 | |

See

Notes to Financial Statements.

| Semi-Annual Report | June

30, 2024 |

19 |

| Blackstone Senior Floating Rate 2027 Term Fund |

Portfolio of Investments |

June

30, 2024 (Unaudited)

| | |

Principal

Amount | | |

Value | |

| Life Sciences Tools & Services (continued) | |

| | |

| |

| Parexel International Corporation, First Lien Term Loan, 1M US SOFR + 3.25%, 0.50% Floor, 11/15/2028 | |

$ | 581,643 | | |

$ | 583,550 | |

| | |

| | | |

| 4,270,177 | |

| | |

| | | |

| | |

| Machinery - 6.50% | |

| | | |

| | |

| Asp Blade Holdings, Inc., First Lien Term Loan, 3M CME TERM SOFR + 4.00%, 0.50% Floor, 10/13/2028 | |

| 238,402 | | |

| 182,318 | |

| Bettcher Industries, Inc., First Lien Term Loan, 3M CME TERM SOFR + 4.00%, 12/14/2028 | |

| 825,902 | | |

| 824,353 | |

| Crosby US Acquisition corp., First Lien Term Loan, 1M US SOFR + 4.00%, 08/16/2029 | |

| 399,189 | | |

| 401,892 | |

| Engineered Machinery Holdings, Inc., First Lien Term Loan, 3M CME TERM SOFR + 3.75%, 0.75% Floor, 05/19/2028 | |

| 1,413,479 | | |

| 1,420,879 | |

| Hyperion Materials & Technologies, Inc., First Lien Initial Term Loan, 3M CME TERM SOFR + 4.50%, 0.50% Floor, 08/30/2028 | |

| 716,388 | | |

| 699,732 | |

| INNIO Group Hldg GmbH, First Lien Term Loan, 6M CME TERM SOFR + 3.50%, 11/02/2028 | |

| 184,467 | | |

| 185,102 | |

| LSF11 Trinity Bidco Inc, First Lien Term Loan, 3M CME TERM SOFR + 3.50%, 06/14/2030 | |

| 1,067,892 | | |

| 1,074,235 | |

| Osmosis Buyer Limited, First Lien Initial B Term Loan, 3M CME TERM SOFR + 4.00%, 0.50% Floor, 07/31/2028 | |

| 1,613,606 | | |

| 1,618,301 | |

| Pro Mach Group, Inc., First Lien Closing Date Initial Term Loan, 1M US SOFR + 3.50%, 1.00% Floor, 08/31/2028 | |

| 1,448,756 | | |

| 1,457,810 | |

| Project Castle, Inc., First Lien Term Loan, 3M CME TERM SOFR + 5.50%, 06/01/2029 | |

| 1,493,400 | | |

| 1,337,840 | |

| SPX FLOW Inc, First Lien Term Loan, 1M US SOFR + 3.50%, 04/05/2029 | |

| 430,235 | | |

| 433,212 | |

| TK Elevator Midco GmbH, First Lien Term Loan, 6M CME TERM SOFR + 3.50%, 04/30/2030 | |

| 1,792,009 | | |

| 1,803,487 | |

| Victory Buyer LLC, First Lien Term Loan, 3M CME TERM SOFR + 3.75%, 0.50% Floor, 11/19/2028 | |

| 1,122,205 | | |

| 1,082,928 | |

| | |

| | | |

| 12,522,089 | |

| | |

| | | |

| | |

| Media - 1.43% | |

| | | |

| | |

| ABG Intermediate Holdings 2 LLC, First Lien Term Loan, 6M CME TERM SOFR + 2.75%, 12/21/2028 | |

| 218,958 | | |

| 219,438 | |

| American Greetings Corp., First Lien Term Loan, 1M US SOFR + 5.75%, 10/30/2029 | |

| 859,413 | | |

| 865,592 | |

| Cable One, Inc., First Lien Term Loan, 3M US L + 2.00%, 05/03/2028 | |

| 350,384 | | |

| 345,566 | |

| Cogeco Financing 2 LP, First Lien Term Loan, 3M CME TERM SOFR + 2.50%, 0.50% Floor, 09/01/2028 | |

| 198,311 | | |

| 192,256 | |

| Fleet Midco I Ltd., First Lien Term Loan, 1M US SOFR + 3.25%, 02/21/2031 | |

| 444,701 | | |

| 447,480 | |

| Univision Communications, Inc., First Lien Term Loan, 1M US SOFR + 3.25%, 0.75% Floor, 03/15/2026 | |

| 691,938 | | |

| 693,108 | |

| | |

| | | |

| 2,763,440 | |

| | |

| | | |

| | |

| Metals & Mining - 0.18% | |

| | | |

| | |

| Arsenal AIC Parent, LLC, First Lien Term Loan, 1M US SOFR + 3.75%, 08/18/2030 | |

| 341,639 | | |

| 344,116 | |

| | |

| | | |

| | |

| | |

| | | |

| | |

| Mortgage Real Estate Investment - 0.30% | |

| | | |

| | |

| Blackstone Mortgage Trust, Inc., First Lien Term Loan: | |

| | | |

| | |

| 1M US SOFR + 2.25%, 04/23/2026 | |

| 294,588 | | |

| 289,800 | |

| 1M US SOFR + 2.75%, 0.50% Floor, 04/23/2026 | |

| 294,670 | | |

| 290,987 | |

| | |

| | | |

| 580,787 | |

| | |

| | | |

| | |

| Oil, Gas & Consumable Fuels - 0.90% | |

| | | |

| | |

| Buckeye Partners LP, First Lien Term Loan: | |

| | | |

| | |

| 1M US SOFR + 2.00%, 11/01/2026 | |

| 354,058 | | |

| 354,816 | |

| 3M CME TERM SOFR + 2.00%, 11/22/2030 | |

| 259,145 | | |

| 259,428 | |

| Freeport LNG, First Lien Term Loan, 3M CME TERM SOFR + 3.50%, 12/21/2028 | |

| 363,368 | | |

| 363,417 | |