Form 8-K - Current report

03 Octubre 2024 - 3:12PM

Edgar (US Regulatory)

false

0000896159

0000896159

2024-10-03

2024-10-03

0000896159

us-gaap:CommonStockMember

2024-10-03

2024-10-03

0000896159

CB:INASeniorNotesDueDecember2024Member

2024-10-03

2024-10-03

0000896159

CB:INASeniorNotesDueJune2027Member

2024-10-03

2024-10-03

0000896159

CB:INASeniorNotesDueMarch2028Member

2024-10-03

2024-10-03

0000896159

CB:INASeniorNotesDueDecember2029Member

2024-10-03

2024-10-03

0000896159

CB:INASeniorNotesDueJune2031Member

2024-10-03

2024-10-03

0000896159

CB:INASeniorNotesDueMarch2038Member

2024-10-03

2024-10-03

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

Current Report

Pursuant To Section 13

or 15 (d) of the

Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): October 3,

2024

CHUBB

LIMITED

(Exact

name of registrant as specified in its charter)

| Switzerland |

|

1-11778 |

|

98-0091805 |

(State

or other jurisdiction of

incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S.

Employer Identification No.)

|

Baerengasse

32

CH-8001

Zurich, Switzerland

(Address of principal executive

offices)

Registrant’s telephone

number, including area code: +41 (0)43 456

76 00

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions (see General Instruction A.2. below):

| |

¨ |

Written communications pursuant to Rule 425 under the Securities Act

(17 CFR 230.425) |

| |

¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act

(17 CFR 240.14a-12) |

| |

¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the

Exchange Act (17 CFR 240.14d-2(b)) |

| |

¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the

Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

| Title

of each class |

|

Trading Symbol(s) |

|

Name

of each exchange on which

registered |

| Common

Shares, par value CHF 0.50 per share |

|

CB |

|

New

York Stock Exchange |

| Guarantee

of Chubb INA Holdings LLC 0.30% Senior Notes due 2024 |

|

CB/24A |

|

New

York Stock Exchange |

| Guarantee

of Chubb INA Holdings LLC 0.875% Senior Notes due 2027 |

|

CB/27 |

|

New

York Stock Exchange |

| Guarantee

of Chubb INA Holdings LLC 1.55% Senior Notes due 2028 |

|

CB/28 |

|

New

York Stock Exchange |

| Guarantee

of Chubb INA Holdings LLC 0.875% Senior Notes due 2029 |

|

CB/29A |

|

New

York Stock Exchange |

| Guarantee

of Chubb INA Holdings LLC 1.40% Senior Notes due 2031 |

|

CB/31 |

|

New

York Stock Exchange |

| Guarantee

of Chubb INA Holdings LLC 2.50% Senior Notes due 2038 |

|

CB/38A |

|

New

York Stock Exchange |

Indicate by check mark

whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2

of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ¨

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 9.01. | Financial Statements and Exhibits |

The following Exhibits 5.1, 23.1, 99.1, 99.2, 99.3 and 99.4 are incorporated

by reference into the automatic shelf registration statement on Form S-3 of Chubb Limited (the “Company”), filed on the date

hereof, as exhibits thereto in connection with the delivery of common shares of the Company, par value CHF 0.50 per share (“Common

Shares”), in connection with the settlement of deferred equity awards held by individuals who, as of January 14, 2016, were

former employees of The Chubb Corporation, which was acquired by the Company on January 14, 2016.

| |

Exhibit

Number |

Description |

| |

5.1 |

Opinion of Bär & Karrer AG as to the legality of the Common Shares, filed herewith. |

| |

23.1 |

Consent of Bär & Karrer AG (included in Exhibit 5.1). |

| |

99.1 |

The Chubb Corporation Long-Term Stock Incentive Plan (2004), incorporated by reference to Annex B of The Chubb Corporation’s definitive proxy statement for the Annual Meeting of Shareholders held on April 27, 2004, filed on March 25, 2004 (File No. 001-08661). |

| |

99.2 |

Amendment to The Chubb Corporation Long-Term Stock Incentive Plan (2004), incorporated by reference to Exhibit 10.8 of The Chubb Corporation’s Annual Report on Form 10-K for the year ended December 31, 2008, filed on March 2, 2009 (File No. 001-08661). |

| |

99.3 |

The Chubb Corporation Long-Term Incentive Plan (2009), incorporated by reference to Exhibit 99.1 of The Chubb Corporation’s registration statement on Form S-8 (No. 333-158841). |

| |

99.4 |

The Chubb Corporation Long-Term Incentive Plan (2014), incorporated by reference to Exhibit 99.1 of The Chubb Corporation's registration statement on Form S-8 (No. 333-195560) |

| |

104 |

Cover Page Interactive Data File (the cover page XBRL tags are embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

CHUBB

LIMITED |

| |

|

| |

By: |

/s/

Joseph F. Wayland |

| |

|

Joseph

F. Wayland |

| |

|

General

Counsel |

DATE: October 3, 2024

Exhibit 5.1

Chubb Limited

Bärengasse 32

CH-8001 Zurich

Switzerland

Zurich, 3 October 2024

Prospectus Supplement Pursuant to Form S-3 Registration Statement

Dear Sir or Madam,

We have been asked to issue a legal opinion letter

as special Swiss legal counsel of Chubb Limited, Bärengasse 32, CH-8001 Zurich, Switzerland, Swiss business identification number

CHE-114.425.464 (the "Company"), in connection with a prospectus supplement (the "Prospectus Supplement")

being filed with the Securities and Exchange Commission (the "Commission") pursuant to the Company's registration statement

on Form S-3 (the "Registration Statement") to be filed on or about 3 October 2024 under the United States Securities

Act of 1933, as amended (the "Act"), for the registration of common shares of the Company with a nominal value of CHF

0.50 (the "Shares") that may be delivered to individuals who, as of 14 January 2016, were former employees (the

"Former Employees") of (former) The Chubb Corporation, at the time a corporation organized under the laws of the State

of New Jersey (the "Chubb Corp"), following the merger, on 14 January 2016, of Chubb Corp with a wholly owned subsidiary

of the Company (the "Merger"), in connection with the settlement by the Company of deferred equity awards held by the

Former Employees under certain incentive plans of Chubb Corp (the "Awards").

The Shares subject to the Prospectus Supplement

will be 1,261 Shares (the "Registered Shares"). You have instructed us (the "Instructions") that the

Registered Shares will only consist of Shares already validly issued before 31 December 2023 that are (directly or indirectly) held

by the Company (the "Treasury Shares").

| Bär & Karrer |

Zürich |

Genf |

Lugano |

Zug |

www.baerkarrer.ch |

| Rechtsanwälte |

Bär & Karrer AG |

Bär & Karrer SA |

Bär & Karrer SA |

Bär & Karrer AG |

|

| |

Brandschenkestrasse 90 |

12, quai de la Poste |

Via Vegezzi 6 |

Baarerstrasse 8 |

|

| |

CH-8027 Zürich |

CH-1211 Genève 11 |

CH-6901 Lugano |

CH-6301 Zug |

|

| |

Phone: +41 58 261 50 00 |

Phone: +41 58 261 57 00 |

Phone: +41 58 261 58 00 |

Phone: +41 58 261 59 00 |

|

| |

Fax: +41

58 261 50 01 |

Fax: +41

58 261 57 01 |

Fax: +41

58 261 58 01 |

Fax: +41

58 261 59 01 |

|

| |

zuerich@baerkarrer.ch |

geneve@baerkarrer.ch |

lugano@baerkarrer.ch |

zug@baerkarrer.ch |

|

All capitalized terms used in this legal opinion

letter shall have the meaning as defined herein.

In arriving at the opinions expressed in section

III below, we have exclusively reviewed and relied on the following documents, the sufficiency of which we confirm for purposes of this

legal opinion letter (the documents referred to in this section I collectively the "Documents" and any individual document

thereof "Document"):

| a) | an excerpt from the commercial register of the Canton of Zurich,

Switzerland, in relation to the Company, certified by said register to be up-to-date as of 1 October 2024; |

| b) | a copy of the articles of association of the Company, certified by the commercial register of the

Canton of Zurich, Switzerland, to be up-to-date as deposited with such register as of 1 October 2024 (the

"Articles") in their version of 16 May 2024; and |

| c) | a copy of the Prospectus Supplement (in substantially final

draft form). |

In arriving at the opinions expressed in section

III below, we have assumed (without verification) cumulatively that:

| a) | the information set out in the Documents and in the Instructions

is true, accurate, complete and up-to-date as of the date of this legal opinion letter and no changes have been made or will be made

that should have been or should be reflected in the Documents as of the date of this legal opinion letter; |

| b) | the Documents submitted to us as (hard or electronic) copies

are complete and conform to the original document; |

| c) | all signatures and seals on any Document are genuine; |

| d) | where a name is indicated (in print or in handwriting) next

to a signature appearing on any Document, the signature has been affixed by the person whose name is indicated, and where no name is

indicated (in print or in handwriting) next to a signature appearing on any Document, the relevant Documents have been duly signed by

authorized signatories; |

| e) | to the extent any authorizations, approvals, consents, licenses,

exemptions or other requirements (collectively the "Authorizations") had or will have to be obtained outside Switzerland

in connection with the delivery of the Shares, such Authorizations have been obtained or fulfilled or will be obtained or fulfilled in

due time, and have remained or will remain in full force and effect at all times through the delivery of the Shares; |

| f) | the Company is not listed in Switzerland; |

| g) | to the extent agreements or documents have to be executed or

any obligations have to be performed under applicable laws other than Swiss law or in any jurisdiction outside Switzerland, such execution

or performance will not be illegal or unenforceable by virtue of the laws of such jurisdiction; and |

| h) | the Company will not pass a voluntary winding-up resolution,

no petition will be presented or order made by a court for the winding-up, dissolution, bankruptcy or administration of the Company,

and no receiver, trustee in bankruptcy, administrator or similar officer will have been appointed in relation to the Company or any of

its assets or revenues between the date of this legal opinion letter and the date of the delivery of the Shares. |

Based upon the foregoing, and subject to the qualifications

and reliance limitations set out in section IV and section V below, we are of the opinion that under the laws of Switzerland as currently

in force and interpreted:

| a) | the Company is a stock corporation (Aktiengesellschaft) duly

organized and validly existing under the laws of Switzerland, with corporate power and authority to conduct its business; |

| b) | the Registered Shares are validly issued, fully paid in and

non-assessable (i.e. no further contributions in respect thereof will be required to be made to the Company by the holders thereof, by

reason only of their being such holders); |

| c) | insofar as Swiss law is concerned, all regulatory consents,

authorizations, approvals and filings required to be obtained or made by the Company for the re-use of the Treasury Shares have been

obtained or made. |

The opinions given under section III above are

each subject to the following cumulative qualifications:

| a) | The opinions expressed herein are strictly limited to matters

governed by the laws of Switzerland and thus to opinions on certain Swiss law matters. |

| b) | The opinions expressed herein are based on and subject to the

laws of Switzerland as in force and generally interpreted based on available legal sources as of the date of this legal opinion letter,

and where this legal opinion letter refers to "Swiss law" or "the laws of Switzerland", it solely refers to Swiss

law as in force and generally interpreted based on available legal sources as of the date of this legal opinion letter. Such laws are

subject to change. |

| c) | We have made no investigation of the laws of any other jurisdiction

(but the laws of Switzerland) as a basis for this legal opinion letter and do not express or imply any opinion thereon. |

| d) | The opinions expressed herein relate only to legal matters explicitly

covered by this legal opinion letter (taking into account cumulatively all assumptions and qualifications) and no opinion is given by

implication or otherwise on any other matter. |

| e) | In issuing this legal opinion letter, we based ourselves solely

on the Documents and Instructions and were not instructed to, and did not, make any further independent search or due diligence; we do

not opine as to any facts or circumstances occurring or coming to our attention subsequently to the date hereof. |

| f) | The assumptions and qualifications apply to all opinions expressed

in this legal opinion letter. |

| g) | We express no opinion herein as to the accuracy or completeness

of the information set out in the Registration Statement and the Prospectus Supplement or of the representations and warranties set out

in the Registration Statement and the Prospectus Supplement. |

| h) | We express no opinion herein as to regulatory matters or as

to any commercial, accounting, calculating, auditing, tax, or other non-corporate law matter. |

| i) | We express no opinion herein as to regulatory matters (except

as provided in III.c)) or as to any commercial, accounting, calculating, auditing, tax, or other non-corporate law matter. |

| j) | As a matter of mandatory Swiss law, shareholders as well as

the board of directors of a company are entitled to challenge resolutions adopted by a general shareholders' meeting, including those

on which the issuance of the Shares is based, believed to violate the law or the company's articles of association by initiating legal

proceedings against such company within two months following such meeting. |

| k) | In this opinion, Swiss legal concepts are expressed in English

terms and not in any official Swiss language; these concepts may not be identical to the concepts described by the same English terms

as they exist under the laws of other jurisdictions. |

This legal opinion letter is addressed to the

Company. We hereby consent to the filing of this legal opinion letter as an exhibit to the Registration Statement and to the use of our

name under the heading "Validity of Common Shares" in the Prospectus Supplement. In giving such consent, we do not admit or

imply that we are in the category of persons whose consent is required under section 7 of the Act or the rules and regulations of

the Commission issued thereunder.

This legal opinion letter is furnished by us,

as special Swiss legal counsel to the Company, in connection with the filing of the Prospectus Supplement pursuant to the Registration

Statement. Without our prior consent, it may not be used by, copied by, circulated by, quoted by, referred to, or disclosed to any party

or for any purpose, except for such filing or in connection with any reliance by investors on such filing pursuant to US securities laws.

Any reliance on this opinion is limited to the

legal situation existing at the date of this legal opinion letter, and we shall be under no obligation to advise you on or to amend this

legal opinion letter to reflect any change in circumstances or applicable laws or regulations for any period after the date of issuance

of this legal opinion letter.

This legal opinion letter shall be governed by

and construed in accordance with the laws of Switzerland. This legal opinion letter may only be relied upon on the express condition that

any issues of interpretation arising hereunder will be governed by the laws of Switzerland.

| |

Yours faithfully, |

|

| |

|

|

| |

Bär & Karrer AG |

|

| |

|

|

| |

/s/

Dr. Urs Kägi |

|

| |

Dr. Urs Kägi |

|

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CB_INASeniorNotesDueDecember2024Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CB_INASeniorNotesDueJune2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CB_INASeniorNotesDueMarch2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CB_INASeniorNotesDueDecember2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CB_INASeniorNotesDueJune2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=CB_INASeniorNotesDueMarch2038Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

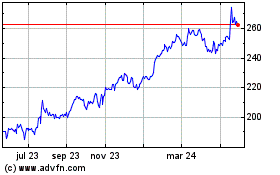

DBA Chubb (NYSE:CB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

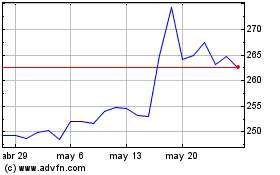

DBA Chubb (NYSE:CB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024